2e9a6dfdd9f003f2961a55c275944430.ppt

- Количество слайдов: 28

• Jane Jarcho, National Associate Director of the IA/IC Exam Program at OCIE • Michelle Jacko, Managing Partner, Jacko Law Group and CEO of Core Compliance & Legal Services in San Diego • Tanya Kerrigan, General Counsel/CCO, Boston Advisors • Brian Moran, CCO, Sterling Capital Management in Charlotte, N. C

• Jane Jarcho, National Associate Director of the IA/IC Exam Program at OCIE • Michelle Jacko, Managing Partner, Jacko Law Group and CEO of Core Compliance & Legal Services in San Diego • Tanya Kerrigan, General Counsel/CCO, Boston Advisors • Brian Moran, CCO, Sterling Capital Management in Charlotte, N. C

You’ve got questions…we’ve got answers. Use the question pane on your dashboard throughout the webinar. We’ll address your questions at the end of the webinar.

You’ve got questions…we’ve got answers. Use the question pane on your dashboard throughout the webinar. We’ll address your questions at the end of the webinar.

Jane Jarcho National Associate Director of the IA/IC Exam Program at OCIE

Jane Jarcho National Associate Director of the IA/IC Exam Program at OCIE

Jane Jarcho 2015 OCIE Exam Priorities

Jane Jarcho 2015 OCIE Exam Priorities

What is Happening in Examinations 2015 OCIE Priorities Matters of Importance to Retail Investors and Investors Saving for Retirement Assessing Issues Related to Market-Wide Risks Data Analytics and Applying Risk Ratings to Entities What the SEC is Examining Technology – Cybersecurity Controls for BDs, IAs and Transfer Agents and Resources to Support Compliance Investment Recommendations and Related Marketing, Suitability and Fee Structures 5

What is Happening in Examinations 2015 OCIE Priorities Matters of Importance to Retail Investors and Investors Saving for Retirement Assessing Issues Related to Market-Wide Risks Data Analytics and Applying Risk Ratings to Entities What the SEC is Examining Technology – Cybersecurity Controls for BDs, IAs and Transfer Agents and Resources to Support Compliance Investment Recommendations and Related Marketing, Suitability and Fee Structures 5

Other Examination Initiatives Newly Registered Municipal Advisors Never-Before-Examined Investment Companies Proxy Services Includes how proxy advisory service firms are making recommendations and disclosing conflicts of interest as well as the adviser’s fiduciary duty to vote such proxies Fees and Expenses in Private Equity Transfer Agents Includes an exam of those involved with microcap securities and private offerings 6

Other Examination Initiatives Newly Registered Municipal Advisors Never-Before-Examined Investment Companies Proxy Services Includes how proxy advisory service firms are making recommendations and disclosing conflicts of interest as well as the adviser’s fiduciary duty to vote such proxies Fees and Expenses in Private Equity Transfer Agents Includes an exam of those involved with microcap securities and private offerings 6

Michelle Jacko Managing Partner, Jacko Law Group and CEO of Core Compliance & Legal Services in San Diego

Michelle Jacko Managing Partner, Jacko Law Group and CEO of Core Compliance & Legal Services in San Diego

Current SEC Examination Focus Areas Portfolio Management Trading Practices Conflicts of Interest Client Disclosures Compliance Programs Performance Calculations & Advertising Issues Custody Valuation Business Continuity / Disaster Recovery Cybersecurity 8

Current SEC Examination Focus Areas Portfolio Management Trading Practices Conflicts of Interest Client Disclosures Compliance Programs Performance Calculations & Advertising Issues Custody Valuation Business Continuity / Disaster Recovery Cybersecurity 8

Hot Topic Example #1: Performance Calculations & Advertising Anti Fraud Provisions: It is illegal to make a misstatement or omission of a material fact in connection with an offering of securities Firms should have policies and procedures in place to verify the accuracy of the performance and marketing information provided to solicit new clients Recent deficiencies include: Unsupported claims Use of superlatives Inadequacy of risk and conflict disclosures Inaccurate performance reporting 9

Hot Topic Example #1: Performance Calculations & Advertising Anti Fraud Provisions: It is illegal to make a misstatement or omission of a material fact in connection with an offering of securities Firms should have policies and procedures in place to verify the accuracy of the performance and marketing information provided to solicit new clients Recent deficiencies include: Unsupported claims Use of superlatives Inadequacy of risk and conflict disclosures Inaccurate performance reporting 9

