2b7eefb3500f9892a0ed046bbf700e0a.ppt

- Количество слайдов: 40

John Hancock Multi-Life Programs Presented to: Capitas Financial November 15, 2006 Courtney Turner Sponsored Group Manager Laurie Picardi LTC Sales Consultant Corporate. Choice Implementation Manager Kristen Marie Martin Corporate Solutions Manager LTC Sales Consultant Capitas Training Call 111506. For agent educational and training purposes only. Not intended for the general public. Program specifics may vary by state. Presentation is designed to be a general overview of several programs. Please refer to the specific program guide for details.

John Hancock Multi-Life Programs Presented to: Capitas Financial November 15, 2006 Courtney Turner Sponsored Group Manager Laurie Picardi LTC Sales Consultant Corporate. Choice Implementation Manager Kristen Marie Martin Corporate Solutions Manager LTC Sales Consultant Capitas Training Call 111506. For agent educational and training purposes only. Not intended for the general public. Program specifics may vary by state. Presentation is designed to be a general overview of several programs. Please refer to the specific program guide for details.

Agenda • John Hancock Multi-Life Programs/Products • Continuum of LTC Products – Sponsored Group Discount Program – Corporate Solutions – Corporate Choice - Review of Implementation Process

Agenda • John Hancock Multi-Life Programs/Products • Continuum of LTC Products – Sponsored Group Discount Program – Corporate Solutions – Corporate Choice - Review of Implementation Process

John Hancock Has A Product for All Markets • Sponsored Group: (Individual products with group discount, targeting employers of 5+ and trade and professional associations of 10+) • Corporate Solutions: (15 -500 Eligible Employees) • Corporate. Choice: (50 -1000 Eligible Employees) • Care. Choice: Large Employer (1000+ Eligible Employees)

John Hancock Has A Product for All Markets • Sponsored Group: (Individual products with group discount, targeting employers of 5+ and trade and professional associations of 10+) • Corporate Solutions: (15 -500 Eligible Employees) • Corporate. Choice: (50 -1000 Eligible Employees) • Care. Choice: Large Employer (1000+ Eligible Employees)

Best Target Employer Groups • High potential Groups – Age: 60% over age 40 – Salary: High for geographical area (1. 5 times the state average individual income is the true target) – Voluntary Benefit Participation – Medical/Flexible Spending Accounts: >20% participation – 401(k) Plan: >80% participation – Supplemental Term Life: >40% participation – Physicians, Law Firms, Accounting, Engineering… • Low potential – Retail, Hospitals employees, manufacturing

Best Target Employer Groups • High potential Groups – Age: 60% over age 40 – Salary: High for geographical area (1. 5 times the state average individual income is the true target) – Voluntary Benefit Participation – Medical/Flexible Spending Accounts: >20% participation – 401(k) Plan: >80% participation – Supplemental Term Life: >40% participation – Physicians, Law Firms, Accounting, Engineering… • Low potential – Retail, Hospitals employees, manufacturing

Sponsored Group Discount Program* Marketing Long Term Care Insurance to Small Business and Associations 2, 800 approved Sponsored Groups as of April 2006 • Employer Groups – 1, 717 • Associations – 1, 083 Long Term Care is Underwritten by John Hancock Life Insurance Company, Boston, MA 02117. For professional use only. Not for use with consumers. LTC-3174 Program in New York and Texas *Marketing Discount 10/2005

Sponsored Group Discount Program* Marketing Long Term Care Insurance to Small Business and Associations 2, 800 approved Sponsored Groups as of April 2006 • Employer Groups – 1, 717 • Associations – 1, 083 Long Term Care is Underwritten by John Hancock Life Insurance Company, Boston, MA 02117. For professional use only. Not for use with consumers. LTC-3174 Program in New York and Texas *Marketing Discount 10/2005

Sponsored Group (SG) Eligible Groups • Employer – 5 or more actively at work employees – Receipt of 5 or more applications in 60 days • Association – 10 or more members – Receipt of 5 or more applications in 60 days – In existence for 2+ years, have constitution, by-laws or charter – Formed for purposed other than insurance or social – Primary focus is limited to trade or professional – Alumni associations

Sponsored Group (SG) Eligible Groups • Employer – 5 or more actively at work employees – Receipt of 5 or more applications in 60 days • Association – 10 or more members – Receipt of 5 or more applications in 60 days – In existence for 2+ years, have constitution, by-laws or charter – Formed for purposed other than insurance or social – Primary focus is limited to trade or professional – Alumni associations

SG Employee Advantages • 5% discount – 10% for NY RWJ • Additional 15%/30% if married/partner – 10% or 20% in FL & NY • • Available ages 18 -84 Maximum policy flexibility Portable Ongoing, open ended enrollment period – Best for protracted marketing efforts

SG Employee Advantages • 5% discount – 10% for NY RWJ • Additional 15%/30% if married/partner – 10% or 20% in FL & NY • • Available ages 18 -84 Maximum policy flexibility Portable Ongoing, open ended enrollment period – Best for protracted marketing efforts

SG Eligible Individuals • • • Employees Retirees Spouses/Partners Parents and Parent in laws Grandparents Children and step children

SG Eligible Individuals • • • Employees Retirees Spouses/Partners Parents and Parent in laws Grandparents Children and step children

SG Employer Target Profile • • Existing clients Family owned businesses < 200 employees Strong group life, health & 401 K insurance benefits • Enrollment rate 5%-10%

SG Employer Target Profile • • Existing clients Family owned businesses < 200 employees Strong group life, health & 401 K insurance benefits • Enrollment rate 5%-10%

SG Association Target Market • • • Accounting and law firms Bar associations Medical/dental practices Computer/Hi-tech firms Professional Women’s Organizations • Teachers/Education Associations

