January, 2007

January, 2007

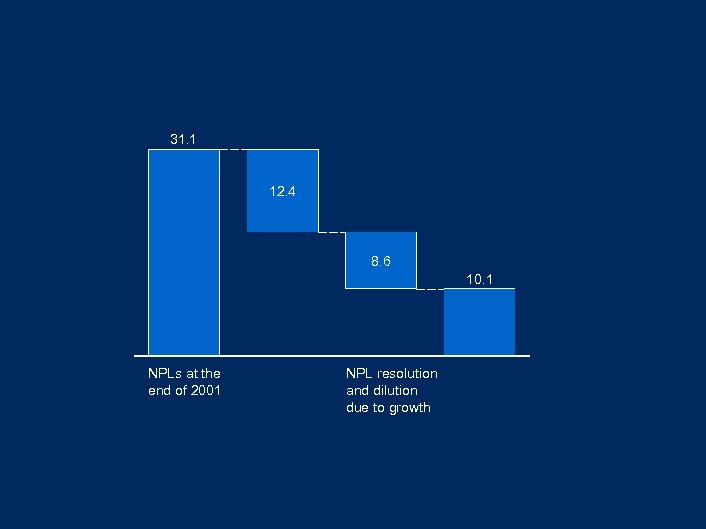

31. 1 12. 4 8. 6 10. 1 NPLs at the end of 2001 NPL resolution and dilution due to growth

31. 1 12. 4 8. 6 10. 1 NPLs at the end of 2001 NPL resolution and dilution due to growth

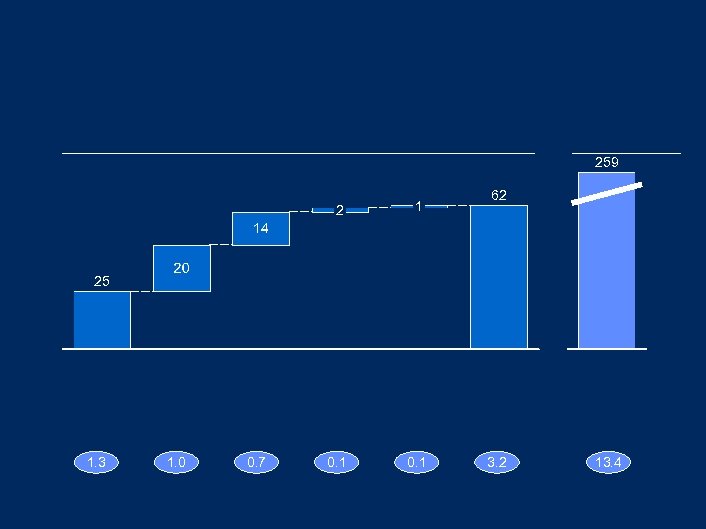

259 2 1 0. 1 62 25 1. 3 1. 0 0. 7 3. 2 13. 4

259 2 1 0. 1 62 25 1. 3 1. 0 0. 7 3. 2 13. 4

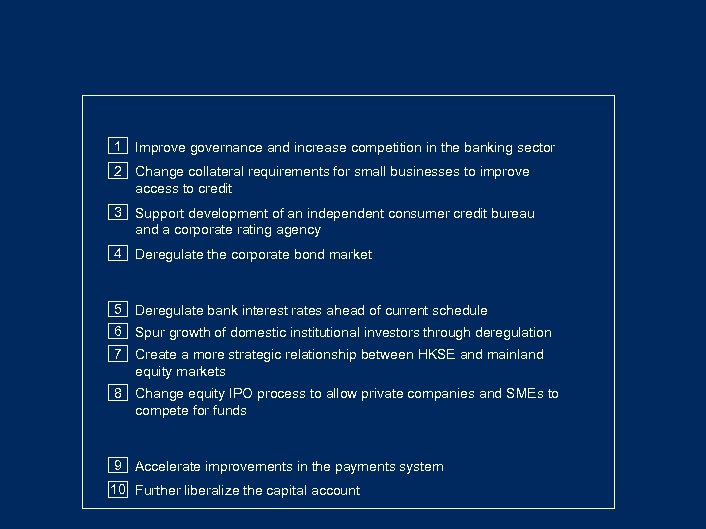

1 Improve governance and increase competition in the banking sector 2 Change collateral requirements for small businesses to improve access to credit 3 Support development of an independent consumer credit bureau and a corporate rating agency 4 Deregulate the corporate bond market 5 Deregulate bank interest rates ahead of current schedule 6 Spur growth of domestic institutional investors through deregulation 7 Create a more strategic relationship between HKSE and mainland equity markets 8 Change equity IPO process to allow private companies and SMEs to compete for funds 9 Accelerate improvements in the payments system 10 Further liberalize the capital account

