467e3575fd7beb694ad6b126b150f22c.ppt

- Количество слайдов: 84

January 10, 2013 NY 2 713434 © 2012 Morrison & Foerster LLP All Rights Reserved | mofo. com How Foreign Banks Can Finance in the United States

January 10, 2013 NY 2 713434 © 2012 Morrison & Foerster LLP All Rights Reserved | mofo. com How Foreign Banks Can Finance in the United States

Topics for Presentation • • Rule 144 A offerings Section 3(a)(2) offerings Covered bond offerings Registration process for registered offerings • Confidential submissions and the registration process (including Industry Guide 3 disclosures in registration statements) • Benefits available to foreign private issuers (“FPIs”) • Accounting considerations • Corporate governance considerations • Ongoing reporting obligations • Specialized disclosure requirements This is Mo. Fo. | 2

Topics for Presentation • • Rule 144 A offerings Section 3(a)(2) offerings Covered bond offerings Registration process for registered offerings • Confidential submissions and the registration process (including Industry Guide 3 disclosures in registration statements) • Benefits available to foreign private issuers (“FPIs”) • Accounting considerations • Corporate governance considerations • Ongoing reporting obligations • Specialized disclosure requirements This is Mo. Fo. | 2

Foreign Bank Debt Financing Activities • Types of bank debt issuances • • Senior unsecured debt Senior secured debt (including covered bonds) Subordinated debt Structured debt (e. g. , equity-linked and commodity-linked notes) Hybrid debt / preferred stock Contingent capital (“coco”) debt Deposit liabilities • Issuing entities • Home offices • US branches • Other affiliated entities (e. g. , financing SPVs) • Issuance formats • • Private placements (pursuant to Section 4(a)(2) of the Securities Act). Rule 144 A offerings Section 3(a)(2) offerings SEC-registered offerings This is Mo. Fo. | 3

Foreign Bank Debt Financing Activities • Types of bank debt issuances • • Senior unsecured debt Senior secured debt (including covered bonds) Subordinated debt Structured debt (e. g. , equity-linked and commodity-linked notes) Hybrid debt / preferred stock Contingent capital (“coco”) debt Deposit liabilities • Issuing entities • Home offices • US branches • Other affiliated entities (e. g. , financing SPVs) • Issuance formats • • Private placements (pursuant to Section 4(a)(2) of the Securities Act). Rule 144 A offerings Section 3(a)(2) offerings SEC-registered offerings This is Mo. Fo. | 3

Rule 144 A Offerings This is Mo. Fo. | 4

Rule 144 A Offerings This is Mo. Fo. | 4

Why Are Rule 144 A Offerings Attractive to Non. U. S. Banks? • Rule 144 A provides a clear safe harbor for offerings to institutional investors. • Does not require extensive ongoing registration or disclosure requirements. • Index eligible issuances have good liquidity in the Rule 144 A market. This is Mo. Fo. | 5

Why Are Rule 144 A Offerings Attractive to Non. U. S. Banks? • Rule 144 A provides a clear safe harbor for offerings to institutional investors. • Does not require extensive ongoing registration or disclosure requirements. • Index eligible issuances have good liquidity in the Rule 144 A market. This is Mo. Fo. | 5

Rule 144 A – Overview • Rule 144 A provides a non-exclusive safe harbor from the registration requirements of Section 5 of the Securities Act for resales of restricted securities to “qualified institutional buyers” (QIBs). • The rule recognizes that not all investors are in need of the protections of the prospectus requirements of the Securities Act. • The rule applies to offers made by persons other than the issuer of the securities. (i. e. , “resales”). • The rule applies to securities that are not listed on a U. S. securities exchange or quoted on an automated inter-dealer quotation system. • A reseller may rely on any applicable exemption from the registration requirements of the Securities Act in connection with the resale of restricted securities (such as Regulation S or Rule 144). This is Mo. Fo. | 6

Rule 144 A – Overview • Rule 144 A provides a non-exclusive safe harbor from the registration requirements of Section 5 of the Securities Act for resales of restricted securities to “qualified institutional buyers” (QIBs). • The rule recognizes that not all investors are in need of the protections of the prospectus requirements of the Securities Act. • The rule applies to offers made by persons other than the issuer of the securities. (i. e. , “resales”). • The rule applies to securities that are not listed on a U. S. securities exchange or quoted on an automated inter-dealer quotation system. • A reseller may rely on any applicable exemption from the registration requirements of the Securities Act in connection with the resale of restricted securities (such as Regulation S or Rule 144). This is Mo. Fo. | 6

Types of Rule 144 A Offerings • Rule 144 A offering for an issuer that is not registered in the U. S. – usually a standalone • Rule 144 A continuous offering program • Used for repeat offerings, often by financial institution and insurance company issuers, to institutional investors. • Often used for structured products and for covered bonds sold to QIBs. This is Mo. Fo. | 7

Types of Rule 144 A Offerings • Rule 144 A offering for an issuer that is not registered in the U. S. – usually a standalone • Rule 144 A continuous offering program • Used for repeat offerings, often by financial institution and insurance company issuers, to institutional investors. • Often used for structured products and for covered bonds sold to QIBs. This is Mo. Fo. | 7

How Are Rule 144 A Offerings Structured? • The issuer initially sells restricted securities to investment bank(s) as “initial purchasers” in a Section 4(a)(2) or Regulation D private placement. • The investment bank reoffers and immediately resells the securities to QIBs under Rule 144 A. • Often combined with a Regulation S offering. This is Mo. Fo. | 8

How Are Rule 144 A Offerings Structured? • The issuer initially sells restricted securities to investment bank(s) as “initial purchasers” in a Section 4(a)(2) or Regulation D private placement. • The investment bank reoffers and immediately resells the securities to QIBs under Rule 144 A. • Often combined with a Regulation S offering. This is Mo. Fo. | 8

Rule 144 A Offering Memorandum • May contain similar information to a full “S-1/F-1” prospectus, or may be much shorter. • If the issuer is a public company, it may incorporate by reference the issuer’s filings from its home country. • Scope of disclosure (whether included or incorporated by reference) may be comparable to a public offering, as the initial purchasers/underwriters expect “ 10 b-5” representations from the issuer, and legal opinions from counsel. • Due diligence by counsel will often be similar to that performed in a public offering. • For a non-U. S. offering, with a Rule 144 A “tranche, ” there may be a U. S. “Rule 144 A wrapper” attached to the non-U. S. offering document. This is Mo. Fo. | 9

Rule 144 A Offering Memorandum • May contain similar information to a full “S-1/F-1” prospectus, or may be much shorter. • If the issuer is a public company, it may incorporate by reference the issuer’s filings from its home country. • Scope of disclosure (whether included or incorporated by reference) may be comparable to a public offering, as the initial purchasers/underwriters expect “ 10 b-5” representations from the issuer, and legal opinions from counsel. • Due diligence by counsel will often be similar to that performed in a public offering. • For a non-U. S. offering, with a Rule 144 A “tranche, ” there may be a U. S. “Rule 144 A wrapper” attached to the non-U. S. offering document. This is Mo. Fo. | 9

Additional Documentation for a Rule 144 A Offering • A purchase agreement between the issuer and the initial purchasers/underwriter(s) • Similar to an underwriting agreement in terms of representations, covenants, closing conditions and indemnities. • Legal opinions • 10 b-5 negative assurance letters • Comfort letters This is Mo. Fo. | 10

Additional Documentation for a Rule 144 A Offering • A purchase agreement between the issuer and the initial purchasers/underwriter(s) • Similar to an underwriting agreement in terms of representations, covenants, closing conditions and indemnities. • Legal opinions • 10 b-5 negative assurance letters • Comfort letters This is Mo. Fo. | 10

How Are Rule 144 A Offerings Conducted? • Often similar to a registered offering. • “Road show” with a preliminary offering memorandum. • Confirmation of orders with the final offering memorandum. • The offering memorandum may be delivered electronically. • The purchase agreement is executed at pricing, together with the delivery of a comfort letter. • Closing on a “T+3” basis, or as otherwise agreed with the investors. • Publicity: generally limited to a Rule 135 c compliant press release – limited information about the offering. This is Mo. Fo. | 11

How Are Rule 144 A Offerings Conducted? • Often similar to a registered offering. • “Road show” with a preliminary offering memorandum. • Confirmation of orders with the final offering memorandum. • The offering memorandum may be delivered electronically. • The purchase agreement is executed at pricing, together with the delivery of a comfort letter. • Closing on a “T+3” basis, or as otherwise agreed with the investors. • Publicity: generally limited to a Rule 135 c compliant press release – limited information about the offering. This is Mo. Fo. | 11

The JOBS Act and Marketing Rule 144 A Offerings • The JOBS Act requires the SEC to adopt rules to permit general solicitations in connection with Rule 144 A offerings, provided that sales are made solely to QIBs. • The SEC issued proposed rules on August 29, 2012 and the comment period ended on October 5, 2012. The SEC has not issued final rules at this time. • Potential impact: • Use of additional offering modalities to market transactions and disseminate information. • For example, public websites that describe the offering and press releases. This is Mo. Fo. | 12

The JOBS Act and Marketing Rule 144 A Offerings • The JOBS Act requires the SEC to adopt rules to permit general solicitations in connection with Rule 144 A offerings, provided that sales are made solely to QIBs. • The SEC issued proposed rules on August 29, 2012 and the comment period ended on October 5, 2012. The SEC has not issued final rules at this time. • Potential impact: • Use of additional offering modalities to market transactions and disseminate information. • For example, public websites that describe the offering and press releases. This is Mo. Fo. | 12

