32aba9bcdff01c1e8bcb2b98e27f1242.ppt

- Количество слайдов: 29

ISO 20022 in the US X 9 Webinar Bob Blair June 21, 2016. Copyright © 2016 Accredited Standards Committee X 9, Inc. All rights reserved.

ISO 20022 in the US - Synopsis o ISO 20022 is a set of next generation, financial services messaging standards: o Developed by and addressing the interests of the US as well as others. o These standards are increasingly important in the US and internationally: o For payment systems, securities operations, FX, trade finance and cards. o Efforts are underway to apply ISO 20022 to US payment systems. o In this session we will cover o An introduction to ISO 20022 in the US with an emphasis on payment systems o Resources Copyright © 2016 Accredited Standards Committee X 9, Inc. All rights reserved.

Agenda o Introduction to ISO 20022 o History o Organization o Body of Work o Domains, Message Standards o Versions, variants, harmonization, and interoperability o C 2 B and B 2 B o The US and ISO 20022 o US involvement in ISO and ISO 20022 o Adoption to date o Resources Copyright © 2016 Accredited Standards Committee X 9, Inc. All rights reserved.

Introduction to ISO 20022 is: o o An international standard. A framework for development of financial services messaging specifications (schema). These schema are extensively used today in a variety of contexts. In the US and elsewhere. An open standard covering financial services domains including Cards, FX, Payments, Securities, and Trade Finance Schema are freely available off the internet. o Designed as the next generation of financial services messaging standards. o A data dictionary consistently used across all domains. o Capacities and data specificity, language and character set. o The designated successor to a number of legacy standards e. g. SWIFT MT. Standards Organization TC 68 Financial o Development of ISO 20022 in the early 2000’s, first publication in 2006. o A large number of message specifications are published and in use today. More are in development. o ISO 20022 is important to the US ISO International Services, US Secretariat ISO 20022 RMG o The US has been engaged in development and management of the standard since its inception. o US has implemented or is implementing ISO 20022 schema in a variety of contexts, including for use with US payment systems. Copyright © 2016 Accredited Standards Committee X 9, Inc. All rights reserved.

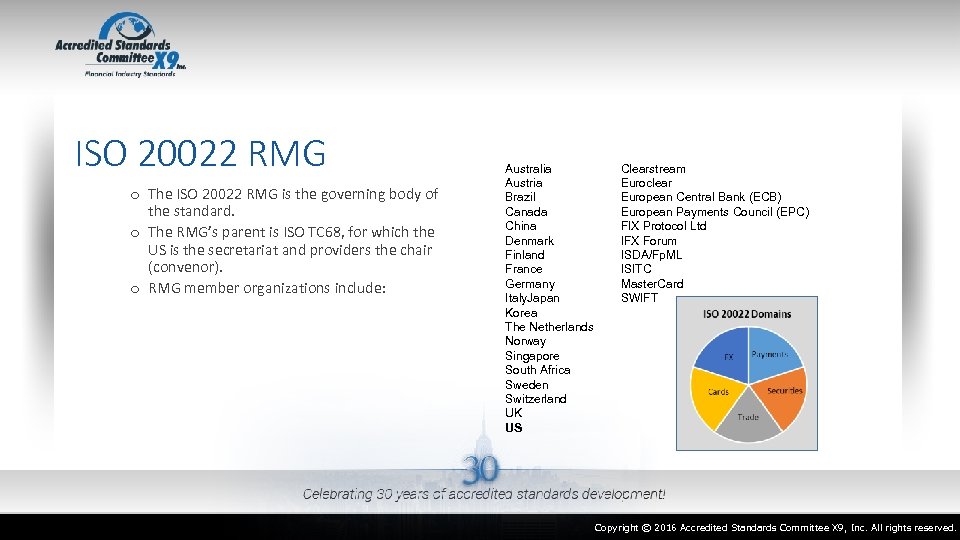

ISO 20022 RMG o The ISO 20022 RMG is the governing body of the standard. o The RMG’s parent is ISO TC 68, for which the US is the secretariat and providers the chair (convenor). o RMG member organizations include: Australia Austria Brazil Canada China Denmark Finland France Germany Italy. Japan Korea The Netherlands Norway Singapore South Africa Sweden Switzerland UK US Clearstream Euroclear European Central Bank (ECB) European Payments Council (EPC) FIX Protocol Ltd IFX Forum ISDA/Fp. ML ISITC Master. Card SWIFT Copyright © 2016 Accredited Standards Committee X 9, Inc. All rights reserved.

