2031f8fcb084abe8f877649798bc0035.ppt

- Количество слайдов: 25

Keep your eyes on the ball - design, cost and risk Good pensions at best possible costs - towards a well-funtioning pension market? FAFO, Oslo 11 February 2009 Ole Beier Sørensen Chief of analysis, Strategy and SRI obs@atp. dk

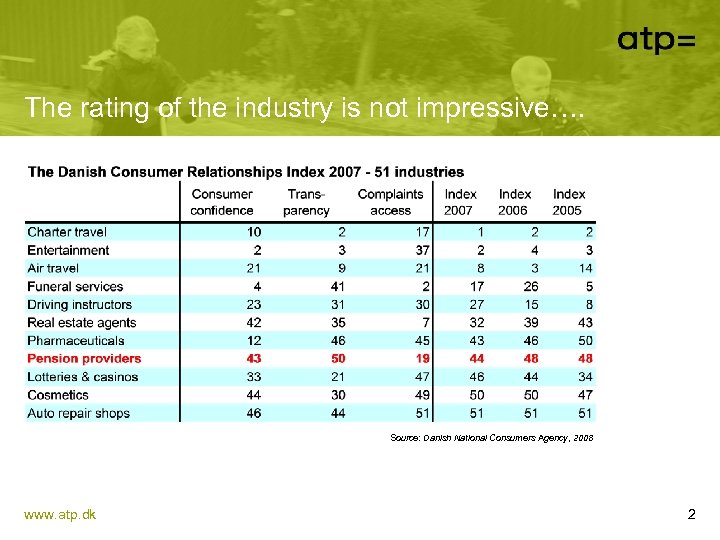

The rating of the industry is not impressive…. Source: Danish National Consumers Agency, 2008 www. atp. dk 2

…reflecting a notoriously bad reputation… § A closed and introvert industry § Products nobody understands § Complex and very technical information § “Credible advisors are hard to find!” www. atp. dk 3

…but it is nevertheless sadly astonishing!. . . § Currently app. € 300 bio. – and counting § 12 -21 pct. of wages § The largest and most important financial transaction for most households § A low interest area § Recent survey by F&P: - “People know they are paying… - …but they only have faint ideas as to what they get” www. atp. dk 4

…and it may call for government intervention § Strong pressure on the industry to inform… § …and to increase the quality of its’ information § Politicians: - ”If the industry does not succeed, government may become helpfull” § A new industry initiative based on a look through principle is to enhance transparency - administration costs - investment costs www. atp. dk 5

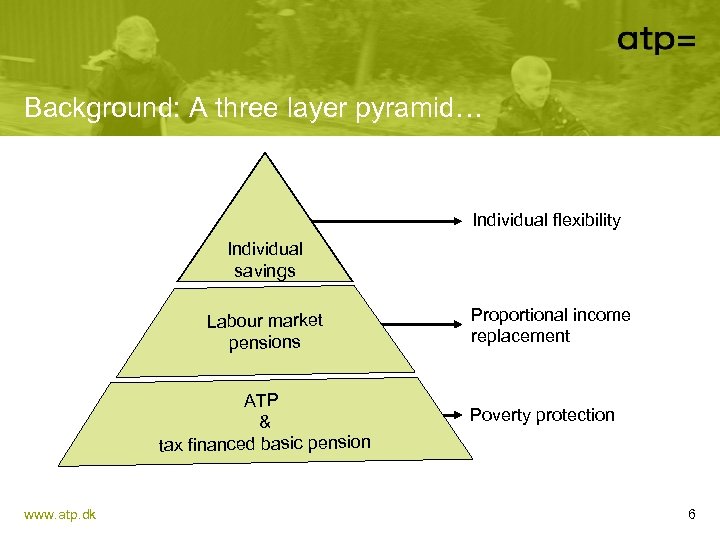

Background: A three layer pyramid… Individual flexibility Individual savings Labour market pensions ATP & tax financed basic pension www. atp. dk Proportional income replacement Poverty protection 6