Conditions for Rule 144 A Offering • Reoffers or resales only to a QIB, or to an offeree or purchaser that the reseller reasonably believes is a QIB. • Reseller must take steps to ensure that the buyer is aware that the reseller may rely on Rule 144 A in connection with such resale. • The securities reoffered or resold (a) when issued were not of the same class as securities listed on a U. S. national securities exchange or quoted on a U. S. automated inter-dealer quotation system and (b) are not securities of an open-end investment company, UIT, etc. • For an issuer that is not an Exchange Act reporting company or exempt from reporting pursuant to Rule 12 g 3 -2(b) under the Exchange Act, the holder and a prospective buyer designated by the holder must have the right to obtain from the issuer, upon the holder’s request, certain reasonably current information. This is Mo. Fo. | 13

Conditions for Rule 144 A Offering • Reoffers or resales only to a QIB, or to an offeree or purchaser that the reseller reasonably believes is a QIB. • Reseller must take steps to ensure that the buyer is aware that the reseller may rely on Rule 144 A in connection with such resale. • The securities reoffered or resold (a) when issued were not of the same class as securities listed on a U. S. national securities exchange or quoted on a U. S. automated inter-dealer quotation system and (b) are not securities of an open-end investment company, UIT, etc. • For an issuer that is not an Exchange Act reporting company or exempt from reporting pursuant to Rule 12 g 3 -2(b) under the Exchange Act, the holder and a prospective buyer designated by the holder must have the right to obtain from the issuer, upon the holder’s request, certain reasonably current information. This is Mo. Fo. | 13

Rule 159: “Time of Sale Information” • Although Rule 159 under the Securities Act is not expressly applicable to Rule 144 A offerings, many investment banks apply the same treatment, in order to help reduce the risk of liability. • Use of term sheets and offering memoranda supplements, to ensure that all material information is conveyed to investors at the time of pricing. • Counsel is typically expected to opine as to the “disclosure package, ” as in the case of a public offering. This NY 2 632073 is Mo. Fo. | 14

Rule 159: “Time of Sale Information” • Although Rule 159 under the Securities Act is not expressly applicable to Rule 144 A offerings, many investment banks apply the same treatment, in order to help reduce the risk of liability. • Use of term sheets and offering memoranda supplements, to ensure that all material information is conveyed to investors at the time of pricing. • Counsel is typically expected to opine as to the “disclosure package, ” as in the case of a public offering. This NY 2 632073 is Mo. Fo. | 14

Section 3(a)(2) Offerings This is Mo. Fo. | 15

Section 3(a)(2) Offerings This is Mo. Fo. | 15

Section 3(a)(2) and Offerings by Banks • Section 3(a)(2) of the Securities Act exempts from registration under the Securities Act any security issued or guaranteed by a bank. • Basis: banks are highly regulated, and provide adequate disclosure to investors about their finances in the absence of federal securities registration requirements. Banks are also subject to various capital requirements that may increase the likelihood that holders of their debt securities will receive timely payments of principal and interest. This is Mo. Fo. | 16

Section 3(a)(2) and Offerings by Banks • Section 3(a)(2) of the Securities Act exempts from registration under the Securities Act any security issued or guaranteed by a bank. • Basis: banks are highly regulated, and provide adequate disclosure to investors about their finances in the absence of federal securities registration requirements. Banks are also subject to various capital requirements that may increase the likelihood that holders of their debt securities will receive timely payments of principal and interest. This is Mo. Fo. | 16

What Is a “Bank”? • Under Section 3(a)(2), the institution must meet both of the following requirements: • it must be a national bank or any institution supervised by a state banking commission or similar authority; and • its business must be substantially confined to banking. • Examples of entities that do not qualify: • • Bank holding companies Finance companies Investment banks Foreign banks This is Mo. Fo. | 17

What Is a “Bank”? • Under Section 3(a)(2), the institution must meet both of the following requirements: • it must be a national bank or any institution supervised by a state banking commission or similar authority; and • its business must be substantially confined to banking. • Examples of entities that do not qualify: • • Bank holding companies Finance companies Investment banks Foreign banks This is Mo. Fo. | 17

Guarantees • Another basis for qualification as a bank: securities guaranteed by a bank. • Not limited to a guaranty in a legal sense, but also includes arrangements in which the bank agrees to ensure the payment of a security. • The guaranty or assurance of payment, however has to cover the entire obligation; it cannot be a partial guarantee or promise of payment. • Again, guarantees by foreign banks (other than those of an eligible U. S. branch or agency) would not qualify for this exception. • The guarantee is a legal requirement to qualify for the exemption; investors will not be looking to the US branch for payment/credit. Investors will look to the home office. This is Mo. Fo. | 18

Guarantees • Another basis for qualification as a bank: securities guaranteed by a bank. • Not limited to a guaranty in a legal sense, but also includes arrangements in which the bank agrees to ensure the payment of a security. • The guaranty or assurance of payment, however has to cover the entire obligation; it cannot be a partial guarantee or promise of payment. • Again, guarantees by foreign banks (other than those of an eligible U. S. branch or agency) would not qualify for this exception. • The guarantee is a legal requirement to qualify for the exemption; investors will not be looking to the US branch for payment/credit. Investors will look to the home office. This is Mo. Fo. | 18

Non-U. S. Banks/U. S. Offices • U. S. branches/agencies of foreign banks are conditionally entitled to rely on the Section 3(a)(2) exemption. • 1986: the SEC takes the position that a foreign branch/agency will be deemed to be a “national bank” or a “banking institution organized under the laws of any state” if “the nature and extent of federal and/or state regulation and supervision of that particular branch or agency is substantially equivalent to that applicable to federal or state chartered domestic banks doing business in the same jurisdiction. ” • As a result, U. S. branches/agencies of foreign banks are frequent issuers or guarantors of debt securities in the U. S. Most issuances or guarantees occur through the NY branches of these banks. This is Mo. Fo. | 19

Non-U. S. Banks/U. S. Offices • U. S. branches/agencies of foreign banks are conditionally entitled to rely on the Section 3(a)(2) exemption. • 1986: the SEC takes the position that a foreign branch/agency will be deemed to be a “national bank” or a “banking institution organized under the laws of any state” if “the nature and extent of federal and/or state regulation and supervision of that particular branch or agency is substantially equivalent to that applicable to federal or state chartered domestic banks doing business in the same jurisdiction. ” • As a result, U. S. branches/agencies of foreign banks are frequent issuers or guarantors of debt securities in the U. S. Most issuances or guarantees occur through the NY branches of these banks. This is Mo. Fo. | 19

FINRA Requirements • Even though securities offerings under Section 3(a)(2) are exempt from registration under the Securities Act, public securities offerings conducted by banks must be filed with the Financial Industry Regulatory Authority (“FINRA”) for review under Rule 5110(b)(9), unless an exemption is available. • Transactions under Section 3(a)(2) must also be reported through FINRA’s Trade Reporting and Compliance Engine (“TRACE”). TRACE eligibility provides greater transparency for investors. Currently, Rule 144 A securities are not TRACE reported. This is Mo. Fo. | 20

FINRA Requirements • Even though securities offerings under Section 3(a)(2) are exempt from registration under the Securities Act, public securities offerings conducted by banks must be filed with the Financial Industry Regulatory Authority (“FINRA”) for review under Rule 5110(b)(9), unless an exemption is available. • Transactions under Section 3(a)(2) must also be reported through FINRA’s Trade Reporting and Compliance Engine (“TRACE”). TRACE eligibility provides greater transparency for investors. Currently, Rule 144 A securities are not TRACE reported. This is Mo. Fo. | 20

OCC Registration/Disclosure • National banks or federally licensed U. S. branches/agencies of foreign banks regulated by the Office of the Comptroller of the Currency (the “OCC”) are subject to OCC securities offering (Part 16) regulations. • Part 16 of OCC regulations provides that these banks or banking offices may not offer and sell their securities until a registration statement has been filed and declared effective with the OCC, unless an exemption applies. • An OCC registration statement is generally comparable in scope and detail to an SEC registration statement; as a result, most bank issuers prefer to rely upon an exemption from the OCC’s registration requirements. Section 16. 5 provides a list of exemptions, which includes: • Regulation D offerings • Rule 144 A offerings This is Mo. Fo. | 21

OCC Registration/Disclosure • National banks or federally licensed U. S. branches/agencies of foreign banks regulated by the Office of the Comptroller of the Currency (the “OCC”) are subject to OCC securities offering (Part 16) regulations. • Part 16 of OCC regulations provides that these banks or banking offices may not offer and sell their securities until a registration statement has been filed and declared effective with the OCC, unless an exemption applies. • An OCC registration statement is generally comparable in scope and detail to an SEC registration statement; as a result, most bank issuers prefer to rely upon an exemption from the OCC’s registration requirements. Section 16. 5 provides a list of exemptions, which includes: • Regulation D offerings • Rule 144 A offerings This is Mo. Fo. | 21

Part 16. 6 of the OCC Regulations • 12 CFR 16. 6 provides a separate partial exemption for offerings of “non-convertible debt” to accredited investors in denominations of $250, 000 or more. • National banks with foreign parents that have shares traded in the US may be able to rely upon this exemption by furnishing the foreign private issuer reports (Forms 20 -F, 6 -K) filed by foreign issuers. • Alternatively, Federal branches/agencies may rely on this exemption by furnishing to the OCC parent bank information which is required under Exchange Act Rule 12 g 3 -2(b), and to purchasers the information required under Securities Act Rule 144 A(d)(4)(i). This is Mo. Fo. | 22

