29723e06dbdf8924103c2b757ee14dd3.ppt

- Количество слайдов: 25

KAZAKHSTAN STOCK EXCHANGE INC (KASE) Relevant as at July 1, 2008

KAZAKHSTAN STOCK EXCHANGE INC (KASE) Relevant as at July 1, 2008

COEVAL OF TENGE … KASE was established on November 17, 1993 under the name of Kazakh Inter-bank Currency Exchange – two days after Tenge (the new national currency of Kazakhstan) was introduced on November 15, 1993. Nowadays, November 15 is celebrated as the official "Day of Tenge". "Old" tenge (1993– 2006) "New" tenge (since 2006)

COEVAL OF TENGE … KASE was established on November 17, 1993 under the name of Kazakh Inter-bank Currency Exchange – two days after Tenge (the new national currency of Kazakhstan) was introduced on November 15, 1993. Nowadays, November 15 is celebrated as the official "Day of Tenge". "Old" tenge (1993– 2006) "New" tenge (since 2006)

NOW COMMERCIAL KASE is a commercial joint-stock company with 72 shareholders (as of July 1, 2008). The Regional Financial Center of Almaty JSC is the largest shareholder. Other shareholders include: banks, brokerage firms, asset management companies, pension funds and other professional financial institutions. Voting method: one share – one vote.

NOW COMMERCIAL KASE is a commercial joint-stock company with 72 shareholders (as of July 1, 2008). The Regional Financial Center of Almaty JSC is the largest shareholder. Other shareholders include: banks, brokerage firms, asset management companies, pension funds and other professional financial institutions. Voting method: one share – one vote.

THE SIZE MATTERS As of July 1, 2008 own capital $9. 6 m paid up charter capital $1. 4 m issued shares 450 offered shares 450 share balance value 2. 6 m tenge

THE SIZE MATTERS As of July 1, 2008 own capital $9. 6 m paid up charter capital $1. 4 m issued shares 450 offered shares 450 share balance value 2. 6 m tenge

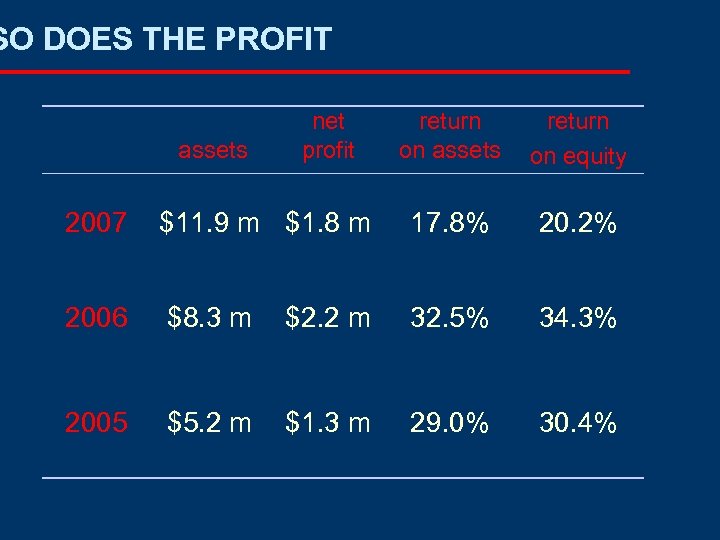

SO DOES THE PROFIT assets net profit return on assets return on equity 2007 $11. 9 m $1. 8 m 17. 8% 20. 2% 2006 $8. 3 m $2. 2 m 32. 5% 34. 3% 2005 $5. 2 m $1. 3 m 29. 0% 30. 4%

SO DOES THE PROFIT assets net profit return on assets return on equity 2007 $11. 9 m $1. 8 m 17. 8% 20. 2% 2006 $8. 3 m $2. 2 m 32. 5% 34. 3% 2005 $5. 2 m $1. 3 m 29. 0% 30. 4%

