56eb2585fe68c13f343b2a138c76309c.ppt

- Количество слайдов: 22

Italian National Institute of Statistics National Accounts Department The analysis of gross fixed capital formation in institutional sectors accounts Paola Santoro Francesca Tartamella STATISTICS: Investment in the Future 2 Prague, 14 -15 September 2009 Roofs of Prague

Italian National Institute of Statistics National Accounts Department The analysis of gross fixed capital formation in institutional sectors accounts Paola Santoro Francesca Tartamella STATISTICS: Investment in the Future 2 Prague, 14 -15 September 2009 Roofs of Prague

STATISTICS “Investment in the Future 2” Introduction Methodology In 2007 the Italian institute of statistics (Istat) published the revised estimates of total fixed capital formation (GFCF) by institutional Results sector. Conclusions In this report we describe: - the new estimation methodology; - the main results obtained. Prague, 14 -15 September 2009

STATISTICS “Investment in the Future 2” Introduction Methodology In 2007 the Italian institute of statistics (Istat) published the revised estimates of total fixed capital formation (GFCF) by institutional Results sector. Conclusions In this report we describe: - the new estimation methodology; - the main results obtained. Prague, 14 -15 September 2009

STATISTICS “Investment in the Future 2” Definition Introduction Methodology “Gross fixed capital formation consists of resident producers’ acquisitions, less disposals, of fixed assets during a given period plus certain additions Results to the value of non-produced assets realised by the productive activity of Conclusions producer or institutional units. Fixed assets are tangible or intangible assets produced as outputs from processes of production that are themselves used repeatedly, or continuously, in processes of production for more than one year” (ESA 95, 3. 102). GFCF is recorded when the ownership of the fixed assets is transferred and must be evaluated at purchasers’ prices (ESA 95, 3. 112). Prague, 14 -15 September 2009

STATISTICS “Investment in the Future 2” Definition Introduction Methodology “Gross fixed capital formation consists of resident producers’ acquisitions, less disposals, of fixed assets during a given period plus certain additions Results to the value of non-produced assets realised by the productive activity of Conclusions producer or institutional units. Fixed assets are tangible or intangible assets produced as outputs from processes of production that are themselves used repeatedly, or continuously, in processes of production for more than one year” (ESA 95, 3. 102). GFCF is recorded when the ownership of the fixed assets is transferred and must be evaluated at purchasers’ prices (ESA 95, 3. 112). Prague, 14 -15 September 2009

STATISTICS “Investment in the Future 2” GFCF estimates Introduction The aggregate is estimated from two points of view: Methodology • from the viewpoint of the producer of GFCF goods or services (GFCF by producer industry); Results Conclusions • from the viewpoint of the user of GFCF goods or services (GFCF by owner industry). From economic owner point of view, the aggregate is also estimated by institutional sector (GFCF by institutional sector). By construction, for every asset, the value of GFCF by institutional sector is totally consistent with the value of GFCF by producer and by owner industry. Prague, 14 -15 September 2009

STATISTICS “Investment in the Future 2” GFCF estimates Introduction The aggregate is estimated from two points of view: Methodology • from the viewpoint of the producer of GFCF goods or services (GFCF by producer industry); Results Conclusions • from the viewpoint of the user of GFCF goods or services (GFCF by owner industry). From economic owner point of view, the aggregate is also estimated by institutional sector (GFCF by institutional sector). By construction, for every asset, the value of GFCF by institutional sector is totally consistent with the value of GFCF by producer and by owner industry. Prague, 14 -15 September 2009

STATISTICS “Investment in the Future 2” GFCF by institutional sector Introduction Methodology In every industry, the value of GFCF by asset has to be allocated to all the institutional sectors engaged in that activity. Results Conclusions GFCF by institutional sector is estimated for: − Non-financial corporations (S. 11) − Financial corporations (S. 12) − General government (S. 13) − Households (S. 14) − Non-profit institutions serving households (S. 15) GFCF for the Rest of the world (S. 2) equals zero by definition. Prague, 14 -15 September 2009

STATISTICS “Investment in the Future 2” GFCF by institutional sector Introduction Methodology In every industry, the value of GFCF by asset has to be allocated to all the institutional sectors engaged in that activity. Results Conclusions GFCF by institutional sector is estimated for: − Non-financial corporations (S. 11) − Financial corporations (S. 12) − General government (S. 13) − Households (S. 14) − Non-profit institutions serving households (S. 15) GFCF for the Rest of the world (S. 2) equals zero by definition. Prague, 14 -15 September 2009

