60bfc615e62ef2a427fabdd0d631c292.ppt

- Количество слайдов: 17

JML Consumer Insight 2006

JML Consumer Insight 2006

Method • TNS – Consumer Panel circa. 20, 000 households • Outlook – Exit Polls in Woolworths stores 400 interviewees

Method • TNS – Consumer Panel circa. 20, 000 households • Outlook – Exit Polls in Woolworths stores 400 interviewees

TNS Results – Brief Summary (1) • 2. 4 million households buy JML products (10% of UK households) • The average JML consumer purchases 1. 5 times per year • Average spend on JML products per year is £ 11. 39 per consumer • JML have in the past 2 years – Increased JML buyers by 11. 4% – Increased average price per unit by 3. 6% – Increased average trip volume (packs) by 2. 7%

TNS Results – Brief Summary (1) • 2. 4 million households buy JML products (10% of UK households) • The average JML consumer purchases 1. 5 times per year • Average spend on JML products per year is £ 11. 39 per consumer • JML have in the past 2 years – Increased JML buyers by 11. 4% – Increased average price per unit by 3. 6% – Increased average trip volume (packs) by 2. 7%

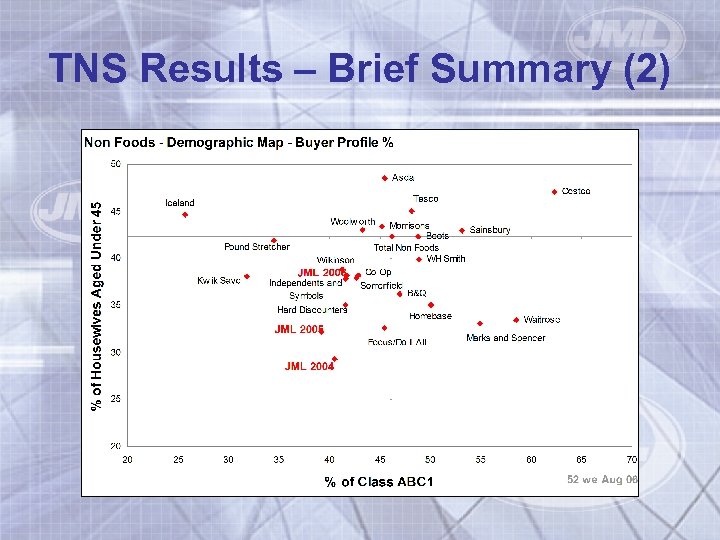

TNS Results – Brief Summary (2)

TNS Results – Brief Summary (2)

TNS Results – Brief Summary (3) • Who is buying? – Overall the JML buyer has got younger and less downmarket than in 2004. – Heavy buyers (top 20%): Older & more mass market, account for 40% of spend. Majority in the midlands. Shop in Boots, Woolworths, Wilkinsons & £stretcher – Medium buyers (30%): 40% are under 45 years old, mass market. More than 40% live in the North. Shop in Boots, Woolworths, Homebase & Morrisons. – Light buyers (50%): Account for just 26% of spend. Younger & more upmarket. 48% live in the North. Shop in Asda, £stretcher, Homebase and Co-op.

TNS Results – Brief Summary (3) • Who is buying? – Overall the JML buyer has got younger and less downmarket than in 2004. – Heavy buyers (top 20%): Older & more mass market, account for 40% of spend. Majority in the midlands. Shop in Boots, Woolworths, Wilkinsons & £stretcher – Medium buyers (30%): 40% are under 45 years old, mass market. More than 40% live in the North. Shop in Boots, Woolworths, Homebase & Morrisons. – Light buyers (50%): Account for just 26% of spend. Younger & more upmarket. 48% live in the North. Shop in Asda, £stretcher, Homebase and Co-op.