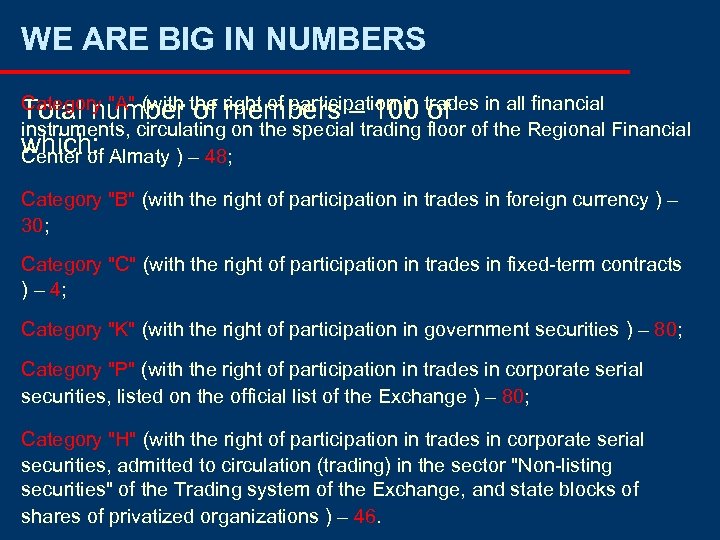

WE ARE BIG IN NUMBERS Category "A" (with the right of participation in trades in all financial Total number of members – 100 of instruments, circulating on the special trading floor of the Regional Financial which: Center of Almaty ) – 48; Category "B" (with the right of participation in trades in foreign currency ) – 30; Category "C" (with the right of participation in trades in fixed-term contracts ) – 4; Category "K" (with the right of participation in government securities ) – 80; Category "P" (with the right of participation in trades in corporate serial securities, listed on the official list of the Exchange ) – 80; Category "H" (with the right of participation in trades in corporate serial securities, admitted to circulation (trading) in the sector "Non-listing securities" of the Trading system of the Exchange, and state blocks of shares of privatized organizations ) – 46.

WE ARE BIG IN NUMBERS Category "A" (with the right of participation in trades in all financial Total number of members – 100 of instruments, circulating on the special trading floor of the Regional Financial which: Center of Almaty ) – 48; Category "B" (with the right of participation in trades in foreign currency ) – 30; Category "C" (with the right of participation in trades in fixed-term contracts ) – 4; Category "K" (with the right of participation in government securities ) – 80; Category "P" (with the right of participation in trades in corporate serial securities, listed on the official list of the Exchange ) – 80; Category "H" (with the right of participation in trades in corporate serial securities, admitted to circulation (trading) in the sector "Non-listing securities" of the Trading system of the Exchange, and state blocks of shares of privatized organizations ) – 46.

WE MAKE THE HISTORY (1) Today KASE is the single universal financial exchange in Kazakhstan with brief but bright history: 1993 – first trades with foreign currency (US dollars) 1995 – first trades with T-bills 1996 – first trades with derivatives (KZT/USD exchange rate futures) 1997 – first trades with listed shares 1997 – first trades with state blocks of shares 1997 – first trades with non-listed corporate securities 1998 – launching of "nego" deals system on KASE (instead of over-the-counter securities market )

WE MAKE THE HISTORY (1) Today KASE is the single universal financial exchange in Kazakhstan with brief but bright history: 1993 – first trades with foreign currency (US dollars) 1995 – first trades with T-bills 1996 – first trades with derivatives (KZT/USD exchange rate futures) 1997 – first trades with listed shares 1997 – first trades with state blocks of shares 1997 – first trades with non-listed corporate securities 1998 – launching of "nego" deals system on KASE (instead of over-the-counter securities market )

WE MAKE THE HISTORY (2) 1998 – first trades with eurobonds of Kazakhstan 1999 – first trades with listed corporate bonds 1999 – first trades with municipal bonds (since 2005 the issuance of these bonds is prohibited) 1999 – launching of the "nego" repo market 2001 – first trades with bonds of international financial organizations (IFO) 2001 – launching of "automatic" repo market (the most massive and active sector of the KASE market) 2002 – first trades with promissory notes 2003 – first trades with foreign T-bills (Russia 2028 & Russia 2030 )

