Joseph V. Rizzi March, 2013

Joseph V. Rizzi March, 2013

Market Overview Underlying Focus Framework Fin 70410 M&A Spring 2

Market Overview Underlying Focus Framework Fin 70410 M&A Spring 2

Market Overview Underlying Focus Framework Fin 70410 M&A Spring 2007 3

Market Overview Underlying Focus Framework Fin 70410 M&A Spring 2007 3

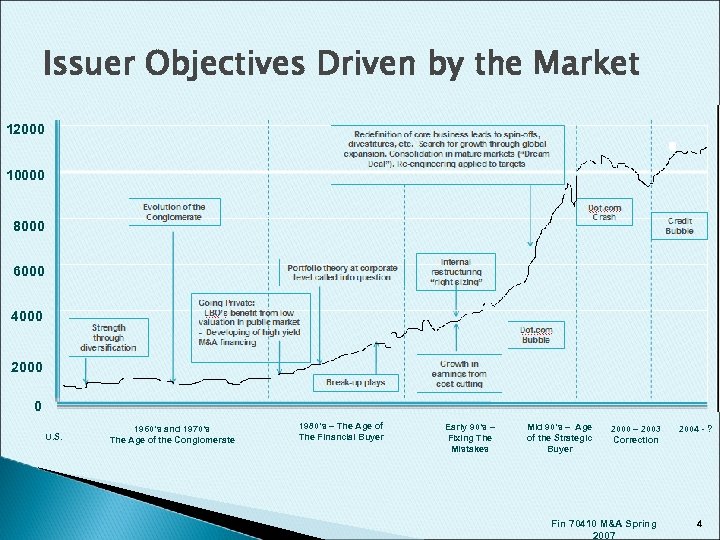

Issuer Objectives Driven by the Market 12000 10000 8000 6000 4000 2000 0 U. S. 1960’s and 1970’s The Age of the Conglomerate 1980’s – The Age of The Financial Buyer Early 90’s – Fixing The Mistakes Mid 90’s – Age of the Strategic Buyer 2000 – 2003 Correction Fin 70410 M&A Spring 2007 2004 - ? 4

Issuer Objectives Driven by the Market 12000 10000 8000 6000 4000 2000 0 U. S. 1960’s and 1970’s The Age of the Conglomerate 1980’s – The Age of The Financial Buyer Early 90’s – Fixing The Mistakes Mid 90’s – Age of the Strategic Buyer 2000 – 2003 Correction Fin 70410 M&A Spring 2007 2004 - ? 4

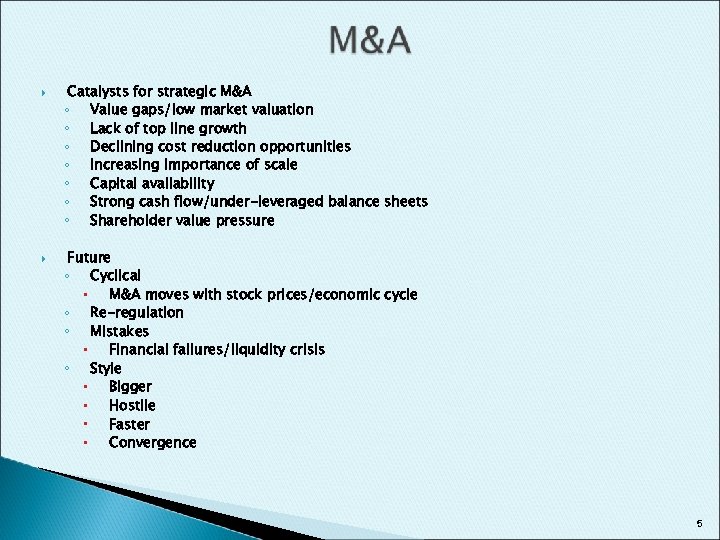

Catalysts for strategic M&A ◦ Value gaps/low market valuation ◦ Lack of top line growth ◦ Declining cost reduction opportunities ◦ Increasing importance of scale ◦ Capital availability ◦ Strong cash flow/under-leveraged balance sheets ◦ Shareholder value pressure Future ◦ Cyclical M&A moves with stock prices/economic cycle ◦ Re-regulation ◦ Mistakes Financial failures/liquidity crisis ◦ Style Bigger Hostile Faster Convergence 5

Catalysts for strategic M&A ◦ Value gaps/low market valuation ◦ Lack of top line growth ◦ Declining cost reduction opportunities ◦ Increasing importance of scale ◦ Capital availability ◦ Strong cash flow/under-leveraged balance sheets ◦ Shareholder value pressure Future ◦ Cyclical M&A moves with stock prices/economic cycle ◦ Re-regulation ◦ Mistakes Financial failures/liquidity crisis ◦ Style Bigger Hostile Faster Convergence 5

