e326d7ae610a806e0bf2cabbcfeeea39.ppt

- Количество слайдов: 59

Islamic Finance – concepts and Practices Presented at Manila, Philippines 05 -06 -2015 Session One: Mufti Zeeshan Abdul Aziz Shariah Advisor Sindh Bank Limited Jubilee General & Life Insurance Ltd.

Islamic Finance – concepts and Practices Presented at Manila, Philippines 05 -06 -2015 Session One: Mufti Zeeshan Abdul Aziz Shariah Advisor Sindh Bank Limited Jubilee General & Life Insurance Ltd.

Islamic Economic System ØIslam is a Deen which gives guidance for Aqaid, Ibadat, Mu’ashrat, Akhlaq & Mu’amalat. ØIslam accepts the market forces of supply and demand but this acceptance is not un conditional rathere are some prohibitions: 1. Divine Restrictions 2. Govt. Restrictions 3. Ethical Restrictions

Islamic Economic System ØIslam is a Deen which gives guidance for Aqaid, Ibadat, Mu’ashrat, Akhlaq & Mu’amalat. ØIslam accepts the market forces of supply and demand but this acceptance is not un conditional rathere are some prohibitions: 1. Divine Restrictions 2. Govt. Restrictions 3. Ethical Restrictions

Riba-Quran “O you who believe, Fear Allah and give up what remains of your demand for Interest, if you are indeed a believer. If you do not, then you are warned of the declaration of war from Allah and His Messenger; But if you turn back you shall have your principal: Deal not unjustly and you shall not be dealt with unjustly. ” Al Baqarah 278 - 279 (Fourth Revelation)

Riba-Quran “O you who believe, Fear Allah and give up what remains of your demand for Interest, if you are indeed a believer. If you do not, then you are warned of the declaration of war from Allah and His Messenger; But if you turn back you shall have your principal: Deal not unjustly and you shall not be dealt with unjustly. ” Al Baqarah 278 - 279 (Fourth Revelation)

Riba-Hadith It has been reported by Hazrat Abu Hurairah ( on the authority of the Prophet ) Sallallahu Alyhi Wasallam, that the Prophet Sallallahu Alyhi Wasallam said, “Refrain from seven things which are deadly”. The companions asked him (]) what are these? He (]) said (i) to associate partners with Allah, (ii) to case spell, (iii) to kill someone without a reason valid in the eye of Allah, (iv) to devour interest, (v) to devour the properly wealth of an orphan, (vi) to runaway from the battle field, and (vii) to falsely implicate innocent and chaste women of vulgarity”. This saying has been reported by Bukhari, Muslim, Abu Dawood and Nisai.

Riba-Hadith It has been reported by Hazrat Abu Hurairah ( on the authority of the Prophet ) Sallallahu Alyhi Wasallam, that the Prophet Sallallahu Alyhi Wasallam said, “Refrain from seven things which are deadly”. The companions asked him (]) what are these? He (]) said (i) to associate partners with Allah, (ii) to case spell, (iii) to kill someone without a reason valid in the eye of Allah, (iv) to devour interest, (v) to devour the properly wealth of an orphan, (vi) to runaway from the battle field, and (vii) to falsely implicate innocent and chaste women of vulgarity”. This saying has been reported by Bukhari, Muslim, Abu Dawood and Nisai.

Riba-Hadith Hazrat Jabir Ibn-e-Abdullah ( has reported the Prophet Sallallahu Alyhi Wasallam to ) have cursed those who charge interest, those who pay it, those who write documents pertaining thereto, those who keep the accounts of such matters and those who sign as witness. He (]) said that they are all equal in this crime.

Riba-Hadith Hazrat Jabir Ibn-e-Abdullah ( has reported the Prophet Sallallahu Alyhi Wasallam to ) have cursed those who charge interest, those who pay it, those who write documents pertaining thereto, those who keep the accounts of such matters and those who sign as witness. He (]) said that they are all equal in this crime.

Riba-Hadith Hazrat Abu Hurairah ( has reported the Prophet Sallallahu Alyhi Wasallam to have ) said, “four categories of people are such that Allah has made it binding upon Himself to refuse them admission to the paradise or to let them enjoy is goodies. The first is the one who is a habitual drinker of alcoholic drinks. The second is the one who devours interest, the third is the one who devours the wealth belonging to an orphan, without any justification therefore, and the fourth is the one who is disobedient to his parents

Riba-Hadith Hazrat Abu Hurairah ( has reported the Prophet Sallallahu Alyhi Wasallam to have ) said, “four categories of people are such that Allah has made it binding upon Himself to refuse them admission to the paradise or to let them enjoy is goodies. The first is the one who is a habitual drinker of alcoholic drinks. The second is the one who devours interest, the third is the one who devours the wealth belonging to an orphan, without any justification therefore, and the fourth is the one who is disobedient to his parents

Riba-Hadith Hazrat Ibn-e-Masood reporting a saying of the Prophet Sallallahu Alyhi Wassallam in which the Prophet said, “When adultery and interest become common place in a people, then they have definitely asked for Allah’s punishment for themselves

Riba-Hadith Hazrat Ibn-e-Masood reporting a saying of the Prophet Sallallahu Alyhi Wassallam in which the Prophet said, “When adultery and interest become common place in a people, then they have definitely asked for Allah’s punishment for themselves

Presentation Outline • • Definition of Shariah Sources of Shariah • • • Quran Sunnah Ijma Qiyas Ijtihad

Presentation Outline • • Definition of Shariah Sources of Shariah • • • Quran Sunnah Ijma Qiyas Ijtihad

Definition SHARI’AH 1. Lexical meaning: Plain Way 2. Technical meaning: The Divine Law

Definition SHARI’AH 1. Lexical meaning: Plain Way 2. Technical meaning: The Divine Law

Definition Then We have put you (O prophet) on a plain way of (our) commandment. So follow it and do not follow the desires of those who do not know. (45: 18) 10

Definition Then We have put you (O prophet) on a plain way of (our) commandment. So follow it and do not follow the desires of those who do not know. (45: 18) 10

Sources of Shariah 1. 2. 3. 4. The Holy Qur’an The Sunnah of the Holy Prophet (SAW) Ijma’ (consensus of the Ummah) Qiyas (Anology) 11

Sources of Shariah 1. 2. 3. 4. The Holy Qur’an The Sunnah of the Holy Prophet (SAW) Ijma’ (consensus of the Ummah) Qiyas (Anology) 11

Fundamental principles of Islamic Economics; Basics of Islamic Finance; Concept of Riba, Gharar & Qimar; Islamic Law of Contract; 12

Fundamental principles of Islamic Economics; Basics of Islamic Finance; Concept of Riba, Gharar & Qimar; Islamic Law of Contract; 12

Basic Islamic economic guidelines

Basic Islamic economic guidelines

Islamic Economic Guidelines Islamic Economic Model is based on two underlying principles: (1) Importance of economic goals, and (2) Real nature of wealth and property; Importance of economic goals; Economic activities of a man are of three levels: Obligatory and necessary: Earning minimum means to live is essential. Prophet (SAW) once said: “. . . and that you leave your heirs well off (or he said: prosperous) is better than to leave them (poor and) begging from people. . . ” (Bukhari, Book 013, Number 3997); Lawful and permissible: Earning more than basic needs but with due care of all rights of Allah and his creations; Prohibited and impermissible: Earning through impermissible ways and low or no attention to rights of Allah and His creations; Because economic activities are not the basic problem therefore economic progress is not the ultimate and the only target of human existence;

Islamic Economic Guidelines Islamic Economic Model is based on two underlying principles: (1) Importance of economic goals, and (2) Real nature of wealth and property; Importance of economic goals; Economic activities of a man are of three levels: Obligatory and necessary: Earning minimum means to live is essential. Prophet (SAW) once said: “. . . and that you leave your heirs well off (or he said: prosperous) is better than to leave them (poor and) begging from people. . . ” (Bukhari, Book 013, Number 3997); Lawful and permissible: Earning more than basic needs but with due care of all rights of Allah and his creations; Prohibited and impermissible: Earning through impermissible ways and low or no attention to rights of Allah and His creations; Because economic activities are not the basic problem therefore economic progress is not the ultimate and the only target of human existence;

Islamic Economic Guidelines ► Real nature of wealth and property; ─ Islam has a different viewpoint about the four Basic Economic Problems: o Determination of Priorities: Adherence to commandment of ALLAH should be the top priority; o Allocation of Resources (Land, Labor, Capital, Entrepreneur): No remuneration to financial capital as it is rewarded under entrepreneur; o Distribution of Income: Both wealth creators and non creators have right in wealth. (Zakat, Sadaqaat, etc. are for non creators); o Development: Only through Halal (permissible) ways and for Halal purposes;

Islamic Economic Guidelines ► Real nature of wealth and property; ─ Islam has a different viewpoint about the four Basic Economic Problems: o Determination of Priorities: Adherence to commandment of ALLAH should be the top priority; o Allocation of Resources (Land, Labor, Capital, Entrepreneur): No remuneration to financial capital as it is rewarded under entrepreneur; o Distribution of Income: Both wealth creators and non creators have right in wealth. (Zakat, Sadaqaat, etc. are for non creators); o Development: Only through Halal (permissible) ways and for Halal purposes;

