8029c133f50662ee388f478bd6f0ee37.ppt

- Количество слайдов: 68

June 2012

June 2012

Agenda • Introduction to the Smart Campaign • Appropriate Product Design and Delivery • Prevention of Over-Indebtedness and Transparency • Responsible Pricing & Fair and Respectful Treatment of Clients • Privacy of Client Data & Mechanisms for Complaint Resolution • Wrap-up and Questions 2

Agenda • Introduction to the Smart Campaign • Appropriate Product Design and Delivery • Prevention of Over-Indebtedness and Transparency • Responsible Pricing & Fair and Respectful Treatment of Clients • Privacy of Client Data & Mechanisms for Complaint Resolution • Wrap-up and Questions 2

The Smart Campaign… …represents a global, industry-wide effort: 2, 690+ endorsers from over 130 countries …has an international steering committee …collaborates with the Social Performance Task Force (SPTF), MIX Market Social Reporting, MF Rating Agencies, MFTransparency, and many others …is housed at the Center for Financial Inclusion at ACCION International 3

The Smart Campaign… …represents a global, industry-wide effort: 2, 690+ endorsers from over 130 countries …has an international steering committee …collaborates with the Social Performance Task Force (SPTF), MIX Market Social Reporting, MF Rating Agencies, MFTransparency, and many others …is housed at the Center for Financial Inclusion at ACCION International 3

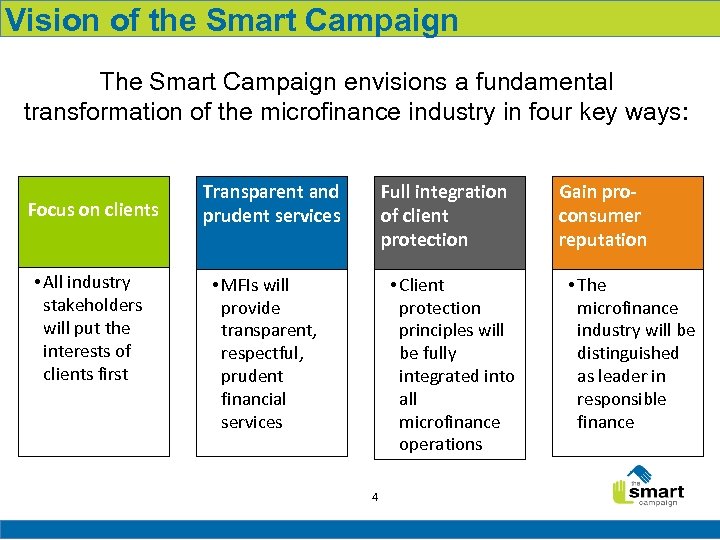

Vision of the Smart Campaign The Smart Campaign envisions a fundamental transformation of the microfinance industry in four key ways: Focus on clients • All industry stakeholders will put the interests of clients first Transparent and prudent services Full integration of client protection • MFIs will provide transparent, respectful, prudent financial services • Client protection principles will be fully integrated into all microfinance operations 4 Gain proconsumer reputation • The microfinance industry will be distinguished as leader in responsible finance

Vision of the Smart Campaign The Smart Campaign envisions a fundamental transformation of the microfinance industry in four key ways: Focus on clients • All industry stakeholders will put the interests of clients first Transparent and prudent services Full integration of client protection • MFIs will provide transparent, respectful, prudent financial services • Client protection principles will be fully integrated into all microfinance operations 4 Gain proconsumer reputation • The microfinance industry will be distinguished as leader in responsible finance

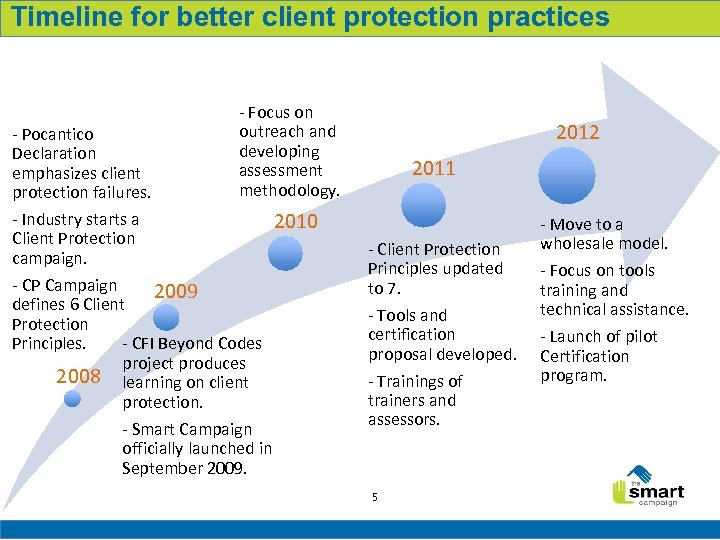

Timeline for better client protection practices - Focus on outreach and developing assessment methodology. - Pocantico Declaration emphasizes client protection failures. - Industry starts a 2010 Client Protection campaign. - CP Campaign 2009 defines 6 Client Protection Principles. - CFI Beyond Codes project produces 2008 learning on client protection. - Smart Campaign officially launched in September 2009. 2012 2011 - Client Protection Principles updated to 7. - Tools and certification proposal developed. - Trainings of trainers and assessors. 5 - Move to a wholesale model. - Focus on tools training and technical assistance. - Launch of pilot Certification program.

Timeline for better client protection practices - Focus on outreach and developing assessment methodology. - Pocantico Declaration emphasizes client protection failures. - Industry starts a 2010 Client Protection campaign. - CP Campaign 2009 defines 6 Client Protection Principles. - CFI Beyond Codes project produces 2008 learning on client protection. - Smart Campaign officially launched in September 2009. 2012 2011 - Client Protection Principles updated to 7. - Tools and certification proposal developed. - Trainings of trainers and assessors. 5 - Move to a wholesale model. - Focus on tools training and technical assistance. - Launch of pilot Certification program.

Client protection: 3 pillars RESPONSIBLE FINANCE Regulation for client protection and supervision Financial RESPONSIBLE education and FINANCE capability Standards and codes of conduct for the industry 6

Client protection: 3 pillars RESPONSIBLE FINANCE Regulation for client protection and supervision Financial RESPONSIBLE education and FINANCE capability Standards and codes of conduct for the industry 6

Why Now? Now is a critical time to focus on client protection, for several reasons: • Demands for accountability and transparency • Microfinance crises in several countries • Negative media attention regarding impact • Public and governmental concern over high interest rates • Rapid growth, rising competition, and new players 7

Why Now? Now is a critical time to focus on client protection, for several reasons: • Demands for accountability and transparency • Microfinance crises in several countries • Negative media attention regarding impact • Public and governmental concern over high interest rates • Rapid growth, rising competition, and new players 7

Smart Campaign activities Outreach • Partnerships with networks, support organizations • Participation in conferences Trainings • 53 Trainers and 42 Assessors • 1, 000 managers and staff of MFIs trained 8

Smart Campaign activities Outreach • Partnerships with networks, support organizations • Participation in conferences Trainings • 53 Trainers and 42 Assessors • 1, 000 managers and staff of MFIs trained 8

Smart Campaign activities Assessments • Self-assessment for MFIs • External assessments by certified assessors • Certification being piloted Tool development and dissemination • Now 50+ tools on www. smartcampaign. org 9

Smart Campaign activities Assessments • Self-assessment for MFIs • External assessments by certified assessors • Certification being piloted Tool development and dissemination • Now 50+ tools on www. smartcampaign. org 9

Tools to improve practice include: “How to” Guides Strategic planning guides Case studies Training presentations Technical guides Example forms 10

Tools to improve practice include: “How to” Guides Strategic planning guides Case studies Training presentations Technical guides Example forms 10

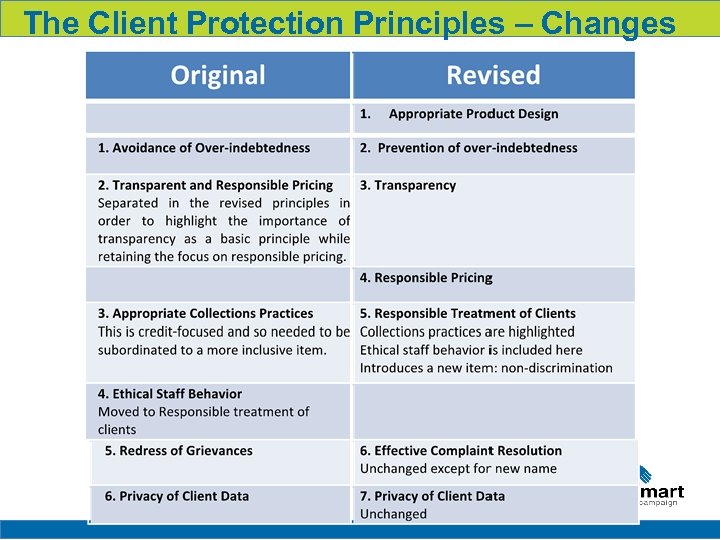

The Client Protection Principles – Changes 11

The Client Protection Principles – Changes 11

What´s new at the Campaign? New partnerships with networks Certification program State of Practice Report Client Voice Task Force 12

