384e463cd993620e0e46ba04584937ce.ppt

- Количество слайдов: 15

Jacobs Aston Conference 2009 The vital role of local government and PPP capital programmes Chris Wilson Executive Director 4 ps 30 th April 2009

About 4 ps We are: We provide: • Owned by local government • Project & transactor support • Part of the LGA • Financial, legal, contractual support • Local government’s partnership and project delivery partner We have: • Helped many of the local government PPP and PFI schemes • Extensive experience of structuring successful schemes • Skills development • Gateway reviews We work with: • Local government • Service providers • Central government • Other organisations

agenda • context – local government capital expenditure • ppp’s and the pfi in local government • issues for private and public sector • looking to the future

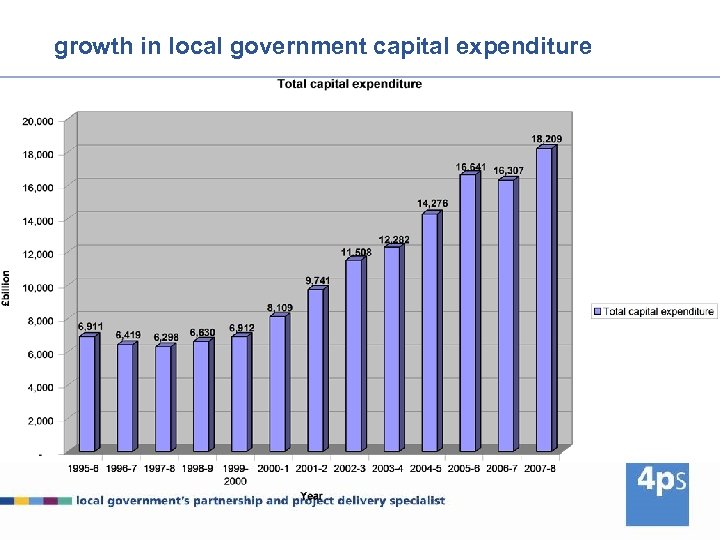

growth in local government capital expenditure

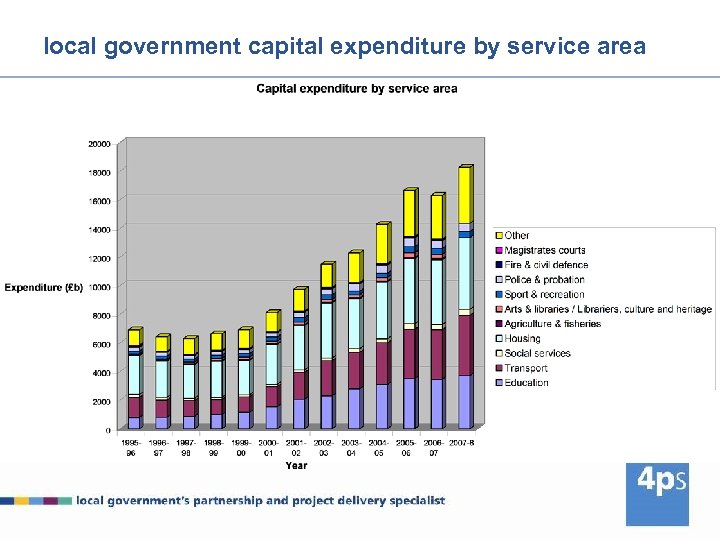

local government capital expenditure by service area

impact of credit crunch on council capital expenditure • reduced capital receipts • falling sales e. g. through ‘right to buy’ • falling commercial property values • delayed housing led regeneration schemes BUT • reduced construction costs • government’s accelerated capital programme

