46f0f0e8efe0cc4f069250ef1198dc9a.ppt

- Количество слайдов: 54

ISHC Conference - 2010 Mark Lomanno President Smith Travel Research / STR Global

ISHC Conference - 2010 Mark Lomanno President Smith Travel Research / STR Global

Today’s Agenda • Global Overview • U. S. Performance • Chain Scale Performance • Group/Transient Performance • Construction Pipeline • Forecast/Takeaways

Today’s Agenda • Global Overview • U. S. Performance • Chain Scale Performance • Group/Transient Performance • Construction Pipeline • Forecast/Takeaways

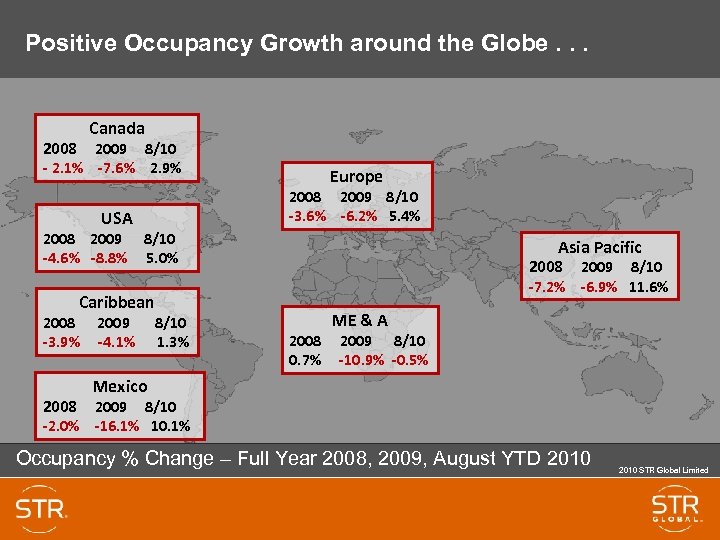

Positive Occupancy Growth around the Globe. . . Canada 2008 2009 8/10 - 2. 1% -7. 6% 2. 9% USA 2008 2009 -4. 6% -8. 8% Europe 2008 2009 8/10 -3. 6% -6. 2% 5. 4% 8/10 5. 0% Asia Pacific 2008 2009 8/10 -7. 2% -6. 9% 11. 6% Caribbean 2008 -3. 9% 2009 -4. 1% 8/10 1. 3% 2008 0. 7% ME & A 2009 8/10 -10. 9% -0. 5% Mexico 2008 2009 8/10 -2. 0% -16. 1% 10. 1% Occupancy % Change – Full Year 2008, 2009, August YTD 2010 STR Global Limited

Positive Occupancy Growth around the Globe. . . Canada 2008 2009 8/10 - 2. 1% -7. 6% 2. 9% USA 2008 2009 -4. 6% -8. 8% Europe 2008 2009 8/10 -3. 6% -6. 2% 5. 4% 8/10 5. 0% Asia Pacific 2008 2009 8/10 -7. 2% -6. 9% 11. 6% Caribbean 2008 -3. 9% 2009 -4. 1% 8/10 1. 3% 2008 0. 7% ME & A 2009 8/10 -10. 9% -0. 5% Mexico 2008 2009 8/10 -2. 0% -16. 1% 10. 1% Occupancy % Change – Full Year 2008, 2009, August YTD 2010 STR Global Limited

