2aa96cd6458a7e622ead6bf68f8b738a.ppt

- Количество слайдов: 60

Issues linked with TDS Compiled by. CA Kishor Phadke 1

Background Different terms used in various sections covering many situations, leading to a complex matrix. Consider an example of some key words Ø Any income chargeable under the head salaries … Ø Any income by way of interest … Ø Any sum for carrying out any work. . Ø Any income referred to in section 115 BBA … Ø Any income by way of rent. . Ø Any sum by way of consideration for transfer of immovable. . Ø Any sum by way of fees for professional services … Many issues arise while understanding their meaning … 2

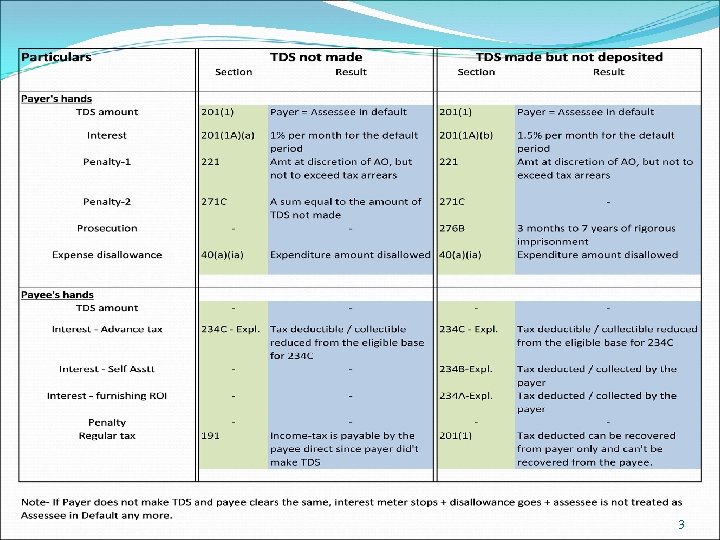

3

Scheme of the provisions If payer does not deduct, he is liable till payee files return and accepts corresponding liability (but, interest and penalty for payer) If payer deducts tax, payee can’t be called to pay the same again (interest and prosecution for payer) No simultaneous liability as per the scheme Ø ACIT V. Omprakash Gattani – 242 ITR 638 (Gau. ) Ø Yashpal Sahni V. ACIT – 293 ITR 539 (Bom) 4

Issue-1 contd. Income should exist / be embedded In cases where income, per se, is not embedded or not transpiring, TDS uncalled for Ø CIT V. Karma Energy Ltd - 375 ITR 264 (Bom) Consideration paid for sharing utilities is not a revenue receipt and hence not liable for TDS u/s 194 C Ø CIT V. Harbanslal Malhotra – 361 ITR 82 (Cal) No TDS when amount paid to an agent (and when, the agent has made TDS while making payment to end party) 5

Issue-2 TDS only in case of Payer-Payee transaction ITC Limited V. CIT – 68 Taxmann. com 323 (SC) Ø While reversing the Delhi HC decision, apex court held that tips paid by customers are merely voluntary Ø If employer collects them and distributes to employees, the same are in fiduciary capacity (trusteeship) and hence, not salary and hence, not liable to TDS Sharma Kajaria & Co. V. DCIT – 50 SOT 282 (Kol) Ø Reimbursements claimed from clients for counsels fees Ø Such counsel fees not claimed as expenditure Ø Hence, TDS not required to be made vis-à-vis such payments and, disallowance u/s 40(a)(ia) uncalled for on the same 6

Issue-3 Uncertain payee Uco Bank V. Union of India – 369 ITR 335 (Del) Ø FD created in name of Registrar General of High Court, as per direction of court relating to some suit between two parties Ø Interest was determined but no TDS was made Ø Issue raised by I-T department asking for TDS and proceedings u/s 291(1) / 201(1 A) Ø HC observes that when payee is uncertain, no question of TDS Ø Position accepted by CBDT vide circular no. 23/2015 Even in case of deep discount bonds, no TDS called for as 7

Issue-4 TDS and corresponding income to go hand-in-hand CIT V. Bhoortnam and Company – 357 ITR 396 (AP) Ø Assessee, with others, formed an AOP for securing works from GOVT authorities Ø Work of each party specific Ø Assessee offering revenue relating to his work in his return Ø Claims corresponding TDS Ø Denied by AO since TDS certificate in name of AOP Ø Contention rejected by HC, holding that, TDS credit must be given Ø (Many such AOPs formed in and around Pune for INFRA work) 8

Issue-5 Terms used u/s 40(a) deserves strict interpretation ANZ Grindlays Bank v. DCIT – 382 ITR 156 (Del) Ø U/s 40(a)(iii), there is no mechanism for granting deduction in a different year (of payment) than the year of deduction and hence, as soon as paid anytime afterwards, first year’s disallowance becomes incorrect CIT V. Petroleum India International – 351 ITR 295 (Bom) Ø Assessee was an AOP of 9 companies Ø Employees of respective companies seconded to assessee and deployed on overseas projects Ø Issue of non-TDS on daily allowance and disallowance u/s 40(a)(iii) Ø Held that, seconded employees still legally employees of 9 companies and hence, not employees of AOP, and hence, disallowance deleted 9

Issue-6 Characterization - Service V. Commission V. Retail Margin Bharti Airtel Ltd. v. DCIT- 372 ITR 33 (Kar) Ø Service can only be rendered and not sold, however, right to service can be sold. Ø Sale of SIM by service provider to distributor involves sale of right to services, therefore, relationship between assessee and distributor would be that of principal and not principal and agent. Ø Since SIM cards and prepaid recharge coupons were sold by assessee Telecom operators to distributors at discounted MRP, there was no payment of commission or brokerage to distributor, hence, TDS under section 194 H was not attracted 10

