3b71594f02039fbfe4fff8a73ae6c741.ppt

- Количество слайдов: 39

ISLAMIC PRIVATE EQUITY, DERIVATIVES AND STRUCTURED PRODUCTS & INVESTMENTS Dr. Mohd Daud Bakar President/CEO Amanie Business Solutions

ISLAMIC PRIVATE EQUITY, DERIVATIVES AND STRUCTURED PRODUCTS & INVESTMENTS Dr. Mohd Daud Bakar President/CEO Amanie Business Solutions

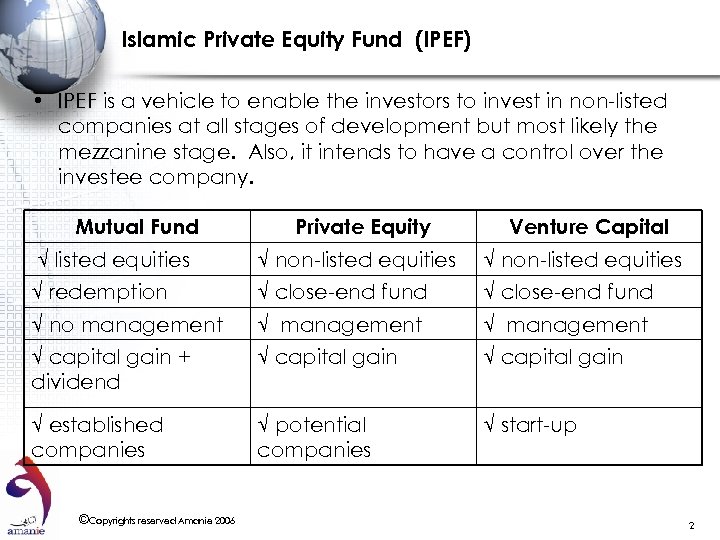

Islamic Private Equity Fund (IPEF) • IPEF is a vehicle to enable the investors to invest in non-listed companies at all stages of development but most likely the mezzanine stage. Also, it intends to have a control over the investee company. Mutual Fund Private Equity Venture Capital √ listed equities √ non-listed equities √ redemption √ close-end fund √ no management √ capital gain + dividend √ capital gain √ established companies √ potential companies √ start-up ©Copyrights reserved Amanie 2006 2

Islamic Private Equity Fund (IPEF) • IPEF is a vehicle to enable the investors to invest in non-listed companies at all stages of development but most likely the mezzanine stage. Also, it intends to have a control over the investee company. Mutual Fund Private Equity Venture Capital √ listed equities √ non-listed equities √ redemption √ close-end fund √ no management √ capital gain + dividend √ capital gain √ established companies √ potential companies √ start-up ©Copyrights reserved Amanie 2006 2

Shari’ah Issues of IPEF • Investment guidelines-listed vs. non listed companies. • Controlling position and the tolerable ratio of conventional leverage. • Co-investment in the investee companies. ©Copyrights reserved Amanie 2006 3

Shari’ah Issues of IPEF • Investment guidelines-listed vs. non listed companies. • Controlling position and the tolerable ratio of conventional leverage. • Co-investment in the investee companies. ©Copyrights reserved Amanie 2006 3

Structured Finance : An Overview • Encompasses all advance private and public arrangements that serve to efficiently refinance and hedge any profitable economic activity beyond the scope of conventional forms on-balance sheet securities in the effort to lower the cost of capital and to mitigate agency costs of market impediments on liquidity. • Most structured investment: i. Combine traditional assets classes with contingent claims such as risk transfer derivatives and/on derivative claims on commodities, currencies or receivables from other reference assets, or … ©Copyrights reserved Amanie 2006 4

Structured Finance : An Overview • Encompasses all advance private and public arrangements that serve to efficiently refinance and hedge any profitable economic activity beyond the scope of conventional forms on-balance sheet securities in the effort to lower the cost of capital and to mitigate agency costs of market impediments on liquidity. • Most structured investment: i. Combine traditional assets classes with contingent claims such as risk transfer derivatives and/on derivative claims on commodities, currencies or receivables from other reference assets, or … ©Copyrights reserved Amanie 2006 4

Cont’d ii. • Replicate traditional synthetication. assets classes through The premier form of structured finance is capital market-based risk transfer whose two major asset classes include asset securitization and credit derivative transactions. ©Copyrights reserved Amanie 2006 5

Cont’d ii. • Replicate traditional synthetication. assets classes through The premier form of structured finance is capital market-based risk transfer whose two major asset classes include asset securitization and credit derivative transactions. ©Copyrights reserved Amanie 2006 5

