c49df65b37e30e0b2506faef613b395d.ppt

- Количество слайдов: 38

IT As - Is Analysis

IT As - Is Analysis

Contents • Data Gathering Approach • Findings - Financial System Fragmentation Diversity and Standardization Technical and Functional Quality IT Alignment Time to Market • Conclusions -2 -

Contents • Data Gathering Approach • Findings - Financial System Fragmentation Diversity and Standardization Technical and Functional Quality IT Alignment Time to Market • Conclusions -2 -

Data Gathering Approach

Data Gathering Approach

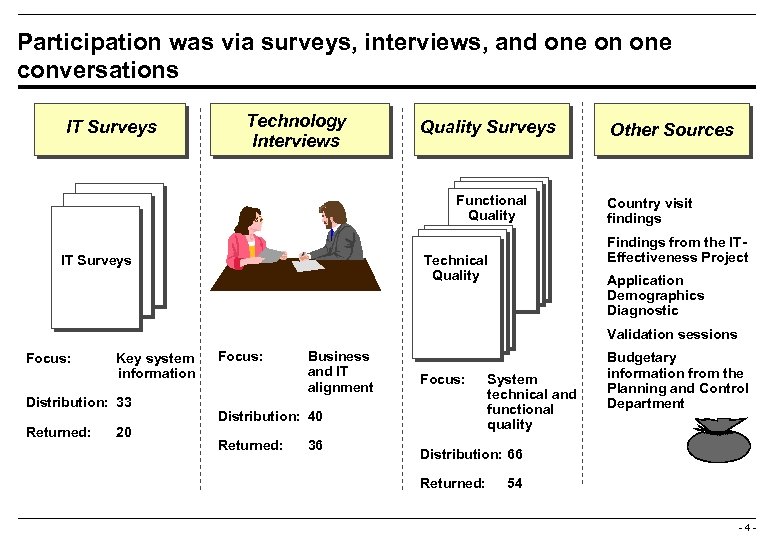

Participation was via surveys, interviews, and one on one conversations IT Surveys Technology Interviews Quality Surveys Functional Quality Country visit findings Findings from the ITEffectiveness Project Technical Quality IT Surveys Other Sources Application Demographics Diagnostic Validation sessions Focus: Key system information Distribution: 33 Returned: 20 Focus: Business and IT alignment Focus: Distribution: 40 Returned: 36 System technical and functional quality Budgetary information from the Planning and Control Department Distribution: 66 Returned: 54 -4 -

Participation was via surveys, interviews, and one on one conversations IT Surveys Technology Interviews Quality Surveys Functional Quality Country visit findings Findings from the ITEffectiveness Project Technical Quality IT Surveys Other Sources Application Demographics Diagnostic Validation sessions Focus: Key system information Distribution: 33 Returned: 20 Focus: Business and IT alignment Focus: Distribution: 40 Returned: 36 System technical and functional quality Budgetary information from the Planning and Control Department Distribution: 66 Returned: 54 -4 -

We talked to over 100 people… Names of interviewed people and others. . . … in over 22 countries -5 -

We talked to over 100 people… Names of interviewed people and others. . . … in over 22 countries -5 -

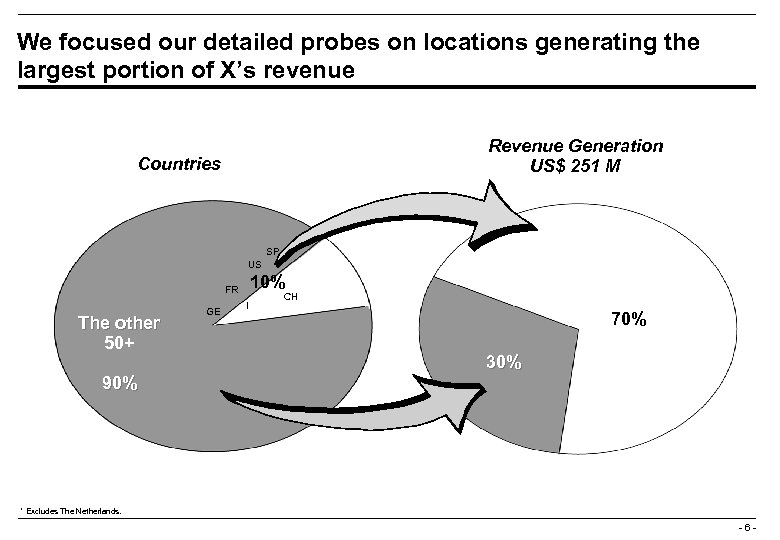

We focused our detailed probes on locations generating the largest portion of X’s revenue Revenue Generation US$ 251 M Countries SP US 10% FR The other 50+ GE I CH 70% 30% 90% * Excludes The Netherlands. -6 -

We focused our detailed probes on locations generating the largest portion of X’s revenue Revenue Generation US$ 251 M Countries SP US 10% FR The other 50+ GE I CH 70% 30% 90% * Excludes The Netherlands. -6 -

Findings

Findings

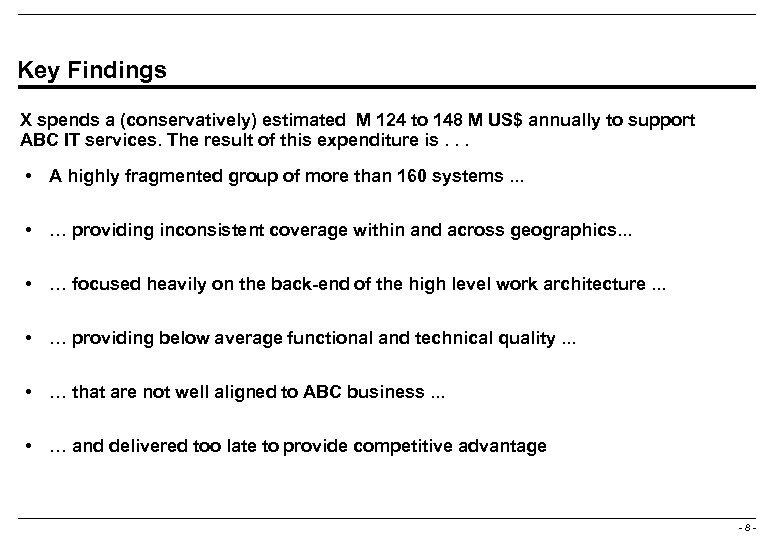

Key Findings X spends a (conservatively) estimated M 124 to 148 M US$ annually to support ABC IT services. The result of this expenditure is. . . • A highly fragmented group of more than 160 systems. . . • … providing inconsistent coverage within and across geographics. . . • … focused heavily on the back-end of the high level work architecture. . . • … providing below average functional and technical quality. . . • … that are not well aligned to ABC business. . . • … and delivered too late to provide competitive advantage -8 -

