7f970e88e02fc6bcd12510619c7af0cc.ppt

- Количество слайдов: 23

July 2011

Safe Harbor Statement This presentation may contain forward-looking statements concerning Asia Pacific Wire & Cable Corporation. The actual results may differ materially depending on a number of risk factors including, but not limited to, the following: general economic and business conditions, development, shipment, market acceptance, additional competition from existing and new competitors, changes in technology or product techniques, and various other factors beyond its control. All forward-looking statements are expressly qualified in their entirety by this Cautionary Statement and the risk factors detailed in the Company's reports filed with the Securities and Exchange Commission. Asia Pacific Wire & Cable Corporation undertakes no duty to revise or update any forwardlooking statements to reflect events or circumstances after the date of this presentation. 1 www. apwcc. com

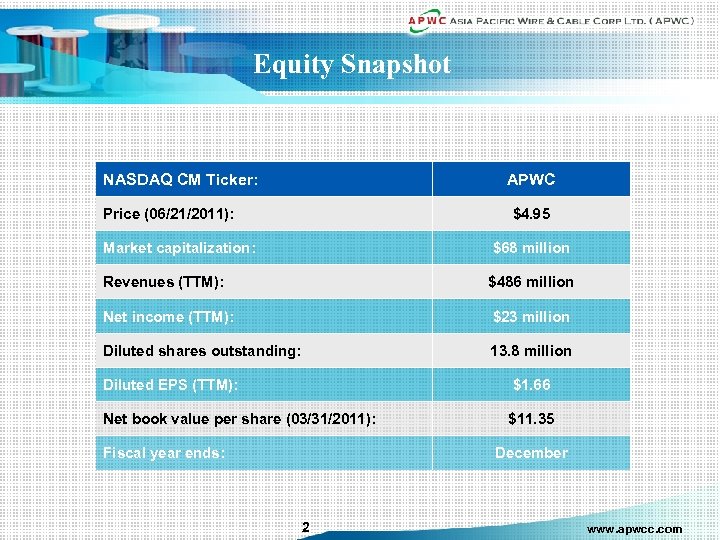

Equity Snapshot NASDAQ CM Ticker: APWC Price (06/21/2011): $4. 95 Market capitalization: $68 million Revenues (TTM): $486 million Net income (TTM): $23 million Diluted shares outstanding: 13. 8 million Diluted EPS (TTM): $1. 66 Net book value per share (03/31/2011): $11. 35 Fiscal year ends: December 2 www. apwcc. com

Investment Highlights u Taiwan-based leader in several Asia-Pacific markets u Strong and growing underlying market demand u Broad geographic coverage offers diversification u Experienced and knowledgeable in-house sales, service & technical team u Improving financial performance including solid revenue growth u Strong balance sheet, cash flow, and an attractive valuation 3 www. apwcc. com

Company Overview 1 Founded in 1996 2 Headquartered in Taipei, Taiwan 3 Subsidiaries: China, Thailand, Singapore and Australia 4 Core business: manufacturing and distribution of wire and cable products 5 Additional services: project engineering of Supply, Delivery and Installation (SDI) services for power cables 6 Total number of employees: approximately 1, 715 4 www. apwcc. com

