5ac693e9b083d07623800dcc3d7fda16.ppt

- Количество слайдов: 23

IT ADVISORY Managing IT Through Turbulent Times KPMG LLP Tom Pankey Managing Director IT Advisory Services February 26, 2009 727 -641 -6957 tpankey@kpmg. com www. us. kpmg. com © 2008 KPMG LLP, a U. S. limited liability partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International, a Swiss cooperative. All rights reserved. Printed in the U. S. A. KPMG and the KPMG logo are registered trademarks of KPMG International, a Swiss cooperative. 1

Today’s Discussion Turbulent times – challenge and opportunity Risk Management and Controls Portfolios Four levers for driving IT value Achievability supported by stories from the field Things to get right How to proceed How KPMG is helping our clients be more successful All information provided is of a general nature and is not intended to address the circumstances of any particular individual or entity. Although we endeavor to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to accurate in the future. No one should act upon such information without appropriate professional advice after a thorough examination of the particular situation. © 2008 KPMG LLP, a U. S. limited liability partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International, a Swiss cooperative. All rights reserved. Printed in the U. S. A. KPMG and the KPMG logo are registered trademarks of KPMG International, a Swiss cooperative. 2

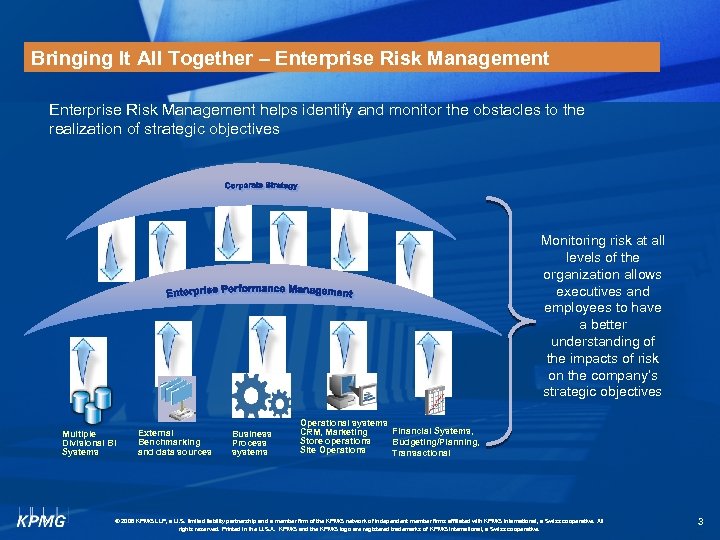

Bringing It All Together – Enterprise Risk Management helps identify and monitor the obstacles to the realization of strategic objectives Monitoring risk at all levels of the organization allows executives and employees to have a better understanding of the impacts of risk on the company’s strategic objectives Multiple Divisional BI Systems 3 External Benchmarking and data sources Business Process systems Operational systems Financial Systems, CRM, Marketing Store operations Budgeting/Planning, Site Operations Transactional © 2008 KPMG LLP, a U. S. limited liability partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International, a Swiss cooperative. All rights reserved. Printed in the U. S. A. KPMG and the KPMG logo are registered trademarks of KPMG International, a Swiss cooperative. 3

The role of Enterprise Risk Management in today’s business environment Governanc e Strategy Performance 4 • Meet State and Federal government requirements • Enhance corporate stewardship over strategic priorities and nonfinancial aspects of performance • Meet Credit Rating agencies’ expectations with regards to risk, to ensure a “no surprises” culture • Meet enhanced securities exchange listing requirements • Meet SEC requirements: 10 -K description of “Risk Factors” in plain English • Beyond regulation: provides a competitive advantage versus industry peers • Align prioritized risk with business strategy objectives • Improve accountability and transparency through coordinated enterprise risk monitoring and reporting • Reduce cash flow volatility using derivatives, insurance or improved controls • Reduce costs through risk consolidation and cross-functional efficiencies © 2008 KPMG LLP, a U. S. limited liability partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International, a Swiss cooperative. All rights reserved. Printed in the U. S. A. KPMG and the KPMG logo are registered trademarks of KPMG International, a Swiss cooperative. 4