◦ ◦ Value Gaps Expectations Strategy Current Market Value Potential Value With Internal Improvements Maximum Market Value External Improvements e. g. M&A 6

◦ ◦ Value Gaps Expectations Strategy Current Market Value Potential Value With Internal Improvements Maximum Market Value External Improvements e. g. M&A 6

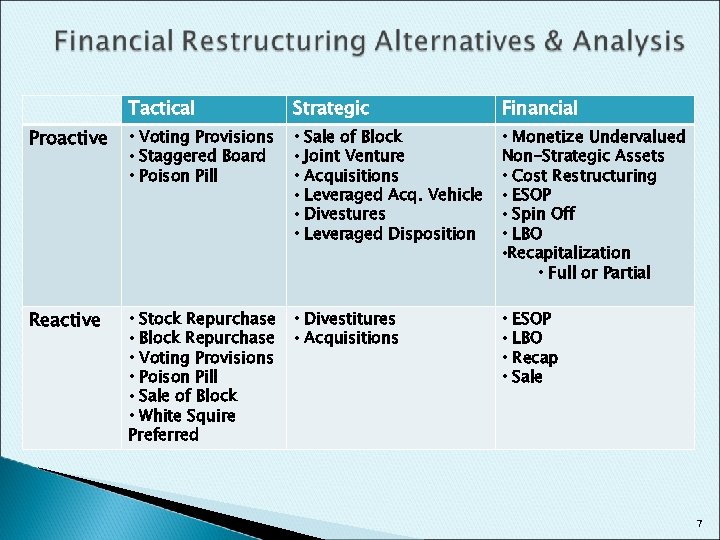

Tactical Strategic Proactive • Voting Provisions • Staggered Board • Poison Pill • • • Reactive • Stock Repurchase • Block Repurchase • Voting Provisions • Poison Pill • Sale of Block • White Squire Preferred • Divestitures • Acquisitions Sale of Block Joint Venture Acquisitions Leveraged Acq. Vehicle Divestures Leveraged Disposition Financial • Monetize Undervalued Non-Strategic Assets • Cost Restructuring • ESOP • Spin Off • LBO • Recapitalization • Full or Partial • • ESOP LBO Recap Sale 7

Tactical Strategic Proactive • Voting Provisions • Staggered Board • Poison Pill • • • Reactive • Stock Repurchase • Block Repurchase • Voting Provisions • Poison Pill • Sale of Block • White Squire Preferred • Divestitures • Acquisitions Sale of Block Joint Venture Acquisitions Leveraged Acq. Vehicle Divestures Leveraged Disposition Financial • Monetize Undervalued Non-Strategic Assets • Cost Restructuring • ESOP • Spin Off • LBO • Recapitalization • Full or Partial • • ESOP LBO Recap Sale 7

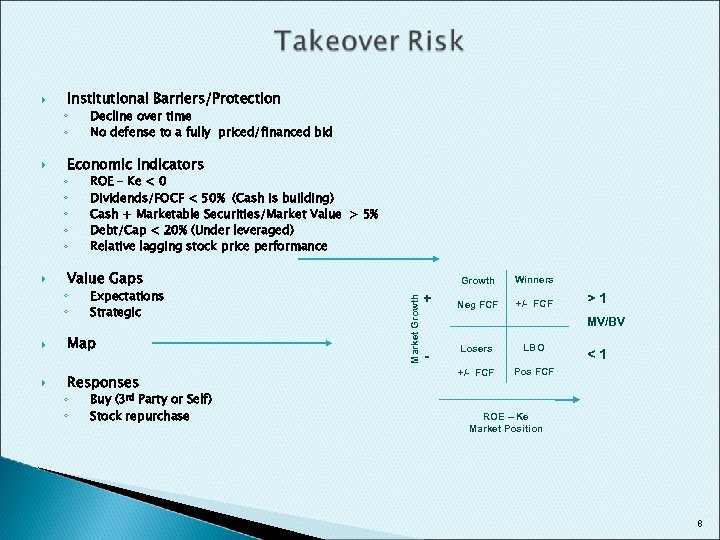

Institutional Barriers/Protection ◦ ◦ Economic Indicators ◦ ◦ ◦ Decline over time No defense to a fully priced/financed bid ROE – Ke < 0 Dividends/FOCF < 50% (Cash is building) Cash + Marketable Securities/Market Value > 5% Debt/Cap < 20% (Under leveraged) Relative lagging stock price performance Value Gaps ◦ ◦ Expectations Strategic Map Responses ◦ ◦ Buy (3 rd Party or Self) Stock repurchase Growth Market Growth + Winners Neg FCF +/- FCF >1 MV/BV - Losers LBO +/- FCF Pos FCF <1 ROE – Ke Market Position 8