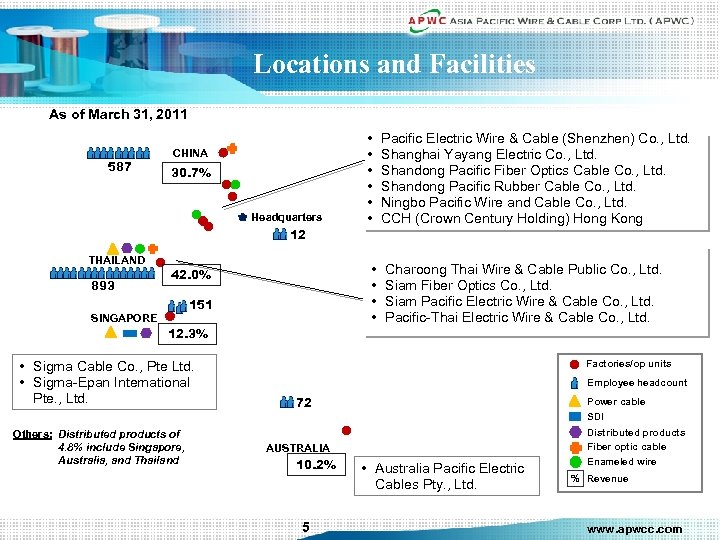

Locations and Facilities As of March 31, 2011 587 30. 7% Headquarters Pacific Electric Wire & Cable (Shenzhen) Co. , Ltd. Shanghai Yayang Electric Co. , Ltd. Shandong Pacific Fiber Optics Cable Co. , Ltd. Shandong Pacific Rubber Cable Co. , Ltd. Ningbo Pacific Wire and Cable Co. , Ltd. CCH (Crown Century Holding) Hong Kong • • CHINA • • • Charoong Thai Wire & Cable Public Co. , Ltd. Siam Fiber Optics Co. , Ltd. Siam Pacific Electric Wire & Cable Co. , Ltd. Pacific-Thai Electric Wire & Cable Co. , Ltd. 12 THAILAND 893 42. 0% 151 SINGAPORE 12. 3% • Sigma Cable Co. , Pte Ltd. • Sigma-Epan Intemational Pte. , Ltd. Others: Distributed products of 4. 8% include Singapore, Australia, and Thailand Factories/op units Employee headcount 72 Power cable SDI project engineering Distributed products AUSTRALIA 10. 2% 5 • Australia Pacific Electric Cables Pty. , Ltd. Fiber optic cable Enameled wire % Revenue contribution (1 H 09) www. apwcc. com

Global Industry Overview u Ø Energy-related infrastructure spending Ø Telecom-related infrastructure spending Ø Construction cycle Ø u Industrial activity Local presence required Ø Ø Ø u Global Cable Production by Type Wire & cable growth industry growth drivers High transportation costs Products need to meet regional specifications Global Fiber Optic Cable Market Growth Forecast (M f-km) Handling and logistics ~ 80% of manufacturing cost attributable to raw materials Ø Ø Pass-through pricing generally utilized for long-term agreements About one-half of business priced short cycle Source: CRU estimates 6 www. apwcc. com

China Businesses u Long-term partnership with China Unicom Top Customers Ø Ø Ø Telecom carriers Toolmakers and appliances makers Mining companies CAGR = 16. 8% Products Ø Ø Ø Enameled wire Telecom cable Fiber-optic cable Optical fiber (JV) Rubber cable 7 www. apwcc. com

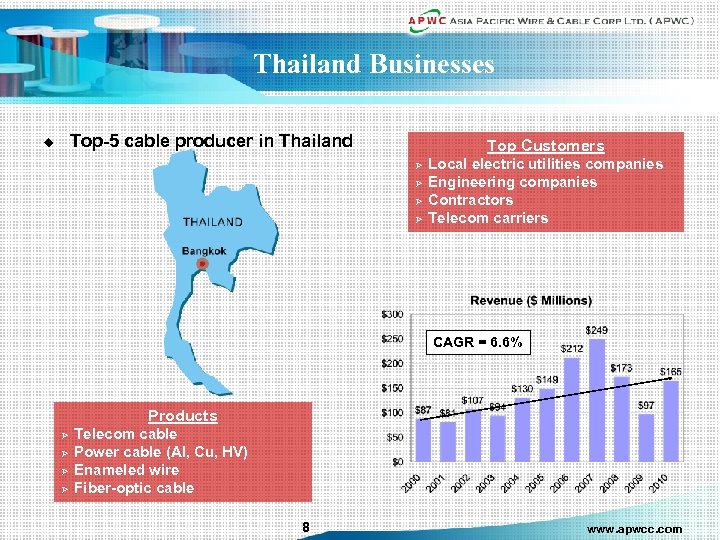

Thailand Businesses Top-5 cable producer in Thailand u Top Customers Ø Ø Local electric utilities companies Engineering companies Contractors Telecom carriers CAGR = 6. 6% Products Ø Ø Telecom cable Power cable (Al, Cu, HV) Enameled wire Fiber-optic cable 8 www. apwcc. com