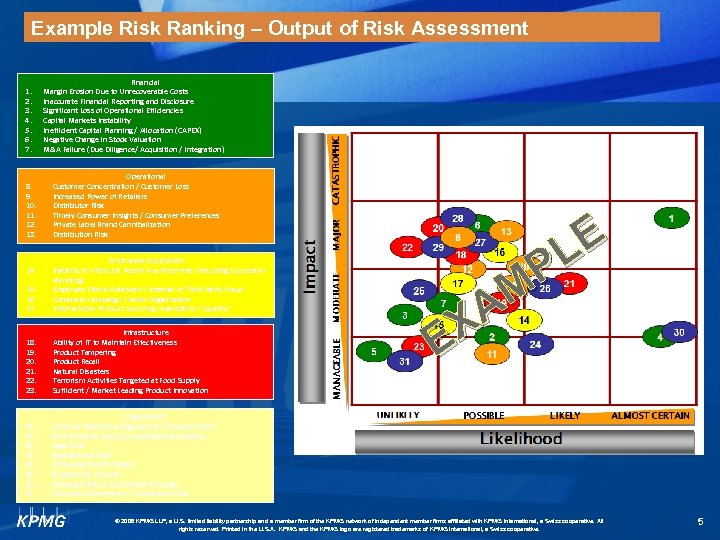

Example Risk Ranking – Output of Risk Assessment 1. 2. 3. 4. 5. 6. 7. Financial Margin Erosion Due to Unrecoverable Costs Inaccurate Financial Reporting and Disclosure Significant Loss of Operational Efficiencies Capital Markets Instability Inefficient Capital Planning / Allocation (CAPEX) Negative Change in Stock Valuation M&A Failure (Due Diligence/ Acquisition / Integration) Operational Customer Concentration / Customer Loss Increased Power of Retailers Distributor Risk Timely Consumer Insights / Consumer Preferences Private Label Brand Cannibalization Distribution Risk 8. 9. 10. 11. 12. 13. 15. 16. 17. Employees & Suppliers Inability to Attract & Retain Key Personnel (Including Succession Planning) Employee Ethics Violations / Internal or Third Party Fraud Corporate Campaign / Labor Organization International Product Sourcing (Availability / Quality) 18. 19. 20. 21. 22. 23. Infrastructure Ability of IT to Maintain Effectiveness Product Tampering Product Recall Natural Disasters Terrorism Activities Targeted at Food Supply Sufficient / Market Leading Product Innovation 24. 25. 26. 27. 28. 29. 30. 31. E L P M A X E Organization Costly or Restrictive Regulations / Requirements ( Environmental Issues (including sustainability) Legal Risk Reputational Risk Achieving Growth Target Shareholder Activism Pending Political Environment Change Corporate Governance / Compliance Risk 14. 5 © 2008 KPMG LLP, a U. S. limited liability partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International, a Swiss cooperative. All rights reserved. Printed in the U. S. A. KPMG and the KPMG logo are registered trademarks of KPMG International, a Swiss cooperative. 5

Linking of Individual Enterprise Risks to Strategic Objectives Strategic Alignment Strategic Objective Related Initiative Risk Assessment Risks To Initiative Key Risk Indicators Target Values Actual Value Compensation Benchmark Surveys Quality Improvement Max. 10% difference in compensation per level compared to main competitors 15% Varianc e Attract and Retain Key Personnel Employee Survey Scores Annual Volume Growth of 5 -8% Focus on Employee 6 Risk Monitoring Potential decrease in margins as a result of higher cost associated with employee initiatives Min. 80% of staff satisfied or highly satisfied with job and company 90% Overtime Worked Max. 100 hours total accumulated overtime per employee 80 Hours © 2008 KPMG LLP, a U. S. limited liability partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International, a Swiss cooperative. All rights reserved. Printed in the U. S. A. KPMG and the KPMG logo are registered trademarks of KPMG International, a Swiss cooperative. 6

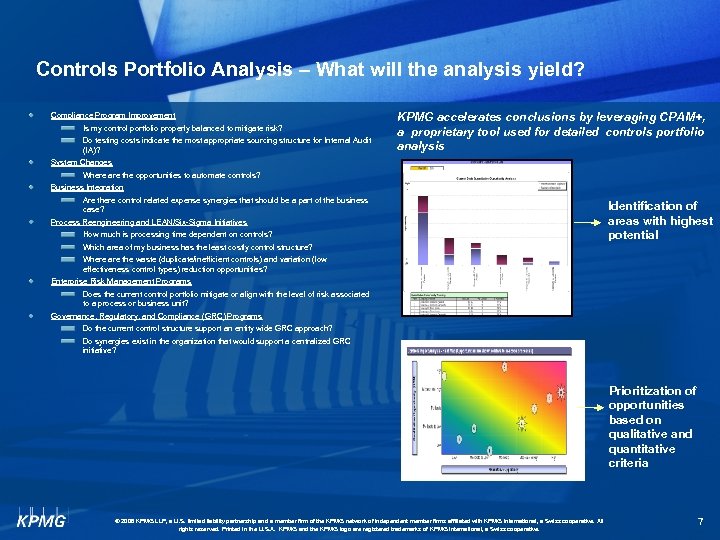

Controls Portfolio Analysis – What will the analysis yield? Compliance Program Improvement Is my control portfolio properly balanced to mitigate risk? Do testing costs indicate the most appropriate sourcing structure for Internal Audit (IA)? KPMG accelerates conclusions by leveraging CPAM+, a proprietary tool used for detailed controls portfolio analysis System Changes Where are the opportunities to automate controls? Business Integration Are there control related expense synergies that should be a part of the business case? Process Reengineering and LEAN/Six-Sigma Initiatives How much is processing time dependent on controls? Identification of areas with highest potential Which area of my business has the least costly control structure? Where are the waste (duplicate/inefficient controls) and variation (low effectiveness control types) reduction opportunities? Enterprise Risk Management Programs Does the current control portfolio mitigate or align with the level of risk associated to a process or business unit? Governance, Regulatory, and Compliance (GRC) Programs Do the current control structure support an entity wide GRC approach? Do synergies exist in the organization that would support a centralized GRC initiative? Prioritization of opportunities based on qualitative and quantitative criteria © 2008 KPMG LLP, a U. S. limited liability partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International, a Swiss cooperative. All rights reserved. Printed in the U. S. A. KPMG and the KPMG logo are registered trademarks of KPMG International, a Swiss cooperative. 7