WE MAKE THE HISTORY (2) 1998 – first trades with eurobonds of Kazakhstan 1999 – first trades with listed corporate bonds 1999 – first trades with municipal bonds (since 2005 the issuance of these bonds is prohibited) 1999 – launching of the "nego" repo market 2001 – first trades with bonds of international financial organizations (IFO) 2001 – launching of "automatic" repo market (the most massive and active sector of the KASE market) 2002 – first trades with promissory notes 2003 – first trades with foreign T-bills (Russia 2028 & Russia 2030 )

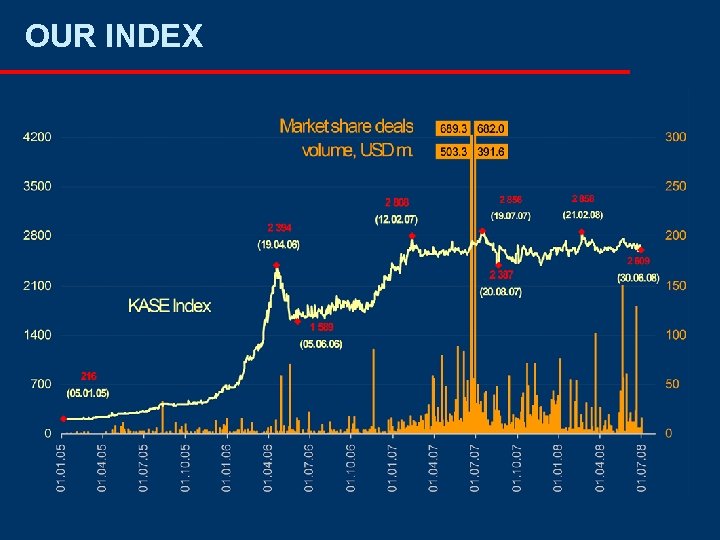

WE MAKE THE HISTORY (3) 2006 – first trades with foreign corporate bonds (JP Morgan and Merrill Lynch) 2006 – IPO of Kaz. Munai. Gas Exploration Production shares with the use of KASE settlement system 2006 – secondary distribution of KAZAKHMYS PLC (UK) shares with the use of KASE settlement system 2007 – special trading floor of the Regional Financial Center of Almaty city was founded on the base of KASE (founded to attract foreign issuers and investors) 2007 – launch of the new index on the share market – KASE Index, which continued the number series of KASE_Shares Index

WE MAKE THE HISTORY (3) 2006 – first trades with foreign corporate bonds (JP Morgan and Merrill Lynch) 2006 – IPO of Kaz. Munai. Gas Exploration Production shares with the use of KASE settlement system 2006 – secondary distribution of KAZAKHMYS PLC (UK) shares with the use of KASE settlement system 2007 – special trading floor of the Regional Financial Center of Almaty city was founded on the base of KASE (founded to attract foreign issuers and investors) 2007 – launch of the new index on the share market – KASE Index, which continued the number series of KASE_Shares Index