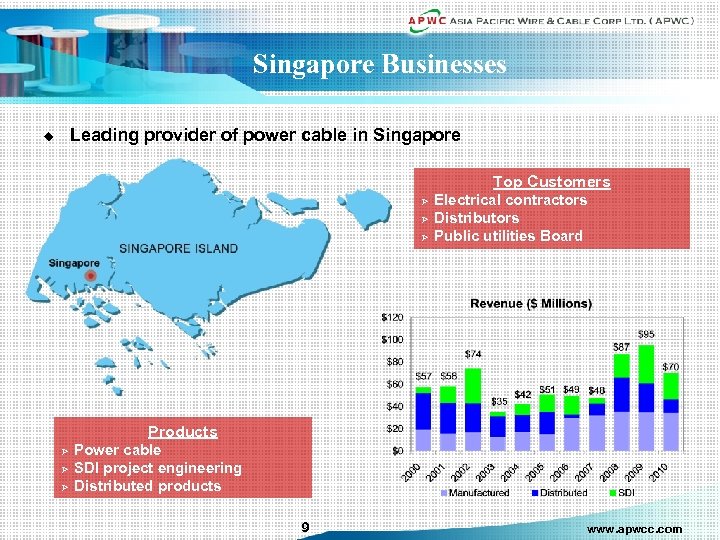

Singapore Businesses Leading provider of power cable in Singapore u Top Customers Ø Ø Ø Electrical contractors Distributors Public utilities Board Products Ø Ø Ø Power cable SDI project engineering Distributed products 9 www. apwcc. com

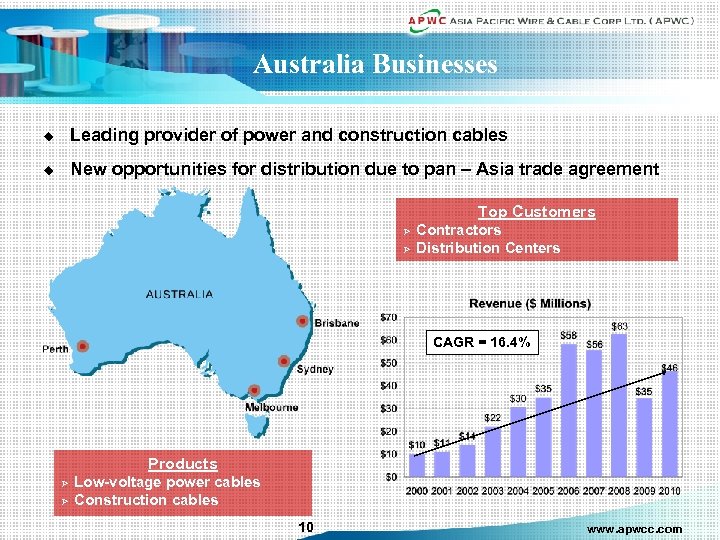

Australia Businesses u Leading provider of power and construction cables u New opportunities for distribution due to pan – Asia trade agreement Top Customers Ø Ø Contractors Distribution Centers CAGR = 16. 4% Products Ø Ø Low-voltage power cables Construction cables 10 www. apwcc. com

