51d26ef2964d81ac149edc6425f268b8.ppt

- Количество слайдов: 47

Japan Updates, and draft EAEF Scenarios Kae Takase (Governance Design Lab. ) Tatsujiro Suzuki (CRIEPI) EAEF Workshop, Beijing China, May. 12 -14, 2004

Japan Updates, and draft EAEF Scenarios Kae Takase (Governance Design Lab. ) Tatsujiro Suzuki (CRIEPI) EAEF Workshop, Beijing China, May. 12 -14, 2004

Outline v Updates of latest statistics v Feature of new government outlook v NGO outlook v EAEF Japan Scenarios v BAU, National Alternative, and Regional Alternative v Concept of scenarios v Results v Discussion topics

Outline v Updates of latest statistics v Feature of new government outlook v NGO outlook v EAEF Japan Scenarios v BAU, National Alternative, and Regional Alternative v Concept of scenarios v Results v Discussion topics

Topics in Energy Policies v “Energy policy basic law” is now leading Japan to more nuclear-friendly country. v Nuclear fuel cycle is at the crossroad (stop before active test? ) v RPS law is interrupting fine diffusion of renewable energy v Turn back in deregulation. v Compliance of Kyoto Protocol (2008 -2012) is difficult.

Topics in Energy Policies v “Energy policy basic law” is now leading Japan to more nuclear-friendly country. v Nuclear fuel cycle is at the crossroad (stop before active test? ) v RPS law is interrupting fine diffusion of renewable energy v Turn back in deregulation. v Compliance of Kyoto Protocol (2008 -2012) is difficult.

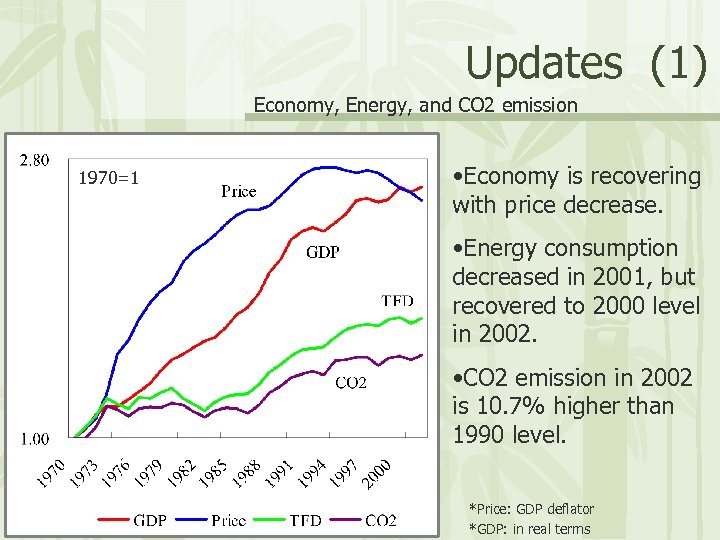

Updates (1) Economy, Energy, and CO 2 emission 1970=1 • Economy is recovering with price decrease. • Energy consumption decreased in 2001, but recovered to 2000 level in 2002. • CO 2 emission in 2002 is 10. 7% higher than 1990 level. *Price: GDP deflator *GDP: in real terms

Updates (1) Economy, Energy, and CO 2 emission 1970=1 • Economy is recovering with price decrease. • Energy consumption decreased in 2001, but recovered to 2000 level in 2002. • CO 2 emission in 2002 is 10. 7% higher than 1990 level. *Price: GDP deflator *GDP: in real terms

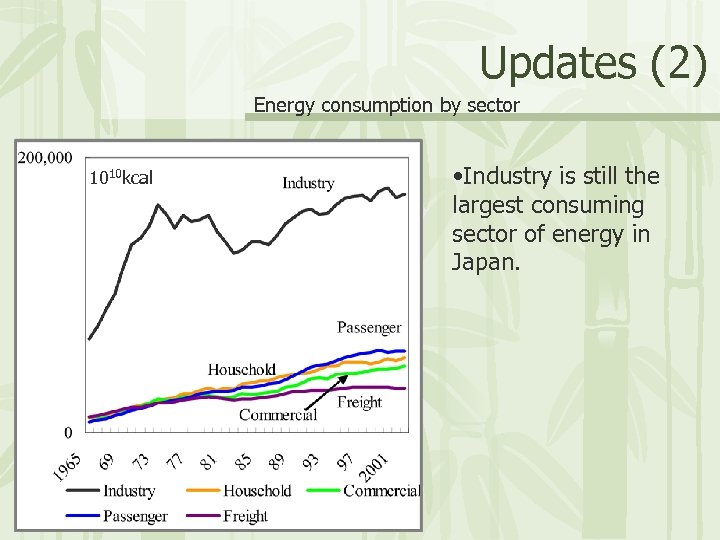

Updates (2) Energy consumption by sector 1010 kcal • Industry is still the largest consuming sector of energy in Japan.

Updates (2) Energy consumption by sector 1010 kcal • Industry is still the largest consuming sector of energy in Japan.

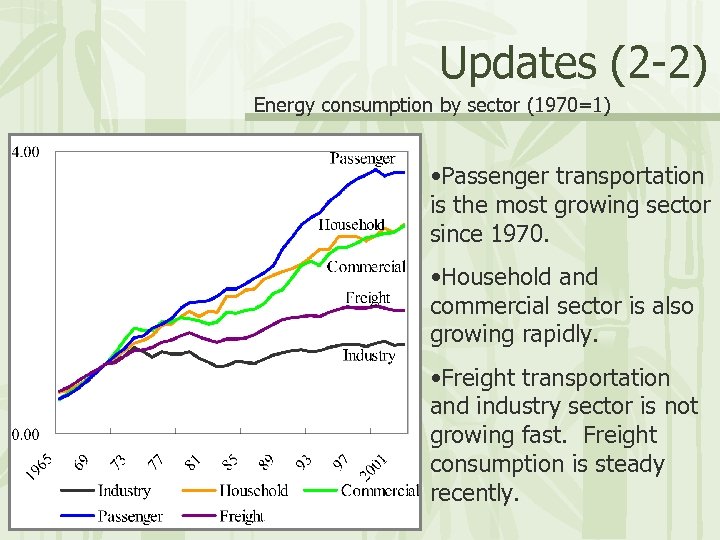

Updates (2 -2) Energy consumption by sector (1970=1) • Passenger transportation is the most growing sector since 1970. • Household and commercial sector is also growing rapidly. • Freight transportation and industry sector is not growing fast. Freight consumption is steady recently.

Updates (2 -2) Energy consumption by sector (1970=1) • Passenger transportation is the most growing sector since 1970. • Household and commercial sector is also growing rapidly. • Freight transportation and industry sector is not growing fast. Freight consumption is steady recently.

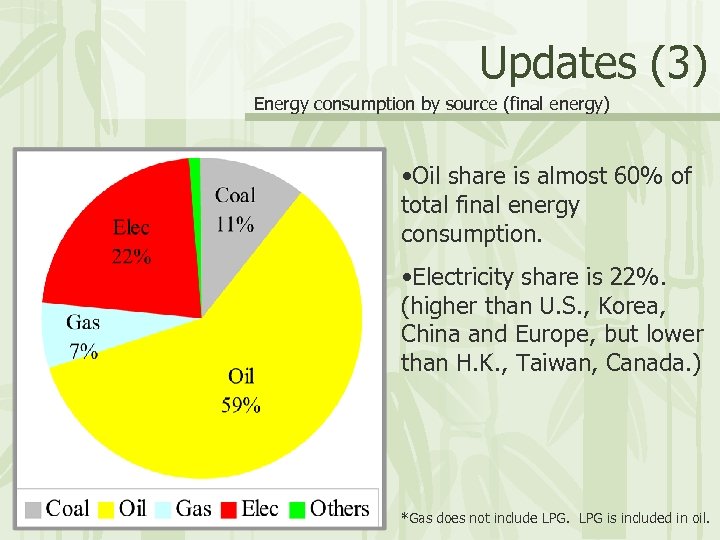

Updates (3) Energy consumption by source (final energy) • Oil share is almost 60% of total final energy consumption. • Electricity share is 22%. (higher than U. S. , Korea, China and Europe, but lower than H. K. , Taiwan, Canada. ) *Gas does not include LPG is included in oil.