SG Association Target Market • • • Accounting and law firms Bar associations Medical/dental practices Computer/Hi-tech firms Professional Women’s Organizations • Teachers/Education Associations

When to use which program? Sponsored Group (SG) PROS of SG: – Best suited for continuous marketing programs – All rate classes and all benefit options available – Open ended enrollment period – Not limited to 60 days – Minimal requirements to qualify an employer CONS of SG: – Full application and underwriting programs – No minimum offer

When to use which program? Sponsored Group (SG) PROS of SG: – Best suited for continuous marketing programs – All rate classes and all benefit options available – Open ended enrollment period – Not limited to 60 days – Minimal requirements to qualify an employer CONS of SG: – Full application and underwriting programs – No minimum offer

Sponsored Group Discount Program 2005 Individual Multi-life LTCI Inforce Business as reported to LIMRA

Sponsored Group Discount Program 2005 Individual Multi-life LTCI Inforce Business as reported to LIMRA

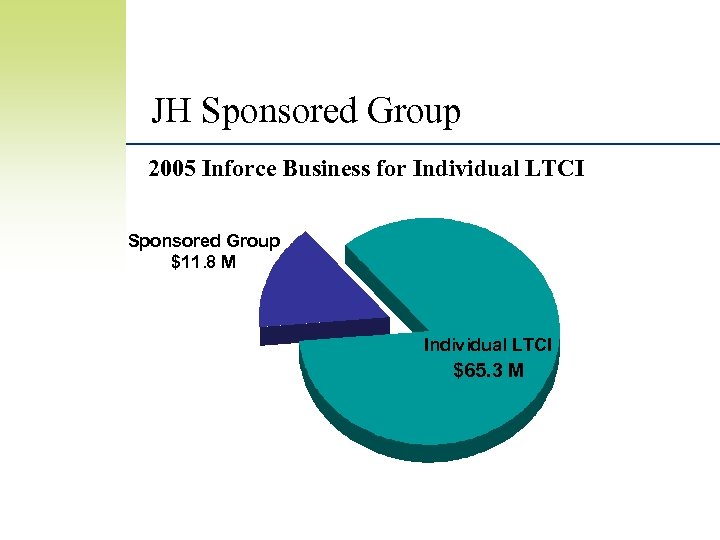

JH Sponsored Group 2005 Inforce Business for Individual LTCI Sponsored Group $11. 8 M Individual LTCI $65. 3 M

JH Sponsored Group 2005 Inforce Business for Individual LTCI Sponsored Group $11. 8 M Individual LTCI $65. 3 M

Corporate Solutions • John Hancock LTC Insurance solution for the small business market: • Allows customization of individual product in a group setting – Simplified underwriting – Simplified enrollment • Includes marketing support for the sales process – Announcement – Education and motivation – Enrollment

Corporate Solutions • John Hancock LTC Insurance solution for the small business market: • Allows customization of individual product in a group setting – Simplified underwriting – Simplified enrollment • Includes marketing support for the sales process – Announcement – Education and motivation – Enrollment

Two Program Options Corporate Solutions: • MGSI or Modified Guaranteed Standard Issue – Best for employer pay cases • MGTI or Modified Guaranteed to Issue – Best for voluntary pay cases

Two Program Options Corporate Solutions: • MGSI or Modified Guaranteed Standard Issue – Best for employer pay cases • MGTI or Modified Guaranteed to Issue – Best for voluntary pay cases

MGSI Modified Guaranteed Standard Issue • Most simplified application and process • 15 Eligible Employees (or 3% for 500+ lives) • 60 Day enrollment window • Five knockout questions; No further underwriting • Ability to buy-up without additional underwriting if within maximum limit • No preferred or substandard rates (just one rate class) but all other discounts applicable • Limited plan options • Best for employer pay all cases

MGSI Modified Guaranteed Standard Issue • Most simplified application and process • 15 Eligible Employees (or 3% for 500+ lives) • 60 Day enrollment window • Five knockout questions; No further underwriting • Ability to buy-up without additional underwriting if within maximum limit • No preferred or substandard rates (just one rate class) but all other discounts applicable • Limited plan options • Best for employer pay all cases

MGTI Modified Guaranteed to Issue • Simplified application and process • Slightly expanded underwriting • Access to preferred rates • All benefit options except lifetime • Offers minimum guaranteed coverage for declines if meet minimum participation requirements • Best for voluntary enrollments

MGTI Modified Guaranteed to Issue • Simplified application and process • Slightly expanded underwriting • Access to preferred rates • All benefit options except lifetime • Offers minimum guaranteed coverage for declines if meet minimum participation requirements • Best for voluntary enrollments

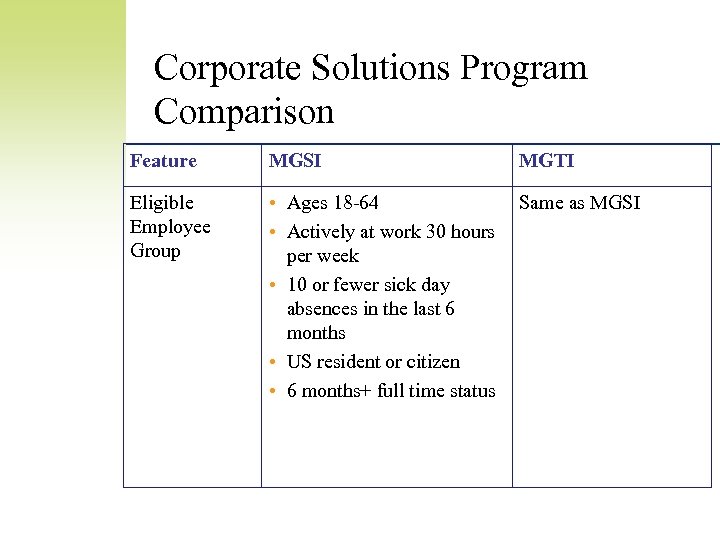

Corporate Solutions Program Comparison Feature MGSI MGTI Eligible Employee Group • Ages 18 -64 • Actively at work 30 hours per week • 10 or fewer sick day absences in the last 6 months • US resident or citizen • 6 months+ full time status Same as MGSI