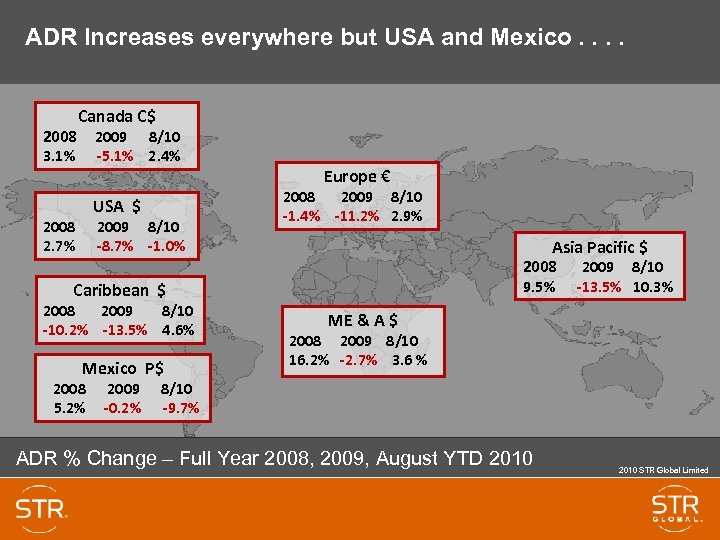

ADR Increases everywhere but USA and Mexico. . 2008 3. 1% Canada C$ 2009 8/10 -5. 1% 2. 4% USA $ 2008 2. 7% 2009 8/10 -8. 7% -1. 0% Europe € 2008 2009 8/10 -1. 4% -11. 2% 2. 9% Asia Pacific $ 2008 9. 5% Caribbean $ 2008 2009 8/10 -10. 2% -13. 5% 4. 6% Mexico P$ 2008 5. 2% 2009 -0. 2% 2009 8/10 -13. 5% 10. 3% ME & A $ 2008 2009 8/10 16. 2% -2. 7% 3. 6 % 8/10 -9. 7% ADR % Change – Full Year 2008, 2009, August YTD 2010 STR Global Limited

ADR Increases everywhere but USA and Mexico. . 2008 3. 1% Canada C$ 2009 8/10 -5. 1% 2. 4% USA $ 2008 2. 7% 2009 8/10 -8. 7% -1. 0% Europe € 2008 2009 8/10 -1. 4% -11. 2% 2. 9% Asia Pacific $ 2008 9. 5% Caribbean $ 2008 2009 8/10 -10. 2% -13. 5% 4. 6% Mexico P$ 2008 5. 2% 2009 -0. 2% 2009 8/10 -13. 5% 10. 3% ME & A $ 2008 2009 8/10 16. 2% -2. 7% 3. 6 % 8/10 -9. 7% ADR % Change – Full Year 2008, 2009, August YTD 2010 STR Global Limited

Global Rev. PAR Recovers – Primarily Occupancy Driven Canada C$ 2008 2009 0. 9% -12. 3% 2008 -1. 9% USA $ 2009 -16. 7% 8/10 5. 3% 8/10 4. 0% Europe € 2008 2009 8/10 -4. 9% -16. 7% 8. 4% Asia Pacific $ 2008 1. 6% Caribbean $ 2008 -14. 4% 2008 2. 9% 2009 -17. 1% 8/10 6. 0% Mexico P$ 2009 -16. 1% 2009 8/10 -19. 4% 23. 1% ME & A $ 2008 2009 8/10 17. 1% -13. 3% 3. 1% 8/10 -0. 5% Rev. PAR % Change – Full Year 2008, 2009, August YTD 2010 STR Global Limited

Global Rev. PAR Recovers – Primarily Occupancy Driven Canada C$ 2008 2009 0. 9% -12. 3% 2008 -1. 9% USA $ 2009 -16. 7% 8/10 5. 3% 8/10 4. 0% Europe € 2008 2009 8/10 -4. 9% -16. 7% 8. 4% Asia Pacific $ 2008 1. 6% Caribbean $ 2008 -14. 4% 2008 2. 9% 2009 -17. 1% 8/10 6. 0% Mexico P$ 2009 -16. 1% 2009 8/10 -19. 4% 23. 1% ME & A $ 2008 2009 8/10 17. 1% -13. 3% 3. 1% 8/10 -0. 5% Rev. PAR % Change – Full Year 2008, 2009, August YTD 2010 STR Global Limited