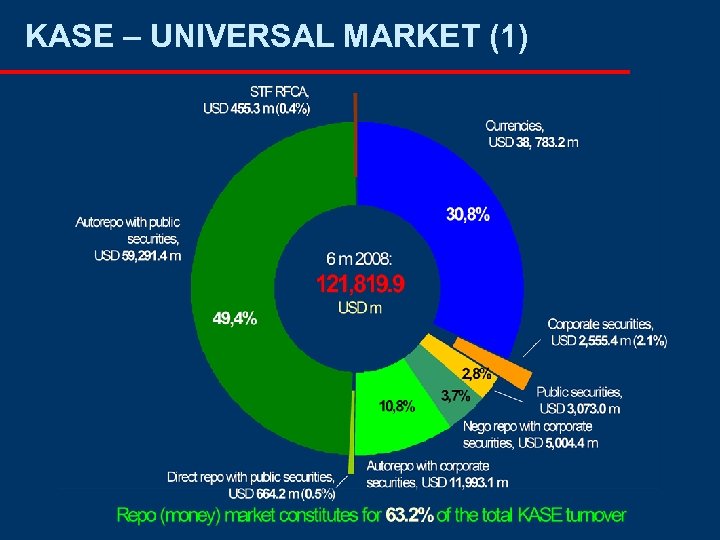

KASE – UNIVERSAL MARKET (1)

KASE – UNIVERSAL MARKET (1)

KASE – UNIVERSAL MARKET (2) KASE serves the markets of: ü "nego" and "automatic" repo with public and corporate securities ü foreign currencies (US dollar, euro, Russian rouble) ü public securities of Kazakhstan issued by the National Bank, municipalities and Ministry of Finance (including international bonds of Kazakhstan) ü IFO bonds and foreign T-bills ü promissory notes ü equities

KASE – UNIVERSAL MARKET (2) KASE serves the markets of: ü "nego" and "automatic" repo with public and corporate securities ü foreign currencies (US dollar, euro, Russian rouble) ü public securities of Kazakhstan issued by the National Bank, municipalities and Ministry of Finance (including international bonds of Kazakhstan) ü IFO bonds and foreign T-bills ü promissory notes ü equities

A GREAT VARIETY OF BONDS ü "regular" domestic bonds (nominated in Tenge or foreign currencies, with discount or coupon, with fixed or floating coupon) ü international bonds of Kazakhstani issuers ü agency bonds (with the tax regime equal to the tax regime of T-bills) ü infrastructural bonds (secured by the government guarantee) ü bonds of foreign issuers (previously registered outside Kazakhstan) ü soon: bonds of foreign issuers (registered in Kazakhstan)

A GREAT VARIETY OF BONDS ü "regular" domestic bonds (nominated in Tenge or foreign currencies, with discount or coupon, with fixed or floating coupon) ü international bonds of Kazakhstani issuers ü agency bonds (with the tax regime equal to the tax regime of T-bills) ü infrastructural bonds (secured by the government guarantee) ü bonds of foreign issuers (previously registered outside Kazakhstan) ü soon: bonds of foreign issuers (registered in Kazakhstan)

REPO AND FOREX MARKET DOMINANCE KASE repo market is specially designed for domestic purposes – to satisfy the needs of local pension funds and banks in short-term money borrowing and lending. KASE foreign currencies market – the basic trading floor for the National Bank of the Republic of Kazakhstan to regulate the exchange rate of Tenge. KZT/USD: the KASE exchange rate today = official exchange rate tomorrow.

REPO AND FOREX MARKET DOMINANCE KASE repo market is specially designed for domestic purposes – to satisfy the needs of local pension funds and banks in short-term money borrowing and lending. KASE foreign currencies market – the basic trading floor for the National Bank of the Republic of Kazakhstan to regulate the exchange rate of Tenge. KZT/USD: the KASE exchange rate today = official exchange rate tomorrow.

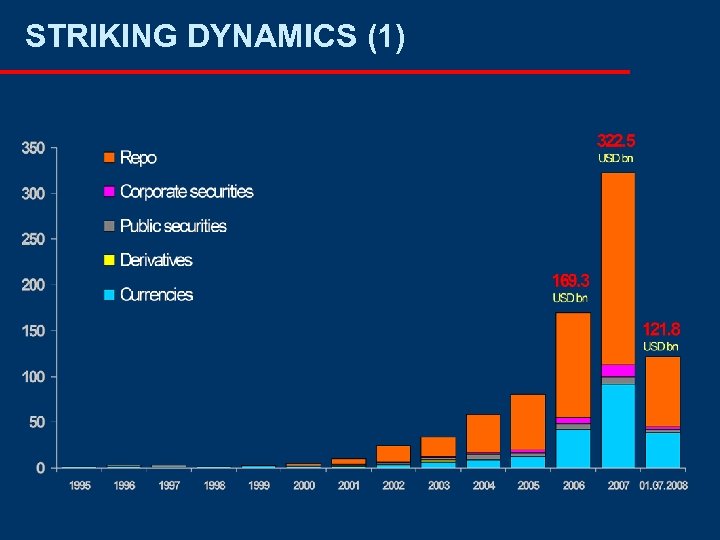

STRIKING DYNAMICS (1)