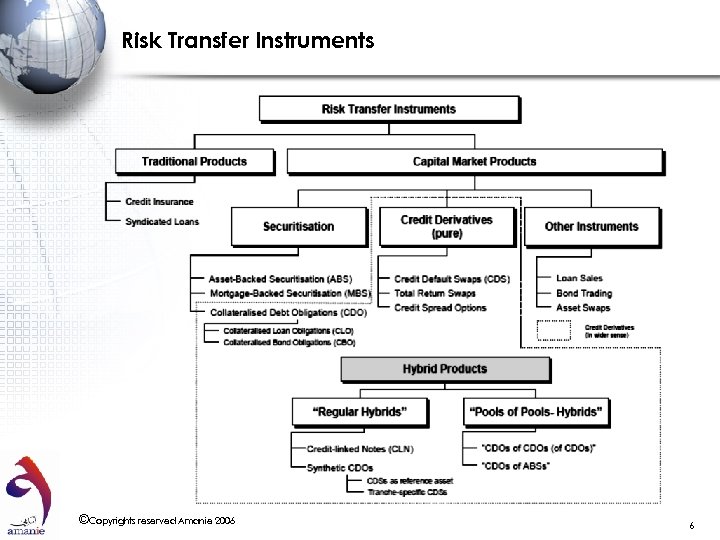

Risk Transfer Instruments ©Copyrights reserved Amanie 2006 6

Risk Transfer Instruments ©Copyrights reserved Amanie 2006 6

Illustration of Securitisation • Via securitisation, the issuer raises funds by issuing certificates of ownership as pledge against existing or future cash flows from an investment pool of financial assets in the bid to increase the issuer’s liquidity position without increasing the capital base or by selling these reference assets to a SPV, which subsequently issues debt to investors to fund the purchase. • Apart from being a flexible efficient source of funding, the off-balance sheet treatment of securitisation also serves : - ©Copyrights reserved Amanie 2006 7

Illustration of Securitisation • Via securitisation, the issuer raises funds by issuing certificates of ownership as pledge against existing or future cash flows from an investment pool of financial assets in the bid to increase the issuer’s liquidity position without increasing the capital base or by selling these reference assets to a SPV, which subsequently issues debt to investors to fund the purchase. • Apart from being a flexible efficient source of funding, the off-balance sheet treatment of securitisation also serves : - ©Copyrights reserved Amanie 2006 7

Cont’d i. To reduce both economic cost of capital and regulatory minimum capital requirements as a balance sheet restructuring tool. ii. To diversify asset exposures • Credit derivatives, on the other hand, are financial instruments that isolate and transfer credit risk. Based on derivatives principle, they involved the sale of contingent credit protection for pre-defined credit events of lending transactions. • In their basic concepts, credit derivatives sever the link between the loan origination associated credit risk, but leave the original borrower-creditor relationship intact. ©Copyrights reserved Amanie 2006 8

Cont’d i. To reduce both economic cost of capital and regulatory minimum capital requirements as a balance sheet restructuring tool. ii. To diversify asset exposures • Credit derivatives, on the other hand, are financial instruments that isolate and transfer credit risk. Based on derivatives principle, they involved the sale of contingent credit protection for pre-defined credit events of lending transactions. • In their basic concepts, credit derivatives sever the link between the loan origination associated credit risk, but leave the original borrower-creditor relationship intact. ©Copyrights reserved Amanie 2006 8

Cont’d • The protection buyer of a credit derivatives hedges specific risk, in return for periodic premium payments to the protection seller, who assumes the credit of a financial contract isolated from the underlying transaction. • Credit derivatives include among others; – Credit Default Swap – Total Return Swap – Credit Spread Options – Collateralised debt Obligations ©Copyrights reserved Amanie 2006 9

Cont’d • The protection buyer of a credit derivatives hedges specific risk, in return for periodic premium payments to the protection seller, who assumes the credit of a financial contract isolated from the underlying transaction. • Credit derivatives include among others; – Credit Default Swap – Total Return Swap – Credit Spread Options – Collateralised debt Obligations ©Copyrights reserved Amanie 2006 9

Structured Product Under SC’s Guidelines • Any investment product that falls within the definition of “securities” under SCA which provides the holder with an economic, legal or the interest in another asset (“underlying asset”) and derives its value by reference to the price or value of the underlying asset. • The term “underlying asset” means any security, index, currency, commodity or other assets or combination of such asset. ©Copyrights reserved Amanie 2006 10

Structured Product Under SC’s Guidelines • Any investment product that falls within the definition of “securities” under SCA which provides the holder with an economic, legal or the interest in another asset (“underlying asset”) and derives its value by reference to the price or value of the underlying asset. • The term “underlying asset” means any security, index, currency, commodity or other assets or combination of such asset. ©Copyrights reserved Amanie 2006 10

Cont’d • These structured product include: i. Bond Options ii. Credit Default Swaps iii. Credit Options iv. Total Return Swaps v. Equity Swaps/ Options ©Copyrights reserved Amanie 2006 11

Cont’d • These structured product include: i. Bond Options ii. Credit Default Swaps iii. Credit Options iv. Total Return Swaps v. Equity Swaps/ Options ©Copyrights reserved Amanie 2006 11