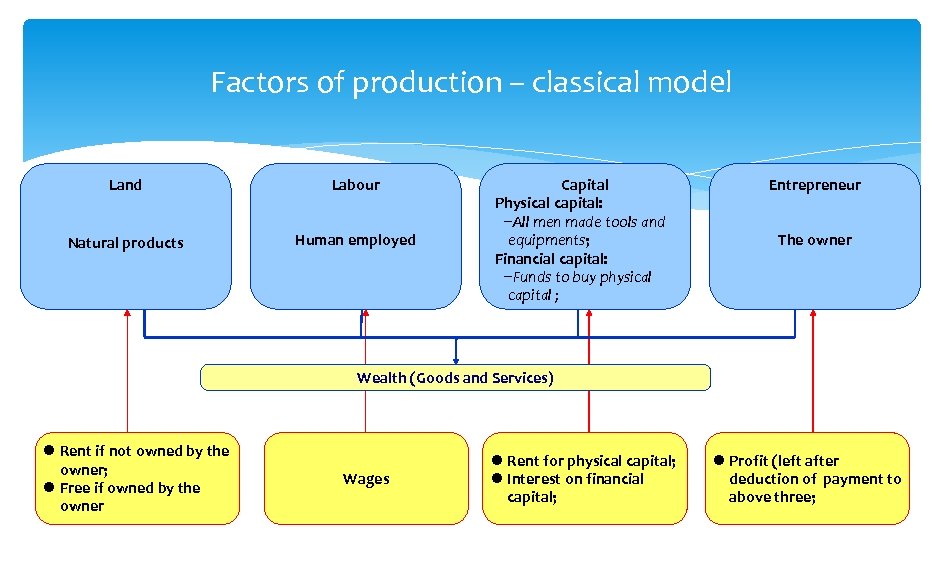

Factors of production – classical model Land Labour Natural products Human employed Capital Physical capital: −All men made tools and equipments; Financial capital: −Funds to buy physical capital ; Entrepreneur The owner Wealth (Goods and Services) Rent if not owned by the owner; Free if owned by the owner Wages Rent for physical capital; Interest on financial capital; Profit (left after deduction of payment to above three;

Factors of production – classical model Land Labour Natural products Human employed Capital Physical capital: −All men made tools and equipments; Financial capital: −Funds to buy physical capital ; Entrepreneur The owner Wealth (Goods and Services) Rent if not owned by the owner; Free if owned by the owner Wages Rent for physical capital; Interest on financial capital; Profit (left after deduction of payment to above three;

Factors of production – Islamic view According to a view, factors of production should be three: ► (1) Land, (2) Labor, and (3) Entrepreneur; This viewpoint suggests that Land will include all natural and man made resources while Entrepreneur and financial capital become a single factor of production; Any amount provided as capital should be on the basis of profit and loss sharing;

Factors of production – Islamic view According to a view, factors of production should be three: ► (1) Land, (2) Labor, and (3) Entrepreneur; This viewpoint suggests that Land will include all natural and man made resources while Entrepreneur and financial capital become a single factor of production; Any amount provided as capital should be on the basis of profit and loss sharing;

Wealth creation and distribution Islam accepts the following economic laws thing within a certain limits: ► Market forces: Laws of demand supply; ► Exchange of services and goods; ► Motive of personal profit; ► Natural relation of employer and employee; ► Profit and loss distribution; ► Asset based system rather than speculation and document based system;

Wealth creation and distribution Islam accepts the following economic laws thing within a certain limits: ► Market forces: Laws of demand supply; ► Exchange of services and goods; ► Motive of personal profit; ► Natural relation of employer and employee; ► Profit and loss distribution; ► Asset based system rather than speculation and document based system;

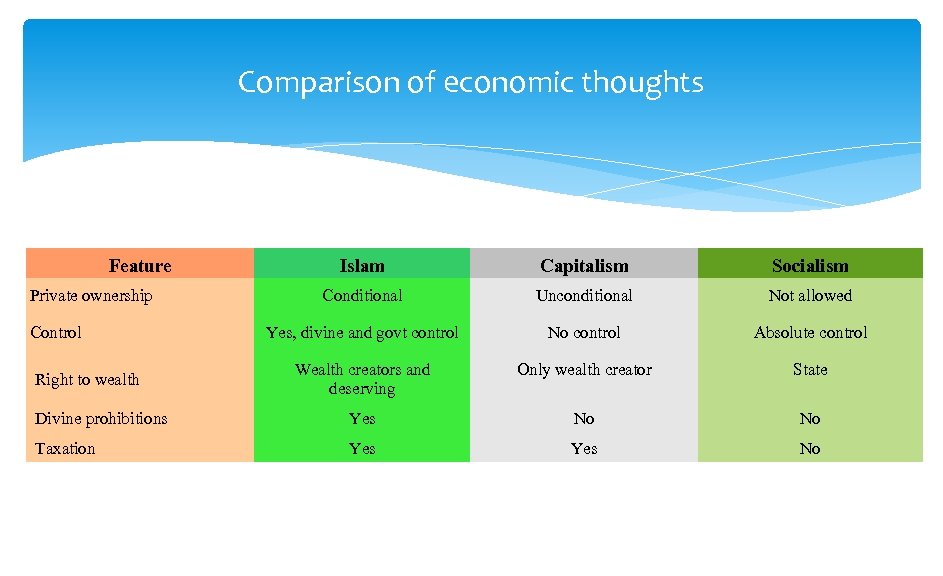

Comparison of economic thoughts Feature Islam Capitalism Socialism Conditional Unconditional Not allowed Yes, divine and govt control No control Absolute control Wealth creators and deserving Only wealth creator State Divine prohibitions Yes No No Taxation Yes No Private ownership Control Right to wealth

Comparison of economic thoughts Feature Islam Capitalism Socialism Conditional Unconditional Not allowed Yes, divine and govt control No control Absolute control Wealth creators and deserving Only wealth creator State Divine prohibitions Yes No No Taxation Yes No Private ownership Control Right to wealth

Status of economic activities in Islam prohibits some economic activities and consider them harmful for human society. Some big problems are listed below and we call it (8 ills): ► Haram Economic dealings and activities (general prohibitions); ► Riba (interest); ► Gharar (excessive uncertainty); ► Qimar (gambling); ► Violation of law of contract; ► Concentration of wealth [Irtikaaz] (circulation in hand of few); ► Hoarding [Ihtikaar] (gathering for creation of scarcity) ; ► Concealment of wealth [Iktinaaz] (non-fulfillment of obligations related to wealth – Zakat, Sadaqaat etc. );

Status of economic activities in Islam prohibits some economic activities and consider them harmful for human society. Some big problems are listed below and we call it (8 ills): ► Haram Economic dealings and activities (general prohibitions); ► Riba (interest); ► Gharar (excessive uncertainty); ► Qimar (gambling); ► Violation of law of contract; ► Concentration of wealth [Irtikaaz] (circulation in hand of few); ► Hoarding [Ihtikaar] (gathering for creation of scarcity) ; ► Concealment of wealth [Iktinaaz] (non-fulfillment of obligations related to wealth – Zakat, Sadaqaat etc. );

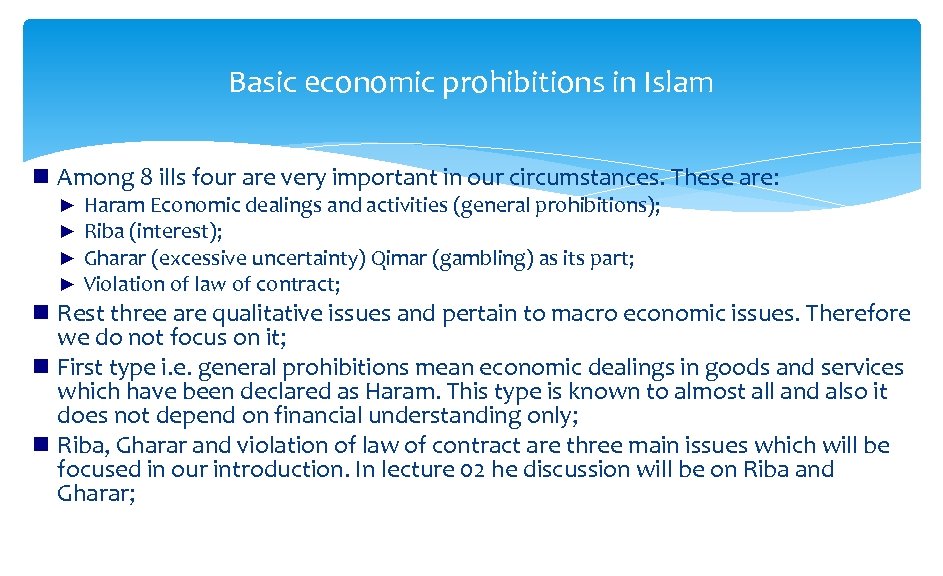

Basic economic prohibitions in Islam Among 8 ills four are very important in our circumstances. These are: ► ► Haram Economic dealings and activities (general prohibitions); Riba (interest); Gharar (excessive uncertainty) Qimar (gambling) as its part; Violation of law of contract; Rest three are qualitative issues and pertain to macro economic issues. Therefore we do not focus on it; First type i. e. general prohibitions mean economic dealings in goods and services which have been declared as Haram. This type is known to almost all and also it does not depend on financial understanding only; Riba, Gharar and violation of law of contract are three main issues which will be focused in our introduction. In lecture 02 he discussion will be on Riba and Gharar;

Basic economic prohibitions in Islam Among 8 ills four are very important in our circumstances. These are: ► ► Haram Economic dealings and activities (general prohibitions); Riba (interest); Gharar (excessive uncertainty) Qimar (gambling) as its part; Violation of law of contract; Rest three are qualitative issues and pertain to macro economic issues. Therefore we do not focus on it; First type i. e. general prohibitions mean economic dealings in goods and services which have been declared as Haram. This type is known to almost all and also it does not depend on financial understanding only; Riba, Gharar and violation of law of contract are three main issues which will be focused in our introduction. In lecture 02 he discussion will be on Riba and Gharar;