How to Prepare and Manage the Examination Identify Securities Regulations that Govern the Firm’s Practice Areas Review and Update Firm Policies and Procedures Have you identified risks and conflicts Are your protocols clear Who is the supervisor and do they understand their roles and responsibilities Question adequacy of each policy and procedure Perform tests to determine effectiveness 10

How to Prepare and Manage the Examination Identify Securities Regulations that Govern the Firm’s Practice Areas Review and Update Firm Policies and Procedures Have you identified risks and conflicts Are your protocols clear Who is the supervisor and do they understand their roles and responsibilities Question adequacy of each policy and procedure Perform tests to determine effectiveness 10

How to Prepare and Manage the Examination Gather Compliance Program Documentation Risk Assessment and Annual Review Reports Evidence of Testing and Exception Reports Training Program for Associated Persons Substantiation of a Customized Compliance System Assess Overall Effectiveness “Not all compliance failures result in fraud, but many frauds take root in compliance deficiencies. ” -Robert Khuzami, Former Director of the SEC Division of Enforcement 11

How to Prepare and Manage the Examination Gather Compliance Program Documentation Risk Assessment and Annual Review Reports Evidence of Testing and Exception Reports Training Program for Associated Persons Substantiation of a Customized Compliance System Assess Overall Effectiveness “Not all compliance failures result in fraud, but many frauds take root in compliance deficiencies. ” -Robert Khuzami, Former Director of the SEC Division of Enforcement 11

Priorities for Advisers Review new services and business lines carefully; identify potential conflicts of interests and risks, and mitigate where possible Consider internal controls, suitability for clients, compensation arrangements, effective disclosures and use of technology Stay apprised of new regulations and how they may impact your business Be aware of how the firm and its services are being promoted to prospective and existing clients 12

Priorities for Advisers Review new services and business lines carefully; identify potential conflicts of interests and risks, and mitigate where possible Consider internal controls, suitability for clients, compensation arrangements, effective disclosures and use of technology Stay apprised of new regulations and how they may impact your business Be aware of how the firm and its services are being promoted to prospective and existing clients 12

Tanya Kerrigan General Counsel/CCO Boston Advisors

Tanya Kerrigan General Counsel/CCO Boston Advisors

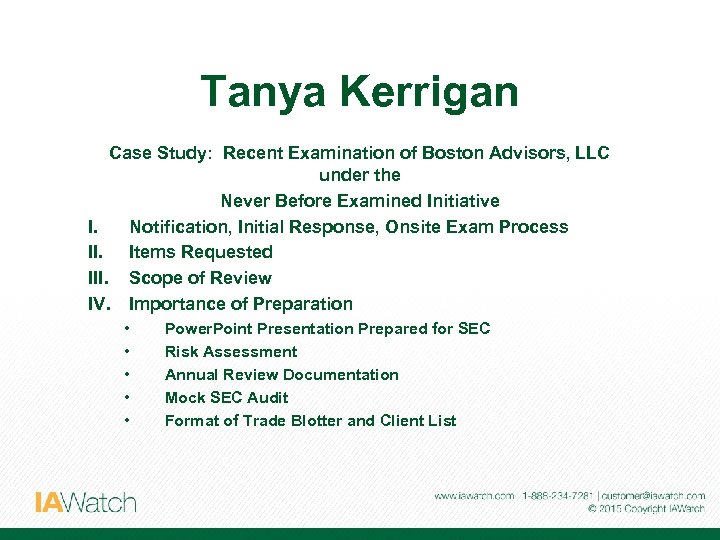

Tanya Kerrigan Case Study: Recent Examination of Boston Advisors, LLC under the Never Before Examined Initiative I. Notification, Initial Response, Onsite Exam Process II. Items Requested III. Scope of Review IV. Importance of Preparation • • • Power. Point Presentation Prepared for SEC Risk Assessment Annual Review Documentation Mock SEC Audit Format of Trade Blotter and Client List

Tanya Kerrigan Case Study: Recent Examination of Boston Advisors, LLC under the Never Before Examined Initiative I. Notification, Initial Response, Onsite Exam Process II. Items Requested III. Scope of Review IV. Importance of Preparation • • • Power. Point Presentation Prepared for SEC Risk Assessment Annual Review Documentation Mock SEC Audit Format of Trade Blotter and Client List

