c2e5ee8bf89a5e51db81d32c6779506e.ppt

- Количество слайдов: 68

JSE Strategic Communication Session 3/15/2018

JSE Strategic Communication Session 3/15/2018

Agenda • JSE Strategy Recap • JSE Strategic Initiatives – CRM – Interest Rate Market (IRM) – Alt-X – Indices – New Products – APD System Issues – Orion

Agenda • JSE Strategy Recap • JSE Strategic Initiatives – CRM – Interest Rate Market (IRM) – Alt-X – Indices – New Products – APD System Issues – Orion

Agenda • JSE Strategy Recap • JSE Strategic Initiatives – CRM – Interest Rate Market (IRM) – Alt-X – Indices – New Products – APD System Issues – Orion

Agenda • JSE Strategy Recap • JSE Strategic Initiatives – CRM – Interest Rate Market (IRM) – Alt-X – Indices – New Products – APD System Issues – Orion

JSE Strategy Recap

JSE Strategy Recap

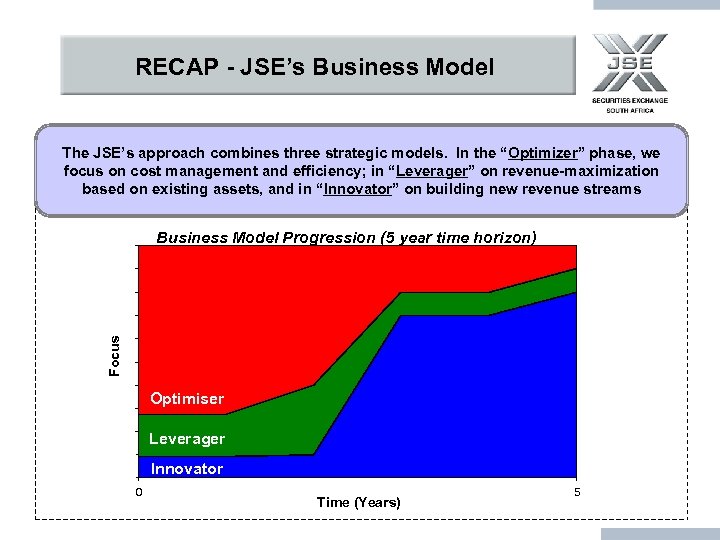

RECAP - JSE’s Business Model The JSE’s approach combines three strategic models. In the “Optimizer” phase, we focus on cost management and efficiency; in “Leverager” on revenue-maximization based on existing assets, and in “Innovator” on building new revenue streams Focus Business Model Progression (5 year time horizon) Optimiser Leverager Innovator 0 Time (Years) 5

RECAP - JSE’s Business Model The JSE’s approach combines three strategic models. In the “Optimizer” phase, we focus on cost management and efficiency; in “Leverager” on revenue-maximization based on existing assets, and in “Innovator” on building new revenue streams Focus Business Model Progression (5 year time horizon) Optimiser Leverager Innovator 0 Time (Years) 5

Strategic Objectives - Initial Optimiser Focus • Addressing costs • Focusing on business efficiency • Re-evaluating existing and determining new revenue drivers for sustained revenue growth • Developing a customer-focused mentality • Realising economies of scale around SAFEX acquisition and passing these on to the members • Creating a performance-driven environment • Define a JSE Brand Strategy to build the JSE brand locally and internationally • Building relationships with key stakeholders (business and political; local and international) and leveraging these to the advantage of the market

Strategic Objectives - Initial Optimiser Focus • Addressing costs • Focusing on business efficiency • Re-evaluating existing and determining new revenue drivers for sustained revenue growth • Developing a customer-focused mentality • Realising economies of scale around SAFEX acquisition and passing these on to the members • Creating a performance-driven environment • Define a JSE Brand Strategy to build the JSE brand locally and internationally • Building relationships with key stakeholders (business and political; local and international) and leveraging these to the advantage of the market

Strategic Objectives - Longer Leverager and Innovator • Maintaining and refining heightened levels of efficiency and cost-effectiveness within the organisation • Introducing new, innovative products and markets that cater to the demands of local and international investors and intermediaries • Actively nurturing and developing local primary and secondary markets • Aggressively developing a customer-centric environment that allows for maximum investor accessibility and security • Enhancing Investors’ awareness of the JSE’s products and companies through the initiation of dynamic educational and marketing drives • Implementing JSE Brand Strategy that brands the JSE as an investment destination of choice • Developing a JSE “Africa Inc. ” Initiative

Strategic Objectives - Longer Leverager and Innovator • Maintaining and refining heightened levels of efficiency and cost-effectiveness within the organisation • Introducing new, innovative products and markets that cater to the demands of local and international investors and intermediaries • Actively nurturing and developing local primary and secondary markets • Aggressively developing a customer-centric environment that allows for maximum investor accessibility and security • Enhancing Investors’ awareness of the JSE’s products and companies through the initiation of dynamic educational and marketing drives • Implementing JSE Brand Strategy that brands the JSE as an investment destination of choice • Developing a JSE “Africa Inc. ” Initiative

Agenda • JSE Strategy Recap • JSE Strategic Initiatives – CRM – Interest Rate Market (IRM) – Alt-X – Indices – New Products – APD System Issues – Orion

Agenda • JSE Strategy Recap • JSE Strategic Initiatives – CRM – Interest Rate Market (IRM) – Alt-X – Indices – New Products – APD System Issues – Orion

JSE Strategic Initiatives Customer Relationship Management (CRM)

JSE Strategic Initiatives Customer Relationship Management (CRM)

