f40aa5df3e156c47075997af3418b9b5.ppt

- Количество слайдов: 37

July 22, 2002 Better execution despite weak markets DBS Group Holdings 1 H 2002 Financial Results Presentation to Media and Analysts This presentation is available at www. dbs. com Disclaimer: The material that follows is a presentation of general background information about the Bank’s activities current at the date of the presentation. It is information given in summary form and does not purport to be complete. It is not intended to be relied upon as advice to investors or potential investors and does not take into account the investment objectives, financial situation or needs of any particular investor. These factors should be considered, with or without professional advice, when deciding if an investment is appropriate. DBS accepts no liability whatsoever with respect to the use of this document or its contents.

Better execution despite weak markets q Delivering more disciplined financial results q Strategy intact, focus is now on execution 2

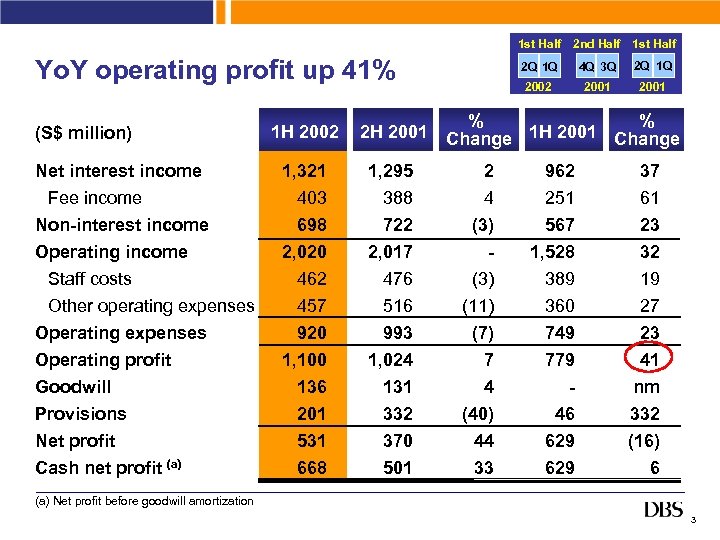

1 st Half Yo. Y operating profit up 41% (S$ million) Net interest income Fee income Non-interest income Operating income Staff costs Other operating expenses Operating profit Goodwill Provisions Net profit Cash net profit (a) 1 H 2002 1, 321 403 698 2, 020 462 457 920 1, 100 136 201 531 668 2 nd Half 1 st Half 2 Q 1 Q 4 Q 3 Q 2 Q 1 Q 2002 2001 % % 2 H 2001 Change 1, 295 388 722 2, 017 476 516 993 1, 024 131 332 370 501 2 4 (3) (11) (7) 7 4 (40) 44 33 962 251 567 1, 528 389 360 749 779 46 629 37 61 23 32 19 27 23 41 nm 332 (16) 6 (a) Net profit before goodwill amortization 3

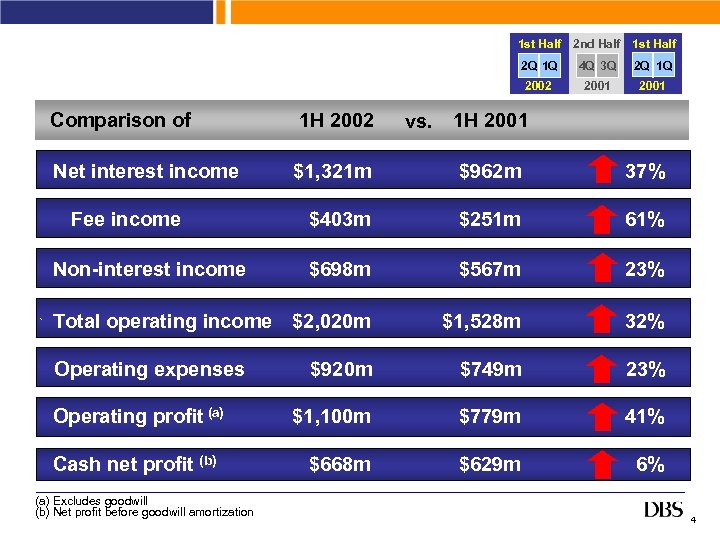

1 st Half 2 nd Half 1 st Half 2 Q 1 Q 4 Q 3 Q 2 Q 1 Q 2002 2001 Comparison of 1 H 2002 Net interest income $1, 321 m $962 m 37% $403 m $251 m 61% $698 m $567 m 23% Total operating income $2, 020 m $1, 528 m 32% $920 m $749 m 23% $1, 100 m $779 m 41% $668 m $629 m 6% Fee income Non-interest income ` Operating expenses Operating profit (a) Cash net profit (b) (a) Excludes goodwill (b) Net profit before goodwill amortization vs. 1 H 2001 4

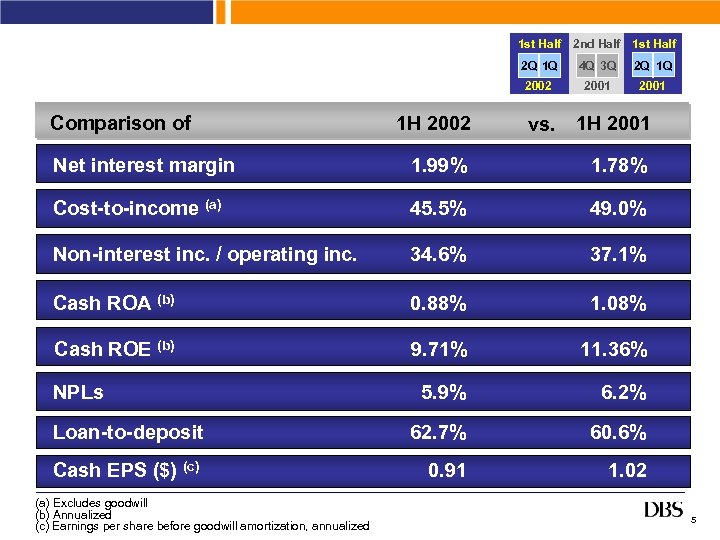

1 st Half 2 nd Half 1 st Half 2 Q 1 Q 2002 Comparison of 4 Q 3 Q 2001 1 H 2002 vs. 1 H 2001 Net interest margin 1. 99% 1. 78% Cost-to-income (a) 45. 5% 49. 0% Non-interest inc. / operating inc. 34. 6% 37. 1% Cash ROA (b) 0. 88% 1. 08% Cash ROE (b) 9. 71% 11. 36% 5. 9% 6. 2% Loan-to-deposit 62. 7% 60. 6% Cash EPS ($) (c) 0. 91 1. 02 NPLs (a) Excludes goodwill (b) Annualized (c) Earnings per share before goodwill amortization, annualized 5