Updates (3) Energy consumption by source (final energy) • Oil share is almost 60% of total final energy consumption. • Electricity share is 22%. (higher than U. S. , Korea, China and Europe, but lower than H. K. , Taiwan, Canada. ) *Gas does not include LPG is included in oil.

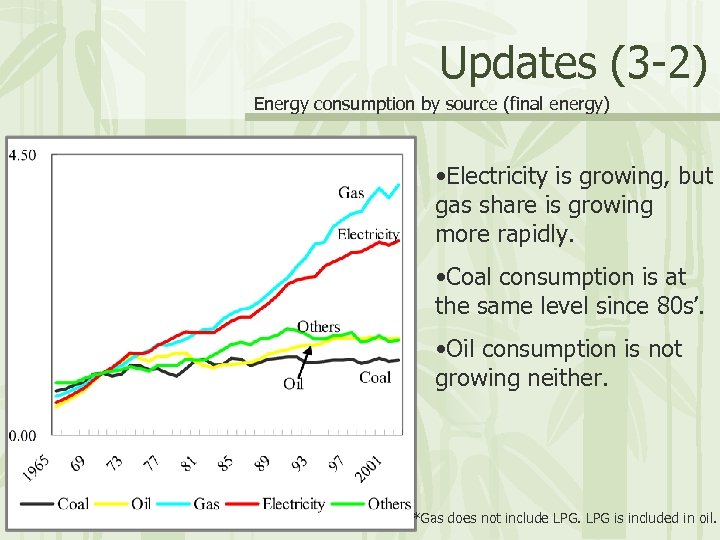

Updates (3 -2) Energy consumption by source (final energy) • Electricity is growing, but gas share is growing more rapidly. • Coal consumption is at the same level since 80 s’. • Oil consumption is not growing neither. *Gas does not include LPG is included in oil.

Updates (3 -2) Energy consumption by source (final energy) • Electricity is growing, but gas share is growing more rapidly. • Coal consumption is at the same level since 80 s’. • Oil consumption is not growing neither. *Gas does not include LPG is included in oil.

New government outlook v Intermediate outlook will be published on May 17 th. v Outlook will be calculated up to 2030. v Economic growth assumption and energy demand by sector is published in Feb.

New government outlook v Intermediate outlook will be published on May 17 th. v Outlook will be calculated up to 2030. v Economic growth assumption and energy demand by sector is published in Feb.

Economic Growth

Economic Growth

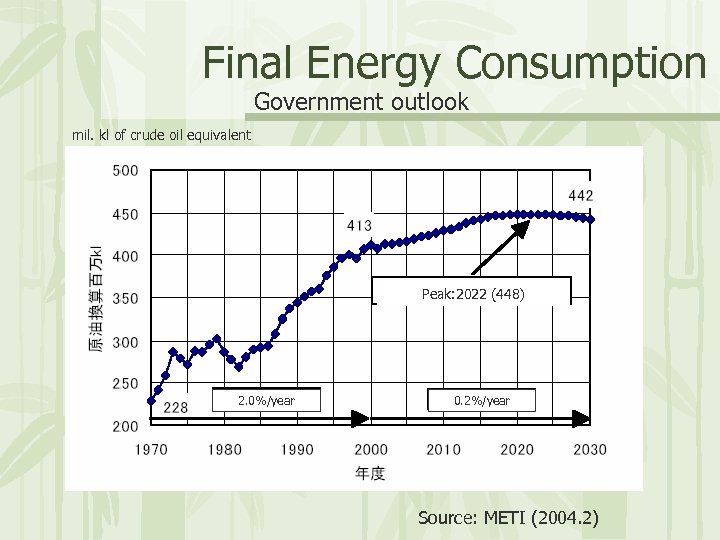

Final Energy Consumption Government outlook mil. kl of crude oil equivalent Peak: 2022 (448) 2. 0%/year 0. 2%/year Source: METI (2004. 2)

Final Energy Consumption Government outlook mil. kl of crude oil equivalent Peak: 2022 (448) 2. 0%/year 0. 2%/year Source: METI (2004. 2)

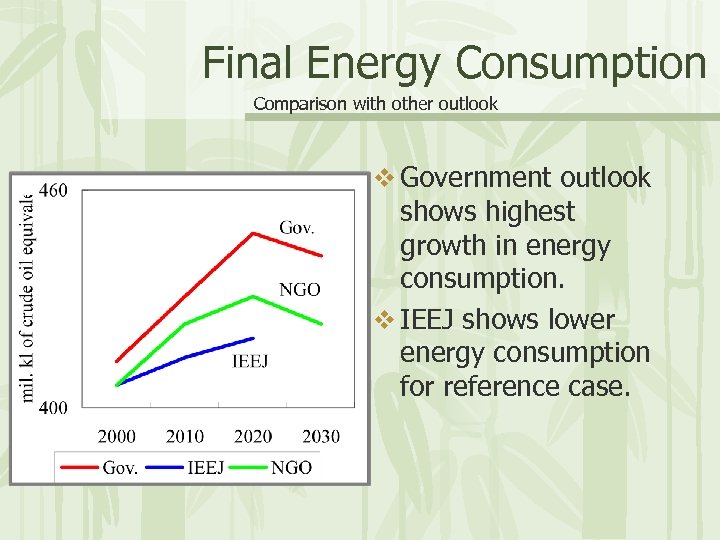

Final Energy Consumption Comparison with other outlook v Government outlook shows highest growth in energy consumption. v IEEJ shows lower energy consumption for reference case.

Final Energy Consumption Comparison with other outlook v Government outlook shows highest growth in energy consumption. v IEEJ shows lower energy consumption for reference case.