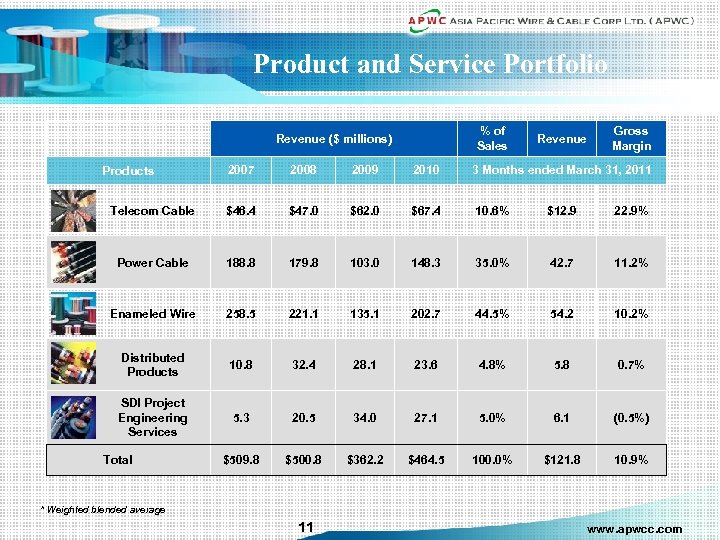

Product and Service Portfolio % of Sales Revenue ($ millions) Revenue Gross Margin 2007 2008 2009 2010 Telecom Cable $46. 4 $47. 0 $62. 0 $67. 4 10. 6% $12. 9 22. 9% Power Cable 188. 8 179. 8 103. 0 148. 3 35. 0% 42. 7 11. 2% Enameled Wire 258. 5 221. 1 135. 1 202. 7 44. 5% 54. 2 10. 2% Distributed Products 10. 8 32. 4 28. 1 23. 6 4. 8% 5. 8 0. 7% SDI Project Engineering Services 5. 3 20. 5 34. 0 27. 1 5. 0% 6. 1 (0. 5%) $509. 8 $500. 8 $362. 2 $464. 5 100. 0% $121. 8 10. 9% Products Total 3 Months ended March 31, 2011 * Weighted blended average 11 www. apwcc. com

Quality Assurance u ISO 9001: Quality Management System Certification u ISO 14001: Environmental Management System Certification u ISO 17025: Testing and Calibration Laboratories Certification u UL: Japan Industrial Standard u C. E. : Thailand Industrial Standard u ISO: Australian Quality Accredited 12 www. apwcc. com

Competitive Advantages Competitive Landscape Competitors include both independent domestic and foreign suppliers Local competitors have advantages in sales, R&D spending or financial resources Global competitors include Draka, Furukawa, Nexans, Prysmian, etc. Competitive Advantages Reliable product supply and distribution Superior product quality and performance Raw-material cost advantage over local producers Excellent customer service and knowledgeable sales and technical team First-mover advantage in key local markets 13 www. apwcc. com

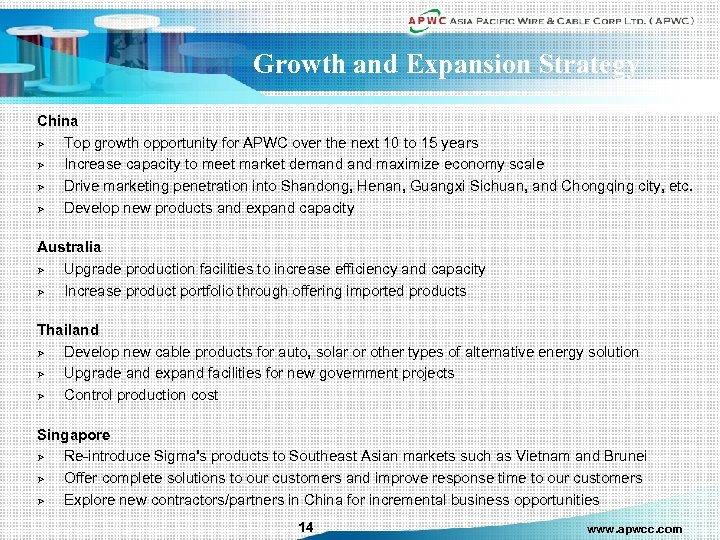

Growth and Expansion Strategy China Ø Top growth opportunity for APWC over the next 10 to 15 years Ø Increase capacity to meet market demand maximize economy scale Ø Drive marketing penetration into Shandong, Henan, Guangxi Sichuan, and Chongqing city, etc. Ø Develop new products and expand capacity Australia Ø Upgrade production facilities to increase efficiency and capacity Ø Increase product portfolio through offering imported products Thailand Ø Develop new cable products for auto, solar or other types of alternative energy solution Ø Upgrade and expand facilities for new government projects Ø Control production cost Singapore Ø Re-introduce Sigma's products to Southeast Asian markets such as Vietnam and Brunei Ø Offer complete solutions to our customers and improve response time to our customers Ø Explore new contractors/partners in China for incremental business opportunities 14 www. apwcc. com

