JJ Mois Année Emerging markets development in AMEDA countries October, 23 2008 R. BOURGI

JJ Mois Année Emerging markets development in AMEDA countries October, 23 2008 R. BOURGI

Agenda n Basis for strategic consideration: funds flows n Basis for strategic consideration: infrastructure & experience n Snapshot of key indicators for AMEDA markets n Focus on South Africa, Egypt & Morocco n Market entry considerations for SG n Appendix: List of existing & proposed SGSS coverage in AMEDA October 2008 Emerging markets development in AMEDA countries 2

Agenda n Basis for strategic consideration: funds flows n Basis for strategic consideration: infrastructure & experience n Snapshot of key indicators for AMEDA markets n Focus on South Africa, Egypt & Morocco n Market entry considerations for SG n Appendix: List of existing & proposed SGSS coverage in AMEDA October 2008 Emerging markets development in AMEDA countries 2

Basis for strategic consideration: funds flows n Domestic 4 local clients investing locally n Inbound 4 foreign investors investing in local market n Outbound 4 local investors investing in neighbour markets and / or International markets October 2008 Emerging markets development in AMEDA countries 3

Basis for strategic consideration: funds flows n Domestic 4 local clients investing locally n Inbound 4 foreign investors investing in local market n Outbound 4 local investors investing in neighbour markets and / or International markets October 2008 Emerging markets development in AMEDA countries 3

Basis for strategic consideration: infrastructure & experience n Stock market & general market infrastructure 4 4 CSD’s Registrars Covering bodies Etc. . . n Presence of local custodians 4 4 4 Automation Compliance & risk Financial stability Customer service Local know-how Etc… n Presence of foreign players in markets 4 4 4 October 2008 Fund managers Banks Insurance companies Custodians Brokers Emerging markets development in AMEDA countries 4

Basis for strategic consideration: infrastructure & experience n Stock market & general market infrastructure 4 4 CSD’s Registrars Covering bodies Etc. . . n Presence of local custodians 4 4 4 Automation Compliance & risk Financial stability Customer service Local know-how Etc… n Presence of foreign players in markets 4 4 4 October 2008 Fund managers Banks Insurance companies Custodians Brokers Emerging markets development in AMEDA countries 4

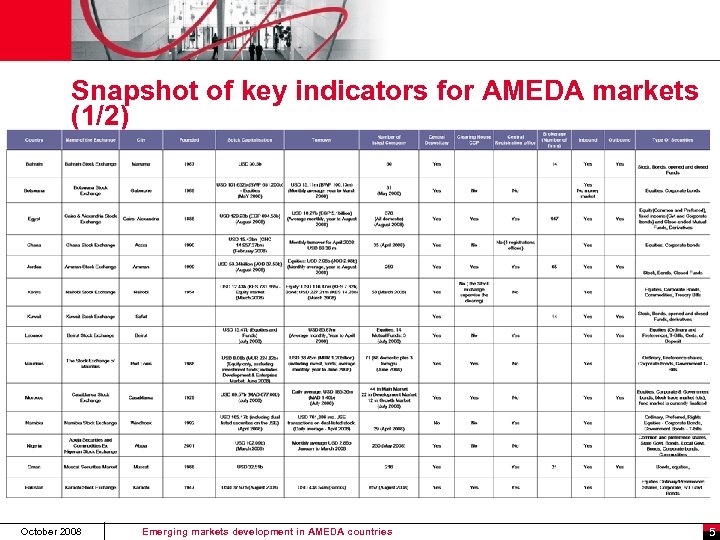

Snapshot of key indicators for AMEDA markets (1/2) October 2008 Emerging markets development in AMEDA countries 5

Snapshot of key indicators for AMEDA markets (1/2) October 2008 Emerging markets development in AMEDA countries 5

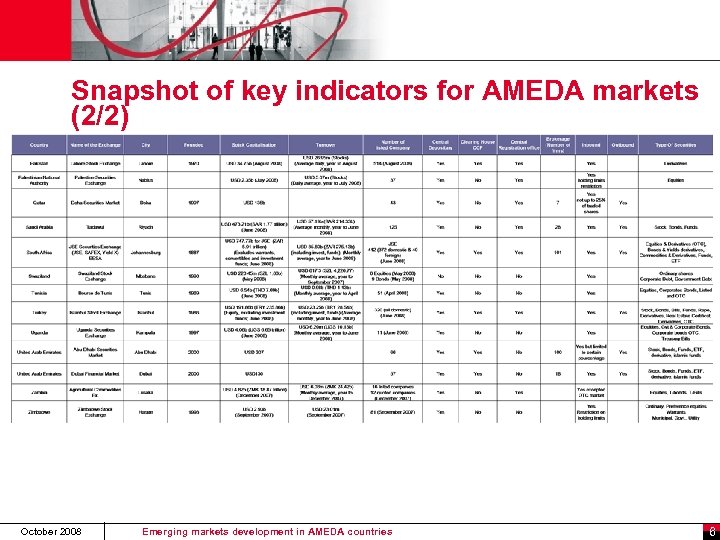

Snapshot of key indicators for AMEDA markets (2/2) October 2008 Emerging markets development in AMEDA countries 6

Snapshot of key indicators for AMEDA markets (2/2) October 2008 Emerging markets development in AMEDA countries 6