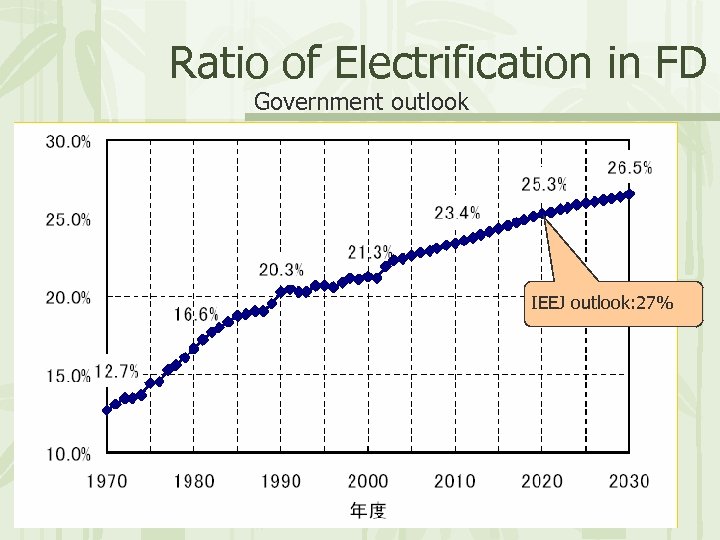

Ratio of Electrification in FD Government outlook IEEJ outlook: 27%

Ratio of Electrification in FD Government outlook IEEJ outlook: 27%

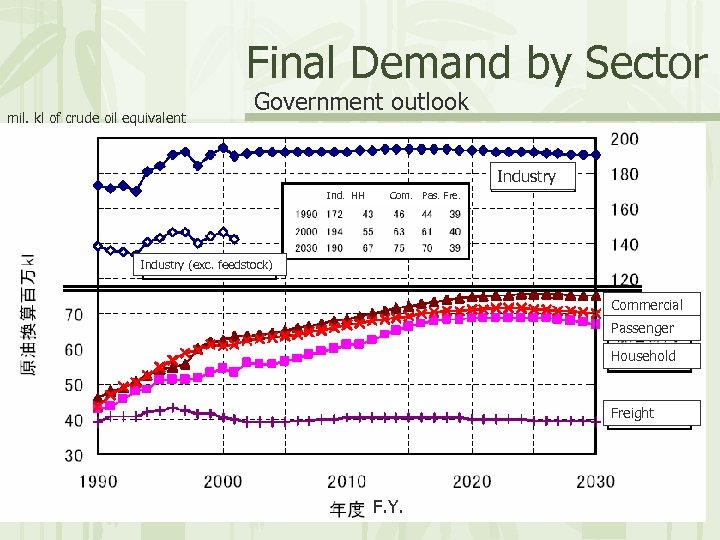

Final Demand by Sector mil. kl of crude oil equivalent Government outlook Industry Ind. HH Com. Pas. Fre. Industry (exc. feedstock) Commercial Passenger Household Freight F. Y.

Final Demand by Sector mil. kl of crude oil equivalent Government outlook Industry Ind. HH Com. Pas. Fre. Industry (exc. feedstock) Commercial Passenger Household Freight F. Y.

Comment by Government v Energy demand will not grow as it did in 1990 s even in high economic growth case. v. Government’s assumption of economic growth is much higher than that of IEEJ and NGO. v Calculated energy demand differs 10% by different economic assumption. Electricity demand differs 20%.

Comment by Government v Energy demand will not grow as it did in 1990 s even in high economic growth case. v. Government’s assumption of economic growth is much higher than that of IEEJ and NGO. v Calculated energy demand differs 10% by different economic assumption. Electricity demand differs 20%.

Comparison with IEEJ and NGO v Government assumption of economic growth is much higher than that of IEEJ and NGO. v Calculated energy demand by government is higher than that of IEEJ and NGO. IEEJ shows lowest energy demand.

Comparison with IEEJ and NGO v Government assumption of economic growth is much higher than that of IEEJ and NGO. v Calculated energy demand by government is higher than that of IEEJ and NGO. IEEJ shows lowest energy demand.

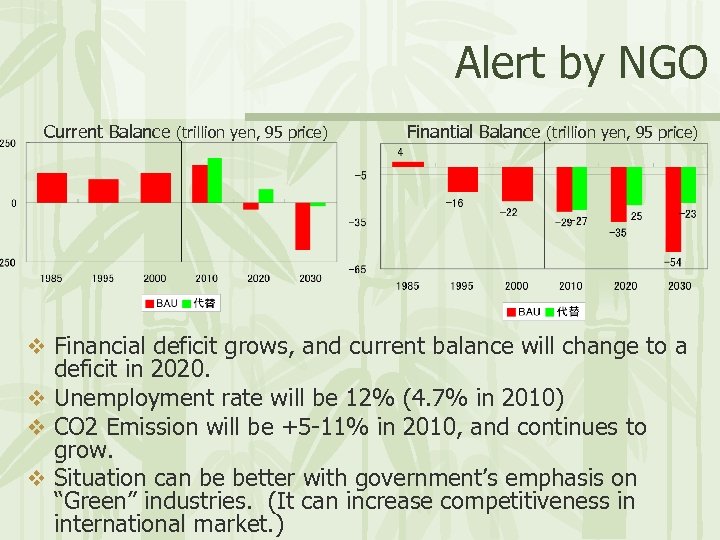

Alert by NGO Current Balance (trillion yen, 95 price) Finantial Balance (trillion yen, 95 price) v Financial deficit grows, and current balance will change to a deficit in 2020. v Unemployment rate will be 12% (4. 7% in 2010) v CO 2 Emission will be +5 -11% in 2010, and continues to grow. v Situation can be better with government’s emphasis on “Green” industries. (It can increase competitiveness in international market. )

Alert by NGO Current Balance (trillion yen, 95 price) Finantial Balance (trillion yen, 95 price) v Financial deficit grows, and current balance will change to a deficit in 2020. v Unemployment rate will be 12% (4. 7% in 2010) v CO 2 Emission will be +5 -11% in 2010, and continues to grow. v Situation can be better with government’s emphasis on “Green” industries. (It can increase competitiveness in international market. )

EAEF Scenarios 1. Reference Activity Level, Unit consumption, share of each energy source: IEEJ v Renewable energy: ISEP study v 2. National Alternative v 3. Reference + energy conservation (WWF) + more renewables (ISEP) + elec. generation composition by sources (WWF) Regional Alternative Oil pipeline, Natural Gas pipeline, Electricity import v For nuclear and renewables & conservation cooperation (only affect to the cost) v

EAEF Scenarios 1. Reference Activity Level, Unit consumption, share of each energy source: IEEJ v Renewable energy: ISEP study v 2. National Alternative v 3. Reference + energy conservation (WWF) + more renewables (ISEP) + elec. generation composition by sources (WWF) Regional Alternative Oil pipeline, Natural Gas pipeline, Electricity import v For nuclear and renewables & conservation cooperation (only affect to the cost) v

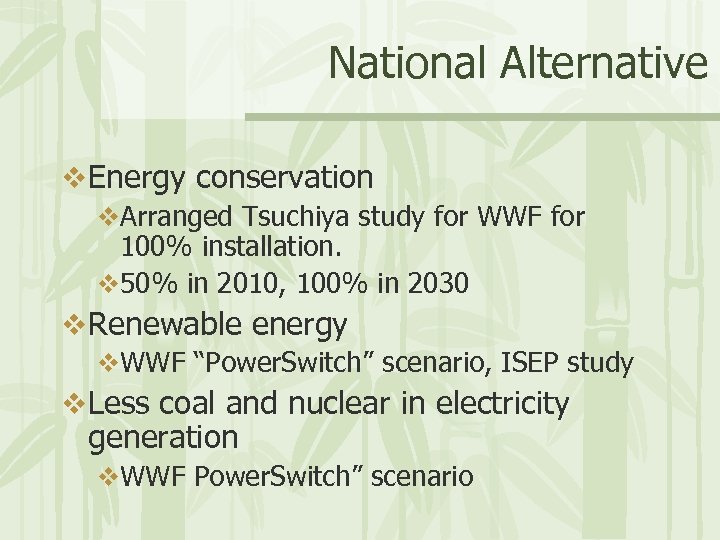

National Alternative v Energy conservation v. Arranged Tsuchiya study for WWF for 100% installation. v 50% in 2010, 100% in 2030 v Renewable energy v. WWF “Power. Switch” scenario, ISEP study v Less coal and nuclear in electricity generation v. WWF Power. Switch” scenario

National Alternative v Energy conservation v. Arranged Tsuchiya study for WWF for 100% installation. v 50% in 2010, 100% in 2030 v Renewable energy v. WWF “Power. Switch” scenario, ISEP study v Less coal and nuclear in electricity generation v. WWF Power. Switch” scenario