Interest/Profit Rate Swap/Exchange • Definition: Involves exchanging (swapping) interest payments on Floating-rate debt for interest payments on Fixed-rate debt, with both payments in the same currency. • Reason: One party actually wants fixed rate debt, but can get a better deal on floating rate; the other party wants floating rate. Both parties can gain by swapping loan payments, usually through a bank as a financial intermediary which charges a fee to broker the transaction. ©Copyrights reserved Amanie 2006 12

Interest/Profit Rate Swap/Exchange • Definition: Involves exchanging (swapping) interest payments on Floating-rate debt for interest payments on Fixed-rate debt, with both payments in the same currency. • Reason: One party actually wants fixed rate debt, but can get a better deal on floating rate; the other party wants floating rate. Both parties can gain by swapping loan payments, usually through a bank as a financial intermediary which charges a fee to broker the transaction. ©Copyrights reserved Amanie 2006 12

Features Of Interest / Profit Swap • A swap of fixed-for-floating interest rate. • A master agreement for fixed rate interest. • A floating or variable rate which is reset periodically. • A set-off (muqasah) exercise at every reset time to swap a fixed-for-floating interest rate. • Floating interest rate is to based on a certain benchmark. • The counterparty making fixed rate payments in a swap is predominantly the less creditworthy participant. ©Copyrights reserved Amanie 2006 13

Features Of Interest / Profit Swap • A swap of fixed-for-floating interest rate. • A master agreement for fixed rate interest. • A floating or variable rate which is reset periodically. • A set-off (muqasah) exercise at every reset time to swap a fixed-for-floating interest rate. • Floating interest rate is to based on a certain benchmark. • The counterparty making fixed rate payments in a swap is predominantly the less creditworthy participant. ©Copyrights reserved Amanie 2006 13

Proposed Islamic Profit Rate Swap • The above characteristics of the conventional interest rate swap are to be maintained. • Therefore, it must consist of three important documents: i. Master Fixed – Rate Transaction. ii. Master Revolving Floating – Rate iii. Settlement Agreement. ©Copyrights reserved Amanie 2006 Transaction. 14

Proposed Islamic Profit Rate Swap • The above characteristics of the conventional interest rate swap are to be maintained. • Therefore, it must consist of three important documents: i. Master Fixed – Rate Transaction. ii. Master Revolving Floating – Rate iii. Settlement Agreement. ©Copyrights reserved Amanie 2006 Transaction. 14

Cont’d • The challenge in Islamic finance is to create a mechanism which is floating and revolving to assist the parties in their swap transactions I. e. to give floating rate profit to the party who seeks to match their floating payment obligations and to give fixed rate profit to the party who seeks to match their fixed payment obligations (in addition to achieve ‘Quality Spread Differential’ that is spread between fixed interest rate and variable interest rate. ©Copyrights reserved Amanie 2006 15

Cont’d • The challenge in Islamic finance is to create a mechanism which is floating and revolving to assist the parties in their swap transactions I. e. to give floating rate profit to the party who seeks to match their floating payment obligations and to give fixed rate profit to the party who seeks to match their fixed payment obligations (in addition to achieve ‘Quality Spread Differential’ that is spread between fixed interest rate and variable interest rate. ©Copyrights reserved Amanie 2006 15

ISLAMIC PROFIT RATE SWAP: AN OVERVIEW (A HYPOTHETICAL CASE) • ABC Bank has floating rate funding and fixed rate investment. In order to match funding rates with return rate (investment), ABC Bank may decide to enter into an Islamic Profit Rate Swap with a counter-party. Stage 1: Fixed Profit Rate • Step 1: XYZ Bank (counter party) sells an asset to ABC Bank on Murabahah basis at a selling price that comprises both principal and profit margin to be paid upon completion of subsequent transaction I. e. ©Copyrights reserved Amanie 2006 16

ISLAMIC PROFIT RATE SWAP: AN OVERVIEW (A HYPOTHETICAL CASE) • ABC Bank has floating rate funding and fixed rate investment. In order to match funding rates with return rate (investment), ABC Bank may decide to enter into an Islamic Profit Rate Swap with a counter-party. Stage 1: Fixed Profit Rate • Step 1: XYZ Bank (counter party) sells an asset to ABC Bank on Murabahah basis at a selling price that comprises both principal and profit margin to be paid upon completion of subsequent transaction I. e. ©Copyrights reserved Amanie 2006 16

Cont’d • Step 2: An Asset Purchase Agreement is executed by the two parties. • Illustration: Suppose the notional principal amount intended is RM 500, 000 and the fixed mark-up is 5. 75% for 2 years. The fixed mark-up profit rate amount is payable every 6 months for 2 years (RM 500, 000 x 5. 75% x 180/365 = RM 14, 178. 08) ©Copyrights reserved Amanie 2006 17

