J A N U A R Y 1 9 , 2 0 0 6 S T R I C T L Y P R I V A T E A N D C O N F I D E N T I A L I P A A P R I V A T E C A P I T A L C O N F E R E N C E - P U B L I C C A P I T A L M A R K E T S

J A N U A R Y 1 9 , 2 0 0 6 S T R I C T L Y P R I V A T E A N D C O N F I D E N T I A L I P A A P R I V A T E C A P I T A L C O N F E R E N C E - P U B L I C C A P I T A L M A R K E T S

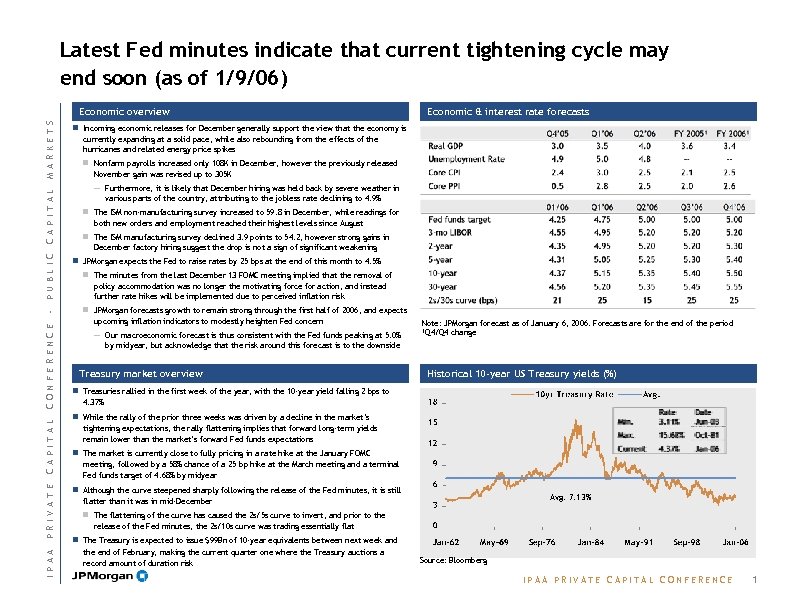

Latest Fed minutes indicate that current tightening cycle may end soon (as of 1/9/06) I P A A P R I V A T E C A P I T A L C O N F E R E N C E - P U B L I C C A P I T A L M A R K E T S Economic overview Economic & interest rate forecasts n Incoming economic releases for December generally support the view that the economy is currently expanding at a solid pace, while also rebounding from the effects of the hurricanes and related energy price spikes n Nonfarm payrolls increased only 108 K in December, however the previously released November gain was revised up to 305 K — Furthermore, it is likely that December hiring was held back by severe weather in various parts of the country, attributing to the jobless rate declining to 4. 9% n The ISM non-manufacturing survey increased to 59. 8 in December, while readings for both new orders and employment reached their highest levels since August n The ISM manufacturing survey declined 3. 9 points to 54. 2, however strong gains in December factory hiring suggest the drop is not a sign of significant weakening n JPMorgan expects the Fed to raise rates by 25 bps at the end of this month to 4. 5% n The minutes from the last December 13 FOMC meeting implied that the removal of policy accommodation was no longer the motivating force for action, and instead further rate hikes will be implemented due to perceived inflation risk n JPMorgan forecasts growth to remain strong through the first half of 2006, and expects upcoming inflation indicators to modestly heighten Fed concern — Our macroeconomic forecast is thus consistent with the Fed funds peaking at 5. 0% Note: JPMorgan forecast as of January 6, 2006. Forecasts are for the end of the period ¹Q 4/Q 4 change by midyear, but acknowledge that the risk around this forecast is to the downside Treasury market overview Historical 10 -year US Treasury yields (%) n Treasuries rallied in the first week of the year, with the 10 -year yield falling 2 bps to 4. 37% n While the rally of the prior three weeks was driven by a decline in the market’s tightening expectations, the rally flattening implies that forward long-term yields remain lower than the market’s forward Fed funds expectations n The market is currently close to fully pricing in a rate hike at the January FOMC meeting, followed by a 58% chance of a 25 bp hike at the March meeting and a terminal Fed funds target of 4. 68% by midyear n Although the curve steepened sharply following the release of the Fed minutes, it is still flatter than it was in mid-December Avg. 7. 13% n The flattening of the curve has caused the 2 s/5 s curve to invert, and prior to the release of the Fed minutes, the 2 s/10 s curve was trading essentially flat n The Treasury is expected to issue $99 Bn of 10 -year equivalents between next week and the end of February, making the current quarter one where the Treasury auctions a record amount of duration risk Source: Bloomberg I P A A P R I V A T E C A P I T A L C O N F E R E N C E 1

Latest Fed minutes indicate that current tightening cycle may end soon (as of 1/9/06) I P A A P R I V A T E C A P I T A L C O N F E R E N C E - P U B L I C C A P I T A L M A R K E T S Economic overview Economic & interest rate forecasts n Incoming economic releases for December generally support the view that the economy is currently expanding at a solid pace, while also rebounding from the effects of the hurricanes and related energy price spikes n Nonfarm payrolls increased only 108 K in December, however the previously released November gain was revised up to 305 K — Furthermore, it is likely that December hiring was held back by severe weather in various parts of the country, attributing to the jobless rate declining to 4. 9% n The ISM non-manufacturing survey increased to 59. 8 in December, while readings for both new orders and employment reached their highest levels since August n The ISM manufacturing survey declined 3. 9 points to 54. 2, however strong gains in December factory hiring suggest the drop is not a sign of significant weakening n JPMorgan expects the Fed to raise rates by 25 bps at the end of this month to 4. 5% n The minutes from the last December 13 FOMC meeting implied that the removal of policy accommodation was no longer the motivating force for action, and instead further rate hikes will be implemented due to perceived inflation risk n JPMorgan forecasts growth to remain strong through the first half of 2006, and expects upcoming inflation indicators to modestly heighten Fed concern — Our macroeconomic forecast is thus consistent with the Fed funds peaking at 5. 0% Note: JPMorgan forecast as of January 6, 2006. Forecasts are for the end of the period ¹Q 4/Q 4 change by midyear, but acknowledge that the risk around this forecast is to the downside Treasury market overview Historical 10 -year US Treasury yields (%) n Treasuries rallied in the first week of the year, with the 10 -year yield falling 2 bps to 4. 37% n While the rally of the prior three weeks was driven by a decline in the market’s tightening expectations, the rally flattening implies that forward long-term yields remain lower than the market’s forward Fed funds expectations n The market is currently close to fully pricing in a rate hike at the January FOMC meeting, followed by a 58% chance of a 25 bp hike at the March meeting and a terminal Fed funds target of 4. 68% by midyear n Although the curve steepened sharply following the release of the Fed minutes, it is still flatter than it was in mid-December Avg. 7. 13% n The flattening of the curve has caused the 2 s/5 s curve to invert, and prior to the release of the Fed minutes, the 2 s/10 s curve was trading essentially flat n The Treasury is expected to issue $99 Bn of 10 -year equivalents between next week and the end of February, making the current quarter one where the Treasury auctions a record amount of duration risk Source: Bloomberg I P A A P R I V A T E C A P I T A L C O N F E R E N C E 1