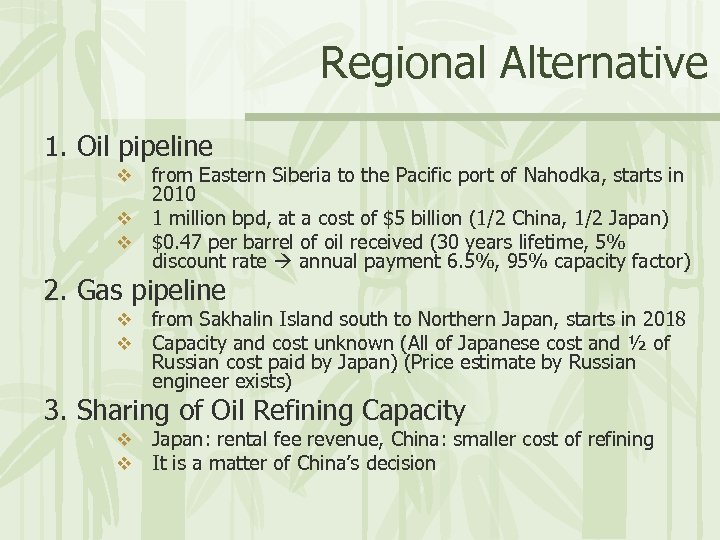

Regional Alternative 1. Oil pipeline from Eastern Siberia to the Pacific port of Nahodka, starts in 2010 v 1 million bpd, at a cost of $5 billion (1/2 China, 1/2 Japan) v $0. 47 per barrel of oil received (30 years lifetime, 5% discount rate annual payment 6. 5%, 95% capacity factor) v 2. Gas pipeline v v from Sakhalin Island south to Northern Japan, starts in 2018 Capacity and cost unknown (All of Japanese cost and ½ of Russian cost paid by Japan) (Price estimate by Russian engineer exists) 3. Sharing of Oil Refining Capacity v v Japan: rental fee revenue, China: smaller cost of refining It is a matter of China’s decision

Regional Alternative 1. Oil pipeline from Eastern Siberia to the Pacific port of Nahodka, starts in 2010 v 1 million bpd, at a cost of $5 billion (1/2 China, 1/2 Japan) v $0. 47 per barrel of oil received (30 years lifetime, 5% discount rate annual payment 6. 5%, 95% capacity factor) v 2. Gas pipeline v v from Sakhalin Island south to Northern Japan, starts in 2018 Capacity and cost unknown (All of Japanese cost and ½ of Russian cost paid by Japan) (Price estimate by Russian engineer exists) 3. Sharing of Oil Refining Capacity v v Japan: rental fee revenue, China: smaller cost of refining It is a matter of China’s decision

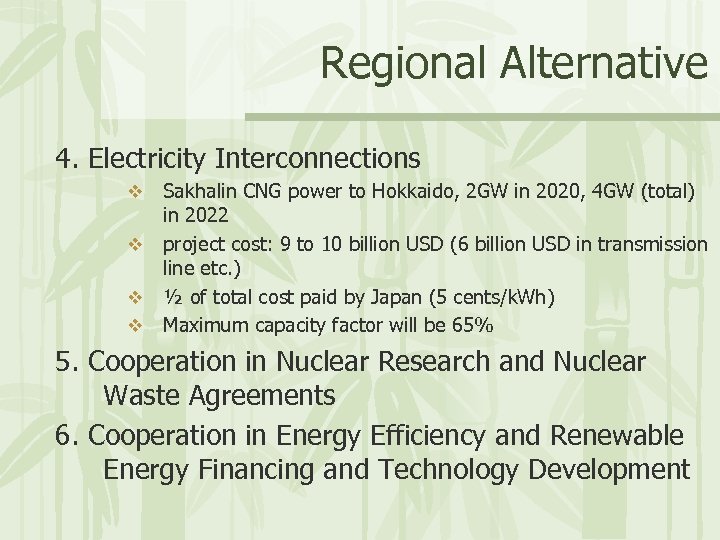

Regional Alternative 4. Electricity Interconnections Sakhalin CNG power to Hokkaido, 2 GW in 2020, 4 GW (total) in 2022 v project cost: 9 to 10 billion USD (6 billion USD in transmission line etc. ) v ½ of total cost paid by Japan (5 cents/k. Wh) v Maximum capacity factor will be 65% v 5. Cooperation in Nuclear Research and Nuclear Waste Agreements 6. Cooperation in Energy Efficiency and Renewable Energy Financing and Technology Development

Regional Alternative 4. Electricity Interconnections Sakhalin CNG power to Hokkaido, 2 GW in 2020, 4 GW (total) in 2022 v project cost: 9 to 10 billion USD (6 billion USD in transmission line etc. ) v ½ of total cost paid by Japan (5 cents/k. Wh) v Maximum capacity factor will be 65% v 5. Cooperation in Nuclear Research and Nuclear Waste Agreements 6. Cooperation in Energy Efficiency and Renewable Energy Financing and Technology Development

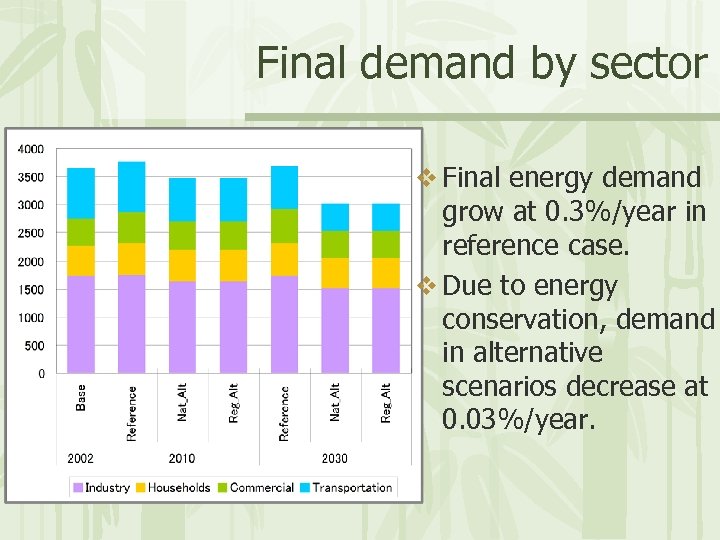

Final demand by sector v Final energy demand grow at 0. 3%/year in reference case. v Due to energy conservation, demand in alternative scenarios decrease at 0. 03%/year.

Final demand by sector v Final energy demand grow at 0. 3%/year in reference case. v Due to energy conservation, demand in alternative scenarios decrease at 0. 03%/year.

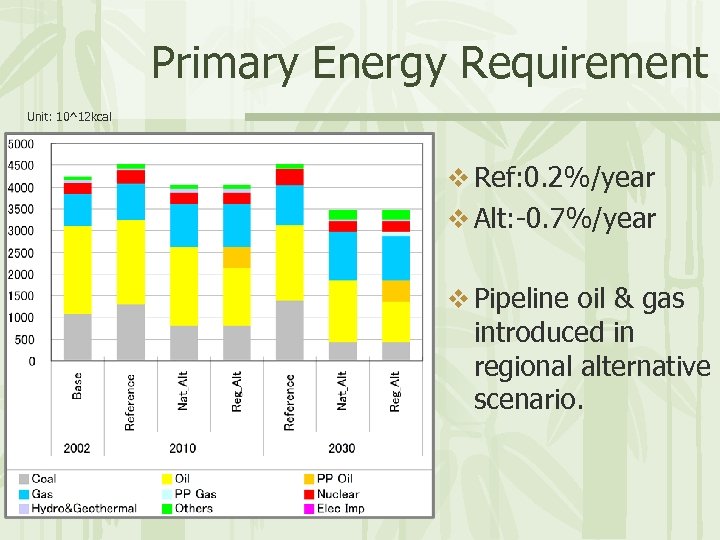

Primary Energy Requirement Unit: 10^12 kcal v Ref: 0. 2%/year v Alt: -0. 7%/year v Pipeline oil & gas introduced in regional alternative scenario.