Cont’d • Step 2: An Asset Purchase Agreement is executed by the two parties. • Illustration: Suppose the notional principal amount intended is RM 500, 000 and the fixed mark-up is 5. 75% for 2 years. The fixed mark-up profit rate amount is payable every 6 months for 2 years (RM 500, 000 x 5. 75% x 180/365 = RM 14, 178. 08) ©Copyrights reserved Amanie 2006 17

Cont’d Stage 2: Floating Profit Rate • Step 1: Just prior to 6 months, ABC Bank will sell an asset to XYZ Bank at a selling price of RM 500, 000 plus a markup based on CURRENT profit rate (agreed spread plus current benchmark). An Asset Sale Agreement is executed by the two parties. • Step II: Payment of selling price by both ABC and XYZ Bank is netted-off. • Step III: The net difference is profit, and is paid to the receiving party as the case may be spelt out in the settlement agreement. ©Copyrights reserved Amanie 2006 18

Cont’d Stage 2: Floating Profit Rate • Step 1: Just prior to 6 months, ABC Bank will sell an asset to XYZ Bank at a selling price of RM 500, 000 plus a markup based on CURRENT profit rate (agreed spread plus current benchmark). An Asset Sale Agreement is executed by the two parties. • Step II: Payment of selling price by both ABC and XYZ Bank is netted-off. • Step III: The net difference is profit, and is paid to the receiving party as the case may be spelt out in the settlement agreement. ©Copyrights reserved Amanie 2006 18

Cont’d Stage 3 • Floating Profit Rate (Stage II) is repeated every 6 months until maturity. ©Copyrights reserved Amanie 2006 19

Cont’d Stage 3 • Floating Profit Rate (Stage II) is repeated every 6 months until maturity. ©Copyrights reserved Amanie 2006 19

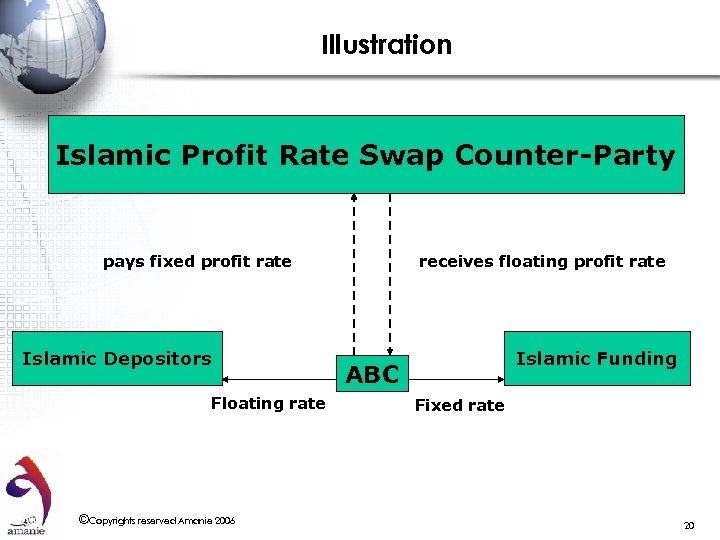

Illustration Islamic Profit Rate Swap Counter-Party pays fixed profit rate Islamic Depositors Floating rate ©Copyrights reserved Amanie 2006 receives floating profit rate Islamic Funding ABC Fixed rate 20

Illustration Islamic Profit Rate Swap Counter-Party pays fixed profit rate Islamic Depositors Floating rate ©Copyrights reserved Amanie 2006 receives floating profit rate Islamic Funding ABC Fixed rate 20

Equity Linked Notes (ELN) • ELN is an instrument that provides investors fixed income like principal protection together with equity market upside exposure. • An ELN is structured by combining the economics of a long call option on equity with along discount bond position. As for Islamic Equity Linked Notes, two requirements are to be met: – Equity must be Shari’ah compliant – Option must be structured under the ‘urbun concept i. e. down payment, earnest money i. e. this option cannot be traded (at least from International Shari`ah Standard. ©Copyrights reserved Amanie 2006 21

Equity Linked Notes (ELN) • ELN is an instrument that provides investors fixed income like principal protection together with equity market upside exposure. • An ELN is structured by combining the economics of a long call option on equity with along discount bond position. As for Islamic Equity Linked Notes, two requirements are to be met: – Equity must be Shari’ah compliant – Option must be structured under the ‘urbun concept i. e. down payment, earnest money i. e. this option cannot be traded (at least from International Shari`ah Standard. ©Copyrights reserved Amanie 2006 21

Cont’d • The investment structure generally provides 100% Capital Principle Protection. The coupon or final payment at maturity is determined by the appreciation of the underlying equity. • The instrument is appropriate for conservative equity investors or fixed income investors who desire equity exposure with controlled risk. ©Copyrights reserved Amanie 2006 22

Cont’d • The investment structure generally provides 100% Capital Principle Protection. The coupon or final payment at maturity is determined by the appreciation of the underlying equity. • The instrument is appropriate for conservative equity investors or fixed income investors who desire equity exposure with controlled risk. ©Copyrights reserved Amanie 2006 22