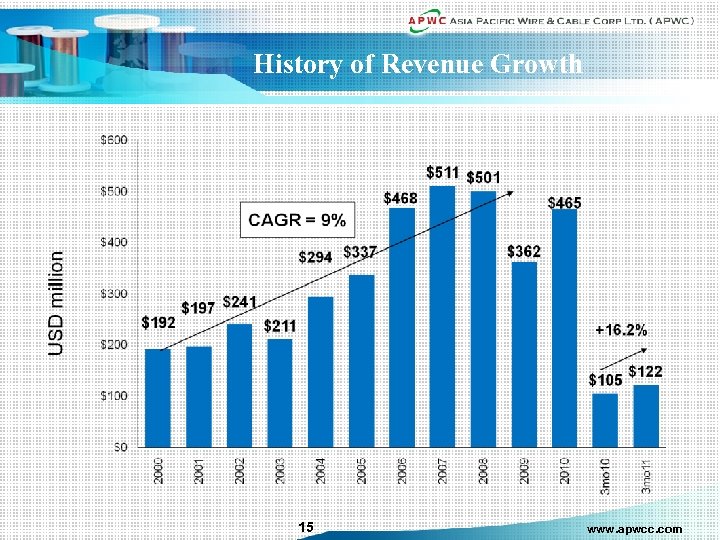

History of Revenue Growth 15 www. apwcc. com

USD Million Recovery in Gross Profit 16 www. apwcc. com

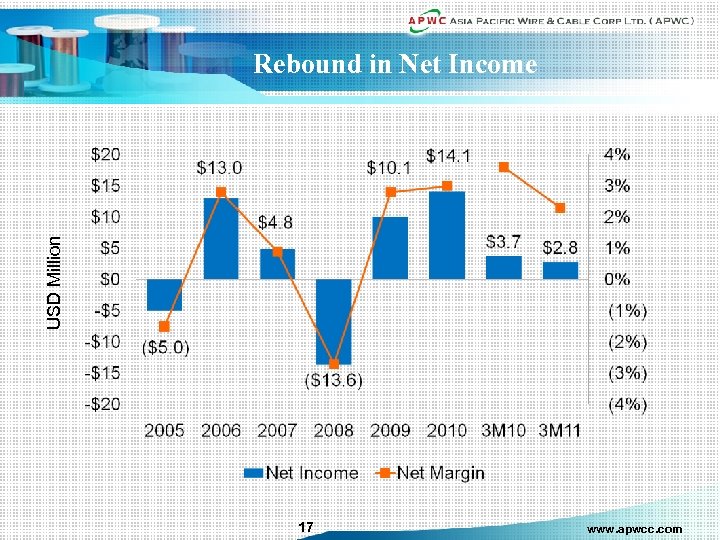

USD Million Rebound in Net Income 17 www. apwcc. com

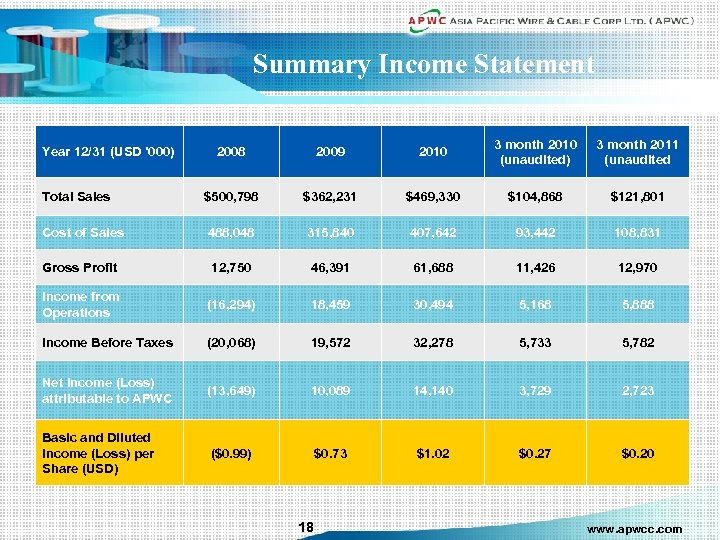

Summary Income Statement 2008 2009 2010 3 month 2010 (unaudited) 3 month 2011 (unaudited Total Sales $500, 798 $362, 231 $469, 330 $104, 868 $121, 801 Cost of Sales 488, 048 315, 840 407, 642 93, 442 108, 831 Gross Profit 12, 750 46, 391 61, 688 11, 426 12, 970 Income from Operations (16, 294) 18, 459 30, 494 5, 168 5, 888 Income Before Taxes (20, 068) 19, 572 32, 278 5, 733 5, 782 Net Income (Loss) attributable to APWC (13, 649) 10, 089 14, 140 3, 729 2, 723 Basic and Diluted Income (Loss) per Share (USD) ($0. 