24696ff7fd42a36b76f8febf01529312.ppt

- Количество слайдов: 95

JSE UPDATE COMMUNICATION SESSION - CAPE TOWN Leanne Parsons 16 November 2006 Copyright© JSE Limited 2005 www. jse. co. za

JSE UPDATE COMMUNICATION SESSION - CAPE TOWN Leanne Parsons 16 November 2006 Copyright© JSE Limited 2005 www. jse. co. za

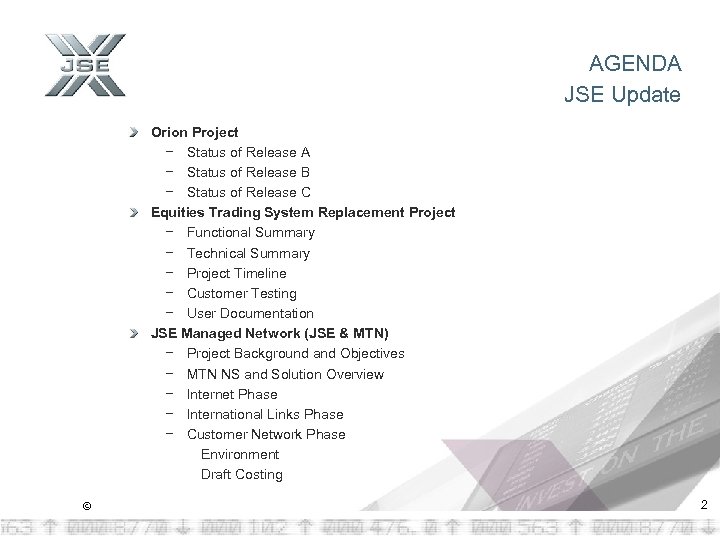

AGENDA JSE Update Orion Project − Status of Release A − Status of Release B − Status of Release C Equities Trading System Replacement Project − Functional Summary − Technical Summary − Project Timeline − Customer Testing − User Documentation JSE Managed Network (JSE & MTN) − Project Background and Objectives − MTN NS and Solution Overview − Internet Phase − International Links Phase − Customer Network Phase Environment Draft Costing © 2

AGENDA JSE Update Orion Project − Status of Release A − Status of Release B − Status of Release C Equities Trading System Replacement Project − Functional Summary − Technical Summary − Project Timeline − Customer Testing − User Documentation JSE Managed Network (JSE & MTN) − Project Background and Objectives − MTN NS and Solution Overview − Internet Phase − International Links Phase − Customer Network Phase Environment Draft Costing © 2

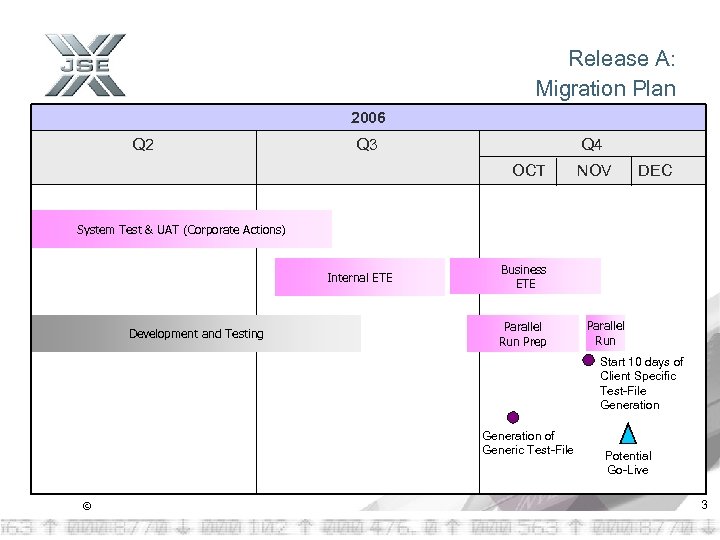

Release A: Migration Plan 2006 Q 2 Q 3 Q 4 OCT NOV DEC System Test & UAT (Corporate Actions) Internal ETE Development and Testing Business ETE Parallel Run Prep Parallel Run Start 10 days of Client Specific Test-File Generation of Generic Test-File © Potential Go-Live 3

Release A: Migration Plan 2006 Q 2 Q 3 Q 4 OCT NOV DEC System Test & UAT (Corporate Actions) Internal ETE Development and Testing Business ETE Parallel Run Prep Parallel Run Start 10 days of Client Specific Test-File Generation of Generic Test-File © Potential Go-Live 3

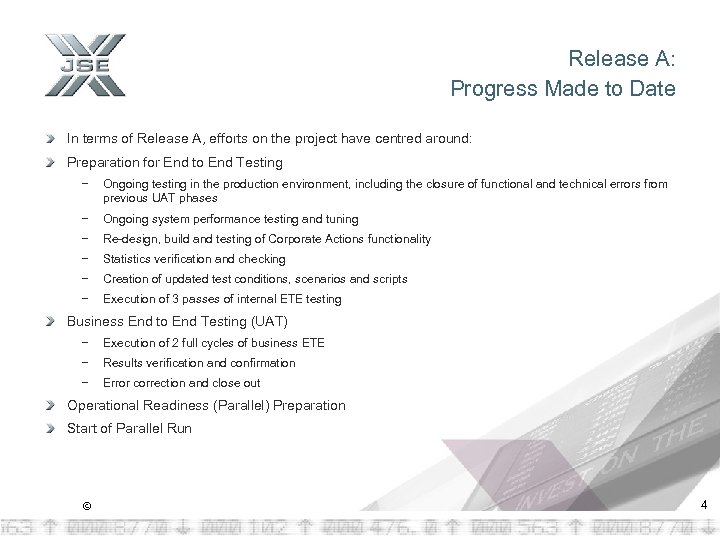

Release A: Progress Made to Date In terms of Release A, efforts on the project have centred around: Preparation for End to End Testing − Ongoing testing in the production environment, including the closure of functional and technical errors from previous UAT phases − Ongoing system performance testing and tuning − Re-design, build and testing of Corporate Actions functionality − Statistics verification and checking − Creation of updated test conditions, scenarios and scripts − Execution of 3 passes of internal ETE testing Business End to End Testing (UAT) − Execution of 2 full cycles of business ETE − Results verification and confirmation − Error correction and close out Operational Readiness (Parallel) Preparation Start of Parallel Run © 4

Release A: Progress Made to Date In terms of Release A, efforts on the project have centred around: Preparation for End to End Testing − Ongoing testing in the production environment, including the closure of functional and technical errors from previous UAT phases − Ongoing system performance testing and tuning − Re-design, build and testing of Corporate Actions functionality − Statistics verification and checking − Creation of updated test conditions, scenarios and scripts − Execution of 3 passes of internal ETE testing Business End to End Testing (UAT) − Execution of 2 full cycles of business ETE − Results verification and confirmation − Error correction and close out Operational Readiness (Parallel) Preparation Start of Parallel Run © 4

Release A: Next Steps A further set of system generated non-client specific EOD Equity Dissemination files were made available during the week of the 9 October 2006. At the completion of ETE on Friday 10 November 2006, the project has moved into the operational readiness phase. During this time, new Orion systems will be run in parallel with the legacy applications to ensure operational readiness. This is a cautious approach to ensure that we do not impact our existing services. Should operational readiness be proven quickly it is likely that the JSE will be ready for implementation of Release A on either 27 November 2006 or 11 December 2006. The JSE did commit to provide new client-specific EOD files for a minimum of ten business days (in addition to the current files) prior to the formal implementation (Go-Live) of Release A. This parallel phase officially commenced on Monday, 13 November. The first set of client specific EOD test files were already provided on Sunday evening, which contained the data for Friday, 10 November. Any queries on the files should be sent to: eodspec@jse. co. za © 5

Release A: Next Steps A further set of system generated non-client specific EOD Equity Dissemination files were made available during the week of the 9 October 2006. At the completion of ETE on Friday 10 November 2006, the project has moved into the operational readiness phase. During this time, new Orion systems will be run in parallel with the legacy applications to ensure operational readiness. This is a cautious approach to ensure that we do not impact our existing services. Should operational readiness be proven quickly it is likely that the JSE will be ready for implementation of Release A on either 27 November 2006 or 11 December 2006. The JSE did commit to provide new client-specific EOD files for a minimum of ten business days (in addition to the current files) prior to the formal implementation (Go-Live) of Release A. This parallel phase officially commenced on Monday, 13 November. The first set of client specific EOD test files were already provided on Sunday evening, which contained the data for Friday, 10 November. Any queries on the files should be sent to: eodspec@jse. co. za © 5

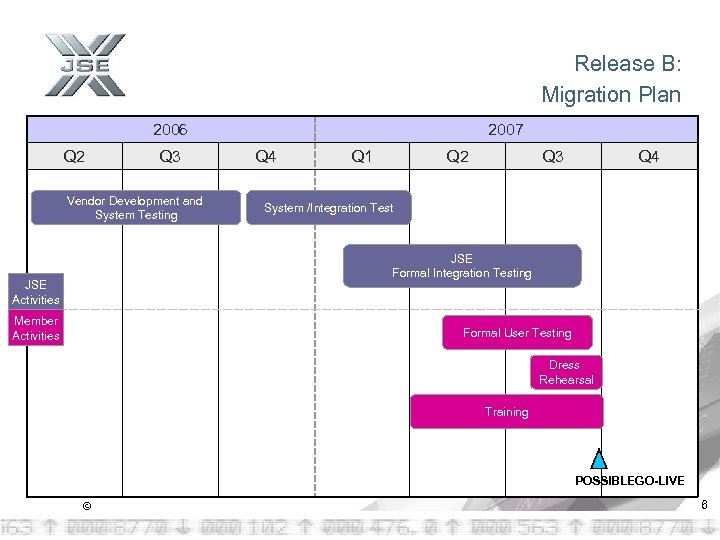

Release B: Migration Plan 2006 Q 2 Q 3 Vendor Development and System Testing 2007 Q 4 Q 1 Q 2 Q 3 Q 4 System /Integration Test JSE Formal Integration Testing JSE Activities Member Activities Formal User Testing Dress Rehearsal Training POSSIBLEGO-LIVE © 6

Release B: Migration Plan 2006 Q 2 Q 3 Vendor Development and System Testing 2007 Q 4 Q 1 Q 2 Q 3 Q 4 System /Integration Test JSE Formal Integration Testing JSE Activities Member Activities Formal User Testing Dress Rehearsal Training POSSIBLEGO-LIVE © 6

Release B: Progress Made to Date MSS Update: − Design Close-out: • A total of 33 functional specifications have been signed off. • Reports Functional Design has been signed off and Reports Technical specifications are complete and agreed with FRI. • The following Design activities are complete: » Interface Design » Batch Design » Data Integrator (the MSS loader tool for file interfaces) and Technical Architecture » All Dissemination Designs − Update on Code Delivery: • FRI has delivered 10 code drops to date. − Testing: • Progress with installation of FRI code drops into the test environment. • System Test Models signed-off for 70% of all Functional System Test Models, expected to be completed during 2006. © 7

Release B: Progress Made to Date MSS Update: − Design Close-out: • A total of 33 functional specifications have been signed off. • Reports Functional Design has been signed off and Reports Technical specifications are complete and agreed with FRI. • The following Design activities are complete: » Interface Design » Batch Design » Data Integrator (the MSS loader tool for file interfaces) and Technical Architecture » All Dissemination Designs − Update on Code Delivery: • FRI has delivered 10 code drops to date. − Testing: • Progress with installation of FRI code drops into the test environment. • System Test Models signed-off for 70% of all Functional System Test Models, expected to be completed during 2006. © 7

Release B: Progress Made to Date (Cont. ) MSS Workgroups Update − Two successful screen demonstration sessions were done on some of the new system screens with the Orion Core Group. − Demonstration of the screens to the entire market at a later stage (only applicable to Johannesburg). − All members have signed the required Non-disclosure Agreements – every staff member should have access to the functional specifications. − TWG Sessions were held for developers involved in downstream applications: • To discuss new dissemination files and API’s • To provide an overview of fundamental functional changes • To provide a demonstration of new functional screens MSS Training Update − The JSE will be offering Conceptual and User Training in Cape Town during 2007, prior to Go-Live. © 8

Release B: Progress Made to Date (Cont. ) MSS Workgroups Update − Two successful screen demonstration sessions were done on some of the new system screens with the Orion Core Group. − Demonstration of the screens to the entire market at a later stage (only applicable to Johannesburg). − All members have signed the required Non-disclosure Agreements – every staff member should have access to the functional specifications. − TWG Sessions were held for developers involved in downstream applications: • To discuss new dissemination files and API’s • To provide an overview of fundamental functional changes • To provide a demonstration of new functional screens MSS Training Update − The JSE will be offering Conceptual and User Training in Cape Town during 2007, prior to Go-Live. © 8

Release B: Progress Made to Date (Cont. ) Equities Clearing Update − Design Close-out: • Functional specifications completed and signed-off. • Technical interface specifications completed. • This concludes all of the design portions for the Equities Clearing application. − Update on Code Delivery: • Final code drop, including bug fixes, has been received and installed. − Training: • Internal training with the Clearing and Settlement Division has commenced on the installed application. • Clearing training is due to commence early 2007. • ECS training manuals have been delivered and are currently under internal review. © 9

Release B: Progress Made to Date (Cont. ) Equities Clearing Update − Design Close-out: • Functional specifications completed and signed-off. • Technical interface specifications completed. • This concludes all of the design portions for the Equities Clearing application. − Update on Code Delivery: • Final code drop, including bug fixes, has been received and installed. − Training: • Internal training with the Clearing and Settlement Division has commenced on the installed application. • Clearing training is due to commence early 2007. • ECS training manuals have been delivered and are currently under internal review. © 9

Release B: Progress Made to Date (Cont. ) Data Conversion Update: − Conversion design specifications for the Market Services Solution Corporate Actions module are still in progress. Specifications for data covering the rest of the Market Services Solution’s modules have all been finalised. − Specifications detailing the Data Reconciliation requirements are currently in progress. These specify the data extracts and reporting metrics that will be used to verify the converted data between the source systems and the Market Services Solution. − Activities covering the build and unit test of the numerous components to source and transform the data for these modules that have completed design, is well underway − Conversion testing activities are currently in progress where data from select brokers is being converted into the Market Services Solution based upon the conversion rules specified in the conversion design specifications. © 10

Release B: Progress Made to Date (Cont. ) Data Conversion Update: − Conversion design specifications for the Market Services Solution Corporate Actions module are still in progress. Specifications for data covering the rest of the Market Services Solution’s modules have all been finalised. − Specifications detailing the Data Reconciliation requirements are currently in progress. These specify the data extracts and reporting metrics that will be used to verify the converted data between the source systems and the Market Services Solution. − Activities covering the build and unit test of the numerous components to source and transform the data for these modules that have completed design, is well underway − Conversion testing activities are currently in progress where data from select brokers is being converted into the Market Services Solution based upon the conversion rules specified in the conversion design specifications. © 10