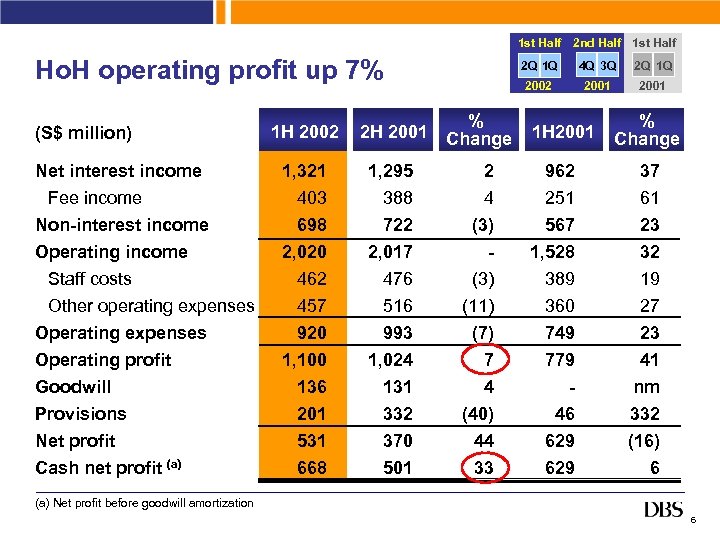

1 st Half Ho. H operating profit up 7% (S$ million) Net interest income Fee income Non-interest income Operating income Staff costs Other operating expenses Operating profit Goodwill Provisions Net profit Cash net profit (a) 1 H 2002 1, 321 403 698 2, 020 462 457 920 1, 100 136 201 531 668 2 Q 1 Q 2 4 (3) (11) (7) 7 4 (40) 44 33 4 Q 3 Q 2 Q 1 Q 2002 % 2 H 2001 Change 1, 295 388 722 2, 017 476 516 993 1, 024 131 332 370 501 2 nd Half 1 st Half 2001 1 H 2001 962 251 567 1, 528 389 360 749 779 46 629 % Change 37 61 23 32 19 27 23 41 nm 332 (16) 6 (a) Net profit before goodwill amortization 6

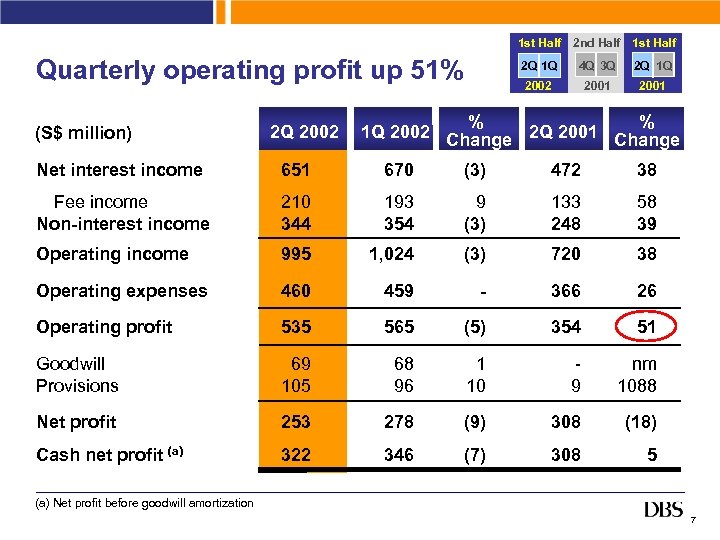

1 st Half Quarterly operating profit up 51% (S$ million) 2 Q 2002 2 nd Half 1 st Half 2 Q 1 Q 4 Q 3 Q 2 Q 1 Q 2002 2001 % % 1 Q 2002 Change 2 Q 2001 Change Net interest income 651 670 (3) 472 38 Fee income Non-interest income 210 344 193 354 9 (3) 133 248 58 39 Operating income 995 1, 024 (3) 720 38 Operating expenses 460 459 - 366 26 Operating profit 535 565 (5) 354 51 Goodwill Provisions 69 105 68 96 1 10 9 nm 1088 Net profit 253 278 (9) 308 (18) Cash net profit (a) 322 346 (7) 308 5 (a) Net profit before goodwill amortization 7

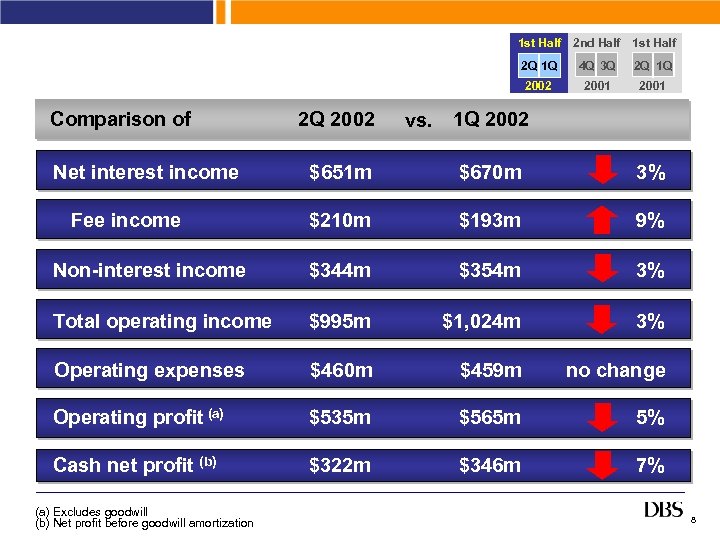

1 st Half 2 nd Half 1 st Half 2 Q 1 Q Net interest income 2 Q 2002 2 Q 1 Q 2002 Comparison of 4 Q 3 Q 2001 vs. 1 Q 2002 $651 m $670 m 3% $210 m $193 m 9% Non-interest income $344 m $354 m 3% Total operating income $995 m $1, 024 m 3% Operating expenses $460 m $459 m no change Operating profit (a) $535 m $565 m 5% Cash net profit (b) $322 m $346 m 7% Fee income ` (a) Excludes goodwill (b) Net profit before goodwill amortization 8

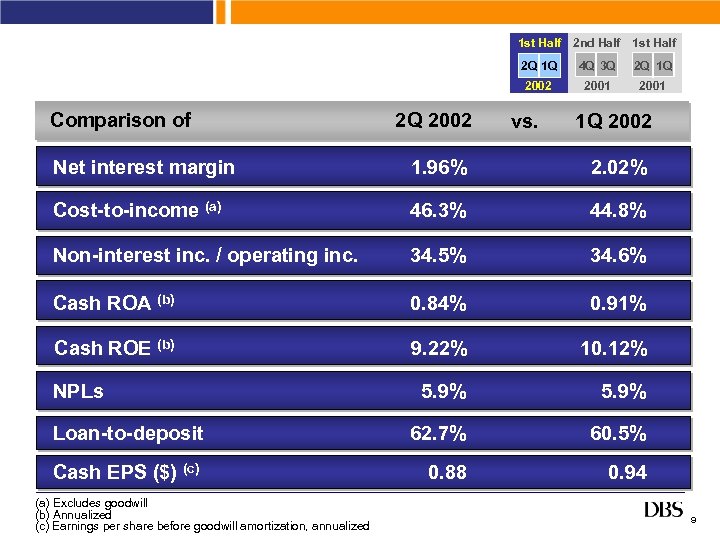

1 st Half 2 nd Half 1 st Half 2 Q 1 Q 2 Q 2002 2 Q 1 Q 2002 Comparison of 4 Q 3 Q 2001 vs. 1 Q 2002 Net interest margin 1. 96% 2. 02% Cost-to-income (a) 46. 3% 44. 8% Non-interest inc. / operating inc. 34. 5% 34. 6% Cash ROA (b) 0. 84% 0. 91% Cash ROE (b) 9. 22% 10. 12% 5. 9% Loan-to-deposit 62. 7% 60. 5% Cash EPS ($) (c) 0. 88 0. 94 NPLs (a) Excludes goodwill (b) Annualized (c) Earnings per share before goodwill amortization, annualized 9