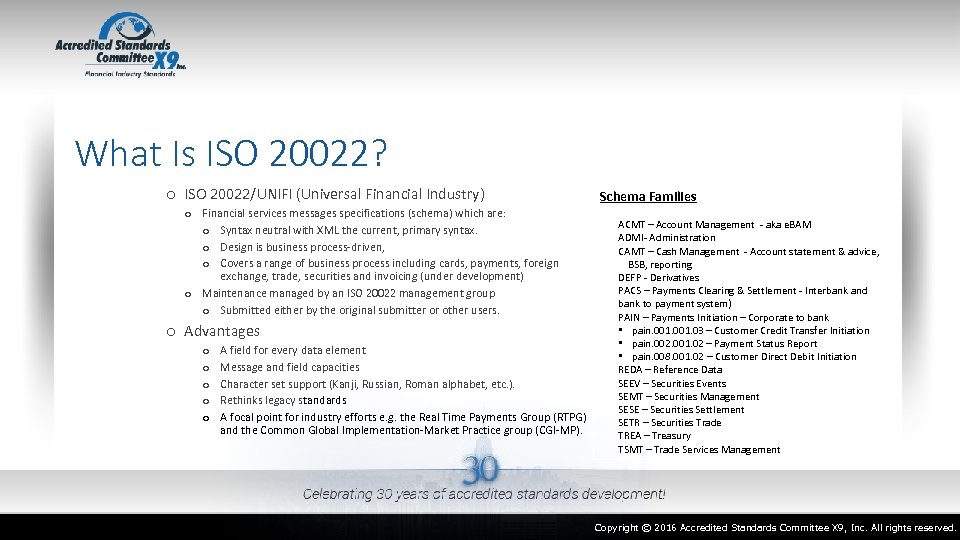

What Is ISO 20022? o ISO 20022/UNIFI (Universal Financial Industry) o Financial services messages specifications (schema) which are: o Syntax neutral with XML the current, primary syntax. o Design is business process-driven, o Covers a range of business process including cards, payments, foreign exchange, trade, securities and invoicing (under development) o Maintenance managed by an ISO 20022 management group o Submitted either by the original submitter or other users. o Advantages o o o A field for every data element Message and field capacities Character set support (Kanji, Russian, Roman alphabet, etc. ). Rethinks legacy standards A focal point for industry efforts e. g. the Real Time Payments Group (RTPG) and the Common Global Implementation-Market Practice group (CGI-MP). Schema Families ACMT – Account Management - aka e. BAM ADMI- Administration CAMT – Cash Management - Account statement & advice, BSB, reporting DEFP - Derivatives PACS – Payments Clearing & Settlement - Interbank and bank to payment system) PAIN – Payments Initiation – Corporate to bank • pain. 001. 03 – Customer Credit Transfer Initiation • pain. 002. 001. 02 – Payment Status Report • pain. 008. 001. 02 – Customer Direct Debit Initiation REDA – Reference Data SEEV – Securities Events SEMT – Securities Management SESE – Securities Settlement SETR – Securities Trade TREA – Treasury TSMT – Trade Services Management Copyright © 2016 Accredited Standards Committee X 9, Inc. All rights reserved.

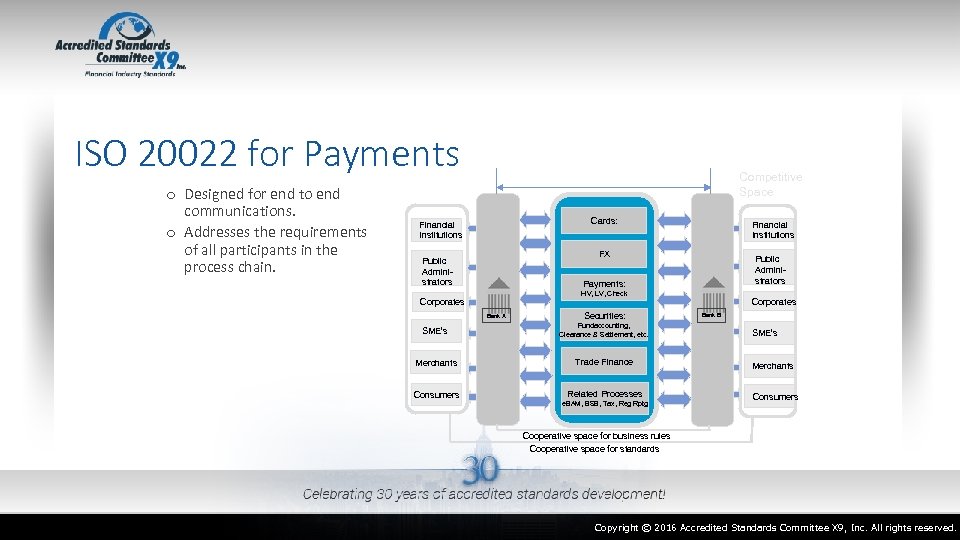

ISO 20022 for Payments o Designed for end to end communications. o Addresses the requirements of all participants in the process chain. Competitive Space Cards: Financial Institutions FX Public Administrators Payments: Bank A Merchants Consumers Public Administrators HV, LV, Check Corporates SME’s Financial Institutions Securities: Fundaccounting, Clearance & Settlement, etc. Corporates Bank B SME’s Trade Finance Merchants Related Processes Consumers e. BAM, BSB, Tax, Reg Rptg Cooperative space for business rules Cooperative space for standards Copyright © 2016 Accredited Standards Committee X 9, Inc. All rights reserved.