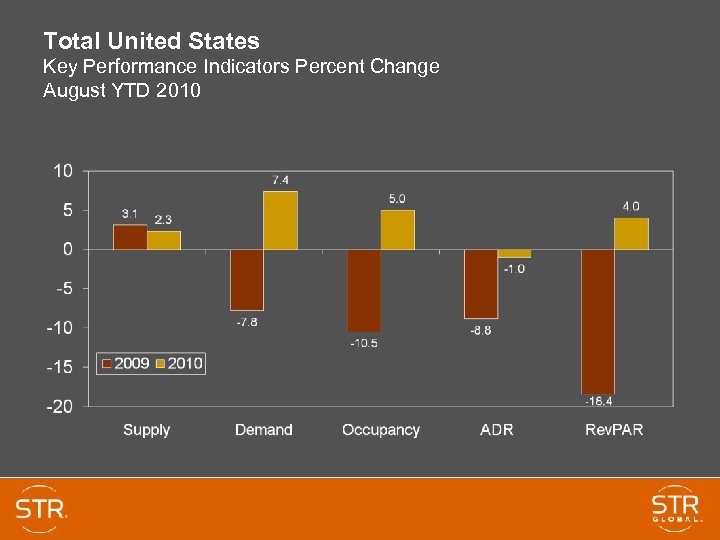

Total United States Key Performance Indicators Percent Change August YTD 2010

Total United States Key Performance Indicators Percent Change August YTD 2010

Strong Demand Rebound – Supply Slowing 4. 3% 2. 5% -4. 7% -6. 9% Total United States: Twelve Month Moving Average 1989 thru August 2010

Strong Demand Rebound – Supply Slowing 4. 3% 2. 5% -4. 7% -6. 9% Total United States: Twelve Month Moving Average 1989 thru August 2010

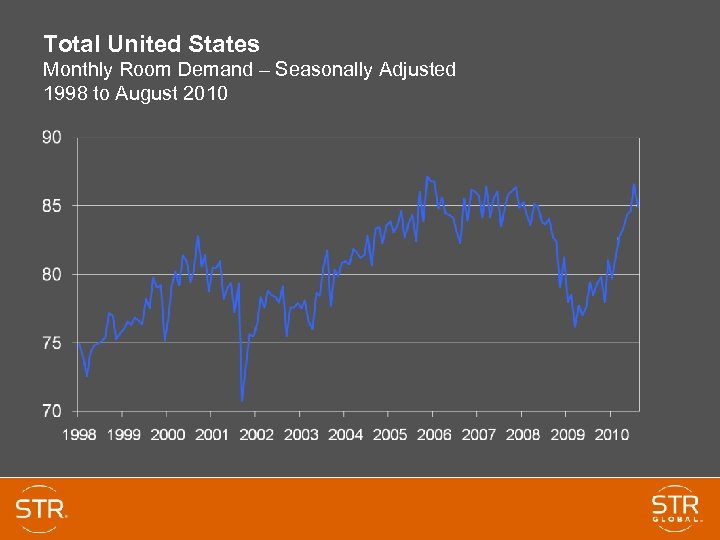

Total United States Monthly Room Demand – Seasonally Adjusted 1998 to August 2010

Total United States Monthly Room Demand – Seasonally Adjusted 1998 to August 2010

102, 307, 179 July 2010 The Most U. S. Monthly Rooms Sold – EVER!!!

102, 307, 179 July 2010 The Most U. S. Monthly Rooms Sold – EVER!!!

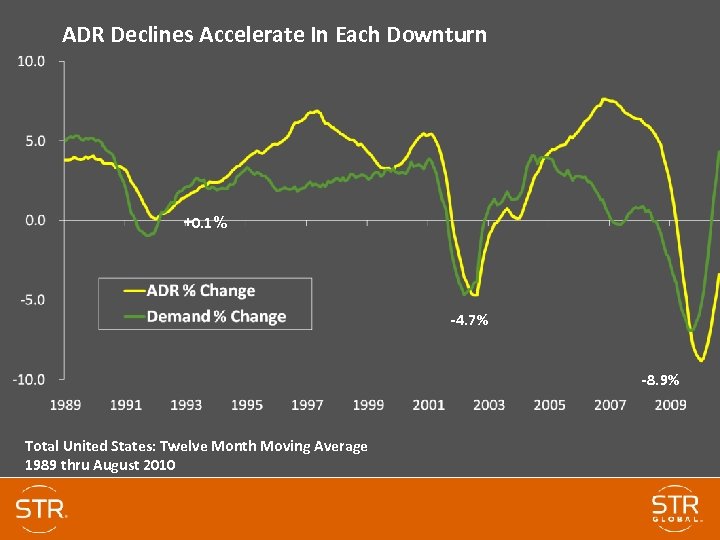

ADR Declines Accelerate In Each Downturn +0. 1% -4. 7% -8. 9% Total United States: Twelve Month Moving Average 1989 thru August 2010