Basics of Islamic Finance 22

Basics of Islamic Finance 22

Contents Shari'ah framework for Financial Transactions; Theory of permissible and prohibited economic activities and dealings; Prohibition of Riba, Gharar and Maiser & Qimar; Other Prohibited Activities; Permissible activities: Islamic modes of financing; 23

Contents Shari'ah framework for Financial Transactions; Theory of permissible and prohibited economic activities and dealings; Prohibition of Riba, Gharar and Maiser & Qimar; Other Prohibited Activities; Permissible activities: Islamic modes of financing; 23

Prohibition in Islamic financial system Islamic economic guideline are of two types: Prohibitive guidelines: The guidelines that provide guidance on prohibited economic activities, action and contract in Islam; Prohibition of interest is an example of it; Permissive guidelines: The guidelines that explain preferable and permissible economic activities, actions and contracts in Islam; Preference of equitable wealth distribution and permissibility of trade are example of this type; 24

Prohibition in Islamic financial system Islamic economic guideline are of two types: Prohibitive guidelines: The guidelines that provide guidance on prohibited economic activities, action and contract in Islam; Prohibition of interest is an example of it; Permissive guidelines: The guidelines that explain preferable and permissible economic activities, actions and contracts in Islam; Preference of equitable wealth distribution and permissibility of trade are example of this type; 24

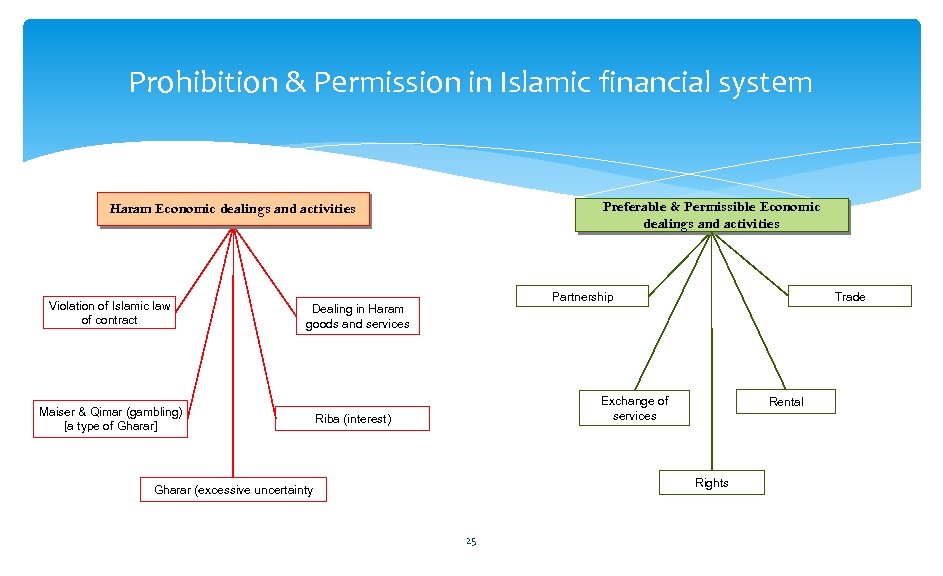

Prohibition & Permission in Islamic financial system Preferable & Permissible Economic dealings and activities Haram Economic dealings and activities Violation of Islamic law of contract Partnership Dealing in Haram goods and services Maiser & Qimar (gambling) [a type of Gharar] Trade Exchange of services Riba (interest) Rental Rights Gharar (excessive uncertainty 25

Prohibition & Permission in Islamic financial system Preferable & Permissible Economic dealings and activities Haram Economic dealings and activities Violation of Islamic law of contract Partnership Dealing in Haram goods and services Maiser & Qimar (gambling) [a type of Gharar] Trade Exchange of services Riba (interest) Rental Rights Gharar (excessive uncertainty 25

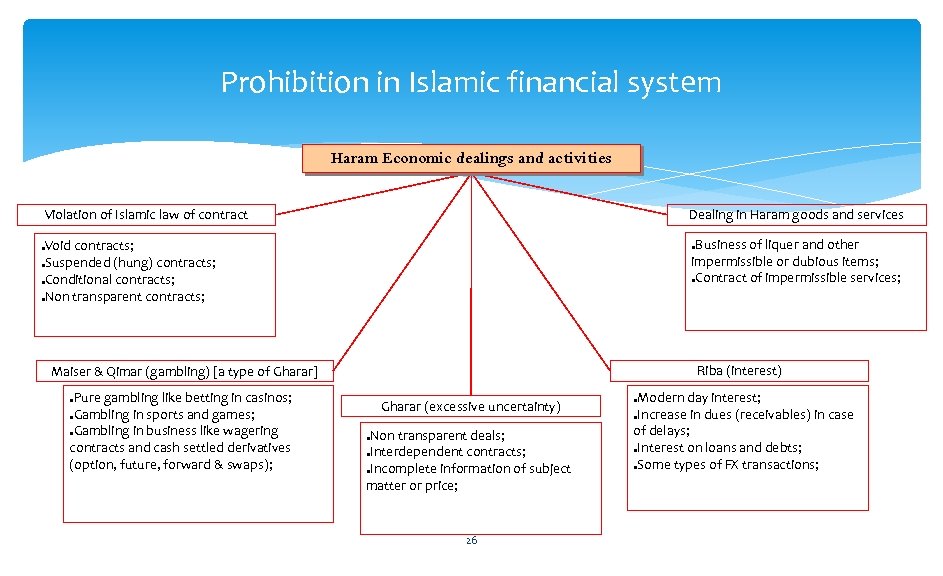

Prohibition in Islamic financial system Haram Economic dealings and activities Violation of Islamic law of contract Dealing in Haram goods and services Business of liquer and other impermissible or dubious items; ●Contract of impermissible services; Void contracts; ●Suspended (hung) contracts; ●Conditional contracts; ●Non transparent contracts; ● ● Riba (interest) Maiser & Qimar (gambling) [a type of Gharar] Pure gambling like betting in casinos; ●Gambling in sports and games; ●Gambling in business like wagering contracts and cash settled derivatives (option, future, forward & swaps); ● Gharar (excessive uncertainty) Non transparent deals; ●Interdependent contracts; ●Incomplete information of subject matter or price; ● 26 Modern day interest; ●Increase in dues (receivables) in case of delays; ●Interest on loans and debts; ●Some types of FX transactions; ●

Prohibition in Islamic financial system Haram Economic dealings and activities Violation of Islamic law of contract Dealing in Haram goods and services Business of liquer and other impermissible or dubious items; ●Contract of impermissible services; Void contracts; ●Suspended (hung) contracts; ●Conditional contracts; ●Non transparent contracts; ● ● Riba (interest) Maiser & Qimar (gambling) [a type of Gharar] Pure gambling like betting in casinos; ●Gambling in sports and games; ●Gambling in business like wagering contracts and cash settled derivatives (option, future, forward & swaps); ● Gharar (excessive uncertainty) Non transparent deals; ●Interdependent contracts; ●Incomplete information of subject matter or price; ● 26 Modern day interest; ●Increase in dues (receivables) in case of delays; ●Interest on loans and debts; ●Some types of FX transactions; ●

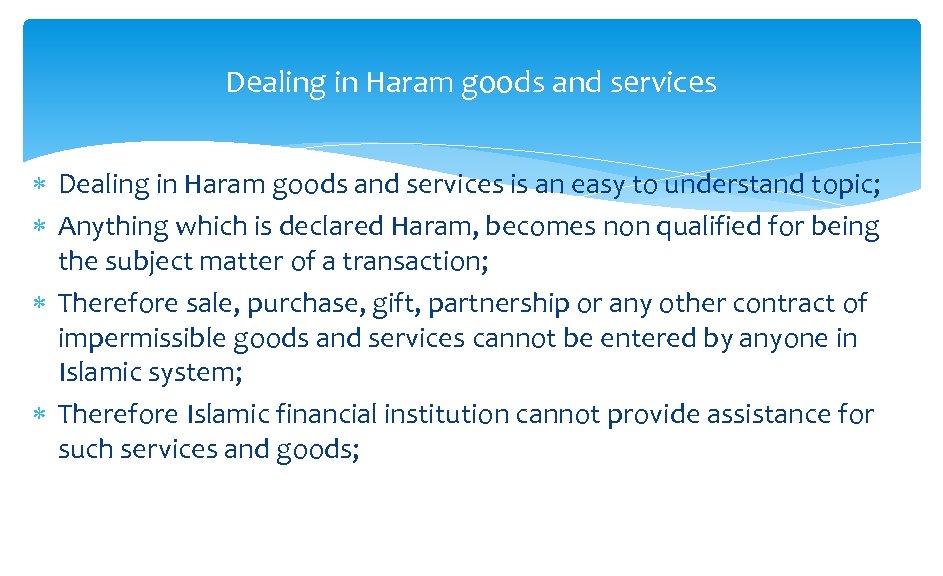

Dealing in Haram goods and services is an easy to understand topic; Anything which is declared Haram, becomes non qualified for being the subject matter of a transaction; Therefore sale, purchase, gift, partnership or any other contract of impermissible goods and services cannot be entered by anyone in Islamic system; Therefore Islamic financial institution cannot provide assistance for such services and goods;