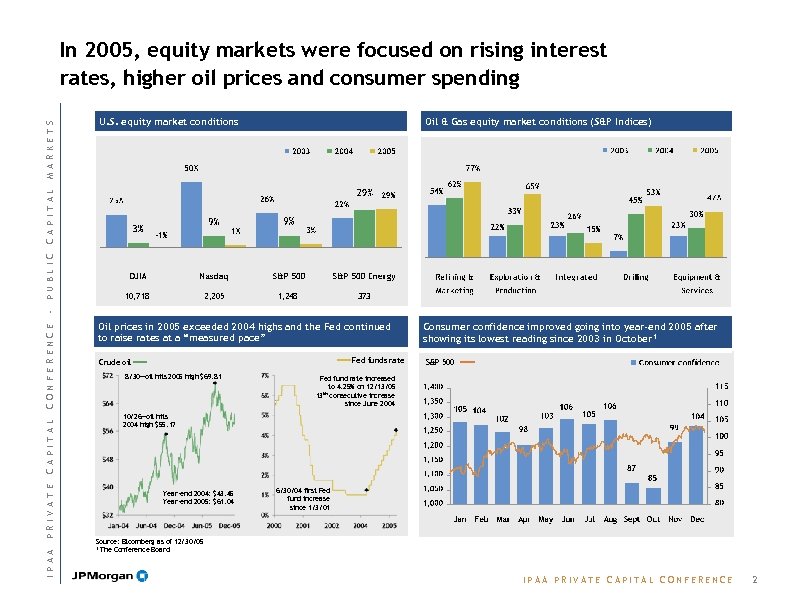

I P A A P R I V A T E C A P I T A L C O N F E R E N C E - P U B L I C C A P I T A L M A R K E T S In 2005, equity markets were focused on rising interest rates, higher oil prices and consumer spending U. S. equity market conditions 10, 718 2, 205 Oil & Gas equity market conditions (S&P Indices) 1, 248 373 Oil prices in 2005 exceeded 2004 highs and the Fed continued to raise rates at a “measured pace” Fed funds rate Crude oil 8/30—oil hits 2005 high $69. 81 Consumer confidence improved going into year-end 2005 after showing its lowest reading since 2003 in October 1 S&P 500 Fed fund rate increased to 4. 25% on 12/13/05 13 th consecutive increase since June 2004 10/26—oil hits 2004 high $55. 17 Year-end 2004: $43. 45 Year-end 2005: $61. 04 6/30/04 first Fed fund increase since 1/3/01 275 182 73 434 515 318 83 215 138 Source: Bloomberg as of 12/30/05 1 The Conference Board I P A A P R I V A T E C A P I T A L C O N F E R E N C E 2

I P A A P R I V A T E C A P I T A L C O N F E R E N C E - P U B L I C C A P I T A L M A R K E T S In 2005, equity markets were focused on rising interest rates, higher oil prices and consumer spending U. S. equity market conditions 10, 718 2, 205 Oil & Gas equity market conditions (S&P Indices) 1, 248 373 Oil prices in 2005 exceeded 2004 highs and the Fed continued to raise rates at a “measured pace” Fed funds rate Crude oil 8/30—oil hits 2005 high $69. 81 Consumer confidence improved going into year-end 2005 after showing its lowest reading since 2003 in October 1 S&P 500 Fed fund rate increased to 4. 25% on 12/13/05 13 th consecutive increase since June 2004 10/26—oil hits 2004 high $55. 17 Year-end 2004: $43. 45 Year-end 2005: $61. 04 6/30/04 first Fed fund increase since 1/3/01 275 182 73 434 515 318 83 215 138 Source: Bloomberg as of 12/30/05 1 The Conference Board I P A A P R I V A T E C A P I T A L C O N F E R E N C E 2

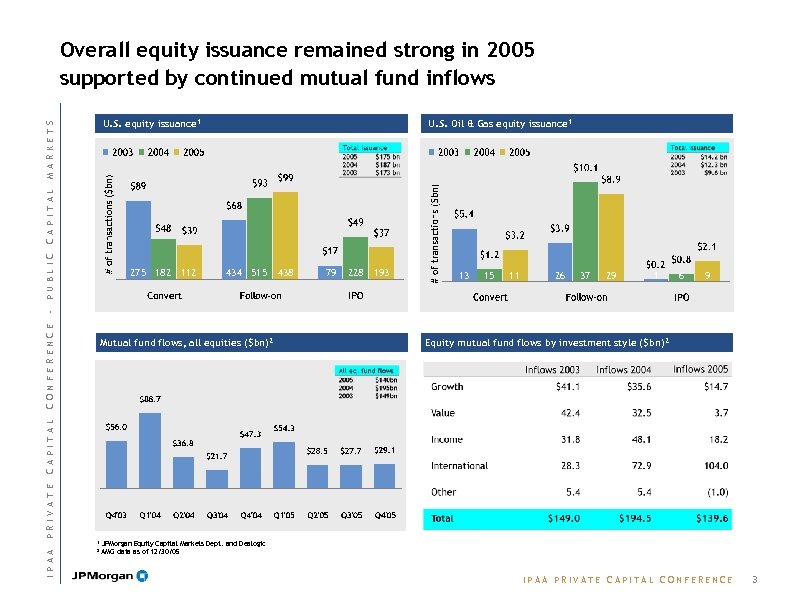

I P A A P R I V A T E C A P I T A L C O N F E R E N C E - P U B L I C C A P I T A L M A R K E T S Overall equity issuance remained strong in 2005 supported by continued mutual fund inflows U. S. equity issuance 1 275 182 112 U. S. Oil & Gas equity issuance 1 434 515 Mutual fund flows, all equities ($bn) 2 1 2 438 79 228 193 13 15 11 26 37 29 1 6 9 Equity mutual fund flows by investment style ($bn) 2 JPMorgan Equity Capital Markets Dept. and Dealogic AMG data as of 12/30/05 I P A A P R I V A T E C A P I T A L C O N F E R E N C E 3