Part 16. 6 of the OCC Regulations • 12 CFR 16. 6 provides a separate partial exemption for offerings of “non-convertible debt” to accredited investors in denominations of $250, 000 or more. • National banks with foreign parents that have shares traded in the US may be able to rely upon this exemption by furnishing the foreign private issuer reports (Forms 20 -F, 6 -K) filed by foreign issuers. • Alternatively, Federal branches/agencies may rely on this exemption by furnishing to the OCC parent bank information which is required under Exchange Act Rule 12 g 3 -2(b), and to purchasers the information required under Securities Act Rule 144 A(d)(4)(i). This is Mo. Fo. | 22

Denominations • The 3(a)(2) exemption does not require specific minimum denominations in order to obtain the exemption. • However, for a variety of reasons, denominations may at times be significantly higher than in retail transactions: • Offerings targeted to institutional investors. • Complex securities. • Relationship to 16. 6’s requirement of $250, 000 minimum denominations. This is Mo. Fo. | 23

Denominations • The 3(a)(2) exemption does not require specific minimum denominations in order to obtain the exemption. • However, for a variety of reasons, denominations may at times be significantly higher than in retail transactions: • Offerings targeted to institutional investors. • Complex securities. • Relationship to 16. 6’s requirement of $250, 000 minimum denominations. This is Mo. Fo. | 23

Deposits Versus Other Liabilities • Foreign banks may elect to issue debt instruments in the form of deposit liabilities as opposed to “pure” debt: • Yankee CDs (US$-denominated deposit liabilities of a foreign bank or its US branch). • Other types of deposits (e. g. , structured deposits). • What are the legal differences between deposit liabilities and other debt issuances? • In the case of foreign banks, less than meets the eye. • Foreign banking organization (“FBO”) deposit liabilities are not insured and generally are issued in large denominations (minimum $100, 000 and usually higher). • For capital equivalency/asset segregation purposes, deposits and non-deposit liabilities generally are treated in the same manner. This is Mo. Fo. | 24

Deposits Versus Other Liabilities • Foreign banks may elect to issue debt instruments in the form of deposit liabilities as opposed to “pure” debt: • Yankee CDs (US$-denominated deposit liabilities of a foreign bank or its US branch). • Other types of deposits (e. g. , structured deposits). • What are the legal differences between deposit liabilities and other debt issuances? • In the case of foreign banks, less than meets the eye. • Foreign banking organization (“FBO”) deposit liabilities are not insured and generally are issued in large denominations (minimum $100, 000 and usually higher). • For capital equivalency/asset segregation purposes, deposits and non-deposit liabilities generally are treated in the same manner. This is Mo. Fo. | 24

Blue Sky Regulation • Securities issued under Section 3(a)(2) are considered “covered securities” under Section 18 of the Securities Act. • As a result, blue sky filings are not needed in any state in which the securities are offered. This is Mo. Fo. | 25

Blue Sky Regulation • Securities issued under Section 3(a)(2) are considered “covered securities” under Section 18 of the Securities Act. • As a result, blue sky filings are not needed in any state in which the securities are offered. This is Mo. Fo. | 25

Exchange Act Reporting • Section 12(i) of the Exchange Act provides that the administration and enforcement of Exchange Act Sections 12, 13, 14(a), 14(c), 14(d), 14(f), and 16 is vested in the OCC with respect to national banks, the Federal Reserve Board as to member banks of the Federal Reserve System, the FDIC as to all other insured banks, and the OTS as to savings associations. • As a result, a bank that otherwise would be subject to Exchange Act periodic reporting requirements would submit its reports to the appropriate banking agency, and not to the SEC. This is Mo. Fo. | 26

Exchange Act Reporting • Section 12(i) of the Exchange Act provides that the administration and enforcement of Exchange Act Sections 12, 13, 14(a), 14(c), 14(d), 14(f), and 16 is vested in the OCC with respect to national banks, the Federal Reserve Board as to member banks of the Federal Reserve System, the FDIC as to all other insured banks, and the OTS as to savings associations. • As a result, a bank that otherwise would be subject to Exchange Act periodic reporting requirements would submit its reports to the appropriate banking agency, and not to the SEC. This is Mo. Fo. | 26

Exchange Act Reporting (cont’d) • Foreign banks are not Section 3(a)(2) “banks” and therefore are not subject to Exchange Act Section 12(i), but to the extent they otherwise are required to register under the Exchange Act as issuers, or submit reports as foreign private issuers, they would register and file their reports with the SEC. • U. S. branches/agencies of foreign banks would not be subject to Exchange Act Section 12(i) requirements solely by virtue of their issuance of debt securities. This is Mo. Fo. | 27

Exchange Act Reporting (cont’d) • Foreign banks are not Section 3(a)(2) “banks” and therefore are not subject to Exchange Act Section 12(i), but to the extent they otherwise are required to register under the Exchange Act as issuers, or submit reports as foreign private issuers, they would register and file their reports with the SEC. • U. S. branches/agencies of foreign banks would not be subject to Exchange Act Section 12(i) requirements solely by virtue of their issuance of debt securities. This is Mo. Fo. | 27

Securities Liability • Securities offerings of, or guaranteed by, a bank under Section 3(a)(2) are not subject to the civil liability provisions under Section 11 and Section 12(a)(2) of the Securities Act. • However, the anti-fraud provisions of Section 17 of the Securities Act are applicable to offerings under Section 3(a)(2). • Additionally, offerings under Section 3(a)(2) are also subject to Section 10(b) of the Exchange Act and the anti-fraud provisions of Rule 10 b-5 of the Exchange Act. • Impact on offering documents, and use of offering circulars to convey material information and risk factors. This is Mo. Fo. | 28

Securities Liability • Securities offerings of, or guaranteed by, a bank under Section 3(a)(2) are not subject to the civil liability provisions under Section 11 and Section 12(a)(2) of the Securities Act. • However, the anti-fraud provisions of Section 17 of the Securities Act are applicable to offerings under Section 3(a)(2). • Additionally, offerings under Section 3(a)(2) are also subject to Section 10(b) of the Exchange Act and the anti-fraud provisions of Rule 10 b-5 of the Exchange Act. • Impact on offering documents, and use of offering circulars to convey material information and risk factors. This is Mo. Fo. | 28

Section 3(a)(2) Offering Documentation • The offering documentation for bank notes is similar to that of a registered offering. • Base offering document, which may be an “offering memorandum” or an “offering circular” (instead of a “prospectus”). • The base document is supplemented for a particular offering by one or more “pricing supplements” and/or “product supplements. ” • These offering documents may be supplemented by additional offering materials, including term sheets and brochures. This is Mo. Fo. | 29

Section 3(a)(2) Offering Documentation • The offering documentation for bank notes is similar to that of a registered offering. • Base offering document, which may be an “offering memorandum” or an “offering circular” (instead of a “prospectus”). • The base document is supplemented for a particular offering by one or more “pricing supplements” and/or “product supplements. ” • These offering documents may be supplemented by additional offering materials, including term sheets and brochures. This is Mo. Fo. | 29

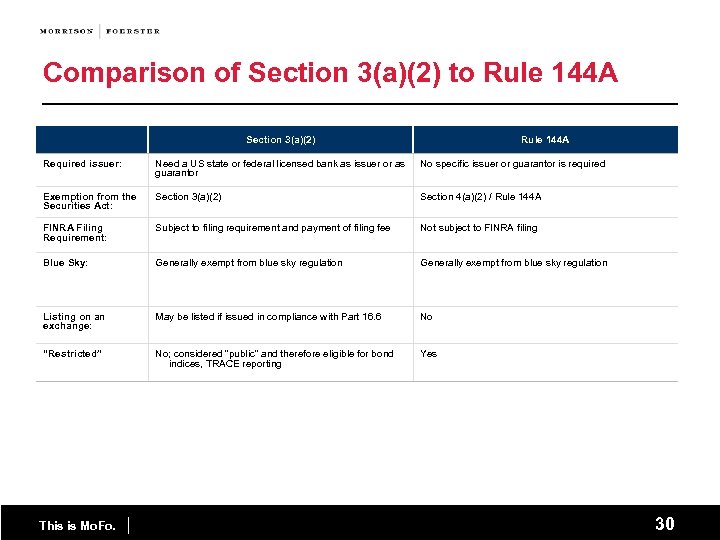

Comparison of Section 3(a)(2) to Rule 144 A Section 3(a)(2) Rule 144 A Required issuer: Need a US state or federal licensed bank as issuer or as guarantor No specific issuer or guarantor is required Exemption from the Securities Act: Section 3(a)(2) Section 4(a)(2) / Rule 144 A FINRA Filing Requirement: Subject to filing requirement and payment of filing fee Not subject to FINRA filing Blue Sky: Generally exempt from blue sky regulation Listing on an exchange: May be listed if issued in compliance with Part 16. 6 No “Restricted” No; considered “public” and therefore eligible for bond indices, TRACE reporting Yes This is Mo. Fo. | 30

Comparison of Section 3(a)(2) to Rule 144 A Section 3(a)(2) Rule 144 A Required issuer: Need a US state or federal licensed bank as issuer or as guarantor No specific issuer or guarantor is required Exemption from the Securities Act: Section 3(a)(2) Section 4(a)(2) / Rule 144 A FINRA Filing Requirement: Subject to filing requirement and payment of filing fee Not subject to FINRA filing Blue Sky: Generally exempt from blue sky regulation Listing on an exchange: May be listed if issued in compliance with Part 16. 6 No “Restricted” No; considered “public” and therefore eligible for bond indices, TRACE reporting Yes This is Mo. Fo. | 30