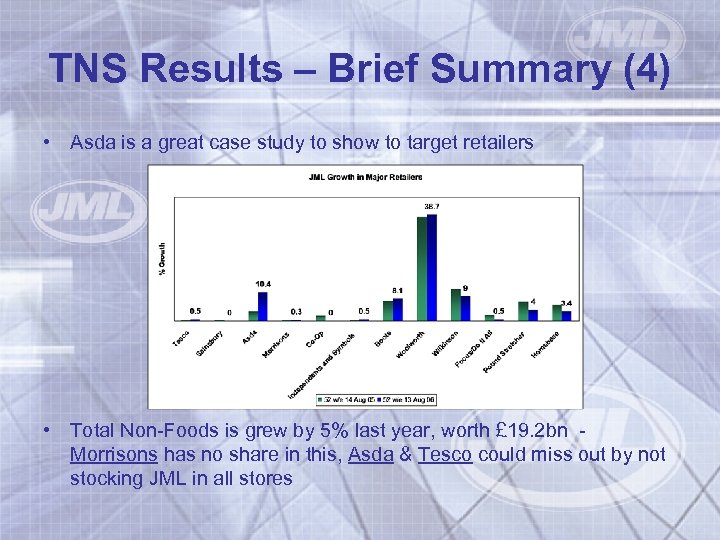

TNS Results – Brief Summary (4) • Asda is a great case study to show to target retailers • Total Non-Foods is grew by 5% last year, worth £ 19. 2 bn Morrisons has no share in this, Asda & Tesco could miss out by not stocking JML in all stores

TNS Results – Brief Summary (4) • Asda is a great case study to show to target retailers • Total Non-Foods is grew by 5% last year, worth £ 19. 2 bn Morrisons has no share in this, Asda & Tesco could miss out by not stocking JML in all stores

Outlook - Method • Exit Poll Questionnaire in Woolworths stores – 15 questions, 7 minutes each, 400 people • Focused on 10 key products, but also accounted for other product bought in the past • Key Purposes: – To identify impact of JML advertising on incremental footfall at Woolworths – To establish whether sales of additional (non JML) products can be directly related to JML activity

Outlook - Method • Exit Poll Questionnaire in Woolworths stores – 15 questions, 7 minutes each, 400 people • Focused on 10 key products, but also accounted for other product bought in the past • Key Purposes: – To identify impact of JML advertising on incremental footfall at Woolworths – To establish whether sales of additional (non JML) products can be directly related to JML activity

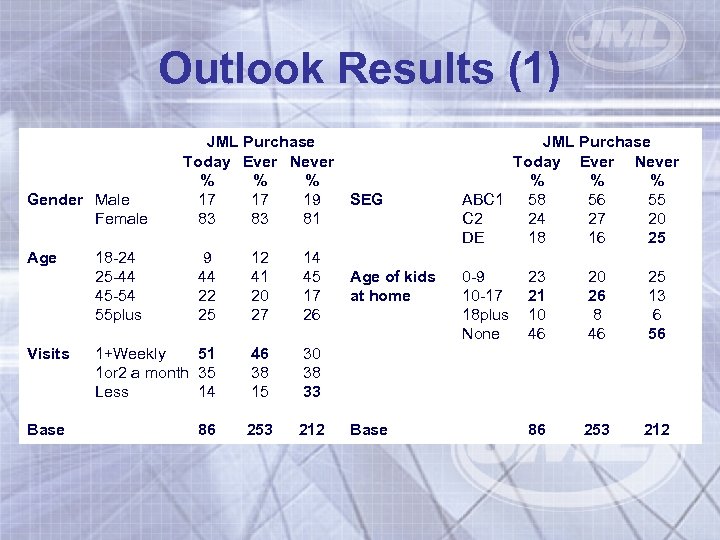

Outlook Results (1) Gender Male Female Age 18 -24 25 -44 45 -54 55 plus JML Purchase Today Ever Never % % % 17 17 19 SEG 83 83 81 9 44 22 25 12 41 20 27 14 45 17 26 Visits 1+Weekly 51 1 or 2 a month 35 Less 14 46 38 15 30 38 33 Base 86 253 212 JML Purchase Today Ever Never % % % ABC 1 58 56 55 C 2 24 27 20 DE 18 16 25 Age of kids at home Base 0 -9 10 -17 18 plus None 23 21 10 46 20 26 8 46 25 13 6 56 86 253 212