Corporate Solutions Program Comparison Feature MGSI MGTI Eligible Employee Group • Ages 18 -64 • Actively at work 30 hours per week • 10 or fewer sick day absences in the last 6 months • US resident or citizen • 6 months+ full time status Same as MGSI

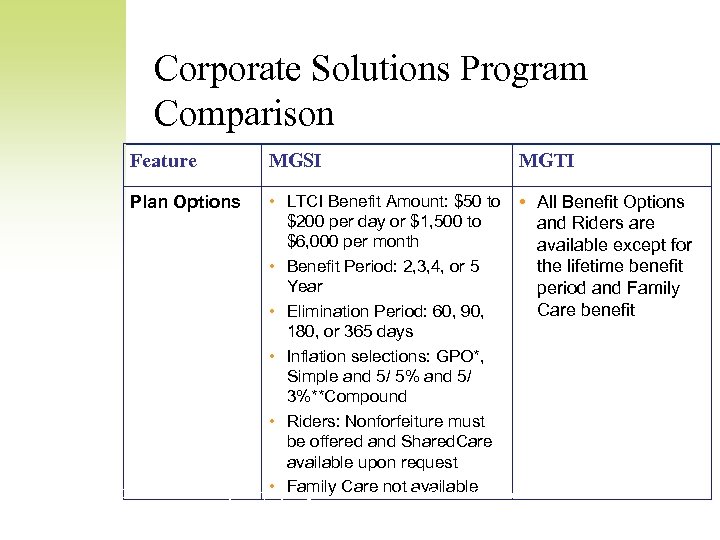

Corporate Solutions Program Comparison Feature MGSI MGTI • LTCI Benefit Amount: $50 to • All Benefit Options $200 per day or $1, 500 to and Riders are $6, 000 per month available except for • Benefit Period: 2, 3, 4, or 5 the lifetime benefit Year period and Family Care benefit • Elimination Period: 60, 90, 180, or 365 days • Inflation selections: GPO*, Simple and 5/ 5% and 5/ 3%**Compound • Riders: Nonforfeiture must be offered and Shared. Care available upon request • Family Care not ** Not available for CCI states * GPO is available only if Employer agrees to administer available Plan Options

Corporate Solutions Program Comparison Feature MGSI MGTI • LTCI Benefit Amount: $50 to • All Benefit Options $200 per day or $1, 500 to and Riders are $6, 000 per month available except for • Benefit Period: 2, 3, 4, or 5 the lifetime benefit Year period and Family Care benefit • Elimination Period: 60, 90, 180, or 365 days • Inflation selections: GPO*, Simple and 5/ 5% and 5/ 3%**Compound • Riders: Nonforfeiture must be offered and Shared. Care available upon request • Family Care not ** Not available for CCI states * GPO is available only if Employer agrees to administer available Plan Options

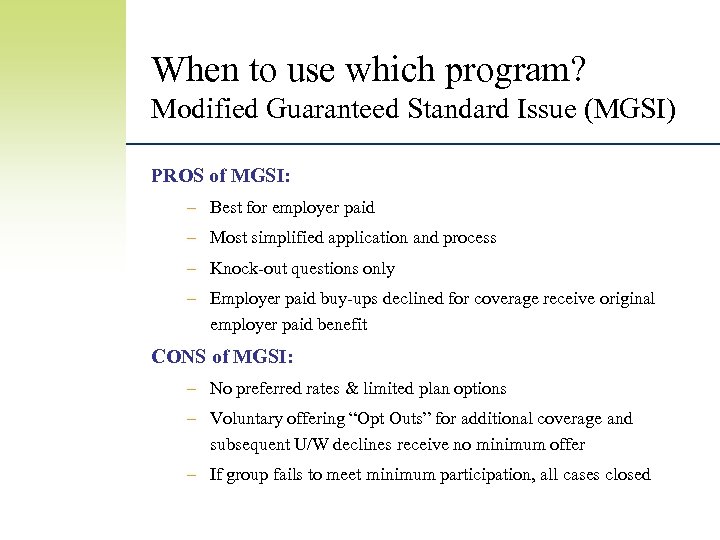

When to use which program? Modified Guaranteed Standard Issue (MGSI) PROS of MGSI: – Best for employer paid – Most simplified application and process – Knock-out questions only – Employer paid buy-ups declined for coverage receive original employer paid benefit CONS of MGSI: – No preferred rates & limited plan options – Voluntary offering “Opt Outs” for additional coverage and subsequent U/W declines receive no minimum offer – If group fails to meet minimum participation, all cases closed

When to use which program? Modified Guaranteed Standard Issue (MGSI) PROS of MGSI: – Best for employer paid – Most simplified application and process – Knock-out questions only – Employer paid buy-ups declined for coverage receive original employer paid benefit CONS of MGSI: – No preferred rates & limited plan options – Voluntary offering “Opt Outs” for additional coverage and subsequent U/W declines receive no minimum offer – If group fails to meet minimum participation, all cases closed