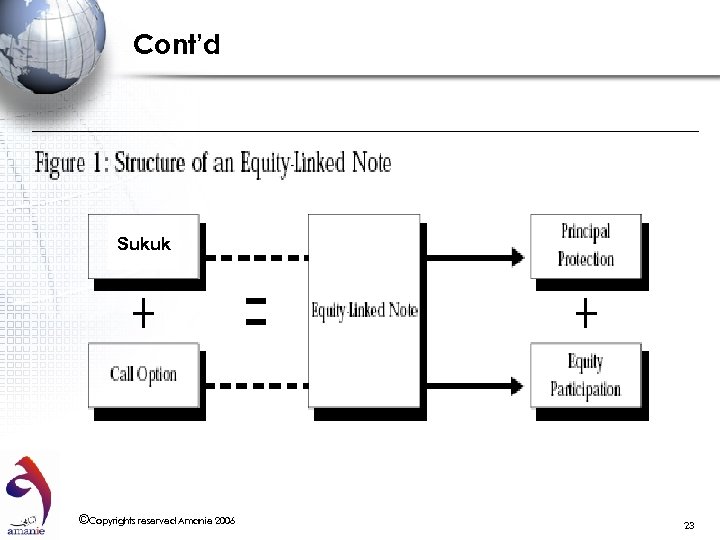

Cont’d Sukuk ©Copyrights reserved Amanie 2006 23

Cont’d Sukuk ©Copyrights reserved Amanie 2006 23

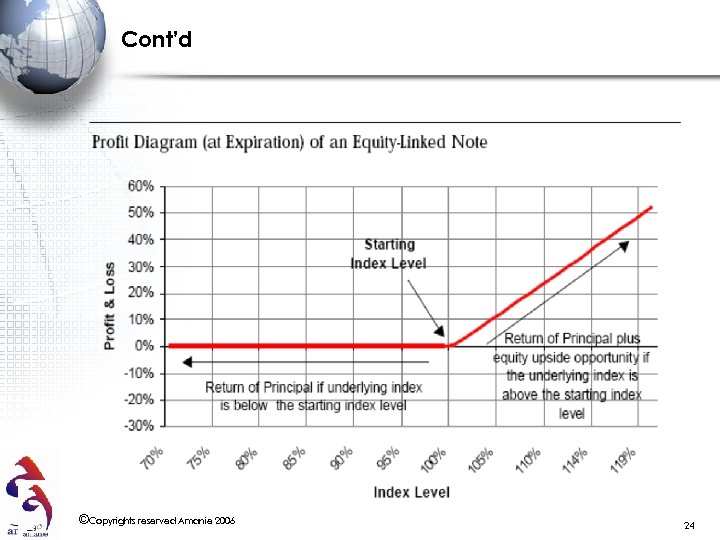

Cont’d ©Copyrights reserved Amanie 2006 24

Cont’d ©Copyrights reserved Amanie 2006 24

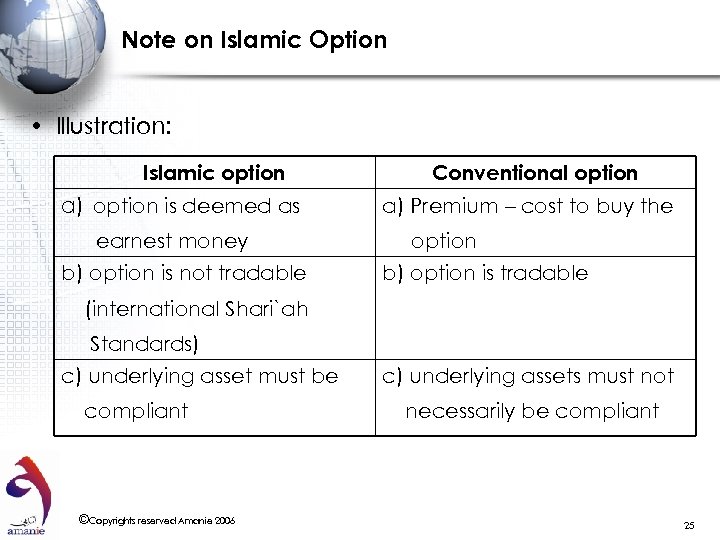

Note on Islamic Option • Illustration: Islamic option a) option is deemed as earnest money b) option is not tradable Conventional option a) Premium – cost to buy the option b) option is tradable (international Shari`ah Standards) c) underlying asset must be compliant ©Copyrights reserved Amanie 2006 c) underlying assets must not necessarily be compliant 25

Note on Islamic Option • Illustration: Islamic option a) option is deemed as earnest money b) option is not tradable Conventional option a) Premium – cost to buy the option b) option is tradable (international Shari`ah Standards) c) underlying asset must be compliant ©Copyrights reserved Amanie 2006 c) underlying assets must not necessarily be compliant 25