Dealing in Haram goods and services is an easy to understand topic; Anything which is declared Haram, becomes non qualified for being the subject matter of a transaction; Therefore sale, purchase, gift, partnership or any other contract of impermissible goods and services cannot be entered by anyone in Islamic system; Therefore Islamic financial institution cannot provide assistance for such services and goods;

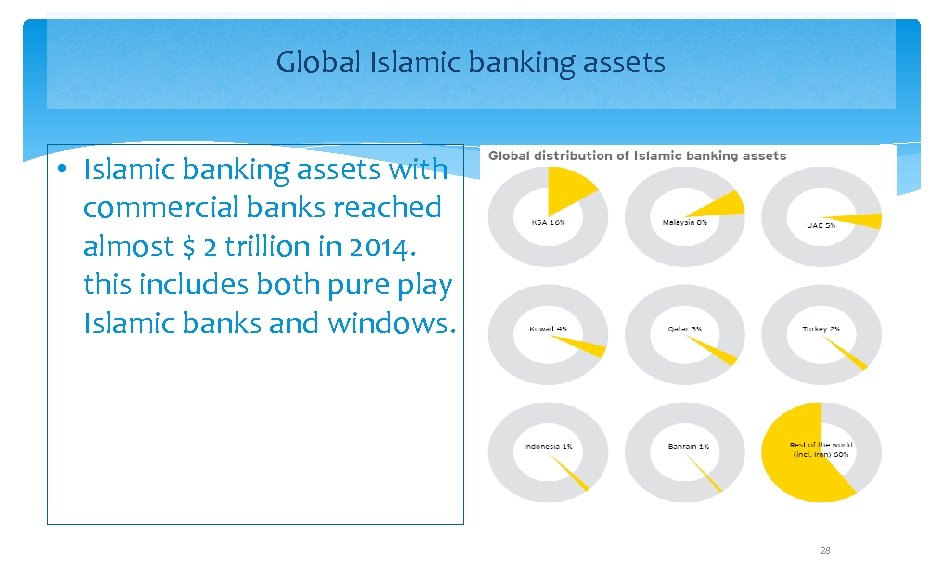

Global Islamic banking assets • Islamic banking assets with commercial banks reached almost $ 2 trillion in 2014. this includes both pure play Islamic banks and windows. 28

Global Islamic banking assets • Islamic banking assets with commercial banks reached almost $ 2 trillion in 2014. this includes both pure play Islamic banks and windows. 28

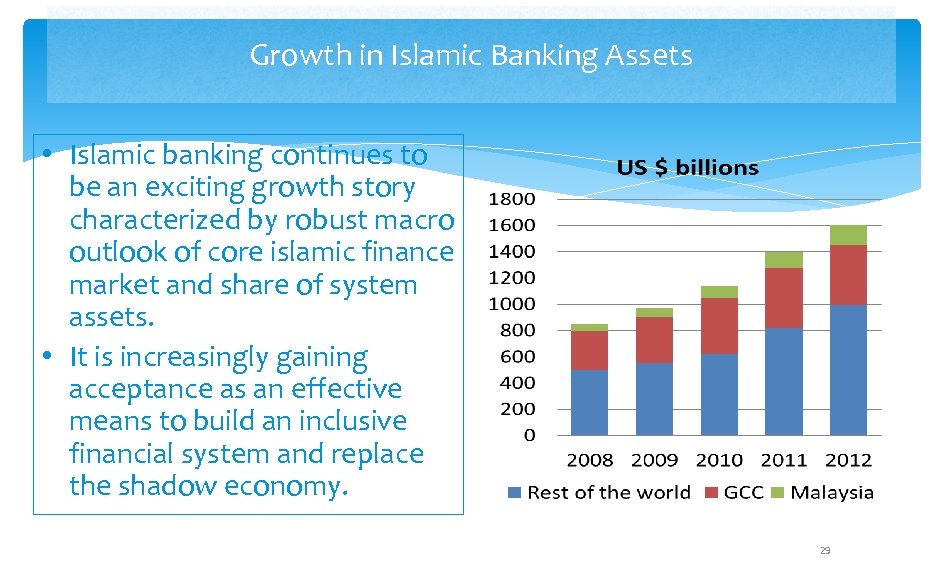

Growth in Islamic Banking Assets • Islamic banking continues to be an exciting growth story characterized by robust macro outlook of core islamic finance market and share of system assets. • It is increasingly gaining acceptance as an effective means to build an inclusive financial system and replace the shadow economy. 29

Growth in Islamic Banking Assets • Islamic banking continues to be an exciting growth story characterized by robust macro outlook of core islamic finance market and share of system assets. • It is increasingly gaining acceptance as an effective means to build an inclusive financial system and replace the shadow economy. 29

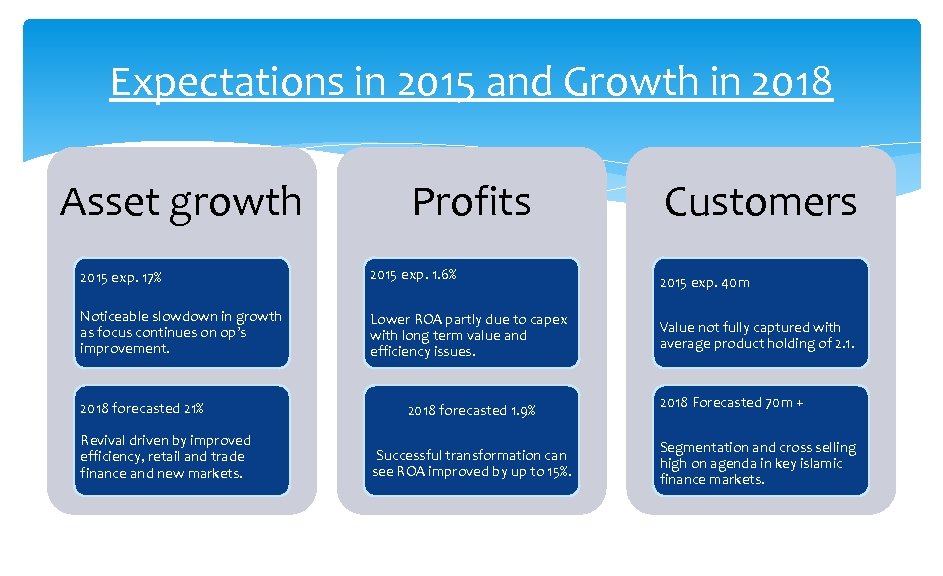

Expectations in 2015 and Growth in 2018 Asset growth Profits 2015 exp. 17% 2015 exp. 1. 6% Noticeable slowdown in growth as focus continues on op’s improvement. Lower ROA partly due to capex with long term value and efficiency issues. 2018 forecasted 21% Revival driven by improved efficiency, retail and trade finance and new markets. 2018 forecasted 1. 9% Successful transformation can see ROA improved by up to 15%. Customers 2015 exp. 40 m Value not fully captured with average product holding of 2. 1. 2018 Forecasted 70 m + Segmentation and cross selling high on agenda in key islamic finance markets.

Expectations in 2015 and Growth in 2018 Asset growth Profits 2015 exp. 17% 2015 exp. 1. 6% Noticeable slowdown in growth as focus continues on op’s improvement. Lower ROA partly due to capex with long term value and efficiency issues. 2018 forecasted 21% Revival driven by improved efficiency, retail and trade finance and new markets. 2018 forecasted 1. 9% Successful transformation can see ROA improved by up to 15%. Customers 2015 exp. 40 m Value not fully captured with average product holding of 2. 1. 2018 Forecasted 70 m + Segmentation and cross selling high on agenda in key islamic finance markets.

BANKING & SHARIAH 31

BANKING & SHARIAH 31

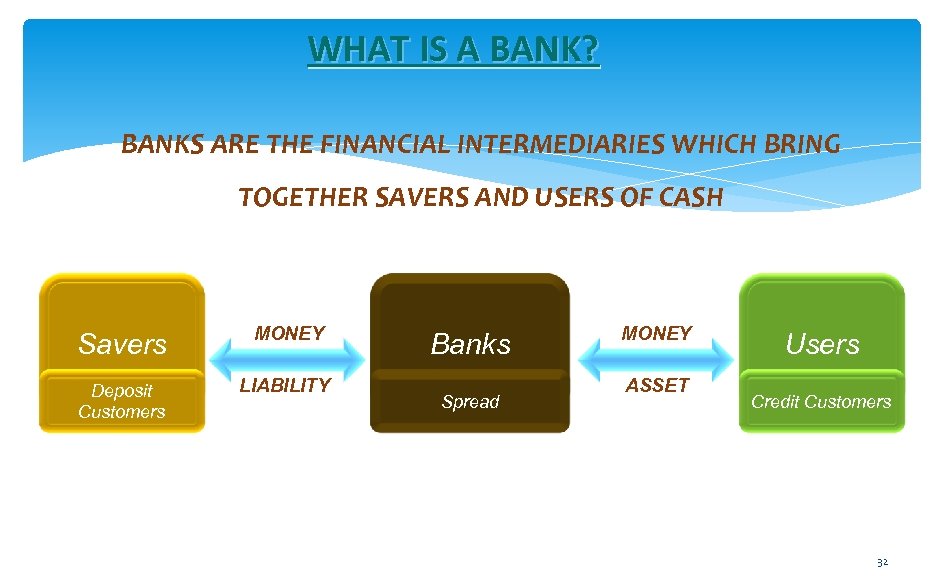

WHAT IS A BANK? BANKS ARE THE FINANCIAL INTERMEDIARIES WHICH BRING TOGETHER SAVERS AND USERS OF CASH Savers MONEY Deposit Customers LIABILITY Banks Spread MONEY ASSET Users Credit Customers 32