STATISTICS “Investment in the Future 2” Households sector in Italian National Accounts Introduction Methodology Inside the Households sector Istat distinguishes between: • Consumer households (S. 14 HC), whose main function consists in Results consumption and output of goods and services for own final use, Conclusions • Producer households (S. 14 HP), that includes all the market activities of the sector. Assets acquired by Consumer households are not considered GFCF but final consumption (ESA 95, 7. 15). An exception are dwellings: the production of housing services by owneroccupiers is considered as own account production (ESA 95, 1. 13). Prague, 14 -15 September 2009

STATISTICS “Investment in the Future 2” Households sector in Italian National Accounts Introduction Methodology Inside the Households sector Istat distinguishes between: • Consumer households (S. 14 HC), whose main function consists in Results consumption and output of goods and services for own final use, Conclusions • Producer households (S. 14 HP), that includes all the market activities of the sector. Assets acquired by Consumer households are not considered GFCF but final consumption (ESA 95, 7. 15). An exception are dwellings: the production of housing services by owneroccupiers is considered as own account production (ESA 95, 1. 13). Prague, 14 -15 September 2009

STATISTICS “Investment in the Future 2” Introduction Estimation method The methodology is carried out in two phases: Methodology 1) The estimation of GFCF value of General government, Financial Results Conclusions corporations and Non-profit institutions serving households, by industry and by asset; 2) The attribution of the remaining part of GFCF to Non-financial corporations and Households, by industry and by asset. Prague, 14 -15 September 2009

STATISTICS “Investment in the Future 2” Introduction Estimation method The methodology is carried out in two phases: Methodology 1) The estimation of GFCF value of General government, Financial Results Conclusions corporations and Non-profit institutions serving households, by industry and by asset; 2) The attribution of the remaining part of GFCF to Non-financial corporations and Households, by industry and by asset. Prague, 14 -15 September 2009

STATISTICS “Investment in the Future 2” Estimation method for Households and Nonfinancial corporations (1) Introduction We obtain average values of GFCF, based on total employment, from Methodology information provided by business surveys: Results ajik Conclusions These average values are estimated: • for each asset j (1, . . , 5: buildings; machinery; furniture; transport equipment; software) • in every industry i (1, …, 101) • by size class+legal form k (1, 2 where k = 1 identifies enterprises with size class 1 -5 people employed and legal form sole proprietorships, società semplici and società di fatto; k = 2 identifies enterprises with size class 6+ people employed and other legal form). Prague, 14 -15 September 2009

STATISTICS “Investment in the Future 2” Estimation method for Households and Nonfinancial corporations (1) Introduction We obtain average values of GFCF, based on total employment, from Methodology information provided by business surveys: Results ajik Conclusions These average values are estimated: • for each asset j (1, . . , 5: buildings; machinery; furniture; transport equipment; software) • in every industry i (1, …, 101) • by size class+legal form k (1, 2 where k = 1 identifies enterprises with size class 1 -5 people employed and legal form sole proprietorships, società semplici and società di fatto; k = 2 identifies enterprises with size class 6+ people employed and other legal form). Prague, 14 -15 September 2009

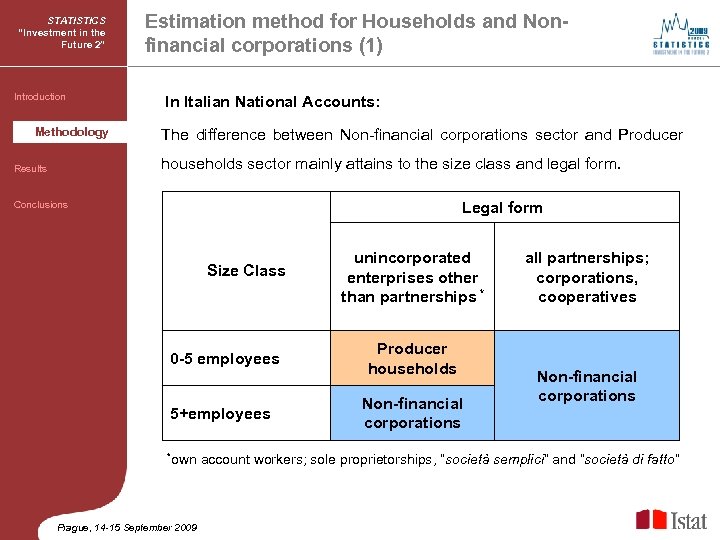

STATISTICS “Investment in the Future 2” Introduction Estimation method for Households and Nonfinancial corporations (1) In Italian National Accounts: Methodology The difference between Non-financial corporations sector and Producer Results households sector mainly attains to the size class and legal form. Legal form Conclusions Size Class unincorporated enterprises other than partnerships * 0 -5 employees Producer households 5+employees Non-financial corporations *own Prague, 14 -15 September 2009 all partnerships; corporations, cooperatives Non-financial corporations account workers; sole proprietorships, “società semplici” and “società di fatto”