Issue-6 contd. Characterization – Service V. Commission V. Retail Margin Vodafone Essar Cellular Ltd. v. ACIT- 332 ITR 255 (Ker) Ø Discount given by assessee, a mobile cellular operator, to distributors in course of selling of sim cards and recharge coupons under pre-paid scheme of getting a connection is, in substance, a payment for services to be rendered by distributors to assessee and, so much so, it would fall within definition of ‘commission or brokerage’ under section 194 H Ø Similar view taken in the case of Bharti Cellular Ltd. v. ACIT - 244 CTR 185 (Cal) 11

Issue-6 contd. Characterization – Service V. Commission V. Retail Margin Recently Hon. Ahmedabad Tribunal took has followed the view taken by Hon. Karnataka High Court in the case of Bharati Airtel (supra) in the case of Vodafone Essar Gujarat Ltd. v. ACIT (60 taxmann. com 214 )and held that difference between face value and selling price of prepaid voucher could not be regarded as commission requiring deduction of tax at source under section 194 H. 12

Issue-6 contd. Characterization – Service V. Commission V. Retail Margin CIT v. Ahmedabad Stamp Vendors Association - 348 ITR 378 (SC) Ø Discount given to the Stamp Vendors is for purchasing the stamps in bulk quantity and the said discount is in the nature of cash discount. Ø Vendors purchase the stamp papers on a “principal to principal” basis as the property in the good passes on to the vendor buyer without having any control or title of the seller in it. There is no contract of agency at any point of time. Therefore, sec. 194 H is not attracted 13

Issue-6 contd. Characterization – Service V. Commission V. Retail Margin CIT v. Qatar Airways- 332 ITR 253 (Bom) Ø agents of an airline had been given discretion to sell tickets at any rate between fixed minimum commercial price and published price, Ø amount which agent earned over and above fixed minimum commercial price would neither amount to commission nor brokerage at hands of agent, and, therefore, tax at source was not deductible on that amount under section 194 H. Ø The airlines would have no information about the exact rate at which the tickets were ultimately sold by their agents since the agents had been given discretion to sell the tickets at any rate between the fixed minimum commercial price and the published price and it would be impracticable and unreasonable to expect the assessee to get a feed back from their numerous agents in respect of each ticket sold 14

Issue-6 contd. Characterization – Service V. Commission V. Retail Margin CIT v. Mother Dairy India Ltd. - 358 ITR 218 (Del) Ø The fact that the booth and the equipment installed therein were owned by the Dairy is of no relevance in deciding the nature of relationship between the assessee and the concessionaire. Ø Further, the fact that the Dairy can inspect the booths and check the records maintained by the concessionaire is also not decisive. These are only terms included in the agreement to ensure that the system operates safely and smoothly. That question must be decided, on the basis of the fact as to when and at what point of time the property in the goods passed to the concessionaire. Ø No TDS liability 15

Issue-6 contd. Characterization – Service V. Commission V. Retail Margin National Panasonic India (P. ) Ltd. v. DCIT- 3 SOT 16 (Delhi Trib) Ø There are various sales promotion schemes, which keep on coming and going. They may be area-specific, class of customer-specific, period-specific etc. They are never permanent and therefore, incentives earned from such schemes cannot be said to have been earned in the course of buying and selling the goods. Ø The fact that these schemes do not form part of the agreement, itself suggests that they are not permanent and the profits of the dealer do not predominantly depend on these schemes. Ø These incentives cannot be termed as commission in the normal course of buying and selling the goods as envisaged in section 194 H of the Act. 16

Issue-6 contd. Characterization – Service V. Commission V. Retail Margin Foster’s India (P. ) Ltd. v. ITO- 29 SOT 32 (Pune ITAT) Ø ‘Giving free bottles of beer on sale of specified quantities’ is nothing but a sale incentive by way of trade discount. Ø Similarly, ‘free gifts of beer bottles on sponsorships and promotions’ is sales promotion cost for assessee-company and so was ‘incentive travel’ for distributors. Ø So far as ‘early payment discount’ was concerned, it was nothing but a cash discount for timely payment of bills by distributors to assessee-company 17

Issue-6 contd. Characterization – Service V. Commission V. Retail Margin ACIT v. Jet Airways (India) Ltd. - 158 TTJ 289 (Mumbai. Trib) Ø Payments made to banks on account of utilization of credit card facilities would be in nature of bank charges and not in nature of commission within meaning of section 194 H and, hence, no TDS is required to be deducted under section 194 H. Ø This is not a case of commission agent as assessee sold its goods through credit card and on presentation of bill issued against credit card, the bank makes payment to the assessee after deducting agreed fees as per terms and conditions in case of credit card. This is not a commission payment but a fees deducted by the bank. 18

Issue-6 contd. Characterization – Service V. Commission V. Retail Margin Kotak Securities Ltd. v. ACIT- 147 TTJ 443 (Mumbai ITAT) Ø Principal-agent relationship is a sine qua non for invoking provisions of section 194 H. Ø When bank issues bank guarantee on behalf of assessee, there is no principal-agent relationship between bank and assessee and, therefore, assessee is not required to deduct tax at source under section 194 H from payment of bank guarantee commission made to bank 19

Issue-7 Substance over form CIT V. Cargo Linkers – 179 Taxman 0151 (Del) Ø Assessee acting as a C & F agent between Exporters and Airlines Ø Assessee not a person responsible for effecting TDS u/s 194 C CIT V. Hardarshan Sing – 350 ITR 427 (Del) Ø Transport arrangers / facilitators / intermediaries, typically arranges transport for the clients Ø Such arrangers establish link between such transporter and the client Ø Such arrangers not responsible for making TDS u/s 194 C 20