I P A A P R I V A T E C A P I T A L C O N F E R E N C E - P U B L I C C A P I T A L M A R K E T S Overall equity issuance remained strong in 2005 supported by continued mutual fund inflows U. S. equity issuance 1 275 182 112 U. S. Oil & Gas equity issuance 1 434 515 Mutual fund flows, all equities ($bn) 2 1 2 438 79 228 193 13 15 11 26 37 29 1 6 9 Equity mutual fund flows by investment style ($bn) 2 JPMorgan Equity Capital Markets Dept. and Dealogic AMG data as of 12/30/05 I P A A P R I V A T E C A P I T A L C O N F E R E N C E 3

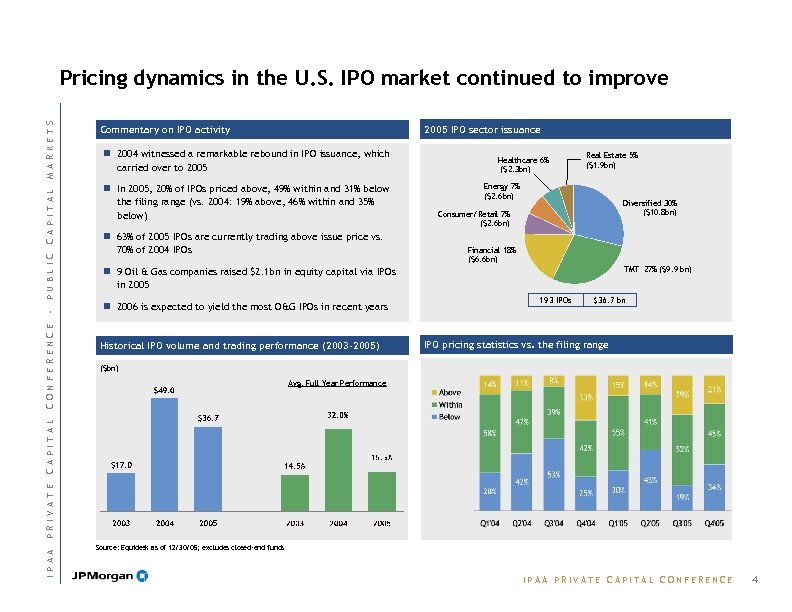

I P A A P R I V A T E C A P I T A L C O N F E R E N C E - P U B L I C C A P I T A L M A R K E T S Pricing dynamics in the U. S. IPO market continued to improve 2005 IPO sector issuance Commentary on IPO activity n 2004 witnessed a remarkable rebound in IPO issuance, which carried over to 2005 n In 2005, 20% of IPOs priced above, 49% within and 31% below the filing range (vs. 2004: 19% above, 46% within and 35% below) n 63% of 2005 IPOs are currently trading above issue price vs. 70% of 2004 IPOs Healthcare 6% ($2. 3 bn) Real Estate 5% ($1. 9 bn) Energy 7% ($2. 6 bn) Diversified 30% ($10. 8 bn) Consumer/Retail 7% ($2. 6 bn) Financial 18% ($6. 6 bn) TMT 27% ($9. 9 bn) n 9 Oil & Gas companies raised $2. 1 bn in equity capital via IPOs in 2005 n 2006 is expected to yield the most O&G IPOs in recent years Historical IPO volume and trading performance (2003 -2005) 193 IPOs $36. 7 bn IPO pricing statistics vs. the filing range ($bn) Avg. Full Year Performance Source: Equidesk as of 12/30/05; excludes closed-end funds I P A A P R I V A T E C A P I T A L C O N F E R E N C E 4

I P A A P R I V A T E C A P I T A L C O N F E R E N C E - P U B L I C C A P I T A L M A R K E T S Pricing dynamics in the U. S. IPO market continued to improve 2005 IPO sector issuance Commentary on IPO activity n 2004 witnessed a remarkable rebound in IPO issuance, which carried over to 2005 n In 2005, 20% of IPOs priced above, 49% within and 31% below the filing range (vs. 2004: 19% above, 46% within and 35% below) n 63% of 2005 IPOs are currently trading above issue price vs. 70% of 2004 IPOs Healthcare 6% ($2. 3 bn) Real Estate 5% ($1. 9 bn) Energy 7% ($2. 6 bn) Diversified 30% ($10. 8 bn) Consumer/Retail 7% ($2. 6 bn) Financial 18% ($6. 6 bn) TMT 27% ($9. 9 bn) n 9 Oil & Gas companies raised $2. 1 bn in equity capital via IPOs in 2005 n 2006 is expected to yield the most O&G IPOs in recent years Historical IPO volume and trading performance (2003 -2005) 193 IPOs $36. 7 bn IPO pricing statistics vs. the filing range ($bn) Avg. Full Year Performance Source: Equidesk as of 12/30/05; excludes closed-end funds I P A A P R I V A T E C A P I T A L C O N F E R E N C E 4