1 Improve governance and increase competition in the banking sector 2 Change collateral requirements for small businesses to improve access to credit 3 Support development of an independent consumer credit bureau and a corporate rating agency 4 Deregulate the corporate bond market 5 Deregulate bank interest rates ahead of current schedule 6 Spur growth of domestic institutional investors through deregulation 7 Create a more strategic relationship between HKSE and mainland equity markets 8 Change equity IPO process to allow private companies and SMEs to compete for funds 9 Accelerate improvements in the payments system 10 Further liberalize the capital account

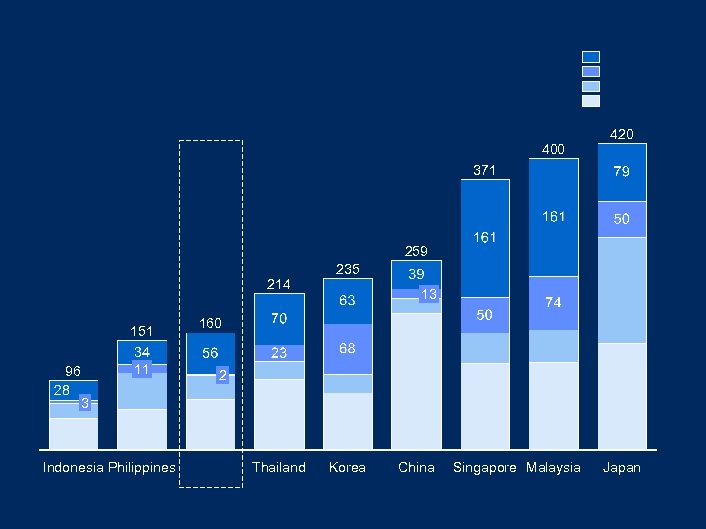

400 420 371 259 214 151 11 96 235 13 160 2 3 Indonesia Philippines Thailand Korea China Singapore Malaysia Japan

400 420 371 259 214 151 11 96 235 13 160 2 3 Indonesia Philippines Thailand Korea China Singapore Malaysia Japan

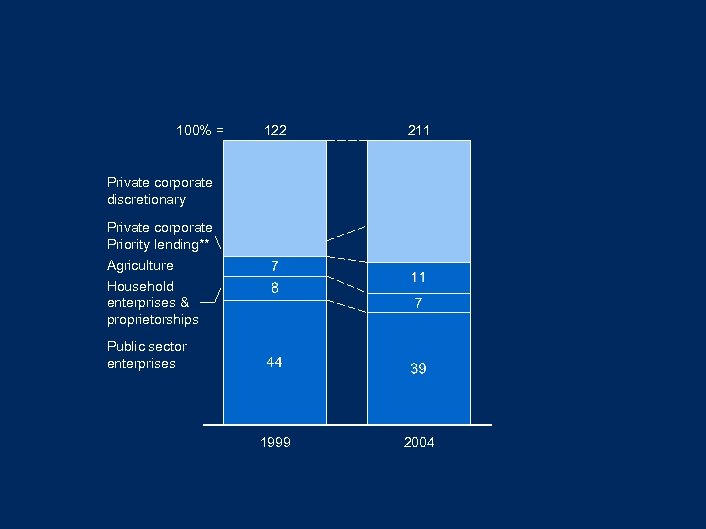

100% = 122 211 1999 2004 Private corporate discretionary Private corporate Priority lending** Agriculture Household enterprises & proprietorships Public sector enterprises

100% = 122 211 1999 2004 Private corporate discretionary Private corporate Priority lending** Agriculture Household enterprises & proprietorships Public sector enterprises

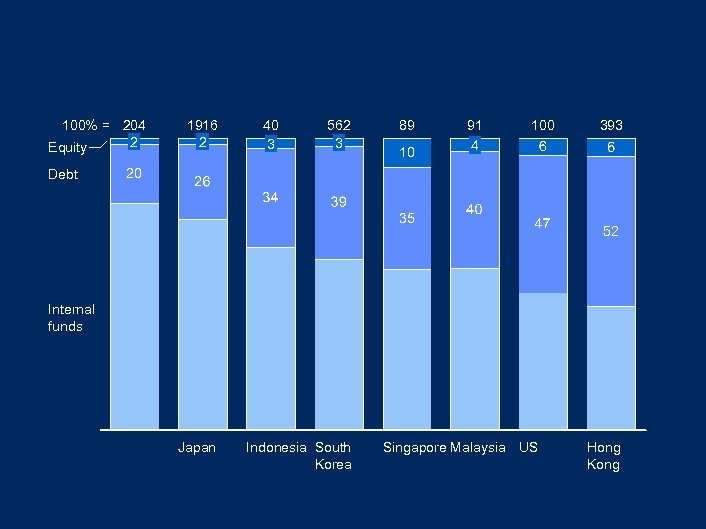

100% = 204 2 Equity 1916 2 40 3 562 3 89 91 4 100 393 Debt Internal funds Japan Indonesia South Korea Singapore Malaysia US Hong Kong

