d2ddb640d6377b7f6b14bcc13328e83f.ppt

- Количество слайдов: 47

kar. RKb; RKghir. BaØvtßúsa. Far. N³s Rmab; GPiv. DÆn_vis½y. Cnb. T ¬ Epñk. TI 1¦ CMn. Yyts. MNgrbs; Fna. Kar. GPiv. D KNenyüCan; x<s; 1Æn_Gasu. I elx 0133 -CAM m. Uldæan. Ts. Sna. Tan éf¶TI 1³ 07 -mifuna-2010 én. KNenyürdæa. Pi)al Ts. Sna. Tan. KNenyü ADB Grant No. 0133 -CAM/Component 1: PFMRD

éf¶TI 1³ Ts. Sna. Tanrdæa. Pi)al matika e. Kalb e. Rbobe MNg nig Gñke. R b. IR)as; KNeny ürdæa Pi)al Fob. KN enyürd æa. Pi)al Cam. Yy KNeny üBa. Ni. C ¢kmµ ADB Grant No. 0133 -CAM/Component 1: PFMRD vi. Fan nig. Ts. S na. Tan KNeny ü 2

e. Kalb. MNgrbs; KNenyü • karkt; Rta. Rbtibtþikar. KNen yü • Pa. BCa. Gñk. RKb; RKg. RTBü • kar. RKb; RKg. B½t’man • kare. FVIesckþIse. Rmccitþ • karerobc. Mfvika nig KNenyüPa. B • karvaytémøel. Ikarvinieya. K tmøa. Pa. Bén. Rbtibtþikar nig ¬Rbtibtþikarhir. BaØvtßú¦n • lkçN³Rtwm. Rt. Uvtam • B½t’mansa. Far. N³ ana ¬c, ab; ¼vi. Fan – ADB Grant No. 0133 -CAM/Component 1: PFMRD 3

Gñke. Rb. IR)as; KNenyürdæa. Pi) rdæs. Pa ¼ al s. Pa. Gnum½tc, ab; rdæm®nþI nig fñak; dwkna. Mrdæelxa. Fikar nig naykdæan kmµvi. FI sa. Far. NCn. TUe. TA nig Ke. Rmag. Rb. B½n§p. SBVp. Say KN³kmµakar. KNenyür dæa. Pi)al vi. Tüasßan. Gnþr. Cati NTayik ¼ GñkpÁt; pÁg; nig Gñkpþl; CMn. Yy sßab½npþl; km©I nig svnkr nig Fna. Kar GCJa. Frmansmtßkic©n ana ADB Grant No. 0133 -CAM/Component 1: PFMRD 4

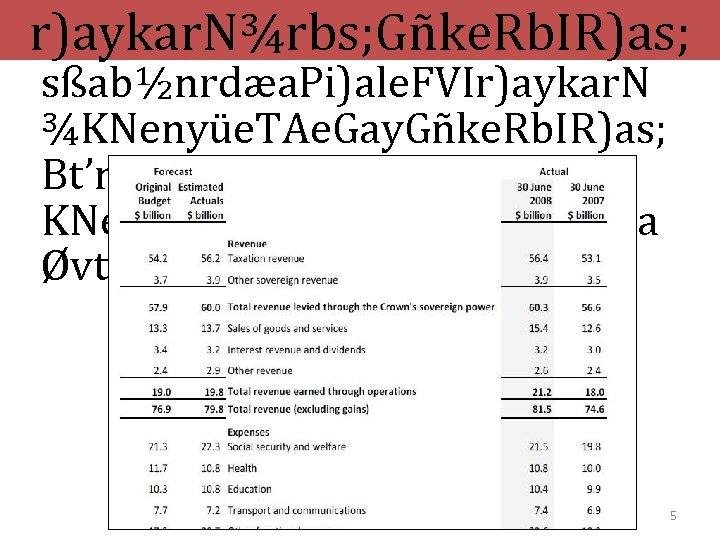

r)aykar. N¾rbs; Gñke. Rb. IR)as; sßab½nrdæa. Pi)ale. FVIr)aykar. N ¾KNenyüe. TAe. Gay. Gñke. Rb. IR)as; Bt’man KNenyüedayecjr)aykar. N¾hir. Ba Øvtßú. 5

Rbe. PTénr)aykar. N¾hir. BaØvtß ú r)aykar. N¾hi r. BaØvtßú e. Kalb. MNgr)a ykar. N¾ hir. BaØvtßúT Ue. TA ADB Grant No. 0133 -CAM/Component 1: PFMRD 6

e. Kalb. MNgr)aykar. N¾hir. BaØvt ßúTUe. TA • r)aykar. N¾hir. BaØvtßúTa. Mgen. Hecje Gay. Gñke. Rb. IR)as; Ta. Mg. Lay. Na. Edlminca M)ac; e)a sgÁms Tam. Tarr)aykar. N¾hir. BaØvtßúCak; lak; Iuvil Heq nigsß Nam. Yy. ñat ab½n • s. Mrab; rdæa. Pi)almann½yee. Gaysa. Far Rb. C NCn. TUe. TAdwg. t. MNa gra. Rs a. Blr Gñke Gtifi. C Rb. Ies þ n nig dæ sar GgÁni vakm Gñkp Át; pÁ g; µrbs; rdæa Bt’ man tib. Ba Øti 7

e. Kalb. MNgr)aykar. N¾hir. BaØvt sßa ßúBiess b½ • r)aykar. N¾hi r. BaØvtßúTa Mgen. Hecje. Ga y. Gñke. Rb. IR)a s; Ta. Mg. Lay. Na Edlca. M)ac; Ta m. Tar r)aykar. N¾hi r. BaØvtßúCak; lak; Nam. Yy. • s. Mrab; Gñke nrd sßab æa. P ½n. R i)al Kb; R Kg Ke. R mag m. Ul ni. Fi 8

e. Kalb. MNgr)aykar. N¾hir. BaØvtß • KNenyühir. Ba nig. TUe. TA úBiess e. Kalb. MNgr)ayka Øvtßú r. N¾hir. BaØvtßú ¬karqøúHb. Ba TUe. TA ©a. Mg. BI sßan. Pa. Bc, ab; fv ika. Rbca. Mqña. M ¦ • kar. RKb; RKgf vika. Rbca. Mqña M. e. Kalb. MNgr)ayka r. N¾hir. BaØvtßú Biess • b. Nþa. KNn. IKe Rmag. Cayfa Rbe. PT • b. Nþa. KNn. Im. U lni. Fiyfa Rbe. PT ADB Grant No. 0133 -CAM/Component 1: PFMRD 9