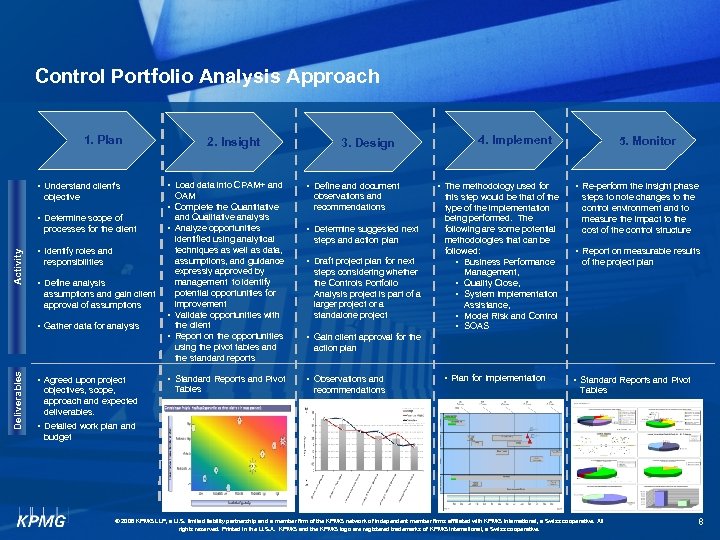

Control Portfolio Analysis Approach 1. Plan • Understand client’s objective processes for the client Activity • Load data into CPAM+ and • • Determine scope of • • Identify roles and responsibilities • Define analysis assumptions and gain client approval of assumptions • Gather data for analysis Deliverables 2. Insight § § Agreed upon project objectives, scope, approach and expected deliverables. • • § OAM Complete the Quantitative and Qualitative analysis Analyze opportunities identified using analytical techniques as well as data, assumptions, and guidance expressly approved by management to identify potential opportunities for improvement Validate opportunities with the client Report on the opportunities using the pivot tables and the standard reports Standard Reports and Pivot Tables 4. Implement 3. Design • Define and document observations and recommendations • Determine suggested next steps and action plan • Draft project plan for next steps considering whether the Controls Portfolio Analysis project is part of a larger project or a standalone project • Gain client approval for the • The methodology used for this step would be that of the type of the implementation being performed. The following are some potential methodologies that can be followed: • Business Performance Management, • Quality Close, • System Implementation Assistance, • Model Risk and Control • SOAS 5. Monitor • Re-perform the Insight phase steps to note changes to the control environment and to measure the impact to the cost of the control structure • Report on measurable results of the project plan action plan § Observations and recommendations § Plan for Implementation Action plan for next steps § § Standard Reports and Pivot Tables Detailed work plan and budget © 2008 KPMG LLP, a U. S. limited liability partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International, a Swiss cooperative. All rights reserved. Printed in the U. S. A. KPMG and the KPMG logo are registered trademarks of KPMG International, a Swiss cooperative. 8

These turbulent times call for IT executives to take bold, yet sensible actions to drive value. No one can predict the impact resulting from the current economic situation Business executives are being told to Cut spending Accelerate revenue growth Decrease dependence on capital IT executives report they are expected to contribute a disproportionately large share, especially in cutting costs and capital consumption Applying an axe where an aggressive scalpel is needed may damage business results, harm customer relationships, and cause years of catch-up investments once conditions improve A thoughtful program of sensible opportunities may enable IT executives to achieve tactical improvements without damaging service levels or harming critical development programs © 2008 KPMG LLP, a U. S. limited liability partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International, a Swiss cooperative. All rights reserved. Printed in the U. S. A. KPMG and the KPMG logo are registered trademarks of KPMG International, a Swiss cooperative. 9

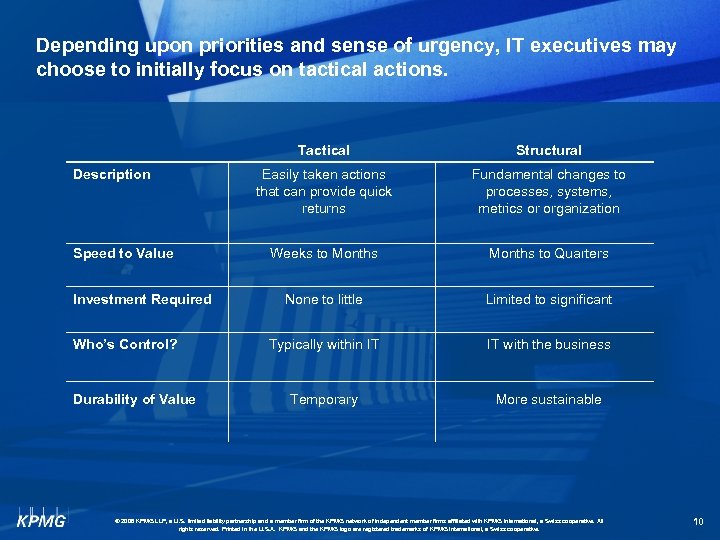

Depending upon priorities and sense of urgency, IT executives may choose to initially focus on tactical actions. Tactical Description Speed to Value Investment Required Who’s Control? Durability of Value Structural Easily taken actions that can provide quick returns Fundamental changes to processes, systems, metrics or organization Weeks to Months to Quarters None to little Limited to significant Typically within IT IT with the business Temporary More sustainable © 2008 KPMG LLP, a U. S. limited liability partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International, a Swiss cooperative. All rights reserved. Printed in the U. S. A. KPMG and the KPMG logo are registered trademarks of KPMG International, a Swiss cooperative. 10

Progressive IT executives are using the current economic situation as an opportunity to re-position IT, while responding to the urgent. Set the stage for longer-term structural changes to: Redefine IT’s value propositions Establish trusted, beneficial relationships with business stakeholders Improve IT governance and overall operating model to deliver business value Revisit previously rejected options e. g. outsourcing/ off-shoring, shared services, application and infrastructure rationalization Have meaningful dialog with key business stakeholders around the value of IT, alignment with business priorities, and balancing risks/ rewards, while achieving cost reduction targets © 2008 KPMG LLP, a U. S. limited liability partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International, a Swiss cooperative. All rights reserved. Printed in the U. S. A. KPMG and the KPMG logo are registered trademarks of KPMG International, a Swiss cooperative. 11

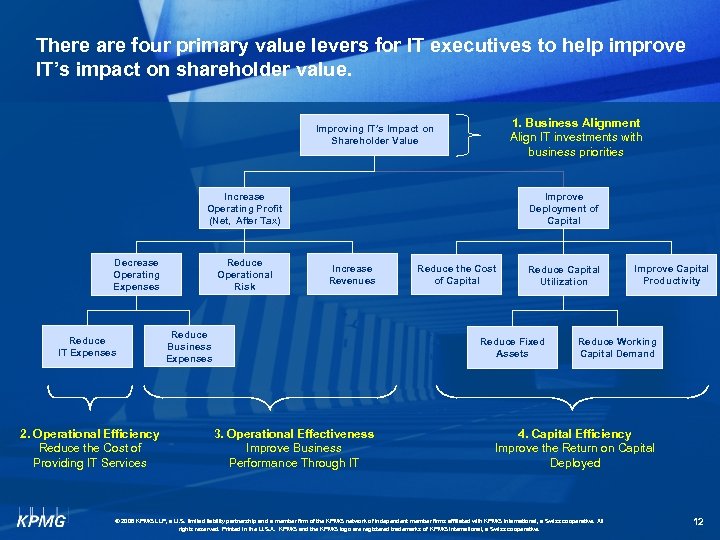

There are four primary value levers for IT executives to help improve IT’s impact on shareholder value. 1. Business Alignment Align IT investments with business priorities Improving IT’s Impact on Shareholder Value Increase Operating Profit (Net, After Tax) Reduce Operational Risk Decrease Operating Expenses Reduce IT Expenses 2. Operational Efficiency Reduce the Cost of Providing IT Services Improve Deployment of Capital Increase Revenues Reduce Business Expenses Reduce the Cost of Capital Reduce Capital Utilization Reduce Fixed Assets 3. Operational Effectiveness Improve Business Performance Through IT Improve Capital Productivity Reduce Working Capital Demand 4. Capital Efficiency Improve the Return on Capital Deployed © 2008 KPMG LLP, a U. S. limited liability partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International, a Swiss cooperative. All rights reserved. Printed in the U. S. A. KPMG and the KPMG logo are registered trademarks of KPMG International, a Swiss cooperative. 12