Institutional Barriers/Protection ◦ ◦ Economic Indicators ◦ ◦ ◦ Decline over time No defense to a fully priced/financed bid ROE – Ke < 0 Dividends/FOCF < 50% (Cash is building) Cash + Marketable Securities/Market Value > 5% Debt/Cap < 20% (Under leveraged) Relative lagging stock price performance Value Gaps ◦ ◦ Expectations Strategic Map Responses ◦ ◦ Buy (3 rd Party or Self) Stock repurchase Growth Market Growth + Winners Neg FCF +/- FCF >1 MV/BV - Losers LBO +/- FCF Pos FCF <1 ROE – Ke Market Position 8

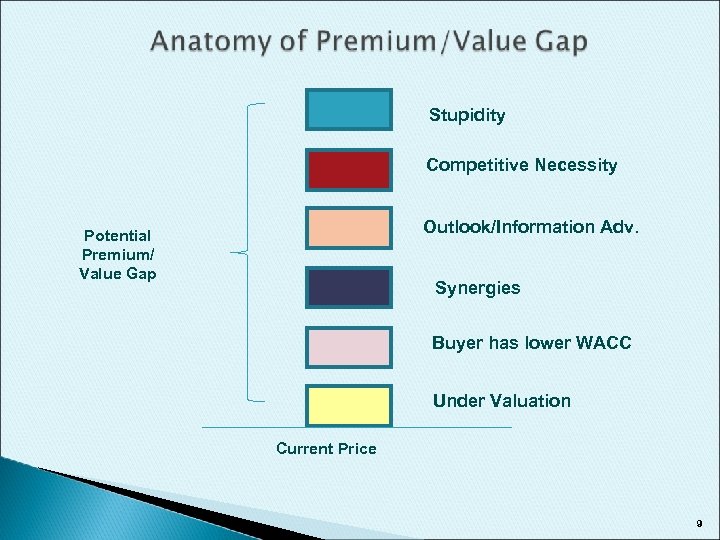

Stupidity Competitive Necessity Outlook/Information Adv. Potential Premium/ Value Gap Synergies Buyer has lower WACC Under Valuation Current Price 9

Stupidity Competitive Necessity Outlook/Information Adv. Potential Premium/ Value Gap Synergies Buyer has lower WACC Under Valuation Current Price 9

Market Overview Underlying Focus Framework 10

Market Overview Underlying Focus Framework 10

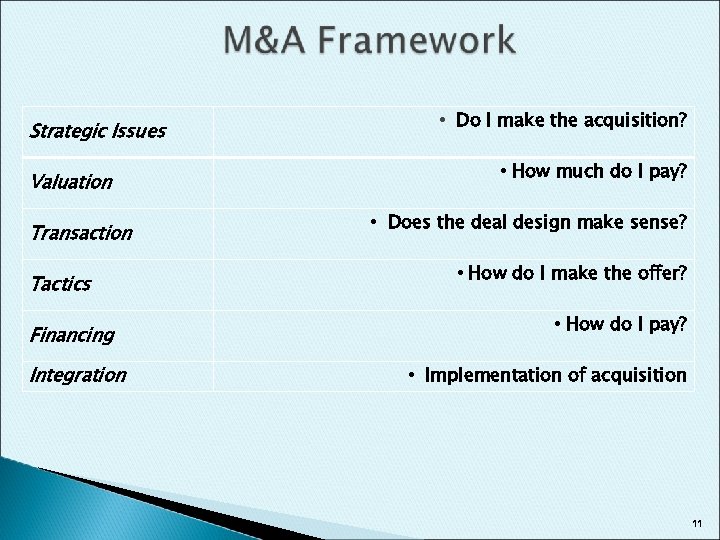

Strategic Issues Valuation Transaction Tactics Financing Integration • Do I make the acquisition? • How much do I pay? • Does the deal design make sense? • How do I make the offer? • How do I pay? • Implementation of acquisition 11

Strategic Issues Valuation Transaction Tactics Financing Integration • Do I make the acquisition? • How much do I pay? • Does the deal design make sense? • How do I make the offer? • How do I pay? • Implementation of acquisition 11

12

12