KNn. IRKb; RKgépÞkñúg • kñúg. Bt’manb. Enßmc. Me. Ba. Hr) aykar. N¾hir. BaØvtßúsßab½nr dæa. Pi)al Rt. Uv. Etrk. Sakarkt; Rta. KNn. IRKb; RKge. Gay)anl. MGit s. Mrab; kar e. Rb. IR)as; épÞkñúg. Etm. Yy. Kt ; . ¬d. Uc. KNn. IGa. CIvkmµ¦ ADB Grant No. 0133 -CAM/Component 1: PFMRD 10

KNenyü KNn. IRKb; RKgé r)aykar. N pÞkñúg ¾hir ¬e. Rb. Is. Mrba; ép r)ayk tulüka ar. N rsac; R) BaØvtßú Þkñúg. Etm. Yy. Kt ¾éfø ak; kar l. MGit e. Kal ; ¦ énkar ed. Im. pÁÚrp b. MN gr)ay kar. N ¾TU ¾Bie kt; Rta r)ayk Ág; ar. N Fna. Kar RTBü ¾Rt karpÁ l. MGit Yt. Bin ÚrpÁg; énkar 11

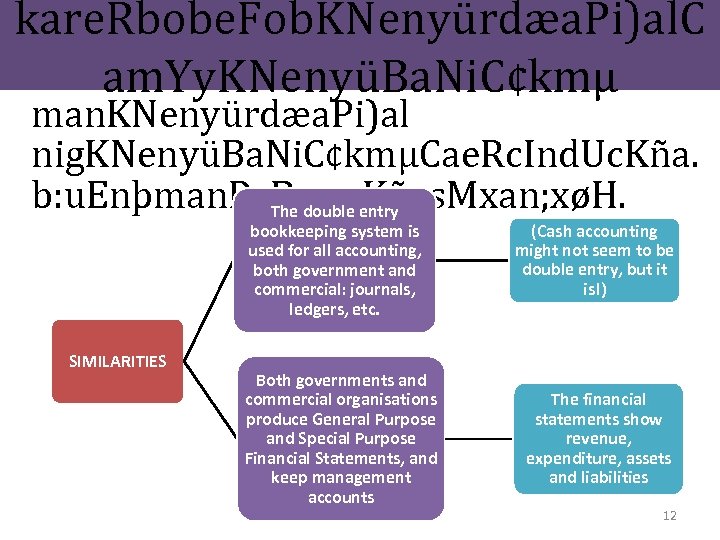

kare. Rbobe. Fob. KNenyürdæa. Pi)al. C am. Yy. KNenyüBa. Ni. C¢kmµ man. KNenyürdæa. Pi)al nig. KNenyüBa. Ni. C¢kmµCae. Rc. Ind. Uc. Kña. b: u. Enþman. Pa. Bxus entry Kñas. Mxan; xøH. The double bookkeeping system is used for all accounting, both government and commercial: journals, ledgers, etc. SIMILARITIES Both governments and commercial organisations produce General Purpose and Special Purpose Financial Statements, and keep management accounts (Cash accounting might not seem to be double entry, but it is!) The financial statements show revenue, expenditure, assets and liabilities 12

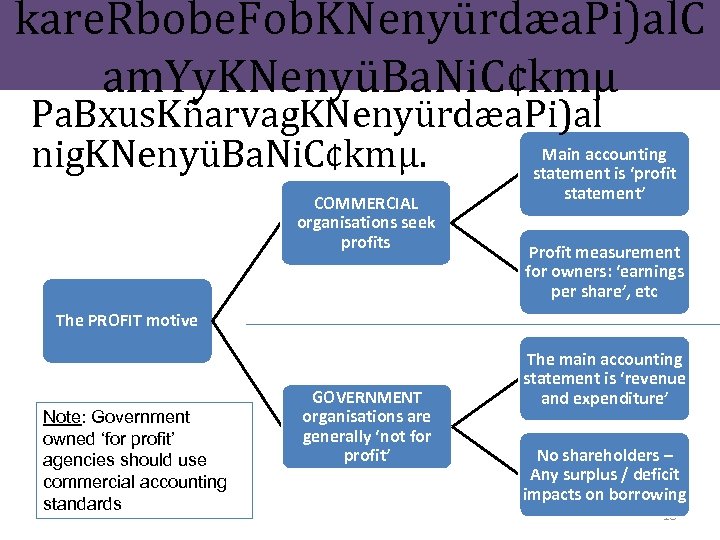

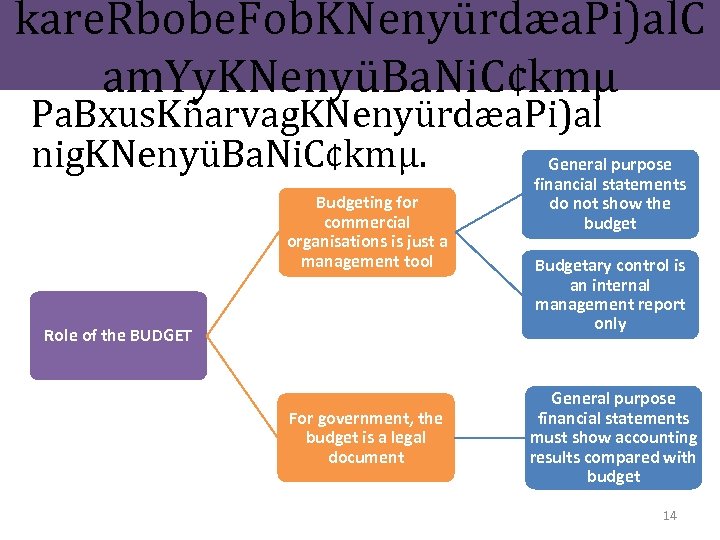

kare. Rbobe. Fob. KNenyürdæa. Pi)al. C am. Yy. KNenyüBa. Ni. C¢kmµ Pa. Bxus. Kñarvag. KNenyürdæa. Pi)al Main accounting nig. KNenyüBa. Ni. C¢kmµ. statement is ‘profit COMMERCIAL organisations seek profits statement’ Profit measurement for owners: ‘earnings per share’, etc The PROFIT motive Note: Government owned ‘for profit’ agencies should use commercial accounting standards GOVERNMENT organisations are generally ‘not for profit’ The main accounting statement is ‘revenue and expenditure’ No shareholders – Any surplus / deficit impacts on borrowing 13