STRIKING DYNAMICS (1)

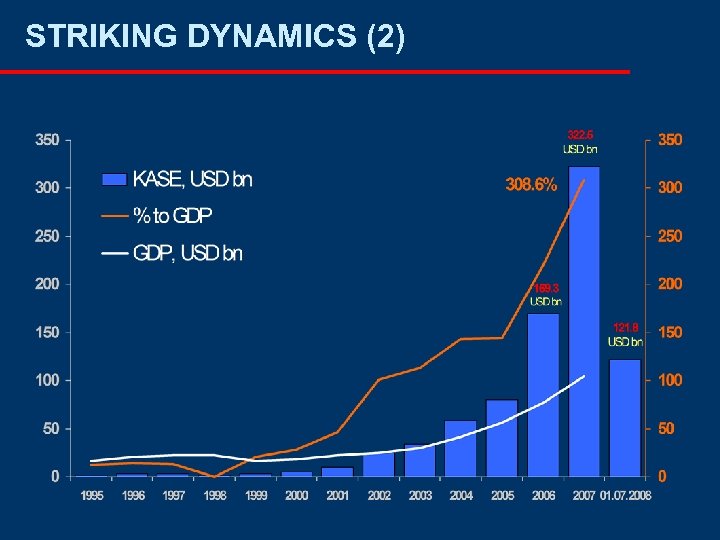

STRIKING DYNAMICS (2)

STRIKING DYNAMICS (2)

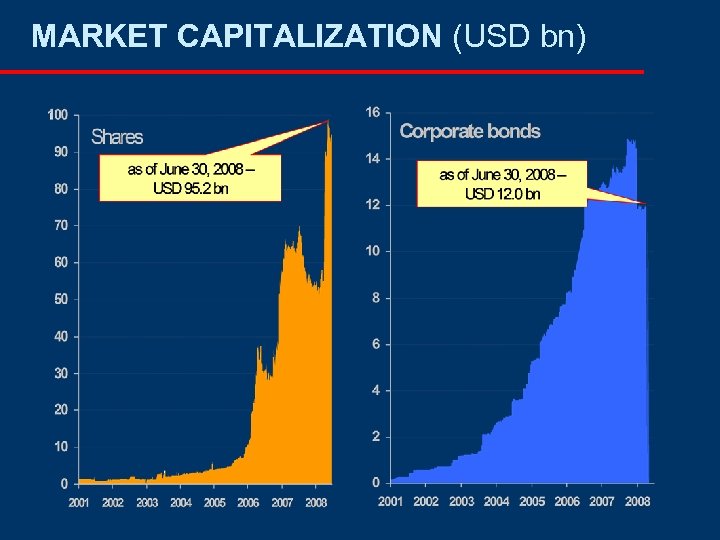

MARKET CAPITALIZATION (USD bn)

MARKET CAPITALIZATION (USD bn)