STATISTICS “Investment in the Future 2” Introduction Estimation method for Households and Nonfinancial corporations (1) In Italian National Accounts: Methodology The difference between Non-financial corporations sector and Producer Results households sector mainly attains to the size class and legal form. Legal form Conclusions Size Class unincorporated enterprises other than partnerships * 0 -5 employees Producer households 5+employees Non-financial corporations *own Prague, 14 -15 September 2009 all partnerships; corporations, cooperatives Non-financial corporations account workers; sole proprietorships, “società semplici” and “società di fatto”

STATISTICS “Investment in the Future 2” Estimation method for Households and Nonfinancial corporations (1) Introduction Methodology Results • aji 1 is a proxy of the average value of the GFCF of Producer households in Conclusions asset j in industry i; • aji 2 is a proxy of the average value of the GFCF of Non-financial corporations in asset j in industry i. Prague, 14 -15 September 2009

STATISTICS “Investment in the Future 2” Estimation method for Households and Nonfinancial corporations (1) Introduction Methodology Results • aji 1 is a proxy of the average value of the GFCF of Producer households in Conclusions asset j in industry i; • aji 2 is a proxy of the average value of the GFCF of Non-financial corporations in asset j in industry i. Prague, 14 -15 September 2009

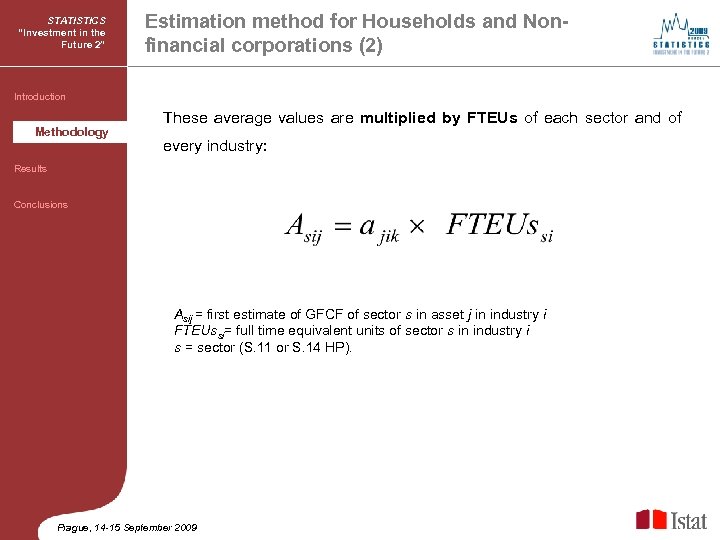

STATISTICS “Investment in the Future 2” Estimation method for Households and Nonfinancial corporations (2) Introduction Methodology These average values are multiplied by FTEUs of each sector and of every industry: Results Conclusions Asij = first estimate of GFCF of sector s in asset j in industry i FTEUssi= full time equivalent units of sector s in industry i s = sector (S. 11 or S. 14 HP). Prague, 14 -15 September 2009

STATISTICS “Investment in the Future 2” Estimation method for Households and Nonfinancial corporations (2) Introduction Methodology These average values are multiplied by FTEUs of each sector and of every industry: Results Conclusions Asij = first estimate of GFCF of sector s in asset j in industry i FTEUssi= full time equivalent units of sector s in industry i s = sector (S. 11 or S. 14 HP). Prague, 14 -15 September 2009