Key Findings X spends a (conservatively) estimated M 124 to 148 M US$ annually to support ABC IT services. The result of this expenditure is. . . • A highly fragmented group of more than 160 systems. . . • … providing inconsistent coverage within and across geographics. . . • … focused heavily on the back-end of the high level work architecture. . . • … providing below average functional and technical quality. . . • … that are not well aligned to ABC business. . . • … and delivered too late to provide competitive advantage -8 -

Financial Findings

Financial Findings

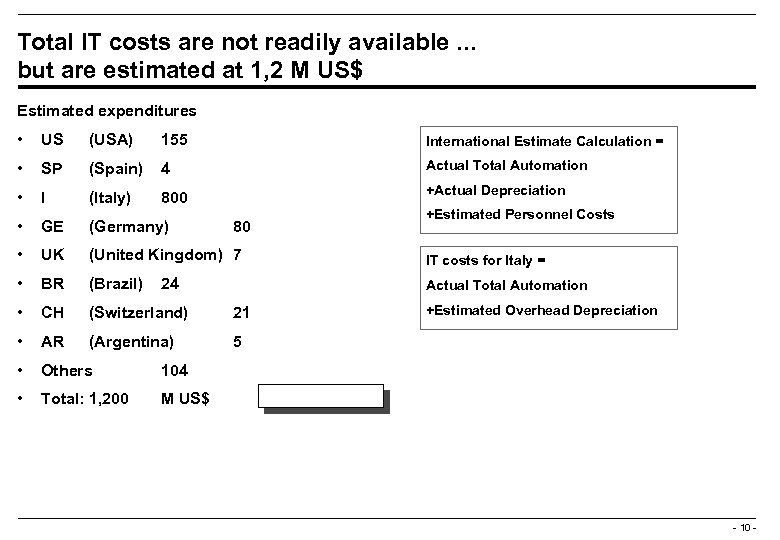

Total IT costs are not readily available. . . but are estimated at 1, 2 M US$ Estimated expenditures • US (USA) 155 International Estimate Calculation = • SP (Spain) 4 Actual Total Automation • I (Italy) 800 +Actual Depreciation • GE (Germany) • UK (United Kingdom) 7 IT costs for Italy = • BR (Brazil) Actual Total Automation • CH (Switzerland) 21 • AR (Argentina) 5 • Others 104 • Total: 1, 200 M US$ 80 24 +Estimated Personnel Costs +Estimated Overhead Depreciation - 10 -

Total IT costs are not readily available. . . but are estimated at 1, 2 M US$ Estimated expenditures • US (USA) 155 International Estimate Calculation = • SP (Spain) 4 Actual Total Automation • I (Italy) 800 +Actual Depreciation • GE (Germany) • UK (United Kingdom) 7 IT costs for Italy = • BR (Brazil) Actual Total Automation • CH (Switzerland) 21 • AR (Argentina) 5 • Others 104 • Total: 1, 200 M US$ 80 24 +Estimated Personnel Costs +Estimated Overhead Depreciation - 10 -

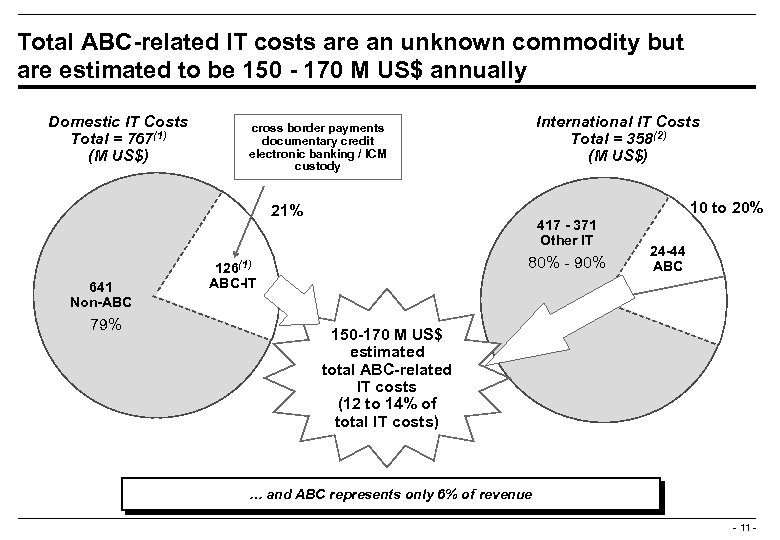

Total ABC-related IT costs are an unknown commodity but are estimated to be 150 - 170 M US$ annually Domestic IT Costs Total = 767(1) (M US$) International IT Costs Total = 358(2) (M US$) cross border payments documentary credit electronic banking / ICM custody 10 to 20% 21% 417 - 371 Other IT 80% - 90% 126(1) 641 Non-ABC 79% 24 -44 ABC-IT 150 -170 M US$ estimated total ABC-related IT costs (12 to 14% of total IT costs) … and ABC represents only 6% of revenue - 11 -

Total ABC-related IT costs are an unknown commodity but are estimated to be 150 - 170 M US$ annually Domestic IT Costs Total = 767(1) (M US$) International IT Costs Total = 358(2) (M US$) cross border payments documentary credit electronic banking / ICM custody 10 to 20% 21% 417 - 371 Other IT 80% - 90% 126(1) 641 Non-ABC 79% 24 -44 ABC-IT 150 -170 M US$ estimated total ABC-related IT costs (12 to 14% of total IT costs) … and ABC represents only 6% of revenue - 11 -

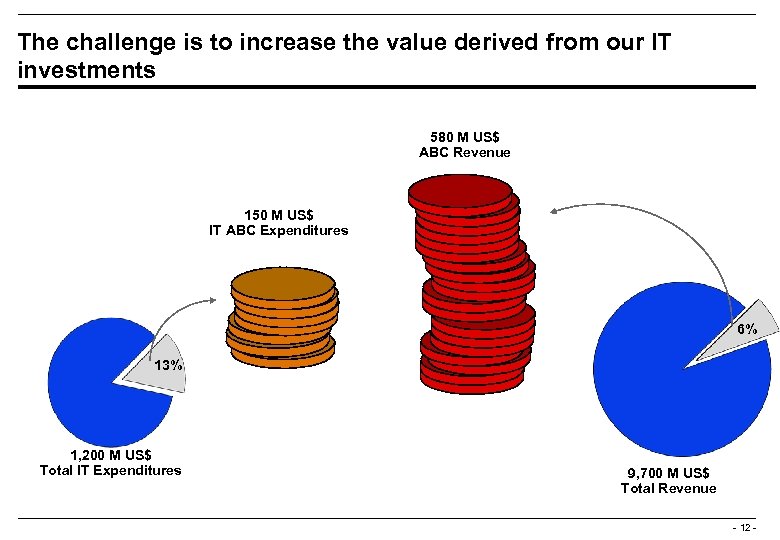

The challenge is to increase the value derived from our IT investments 580 M US$ ABC Revenue 150 M US$ IT ABC Expenditures 6% 13% 1, 200 M US$ Total IT Expenditures 9, 700 M US$ Total Revenue - 12 -