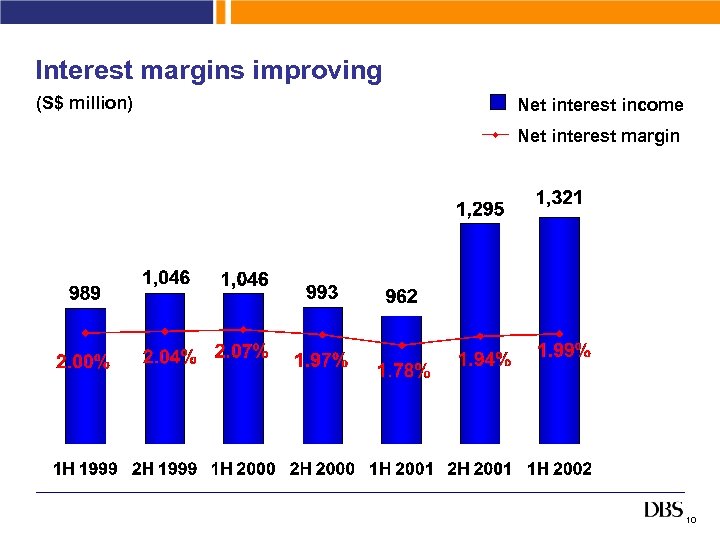

Interest margins improving (S$ million) Net interest income Net interest margin 10

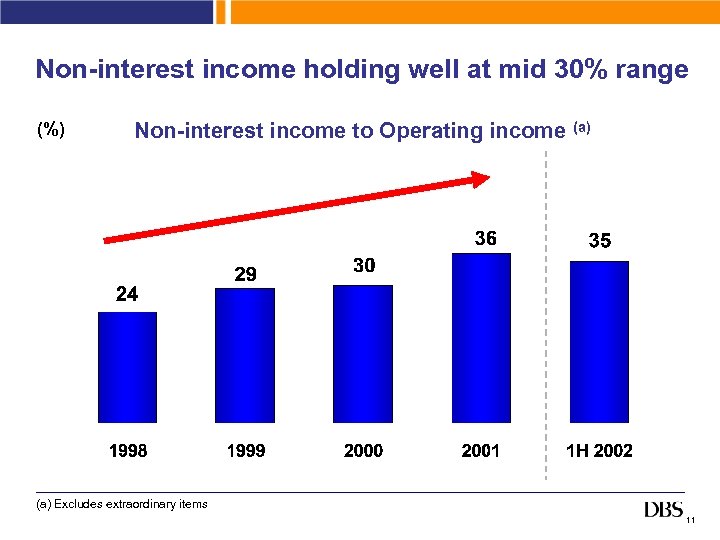

Non-interest income holding well at mid 30% range (%) Non-interest income to Operating income (a) Excludes extraordinary items 11

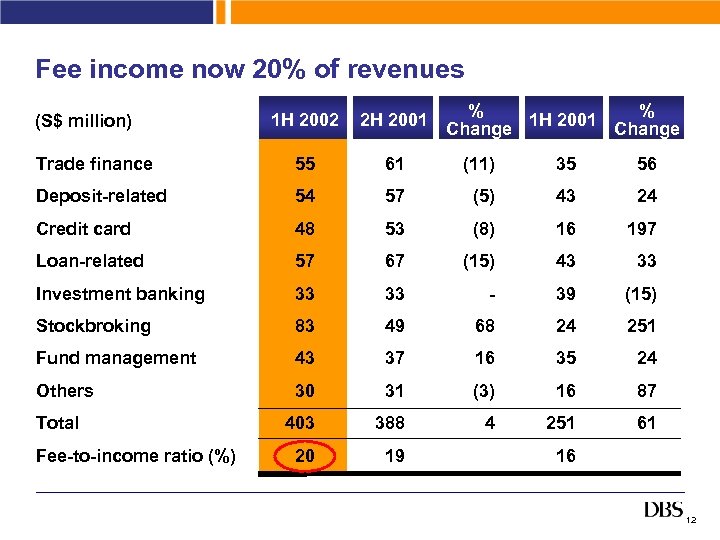

Fee income now 20% of revenues % % 1 H 2001 Change 1 H 2002 2 H 2001 Trade finance 55 61 (11) 35 56 Deposit-related 54 57 (5) 43 24 Credit card 48 53 (8) 16 197 Loan-related 57 67 (15) 43 33 Investment banking 33 33 - 39 (15) Stockbroking 83 49 68 24 251 Fund management 43 37 16 35 24 Others 30 31 (3) 16 87 403 388 4 251 61 20 19 (S$ million) Total Fee-to-income ratio (%) 16 12

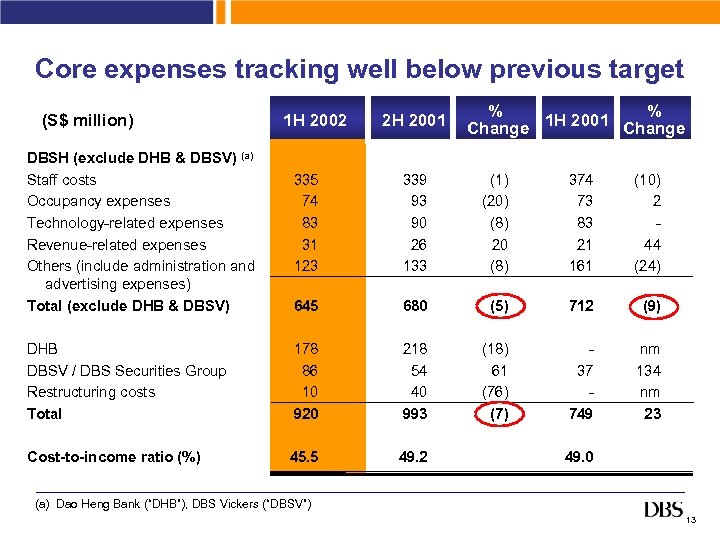

Core expenses tracking well below previous target (S$ million) DBSH (exclude DHB & DBSV) (a) Staff costs Occupancy expenses Technology-related expenses Revenue-related expenses Others (include administration and advertising expenses) Total (exclude DHB & DBSV) 1 H 2002 2 H 2001 % % 1 H 2001 Change 335 74 83 31 123 339 93 90 26 133 (1) (20) (8) 20 (8) 374 73 83 21 161 (10) 2 44 (24) 645 680 (5) 712 (9) DHB DBSV / DBS Securities Group Restructuring costs Total 178 86 10 920 218 54 40 993 (18) 61 (76) (7) 37 749 nm 134 nm 23 Cost-to-income ratio (%) 45. 5 49. 2 49. 0 (a) Dao Heng Bank (“DHB”), DBS Vickers (“DBSV”) 13