ISO 20022 - Payments o Schema standardize communications for: o Parties: Bank to bank and market infrastructure, Corporate to bank o Transaction types: Wires, ACH, Check, and real time payment (faster payments, instant payments). o Business processes: Transact, advise, administer, etc. o Adopted by many banks, payment systems, financial application providers corporates. o Bank to bank and market infrastructure: o The standard for use with SEPA (Single Euro Payment Area) and a number of countries, payment systems globally including major US trading partners are in development or production: o Australia, Canada, China, Eurozone, IPFA, Japan, New Zealand, Singapore, UK and others o Corporate to bank: o In use by many corporates, banks, supported by numerous financial application providers. Piloted 2004 (Rosetta. Net Payment Milestone Program). In full production by 2007. o Addresses requirements for single, standardized bank interface supported by both banks and fintech companies. o Relevant in many contexts: SWIFTNet, IP transmission, online applications, APIs, etc. Copyright © 2016 Accredited Standards Committee X 9, Inc. All rights reserved.

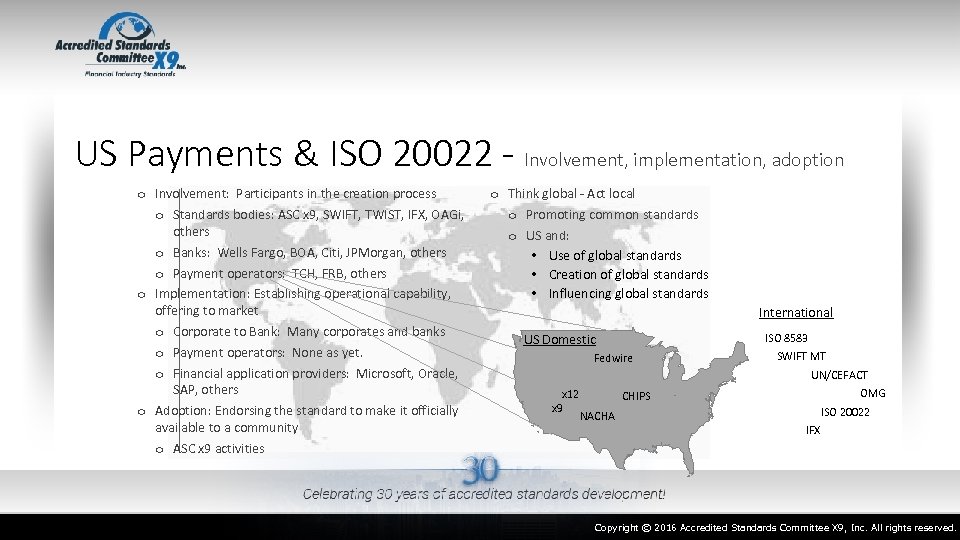

US Payments & ISO 20022 - Involvement, implementation, adoption o Involvement: Participants in the creation process o Standards bodies: ASC x 9, SWIFT, TWIST, IFX, OAGi, others o Banks: Wells Fargo, BOA, Citi, JPMorgan, others o Payment operators: TCH, FRB, others o Implementation: Establishing operational capability, offering to market o Corporate to Bank: Many corporates and banks o Payment operators: None as yet. o Financial application providers: Microsoft, Oracle, SAP, others o Adoption: Endorsing the standard to make it officially available to a community o ASC x 9 activities o Think global - Act local o Promoting common standards o US and: • Use of global standards • Creation of global standards • Influencing global standards International ISO 8583 US Domestic Fedwire SWIFT MT UN/CEFACT x 12 x 9 OMG CHIPS NACHA ISO 20022 IFX Copyright © 2016 Accredited Standards Committee X 9, Inc. All rights reserved.

US Payments Industry and ISO 20022 o Industry Engagement e. g. : US Stakeholders Group, the Remittance Coalition. The Joint Fed/TCH Format Advisory Group Meeting o Wire transfer o Fedwire and CHIPS, o Working together o In the past: Research, business case, industry consultation o At present: Planning in progress for 2020 production o Feature set expansion tbd. For example, status tracking, extended remittance information, other. o ACH o Expansion of remittance information capabilities o Corporate to bank specifications, move to ISO 20022 o Real time payments o TCH developing an ISO 20022 based, real time payment system. Copyright © 2013 Accredited Standards Committee X 9, Inc. All rights reserved.