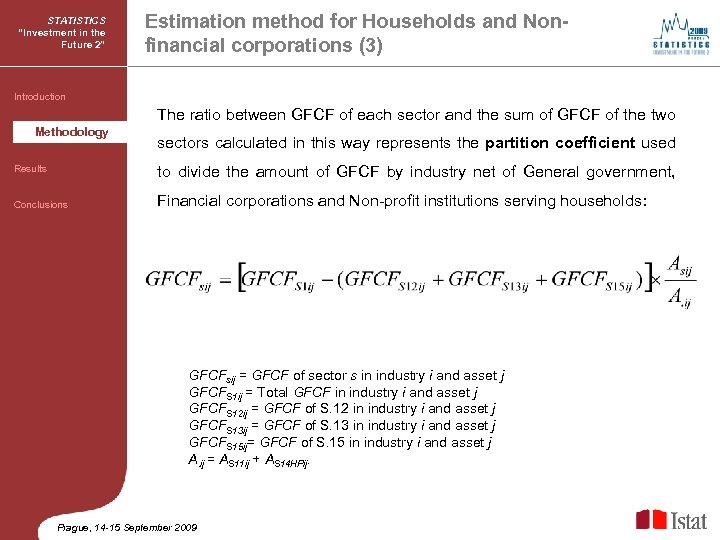

STATISTICS “Investment in the Future 2” Estimation method for Households and Nonfinancial corporations (3) Introduction The ratio between GFCF of each sector and the sum of GFCF of the two Methodology sectors calculated in this way represents the partition coefficient used Results to divide the amount of GFCF by industry net of General government, Conclusions Financial corporations and Non-profit institutions serving households: GFCFsij = GFCF of sector s in industry i and asset j GFCFS 1 ij = Total GFCF in industry i and asset j GFCFS 12 ij = GFCF of S. 12 in industry i and asset j GFCFS 13 ij = GFCF of S. 13 in industry i and asset j GFCFS 15 ij= GFCF of S. 15 in industry i and asset j A. ij = AS 11 ij + AS 14 HPij. Prague, 14 -15 September 2009

STATISTICS “Investment in the Future 2” Estimation method for Households and Nonfinancial corporations (3) Introduction The ratio between GFCF of each sector and the sum of GFCF of the two Methodology sectors calculated in this way represents the partition coefficient used Results to divide the amount of GFCF by industry net of General government, Conclusions Financial corporations and Non-profit institutions serving households: GFCFsij = GFCF of sector s in industry i and asset j GFCFS 1 ij = Total GFCF in industry i and asset j GFCFS 12 ij = GFCF of S. 12 in industry i and asset j GFCFS 13 ij = GFCF of S. 13 in industry i and asset j GFCFS 15 ij= GFCF of S. 15 in industry i and asset j A. ij = AS 11 ij + AS 14 HPij. Prague, 14 -15 September 2009

STATISTICS “Investment in the Future 2” Results Introduction GFCF by institutional sector is estimated at a high level of detail, by 11 Methodology Results types of assets and 101 industries. Results Conclusions The features of corporations may be distinguished from those of small unincorporated enterprises: • Institutional sectors perform their economic activity in industries characterized by different capital intensity; • in the same industry, the investment behaviour of small enterprises may differ from the one of corporations. Prague, 14 -15 September 2009

STATISTICS “Investment in the Future 2” Results Introduction GFCF by institutional sector is estimated at a high level of detail, by 11 Methodology Results types of assets and 101 industries. Results Conclusions The features of corporations may be distinguished from those of small unincorporated enterprises: • Institutional sectors perform their economic activity in industries characterized by different capital intensity; • in the same industry, the investment behaviour of small enterprises may differ from the one of corporations. Prague, 14 -15 September 2009

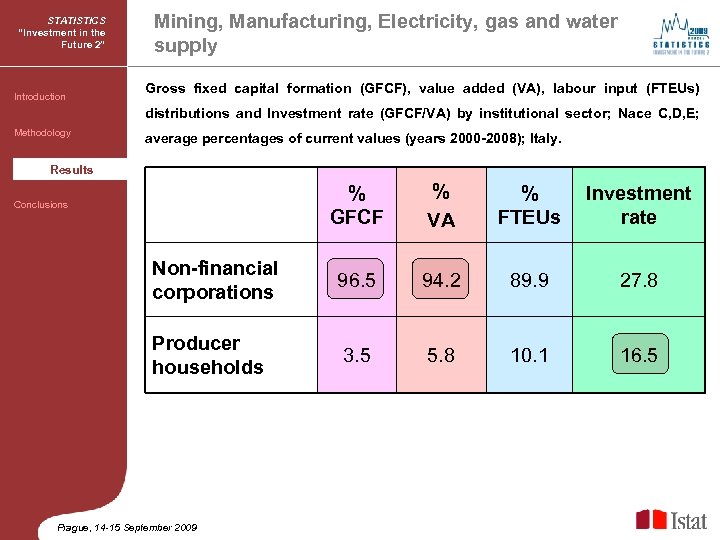

STATISTICS “Investment in the Future 2” Introduction Mining, Manufacturing, Electricity, gas and water supply Gross fixed capital formation (GFCF), value added (VA), labour input (FTEUs) distributions and Investment rate (GFCF/VA) by institutional sector; Nace C, D, E; Methodology Results average percentages of current values (years 2000 -2008); Italy. Results % GFCF % VA % FTEUs Investment rate Non-financial corporations 96. 5 94. 2 89. 9 27. 8 Producer households 3. 5 5. 8 10. 1 16. 5 Conclusions Prague, 14 -15 September 2009

STATISTICS “Investment in the Future 2” Introduction Mining, Manufacturing, Electricity, gas and water supply Gross fixed capital formation (GFCF), value added (VA), labour input (FTEUs) distributions and Investment rate (GFCF/VA) by institutional sector; Nace C, D, E; Methodology Results average percentages of current values (years 2000 -2008); Italy. Results % GFCF % VA % FTEUs Investment rate Non-financial corporations 96. 5 94. 2 89. 9 27. 8 Producer households 3. 5 5. 8 10. 1 16. 5 Conclusions Prague, 14 -15 September 2009