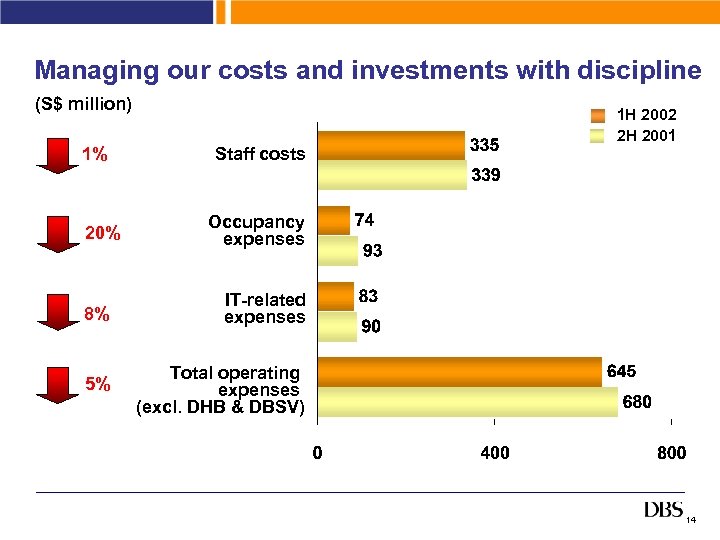

Managing our costs and investments with discipline (S$ million) 1% 20% 1 H 2002 2 H 2001 Staff costs Occupancy expenses 8% IT-related expenses 5% Total operating expenses (excl. DHB & DBSV) 14

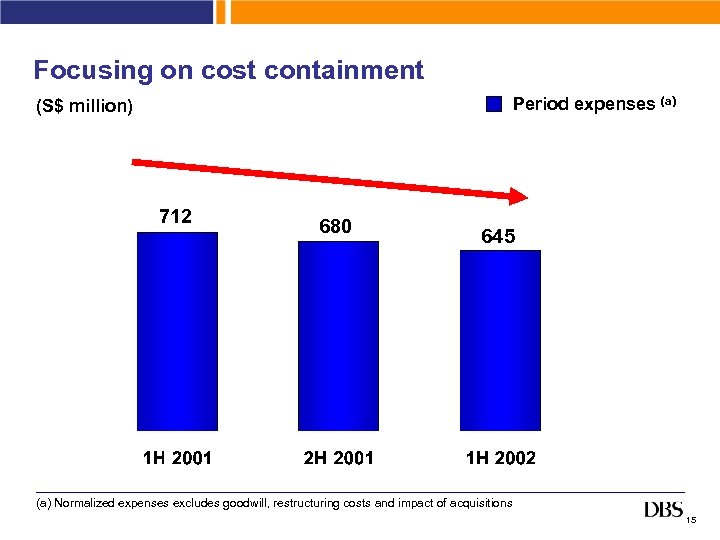

Focusing on cost containment Period expenses (a) (S$ million) 712 680 645 (a) Normalized expenses excludes goodwill, restructuring costs and impact of acquisitions 15

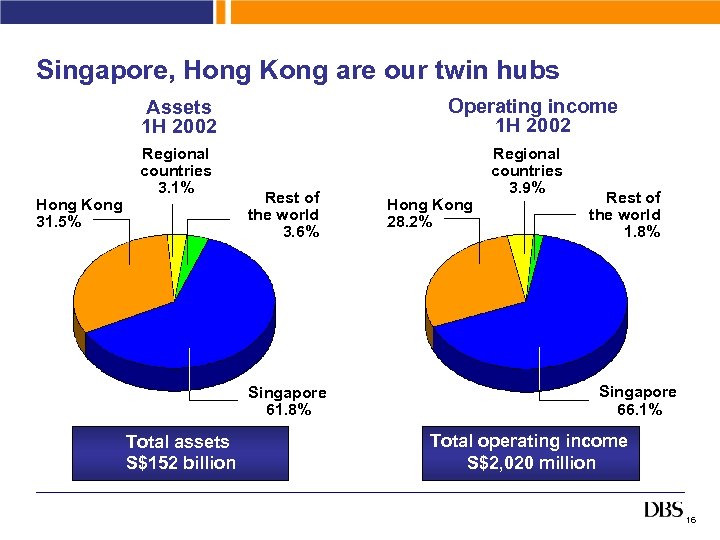

Singapore, Hong Kong are our twin hubs Operating income 1 H 2002 Assets 1 H 2002 Hong Kong 31. 5% Regional countries 3. 1% Rest of the world 3. 6% Singapore 61. 8% Total assets S$152 billion Hong Kong 28. 2% Regional countries 3. 9% Rest of the world 1. 8% Singapore 66. 1% Total operating income S$2, 020 million 16

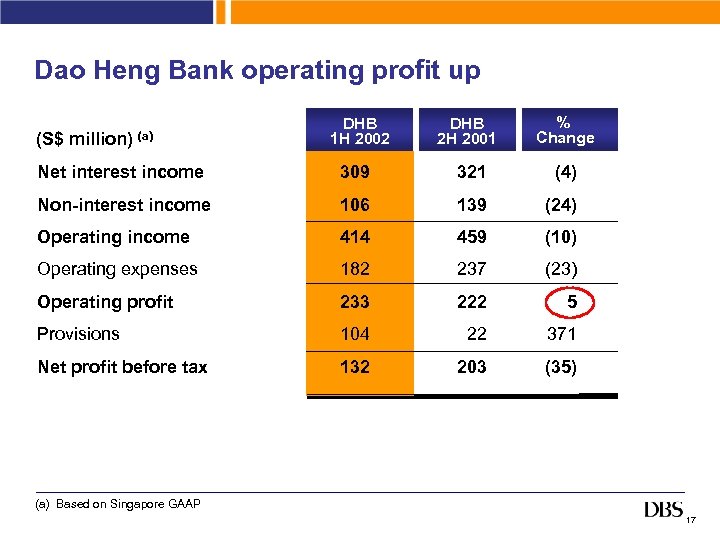

Dao Heng Bank operating profit up (S$ million) (a) DHB 1 H 2002 DHB 2 H 2001 % Change Net interest income 309 321 (4) Non-interest income 106 139 (24) Operating income 414 459 (10) Operating expenses 182 237 (23) Operating profit 233 222 5 Provisions 104 22 371 Net profit before tax 132 203 (35) (a) Based on Singapore GAAP 17