Primary Energy Requirement Unit: 10^12 kcal v Ref: 0. 2%/year v Alt: -0. 7%/year v Pipeline oil & gas introduced in regional alternative scenario.

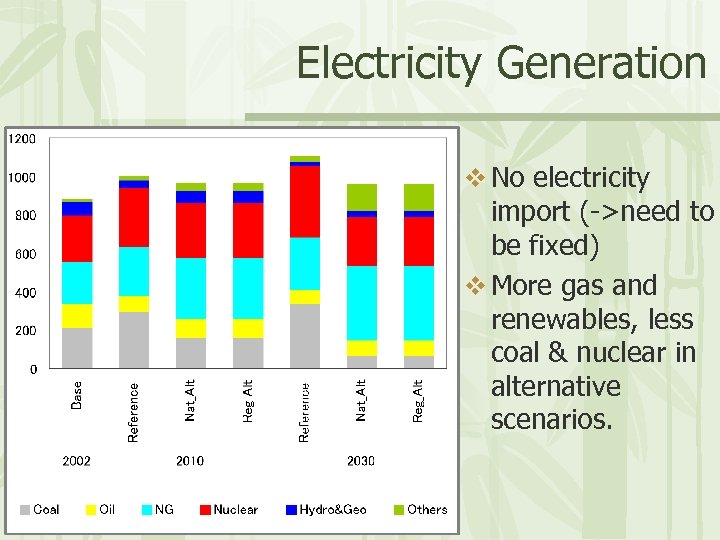

Electricity Generation v No electricity import (->need to be fixed) v More gas and renewables, less coal & nuclear in alternative scenarios.

Electricity Generation v No electricity import (->need to be fixed) v More gas and renewables, less coal & nuclear in alternative scenarios.

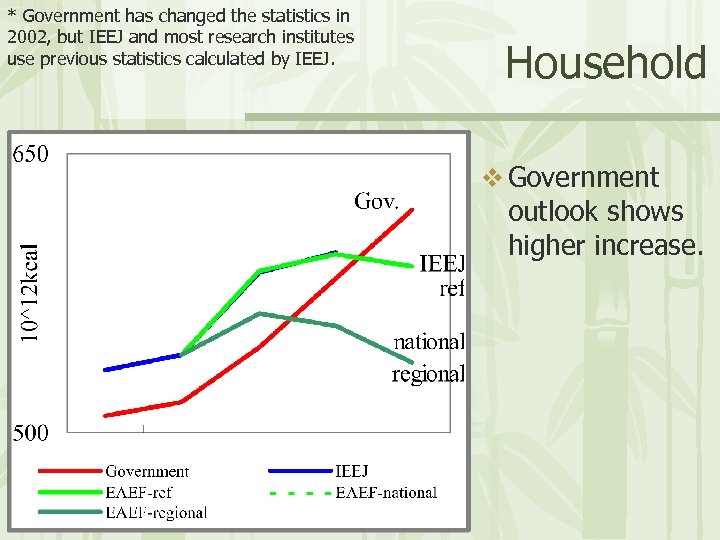

* Government has changed the statistics in 2002, but IEEJ and most research institutes use previous statistics calculated by IEEJ. Household v Government outlook shows higher increase.

* Government has changed the statistics in 2002, but IEEJ and most research institutes use previous statistics calculated by IEEJ. Household v Government outlook shows higher increase.

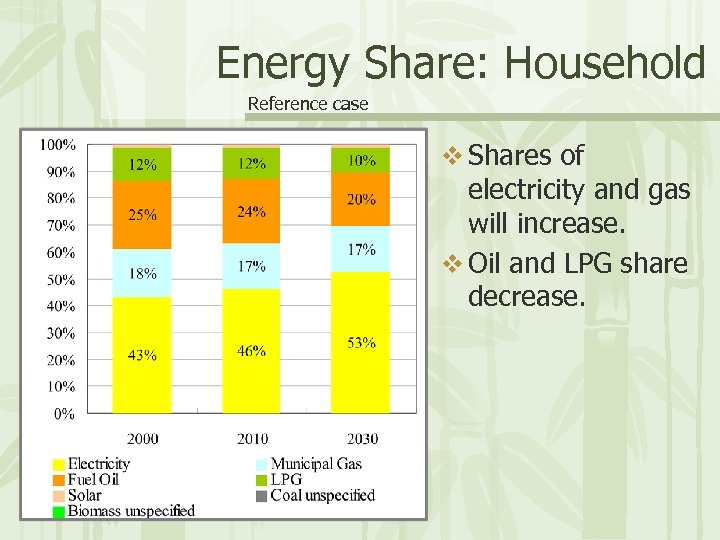

Energy Share: Household Reference case v Shares of electricity and gas will increase. v Oil and LPG share decrease.

Energy Share: Household Reference case v Shares of electricity and gas will increase. v Oil and LPG share decrease.

Energy Conservation: Household v LCD TV, LCD PC, double efficiency refrigerator, diminish stand-by electricity loss v replace boilers to supply hot water to ones with latent heat recovery system v passive solar (heat, hot water) v efficient gas table v change incandescent lamp to fluorescent lamp v installation of dishwasher 50% in 2020, 100% in 2030

Energy Conservation: Household v LCD TV, LCD PC, double efficiency refrigerator, diminish stand-by electricity loss v replace boilers to supply hot water to ones with latent heat recovery system v passive solar (heat, hot water) v efficient gas table v change incandescent lamp to fluorescent lamp v installation of dishwasher 50% in 2020, 100% in 2030

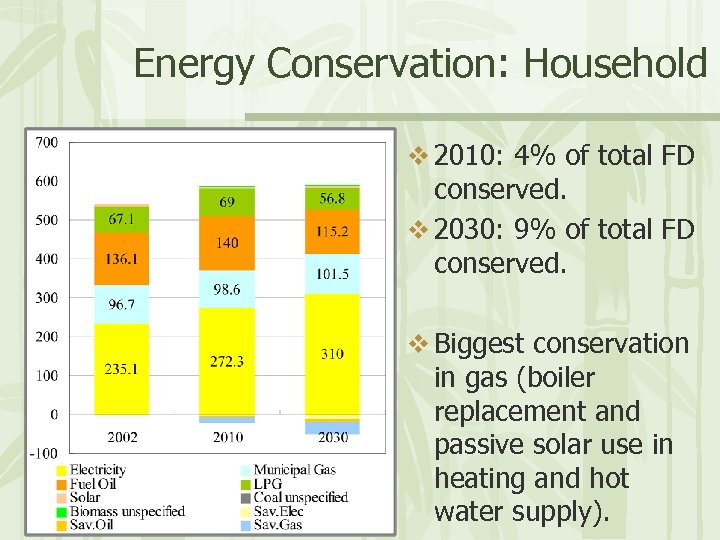

Energy Conservation: Household v 2010: 4% of total FD conserved. v 2030: 9% of total FD conserved. v Biggest conservation in gas (boiler replacement and passive solar use in heating and hot water supply).

Energy Conservation: Household v 2010: 4% of total FD conserved. v 2030: 9% of total FD conserved. v Biggest conservation in gas (boiler replacement and passive solar use in heating and hot water supply).

