f9554c0880f601943cbb1622c6f790a6.ppt

- Количество слайдов: 26

Jack Henry & Associates, Inc Presented By: Matthew Thompson & Daniel De. Rose Jr. Presented April 17, 2007

Presentation Outline • • Company overview Industry Background Firm strategy and development Acquisition Strategy RCMP position Stock Performance Portfolio fit Firm Performance ▫ Dupont analysis • Valuation ▫ DCF • Recommendation

Company Overview • Founded in 1976 • Based in Monett, Mo. • Provides software and services for more than 8, 700 financial institutions throughout the U. S.

Company Overview • 3 Primary Brands: ▫ Jack Henry & Associates Sells core processing solutions and integrated complimentary products to US commercial banks with assets up to $30 B ▫ Symitar Markets and sells same solutions to US credit unions ▫ Profit. Stars Markets and sells specialized solutions to US banks and credit unions of all sizes, as well as international financial institutions and other diverse businesses • 3 Primary Sources of Revenue ▫ Software licenses ▫ Support and service fees which include implementation services ▫ Hardware sales, which include all non-software remarketed products

Company Overview Continued • Offer integrated suite of data processing system solutions to improve customers' management of internal/office applications and customer/member interaction processes, as well as specialized data processing solutions to meet specific business needs • Believe solutions enable customers to provide better service to their customers and compete more effectively against other banks, credit unions, and alternative financial institutions

Customer Options • Install Jack Henry comprehensive system in house • Perform outsourcing services with the entire suite of products and services ▫ 5 -10 year contracts

Industry Background • Financial Institutions (commercial banks, thrifts, and credit unions) have increased spending on hardware, software, services and telecommunications by an annual compound growth rate 6% from 2001 to 2005 • Industry spending increased 9. 5% from 2004 to 2005

Industry Effect • Approx. 9, 000 commercial and savings banks in the US, saw a 2% decline due to industry consolidation 1 ▫ 80% of JKHY total revenues • Number of credit unions has declined at a 3% compound annual rate from 2001 to 2005, however these institutions aggregate assets have increased at a 9% compound annual growth rate 2 ▫ 20% of JKHY total revenues 1) 2006 Form 10 -K, p. 8 2) 2006 Form 10 -K, p. 8

Firm Strategy and Development • Offer the highest quality products and services ▫ Developed reputation as premium brand name in the industry • Keep up with most cutting edge technology to continually serve clients with new products and services • Increase current customer relationships ▫ Minimal marketing and sales costs • Increased product capability ▫ Ability to integrate with other 3 rd party services and products

Firm S&D Continued • Increased customer base through sales and marketing campaigns ▫ Increased 211% from ’ 02 -’ 06 • Attract and retain high quality employees ▫ Built into corporate culture • Make Strategic Acquisitions

Acquisitions Strategy • Reasons for: More products and services that compliment existing offerings New customers Enter new markets w/in financial services and other vertical markets Additional outsourcing capabilities • Acquisition Focus: Products in high demand Strong management team Excellent customer relationships