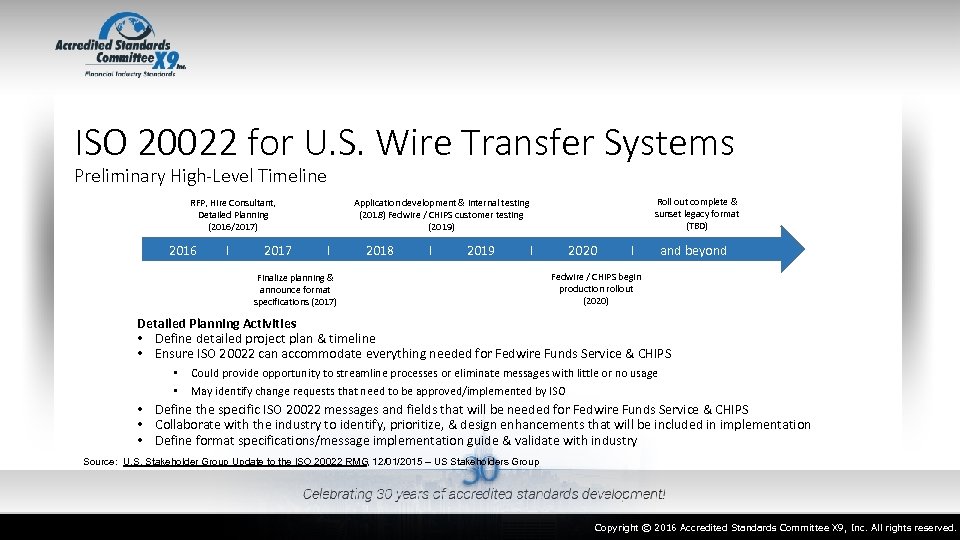

ISO 20022 for U. S. Wire Transfer Systems Preliminary High-Level Timeline RFP, Hire Consultant, Detailed Planning (2016/2017) Roll out complete & sunset legacy format (TBD) Application development & internal testing (2018) Fedwire / CHIPS customer testing (2019) 2016 I 2017 I 2018 I 2019 I 2020 I and beyond Finalize planning & announce format specifications (2017) Fedwire / CHIPS begin production rollout (2020) Detailed Planning Activities • Define detailed project plan & timeline • Ensure ISO 20022 can accommodate everything needed for Fedwire Funds Service & CHIPS • • Could provide opportunity to streamline processes or eliminate messages with little or no usage May identify change requests that need to be approved/implemented by ISO • Define the specific ISO 20022 messages and fields that will be needed for Fedwire Funds Service & CHIPS • Collaborate with the industry to identify, prioritize, & design enhancements that will be included in implementation • Define format specifications/message implementation guide & validate with industry Source: U. S. Stakeholder Group Update to the ISO 20022 RMG, 12/01/2015 – US Stakeholders Group Copyright © 2016 Accredited Standards Committee X 9, Inc. All rights reserved.

ISO 20022 for U. S. Wire Transfer Systems to Adopt ISO 20022 as of 2020 o Adoption of ISO 20022 messages for U. S. wire transfer systems is a strategic imperative and no longer a question of “if” but of “when” and “how” o When? o The Federal Reserve Banks and The Clearing House (TCH) have announced a high-level strategy to begin the conversion to the ISO 20022 message format for both inputs and outputs for their wire transfer systems in 2020. o How? o The Federal Reserve Banks and TCH each plan to implement mandated phases for conversion and a sunset date for their legacy message formats. Source: ISO® 20022 Messaging Standards: Achieving Greater End-to-End Efficiency, 1 NACHA Payments, 4/01/2015 – US Stakeholders Group Copyright © 2016 Accredited Standards Committee X 9, Inc. All rights reserved.

ISO 20022 for U. S. Wire Transfer Systems Strategic reasons to adopt ISO 20022 messages for U. S. wire transfer systems o The U. S. needs to modernize the message formats to meet increasing demands for richer data, more easily comply with evolving regulatory requirements, improve interoperability, and provide enhanced services to clients. o The ISO 20022 format has characteristics that can help the U. S. payments market meet these needs. o Provides richer data o Message and field capacities, a field for every data element. o Promotes domestic & cross-border interoperability o Promotes ease of transacting domestically and globally by using a single, open standard rather than multiple proprietary standards o Contains fields that are common across the suite of ISO 20022 payment messages so that the same information can be carried end to end o Other payments markets, including key U. S. trading partners, are live (e. g. Japan, India, China) or in dev (e. g. Switzerland, Europe, Canada). o Provides opportunities to improve existing processes or add new services o Reduce the need for market practices. o Improve extended remittance information capabilities, other value-added services. o U. S. payment systems could fall behind the rest of the world and be perceived as “outdated” which could: o Degrade the U. S. dollar’s leadership as a global settlement currency o Encourage migration of U. S. dollar clearing offshore, to other currencies, or to emerging payment systems built with new technologies. Source: ISO® 20022 Messaging Standards: Achieving Greater End-to-End Efficiency, 1 NACHA Payments, 4/18/2015 – US Stakeholders Group Copyright © 2016 Accredited Standards Committee X 9, Inc. All rights reserved.

ISO 20022 for US ACH o Current Capabilities o Support for o Extended remittance information in ISO 20022 format o Corporate to bank communication using ISO 20022 (CGI-MP) o Credit transfer March 2016 o Future o Further developments related to above o No specific plans to migrate US ACH to ISO 20022. In review. Source: ISO® 20022 Messaging Standards: Achieving Greater End-to-End Efficiency, 1 NACHA Payments, 4/01/2015 – US Stakeholders Group Copyright © 2016 Accredited Standards Committee X 9, Inc. All rights reserved.