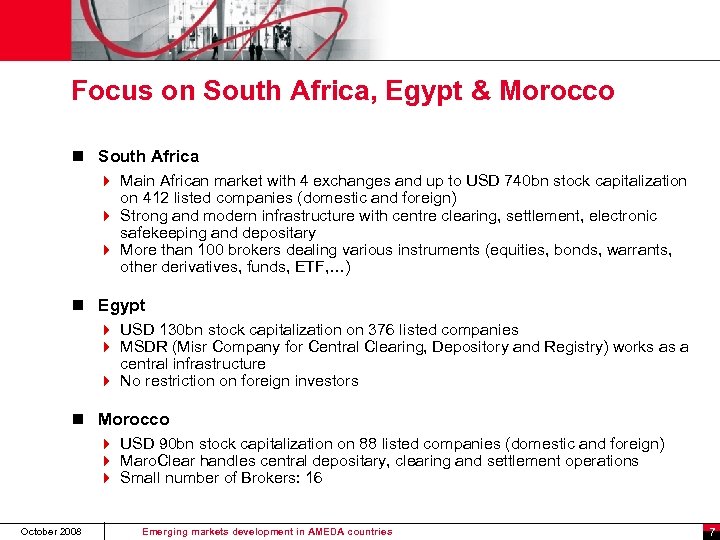

Focus on South Africa, Egypt & Morocco n South Africa 4 Main African market with 4 exchanges and up to USD 740 bn stock capitalization on 412 listed companies (domestic and foreign) 4 Strong and modern infrastructure with centre clearing, settlement, electronic safekeeping and depositary 4 More than 100 brokers dealing various instruments (equities, bonds, warrants, other derivatives, funds, ETF, …) n Egypt 4 USD 130 bn stock capitalization on 376 listed companies 4 MSDR (Misr Company for Central Clearing, Depository and Registry) works as a central infrastructure 4 No restriction on foreign investors n Morocco 4 USD 90 bn stock capitalization on 88 listed companies (domestic and foreign) 4 Maro. Clear handles central depositary, clearing and settlement operations 4 Small number of Brokers: 16 October 2008 Emerging markets development in AMEDA countries 7

Focus on South Africa, Egypt & Morocco n South Africa 4 Main African market with 4 exchanges and up to USD 740 bn stock capitalization on 412 listed companies (domestic and foreign) 4 Strong and modern infrastructure with centre clearing, settlement, electronic safekeeping and depositary 4 More than 100 brokers dealing various instruments (equities, bonds, warrants, other derivatives, funds, ETF, …) n Egypt 4 USD 130 bn stock capitalization on 376 listed companies 4 MSDR (Misr Company for Central Clearing, Depository and Registry) works as a central infrastructure 4 No restriction on foreign investors n Morocco 4 USD 90 bn stock capitalization on 88 listed companies (domestic and foreign) 4 Maro. Clear handles central depositary, clearing and settlement operations 4 Small number of Brokers: 16 October 2008 Emerging markets development in AMEDA countries 7

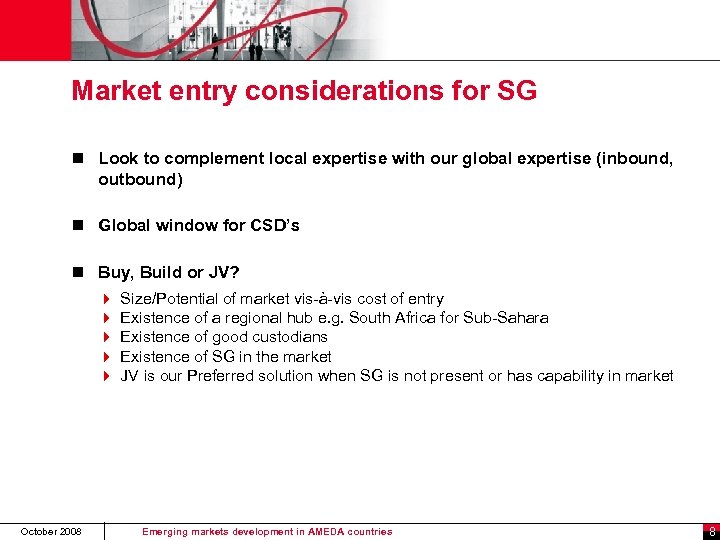

Market entry considerations for SG n Look to complement local expertise with our global expertise (inbound, outbound) n Global window for CSD’s n Buy, Build or JV? 4 4 4 October 2008 Size/Potential of market vis-à-vis cost of entry Existence of a regional hub e. g. South Africa for Sub-Sahara Existence of good custodians Existence of SG in the market JV is our Preferred solution when SG is not present or has capability in market Emerging markets development in AMEDA countries 8

Market entry considerations for SG n Look to complement local expertise with our global expertise (inbound, outbound) n Global window for CSD’s n Buy, Build or JV? 4 4 4 October 2008 Size/Potential of market vis-à-vis cost of entry Existence of a regional hub e. g. South Africa for Sub-Sahara Existence of good custodians Existence of SG in the market JV is our Preferred solution when SG is not present or has capability in market Emerging markets development in AMEDA countries 8

Appendix: list of existing & proposed SGSS coverage in AMEDA n Existing 4 South Africa 4 Egypt 4 Morocco n Proposed 4 GCC 4 Algeria 4 North African states October 2008 Emerging markets development in AMEDA countries 9

Appendix: list of existing & proposed SGSS coverage in AMEDA n Existing 4 South Africa 4 Egypt 4 Morocco n Proposed 4 GCC 4 Algeria 4 North African states October 2008 Emerging markets development in AMEDA countries 9