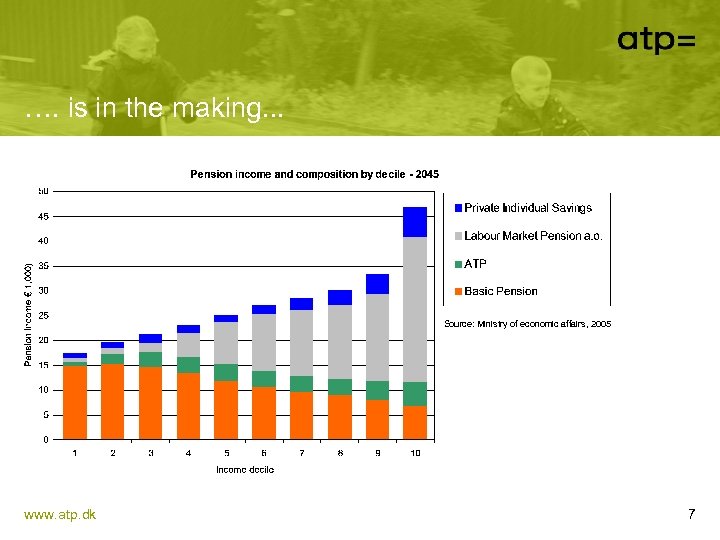

…. is in the making. . . Source: Ministry of economic affairs, 2005 www. atp. dk 7

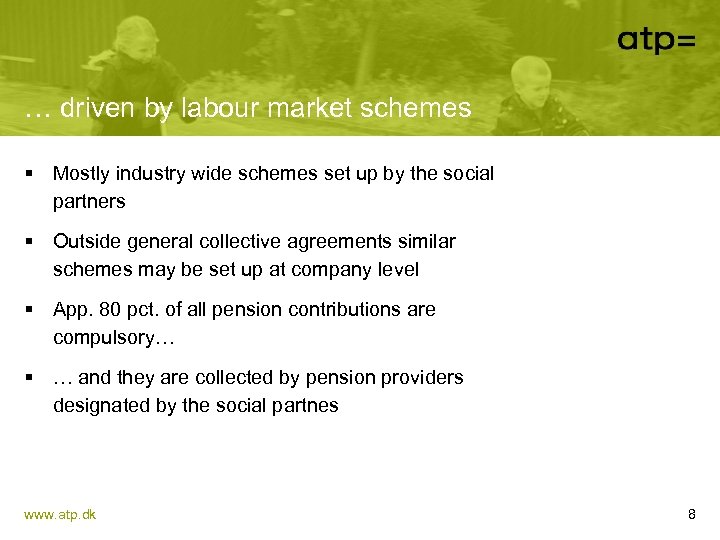

… driven by labour market schemes § Mostly industry wide schemes set up by the social partners § Outside general collective agreements similar schemes may be set up at company level § App. 80 pct. of all pension contributions are compulsory… § … and they are collected by pension providers designated by the social partnes www. atp. dk 8

