544033aeb934d98374be90621ee325de.ppt

- Количество слайдов: 30

Jersey’s Economic performance & Labour Market Statistics Unit

Overview • Official Statistics in Jersey – Who we are & what we do – Inform evidence-based Policy development • Economic performance 2000 - 2012 » Gross Value Added, GVA » Total and by sector » Economic standard of living • Labour Market: June 2013 » Total » public and private sectors » Unemployment: registered and ILO Statistics Unit

Background: States of Jersey Statistics Unit Who we are: • States of Jersey’s “National Statistics Office” • Part of Chief Minister’s Department – but professionally independent • Publicly accountable to the Statistics Users Group Statistics Unit

Robust Official Statistics => Evidenced-based policy • Economic: Inflation: retail & house price indices Labour market: employment; earnings Performance: GVA, overall and by sector • Social: Annual Social Survey, JASS Household Expenditure Survey, HES Income Distribution Survey, IDS • Population: The Census & annual updates Total population and Net migration Modelling and projections Statistics Unit

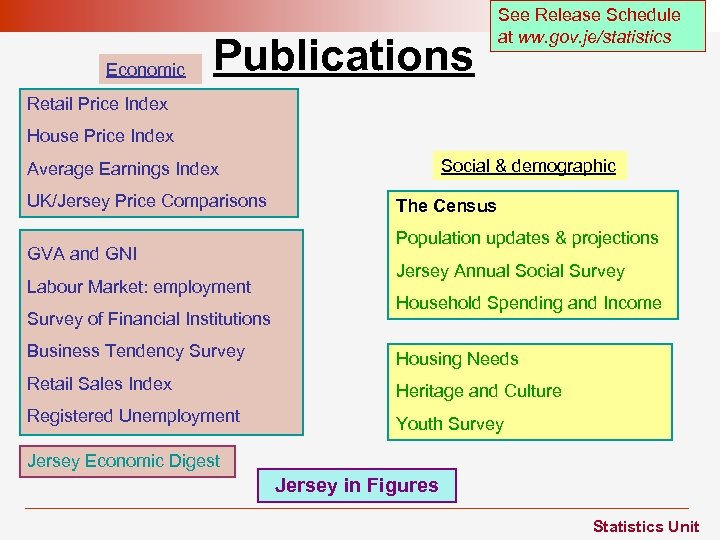

Economic Publications See Release Schedule at ww. gov. je/statistics Retail Price Index House Price Index Social & demographic Average Earnings Index UK/Jersey Price Comparisons GVA and GNI Labour Market: employment Survey of Financial Institutions The Census Population updates & projections Jersey Annual Social Survey Household Spending and Income Business Tendency Survey Housing Needs Retail Sales Index Heritage and Culture Registered Unemployment Youth Survey Jersey Economic Digest Jersey in Figures Statistics Unit

Measuring Jersey’s Economy Gross Value Added (GVA) 2012 Statistics Unit

Economic performance: measure by Gross Value Added, GVA • Gross operating surplus (business “profits”) + • Compensation of employees – wages, salaries, bonuses – social security, pension contributions + • Mixed Income (sole traders) Statistics Unit

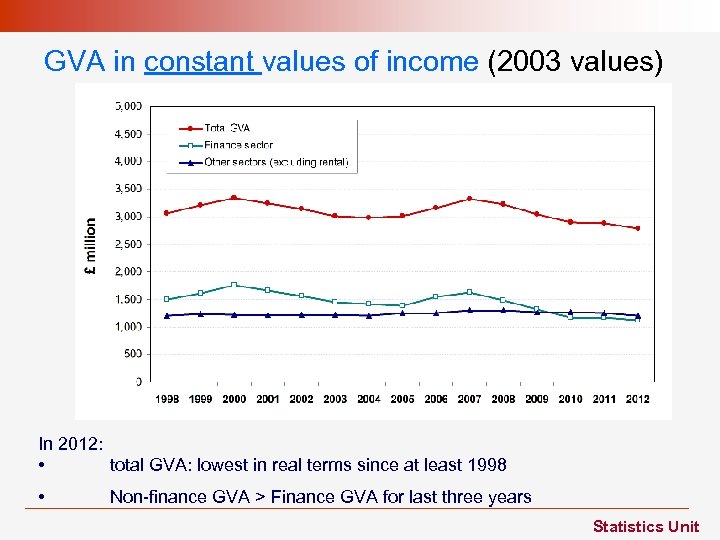

GVA in constant values of income (2003 values) In 2012: • total GVA: lowest in real terms since at least 1998 • Non-finance GVA > Finance GVA for last three years Statistics Unit