Issue -7 contd. Substance over form Bharat Forge Ltd. v. Addl. CIT- 144 ITD 455 (Pune ITAT) Ø Assessee has made payments towards testing and inspection charges and deducted tax u/s 194 C of the ITA, 1961. Ø It was held that any payment technical services in order to cover under s. 194 J should be a consideration for acquiring or using technical know-how simpliciter provided or made available by human element. Merely because the payee used technical knowledge or installs sophisticated equipments, it does not result into the above services to be professional or technical services Ø There should be direct and live link between the payment and receipt/use of technical services/information. Ø Similar issue dealt with in Circular No 715 issued by CBDT 21

Issue- 8 Overlapping situations Japan Airlines Co. Ltd. v. CIT- 377 ITR 372 (SC) Ø Charges that are paid by international airlines to Airport Authority of India (AAI) for landing and take-off services as well as for parking of aircrafts are not, in substance, for use of land but for various other facilities such as providing of air traffic services, ground safety services, aeronautical communication facilities, installation and maintenance of navigational aids and meteorological services at airport which are to be compulsorily offered by AAI in tune with requirements of various international protocols extended by AAI in connection with aircraft operation Ø such charges are not covered under section 194 -I 22

Issue- 9 Human intervention in provision of services CIT v. Bharti Cellular Ltd. – 330 ITR 239 (SC) Ø Interconnect agreement with BSNL/MTNL under which interconnect/access/port charges are paid to BSNL/MTNL Ø The words "technical services" in section 9(1)(vii) read with Explanation 2 comes in between the words "managerial and consultancy services". Ø Matter was remanded to decide whether manual intervention is involved in the technical operations by which a cellular service provider 23

Issue- 9 contd. Human intervention in provision of services CIT v. Kotak Securities Ltd. - 67 taxmann. com 356 (SC) Ø Service made available by Bombay Stock Exchange [BSE Online Trading (BOLT) System] for which transaction charges are paid by members of BSE Ø It cannot be lost sight of that modern day scientific and technological developments may tend to blur the specific human element in an otherwise fully automated process by which such services may be provided 24

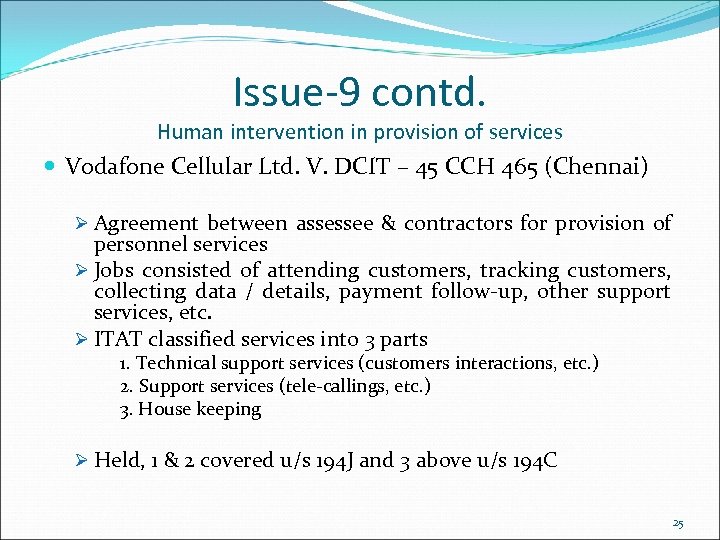

Issue-9 contd. Human intervention in provision of services Vodafone Cellular Ltd. V. DCIT – 45 CCH 465 (Chennai) Ø Agreement between assessee & contractors for provision of personnel services Ø Jobs consisted of attending customers, tracking customers, collecting data / details, payment follow-up, other support services, etc. Ø ITAT classified services into 3 parts 1. Technical support services (customers interactions, etc. ) 2. Support services (tele-callings, etc. ) 3. House keeping Ø Held, 1 & 2 covered u/s 194 J and 3 above u/s 194 C 25

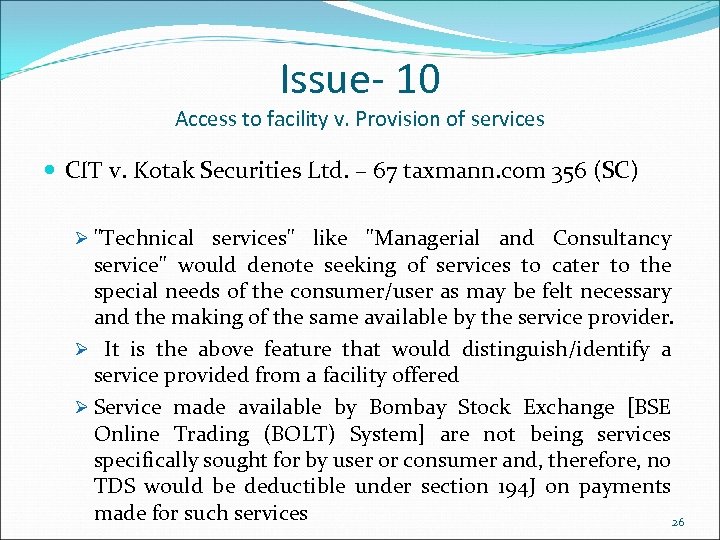

Issue- 10 Access to facility v. Provision of services CIT v. Kotak Securities Ltd. – 67 taxmann. com 356 (SC) Ø "Technical services" like "Managerial and Consultancy service" would denote seeking of services to cater to the special needs of the consumer/user as may be felt necessary and the making of the same available by the service provider. Ø It is the above feature that would distinguish/identify a service provided from a facility offered Ø Service made available by Bombay Stock Exchange [BSE Online Trading (BOLT) System] are not being services specifically sought for by user or consumer and, therefore, no TDS would be deductible under section 194 J on payments made for such services 26