Customer Relationship Management (CRM)

Customer Relationship Management (CRM)

e. CRM Initiative • What is the ACCPAC CRM solution? – An 'off-the-shelf' package customised to suit the JSE’s requirements – It is a flexible browser based application that can integrate with almost any application • Why do we want to implement an ACCPAC CRM solution? – It will provide the JSE with a single view of the client from inception throughout the life cycle of the client – The application is fully integrated with Outlook and has the ability to integrate with most applications

e. CRM Initiative • What is the ACCPAC CRM solution? – An 'off-the-shelf' package customised to suit the JSE’s requirements – It is a flexible browser based application that can integrate with almost any application • Why do we want to implement an ACCPAC CRM solution? – It will provide the JSE with a single view of the client from inception throughout the life cycle of the client – The application is fully integrated with Outlook and has the ability to integrate with most applications

JSE Strategic Initiatives Interest Rate Market (IRM)

JSE Strategic Initiatives Interest Rate Market (IRM)

Interest Rate Market (IRM) • JSE’s intention to respond to client needs by expanding the range of the current SAFEX interest rate products and increase liquidity – as an alternative trading platform closely aligned with current FDD structure – and a market with separate membership and comprehensive regulation and supervision • Variety of innovative products and new instruments • Order driven, anonymous central order book • JSE’s world class equity and derivative market model • World first in terms of offering a single platform for the trading of interest rate products both on a price and yield basis • IRM is being investigated for implementation for the last quarter of 2004

Interest Rate Market (IRM) • JSE’s intention to respond to client needs by expanding the range of the current SAFEX interest rate products and increase liquidity – as an alternative trading platform closely aligned with current FDD structure – and a market with separate membership and comprehensive regulation and supervision • Variety of innovative products and new instruments • Order driven, anonymous central order book • JSE’s world class equity and derivative market model • World first in terms of offering a single platform for the trading of interest rate products both on a price and yield basis • IRM is being investigated for implementation for the last quarter of 2004

JSE Strategic Initiatives The Alternative Exchange (Alt. X)

JSE Strategic Initiatives The Alternative Exchange (Alt. X)

The Alternative Exchange (Alt. X) • 4 Companies currently listed – – Beige – Insure – ABC Cash Plus – Onelogix • 16 new companies in various stages of the listings process • VCM and DCM will close in July – expect more companies to apply for an Alt. X Listing before this deadline. • 16 designated advisors supporting the new market

The Alternative Exchange (Alt. X) • 4 Companies currently listed – – Beige – Insure – ABC Cash Plus – Onelogix • 16 new companies in various stages of the listings process • VCM and DCM will close in July – expect more companies to apply for an Alt. X Listing before this deadline. • 16 designated advisors supporting the new market

JSE Strategic Initiatives New Indices

JSE Strategic Initiatives New Indices

Style Indices • Style – Investment strategy that groups companies by apparent different rate of returns. • All existing indices remain unchanged. Just another way to look at the companies listed on the JSE. • Another dimension of JSE companies. Other dimensions are size, returns, sectors etc. • Used to – – Forecast returns, – Provide greater choice to clients – Management tool – Improve reporting to clients – Performance measurement / attribution

Style Indices • Style – Investment strategy that groups companies by apparent different rate of returns. • All existing indices remain unchanged. Just another way to look at the companies listed on the JSE. • Another dimension of JSE companies. Other dimensions are size, returns, sectors etc. • Used to – – Forecast returns, – Provide greater choice to clients – Management tool – Improve reporting to clients – Performance measurement / attribution

Style Indices (Cont. ) • Live in July • History till 2 January 2002 will be provided immediately • Earlier history to be done in 2005 (IT technicalities)

Style Indices (Cont. ) • Live in July • History till 2 January 2002 will be provided immediately • Earlier history to be done in 2005 (IT technicalities)

Social Responsibility Investment (SRI) Index • SRI Index created as a means of helping to focus debate on triple bottom line practices and to recognise tremendous efforts already made by SA companies in this area • Measures companies policies, performance and reporting in relation to the 3 pillars of the bottom line (environmental, economic and social sustainability) and corporate governance practice

Social Responsibility Investment (SRI) Index • SRI Index created as a means of helping to focus debate on triple bottom line practices and to recognise tremendous efforts already made by SA companies in this area • Measures companies policies, performance and reporting in relation to the 3 pillars of the bottom line (environmental, economic and social sustainability) and corporate governance practice

Social Responsibility Investment (SRI) Index (Cont. ) • All companies in FTSE/JSE All Share Index invited to participate in process on a voluntary basis. – 74 Listed companies participated and 51 companies met the criteria • SRI Index is the first index of this nature in an emerging market and the first in the world to be launch by an exchange • 17 of the constituents are part of Mid. Cap Index and 3 are part of the Small. Cap Index

Social Responsibility Investment (SRI) Index (Cont. ) • All companies in FTSE/JSE All Share Index invited to participate in process on a voluntary basis. – 74 Listed companies participated and 51 companies met the criteria • SRI Index is the first index of this nature in an emerging market and the first in the world to be launch by an exchange • 17 of the constituents are part of Mid. Cap Index and 3 are part of the Small. Cap Index

JSE Strategic Initiatives New Products

JSE Strategic Initiatives New Products

Inward Dual Listings • Minister of Finance announced in 2004 budget that Companies will able to raise capital in South African Capital Markets – Details still to be finalised with National Treasury • Will be subject to current Exchange Control restrictions – 5% Institutional Investment – R 750 000 Individual Limit

Inward Dual Listings • Minister of Finance announced in 2004 budget that Companies will able to raise capital in South African Capital Markets – Details still to be finalised with National Treasury • Will be subject to current Exchange Control restrictions – 5% Institutional Investment – R 750 000 Individual Limit

JSE Strategic Initiatives APD Systems Issues

JSE Strategic Initiatives APD Systems Issues

Agricultural Products – ATS System • Various options investigated to address the APD ATS system performance issues. SAFEX system originally written to support much smaller market - software has not been upgraded to cater for ongoing market growth/demand. • JSE conducted investigations into possible solutions – – Initial analysis of new software version implemented in November 2003 indicate new version was generating increased message volumes between trading engine and member trading front-end. Testing indicates current and previous releases of software do not differ in message volumes.