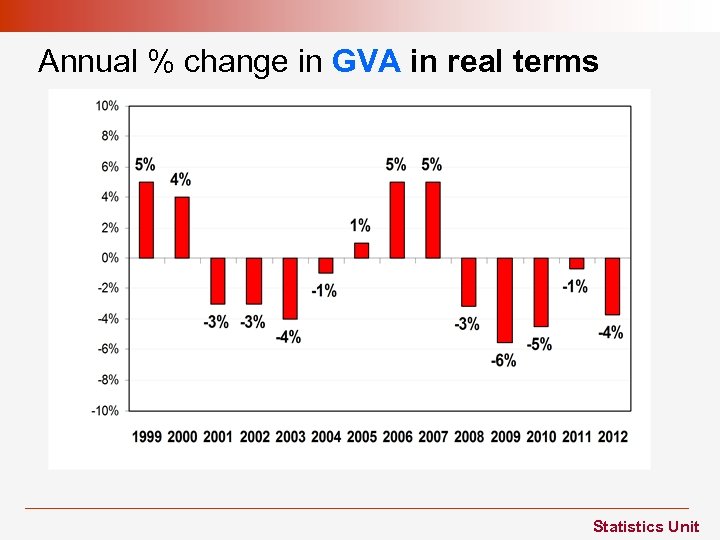

Annual % change in GVA in real terms Statistics Unit

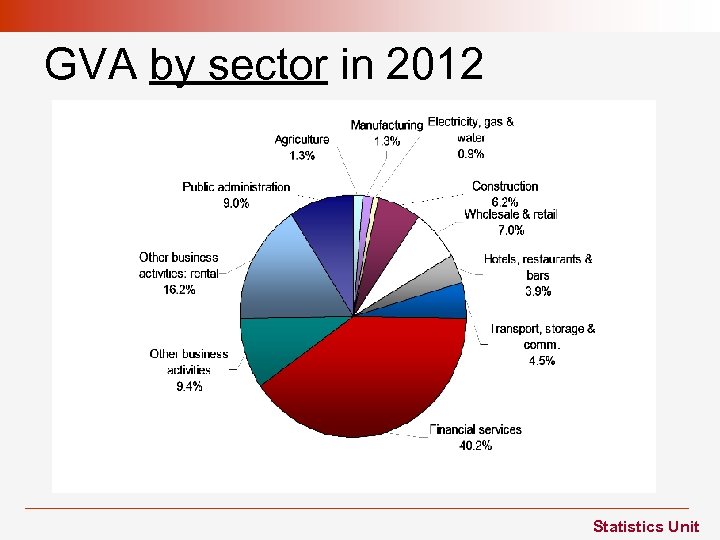

GVA by sector in 2012 Statistics Unit

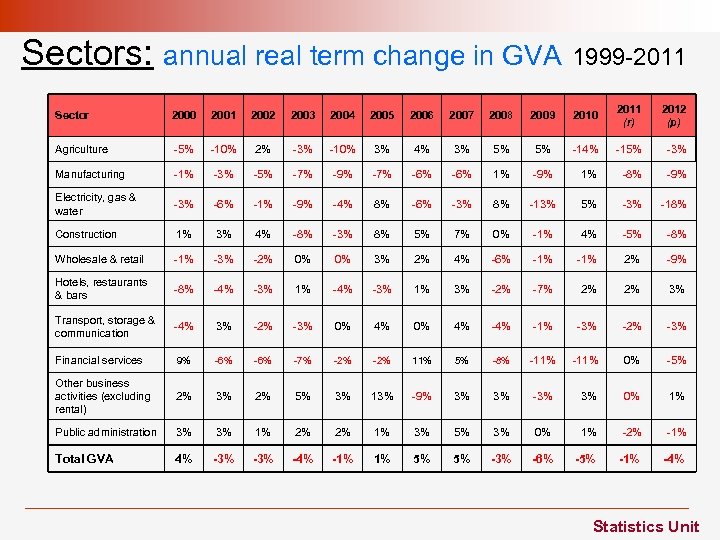

Sectors: annual real term change in GVA 1999 -2011 Sector 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 (r) 2012 (p) Agriculture -5% -10% 2% -3% -10% 3% 4% 3% 5% 5% -14% -15% -3% Manufacturing -1% -3% -5% -7% -9% -7% -6% 1% -9% 1% -8% -9% Electricity, gas & water -3% -6% -1% -9% -4% 8% -6% -3% 8% -13% 5% -3% -18% Construction 1% 3% 4% -8% -3% 8% 5% 7% 0% -1% 4% -5% -8% Wholesale & retail -1% -3% -2% 0% 0% 3% 2% 4% -6% -1% 2% -9% Hotels, restaurants & bars -8% -4% -3% 1% 3% -2% -7% 2% 2% 