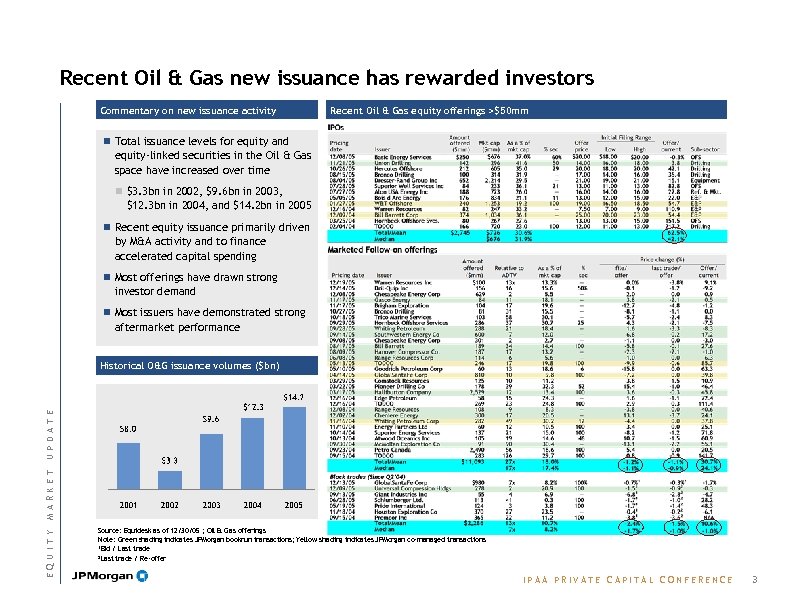

Recent Oil & Gas new issuance has rewarded investors Commentary on new issuance activity Recent Oil & Gas equity offerings >$50 mm n Total issuance levels for equity and equity-linked securities in the Oil & Gas space have increased over time n $3. 3 bn in 2002, $9. 6 bn in 2003, $12. 3 bn in 2004, and $14. 2 bn in 2005 n Recent equity issuance primarily driven by M&A activity and to finance accelerated capital spending n Most offerings have drawn strong investor demand n Most issuers have demonstrated strong aftermarket performance E Q U I T Y M A R K E T U P D A T E Historical O&G issuance volumes ($bn) Source: Equidesk as of 12/30/05 ; Oil & Gas offerings Note: Green shading indicates JPMorgan bookrun transactions; Yellow shading indicates JPMorgan co-managed transactions 1 Bid / Last trade 2 Last trade / Re-offer I P A A P R I V A T E C A P I T A L C O N F E R E N C E 3

Recent Oil & Gas new issuance has rewarded investors Commentary on new issuance activity Recent Oil & Gas equity offerings >$50 mm n Total issuance levels for equity and equity-linked securities in the Oil & Gas space have increased over time n $3. 3 bn in 2002, $9. 6 bn in 2003, $12. 3 bn in 2004, and $14. 2 bn in 2005 n Recent equity issuance primarily driven by M&A activity and to finance accelerated capital spending n Most offerings have drawn strong investor demand n Most issuers have demonstrated strong aftermarket performance E Q U I T Y M A R K E T U P D A T E Historical O&G issuance volumes ($bn) Source: Equidesk as of 12/30/05 ; Oil & Gas offerings Note: Green shading indicates JPMorgan bookrun transactions; Yellow shading indicates JPMorgan co-managed transactions 1 Bid / Last trade 2 Last trade / Re-offer I P A A P R I V A T E C A P I T A L C O N F E R E N C E 3

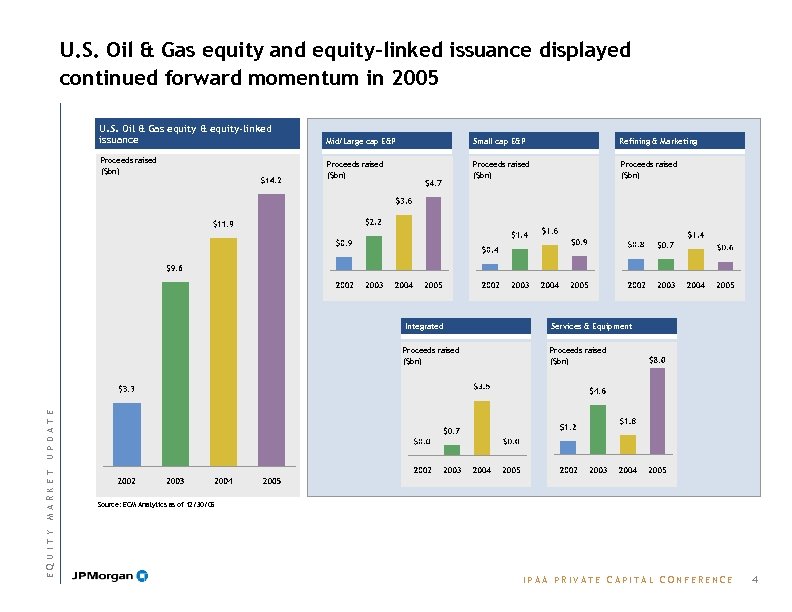

U. S. Oil & Gas equity and equity-linked issuance displayed continued forward momentum in 2005 U. S. Oil & Gas equity & equity-linked issuance Mid/Large cap E&P Small cap E&P Refining & Marketing Proceeds raised ($bn) Services & Equipment Proceeds raised ($bn) E Q U I T Y M A R K E T U P D A T E Integrated Proceeds raised ($bn) Source: ECM Analytics as of 12/30/05 I P A A P R I V A T E C A P I T A L C O N F E R E N C E 4

U. S. Oil & Gas equity and equity-linked issuance displayed continued forward momentum in 2005 U. S. Oil & Gas equity & equity-linked issuance Mid/Large cap E&P Small cap E&P Refining & Marketing Proceeds raised ($bn) Services & Equipment Proceeds raised ($bn) E Q U I T Y M A R K E T U P D A T E Integrated Proceeds raised ($bn) Source: ECM Analytics as of 12/30/05 I P A A P R I V A T E C A P I T A L C O N F E R E N C E 4