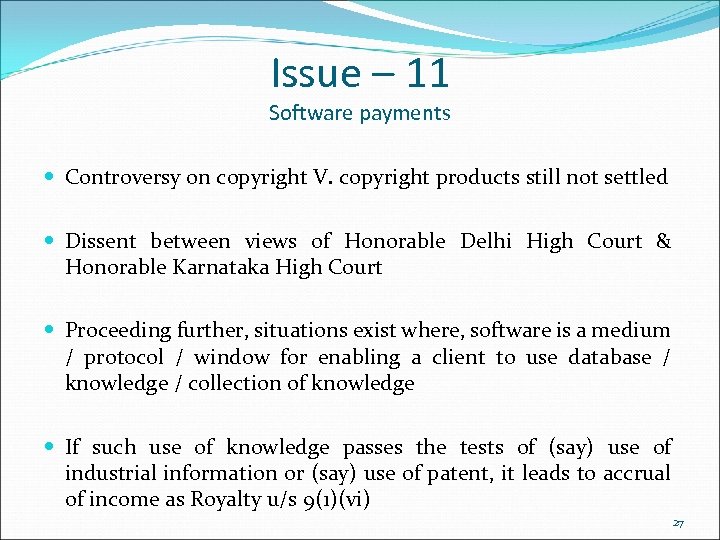

Issue – 11 Software payments Controversy on copyright V. copyright products still not settled Dissent between views of Honorable Delhi High Court & Honorable Karnataka High Court Proceeding further, situations exist where, software is a medium / protocol / window for enabling a client to use database / knowledge / collection of knowledge If such use of knowledge passes the tests of (say) use of industrial information or (say) use of patent, it leads to accrual of income as Royalty u/s 9(1)(vi) 27

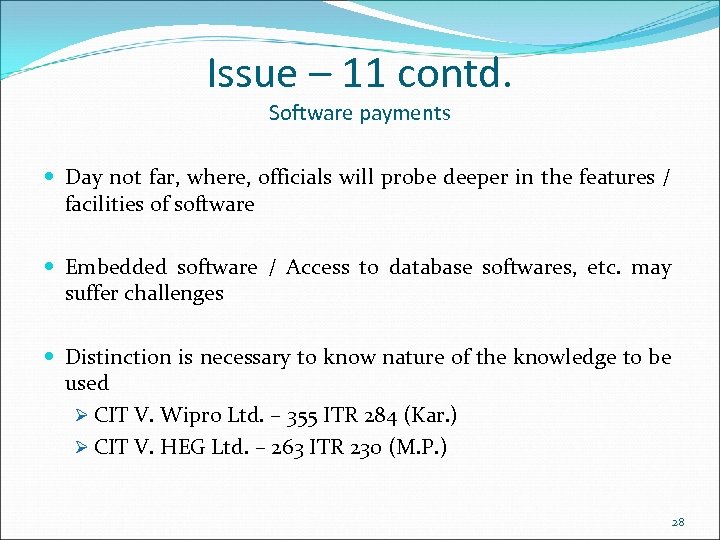

Issue – 11 contd. Software payments Day not far, where, officials will probe deeper in the features / facilities of software Embedded software / Access to database softwares, etc. may suffer challenges Distinction is necessary to know nature of the knowledge to be used Ø CIT V. Wipro Ltd. – 355 ITR 284 (Kar. ) Ø CIT V. HEG Ltd. – 263 ITR 230 (M. P. ) 28

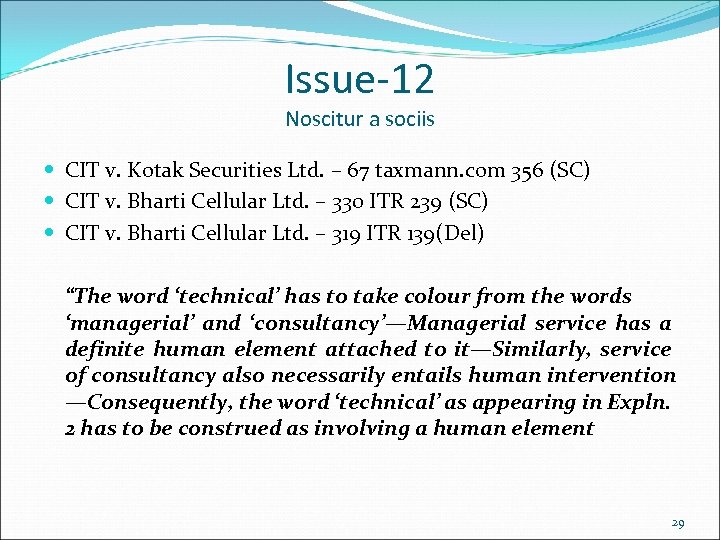

Issue-12 Noscitur a sociis CIT v. Kotak Securities Ltd. – 67 taxmann. com 356 (SC) CIT v. Bharti Cellular Ltd. – 330 ITR 239 (SC) CIT v. Bharti Cellular Ltd. – 319 ITR 139(Del) “The word ‘technical’ has to take colour from the words ‘managerial’ and ‘consultancy’—Managerial service has a definite human element attached to it—Similarly, service of consultancy also necessarily entails human intervention —Consequently, the word ‘technical’ as appearing in Expln. 2 has to be construed as involving a human element 29