3% Transport, storage & communication -4% 3% -2% -3% 0% 4% -4% -1% -3% -2% -3% Financial services 9% -6% -7% -2% 11% 5% -8% -11% 0% -5% Other business activities (excluding rental) 2% 3% 2% 5% 3% 13% -9% 3% 3% -3% 3% 0% 1% Public administration 3% 3% 1% 2% 2% 1% 3% 5% 3% 0% 1% -2% -1% Total GVA 4% -3% -4% -1% 1% 5% 5% -3% -6% -5% -1% -4% Statistics Unit

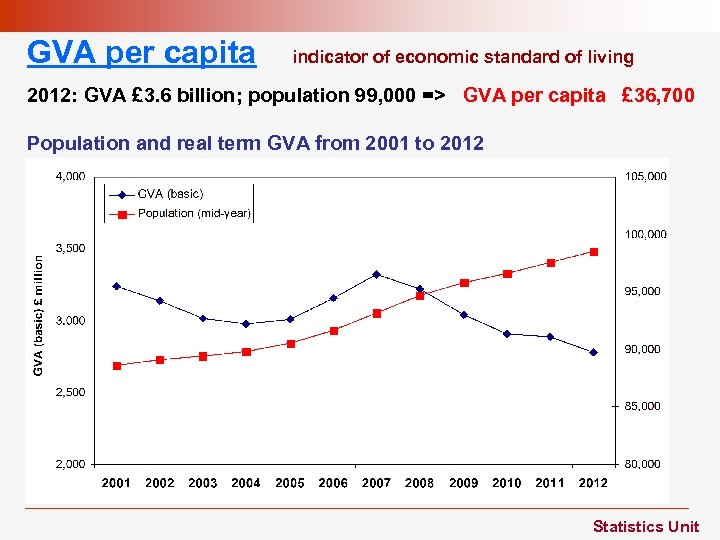

GVA per capita indicator of economic standard of living 2012: GVA £ 3. 6 billion; population 99, 000 => GVA per capita £ 36, 700 Population and real term GVA from 2001 to 2012 Statistics Unit

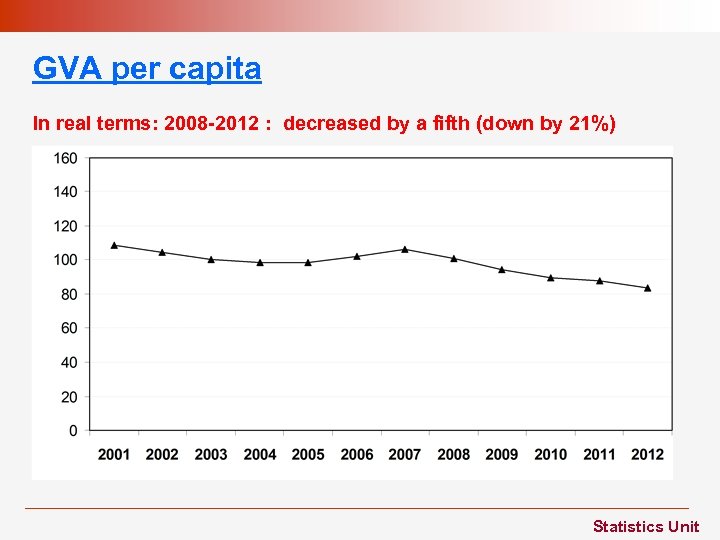

GVA per capita In real terms: 2008 -2012 : decreased by a fifth (down by 21%) Statistics Unit