Outlook Results (1) Gender Male Female Age 18 -24 25 -44 45 -54 55 plus JML Purchase Today Ever Never % % % 17 17 19 SEG 83 83 81 9 44 22 25 12 41 20 27 14 45 17 26 Visits 1+Weekly 51 1 or 2 a month 35 Less 14 46 38 15 30 38 33 Base 86 253 212 JML Purchase Today Ever Never % % % ABC 1 58 56 55 C 2 24 27 20 DE 18 16 25 Age of kids at home Base 0 -9 10 -17 18 plus None 23 21 10 46 20 26 8 46 25 13 6 56 86 253 212

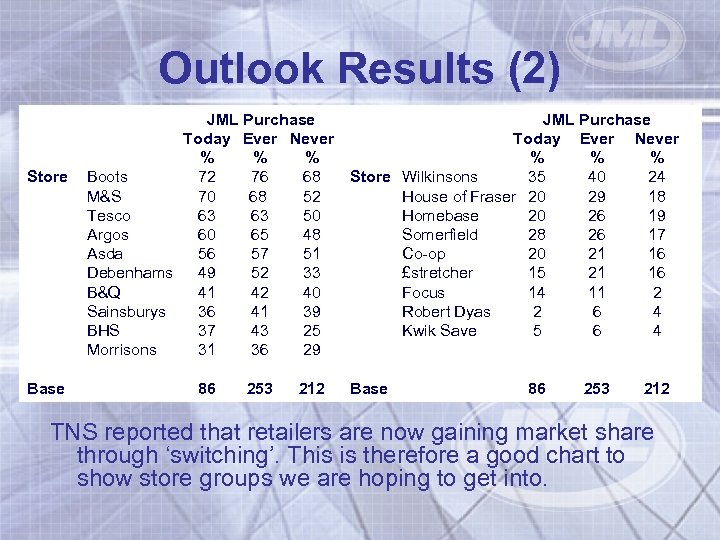

Outlook Results (2) Store Base JML Purchase Today Ever Never % % % Boots 72 76 68 Store Wilkinsons 35 40 24 M&S 70 68 52 House of Fraser 20 29 18 Tesco 63 63 50 Homebase 20 26 19 Argos 60 65 48 Somerfield 28 26 17 Asda 56 57 51 Co-op 20 21 16 Debenhams 49 52 33 £stretcher 15 21 16 B&Q 41 42 40 Focus 14 11 2 Sainsburys 36 41 39 Robert Dyas 2 6 4 BHS 37 43 25 Kwik Save 5 6 4 Morrisons 31 36 29 86 253 212 Base 86 253 212 TNS reported that retailers are now gaining market share through ‘switching’. This is therefore a good chart to show store groups we are hoping to get into.

Outlook Results (2) Store Base JML Purchase Today Ever Never % % % Boots 72 76 68 Store Wilkinsons 35 40 24 M&S 70 68 52 House of Fraser 20 29 18 Tesco 63 63 50 Homebase 20 26 19 Argos 60 65 48 Somerfield 28 26 17 Asda 56 57 51 Co-op 20 21 16 Debenhams 49 52 33 £stretcher 15 21 16 B&Q 41 42 40 Focus 14 11 2 Sainsburys 36 41 39 Robert Dyas 2 6 4 BHS 37 43 25 Kwik Save 5 6 4 Morrisons 31 36 29 86 253 212 Base 86 253 212 TNS reported that retailers are now gaining market share through ‘switching’. This is therefore a good chart to show store groups we are hoping to get into.