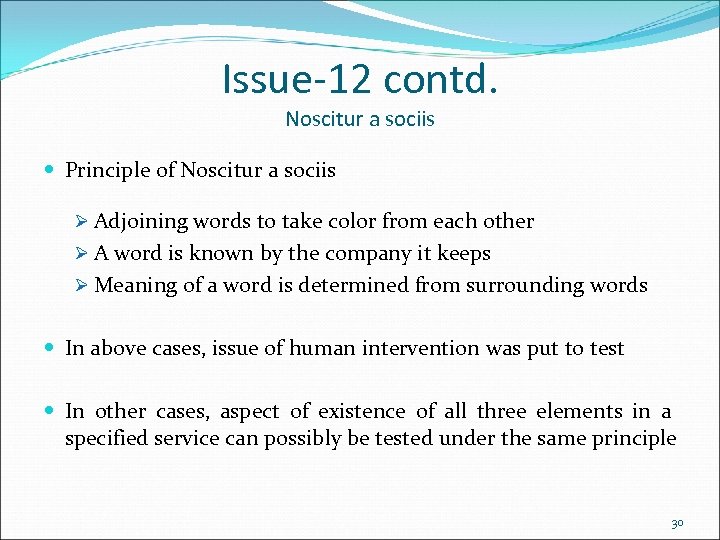

Issue-12 contd. Noscitur a sociis Principle of Noscitur a sociis Ø Adjoining words to take color from each other Ø A word is known by the company it keeps Ø Meaning of a word is determined from surrounding words In above cases, issue of human intervention was put to test In other cases, aspect of existence of all three elements in a specified service can possibly be tested under the same principle 30

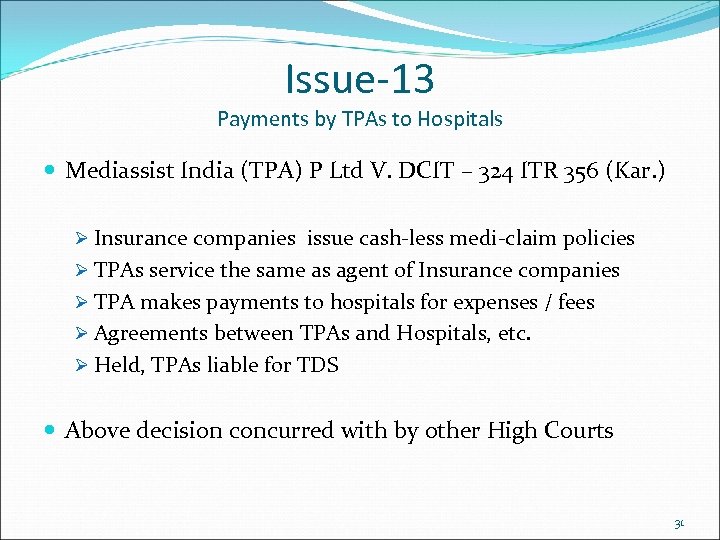

Issue-13 Payments by TPAs to Hospitals Mediassist India (TPA) P Ltd V. DCIT – 324 ITR 356 (Kar. ) Ø Insurance companies issue cash-less medi-claim policies Ø TPAs service the same as agent of Insurance companies Ø TPA makes payments to hospitals for expenses / fees Ø Agreements between TPAs and Hospitals, etc. Ø Held, TPAs liable for TDS Above decision concurred with by other High Courts 31

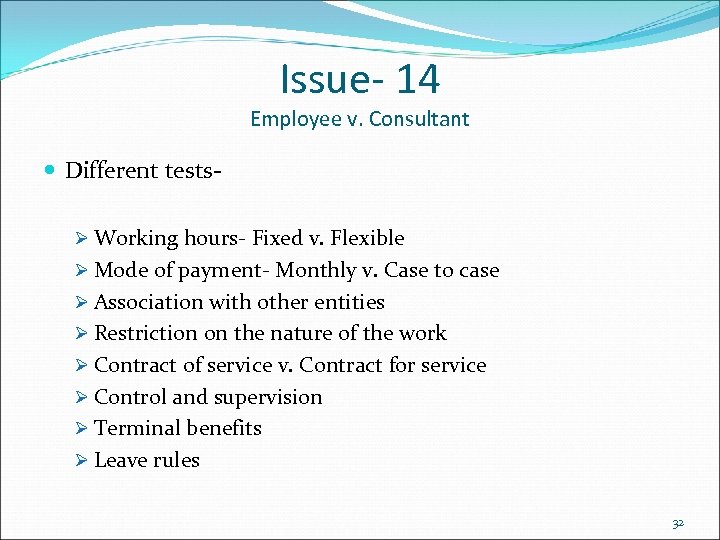

Issue- 14 Employee v. Consultant Different testsØ Working hours- Fixed v. Flexible Ø Mode of payment- Monthly v. Case to case Ø Association with other entities Ø Restriction on the nature of the work Ø Contract of service v. Contract for service Ø Control and supervision Ø Terminal benefits Ø Leave rules 32

Issue- 14 contd. Employee v. Consultant CIT(TDS), Pune v. Grant Medical Foundation- 375 ITR 49 (Bom) Ø Well-known doctors in specified fields are invited to join hospitals for a fee or honorarium and there are certain terms drawn so as to understand relationship, then, in every case such terms and attendant circumstances would have to be seen in their entirety before arriving at a conclusion that there exists a employer-employee relationship and no general rule could be laid down 33

Issue- 14 contd. Employee v. Consultant Max-Mueller Bhavan – 268 ITR 31 (AAR) Ø Mere fact that agreement gives liberty to teachers to work for any place, institute or company during tenure of agreement and it clarifies that teacher shall not have status of employee nor shall be entitled to avail benefits of regular employees, will not militate against relationship of master and servant between applicant and teacher Ø Therefore, applicant is obliged to deduct tax at source from payment of honorarium to honorary part-time teachers under section 192 34

Issue - 15 Subsuming payments CIT V. Krishak Bharati Co-op. Ltd. – 349 ITR 68 (Guj) Ø Contract for supply of gas to the buyer’s factory Ø Pipelines used for carriage of gas Ø Separate agreements, one for sell of gas and other for carriage of gas Ø AO held, 194 C applies Ø Held, transportation charges were only in furtherance of sale of gas and hence, part of sale transaction Ø Held, 194 C not applicable in such a case 35

Issue – 15 contd. Subsuming payments CIT V. Bhagwati Steels - 326 ITR 108 (P & H) Ø Bills for sale of goods included freight charges Ø Understanding was for purchase and sale of goods as per distribution agreement Ø No any separate understanding for transport Ø Hence, separately charged freight charges not liable for TDS u/s 194 C Ø SLP against the said case dismissed at 336 ITR 14 (St. ) 36