99) $0. 73 $1. 02 $0. 27 $0. 20 Year 12/31 (USD '000) 18 www. apwcc. com

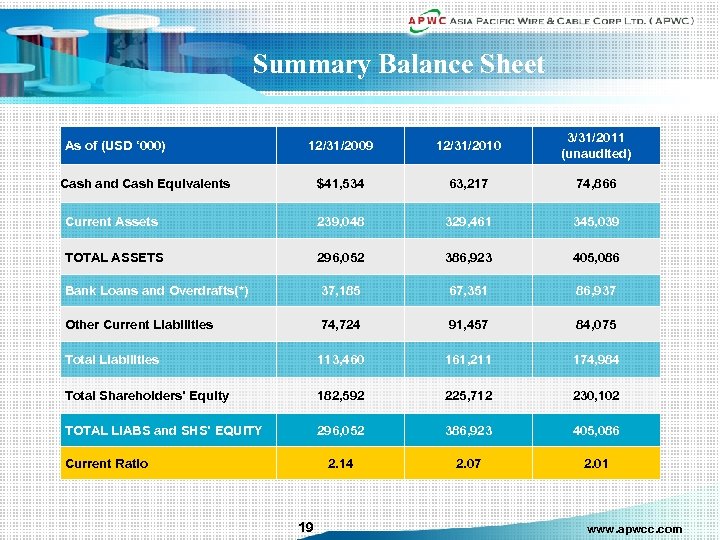

Summary Balance Sheet 12/31/2009 12/31/2010 3/31/2011 (unaudited) $41, 534 63, 217 74, 866 Current Assets 239, 048 329, 461 345, 039 TOTAL ASSETS 296, 052 386, 923 405, 086 Bank Loans and Overdrafts(*) 37, 185 67, 351 86, 937 Other Current Liabilities 74, 724 91, 457 84, 075 Total Liabilities 113, 460 161, 211 174, 984 Total Shareholders’ Equity 182, 592 225, 712 230, 102 TOTAL LIABS and SHS’ EQUITY 296, 052 386, 923 405, 086 2. 14 2. 07 2. 01 As of (USD ‘ 000) Cash and Cash Equivalents Current Ratio 19 www. apwcc. com