ISO 20022 for US ACH • ISO 20022 ACH solutions currently available in the marketplace • • XML-ACH Remittance Opt-In Program – defines rules for the exchange of ISO 20022 formatted remittance messages for B 2 B transactions in a standardized XML format that supports extensive remittance information. More information on the XML Opt-in program can be found at: https: //www. nacha. org/programs/xml-ach-remittance-xml-ach ISO 20022 Mapping Guide and Tool – provides standardized guidance to facilitate translation of ISO 20022 payment initiation credit transfer payment messages into ACH transactions. ISO Mapping Guide can be found at: https: //www. nacha. org/iso-20022 -mapping • What’s next? • • • Enhancements to ISO 20022 ACH integration solutions in the marketplace. • Additional SEC mappings to be added to the NACHA Mapping Guide Continued industry outreach and collaboration to obtain feedback and document user case studies. Identify additional areas where work today can be leveraged to help move to tomorrow. Continued work with the U. S. ISO 20022 Stakeholder Group on events to educate industry on ISO 20022 and opportunities for low-value payments. U. S. ACH Conversion to an ISO 20022 Format: There are potential triggers that will influence decisions around when, if or how to convert the current ACH format to an ISO 20022 format. Source: ISO® 20022 Messaging Standards: Achieving Greater End-to-End Efficiency, 1 NACHA Payments, 4/18/2015 – US Stakeholders Group Copyright © 2016 Accredited Standards Committee X 9, Inc. All rights reserved.

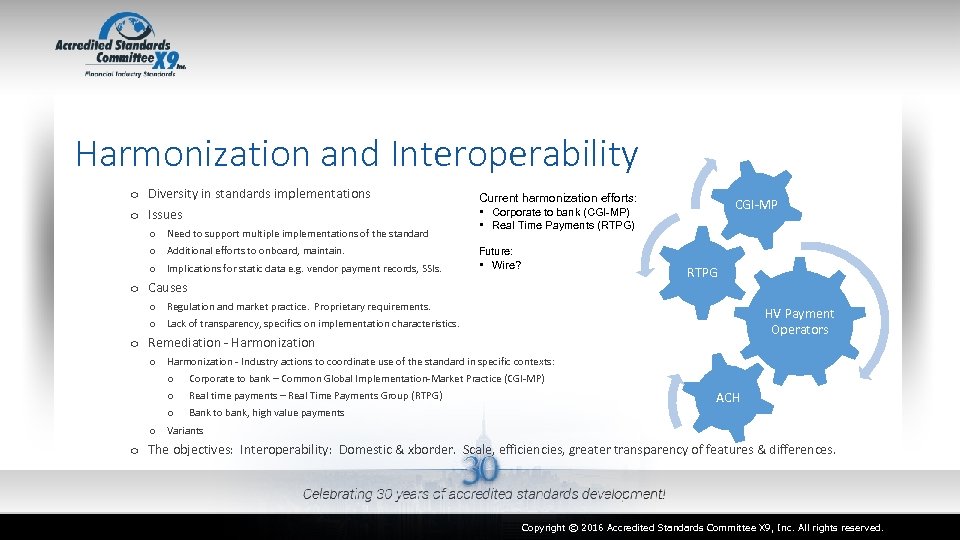

Harmonization and Interoperability o Diversity in standards implementations o Issues o Need to support multiple implementations of the standard o Additional efforts to onboard, maintain. o Implications for static data e. g. vendor payment records, SSIs. Current harmonization efforts: • Corporate to bank (CGI-MP) • Real Time Payments (RTPG) Future: • Wire? CGI-MP RTPG o Causes o Regulation and market practice. Proprietary requirements. o Lack of transparency, specifics on implementation characteristics. HV Payment Operators o Remediation - Harmonization o Harmonization - Industry actions to coordinate use of the standard in specific contexts: o Corporate to bank – Common Global Implementation-Market Practice (CGI-MP) o Real time payments – Real Time Payments Group (RTPG) o Bank to bank, high value payments o Variants ACH o The objectives: Interoperability: Domestic & xborder. Scale, efficiencies, greater transparency of features & differences. Copyright © 2016 Accredited Standards Committee X 9, Inc. All rights reserved.