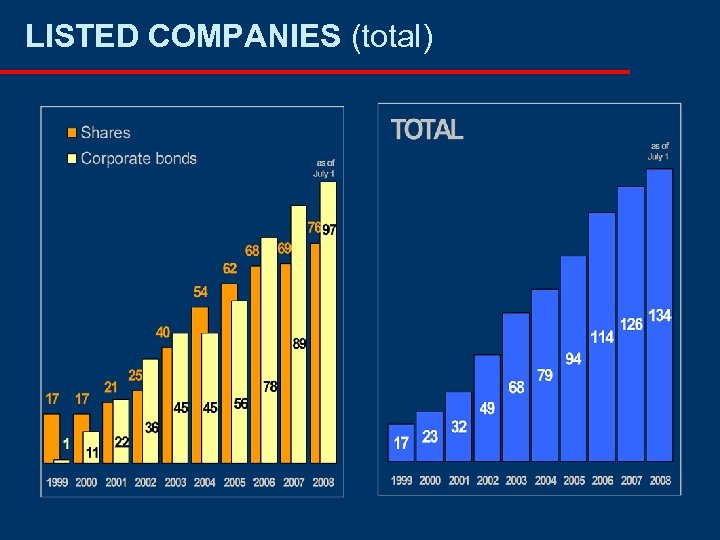

LISTED COMPANIES (total)

LISTED COMPANIES (total)

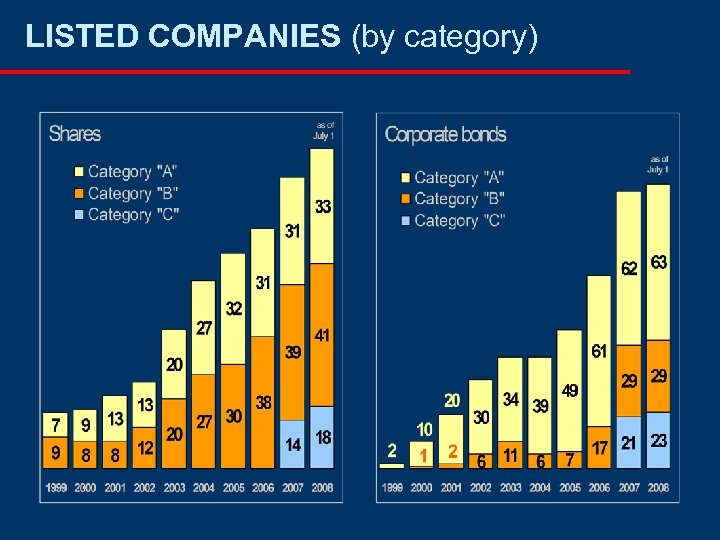

LISTED COMPANIES (by category)

LISTED COMPANIES (by category)

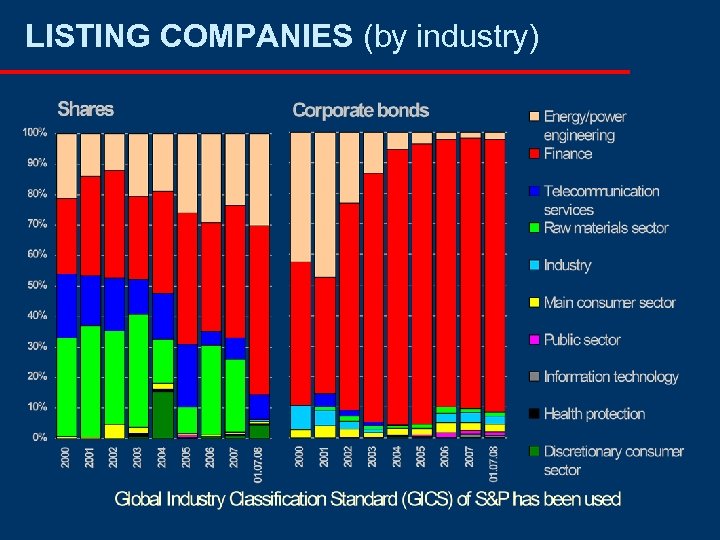

LISTING COMPANIES (by industry)

LISTING COMPANIES (by industry)