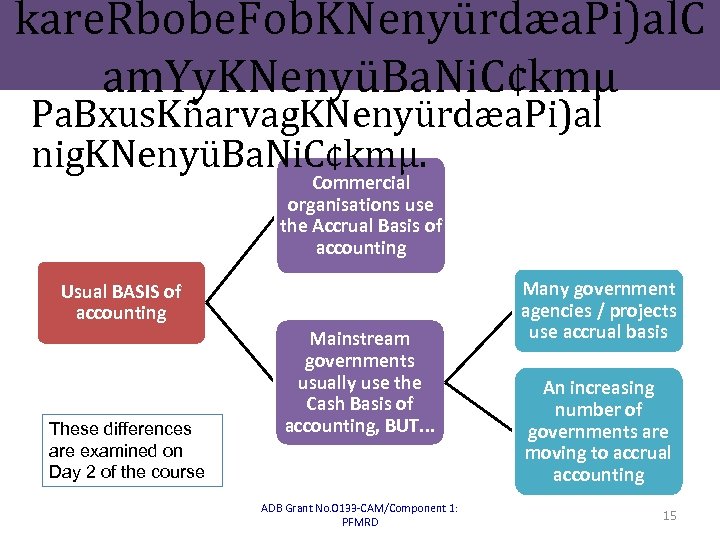

kare. Rbobe. Fob. KNenyürdæa. Pi)al. C am. Yy. KNenyüBa. Ni. C¢kmµ Pa. Bxus. Kñarvag. KNenyürdæa. Pi)al nig. KNenyüBa. Ni. C¢kmµ. General purpose Budgeting for commercial organisations is just a management tool Role of the BUDGET For government, the budget is a legal document financial statements do not show the budget Budgetary control is an internal management report only General purpose financial statements must show accounting results compared with budget 14

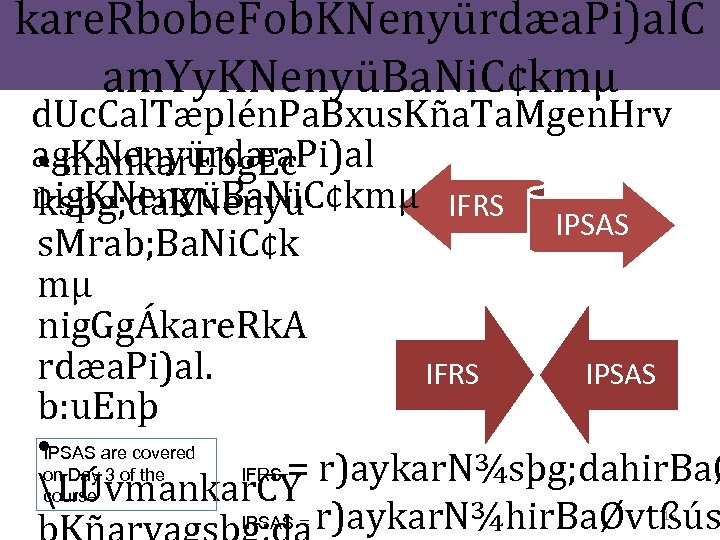

kare. Rbobe. Fob. KNenyürdæa. Pi)al. C am. Yy. KNenyüBa. Ni. C¢kmµ Pa. Bxus. Kñarvag. KNenyürdæa. Pi)al nig. KNenyüBa. Ni. C¢kmµ. Commercial organisations use the Accrual Basis of accounting Usual BASIS of accounting These differences are examined on Day 2 of the course Mainstream governments usually use the Cash Basis of accounting, BUT. . . ADB Grant No. 0133 -CAM/Component 1: PFMRD Many government agencies / projects use accrual basis An increasing number of governments are moving to accrual accounting 15

kare. Rbobe. Fob. KNenyürdæa. Pi)al. C am. Yy. KNenyüBa. Ni. C¢kmµ d. Uc. Cal. Tæplén. Pa. Bxus. Kña. Ta. Mgen. Hrv ag. KNenyürdæa. Pi)al • mankar. Ebg. Ec nig. KNenyüBa. Ni. C¢kmµ IFRS ksþg; da. KNenyü IPSAS s. Mrab; Ba. Ni. C¢k mµ nig. GgÁkare. Rk. A rdæa. Pi)al. IFRS IPSAS b: u. Enþ IPSAS • are covered IFRS = r)aykar. N¾sþg; dahir. BaØ on Day 3 of the LÚvmankar. CY course IPSAS = r)aykar. N¾hir. BaØvtßús 16

vi. Fan. KNenyü nig. Ts. Sna. Tan ey. Ignwg. Bi. BN’na³ 1> RBMEdnénvi. Fan 2> karvas; Evgvi. Fannana 3> vi. Fan. Rbkbedays. Il. Fm’ 4> muxgarc. MNUl nigm. Ul. Fn 5> vi. Fanvayt. Mél. RTBü ADB Grant No. 0133 -CAM/Component 1: PFMRD 17

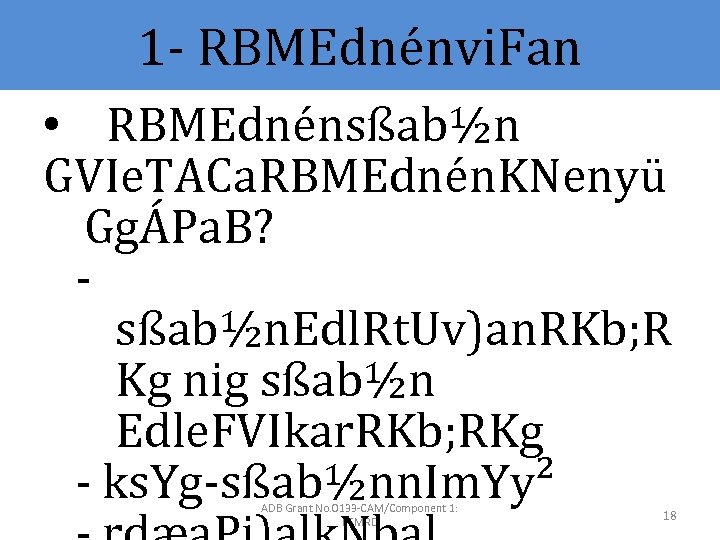

1 - RBMEdnénvi. Fan • RBMEdnénsßab½n GVIe. TACa. RBMEdnén. KNenyü GgÁPa. B? sßab½n. Edl. Rt. Uv)an. RKb; R Kg nig sßab½n Edle. FVIkar. RKb; RKg - ks. Yg-sßab½nn. Im. Yy² ADB Grant No. 0133 -CAM/Component 1: PFMRD 18

1 - RBMEdnénvi. Fan ¬t¦ • RBMEdnénkariybriecäT - Ca. TUe. TA 12 Ex s. Rmab; KNenyüRKb; RKged ayc, ab; b: u. Enþk¾d. Uc. Kña. Edrs. Rm ab; KNenyüRKb; RKgtame. B ADB Grant No. 0133 -CAM/Component 1: PFMRD 19