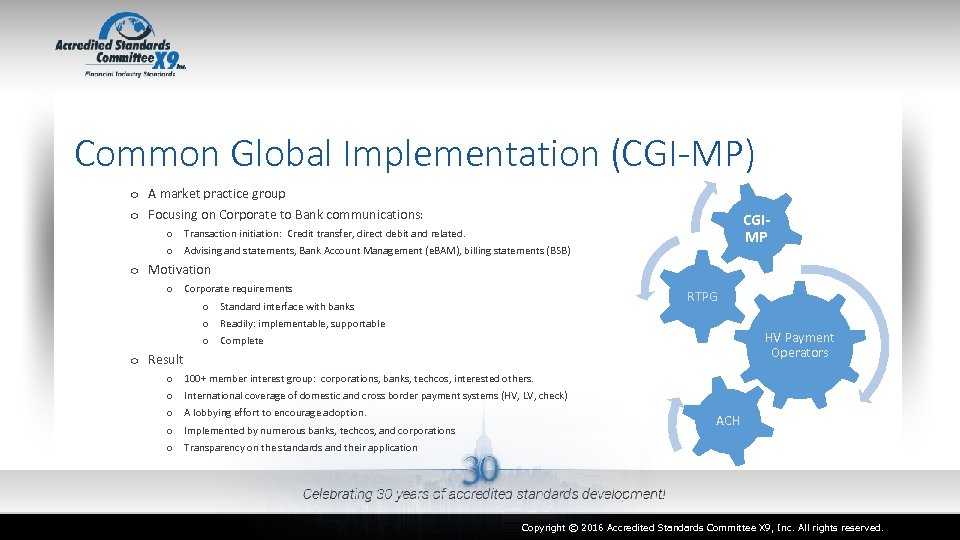

Common Global Implementation (CGI-MP) o A market practice group o Focusing on Corporate to Bank communications: CGIMP o Transaction initiation: Credit transfer, direct debit and related. o Advising and statements, Bank Account Management (e. BAM), billing statements (BSB) o Motivation o Corporate requirements o Standard interface with banks o Readily: implementable, supportable o Complete RTPG HV Payment Operators o Result o o o 100+ member interest group: corporations, banks, techcos, interested others. International coverage of domestic and cross border payment systems (HV, LV, check) A lobbying effort to encourage adoption. Implemented by numerous banks, techcos, and corporations ACH Transparency on the standards and their application Copyright © 2016 Accredited Standards Committee X 9, Inc. All rights reserved.

High Value Payments Harmonization o Harmonization TBD o Industry Needs (my suggestions): CGI-MP o US o Completion of NACHA CGI-MP specs to include wires (corporate to bank). Including message choreography, cases, sample transactions o Specifications for Fedwire and TCH (bank to bank, a common set of specifications) including message choreography, cases, sample transactions o Global o Outreach to other high value payment operators who have implemented or are implementing ISO 20022 for HVP operations. o Optimally o Agree to a common base. o To accommodate diversity, increase transparency: Identify areas for which national variation may be needed (e. g. regulatory reporting), o Address common areas requiring attention e. g. purpose codes. o Encourage SWIFT and correspondent banking progress towards adoption of ISO 20022 for cross border including ACH (e. g. IAT, IPFA) and wires. RTPG HV Payment Operators ACH Copyright © 2016 Accredited Standards Committee X 9, Inc. All rights reserved.

Real Time Payments Group (ISO 20022 RMG) o Formed May 2015 as a subgroup of the ISO 20022 RMG o Created with the objective of: CGI-MP o Develop market practice guidelines for the usage of ISO 20022 for real-time payments. o Document a harmonized and consistent view of ISO 20022 business processes, message components, elements and data content across multiple markets. The work is intended to be flexible, open and transparent and incorporate regional differences & market practices. RTPG o Chaired by the US: Roy De. Cicco o Harmonization status: o Pacs 008 and 002 were presented for approval December 2015 and have been published on iso 20022. org. . o Pacs 004 is with the full RTPG for their review and approval. Work on Pain 013, 014 was considered and deferred. o The RTPG has identified a potential new Business Justification area in the Request For Information space. HV Payment Operators ACH Copyright © 2016 Accredited Standards Committee X 9, Inc. All rights reserved.