Jersey Labour Market June 2013 Private + Public sectors Statistics Unit

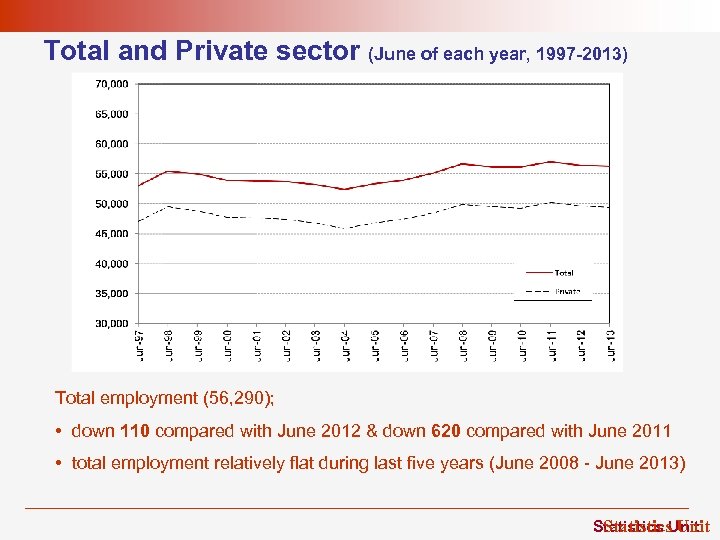

Total and Private sector (June of each year, 1997 -2013) Total employment (56, 290); • down 110 compared with June 2012 & down 620 compared with June 2011 • total employment relatively flat during last five years (June 2008 - June 2013) Statistics Unit

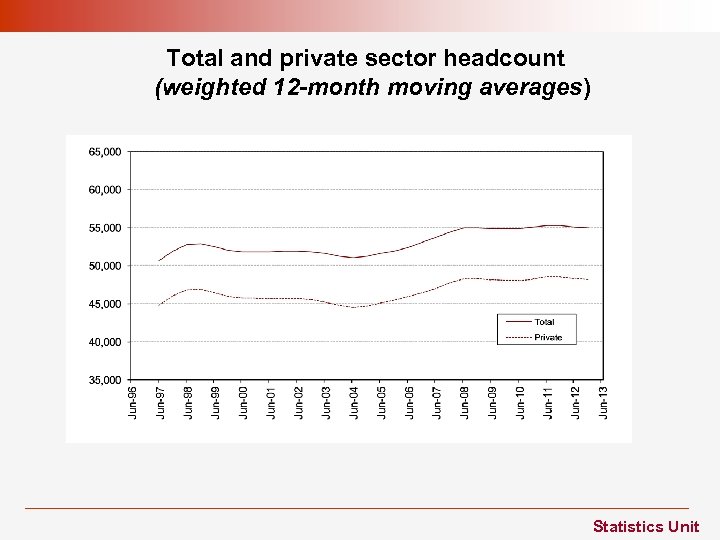

Total and private sector headcount (weighted 12 -month moving averages) Statistics Unit

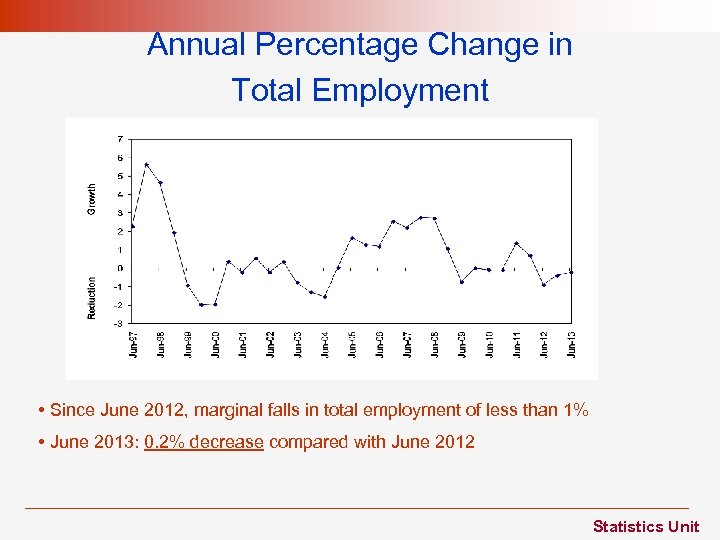

Annual Percentage Change in Total Employment • Since June 2012, marginal falls in total employment of less than 1% • June 2013: 0. 2% decrease compared with June 2012 Statistics Unit