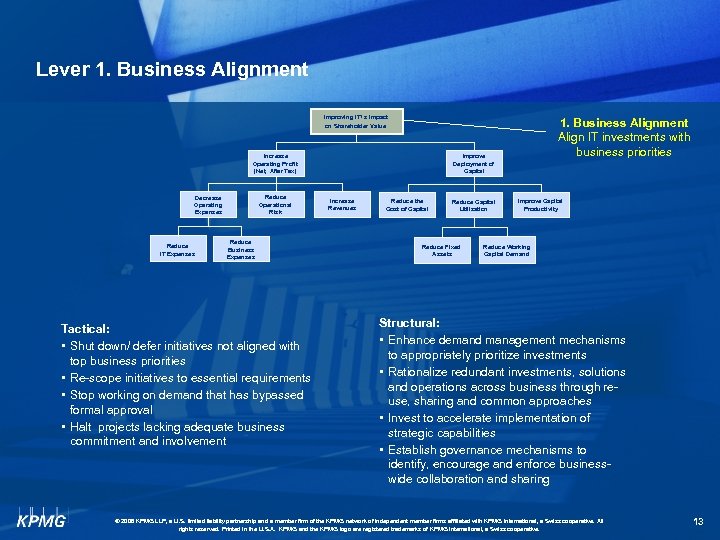

Lever 1. Business Alignment Improving IT’ s Impact on Shareholder Value Increase Operating Profit (Net, After Tax) Reduce Operational Risk Decrease Operating Expenses Reduce IT Expenses Reduce Business Expenses Tactical: • Shut down/ defer initiatives not aligned with top business priorities • Re-scope initiatives to essential requirements • Stop working on demand that has bypassed formal approval • Halt projects lacking adequate business commitment and involvement 1. Business Alignment Align IT investments with business priorities Improve Deployment of Capital Increase Revenues Reduce the Cost of Capital Reduce Capital Utilization Reduce Fixed Assets Capital Improve Capital Productivity Reduce Working Capital Demand Structural: • Enhance demand management mechanisms to appropriately prioritize investments • Rationalize redundant investments, solutions and operations across business through reuse, sharing and common approaches • Invest to accelerate implementation of strategic capabilities • Establish governance mechanisms to identify, encourage and enforce businesswide collaboration and sharing © 2008 KPMG LLP, a U. S. limited liability partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International, a Swiss cooperative. All rights reserved. Printed in the U. S. A. KPMG and the KPMG logo are registered trademarks of KPMG International, a Swiss cooperative. 13

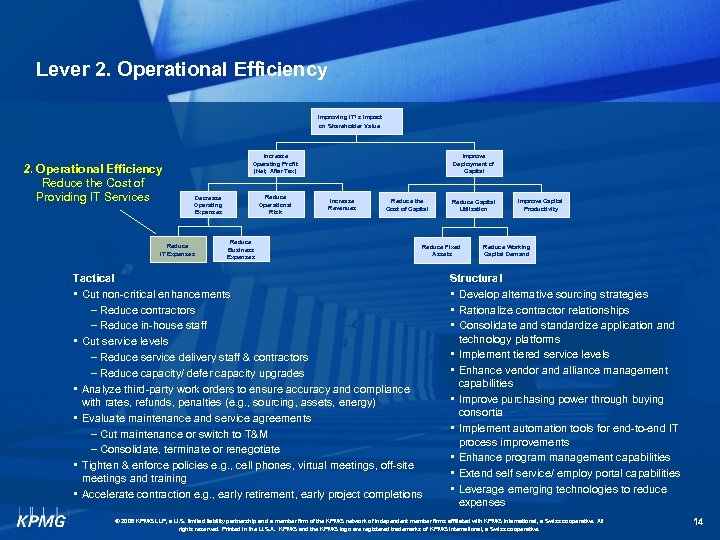

Lever 2. Operational Efficiency Improving IT’ s Impact on Shareholder Value 2. Operational Efficiency Reduce the Cost of Providing IT Services Increase Operating Profit (Net, After Tax) Reduce Operational Risk Decrease Operating Expenses Reduce IT Expenses Reduce Business Expenses Improve Deployment of Capital Increase Revenues Reduce the Cost of Capital Reduce Capital Utilization Reduce Fixed Assets Capital Tactical • Cut non-critical enhancements – Reduce contractors – Reduce in-house staff • Cut service levels – Reduce service delivery staff & contractors – Reduce capacity/ defer capacity upgrades • Analyze third-party work orders to ensure accuracy and compliance with rates, refunds, penalties (e. g. , sourcing, assets, energy) • Evaluate maintenance and service agreements – Cut maintenance or switch to T&M – Consolidate, terminate or renegotiate • Tighten & enforce policies e. g. , cell phones, virtual meetings, off-site meetings and training • Accelerate contraction e. g. , early retirement, early project completions Improve Capital Productivity Reduce Working Capital Demand Structural • Develop alternative sourcing strategies • Rationalize contractor relationships • Consolidate and standardize application and technology platforms • Implement tiered service levels • Enhance vendor and alliance management capabilities • Improve purchasing power through buying consortia • Implement automation tools for end-to-end IT process improvements • Enhance program management capabilities • Extend self service/ employ portal capabilities • Leverage emerging technologies to reduce expenses © 2008 KPMG LLP, a U. S. limited liability partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International, a Swiss cooperative. All rights reserved. Printed in the U. S. A. KPMG and the KPMG logo are registered trademarks of KPMG International, a Swiss cooperative. 14