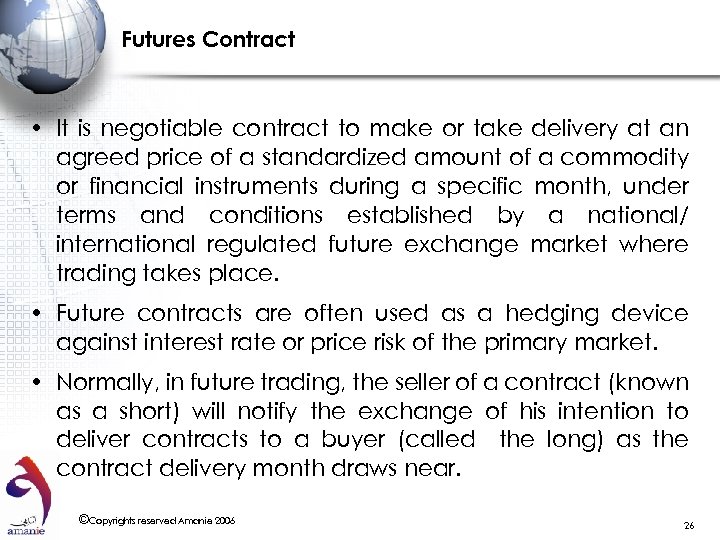

Futures Contract • It is negotiable contract to make or take delivery at an agreed price of a standardized amount of a commodity or financial instruments during a specific month, under terms and conditions established by a national/ international regulated future exchange market where trading takes place. • Future contracts are often used as a hedging device against interest rate or price risk of the primary market. • Normally, in future trading, the seller of a contract (known as a short) will notify the exchange of his intention to deliver contracts to a buyer (called the long) as the contract delivery month draws near. ©Copyrights reserved Amanie 2006 26

Futures Contract • It is negotiable contract to make or take delivery at an agreed price of a standardized amount of a commodity or financial instruments during a specific month, under terms and conditions established by a national/ international regulated future exchange market where trading takes place. • Future contracts are often used as a hedging device against interest rate or price risk of the primary market. • Normally, in future trading, the seller of a contract (known as a short) will notify the exchange of his intention to deliver contracts to a buyer (called the long) as the contract delivery month draws near. ©Copyrights reserved Amanie 2006 26

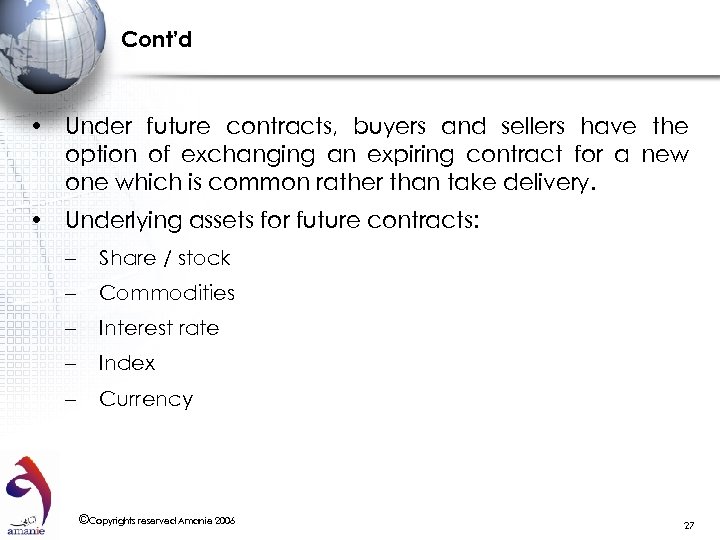

Cont’d • Under future contracts, buyers and sellers have the option of exchanging an expiring contract for a new one which is common rather than take delivery. • Underlying assets for future contracts: – Share / stock – Commodities – Interest rate – Index – Currency ©Copyrights reserved Amanie 2006 27

Cont’d • Under future contracts, buyers and sellers have the option of exchanging an expiring contract for a new one which is common rather than take delivery. • Underlying assets for future contracts: – Share / stock – Commodities – Interest rate – Index – Currency ©Copyrights reserved Amanie 2006 27