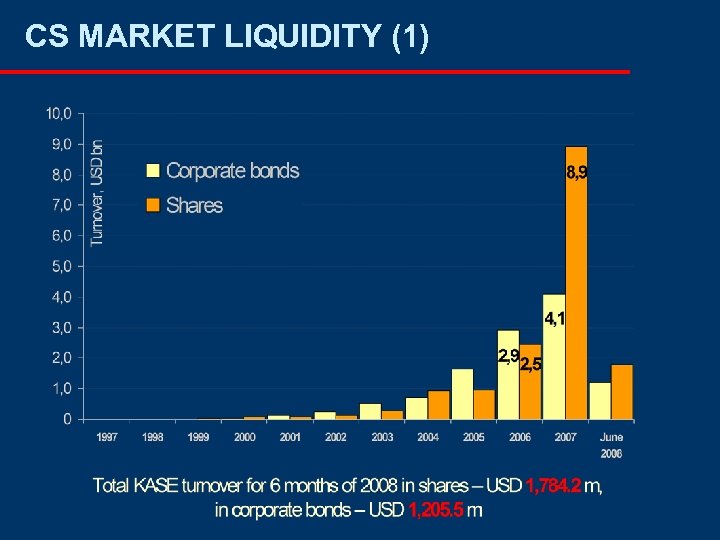

CS MARKET LIQUIDITY (1)

CS MARKET LIQUIDITY (1)

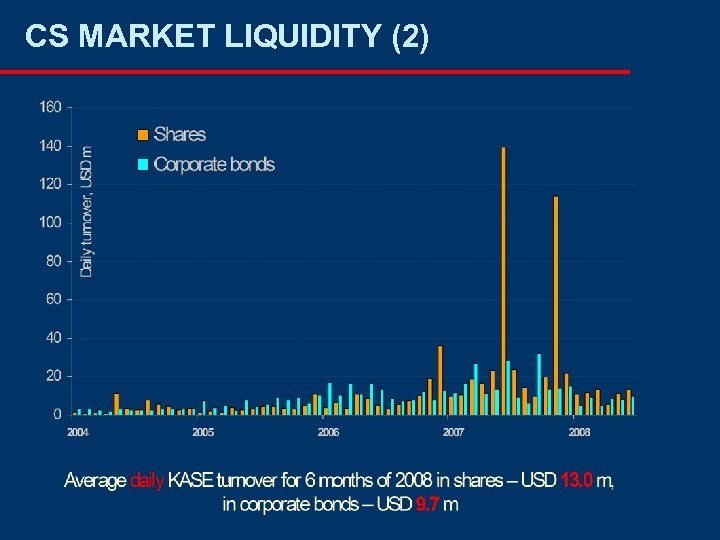

CS MARKET LIQUIDITY (2)

CS MARKET LIQUIDITY (2)

MAIN PROBLEMS OF THE MARKET The main problems are: • lack of free-float equities (the heritage of case-bycase privatization) • conservative policy of the main domestic investors ("buy bonds and hold till maturity")

MAIN PROBLEMS OF THE MARKET The main problems are: • lack of free-float equities (the heritage of case-bycase privatization) • conservative policy of the main domestic investors ("buy bonds and hold till maturity")

OUR INDEX

OUR INDEX

ON OUR TECHNOLOGIES KASE uses its own trading platform: ü on-screen based electronic "Server – Client" system ü remote access ü electronic signature and electronic documents circulation ü traffic encryption ü on-line data saving

ON OUR TECHNOLOGIES KASE uses its own trading platform: ü on-screen based electronic "Server – Client" system ü remote access ü electronic signature and electronic documents circulation ü traffic encryption ü on-line data saving

CONTACT US … Internet: e-mail: www. kase. kz kase@kase. kz phone: (+7 727) 237 53 00, 272 98 98, 237 53 11, 272 06 00 fax: (+7 727) 296 64 02, 272 09 25 address: 291/3 a, Dostyk ave, Almaty, Kazakhstan

CONTACT US … Internet: e-mail: www. kase. kz kase@kase. kz phone: (+7 727) 237 53 00, 272 98 98, 237 53 11, 272 06 00 fax: (+7 727) 296 64 02, 272 09 25 address: 291/3 a, Dostyk ave, Almaty, Kazakhstan