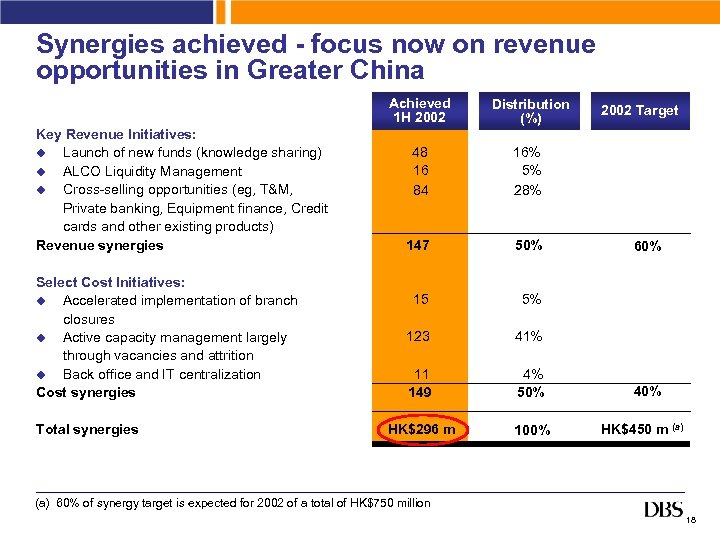

Synergies achieved - focus now on revenue opportunities in Greater China Achieved 1 H 2002 Key Revenue Initiatives: u Launch of new funds (knowledge sharing) u ALCO Liquidity Management u Cross-selling opportunities (eg, T&M, Private banking, Equipment finance, Credit cards and other existing products) Revenue synergies Select Cost Initiatives: u Accelerated implementation of branch closures u Active capacity management largely through vacancies and attrition u Back office and IT centralization Cost synergies Total synergies Distribution (%) 48 16 84 16% 5% 28% 147 50% 15 5% 123 41% 11 149 4% 50% HK$296 m 100% 2002 Target 60% 40% HK$450 m (a) 60% of synergy target is expected for 2002 of a total of HK$750 million 18

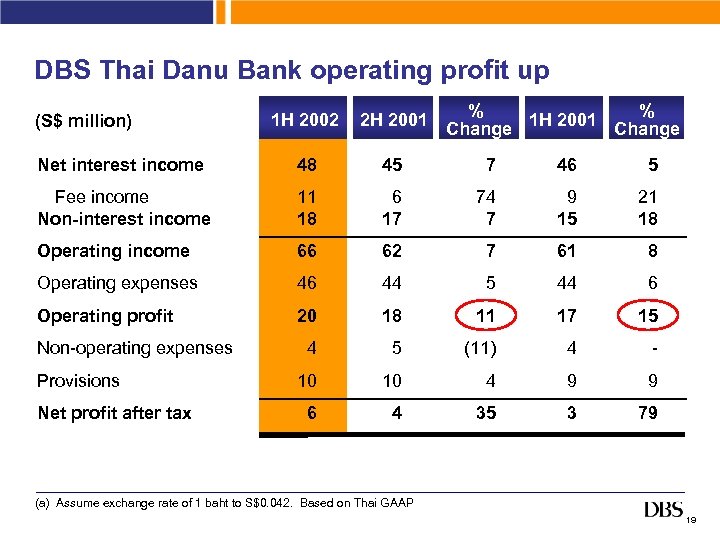

DBS Thai Danu Bank operating profit up % % 1 H 2001 Change 1 H 2002 2 H 2001 Net interest income 48 45 7 46 5 Fee income Non-interest income 11 18 6 17 74 7 9 15 21 18 Operating income 66 62 7 61 8 Operating expenses 46 44 5 44 6 Operating profit 20 18 11 17 15 4 5 (11) 4 - 10 10 4 9 9 6 4 35 3 79 (S$ million) Non-operating expenses Provisions Net profit after tax (a) Assume exchange rate of 1 baht to S$0. 042. Based on Thai GAAP 19

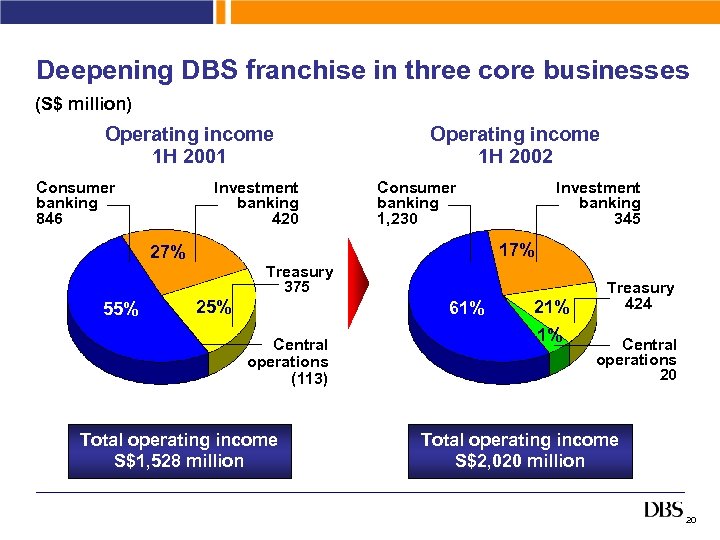

Deepening DBS franchise in three core businesses (S$ million) Operating income 1 H 2001 Consumer banking 846 Investment banking 420 Operating income 1 H 2002 Consumer banking 1, 230 Investment banking 345 17% 27% Treasury 375 55% 25% 61% Central operations (113) Total operating income S$1, 528 million 21% 1% Treasury 424 Central operations 20 Total operating income S$2, 020 million 20

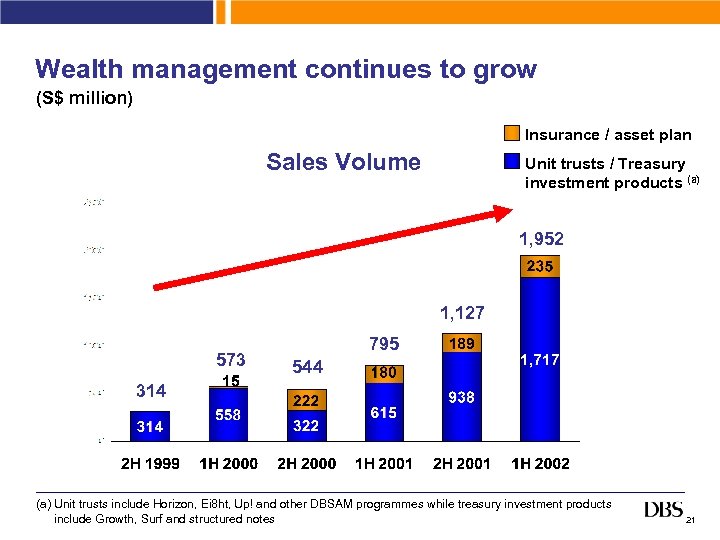

Wealth management continues to grow (S$ million) Insurance / asset plan Sales Volume Unit trusts / Treasury investment products (a) 1, 952 1, 127 573 795 544 314 (a) Unit trusts include Horizon, Ei 8 ht, Up! and other DBSAM programmes while treasury investment products include Growth, Surf and structured notes 21