Agricultural Products – ATS System • Various options investigated to address the APD ATS system performance issues. SAFEX system originally written to support much smaller market - software has not been upgraded to cater for ongoing market growth/demand. • JSE conducted investigations into possible solutions – – Initial analysis of new software version implemented in November 2003 indicate new version was generating increased message volumes between trading engine and member trading front-end. Testing indicates current and previous releases of software do not differ in message volumes.

Agricultural Products – ATS System (Cont. ) – Performance problems experienced under load conditions and increased market activity. Application performance test tool developed to simulate market activity/ ID any performance bottlenecks. – Application re-engineering options under consideration redesign of application message flows and/or implementation of message compression to reduce message sizes and improve message throughput. • Work currently in progress to identify correct re-engineering option

Agricultural Products – ATS System (Cont. ) – Performance problems experienced under load conditions and increased market activity. Application performance test tool developed to simulate market activity/ ID any performance bottlenecks. – Application re-engineering options under consideration redesign of application message flows and/or implementation of message compression to reduce message sizes and improve message throughput. • Work currently in progress to identify correct re-engineering option

Agricultural Products – ATS System (Cont. ) • User Community tests will be held requiring full market participation in production environment to assist in confirming successful resolution of the problem. • Proposed solutions short-term – Project Orion will provide permanent solution.

Agricultural Products – ATS System (Cont. ) • User Community tests will be held requiring full market participation in production environment to assist in confirming successful resolution of the problem. • Proposed solutions short-term – Project Orion will provide permanent solution.

Project Orion Background and Objective

Project Orion Background and Objective

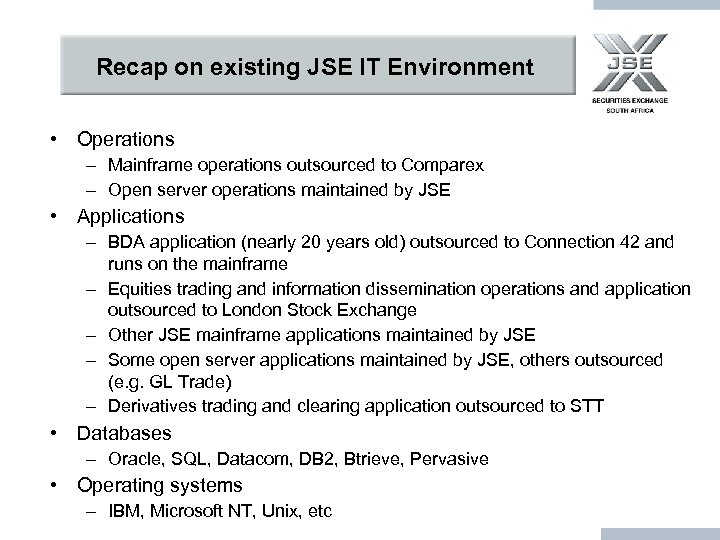

Recap on existing JSE IT Environment • Operations – Mainframe operations outsourced to Comparex – Open server operations maintained by JSE • Applications – BDA application (nearly 20 years old) outsourced to Connection 42 and runs on the mainframe – Equities trading and information dissemination operations and application outsourced to London Stock Exchange – Other JSE mainframe applications maintained by JSE – Some open server applications maintained by JSE, others outsourced (e. g. GL Trade) – Derivatives trading and clearing application outsourced to STT • Databases – Oracle, SQL, Datacom, DB 2, Btrieve, Pervasive • Operating systems – IBM, Microsoft NT, Unix, etc

Recap on existing JSE IT Environment • Operations – Mainframe operations outsourced to Comparex – Open server operations maintained by JSE • Applications – BDA application (nearly 20 years old) outsourced to Connection 42 and runs on the mainframe – Equities trading and information dissemination operations and application outsourced to London Stock Exchange – Other JSE mainframe applications maintained by JSE – Some open server applications maintained by JSE, others outsourced (e. g. GL Trade) – Derivatives trading and clearing application outsourced to STT • Databases – Oracle, SQL, Datacom, DB 2, Btrieve, Pervasive • Operating systems – IBM, Microsoft NT, Unix, etc