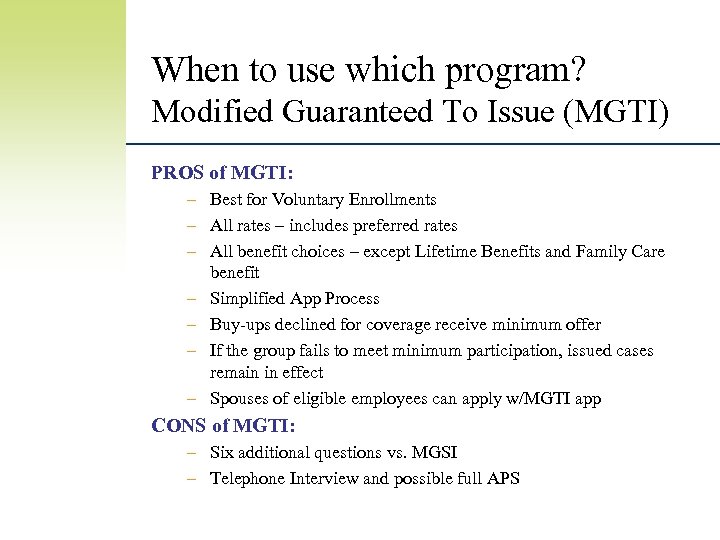

When to use which program? Modified Guaranteed To Issue (MGTI) PROS of MGTI: – Best for Voluntary Enrollments – All rates – includes preferred rates – All benefit choices – except Lifetime Benefits and Family Care benefit – Simplified App Process – Buy-ups declined for coverage receive minimum offer – If the group fails to meet minimum participation, issued cases remain in effect – Spouses of eligible employees can apply w/MGTI app CONS of MGTI: – Six additional questions vs. MGSI – Telephone Interview and possible full APS

When to use which program? Modified Guaranteed To Issue (MGTI) PROS of MGTI: – Best for Voluntary Enrollments – All rates – includes preferred rates – All benefit choices – except Lifetime Benefits and Family Care benefit – Simplified App Process – Buy-ups declined for coverage receive minimum offer – If the group fails to meet minimum participation, issued cases remain in effect – Spouses of eligible employees can apply w/MGTI app CONS of MGTI: – Six additional questions vs. MGSI – Telephone Interview and possible full APS

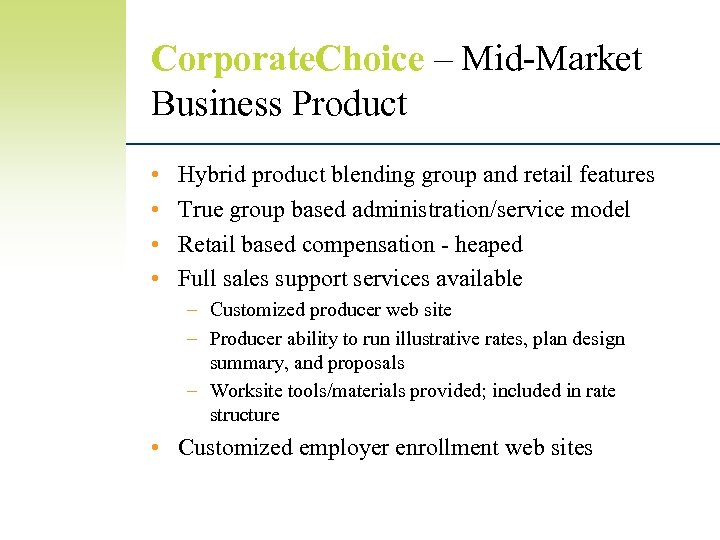

Corporate. Choice – Mid-Market Business Product • • Hybrid product blending group and retail features True group based administration/service model Retail based compensation - heaped Full sales support services available – Customized producer web site – Producer ability to run illustrative rates, plan design summary, and proposals – Worksite tools/materials provided; included in rate structure • Customized employer enrollment web sites

Corporate. Choice – Mid-Market Business Product • • Hybrid product blending group and retail features True group based administration/service model Retail based compensation - heaped Full sales support services available – Customized producer web site – Producer ability to run illustrative rates, plan design summary, and proposals – Worksite tools/materials provided; included in rate structure • Customized employer enrollment web sites

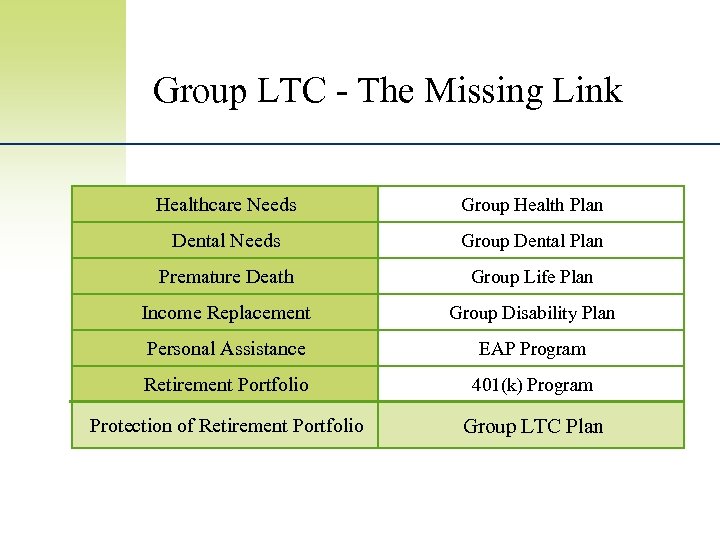

Group LTC - The Missing Link Healthcare Needs Group Health Plan Dental Needs Group Dental Plan Premature Death Group Life Plan Income Replacement Group Disability Plan Personal Assistance EAP Program Retirement Portfolio 401(k) Program Protection of Retirement Portfolio Group LTC Plan

Group LTC - The Missing Link Healthcare Needs Group Health Plan Dental Needs Group Dental Plan Premature Death Group Life Plan Income Replacement Group Disability Plan Personal Assistance EAP Program Retirement Portfolio 401(k) Program Protection of Retirement Portfolio Group LTC Plan