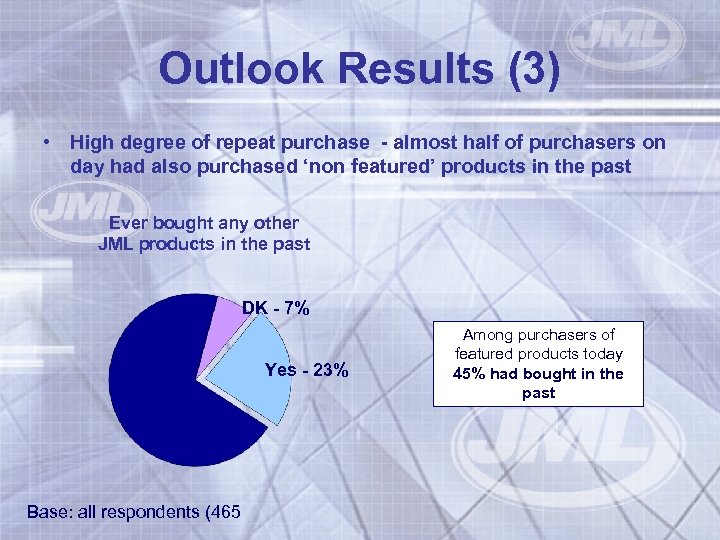

Outlook Results (3) • High degree of repeat purchase - almost half of purchasers on day had also purchased ‘non featured’ products in the past Ever bought any other JML products in the past DK - 7% Yes - 23% Base: all respondents (465 Among purchasers of featured products today 45% had bought in the past

Outlook Results (3) • High degree of repeat purchase - almost half of purchasers on day had also purchased ‘non featured’ products in the past Ever bought any other JML products in the past DK - 7% Yes - 23% Base: all respondents (465 Among purchasers of featured products today 45% had bought in the past

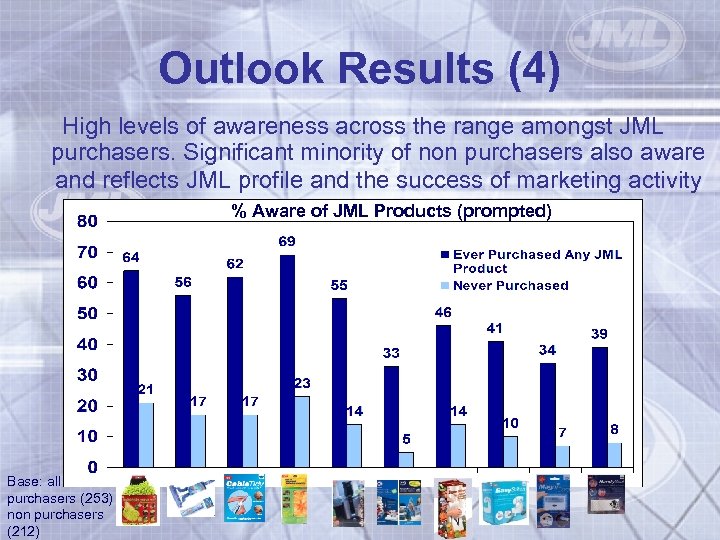

Outlook Results (4) High levels of awareness across the range amongst JML purchasers. Significant minority of non purchasers also aware and reflects JML profile and the success of marketing activity % Aware of JML Products (prompted) Base: all purchasers (253) non purchasers (212)

Outlook Results (4) High levels of awareness across the range amongst JML purchasers. Significant minority of non purchasers also aware and reflects JML profile and the success of marketing activity % Aware of JML Products (prompted) Base: all purchasers (253) non purchasers (212)

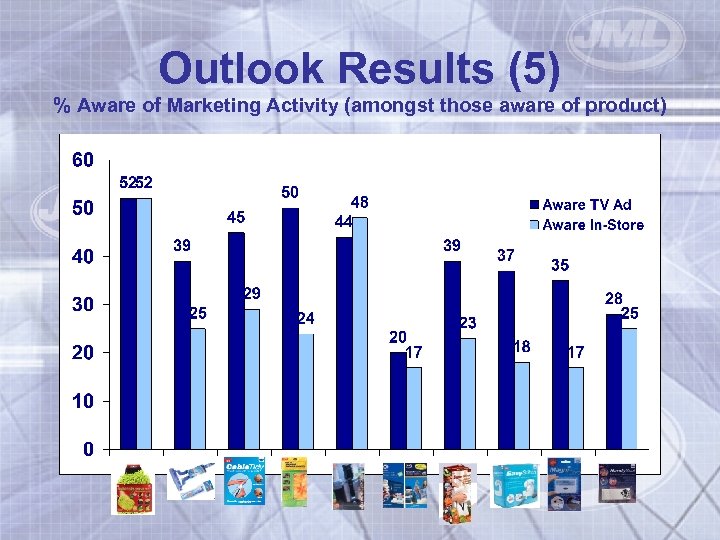

Outlook Results (5) % Aware of Marketing Activity (amongst those aware of product)