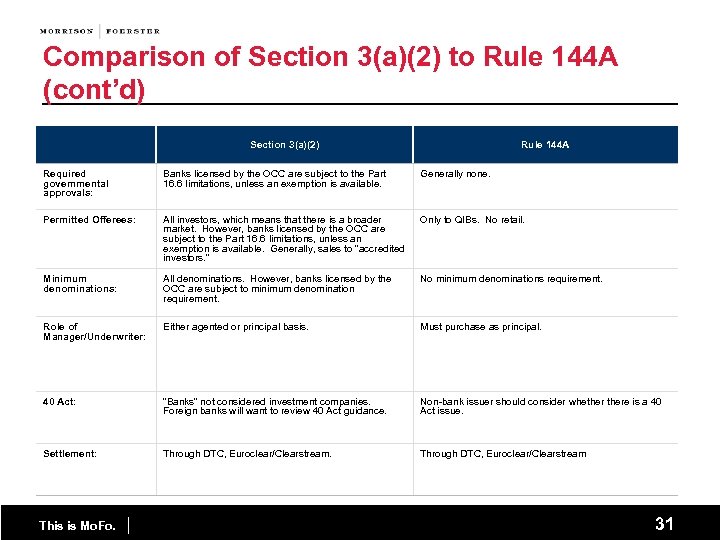

Comparison of Section 3(a)(2) to Rule 144 A (cont’d) Section 3(a)(2) Rule 144 A Required governmental approvals: Banks licensed by the OCC are subject to the Part 16. 6 limitations, unless an exemption is available. Generally none. Permitted Offerees: All investors, which means that there is a broader market. However, banks licensed by the OCC are subject to the Part 16. 6 limitations, unless an exemption is available. Generally, sales to “accredited investors. ” Only to QIBs. No retail. Minimum denominations: All denominations. However, banks licensed by the OCC are subject to minimum denomination requirement. No minimum denominations requirement. Role of Manager/Underwriter: Either agented or principal basis. Must purchase as principal. 40 Act: “Banks” not considered investment companies. Foreign banks will want to review 40 Act guidance. Non-bank issuer should consider whethere is a 40 Act issue. Settlement: Through DTC, Euroclear/Clearstream This is Mo. Fo. | 31

Comparison of Section 3(a)(2) to Rule 144 A (cont’d) Section 3(a)(2) Rule 144 A Required governmental approvals: Banks licensed by the OCC are subject to the Part 16. 6 limitations, unless an exemption is available. Generally none. Permitted Offerees: All investors, which means that there is a broader market. However, banks licensed by the OCC are subject to the Part 16. 6 limitations, unless an exemption is available. Generally, sales to “accredited investors. ” Only to QIBs. No retail. Minimum denominations: All denominations. However, banks licensed by the OCC are subject to minimum denomination requirement. No minimum denominations requirement. Role of Manager/Underwriter: Either agented or principal basis. Must purchase as principal. 40 Act: “Banks” not considered investment companies. Foreign banks will want to review 40 Act guidance. Non-bank issuer should consider whethere is a 40 Act issue. Settlement: Through DTC, Euroclear/Clearstream This is Mo. Fo. | 31

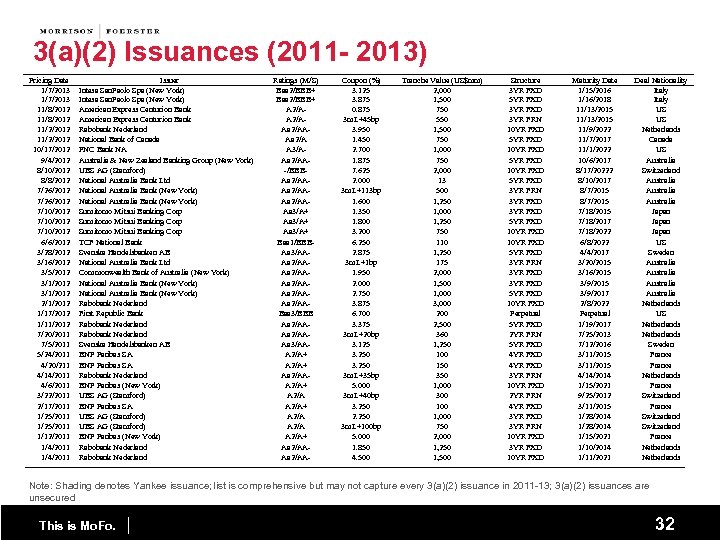

3(a)(2) Issuances (2011 - 2013) Pricing Date 1/7/2013 11/8/2012 11/2/2012 10/17/2012 9/4/2012 8/10/2012 8/8/2012 7/26/2012 7/10/2012 6/6/2012 3/28/2012 3/16/2012 3/5/2012 3/1/2012 2/1/2012 1/17/2012 1/11/2012 7/20/2011 7/5/2011 5/24/2011 4/20/211 4/14/2011 4/6/2011 3/22/2011 2/17/2011 1/25/2011 1/12/2011 1/4/2011 Issuer Intesa San. Paolo Spa (New York) American Express Centurion Bank Rabobank Nederland National Bank of Canada PNC Bank NA Australia & New Zealand Banking Group (New York) UBS AG (Stamford) National Australia Bank Ltd National Australia Bank (New York) Sumitomo Mitsui Banking Corp TCF National Bank Svenska Handelsbanken AB National Australia Bank Ltd Commonwealth Bank of Australia (New York) National Australia Bank (New York) Rabobank Nederland First Republic Bank Rabobank Nederland Svenska Handelsbanken AB BNP Paribas SA Rabobank Nederland BNP Paribas (New York) UBS AG (Stamford) BNP Paribas SA UBS AG (Stamford) BNP Paribas (New York) Rabobank Nederland Ratings (M/S) Baa 2/BBB+ A 2/AAa 2/AAAa 2/A A 3/AAa 2/AA-/BBBAa 2/AAAa 3/A+ Aa 3/A+ Baa 1/BBBAa 3/AAAa 2/AAAa 2/AABaa 3/BBB Aa 2/AAAa 3/AAA 2/A+ Aa 2/AAA 2/A+ A 2/A A 2/A+ Aa 2/AA- Coupon (%) 3. 125 3. 875 0. 875 3 m. L+45 bp 3. 950 1. 450 2. 700 1. 875 7. 625 2. 000 3 m. L+113 bp 1. 600 1. 350 1. 800 3. 200 6. 250 2. 875 3 m. L+1 bp 1. 950 2. 000 2. 750 3. 875 6. 700 3. 375 3 m. L+20 bp 3. 125 3. 250 3 m. L+35 bp 5. 000 3 m. L+40 bp 3. 250 2. 250 3 m. L+100 bp 5. 000 1. 850 4. 500 Tranche Value (US$mm) 2, 000 1, 500 750 550 1, 500 750 1, 000 750 2, 000 13 500 1, 250 1, 000 1, 250 750 110 1, 250 175 2, 000 1, 500 1, 000 3, 000 2, 500 360 1, 250 100 150 350 1, 000 300 1, 000 750 2, 000 1, 250 1, 500 Structure 3 YR FXD 5 YR FXD 3 YR FRN 10 YR FXD 5 YR FXD 3 YR FRN 3 YR FXD 5 YR FXD 10 YR FXD Perpetual 5 YR FXD 2 YR FRN 5 YR FXD 4 YR FXD 3 YR FRN 10 YR FXD 2 YR FRN 4 YR FXD 3 YR FRN 10 YR FXD 3 YR FXD 10 YR FXD Maturity Date 1/15/2016 1/16/2018 11/13/2015 11/9/2022 11/7/2017 11/1/2022 10/6/2017 8/17/20222 8/10/2017 8/7/2015 7/18/2015 7/18/2017 7/18/2022 6/8/2022 4/4/2017 3/20/2015 3/16/2015 3/9/2017 2/8/2022 Perpetual 1/19/2017 7/25/2013 7/12/2016 3/11/2015 4/14/2014 1/15/2021 9/25/2012 3/11/2015 1/28/2014 1/15/2021 1/10/2014 1/11/2021 Deal Nationality Italy US US Netherlands Canada US Australia Switzerland Australia Japan US Sweden Australia Netherlands US Netherlands Sweden France Netherlands France Switzerland France Netherlands Note: Shading denotes Yankee issuance; list is comprehensive but may not capture every 3(a)(2) issuance in 2011 -13; 3(a)(2) issuances are unsecured This is Mo. Fo. | 32