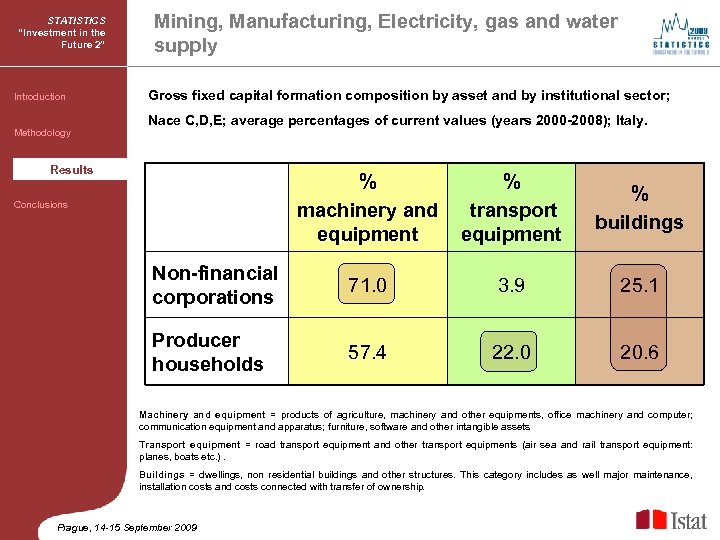

STATISTICS “Investment in the Future 2” Introduction Methodology Results Mining, Manufacturing, Electricity, gas and water supply Gross fixed capital formation composition by asset and by institutional sector; Nace C, D, E; average percentages of current values (years 2000 -2008); Italy. Results % % machinery and transport equipment Conclusions % buildings Non-financial corporations 71. 0 3. 9 25. 1 Producer households 57. 4 22. 0 20. 6 Machinery and equipment = products of agriculture, machinery and other equipments, office machinery and computer; communication equipment and apparatus; furniture, software and other intangible assets. Transport equipment = road transport equipment and other transport equipments (air sea and rail transport equipment: planes, boats etc. ). Buildings = dwellings, non residential buildings and other structures. This category includes as well major maintenance, installation costs and costs connected with transfer of ownership. Prague, 14 -15 September 2009

STATISTICS “Investment in the Future 2” Introduction Methodology Results Mining, Manufacturing, Electricity, gas and water supply Gross fixed capital formation composition by asset and by institutional sector; Nace C, D, E; average percentages of current values (years 2000 -2008); Italy. Results % % machinery and transport equipment Conclusions % buildings Non-financial corporations 71. 0 3. 9 25. 1 Producer households 57. 4 22. 0 20. 6 Machinery and equipment = products of agriculture, machinery and other equipments, office machinery and computer; communication equipment and apparatus; furniture, software and other intangible assets. Transport equipment = road transport equipment and other transport equipments (air sea and rail transport equipment: planes, boats etc. ). Buildings = dwellings, non residential buildings and other structures. This category includes as well major maintenance, installation costs and costs connected with transfer of ownership. Prague, 14 -15 September 2009

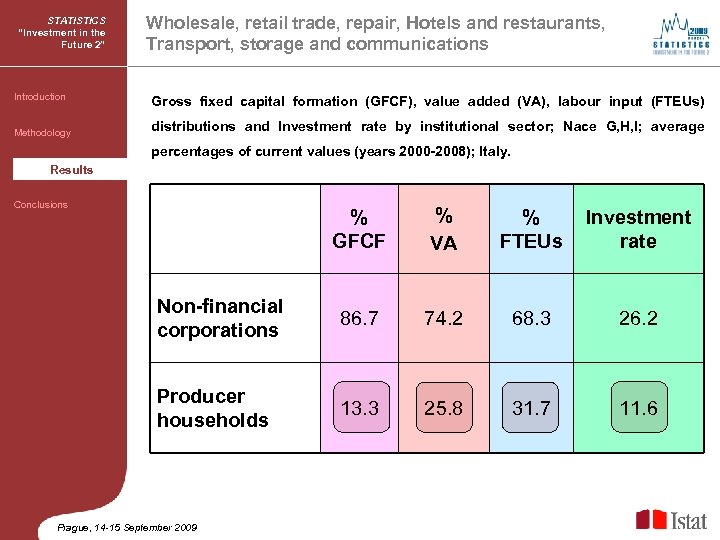

STATISTICS “Investment in the Future 2” Introduction Methodology Wholesale, retail trade, repair, Hotels and restaurants, Transport, storage and communications Gross fixed capital formation (GFCF), value added (VA), labour input (FTEUs) distributions and Investment rate by institutional sector; Nace G, H, I; average percentages of current values (years 2000 -2008); Italy. Results Conclusions % GFCF % VA % FTEUs Investment rate Non-financial corporations 86. 7 74. 2 68. 3 26. 2 Producer households 13. 3 25. 8 31. 7 11. 6 Prague, 14 -15 September 2009