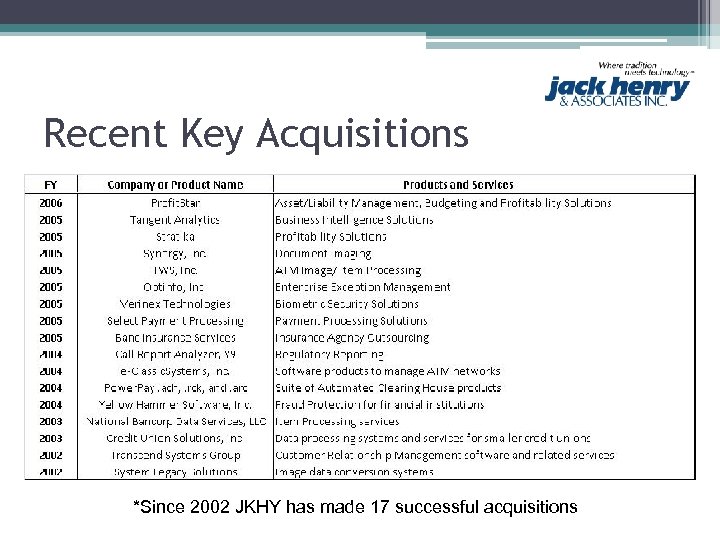

Recent Key Acquisitions *Since 2002 JKHY has made 17 successful acquisitions

RCMP Position • Entered Position November 11, 1999: ▫ BOT: 200 shares @ $36. 00/share • Stock splits: ▫ March 3, 2000 (2: 1); March 5, 2001 (2: 1) • Sold 400 shares last semester, fall 2006 • Current Position: ▫ Owned shares: 400 ▫ Stock Price as of April 16: $24. 91