WHAT IS A BANK? BANKS ARE THE FINANCIAL INTERMEDIARIES WHICH BRING TOGETHER SAVERS AND USERS OF CASH Savers MONEY Deposit Customers LIABILITY Banks Spread MONEY ASSET Users Credit Customers 32

ISLAMIC BANKING § The objectives and philosophies of Islamic banks must be in line with the teachings of Quran and Sunnah of the Prophet (PBUH). § Islamic banks must be guided by the entire comprehensive principles and rules of Islamic law derived from these two basic sources. 7 May 2014 33

ISLAMIC BANKING § The objectives and philosophies of Islamic banks must be in line with the teachings of Quran and Sunnah of the Prophet (PBUH). § Islamic banks must be guided by the entire comprehensive principles and rules of Islamic law derived from these two basic sources. 7 May 2014 33

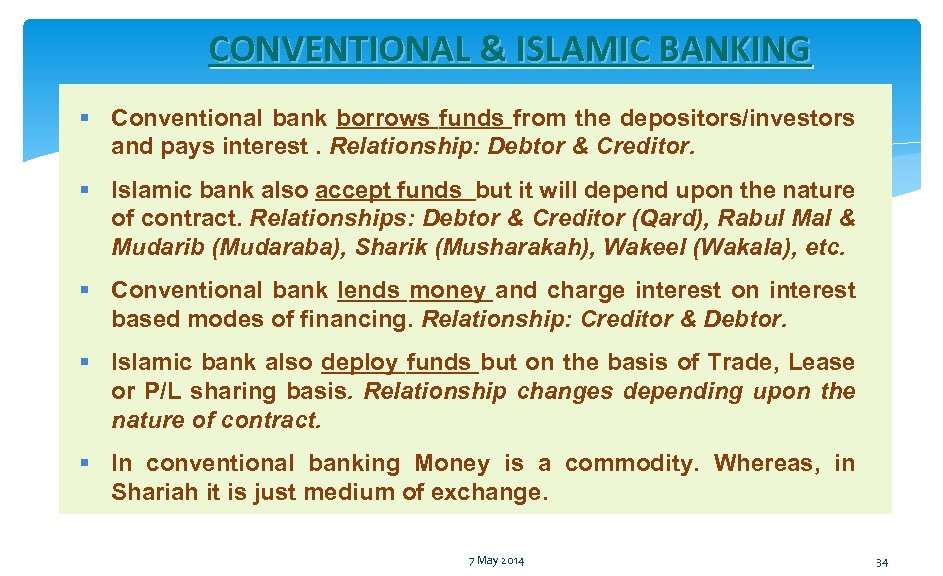

CONVENTIONAL & ISLAMIC BANKING § Conventional bank borrows funds from the depositors/investors and pays interest. Relationship: Debtor & Creditor. § Islamic bank also accept funds but it will depend upon the nature of contract. Relationships: Debtor & Creditor (Qard), Rabul Mal & Mudarib (Mudaraba), Sharik (Musharakah), Wakeel (Wakala), etc. § Conventional bank lends money and charge interest on interest based modes of financing. Relationship: Creditor & Debtor. § Islamic bank also deploy funds but on the basis of Trade, Lease or P/L sharing basis. Relationship changes depending upon the nature of contract. § In conventional banking Money is a commodity. Whereas, in Shariah it is just medium of exchange. 7 May 2014 34

CONVENTIONAL & ISLAMIC BANKING § Conventional bank borrows funds from the depositors/investors and pays interest. Relationship: Debtor & Creditor. § Islamic bank also accept funds but it will depend upon the nature of contract. Relationships: Debtor & Creditor (Qard), Rabul Mal & Mudarib (Mudaraba), Sharik (Musharakah), Wakeel (Wakala), etc. § Conventional bank lends money and charge interest on interest based modes of financing. Relationship: Creditor & Debtor. § Islamic bank also deploy funds but on the basis of Trade, Lease or P/L sharing basis. Relationship changes depending upon the nature of contract. § In conventional banking Money is a commodity. Whereas, in Shariah it is just medium of exchange. 7 May 2014 34

Islamic modes of financing 35

Islamic modes of financing 35

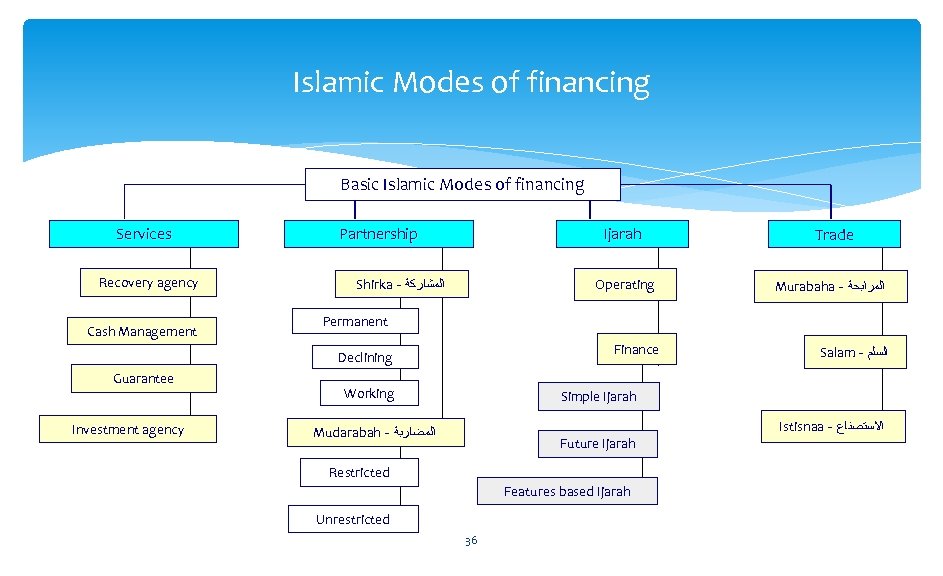

Islamic Modes of financing Basic Islamic Modes of financing Services Recovery agency Cash Management Ijarah Partnership Shirka - ﺍﻟﻤﺸﺎﺭﻛﺔ Operating Investment agency Murabaha - ﺍﻟﻤﺮﺍﺑﺤﺔ Permanent Finance Declining Guarantee Trade Working Salam - ﺍﻟﺴﻠﻢ Simple Ijarah Mudarabah - ﺍﻟﻤﻀﺎﺭﺑﺔ Future Ijarah Restricted Features based Ijarah Unrestricted 36 Istisnaa - ﺍﻻﺳﺘﺼﻨﺎﻉ

Islamic Modes of financing Basic Islamic Modes of financing Services Recovery agency Cash Management Ijarah Partnership Shirka - ﺍﻟﻤﺸﺎﺭﻛﺔ Operating Investment agency Murabaha - ﺍﻟﻤﺮﺍﺑﺤﺔ Permanent Finance Declining Guarantee Trade Working Salam - ﺍﻟﺴﻠﻢ Simple Ijarah Mudarabah - ﺍﻟﻤﻀﺎﺭﺑﺔ Future Ijarah Restricted Features based Ijarah Unrestricted 36 Istisnaa - ﺍﻻﺳﺘﺼﻨﺎﻉ

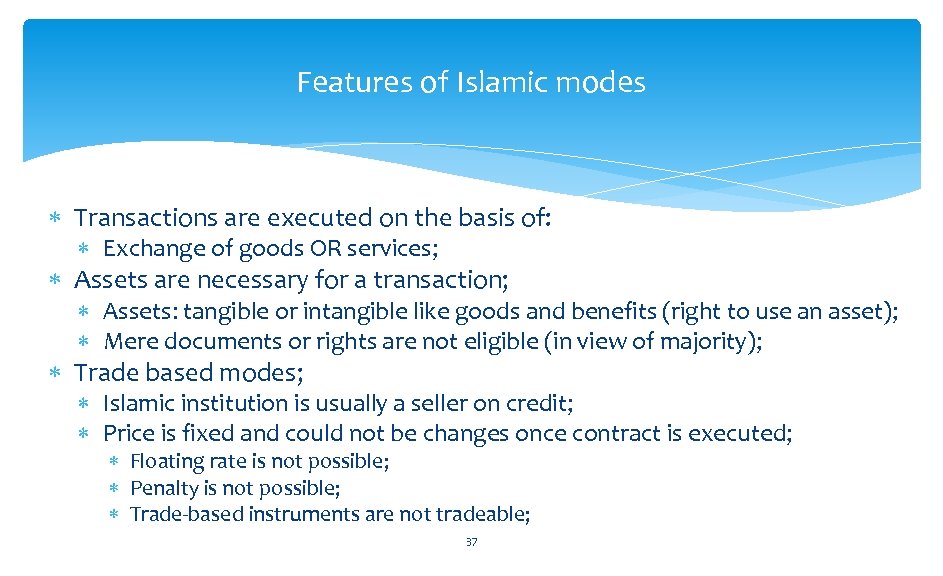

Features of Islamic modes Transactions are executed on the basis of: Exchange of goods OR services; Assets are necessary for a transaction; Assets: tangible or intangible like goods and benefits (right to use an asset); Mere documents or rights are not eligible (in view of majority); Trade based modes; Islamic institution is usually a seller on credit; Price is fixed and could not be changes once contract is executed; Floating rate is not possible; Penalty is not possible; Trade-based instruments are not tradeable; 37