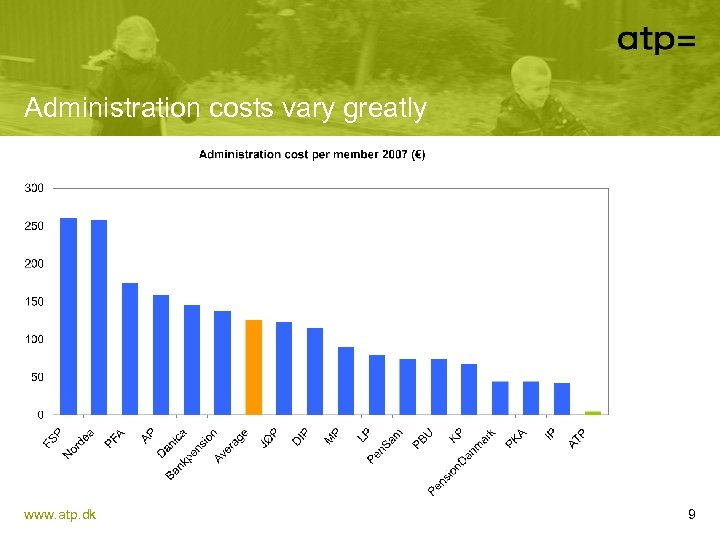

Administration costs vary greatly www. atp. dk 9

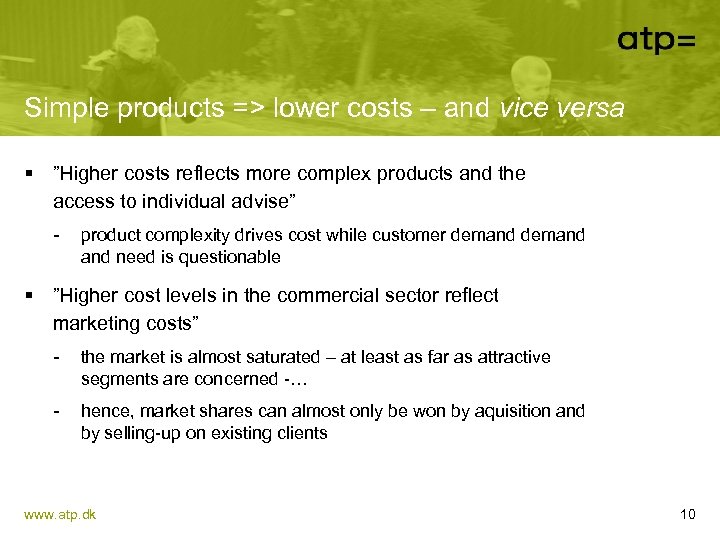

Simple products => lower costs – and vice versa § ”Higher costs reflects more complex products and the access to individual advise” - product complexity drives cost while customer demand and need is questionable § ”Higher cost levels in the commercial sector reflect marketing costs” - the market is almost saturated – at least as far as attractive segments are concerned -… - hence, market shares can almost only be won by aquisition and by selling-up on existing clients www. atp. dk 10

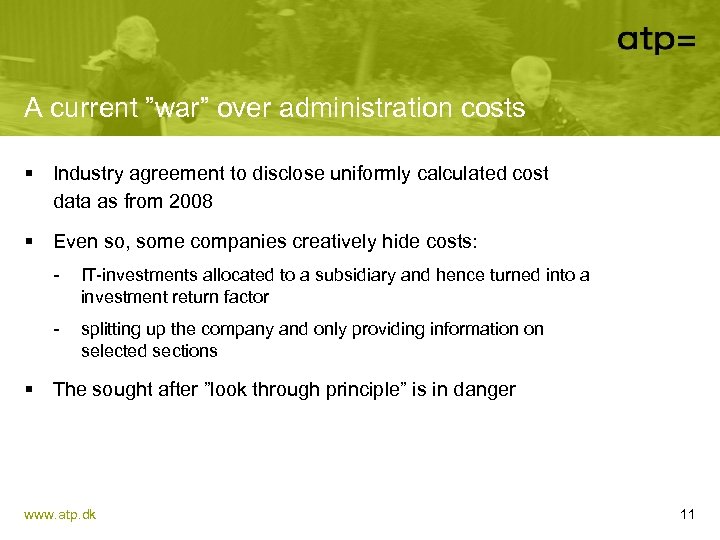

A current ”war” over administration costs § Industry agreement to disclose uniformly calculated cost data as from 2008 § Even so, some companies creatively hide costs: - IT-investments allocated to a subsidiary and hence turned into a investment return factor - splitting up the company and only providing information on selected sections § The sought after ”look through principle” is in danger www. atp. dk 11

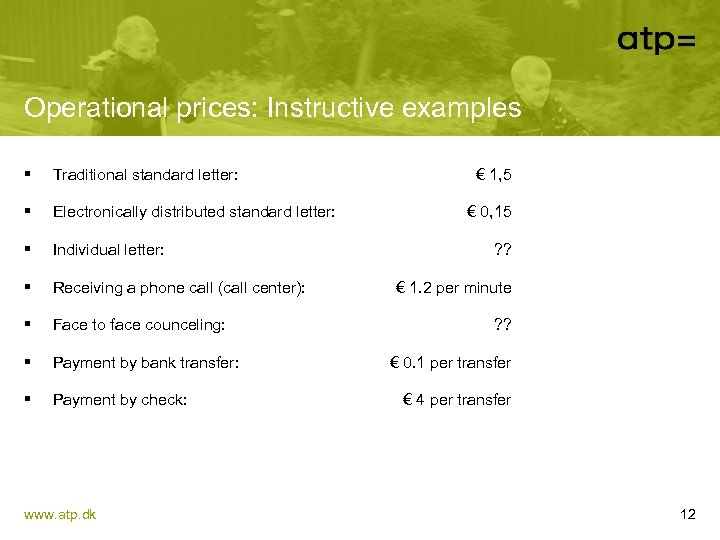

Operational prices: Instructive examples § Traditional standard letter: § Electronically distributed standard letter: § Individual letter: § Receiving a phone call (call center): § Face to face counceling: § Payment by bank transfer: § Payment by check: www. atp. dk € 1, 5 € 0, 15 ? ? € 1. 2 per minute ? ? € 0. 1 per transfer € 4 per transfer 12