Release B: Progress Made to Date (Cont. ) Surveillance System Update: − User Functional Specifications have been signed off. − Technical Specification development in progress. − Business Functions to be tested across all Surveillance modules have been identified. Update on Technical Specifications to the Market: − MSS API Specs • All the interface specifications have been published and are final − All MSS Dissemination Specs are final − Please forward any queries relating to: • Dissemination Specs: orion_spec_mssdis@jse. co. za; and • API Specs: orion_spec_mssapi@jse. co. za Testing Update: − ECS Systems Test Preparation and Execution by Accenture is completed for all ECS modules. − System Test Preparation of Test Models and Test Scripts for all other Release B systems are in progress. − System Test Execution for other Release B systems expected to start Q 1 2007. © 11

Release B: Progress Made to Date (Cont. ) Surveillance System Update: − User Functional Specifications have been signed off. − Technical Specification development in progress. − Business Functions to be tested across all Surveillance modules have been identified. Update on Technical Specifications to the Market: − MSS API Specs • All the interface specifications have been published and are final − All MSS Dissemination Specs are final − Please forward any queries relating to: • Dissemination Specs: orion_spec_mssdis@jse. co. za; and • API Specs: orion_spec_mssapi@jse. co. za Testing Update: − ECS Systems Test Preparation and Execution by Accenture is completed for all ECS modules. − System Test Preparation of Test Models and Test Scripts for all other Release B systems are in progress. − System Test Execution for other Release B systems expected to start Q 1 2007. © 11

Bandwidth Requirements: Context & Assumptions of the Testing LANmetrix (LMX) conducted a bandwidth test on the MSS on 23/11/2005. − The test was conducted on the Market Services Code Drop Environment utilising a network sniffer that was inserted into the Local Area Network and configured to record all traffic flowing between the user workstation and the MSS terminal server. On 27 February 2006, representative workload scenarios were constructed and agreed to represent a typical workload of an MSS user, during a typical day, in a fully deployed MSS environment. LMX has conducted a new simulation/modelling exercise which combines the recorded transactions with the new scenarios. MSS is being deployed over Microsoft terminal services which will result in a Bandwidth (BW) increase over BDA. The BW consumption of the application would be related to the intensity of use and the usage patterns of the MSS. Reporting usage patterns will have a significant impact on the BW consumption. The BW usage would naturally increase with the number of users concurrently operating across the network. Therefore the approach was to simulate a series of scenarios which are believed to be representative of typical user scenarios in the application. Further details on the testing and on the scenarios can be made available on request. © 12

Bandwidth Requirements: Context & Assumptions of the Testing LANmetrix (LMX) conducted a bandwidth test on the MSS on 23/11/2005. − The test was conducted on the Market Services Code Drop Environment utilising a network sniffer that was inserted into the Local Area Network and configured to record all traffic flowing between the user workstation and the MSS terminal server. On 27 February 2006, representative workload scenarios were constructed and agreed to represent a typical workload of an MSS user, during a typical day, in a fully deployed MSS environment. LMX has conducted a new simulation/modelling exercise which combines the recorded transactions with the new scenarios. MSS is being deployed over Microsoft terminal services which will result in a Bandwidth (BW) increase over BDA. The BW consumption of the application would be related to the intensity of use and the usage patterns of the MSS. Reporting usage patterns will have a significant impact on the BW consumption. The BW usage would naturally increase with the number of users concurrently operating across the network. Therefore the approach was to simulate a series of scenarios which are believed to be representative of typical user scenarios in the application. Further details on the testing and on the scenarios can be made available on request. © 12

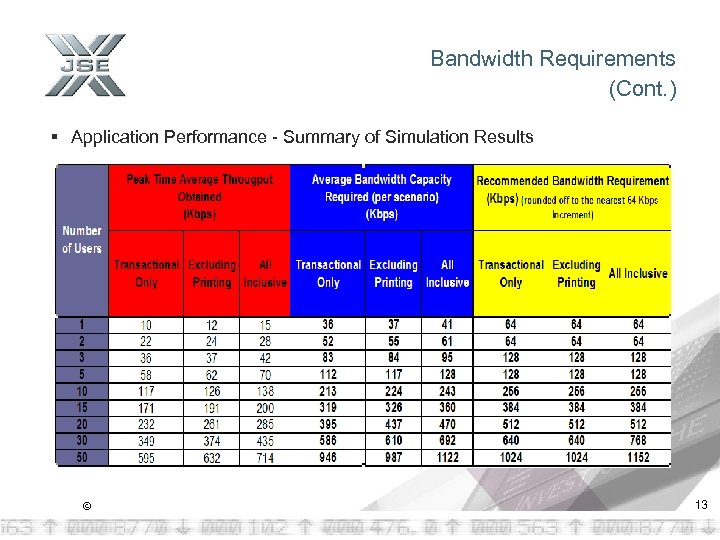

Bandwidth Requirements (Cont. ) § Application Performance - Summary of Simulation Results © 13

Bandwidth Requirements (Cont. ) § Application Performance - Summary of Simulation Results © 13

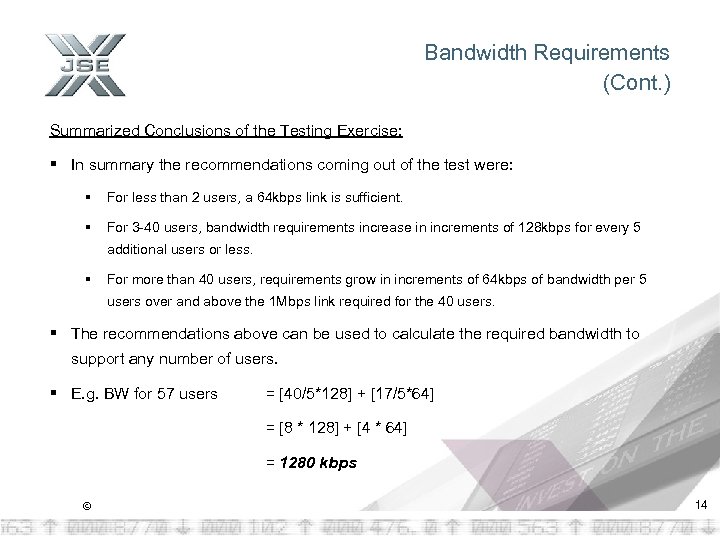

Bandwidth Requirements (Cont. ) Summarized Conclusions of the Testing Exercise: § In summary the recommendations coming out of the test were: § For less than 2 users, a 64 kbps link is sufficient. § For 3 -40 users, bandwidth requirements increase in increments of 128 kbps for every 5 additional users or less. § For more than 40 users, requirements grow in increments of 64 kbps of bandwidth per 5 users over and above the 1 Mbps link required for the 40 users. § The recommendations above can be used to calculate the required bandwidth to support any number of users. § E. g. BW for 57 users = [40/5*128] + [17/5*64] § = [8 * 128] + [4 * 64] § = 1280 kbps © 14

Bandwidth Requirements (Cont. ) Summarized Conclusions of the Testing Exercise: § In summary the recommendations coming out of the test were: § For less than 2 users, a 64 kbps link is sufficient. § For 3 -40 users, bandwidth requirements increase in increments of 128 kbps for every 5 additional users or less. § For more than 40 users, requirements grow in increments of 64 kbps of bandwidth per 5 users over and above the 1 Mbps link required for the 40 users. § The recommendations above can be used to calculate the required bandwidth to support any number of users. § E. g. BW for 57 users = [40/5*128] + [17/5*64] § = [8 * 128] + [4 * 64] § = 1280 kbps © 14

QUESTIONS? Refer all Release B queries to Orion_Info@jse. co. za Copyright© JSE Limited 2005 www. jse. co. za

QUESTIONS? Refer all Release B queries to Orion_Info@jse. co. za Copyright© JSE Limited 2005 www. jse. co. za

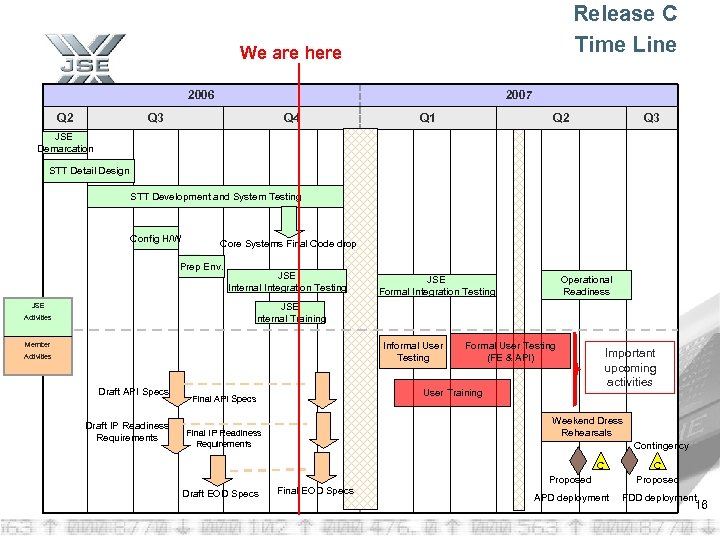

Release C Time Line We are here 2006 Q 2 2007 Q 3 Q 4 Q 1 Q 2 Q 3 JSE Demarcation STT Detail Design STT Development and System Testing Config H/W Core Systems Final Code drop Prep Env. JSE Internal Integration Testing Operational Readiness JSE Formal Integration Testing JSE Internal Training JSE Activities Informal User Testing Member Activities Draft API Specs Draft IP Readiness Requirements Formal User Testing (FE & API) User Training Final API Specs Important upcoming activities Weekend Dress Rehearsals Final IP Readiness Requirements Contingency C Proposed Draft EOD Specs © Final EOD Specs C Proposed APD deployment FDD deployment 16

Release C Time Line We are here 2006 Q 2 2007 Q 3 Q 4 Q 1 Q 2 Q 3 JSE Demarcation STT Detail Design STT Development and System Testing Config H/W Core Systems Final Code drop Prep Env. JSE Internal Integration Testing Operational Readiness JSE Formal Integration Testing JSE Internal Training JSE Activities Informal User Testing Member Activities Draft API Specs Draft IP Readiness Requirements Formal User Testing (FE & API) User Training Final API Specs Important upcoming activities Weekend Dress Rehearsals Final IP Readiness Requirements Contingency C Proposed Draft EOD Specs © Final EOD Specs C Proposed APD deployment FDD deployment 16

RELEASE C Status Update JSE internal testing for Release C commenced in November 2006. The training approach for members will be distributed to the market before 15 December 2006. The training booking requirements document will be distributed by end January 2007, highlighting the training dates and timeslots. The JSE intends to start training by end February 2007 We would like to remind all users to review the API Specification and User Connectivity documentation. The final API Specification document is expected to be issued mid -December 2006. © 17

RELEASE C Status Update JSE internal testing for Release C commenced in November 2006. The training approach for members will be distributed to the market before 15 December 2006. The training booking requirements document will be distributed by end January 2007, highlighting the training dates and timeslots. The JSE intends to start training by end February 2007 We would like to remind all users to review the API Specification and User Connectivity documentation. The final API Specification document is expected to be issued mid -December 2006. © 17

RELEASE C Connectivity Requirements New connectivity requirements in terms of Release C of project Orion entails the following: All trading members are able to access the new system via their existing lines to SAFEX. The new system runs off TCP/IP, trading members need to in conjunction with the JSE, load the TCP/IP protocol on these circuits. Routers currently support the IP protocol thus it should only be a configuration issue. The JSE has contracted an external company to conduct independent testing and verification of bandwidth requirements. Once these are complete the JSE will publish the bandwidth requirements which may result in members having to increase their line capacities. © 18

RELEASE C Connectivity Requirements New connectivity requirements in terms of Release C of project Orion entails the following: All trading members are able to access the new system via their existing lines to SAFEX. The new system runs off TCP/IP, trading members need to in conjunction with the JSE, load the TCP/IP protocol on these circuits. Routers currently support the IP protocol thus it should only be a configuration issue. The JSE has contracted an external company to conduct independent testing and verification of bandwidth requirements. Once these are complete the JSE will publish the bandwidth requirements which may result in members having to increase their line capacities. © 18