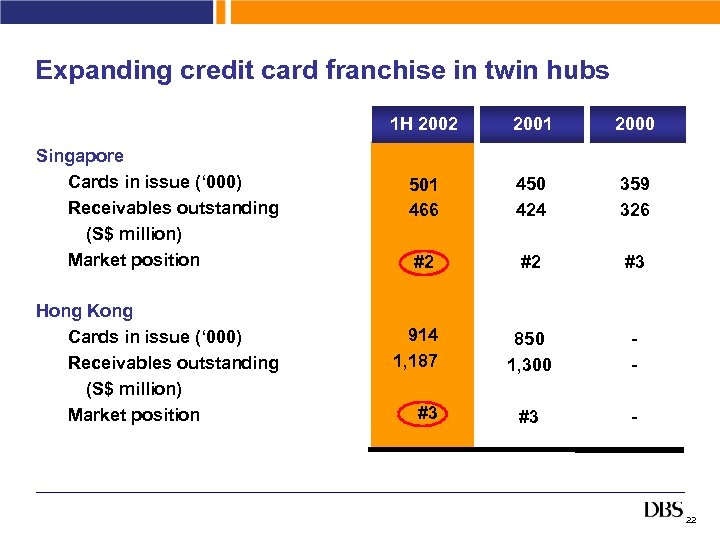

Expanding credit card franchise in twin hubs 1 H 2002 Singapore Cards in issue (‘ 000) Receivables outstanding (S$ million) Market position Hong Kong Cards in issue (‘ 000) Receivables outstanding (S$ million) Market position 2001 2000 501 466 450 424 359 326 #2 #2 #3 850 1, 300 - #3 - 914 1, 187 #3 22

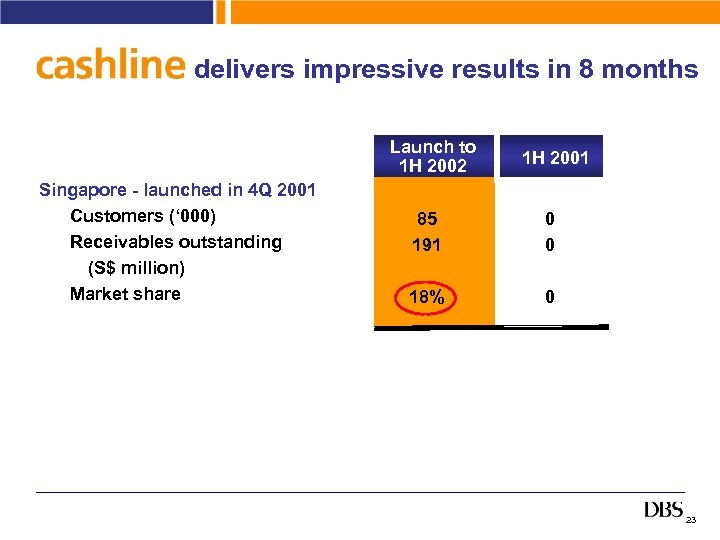

delivers impressive results in 8 months Launch to 1 H 2002 Singapore - launched in 4 Q 2001 Customers (‘ 000) Receivables outstanding (S$ million) Market share 1 H 2001 85 191 0 0 18% 0 23

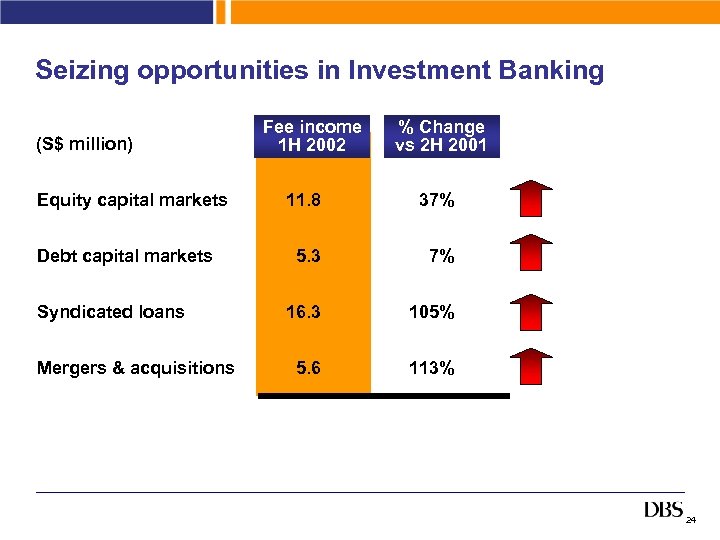

Seizing opportunities in Investment Banking (S$ million) Equity capital markets Debt capital markets Syndicated loans Mergers & acquisitions Fee income 1 H 2002 % Change vs 2 H 2001 11. 8 37% 5. 3 7% 16. 3 105% 5. 6 113% 24

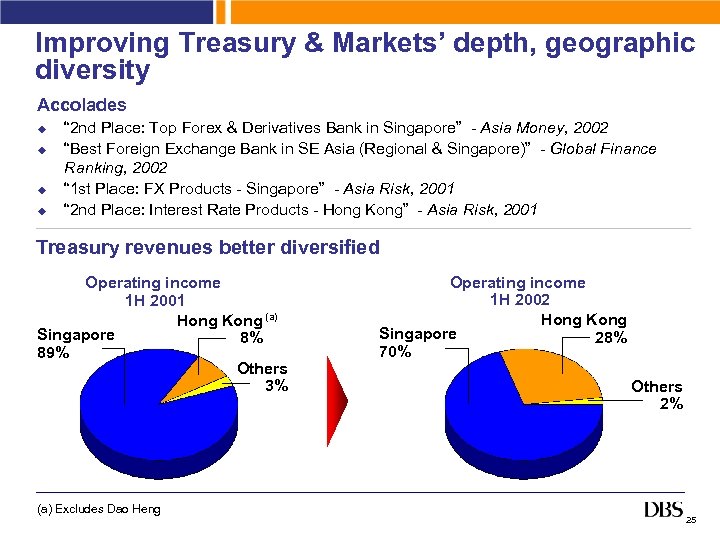

Improving Treasury & Markets’ depth, geographic diversity Accolades u u “ 2 nd Place: Top Forex & Derivatives Bank in Singapore” - Asia Money, 2002 “Best Foreign Exchange Bank in SE Asia (Regional & Singapore)” - Global Finance Ranking, 2002 “ 1 st Place: FX Products - Singapore” - Asia Risk, 2001 “ 2 nd Place: Interest Rate Products - Hong Kong” - Asia Risk, 2001 Treasury revenues better diversified Operating income 1 H 2001 Hong Kong (a) Singapore 8% 89% Others 3% (a) Excludes Dao Heng Operating income 1 H 2002 Hong Kong Singapore 28% 70% Others 2% 25