3(a)(2) Issuances (2011 - 2013) Pricing Date 1/7/2013 11/8/2012 11/2/2012 10/17/2012 9/4/2012 8/10/2012 8/8/2012 7/26/2012 7/10/2012 6/6/2012 3/28/2012 3/16/2012 3/5/2012 3/1/2012 2/1/2012 1/17/2012 1/11/2012 7/20/2011 7/5/2011 5/24/2011 4/20/211 4/14/2011 4/6/2011 3/22/2011 2/17/2011 1/25/2011 1/12/2011 1/4/2011 Issuer Intesa San. Paolo Spa (New York) American Express Centurion Bank Rabobank Nederland National Bank of Canada PNC Bank NA Australia & New Zealand Banking Group (New York) UBS AG (Stamford) National Australia Bank Ltd National Australia Bank (New York) Sumitomo Mitsui Banking Corp TCF National Bank Svenska Handelsbanken AB National Australia Bank Ltd Commonwealth Bank of Australia (New York) National Australia Bank (New York) Rabobank Nederland First Republic Bank Rabobank Nederland Svenska Handelsbanken AB BNP Paribas SA Rabobank Nederland BNP Paribas (New York) UBS AG (Stamford) BNP Paribas SA UBS AG (Stamford) BNP Paribas (New York) Rabobank Nederland Ratings (M/S) Baa 2/BBB+ A 2/AAa 2/AAAa 2/A A 3/AAa 2/AA-/BBBAa 2/AAAa 3/A+ Aa 3/A+ Baa 1/BBBAa 3/AAAa 2/AAAa 2/AABaa 3/BBB Aa 2/AAAa 3/AAA 2/A+ Aa 2/AAA 2/A+ A 2/A A 2/A+ Aa 2/AA- Coupon (%) 3. 125 3. 875 0. 875 3 m. L+45 bp 3. 950 1. 450 2. 700 1. 875 7. 625 2. 000 3 m. L+113 bp 1. 600 1. 350 1. 800 3. 200 6. 250 2. 875 3 m. L+1 bp 1. 950 2. 000 2. 750 3. 875 6. 700 3. 375 3 m. L+20 bp 3. 125 3. 250 3 m. L+35 bp 5. 000 3 m. L+40 bp 3. 250 2. 250 3 m. L+100 bp 5. 000 1. 850 4. 500 Tranche Value (US$mm) 2, 000 1, 500 750 550 1, 500 750 1, 000 750 2, 000 13 500 1, 250 1, 000 1, 250 750 110 1, 250 175 2, 000 1, 500 1, 000 3, 000 2, 500 360 1, 250 100 150 350 1, 000 300 1, 000 750 2, 000 1, 250 1, 500 Structure 3 YR FXD 5 YR FXD 3 YR FRN 10 YR FXD 5 YR FXD 3 YR FRN 3 YR FXD 5 YR FXD 10 YR FXD Perpetual 5 YR FXD 2 YR FRN 5 YR FXD 4 YR FXD 3 YR FRN 10 YR FXD 2 YR FRN 4 YR FXD 3 YR FRN 10 YR FXD 3 YR FXD 10 YR FXD Maturity Date 1/15/2016 1/16/2018 11/13/2015 11/9/2022 11/7/2017 11/1/2022 10/6/2017 8/17/20222 8/10/2017 8/7/2015 7/18/2015 7/18/2017 7/18/2022 6/8/2022 4/4/2017 3/20/2015 3/16/2015 3/9/2017 2/8/2022 Perpetual 1/19/2017 7/25/2013 7/12/2016 3/11/2015 4/14/2014 1/15/2021 9/25/2012 3/11/2015 1/28/2014 1/15/2021 1/10/2014 1/11/2021 Deal Nationality Italy US US Netherlands Canada US Australia Switzerland Australia Japan US Sweden Australia Netherlands US Netherlands Sweden France Netherlands France Switzerland France Netherlands Note: Shading denotes Yankee issuance; list is comprehensive but may not capture every 3(a)(2) issuance in 2011 -13; 3(a)(2) issuances are unsecured This is Mo. Fo. | 32

Covered Bond Offerings This is Mo. Fo. | 33

Covered Bond Offerings This is Mo. Fo. | 33

What Are Covered Bonds? • Senior debt of a regulated financial entity • Secured by a pool of financial assets • Mortgage loans – residential and commercial • Public sector obligations • Ship loans • Protected from acceleration in the event of issuer insolvency • By statute or legal structure • Collateral is isolated from insolvency estate of the issuer • Collateral pays bonds as scheduled through maturity • • • A dynamic collateral pool – refreshed every month Typically bullet maturity, fixed rate bonds Repayment liabilities remain on the balance sheet of the originator Most countries have statutes enabling covered bond. Very strong implicit government support in many jurisdictions This is Mo. Fo. | 34

What Are Covered Bonds? • Senior debt of a regulated financial entity • Secured by a pool of financial assets • Mortgage loans – residential and commercial • Public sector obligations • Ship loans • Protected from acceleration in the event of issuer insolvency • By statute or legal structure • Collateral is isolated from insolvency estate of the issuer • Collateral pays bonds as scheduled through maturity • • • A dynamic collateral pool – refreshed every month Typically bullet maturity, fixed rate bonds Repayment liabilities remain on the balance sheet of the originator Most countries have statutes enabling covered bond. Very strong implicit government support in many jurisdictions This is Mo. Fo. | 34

Benefits to Issuing Banks • Lower funding cost than senior bank debt • Extension of WAM for bank funding • Typical maturities for covered bonds of seven years or more. • Diversification of funding base • Investors typically do not buy RMBS or senior bank debt. • Mortgage modifications to accommodate borrower is easy (no competing interests) • Brings mortgage finance out of the “shadow banking” world • Levels the playing field • Foreign banks currently have access to this investor base, including in the U. S. , while U. S. banks do not. This is Mo. Fo. | 35

Benefits to Issuing Banks • Lower funding cost than senior bank debt • Extension of WAM for bank funding • Typical maturities for covered bonds of seven years or more. • Diversification of funding base • Investors typically do not buy RMBS or senior bank debt. • Mortgage modifications to accommodate borrower is easy (no competing interests) • Brings mortgage finance out of the “shadow banking” world • Levels the playing field • Foreign banks currently have access to this investor base, including in the U. S. , while U. S. banks do not. This is Mo. Fo. | 35

Covered Bond Investors • • Covered bond investors buy sovereign and agency debt Some of these same investors buy FNMA, FHLMC, GNMA debt Typically they will not buy senior bank debt They do not buy CMBS or ABS or RMBS To attract these investors you need statutory covered bonds Predominantly banks, central banks, funds and insurance companies A € 3 trillion market in Europe The U. S. investor base is opening up (foreign banks issued approximately $50 billion in covered bonds in the U. S. in 2012) This is Mo. Fo. | 36

Covered Bond Investors • • Covered bond investors buy sovereign and agency debt Some of these same investors buy FNMA, FHLMC, GNMA debt Typically they will not buy senior bank debt They do not buy CMBS or ABS or RMBS To attract these investors you need statutory covered bonds Predominantly banks, central banks, funds and insurance companies A € 3 trillion market in Europe The U. S. investor base is opening up (foreign banks issued approximately $50 billion in covered bonds in the U. S. in 2012) This is Mo. Fo. | 36

Benefits to Investors • • • High credit quality – most bonds are triple-A rated In Europe, favorable capital treatment for bank investors Higher yield than sovereign debt Diversification – sovereign or agency debt is viewed as similar risk Good liquidity Issuance regulated by statute in many European jurisdictions More investor friendly than RMBS or CMBS Not an ‘originate-to-sell’ model No complex tranching – good transparency No negative convexity (prepayment) risk 100% ‘skin in the game’ This is Mo. Fo. | 37

Benefits to Investors • • • High credit quality – most bonds are triple-A rated In Europe, favorable capital treatment for bank investors Higher yield than sovereign debt Diversification – sovereign or agency debt is viewed as similar risk Good liquidity Issuance regulated by statute in many European jurisdictions More investor friendly than RMBS or CMBS Not an ‘originate-to-sell’ model No complex tranching – good transparency No negative convexity (prepayment) risk 100% ‘skin in the game’ This is Mo. Fo. | 37

Foreign Bank Issuances • Foreign banks issuing into the U. S. market have been relying on their domestic covered bond framework and have been using cover pool assets that are foreign (not in the U. S. ). • Issuances into the U. S. have been structured as program issuances (or syndicated takedowns) conducted on an exempt basis, that means that the foreign issuer is relying on exemptions from the U. S. securities laws requiring registration of public offerings of securities. • To date, only one issuer (RBC) has registered a covered bond with the SEC. It is expected that other foreign issuers will follow suit. • As a result, offerings have been targeted at U. S. institutional investors and generally conducted in reliance on Rule 144 A. This is Mo. Fo. | 38

Foreign Bank Issuances • Foreign banks issuing into the U. S. market have been relying on their domestic covered bond framework and have been using cover pool assets that are foreign (not in the U. S. ). • Issuances into the U. S. have been structured as program issuances (or syndicated takedowns) conducted on an exempt basis, that means that the foreign issuer is relying on exemptions from the U. S. securities laws requiring registration of public offerings of securities. • To date, only one issuer (RBC) has registered a covered bond with the SEC. It is expected that other foreign issuers will follow suit. • As a result, offerings have been targeted at U. S. institutional investors and generally conducted in reliance on Rule 144 A. This is Mo. Fo. | 38

Registration Process for Registered Offerings This is Mo. Fo. 39

Registration Process for Registered Offerings This is Mo. Fo. 39

What Securities to Register? A foreign private issuer (“FPI”) may offer any type of security that a U. S. domestic issuer is permitted to offer. In addition, an FPI may offer its securities using American Depositary Receipts (“ADRs”). An FPI registering securities for the first time, will register ordinary shares or ADRs. Once an FPI has ordinary shares or ADRs listed in the U. S. , it may register debt securities under another registration statement. This is Mo. Fo. 40

What Securities to Register? A foreign private issuer (“FPI”) may offer any type of security that a U. S. domestic issuer is permitted to offer. In addition, an FPI may offer its securities using American Depositary Receipts (“ADRs”). An FPI registering securities for the first time, will register ordinary shares or ADRs. Once an FPI has ordinary shares or ADRs listed in the U. S. , it may register debt securities under another registration statement. This is Mo. Fo. 40

Which Registration Form Should be Used? Typically, an FPI will register ordinary shares on Form F-1. A registration statement on Form F-1 is similar to a Form S-1 filed by U. S. domestic issuers and requires extensive disclosure about the FPI’s business and operations. However, Form 20 -F may also be filed as a registration statement for ordinary shares when an FPI is not engaged in a public offering of its securities, but is still required to be registered under the Exchange Act. For example, when an FPI reaches the holder of record threshold under Section 12(g) of the Exchange Act, and there is no other exemption available. “Unsponsored” ADRs must be registered on Form F-6. This is Mo. Fo. 41