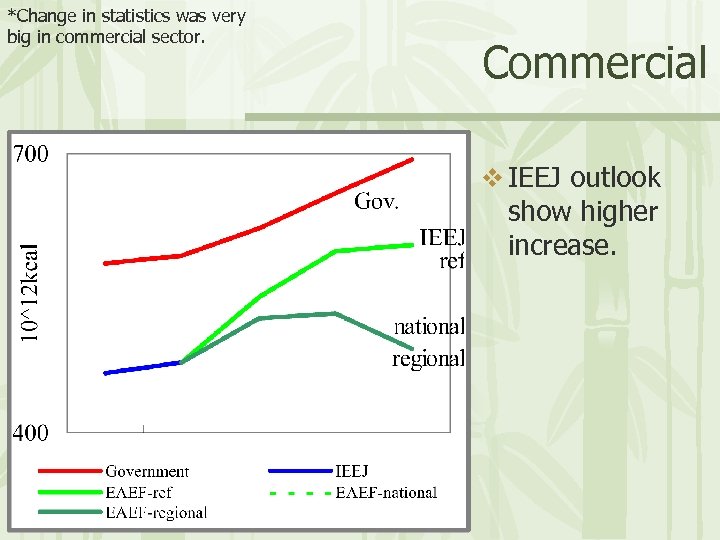

*Change in statistics was very big in commercial sector. Commercial v IEEJ outlook show higher increase.

*Change in statistics was very big in commercial sector. Commercial v IEEJ outlook show higher increase.

Energy Share: Commercial Reference case v Shares of electricity and gas will increase. v Oil and LPG share decrease.

Energy Share: Commercial Reference case v Shares of electricity and gas will increase. v Oil and LPG share decrease.

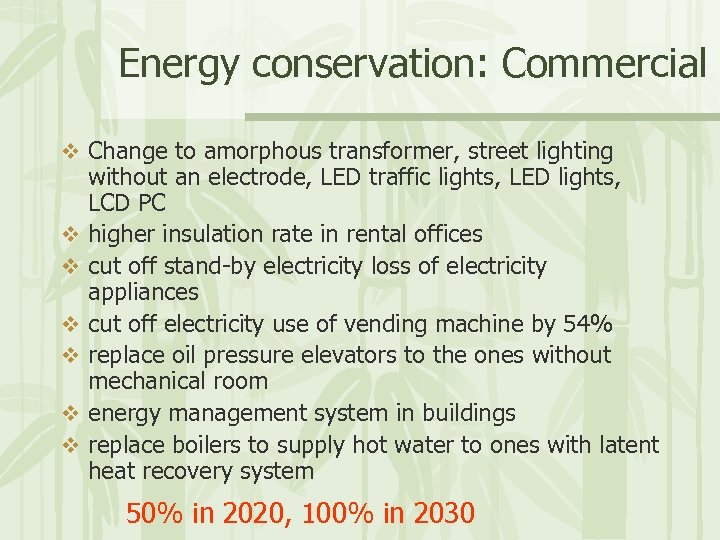

Energy conservation: Commercial v Change to amorphous transformer, street lighting v v v without an electrode, LED traffic lights, LED lights, LCD PC higher insulation rate in rental offices cut off stand-by electricity loss of electricity appliances cut off electricity use of vending machine by 54% replace oil pressure elevators to the ones without mechanical room energy management system in buildings replace boilers to supply hot water to ones with latent heat recovery system 50% in 2020, 100% in 2030

Energy conservation: Commercial v Change to amorphous transformer, street lighting v v v without an electrode, LED traffic lights, LED lights, LCD PC higher insulation rate in rental offices cut off stand-by electricity loss of electricity appliances cut off electricity use of vending machine by 54% replace oil pressure elevators to the ones without mechanical room energy management system in buildings replace boilers to supply hot water to ones with latent heat recovery system 50% in 2020, 100% in 2030

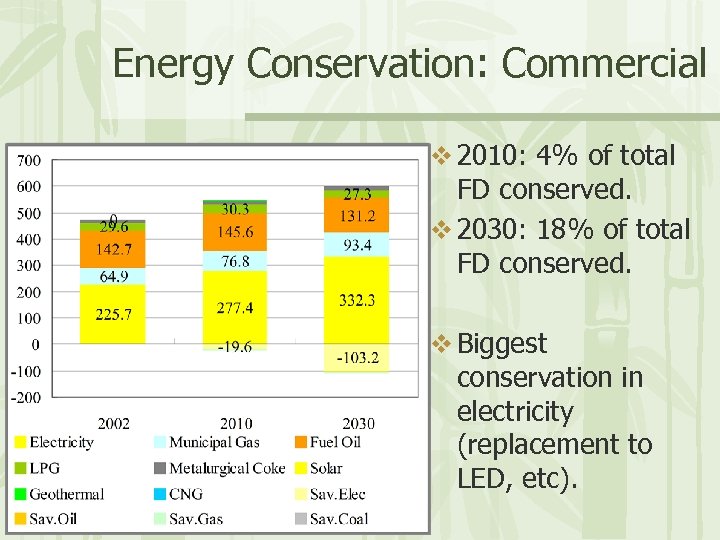

Energy Conservation: Commercial v 2010: 4% of total FD conserved. v 2030: 18% of total FD conserved. v Biggest conservation in electricity (replacement to LED, etc).

Energy Conservation: Commercial v 2010: 4% of total FD conserved. v 2030: 18% of total FD conserved. v Biggest conservation in electricity (replacement to LED, etc).

Transportation v Government assumes growing energy consumption in transportation sector, but IEEJ assumes decrease since 2010.

Transportation v Government assumes growing energy consumption in transportation sector, but IEEJ assumes decrease since 2010.

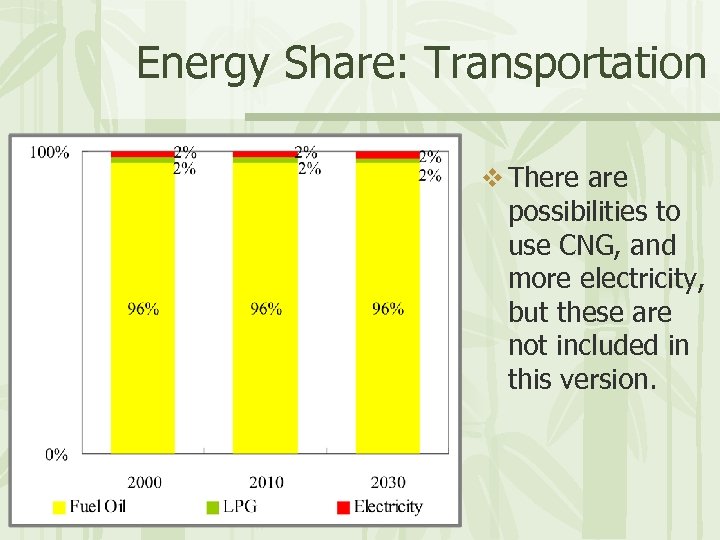

Energy Share: Transportation v There are possibilities to use CNG, and more electricity, but these are not included in this version.

Energy Share: Transportation v There are possibilities to use CNG, and more electricity, but these are not included in this version.