STATISTICS “Investment in the Future 2” Introduction Methodology Wholesale, retail trade, repair, Hotels and restaurants, Transport, storage and communications Gross fixed capital formation (GFCF), value added (VA), labour input (FTEUs) distributions and Investment rate by institutional sector; Nace G, H, I; average percentages of current values (years 2000 -2008); Italy. Results Conclusions % GFCF % VA % FTEUs Investment rate Non-financial corporations 86. 7 74. 2 68. 3 26. 2 Producer households 13. 3 25. 8 31. 7 11. 6 Prague, 14 -15 September 2009

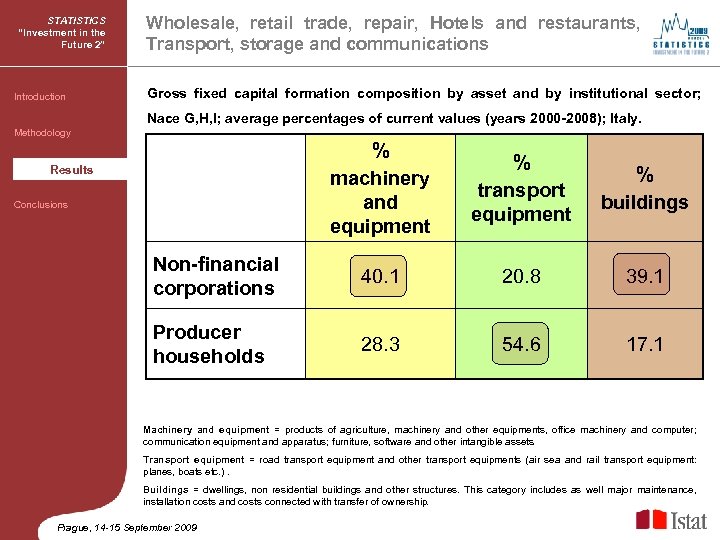

STATISTICS “Investment in the Future 2” Introduction Wholesale, retail trade, repair, Hotels and restaurants, Transport, storage and communications Gross fixed capital formation composition by asset and by institutional sector; Nace G, H, I; average percentages of current values (years 2000 -2008); Italy. Methodology Results % machinery and equipment % transport equipment % buildings Non-financial corporations 40. 1 20. 8 39. 1 Producer households 28. 3 54. 6 17. 1 Results Conclusions Machinery and equipment = products of agriculture, machinery and other equipments, office machinery and computer; communication equipment and apparatus; furniture, software and other intangible assets. Transport equipment = road transport equipment and other transport equipments (air sea and rail transport equipment: planes, boats etc. ). Buildings = dwellings, non residential buildings and other structures. This category includes as well major maintenance, installation costs and costs connected with transfer of ownership. Prague, 14 -15 September 2009

STATISTICS “Investment in the Future 2” Introduction Wholesale, retail trade, repair, Hotels and restaurants, Transport, storage and communications Gross fixed capital formation composition by asset and by institutional sector; Nace G, H, I; average percentages of current values (years 2000 -2008); Italy. Methodology Results % machinery and equipment % transport equipment % buildings Non-financial corporations 40. 1 20. 8 39. 1 Producer households 28. 3 54. 6 17. 1 Results Conclusions Machinery and equipment = products of agriculture, machinery and other equipments, office machinery and computer; communication equipment and apparatus; furniture, software and other intangible assets. Transport equipment = road transport equipment and other transport equipments (air sea and rail transport equipment: planes, boats etc. ). Buildings = dwellings, non residential buildings and other structures. This category includes as well major maintenance, installation costs and costs connected with transfer of ownership. Prague, 14 -15 September 2009