ADR Declines Accelerate In Each Downturn +0. 1% -4. 7% -8. 9% Total United States: Twelve Month Moving Average 1989 thru August 2010

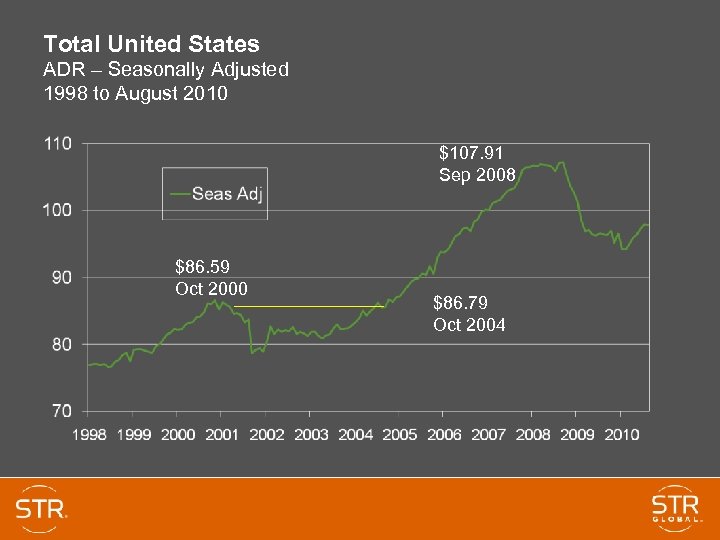

Total United States ADR – Seasonally Adjusted 1998 to August 2010 $107. 91 Sep 2008 $86. 59 Oct 2000 $86. 79 Oct 2004

Total United States ADR – Seasonally Adjusted 1998 to August 2010 $107. 91 Sep 2008 $86. 59 Oct 2000 $86. 79 Oct 2004

Absolute ADR Will Not Recover for At Least 2 More Years 23 Months -$10. 25 41 Months -$3. 70 Total United States: ADR Twelve Month Moving Average 2000 – August 2010

Absolute ADR Will Not Recover for At Least 2 More Years 23 Months -$10. 25 41 Months -$3. 70 Total United States: ADR Twelve Month Moving Average 2000 – August 2010