Energy Conservation: Transportation v Tax reform for smaller cars v Share of double efficiency cars (hybrid, fuel cell) will be 60% in 2030 50% in 2020, 100% in 2030

Energy Conservation: Transportation v Tax reform for smaller cars v Share of double efficiency cars (hybrid, fuel cell) will be 60% in 2030 50% in 2020, 100% in 2030

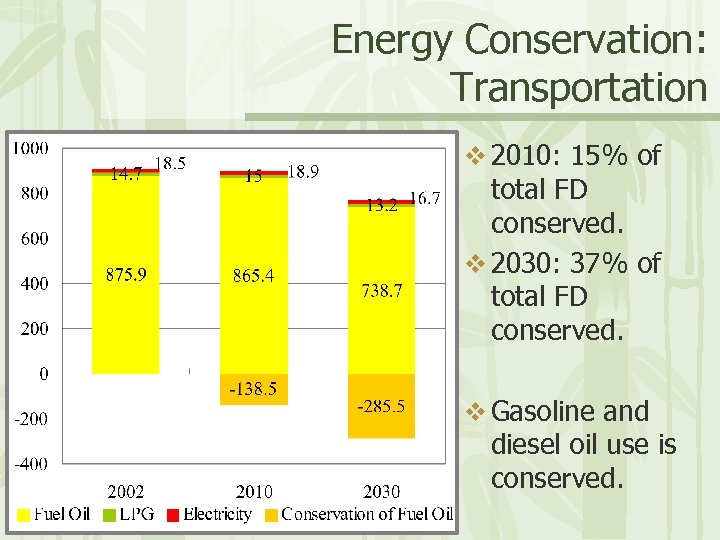

Energy Conservation: Transportation v 2010: 15% of total FD conserved. v 2030: 37% of total FD conserved. v Gasoline and diesel oil use is conserved.

Energy Conservation: Transportation v 2010: 15% of total FD conserved. v 2030: 37% of total FD conserved. v Gasoline and diesel oil use is conserved.

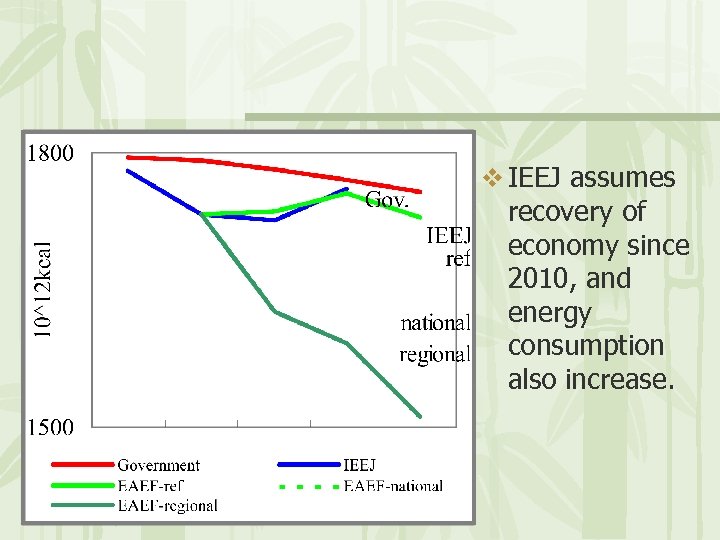

v IEEJ assumes recovery of economy since 2010, and energy consumption also increase.

v IEEJ assumes recovery of economy since 2010, and energy consumption also increase.

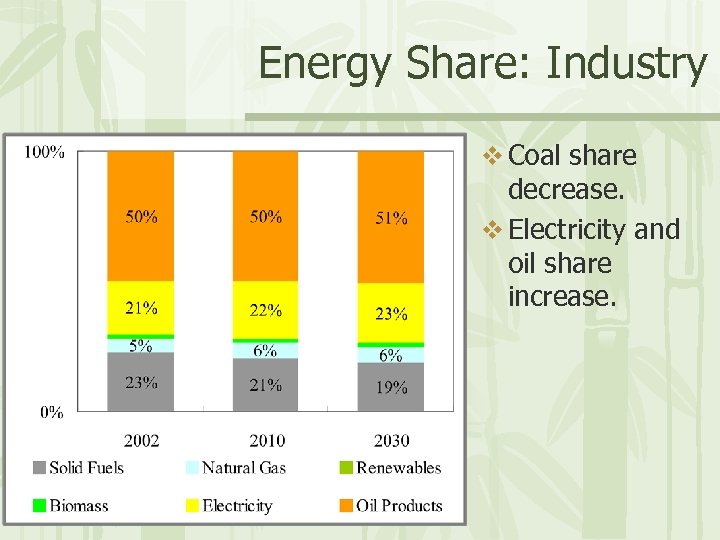

Energy Share: Industry v Coal share decrease. v Electricity and oil share increase.

Energy Share: Industry v Coal share decrease. v Electricity and oil share increase.

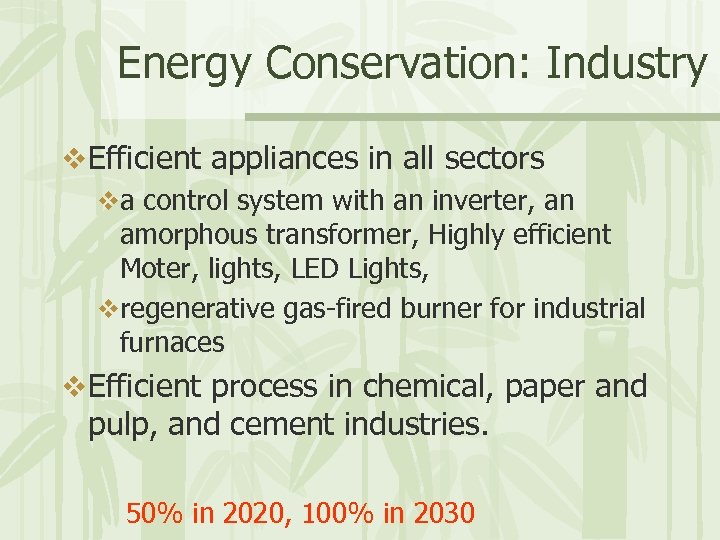

Energy Conservation: Industry v Efficient appliances in all sectors va control system with an inverter, an amorphous transformer, Highly efficient Moter, lights, LED Lights, vregenerative gas-fired burner for industrial furnaces v Efficient process in chemical, paper and pulp, and cement industries. 50% in 2020, 100% in 2030

Energy Conservation: Industry v Efficient appliances in all sectors va control system with an inverter, an amorphous transformer, Highly efficient Moter, lights, LED Lights, vregenerative gas-fired burner for industrial furnaces v Efficient process in chemical, paper and pulp, and cement industries. 50% in 2020, 100% in 2030

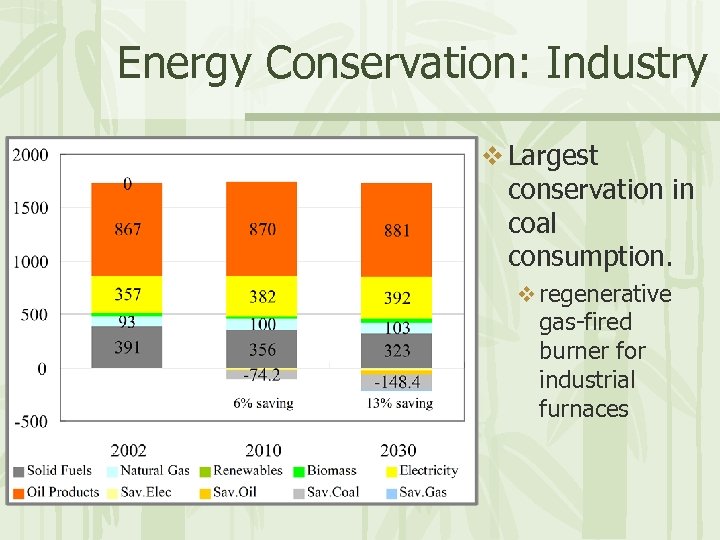

Energy Conservation: Industry v Largest conservation in coal consumption. v regenerative gas-fired burner for industrial furnaces