What´s new at the Campaign? New partnerships with networks Certification program State of Practice Report Client Voice Task Force 12

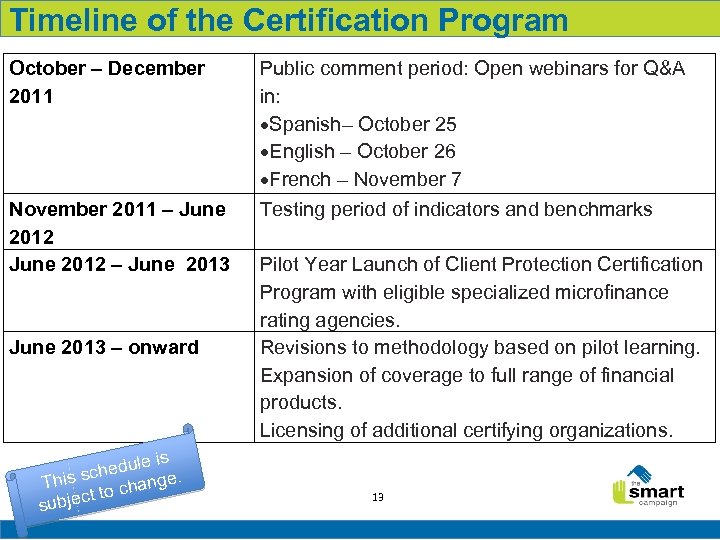

Timeline of the Certification Program October – December 2011 Public comment period: Open webinars for Q&A in: Spanish– October 25 English – October 26 French – November 7 November 2011 – June 2012 June 2012 – June 2013 Testing period of indicators and benchmarks June 2013 – onward is edule. ch This s o change t ubject s Pilot Year Launch of Client Protection Certification Program with eligible specialized microfinance rating agencies. Revisions to methodology based on pilot learning. Expansion of coverage to full range of financial products. Licensing of additional certifying organizations. 13

Timeline of the Certification Program October – December 2011 Public comment period: Open webinars for Q&A in: Spanish– October 25 English – October 26 French – November 7 November 2011 – June 2012 June 2012 – June 2013 Testing period of indicators and benchmarks June 2013 – onward is edule. ch This s o change t ubject s Pilot Year Launch of Client Protection Certification Program with eligible specialized microfinance rating agencies. Revisions to methodology based on pilot learning. Expansion of coverage to full range of financial products. Licensing of additional certifying organizations. 13

Principles of client protection 1. Appropriate product design and delivery 2. Prevention of over-indebtedness 3. Transparency 4. Responsible pricing 5. Fair and respectful treatment of clients 6. Privacy of client data 7. Mechanisms for complaint resolution 15

Principles of client protection 1. Appropriate product design and delivery 2. Prevention of over-indebtedness 3. Transparency 4. Responsible pricing 5. Fair and respectful treatment of clients 6. Privacy of client data 7. Mechanisms for complaint resolution 15

Principle #1 – Appropriate Product Design and Delivery 16

Principle #1 – Appropriate Product Design and Delivery 16

Appropriate product design and delivery The Principle: • Providers take adequate care to design products and delivery channels in such a way that they do not cause clients harm. • Products and delivery channels are designed with client characteristics taken into account. Consider this: Appropriate products and services not only provide access to clients, but they also create value for clients. 17

Appropriate product design and delivery The Principle: • Providers take adequate care to design products and delivery channels in such a way that they do not cause clients harm. • Products and delivery channels are designed with client characteristics taken into account. Consider this: Appropriate products and services not only provide access to clients, but they also create value for clients. 17

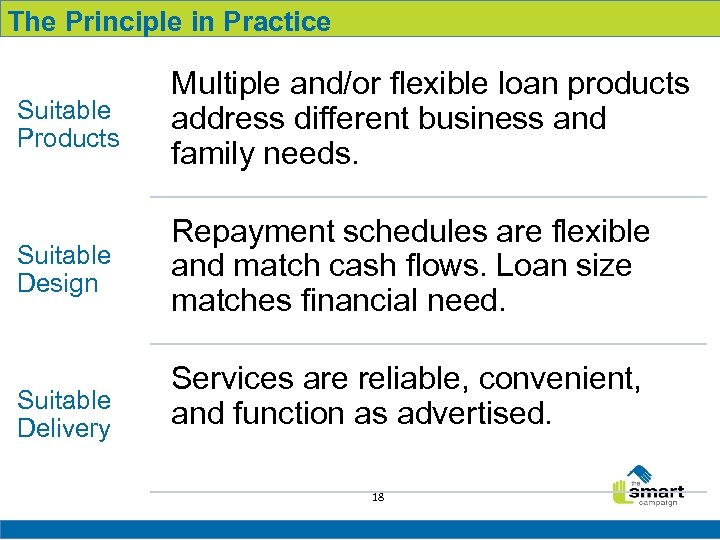

The Principle in Practice Suitable Products Multiple and/or flexible loan products address different business and family needs. Suitable Design Repayment schedules are flexible and match cash flows. Loan size matches financial need. Suitable Delivery Services are reliable, convenient, and function as advertised. 18

The Principle in Practice Suitable Products Multiple and/or flexible loan products address different business and family needs. Suitable Design Repayment schedules are flexible and match cash flows. Loan size matches financial need. Suitable Delivery Services are reliable, convenient, and function as advertised. 18

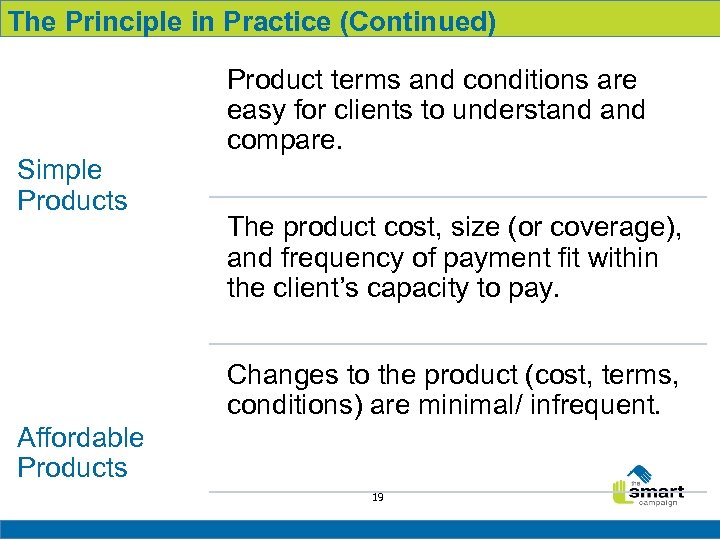

The Principle in Practice (Continued) Simple Products Product terms and conditions are easy for clients to understand compare. The product cost, size (or coverage), and frequency of payment fit within the client’s capacity to pay. Changes to the product (cost, terms, conditions) are minimal/ infrequent. Affordable Products 19

The Principle in Practice (Continued) Simple Products Product terms and conditions are easy for clients to understand compare. The product cost, size (or coverage), and frequency of payment fit within the client’s capacity to pay. Changes to the product (cost, terms, conditions) are minimal/ infrequent. Affordable Products 19

Tools available from the Smart Campaign Technical Tools Samples and Case Studies Smart Lending Smart Savings Educating Clients About Client Protection How to Talk to a Bank: A Brochure for Consumers Client Protection and Financial Education Simulation 20

Tools available from the Smart Campaign Technical Tools Samples and Case Studies Smart Lending Smart Savings Educating Clients About Client Protection How to Talk to a Bank: A Brochure for Consumers Client Protection and Financial Education Simulation 20

Principle #2 – Prevention of Over-indebtedness 21

Principle #2 – Prevention of Over-indebtedness 21

Group activity 1. Together, make a list of causes of overindebtedness. (3 minutes) 22

Group activity 1. Together, make a list of causes of overindebtedness. (3 minutes) 22

Over-indebtedness Solutions Causes 23

Over-indebtedness Solutions Causes 23

Prevent Over-indebtedness: The principle MFI Borrowers Are able to handle debt service requirements without sacrificing their basic quality of life. Carefully establishes the borrower’s ability to afford the loan and repay it. 24

Prevent Over-indebtedness: The principle MFI Borrowers Are able to handle debt service requirements without sacrificing their basic quality of life. Carefully establishes the borrower’s ability to afford the loan and repay it. 24