Features of Islamic modes Transactions are executed on the basis of: Exchange of goods OR services; Assets are necessary for a transaction; Assets: tangible or intangible like goods and benefits (right to use an asset); Mere documents or rights are not eligible (in view of majority); Trade based modes; Islamic institution is usually a seller on credit; Price is fixed and could not be changes once contract is executed; Floating rate is not possible; Penalty is not possible; Trade-based instruments are not tradeable; 37

MURABAHA DEFINITIONS • Murabaha means a Sale of Goods by a person to another under an arrangement whereby the seller is obliged to disclose the Cost of goods sold to the buyer on Cash basis or Deferred Payment basis. • Murabaha is a Cost plus Profit sale, i. e, a sale in which the seller informs the customer about his cost and the amount of profit. • Ba’i Murabaha is a purchase-sale /trading transaction. In other words it is not a “Financing Transaction” and instead, it is a substitute to financing transactions. 38

MURABAHA DEFINITIONS • Murabaha means a Sale of Goods by a person to another under an arrangement whereby the seller is obliged to disclose the Cost of goods sold to the buyer on Cash basis or Deferred Payment basis. • Murabaha is a Cost plus Profit sale, i. e, a sale in which the seller informs the customer about his cost and the amount of profit. • Ba’i Murabaha is a purchase-sale /trading transaction. In other words it is not a “Financing Transaction” and instead, it is a substitute to financing transactions. 38

MURABAHA SALIENT FEATURES • Murabaha may be transacted in Tangible assets , but not in Credit Documents • All conditions of Sale must be met: Existence, Specification, Ownership, Possession, Price, Delivery, Date of Delivery • Buy-back arrangement and roll over is prohibited. ü • There should be no prior contractual relationship between the customer and the supplier. • Buyer (customer) may be asked to furnish security. • Customer may be appointed as an Agent. • Once the sale transaction has been concluded, the Selling Price determined cannot be changed. 39

MURABAHA SALIENT FEATURES • Murabaha may be transacted in Tangible assets , but not in Credit Documents • All conditions of Sale must be met: Existence, Specification, Ownership, Possession, Price, Delivery, Date of Delivery • Buy-back arrangement and roll over is prohibited. ü • There should be no prior contractual relationship between the customer and the supplier. • Buyer (customer) may be asked to furnish security. • Customer may be appointed as an Agent. • Once the sale transaction has been concluded, the Selling Price determined cannot be changed. 39

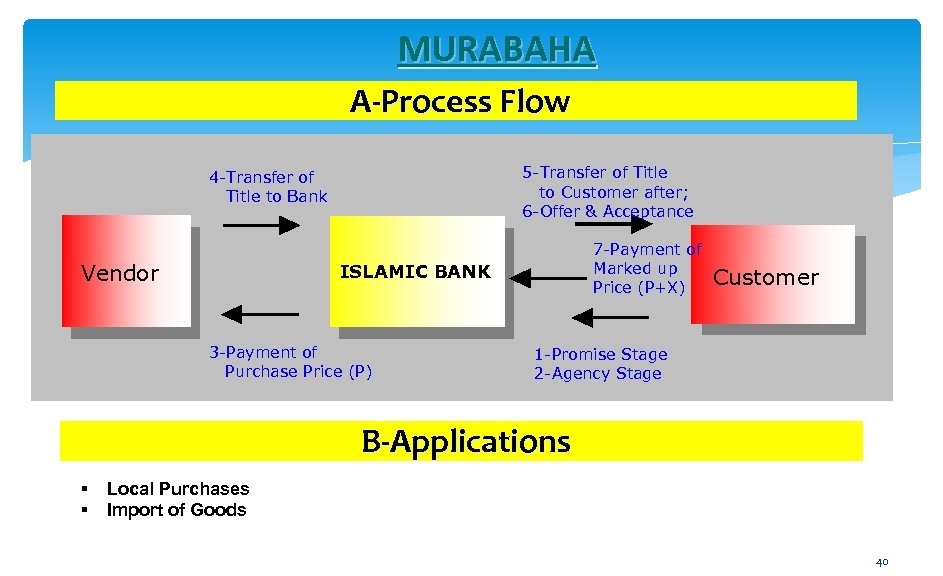

MURABAHA A-Process Flow 5 -Transfer of Title to Customer after; 6 -Offer & Acceptance 4 -Transfer of Title to Bank Vendor 7 -Payment of Marked up Price (P+X) ISLAMIC BANK 3 -Payment of Purchase Price (P) Customer 1 -Promise Stage 2 -Agency Stage B-Applications § § Local Purchases Import of Goods 40

MURABAHA A-Process Flow 5 -Transfer of Title to Customer after; 6 -Offer & Acceptance 4 -Transfer of Title to Bank Vendor 7 -Payment of Marked up Price (P+X) ISLAMIC BANK 3 -Payment of Purchase Price (P) Customer 1 -Promise Stage 2 -Agency Stage B-Applications § § Local Purchases Import of Goods 40

Features of Islamic modes Rental based modes; Islamic institution is usually a lessor on credit (rentals received in arrears); Rent can be amended for future tenures; Floating rate is possible; Penalty is not possible however increase in future rentals is possible; Rental-based instruments are tradeable; 41

Features of Islamic modes Rental based modes; Islamic institution is usually a lessor on credit (rentals received in arrears); Rent can be amended for future tenures; Floating rate is possible; Penalty is not possible however increase in future rentals is possible; Rental-based instruments are tradeable; 41

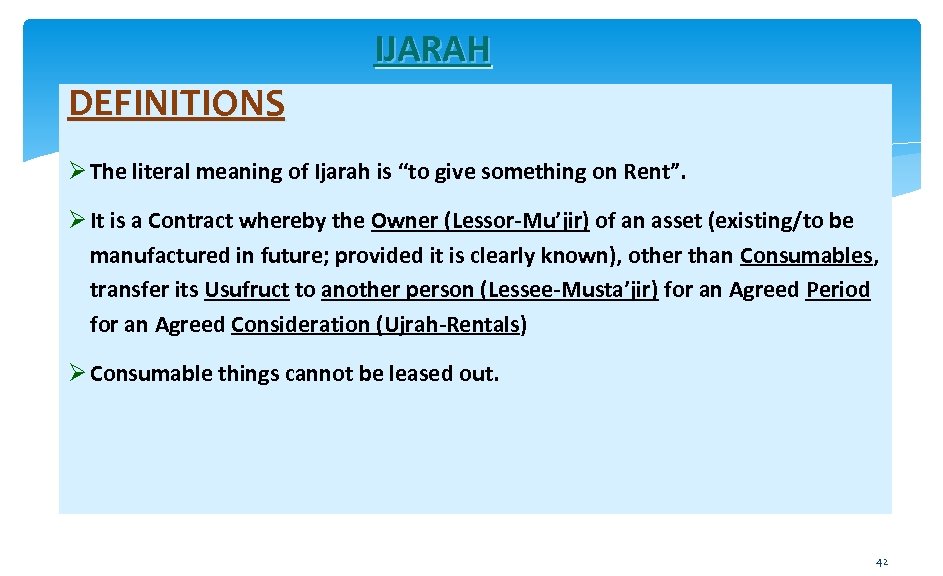

IJARAH DEFINITIONS Ø The literal meaning of Ijarah is “to give something on Rent”. Ø It is a Contract whereby the Owner (Lessor-Mu’jir) of an asset (existing/to be manufactured in future; provided it is clearly known), other than Consumables, transfer its Usufruct to another person (Lessee-Musta’jir) for an Agreed Period for an Agreed Consideration (Ujrah-Rentals) Ø Consumable things cannot be leased out. 42

IJARAH DEFINITIONS Ø The literal meaning of Ijarah is “to give something on Rent”. Ø It is a Contract whereby the Owner (Lessor-Mu’jir) of an asset (existing/to be manufactured in future; provided it is clearly known), other than Consumables, transfer its Usufruct to another person (Lessee-Musta’jir) for an Agreed Period for an Agreed Consideration (Ujrah-Rentals) Ø Consumable things cannot be leased out. 42

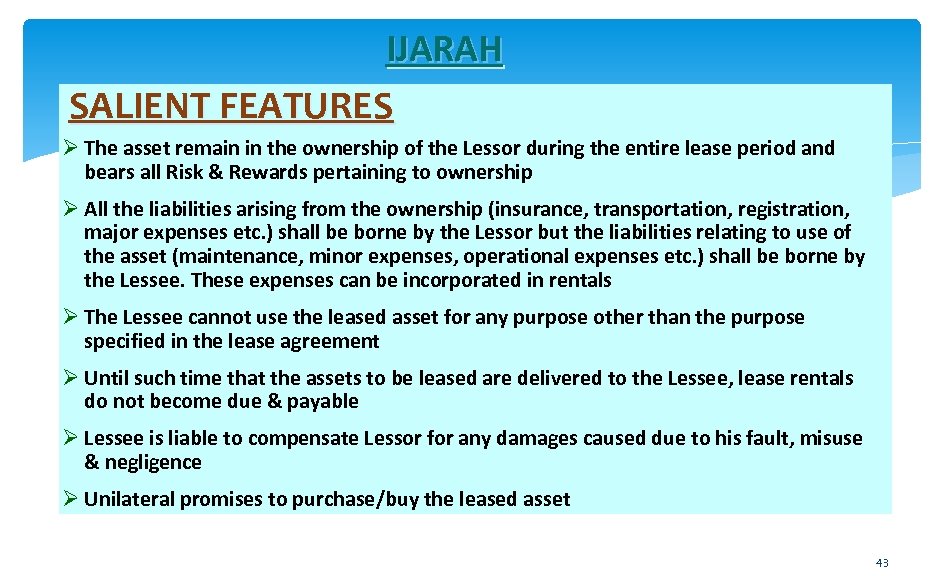

IJARAH SALIENT FEATURES Ø The asset remain in the ownership of the Lessor during the entire lease period and bears all Risk & Rewards pertaining to ownership Ø All the liabilities arising from the ownership (insurance, transportation, registration, major expenses etc. ) shall be borne by the Lessor but the liabilities relating to use of the asset (maintenance, minor expenses, operational expenses etc. ) shall be borne by the Lessee. These expenses can be incorporated in rentals Ø The Lessee cannot use the leased asset for any purpose other than the purpose specified in the lease agreement Ø Until such time that the assets to be leased are delivered to the Lessee, lease rentals do not become due & payable Ø Lessee is liable to compensate Lessor for any damages caused due to his fault, misuse & negligence Ø Unilateral promises to purchase/buy the leased asset 43