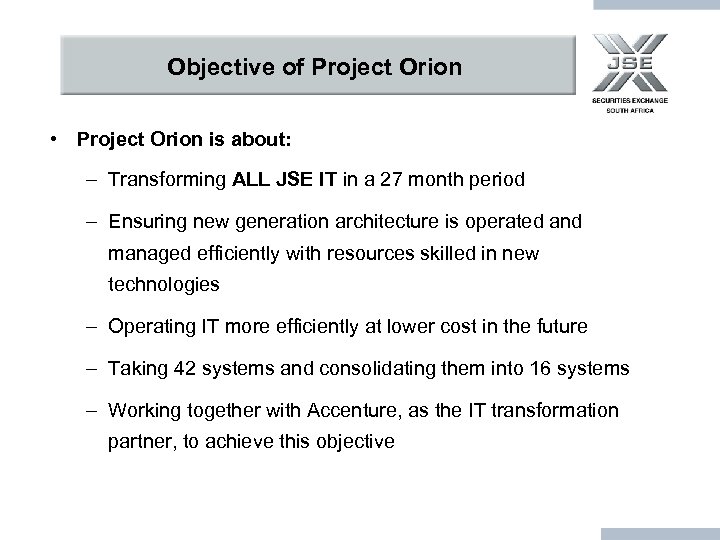

Objective of Project Orion • Project Orion is about: – Transforming ALL JSE IT in a 27 month period – Ensuring new generation architecture is operated and managed efficiently with resources skilled in new technologies – Operating IT more efficiently at lower cost in the future – Taking 42 systems and consolidating them into 16 systems – Working together with Accenture, as the IT transformation partner, to achieve this objective

Objective of Project Orion • Project Orion is about: – Transforming ALL JSE IT in a 27 month period – Ensuring new generation architecture is operated and managed efficiently with resources skilled in new technologies – Operating IT more efficiently at lower cost in the future – Taking 42 systems and consolidating them into 16 systems – Working together with Accenture, as the IT transformation partner, to achieve this objective

Why do we want to do this? • JSE business totally dependent on IT • IT becoming increasingly commoditised and therefore low TCO will be a major determinant for success of Exchanges in the future • JSE historical IT cost growth in excess of inflation • Existing JSE IT environment challenges • Empowering business units to exploit IT capability • Reduce IT costs ……. Whilst still retaining control

Why do we want to do this? • JSE business totally dependent on IT • IT becoming increasingly commoditised and therefore low TCO will be a major determinant for success of Exchanges in the future • JSE historical IT cost growth in excess of inflation • Existing JSE IT environment challenges • Empowering business units to exploit IT capability • Reduce IT costs ……. Whilst still retaining control

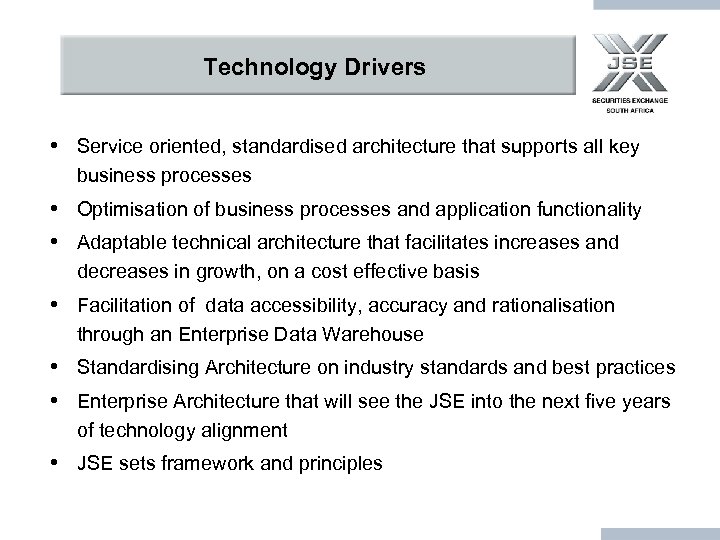

Technology Drivers • Service oriented, standardised architecture that supports all key business processes • Optimisation of business processes and application functionality • Adaptable technical architecture that facilitates increases and decreases in growth, on a cost effective basis • Facilitation of data accessibility, accuracy and rationalisation through an Enterprise Data Warehouse • Standardising Architecture on industry standards and best practices • Enterprise Architecture that will see the JSE into the next five years of technology alignment • JSE sets framework and principles

Technology Drivers • Service oriented, standardised architecture that supports all key business processes • Optimisation of business processes and application functionality • Adaptable technical architecture that facilitates increases and decreases in growth, on a cost effective basis • Facilitation of data accessibility, accuracy and rationalisation through an Enterprise Data Warehouse • Standardising Architecture on industry standards and best practices • Enterprise Architecture that will see the JSE into the next five years of technology alignment • JSE sets framework and principles

Project Orion Architecture

Project Orion Architecture

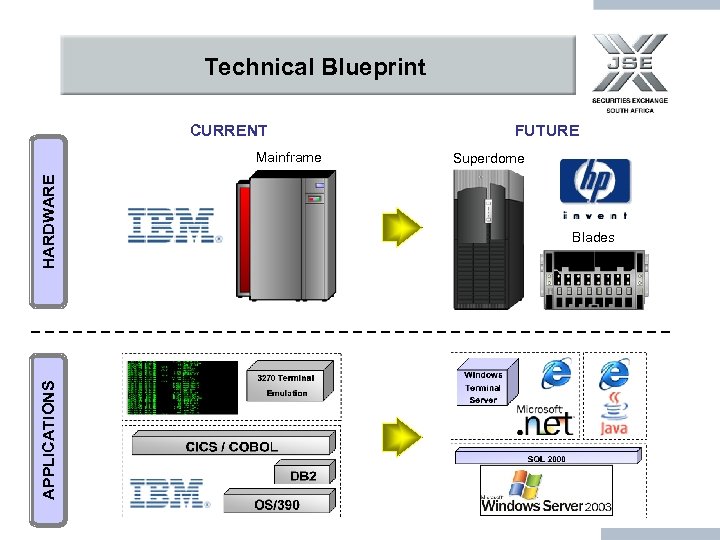

Technical Blueprint CURRENT APPLICATIONS HARDWARE Mainframe FUTURE Superdome Blades