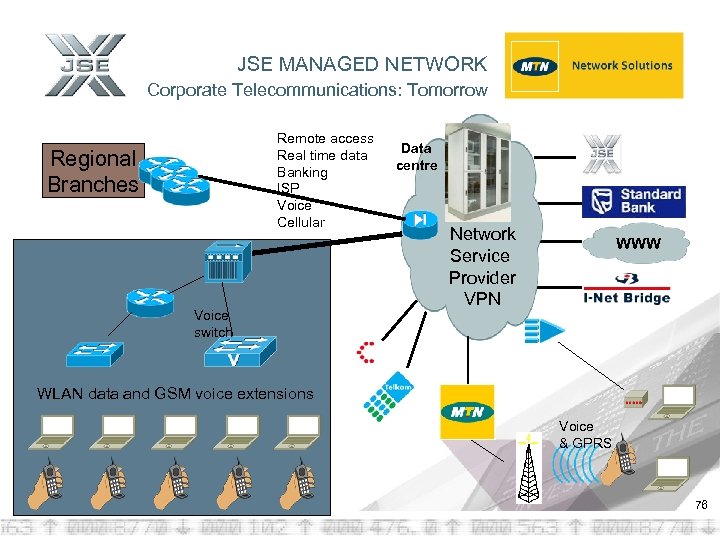

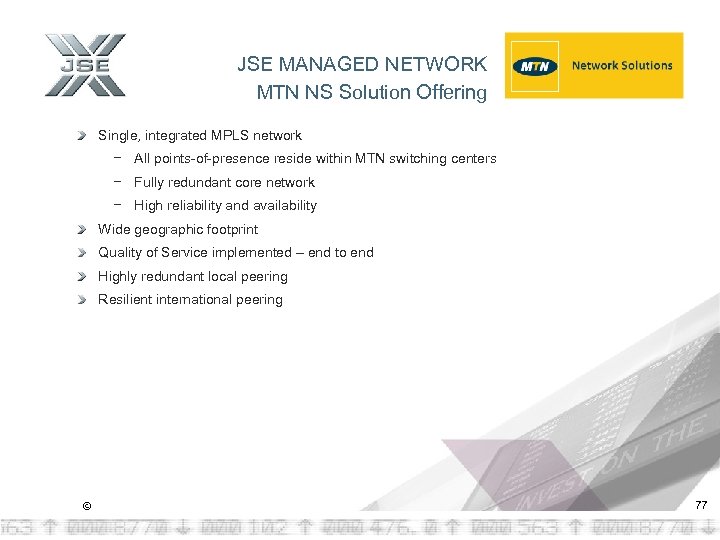

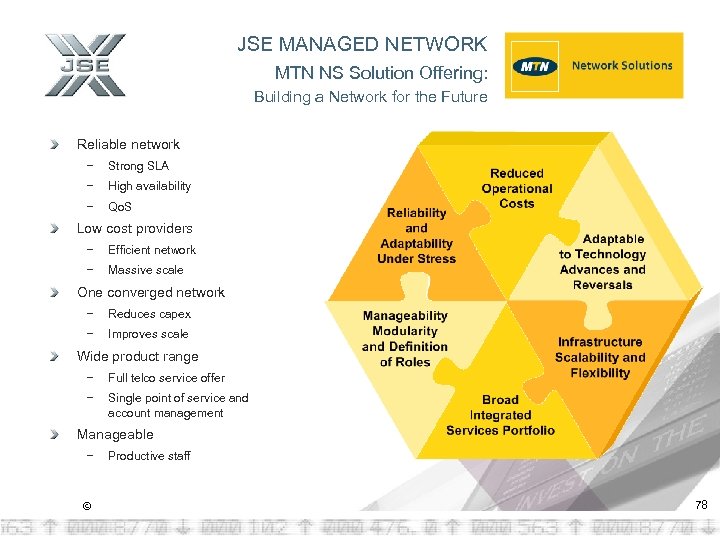

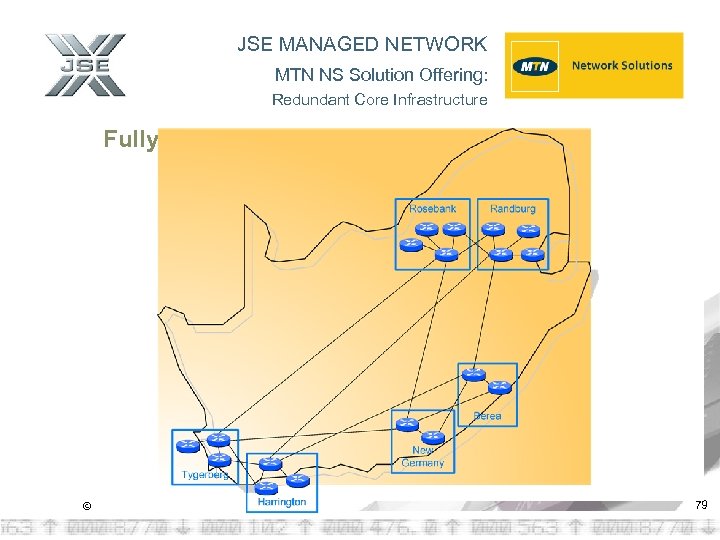

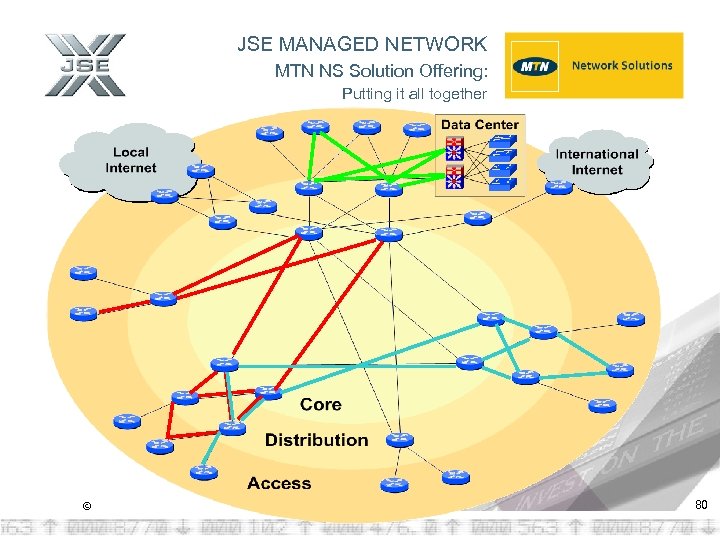

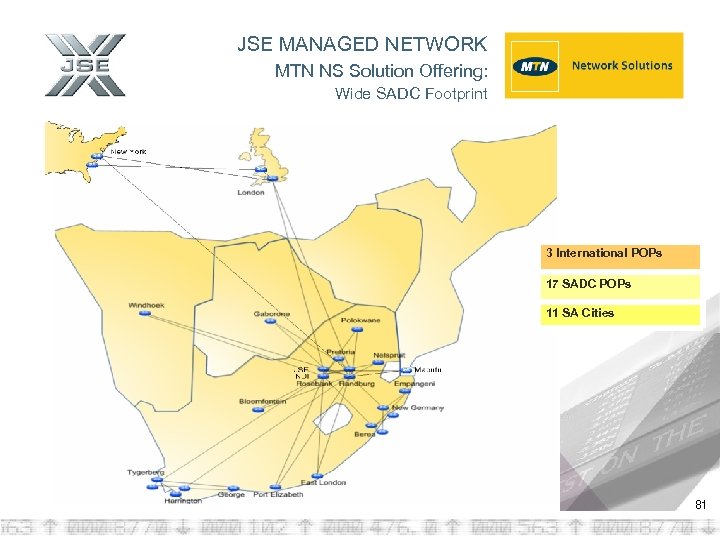

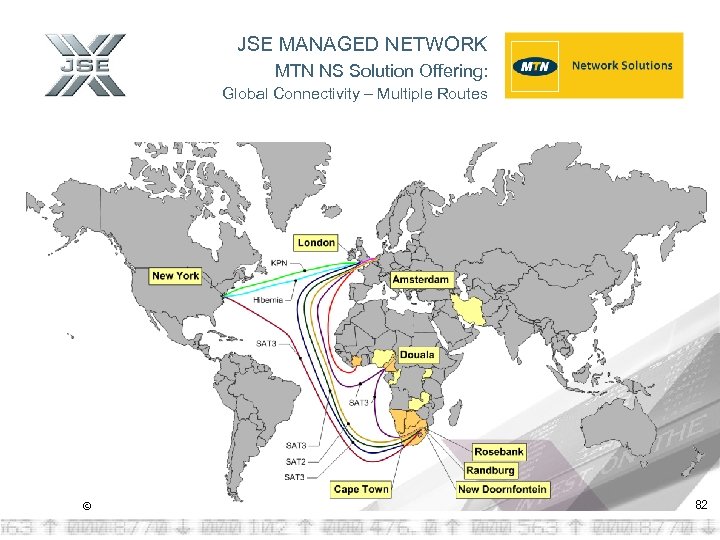

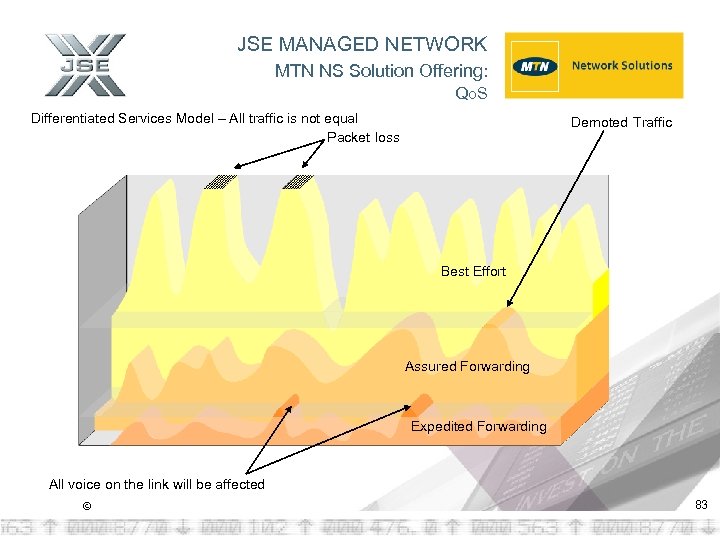

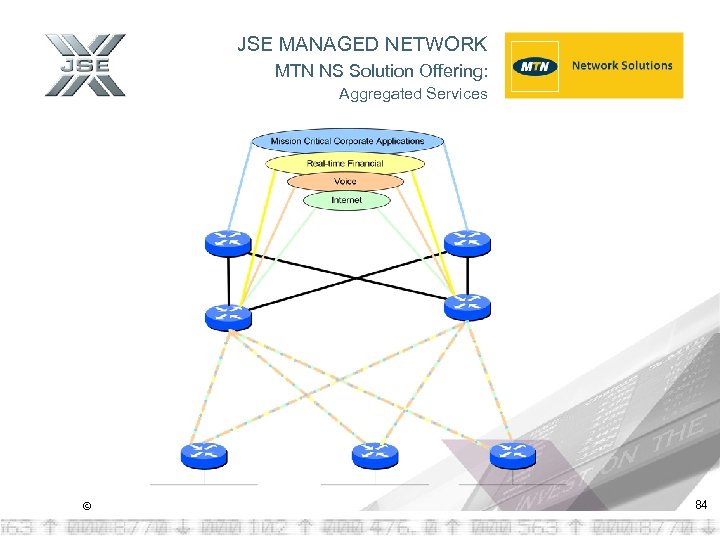

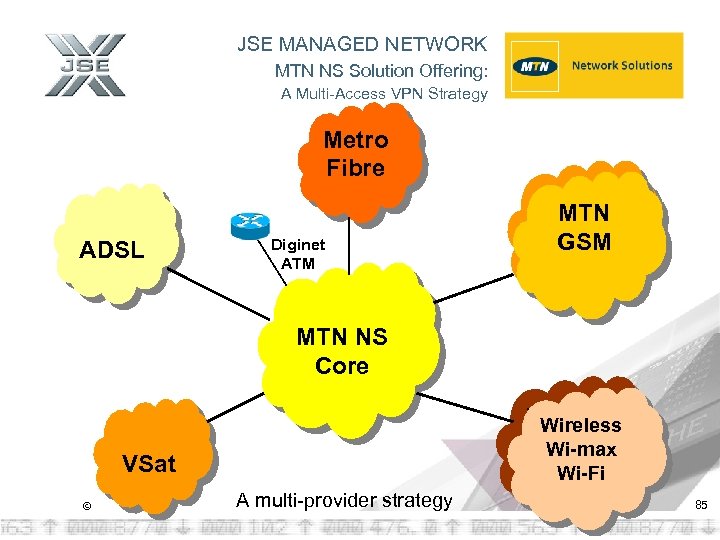

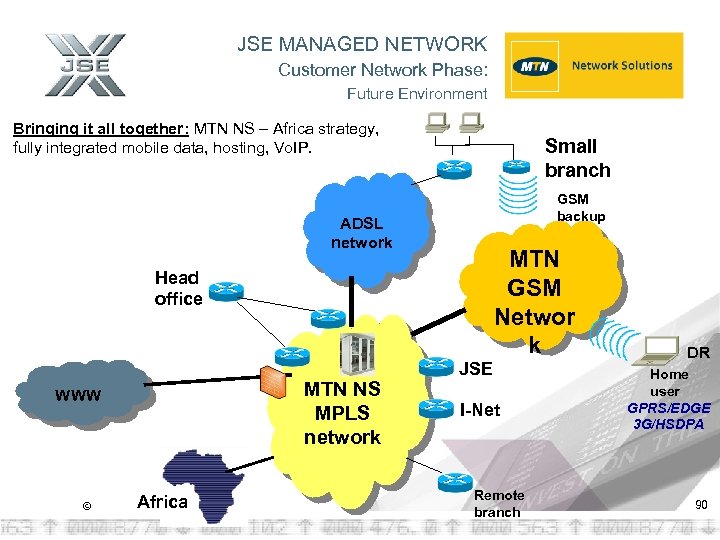

RELEASE C Connectivity Requirements cont. Similarly a user may want to use their existing circuit for trading (on the current SAFEX system) and testing on the new system until go live mid 2007 – this may also require the increase in their bandwidth (perhaps only temporarily) or to schedule their testing outside of core trading hours as not to impact their production systems. The JSE is proposing to offer a potential solution for members using the managed network through MTN Network Solutions. This will ultimately result in members having more flexible ways of connecting to the JSE (e. g. 3 G, ADSL, leased line to a local POP of MTN to reduce line costs, etcetera). Details of this will also be communicated shortly here after. © 19

RELEASE C Connectivity Requirements cont. Similarly a user may want to use their existing circuit for trading (on the current SAFEX system) and testing on the new system until go live mid 2007 – this may also require the increase in their bandwidth (perhaps only temporarily) or to schedule their testing outside of core trading hours as not to impact their production systems. The JSE is proposing to offer a potential solution for members using the managed network through MTN Network Solutions. This will ultimately result in members having more flexible ways of connecting to the JSE (e. g. 3 G, ADSL, leased line to a local POP of MTN to reduce line costs, etcetera). Details of this will also be communicated shortly here after. © 19

QUESTIONS? Refer all Derivative queries to Derivative_Info@jse. co. za Copyright© JSE Limited 2005 www. jse. co. za

QUESTIONS? Refer all Derivative queries to Derivative_Info@jse. co. za Copyright© JSE Limited 2005 www. jse. co. za

JSE EQUITIES TRADING SYSTEM REPLACEMENT MARKET COMMUNICATION SESSION – CAPE TOWN 16 November 2006 Leanne Parsons Copyright© JSE Limited 2005 www. jse. co. za

JSE EQUITIES TRADING SYSTEM REPLACEMENT MARKET COMMUNICATION SESSION – CAPE TOWN 16 November 2006 Leanne Parsons Copyright© JSE Limited 2005 www. jse. co. za

AGENDA Equities Trading System - Market Communication Background & Objectives Functional Summary Technical Summary Project Timeline Customer Testing User Documentation General − Connectivity − Online FAQ’s − Technical Workgroup Meetings − Further Market Communication Sessions Questions? © 22

AGENDA Equities Trading System - Market Communication Background & Objectives Functional Summary Technical Summary Project Timeline Customer Testing User Documentation General − Connectivity − Online FAQ’s − Technical Workgroup Meetings − Further Market Communication Sessions Questions? © 22

AGENDA Equities Trading System - Market Communication Background & Objectives Functional Summary Technical Summary Project Timeline Customer Testing User Documentation General − Connectivity − Online FAQ’s − Technical Workgroup Meetings − Further Market Communication Sessions Questions © 23

AGENDA Equities Trading System - Market Communication Background & Objectives Functional Summary Technical Summary Project Timeline Customer Testing User Documentation General − Connectivity − Online FAQ’s − Technical Workgroup Meetings − Further Market Communication Sessions Questions © 23

JSE EQUITIES TRADING SYSTEM Background & Objectives The current technology and business agreements between the JSE Limited (‘the JSE’) and the London Stock Exchange (‘the LSE’) expire in May 2007. The London Stock Exchange (‘the LSE’) is nearing completion of a four year technology roadmap strategy to deliver systems offering increased performance, scalability and reliability. During 2005, the JSE Executive and Board agreed to retain the LSE as the preferred supplier for the Equities Trading Solution, based on their current track record of service delivery, reliability, robustness and functionality. Negotiations are currently in progress to refine and extend these contracts. Key technical and functional changes available in the new system will provide more functionality and flexibility. The JSE therefore needs to align itself to the LSE TRM project and phases. © 24