The Principle in Practice Management and Board are aware of and regularly monitor client overindebtedness. Monitor overindebtedness Loan approval requires evaluation of client repayment capacity and loan affordability—approval is not based only on guarantee/collateral. Evaluate client Credit policies give guidance on capacity debt thresholds and acceptable amount of debt from other sources. 25

The Principle in Practice Management and Board are aware of and regularly monitor client overindebtedness. Monitor overindebtedness Loan approval requires evaluation of client repayment capacity and loan affordability—approval is not based only on guarantee/collateral. Evaluate client Credit policies give guidance on capacity debt thresholds and acceptable amount of debt from other sources. 25

The Principle in Practice (Continued) Verify credit history If available, check the credit bureau. If unavailable, maintain and check internal records and consult competitors. Use internal audit to verify staff compliance with the procedures that prevent over-indebtedness. Audit credit procedures Set targets and incentives that value portfolio quality as least as highly as portfolio size and growth. 26

The Principle in Practice (Continued) Verify credit history If available, check the credit bureau. If unavailable, maintain and check internal records and consult competitors. Use internal audit to verify staff compliance with the procedures that prevent over-indebtedness. Audit credit procedures Set targets and incentives that value portfolio quality as least as highly as portfolio size and growth. 26

Tools available from the Smart Campaign Technical Tools Avoiding Over-indebtedness: Guidelines for Financial and Non-Financial Evaluation Samples and Case Studies Client Business Evaluation Toolkit from Microfund for Women Loan Calculator from Opportunity Bank Serbia Smart Note: Facing Over-indebtedness at Partner Loan Officer Training Manual from Banco Solidario Debt Management Guide from NCR South Africa 27

Tools available from the Smart Campaign Technical Tools Avoiding Over-indebtedness: Guidelines for Financial and Non-Financial Evaluation Samples and Case Studies Client Business Evaluation Toolkit from Microfund for Women Loan Calculator from Opportunity Bank Serbia Smart Note: Facing Over-indebtedness at Partner Loan Officer Training Manual from Banco Solidario Debt Management Guide from NCR South Africa 27

Principle #3 – Transparency 28

Principle #3 – Transparency 28

Transparency The Principle: Providers will communicate clear, sufficient, and timely information in a manner and language that client can understand, so that clients can make informed decisions. Consider this: Transparency is a pre-condition to many of the other principles—foremost, responsible pricing. 29

Transparency The Principle: Providers will communicate clear, sufficient, and timely information in a manner and language that client can understand, so that clients can make informed decisions. Consider this: Transparency is a pre-condition to many of the other principles—foremost, responsible pricing. 29

Group activity Bad Guys Make a list of things MFIs do to hide prices and information. Good Guys Make a list of things they can do to be transparent. 30

Group activity Bad Guys Make a list of things MFIs do to hide prices and information. Good Guys Make a list of things they can do to be transparent. 30

Bad Guys Good Guys 31

Bad Guys Good Guys 31

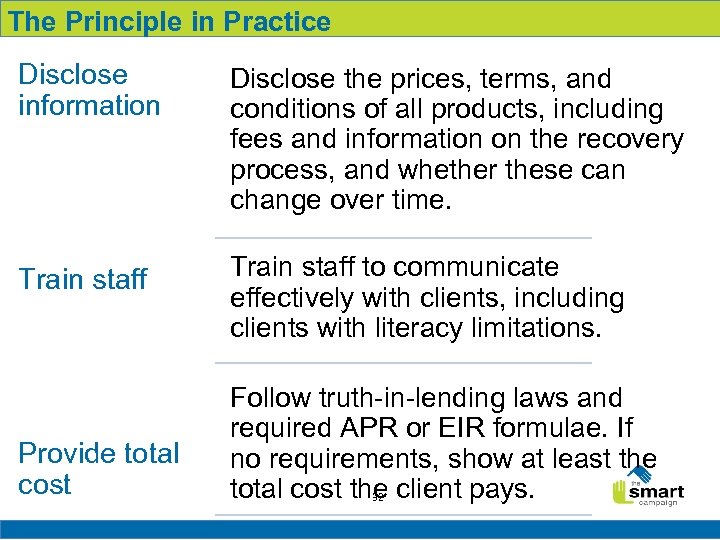

The Principle in Practice Disclose information Disclose the prices, terms, and conditions of all products, including fees and information on the recovery process, and whether these can change over time. Train staff to communicate effectively with clients, including clients with literacy limitations. Provide total cost Follow truth-in-lending laws and required APR or EIR formulae. If no requirements, show at least the total cost the client pays. 32

The Principle in Practice Disclose information Disclose the prices, terms, and conditions of all products, including fees and information on the recovery process, and whether these can change over time. Train staff to communicate effectively with clients, including clients with literacy limitations. Provide total cost Follow truth-in-lending laws and required APR or EIR formulae. If no requirements, show at least the total cost the client pays. 32

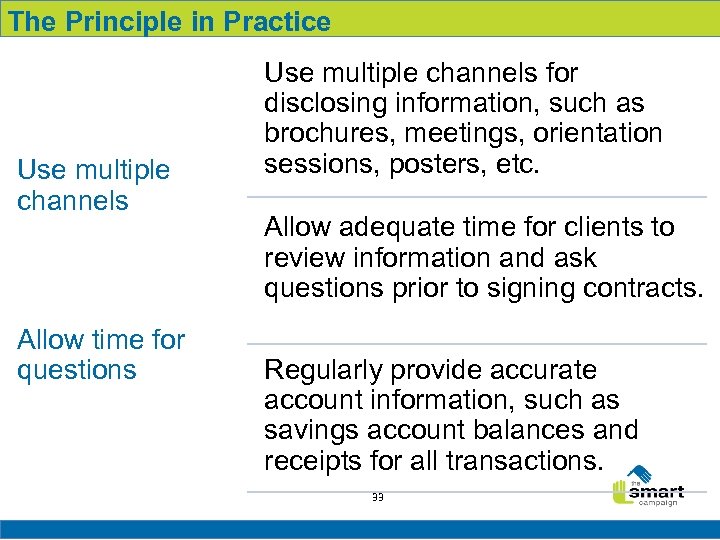

The Principle in Practice Use multiple channels Allow time for questions Use multiple channels for disclosing information, such as brochures, meetings, orientation sessions, posters, etc. Allow adequate time for clients to review information and ask questions prior to signing contracts. Regularly provide accurate account information, such as savings account balances and receipts for all transactions. 33

The Principle in Practice Use multiple channels Allow time for questions Use multiple channels for disclosing information, such as brochures, meetings, orientation sessions, posters, etc. Allow adequate time for clients to review information and ask questions prior to signing contracts. Regularly provide accurate account information, such as savings account balances and receipts for all transactions. 33

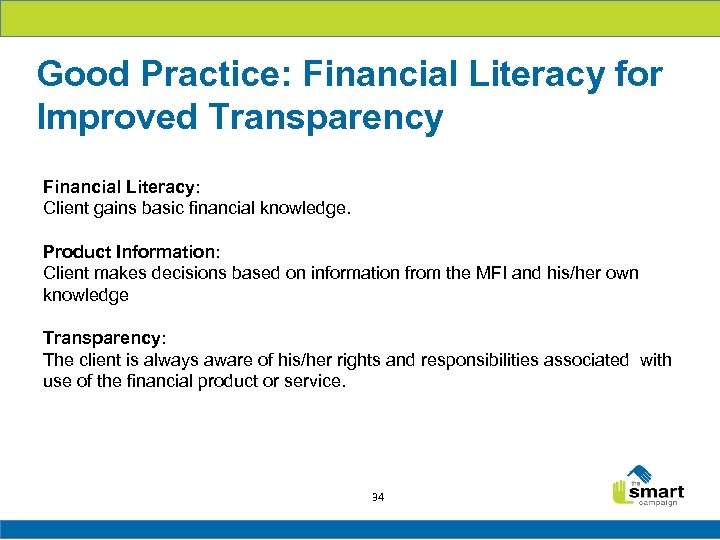

Good Practice: Financial Literacy for Improved Transparency Financial Literacy: Client gains basic financial knowledge. Product Information: Client makes decisions based on information from the MFI and his/her own knowledge Transparency: The client is always aware of his/her rights and responsibilities associated with use of the financial product or service. 34

Good Practice: Financial Literacy for Improved Transparency Financial Literacy: Client gains basic financial knowledge. Product Information: Client makes decisions based on information from the MFI and his/her own knowledge Transparency: The client is always aware of his/her rights and responsibilities associated with use of the financial product or service. 34