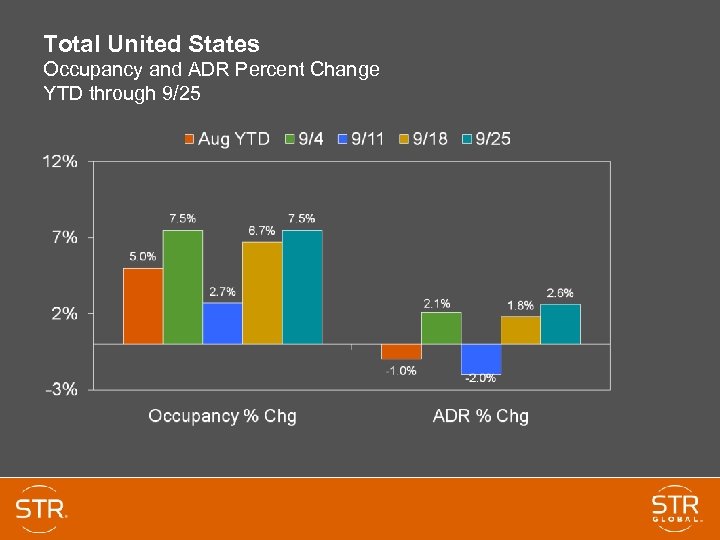

Total United States Occupancy and ADR Percent Change YTD through 9/25

Total United States Occupancy and ADR Percent Change YTD through 9/25

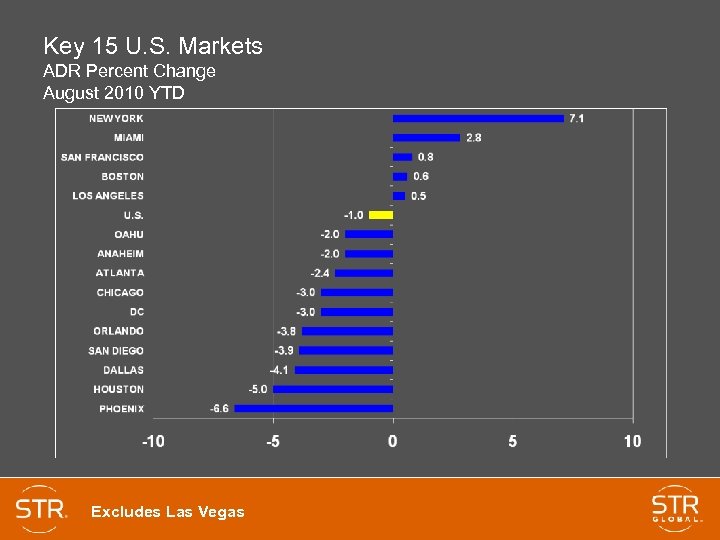

Key 15 U. S. Markets ADR Percent Change August 2010 YTD Excludes Las Vegas

Key 15 U. S. Markets ADR Percent Change August 2010 YTD Excludes Las Vegas

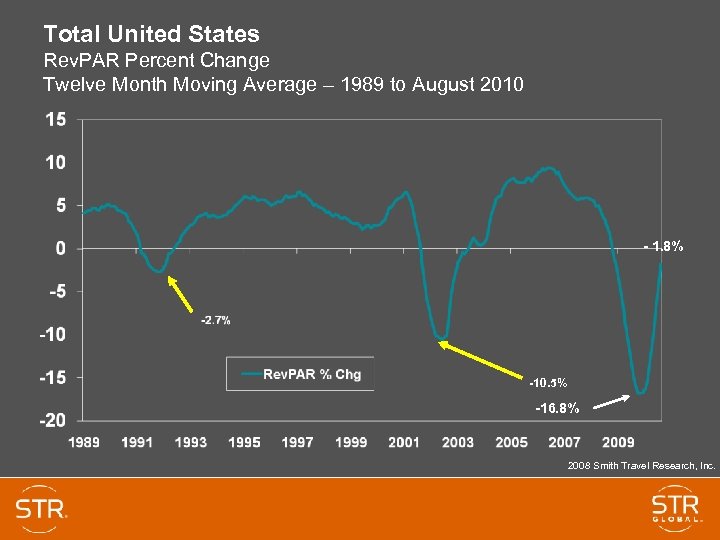

Total United States Rev. PAR Percent Change Twelve Month Moving Average – 1989 to August 2010 - 1. 8% -10. 5% -16. 8% 2008 Smith Travel Research, Inc.

Total United States Rev. PAR Percent Change Twelve Month Moving Average – 1989 to August 2010 - 1. 8% -10. 5% -16. 8% 2008 Smith Travel Research, Inc.

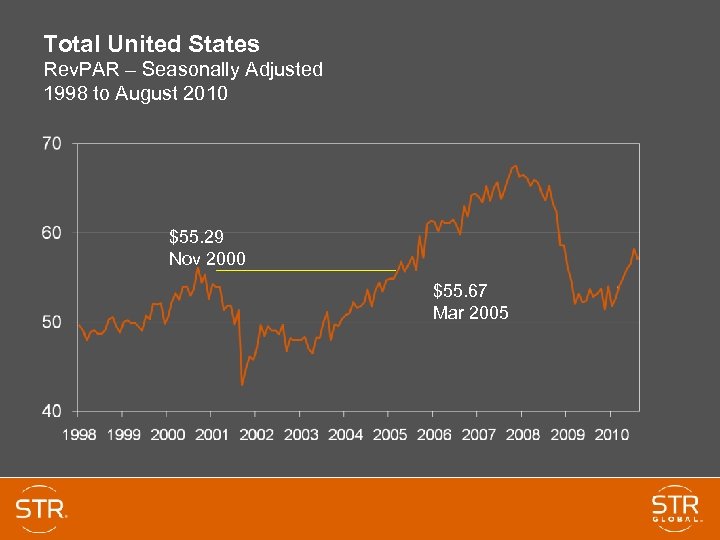

Total United States Rev. PAR – Seasonally Adjusted 1998 to August 2010 $55. 29 Nov 2000 $55. 67 Mar 2005