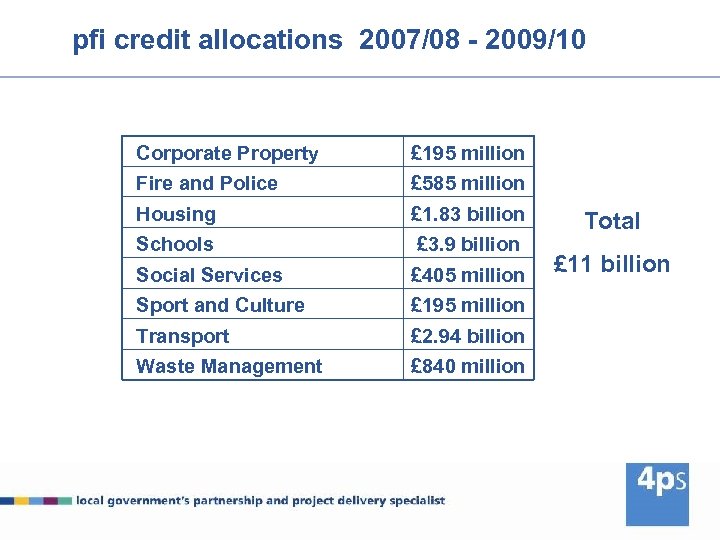

pfi credit allocations 2007/08 - 2009/10 Corporate Property £ 195 million Fire and Police £ 585 million Housing £ 1. 83 billion Schools £ 3. 9 billion Social Services £ 405 million Sport and Culture £ 195 million Transport £ 2. 94 billion Waste Management £ 840 million Total £ 11 billion

benefits of local government PPP/PFI • mature market with strong competition • track record of delivery on time and budget • fixed price design, build and operate contracts • risk transfer • due diligence and scrutiny • whole life costing • output based specifications • performance regimes resulting in high user satisfaction

impact of credit crunch • status of ppp/pfi debt • banks’ appetite for risk • changes to the structure of bank finance for ppp/pfi • margins on senior debt • procurement timescales

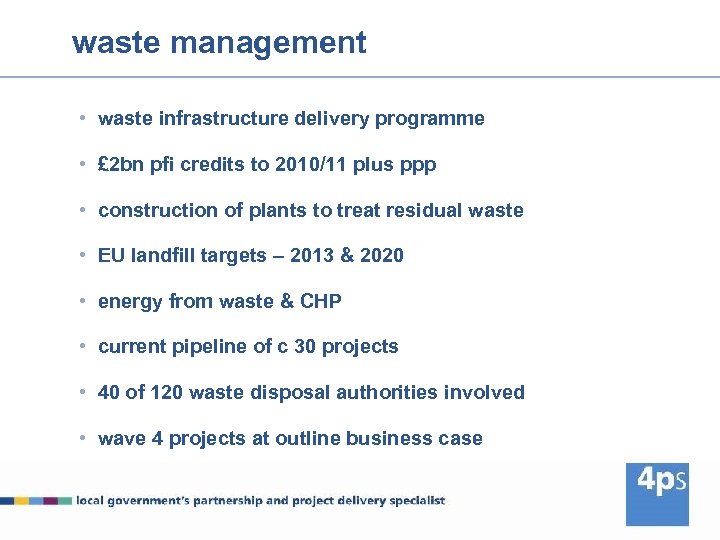

waste management • waste infrastructure delivery programme • £ 2 bn pfi credits to 2010/11 plus ppp • construction of plants to treat residual waste • EU landfill targets – 2013 & 2020 • energy from waste & CHP • current pipeline of c 30 projects • 40 of 120 waste disposal authorities involved • wave 4 projects at outline business case

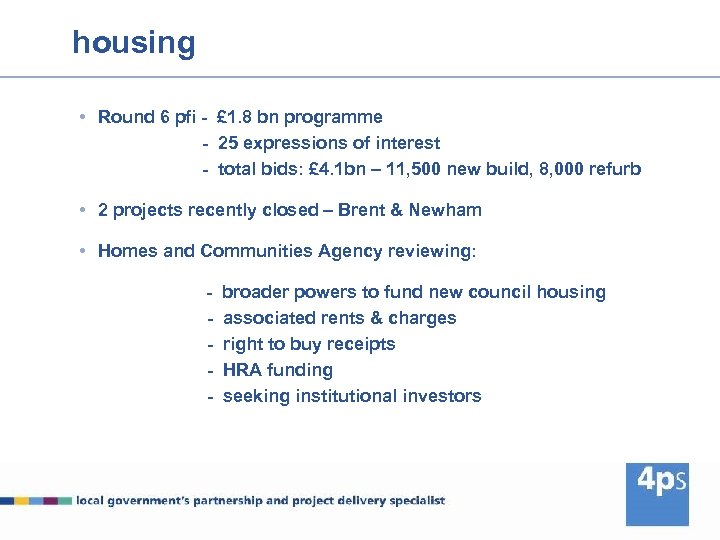

housing • Round 6 pfi - £ 1. 8 bn programme - 25 expressions of interest - total bids: £ 4. 1 bn – 11, 500 new build, 8, 000 refurb • 2 projects recently closed – Brent & Newham • Homes and Communities Agency reviewing: - broader powers to fund new council housing associated rents & charges right to buy receipts HRA funding seeking institutional investors