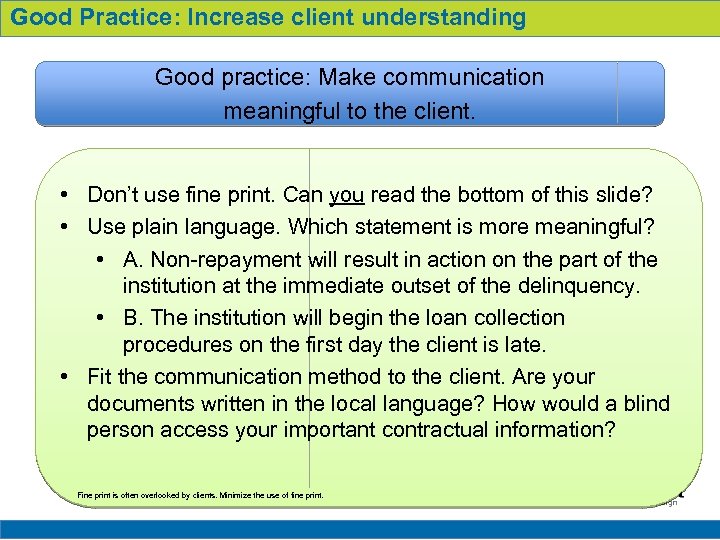

Good Practice: Increase client understanding Good practice: Make communication meaningful to the client. • Don’t use fine print. Can you read the bottom of this slide? • Use plain language. Which statement is more meaningful? • A. Non-repayment will result in action on the part of the institution at the immediate outset of the delinquency. • B. The institution will begin the loan collection procedures on the first day the client is late. • Fit the communication method to the client. Are your documents written in the local language? How would a blind person access your important contractual information? Fine print is often overlooked by clients. Minimize the use of fine print. 35

Good Practice: Increase client understanding Good practice: Make communication meaningful to the client. • Don’t use fine print. Can you read the bottom of this slide? • Use plain language. Which statement is more meaningful? • A. Non-repayment will result in action on the part of the institution at the immediate outset of the delinquency. • B. The institution will begin the loan collection procedures on the first day the client is late. • Fit the communication method to the client. Are your documents written in the local language? How would a blind person access your important contractual information? Fine print is often overlooked by clients. Minimize the use of fine print. 35

Good Practice: Confirm client understanding Good practice: Confirm client understanding. Use: • Call backs • Check lists • “Key facts” or FAQ document • Glossaries for key terms • Analysis of common complaints/questions to improve communication 36

Good Practice: Confirm client understanding Good practice: Confirm client understanding. Use: • Call backs • Check lists • “Key facts” or FAQ document • Glossaries for key terms • Analysis of common complaints/questions to improve communication 36

Tools available from the Smart Campaign Technical Tools Samples and Case Studies Calculating Transparent Prices (MFTransparency) Putting Transparency into Practice: Communicating About Pricing Responsible Pricing State of Practice Client Welcome Kit Loan Agreement for Small Business Clients from Crystal Loan Contract Summary Handout from Mi. Banco Smart Note: Transparent & Responsible Pricing at Mi-Bospo 37

Tools available from the Smart Campaign Technical Tools Samples and Case Studies Calculating Transparent Prices (MFTransparency) Putting Transparency into Practice: Communicating About Pricing Responsible Pricing State of Practice Client Welcome Kit Loan Agreement for Small Business Clients from Crystal Loan Contract Summary Handout from Mi. Banco Smart Note: Transparent & Responsible Pricing at Mi-Bospo 37

Principle #4 – Responsible Pricing 38

Principle #4 – Responsible Pricing 38

Responsible Pricing The Principle: Pricing, terms, and conditions are set in a way that is both affordable to clients and sustainable for the financial institution. 39

Responsible Pricing The Principle: Pricing, terms, and conditions are set in a way that is both affordable to clients and sustainable for the financial institution. 39

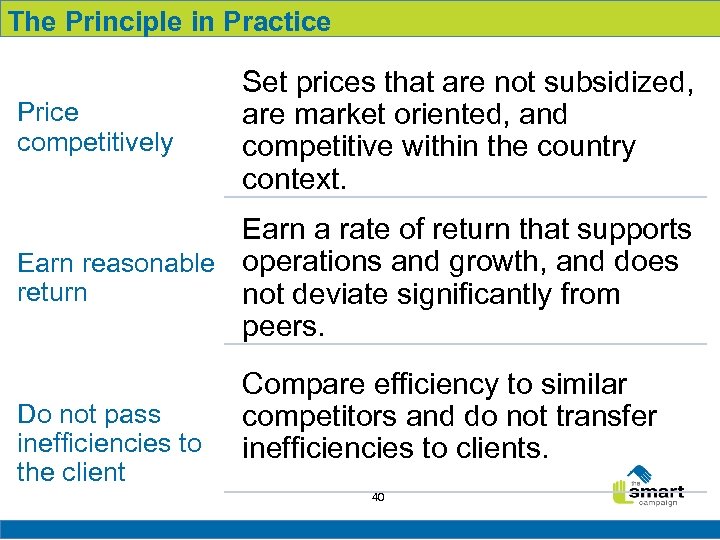

The Principle in Practice Price competitively Set prices that are not subsidized, are market oriented, and competitive within the country context. Earn a rate of return that supports Earn reasonable operations and growth, and does return not deviate significantly from peers. Do not pass inefficiencies to the client Compare efficiency to similar competitors and do not transfer inefficiencies to clients. 40

The Principle in Practice Price competitively Set prices that are not subsidized, are market oriented, and competitive within the country context. Earn a rate of return that supports Earn reasonable operations and growth, and does return not deviate significantly from peers. Do not pass inefficiencies to the client Compare efficiency to similar competitors and do not transfer inefficiencies to clients. 40

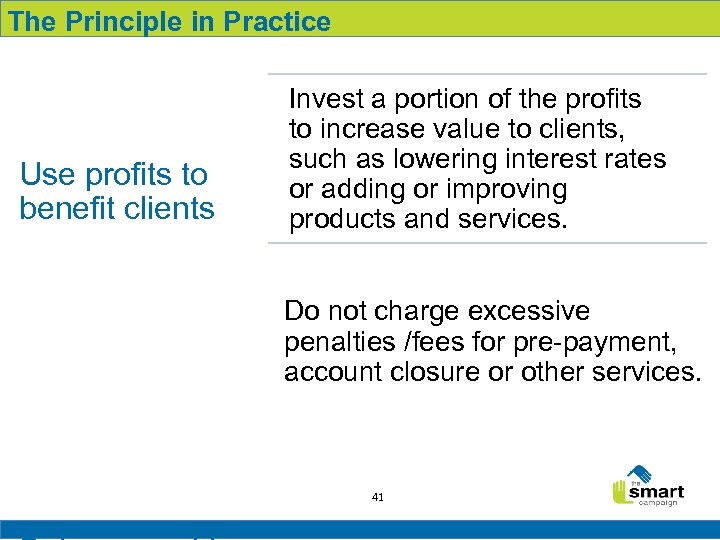

The Principle in Practice Use profits to benefit clients Invest a portion of the profits to increase value to clients, such as lowering interest rates or adding or improving products and services. Do not charge excessive penalties /fees for pre-payment, account closure or other services. 41

The Principle in Practice Use profits to benefit clients Invest a portion of the profits to increase value to clients, such as lowering interest rates or adding or improving products and services. Do not charge excessive penalties /fees for pre-payment, account closure or other services. 41

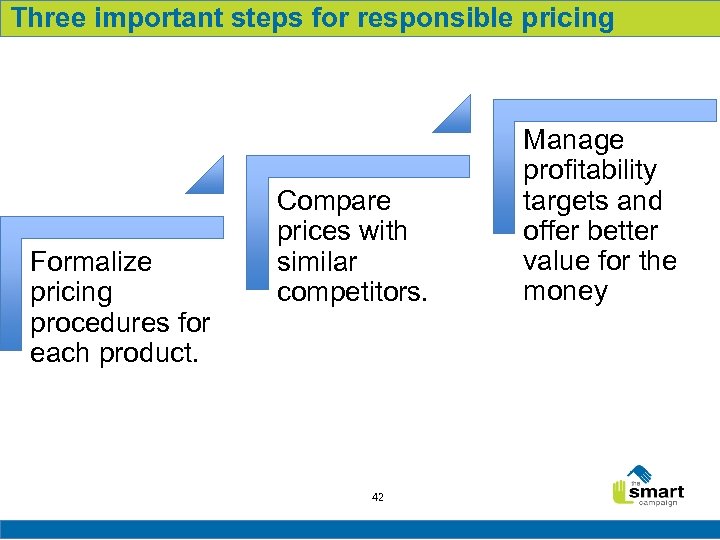

Three important steps for responsible pricing Formalize pricing procedures for each product. Compare prices with similar competitors. 42 Manage profitability targets and offer better value for the money

Three important steps for responsible pricing Formalize pricing procedures for each product. Compare prices with similar competitors. 42 Manage profitability targets and offer better value for the money

Tools available from the Smart Campaign Technical Tools Samples and Case Studies Calculating Transparent Prices (MFTransparency) Putting Transparency into Practice: Communicating About Pricing Responsible Pricing State of Practice Transparent & Responsible Pricing at Mi-Bospo 43

Tools available from the Smart Campaign Technical Tools Samples and Case Studies Calculating Transparent Prices (MFTransparency) Putting Transparency into Practice: Communicating About Pricing Responsible Pricing State of Practice Transparent & Responsible Pricing at Mi-Bospo 43

Principle #5 – Fair and respectful treatment of clients 44

Principle #5 – Fair and respectful treatment of clients 44

Rapid assessment – Answer Yes or No 1. Does your organization have a written code of ethics? 2. Have you heard a senior member of your organization talk about your code of ethics? 3. Do you have staff rules that clearly specify acceptable and unacceptable behavior? 4. Have you received training on your code of ethics and staff rules? 5. Is ethical behavior part of your performance 45 review?