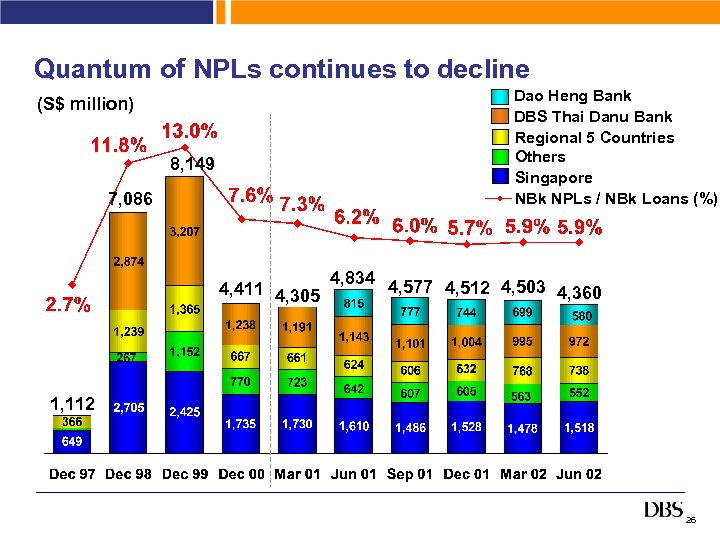

Quantum of NPLs continues to decline Dao Heng Bank DBS Thai Danu Bank Regional 5 Countries Others Singapore NBk NPLs / NBk Loans (%) (S$ million) 8, 149 7, 086 4, 411 4, 305 4, 834 4, 577 4, 512 4, 503 4, 360 1, 112 26

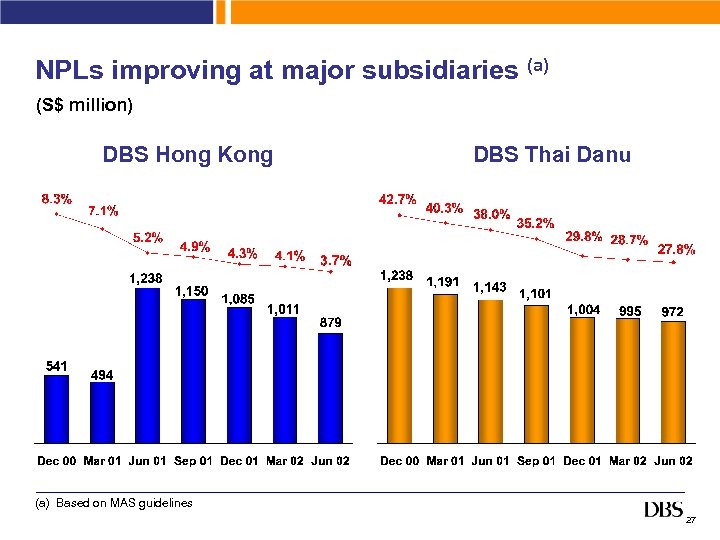

NPLs improving at major subsidiaries (a) (S$ million) DBS Hong Kong DBS Thai Danu (a) Based on MAS guidelines 27

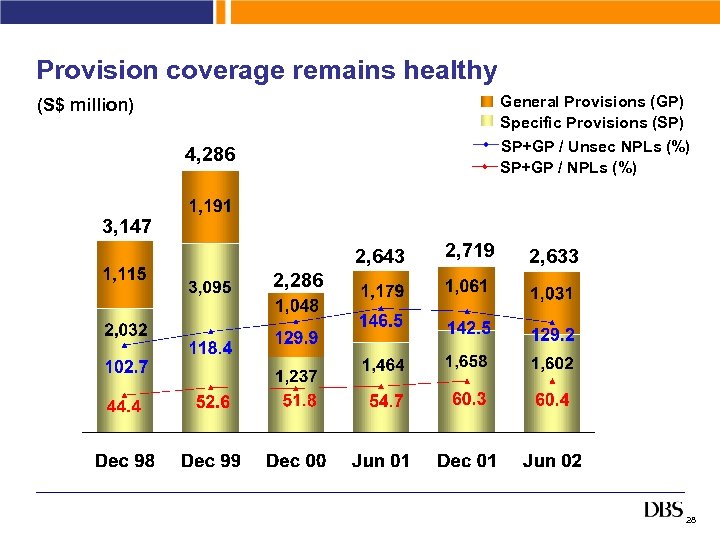

Provision coverage remains healthy General Provisions (GP) Specific Provisions (SP) SP+GP / Unsec NPLs (%) SP+GP / NPLs (%) (S$ million) 4, 286 3, 147 2, 643 2, 719 2, 633 2, 286 28

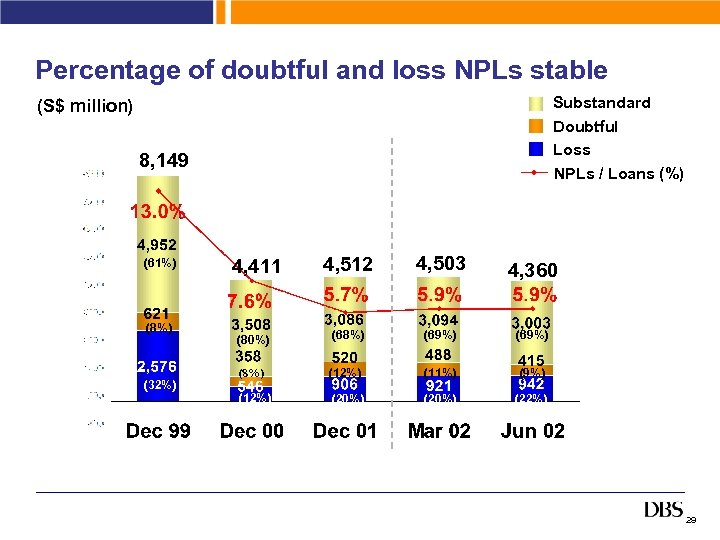

Percentage of doubtful and loss NPLs stable Substandard (S$ million) Doubtful Loss NPLs / Loans (%) 8, 149 (61%) (8%) (32%) 4, 411 4, 512 4, 503 (80%) (68%) (69%) (8%) (12%) (11%) (9%) (12%) (20%) (22%) 4, 360 29

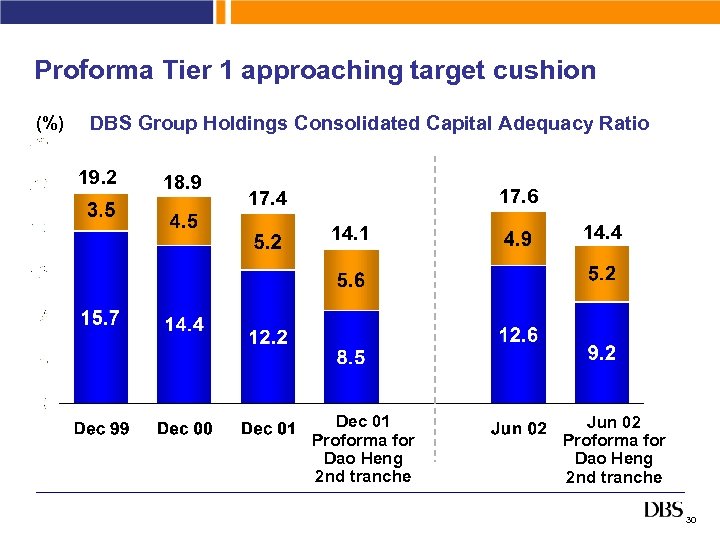

Proforma Tier 1 approaching target cushion (%) DBS Group Holdings Consolidated Capital Adequacy Ratio 19. 2 18. 9 17. 6 17. 4 14. 1 Dec 01 Proforma for Dao Heng 2 nd tranche 14. 4 Jun 02 Proforma for Dao Heng 2 nd tranche 30