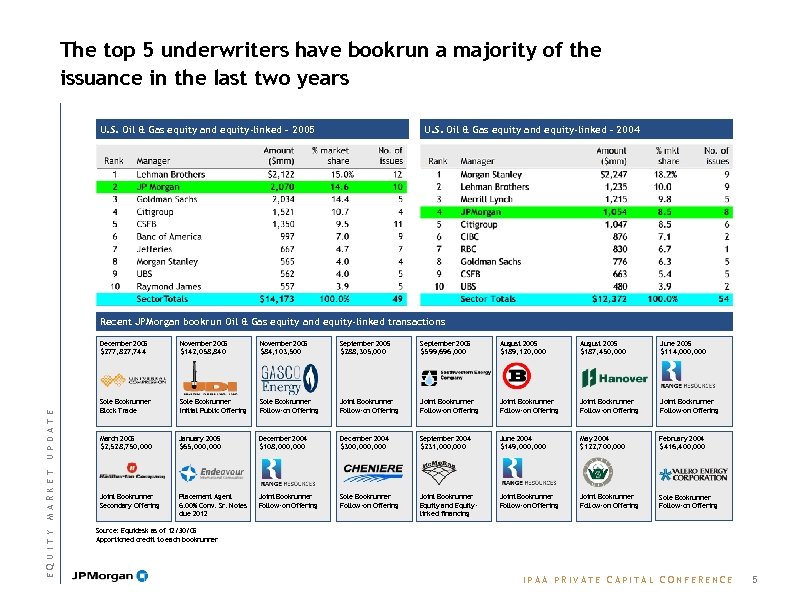

The top 5 underwriters have bookrun a majority of the issuance in the last two years U. S. Oil & Gas equity and equity-linked – 2005 U. S. Oil & Gas equity and equity-linked – 2004 Recent JPMorgan bookrun Oil & Gas equity and equity-linked transactions E Q U I T Y M A R K E T U P D A T E December 2005 $277, 827, 744 November 2005 $142, 058, 840 November 2005 $84, 103, 500 September 2005 $288, 305, 000 September 2005 $599, 696, 000 August 2005 $189, 120, 000 August 2005 $187, 450, 000 June 2005 $114, 000 Sole Bookrunner Block Trade Sole Bookrunner Initial Public Offering Sole Bookrunner Follow-on Offering Joint Bookrunner Follow-on Offering Joint Bookrunner Follow-on Offering March 2005 $2, 528, 750, 000 January 2005 $65, 000 December 2004 $108, 000 December 2004 $300, 000 September 2004 $231, 000 June 2004 $149, 000 May 2004 $122, 700, 000 February 2004 $416, 400, 000 Joint Bookrunner Secondary Offering Placement Agent 6. 00% Conv. Sr. Notes due 2012 Joint Bookrunner Follow-on Offering Sole Bookrunner Follow-on Offering Joint Bookrunner Equity and Equitylinked financing Joint Bookrunner Follow-on Offering Sole Bookrunner Follow-on Offering Source: Equidesk as of 12/30/05 Apportioned credit to each bookrunner I P A A P R I V A T E C A P I T A L C O N F E R E N C E 5

The top 5 underwriters have bookrun a majority of the issuance in the last two years U. S. Oil & Gas equity and equity-linked – 2005 U. S. Oil & Gas equity and equity-linked – 2004 Recent JPMorgan bookrun Oil & Gas equity and equity-linked transactions E Q U I T Y M A R K E T U P D A T E December 2005 $277, 827, 744 November 2005 $142, 058, 840 November 2005 $84, 103, 500 September 2005 $288, 305, 000 September 2005 $599, 696, 000 August 2005 $189, 120, 000 August 2005 $187, 450, 000 June 2005 $114, 000 Sole Bookrunner Block Trade Sole Bookrunner Initial Public Offering Sole Bookrunner Follow-on Offering Joint Bookrunner Follow-on Offering Joint Bookrunner Follow-on Offering March 2005 $2, 528, 750, 000 January 2005 $65, 000 December 2004 $108, 000 December 2004 $300, 000 September 2004 $231, 000 June 2004 $149, 000 May 2004 $122, 700, 000 February 2004 $416, 400, 000 Joint Bookrunner Secondary Offering Placement Agent 6. 00% Conv. Sr. Notes due 2012 Joint Bookrunner Follow-on Offering Sole Bookrunner Follow-on Offering Joint Bookrunner Equity and Equitylinked financing Joint Bookrunner Follow-on Offering Sole Bookrunner Follow-on Offering Source: Equidesk as of 12/30/05 Apportioned credit to each bookrunner I P A A P R I V A T E C A P I T A L C O N F E R E N C E 5

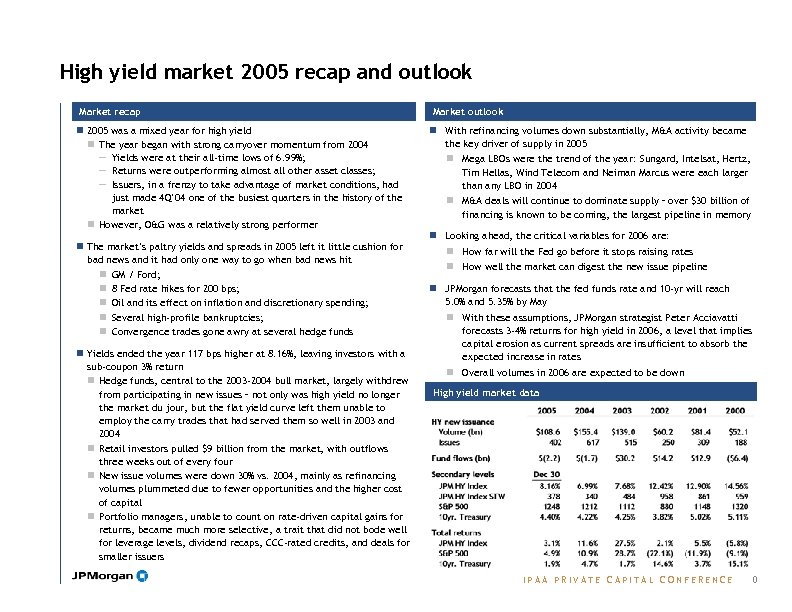

High yield market 2005 recap and outlook Market recap n 2005 was a mixed year for high yield n The year began with strong carryover momentum from 2004 — Yields were at their all-time lows of 6. 99%; — Returns were outperforming almost all other asset classes; — Issuers, in a frenzy to take advantage of market conditions, had just made 4 Q’ 04 one of the busiest quarters in the history of the market n However, O&G was a relatively strong performer n The market’s paltry yields and spreads in 2005 left it little cushion for bad news and it had only one way to go when bad news hit n GM / Ford; n 8 Fed rate hikes for 200 bps; n Oil and its effect on inflation and discretionary spending; n Several high-profile bankruptcies; n Convergence trades gone awry at several hedge funds n Yields ended the year 117 bps higher at 8. 16%, leaving investors with a sub-coupon 3% return n Hedge funds, central to the 2003 -2004 bull market, largely withdrew from participating in new issues – not only was high yield no longer the market du jour, but the flat yield curve left them unable to employ the carry trades that had served them so well in 2003 and 2004 n Retail investors pulled $9 billion from the market, with outflows three weeks out of every four n New issue volumes were down 30% vs. 2004, mainly as refinancing volumes plummeted due to fewer opportunities and the higher cost of capital n Portfolio managers, unable to count on rate-driven capital gains for returns, became much more selective, a trait that did not bode well for leverage levels, dividend recaps, CCC-rated credits, and deals for smaller issuers Market outlook n With refinancing volumes down substantially, M&A activity became the key driver of supply in 2005 n Mega LBOs were the trend of the year: Sungard, Intelsat, Hertz, Tim Hellas, Wind Telecom and Neiman Marcus were each larger than any LBO in 2004 n M&A deals will continue to dominate supply – over $30 billion of financing is known to be coming, the largest pipeline in memory n Looking ahead, the critical variables for 2006 are: n How far will the Fed go before it stops raising rates n How well the market can digest the new issue pipeline n JPMorgan forecasts that the fed funds rate and 10 -yr will reach 5. 0% and 5. 35% by May n With these assumptions, JPMorgan strategist Peter Acciavatti forecasts 3 -4% returns for high yield in 2006, a level that implies capital erosion as current spreads are insufficient to absorb the expected increase in rates n Overall volumes in 2006 are expected to be down High yield market data I P A A P R I V A T E C A P I T A L C O N F E R E N C E 0