Technical Blueprint CURRENT APPLICATIONS HARDWARE Mainframe FUTURE Superdome Blades

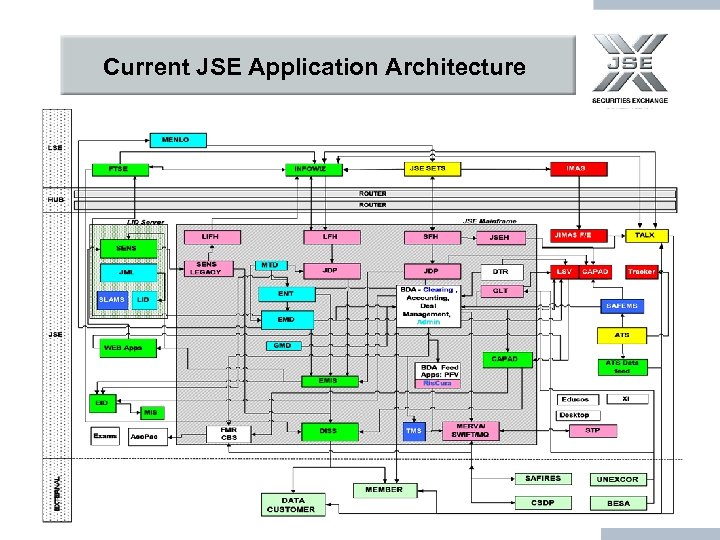

Current JSE Application Architecture

Current JSE Application Architecture

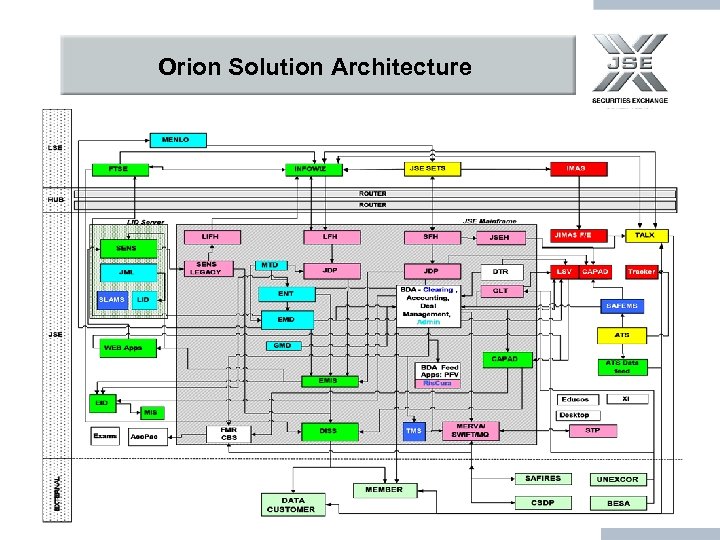

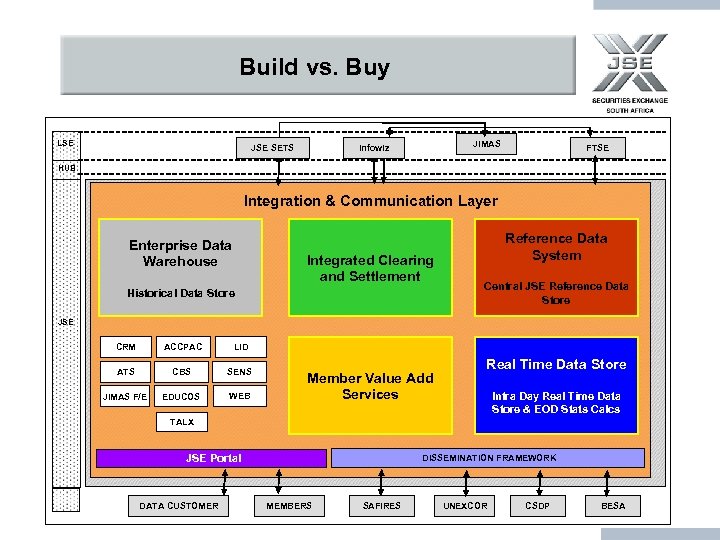

Orion Solution Architecture LSE JIMAS Infowiz JSE SETS FTSE HUB Integration & Communication Layer Enterprise Data Warehouse Historical Data Store Integrated Clearing and Settlement Reference Data System Central JSE Reference Data Store JSE CRM ACCPAC LID ATS CBS SENS JIMAS F/E EDUCOS WEB Member Value Add Services TALX JSE Portal DATA CUSTOMER Real Time Data Store Intra Day Real Time Data Store. EOD Stats Calcs & & EOD Stats Calcs DISSEMINATION FRAMEWORK MEMBERS SAFIRES UNEXCOR CSDP BESA

Orion Solution Architecture LSE JIMAS Infowiz JSE SETS FTSE HUB Integration & Communication Layer Enterprise Data Warehouse Historical Data Store Integrated Clearing and Settlement Reference Data System Central JSE Reference Data Store JSE CRM ACCPAC LID ATS CBS SENS JIMAS F/E EDUCOS WEB Member Value Add Services TALX JSE Portal DATA CUSTOMER Real Time Data Store Intra Day Real Time Data Store. EOD Stats Calcs & & EOD Stats Calcs DISSEMINATION FRAMEWORK MEMBERS SAFIRES UNEXCOR CSDP BESA