100% = 204 2 Equity 1916 2 40 3 562 3 89 91 4 100 393 Debt Internal funds Japan Indonesia South Korea Singapore Malaysia US Hong Kong

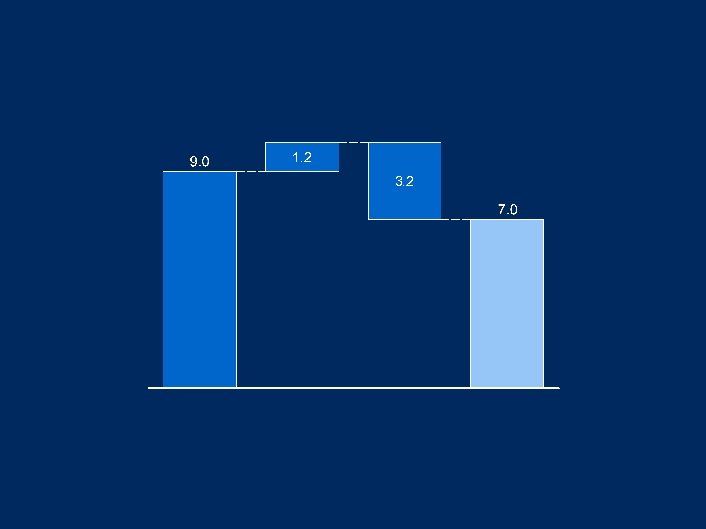

1. 2 3. 2

1. 2 3. 2

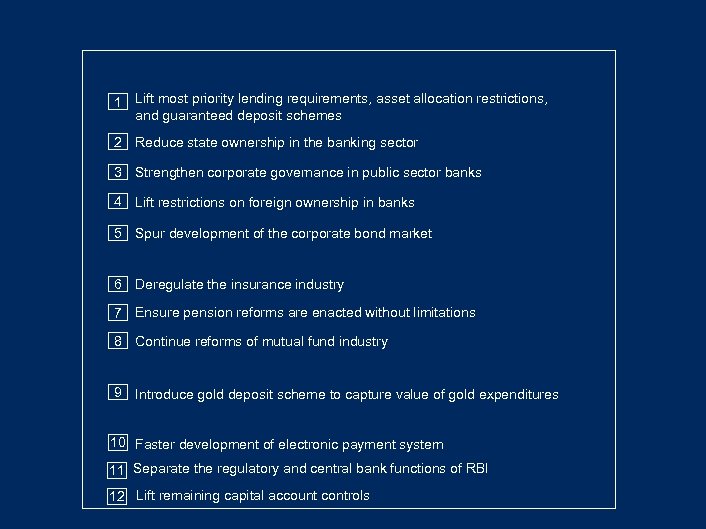

1 Lift most priority lending requirements, asset allocation restrictions, and guaranteed deposit schemes 2 Reduce state ownership in the banking sector 3 Strengthen corporate governance in public sector banks 4 Lift restrictions on foreign ownership in banks 5 Spur development of the corporate bond market 6 Deregulate the insurance industry 7 Ensure pension reforms are enacted without limitations 8 Continue reforms of mutual fund industry 9 Introduce gold deposit scheme to capture value of gold expenditures 10 Faster development of electronic payment system 11 Separate the regulatory and central bank functions of RBI 12 Lift remaining capital account controls

1 Lift most priority lending requirements, asset allocation restrictions, and guaranteed deposit schemes 2 Reduce state ownership in the banking sector 3 Strengthen corporate governance in public sector banks 4 Lift restrictions on foreign ownership in banks 5 Spur development of the corporate bond market 6 Deregulate the insurance industry 7 Ensure pension reforms are enacted without limitations 8 Continue reforms of mutual fund industry 9 Introduce gold deposit scheme to capture value of gold expenditures 10 Faster development of electronic payment system 11 Separate the regulatory and central bank functions of RBI 12 Lift remaining capital account controls