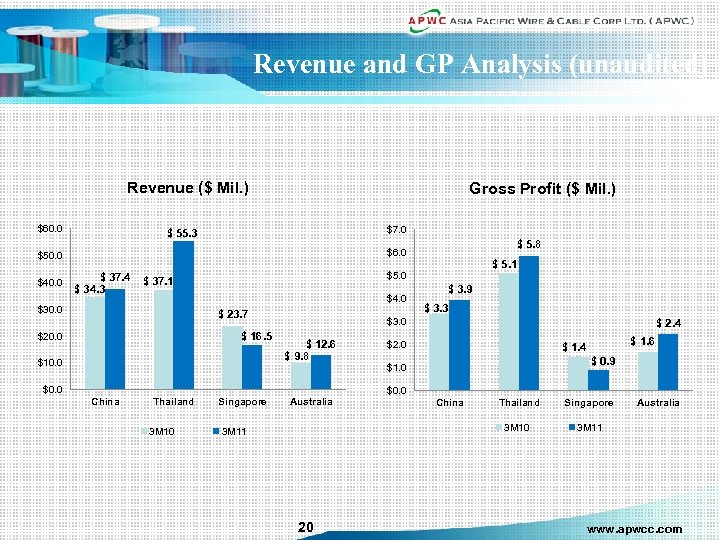

Revenue and GP Analysis (unaudited) Revenue ($ Mil. ) $60. 0 Gross Profit ($ Mil. ) $7. 0 $ 55. 3 $40. 0 $ 5. 8 $6. 0 $50. 0 $ 37. 4 $ 34. 3 $ 37. 1 $4. 0 $30. 0 $ 23. 7 $ 16. 5 $20. 0 $ 5. 1 $5. 0 $10. 0 $ 3. 9 $ 3. 3 $3. 0 $ 12. 6 $ 9. 8 $0. 0 $ 2. 4 $2. 0 $ 1. 6 $ 1. 4 $ 0. 9 $1. 0 $0. 0 China Thailand 3 M 10 Singapore Australia 20 Thailand Singapore 3 M 10 3 M 11 China Australia 3 M 11 www. apwcc. com

Strong Management Team u Andy C. C. CHENG – Chairman of the Board Mr. Andy C. C. CHENG was a member of the company’s Board of Directors from 2004 to 2005 and was re-elected in 2007. From 1987 to 2003, Mr. Cheng was the Vice President of procurement and later Executive Vice President and Chairman of the Investment division, all served at PEWC. Mr. Cheng was elected Chairman of the Board of APWC in October 2009. u Chun Tang YUAN – Chief Executive Officer Mr. Chun Tang YUAN also serves as Chairman of PEWC since 2004 and has been the Director of Pacific Construction Corp. Ltd since 2002. He served as the Director of Taiwan Co-generation Corp from 2005 to 2008. Mr. Yuan is also the Chairman of Taiwan Electric Wire and cable Industries Association since 2004. He has served as the Supervisor to Taipei Importers/Exporters Association as well as the Director of Chinese National Federation of Industries in Taiwan since 1998 and 2004 respectively. u Frank TSENG – Chief Financial Officer Mr. Frank TSENG has served as CFO since October 2009. Before joining APWCC, he was the deputy CFO for ABB Taiwan and, prior to that, the APAC regional controller for Phoenix Technologies, a Silicon Valley-based company that is publicly traded on NASDAQ. Mr. Tseng holds a Masters Degree of Accountancy from Georgia State University. He is also a CPA by the State of Illinois. u Carson TIEN – Chief Operating Officer Mr. Carson TIEN serves as Chief Operating Officer since 2005 and has been with Pacific Electric Wire and Cable Group Companies since 1969. He started as engineer in PEWC's Tao Yuan plant in 1969 and later promoted to plant manager in 1977 and Assistant VP responsible for Engineering and Manufacturing in 1990. He transferred to APWC to head the Shenzhen plant in 1996 and was promoted to COO of APWC in 2005. u Daphne HSU – Financial Controller Ms. Daphne HSU has been Financial Controller of the Company since March of 2005, prior to which she served as Financial Controller for ten years in Taiwan and China at a Thomson SA joint venture. Daphne graduated from National of Taipei College of Business with a major in accounting. 21 www. apwcc. com

This Presentation of APWC was developed by the Company and CCG and is intended solely for informational purposes and is not to be construed as an offer to sell or the solicitation of an offer to buy the Company’s stock. This presentation is based upon information available to the public, as well as other information from sources which management believes to be reliable, but is not represented by APWC or CCG as being fully accurate nor does it purport to be complete. Opinions expressed herein are those of management as of the date of publication and are subject to change without notice.

7f970e88e02fc6bcd12510619c7af0cc.ppt