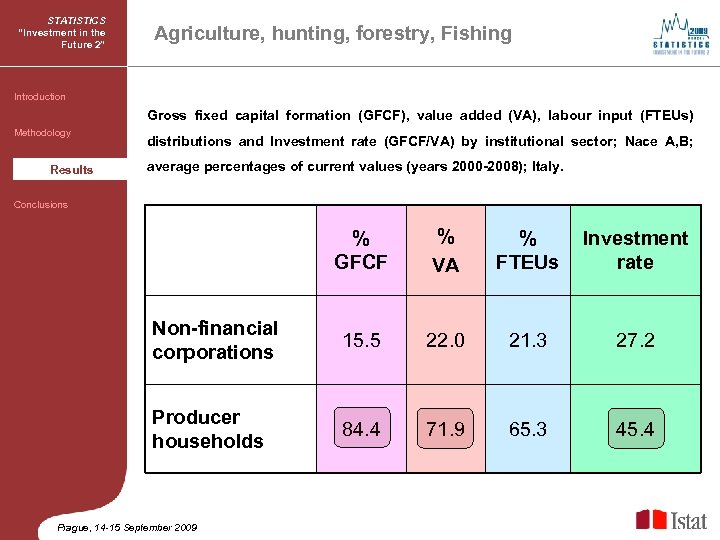

STATISTICS “Investment in the Future 2” Agriculture, hunting, forestry, Fishing Introduction Gross fixed capital formation (GFCF), value added (VA), labour input (FTEUs) Methodology Results distributions and Investment rate (GFCF/VA) by institutional sector; Nace A, B; average percentages of current values (years 2000 -2008); Italy. Conclusions % GFCF % VA % FTEUs Investment rate Non-financial corporations 15. 5 22. 0 21. 3 27. 2 Producer households 84. 4 71. 9 65. 3 45. 4 Prague, 14 -15 September 2009

STATISTICS “Investment in the Future 2” Agriculture, hunting, forestry, Fishing Introduction Gross fixed capital formation (GFCF), value added (VA), labour input (FTEUs) Methodology Results distributions and Investment rate (GFCF/VA) by institutional sector; Nace A, B; average percentages of current values (years 2000 -2008); Italy. Conclusions % GFCF % VA % FTEUs Investment rate Non-financial corporations 15. 5 22. 0 21. 3 27. 2 Producer households 84. 4 71. 9 65. 3 45. 4 Prague, 14 -15 September 2009

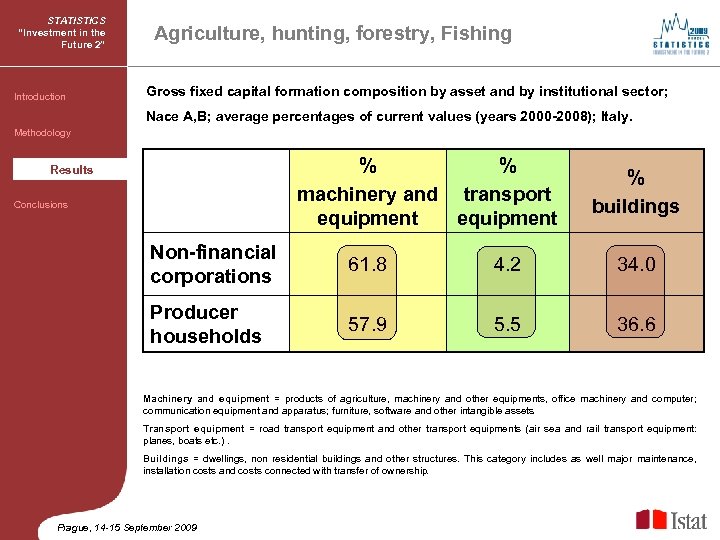

STATISTICS “Investment in the Future 2” Introduction Agriculture, hunting, forestry, Fishing Gross fixed capital formation composition by asset and by institutional sector; Nace A, B; average percentages of current values (years 2000 -2008); Italy. Methodology Results % % machinery and transport equipment Results Conclusions % buildings Non-financial corporations 61. 8 4. 2 34. 0 Producer households 57. 9 5. 5 36. 6 Machinery and equipment = products of agriculture, machinery and other equipments, office machinery and computer; communication equipment and apparatus; furniture, software and other intangible assets. Transport equipment = road transport equipment and other transport equipments (air sea and rail transport equipment: planes, boats etc. ). Buildings = dwellings, non residential buildings and other structures. This category includes as well major maintenance, installation costs and costs connected with transfer of ownership. Prague, 14 -15 September 2009

STATISTICS “Investment in the Future 2” Introduction Agriculture, hunting, forestry, Fishing Gross fixed capital formation composition by asset and by institutional sector; Nace A, B; average percentages of current values (years 2000 -2008); Italy. Methodology Results % % machinery and transport equipment Results Conclusions % buildings Non-financial corporations 61. 8 4. 2 34. 0 Producer households 57. 9 5. 5 36. 6 Machinery and equipment = products of agriculture, machinery and other equipments, office machinery and computer; communication equipment and apparatus; furniture, software and other intangible assets. Transport equipment = road transport equipment and other transport equipments (air sea and rail transport equipment: planes, boats etc. ). Buildings = dwellings, non residential buildings and other structures. This category includes as well major maintenance, installation costs and costs connected with transfer of ownership. Prague, 14 -15 September 2009