Issue – 15 contd. Subsuming payments DCIT V. Dwarkadhish SSK Ltd. – 55 taxmann. com 471 (Pune) Ø Members liability to supply cane at the factory gate Ø Harvesting & transportation payments made on behalf of the members of sugar factory Ø Though payments made to transporters by assessee direct, same not assessee’s own expenses and part of sugarcane price Ø Hence, TDS u/s 194 C not applicable 37

Issue – 16 Interest Shri Venkatesh Paper Agencies V. DCIT – 55 SOT 332 (Hyd) Ø Interest paid on overdue bills Ø AO invoked section 194 A and made disallowance u/s 40(a)(ia) Ø ITAT held that the interest has a direct nexus with trading liability and hence, not an interest for money borrowed, etc. Ø Held, not liable for TDS u/s 194 A and disallowance u/s 40(a)(ia) 38

Issue – 16 contd. Interest Beacon Projects Pvt Ltd V. CIT – 377 ITR 237 (Ker) Ø Assessee a builder who recd advances from customers Ø Some advances were required to be refunded Ø While so refunding, additional amts were paid too Ø AO held these additional amts as interest u/s 194 A Ø Held for qualifying as interest, debtor-creditor and pre- existing obligation ought to exist Ø Else, not an interest u/s 2(28 A) Ø TDS liability deleted & appeal allowed 39

Issue-17 Sale v. Works CIT V. AP State Road Transport Cor. – 371 ITR 621 (AP) Ø Assessee buying chassis and getting bodies of buses built thereon from Ø Ø Ø fabricating agency Specifications provided by assessee Buses made by fabricator and sold to the assessee AO applied 194 C and observed a default Held, transaction essentially one of s “sale” and not “works” Hence, held, no need for TDS u/s 194 C CIT V. Glenmark Pharmaceuticals Limited – 324 ITR 199 (Bom) Ø Contract manufacturer producing pharma products, held not a works contractor 40

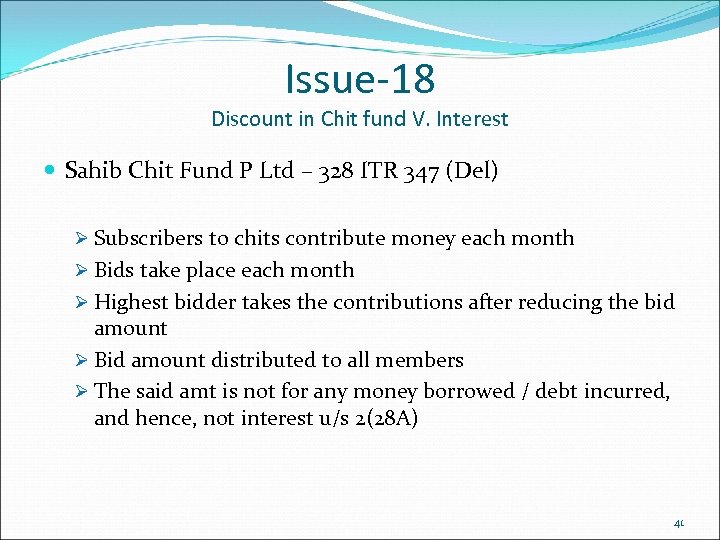

Issue-18 Discount in Chit fund V. Interest Sahib Chit Fund P Ltd – 328 ITR 347 (Del) Ø Subscribers to chits contribute money each month Ø Bids take place each month Ø Highest bidder takes the contributions after reducing the bid amount Ø Bid amount distributed to all members Ø The said amt is not for any money borrowed / debt incurred, and hence, not interest u/s 2(28 A) 41

![Issue-19 Adoption of incorrect section CIT v. S. K. Tekriwal [2014] 361 ITR 432 Issue-19 Adoption of incorrect section CIT v. S. K. Tekriwal [2014] 361 ITR 432](https://present5.com/presentation/2aa96cd6458a7e622ead6bf68f8b738a/image-42.jpg)

Issue-19 Adoption of incorrect section CIT v. S. K. Tekriwal [2014] 361 ITR 432 (Cal) Ø It was held that where tax is deducted by the assessee, even if it is under a wrong provision of law, as in this case, the provisions of Section 40(a)(ia) of the Act cannot be invoked CIT V. P V S Memorial Hospital Ltd – 380 ITR 284 (Ker) Ø Assessee made TDS @2% u/s 194 C instead of @ 5% u/s 194 J Ø HC observed that deduction under wrong section does not save the assessee from section 40(a)(ia) 42

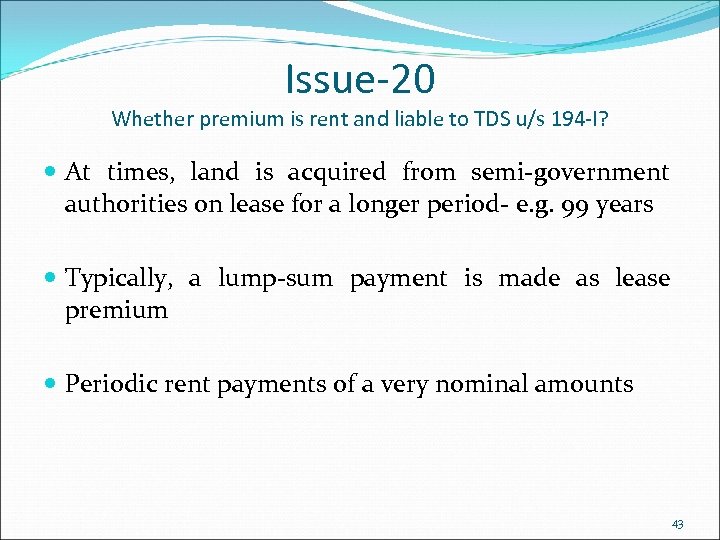

Issue-20 Whether premium is rent and liable to TDS u/s 194 -I? At times, land is acquired from semi-government authorities on lease for a longer period- e. g. 99 years Typically, a lump-sum payment is made as lease premium Periodic rent payments of a very nominal amounts 43