JSE EQUITIES TRADING SYSTEM Background & Objectives The current technology and business agreements between the JSE Limited (‘the JSE’) and the London Stock Exchange (‘the LSE’) expire in May 2007. The London Stock Exchange (‘the LSE’) is nearing completion of a four year technology roadmap strategy to deliver systems offering increased performance, scalability and reliability. During 2005, the JSE Executive and Board agreed to retain the LSE as the preferred supplier for the Equities Trading Solution, based on their current track record of service delivery, reliability, robustness and functionality. Negotiations are currently in progress to refine and extend these contracts. Key technical and functional changes available in the new system will provide more functionality and flexibility. The JSE therefore needs to align itself to the LSE TRM project and phases. © 24

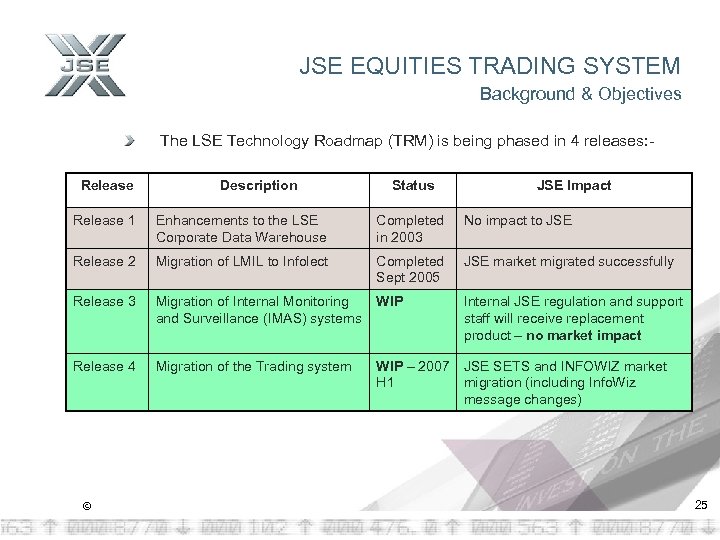

JSE EQUITIES TRADING SYSTEM Background & Objectives The LSE Technology Roadmap (TRM) is being phased in 4 releases: - Release Description Status JSE Impact Release 1 Enhancements to the LSE Corporate Data Warehouse Completed in 2003 No impact to JSE Release 2 Migration of LMIL to Infolect Completed Sept 2005 JSE market migrated successfully Release 3 Migration of Internal Monitoring and Surveillance (IMAS) systems WIP Internal JSE regulation and support staff will receive replacement product – no market impact Release 4 Migration of the Trading system WIP – 2007 JSE SETS and INFOWIZ market H 1 migration (including Info. Wiz message changes) © 25

JSE EQUITIES TRADING SYSTEM Background & Objectives The LSE Technology Roadmap (TRM) is being phased in 4 releases: - Release Description Status JSE Impact Release 1 Enhancements to the LSE Corporate Data Warehouse Completed in 2003 No impact to JSE Release 2 Migration of LMIL to Infolect Completed Sept 2005 JSE market migrated successfully Release 3 Migration of Internal Monitoring and Surveillance (IMAS) systems WIP Internal JSE regulation and support staff will receive replacement product – no market impact Release 4 Migration of the Trading system WIP – 2007 JSE SETS and INFOWIZ market H 1 migration (including Info. Wiz message changes) © 25

JSE EQUITIES TRADING SYSTEM Benefits Equities Trading System will be the same technology running Info. Wiz today - a Microsoft. NET solution Enhancements as a result of the new technology includes: − Performance » Reduce end-to-end latency » Increase message throughput and processing » Greater transparency − Scalability » Adding capacity seamlessly » Message throughput − Functionality » Multi-product hooks – multiple markets across multiple assets can be added later » Multi-Functional – support for integrated cash and derivatives trading can be added later » Global capability – Full multi time zone, multi currency © » Open standards - able to support current interfaces as well as emerging standards 26

JSE EQUITIES TRADING SYSTEM Benefits Equities Trading System will be the same technology running Info. Wiz today - a Microsoft. NET solution Enhancements as a result of the new technology includes: − Performance » Reduce end-to-end latency » Increase message throughput and processing » Greater transparency − Scalability » Adding capacity seamlessly » Message throughput − Functionality » Multi-product hooks – multiple markets across multiple assets can be added later » Multi-Functional – support for integrated cash and derivatives trading can be added later » Global capability – Full multi time zone, multi currency © » Open standards - able to support current interfaces as well as emerging standards 26

JSE EQUITIES TRADING SYSTEM Benefits Enhancements as a result of the new technology includes: − Impact » Three common application interfaces unchanged (MC, SII, IRI) » Fixed-width message formats and BDGs unchanged − Availability » Info. Wiz has proven that new technology is robust to continue an outstanding level of availability » Extensive Internal Testing to prove the solution » Active-Active, Active-Passive components across LSE data centers » Sub-second automated fail-over of service and components » Loss of a full site – Less than 5 second interruption of service, automatic recovery to just single site operation, market put into selected period rule state © 27

JSE EQUITIES TRADING SYSTEM Benefits Enhancements as a result of the new technology includes: − Impact » Three common application interfaces unchanged (MC, SII, IRI) » Fixed-width message formats and BDGs unchanged − Availability » Info. Wiz has proven that new technology is robust to continue an outstanding level of availability » Extensive Internal Testing to prove the solution » Active-Active, Active-Passive components across LSE data centers » Sub-second automated fail-over of service and components » Loss of a full site – Less than 5 second interruption of service, automatic recovery to just single site operation, market put into selected period rule state © 27

AGENDA Equities Trading System - Market Communication Background & Objectives Functional Summary Technical Summary Project Timeline Customer Testing User Documentation General − Connectivity − Online FAQ’s − Technical Workgroup Meetings − Further Market Communication Sessions Questions © 28

AGENDA Equities Trading System - Market Communication Background & Objectives Functional Summary Technical Summary Project Timeline Customer Testing User Documentation General − Connectivity − Online FAQ’s − Technical Workgroup Meetings − Further Market Communication Sessions Questions © 28

JSE EQUITIES TRADING SYSTEM Functional Summary Functionality Enhancements applicable to the JSE Market − Market Structure − Order Book Enhancements − Trade Reporting − Settlement Information − Broadcast Interface − Quote Book Enhancements (N/A to JSE market but included in JSE Guidance Notes for completeness) © 29

JSE EQUITIES TRADING SYSTEM Functional Summary Functionality Enhancements applicable to the JSE Market − Market Structure − Order Book Enhancements − Trade Reporting − Settlement Information − Broadcast Interface − Quote Book Enhancements (N/A to JSE market but included in JSE Guidance Notes for completeness) © 29

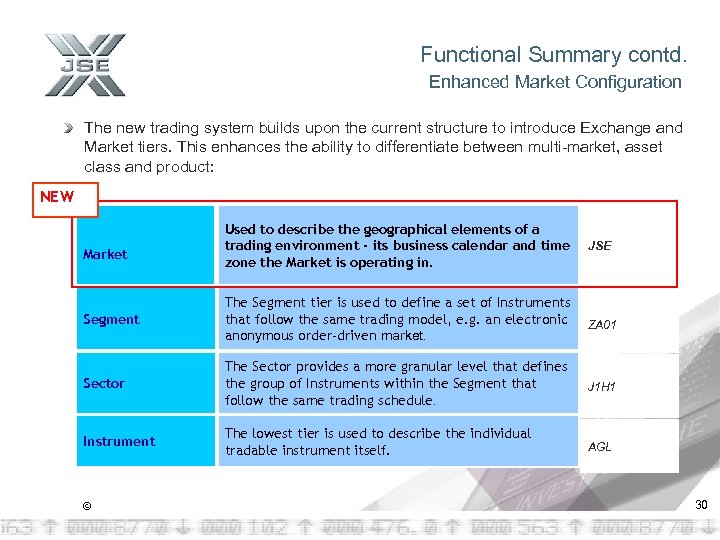

Functional Summary contd. Enhanced Market Configuration The new trading system builds upon the current structure to introduce Exchange and Market tiers. This enhances the ability to differentiate between multi-market, asset class and product: NEW Market Used to describe the geographical elements of a trading environment - its business calendar and time zone the Market is operating in. JSE Segment The Segment tier is used to define a set of Instruments that follow the same trading model, e. g. an electronic anonymous order-driven market. Sector The Sector provides a more granular level that defines the group of Instruments within the Segment that follow the same trading schedule. J 1 H 1 Instrument The lowest tier is used to describe the individual tradable instrument itself. AGL © ZA 01 30

Functional Summary contd. Enhanced Market Configuration The new trading system builds upon the current structure to introduce Exchange and Market tiers. This enhances the ability to differentiate between multi-market, asset class and product: NEW Market Used to describe the geographical elements of a trading environment - its business calendar and time zone the Market is operating in. JSE Segment The Segment tier is used to define a set of Instruments that follow the same trading model, e. g. an electronic anonymous order-driven market. Sector The Sector provides a more granular level that defines the group of Instruments within the Segment that follow the same trading schedule. J 1 H 1 Instrument The lowest tier is used to describe the individual tradable instrument itself. AGL © ZA 01 30

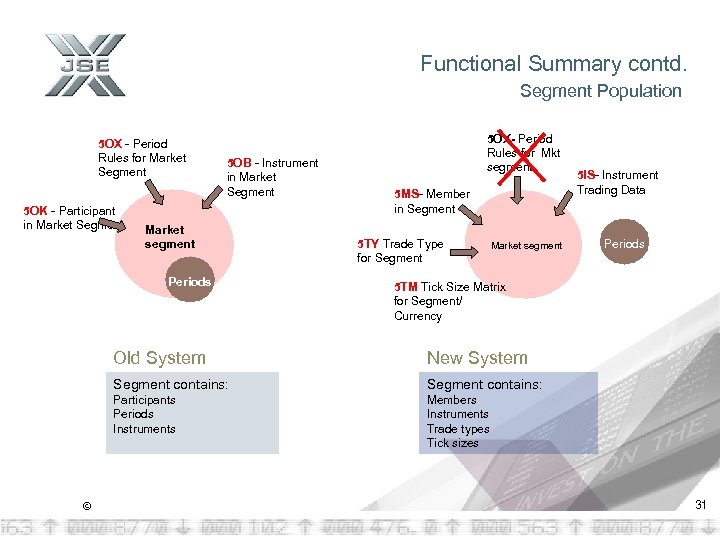

Functional Summary contd. Segment Population 5 OX - Period Rules for Market Segment 5 OK - Participant in Market Segment 5 OB - Instrument in Market Segment Market segment Periods 5 OX- Period Rules for Mkt segment 5 MS- Member in Segment 5 TY Trade Type for Segment Market segment Periods 5 TM Tick Size Matrix for Segment/ Currency Old System New System Segment contains: Participants Periods Instruments © 5 IS- Instrument Trading Data Members Instruments Trade types Tick sizes 31

Functional Summary contd. Segment Population 5 OX - Period Rules for Market Segment 5 OK - Participant in Market Segment 5 OB - Instrument in Market Segment Market segment Periods 5 OX- Period Rules for Mkt segment 5 MS- Member in Segment 5 TY Trade Type for Segment Market segment Periods 5 TM Tick Size Matrix for Segment/ Currency Old System New System Segment contains: Participants Periods Instruments © 5 IS- Instrument Trading Data Members Instruments Trade types Tick sizes 31

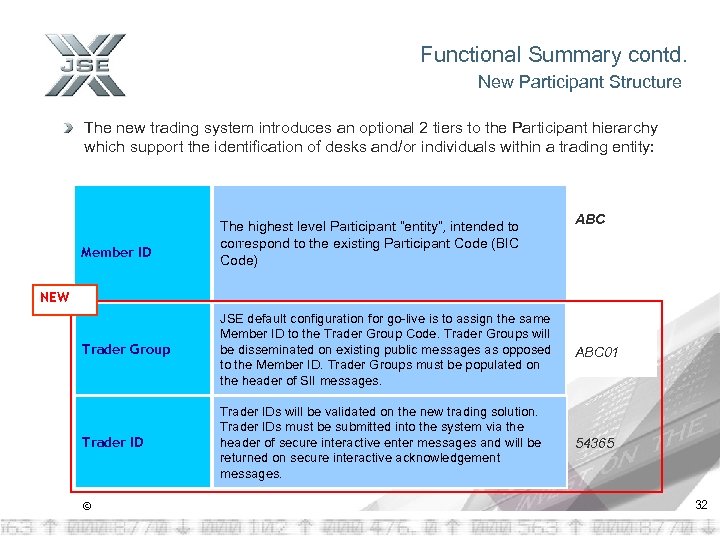

Functional Summary contd. New Participant Structure The new trading system introduces an optional 2 tiers to the Participant hierarchy which support the identification of desks and/or individuals within a trading entity: Member ID The highest level Participant “entity”, intended to correspond to the existing Participant Code (BIC Code) ABC NEW Trader Group JSE default configuration for go-live is to assign the same Member ID to the Trader Group Code. Trader Groups will be disseminated on existing public messages as opposed to the Member ID. Trader Groups must be populated on the header of SII messages. ABC 01 Trader IDs will be validated on the new trading solution. Trader IDs must be submitted into the system via the header of secure interactive enter messages and will be returned on secure interactive acknowledgement messages. 54365 © 32

Functional Summary contd. New Participant Structure The new trading system introduces an optional 2 tiers to the Participant hierarchy which support the identification of desks and/or individuals within a trading entity: Member ID The highest level Participant “entity”, intended to correspond to the existing Participant Code (BIC Code) ABC NEW Trader Group JSE default configuration for go-live is to assign the same Member ID to the Trader Group Code. Trader Groups will be disseminated on existing public messages as opposed to the Member ID. Trader Groups must be populated on the header of SII messages. ABC 01 Trader IDs will be validated on the new trading solution. Trader IDs must be submitted into the system via the header of secure interactive enter messages and will be returned on secure interactive acknowledgement messages. 54365 © 32