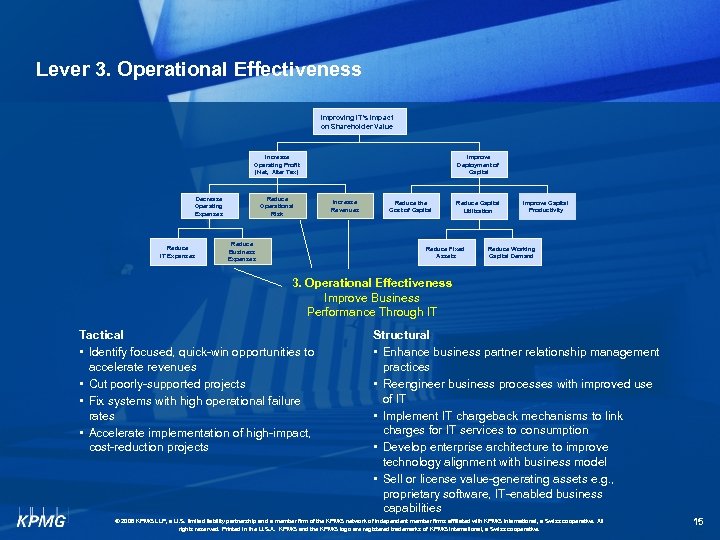

Lever 3. Operational Effectiveness Improving IT’s Impact on Shareholder Value Increase Operating Profit (Net, After Tax) Reduce Operational Risk Decrease Operating Expenses Reduce IT Expenses Reduce Business Expenses Improve Deployment of Capital Increase Revenues Reduce the Cost of Capital Reduce Capital Utilization Reduce Fixed Assets Capital Improve Capital Productivity Reduce Working Capital Demand 3. Operational Effectiveness Improve Business Performance Through IT Tactical • Identify focused, quick-win opportunities to accelerate revenues • Cut poorly-supported projects • Fix systems with high operational failure rates • Accelerate implementation of high-impact, cost-reduction projects Structural • Enhance business partner relationship management practices • Reengineer business processes with improved use of IT • Implement IT chargeback mechanisms to link charges for IT services to consumption • Develop enterprise architecture to improve technology alignment with business model • Sell or license value-generating assets e. g. , proprietary software, IT-enabled business capabilities © 2008 KPMG LLP, a U. S. limited liability partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International, a Swiss cooperative. All rights reserved. Printed in the U. S. A. KPMG and the KPMG logo are registered trademarks of KPMG International, a Swiss cooperative. 15

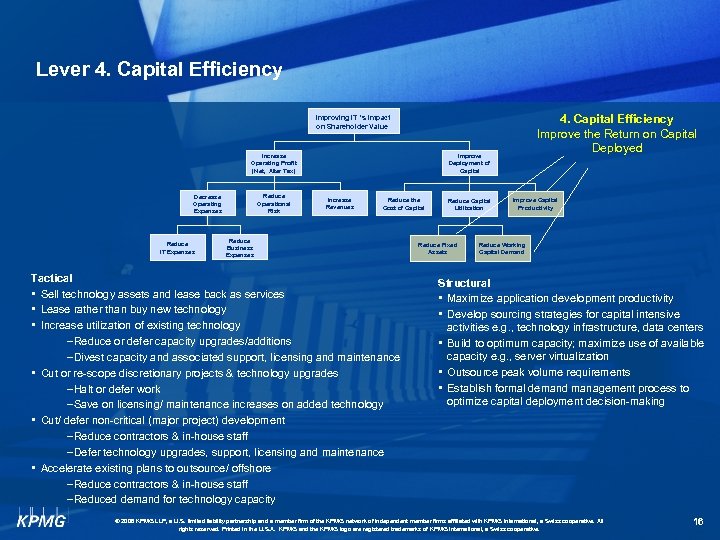

Lever 4. Capital Efficiency Improve the Return on Capital Deployed Improving IT ’s Impact on Shareholder Value Increase Operating Profit (Net, After Tax) Reduce Operational Risk Decrease Operating Expenses Reduce IT Expenses Improve Deployment of Capital Increase Revenues Reduce the Cost of Capital Reduce Business Expenses Tactical • Sell technology assets and lease back as services • Lease rather than buy new technology • Increase utilization of existing technology –Reduce or defer capacity upgrades/additions –Divest capacity and associated support, licensing and maintenance • Cut or re-scope discretionary projects & technology upgrades –Halt or defer work –Save on licensing/ maintenance increases on added technology • Cut/ defer non-critical (major project) development –Reduce contractors & in-house staff –Defer technology upgrades, support, licensing and maintenance • Accelerate existing plans to outsource/ offshore –Reduce contractors & in-house staff –Reduced demand for technology capacity Reduce Capital Utilization Reduce Fixed Assets Capital Improve Capital Productivity Reduce Working Capital Demand Structural • Maximize application development productivity • Develop sourcing strategies for capital intensive activities e. g. , technology infrastructure, data centers • Build to optimum capacity; maximize use of available capacity e. g. , server virtualization • Outsource peak volume requirements • Establish formal demand management process to optimize capital deployment decision-making © 2008 KPMG LLP, a U. S. limited liability partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International, a Swiss cooperative. All rights reserved. Printed in the U. S. A. KPMG and the KPMG logo are registered trademarks of KPMG International, a Swiss cooperative. 16