Build vs. Buy LSE JIMAS Infowiz JSE SETS FTSE HUB Integration & Communication Layer Enterprise Data Warehouse CUSTOM BUILD Historical Data Store Integrated Clearing and Settlement Reference Data System CUSTOM BUILD Central JSE Reference Data Store JSE CRM ACCPAC LID ATS CBS SENS JIMAS F/E EDUCOS WEB Member Value Add Services TALX JSE Portal DATA CUSTOMER Real Time Data Store CUSTOM BUILD Intra Day Real Time Data Store. EOD Stats Calcs & & EOD Stats Calcs DISSEMINATION FRAMEWORK MEMBERS SAFIRES UNEXCOR CSDP BESA

Build vs. Buy LSE JIMAS Infowiz JSE SETS FTSE HUB Integration & Communication Layer Enterprise Data Warehouse CUSTOM BUILD Historical Data Store Integrated Clearing and Settlement Reference Data System CUSTOM BUILD Central JSE Reference Data Store JSE CRM ACCPAC LID ATS CBS SENS JIMAS F/E EDUCOS WEB Member Value Add Services TALX JSE Portal DATA CUSTOMER Real Time Data Store CUSTOM BUILD Intra Day Real Time Data Store. EOD Stats Calcs & & EOD Stats Calcs DISSEMINATION FRAMEWORK MEMBERS SAFIRES UNEXCOR CSDP BESA

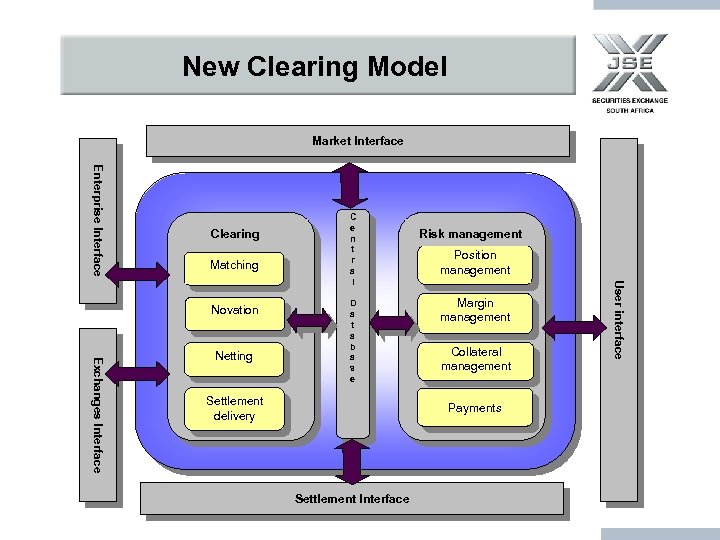

New Clearing Model Market Interface Enterprise Interface Clearing Matching Exchanges Interface Netting D a t a b a s e Settlement delivery Risk management Position management Margin management Collateral management Payments Settlement Interface User interface Novation C e n t r a l

New Clearing Model Market Interface Enterprise Interface Clearing Matching Exchanges Interface Netting D a t a b a s e Settlement delivery Risk management Position management Margin management Collateral management Payments Settlement Interface User interface Novation C e n t r a l

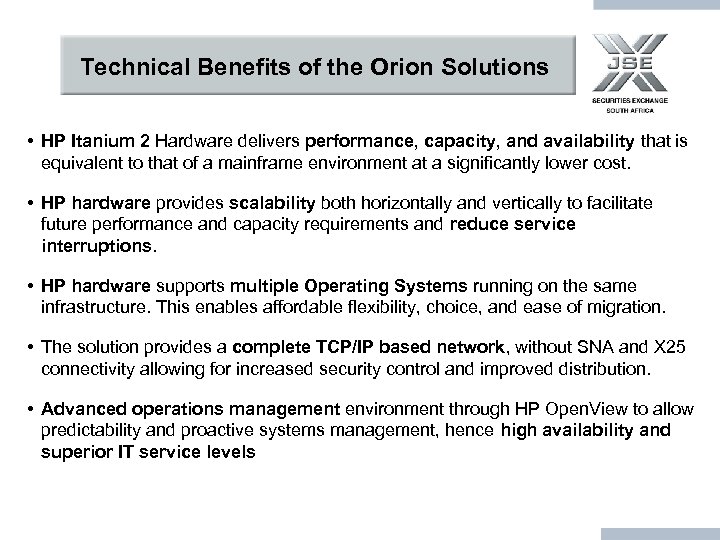

Technical Benefits of the Orion Solutions • HP Itanium 2 Hardware delivers performance, capacity, and availability that is equivalent to that of a mainframe environment at a significantly lower cost. • HP hardware provides scalability both horizontally and vertically to facilitate future performance and capacity requirements and reduce service interruptions. • HP hardware supports multiple Operating Systems running on the same infrastructure. This enables affordable flexibility, choice, and ease of migration. • The solution provides a complete TCP/IP based network, without SNA and X 25 connectivity allowing for increased security control and improved distribution. • Advanced operations management environment through HP Open. View to allow predictability and proactive systems management, hence high availability and superior IT service levels

Technical Benefits of the Orion Solutions • HP Itanium 2 Hardware delivers performance, capacity, and availability that is equivalent to that of a mainframe environment at a significantly lower cost. • HP hardware provides scalability both horizontally and vertically to facilitate future performance and capacity requirements and reduce service interruptions. • HP hardware supports multiple Operating Systems running on the same infrastructure. This enables affordable flexibility, choice, and ease of migration. • The solution provides a complete TCP/IP based network, without SNA and X 25 connectivity allowing for increased security control and improved distribution. • Advanced operations management environment through HP Open. View to allow predictability and proactive systems management, hence high availability and superior IT service levels

Technical Benefits of the Orion Solutions (Cont. ) • Internet Explorer and Microsoft Terminal Server provide a feature rich graphical user interface for the user while minimising the impact on the client infrastructure both on a desktop and network level. • Industry leading open standards technology using Microsoft. Net and J 2 EE ensures ease of adoption, extended support and infrastructure independence of the solution. • Integrated consistent security and systems minimises duplication of information and reduces the introduction time for new members and services. • Modular solution design allows seamless integration and extension of functionality while reducing the impact to the overall architecture of additional changes and extensions. • The solution improve the JSE’s agility in systems development and operations, and help to respond to new business challenges and opportunities quickly.