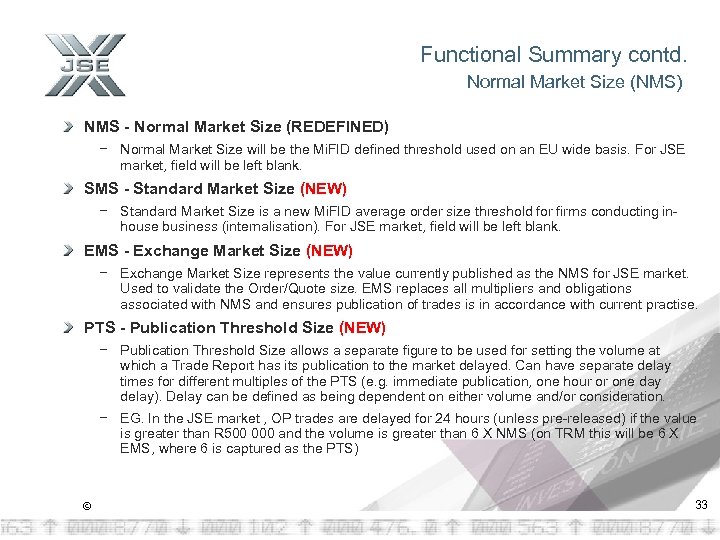

Functional Summary contd. Normal Market Size (NMS) NMS - Normal Market Size (REDEFINED) − Normal Market Size will be the Mi. FID defined threshold used on an EU wide basis. For JSE market, field will be left blank. SMS - Standard Market Size (NEW) − Standard Market Size is a new Mi. FID average order size threshold for firms conducting inhouse business (internalisation). For JSE market, field will be left blank. EMS - Exchange Market Size (NEW) − Exchange Market Size represents the value currently published as the NMS for JSE market. Used to validate the Order/Quote size. EMS replaces all multipliers and obligations associated with NMS and ensures publication of trades is in accordance with current practise. PTS - Publication Threshold Size (NEW) − Publication Threshold Size allows a separate figure to be used for setting the volume at which a Trade Report has its publication to the market delayed. Can have separate delay times for different multiples of the PTS (e. g. immediate publication, one hour or one day delay). Delay can be defined as being dependent on either volume and/or consideration. − EG. In the JSE market , OP trades are delayed for 24 hours (unless pre-released) if the value is greater than R 500 000 and the volume is greater than 6 X NMS (on TRM this will be 6 X EMS, where 6 is captured as the PTS) © 33

Functional Summary contd. Normal Market Size (NMS) NMS - Normal Market Size (REDEFINED) − Normal Market Size will be the Mi. FID defined threshold used on an EU wide basis. For JSE market, field will be left blank. SMS - Standard Market Size (NEW) − Standard Market Size is a new Mi. FID average order size threshold for firms conducting inhouse business (internalisation). For JSE market, field will be left blank. EMS - Exchange Market Size (NEW) − Exchange Market Size represents the value currently published as the NMS for JSE market. Used to validate the Order/Quote size. EMS replaces all multipliers and obligations associated with NMS and ensures publication of trades is in accordance with current practise. PTS - Publication Threshold Size (NEW) − Publication Threshold Size allows a separate figure to be used for setting the volume at which a Trade Report has its publication to the market delayed. Can have separate delay times for different multiples of the PTS (e. g. immediate publication, one hour or one day delay). Delay can be defined as being dependent on either volume and/or consideration. − EG. In the JSE market , OP trades are delayed for 24 hours (unless pre-released) if the value is greater than R 500 000 and the volume is greater than 6 X NMS (on TRM this will be 6 X EMS, where 6 is captured as the PTS) © 33

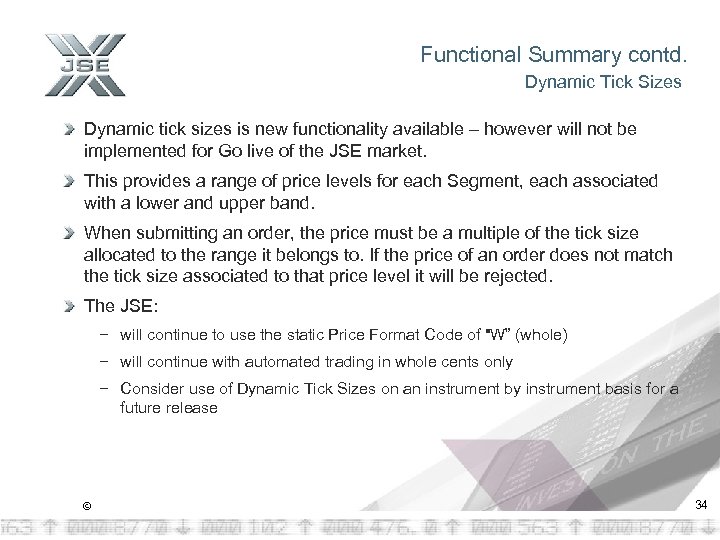

Functional Summary contd. Dynamic Tick Sizes Dynamic tick sizes is new functionality available – however will not be implemented for Go live of the JSE market. This provides a range of price levels for each Segment, each associated with a lower and upper band. When submitting an order, the price must be a multiple of the tick size allocated to the range it belongs to. If the price of an order does not match the tick size associated to that price level it will be rejected. The JSE: − will continue to use the static Price Format Code of "W” (whole) − will continue with automated trading in whole cents only − Consider use of Dynamic Tick Sizes on an instrument by instrument basis for a future release © 34

Functional Summary contd. Dynamic Tick Sizes Dynamic tick sizes is new functionality available – however will not be implemented for Go live of the JSE market. This provides a range of price levels for each Segment, each associated with a lower and upper band. When submitting an order, the price must be a multiple of the tick size allocated to the range it belongs to. If the price of an order does not match the tick size associated to that price level it will be rejected. The JSE: − will continue to use the static Price Format Code of "W” (whole) − will continue with automated trading in whole cents only − Consider use of Dynamic Tick Sizes on an instrument by instrument basis for a future release © 34

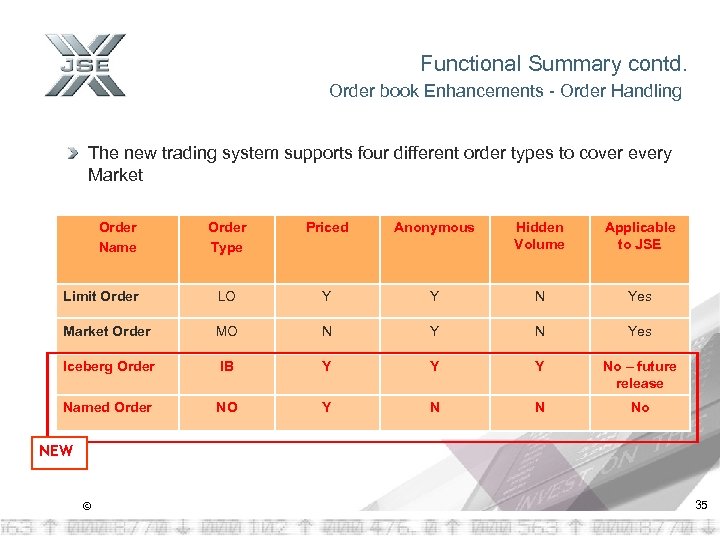

Functional Summary contd. Order book Enhancements - Order Handling The new trading system supports four different order types to cover every Market Order Name Order Type Priced Anonymous Hidden Volume Applicable to JSE Limit Order LO Y Y N Yes Market Order MO N Yes Iceberg Order IB Y Y Y No – future release Named Order NO Y N N No NEW © 35

Functional Summary contd. Order book Enhancements - Order Handling The new trading system supports four different order types to cover every Market Order Name Order Type Priced Anonymous Hidden Volume Applicable to JSE Limit Order LO Y Y N Yes Market Order MO N Yes Iceberg Order IB Y Y Y No – future release Named Order NO Y N N No NEW © 35

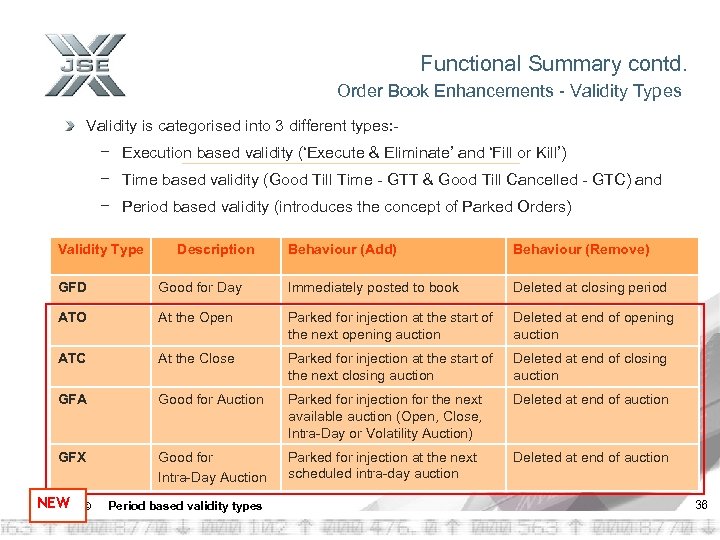

Functional Summary contd. Order Book Enhancements - Validity Types Validity is categorised into 3 different types: - − Execution based validity (‘Execute & Eliminate’ and ‘Fill or Kill’) − Time based validity (Good Till Time - GTT & Good Till Cancelled - GTC) and − Period based validity (introduces the concept of Parked Orders) Validity Type Description Behaviour (Add) Behaviour (Remove) GFD Good for Day Immediately posted to book Deleted at closing period ATO At the Open Parked for injection at the start of the next opening auction Deleted at end of opening auction ATC At the Close Parked for injection at the start of the next closing auction Deleted at end of closing auction GFA Good for Auction Parked for injection for the next available auction (Open, Close, Intra-Day or Volatility Auction) Deleted at end of auction GFX Good for Intra-Day Auction Parked for injection at the next scheduled intra-day auction Deleted at end of auction NEW © Period based validity types 36

Functional Summary contd. Order Book Enhancements - Validity Types Validity is categorised into 3 different types: - − Execution based validity (‘Execute & Eliminate’ and ‘Fill or Kill’) − Time based validity (Good Till Time - GTT & Good Till Cancelled - GTC) and − Period based validity (introduces the concept of Parked Orders) Validity Type Description Behaviour (Add) Behaviour (Remove) GFD Good for Day Immediately posted to book Deleted at closing period ATO At the Open Parked for injection at the start of the next opening auction Deleted at end of opening auction ATC At the Close Parked for injection at the start of the next closing auction Deleted at end of closing auction GFA Good for Auction Parked for injection for the next available auction (Open, Close, Intra-Day or Volatility Auction) Deleted at end of auction GFX Good for Intra-Day Auction Parked for injection at the next scheduled intra-day auction Deleted at end of auction NEW © Period based validity types 36

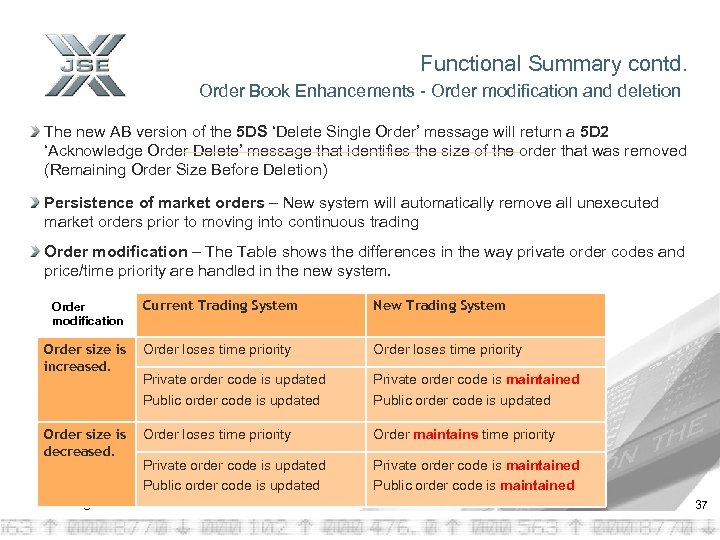

Functional Summary contd. Order Book Enhancements - Order modification and deletion The new AB version of the 5 DS ‘Delete Single Order’ message will return a 5 D 2 ‘Acknowledge Order Delete’ message that identifies the size of the order that was removed (Remaining Order Size Before Deletion) Persistence of market orders – New system will automatically remove all unexecuted market orders prior to moving into continuous trading Order modification – The Table shows the differences in the way private order codes and price/time priority are handled in the new system. Order modification Current Trading System New Trading System Order size is increased. Order loses time priority Private order code is updated Public order code is updated Private order code is maintained Public order code is updated Order size is decreased. Order loses time priority Order maintains time priority Private order code is updated Public order code is updated Private order code is maintained Public order code is maintained © 37

Functional Summary contd. Order Book Enhancements - Order modification and deletion The new AB version of the 5 DS ‘Delete Single Order’ message will return a 5 D 2 ‘Acknowledge Order Delete’ message that identifies the size of the order that was removed (Remaining Order Size Before Deletion) Persistence of market orders – New system will automatically remove all unexecuted market orders prior to moving into continuous trading Order modification – The Table shows the differences in the way private order codes and price/time priority are handled in the new system. Order modification Current Trading System New Trading System Order size is increased. Order loses time priority Private order code is updated Public order code is updated Private order code is maintained Public order code is updated Order size is decreased. Order loses time priority Order maintains time priority Private order code is updated Public order code is updated Private order code is maintained Public order code is maintained © 37

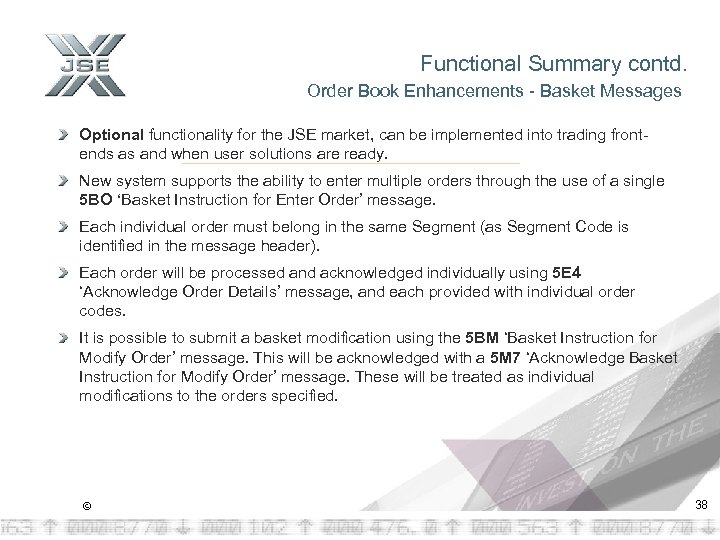

Functional Summary contd. Order Book Enhancements - Basket Messages Optional functionality for the JSE market, can be implemented into trading frontends as and when user solutions are ready. New system supports the ability to enter multiple orders through the use of a single 5 BO ‘Basket Instruction for Enter Order’ message. Each individual order must belong in the same Segment (as Segment Code is identified in the message header). Each order will be processed and acknowledged individually using 5 E 4 ‘Acknowledge Order Details’ message, and each provided with individual order codes. It is possible to submit a basket modification using the 5 BM ‘Basket Instruction for Modify Order’ message. This will be acknowledged with a 5 M 7 ‘Acknowledge Basket Instruction for Modify Order’ message. These will be treated as individual modifications to the orders specified. © 38