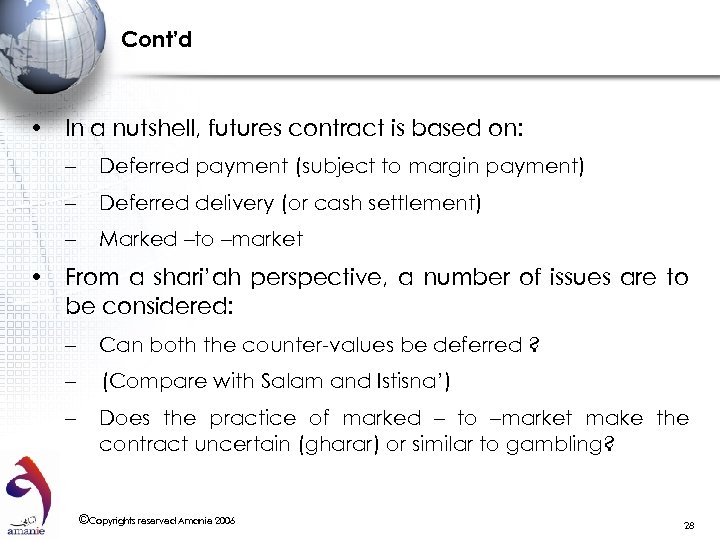

Cont’d • In a nutshell, futures contract is based on: – Deferred payment (subject to margin payment) – Deferred delivery (or cash settlement) – Marked –to –market • From a shari’ah perspective, a number of issues are to be considered: – Can both the counter-values be deferred ? – (Compare with Salam and Istisna’) – Does the practice of marked – to –market make the contract uncertain (gharar) or similar to gambling? ©Copyrights reserved Amanie 2006 28

Cont’d • In a nutshell, futures contract is based on: – Deferred payment (subject to margin payment) – Deferred delivery (or cash settlement) – Marked –to –market • From a shari’ah perspective, a number of issues are to be considered: – Can both the counter-values be deferred ? – (Compare with Salam and Istisna’) – Does the practice of marked – to –market make the contract uncertain (gharar) or similar to gambling? ©Copyrights reserved Amanie 2006 28

Cont’d • The SC’s resolution – “When a crude palm oil futures is offered, specification such as quantity, type, price and delivery date are made known to the market players. Therefore, there is no element of gharar in the contract. All specifications are made clear in the contract, and surveillance and regulation are provided to ensure there is no cheating”. • Futures Contract: The Way Forward: Binding bilateral promise. ©Copyrights reserved Amanie 2006 29

Cont’d • The SC’s resolution – “When a crude palm oil futures is offered, specification such as quantity, type, price and delivery date are made known to the market players. Therefore, there is no element of gharar in the contract. All specifications are made clear in the contract, and surveillance and regulation are provided to ensure there is no cheating”. • Futures Contract: The Way Forward: Binding bilateral promise. ©Copyrights reserved Amanie 2006 29

Islamic Forward FOREX • Forward FOREX involves essentially two dissimilar ribawi items i. e. two different currencies. Currency is a ribawi item. • Under the principles governing any exchange of two dissimilar ribawi items, the exchange of two counter values must be spot or simultaneous (hand to hand). • Forward FOREX entails that the rate of exchange is locked in today (the day of contract) but delivery of two counter values is being deferred to a future date where the delivery of these two counter values will be made on spot basis. ©Copyrights reserved Amanie 2006 30

Islamic Forward FOREX • Forward FOREX involves essentially two dissimilar ribawi items i. e. two different currencies. Currency is a ribawi item. • Under the principles governing any exchange of two dissimilar ribawi items, the exchange of two counter values must be spot or simultaneous (hand to hand). • Forward FOREX entails that the rate of exchange is locked in today (the day of contract) but delivery of two counter values is being deferred to a future date where the delivery of these two counter values will be made on spot basis. ©Copyrights reserved Amanie 2006 30

Cont’d • There is a silent consensus amongst the jurists that this method of exchanging a currency for another is not compliant to the requirement of “hand to hand”. • “Hand to hand” requires the delivery of the two countervalues be made on the day of the contract which is not the practice in current FOREX. ©Copyrights reserved Amanie 2006 31

Cont’d • There is a silent consensus amongst the jurists that this method of exchanging a currency for another is not compliant to the requirement of “hand to hand”. • “Hand to hand” requires the delivery of the two countervalues be made on the day of the contract which is not the practice in current FOREX. ©Copyrights reserved Amanie 2006 31

Islamic Solutions To FOREX • Islamic law requires delivery to be made on the day of the contract. However, Islamic law does not prohibit promise to buy and sell currencies on one date and delivery to be made on another date because the proper contract only concludes on the day of delivery. • This premise of argument has led to the argument/construction of wa’d (promise) in structuring Islamic version of FOREX. ©Copyrights reserved Amanie 2006 32

Islamic Solutions To FOREX • Islamic law requires delivery to be made on the day of the contract. However, Islamic law does not prohibit promise to buy and sell currencies on one date and delivery to be made on another date because the proper contract only concludes on the day of delivery. • This premise of argument has led to the argument/construction of wa’d (promise) in structuring Islamic version of FOREX. ©Copyrights reserved Amanie 2006 32

Cont’d • Under wa’d structure, only one party (obligor / promisor) promises to buy/sell as the case may be, where he is bound by that promise (which is binding). The other party / promisee / obligee is not bound to proceed with the promise that was undertaken by the promisor. • Binding promise from only one party is not deemed valid under Islamic law as a contract. Therefore, this can facilitate FOREX. • Binding promises from both parties are deemed to be leading to a contract conclusion and therefore is prohibited. ©Copyrights reserved Amanie 2006 33