Which Registration Form Should be Used? Typically, an FPI will register ordinary shares on Form F-1. A registration statement on Form F-1 is similar to a Form S-1 filed by U. S. domestic issuers and requires extensive disclosure about the FPI’s business and operations. However, Form 20 -F may also be filed as a registration statement for ordinary shares when an FPI is not engaged in a public offering of its securities, but is still required to be registered under the Exchange Act. For example, when an FPI reaches the holder of record threshold under Section 12(g) of the Exchange Act, and there is no other exemption available. “Unsponsored” ADRs must be registered on Form F-6. This is Mo. Fo. 41

Which Registration Form Should be Used? (cont’d) Certain Canadian issuers may take advantage of the Multi. Jurisdictional Disclosure System (“MJDS”), which allows a shorter form of disclosure and incorporation by reference to Canadian disclosures. Once an FPI has been subject to the U. S. reporting requirements for at least 12 calendar months, it may use Form F-3 to offer securities publicly in the United States. Form F-3 is a short-form registration statement (analogous to Form S-3 for U. S. domestic issuers) and may be used by an FPI if the FPI meets both the form’s registrant requirements and the applicable transaction requirements. Form F-3 permits an FPI to disclose minimal information in the prospectus included in the Form F-3 by incorporating by reference the more extensive disclosures already filed with the SEC under the Exchange Act, primarily in the FPI’s most recent Annual Report on Form 20 -F and its Forms 6 -K. This is Mo. Fo. 42

Which Registration Form Should be Used? (cont’d) Certain Canadian issuers may take advantage of the Multi. Jurisdictional Disclosure System (“MJDS”), which allows a shorter form of disclosure and incorporation by reference to Canadian disclosures. Once an FPI has been subject to the U. S. reporting requirements for at least 12 calendar months, it may use Form F-3 to offer securities publicly in the United States. Form F-3 is a short-form registration statement (analogous to Form S-3 for U. S. domestic issuers) and may be used by an FPI if the FPI meets both the form’s registrant requirements and the applicable transaction requirements. Form F-3 permits an FPI to disclose minimal information in the prospectus included in the Form F-3 by incorporating by reference the more extensive disclosures already filed with the SEC under the Exchange Act, primarily in the FPI’s most recent Annual Report on Form 20 -F and its Forms 6 -K. This is Mo. Fo. 42

Industry Guide 3 Provides guidelines for statistical disclosures by foreign banks and bank holding companies in SEC filings. Market practice to also meet guidelines for unregistered offerings. Statistical disclosures can be included in the registration statement itself or incorporated by reference from the FPI’s annual report or quarterly/period reports to shareholders. Generally, the data provided must be for each of the last three or five fiscal years, plus any interim period if necessary to keep the information from being misleading. Available at http: //www. sec. gov/about/forms/industryguides. pdf. This is Mo. Fo. 43

Industry Guide 3 Provides guidelines for statistical disclosures by foreign banks and bank holding companies in SEC filings. Market practice to also meet guidelines for unregistered offerings. Statistical disclosures can be included in the registration statement itself or incorporated by reference from the FPI’s annual report or quarterly/period reports to shareholders. Generally, the data provided must be for each of the last three or five fiscal years, plus any interim period if necessary to keep the information from being misleading. Available at http: //www. sec. gov/about/forms/industryguides. pdf. This is Mo. Fo. 43

Industry Guide 3 Guidelines require detailed disclosures regarding a foreign bank’s: assets, liabilities and equity accounts, interest rates and interest spreads, investment portfolio, loan maturities, loan sensitivity to changes in interest rates, problem loans, loan concentrations, loan loss experience, other earning assets, deposits and return on equity and assets. This is Mo. Fo. 44

Industry Guide 3 Guidelines require detailed disclosures regarding a foreign bank’s: assets, liabilities and equity accounts, interest rates and interest spreads, investment portfolio, loan maturities, loan sensitivity to changes in interest rates, problem loans, loan concentrations, loan loss experience, other earning assets, deposits and return on equity and assets. This is Mo. Fo. 44

Industry Guide 3 (cont’d) Disclosure requirements are applicable to the extent the requested information is available. Since an FPI is required to disclose in the registration statement all material information necessary to make what is disclosed not misleading, the disclosures may in certain circumstances go beyond the requirements of Industry Guide 3. However, the SEC has permitted deviations from the guidelines if more meaningful disclosure with respect to a particular issue would be provided as a result. If the required information is unavailable or cannot be gathered without undue burden or expense to the FPI, the situation should be brought to the attention of the SEC in the early stages of the registration process. This is Mo. Fo. 45

Industry Guide 3 (cont’d) Disclosure requirements are applicable to the extent the requested information is available. Since an FPI is required to disclose in the registration statement all material information necessary to make what is disclosed not misleading, the disclosures may in certain circumstances go beyond the requirements of Industry Guide 3. However, the SEC has permitted deviations from the guidelines if more meaningful disclosure with respect to a particular issue would be provided as a result. If the required information is unavailable or cannot be gathered without undue burden or expense to the FPI, the situation should be brought to the attention of the SEC in the early stages of the registration process. This is Mo. Fo. 45

SEC Review Process The SEC’s review of the registration statement is an integral part of the registration process and should be view as a collaborative effort. Once a registration statement is filed, a team of SEC Staff members is assigned to review the filing, which consists of accountants and lawyers, including examiners and supervisors. The SEC’s principal focus during the review process is to assess the company’s compliance with the SEC’s registration and disclosure rules, although the nature of some comments shade into substantive review. The SEC considers the disclosures in the registration statement through the eyes of an investor in order to determine the type of information that would be considered material to an investor. The SEC Staff will closely review websites, databases and magazine and newspaper articles, looking in particular for information that they think should be included the registration statement or that contradicts information included in the registration statement. This is Mo. Fo. 46

SEC Review Process The SEC’s review of the registration statement is an integral part of the registration process and should be view as a collaborative effort. Once a registration statement is filed, a team of SEC Staff members is assigned to review the filing, which consists of accountants and lawyers, including examiners and supervisors. The SEC’s principal focus during the review process is to assess the company’s compliance with the SEC’s registration and disclosure rules, although the nature of some comments shade into substantive review. The SEC considers the disclosures in the registration statement through the eyes of an investor in order to determine the type of information that would be considered material to an investor. The SEC Staff will closely review websites, databases and magazine and newspaper articles, looking in particular for information that they think should be included the registration statement or that contradicts information included in the registration statement. This is Mo. Fo. 46

SEC Review Process (cont’d) The review process is time-consuming. While there was a time when the review process could be completed in roughly two months, now given the length of many prospectuses and the complexity of the company’s business and the nature of the issues raised in the review process, it can take three to five months. Initial comments on the registration statement are provided in about 30 days; however, depending on the SEC’s workload and the complexity of the filing, the receipt of first-round comments may take longer. The SEC’s initial comment letter typically includes about 50 to 75 comments, with a majority of the comments addressing accounting issues. The company and counsel will prepare a complete and often lengthy response. In some instances, the company may not agree with the SEC Staff’s comments, and may choose to schedule calls to discuss the matter with the SEC Staff. The company will file an amendment to the registration statement, and provide the response letter along with any additional information. The SEC Staff generally tries to address response letters and amendments within 10 days, but timing varies considerably. This is Mo. Fo. 47

SEC Review Process (cont’d) The review process is time-consuming. While there was a time when the review process could be completed in roughly two months, now given the length of many prospectuses and the complexity of the company’s business and the nature of the issues raised in the review process, it can take three to five months. Initial comments on the registration statement are provided in about 30 days; however, depending on the SEC’s workload and the complexity of the filing, the receipt of first-round comments may take longer. The SEC’s initial comment letter typically includes about 50 to 75 comments, with a majority of the comments addressing accounting issues. The company and counsel will prepare a complete and often lengthy response. In some instances, the company may not agree with the SEC Staff’s comments, and may choose to schedule calls to discuss the matter with the SEC Staff. The company will file an amendment to the registration statement, and provide the response letter along with any additional information. The SEC Staff generally tries to address response letters and amendments within 10 days, but timing varies considerably. This is Mo. Fo. 47

FPIs This is Mo. Fo. 48

FPIs This is Mo. Fo. 48

What is a “Foreign Private Issuer? ” • An FPI is any issuer (other than a foreign government) incorporated or organized under the laws of a jurisdiction outside of the U. S. , unless more than 50% of the issuer’s outstanding voting securities are held directly or indirectly by residents of the U. S. , and any of the following applies: • the majority of the issuer’s executive officers or directors are U. S. citizens or residents; • the majority of the issuer’s assets are located in the U. S. ; or • the issuer’s business is principally administered in the U. S. • Securities held of record by a broker, dealer, bank or nominee for the accounts of customers residing in the U. S. are counted as held in the U. S. by the number of separate accounts for which the securities are held. This is Mo. Fo. 49

What is a “Foreign Private Issuer? ” • An FPI is any issuer (other than a foreign government) incorporated or organized under the laws of a jurisdiction outside of the U. S. , unless more than 50% of the issuer’s outstanding voting securities are held directly or indirectly by residents of the U. S. , and any of the following applies: • the majority of the issuer’s executive officers or directors are U. S. citizens or residents; • the majority of the issuer’s assets are located in the U. S. ; or • the issuer’s business is principally administered in the U. S. • Securities held of record by a broker, dealer, bank or nominee for the accounts of customers residing in the U. S. are counted as held in the U. S. by the number of separate accounts for which the securities are held. This is Mo. Fo. 49