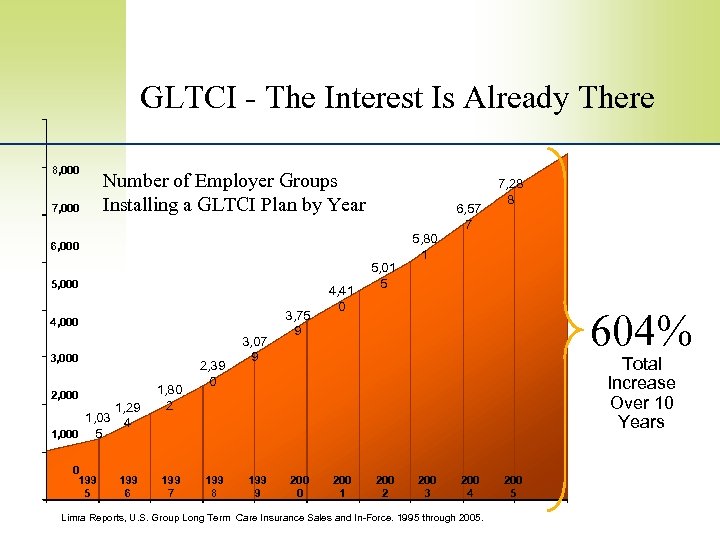

GLTCI - The Interest Is Already There 8, 000 7, 000 Number of Employer Groups Installing a GLTCI Plan by Year 6, 57 7 6, 000 5, 000 4, 000 3, 000 2, 000 1, 03 1, 000 5 0 199 5 1, 29 4 199 6 1, 80 2 199 7 2, 39 0 199 8 3, 07 9 199 9 3, 75 9 4, 41 0 5, 01 5 7, 28 8 5, 80 1 604% Total Increase Over 10 Years 200 0 200 1 200 2 200 3 200 4 Limra Reports, U. S. Group Long Term Care Insurance Sales and In-Force. 1995 through 2005. 200 5

GLTCI - The Interest Is Already There 8, 000 7, 000 Number of Employer Groups Installing a GLTCI Plan by Year 6, 57 7 6, 000 5, 000 4, 000 3, 000 2, 000 1, 03 1, 000 5 0 199 5 1, 29 4 199 6 1, 80 2 199 7 2, 39 0 199 8 3, 07 9 199 9 3, 75 9 4, 41 0 5, 01 5 7, 28 8 5, 80 1 604% Total Increase Over 10 Years 200 0 200 1 200 2 200 3 200 4 Limra Reports, U. S. Group Long Term Care Insurance Sales and In-Force. 1995 through 2005. 200 5

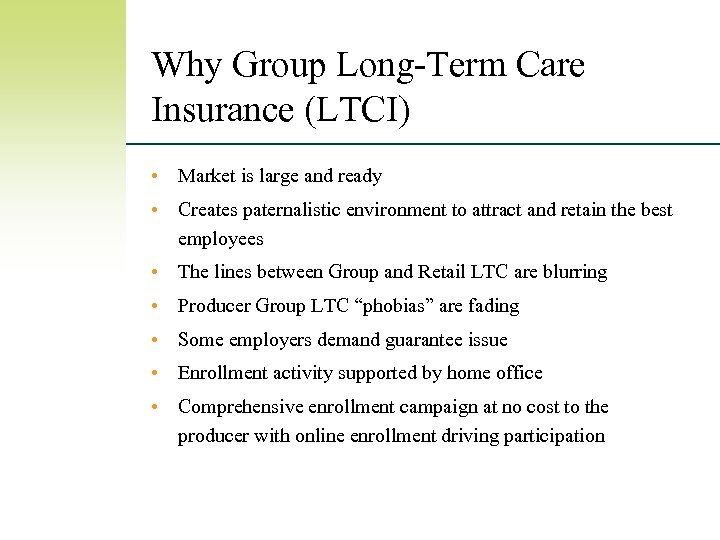

Why Group Long-Term Care Insurance (LTCI) • Market is large and ready • Creates paternalistic environment to attract and retain the best employees • The lines between Group and Retail LTC are blurring • Producer Group LTC “phobias” are fading • Some employers demand guarantee issue • Enrollment activity supported by home office • Comprehensive enrollment campaign at no cost to the producer with online enrollment driving participation

Why Group Long-Term Care Insurance (LTCI) • Market is large and ready • Creates paternalistic environment to attract and retain the best employees • The lines between Group and Retail LTC are blurring • Producer Group LTC “phobias” are fading • Some employers demand guarantee issue • Enrollment activity supported by home office • Comprehensive enrollment campaign at no cost to the producer with online enrollment driving participation

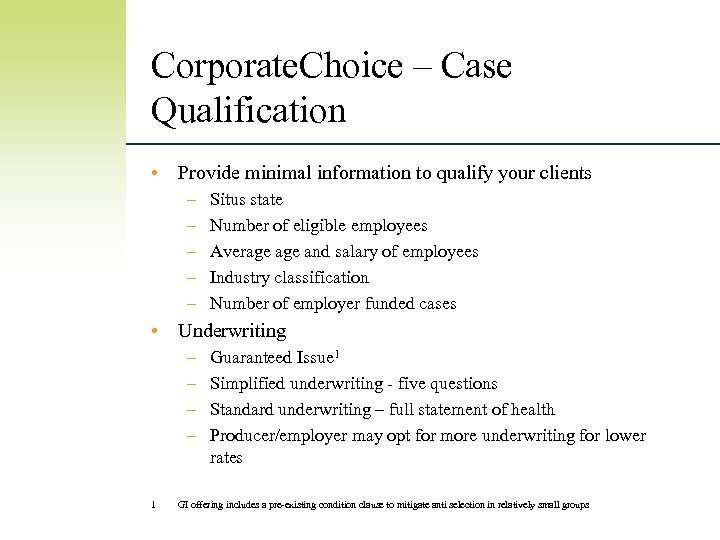

Corporate. Choice – Case Qualification • Provide minimal information to qualify your clients – – – Situs state Number of eligible employees Average and salary of employees Industry classification Number of employer funded cases • Underwriting – – 1 Guaranteed Issue 1 Simplified underwriting - five questions Standard underwriting – full statement of health Producer/employer may opt for more underwriting for lower rates GI offering includes a pre-existing condition clause to mitigate anti selection in relatively small groups

