48a1affa1ba9beed069aeb4b3561c475.ppt

- Количество слайдов: 22

JA Economic for Success 7 th Grade Volunteer’s Name Volunteer’s Title Volunteer’s Company

JA Economic for Success 7 th Grade Volunteer’s Name Volunteer’s Title Volunteer’s Company

Mirror, Mirror Decision Making – The process of choosing among alternative courses of action. Self-knowledge – A person’s awareness of the special qualities he or she has, including skills, interests and values Interests – A person’s preferred activities or hobbies. Values – A person’s belief and ideals. Skills – A person’s talents or abilities.

Mirror, Mirror Decision Making – The process of choosing among alternative courses of action. Self-knowledge – A person’s awareness of the special qualities he or she has, including skills, interests and values Interests – A person’s preferred activities or hobbies. Values – A person’s belief and ideals. Skills – A person’s talents or abilities.

Career Assessment Explore Careers at JA Student Center! • Click on Career Assessment • Click New Users Register Here in the center of the screen • Select Student, and choose your grade level from the drop-down menu • Click Continue to create your account. • Enter Activation Code: N 3235773 GYT • Click Create New Account

Career Assessment Explore Careers at JA Student Center! • Click on Career Assessment • Click New Users Register Here in the center of the screen • Select Student, and choose your grade level from the drop-down menu • Click Continue to create your account. • Enter Activation Code: N 3235773 GYT • Click Create New Account

Be a Success Goal – Something that a person wants or works for. Monetary incentive– The financial reward that motivates a person to take an action. Motivation – A driving force that directs a person’s behavior. Non-monetary incentive – A reward other than money that motivates a person to take an action.

Be a Success Goal – Something that a person wants or works for. Monetary incentive– The financial reward that motivates a person to take an action. Motivation – A driving force that directs a person’s behavior. Non-monetary incentive – A reward other than money that motivates a person to take an action.

Be a Success Commitment – The act of pledging yourself to a course of action. Consequence – The result of a decision or action.

Be a Success Commitment – The act of pledging yourself to a course of action. Consequence – The result of a decision or action.

College JA Student Center Find a College JA Student Center Pay for College

College JA Student Center Find a College JA Student Center Pay for College

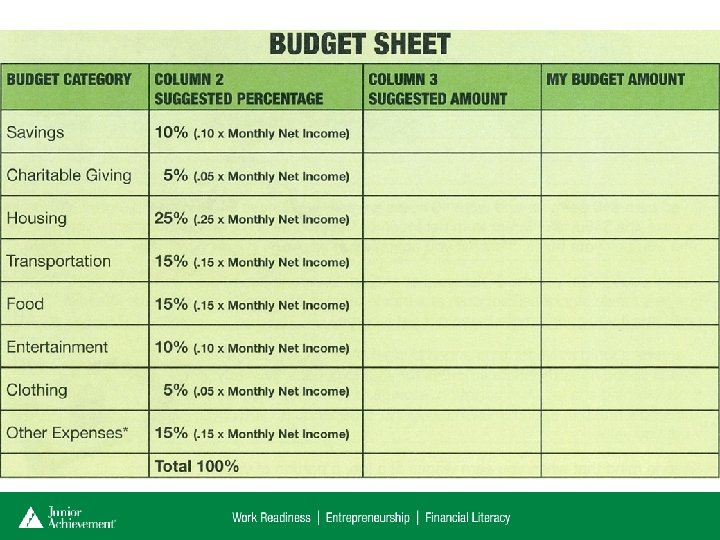

Keeping Your Balance Budget – A careful plan for spending or saving money received within a certain period of time. Opportunity cost – The next best alternative that is given up when a choice is made. Gross Income – Income before all taxes have been deducted. Net Income – Income after all taxes have been deducted. Expenses – The amount spent to make purchases and pay bills.

Keeping Your Balance Budget – A careful plan for spending or saving money received within a certain period of time. Opportunity cost – The next best alternative that is given up when a choice is made. Gross Income – Income before all taxes have been deducted. Net Income – Income after all taxes have been deducted. Expenses – The amount spent to make purchases and pay bills.