The challenge is to increase the value derived from our IT investments 580 M US$ ABC Revenue 150 M US$ IT ABC Expenditures 6% 13% 1, 200 M US$ Total IT Expenditures 9, 700 M US$ Total Revenue - 12 -

System Fragmentation

System Fragmentation

ABC is currently supported by more than 160 Systems List of systems - 14 -

ABC is currently supported by more than 160 Systems List of systems - 14 -

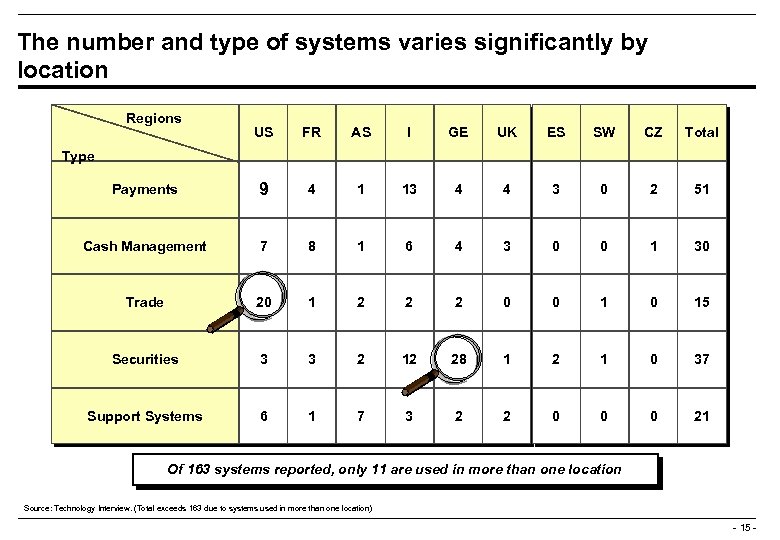

The number and type of systems varies significantly by location Regions US FR AS I GE UK ES SW CZ Total Payments 9 4 1 13 4 4 3 0 2 51 Cash Management 7 8 1 6 4 3 0 0 1 30 Trade 20 1 2 2 2 0 0 15 Securities 3 3 2 12 28 1 2 1 0 37 Support Systems 6 1 7 3 2 2 0 0 0 21 Type Of 163 systems reported, only 11 are used in more than one location Source: Technology Interview. (Total exceeds 163 due to systems used in more than one location) - 15 -

The number and type of systems varies significantly by location Regions US FR AS I GE UK ES SW CZ Total Payments 9 4 1 13 4 4 3 0 2 51 Cash Management 7 8 1 6 4 3 0 0 1 30 Trade 20 1 2 2 2 0 0 15 Securities 3 3 2 12 28 1 2 1 0 37 Support Systems 6 1 7 3 2 2 0 0 0 21 Type Of 163 systems reported, only 11 are used in more than one location Source: Technology Interview. (Total exceeds 163 due to systems used in more than one location) - 15 -

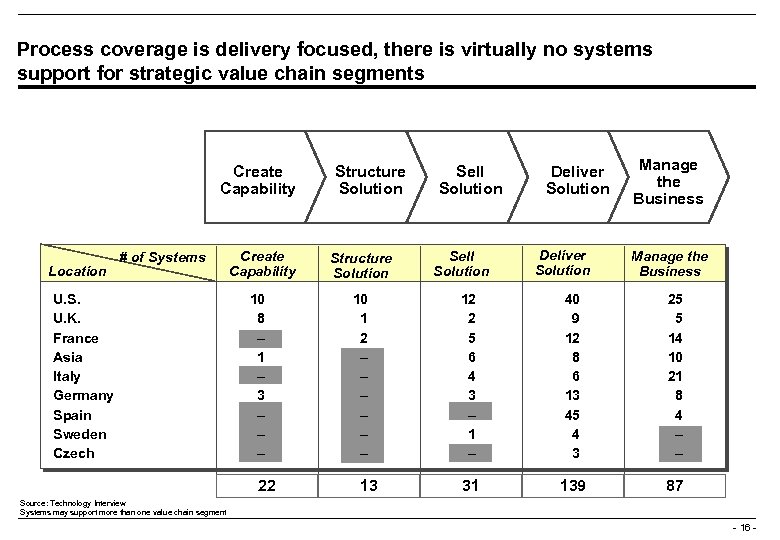

Process coverage is delivery focused, there is virtually no systems support for strategic value chain segments Create Capability Location # of Systems U. S. U. K. France Asia Italy Germany Spain Sweden Czech Create Capability 10 8 – 1 – 3 – – – 22 Structure Solution 10 1 2 – – – 13 Sell Solution Deliver Solution Manage the Business 12 2 5 6 4 3 – 1 – 40 9 12 8 6 13 45 4 3 25 5 14 10 21 8 4 – – 31 139 87 Source: Technology Interview Systems may support more than one value chain segment - 16 -

Process coverage is delivery focused, there is virtually no systems support for strategic value chain segments Create Capability Location # of Systems U. S. U. K. France Asia Italy Germany Spain Sweden Czech Create Capability 10 8 – 1 – 3 – – – 22 Structure Solution 10 1 2 – – – 13 Sell Solution Deliver Solution Manage the Business 12 2 5 6 4 3 – 1 – 40 9 12 8 6 13 45 4 3 25 5 14 10 21 8 4 – – 31 139 87 Source: Technology Interview Systems may support more than one value chain segment - 16 -

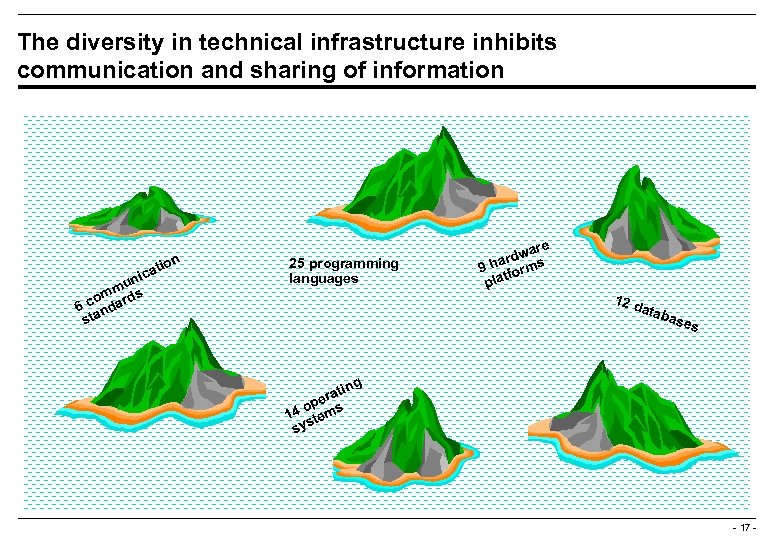

The diversity in technical infrastructure inhibits communication and sharing of information cat ni mu s om d 6 c ndar sta 25 programming languages are rdw s 9 ha form plat 12 d atab ase s ing rat e op 14 tems sys - 17 -