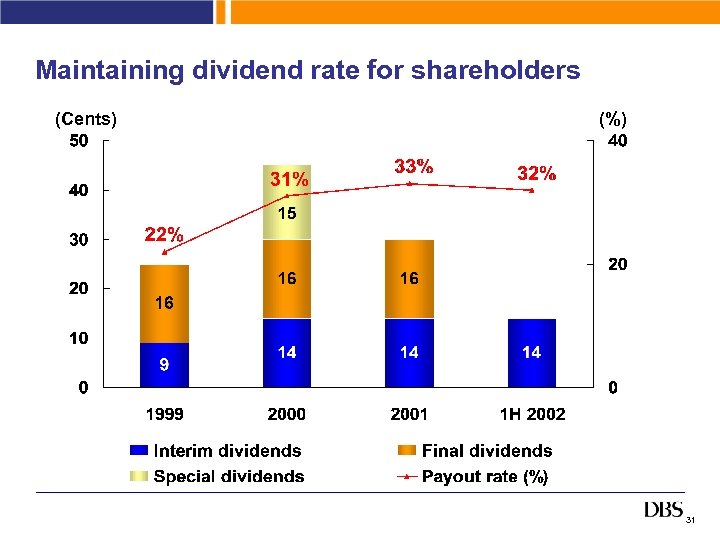

Maintaining dividend rate for shareholders (Cents) (%) 31

Better execution despite weak markets q Delivering more disciplined financial results q Strategy intact, focus is now on execution 32

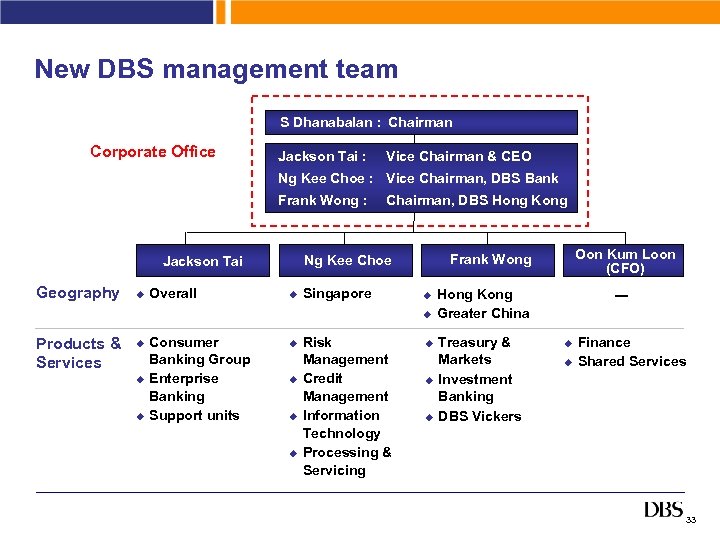

New DBS management team S Dhanabalan : Chairman Corporate Office Jackson Tai : Vice Chairman & CEO Ng Kee Choe : Vice Chairman, DBS Bank Frank Wong : u Overall u Singapore u u Products & Services u u u Consumer Banking Group Enterprise Banking Support units u u Risk Management Credit Management Information Technology Processing & Servicing Oon Kum Loon (CFO) Frank Wong Ng Kee Choe Jackson Tai Geography Chairman, DBS Hong Kong u u u Hong Kong Greater China Treasury & Markets Investment Banking DBS Vickers u u Finance Shared Services 33

Strategy intact, now focussed on execution u u u Build coherent Pan-Asian financial franchise, with early focus on Singapore, Hong Kong and Greater China Leverage dominant market position and retail distribution in Singapore and Hong Kong Differentiate with Treasury & Markets, Capital Markets, Wealth Management, Risk Management and Credit Management Become lower cost producer through scale, integrated up-to-date information technology and straight-through processing Intermediate regional capital flows between issuers and investors Recalibrate investments and resources to changed market conditions 34

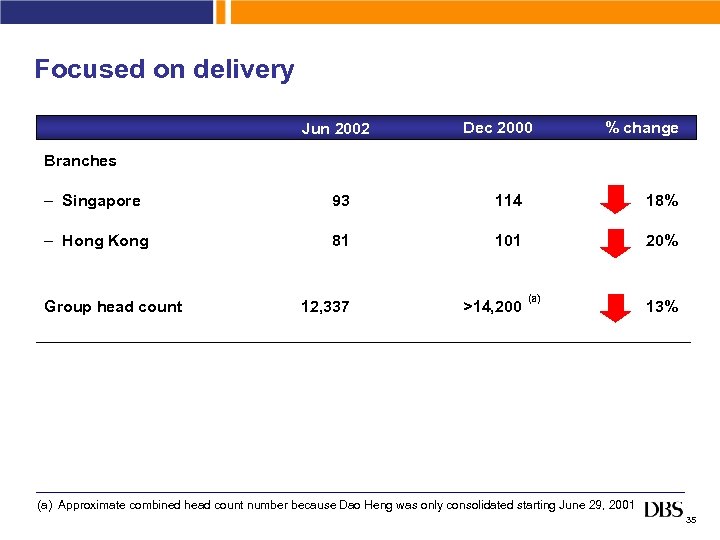

Focused on delivery Jun 2002 Dec 2000 % change Branches – Singapore 93 114 18% – Hong Kong 81 101 20% 12, 337 >14, 200 Group head count (a) 13% (a) Approximate combined head count number because Dao Heng was only consolidated starting June 29, 2001 35

Management depth for the next phase Management Area of focus Experience Corporate Office S. Dhanabalan Jackson Tai Ng Kee Choe Frank Wong Chairman Vice Chairman & CEO Vice Chairman, DBS Bank Chairman, DBS Hong Kong > 42 years > 28 years > 35 years > 36 years Policy Committee Eric Ang Chan Tak Kin Chong Kie Cheong Elsie Foh Hong Tuck Kun Steve Ingram Edmund Koh David Lau Oon Kum Loon Rajan Raju Seck Wai Kwong Greg Seow Randy Sullivan Pornsanong Tuchinda Wong Ban Suan Investment banking Consumer banking, Hong Kong Investment banking - institutional & corporate clients Personal banking & private banking Enterprise banking Information technology Consumer banking, Singapore Treasury & markets Finance Processing & servicing Wealth management Securities Hong Kong Thailand Central treasury > 23 years > 30 years > 26 years > 19 years > 18 years > 19 years > 28 years > 12 years > 20 years > 25 years > 31 years > 16 years > 20 years 36

July 22, 2002 Better execution despite weak markets DBS Group Holdings 1 H 2002 Financial Results Presentation to Media and Analysts This presentation is available at www. dbs. com Disclaimer: The material that follows is a presentation of general background information about the Bank’s activities current at the date of the presentation. It is information given in summary form and does not purport to be complete. It is not intended to be relied upon as advice to investors or potential investors and does not take into account the investment objectives, financial situation or needs of any particular investor. These factors should be considered, with or without professional advice, when deciding if an investment is appropriate. DBS accepts no liability whatsoever with respect to the use of this document or its contents.

f40aa5df3e156c47075997af3418b9b5.ppt