Rapid assessment – Answer Yes or No 1. Does your organization have a written code of ethics? 2. Have you heard a senior member of your organization talk about your code of ethics? 3. Do you have staff rules that clearly specify acceptable and unacceptable behavior? 4. Have you received training on your code of ethics and staff rules? 5. Is ethical behavior part of your performance 45 review?

Fair and respectful treatment of clients The Principle Providers and their agents treat clients fairly and respectfully. They do not discriminate. They ensure safeguards are in place to detect and correct corruption. Consider this: Most abuses happen during the loan sales and debt collection processes—these need special attention by providers. 46

Fair and respectful treatment of clients The Principle Providers and their agents treat clients fairly and respectfully. They do not discriminate. They ensure safeguards are in place to detect and correct corruption. Consider this: Most abuses happen during the loan sales and debt collection processes—these need special attention by providers. 46

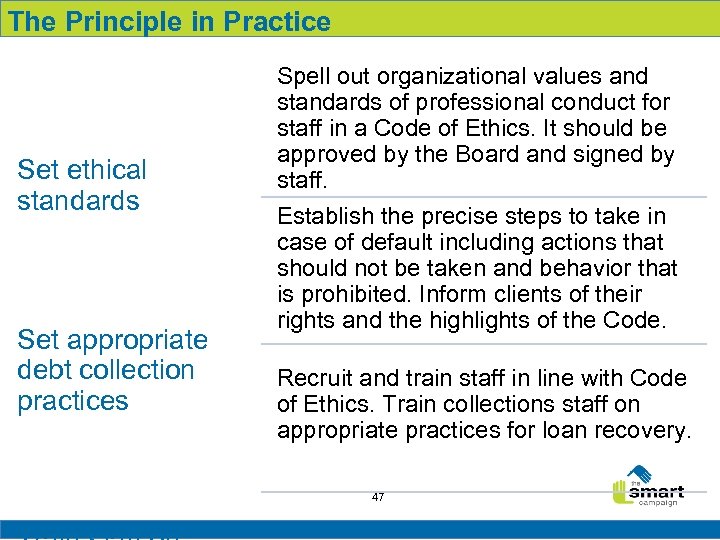

The Principle in Practice Set ethical standards Set appropriate debt collection practices Spell out organizational values and standards of professional conduct for staff in a Code of Ethics. It should be approved by the Board and signed by staff. Establish the precise steps to take in case of default including actions that should not be taken and behavior that is prohibited. Inform clients of their rights and the highlights of the Code. Recruit and train staff in line with Code of Ethics. Train collections staff on appropriate practices for loan recovery. 47

The Principle in Practice Set ethical standards Set appropriate debt collection practices Spell out organizational values and standards of professional conduct for staff in a Code of Ethics. It should be approved by the Board and signed by staff. Establish the precise steps to take in case of default including actions that should not be taken and behavior that is prohibited. Inform clients of their rights and the highlights of the Code. Recruit and train staff in line with Code of Ethics. Train collections staff on appropriate practices for loan recovery. 47

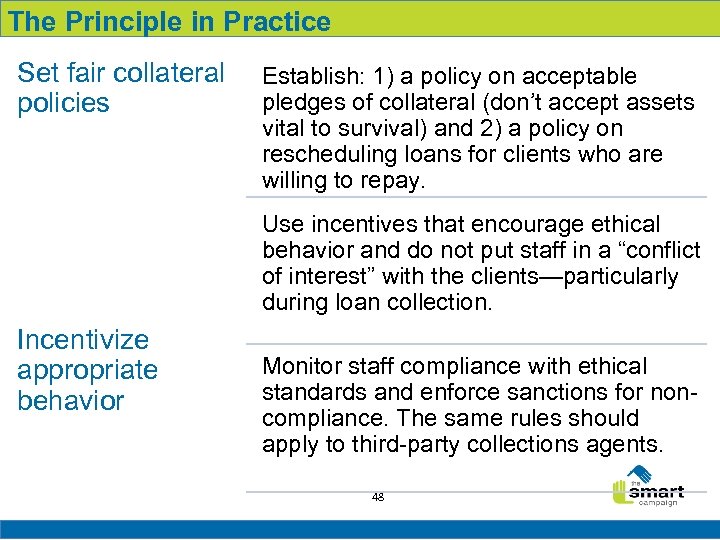

The Principle in Practice Set fair collateral policies Establish: 1) a policy on acceptable pledges of collateral (don’t accept assets vital to survival) and 2) a policy on rescheduling loans for clients who are willing to repay. Use incentives that encourage ethical behavior and do not put staff in a “conflict of interest” with the clients—particularly during loan collection. Incentivize appropriate behavior Monitor staff compliance with ethical standards and enforce sanctions for noncompliance. The same rules should apply to third-party collections agents. 48

The Principle in Practice Set fair collateral policies Establish: 1) a policy on acceptable pledges of collateral (don’t accept assets vital to survival) and 2) a policy on rescheduling loans for clients who are willing to repay. Use incentives that encourage ethical behavior and do not put staff in a “conflict of interest” with the clients—particularly during loan collection. Incentivize appropriate behavior Monitor staff compliance with ethical standards and enforce sanctions for noncompliance. The same rules should apply to third-party collections agents. 48

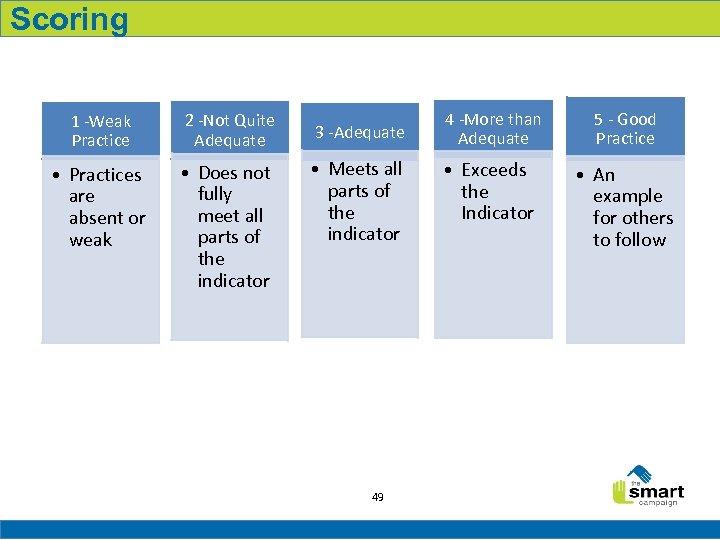

Scoring 1 -Weak Practice 2 -Not Quite Adequate • Practices are absent or weak • Does not fully meet all parts of the indicator 3 -Adequate • Meets all parts of the indicator 49 4 -More than Adequate 5 - Good Practice • Exceeds the Indicator • An example for others to follow

Scoring 1 -Weak Practice 2 -Not Quite Adequate • Practices are absent or weak • Does not fully meet all parts of the indicator 3 -Adequate • Meets all parts of the indicator 49 4 -More than Adequate 5 - Good Practice • Exceeds the Indicator • An example for others to follow

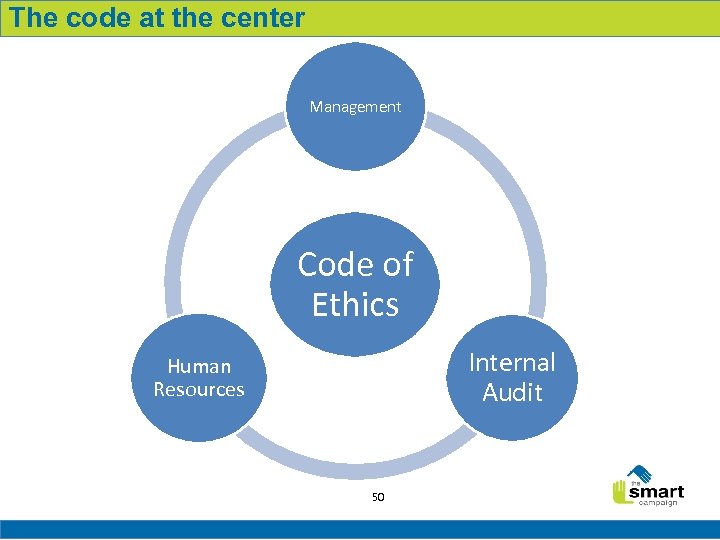

The code at the center Management Code of Ethics Internal Audit Human Resources 50