Outlook Results (5) % Aware of Marketing Activity (amongst those aware of product)

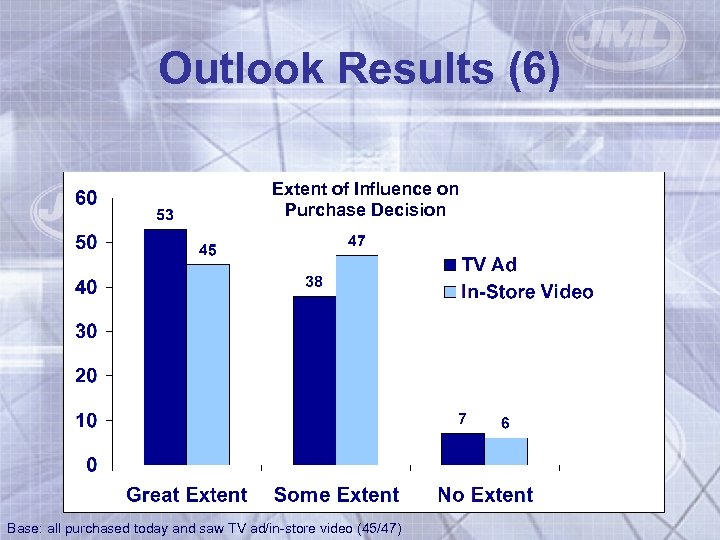

Outlook Results (6) Extent of Influence on Purchase Decision Base: all purchased today and saw TV ad/in-store video (45/47)

Outlook Results (6) Extent of Influence on Purchase Decision Base: all purchased today and saw TV ad/in-store video (45/47)

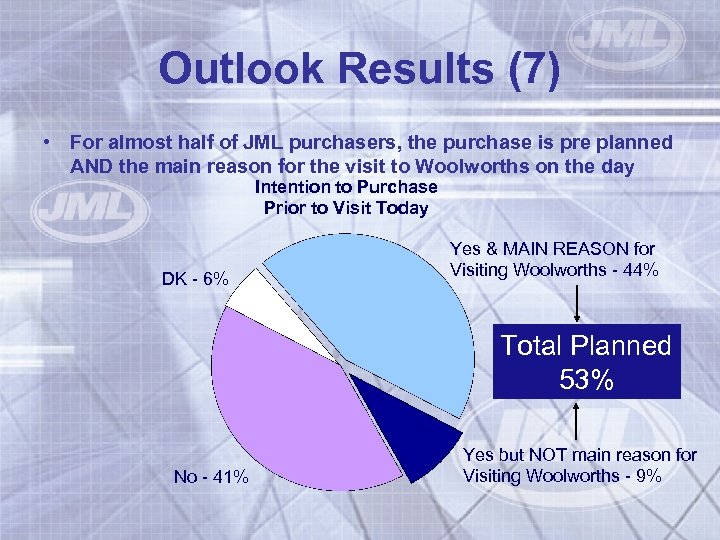

Outlook Results (7) • For almost half of JML purchasers, the purchase is pre planned AND the main reason for the visit to Woolworths on the day Intention to Purchase Prior to Visit Today DK - 6% Yes & MAIN REASON for Visiting Woolworths - 44% Total Planned 53% No - 41% Yes but NOT main reason for Visiting Woolworths - 9%

Outlook Results (7) • For almost half of JML purchasers, the purchase is pre planned AND the main reason for the visit to Woolworths on the day Intention to Purchase Prior to Visit Today DK - 6% Yes & MAIN REASON for Visiting Woolworths - 44% Total Planned 53% No - 41% Yes but NOT main reason for Visiting Woolworths - 9%