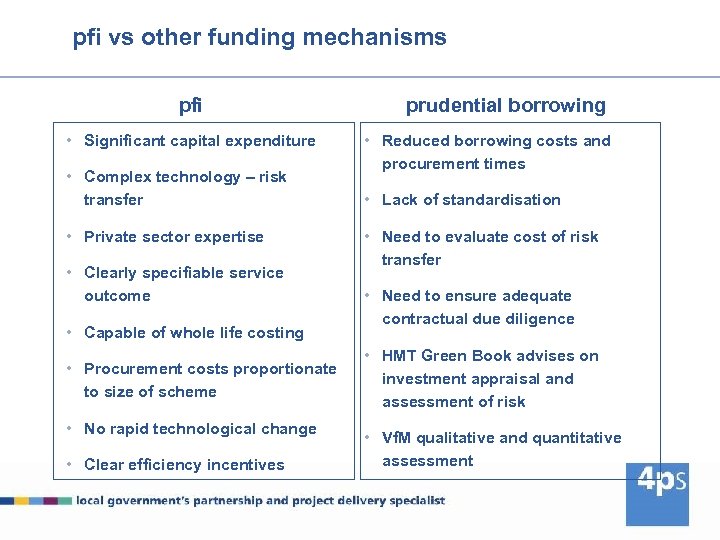

pfi vs other funding mechanisms pfi • Significant capital expenditure • Complex technology – risk transfer • Private sector expertise • Clearly specifiable service outcome • Capable of whole life costing • Procurement costs proportionate to size of scheme • No rapid technological change • Clear efficiency incentives prudential borrowing • Reduced borrowing costs and procurement times • Lack of standardisation • Need to evaluate cost of risk transfer • Need to ensure adequate contractual due diligence • HMT Green Book advises on investment appraisal and assessment of risk • Vf. M qualitative and quantitative assessment

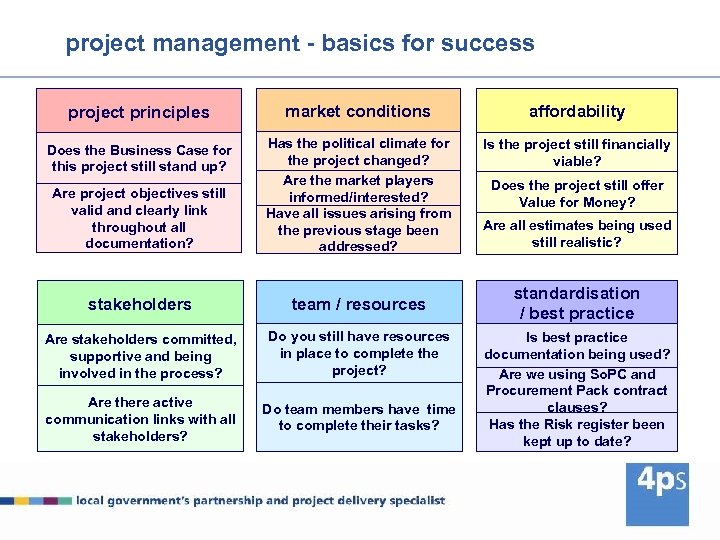

project management - basics for success project principles market conditions affordability Does the Business Case for this project still stand up? Is the project still financially viable? Are project objectives still valid and clearly link throughout all documentation? Has the political climate for the project changed? Are the market players informed/interested? Have all issues arising from the previous stage been addressed? stakeholders team / resources Are stakeholders committed, supportive and being involved in the process? Do you still have resources in place to complete the project? Are there active communication links with all stakeholders? Do team members have time to complete their tasks? Does the project still offer Value for Money? Are all estimates being used still realistic? standardisation / best practice Is best practice documentation being used? Are we using So. PC and Procurement Pack contract clauses? Has the Risk register been kept up to date?

advice to local authorities in current financial climate • right advisors with skills on funding issues • close liaison with 4 ps and sponsoring department • risk mitigation strategies • regular review of bank terms • early involvement of banks but ensure managed by bidders • reserve right for preferred bidder funding competition • reserve right to use borrowing & make capital contribution • comply with standard contractual terms including refinancing

chris. wilson@4 ps. gov. uk 4 ps

384e463cd993620e0e46ba04584937ce.ppt