Energy Conservation: Industry v Largest conservation in coal consumption. v regenerative gas-fired burner for industrial furnaces

Conclusion v Japanese government is in a process of making new outlook to 2030. v. Intermediate report on May 17 th. v. Gov. foresees demand peak will be in 2022 followed by gradual decrease. v Draft EAEF Japan scenarios v. Reference (IEEJ case), National Alternative, and Regional Alternative

Conclusion v Japanese government is in a process of making new outlook to 2030. v. Intermediate report on May 17 th. v. Gov. foresees demand peak will be in 2022 followed by gradual decrease. v Draft EAEF Japan scenarios v. Reference (IEEJ case), National Alternative, and Regional Alternative

Topics for discussion v Cost merit of refinery rental v Cogeneration potential (efficiency factor) v Future of nuclear and renewables

Topics for discussion v Cost merit of refinery rental v Cogeneration potential (efficiency factor) v Future of nuclear and renewables

Major Policy Issues Energy Policy Basic Law v Energy Policy Basic Law(2002. 6. 7 approved) v “Promote non-fossil fuel energy use for environment” v Energy Policy Basic Plan (2003. 10. 17 approved by Cabinet, reported to the Diet) v “Stable supply”: Steady promotion of nuclear and renewable v “Environment”: Improve the use of non-fossil fuel, such as nuclear, photovoltaic, wind, and biomass, improve the use of gas v “Use of market mechanism” : But government should be responsible for “stable supply” and “environment. ” v New “long term outlook” is under construction. v Advisory Committee of Energy will start by the end of 2003. v Final outlook will be determined by March (or June) in 2004.

Major Policy Issues Energy Policy Basic Law v Energy Policy Basic Law(2002. 6. 7 approved) v “Promote non-fossil fuel energy use for environment” v Energy Policy Basic Plan (2003. 10. 17 approved by Cabinet, reported to the Diet) v “Stable supply”: Steady promotion of nuclear and renewable v “Environment”: Improve the use of non-fossil fuel, such as nuclear, photovoltaic, wind, and biomass, improve the use of gas v “Use of market mechanism” : But government should be responsible for “stable supply” and “environment. ” v New “long term outlook” is under construction. v Advisory Committee of Energy will start by the end of 2003. v Final outlook will be determined by March (or June) in 2004.

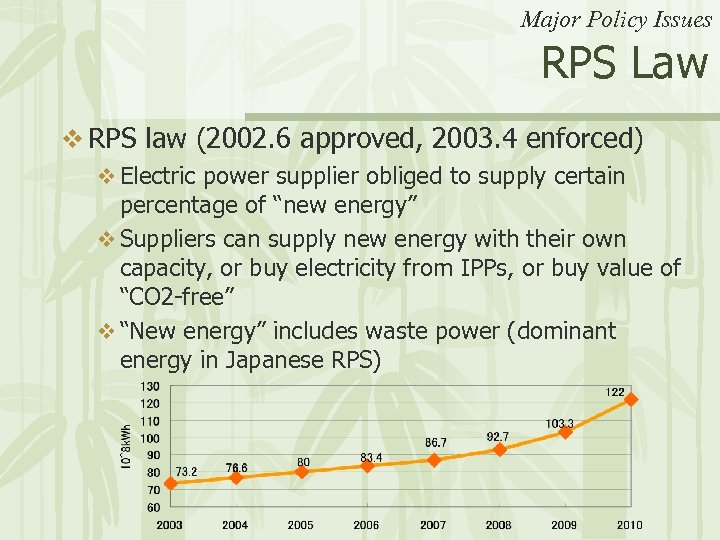

Major Policy Issues RPS Law v RPS law (2002. 6 approved, 2003. 4 enforced) v Electric power supplier obliged to supply certain percentage of “new energy” v Suppliers can supply new energy with their own capacity, or buy electricity from IPPs, or buy value of “CO 2 -free” v “New energy” includes waste power (dominant energy in Japanese RPS)

Major Policy Issues RPS Law v RPS law (2002. 6 approved, 2003. 4 enforced) v Electric power supplier obliged to supply certain percentage of “new energy” v Suppliers can supply new energy with their own capacity, or buy electricity from IPPs, or buy value of “CO 2 -free” v “New energy” includes waste power (dominant energy in Japanese RPS)

Major Policy Issues Concealment of cracks by TEPCO v 2000. 9: former employee of GE reported to METI the alteration of the internal inspection record v 2002. 8: “Nuclear and industrial safety agency” and TEPCO announced, “ 13 plant, 29 data alteration” v (more alternation revealed) v 2002. 9: TEPCO was ordered to stop Fukushima No. 1 plant. v 2003. 4: TEPCO stopped all 17 plants (now 7 working, rest would be restarted by 2004. 3) v 2003. 4 -10 operation rate: 53. 8% (30 point less than last year) v No blackout in the summertime

Major Policy Issues Concealment of cracks by TEPCO v 2000. 9: former employee of GE reported to METI the alteration of the internal inspection record v 2002. 8: “Nuclear and industrial safety agency” and TEPCO announced, “ 13 plant, 29 data alteration” v (more alternation revealed) v 2002. 9: TEPCO was ordered to stop Fukushima No. 1 plant. v 2003. 4: TEPCO stopped all 17 plants (now 7 working, rest would be restarted by 2004. 3) v 2003. 4 -10 operation rate: 53. 8% (30 point less than last year) v No blackout in the summertime

Major Policy Issues Nuclear Fuel Cycle v No more need for NFC v No future for FBR/pluthermal, no more scarcity of uranium v Project cost electricity price v Once started: $90 -130 billion (1 US$=110 yen) 1 cents/k. Wh (nuclear) (Source: Japan v Stop before active test: $40 billion Initiative, 2003. 11) v 2004. 1 - Uranium test (contamination starts) v 2005. 2 - Active test v 2006. 7 - Commercial operation v Whole cycle (2003. 11. 3 The Federation of Electric Power Companies of Japan(? ), 72 years until decommission, mainichi news): $200 billion 2 cents/k. Wh(nuclear) v Problem with used fuel storage for power companies v If the project continues, 5 ton of plutonium per year will be produced in Rokkasho

Major Policy Issues Nuclear Fuel Cycle v No more need for NFC v No future for FBR/pluthermal, no more scarcity of uranium v Project cost electricity price v Once started: $90 -130 billion (1 US$=110 yen) 1 cents/k. Wh (nuclear) (Source: Japan v Stop before active test: $40 billion Initiative, 2003. 11) v 2004. 1 - Uranium test (contamination starts) v 2005. 2 - Active test v 2006. 7 - Commercial operation v Whole cycle (2003. 11. 3 The Federation of Electric Power Companies of Japan(? ), 72 years until decommission, mainichi news): $200 billion 2 cents/k. Wh(nuclear) v Problem with used fuel storage for power companies v If the project continues, 5 ton of plutonium per year will be produced in Rokkasho

Major Policy Issues Deregulation v Retail liberalization v 2001. 3 - : large-scale factories and department store (30% of demand) v 2004 - : +middle-scale factories, office building v 2005 - : +small-scale factories, supermarket (60% of demand) v Turn back of market reforms (midterm report for further reform, 2003. 9) v. Responsible companies for generation- transmission-distribution is vital for stable supply, and nuclear development

Major Policy Issues Deregulation v Retail liberalization v 2001. 3 - : large-scale factories and department store (30% of demand) v 2004 - : +middle-scale factories, office building v 2005 - : +small-scale factories, supermarket (60% of demand) v Turn back of market reforms (midterm report for further reform, 2003. 9) v. Responsible companies for generation- transmission-distribution is vital for stable supply, and nuclear development