Budget Tools Needs vs. Wants Calculator Additional worksheets to help create money knowledge JA Money Might – Budget Game

Budget Tools Needs vs. Wants Calculator Additional worksheets to help create money knowledge JA Money Might – Budget Game

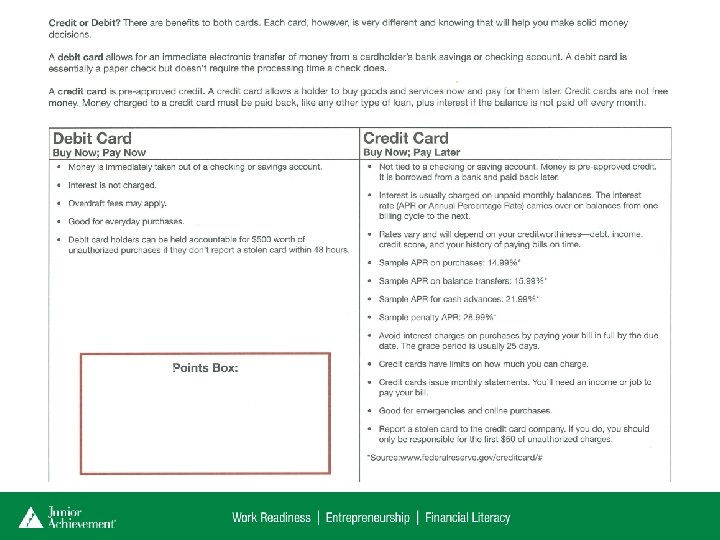

Savvy Shopper Credit –The ability of a consumer to buy goods or services before paying for them, based on an agreement to pay later. Credit Card – A card that allows users to make purchases through a limited personal loan, with the expectation that the money will be repaid at a later date, often with interest. Debt card – A card that pays for a purchase directly from a checking account. Interest – A charge for a loan, usually expressed as a percentage.

Savvy Shopper Credit –The ability of a consumer to buy goods or services before paying for them, based on an agreement to pay later. Credit Card – A card that allows users to make purchases through a limited personal loan, with the expectation that the money will be repaid at a later date, often with interest. Debt card – A card that pays for a purchase directly from a checking account. Interest – A charge for a loan, usually expressed as a percentage.

Using Credit! Advantages Disadvantages

Using Credit! Advantages Disadvantages

Credit Tools What is Credit? Credit Card Shopping Credit Card Statement Credit Card Quiz

Credit Tools What is Credit? Credit Card Shopping Credit Card Statement Credit Card Quiz

Keeping Score Credit – The ability of a customer to buy goods or services before paying for them, based on an agreement to pay later. Credit Score – A standardized measurement of the potential for a borrower to repay debt.

Keeping Score Credit – The ability of a customer to buy goods or services before paying for them, based on an agreement to pay later. Credit Score – A standardized measurement of the potential for a borrower to repay debt.

Why does a credit score matter? (Financial GPA) Employers decide who to hire. Property owners decide who they will rent to. Insurance companies offering or declining coverage. Utility companies determining whether to open an account and/or require a security deposit. Financial institutions decide how much to loan and at what rate of interest.

Why does a credit score matter? (Financial GPA) Employers decide who to hire. Property owners decide who they will rent to. Insurance companies offering or declining coverage. Utility companies determining whether to open an account and/or require a security deposit. Financial institutions decide how much to loan and at what rate of interest.

What’s the Risk? Risk – The possibility of financial loss or physical harm. Insurance – A contract that protects a person against financial loss or damage. Premium – An amount paid for an insurance policy. Policy – A written contract for insurance. Deductible – Money paid out-of-pocket before insurance covers the remaining costs. Co-pay – A fixed fee an insured person must pay for a doctor’s visit, an outpatient service, or a prescription.

What’s the Risk? Risk – The possibility of financial loss or physical harm. Insurance – A contract that protects a person against financial loss or damage. Premium – An amount paid for an insurance policy. Policy – A written contract for insurance. Deductible – Money paid out-of-pocket before insurance covers the remaining costs. Co-pay – A fixed fee an insured person must pay for a doctor’s visit, an outpatient service, or a prescription.

Types of Insurance Home Owner’s Renter Health /Dental/ Vision Auto Comprehensive Auto Liability Cell phone Boat Motorcycle Life Insurance Disability Insurance

Types of Insurance Home Owner’s Renter Health /Dental/ Vision Auto Comprehensive Auto Liability Cell phone Boat Motorcycle Life Insurance Disability Insurance

Insurance Tools What is Risk Management? Health Insurance Disability/Life Insurance Property Insurance Risk Management Quiz

Insurance Tools What is Risk Management? Health Insurance Disability/Life Insurance Property Insurance Risk Management Quiz