IJARAH SALIENT FEATURES Ø The asset remain in the ownership of the Lessor during the entire lease period and bears all Risk & Rewards pertaining to ownership Ø All the liabilities arising from the ownership (insurance, transportation, registration, major expenses etc. ) shall be borne by the Lessor but the liabilities relating to use of the asset (maintenance, minor expenses, operational expenses etc. ) shall be borne by the Lessee. These expenses can be incorporated in rentals Ø The Lessee cannot use the leased asset for any purpose other than the purpose specified in the lease agreement Ø Until such time that the assets to be leased are delivered to the Lessee, lease rentals do not become due & payable Ø Lessee is liable to compensate Lessor for any damages caused due to his fault, misuse & negligence Ø Unilateral promises to purchase/buy the leased asset 43

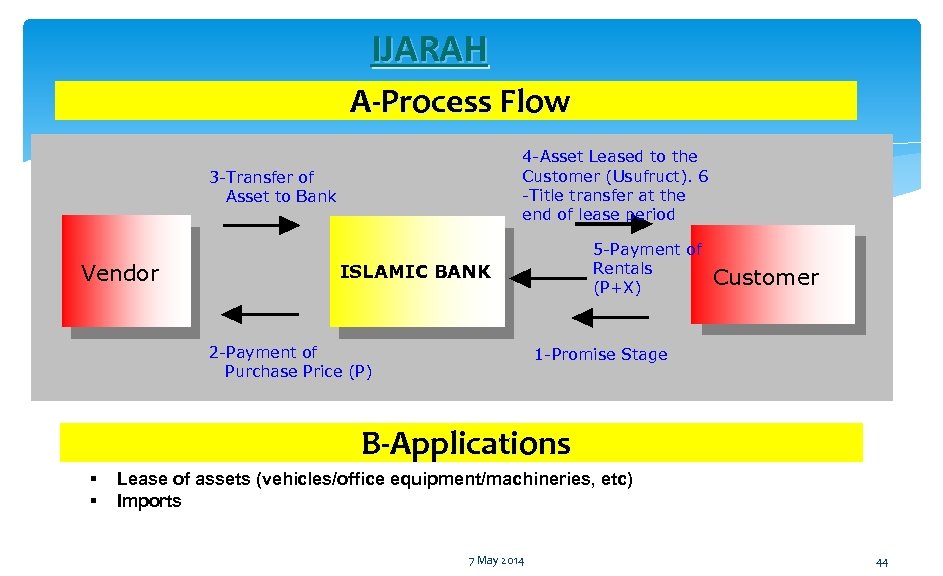

IJARAH A-Process Flow 4 -Asset Leased to the Customer (Usufruct). 6 -Title transfer at the end of lease period 3 -Transfer of Asset to Bank Vendor 5 -Payment of Rentals (P+X) ISLAMIC BANK 2 -Payment of Purchase Price (P) Customer 1 -Promise Stage B-Applications § § Lease of assets (vehicles/office equipment/machineries, etc) Imports 7 May 2014 44

IJARAH A-Process Flow 4 -Asset Leased to the Customer (Usufruct). 6 -Title transfer at the end of lease period 3 -Transfer of Asset to Bank Vendor 5 -Payment of Rentals (P+X) ISLAMIC BANK 2 -Payment of Purchase Price (P) Customer 1 -Promise Stage B-Applications § § Lease of assets (vehicles/office equipment/machineries, etc) Imports 7 May 2014 44

Features of Islamic modes Participatory modes: Islamic institution is a partner in business; Shares in profit and loss like PE and venture capital; P&L sharing; Marketable; 45

Features of Islamic modes Participatory modes: Islamic institution is a partner in business; Shares in profit and loss like PE and venture capital; P&L sharing; Marketable; 45

Features of Islamic modes Combined modes: More than one mode is used in structuring; Features of all employed modes are necessary to be ensured; DM and Ijarah structure: Islamic institution shares in assets with customer and charges rental on its owned portion; Marketable and floating; 46

Features of Islamic modes Combined modes: More than one mode is used in structuring; Features of all employed modes are necessary to be ensured; DM and Ijarah structure: Islamic institution shares in assets with customer and charges rental on its owned portion; Marketable and floating; 46

DIMINISHING MUSHARAKAH DEFINITIONS The literal meaning of word Shirkah is ‘sharing’ Technical meaning of the Shirkah is that, two or more persons take part either in a property without business intention or in a business to generate profits. According to SBP: Musharakah means relationship establish under a Contract by the Mutual Consent of the Parties for Sharing of Profits and Losses arising from a joint enterprise or venture. 47

DIMINISHING MUSHARAKAH DEFINITIONS The literal meaning of word Shirkah is ‘sharing’ Technical meaning of the Shirkah is that, two or more persons take part either in a property without business intention or in a business to generate profits. According to SBP: Musharakah means relationship establish under a Contract by the Mutual Consent of the Parties for Sharing of Profits and Losses arising from a joint enterprise or venture. 47

MECHANISM: There are three main Pillars of DM: -Joint ownership of the Islamic Bank (IB) and the client in an asset (Musharakah Mode based on Shirkat-al-Milk). IB share in the asset is divided into ‘units of ownership’. -IB allows the client to avail the usufruct of its share of the asset as a Lessee against Rentals (Ijarah Mode). -The client purchases the ‘units of ownership’ of the IB at an agreed price at mutually agreed intervals. Each payment by the customer is of a consolidated amount i. e. Unit price + Rental. The process lasts till the client acquires full ownership (Sale Mode). 7 May 2014 48

MECHANISM: There are three main Pillars of DM: -Joint ownership of the Islamic Bank (IB) and the client in an asset (Musharakah Mode based on Shirkat-al-Milk). IB share in the asset is divided into ‘units of ownership’. -IB allows the client to avail the usufruct of its share of the asset as a Lessee against Rentals (Ijarah Mode). -The client purchases the ‘units of ownership’ of the IB at an agreed price at mutually agreed intervals. Each payment by the customer is of a consolidated amount i. e. Unit price + Rental. The process lasts till the client acquires full ownership (Sale Mode). 7 May 2014 48

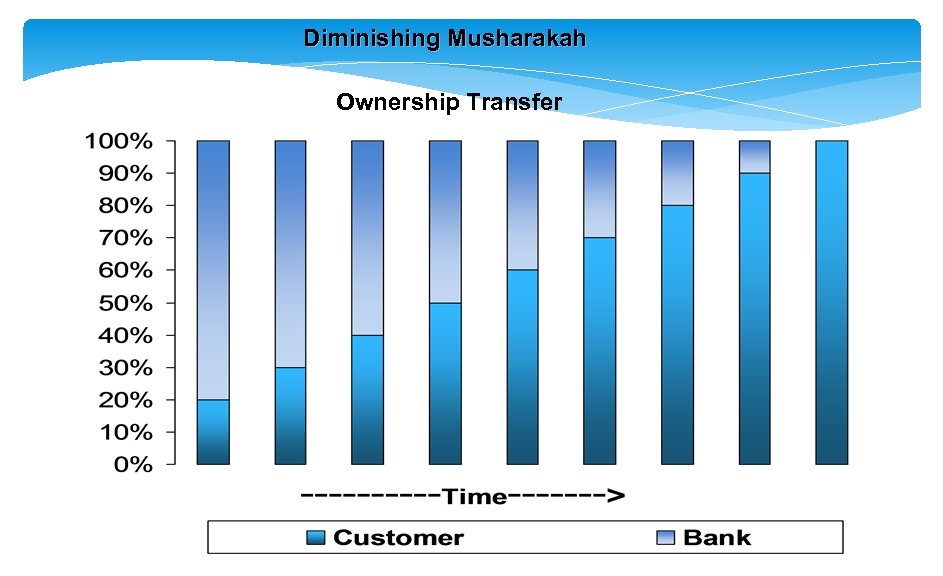

Diminishing Musharakah Ownership Transfer

Diminishing Musharakah Ownership Transfer

Features of Islamic modes Services based modes: Islamic institution provides a services against charges; Fund management, collection, guarantee and recovery are some of the services that Islamic institutions can provide; 50

Features of Islamic modes Services based modes: Islamic institution provides a services against charges; Fund management, collection, guarantee and recovery are some of the services that Islamic institutions can provide; 50