Functional Summary contd. Order Book Enhancements - Basket Messages Optional functionality for the JSE market, can be implemented into trading frontends as and when user solutions are ready. New system supports the ability to enter multiple orders through the use of a single 5 BO ‘Basket Instruction for Enter Order’ message. Each individual order must belong in the same Segment (as Segment Code is identified in the message header). Each order will be processed and acknowledged individually using 5 E 4 ‘Acknowledge Order Details’ message, and each provided with individual order codes. It is possible to submit a basket modification using the 5 BM ‘Basket Instruction for Modify Order’ message. This will be acknowledged with a 5 M 7 ‘Acknowledge Basket Instruction for Modify Order’ message. These will be treated as individual modifications to the orders specified. © 38

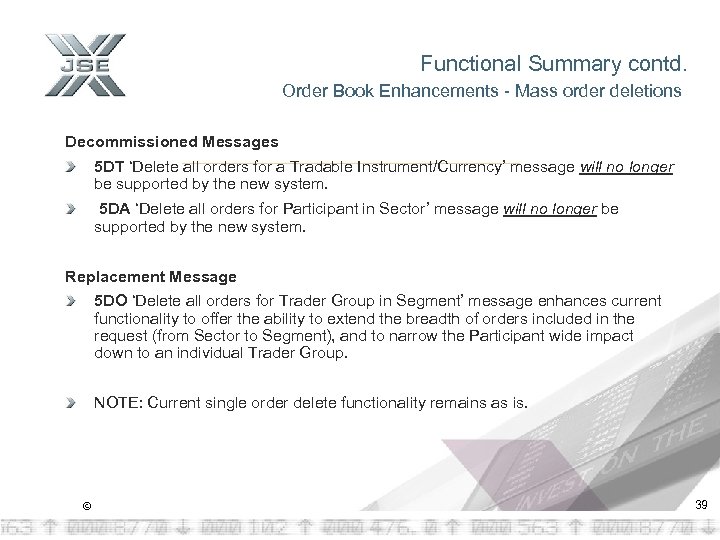

Functional Summary contd. Order Book Enhancements - Mass order deletions Decommissioned Messages 5 DT ‘Delete all orders for a Tradable Instrument/Currency’ message will no longer be supported by the new system. 5 DA ‘Delete all orders for Participant in Sector’ message will no longer be supported by the new system. Replacement Message 5 DO ‘Delete all orders for Trader Group in Segment’ message enhances current functionality to offer the ability to extend the breadth of orders included in the request (from Sector to Segment), and to narrow the Participant wide impact down to an individual Trader Group. NOTE: Current single order delete functionality remains as is. © 39

Functional Summary contd. Order Book Enhancements - Mass order deletions Decommissioned Messages 5 DT ‘Delete all orders for a Tradable Instrument/Currency’ message will no longer be supported by the new system. 5 DA ‘Delete all orders for Participant in Sector’ message will no longer be supported by the new system. Replacement Message 5 DO ‘Delete all orders for Trader Group in Segment’ message enhances current functionality to offer the ability to extend the breadth of orders included in the request (from Sector to Segment), and to narrow the Participant wide impact down to an individual Trader Group. NOTE: Current single order delete functionality remains as is. © 39

Functional Summary contd. Trade Reporting – Trade Type Validation Eligible trade types for segment − Currently restricting the range of trade types within a particular segment impacts all participants enabled in that segment eg: the NX trade type can not be used in JSE Segments (ZA 01, ZA 02, ZA 03 and ZA 04). − Note applied currently in the JSE market – however an extension of functionality – the new system introduces a further restriction through the use of ‘role’ e. g. a Marker maker registered in the security being given sole use of the block trade type for this instrument. Price Validation − Validation of the Price submitted for a Trade Report against a pre-determined tolerance around the previous closing price. If the price falls outside of this range it will be rejected. − This validation is based on a multiplier; i. e. if the multiplier was 10 and closing price was 300 ZAC, the system will reject any price less than 30 ZAC (300/10) and any price greater than 3000 ZAC (300*10). − The JSE will NOT implement this functionality from Go-live but will consider it for a future release. © 40

Functional Summary contd. Trade Reporting – Trade Type Validation Eligible trade types for segment − Currently restricting the range of trade types within a particular segment impacts all participants enabled in that segment eg: the NX trade type can not be used in JSE Segments (ZA 01, ZA 02, ZA 03 and ZA 04). − Note applied currently in the JSE market – however an extension of functionality – the new system introduces a further restriction through the use of ‘role’ e. g. a Marker maker registered in the security being given sole use of the block trade type for this instrument. Price Validation − Validation of the Price submitted for a Trade Report against a pre-determined tolerance around the previous closing price. If the price falls outside of this range it will be rejected. − This validation is based on a multiplier; i. e. if the multiplier was 10 and closing price was 300 ZAC, the system will reject any price less than 30 ZAC (300/10) and any price greater than 3000 ZAC (300*10). − The JSE will NOT implement this functionality from Go-live but will consider it for a future release. © 40

Functional Summary contd. Trade Reporting – Trade Cancellations Currently you cannot link the public contra CT trade type to the original trade cancelled by a participant, as the CT is assigned a new trade code. In the new system, for an automatic trade (AT) the contra is handled differently and will allow specific identification (linking) of the erroneous trade. The new system will treat the contra as a status change to the original trade, specifying the original trade code. This will be accomplished through the publication of a ‘cancel trade report’ message, with a broadcast update action of D (DELETE) – rather than today, where a new ‘CT’ trade report is published with a broadcast update action of A (ADD). © 41

Functional Summary contd. Trade Reporting – Trade Cancellations Currently you cannot link the public contra CT trade type to the original trade cancelled by a participant, as the CT is assigned a new trade code. In the new system, for an automatic trade (AT) the contra is handled differently and will allow specific identification (linking) of the erroneous trade. The new system will treat the contra as a status change to the original trade, specifying the original trade code. This will be accomplished through the publication of a ‘cancel trade report’ message, with a broadcast update action of D (DELETE) – rather than today, where a new ‘CT’ trade report is published with a broadcast update action of A (ADD). © 41

Functional Summary contd. Trade Reporting – Dual-Sided Trade Reports The current JSE Dual Sided Trade Reporting process will remain as is. The current JSE Single Sided Trade Reporting process remains as is, however the valid counterparty codes will change to “INTRAFIRM 1” and “NON-MEMBER 1”. © 42

Functional Summary contd. Trade Reporting – Dual-Sided Trade Reports The current JSE Dual Sided Trade Reporting process will remain as is. The current JSE Single Sided Trade Reporting process remains as is, however the valid counterparty codes will change to “INTRAFIRM 1” and “NON-MEMBER 1”. © 42

Functional Summary contd. Settlement Information - Settlement Account and Venue The new system provides the ability to submit a Settlement Account and Venue on an Order record which can be used downstream for routing Settlement information to a specific settlement venue Settlement Account is a mandatory field on the new 5 EO (Enter Order) messages and must be set to "S" for the JSE market Settlement venue must be left blank on the new 5 EO (Enter Order) messages for the JSE market. It will be defaulted by the trading system to an agreed JSE value (JCP). © 43

Functional Summary contd. Settlement Information - Settlement Account and Venue The new system provides the ability to submit a Settlement Account and Venue on an Order record which can be used downstream for routing Settlement information to a specific settlement venue Settlement Account is a mandatory field on the new 5 EO (Enter Order) messages and must be set to "S" for the JSE market Settlement venue must be left blank on the new 5 EO (Enter Order) messages for the JSE market. It will be defaulted by the trading system to an agreed JSE value (JCP). © 43

Functional Summary contd. Broadcast Interface - Disaster Recovery Today, in a disaster scenario, the 5 RD ‘Disaster Recovery’ message is used to flag when messages should be processed regardless of whether the sequence number has been processed previously and the recovery process having been invoked. The new system will ensure that all messages are synchronised with the alternative site, and guarantees that all re-sent messages will have the same sequence number. This removes the requirement to flag those messages newly originating from the alternate site; therefore this message and process of recovering will be decommissioned. In the event of a total site failure, the JSE may still opt to invoke a HALT period. © 44

Functional Summary contd. Broadcast Interface - Disaster Recovery Today, in a disaster scenario, the 5 RD ‘Disaster Recovery’ message is used to flag when messages should be processed regardless of whether the sequence number has been processed previously and the recovery process having been invoked. The new system will ensure that all messages are synchronised with the alternative site, and guarantees that all re-sent messages will have the same sequence number. This removes the requirement to flag those messages newly originating from the alternate site; therefore this message and process of recovering will be decommissioned. In the event of a total site failure, the JSE may still opt to invoke a HALT period. © 44

Functional Summary contd. Period Rules The trading system currently allows a maximum of 3 auction extensions and these follow a strict sequence of combinations, which in turn are dependant on what extensions have already been triggered. The new system functionality treats the method of extensions differently, with no such restrictions on the number of extensions and allowing these extensions to be triggered according to market conditions at the time A Market Order extension will continue to take priority over Price Monitoring extensions. However, for markets that have a maximum of three extensions to an auction, a Market Order extension can now take place, even after two Price Monitoring extensions have occurred. NOTE: Current JSE period extension rules will apply for go live, the JSE will re-visit the above for a future release. © 45

Functional Summary contd. Period Rules The trading system currently allows a maximum of 3 auction extensions and these follow a strict sequence of combinations, which in turn are dependant on what extensions have already been triggered. The new system functionality treats the method of extensions differently, with no such restrictions on the number of extensions and allowing these extensions to be triggered according to market conditions at the time A Market Order extension will continue to take priority over Price Monitoring extensions. However, for markets that have a maximum of three extensions to an auction, a Market Order extension can now take place, even after two Price Monitoring extensions have occurred. NOTE: Current JSE period extension rules will apply for go live, the JSE will re-visit the above for a future release. © 45

AGENDA Equities Trading System - Market Communication Background & Objectives Functional Summary Technical Summary Project Timeline Customer Testing User Documentation General − Connectivity − Online FAQ’s − Technical Workgroup Meetings − Further Market Communication Sessions Questions © 46

AGENDA Equities Trading System - Market Communication Background & Objectives Functional Summary Technical Summary Project Timeline Customer Testing User Documentation General − Connectivity − Online FAQ’s − Technical Workgroup Meetings − Further Market Communication Sessions Questions © 46

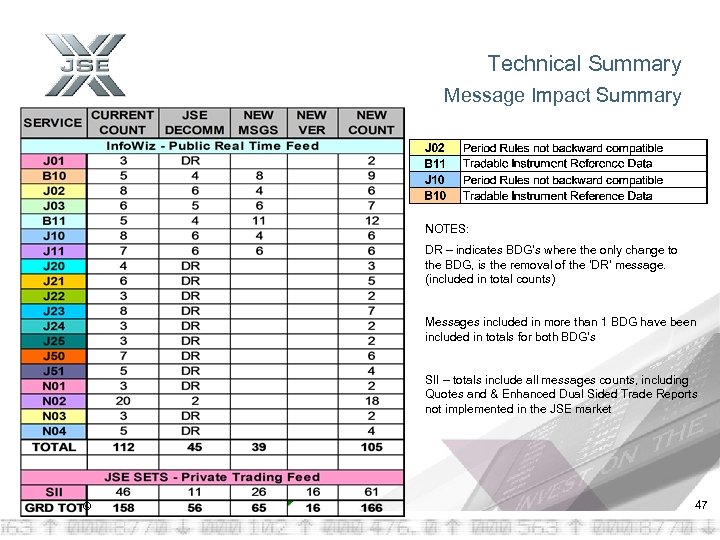

Technical Summary Message Impact Summary NOTES: DR – indicates BDG’s where the only change to the BDG, is the removal of the ‘DR’ message. (included in total counts) Messages included in more than 1 BDG have been included in totals for both BDG’s SII – totals include all messages counts, including Quotes and & Enhanced Dual Sided Trade Reports not implemented in the JSE market © 47

Technical Summary Message Impact Summary NOTES: DR – indicates BDG’s where the only change to the BDG, is the removal of the ‘DR’ message. (included in total counts) Messages included in more than 1 BDG have been included in totals for both BDG’s SII – totals include all messages counts, including Quotes and & Enhanced Dual Sided Trade Reports not implemented in the JSE market © 47

Technical Summary contd. Interactive Services The new system includes a number of enhancements identified during customer consultation in order to facilitate trading: Service Codes - Only certain messages and message versions are enabled for certain Service Codes. Current JSE service codes are T 01 and T 02. As part of TRM, the JSE will use T 02, T 03 and T 04. T 01 will be decommissioned for JSE users. Unsolicited connection status - This field is included in the business header for all interactive messages sent from the Exchange to the Participant. This field indicates that the Participant has stopped acknowledging unsolicited messages and will therefore no longer receive them Own Order Book Download (OOBD) - A new AB version of the 5 RO ‘Request Order Download’, 5 OF ‘First Order Download response’ and 5 S 1 ‘Subsequent Download Response’ messages that provide additional information not currently included with the AA version Own trades book download (OTBD) - OTBD is a new service offering similar functionality to the current Own Order Book Download (OOBD). This provides a Trader Group the ability to request a download of their Trade book (automated and reported) © 48

Technical Summary contd. Interactive Services The new system includes a number of enhancements identified during customer consultation in order to facilitate trading: Service Codes - Only certain messages and message versions are enabled for certain Service Codes. Current JSE service codes are T 01 and T 02. As part of TRM, the JSE will use T 02, T 03 and T 04. T 01 will be decommissioned for JSE users. Unsolicited connection status - This field is included in the business header for all interactive messages sent from the Exchange to the Participant. This field indicates that the Participant has stopped acknowledging unsolicited messages and will therefore no longer receive them Own Order Book Download (OOBD) - A new AB version of the 5 RO ‘Request Order Download’, 5 OF ‘First Order Download response’ and 5 S 1 ‘Subsequent Download Response’ messages that provide additional information not currently included with the AA version Own trades book download (OTBD) - OTBD is a new service offering similar functionality to the current Own Order Book Download (OOBD). This provides a Trader Group the ability to request a download of their Trade book (automated and reported) © 48