2 - xñatvas; énvi. Fan R)ak; kas • karvas; Evg. TUe. TA témøBImun • éføed. Ime. Bl. Tijc. Ul. RTBü RTIsþIep. Sgénkarvayt. Mél. R TBü • Epñkel. Im. Uldæan. Gaclk; )an ¬bnÞab; BIRTBü)ane. Rb. Ir. Yc¦ smi. T§ikmµ • karpÁÚrpÁg. Cam. Yy. RBwtþkar. N¾E TidæPa. BTs. Sna. Tane. TVr. Tis dl)anek. Ite. LIg ³ KNenyüe. TVPa. K • kar. Gacpat; ecal)an • epþate. TAel. Imuxgaresdækic©Casa 20

2 - xñatvas; énvi. Fan³ karpÁÚrpÁg; Ts. Sna. Tan • kar. P¢ab; Rbtibtþikarkñúg k. MLúge. Bl. Nam. Yy. Edlek. Ite LIg. • Ts. Sna. Tan. KWe. Rb. Ien. Akñú g. KNenyübgÁr b: u. Enþminman. KN enyüsac; R)ak; . 21

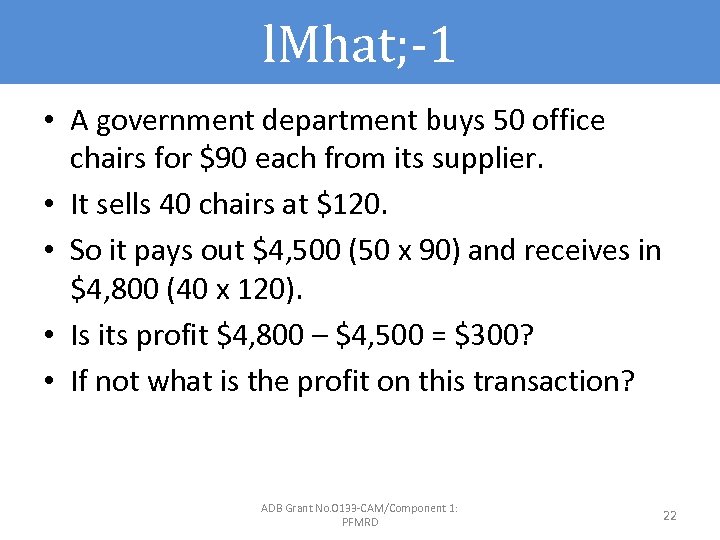

l. Mhat; -1 • A government department buys 50 office chairs for $90 each from its supplier. • It sells 40 chairs at $120. • So it pays out $4, 500 (50 x 90) and receives in $4, 800 (40 x 120). • Is its profit $4, 800 – $4, 500 = $300? • If not what is the profit on this transaction? ADB Grant No. 0133 -CAM/Component 1: PFMRD 22

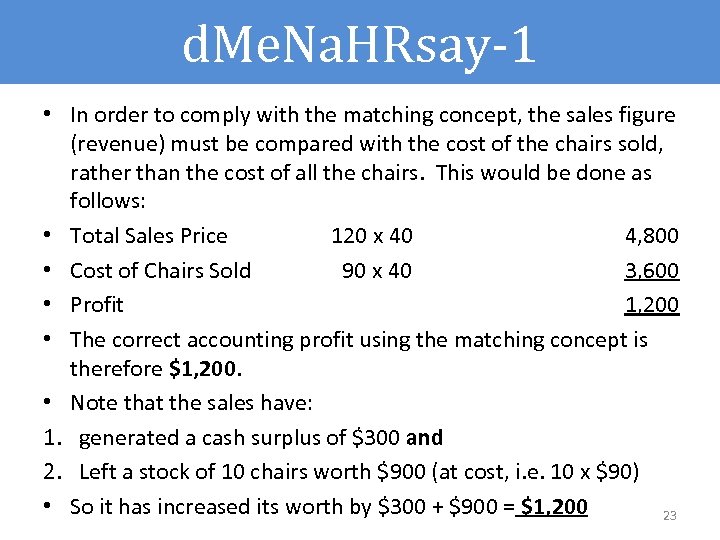

d. Me. Na. HRsay-1 • In order to comply with the matching concept, the sales figure (revenue) must be compared with the cost of the chairs sold, rather than the cost of all the chairs. This would be done as follows: • Total Sales Price 120 x 40 4, 800 • Cost of Chairs Sold 90 x 40 3, 600 • Profit 1, 200 • The correct accounting profit using the matching concept is therefore $1, 200. • Note that the sales have: 1. generated a cash surplus of $300 and 2. Left a stock of 10 chairs worth $900 (at cost, i. e. 10 x $90) • So it has increased its worth by $300 + $900 = $1, 200 23

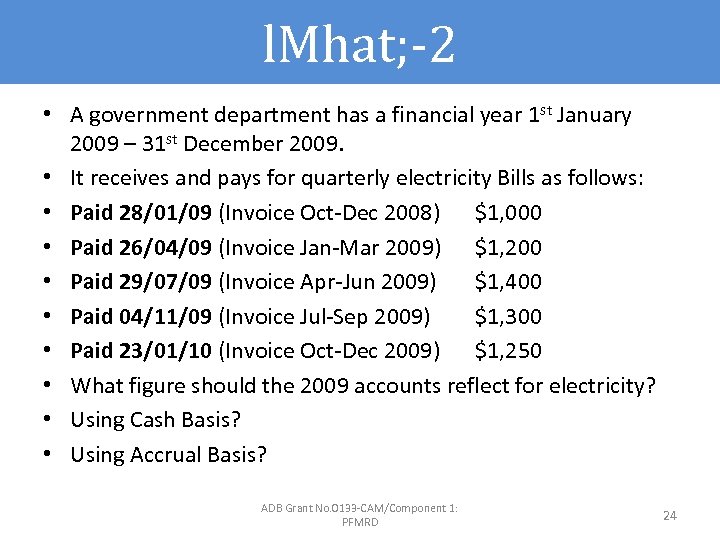

l. Mhat; -2 • A government department has a financial year 1 st January 2009 – 31 st December 2009. • It receives and pays for quarterly electricity Bills as follows: • Paid 28/01/09 (Invoice Oct-Dec 2008) $1, 000 • Paid 26/04/09 (Invoice Jan-Mar 2009) $1, 200 • Paid 29/07/09 (Invoice Apr-Jun 2009) $1, 400 • Paid 04/11/09 (Invoice Jul-Sep 2009) $1, 300 • Paid 23/01/10 (Invoice Oct-Dec 2009) $1, 250 • What figure should the 2009 accounts reflect for electricity? • Using Cash Basis? • Using Accrual Basis? ADB Grant No. 0133 -CAM/Component 1: PFMRD 24