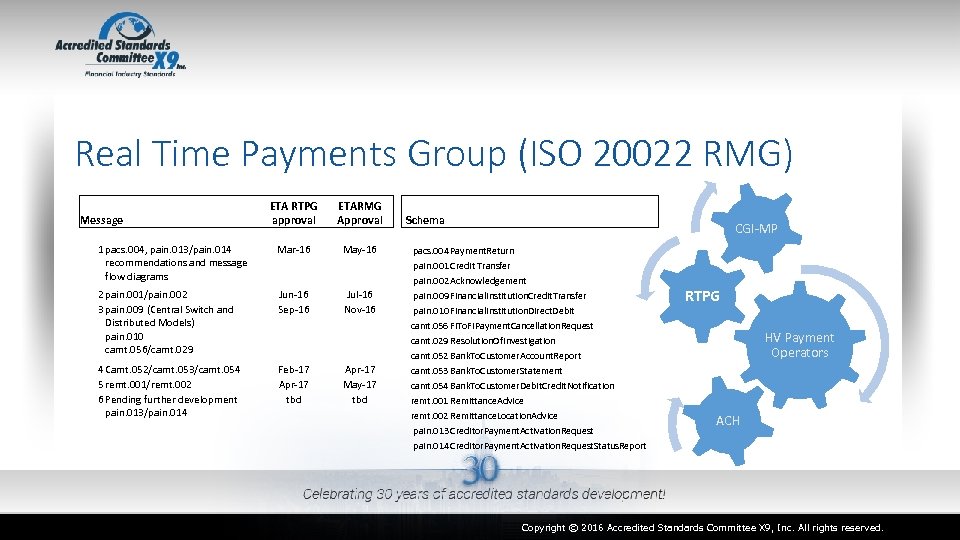

Real Time Payments Group (ISO 20022 RMG) ETA RTPG approval ETARMG Approval 1 pacs. 004, pain. 013/pain. 014 recommendations and message flow diagrams Mar-16 May-16 2 pain. 001/pain. 002 3 pain. 009 (Central Switch and Distributed Models) pain. 010 camt. 056/camt. 029 Jun-16 Sep-16 Jul-16 Nov-16 4 Camt. 052/camt. 053/camt. 054 5 remt. 001/remt. 002 6 Pending further development pain. 013/pain. 014 Feb-17 Apr-17 tbd Message Apr-17 May-17 tbd Schema pacs. 004 Payment. Return pain. 001 Credit Transfer pain. 002 Acknowledgement pain. 009 Financial. Institution. Credit. Transfer pain. 010 Financial. Institution. Direct. Debit camt. 056 FITo. FIPayment. Cancellation. Request camt. 029 Resolution. Of. Investigation camt. 052 Bank. To. Customer. Account. Report camt. 053 Bank. To. Customer. Statement camt. 054 Bank. To. Customer. Debit. Credit. Notification remt. 001 Remittance. Advice remt. 002 Remittance. Location. Advice pain. 013 Creditor. Payment. Activation. Request pain. 014 Creditor. Payment. Activation. Request. Status. Report CGI-MP RTPG HV Payment Operators ACH Copyright © 2016 Accredited Standards Committee X 9, Inc. All rights reserved.

A Vision for the Future… o US payment systems to: o Use a single, complete set of coordinated messaging standards o Common features where needed to include: o Consistent, singular support for extended remittance information o Communication o Format: Base, options o With and without payment o References o Status tracking o End to end design: Addressing the requirements of all process participants: regulators, end users, intermediaries o Corporate to bank: Industry based definitions (and supporting documentation) for all transaction types and related processes o Documentation and specifications publically and freely available. o Support from enablers: financial application providers, others. o Bank to bank: o Common messaging standards o Domestic interoperability o Cross border interoperability. Copyright © 2016 Accredited Standards Committee X 9, Inc. All rights reserved.

The Importance of Industry and Action o Advocacy counts o Sweat equity counts o Voice of the customer Copyright © 2016 Accredited Standards Committee X 9, Inc. All rights reserved.

Resources - The place to start: • Remittance Coalition – Vendor Forum: An inventory of ISO 20022 Resources • • A compilation with synopsis of primary ISO 20022 resources related to the US payments industry https: //fedpaymentsimprovement. org/wp-content/uploads/understanding-iso-20022. pdf • NACHA • ACH-ISO 20022 Mapping Guide webinar and fact sheet • • • https: //www. nacha. org/iso-20022 -mapping The mapping guide was last published March 2016), addresses corporate to bank credit transfer (pain 001) for primary NACHA payment types, and is CGI-MP based. An Introduction to ISO 20022 for U. S. Financial Institutions • • • https: //www. nacha. org/system/files/resources/NACHA_ISO 20022 White. Paper. Final_0. pdf Good introduction to the standard with an emphasis on US payment systems Relevant to readers in addition to banks. • ISO 20022 Adoption Reporting • • Implementations of ISO 20022 standards, in planning or production, within the US and internationally. https: //www. iso 20022. org/news/iso-20022 -adoption-mapp-and-report Copyright © 2016 Accredited Standards Committee X 9, Inc. All rights reserved.

Resources - The place to start: • Remittance Coalition – Vendor Forum: An inventory of ISO 20022 Resources: Excerpt Contents RESOURCE LOCATOR. . . . . . 3 GENERAL ISO 20022 RESOURCES. . . . 5 RESOURCES FOR USING ISO 20022 IN THE ACH NETWORK: . . . 8 RESOURCES FOR USING ISO 20022 FOR WIRE TRANSFERS. . . 10 RESOURCES FOCUSED ON GLOBAL IMPLEMENTATION OF ISO 20022. . . . 12 General Topic Specific Reference(s) GENERAL ISO 20022 RESOURCES: • ISO 20022: The Official Site • Webinar - ISO 20022 Payment Messages in the U. S. • SWIFT My. Standards • Remittance Standards Inventory RESOURCES FOR USING ISO 20022 IN THE ACH NETWORK: • ISO 20022 – Messages Specifications RESOURCES FOR USING ISO 20022 FOR WIRE TRANSFERS: • ISO 20022 – Payment Messages Specifications Copyright © 2016 Accredited Standards Committee X 9, Inc. All rights reserved.