The diversity in technical infrastructure inhibits communication and sharing of information cat ni mu s om d 6 c ndar sta 25 programming languages are rdw s 9 ha form plat 12 d atab ase s ing rat e op 14 tems sys - 17 -

Diversity and Standardization

Diversity and Standardization

While some diversity is desirable. . . Regulatory controls Market differentiation System diversity addresses some key business needs Local control and response “Cost of doing business” Client acquisition/retention Breaking into a new territory/location - 19 -

While some diversity is desirable. . . Regulatory controls Market differentiation System diversity addresses some key business needs Local control and response “Cost of doing business” Client acquisition/retention Breaking into a new territory/location - 19 -

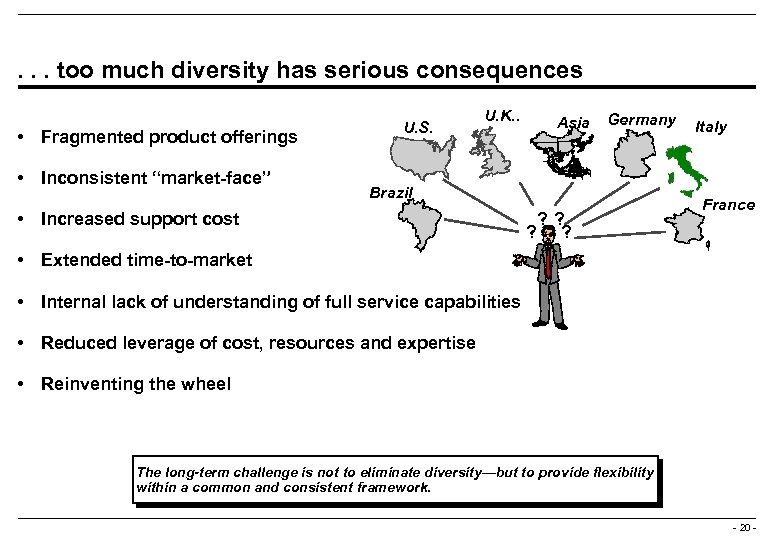

. . . too much diversity has serious consequences • Fragmented product offerings • Inconsistent “market-face” U. S. U. K. . Asia Germany Brazil • Increased support cost ? ? Italy France • Extended time-to-market • Internal lack of understanding of full service capabilities • Reduced leverage of cost, resources and expertise • Reinventing the wheel The long-term challenge is not to eliminate diversity—but to provide flexibility within a common and consistent framework. - 20 -

. . . too much diversity has serious consequences • Fragmented product offerings • Inconsistent “market-face” U. S. U. K. . Asia Germany Brazil • Increased support cost ? ? Italy France • Extended time-to-market • Internal lack of understanding of full service capabilities • Reduced leverage of cost, resources and expertise • Reinventing the wheel The long-term challenge is not to eliminate diversity—but to provide flexibility within a common and consistent framework. - 20 -

Functional and Technical Quality

Functional and Technical Quality

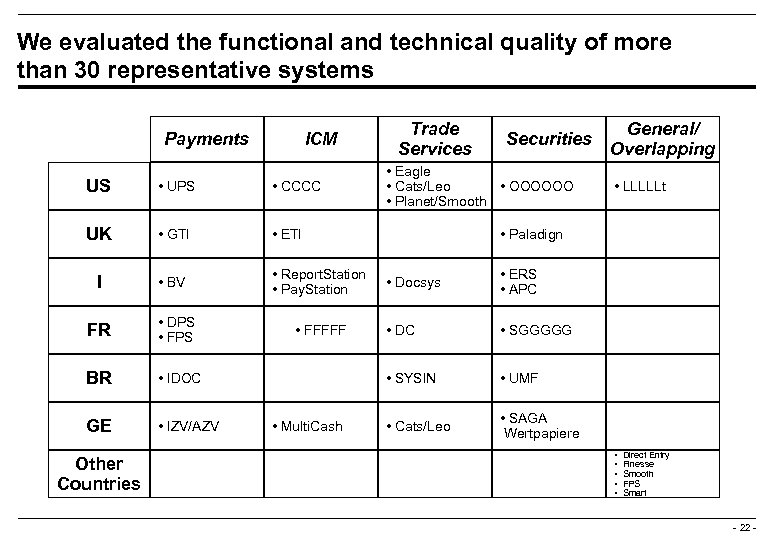

We evaluated the functional and technical quality of more than 30 representative systems Payments ICM US • UPS • CCCC UK • GTI • BV • Report. Station • Pay. Station FR • DPS • FPS BR • IZV/AZV Other Countries • FFFFF • Multi. Cash General/ Overlapping • LLLLLt • Paladign • Docsys • ERS • APC • DC • SGGGGG • SYSIN • IDOC GE Securities • Eagle • Cats/Leo • OOOOOO • Planet/Smooth • ETI I Trade Services • UMF • Cats/Leo • SAGA Wertpapiere • • • Direct Entry Finesse Smooth FPS Smart - 22 -

We evaluated the functional and technical quality of more than 30 representative systems Payments ICM US • UPS • CCCC UK • GTI • BV • Report. Station • Pay. Station FR • DPS • FPS BR • IZV/AZV Other Countries • FFFFF • Multi. Cash General/ Overlapping • LLLLLt • Paladign • Docsys • ERS • APC • DC • SGGGGG • SYSIN • IDOC GE Securities • Eagle • Cats/Leo • OOOOOO • Planet/Smooth • ETI I Trade Services • UMF • Cats/Leo • SAGA Wertpapiere • • • Direct Entry Finesse Smooth FPS Smart - 22 -

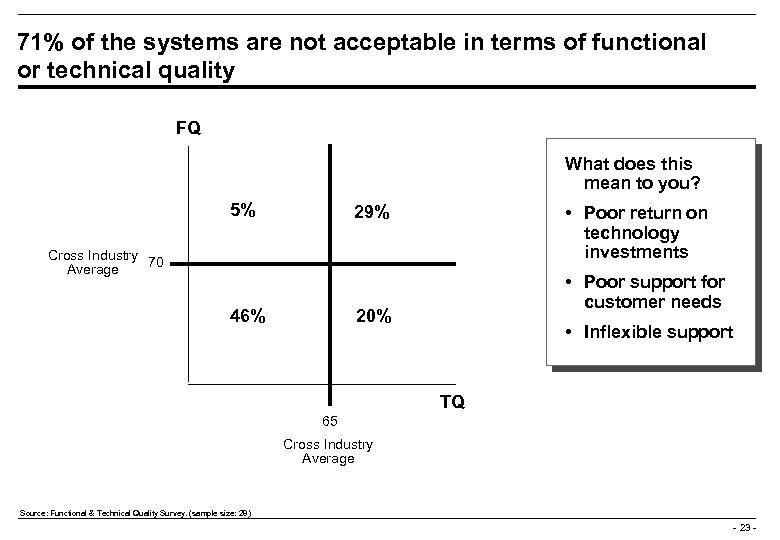

71% of the systems are not acceptable in terms of functional or technical quality FQ What does this mean to you? 5% 29% • Poor return on technology investments Cross Industry 70 Average 46% • Poor support for customer needs 20% • Inflexible support TQ 65 Cross Industry Average Source: Functional & Technical Quality Survey. (sample size: 28) - 23 -