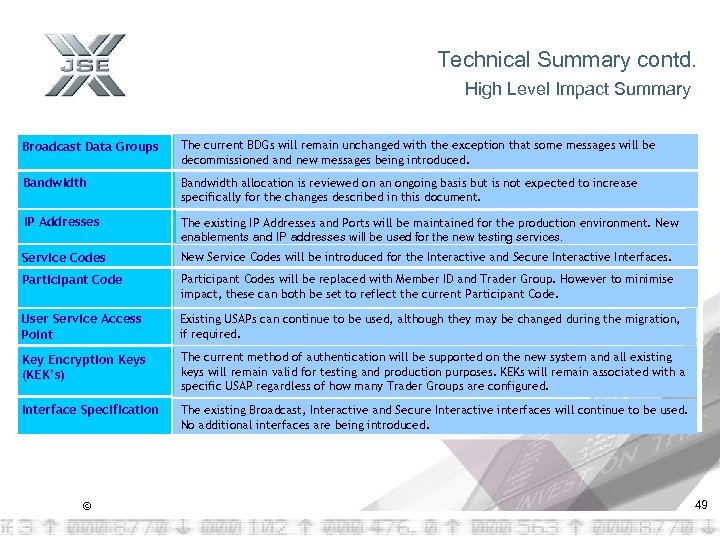

Technical Summary contd. High Level Impact Summary Broadcast Data Groups The current BDGs will remain unchanged with the exception that some messages will be decommissioned and new messages being introduced. Bandwidth allocation is reviewed on an ongoing basis but is not expected to increase specifically for the changes described in this document. IP Addresses The existing IP Addresses and Ports will be maintained for the production environment. New enablements and IP addresses will be used for the new testing services. Service Codes New Service Codes will be introduced for the Interactive and Secure Interactive Interfaces. Participant Codes will be replaced with Member ID and Trader Group. However to minimise impact, these can both be set to reflect the current Participant Code. User Service Access Point Existing USAPs can continue to be used, although they may be changed during the migration, if required. Key Encryption Keys (KEK’s) The current method of authentication will be supported on the new system and all existing keys will remain valid for testing and production purposes. KEKs will remain associated with a specific USAP regardless of how many Trader Groups are configured. Interface Specification The existing Broadcast, Interactive and Secure Interactive interfaces will continue to be used. No additional interfaces are being introduced. © 49

Technical Summary contd. High Level Impact Summary Broadcast Data Groups The current BDGs will remain unchanged with the exception that some messages will be decommissioned and new messages being introduced. Bandwidth allocation is reviewed on an ongoing basis but is not expected to increase specifically for the changes described in this document. IP Addresses The existing IP Addresses and Ports will be maintained for the production environment. New enablements and IP addresses will be used for the new testing services. Service Codes New Service Codes will be introduced for the Interactive and Secure Interactive Interfaces. Participant Codes will be replaced with Member ID and Trader Group. However to minimise impact, these can both be set to reflect the current Participant Code. User Service Access Point Existing USAPs can continue to be used, although they may be changed during the migration, if required. Key Encryption Keys (KEK’s) The current method of authentication will be supported on the new system and all existing keys will remain valid for testing and production purposes. KEKs will remain associated with a specific USAP regardless of how many Trader Groups are configured. Interface Specification The existing Broadcast, Interactive and Secure Interactive interfaces will continue to be used. No additional interfaces are being introduced. © 49

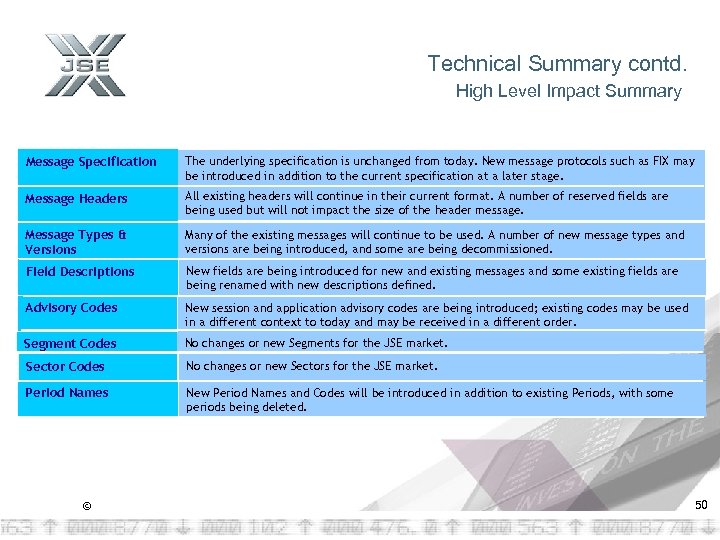

Technical Summary contd. High Level Impact Summary Message Specification The underlying specification is unchanged from today. New message protocols such as FIX may be introduced in addition to the current specification at a later stage. Message Headers All existing headers will continue in their current format. A number of reserved fields are being used but will not impact the size of the header message. Message Types & Versions Many of the existing messages will continue to be used. A number of new message types and versions are being introduced, and some are being decommissioned. Field Descriptions New fields are being introduced for new and existing messages and some existing fields are being renamed with new descriptions defined. Advisory Codes New session and application advisory codes are being introduced; existing codes may be used in a different context to today and may be received in a different order. Segment Codes No changes or new Segments for the JSE market. Sector Codes No changes or new Sectors for the JSE market. Period Names New Period Names and Codes will be introduced in addition to existing Periods, with some periods being deleted. © 50

Technical Summary contd. High Level Impact Summary Message Specification The underlying specification is unchanged from today. New message protocols such as FIX may be introduced in addition to the current specification at a later stage. Message Headers All existing headers will continue in their current format. A number of reserved fields are being used but will not impact the size of the header message. Message Types & Versions Many of the existing messages will continue to be used. A number of new message types and versions are being introduced, and some are being decommissioned. Field Descriptions New fields are being introduced for new and existing messages and some existing fields are being renamed with new descriptions defined. Advisory Codes New session and application advisory codes are being introduced; existing codes may be used in a different context to today and may be received in a different order. Segment Codes No changes or new Segments for the JSE market. Sector Codes No changes or new Sectors for the JSE market. Period Names New Period Names and Codes will be introduced in addition to existing Periods, with some periods being deleted. © 50

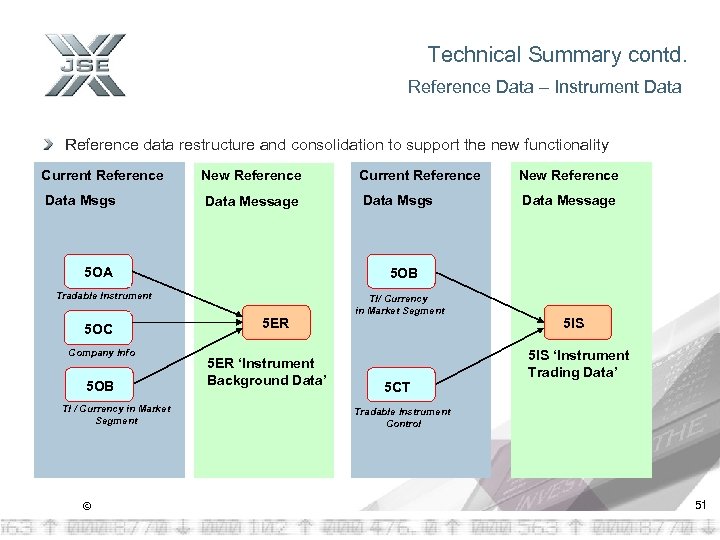

Technical Summary contd. Reference Data – Instrument Data Reference data restructure and consolidation to support the new functionality Current Reference New Reference Data Msgs Data Message 5 OA 5 OB Tradable Instrument 5 OC Company Info 5 OB TI / Currency in Market Segment © 5 ER ‘Instrument Background Data’ TI/ Currency in Market Segment 5 CT 5 IS ‘Instrument Trading Data’ Tradable Instrument Control 51

Technical Summary contd. Reference Data – Instrument Data Reference data restructure and consolidation to support the new functionality Current Reference New Reference Data Msgs Data Message 5 OA 5 OB Tradable Instrument 5 OC Company Info 5 OB TI / Currency in Market Segment © 5 ER ‘Instrument Background Data’ TI/ Currency in Market Segment 5 CT 5 IS ‘Instrument Trading Data’ Tradable Instrument Control 51

AGENDA Equities Trading System - Market Communication Background & Objectives Functional Summary Technical Summary Project Timeline Customer Testing User Documentation General − Connectivity − Online FAQ’s − Technical Workgroup Meetings − Further Market Communication Sessions Questions © 52

AGENDA Equities Trading System - Market Communication Background & Objectives Functional Summary Technical Summary Project Timeline Customer Testing User Documentation General − Connectivity − Online FAQ’s − Technical Workgroup Meetings − Further Market Communication Sessions Questions © 52

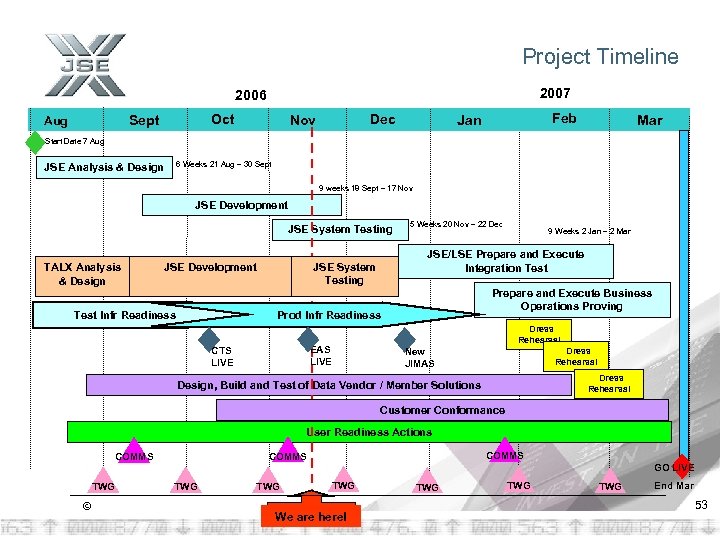

Project Timeline 2007 2006 Oct Sept Aug Dec Nov Feb Jan Mar Start Date 7 Aug 6 Weeks 21 Aug – 30 Sept JSE Analysis & Design 9 weeks 18 Sept – 17 Nov JSE Development JSE System Testing TALX Analysis & Design JSE Development 5 Weeks 20 Nov – 22 Dec JSE/LSE Prepare and Execute Integration Test JSE System Testing Prepare and Execute Business Operations Proving Prod Infr Readiness Test Infr Readiness Dress Rehearsal EAS LIVE CTS LIVE 9 Weeks 2 Jan – 2 Mar New JIMAS Dress Rehearsal Design, Build and Test of Data Vendor / Member Solutions Customer Conformance User Readiness Actions COMMS GO LIVE TWG © TWG TWG We are here! TWG TWG End Mar 53

Project Timeline 2007 2006 Oct Sept Aug Dec Nov Feb Jan Mar Start Date 7 Aug 6 Weeks 21 Aug – 30 Sept JSE Analysis & Design 9 weeks 18 Sept – 17 Nov JSE Development JSE System Testing TALX Analysis & Design JSE Development 5 Weeks 20 Nov – 22 Dec JSE/LSE Prepare and Execute Integration Test JSE System Testing Prepare and Execute Business Operations Proving Prod Infr Readiness Test Infr Readiness Dress Rehearsal EAS LIVE CTS LIVE 9 Weeks 2 Jan – 2 Mar New JIMAS Dress Rehearsal Design, Build and Test of Data Vendor / Member Solutions Customer Conformance User Readiness Actions COMMS GO LIVE TWG © TWG TWG We are here! TWG TWG End Mar 53

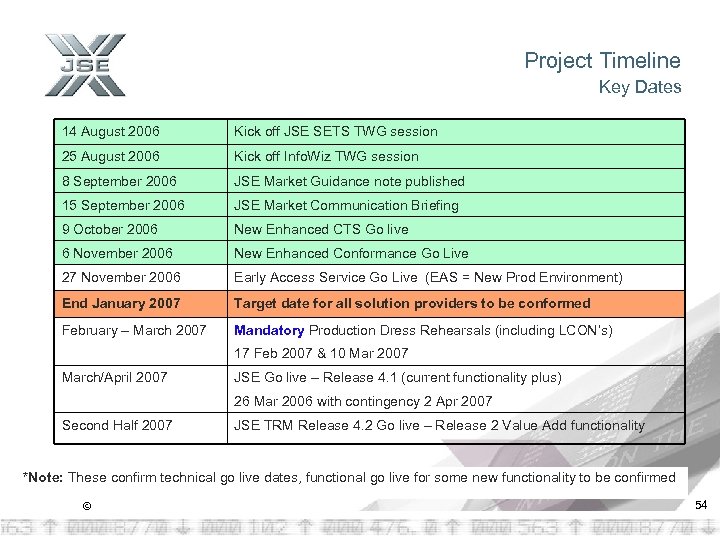

Project Timeline Key Dates 14 August 2006 Kick off JSE SETS TWG session 25 August 2006 Kick off Info. Wiz TWG session 8 September 2006 JSE Market Guidance note published 15 September 2006 JSE Market Communication Briefing 9 October 2006 New Enhanced CTS Go live 6 November 2006 New Enhanced Conformance Go Live 27 November 2006 Early Access Service Go Live (EAS = New Prod Environment) End January 2007 Target date for all solution providers to be conformed February – March 2007 Mandatory Production Dress Rehearsals (including LCON’s) 17 Feb 2007 & 10 Mar 2007 March/April 2007 JSE Go live – Release 4. 1 (current functionality plus) 26 Mar 2006 with contingency 2 Apr 2007 Second Half 2007 JSE TRM Release 4. 2 Go live – Release 2 Value Add functionality *Note: These confirm technical go live dates, functional go live for some new functionality to be confirmed © 54

Project Timeline Key Dates 14 August 2006 Kick off JSE SETS TWG session 25 August 2006 Kick off Info. Wiz TWG session 8 September 2006 JSE Market Guidance note published 15 September 2006 JSE Market Communication Briefing 9 October 2006 New Enhanced CTS Go live 6 November 2006 New Enhanced Conformance Go Live 27 November 2006 Early Access Service Go Live (EAS = New Prod Environment) End January 2007 Target date for all solution providers to be conformed February – March 2007 Mandatory Production Dress Rehearsals (including LCON’s) 17 Feb 2007 & 10 Mar 2007 March/April 2007 JSE Go live – Release 4. 1 (current functionality plus) 26 Mar 2006 with contingency 2 Apr 2007 Second Half 2007 JSE TRM Release 4. 2 Go live – Release 2 Value Add functionality *Note: These confirm technical go live dates, functional go live for some new functionality to be confirmed © 54