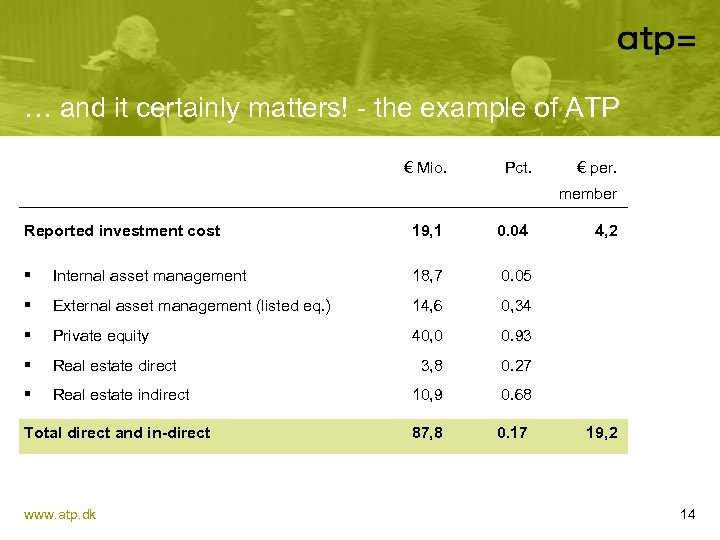

Onwards all investment costs are to be reported. . . § Annual accounts only report direct investment costs… § …making comparison impossible since most funds have out sourced their asset management § Industry initiative to report investment costs including direct as well as indirect costs - asset management by subsidiaries, separate funds or by external managers § Hence, the industry will be complying with a long time practise of ATP www. atp. dk 13

… and it certainly matters! - the example of ATP € Mio. Pct. € per. member Reported investment cost 19, 1 0. 04 § Internal asset management 18, 7 0. 05 § External asset management (listed eq. ) 14, 6 0, 34 § Private equity 40, 0 0. 93 § Real estate direct 3, 8 0. 27 § Real estate indirect 10, 9 0. 68 Total direct and in-direct 87, 8 0. 17 www. atp. dk 4, 2 19, 2 14

Few things can be said with some certainty… § Size matters greatly to investment costs… § …and so does implementation style - ATP is app. 30 pct. below peer group level § Cost levels and return levels do not correllate… § …if they do it is probably a negative one www. atp. dk 15

…and economies of scale matter more than ever § New regulatory demands and new client demands put smaller funds under pressure - e. g. asset management is increasingly being outsourced § Formation of joint administration operations § Market consolidation in the longer term? www. atp. dk 16

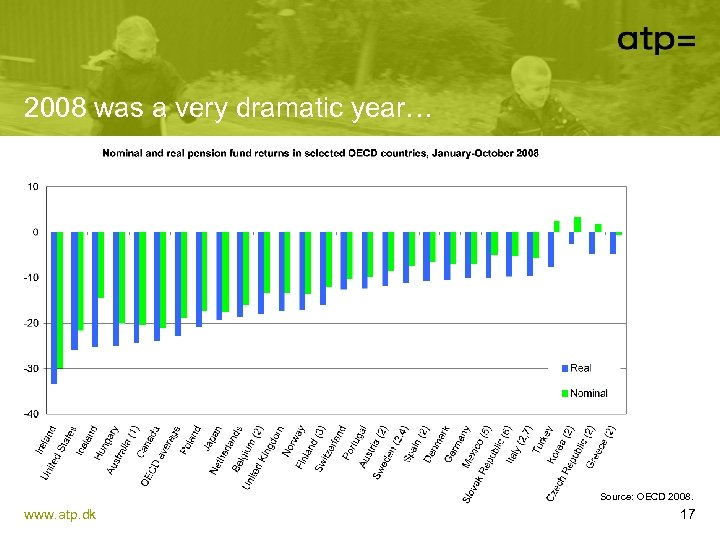

2008 was a very dramatic year… Source: OECD 2008. www. atp. dk 17

…but ATP did rather well…. § Investment result -3. 2 pct. …. § …in an upside down market § Solvency ratio of 115 pct. § Risk management is the key § Diversification and liability hedging are the key tools www. atp. dk 18