High yield market 2005 recap and outlook Market recap n 2005 was a mixed year for high yield n The year began with strong carryover momentum from 2004 — Yields were at their all-time lows of 6. 99%; — Returns were outperforming almost all other asset classes; — Issuers, in a frenzy to take advantage of market conditions, had just made 4 Q’ 04 one of the busiest quarters in the history of the market n However, O&G was a relatively strong performer n The market’s paltry yields and spreads in 2005 left it little cushion for bad news and it had only one way to go when bad news hit n GM / Ford; n 8 Fed rate hikes for 200 bps; n Oil and its effect on inflation and discretionary spending; n Several high-profile bankruptcies; n Convergence trades gone awry at several hedge funds n Yields ended the year 117 bps higher at 8. 16%, leaving investors with a sub-coupon 3% return n Hedge funds, central to the 2003 -2004 bull market, largely withdrew from participating in new issues – not only was high yield no longer the market du jour, but the flat yield curve left them unable to employ the carry trades that had served them so well in 2003 and 2004 n Retail investors pulled $9 billion from the market, with outflows three weeks out of every four n New issue volumes were down 30% vs. 2004, mainly as refinancing volumes plummeted due to fewer opportunities and the higher cost of capital n Portfolio managers, unable to count on rate-driven capital gains for returns, became much more selective, a trait that did not bode well for leverage levels, dividend recaps, CCC-rated credits, and deals for smaller issuers Market outlook n With refinancing volumes down substantially, M&A activity became the key driver of supply in 2005 n Mega LBOs were the trend of the year: Sungard, Intelsat, Hertz, Tim Hellas, Wind Telecom and Neiman Marcus were each larger than any LBO in 2004 n M&A deals will continue to dominate supply – over $30 billion of financing is known to be coming, the largest pipeline in memory n Looking ahead, the critical variables for 2006 are: n How far will the Fed go before it stops raising rates n How well the market can digest the new issue pipeline n JPMorgan forecasts that the fed funds rate and 10 -yr will reach 5. 0% and 5. 35% by May n With these assumptions, JPMorgan strategist Peter Acciavatti forecasts 3 -4% returns for high yield in 2006, a level that implies capital erosion as current spreads are insufficient to absorb the expected increase in rates n Overall volumes in 2006 are expected to be down High yield market data I P A A P R I V A T E C A P I T A L C O N F E R E N C E 0

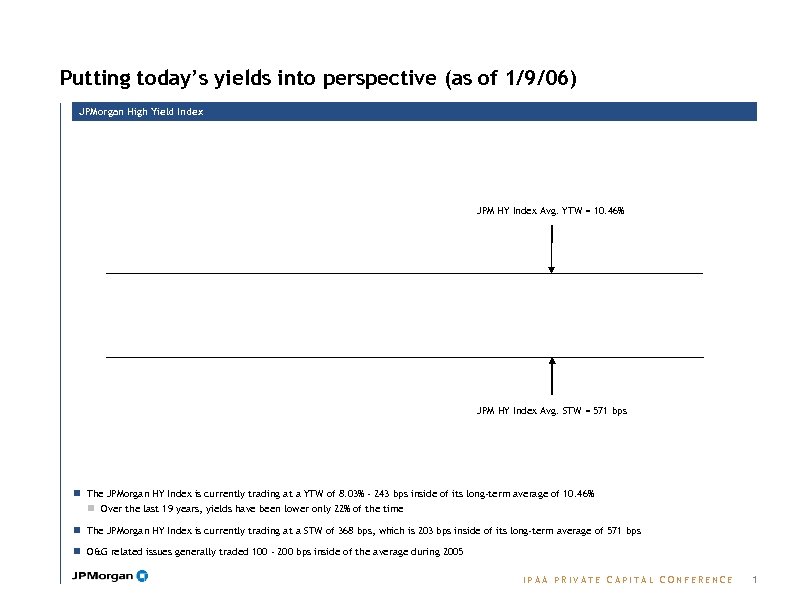

Putting today’s yields into perspective (as of 1/9/06) JPMorgan High Yield Index JPM HY Index Avg. YTW = 10. 46% JPM HY Index Avg. STW = 571 bps n The JPMorgan HY Index is currently trading at a YTW of 8. 03% - 243 bps inside of its long-term average of 10. 46% n Over the last 19 years, yields have been lower only 22% of the time n The JPMorgan HY Index is currently trading at a STW of 368 bps, which is 203 bps inside of its long-term average of 571 bps n O&G related issues generally traded 100 - 200 bps inside of the average during 2005 I P A A P R I V A T E C A P I T A L C O N F E R E N C E 1

Putting today’s yields into perspective (as of 1/9/06) JPMorgan High Yield Index JPM HY Index Avg. YTW = 10. 46% JPM HY Index Avg. STW = 571 bps n The JPMorgan HY Index is currently trading at a YTW of 8. 03% - 243 bps inside of its long-term average of 10. 46% n Over the last 19 years, yields have been lower only 22% of the time n The JPMorgan HY Index is currently trading at a STW of 368 bps, which is 203 bps inside of its long-term average of 571 bps n O&G related issues generally traded 100 - 200 bps inside of the average during 2005 I P A A P R I V A T E C A P I T A L C O N F E R E N C E 1