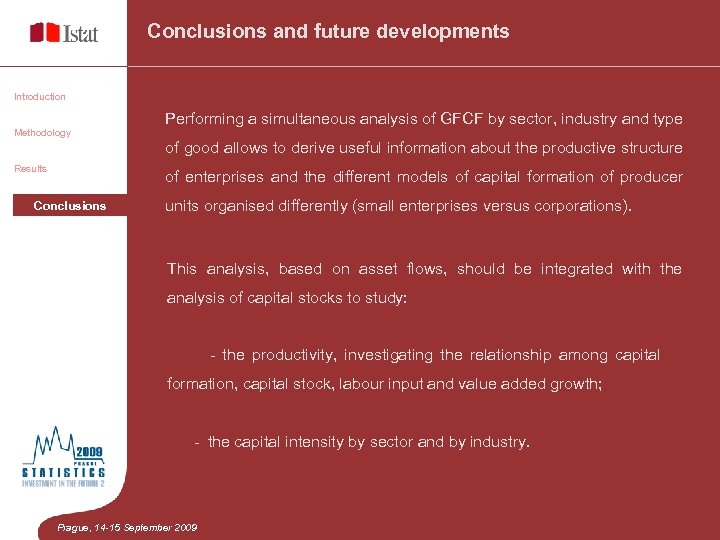

Conclusions and future developments Introduction Methodology Performing a simultaneous analysis of GFCF by sector, industry and type of good allows to derive useful information about the productive structure Results of enterprises and the different models of capital formation of producer Conclusions units organised differently (small enterprises versus corporations). This analysis, based on asset flows, should be integrated with the analysis of capital stocks to study: - the productivity, investigating the relationship among capital formation, capital stock, labour input and value added growth; - the capital intensity by sector and by industry. Prague, 14 -15 September 2009

Conclusions and future developments Introduction Methodology Performing a simultaneous analysis of GFCF by sector, industry and type of good allows to derive useful information about the productive structure Results of enterprises and the different models of capital formation of producer Conclusions units organised differently (small enterprises versus corporations). This analysis, based on asset flows, should be integrated with the analysis of capital stocks to study: - the productivity, investigating the relationship among capital formation, capital stock, labour input and value added growth; - the capital intensity by sector and by industry. Prague, 14 -15 September 2009

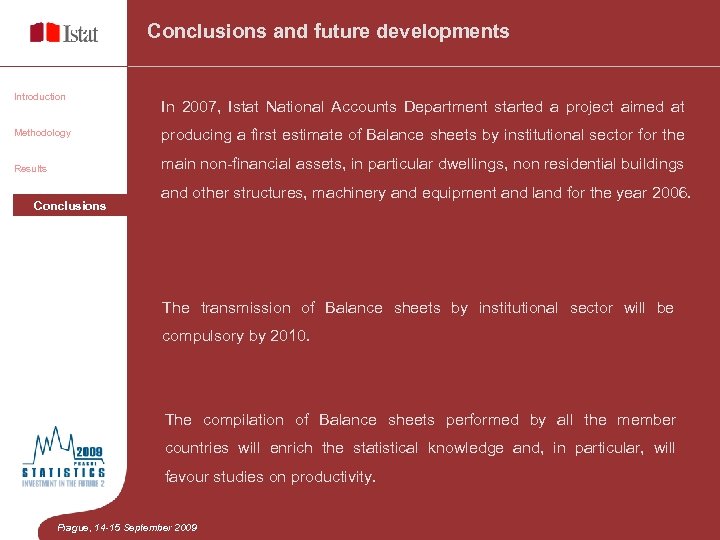

Conclusions and future developments Introduction In 2007, Istat National Accounts Department started a project aimed at Methodology producing a first estimate of Balance sheets by institutional sector for the Results main non-financial assets, in particular dwellings, non residential buildings Conclusions and other structures, machinery and equipment and land for the year 2006. The transmission of Balance sheets by institutional sector will be compulsory by 2010. The compilation of Balance sheets performed by all the member countries will enrich the statistical knowledge and, in particular, will favour studies on productivity. Prague, 14 -15 September 2009

Conclusions and future developments Introduction In 2007, Istat National Accounts Department started a project aimed at Methodology producing a first estimate of Balance sheets by institutional sector for the Results main non-financial assets, in particular dwellings, non residential buildings Conclusions and other structures, machinery and equipment and land for the year 2006. The transmission of Balance sheets by institutional sector will be compulsory by 2010. The compilation of Balance sheets performed by all the member countries will enrich the statistical knowledge and, in particular, will favour studies on productivity. Prague, 14 -15 September 2009

Thank you!

Thank you!