Total United States Rev. PAR – Seasonally Adjusted 1998 to August 2010 $55. 29 Nov 2000 $55. 67 Mar 2005

U. S. Chain Scales

U. S. Chain Scales

STR Chain Scales Selected chains from each segment • Luxury – Four Seasons, Ritz Carlton, Fairmont • Upper Upscale – Hyatt, Embassy, Hilton, Marriott, Kimpton • Upscale – Hyatt Place, Hilton Garden Inn, aloft Hotel • Mid with F&B – Best Western, Holiday Inn, Ramada, Quality Inn • Mid no F&B – Hampton Inn, HI Express, Country Inn & Suites • Economy – Econolodge, Red Roof, Days Inn

STR Chain Scales Selected chains from each segment • Luxury – Four Seasons, Ritz Carlton, Fairmont • Upper Upscale – Hyatt, Embassy, Hilton, Marriott, Kimpton • Upscale – Hyatt Place, Hilton Garden Inn, aloft Hotel • Mid with F&B – Best Western, Holiday Inn, Ramada, Quality Inn • Mid no F&B – Hampton Inn, HI Express, Country Inn & Suites • Economy – Econolodge, Red Roof, Days Inn

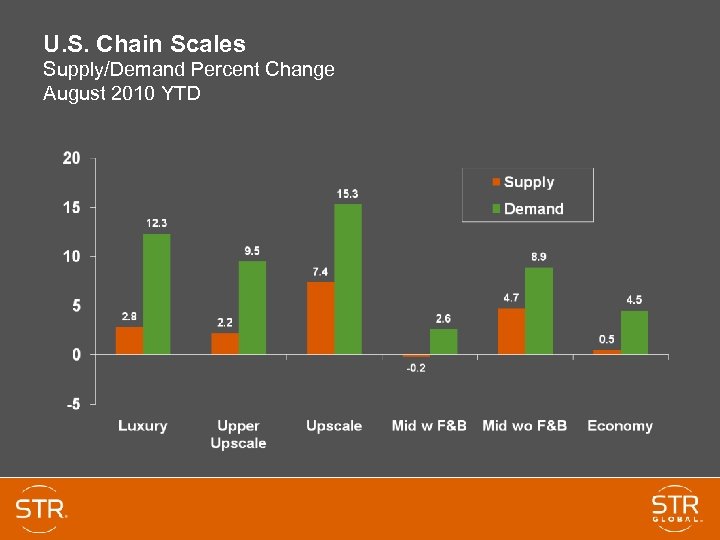

U. S. Chain Scales Supply/Demand Percent Change August 2010 YTD

U. S. Chain Scales Supply/Demand Percent Change August 2010 YTD

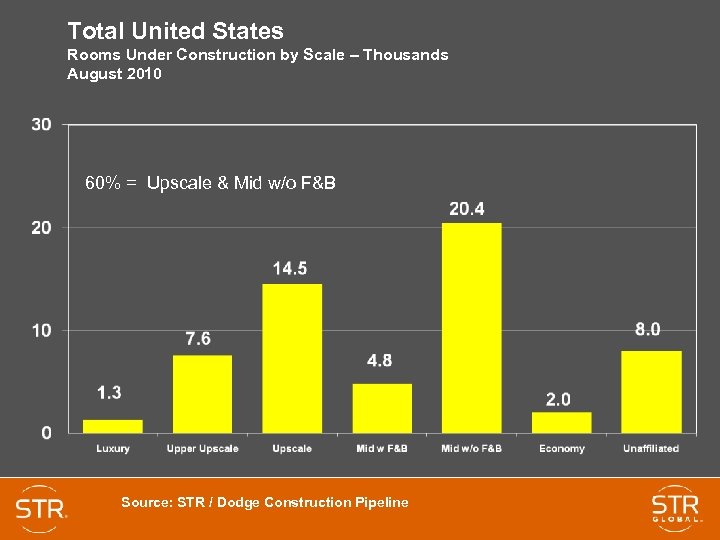

Total United States Rooms Under Construction by Scale – Thousands August 2010 60% = Upscale & Mid w/o F&B Source: STR / Dodge Construction Pipeline