Corporate. Choice – Case Qualification • Provide minimal information to qualify your clients – – – Situs state Number of eligible employees Average and salary of employees Industry classification Number of employer funded cases • Underwriting – – 1 Guaranteed Issue 1 Simplified underwriting - five questions Standard underwriting – full statement of health Producer/employer may opt for more underwriting for lower rates GI offering includes a pre-existing condition clause to mitigate anti selection in relatively small groups

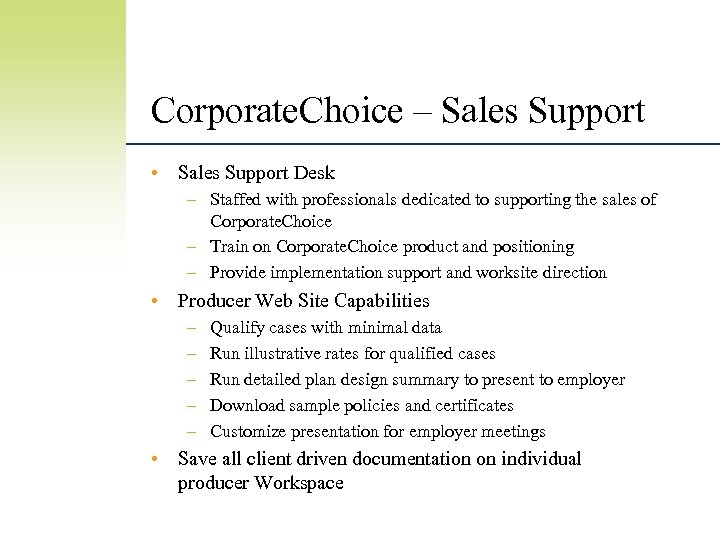

Corporate. Choice – Sales Support • Sales Support Desk – Staffed with professionals dedicated to supporting the sales of Corporate. Choice – Train on Corporate. Choice product and positioning – Provide implementation support and worksite direction • Producer Web Site Capabilities – – – Qualify cases with minimal data Run illustrative rates for qualified cases Run detailed plan design summary to present to employer Download sample policies and certificates Customize presentation for employer meetings • Save all client driven documentation on individual producer Workspace

Corporate. Choice – Sales Support • Sales Support Desk – Staffed with professionals dedicated to supporting the sales of Corporate. Choice – Train on Corporate. Choice product and positioning – Provide implementation support and worksite direction • Producer Web Site Capabilities – – – Qualify cases with minimal data Run illustrative rates for qualified cases Run detailed plan design summary to present to employer Download sample policies and certificates Customize presentation for employer meetings • Save all client driven documentation on individual producer Workspace

Introducing Corporate. Choice: Plan Benefits Corporate. Choice JHFN Cabinet Club 9/05

Introducing Corporate. Choice: Plan Benefits Corporate. Choice JHFN Cabinet Club 9/05

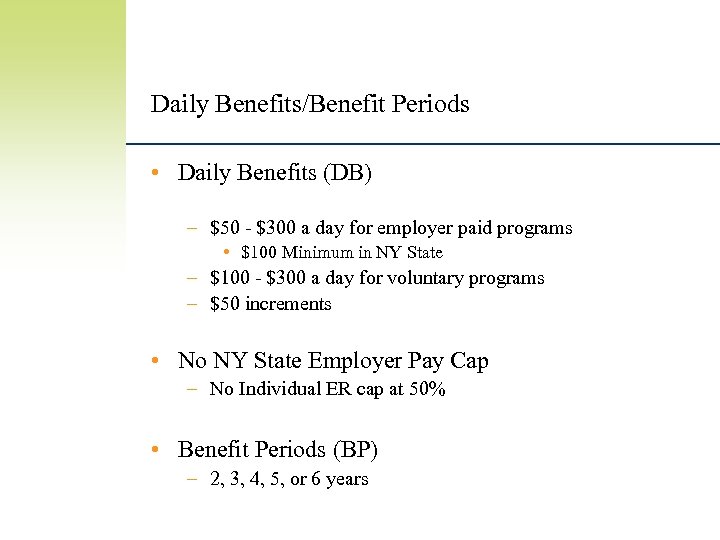

Daily Benefits/Benefit Periods • Daily Benefits (DB) – $50 - $300 a day for employer paid programs • $100 Minimum in NY State – $100 - $300 a day for voluntary programs – $50 increments • No NY State Employer Pay Cap – No Individual ER cap at 50% • Benefit Periods (BP) – 2, 3, 4, 5, or 6 years

Daily Benefits/Benefit Periods • Daily Benefits (DB) – $50 - $300 a day for employer paid programs • $100 Minimum in NY State – $100 - $300 a day for voluntary programs – $50 increments • No NY State Employer Pay Cap – No Individual ER cap at 50% • Benefit Periods (BP) – 2, 3, 4, 5, or 6 years

One-Time Elimination Period (EP) • 30 days or 90 days • 1 day of service = 1 day towards the EP • Only need to meet the EP once during lifetime