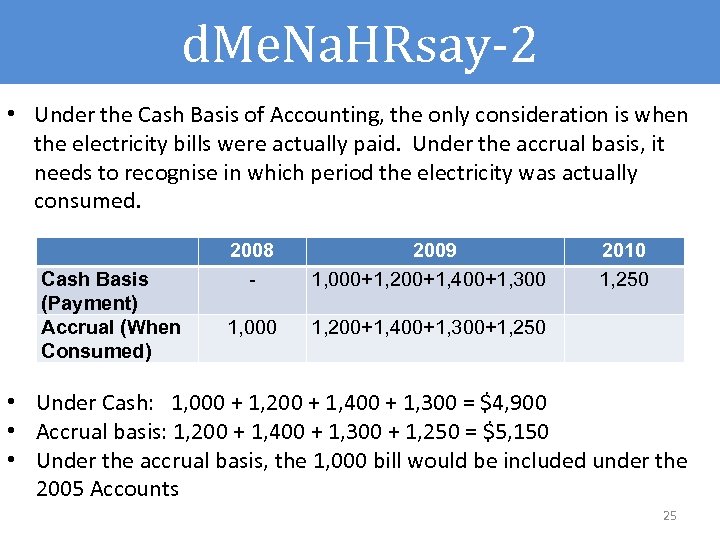

d. Me. Na. HRsay-2 • Under the Cash Basis of Accounting, the only consideration is when the electricity bills were actually paid. Under the accrual basis, it needs to recognise in which period the electricity was actually consumed. Cash Basis (Payment) Accrual (When Consumed) 2008 - 2009 1, 000+1, 200+1, 400+1, 300 1, 000 2010 1, 250 1, 200+1, 400+1, 300+1, 250 • Under Cash: 1, 000 + 1, 200 + 1, 400 + 1, 300 = $4, 900 • Accrual basis: 1, 200 + 1, 400 + 1, 300 + 1, 250 = $5, 150 • Under the accrual basis, the 1, 000 bill would be included under the 2005 Accounts 25

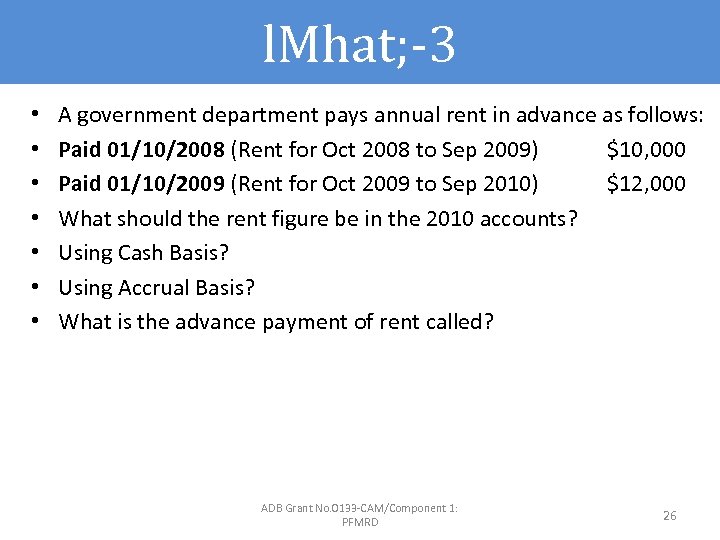

l. Mhat; -3 • • A government department pays annual rent in advance as follows: Paid 01/10/2008 (Rent for Oct 2008 to Sep 2009) $10, 000 Paid 01/10/2009 (Rent for Oct 2009 to Sep 2010) $12, 000 What should the rent figure be in the 2010 accounts? Using Cash Basis? Using Accrual Basis? What is the advance payment of rent called? ADB Grant No. 0133 -CAM/Component 1: PFMRD 26

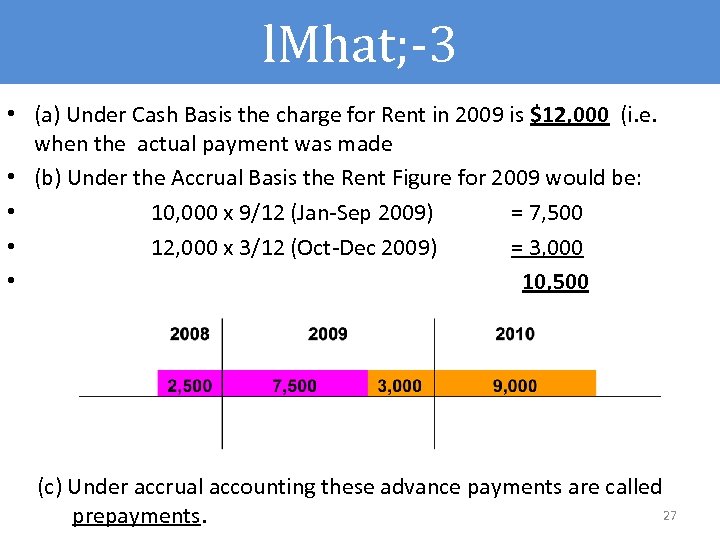

l. Mhat; -3 • (a) Under Cash Basis the charge for Rent in 2009 is $12, 000 (i. e. when the actual payment was made • (b) Under the Accrual Basis the Rent Figure for 2009 would be: • 10, 000 x 9/12 (Jan-Sep 2009) = 7, 500 • 12, 000 x 3/12 (Oct-Dec 2009) = 3, 000 • 10, 500 (c) Under accrual accounting these advance payments are called 27 prepayments.

3 - vi. Fan. Rbkbeday. Rkbs. Il. Fm’ • • vtßúvis½y n. Itüanuk. Ul. Pa. B sgÁt. Pa. B kar. Rbug. Rby½tñ ADB Grant No. 0133 -CAM/Component 1: PFMRD 28

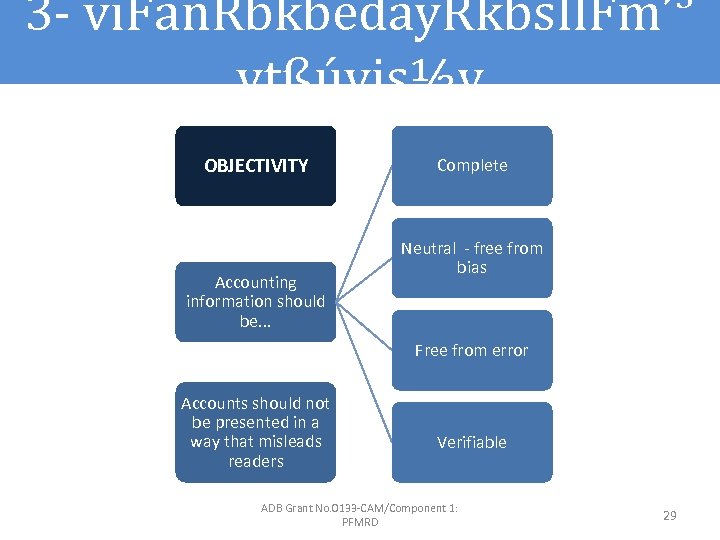

3 - vi. Fan. Rbkbeday. Rkbs. Il. Fm’³ vtßúvis½y OBJECTIVITY Accounting information should be. . . Complete Neutral - free from bias Free from error Accounts should not be presented in a way that misleads readers Verifiable ADB Grant No. 0133 -CAM/Component 1: PFMRD 29