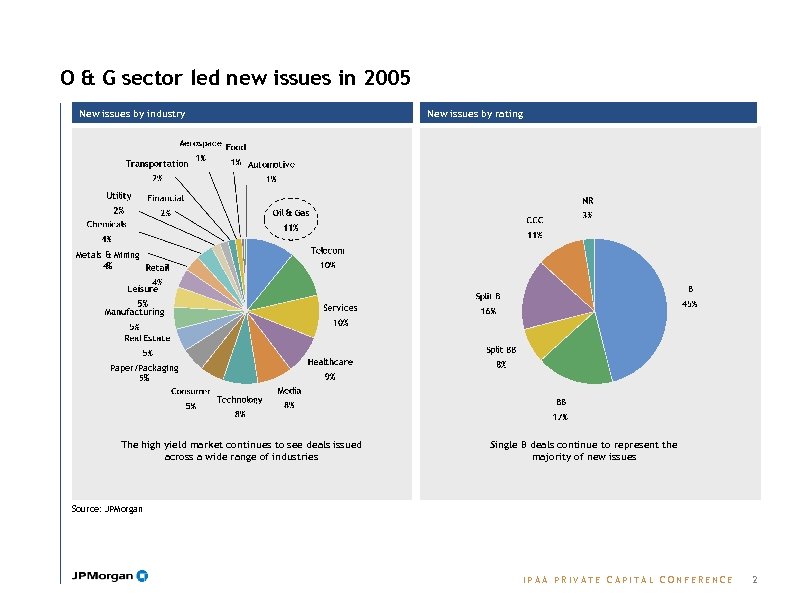

O & G sector led new issues in 2005 New issues by industry New issues by rating Metals & Mining 4% Paper/Packaging 5% The high yield market continues to see deals issued across a wide range of industries Single B deals continue to represent the majority of new issues Source: JPMorgan I P A A P R I V A T E C A P I T A L C O N F E R E N C E 2

O & G sector led new issues in 2005 New issues by industry New issues by rating Metals & Mining 4% Paper/Packaging 5% The high yield market continues to see deals issued across a wide range of industries Single B deals continue to represent the majority of new issues Source: JPMorgan I P A A P R I V A T E C A P I T A L C O N F E R E N C E 2

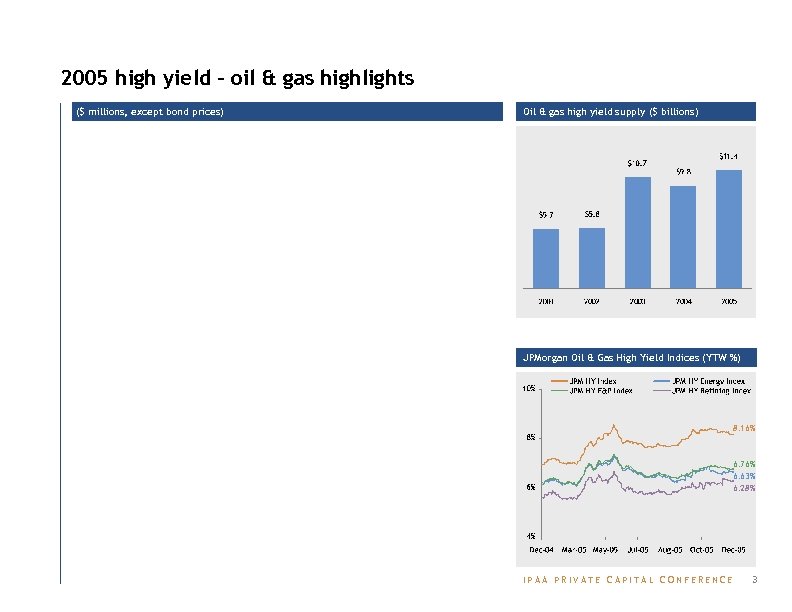

2005 high yield - oil & gas highlights ($ millions, except bond prices) Oil & gas high yield supply ($ billions) JPMorgan Oil & Gas High Yield Indices (YTW %) 8. 16% 6. 76% 6. 63% 6. 28% I P A A P R I V A T E C A P I T A L C O N F E R E N C E 3

2005 high yield - oil & gas highlights ($ millions, except bond prices) Oil & gas high yield supply ($ billions) JPMorgan Oil & Gas High Yield Indices (YTW %) 8. 16% 6. 76% 6. 63% 6. 28% I P A A P R I V A T E C A P I T A L C O N F E R E N C E 3

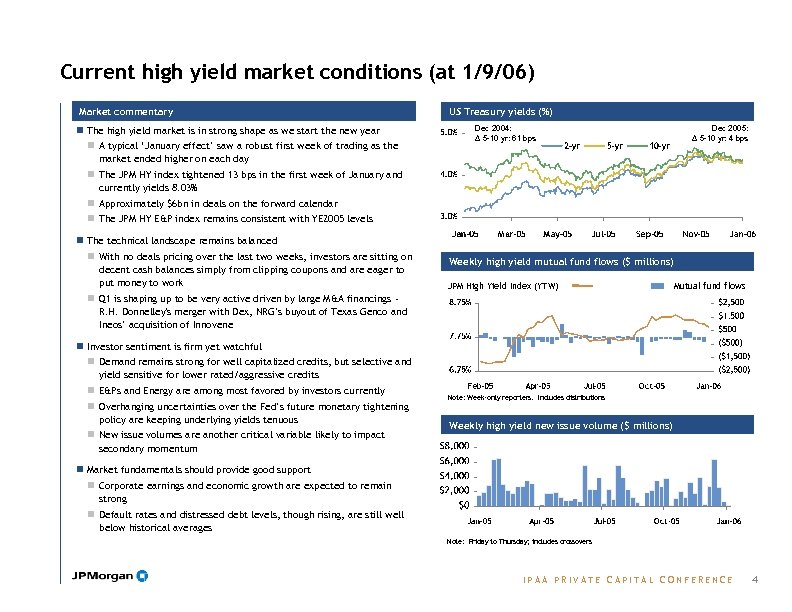

Current high yield market conditions (at 1/9/06) Market commentary n The high yield market is in strong shape as we start the new year n A typical ‘January effect’ saw a robust first week of trading as the market ended higher on each day US Treasury yields (%) Dec 2004: Δ 5 -10 yr: 61 bps Dec 2005: Δ 5 -10 yr: 4 bps n The JPM HY index tightened 13 bps in the first week of January and currently yields 8. 03% n Approximately $6 bn in deals on the forward calendar n The JPM HY E&P index remains consistent with YE 2005 levels n The technical landscape remains balanced n With no deals pricing over the last two weeks, investors are sitting on decent cash balances simply from clipping coupons and are eager to put money to work Weekly high yield mutual fund flows ($ millions) JPM High Yield Index (YTW) Mutual fund flows n Q 1 is shaping up to be very active driven by large M&A financings R. H. Donnelley's merger with Dex, NRG’s buyout of Texas Genco and Ineos’ acquisition of Innovene n Investor sentiment is firm yet watchful n Demand remains strong for well capitalized credits, but selective and yield sensitive for lower rated/aggressive credits n E&Ps and Energy are among most favored by investors currently n Overhanging uncertainties over the Fed’s future monetary tightening policy are keeping underlying yields tenuous n New issue volumes are another critical variable likely to impact secondary momentum Note: Week-only reporters. Includes distributions Weekly high yield new issue volume ($ millions) n Market fundamentals should provide good support n Corporate earnings and economic growth are expected to remain strong n Default rates and distressed debt levels, though rising, are still well below historical averages Note: Friday to Thursday; includes crossovers I P A A P R I V A T E C A P I T A L C O N F E R E N C E 4