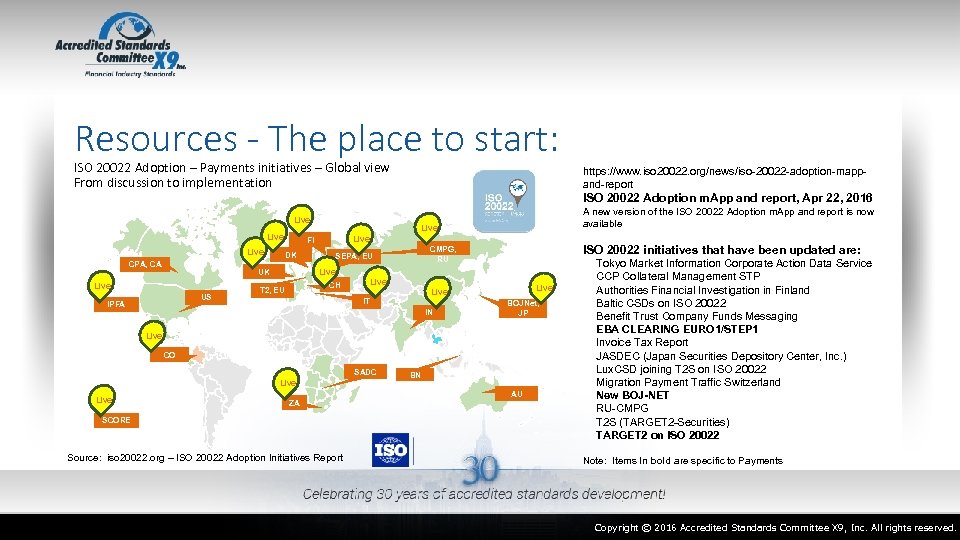

Resources - The place to start: ISO 20022 Adoption – Payments initiatives – Global view From discussion to implementation https: //www. iso 20022. org/news/iso-20022 -adoption-mappand-report ISO 20022 Adoption m. App and report, Apr 22, 2016 Live CPA, CA US IPFA CH T 2, EU ISO 20022 initiatives that have been updated are: CMPG, RU SEPA, EU Live UK Live FI DK A new version of the ISO 20022 Adoption m. App and report is now available Live IT IN BOJNet, JP Live CO SADC Live BN AU ZA SCORE Source: iso 20022. org – ISO 20022 Adoption Initiatives Report Tokyo Market Information Corporate Action Data Service CCP Collateral Management STP Authorities Financial Investigation in Finland Baltic CSDs on ISO 20022 Benefit Trust Company Funds Messaging EBA CLEARING EURO 1/STEP 1 Invoice Tax Report JASDEC (Japan Securities Depository Center, Inc. ) Lux. CSD joining T 2 S on ISO 20022 Migration Payment Traffic Switzerland New BOJ-NET RU-CMPG T 2 S (TARGET 2 -Securities) TARGET 2 on ISO 20022 Note: Items In bold are specific to Payments Copyright © 2016 Accredited Standards Committee X 9, Inc. All rights reserved.

Resources – An extended list: • The US Stakeholders Group: • Federal Reserve System - Resource Center for Adoption of ISO 20022 for Wire Transfers & ACH • • https: //fedpaymentsimprovement. org/payments-efficiency/iso-20022/ The Clearing House: https: //www. theclearinghouse. org/ NACHA - ISO 20022 Resource Center, 2015: https: //www. nacha. org/ISOresources ASC x 9: https: //x 9. org/ • ISO 20022 - Schema, newsletters, publications and presentations: https: //www. iso 20022. org/ • Remittance Coalition: ISO 20022 • https: //fedpaymentsimprovement. org/payments-efficiency/remittance-coalition/vendor-forum/ • CGI-MP - Corporate to bank schema mapped to US and global payment systems, documentation: • https: //corporates. swift. com/en/cgi-mission-and-scope • SWIFT – SWIFT standards and documentation, online tools: • https: //www. swift. com/standards/about-iso-20022 • Ifxforum – Understanding ISO 20022 remittance messages: • http: //www. ifxforum. org/docs/Understanding_the_ISO_20022_Stand-Alone_Remittance_Messages. pdf • And social media (search for ISO 20022): Youtube, Slideshare Copyright © 2016 Accredited Standards Committee X 9, Inc. All rights reserved.

Questions? And some questions for you: “What are YOU going to do about it? ” When will we “connect the dots” for cross border interoperability? SWIFT? High Value payments (wires)? Low Value payments (IPFA, ACH IAT)? Copyright © 2016 Accredited Standards Committee X 9, Inc. All rights reserved.

Speaker Bio - Bob Blair Bob is a consultant to X 9, formerly a member and board alternate. He has over 30 years’ experience as both provider and user of treasury, payments and cash management. He spent many years with J. P. Morgan Chase where he was most recently responsible for wholesale channel management (online, files etc. for US and the Americas) and for SWIFT (globally). Present and former industry positions include: • ASC x 9 - Currently Standards Analyst. Former board alternate. • ISO 20022 – Currently: Chair of the Communications Group (i. e. publisher of the newsletter). Formerly: Vice Convenor of the ISO 20022 Relationship Management Group (RMG) and the ISO 20022 Payment Standards Evaluation Group. • Other • SWIFT – Member of the CAG (Corporate Advisory Group) and various other committees. • Canadian Payments Association (CPA) - Standards Advisory Group advising CPA on payment market adoption of ISO 20022. • Member/contributor to various US payments committees on: messaging standards related matters, notably IO 20022; extended remittance information; digital security and other matters. • Common Global Implementation-Market Practice – Founding and plenary member. • Email: bob. blair@x 9. org Copyright © 2016 Accredited Standards Committee X 9, Inc. All rights reserved.

Copyright © 2016 Accredited Standards Committee X 9, Inc. All rights reserved.

32aba9bcdff01c1e8bcb2b98e27f1242.ppt