3 - vi. Fan. Rbkbeday. Rkbs. Il. Fm’³ n. Itüanuk. Ul. Pa. B n. Itüanuk. Ul. P a. B • KNenyüRt. Uv)anerobc. Me. LIge TAtamc, ab; nigb. BaØti. KNenyü Rt. Uvmankar. TTYlsÁal; KNenyü CalkçNHsþg; tamb. Tdæan. ]Ta³ - ral; Rbtibtþikarhir. BaØvtßúKYr. E t. Rt. Uv)anb. BaÚ©len. Akñúgk. MNt; R ADB Grant No. 0133 -CAM/Component 1: PFMRD 30

3 - vi. Fan. Rbkbeday. Rkbs. Il. Fm’³ n. Itüanuk. Ul. Pa. B ¬t¦ n. Itüanuk. Ul. P a. B - man. Et. Rbtibtþikar. Edl. Tak; Tg Rbtibtþikarhir. BaØvtßúCak; E sþge. T Edl. Rt. Uvb. Ba©Úlkñúg. KNn. I - Rbtibtþikar. Ta. Mg. Gs; KYr. Et. Rt Uv)anbriyay nig. Ecktam. Rbe. PT ADB Grant No. 0133 -CAM/Component 1: PFMRD 31

3 - vi. Fan. Rbkbeday. Rkbs. Il. Fm’³ n. Itüanuk. Ul. Pa. B ¬t¦ n. Itüanuk. Ul. P a. B - Gñkkt; Rta. KYr. Etrk. Sa. Tuk. Pa. B gay. Rs. Ylkñúgkar : e. FVIsnvkmµ : » ü )ane. Bjeljral; karkt; Rta. Rbtibtþ ikar. KNn. I. - Gñkkt; Rtark. Sa. Tukk. MNt; Rta Rbtibtþikar. Ta. Mg. Gs; ya: gticb ADB Grant No. 0133 -CAM/Component 1: PFMRD 32

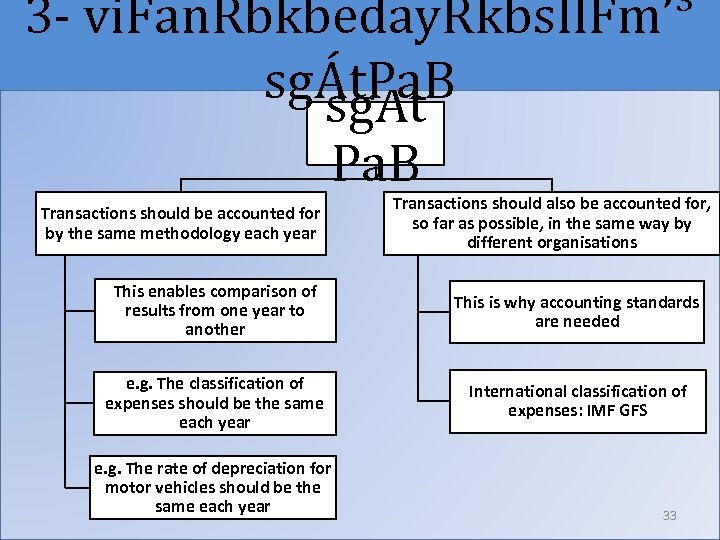

3 - vi. Fan. Rbkbeday. Rkbs. Il. Fm’³ sgÁt. Pa. B sgÁt Pa. B Transactions should be accounted for by the same methodology each year Transactions should also be accounted for, so far as possible, in the same way by different organisations This enables comparison of results from one year to another This is why accounting standards are needed e. g. The classification of expenses should be the same each year International classification of expenses: IMF GFS e. g. The rate of depreciation for motor vehicles should be the same each year 33

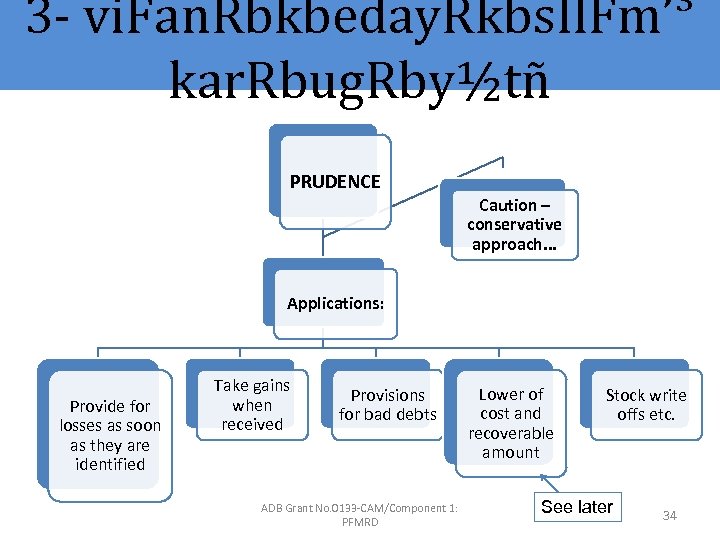

3 - vi. Fan. Rbkbeday. Rkbs. Il. Fm’³ kar. Rbug. Rby½tñ PRUDENCE Caution – conservative approach. . . Applications: Provide for losses as soon as they are identified Take gains when received Provisions for bad debts ADB Grant No. 0133 -CAM/Component 1: PFMRD Lower of cost and recoverable amount Stock write offs etc. See later 34

3 - vi. Fan. Rbkbeday. Rkbs. Il. Fm’³ kar. Rbug. Rby½tñ ¬t¦ • kar. Rbug. Rby½tñKWCa. Ts. Sna Tan. KNenyüs. Mxan; m. Yy nig. Ca. Fmµta si. Tæi. Ca. Ts. Sna. Tanep. Sg². Rbsineb. Iman. CMela. H • ]Tahr. N¾³ • Rbsineb. Irdæa. Pi)al. CMBak; b. M Nulrbs; Pñak; gar. Nam. Yy ADB Grant No. 0133 -CAM/Component 1: PFMRD 35

4 - muxgarc. MNUl nigm. Ul. Fn • sar³s. Mxan; én. Pa. Bxus. Kñakñúg KNenyü³ Pa. Bxus. Kñarvag. KNenyübgÁr nig. KNenyüsac; R)ak; • muxgarc. MNUl³ ry³e. BlxøI ¬ e. Rb. IR)as; kñúgk. MLúge. Bl¦ - c. MNUl nigc. MNay 36