ISLAMIC LAW OF CONTRACTS

ISLAMIC LAW OF CONTRACTS

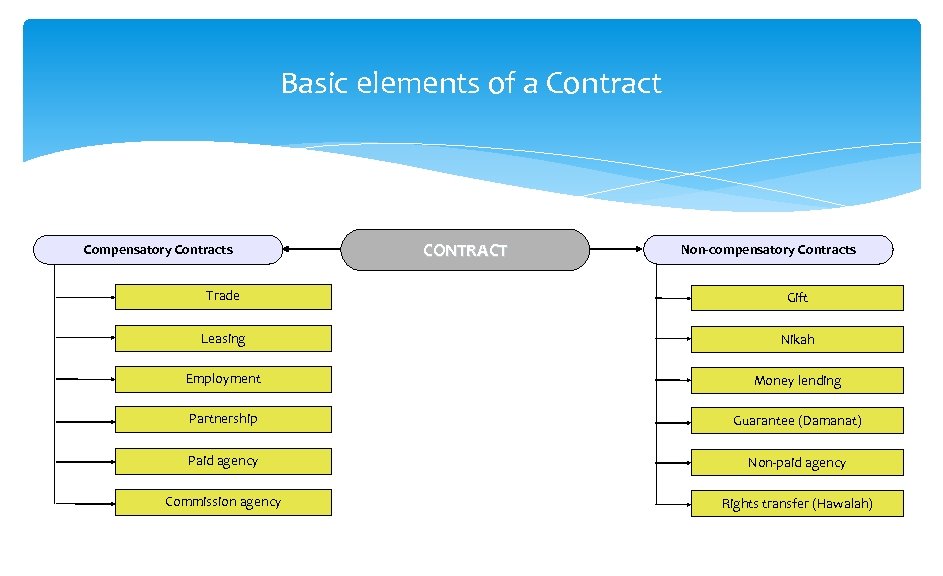

Basic elements of a Contract Compensatory Contracts CONTRACT Non-compensatory Contracts Trade Gift Leasing Nikah Employment Money lending Partnership Guarantee (Damanat) Paid agency Non-paid agency Commission agency Rights transfer (Hawalah)

Basic elements of a Contract Compensatory Contracts CONTRACT Non-compensatory Contracts Trade Gift Leasing Nikah Employment Money lending Partnership Guarantee (Damanat) Paid agency Non-paid agency Commission agency Rights transfer (Hawalah)

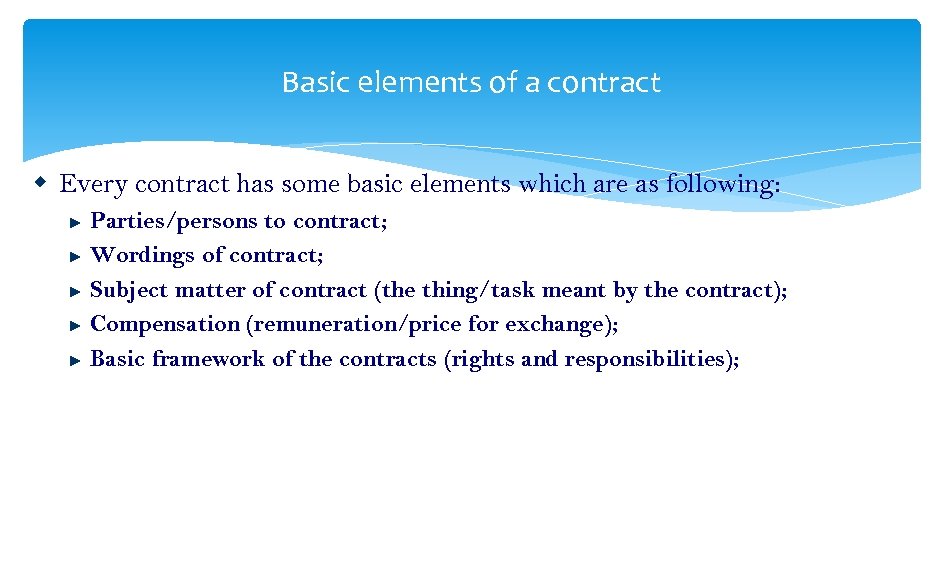

Basic elements of a contract Every contract has some basic elements which are as following: ► ► ► Parties/persons to contract; Wordings of contract; Subject matter of contract (the thing/task meant by the contract); Compensation (remuneration/price for exchange); Basic framework of the contracts (rights and responsibilities);

Basic elements of a contract Every contract has some basic elements which are as following: ► ► ► Parties/persons to contract; Wordings of contract; Subject matter of contract (the thing/task meant by the contract); Compensation (remuneration/price for exchange); Basic framework of the contracts (rights and responsibilities);

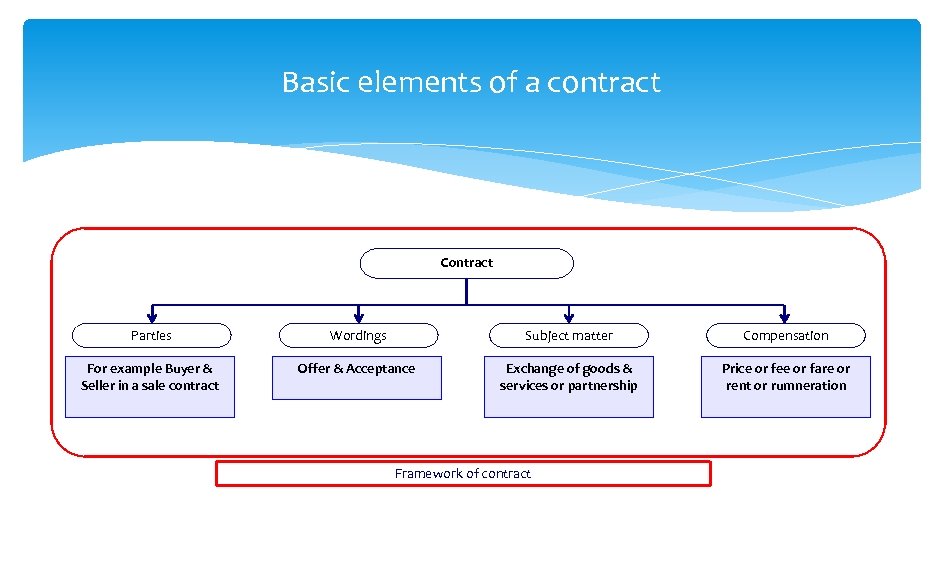

Basic elements of a contract Contract Parties Wordings Subject matter Compensation For example Buyer & Seller in a sale contract Offer & Acceptance Exchange of goods & services or partnership Price or fee or fare or rent or rumneration Framework of contract

Basic elements of a contract Contract Parties Wordings Subject matter Compensation For example Buyer & Seller in a sale contract Offer & Acceptance Exchange of goods & services or partnership Price or fee or fare or rent or rumneration Framework of contract

Basic elements of a contract Parties to contract should be: ► Sane; ─ ► Mature enough to understand the nature of transaction; Eligible to enter in such a contract: ─ ─ Should have authority (ownership or agent) to execute; Legally allowed for executing of such transaction (governmental ban – license/permit requirement etc. );

Basic elements of a contract Parties to contract should be: ► Sane; ─ ► Mature enough to understand the nature of transaction; Eligible to enter in such a contract: ─ ─ Should have authority (ownership or agent) to execute; Legally allowed for executing of such transaction (governmental ban – license/permit requirement etc. );

Basic elements of a contract Wordings of a contract should: ► ► Contain Offer from one party and Acceptance from other ( Ijab-o-Qobool) in session of contract (Majlisul A'qd); This Offer and Acceptance can be: ─ ─ ► ► Oral/verbal (Qauli), purchase through bargaining; Implied/understanding (Ishsraa), purchase in super market; Be Present i. e. they must create sense of immediate effect (words give sense of future are not allowed, “I will buy it” does not make sense of immediate effect); Unconditional and unon contingent: ─ Conditional wording do not create immediate effects, “I will accept if my father allow it” is a conditional wording;

Basic elements of a contract Wordings of a contract should: ► ► Contain Offer from one party and Acceptance from other ( Ijab-o-Qobool) in session of contract (Majlisul A'qd); This Offer and Acceptance can be: ─ ─ ► ► Oral/verbal (Qauli), purchase through bargaining; Implied/understanding (Ishsraa), purchase in super market; Be Present i. e. they must create sense of immediate effect (words give sense of future are not allowed, “I will buy it” does not make sense of immediate effect); Unconditional and unon contingent: ─ Conditional wording do not create immediate effects, “I will accept if my father allow it” is a conditional wording;

Basic elements of a contract Subject matter of a contract should be: ► Lawful – legally and Islamically allowed; ─ ─ ► ► Subject matter and the underlying cause must be lawful; The transacted object must be legally owned by the parties to a contract; Existent – something that exists, contract of supply of mangoes in January; Deliverable – can be transacted and exchanged, sale of fish in water or bird in air; Specified in clear manner; Quantified if quantifiable;

Basic elements of a contract Subject matter of a contract should be: ► Lawful – legally and Islamically allowed; ─ ─ ► ► Subject matter and the underlying cause must be lawful; The transacted object must be legally owned by the parties to a contract; Existent – something that exists, contract of supply of mangoes in January; Deliverable – can be transacted and exchanged, sale of fish in water or bird in air; Specified in clear manner; Quantified if quantifiable;

Basic elements of a contract Compensation (remuneration/price for exchange): ► ► Conditions apply to Subject matter also apply here; In case of barter system the application becomes important; Lawfulness, Existence, Deliverability, Specifiability and Quantifiability become important; In normal trade specification of currency is enough;

Basic elements of a contract Compensation (remuneration/price for exchange): ► ► Conditions apply to Subject matter also apply here; In case of barter system the application becomes important; Lawfulness, Existence, Deliverability, Specifiability and Quantifiability become important; In normal trade specification of currency is enough;

Q&A 59

Q&A 59