The code at the center Management Code of Ethics Internal Audit Human Resources 50

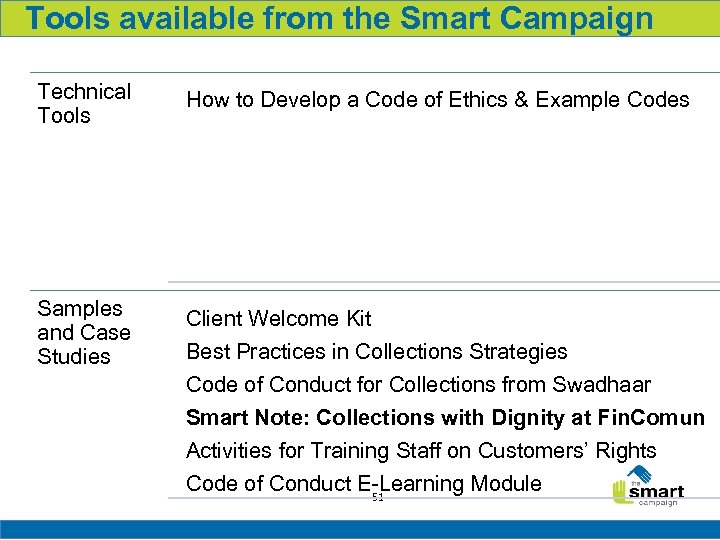

Tools available from the Smart Campaign Technical Tools How to Develop a Code of Ethics & Example Codes Samples and Case Studies Client Welcome Kit Best Practices in Collections Strategies Code of Conduct for Collections from Swadhaar Smart Note: Collections with Dignity at Fin. Comun Activities for Training Staff on Customers’ Rights Code of Conduct E-Learning Module 51

Tools available from the Smart Campaign Technical Tools How to Develop a Code of Ethics & Example Codes Samples and Case Studies Client Welcome Kit Best Practices in Collections Strategies Code of Conduct for Collections from Swadhaar Smart Note: Collections with Dignity at Fin. Comun Activities for Training Staff on Customers’ Rights Code of Conduct E-Learning Module 51

Principle #6 – Privacy of Client Data 52

Principle #6 – Privacy of Client Data 52

Privacy of Client Data The Principle: The provider complies with all local data privacy laws. Client information is only used in the ways agreed upon at the time of data collection. Consider this: Clients trust financial service providers with very sensitive personal and financial information. 53

Privacy of Client Data The Principle: The provider complies with all local data privacy laws. Client information is only used in the ways agreed upon at the time of data collection. Consider this: Clients trust financial service providers with very sensitive personal and financial information. 53

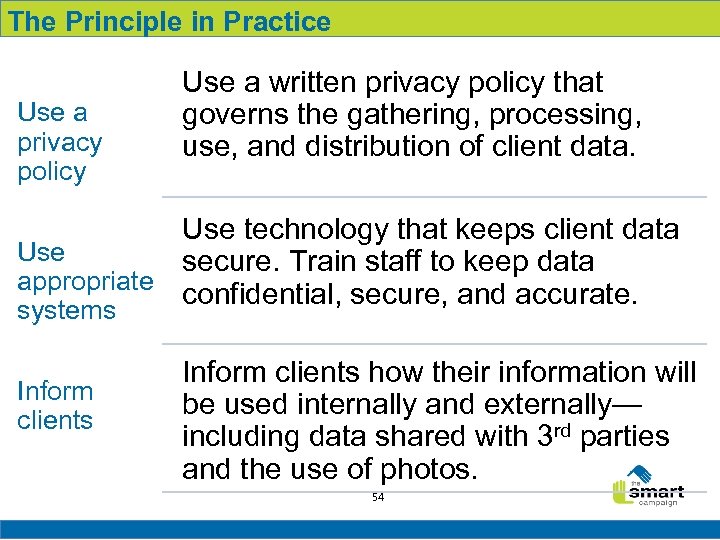

The Principle in Practice Use a privacy policy Use a written privacy policy that governs the gathering, processing, use, and distribution of client data. Use technology that keeps client data Use secure. Train staff to keep data appropriate confidential, secure, and accurate. systems Inform clients how their information will be used internally and externally— including data shared with 3 rd parties and the use of photos. 54

The Principle in Practice Use a privacy policy Use a written privacy policy that governs the gathering, processing, use, and distribution of client data. Use technology that keeps client data Use secure. Train staff to keep data appropriate confidential, secure, and accurate. systems Inform clients how their information will be used internally and externally— including data shared with 3 rd parties and the use of photos. 54

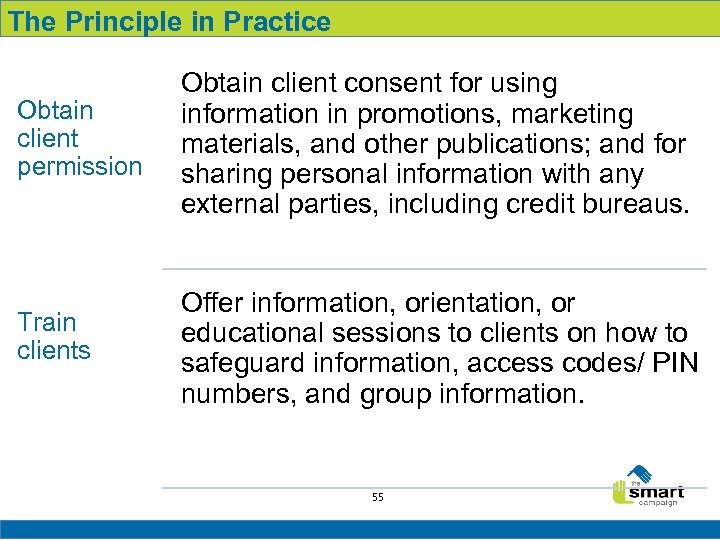

The Principle in Practice Obtain client permission Obtain client consent for using information in promotions, marketing materials, and other publications; and for sharing personal information with any external parties, including credit bureaus. Train clients Offer information, orientation, or educational sessions to clients on how to safeguard information, access codes/ PIN numbers, and group information. 55

The Principle in Practice Obtain client permission Obtain client consent for using information in promotions, marketing materials, and other publications; and for sharing personal information with any external parties, including credit bureaus. Train clients Offer information, orientation, or educational sessions to clients on how to safeguard information, access codes/ PIN numbers, and group information. 55

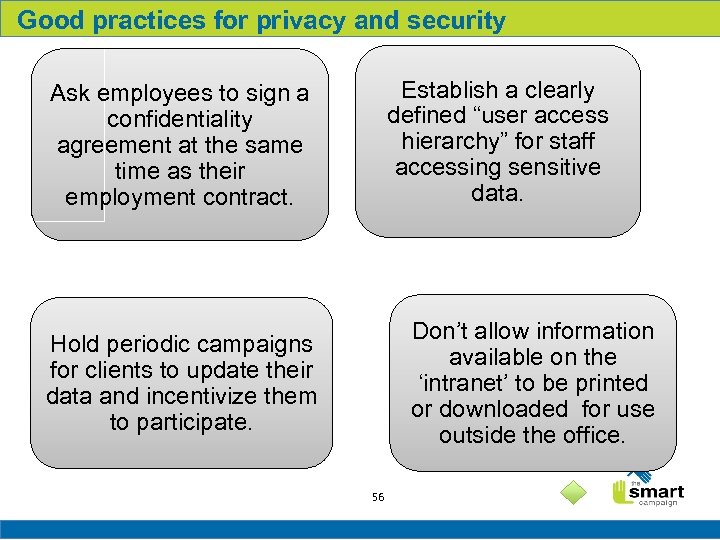

Good practices for privacy and security Establish a clearly defined “user access hierarchy” for staff accessing sensitive data. Ask employees to sign a confidentiality agreement at the same time as their employment contract. Don’t allow information available on the ‘intranet’ to be printed or downloaded for use outside the office. Hold periodic campaigns for clients to update their data and incentivize them to participate. 56

Good practices for privacy and security Establish a clearly defined “user access hierarchy” for staff accessing sensitive data. Ask employees to sign a confidentiality agreement at the same time as their employment contract. Don’t allow information available on the ‘intranet’ to be printed or downloaded for use outside the office. Hold periodic campaigns for clients to update their data and incentivize them to participate. 56