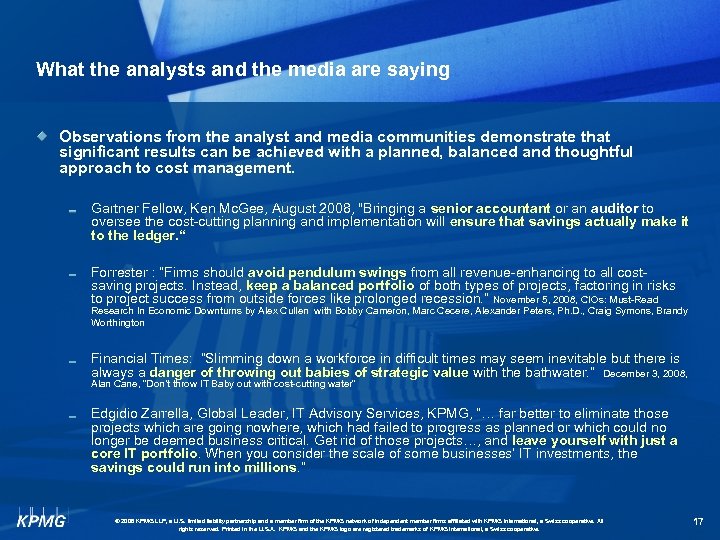

What the analysts and the media are saying Observations from the analyst and media communities demonstrate that significant results can be achieved with a planned, balanced and thoughtful approach to cost management. Gartner Fellow, Ken Mc. Gee, August 2008, "Bringing a senior accountant or an auditor to oversee the cost-cutting planning and implementation will ensure that savings actually make it to the ledger. “ Forrester : “Firms should avoid pendulum swings from all revenue-enhancing to all costsaving projects. Instead, keep a balanced portfolio of both types of projects, factoring in risks to project success from outside forces like prolonged recession. ” November 5, 2008, CIOs: Must-Read Research In Economic Downturns by Alex Cullen with Bobby Cameron, Marc Cecere, Alexander Peters, Ph. D. , Craig Symons, Brandy Worthington Financial Times: “Slimming down a workforce in difficult times may seem inevitable but there is always a danger of throwing out babies of strategic value with the bathwater. ” December 3, 2008, Alan Cane, “Don’t throw IT Baby out with cost-cutting water” Edgidio Zarrella, Global Leader, IT Advisory Services, KPMG, “… far better to eliminate those projects which are going nowhere, which had failed to progress as planned or which could no longer be deemed business critical. Get rid of those projects…, and leave yourself with just a core IT portfolio. When you consider the scale of some businesses’ IT investments, the savings could run into millions. ” © 2008 KPMG LLP, a U. S. limited liability partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International, a Swiss cooperative. All rights reserved. Printed in the U. S. A. KPMG and the KPMG logo are registered trademarks of KPMG International, a Swiss cooperative. 17

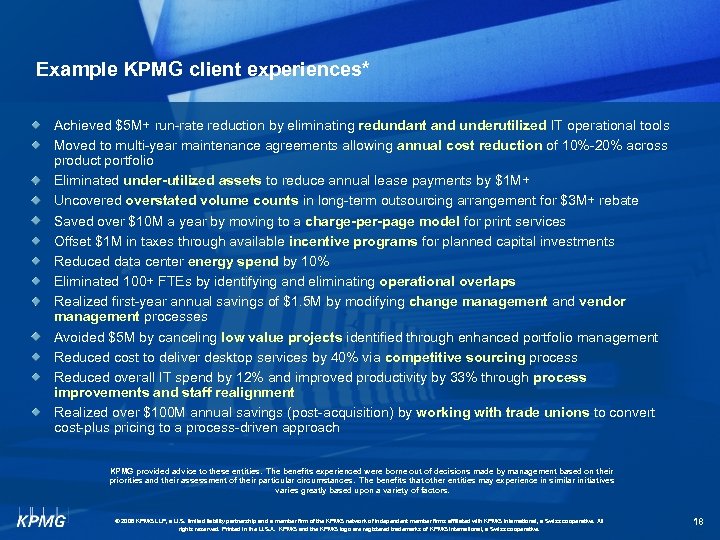

Example KPMG client experiences* Achieved $5 M+ run-rate reduction by eliminating redundant and underutilized IT operational tools Moved to multi-year maintenance agreements allowing annual cost reduction of 10%-20% across product portfolio Eliminated under-utilized assets to reduce annual lease payments by $1 M+ Uncovered overstated volume counts in long-term outsourcing arrangement for $3 M+ rebate Saved over $10 M a year by moving to a charge-per-page model for print services Offset $1 M in taxes through available incentive programs for planned capital investments Reduced data center energy spend by 10% Eliminated 100+ FTEs by identifying and eliminating operational overlaps Realized first-year annual savings of $1. 5 M by modifying change management and vendor management processes Avoided $5 M by canceling low value projects identified through enhanced portfolio management Reduced cost to deliver desktop services by 40% via competitive sourcing process Reduced overall IT spend by 12% and improved productivity by 33% through process improvements and staff realignment Realized over $100 M annual savings (post-acquisition) by working with trade unions to convert cost-plus pricing to a process-driven approach KPMG provided advice to these entities. The benefits experienced were borne out of decisions made by management based on their priorities and their assessment of their particular circumstances. The benefits that other entities may experience in similar initiatives varies greatly based upon a variety of factors. © 2008 KPMG LLP, a U. S. limited liability partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International, a Swiss cooperative. All rights reserved. Printed in the U. S. A. KPMG and the KPMG logo are registered trademarks of KPMG International, a Swiss cooperative. 18