Annual Qualification Test • An FPI is only required to determine its status on the last business day of the most recently completed second fiscal quarter. • An FPI that obtains its issuer status is not immediately obligated to comply with U. S. reporting obligations. • Reporting obligations begin the first day of the FPI’s next fiscal year, when it is required to file an annual report on Form 20 -F for the fiscal year its issuer status was determined (within four months of the end of that fiscal year). • However, a foreign company that obtains FPI status following an annual qualification test can avail itself of the benefits of FPI status immediately. This is Mo. Fo. 50

Annual Qualification Test • An FPI is only required to determine its status on the last business day of the most recently completed second fiscal quarter. • An FPI that obtains its issuer status is not immediately obligated to comply with U. S. reporting obligations. • Reporting obligations begin the first day of the FPI’s next fiscal year, when it is required to file an annual report on Form 20 -F for the fiscal year its issuer status was determined (within four months of the end of that fiscal year). • However, a foreign company that obtains FPI status following an annual qualification test can avail itself of the benefits of FPI status immediately. This is Mo. Fo. 50

How Does an FPI Become Subject to U. S. Reporting Requirements? • An FPI will be subject to the reporting requirements under U. S. federal securities laws if: • it registers with the SEC the public offer and sale of its securities under the Securities Act; • it lists a class of its securities, either equity or debt, on a U. S. national securities exchange (e. g. , NYSE and Nasdaq); or • within 120 days after the last day of its first fiscal year in which the issuer had total assets that exceed $10, 000 and a class of equity securities held of record by either: (1) 2, 000 or more persons or (2) 500 persons who are not “accredited investors” in the United States (or, in the case of an FPI that is a bank holding company, if it had total assets that exceeded $10, 000 and a class of equity securities held of record by either 2, 000 or more persons). • However, an FPI may also deregister more easily than a domestic issuer. This is Mo. Fo. 51

How Does an FPI Become Subject to U. S. Reporting Requirements? • An FPI will be subject to the reporting requirements under U. S. federal securities laws if: • it registers with the SEC the public offer and sale of its securities under the Securities Act; • it lists a class of its securities, either equity or debt, on a U. S. national securities exchange (e. g. , NYSE and Nasdaq); or • within 120 days after the last day of its first fiscal year in which the issuer had total assets that exceed $10, 000 and a class of equity securities held of record by either: (1) 2, 000 or more persons or (2) 500 persons who are not “accredited investors” in the United States (or, in the case of an FPI that is a bank holding company, if it had total assets that exceeded $10, 000 and a class of equity securities held of record by either 2, 000 or more persons). • However, an FPI may also deregister more easily than a domestic issuer. This is Mo. Fo. 51

Considerations for Being a Public Company in the U. S. • Foreign issuers usually weigh having greater access to capital and the imprimatur of success associated with a public offering in the U. S. with the following concerns: • Heightened disclosure standards • Corporate governance considerations, stemming from SRO requirements and requirements under the Sarbanes-Oxley Act of 2002 (“Sarbanes-Oxley”) • Accounting related disclosures • Possibility for exiting the system (deregistration) • Litigation exposure This is Mo. Fo. 52

Considerations for Being a Public Company in the U. S. • Foreign issuers usually weigh having greater access to capital and the imprimatur of success associated with a public offering in the U. S. with the following concerns: • Heightened disclosure standards • Corporate governance considerations, stemming from SRO requirements and requirements under the Sarbanes-Oxley Act of 2002 (“Sarbanes-Oxley”) • Accounting related disclosures • Possibility for exiting the system (deregistration) • Litigation exposure This is Mo. Fo. 52

Benefits Available to FPIs A FPI may exit (or deregister) the U. S. reporting regime more easily than a U. S. issuer Quarterly reports: A FPI is not required to file quarterly reports Proxies: A FPI is not required to file proxy statements Ownership reporting: No Section 16 reporting Governance: A FPI may choose to rely on certain home-country practices XBRL: Temporary XBRL relief for FPIs Internal controls: Annual internal control reporting Executive compensation: As a FPI, certain of the more onerous executive compensation disclosure requirements are not applicable IFRS without GAAP reconciliation 12 g 3 -2(b) exemption This is Mo. Fo. 53

Benefits Available to FPIs A FPI may exit (or deregister) the U. S. reporting regime more easily than a U. S. issuer Quarterly reports: A FPI is not required to file quarterly reports Proxies: A FPI is not required to file proxy statements Ownership reporting: No Section 16 reporting Governance: A FPI may choose to rely on certain home-country practices XBRL: Temporary XBRL relief for FPIs Internal controls: Annual internal control reporting Executive compensation: As a FPI, certain of the more onerous executive compensation disclosure requirements are not applicable IFRS without GAAP reconciliation 12 g 3 -2(b) exemption This is Mo. Fo. 53

Confidential Submissions Only certain kinds of FPIs may now confidentially submit registration statements: An FPI that is listed or is concurrently listing its securities on a non-U. S. securities exchange, An FPI that is being privatized by a foreign government, or An FPI that can demonstrate that the public filing of an initial registration statement would conflict with the law of an applicable foreign jurisdiction. In addition, shell companies, blank check companies and issuers with no or substantially no business operations are precluded from using the confidential submission process. This is Mo. Fo. 54

Confidential Submissions Only certain kinds of FPIs may now confidentially submit registration statements: An FPI that is listed or is concurrently listing its securities on a non-U. S. securities exchange, An FPI that is being privatized by a foreign government, or An FPI that can demonstrate that the public filing of an initial registration statement would conflict with the law of an applicable foreign jurisdiction. In addition, shell companies, blank check companies and issuers with no or substantially no business operations are precluded from using the confidential submission process. This is Mo. Fo. 54

Confidential Submissions (cont’d) However, an FPI may still qualify as an “emerging growth company” (“EGC”) under Title I of the Jumpstart Our Business Startups Act (the “JOBS Act”), in which case it could still submit registration statements confidentially, provided that: The FPI elects to be treated as an EGC; and The initial confidential submissions and all amendments are filed with the SEC no later than 21 days prior to the FPI’s commencement of the road show. This is Mo. Fo. 55

Confidential Submissions (cont’d) However, an FPI may still qualify as an “emerging growth company” (“EGC”) under Title I of the Jumpstart Our Business Startups Act (the “JOBS Act”), in which case it could still submit registration statements confidentially, provided that: The FPI elects to be treated as an EGC; and The initial confidential submissions and all amendments are filed with the SEC no later than 21 days prior to the FPI’s commencement of the road show. This is Mo. Fo. 55

EGCs An EGC is defined as an issuer with total gross revenues of under $1 billion (subject to inflationary adjustment by the SEC every five years) during its most recently completed fiscal year. A company remains an EGC until the earlier of five years or: the last day of the fiscal year during which the issuer has total annual gross revenues in excess of a $1 billion (subject to inflationary indexing); the last day of the issuer’s fiscal year following the fifth anniversary of the date of the first sale of common equity securities of the issuer pursuant to an effective registration statement under the Securities Act; the date on which such issuer has, during the prior three-year period, issued more than $1 billion in nonconvertible debt; or the date on which the issuer is deemed a “large accelerated filer. ” An issuer will not be able to qualify as an EGC if it first sold its common stock in an initial public offering (“IPO”) prior to December 8, 2011. This is Mo. Fo. 56

EGCs An EGC is defined as an issuer with total gross revenues of under $1 billion (subject to inflationary adjustment by the SEC every five years) during its most recently completed fiscal year. A company remains an EGC until the earlier of five years or: the last day of the fiscal year during which the issuer has total annual gross revenues in excess of a $1 billion (subject to inflationary indexing); the last day of the issuer’s fiscal year following the fifth anniversary of the date of the first sale of common equity securities of the issuer pursuant to an effective registration statement under the Securities Act; the date on which such issuer has, during the prior three-year period, issued more than $1 billion in nonconvertible debt; or the date on which the issuer is deemed a “large accelerated filer. ” An issuer will not be able to qualify as an EGC if it first sold its common stock in an initial public offering (“IPO”) prior to December 8, 2011. This is Mo. Fo. 56

Other EGC Accommodations For FPIs that are EGCs, the JOBS Act allows for a streamlined IPO “on-ramp” process in order to phase-in some of the more comprehensive and costly disclosure requirements. For instance, an EGC has the option to do the following: Testing- the- Waters: An EGC is permitted to engage in oral or written communications with qualified institutional buyers (“QIBs”) and institutional accredited investors in order to gauge their interest in a proposed IPO, either prior to or following the initial filing of the IPO registration statement. Research Reports: Broker-dealers are permitted to publish or distribute a research report about an EGC that proposes to register or is in registration. The research report will not be deemed an “offer” under the Securities Act regardless of whether the broker-dealer intends on participating, or is currently participating, in the offering. This is Mo. Fo. 57

Other EGC Accommodations For FPIs that are EGCs, the JOBS Act allows for a streamlined IPO “on-ramp” process in order to phase-in some of the more comprehensive and costly disclosure requirements. For instance, an EGC has the option to do the following: Testing- the- Waters: An EGC is permitted to engage in oral or written communications with qualified institutional buyers (“QIBs”) and institutional accredited investors in order to gauge their interest in a proposed IPO, either prior to or following the initial filing of the IPO registration statement. Research Reports: Broker-dealers are permitted to publish or distribute a research report about an EGC that proposes to register or is in registration. The research report will not be deemed an “offer” under the Securities Act regardless of whether the broker-dealer intends on participating, or is currently participating, in the offering. This is Mo. Fo. 57