One-Time Elimination Period (EP) • 30 days or 90 days • 1 day of service = 1 day towards the EP • Only need to meet the EP once during lifetime

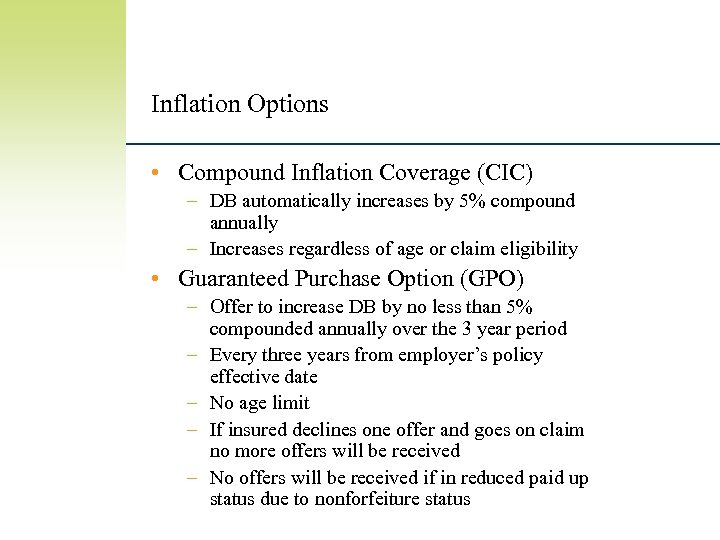

Inflation Options • Compound Inflation Coverage (CIC) – DB automatically increases by 5% compound annually – Increases regardless of age or claim eligibility • Guaranteed Purchase Option (GPO) – Offer to increase DB by no less than 5% compounded annually over the 3 year period – Every three years from employer’s policy effective date – No age limit – If insured declines one offer and goes on claim no more offers will be received – No offers will be received if in reduced paid up status due to nonforfeiture status

Inflation Options • Compound Inflation Coverage (CIC) – DB automatically increases by 5% compound annually – Increases regardless of age or claim eligibility • Guaranteed Purchase Option (GPO) – Offer to increase DB by no less than 5% compounded annually over the 3 year period – Every three years from employer’s policy effective date – No age limit – If insured declines one offer and goes on claim no more offers will be received – No offers will be received if in reduced paid up status due to nonforfeiture status

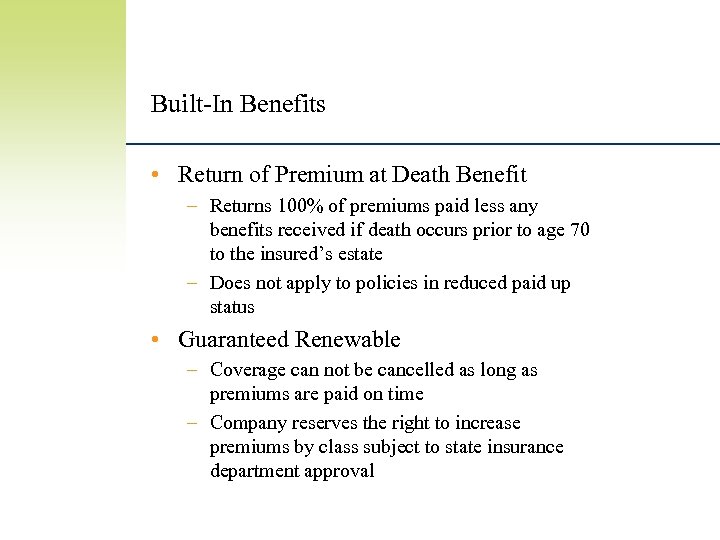

Built-In Benefits • Return of Premium at Death Benefit – Returns 100% of premiums paid less any benefits received if death occurs prior to age 70 to the insured’s estate – Does not apply to policies in reduced paid up status • Guaranteed Renewable – Coverage can not be cancelled as long as premiums are paid on time – Company reserves the right to increase premiums by class subject to state insurance department approval

Built-In Benefits • Return of Premium at Death Benefit – Returns 100% of premiums paid less any benefits received if death occurs prior to age 70 to the insured’s estate – Does not apply to policies in reduced paid up status • Guaranteed Renewable – Coverage can not be cancelled as long as premiums are paid on time – Company reserves the right to increase premiums by class subject to state insurance department approval

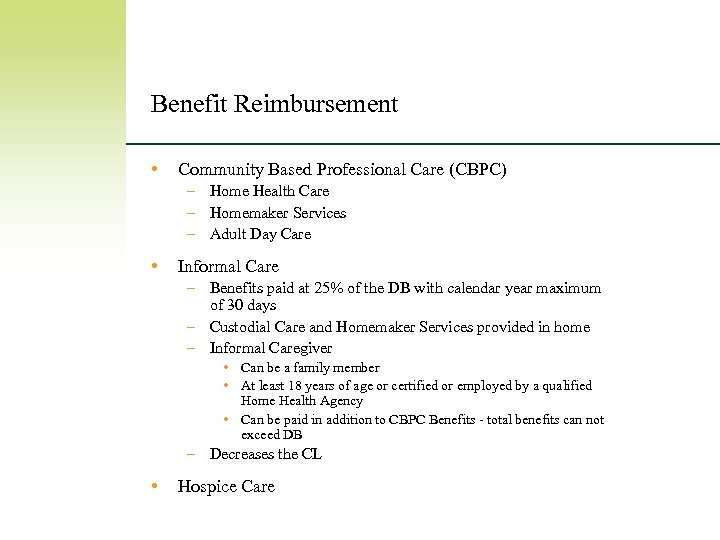

Benefit Reimbursement • Community Based Professional Care (CBPC) – Home Health Care – Homemaker Services – Adult Day Care • Informal Care – Benefits paid at 25% of the DB with calendar year maximum of 30 days – Custodial Care and Homemaker Services provided in home – Informal Caregiver • Can be a family member • At least 18 years of age or certified or employed by a qualified Home Health Agency • Can be paid in addition to CBPC Benefits - total benefits can not exceed DB – Decreases the CL • Hospice Care