Stock Performance Mkt. Cap. - $2. 24 B 52 week range: $17. 40 - $24. 67

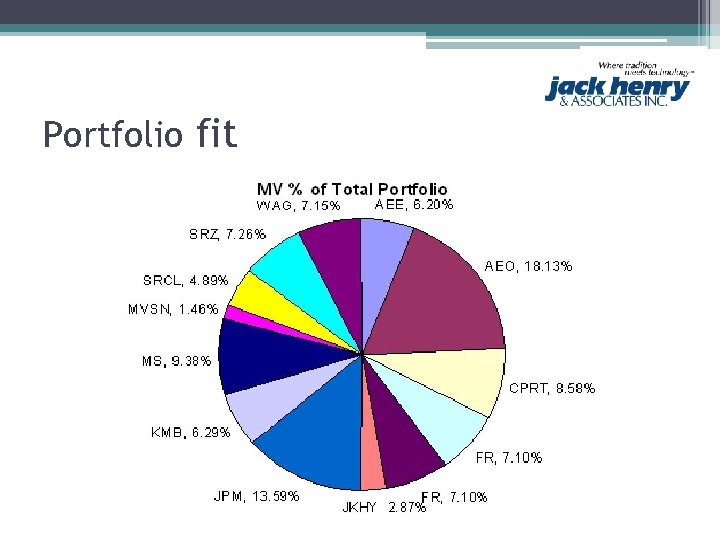

Portfolio fit

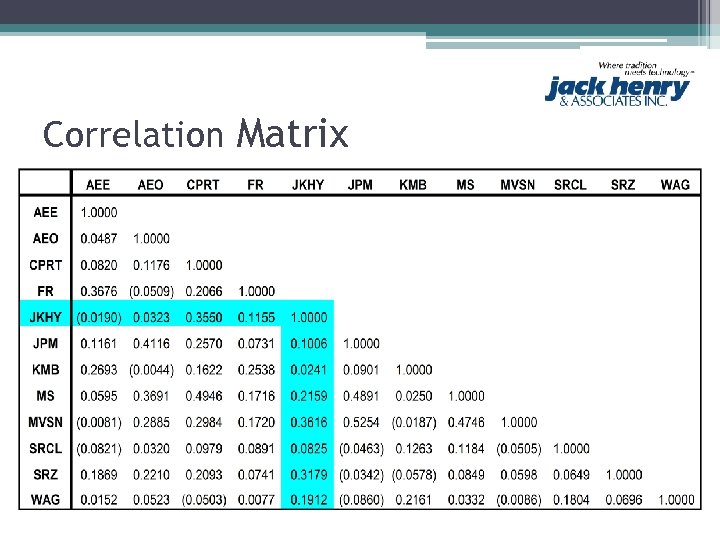

Correlation Matrix

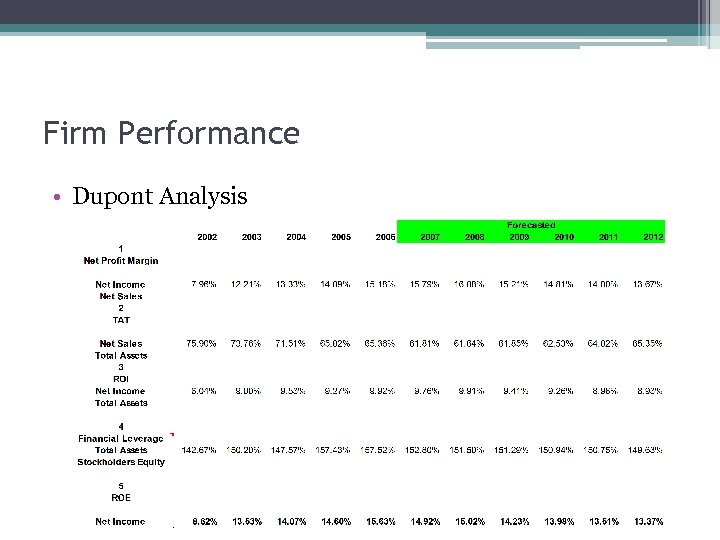

Firm Performance • Dupont Analysis

Discounted Cash Flow Analysis • Basic assumptions ▫ Revenues continue to grow at steady pace due to continued acquisitions ▫ Revenues from Hardware to return to modest 1% growth per year. ▫ Cost of Hardware as a % of Revenues remains almost flat in the future as the price of technology continues to fall ▫ JKHY continues to pay a dividend of 20% of net income ▫ Capital Expenditures stay in the $50 million range

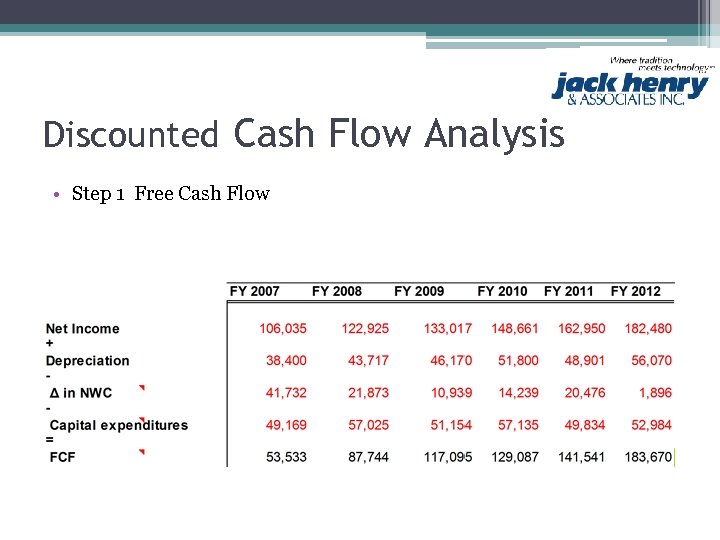

Discounted Cash Flow Analysis • Step 1 Free Cash Flow

Discounted Cash Flow Analysis • Step 2 Calculate WACC • CAPM = 11. 95% ▫ Beta = 1. 2 ▫ Rm = 10. 75% ▫ Rf = 4. 75% • WACC = 11. 75 ▫ Tax Rate = 36% ▫ W(d) = 2. 98% ▫ W(e) = 97. 02% ▫ K(d) = 8. 25% • BUT equity holders (such as ourselves) have experienced a 15. 65% CAGR from 1999 – 2007 • We believe the CAPM is not an appropriate way to capture the entire expected return of stockholders ▫ A WACC of 13% is more appropriate