71% of the systems are not acceptable in terms of functional or technical quality FQ What does this mean to you? 5% 29% • Poor return on technology investments Cross Industry 70 Average 46% • Poor support for customer needs 20% • Inflexible support TQ 65 Cross Industry Average Source: Functional & Technical Quality Survey. (sample size: 28) - 23 -

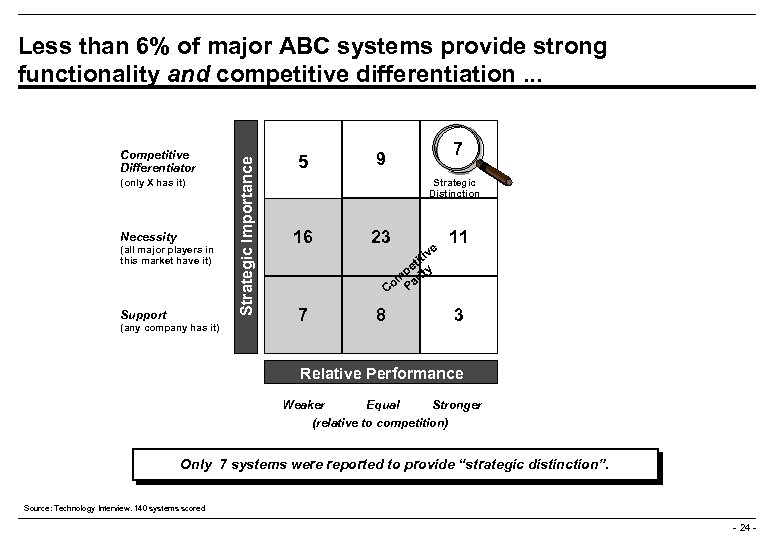

Competitive Differentiator (only X has it) Necessity (all major players in this market have it) Support (any company has it) Strategic Importance Less than 6% of major ABC systems provide strong functionality and competitive differentiation. . . 5 7 9 Strategic Distinction 16 23 ve 11 iti et ty p i om Par C 7 8 3 Relative Performance Weaker Equal Stronger (relative to competition) Only 7 systems were reported to provide “strategic distinction”. Source: Technology Interview. 140 systems scored - 24 -

Competitive Differentiator (only X has it) Necessity (all major players in this market have it) Support (any company has it) Strategic Importance Less than 6% of major ABC systems provide strong functionality and competitive differentiation. . . 5 7 9 Strategic Distinction 16 23 ve 11 iti et ty p i om Par C 7 8 3 Relative Performance Weaker Equal Stronger (relative to competition) Only 7 systems were reported to provide “strategic distinction”. Source: Technology Interview. 140 systems scored - 24 -

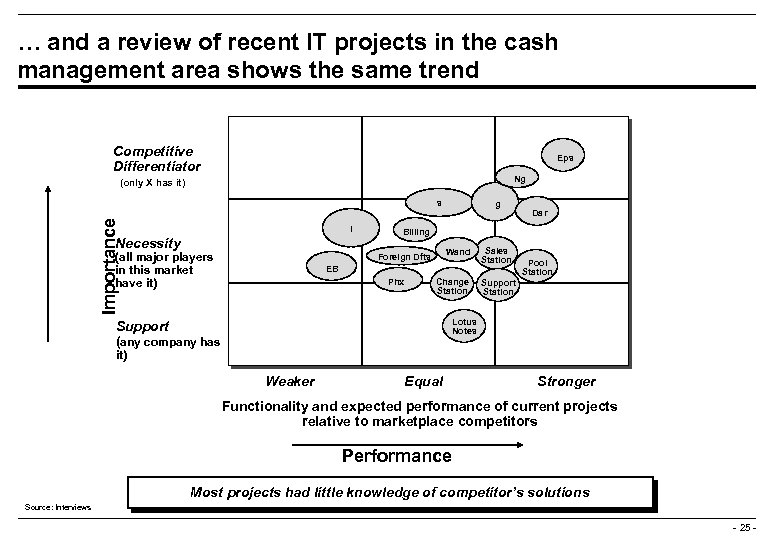

… and a review of recent IT projects in the cash management area shows the same trend Competitive Differentiator Eps Ng (only X has it) Importance s I Necessity (all major players in this market have it) g Dar Billing Wand Foreign Dfts EB Phx Change Station Sales Station Pool Station Support Station Lotus Notes Support (any company has it) Weaker Equal Stronger Functionality and expected performance of current projects relative to marketplace competitors Performance Most projects had little knowledge of competitor’s solutions Source: Interviews - 25 -

… and a review of recent IT projects in the cash management area shows the same trend Competitive Differentiator Eps Ng (only X has it) Importance s I Necessity (all major players in this market have it) g Dar Billing Wand Foreign Dfts EB Phx Change Station Sales Station Pool Station Support Station Lotus Notes Support (any company has it) Weaker Equal Stronger Functionality and expected performance of current projects relative to marketplace competitors Performance Most projects had little knowledge of competitor’s solutions Source: Interviews - 25 -

IT Alignment

IT Alignment

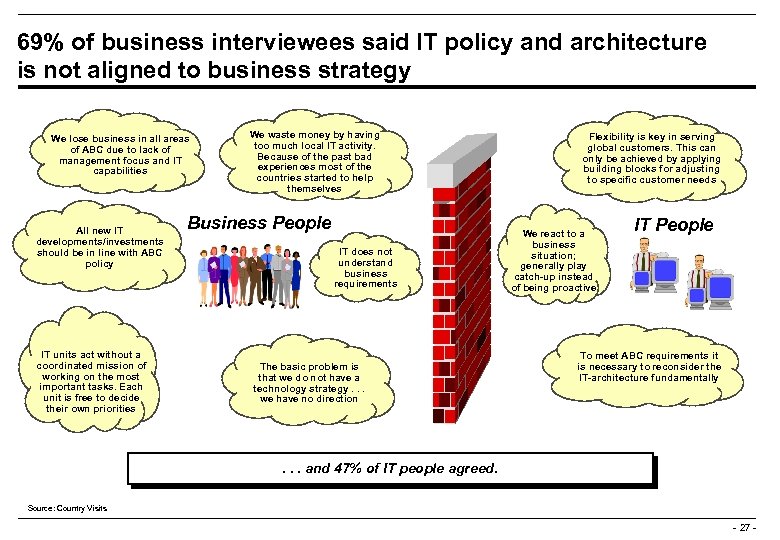

69% of business interviewees said IT policy and architecture is not aligned to business strategy We lose business in all areas of ABC due to lack of management focus and IT capabilities All new IT developments/investments should be in line with ABC policy IT units act without a coordinated mission of working on the most important tasks. Each unit is free to decide their own priorities We waste money by having too much local IT activity. Because of the past bad experiences most of the countries started to help themselves Business People IT does not understand business requirements The basic problem is that we do not have a technology strategy. . . we have no direction Flexibility is key in serving global customers. This can only be achieved by applying building blocks for adjusting to specific customer needs We react to a business situation; generally play catch-up instead of being proactive IT People To meet ABC requirements it is necessary to reconsider the IT-architecture fundamentally . . . and 47% of IT people agreed. Source: Country Visits - 27 -