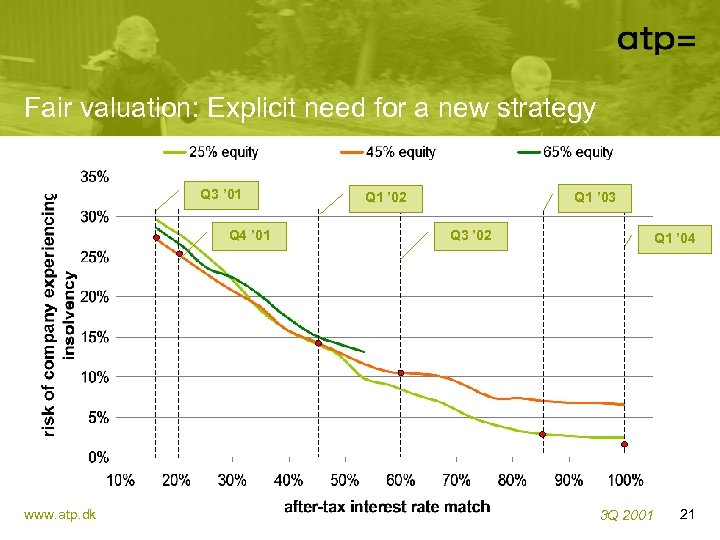

…a success we may partly owe to the Danish FSA § Fair valuation on the liabilities introduced i 2002 § Observing absolute solvency at all times while discounting liabilities at market rate § Consequences: - the interest rate risk becomes readily visible - hedging strategies and advanced risk management become key business areas § Strong need for innovation: - a new business model is needed! www. atp. dk 19

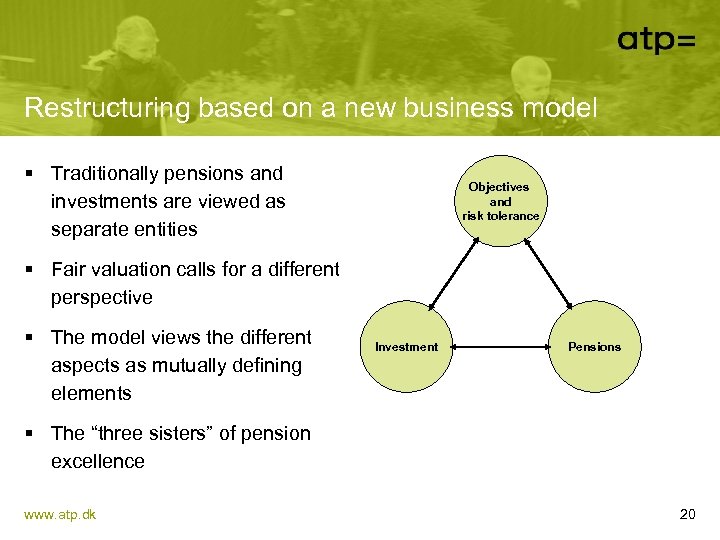

Restructuring based on a new business model § Traditionally pensions and investments are viewed as separate entities Objectives and risk tolerance § Fair valuation calls for a different perspective § The model views the different aspects as mutually defining elements Investment Pensions § The “three sisters” of pension excellence www. atp. dk 20

Fair valuation: Explicit need for a new strategy Q 3 ’ 01 Q 4 ’ 01 www. atp. dk Q 1 ’ 03 Q 1 ’ 02 Q 3 ’ 02 Q 1 ’ 04 3 Q 2001 21