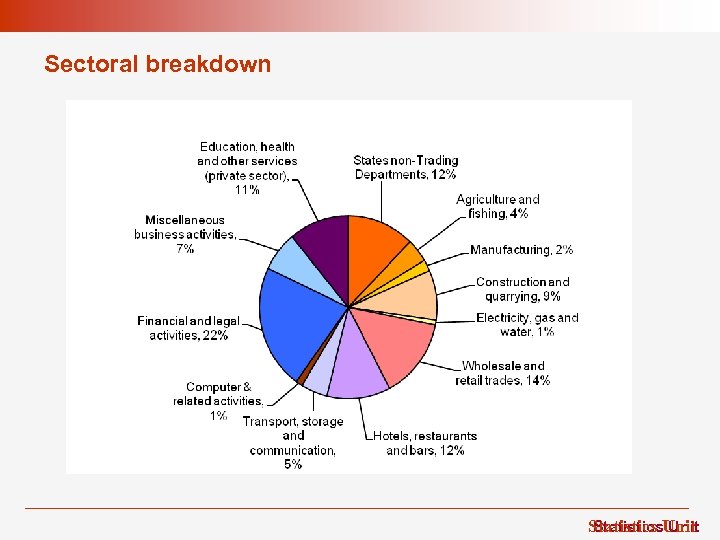

Sectoral breakdown Statistics Unit

Private sector Total = 49, 360 (net decline of 270 employees since June 2012) Net annual decrease driven by: • Wholesale and retail: • Finance: • Construction: -450 -190 -150 Fulfilment (270 employees in June 2013): • - 180 annually • less than a third of that recorded in 2009 & 2010 • - 700 compared in last 3 years In comparison • • Hotels, restaurants & bars: Private Sector Service Industries: + 210 compared with June 2012 + 280 compared with June 2012 Statistics Unit

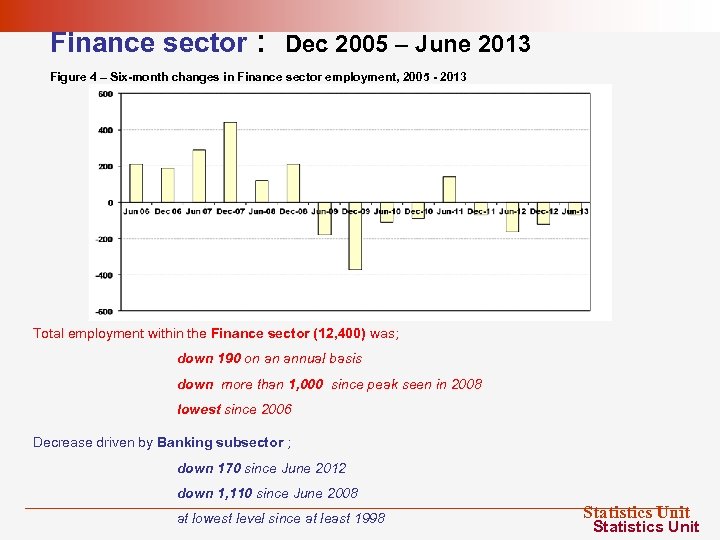

Finance sector : Dec 2005 – June 2013 Figure 4 – Six-month changes in Finance sector employment, 2005 - 2013 Total employment within the Finance sector (12, 400) was; down 190 on an annual basis down more than 1, 000 since peak seen in 2008 lowest since 2006 Decrease driven by Banking subsector ; down 170 since June 2012 down 1, 110 since June 2008 at lowest level since at least 1998 Statistics Unit