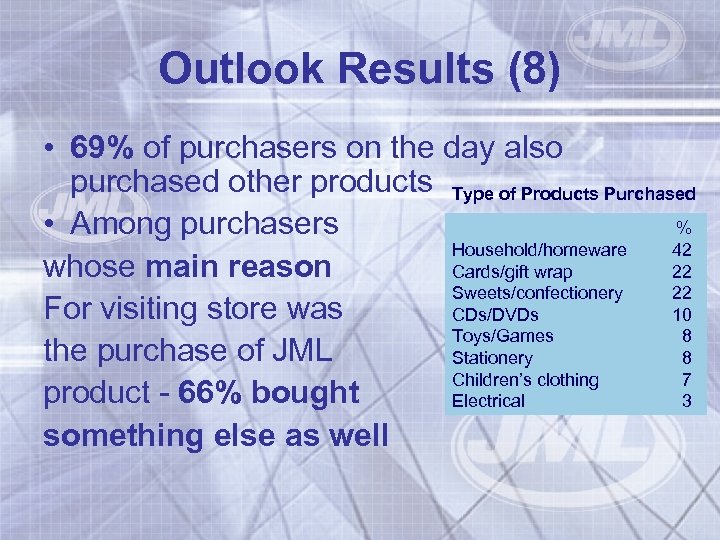

Outlook Results (8) • 69% of purchasers on the day also purchased other products Type of Products Purchased % • Among purchasers Household/homeware 42 whose main reason Cards/gift wrap 22 Sweets/confectionery 22 For visiting store was CDs/DVDs 10 Toys/Games 8 the purchase of JML Stationery 8 Children’s clothing 7 product - 66% bought Electrical 3 something else as well

Outlook Results (8) • 69% of purchasers on the day also purchased other products Type of Products Purchased % • Among purchasers Household/homeware 42 whose main reason Cards/gift wrap 22 Sweets/confectionery 22 For visiting store was CDs/DVDs 10 Toys/Games 8 the purchase of JML Stationery 8 Children’s clothing 7 product - 66% bought Electrical 3 something else as well

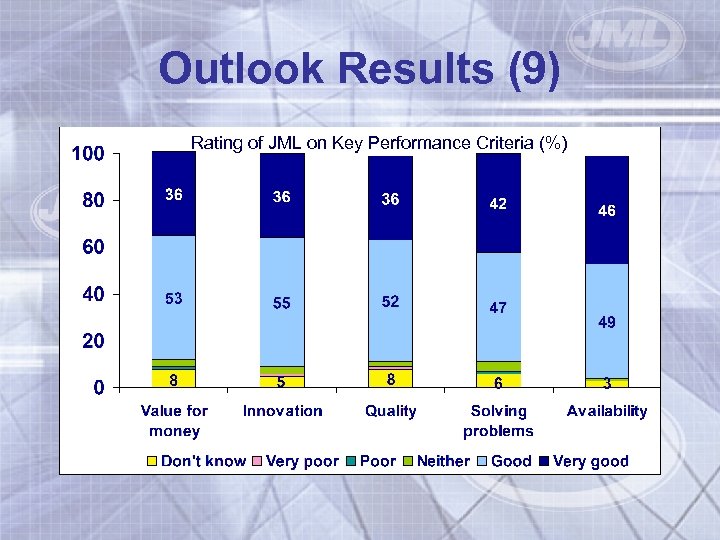

Outlook Results (9) Rating of JML on Key Performance Criteria (%)

Outlook Results (9) Rating of JML on Key Performance Criteria (%)

Outlook Results (10) • The research confirms that JML activity - both TV and instore video presentations - is positively influencing purchasing decisions • In addition, there is strong evidence to suggest that incremental visits to Woolworths are being generated and that these frequently result in additional purchases beyond the target JML product – Half of JML purchasers had planned the purchase before arrival – For most of these, this purchase was the main reason for visiting on that day – Two thirds of those whose main reason for visiting the store was to buy a JML product ended up buying other products

Outlook Results (10) • The research confirms that JML activity - both TV and instore video presentations - is positively influencing purchasing decisions • In addition, there is strong evidence to suggest that incremental visits to Woolworths are being generated and that these frequently result in additional purchases beyond the target JML product – Half of JML purchasers had planned the purchase before arrival – For most of these, this purchase was the main reason for visiting on that day – Two thirds of those whose main reason for visiting the store was to buy a JML product ended up buying other products