Tanya Kerrigan I. Notification, Initial Response, Onsite Examination Process • • • Received exam request on December 17, 2014 and were notified via telephone that the SEC wanted to be onsite on January 3, 2015. Request contained 22 items and turnaround for response was fast. Specifically: Trade Blotter, Policies and Procedures Manual, Annual Testing and Risk Assessment were requested for immediate delivery immediately, if possible. All documentation was sent to SEC within 4 days. Onsite Commenced January 3, 2015 - 4 examiners were present for 4 days. Written and Verbal requests were received sporadically over the next 2 months. 15

Tanya Kerrigan I. Notification, Initial Response, Onsite Examination Process • • • Received exam request on December 17, 2014 and were notified via telephone that the SEC wanted to be onsite on January 3, 2015. Request contained 22 items and turnaround for response was fast. Specifically: Trade Blotter, Policies and Procedures Manual, Annual Testing and Risk Assessment were requested for immediate delivery immediately, if possible. All documentation was sent to SEC within 4 days. Onsite Commenced January 3, 2015 - 4 examiners were present for 4 days. Written and Verbal requests were received sporadically over the next 2 months. 15

Tanya Kerrigan II. Items Requested A. Typical Items you would expect were requested: • • • Policies and Procedures and Risk Assessment List of clients and employees lost during Exam Period Company Balance Sheet, trial balance, income statement, general ledger detail and statement of cash flows List of all principal and cross transactions that took place during Exam Period 206(4)(7) Annual Review List of all threatened, pending the settled litigation/arbitration List of approved broker dealers used List of all IPO’s invested in for clients/firm Evidence of Best Execution testing Evidence of Compliance testing List of all parties that received referral payments 16

Tanya Kerrigan II. Items Requested A. Typical Items you would expect were requested: • • • Policies and Procedures and Risk Assessment List of clients and employees lost during Exam Period Company Balance Sheet, trial balance, income statement, general ledger detail and statement of cash flows List of all principal and cross transactions that took place during Exam Period 206(4)(7) Annual Review List of all threatened, pending the settled litigation/arbitration List of approved broker dealers used List of all IPO’s invested in for clients/firm Evidence of Best Execution testing Evidence of Compliance testing List of all parties that received referral payments 16

Tanya Kerrigan II. Items Requested (continued) B. Items we found surprising • Format of the Trade Blotter Trade blotter request included 27 required fields which was not standard for Advent Moxy and required coding work to comply with request • Format of the Client Request List Client List included 13 required fields and required patching of several different reports together to satisfy request. • Portfolio Starting Positions (a list of all initial holdings positions as of December 17, 2014 • All service agreements for compliance consultants utilized • There were no request for emails or marketing, initially 17

Tanya Kerrigan II. Items Requested (continued) B. Items we found surprising • Format of the Trade Blotter Trade blotter request included 27 required fields which was not standard for Advent Moxy and required coding work to comply with request • Format of the Client Request List Client List included 13 required fields and required patching of several different reports together to satisfy request. • Portfolio Starting Positions (a list of all initial holdings positions as of December 17, 2014 • All service agreements for compliance consultants utilized • There were no request for emails or marketing, initially 17

Tanya Kerrigan III. Scope of Review While we were often reminded that the NBE initiative is a “limited scope” engagement, once the review as begun, the examiners requested information that potentially went beyond a “limited scope” engagement. 18

Tanya Kerrigan III. Scope of Review While we were often reminded that the NBE initiative is a “limited scope” engagement, once the review as begun, the examiners requested information that potentially went beyond a “limited scope” engagement. 18

Tanya Kerrigan IV. Importance of Preparation The most valuable items that we produced which shortened the duration and scope of the exam were: • A Power. Point presentation created in advance for the SEC that summarized the firm. • A detailed risk assessment • A detailed 206(4)(7) Annual Review 19

Tanya Kerrigan IV. Importance of Preparation The most valuable items that we produced which shortened the duration and scope of the exam were: • A Power. Point presentation created in advance for the SEC that summarized the firm. • A detailed risk assessment • A detailed 206(4)(7) Annual Review 19

Brian Moran CCO, Sterling Capital Management in Charlotte, N. C

Brian Moran CCO, Sterling Capital Management in Charlotte, N. C

Brian Moran Specific Investment Adviser Examination Request Items: • A list of all committees including a description of each committee's responsibilities, meeting frequency, and a list of the members of each committee. State whether the committees keep written minutes. • The names and location of all affiliated and unaffiliated key service providers and the services they perform. • Compliance and operational policies and procedures in effect during the Examination Period for the Adviser and its affiliates. Please be sure to also include any Code of Ethics, insider trading, fair valuation, remote office monitoring, contractor oversight, and GIPS policies and procedures that are created and maintained.