69% of business interviewees said IT policy and architecture is not aligned to business strategy We lose business in all areas of ABC due to lack of management focus and IT capabilities All new IT developments/investments should be in line with ABC policy IT units act without a coordinated mission of working on the most important tasks. Each unit is free to decide their own priorities We waste money by having too much local IT activity. Because of the past bad experiences most of the countries started to help themselves Business People IT does not understand business requirements The basic problem is that we do not have a technology strategy. . . we have no direction Flexibility is key in serving global customers. This can only be achieved by applying building blocks for adjusting to specific customer needs We react to a business situation; generally play catch-up instead of being proactive IT People To meet ABC requirements it is necessary to reconsider the IT-architecture fundamentally . . . and 47% of IT people agreed. Source: Country Visits - 27 -

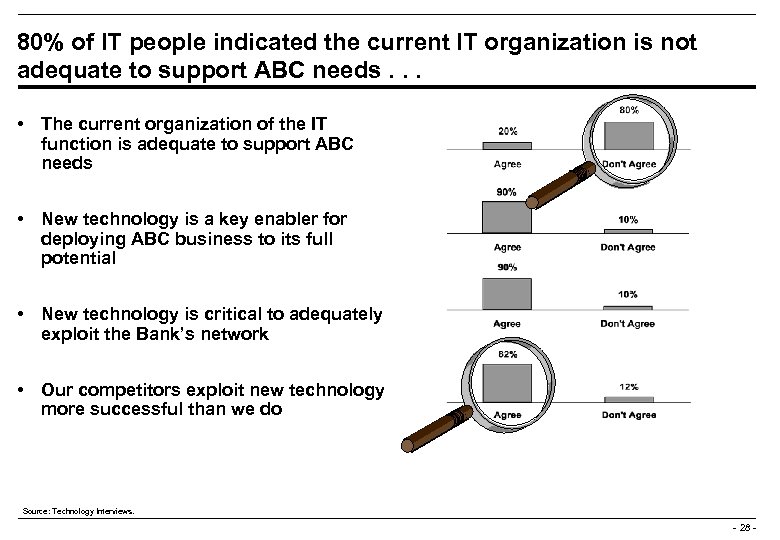

80% of IT people indicated the current IT organization is not adequate to support ABC needs. . . • The current organization of the IT function is adequate to support ABC needs • New technology is a key enabler for deploying ABC business to its full potential • New technology is critical to adequately exploit the Bank’s network • Our competitors exploit new technology more successful than we do Source: Technology Interviews. - 28 -

80% of IT people indicated the current IT organization is not adequate to support ABC needs. . . • The current organization of the IT function is adequate to support ABC needs • New technology is a key enabler for deploying ABC business to its full potential • New technology is critical to adequately exploit the Bank’s network • Our competitors exploit new technology more successful than we do Source: Technology Interviews. - 28 -

. . . and is a barrier to close alignment of IT and business Responses showed that. . . • IT function is currently not organized appropriately to realize ABC technology needs (70% agree) • IT department does not understand the ABC clients’ needs (68% agree) • IM policy and architecture is not aligned to the ABC business strategy (65% agree) • IT department does not understand the ABC IT needs (48% agree) Alignment of business and IT is key to IT success. Source : Technology Interview, n=36 - 29 -

. . . and is a barrier to close alignment of IT and business Responses showed that. . . • IT function is currently not organized appropriately to realize ABC technology needs (70% agree) • IT department does not understand the ABC clients’ needs (68% agree) • IM policy and architecture is not aligned to the ABC business strategy (65% agree) • IT department does not understand the ABC IT needs (48% agree) Alignment of business and IT is key to IT success. Source : Technology Interview, n=36 - 29 -

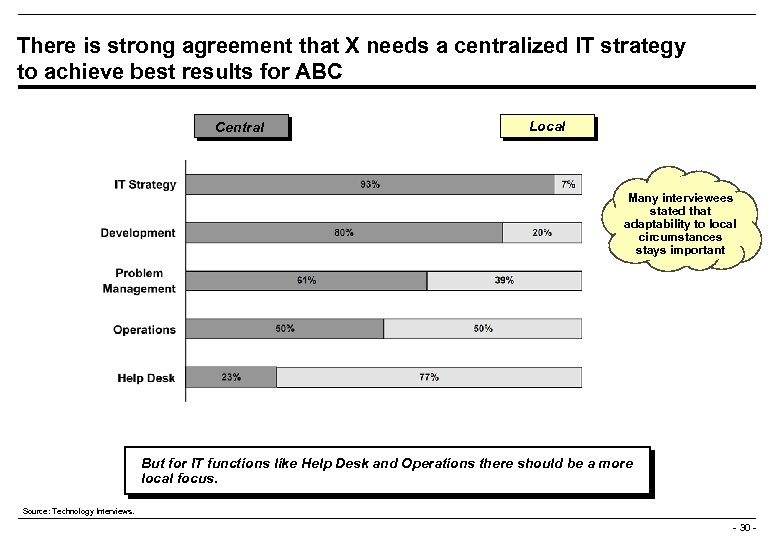

There is strong agreement that X needs a centralized IT strategy to achieve best results for ABC Central Local Many interviewees stated that adaptability to local circumstances stays important But for IT functions like Help Desk and Operations there should be a more local focus. Source: Technology Interviews. - 30 -

There is strong agreement that X needs a centralized IT strategy to achieve best results for ABC Central Local Many interviewees stated that adaptability to local circumstances stays important But for IT functions like Help Desk and Operations there should be a more local focus. Source: Technology Interviews. - 30 -