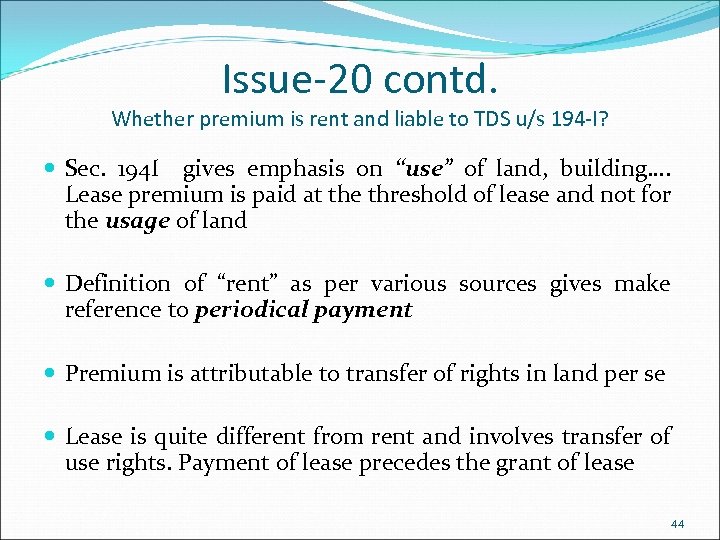

Issue-20 contd. Whether premium is rent and liable to TDS u/s 194 -I? Sec. 194 I gives emphasis on “use” of land, building…. Lease premium is paid at the threshold of lease and not for the usage of land Definition of “rent” as per various sources gives make reference to periodical payment Premium is attributable to transfer of rights in land per se Lease is quite different from rent and involves transfer of use rights. Payment of lease precedes the grant of lease 44

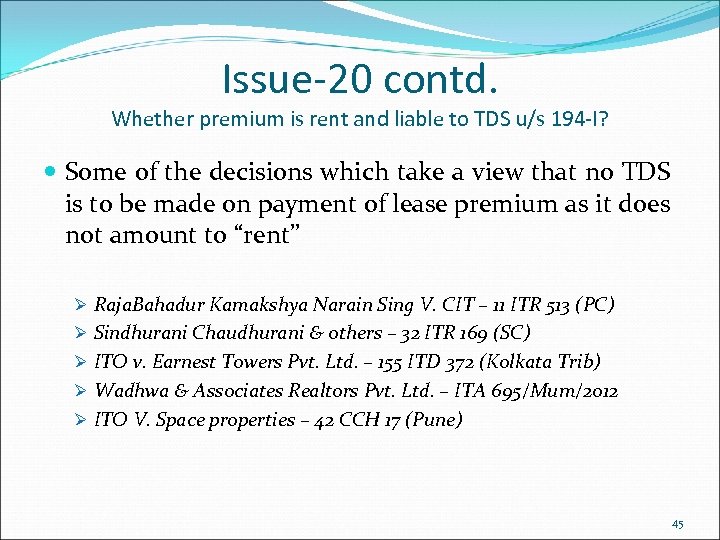

Issue-20 contd. Whether premium is rent and liable to TDS u/s 194 -I? Some of the decisions which take a view that no TDS is to be made on payment of lease premium as it does not amount to “rent” Ø Raja. Bahadur Kamakshya Narain Sing V. CIT – 11 ITR 513 (PC) Ø Sindhurani Chaudhurani & others – 32 ITR 169 (SC) Ø ITO v. Earnest Towers Pvt. Ltd. – 155 ITD 372 (Kolkata Trib) Ø Wadhwa & Associates Realtors Pvt. Ltd. – ITA 695/Mum/2012 Ø ITO V. Space properties – 42 CCH 17 (Pune) 45

Issue-20 contd. Whether premium is rent and liable to TDS u/s 194 -I? Unfavourable decision in the case of Foxconn, now reversed Hon. Chennai ITAT in the case of Foxconn India Developer Pvt. Ltd. v. ITO – ITA No. 492 of 2010, had taken a view that upfront charges paid for taking land on lease would come within definition of 'rent' as per Explanation to section 194 -I However, recently, in April 2016, Hon. High Court of Madras – Tax case appeal no. 801 of 2013, reversed the said decision and held that as the upfront charges are not merely for use of land but for variety of purposes such as becoming a codeveloper, for putting up industry, etc. , they could not be taken to constitute rental income 46

Issue-20 contd. Whether premium is rent and liable to TDS u/s 194 -I? Non-applicability of Circular 718 dated 22/08/1995 The circular states that the tax would be deducted at source from the non-refundable deposit paid by the tenant Short terms tenancy is different from long period lease understanding One-time premium is not similar to advance deposit required to be appropriated over the period of tenancy 47

Issue-21 Challenges in sec. 194 -IA- TDS on immovable property New section since 1/6/2013 Yet to reach to various courts Many issues arise Ø In case of Multiple buyers – who is responsible to deduct tax at source Ø In case of Multiple sellers – 50 lakh amount per seller ? ? Ø Consideration given in form of Constructed Area – How TDS to be done? ? ? Ø 234 E applicability 48

Issue-22 Issues linked with 234 E Fee for defaults in furnishing statements Section 234 E. (1) Without prejudice to the provisions of the Act, where a person fails to deliver or cause to be delivered a statement within the time prescribed in sub-section (3) of section 200 or the proviso to sub-section (3) of section 206 C, he shall be liable to pay, by way of fee, a sum of two hundred rupees for every day during which the failure continues. (2) The amount of fee referred to in sub-section (1) shall not exceed the amount of tax deductible or collectible, as the case may be. 49