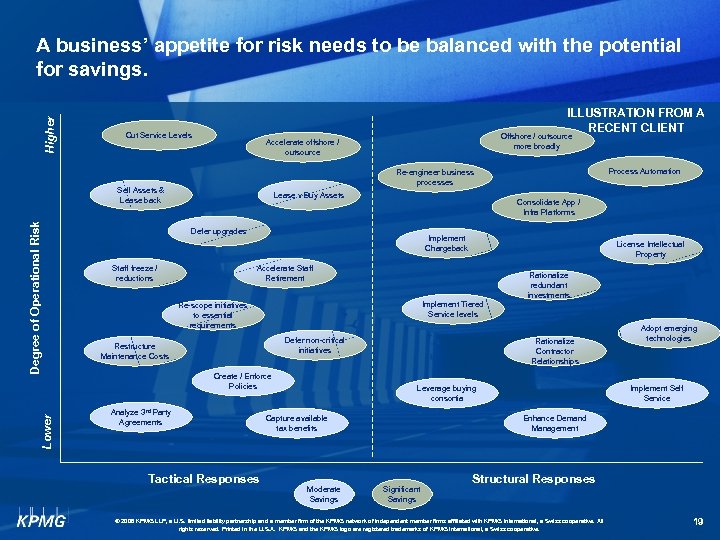

Higher A business’ appetite for risk needs to be balanced with the potential for savings. ILLUSTRATION FROM A RECENT CLIENT Cut Service Levels Degree of Operational Risk Process Automation Re-engineer business processes Sell Assets & Lease back Lower Offshore / outsource more broadly Accelerate offshore / outsource Lease v Buy Assets Consolidate App / Infra Platforms Defer upgrades Staff freeze / reductions Implement Chargeback License Intellectual Property Accelerate Staff Retirement Rationalize redundant investments Implement Tiered Service levels Re-scope initiatives to essential requirements Defer non-critical initiatives Restructure Maintenance Costs Create / Enforce Policies Analyze 3 rd Party Agreements Tactical Responses Rationalize Contractor Relationships Leverage buying consortia Capture available tax benefits Moderate Savings Adopt emerging technologies Implement Self Service Enhance Demand Management Significant Savings Structural Responses © 2008 KPMG LLP, a U. S. limited liability partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International, a Swiss cooperative. All rights reserved. Printed in the U. S. A. KPMG and the KPMG logo are registered trademarks of KPMG International, a Swiss cooperative. 19

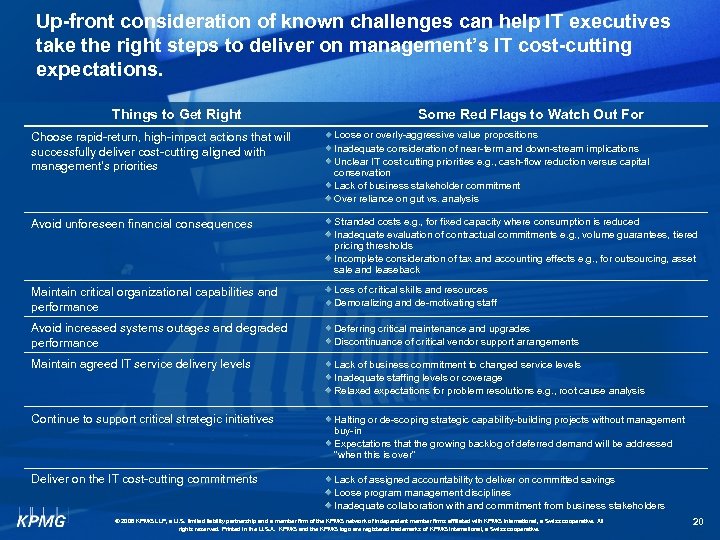

Up-front consideration of known challenges can help IT executives take the right steps to deliver on management’s IT cost-cutting expectations. Things to Get Right Some Red Flags to Watch Out For Choose rapid-return, high-impact actions that will successfully deliver cost-cutting aligned with management’s priorities Loose or overly-aggressive value propositions Inadequate consideration of near-term and down-stream implications Unclear IT cost cutting priorities e. g. , cash-flow reduction versus capital conservation Lack of business stakeholder commitment Over reliance on gut vs. analysis Avoid unforeseen financial consequences Stranded costs e. g. , for fixed capacity where consumption is reduced Inadequate evaluation of contractual commitments e. g. , volume guarantees, tiered pricing thresholds Incomplete consideration of tax and accounting effects e. g. , for outsourcing, asset sale and leaseback Maintain critical organizational capabilities and performance Loss of critical skills and resources Demoralizing and de-motivating staff Avoid increased systems outages and degraded performance Deferring critical maintenance and upgrades Discontinuance of critical vendor support arrangements Maintain agreed IT service delivery levels Lack of business commitment to changed service levels Inadequate staffing levels or coverage Relaxed expectations for problem resolutions e. g. , root cause analysis Continue to support critical strategic initiatives Halting or de-scoping strategic capability-building projects without management buy-in Expectations that the growing backlog of deferred demand will be addressed “when this is over” Deliver on the IT cost-cutting commitments Lack of assigned accountability to deliver on committed savings Loose program management disciplines Inadequate collaboration with and commitment from business stakeholders © 2008 KPMG LLP, a U. S. limited liability partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International, a Swiss cooperative. All rights reserved. Printed in the U. S. A. KPMG and the KPMG logo are registered trademarks of KPMG International, a Swiss cooperative. 20