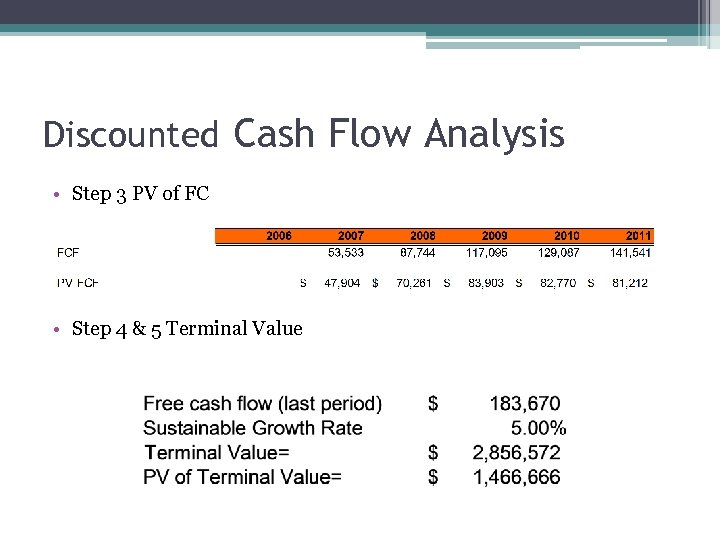

Discounted Cash Flow Analysis • Step 3 PV of FC • Step 4 & 5 Terminal Value

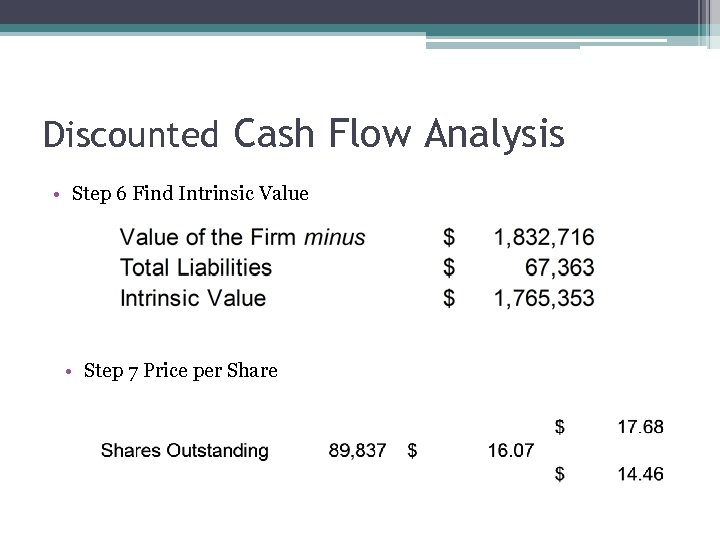

Discounted Cash Flow Analysis • Step 6 Find Intrinsic Value • Step 7 Price per Share

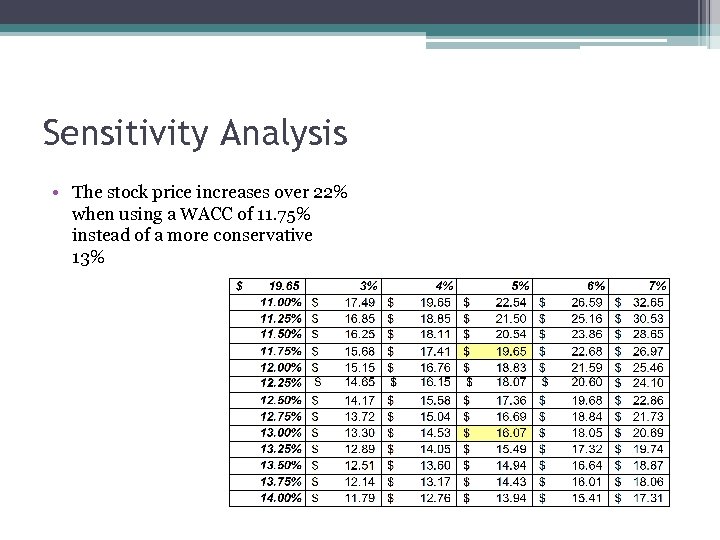

Sensitivity Analysis • The stock price increases over 22% when using a WACC of 11. 75% instead of a more conservative 13%

Recommendation • HOLD all 400 shares ▫ JKHY is a good diversifier in the portfolio and leads to exposure in both technology and financial sectors ▫ We believe a strong management team and a pointed acquisition strategy will overcome the recent trend of consolidation in the industry

Questions ? ? ?

f9554c0880f601943cbb1622c6f790a6.ppt