Brian Moran Specific Investment Adviser Examination Request Items: • A list of all committees including a description of each committee's responsibilities, meeting frequency, and a list of the members of each committee. State whether the committees keep written minutes. • The names and location of all affiliated and unaffiliated key service providers and the services they perform. • Compliance and operational policies and procedures in effect during the Examination Period for the Adviser and its affiliates. Please be sure to also include any Code of Ethics, insider trading, fair valuation, remote office monitoring, contractor oversight, and GIPS policies and procedures that are created and maintained.

Brian Moran Specific Investment Adviser Examination Request Items: • Any written interim or annual compliance reviews, internal control analyses, and forensic or transactional tests performed. Include any significant findings, both positive and negative, and any information about corrective or remedial actions taken regarding these findings. • A current inventory of the Adviser's compliance risks that forms the basis for its policies and procedures. Note any changes made to the inventory during the Examination Period and the dates of the changes.

Brian Moran Specific Investment Adviser Examination Request Items: • Any written interim or annual compliance reviews, internal control analyses, and forensic or transactional tests performed. Include any significant findings, both positive and negative, and any information about corrective or remedial actions taken regarding these findings. • A current inventory of the Adviser's compliance risks that forms the basis for its policies and procedures. Note any changes made to the inventory during the Examination Period and the dates of the changes.

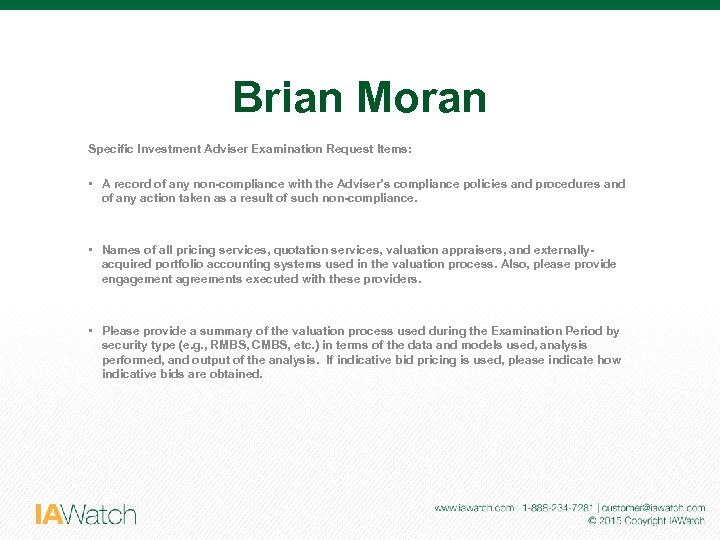

Brian Moran Specific Investment Adviser Examination Request Items: • A record of any non compliance with the Adviser's compliance policies and procedures and of any action taken as a result of such non compliance. • Names of all pricing services, quotation services, valuation appraisers, and externally acquired portfolio accounting systems used in the valuation process. Also, please provide engagement agreements executed with these providers. • Please provide a summary of the valuation process used during the Examination Period by security type (e. g. , RMBS, CMBS, etc. ) in terms of the data and models used, analysis performed, and output of the analysis. If indicative bid pricing is used, please indicate how indicative bids are obtained.

Brian Moran Specific Investment Adviser Examination Request Items: • A record of any non compliance with the Adviser's compliance policies and procedures and of any action taken as a result of such non compliance. • Names of all pricing services, quotation services, valuation appraisers, and externally acquired portfolio accounting systems used in the valuation process. Also, please provide engagement agreements executed with these providers. • Please provide a summary of the valuation process used during the Examination Period by security type (e. g. , RMBS, CMBS, etc. ) in terms of the data and models used, analysis performed, and output of the analysis. If indicative bid pricing is used, please indicate how indicative bids are obtained.

Brian Moran Specific Investment Company Examination Request Items: • The annual reports submitted to the RICs respective Boards of Directors/Trustees (the "Board") by the Chief Compliance Officer ("CCO") during the exam period. • Policy and procedures regarding disclosing, quantifying, and testing liquidity management related risks. • Minutes of RICs' Board meetings for the Inspection Period, meeting agenda for each meeting and, the agenda and a draft of the minutes for the most recent Board meeting(s). • Any internal reports created and maintained that reflect the amount of exposure to illiquid assets.