5 - vi. Fanvayt. Mél. Gcn. RTBütamry³R b. B½n§KNenyübgÁr ey. Igniwg. Bicar. Nae. TAel. I³ • Rbvtþit. Méled. Im ¬t. Mélsu. Tæ = t. Méled. Im-plb. Ukeyagr. Mela. H¦ • c. Mn. Yn. Twk. R)ak; Edl. Gaclk; )an - t. Mélkñúgkare. Rb. IR)as; ¬t. Mél. Edl)anr. MBwg. Tukkñú ge. Bl. Gna. Kt¦ ADB Grant No. 0133 -CAM/Component 1: PFMRD 37

5 - vi. Fanvayt. Mél. Gcn. RTBütamry³R b. B½n§KNenyübgÁr = Rbvtþit. Méled. Im ¬t. Mélsu. Tæ t. Méled. Im-plb. Ukeyagr. Mela. H¦ • RTBüTa. Mg. Layn. Uvkarkt; Rtae n. Akñúgb. B¢a. IKNenyüen. ARbvtþ iéføed. Im • Gcn. RTBüRt. Uv. Etmankarr. Mela He. TAel. Iry³e. Blénkare. Rb. IR)as; RTBü. 38

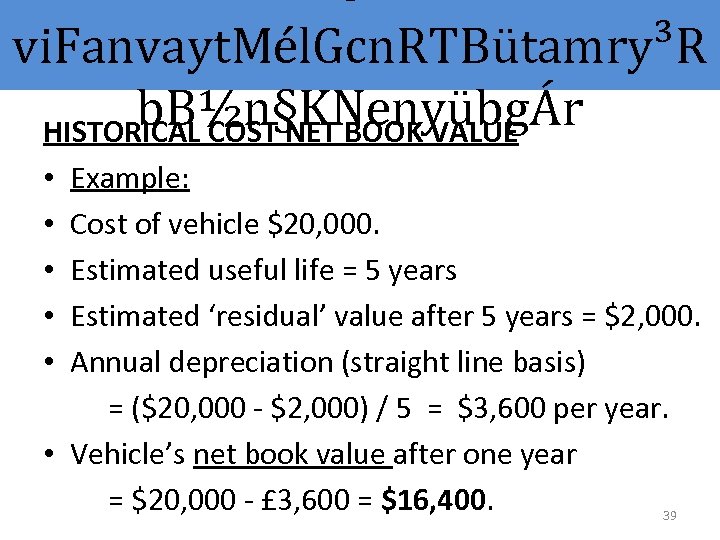

5 - vi. Fanvayt. Mél. Gcn. RTBütamry³R b. B½n§KNenyübgÁr HISTORICAL COST NET BOOK VALUE • Example: • Cost of vehicle $20, 000. • Estimated useful life = 5 years • Estimated ‘residual’ value after 5 years = $2, 000. • Annual depreciation (straight line basis) = ($20, 000 - $2, 000) / 5 = $3, 600 per year. • Vehicle’s net book value after one year = $20, 000 - £ 3, 600 = $16, 400. 39

5 - vi. Fanvayt. Mél. Gcn. RTBütamry³R b. B½n§KNenyübgÁr • c. Mn. Yn. Twk. R)ak; Edl. Gaclk; )an 1 - t. Mélkñúgkare. Rb. IR)as; ¬t. Méle • t. Méle. Blbc©úb, nñén. RTBüEdle - Caer. Oy²Bi)aknwgrkt. Méle. Rb Edley. Igrkva)an. KWvi. FIr. Mela. H Bl. Rbhak; Rb. Ehl. • b¤ 40

5 - vi. Fanvayt. Mél. Gcn. RTBütamry³R b. B½n§KNenyübgÁr 2 - t. Mél. Edl. Gace. COCak; )ansu. Tæ ¬ • t. Mél. TIp. Sarén. RTBü Rbsin. Calk; - 41

5 - vi. Fanvayt. Mél. Gcn. RTBütamry³R b. B½n§KNenyübgÁr GVIe. TAKWCat. Mél. Edl. KYre. Rb. I R)as; )an? • vi. Fan. Ca. TUe. TAKWCa. RTBüK Yr. Etmant. Mél. Tab. Cage. TAel. I 1 - Rbvtþit. Méled. Im ¬t. Mélsu. Tæ = t. Méled. Im 42

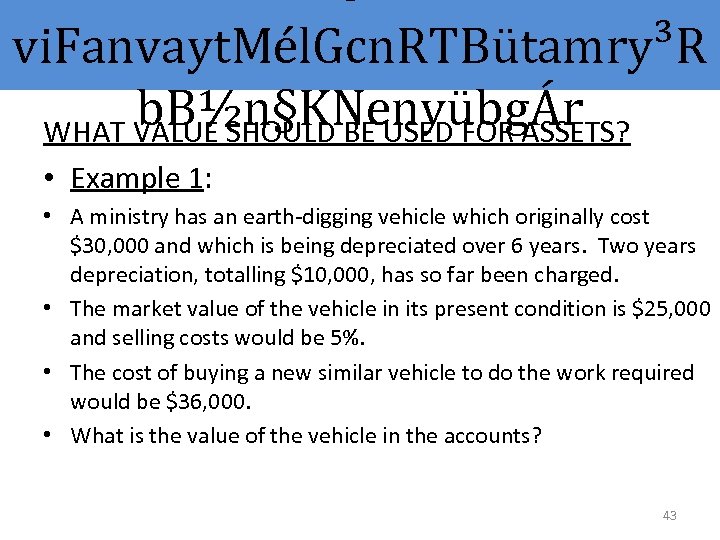

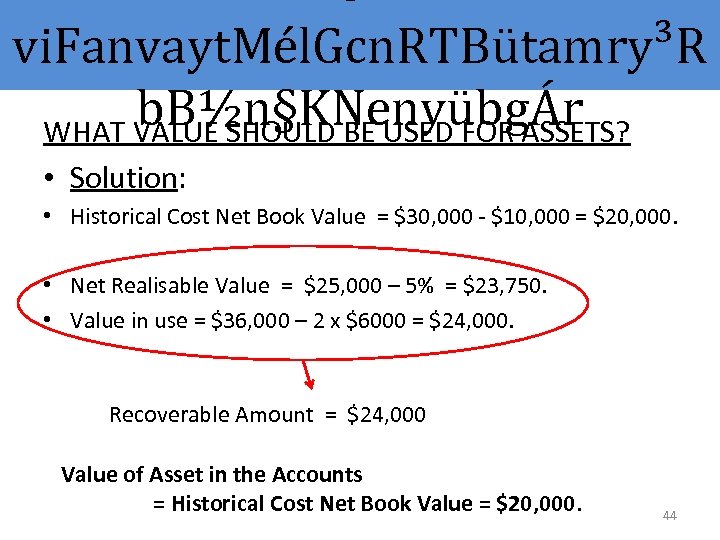

5 - vi. Fanvayt. Mél. Gcn. RTBütamry³R b. B½n§KNenyübgÁr WHAT VALUE SHOULD BE USED FOR ASSETS? • Example 1: • A ministry has an earth-digging vehicle which originally cost $30, 000 and which is being depreciated over 6 years. Two years depreciation, totalling $10, 000, has so far been charged. • The market value of the vehicle in its present condition is $25, 000 and selling costs would be 5%. • The cost of buying a new similar vehicle to do the work required would be $36, 000. • What is the value of the vehicle in the accounts? 43