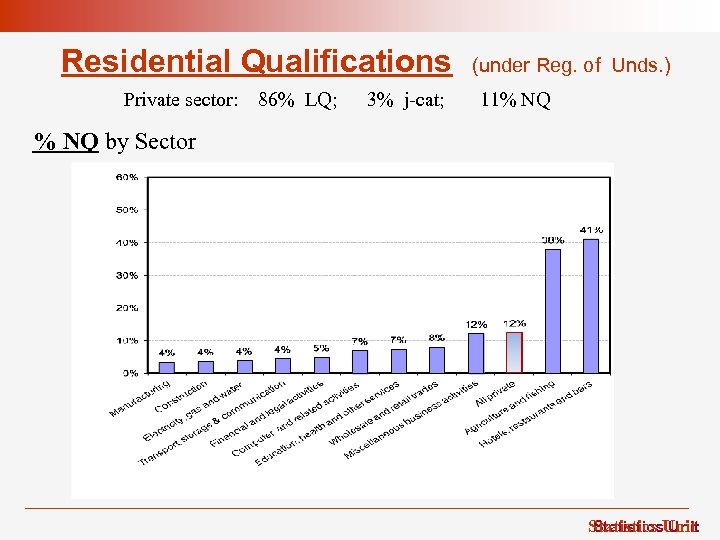

Residential Qualifications Private sector: 86% LQ; 3% j-cat; (under Reg. of Unds. ) 11% NQ by Sector 18% Statistics Unit

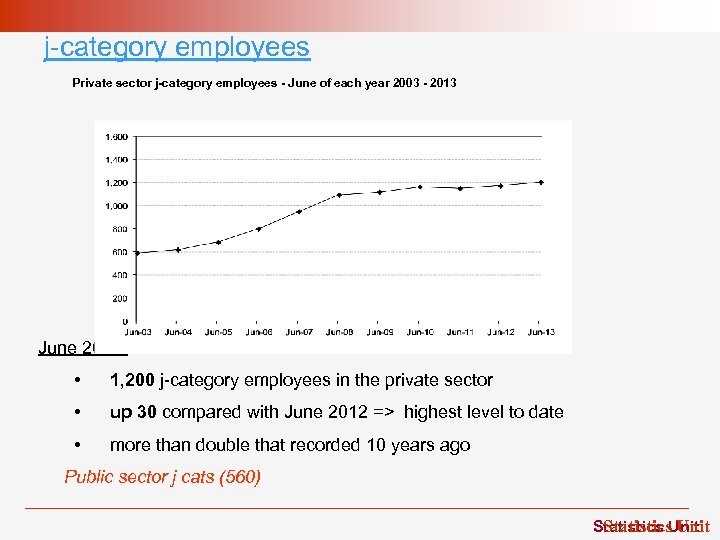

j-category employees Private sector j-category employees - June of each year 2003 - 2013 June 2013: • 1, 200 j-category employees in the private sector • up 30 compared with June 2012 => highest level to date • more than double that recorded 10 years ago Public sector j cats (560) Statistics Unit