Cont’d • Under wa’d structure, only one party (obligor / promisor) promises to buy/sell as the case may be, where he is bound by that promise (which is binding). The other party / promisee / obligee is not bound to proceed with the promise that was undertaken by the promisor. • Binding promise from only one party is not deemed valid under Islamic law as a contract. Therefore, this can facilitate FOREX. • Binding promises from both parties are deemed to be leading to a contract conclusion and therefore is prohibited. ©Copyrights reserved Amanie 2006 33

Are Islamic Derivatives A Need • Some Scholars argue that Islamic Derivatives are not in tandem with Islamic philosophy because they are, interalia: – Artificial products – They are created to suit conventional products which are based on either interest or speculation • Some other scholars argue that “Islamic Derivatives” are needed for protecting real businesses activities and not just for speculation purposes / undertakings. – Forward currency or currency swap to protect real import and export activities involving two different currencies ©Copyrights reserved Amanie 2006 34

Are Islamic Derivatives A Need • Some Scholars argue that Islamic Derivatives are not in tandem with Islamic philosophy because they are, interalia: – Artificial products – They are created to suit conventional products which are based on either interest or speculation • Some other scholars argue that “Islamic Derivatives” are needed for protecting real businesses activities and not just for speculation purposes / undertakings. – Forward currency or currency swap to protect real import and export activities involving two different currencies ©Copyrights reserved Amanie 2006 34

Cont’d – Profit rate swap to manage real asset and liability potential miss-match of a financial institution • Would there be any limits to the usage of Islamic Derivatives or Islamic Structured products? – Investment Fund – Synthetic Products ©Copyrights reserved Amanie 2006 35

Cont’d – Profit rate swap to manage real asset and liability potential miss-match of a financial institution • Would there be any limits to the usage of Islamic Derivatives or Islamic Structured products? – Investment Fund – Synthetic Products ©Copyrights reserved Amanie 2006 35

Islamic Potential Contracts/ Principles For Islamic Structured Products • Earnest money or ‘Urbun • Salam Sale • Unilateral binding promise (wa’d) • Istijrar – purchasing an asset the price of which is to be determined later • Murabahah / Tawarruq contract • Fixed and floating contracts • Short Sale? ©Copyrights reserved Amanie 2006 36

Islamic Potential Contracts/ Principles For Islamic Structured Products • Earnest money or ‘Urbun • Salam Sale • Unilateral binding promise (wa’d) • Istijrar – purchasing an asset the price of which is to be determined later • Murabahah / Tawarruq contract • Fixed and floating contracts • Short Sale? ©Copyrights reserved Amanie 2006 36

Shariah Issue For Deliberation • Deferment of both counter values in the future market • Margin account and marked to market • Enforcement of unilateral binding promise • Fees for guarantee / protection (CPPI) • Third party guarantee • Separate legal entity in Murabahah / Tawarruq and in wa’d structure • Unilateral binding promise ©Copyrights reserved Amanie 2006 37

Shariah Issue For Deliberation • Deferment of both counter values in the future market • Margin account and marked to market • Enforcement of unilateral binding promise • Fees for guarantee / protection (CPPI) • Third party guarantee • Separate legal entity in Murabahah / Tawarruq and in wa’d structure • Unilateral binding promise ©Copyrights reserved Amanie 2006 37

Islamic Structured Products: The Way Forward • Product innovation between the prohibition of interest and prohibition of gharar – Riba is a fixed formula – Gharar is a phenomenon and risk tolerance • Guidelines on Islamic SP • Risk Management in Basel II and IFSB • Research and Development ©Copyrights reserved Amanie 2006 38

Islamic Structured Products: The Way Forward • Product innovation between the prohibition of interest and prohibition of gharar – Riba is a fixed formula – Gharar is a phenomenon and risk tolerance • Guidelines on Islamic SP • Risk Management in Basel II and IFSB • Research and Development ©Copyrights reserved Amanie 2006 38

THANK YOU Services 1. Shari’ah Advisory & Consultancy 2. Structuring & Enhancing Business Products 3. Shari’ah Conversion of Entities or Business 4. Intelligent Networking & Smart Matchmaking Amanie Business Solutions Suite A-D, Level 14, Bangunan Angkasa Raya 50250 Jalan Ampang Kuala Lumpur Tel : +603 2034 2545 Fax : +603 2034 2546 www. iiif-inc. com/ www. amanie. com. my Amanie Business Solutions

THANK YOU Services 1. Shari’ah Advisory & Consultancy 2. Structuring & Enhancing Business Products 3. Shari’ah Conversion of Entities or Business 4. Intelligent Networking & Smart Matchmaking Amanie Business Solutions Suite A-D, Level 14, Bangunan Angkasa Raya 50250 Jalan Ampang Kuala Lumpur Tel : +603 2034 2545 Fax : +603 2034 2546 www. iiif-inc. com/ www. amanie. com. my Amanie Business Solutions