Good practices for privacy and security Spot check the security of physical files in branches (e. g. using internal auditors). Train clients on how to keep group information private. Describe the sanctions for the misuse of client data in the staff book of rules. 57

Good practices for privacy and security Spot check the security of physical files in branches (e. g. using internal auditors). Train clients on how to keep group information private. Describe the sanctions for the misuse of client data in the staff book of rules. 57

Tools available from the Smart Campaign Technical Tools Security is the Key: Pocket Guide to Financial Security for Clients Samples and Case Studies Client Welcome Kit Smart Note: Customized IT at Caja Morelia Smart Note: Protecting Client Data 58

Tools available from the Smart Campaign Technical Tools Security is the Key: Pocket Guide to Financial Security for Clients Samples and Case Studies Client Welcome Kit Smart Note: Customized IT at Caja Morelia Smart Note: Protecting Client Data 58

Principle #7 – Mechanism for Complaint Resolution 59

Principle #7 – Mechanism for Complaint Resolution 59

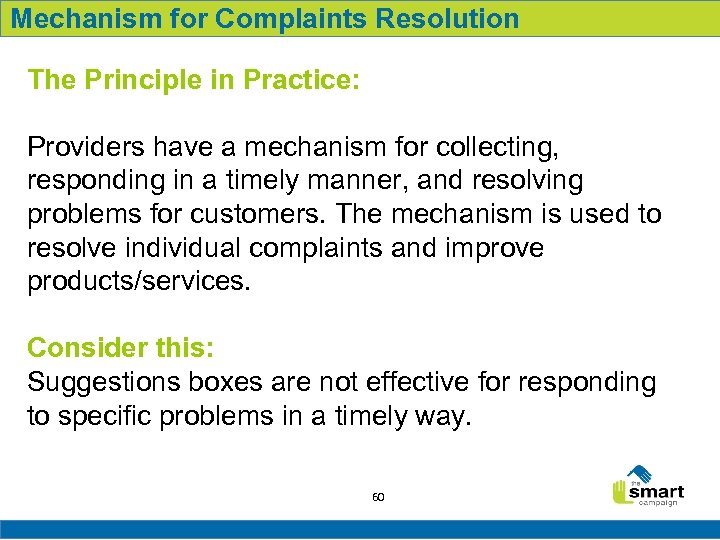

Mechanism for Complaints Resolution The Principle in Practice: Providers have a mechanism for collecting, responding in a timely manner, and resolving problems for customers. The mechanism is used to resolve individual complaints and improve products/services. Consider this: Suggestions boxes are not effective for responding to specific problems in a timely way. 60

Mechanism for Complaints Resolution The Principle in Practice: Providers have a mechanism for collecting, responding in a timely manner, and resolving problems for customers. The mechanism is used to resolve individual complaints and improve products/services. Consider this: Suggestions boxes are not effective for responding to specific problems in a timely way. 60

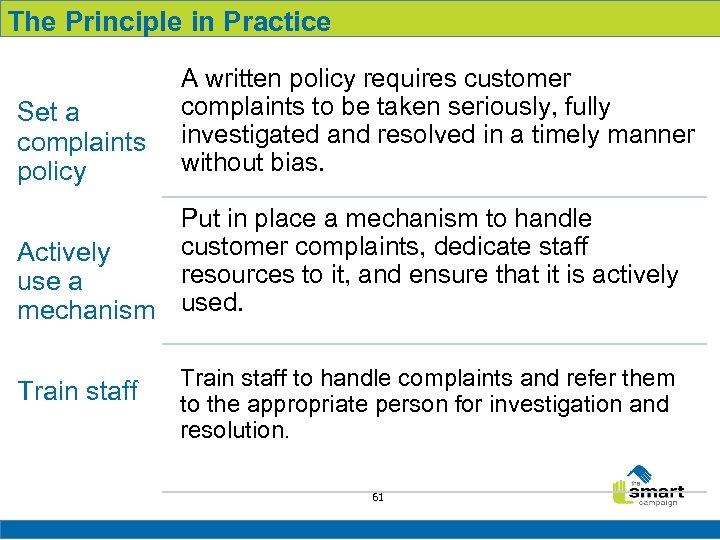

The Principle in Practice Set a complaints policy A written policy requires customer complaints to be taken seriously, fully investigated and resolved in a timely manner without bias. Put in place a mechanism to handle customer complaints, dedicate staff Actively resources to it, and ensure that it is actively use a mechanism used. Train staff to handle complaints and refer them to the appropriate person for investigation and resolution. 61

The Principle in Practice Set a complaints policy A written policy requires customer complaints to be taken seriously, fully investigated and resolved in a timely manner without bias. Put in place a mechanism to handle customer complaints, dedicate staff Actively resources to it, and ensure that it is actively use a mechanism used. Train staff to handle complaints and refer them to the appropriate person for investigation and resolution. 61

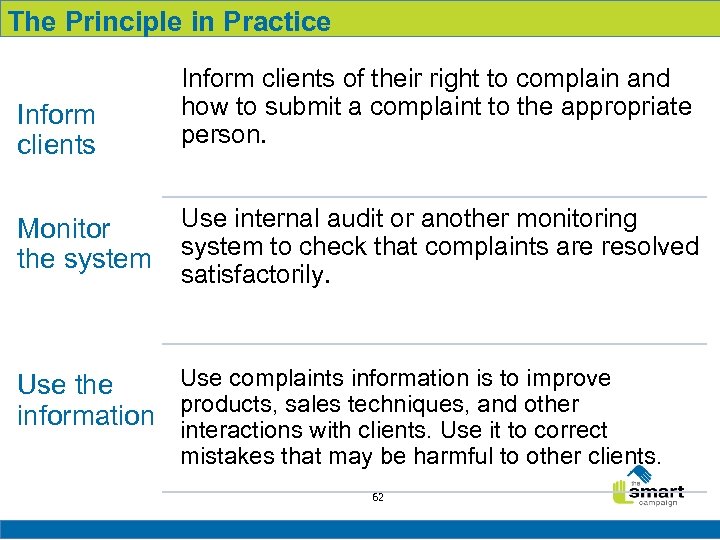

The Principle in Practice Inform clients Monitor the system Inform clients of their right to complain and how to submit a complaint to the appropriate person. Use internal audit or another monitoring system to check that complaints are resolved satisfactorily. Use complaints information is to improve Use the information products, sales techniques, and other interactions with clients. Use it to correct mistakes that may be harmful to other clients. 62

The Principle in Practice Inform clients Monitor the system Inform clients of their right to complain and how to submit a complaint to the appropriate person. Use internal audit or another monitoring system to check that complaints are resolved satisfactorily. Use complaints information is to improve Use the information products, sales techniques, and other interactions with clients. Use it to correct mistakes that may be harmful to other clients. 62

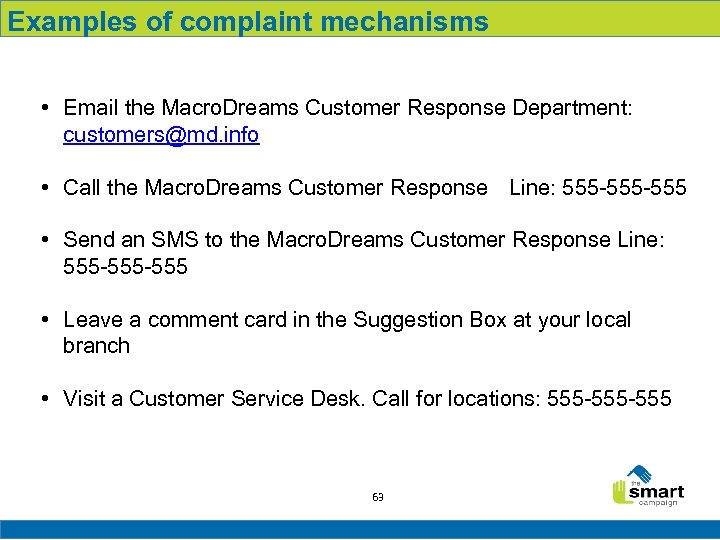

Examples of complaint mechanisms • Email the Macro. Dreams Customer Response Department: customers@md. info • Call the Macro. Dreams Customer Response Line: 555 -555 • Send an SMS to the Macro. Dreams Customer Response Line: 555 -555 • Leave a comment card in the Suggestion Box at your local branch • Visit a Customer Service Desk. Call for locations: 555 -555 63

Examples of complaint mechanisms • Email the Macro. Dreams Customer Response Department: customers@md. info • Call the Macro. Dreams Customer Response Line: 555 -555 • Send an SMS to the Macro. Dreams Customer Response Line: 555 -555 • Leave a comment card in the Suggestion Box at your local branch • Visit a Customer Service Desk. Call for locations: 555 -555 63