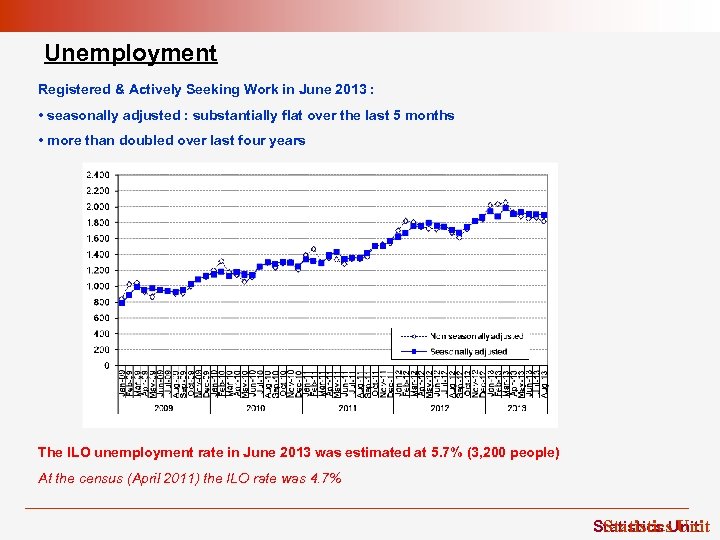

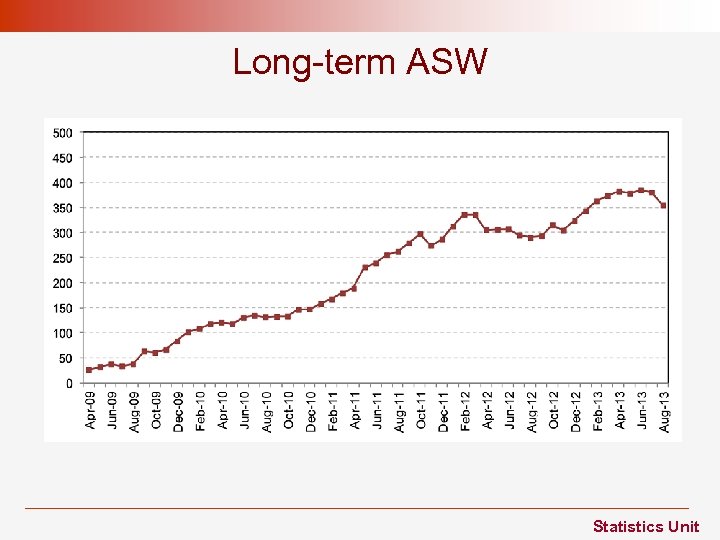

Unemployment Registered & Actively Seeking Work in June 2013 : • seasonally adjusted : substantially flat over the last 5 months • more than doubled over last four years The ILO unemployment rate in June 2013 was estimated at 5. 7% (3, 200 people) At the census (April 2011) the ILO rate was 4. 7% Statistics Unit

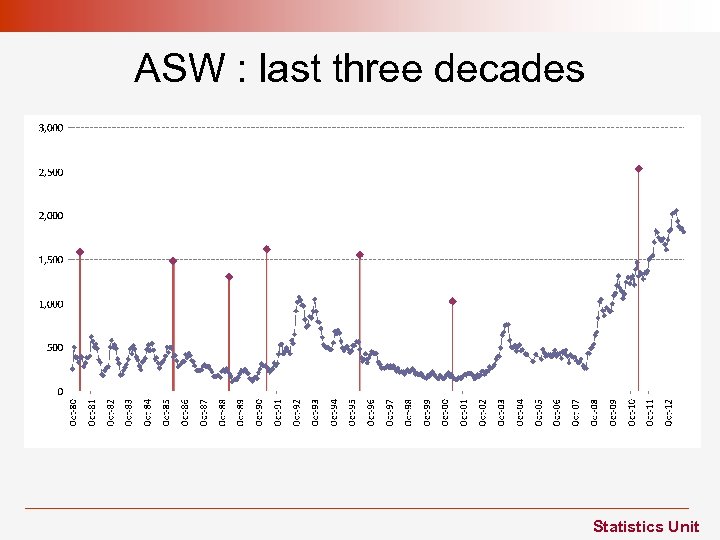

ASW : last three decades Statistics Unit

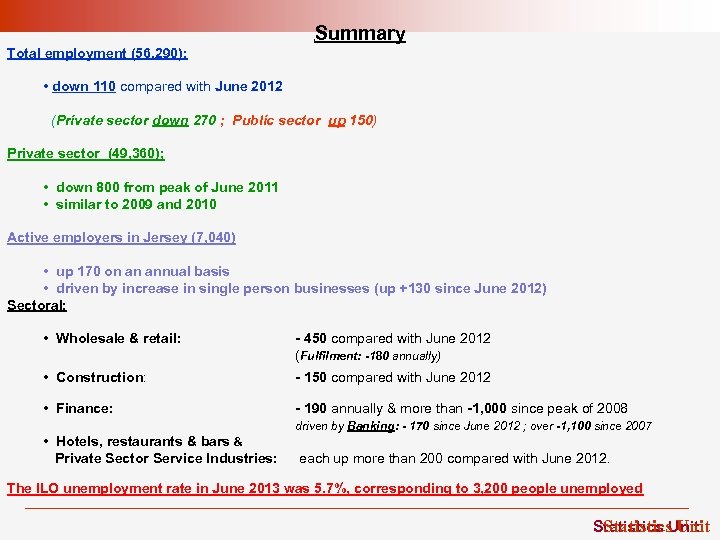

Summary Total employment (56, 290); • down 110 compared with June 2012 (Private sector down 270 ; Public sector up 150) Private sector (49, 360); • down 800 from peak of June 2011 • similar to 2009 and 2010 Active employers in Jersey (7, 040) • up 170 on an annual basis • driven by increase in single person businesses (up +130 since June 2012) Sectoral; • Wholesale & retail: - 450 compared with June 2012 (Fulfilment: -180 annually) • Construction: - 150 compared with June 2012 • Finance: - 190 annually & more than -1, 000 since peak of 2008 driven by Banking: - 170 since June 2012 ; over -1, 100 since 2007 • Hotels, restaurants & bars & Private Sector Service Industries: each up more than 200 compared with June 2012. The ILO unemployment rate in June 2013 was 5. 7%, corresponding to 3, 200 people unemployed Statistics Unit