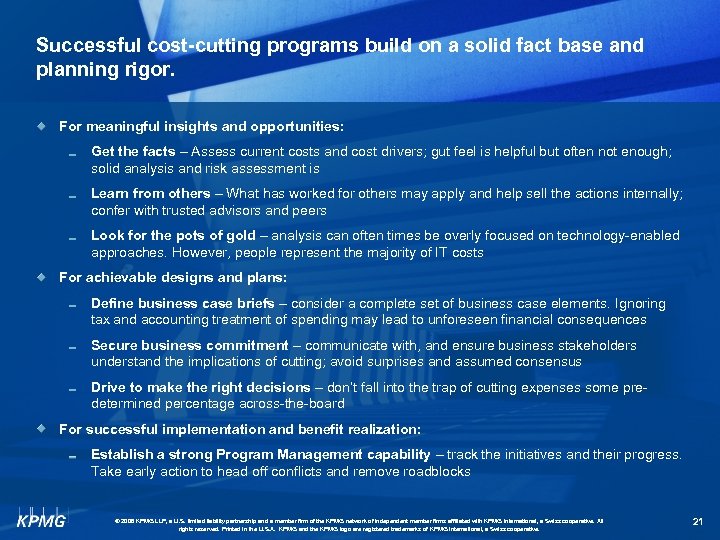

Successful cost-cutting programs build on a solid fact base and planning rigor. For meaningful insights and opportunities: Get the facts – Assess current costs and cost drivers; gut feel is helpful but often not enough; solid analysis and risk assessment is Learn from others – What has worked for others may apply and help sell the actions internally; confer with trusted advisors and peers Look for the pots of gold – analysis can often times be overly focused on technology-enabled approaches. However, people represent the majority of IT costs For achievable designs and plans: Define business case briefs – consider a complete set of business case elements. Ignoring tax and accounting treatment of spending may lead to unforeseen financial consequences Secure business commitment – communicate with, and ensure business stakeholders understand the implications of cutting; avoid surprises and assumed consensus Drive to make the right decisions – don’t fall into the trap of cutting expenses some predetermined percentage across-the-board For successful implementation and benefit realization: Establish a strong Program Management capability – track the initiatives and their progress. Take early action to head off conflicts and remove roadblocks © 2008 KPMG LLP, a U. S. limited liability partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International, a Swiss cooperative. All rights reserved. Printed in the U. S. A. KPMG and the KPMG logo are registered trademarks of KPMG International, a Swiss cooperative. 21

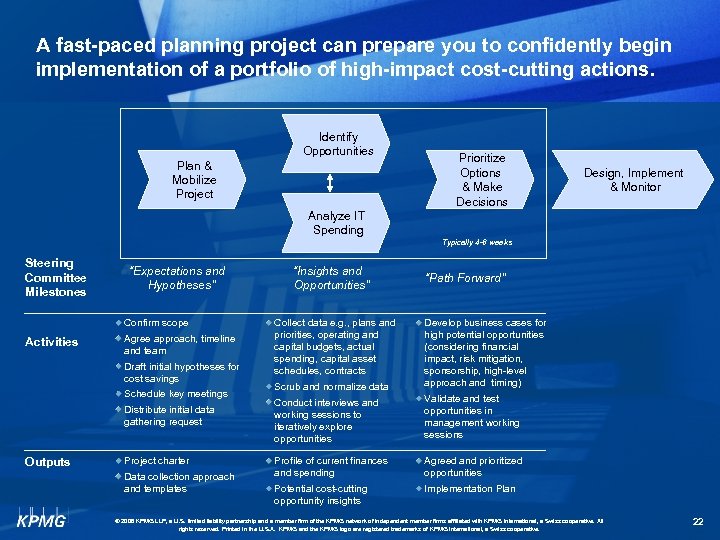

A fast-paced planning project can prepare you to confidently begin implementation of a portfolio of high-impact cost-cutting actions. Identify Opportunities Plan & Mobilize Project Prioritize Options & Make Decisions Design, Implement & Monitor Analyze IT Spending Typically 4 -6 weeks Steering Committee Milestones “Expectations and Hypotheses” Confirm scope Activities Agree approach, timeline and team Draft initial hypotheses for cost savings Schedule key meetings Distribute initial data gathering request Outputs Project charter Data collection approach and templates “Insights and Opportunities” Collect data e. g. , plans and priorities, operating and capital budgets, actual spending, capital asset schedules, contracts “Path Forward” Scrub and normalize data Develop business cases for high potential opportunities (considering financial impact, risk mitigation, sponsorship, high-level approach and timing) Conduct interviews and working sessions to iteratively explore opportunities Validate and test opportunities in management working sessions Profile of current finances and spending Agreed and prioritized opportunities Potential cost-cutting opportunity insights Implementation Plan © 2008 KPMG LLP, a U. S. limited liability partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International, a Swiss cooperative. All rights reserved. Printed in the U. S. A. KPMG and the KPMG logo are registered trademarks of KPMG International, a Swiss cooperative. 22

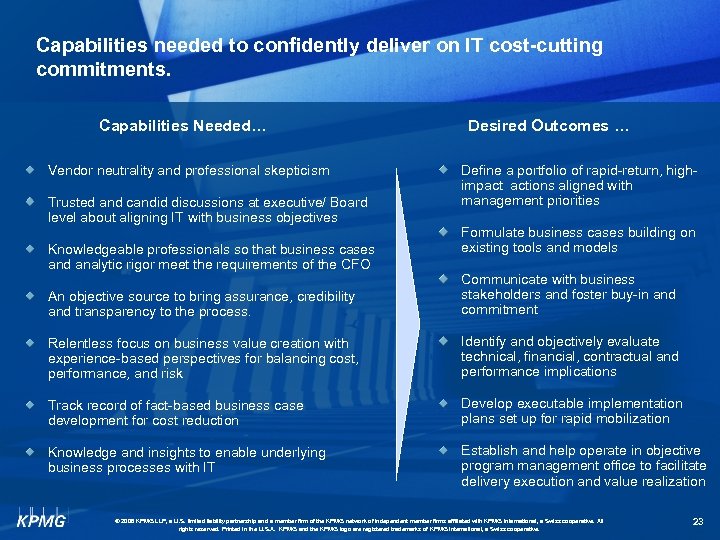

Capabilities needed to confidently deliver on IT cost-cutting commitments. Capabilities Needed… Vendor neutrality and professional skepticism Trusted and candid discussions at executive/ Board level about aligning IT with business objectives Knowledgeable professionals so that business cases and analytic rigor meet the requirements of the CFO Desired Outcomes … Define a portfolio of rapid-return, highimpact actions aligned with management priorities Formulate business cases building on existing tools and models An objective source to bring assurance, credibility and transparency to the process. Communicate with business stakeholders and foster buy-in and commitment Relentless focus on business value creation with experience-based perspectives for balancing cost, performance, and risk Identify and objectively evaluate technical, financial, contractual and performance implications Track record of fact-based business case development for cost reduction Develop executable implementation plans set up for rapid mobilization Knowledge and insights to enable underlying business processes with IT Establish and help operate in objective program management office to facilitate delivery execution and value realization © 2008 KPMG LLP, a U. S. limited liability partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International, a Swiss cooperative. All rights reserved. Printed in the U. S. A. KPMG and the KPMG logo are registered trademarks of KPMG International, a Swiss cooperative. 23

5ac693e9b083d07623800dcc3d7fda16.ppt