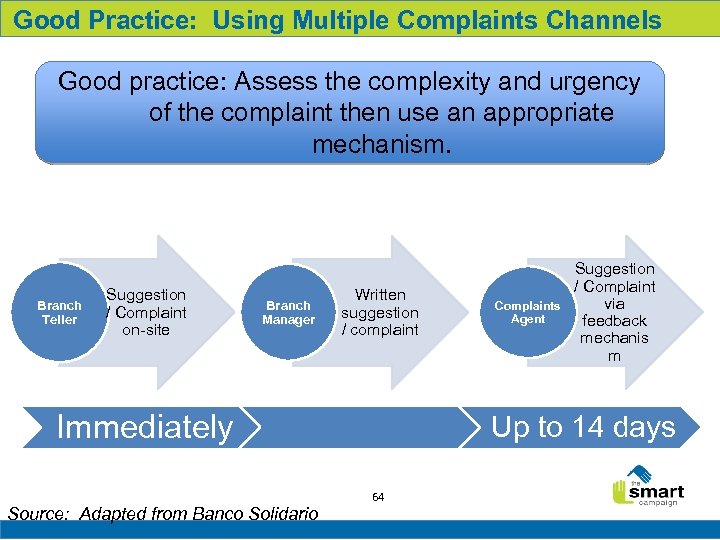

Good Practice: Using Multiple Complaints Channels Good practice: Assess the complexity and urgency of the complaint then use an appropriate mechanism. Branch Teller Suggestion / Complaint on-site Branch Manager Written suggestion / complaint Immediately Source: Adapted from Banco Solidario Complaints Agent Suggestion / Complaint via feedback mechanis m Up to 14 days 64

Good Practice: Using Multiple Complaints Channels Good practice: Assess the complexity and urgency of the complaint then use an appropriate mechanism. Branch Teller Suggestion / Complaint on-site Branch Manager Written suggestion / complaint Immediately Source: Adapted from Banco Solidario Complaints Agent Suggestion / Complaint via feedback mechanis m Up to 14 days 64

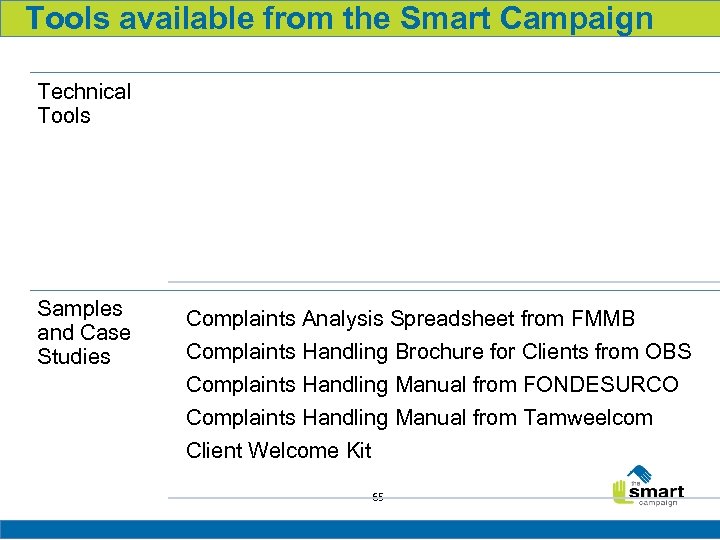

Tools available from the Smart Campaign Technical Tools Samples and Case Studies Complaints Analysis Spreadsheet from FMMB Complaints Handling Brochure for Clients from OBS Complaints Handling Manual from FONDESURCO Complaints Handling Manual from Tamweelcom Client Welcome Kit 65

Tools available from the Smart Campaign Technical Tools Samples and Case Studies Complaints Analysis Spreadsheet from FMMB Complaints Handling Brochure for Clients from OBS Complaints Handling Manual from FONDESURCO Complaints Handling Manual from Tamweelcom Client Welcome Kit 65

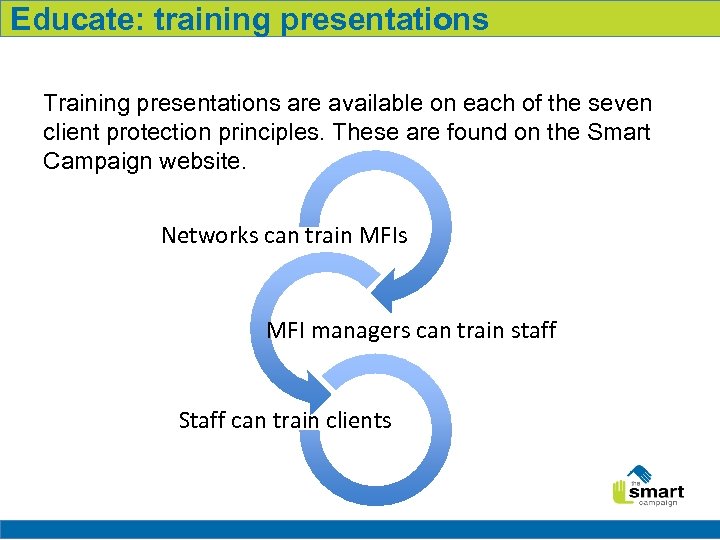

Educate: training presentations Training presentations are available on each of the seven client protection principles. These are found on the Smart Campaign website. Networks can train MFIs MFI managers can train staff Staff can train clients 66

Educate: training presentations Training presentations are available on each of the seven client protection principles. These are found on the Smart Campaign website. Networks can train MFIs MFI managers can train staff Staff can train clients 66

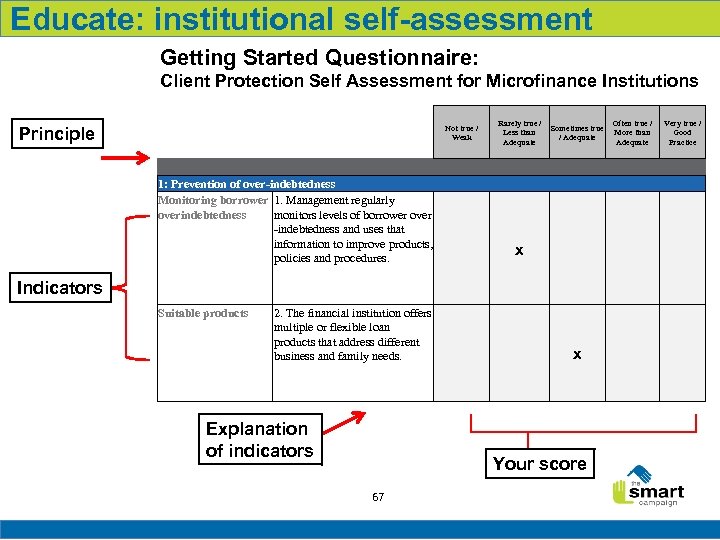

Educate: institutional self-assessment Getting Started Questionnaire: Client Protection Self Assessment for Microfinance Institutions Rarely true / Often true / Sometimes true Less than More than / Adequate Not true / Weak Principle 1: Prevention of over-indebtedness Monitoring borrower 1. Management regularly overindebtedness monitors levels of borrower over -indebtedness and uses that information to improve products, policies and procedures. Very true / Good Practice x Indicators Suitable products 2. The financial institution offers multiple or flexible loan products that address different business and family needs. Explanation of indicators Your score 67

Educate: institutional self-assessment Getting Started Questionnaire: Client Protection Self Assessment for Microfinance Institutions Rarely true / Often true / Sometimes true Less than More than / Adequate Not true / Weak Principle 1: Prevention of over-indebtedness Monitoring borrower 1. Management regularly overindebtedness monitors levels of borrower over -indebtedness and uses that information to improve products, policies and procedures. Very true / Good Practice x Indicators Suitable products 2. The financial institution offers multiple or flexible loan products that address different business and family needs. Explanation of indicators Your score 67

Improving Client Protection Practice “My institution believes that client protection is important—but we need help improving practice!” • The Smart Campaign offers over 50 practical tools to help financial service providers implement the client protection principles. • All of the tools are available for download free of charge. • New tools are added regularly. 68

Improving Client Protection Practice “My institution believes that client protection is important—but we need help improving practice!” • The Smart Campaign offers over 50 practical tools to help financial service providers implement the client protection principles. • All of the tools are available for download free of charge. • New tools are added regularly. 68

Thank you! Endorse the Smart Campaign. Visit www. smartcampaign. org What’s next? Sign up to receive news and information. Download the Getting Started Questionnaire and conduct a client protection self-assessment. Email us with questions or comments! comments@smartcampaign. org 69

Thank you! Endorse the Smart Campaign. Visit www. smartcampaign. org What’s next? Sign up to receive news and information. Download the Getting Started Questionnaire and conduct a client protection self-assessment. Email us with questions or comments! comments@smartcampaign. org 69