GVA per capita comparison with UK GVA per capita 2012: Jersey £ 36, 700 UK £ 21, 900 => Jersey about two-thirds greater GVA per capita than UK Real-term change 2008 -2012 Jersey down 21% UK regions (2011) London South East England Scotland South West Other regions Northern Ireland North East England Wales UK down 7% £ 35, 600 £ 22, 400 £ 21, 300 £ 20, 600 £ 19, 100 £ 17, 000 - £ 19, 000 £ 16, 500 £ 15, 800 £ 15, 700 Statistics Unit

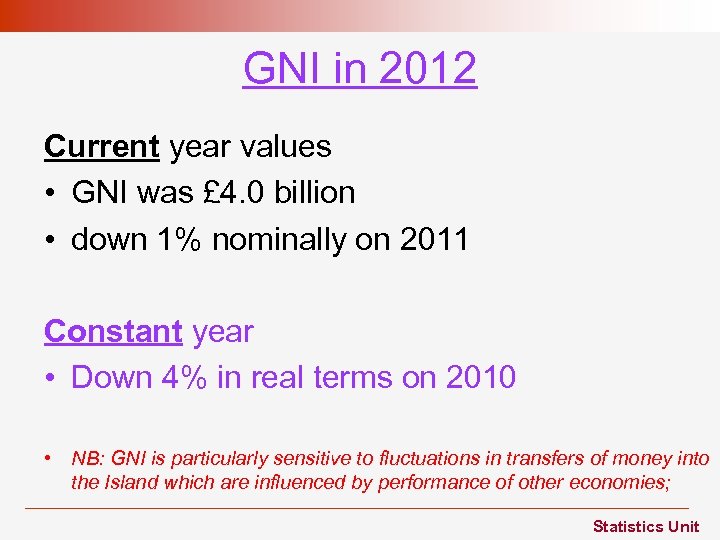

GNI in 2012 Current year values • GNI was £ 4. 0 billion • down 1% nominally on 2011 Constant year • Down 4% in real terms on 2010 • NB: GNI is particularly sensitive to fluctuations in transfers of money into the Island which are influenced by performance of other economies; Statistics Unit

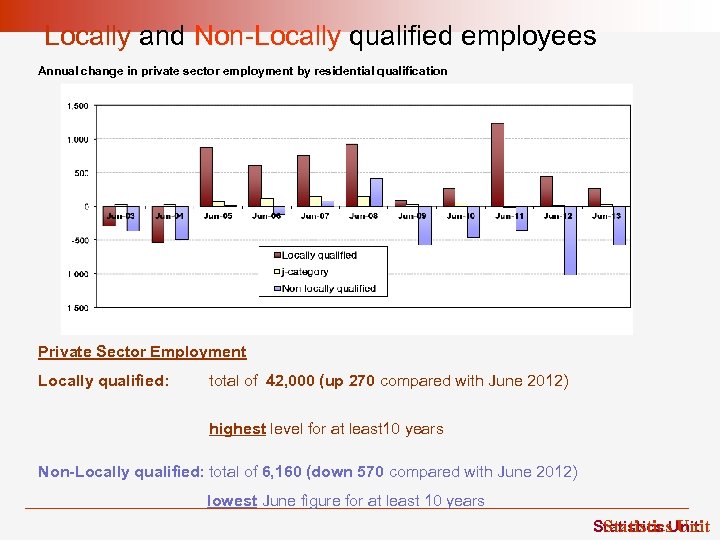

Locally and Non-Locally qualified employees Annual change in private sector employment by residential qualification Private Sector Employment Locally qualified: total of 42, 000 (up 270 compared with June 2012) highest level for at least 10 years Non-Locally qualified: total of 6, 160 (down 570 compared with June 2012) lowest June figure for at least 10 years Statistics Unit

Employment by nationality June 2013: • 69% of contributions from Jersey/UK nationals • A 8 country nationals (3, 220) down 260 compared with June 2012 • driven by reduction in Polish nationals (down 240) • Portuguese nationals (5, 990) up 80 annually Statistics Unit

Long-term ASW Statistics Unit

544033aeb934d98374be90621ee325de.ppt