Technical Benefits of the Orion Solutions (Cont. ) • Internet Explorer and Microsoft Terminal Server provide a feature rich graphical user interface for the user while minimising the impact on the client infrastructure both on a desktop and network level. • Industry leading open standards technology using Microsoft. Net and J 2 EE ensures ease of adoption, extended support and infrastructure independence of the solution. • Integrated consistent security and systems minimises duplication of information and reduces the introduction time for new members and services. • Modular solution design allows seamless integration and extension of functionality while reducing the impact to the overall architecture of additional changes and extensions. • The solution improve the JSE’s agility in systems development and operations, and help to respond to new business challenges and opportunities quickly.

Project Orion Current Status

Project Orion Current Status

Current Status • Analysis Phase is complete • Design Phase has begun • Design Phase will run for an 18 week period and ends at the end of September 2004 • Planning for User Readiness and Training has started

Current Status • Analysis Phase is complete • Design Phase has begun • Design Phase will run for an 18 week period and ends at the end of September 2004 • Planning for User Readiness and Training has started

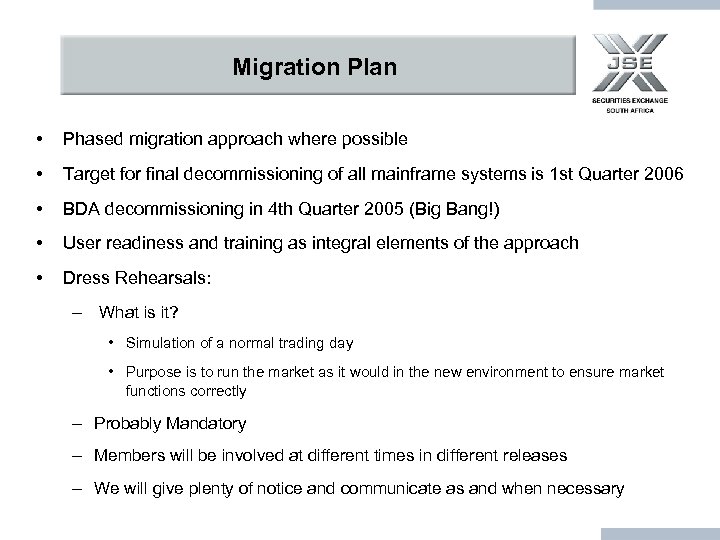

Migration Plan • Phased migration approach where possible • Target for final decommissioning of all mainframe systems is 1 st Quarter 2006 • BDA decommissioning in 4 th Quarter 2005 (Big Bang!) • User readiness and training as integral elements of the approach • Dress Rehearsals: – What is it? • Simulation of a normal trading day • Purpose is to run the market as it would in the new environment to ensure market functions correctly – Probably Mandatory – Members will be involved at different times in different releases – We will give plenty of notice and communicate as and when necessary

Migration Plan • Phased migration approach where possible • Target for final decommissioning of all mainframe systems is 1 st Quarter 2006 • BDA decommissioning in 4 th Quarter 2005 (Big Bang!) • User readiness and training as integral elements of the approach • Dress Rehearsals: – What is it? • Simulation of a normal trading day • Purpose is to run the market as it would in the new environment to ensure market functions correctly – Probably Mandatory – Members will be involved at different times in different releases – We will give plenty of notice and communicate as and when necessary

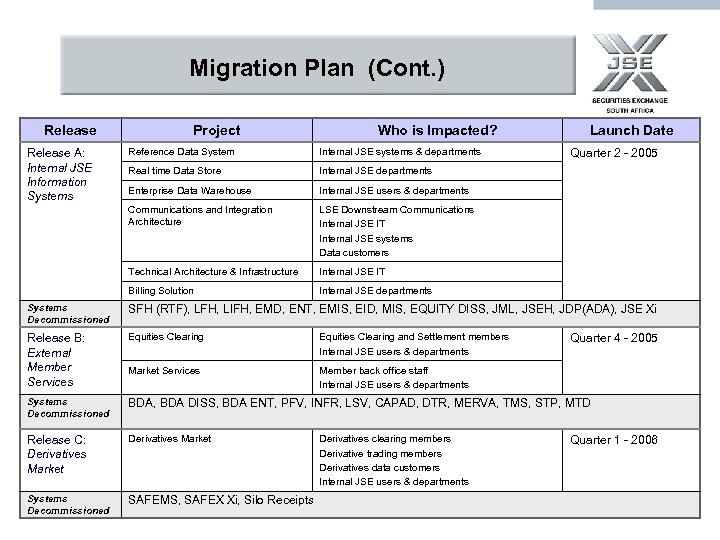

Migration Plan (Cont. ) Release Project Who is Impacted? Reference Data System Internal JSE systems & departments Real time Data Store Internal JSE departments Enterprise Data Warehouse Internal JSE users & departments Communications and Integration Architecture LSE Downstream Communications Internal JSE IT Internal JSE systems Data customers Technical Architecture & Infrastructure Internal JSE IT Billing Solution Release A: Internal JSE Information Systems Launch Date Internal JSE departments Quarter 2 - 2005 Systems Decommissioned SFH (RTF), LFH, LIFH, EMD, ENT, EMIS, EID, MIS, EQUITY DISS, JML, JSEH, JDP(ADA), JSE Xi Release B: External Member Services Equities Clearing and Settlement members Internal JSE users & departments Market Services Member back office staff Internal JSE users & departments Systems Decommissioned BDA, BDA DISS, BDA ENT, PFV, INFR, LSV, CAPAD, DTR, MERVA, TMS, STP, MTD Release C: Derivatives Market Systems Decommissioned SAFEMS, SAFEX Xi, Silo Receipts Derivatives clearing members Derivative trading members Derivatives data customers Internal JSE users & departments Quarter 4 - 2005 Quarter 1 - 2006