Benefit Reimbursement • Community Based Professional Care (CBPC) – Home Health Care – Homemaker Services – Adult Day Care • Informal Care – Benefits paid at 25% of the DB with calendar year maximum of 30 days – Custodial Care and Homemaker Services provided in home – Informal Caregiver • Can be a family member • At least 18 years of age or certified or employed by a qualified Home Health Agency • Can be paid in addition to CBPC Benefits - total benefits can not exceed DB – Decreases the CL • Hospice Care

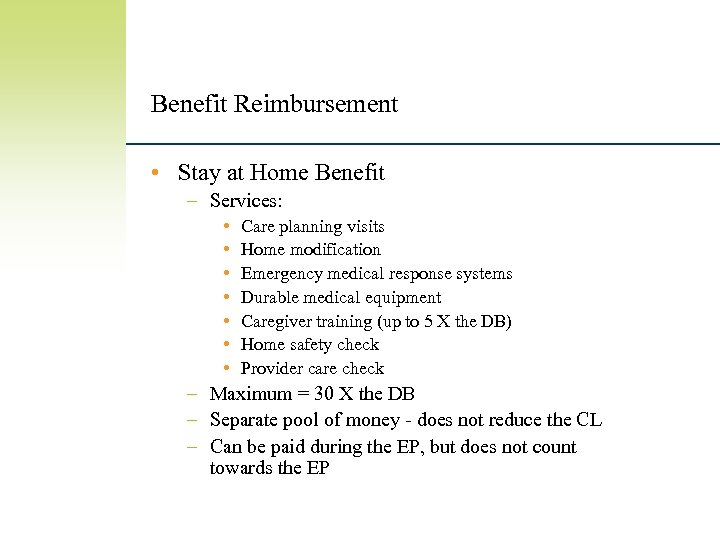

Benefit Reimbursement • Stay at Home Benefit – Services: • • Care planning visits Home modification Emergency medical response systems Durable medical equipment Caregiver training (up to 5 X the DB) Home safety check Provider care check – Maximum = 30 X the DB – Separate pool of money - does not reduce the CL – Can be paid during the EP, but does not count towards the EP

Benefit Reimbursement • Stay at Home Benefit – Services: • • Care planning visits Home modification Emergency medical response systems Durable medical equipment Caregiver training (up to 5 X the DB) Home safety check Provider care check – Maximum = 30 X the DB – Separate pool of money - does not reduce the CL – Can be paid during the EP, but does not count towards the EP

Payment Options • Active employees and spouses/partners can be payroll deducted • Retirees and spouses/partners may be deducted from pension • All others are automatic bank withdrawal or direct bill • Premium payment grace period

Payment Options • Active employees and spouses/partners can be payroll deducted • Retirees and spouses/partners may be deducted from pension • All others are automatic bank withdrawal or direct bill • Premium payment grace period

Spouse/Partner Discounts • Employer option – Some employers may see this as favoring married employees • Available to spouses and domestic partners where approved – Spouse/Partner Discount • A premium discount if you are married or part of a defined partnership – Blended Discount • Based on general employer population • Must be used for all employer paid cases

Spouse/Partner Discounts • Employer option – Some employers may see this as favoring married employees • Available to spouses and domestic partners where approved – Spouse/Partner Discount • A premium discount if you are married or part of a defined partnership – Blended Discount • Based on general employer population • Must be used for all employer paid cases

Introducing Corporate. Choice: Implementation and Enrollment Corporate. Choice JHFN Cabinet Club 9/05

Introducing Corporate. Choice: Implementation and Enrollment Corporate. Choice JHFN Cabinet Club 9/05

Enrollment • Prior to enrollment, employees receive from John Hancock: – An announcement letter (enrollment dates, contact info, employer-dedicated Web site info with online enrollment) – A needs piece explaining why you should consider LTCI – Rate quote with personalized age-based rates – Plan highlights brochure that explains plan benefits

Enrollment • Prior to enrollment, employees receive from John Hancock: – An announcement letter (enrollment dates, contact info, employer-dedicated Web site info with online enrollment) – A needs piece explaining why you should consider LTCI – Rate quote with personalized age-based rates – Plan highlights brochure that explains plan benefits

Elements to an Enrollment Campaign • Awareness – Announcement letters – Web site • Education – Employee presentation – Web site • Implementation – Online via the Web site for Guaranteed Issue – Simplified and Full application on Web or in enrollment kit

Elements to an Enrollment Campaign • Awareness – Announcement letters – Web site • Education – Employee presentation – Web site • Implementation – Online via the Web site for Guaranteed Issue – Simplified and Full application on Web or in enrollment kit

John Hancock Multi-Life Programs Presented to: Capitas Financial November 15, 2006 Courtney Turner Sponsored Group Manager Laurie Picardi LTC Sales Consultant Kristen Marie Martin LTC Sales Consultant Capitas Training Call 111506. For agent educational and training purposes only. Not intended for the general public. Program specifics may vary by state. Presentation is designed to be a general overview of several programs. Please refer to the specific program guide for details.

John Hancock Multi-Life Programs Presented to: Capitas Financial November 15, 2006 Courtney Turner Sponsored Group Manager Laurie Picardi LTC Sales Consultant Kristen Marie Martin LTC Sales Consultant Capitas Training Call 111506. For agent educational and training purposes only. Not intended for the general public. Program specifics may vary by state. Presentation is designed to be a general overview of several programs. Please refer to the specific program guide for details.