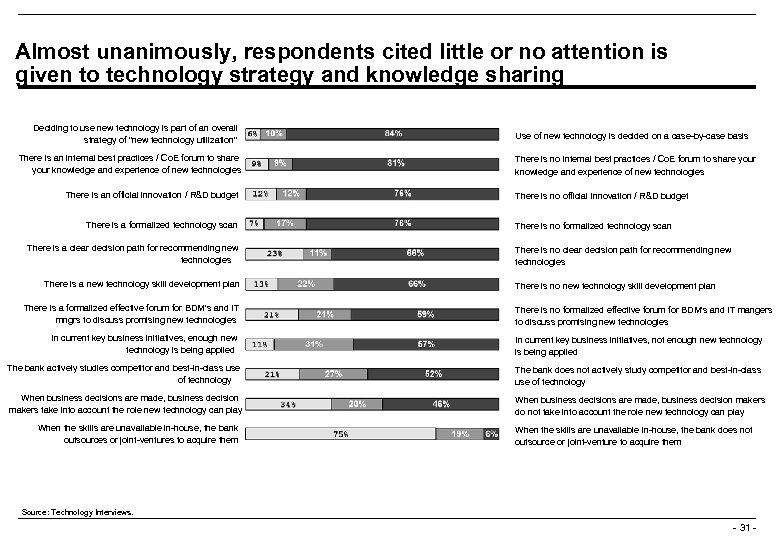

Almost unanimously, respondents cited little or no attention is given to technology strategy and knowledge sharing Deciding to use new technology is part of an overall strategy of "new technology utilization" There is an internal best practices / Co. E forum to share your knowledge and experience of new technologies There is an official innovation / R&D budget There is a formalized technology scan There is a clear decision path for recommending new technologies There is a new technology skill development plan There is a formalized effective forum for BDM's and IT mngrs to discuss promising new technologies In current key business initiatives, enough new technology is being applied Use of new technology is decided on a case-by-case basis There is no internal best practices / Co. E forum to share your knowledge and experience of new technologies There is no official innovation / R&D budget There is no formalized technology scan There is no clear decision path for recommending new technologies There is no new technology skill development plan There is no formalized effective forum for BDM's and IT mangers to discuss promising new technologies In current key business initiatives, not enough new technology is being applied The bank actively studies competitor and best-in-class use of technology The bank does not actively study competitor and best-in-class use of technology When business decisions are made, business decision makers take into account the role new technology can play When business decisions are made, business decision makers do not take into account the role new technology can play When the skills are unavailable in-house, the bank outsources or joint-ventures to acquire them When the skills are unavailable in-house, the bank does not outsource or joint-venture to acquire them Source: Technology Interviews. - 31 -

Almost unanimously, respondents cited little or no attention is given to technology strategy and knowledge sharing Deciding to use new technology is part of an overall strategy of "new technology utilization" There is an internal best practices / Co. E forum to share your knowledge and experience of new technologies There is an official innovation / R&D budget There is a formalized technology scan There is a clear decision path for recommending new technologies There is a new technology skill development plan There is a formalized effective forum for BDM's and IT mngrs to discuss promising new technologies In current key business initiatives, enough new technology is being applied Use of new technology is decided on a case-by-case basis There is no internal best practices / Co. E forum to share your knowledge and experience of new technologies There is no official innovation / R&D budget There is no formalized technology scan There is no clear decision path for recommending new technologies There is no new technology skill development plan There is no formalized effective forum for BDM's and IT mangers to discuss promising new technologies In current key business initiatives, not enough new technology is being applied The bank actively studies competitor and best-in-class use of technology The bank does not actively study competitor and best-in-class use of technology When business decisions are made, business decision makers take into account the role new technology can play When business decisions are made, business decision makers do not take into account the role new technology can play When the skills are unavailable in-house, the bank outsources or joint-ventures to acquire them When the skills are unavailable in-house, the bank does not outsource or joint-venture to acquire them Source: Technology Interviews. - 31 -

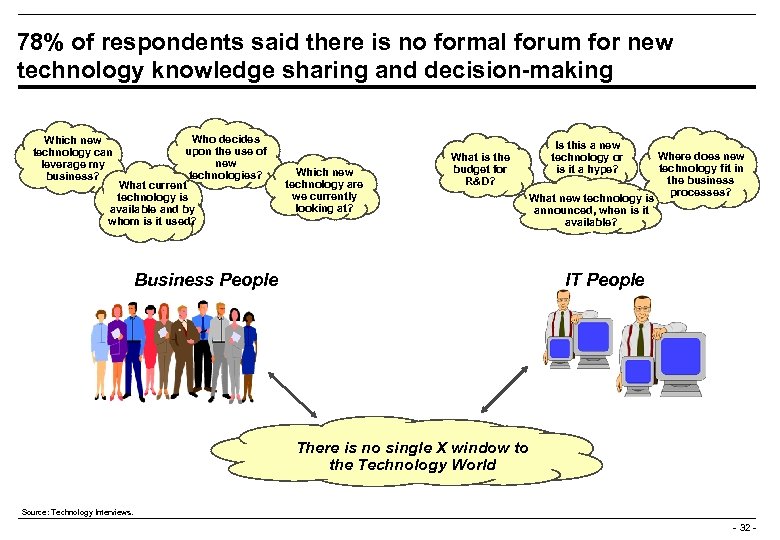

78% of respondents said there is no formal forum for new technology knowledge sharing and decision-making Who decides upon the use of new technologies? What current technology is available and by whom is it used? Which new technology can leverage my business? Which new technology are we currently looking at? Is this a new technology or is it a hype? What is the budget for R&D? What new technology is announced, when is it available? Business People Where does new technology fit in the business processes? IT People There is no single X window to the Technology World Source: Technology Interviews. - 32 -

78% of respondents said there is no formal forum for new technology knowledge sharing and decision-making Who decides upon the use of new technologies? What current technology is available and by whom is it used? Which new technology can leverage my business? Which new technology are we currently looking at? Is this a new technology or is it a hype? What is the budget for R&D? What new technology is announced, when is it available? Business People Where does new technology fit in the business processes? IT People There is no single X window to the Technology World Source: Technology Interviews. - 32 -

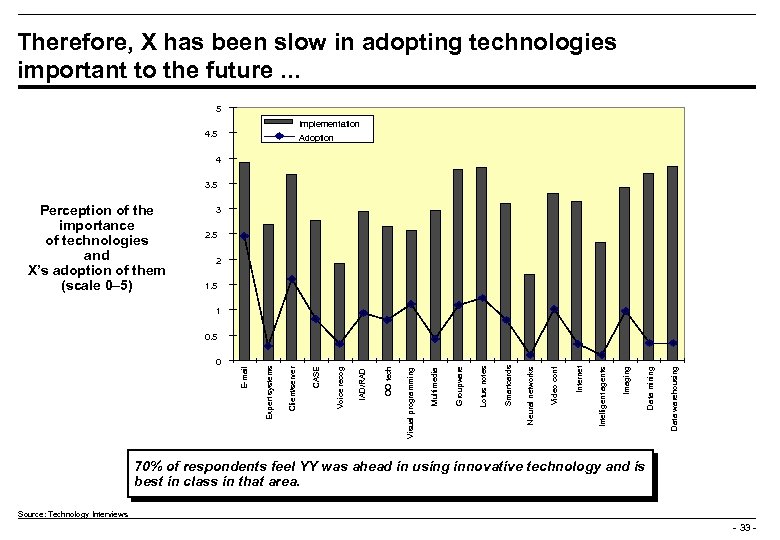

Therefore, X has been slow in adopting technologies important to the future. . . 5 Implementation 4. 5 Adoption 4 3. 5 Perception of the importance of technologies and X’s adoption of them (scale 0– 5) 3 2. 5 2 1. 5 1 Data warehousing Data mining Imaging Intelligent agents Internet Video conf Neural networks Smartcards Lotus notes Groupware Multimedia Visual programming OO tech IAD/RAD Voice recog CASE Client/server Expert systems 0 E-mail 0. 5 70% of respondents feel YY was ahead in using innovative technology and is best in class in that area. Source: Technology Interviews - 33 -