Migration Plan (Cont. ) Release Project Who is Impacted? Reference Data System Internal JSE systems & departments Real time Data Store Internal JSE departments Enterprise Data Warehouse Internal JSE users & departments Communications and Integration Architecture LSE Downstream Communications Internal JSE IT Internal JSE systems Data customers Technical Architecture & Infrastructure Internal JSE IT Billing Solution Release A: Internal JSE Information Systems Launch Date Internal JSE departments Quarter 2 - 2005 Systems Decommissioned SFH (RTF), LFH, LIFH, EMD, ENT, EMIS, EID, MIS, EQUITY DISS, JML, JSEH, JDP(ADA), JSE Xi Release B: External Member Services Equities Clearing and Settlement members Internal JSE users & departments Market Services Member back office staff Internal JSE users & departments Systems Decommissioned BDA, BDA DISS, BDA ENT, PFV, INFR, LSV, CAPAD, DTR, MERVA, TMS, STP, MTD Release C: Derivatives Market Systems Decommissioned SAFEMS, SAFEX Xi, Silo Receipts Derivatives clearing members Derivative trading members Derivatives data customers Internal JSE users & departments Quarter 4 - 2005 Quarter 1 - 2006

User Readiness Initiative • The User Readiness Team … Angelika Nortje, Albri Woodward, Alex Naicker – Equities Faeza Sallie – Financial Derivatives Chris Sturgess – Agricultural Derivatives Ronel Pieterse, Krishna Govender – Data Vendors Neil Vendeiro – EDW Elize Blom – Clearing & Settlement …. will manage your readiness throughout this project

User Readiness Initiative • The User Readiness Team … Angelika Nortje, Albri Woodward, Alex Naicker – Equities Faeza Sallie – Financial Derivatives Chris Sturgess – Agricultural Derivatives Ronel Pieterse, Krishna Govender – Data Vendors Neil Vendeiro – EDW Elize Blom – Clearing & Settlement …. will manage your readiness throughout this project

Training • The User Readiness initiative will adopt a “Train the Trainer” (Training Champions) approach • Extensive training will be provided to ensure efficient and effective use of the new solutions • Training will include conceptual and detailed handson application training • Trainees will be supported through manuals and job aids

Training • The User Readiness initiative will adopt a “Train the Trainer” (Training Champions) approach • Extensive training will be provided to ensure efficient and effective use of the new solutions • Training will include conceptual and detailed handson application training • Trainees will be supported through manuals and job aids

Communication and Information All communication will be via the Web, Extranet, Email and User Readiness Team Check out the Orion Project link on the JSE website for information and status updates on the Orion initiative (www. jse. co. za) Contact us on: Orion_Info@jse. co. za

Communication and Information All communication will be via the Web, Extranet, Email and User Readiness Team Check out the Orion Project link on the JSE website for information and status updates on the Orion initiative (www. jse. co. za) Contact us on: Orion_Info@jse. co. za

Questions

Questions

ENVISIONING THE FUTURE rion OPTIMISING JSE IT

ENVISIONING THE FUTURE rion OPTIMISING JSE IT

ENHANCING COMMUNICATION rion OPTIMISING JSE IT

ENHANCING COMMUNICATION rion OPTIMISING JSE IT

rion OPTIMISING JSE IT REDUCING DOWNTIME

rion OPTIMISING JSE IT REDUCING DOWNTIME

IMPROVING EFFICIENCY rion OPTIMISING JSE IT

IMPROVING EFFICIENCY rion OPTIMISING JSE IT

INCREASING SAVINGS rion OPTIMISING JSE IT

INCREASING SAVINGS rion OPTIMISING JSE IT

It starts with you

It starts with you

Handle with Care: Customer Inside

Handle with Care: Customer Inside

Know their needs

Know their needs

Realising strategy through focussed action

Realising strategy through focussed action

Good business from every angle

Good business from every angle

ENVISIONING THE FUTURE rion OPTIMISING JSE IT

ENVISIONING THE FUTURE rion OPTIMISING JSE IT

ENHANCING COMMUNICATION rion OPTIMISING JSE IT

ENHANCING COMMUNICATION rion OPTIMISING JSE IT

rion OPTIMISING JSE IT REDUCING DOWNTIME

rion OPTIMISING JSE IT REDUCING DOWNTIME

IMPROVING EFFICIENCY rion OPTIMISING JSE IT

IMPROVING EFFICIENCY rion OPTIMISING JSE IT

INCREASING SAVINGS rion OPTIMISING JSE IT

INCREASING SAVINGS rion OPTIMISING JSE IT

It starts with you

It starts with you

Handle with Care: Customer Inside

Handle with Care: Customer Inside

Know their needs

Know their needs

Realising strategy through focussed action

Realising strategy through focussed action

Good business from every angle

Good business from every angle