Total United States Rooms Under Construction by Scale – Thousands August 2010 60% = Upscale & Mid w/o F&B Source: STR / Dodge Construction Pipeline

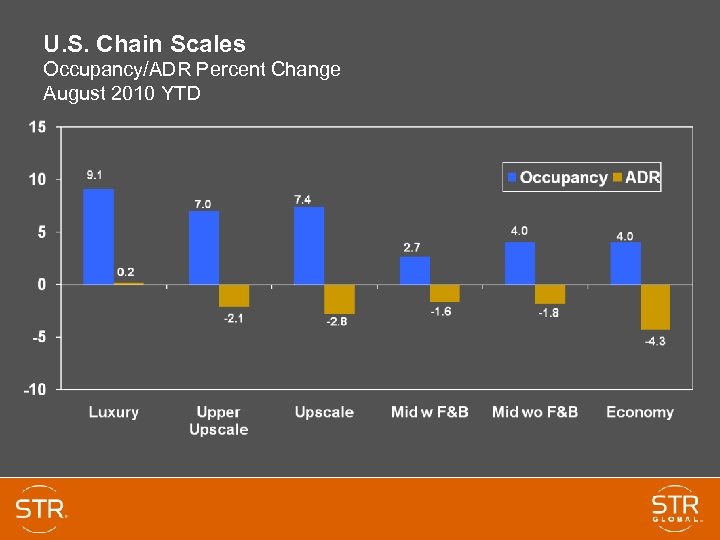

U. S. Chain Scales Occupancy/ADR Percent Change August 2010 YTD

U. S. Chain Scales Occupancy/ADR Percent Change August 2010 YTD

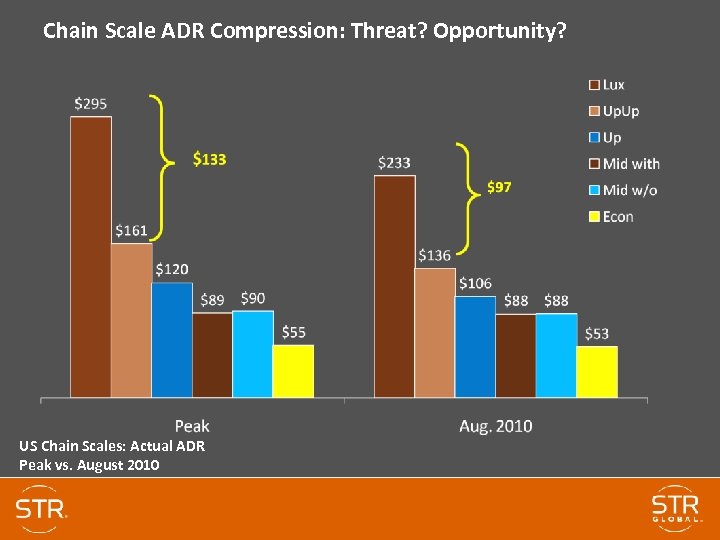

Chain Scale ADR Compression: Threat? Opportunity? US Chain Scales: Actual ADR Peak vs. August 2010

Chain Scale ADR Compression: Threat? Opportunity? US Chain Scales: Actual ADR Peak vs. August 2010