5 - vi. Fanvayt. Mél. Gcn. RTBütamry³R b. B½n§KNenyübgÁr WHAT VALUE SHOULD BE USED FOR ASSETS? • Solution: • Historical Cost Net Book Value = $30, 000 - $10, 000 = $20, 000. • Net Realisable Value = $25, 000 – 5% = $23, 750. • Value in use = $36, 000 – 2 x $6000 = $24, 000. Recoverable Amount = $24, 000 Value of Asset in the Accounts = Historical Cost Net Book Value = $20, 000. 44

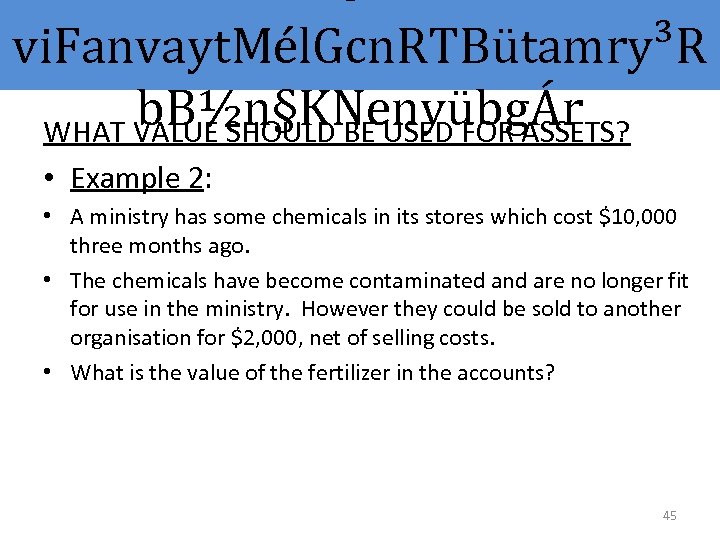

5 - vi. Fanvayt. Mél. Gcn. RTBütamry³R b. B½n§KNenyübgÁr WHAT VALUE SHOULD BE USED FOR ASSETS? • Example 2: • A ministry has some chemicals in its stores which cost $10, 000 three months ago. • The chemicals have become contaminated and are no longer fit for use in the ministry. However they could be sold to another organisation for $2, 000, net of selling costs. • What is the value of the fertilizer in the accounts? 45

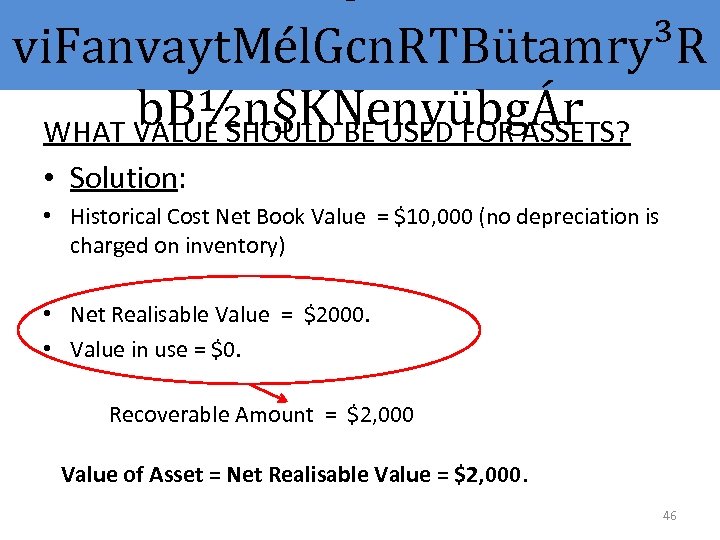

5 - vi. Fanvayt. Mél. Gcn. RTBütamry³R b. B½n§KNenyübgÁr WHAT VALUE SHOULD BE USED FOR ASSETS? • Solution: • Historical Cost Net Book Value = $10, 000 (no depreciation is charged on inventory) • Net Realisable Value = $2000. • Value in use = $0. Recoverable Amount = $2, 000 Value of Asset = Net Realisable Value = $2, 000. 46

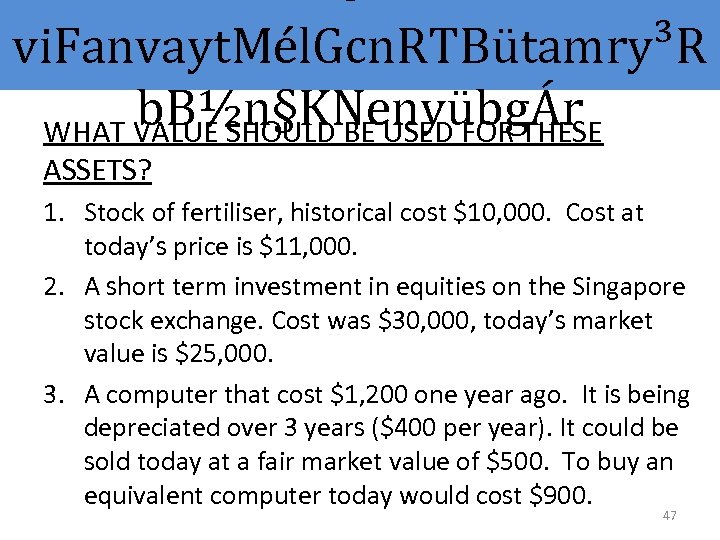

5 - vi. Fanvayt. Mél. Gcn. RTBütamry³R b. B½n§KNenyübgÁr WHAT VALUE SHOULD BE USED FOR THESE ASSETS? 1. Stock of fertiliser, historical cost $10, 000. Cost at today’s price is $11, 000. 2. A short term investment in equities on the Singapore stock exchange. Cost was $30, 000, today’s market value is $25, 000. 3. A computer that cost $1, 200 one year ago. It is being depreciated over 3 years ($400 per year). It could be sold today at a fair market value of $500. To buy an equivalent computer today would cost $900. 47

d2ddb640d6377b7f6b14bcc13328e83f.ppt