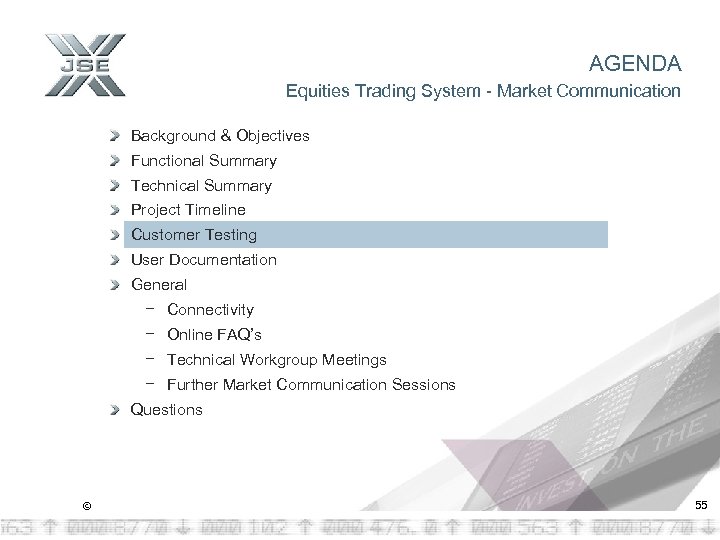

AGENDA Equities Trading System - Market Communication Background & Objectives Functional Summary Technical Summary Project Timeline Customer Testing User Documentation General − Connectivity − Online FAQ’s − Technical Workgroup Meetings − Further Market Communication Sessions Questions © 55

AGENDA Equities Trading System - Market Communication Background & Objectives Functional Summary Technical Summary Project Timeline Customer Testing User Documentation General − Connectivity − Online FAQ’s − Technical Workgroup Meetings − Further Market Communication Sessions Questions © 55

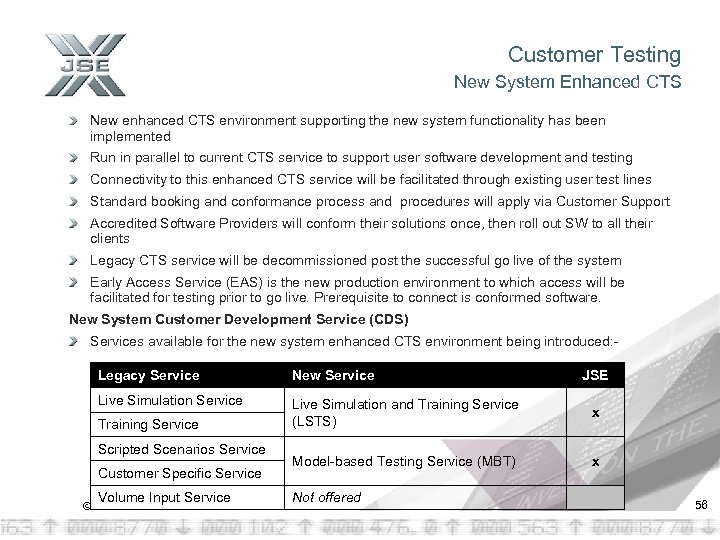

Customer Testing New System Enhanced CTS New enhanced CTS environment supporting the new system functionality has been implemented Run in parallel to current CTS service to support user software development and testing Connectivity to this enhanced CTS service will be facilitated through existing user test lines Standard booking and conformance process and procedures will apply via Customer Support Accredited Software Providers will conform their solutions once, then roll out SW to all their clients Legacy CTS service will be decommissioned post the successful go live of the system Early Access Service (EAS) is the new production environment to which access will be facilitated for testing prior to go live. Prerequisite to connect is conformed software. New System Customer Development Service (CDS) Services available for the new system enhanced CTS environment being introduced: Legacy Service New Service Live Simulation and Training Service (LSTS) x Model-based Testing Service (MBT) x Training Service Scripted Scenarios Service Customer Specific Service © Volume Input Service Not offered JSE 56

Customer Testing New System Enhanced CTS New enhanced CTS environment supporting the new system functionality has been implemented Run in parallel to current CTS service to support user software development and testing Connectivity to this enhanced CTS service will be facilitated through existing user test lines Standard booking and conformance process and procedures will apply via Customer Support Accredited Software Providers will conform their solutions once, then roll out SW to all their clients Legacy CTS service will be decommissioned post the successful go live of the system Early Access Service (EAS) is the new production environment to which access will be facilitated for testing prior to go live. Prerequisite to connect is conformed software. New System Customer Development Service (CDS) Services available for the new system enhanced CTS environment being introduced: Legacy Service New Service Live Simulation and Training Service (LSTS) x Model-based Testing Service (MBT) x Training Service Scripted Scenarios Service Customer Specific Service © Volume Input Service Not offered JSE 56

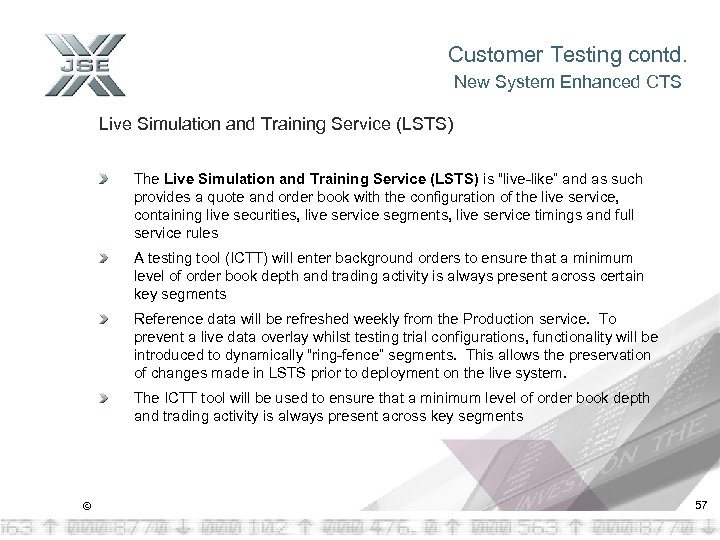

Customer Testing contd. New System Enhanced CTS Live Simulation and Training Service (LSTS) The Live Simulation and Training Service (LSTS) is “live-like” and as such provides a quote and order book with the configuration of the live service, containing live securities, live service segments, live service timings and full service rules A testing tool (ICTT) will enter background orders to ensure that a minimum level of order book depth and trading activity is always present across certain key segments Reference data will be refreshed weekly from the Production service. To prevent a live data overlay whilst testing trial configurations, functionality will be introduced to dynamically “ring-fence” segments. This allows the preservation of changes made in LSTS prior to deployment on the live system. The ICTT tool will be used to ensure that a minimum level of order book depth and trading activity is always present across key segments © 57

Customer Testing contd. New System Enhanced CTS Live Simulation and Training Service (LSTS) The Live Simulation and Training Service (LSTS) is “live-like” and as such provides a quote and order book with the configuration of the live service, containing live securities, live service segments, live service timings and full service rules A testing tool (ICTT) will enter background orders to ensure that a minimum level of order book depth and trading activity is always present across certain key segments Reference data will be refreshed weekly from the Production service. To prevent a live data overlay whilst testing trial configurations, functionality will be introduced to dynamically “ring-fence” segments. This allows the preservation of changes made in LSTS prior to deployment on the live system. The ICTT tool will be used to ensure that a minimum level of order book depth and trading activity is always present across key segments © 57

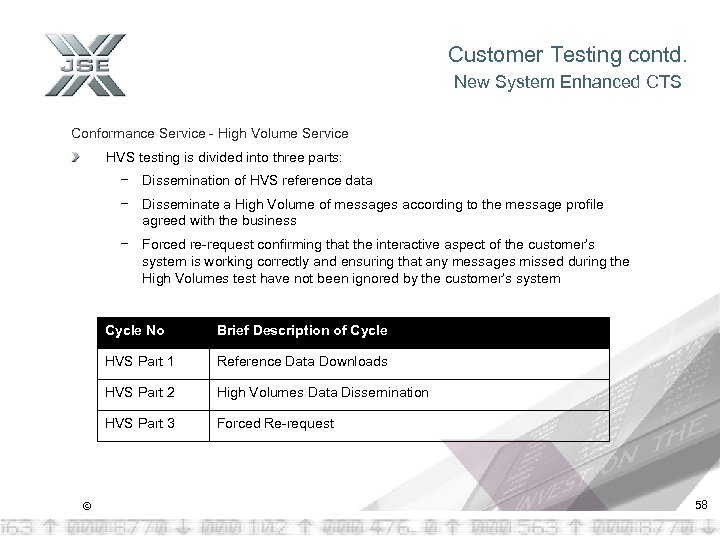

Customer Testing contd. New System Enhanced CTS Conformance Service - High Volume Service HVS testing is divided into three parts: − Dissemination of HVS reference data − Disseminate a High Volume of messages according to the message profile agreed with the business − Forced re-request confirming that the interactive aspect of the customer’s system is working correctly and ensuring that any messages missed during the High Volumes test have not been ignored by the customer’s system Cycle No HVS Part 1 Reference Data Downloads HVS Part 2 High Volumes Data Dissemination HVS Part 3 © Brief Description of Cycle Forced Re-request 58

Customer Testing contd. New System Enhanced CTS Conformance Service - High Volume Service HVS testing is divided into three parts: − Dissemination of HVS reference data − Disseminate a High Volume of messages according to the message profile agreed with the business − Forced re-request confirming that the interactive aspect of the customer’s system is working correctly and ensuring that any messages missed during the High Volumes test have not been ignored by the customer’s system Cycle No HVS Part 1 Reference Data Downloads HVS Part 2 High Volumes Data Dissemination HVS Part 3 © Brief Description of Cycle Forced Re-request 58

Customer Testing contd. Trading Conformance Test Cycles will be introduced or removed according to their fit with live system functionality. Cycle ID Old Cycle ID T 01 Empty Order Book and Empty Trades Book Download New T 02 Pre-Market Trading T 01 T 03 Logon/Logoff and Loss of Secure Interactive Session T 02 T 04 Limit Orders T 08 T 05 Execute and Eliminate Orders T 09 T 06 Fill or Kill Orders T 10 T 07 Iceberg Orders T 10 a T 08 Committed Principal Orders T 11 T 09 Client Order Reference Modification T 12 T 10 © Title Order Deletions/Empty own Order Book Download T 13 59

Customer Testing contd. Trading Conformance Test Cycles will be introduced or removed according to their fit with live system functionality. Cycle ID Old Cycle ID T 01 Empty Order Book and Empty Trades Book Download New T 02 Pre-Market Trading T 01 T 03 Logon/Logoff and Loss of Secure Interactive Session T 02 T 04 Limit Orders T 08 T 05 Execute and Eliminate Orders T 09 T 06 Fill or Kill Orders T 10 T 07 Iceberg Orders T 10 a T 08 Committed Principal Orders T 11 T 09 Client Order Reference Modification T 12 T 10 © Title Order Deletions/Empty own Order Book Download T 13 59

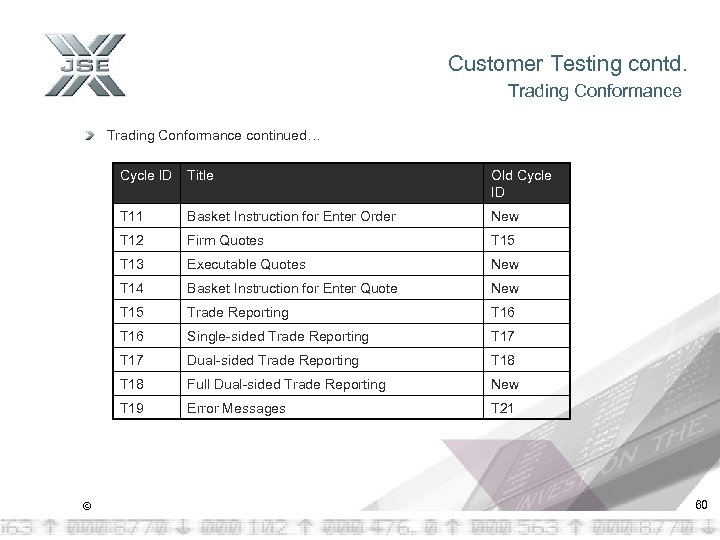

Customer Testing contd. Trading Conformance continued… Cycle ID Old Cycle ID T 11 Basket Instruction for Enter Order New T 12 Firm Quotes T 15 T 13 Executable Quotes New T 14 Basket Instruction for Enter Quote New T 15 Trade Reporting T 16 Single-sided Trade Reporting T 17 Dual-sided Trade Reporting T 18 Full Dual-sided Trade Reporting New T 19 © Title Error Messages T 21 60

Customer Testing contd. Trading Conformance continued… Cycle ID Old Cycle ID T 11 Basket Instruction for Enter Order New T 12 Firm Quotes T 15 T 13 Executable Quotes New T 14 Basket Instruction for Enter Quote New T 15 Trade Reporting T 16 Single-sided Trade Reporting T 17 Dual-sided Trade Reporting T 18 Full Dual-sided Trade Reporting New T 19 © Title Error Messages T 21 60

Customer Testing contd. Trading Conformance Decommissioned Trading Cycles Cycle ID T 04 Indicative Exposure Orders T 05 Firm Exposure Orders T 06 Hit Orders T 07 Passive Market Orders T 14 Indicative Quotes T 19 Company Information T 20 © Title Control Information 61

Customer Testing contd. Trading Conformance Decommissioned Trading Cycles Cycle ID T 04 Indicative Exposure Orders T 05 Firm Exposure Orders T 06 Hit Orders T 07 Passive Market Orders T 14 Indicative Quotes T 19 Company Information T 20 © Title Control Information 61

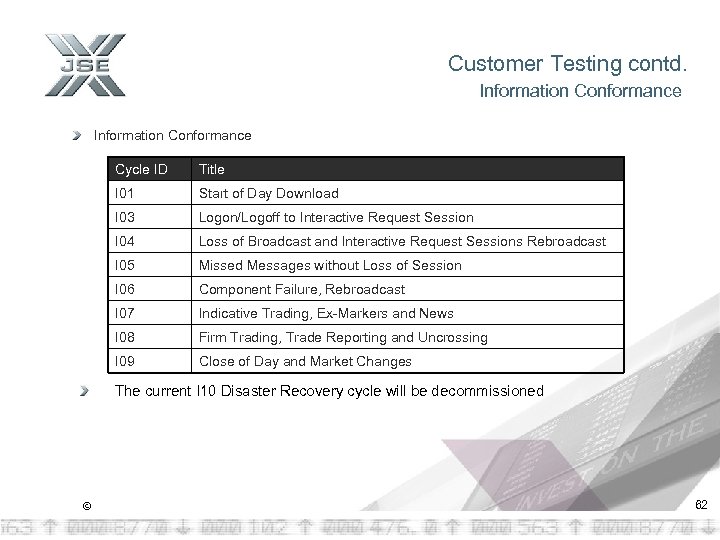

Customer Testing contd. Information Conformance Cycle ID Title I 01 Start of Day Download I 03 Logon/Logoff to Interactive Request Session I 04 Loss of Broadcast and Interactive Request Sessions Rebroadcast I 05 Missed Messages without Loss of Session I 06 Component Failure, Rebroadcast I 07 Indicative Trading, Ex-Markers and News I 08 Firm Trading, Trade Reporting and Uncrossing I 09 Close of Day and Market Changes The current I 10 Disaster Recovery cycle will be decommissioned © 62