Issue-22 contd. Issues linked with 234 E (3) The amount of fee referred to in sub-section (1) shall be paid before delivering or causing to be delivered a statement in accordance with sub-section (3) of section 200 or the proviso to sub-section (3) of section 206 C. (4) The provisions of this section shall apply to a statement referred to in sub-section (3) of section 200 or the proviso to sub-section (3) of section 206 C which is to be delivered or caused to be delivered for tax deducted at source or tax collected at source, as the case may be, on or after the 1 st day of July, 2012. ] 50

Issue-22 contd. Issues linked with 234 E Memorandum explaining Finance Act, 2012 Purpose of Introduction: Ø Delay in furnishing of TDS statement results in delay in granting of credit of TDS. Ø Not furnishing correct information like PAN amount of tax etc. in the TDS statement. Ø To provide effective deterrence against delay in furnishing of TDS statement. 51

Issue-22 contd. Issues linked with 234 E Memorandum explaining Finance Act, 2012 Fees and Penalty: Ø To provide for levy of fee of Rs. 200 per day for late furnishing of TDS statement from the due date till the date of furnishing. Total amount of fee shall not exceed the total amount of tax deductible during the period for which the TDS statement is delayed, and Ø To provide that in addition to said fee, a penalty ranging from Rs. 10, 000 to Rs. 1, 000 shall also be levied for not furnishing TDS statement within the prescribed time 52

Issue-22 contd. Issues linked with 234 E Memorandum explaining Finance Act, 2012 Relief from penalty: Ø No penalty shall be levied for delay in furnishing of TDS statement if the TDS statement is furnished within one year of the prescribed due date after payment of tax deducted along with applicable interest and fee. Ø Amendment in section 273 B so that no penalty shall be levied if the deductor proves that there was a reasonable cause for the failure 53

Issue-22 contd. Issues linked with 234 E Constitutional validity: Challenged massively by numerous petitions on the two grounds mainly Ø Use of word fee: “Fee” is known in the commercial and legal world to be a recompense of some service or some special service performed, and it cannot be collected for any dis-service or default Ø Non-Appellable Order u/s 234 E: The provisions of section 234 E were extremely onerous inasmuch as the Assessing Officer was not vested with any power to condone the delay in filing the TDS return/statements belatedly and there was also no provision of Appeal against any arbitrary order passed by the Assessing Officer under section 234 E of the Act. 54

Issue-22 contd. Issues linked with 234 E Various High Courts granted a stay for levy of penalty levied u/s 234 E Narath Mapila v/s UOI Kerala HC 2013 M/s Om Prakash Dhoot & Co v/s UOI Rajasthan HC 2014 Rashmikant Kundalia Vs UOI Bombay HC 2014 Shree Builders Vs UOI Madhya Pradesh 2014 Aditya Bizorp Solutions India Private Limited Banglore HC 2014 55

Issue-22 contd. Issues linked with 234 E Constitution Validity confirmed by Bombay High Court in case of Rashmikant Kundalia vs. UOI ( WRIT PETITION NO. 771 OF 2014) on following grounds Fee under section 234 E is levied to address this additional work burden forced upon the Department by the deductor by not furnishing the information in time which he is statutorily bound to furnish within the prescribed time 56

Issue-22 contd. Issues linked with 234 E Findings of High Court Ø Right of appeal is not a matter of right but is a creature of the statute, and if the Legislature deems it fit not to provide a remedy of appeal, so be it. Ø Aggrieved person can always approach this Court in its extra ordinary equitable jurisdiction under Article 226 / 227 of the Constitution of India, as the case may be. 57

Issue-22 contd. Issues linked with 234 E Recovery of Fee levied u/s 234 E via section 200 A Prior to 1 June 2015, there was no enabling provision for raising demand in respect of levy of fees under section 234 E and it was indeed beyond the scope of permissible adjustments contemplated under section 200 A. Cases: Sibia Healthcare Private Limited v/s DCIT(TDS), in I. T. A. No. 90/Asr/2015 G. Indhirani (Smt. ) v. DCIT (2015) 172 TTJ 239 / 41 ITR 439 ( (Chennai)(Trib. ) Rajaguru Spinning Mills Ltd. v. DCIT (2015) 41 ITR 439 (Chennai)(Trib. ) A. Dhakshinamurty v. DCIT (2015) 41 ITR 439 (Chennai)(Trib. ) Padma Textiles v. DCIT (2015) 41 ITR 439 (Chennai)(Trib. ); Murty Lungi Co. v. DCIT(2015) 41 ITR 439 (Chennai)(Trib. ) 58

Issue-22 contd. Issues linked with 234 E Whether fees under section 234 E can be recovered via any other mode prior to year 2015 Chennai ITAT in case of Sibia Healthcare When Section 234 E, clearly says that the assessee is liable to pay fee for the delay in delivery of the statement with regard to tax deducted at source, the assessee shall pay the fee as provided under Section 234 E(1) of the Act before delivery of the statement under Section 200(3) of the Act. If the assessee fails to pay the fee for the periods of delay, then the assessing authority has all the powers to levy fee while processing the statement under Section 200 A of the Act by making adjustment after 01. 06. 2015. However, prior to 01. 06. 2015, the Assessing Officer had every authority to pass an order separately levying fee under Section 234 E of the Act. What is not permissible is that levy of fee under Section 234 E of the Act while processing the statement of tax deducted at source and making adjustment before 01. 06. 2015. It does not mean that the Assessing Officer cannot pass a separate order under Section 234 E of the Act levying fee for the delay in filing the statement as 59 required under Section 200(3) of the Act.

Thank You! 60

2aa96cd6458a7e622ead6bf68f8b738a.ppt