Current high yield market conditions (at 1/9/06) Market commentary n The high yield market is in strong shape as we start the new year n A typical ‘January effect’ saw a robust first week of trading as the market ended higher on each day US Treasury yields (%) Dec 2004: Δ 5 -10 yr: 61 bps Dec 2005: Δ 5 -10 yr: 4 bps n The JPM HY index tightened 13 bps in the first week of January and currently yields 8. 03% n Approximately $6 bn in deals on the forward calendar n The JPM HY E&P index remains consistent with YE 2005 levels n The technical landscape remains balanced n With no deals pricing over the last two weeks, investors are sitting on decent cash balances simply from clipping coupons and are eager to put money to work Weekly high yield mutual fund flows ($ millions) JPM High Yield Index (YTW) Mutual fund flows n Q 1 is shaping up to be very active driven by large M&A financings R. H. Donnelley's merger with Dex, NRG’s buyout of Texas Genco and Ineos’ acquisition of Innovene n Investor sentiment is firm yet watchful n Demand remains strong for well capitalized credits, but selective and yield sensitive for lower rated/aggressive credits n E&Ps and Energy are among most favored by investors currently n Overhanging uncertainties over the Fed’s future monetary tightening policy are keeping underlying yields tenuous n New issue volumes are another critical variable likely to impact secondary momentum Note: Week-only reporters. Includes distributions Weekly high yield new issue volume ($ millions) n Market fundamentals should provide good support n Corporate earnings and economic growth are expected to remain strong n Default rates and distressed debt levels, though rising, are still well below historical averages Note: Friday to Thursday; includes crossovers I P A A P R I V A T E C A P I T A L C O N F E R E N C E 4

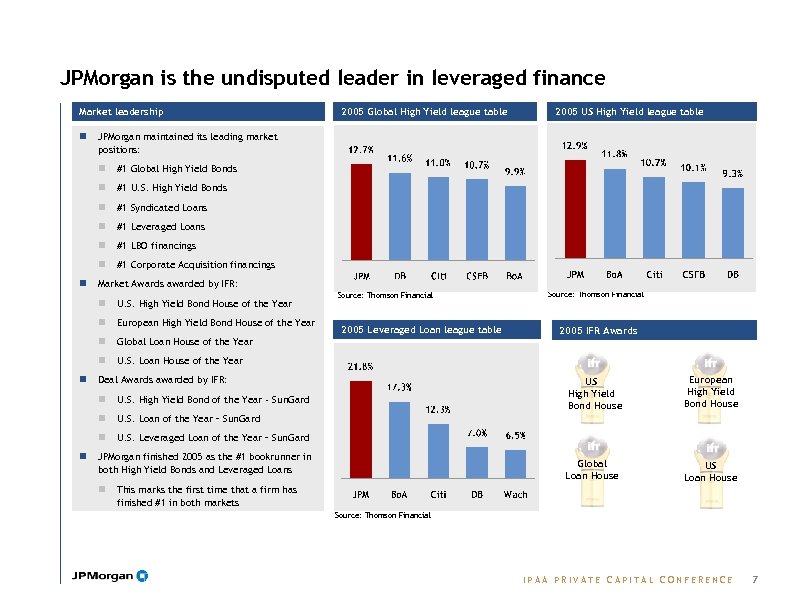

JPMorgan is the undisputed leader in leveraged finance Market leadership n #1 Global High Yield Bonds n #1 U. S. High Yield Bonds n #1 Syndicated Loans n #1 Leveraged Loans n #1 LBO financings n #1 Corporate Acquisition financings Market Awards awarded by IFR: n U. S. High Yield Bond House of the Year n European High Yield Bond House of the Year n Source: Thomson Financial U. S. Loan House of the Year 2005 Leveraged Loan league table Deal Awards awarded by IFR: n European High Yield Bond House Global Loan House US Loan House U. S. Loan of the Year – Sun. Gard n 2005 IFR Awards US High Yield Bond House U. S. High Yield Bond of the Year - Sun. Gard n n Source: Thomson Financial Global Loan House of the Year n n 2005 US High Yield league table JPMorgan maintained its leading market positions: n n 2005 Global High Yield league table U. S. Leveraged Loan of the Year – Sun. Gard JPMorgan finished 2005 as the #1 bookrunner in both High Yield Bonds and Leveraged Loans n This marks the first time that a firm has finished #1 in both markets Source: Thomson Financial I P A A P R I V A T E C A P I T A L C O N F E R E N C E 7

JPMorgan is the undisputed leader in leveraged finance Market leadership n #1 Global High Yield Bonds n #1 U. S. High Yield Bonds n #1 Syndicated Loans n #1 Leveraged Loans n #1 LBO financings n #1 Corporate Acquisition financings Market Awards awarded by IFR: n U. S. High Yield Bond House of the Year n European High Yield Bond House of the Year n Source: Thomson Financial U. S. Loan House of the Year 2005 Leveraged Loan league table Deal Awards awarded by IFR: n European High Yield Bond House Global Loan House US Loan House U. S. Loan of the Year – Sun. Gard n 2005 IFR Awards US High Yield Bond House U. S. High Yield Bond of the Year - Sun. Gard n n Source: Thomson Financial Global Loan House of the Year n n 2005 US High Yield league table JPMorgan maintained its leading market positions: n n 2005 Global High Yield league table U. S. Leveraged Loan of the Year – Sun. Gard JPMorgan finished 2005 as the #1 bookrunner in both High Yield Bonds and Leveraged Loans n This marks the first time that a firm has finished #1 in both markets Source: Thomson Financial I P A A P R I V A T E C A P I T A L C O N F E R E N C E 7