EGC Accommodations (cont’d) Audited Financials: An EGC is required to present only two years of audited financial statements (as opposed to three years) in connection with its IPO registration statement. In any other registration statement or periodic report, an EGC need not include financial information within its selected financial data or in its Management Discussion and Analysis disclosure for periods prior to those presented in its IPO registration statement. Auditor Attestation Report on Internal Control: An EGC is exempt from the requirement to obtain an attestation report on internal control over financial reporting from its registered public accounting firm. This is Mo. Fo. 58

EGC Accommodations (cont’d) Audited Financials: An EGC is required to present only two years of audited financial statements (as opposed to three years) in connection with its IPO registration statement. In any other registration statement or periodic report, an EGC need not include financial information within its selected financial data or in its Management Discussion and Analysis disclosure for periods prior to those presented in its IPO registration statement. Auditor Attestation Report on Internal Control: An EGC is exempt from the requirement to obtain an attestation report on internal control over financial reporting from its registered public accounting firm. This is Mo. Fo. 58

Accounting Considerations This is Mo. Fo. 59

Accounting Considerations This is Mo. Fo. 59

Accounting Considerations FPIs that prepare their financial statements under U. S. GAAP will find that the SEC will require additional disclosures and other explanations in their financial statements. In addition, FPIs that prepare financial statements under U. S. GAAP should be prepared to address SEC accounting comments regarding their registration statements. This is Mo. Fo. 60

Accounting Considerations FPIs that prepare their financial statements under U. S. GAAP will find that the SEC will require additional disclosures and other explanations in their financial statements. In addition, FPIs that prepare financial statements under U. S. GAAP should be prepared to address SEC accounting comments regarding their registration statements. This is Mo. Fo. 60

Elimination of GAAP Reconciliation Modified financial disclosures Under Item 18 of Form 20 -F, an FPI is required to make certain disclosures regarding its financial statements. Traditionally, an FPI listing securities in the U. S. was required to either prepare its financial statements in accordance with U. S. GAAP or reconcile its financial statements to those rules. Most FPIs were obligated to provide information that was not otherwise required under their home countries’ GAAP. This is Mo. Fo. 61

Elimination of GAAP Reconciliation Modified financial disclosures Under Item 18 of Form 20 -F, an FPI is required to make certain disclosures regarding its financial statements. Traditionally, an FPI listing securities in the U. S. was required to either prepare its financial statements in accordance with U. S. GAAP or reconcile its financial statements to those rules. Most FPIs were obligated to provide information that was not otherwise required under their home countries’ GAAP. This is Mo. Fo. 61

Elimination of GAAP Reconciliation (cont’d) New SEC rules omit U. S. GAAP reconciliation requirements if an FPI satisfies the following conditions: The financial statements must be prepared in accordance with the English language version of the International Financial Reporting Standards (“IFRS”) as published by the International Accounting Standards Board (the “IASB”); The FPI must state in the notes to the financial statements that its financial statements are in compliance with IFRS as issued by the IASB; and The FPI must provide an opinion by an independent auditor stating that the financial statements are in compliance with IFRS as issued by the IASB. This is Mo. Fo. 62

Elimination of GAAP Reconciliation (cont’d) New SEC rules omit U. S. GAAP reconciliation requirements if an FPI satisfies the following conditions: The financial statements must be prepared in accordance with the English language version of the International Financial Reporting Standards (“IFRS”) as published by the International Accounting Standards Board (the “IASB”); The FPI must state in the notes to the financial statements that its financial statements are in compliance with IFRS as issued by the IASB; and The FPI must provide an opinion by an independent auditor stating that the financial statements are in compliance with IFRS as issued by the IASB. This is Mo. Fo. 62

GAAP Reconciliation and IFRS Convergence General Instruction G to Form 20 -F permits eligible foreign private issuers to file only two years of statements of income, shareholders’ equity and cash flows prepared in accordance with IFRS for their first year of reporting in accordance with IFRS. In its second year of IFRS reporting and thereafter, an FPI must provide three years of audited IFRS financials. FPIs that do not prepare their financial statements in accordance with IFRS as issued by the IASB can either: Continue to reconcile their financial statements to U. S. GAAP; or Include in their IFRS financial statements such additional information as is necessary to comply with the IASB issued IFRS, as well as the jurisdiction specific IFRS. This is Mo. Fo. 63

GAAP Reconciliation and IFRS Convergence General Instruction G to Form 20 -F permits eligible foreign private issuers to file only two years of statements of income, shareholders’ equity and cash flows prepared in accordance with IFRS for their first year of reporting in accordance with IFRS. In its second year of IFRS reporting and thereafter, an FPI must provide three years of audited IFRS financials. FPIs that do not prepare their financial statements in accordance with IFRS as issued by the IASB can either: Continue to reconcile their financial statements to U. S. GAAP; or Include in their IFRS financial statements such additional information as is necessary to comply with the IASB issued IFRS, as well as the jurisdiction specific IFRS. This is Mo. Fo. 63

Convenience Translations and Exchange Rates If the reporting currency is not the U. S. dollar, U. S. dollar-equivalent financial statements or convenience translations are not permitted to be included, except that an FPI may present a translation of the most recent fiscal year and any subsequent interim period. The exchange rate used for any convenience translations should be as of the most recent balance sheet date included in the registration statement, except where the exchange rate of the most recent practicable date would yield a materially different result. In addition, FPIs that do not prepare their financial statements in U. S. dollars must provide disclosure of the exchange rate between the reporting currency and the U. S. dollar. This is Mo. Fo. 64

Convenience Translations and Exchange Rates If the reporting currency is not the U. S. dollar, U. S. dollar-equivalent financial statements or convenience translations are not permitted to be included, except that an FPI may present a translation of the most recent fiscal year and any subsequent interim period. The exchange rate used for any convenience translations should be as of the most recent balance sheet date included in the registration statement, except where the exchange rate of the most recent practicable date would yield a materially different result. In addition, FPIs that do not prepare their financial statements in U. S. dollars must provide disclosure of the exchange rate between the reporting currency and the U. S. dollar. This is Mo. Fo. 64

Corporate Governance Considerations This is Mo. Fo. 65

Corporate Governance Considerations This is Mo. Fo. 65

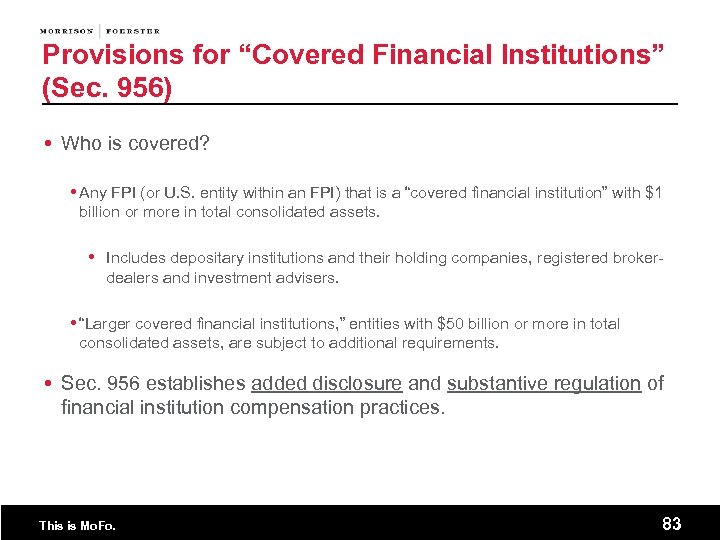

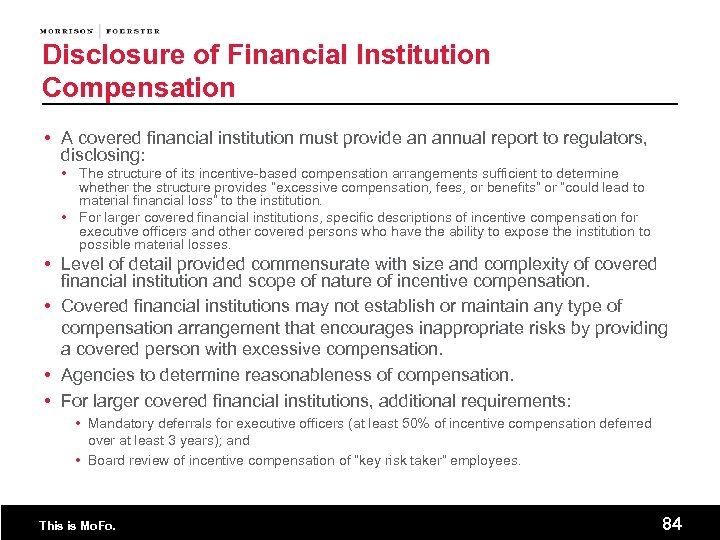

Corporate Governance: Audit Committee Item 6. C. 3 of Form 20 -F requires an FPI to disclose the names and method of operation of its audit committee (however, an FPI has no legal obligation to establish an audit committee). Section 10 A-3 of the Exchange Act, pursuant to Rule 10 A(m) of the Exchange Act and Section 301 of Sarbanes-Oxley, contains specific rules for how to conduct and organize an audit committee (each securities exchange also imposes its own set of rules regarding audit committees). An FPI is required to disclose in its periodic reports whether the audit committee includes at least one financial expert. The audit committee must: (1) exercise “independence; ” (2) possess the authority to employ, compensate and oversee the work of the independent auditors; (3) possess the authority to employ and compensate outside advisors; and (4) implement procedures for handling complaints regarding accounting, internal accounting control or auditing matters, including “confidential, anonymous submission by employees of the issuer of concern regarding questionable accounting or auditing matters. This is Mo. Fo. 66