Therefore, X has been slow in adopting technologies important to the future. . . 5 Implementation 4. 5 Adoption 4 3. 5 Perception of the importance of technologies and X’s adoption of them (scale 0– 5) 3 2. 5 2 1. 5 1 Data warehousing Data mining Imaging Intelligent agents Internet Video conf Neural networks Smartcards Lotus notes Groupware Multimedia Visual programming OO tech IAD/RAD Voice recog CASE Client/server Expert systems 0 E-mail 0. 5 70% of respondents feel YY was ahead in using innovative technology and is best in class in that area. Source: Technology Interviews - 33 -

Time to Market

Time to Market

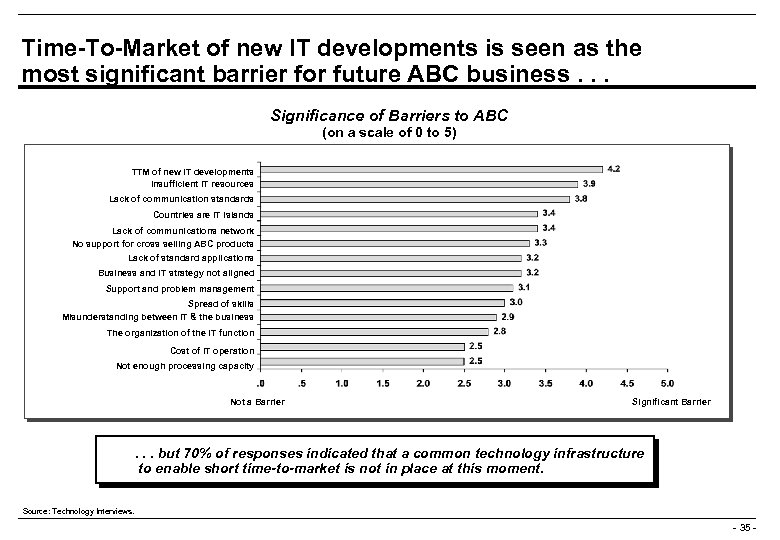

Time-To-Market of new IT developments is seen as the most significant barrier for future ABC business. . . Significance of Barriers to ABC (on a scale of 0 to 5) TTM of new IT developments Insufficient IT resources Lack of communication standards Countries are IT islands Lack of communications network No support for cross selling ABC products Lack of standard applications Business and IT strategy not aligned Support and problem management Spread of skills Misunderstanding between IT & the business The organization of the IT function Cost of IT operation Not enough processing capacity Not a Barrier Significant Barrier . . . but 70% of responses indicated that a common technology infrastructure to enable short time-to-market is not in place at this moment. Source: Technology Interviews. - 35 -

Time-To-Market of new IT developments is seen as the most significant barrier for future ABC business. . . Significance of Barriers to ABC (on a scale of 0 to 5) TTM of new IT developments Insufficient IT resources Lack of communication standards Countries are IT islands Lack of communications network No support for cross selling ABC products Lack of standard applications Business and IT strategy not aligned Support and problem management Spread of skills Misunderstanding between IT & the business The organization of the IT function Cost of IT operation Not enough processing capacity Not a Barrier Significant Barrier . . . but 70% of responses indicated that a common technology infrastructure to enable short time-to-market is not in place at this moment. Source: Technology Interviews. - 35 -

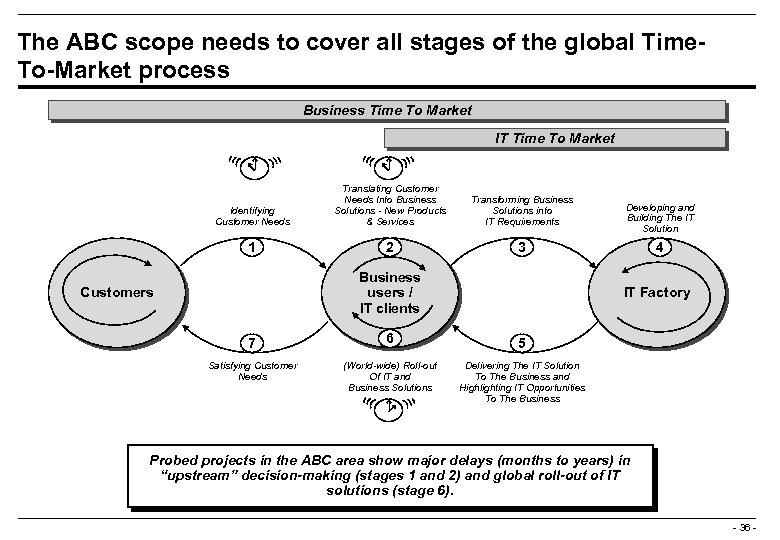

The ABC scope needs to cover all stages of the global Time. To-Market process Business Time To Market IT Time To Market Identifying Customer Needs Translating Customer Needs Into Business Solutions - New Products & Services Transforming Business Solutions into IT Requirements 1 2 3 Business users / IT clients Customers Developing and Building The IT Solution 4 IT Factory 7 6 5 Satisfying Customer Needs (World-wide) Roll-out Of IT and Business Solutions Delivering The IT Solution To The Business and Highlighting IT Opportunities To The Business Probed projects in the ABC area show major delays (months to years) in “upstream” decision-making (stages 1 and 2) and global roll-out of IT solutions (stage 6). - 36 -

The ABC scope needs to cover all stages of the global Time. To-Market process Business Time To Market IT Time To Market Identifying Customer Needs Translating Customer Needs Into Business Solutions - New Products & Services Transforming Business Solutions into IT Requirements 1 2 3 Business users / IT clients Customers Developing and Building The IT Solution 4 IT Factory 7 6 5 Satisfying Customer Needs (World-wide) Roll-out Of IT and Business Solutions Delivering The IT Solution To The Business and Highlighting IT Opportunities To The Business Probed projects in the ABC area show major delays (months to years) in “upstream” decision-making (stages 1 and 2) and global roll-out of IT solutions (stage 6). - 36 -

Conclusions

Conclusions

X faces significant technology challenges • How to improve the support to ABC business • How to overcome geographical barriers through technology solutions • How to gain a better return on IT investments • How to provide an infrastructure that supports uniform services world wide • How to improve time to market of technology solutions • How to build an IT organization that can handle the global dimension - 38 -

X faces significant technology challenges • How to improve the support to ABC business • How to overcome geographical barriers through technology solutions • How to gain a better return on IT investments • How to provide an infrastructure that supports uniform services world wide • How to improve time to market of technology solutions • How to build an IT organization that can handle the global dimension - 38 -