Brian Moran Specific Investment Company Examination Request Items: • The annual reports submitted to the RICs respective Boards of Directors/Trustees (the "Board") by the Chief Compliance Officer ("CCO") during the exam period. • Policy and procedures regarding disclosing, quantifying, and testing liquidity management related risks. • Minutes of RICs' Board meetings for the Inspection Period, meeting agenda for each meeting and, the agenda and a draft of the minutes for the most recent Board meeting(s). • Any internal reports created and maintained that reflect the amount of exposure to illiquid assets.

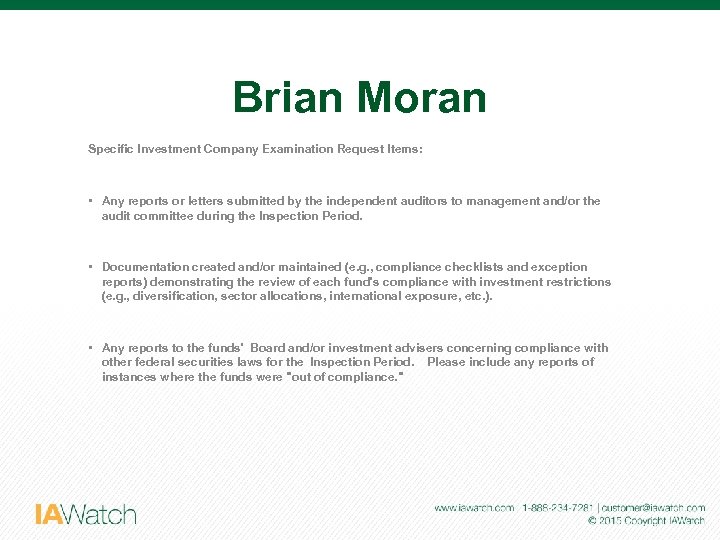

Brian Moran Specific Investment Company Examination Request Items: • Any reports or letters submitted by the independent auditors to management and/or the audit committee during the Inspection Period. • Documentation created and/or maintained (e. g. , compliance checklists and exception reports) demonstrating the review of each fund's compliance with investment restrictions (e. g. , diversification, sector allocations, international exposure, etc. ). • Any reports to the funds' Board and/or investment advisers concerning compliance with other federal securities laws for the Inspection Period. Please include any reports of instances where the funds were "out of compliance. "

Brian Moran Specific Investment Company Examination Request Items: • Any reports or letters submitted by the independent auditors to management and/or the audit committee during the Inspection Period. • Documentation created and/or maintained (e. g. , compliance checklists and exception reports) demonstrating the review of each fund's compliance with investment restrictions (e. g. , diversification, sector allocations, international exposure, etc. ). • Any reports to the funds' Board and/or investment advisers concerning compliance with other federal securities laws for the Inspection Period. Please include any reports of instances where the funds were "out of compliance. "

Brian Moran Specific Investment Company Examination Request Items: • Documents supporting the assessment of the RICs' liquidity and its ability to meet potential redemptions over a number of periods. The assessments may include, for example, needs and sources of fund liquidity over 1 day, 5 days, 30 days, and potentially longer periods. • A list of securities for which the price provided by a pricing service was overridden by the Adviser or Board of Directors and the date of the override. Summation: Examinations are becoming more pointed due to risk assessments to create efficiency but be aware that deeper dives are happening in controls around the operations of fund groups and investment advisers especially with focus on third party providers.

Brian Moran Specific Investment Company Examination Request Items: • Documents supporting the assessment of the RICs' liquidity and its ability to meet potential redemptions over a number of periods. The assessments may include, for example, needs and sources of fund liquidity over 1 day, 5 days, 30 days, and potentially longer periods. • A list of securities for which the price provided by a pricing service was overridden by the Adviser or Board of Directors and the date of the override. Summation: Examinations are becoming more pointed due to risk assessments to create efficiency but be aware that deeper dives are happening in controls around the operations of fund groups and investment advisers especially with focus on third party providers.

• Jane Jarcho, National Associate Director of the IA/IC Exam Program at OCIE • Michelle Jacko, Managing Partner, Jacko Law Group and CEO of Core Compliance & Legal Services in San Diego • Tanya Kerrigan, General Counsel/CCO, Boston Advisors • Brian Moran, CCO, Sterling Capital Management in Charlotte, N. C

• Jane Jarcho, National Associate Director of the IA/IC Exam Program at OCIE • Michelle Jacko, Managing Partner, Jacko Law Group and CEO of Core Compliance & Legal Services in San Diego • Tanya Kerrigan, General Counsel/CCO, Boston Advisors • Brian Moran, CCO, Sterling Capital Management in Charlotte, N. C