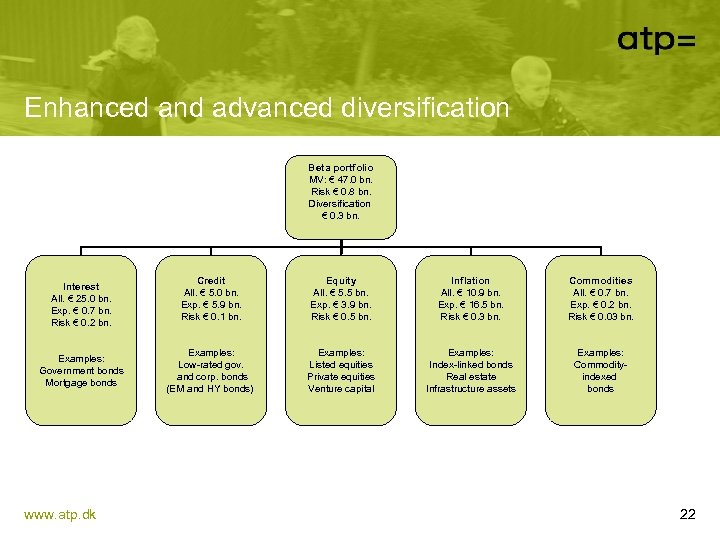

Enhanced and advanced diversification Beta portfolio MV: € 47. 0 bn. Risk € 0. 8 bn. Diversification € 0. 3 bn. Interest All. € 25. 0 bn. Exp. € 0. 7 bn. Risk € 0. 2 bn. Examples: Government bonds Mortgage bonds www. atp. dk Credit All. € 5. 0 bn. Exp. € 5. 9 bn. Risk € 0. 1 bn. Equity All. € 5. 5 bn. Exp. € 3. 9 bn. Risk € 0. 5 bn. Inflation All. € 10. 9 bn. Exp. € 16. 5 bn. Risk € 0. 3 bn. Commodities All. € 0. 7 bn. Exp. € 0. 2 bn. Risk € 0. 03 bn. Examples: Low-rated gov. and corp. bonds (EM and HY bonds) Examples: Listed equities Private equities Venture capital Examples: Index-linked bonds Real estate Infrastructure assets Examples: Commodityindexed bonds 22

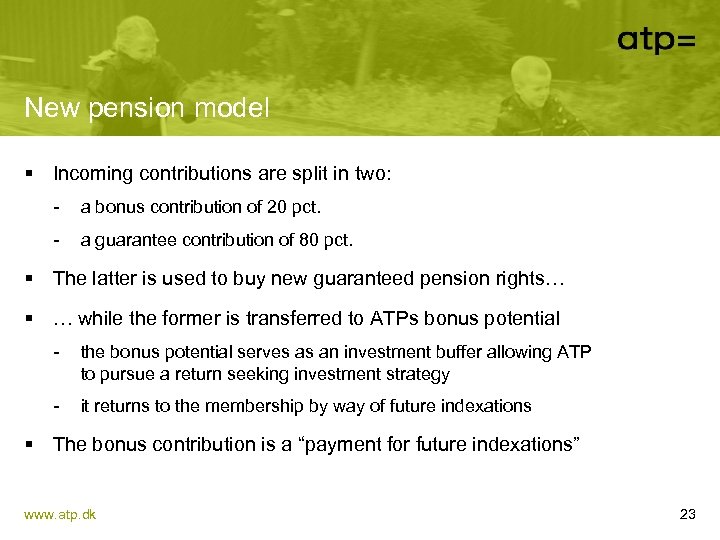

New pension model § Incoming contributions are split in two: - a bonus contribution of 20 pct. - a guarantee contribution of 80 pct. § The latter is used to buy new guaranteed pension rights… § … while the former is transferred to ATPs bonus potential - the bonus potential serves as an investment buffer allowing ATP to pursue a return seeking investment strategy - it returns to the membership by way of future indexations § The bonus contribution is a “payment for future indexations” www. atp. dk 23

Better pensions www. atp. dk 24

Shifting risk onto individuals? § The ATP strategy is slightly unique § Strong provider-driven drive towards ”market products” - traditional preference for guaranteed products – DC-based defereed annuities is to some extent abandoned - investment risk and longevity risks are shifted onto the individual § Disturbing, . . ? - there are strong alternatives allowing return seeking investment strategies and guarantees to co-exist § Keep your eyes on the ball! www. atp. dk 25

2031f8fcb084abe8f877649798bc0035.ppt