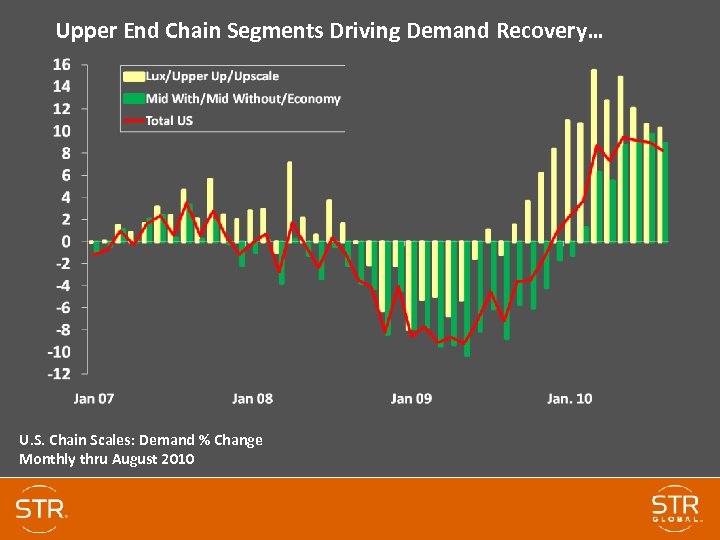

Upper End Chain Segments Driving Demand Recovery… U. S. Chain Scales: Demand % Change Monthly thru August 2010

Upper End Chain Segments Driving Demand Recovery… U. S. Chain Scales: Demand % Change Monthly thru August 2010

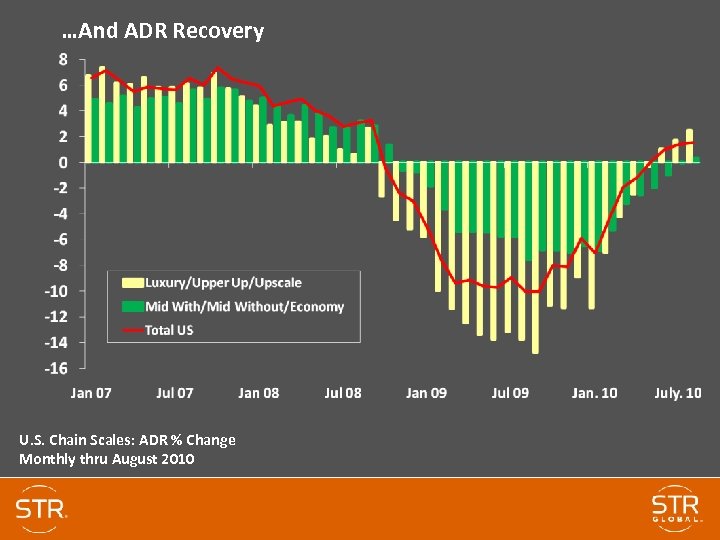

…And ADR Recovery U. S. Chain Scales: ADR % Change Monthly thru August 2010

…And ADR Recovery U. S. Chain Scales: ADR % Change Monthly thru August 2010

Group vs. Transient Performance Transient Customer: Third party, rack rate, government rate. Group Customer: Rooms booked in blocks of 10 or more.

Group vs. Transient Performance Transient Customer: Third party, rack rate, government rate. Group Customer: Rooms booked in blocks of 10 or more.

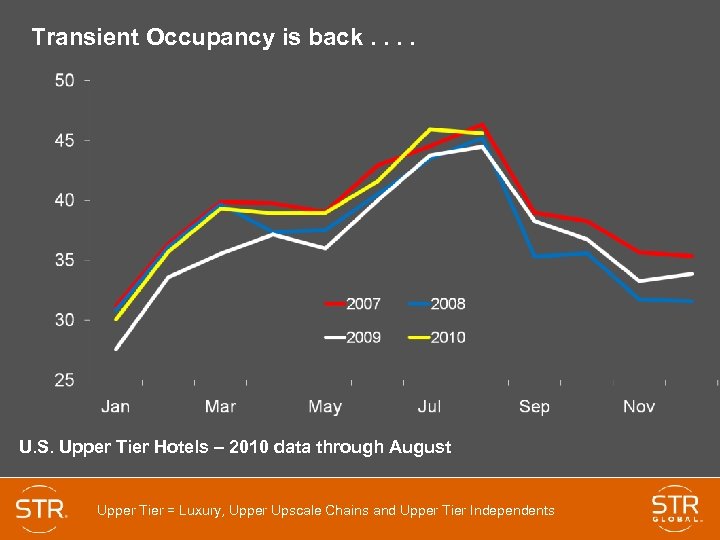

Transient Occupancy is back. . U. S. Upper Tier Hotels – 2010 data through August Upper Tier = Luxury, Upper Upscale Chains and Upper Tier Independents

Transient Occupancy is back. . U. S. Upper Tier Hotels – 2010 data through August Upper Tier = Luxury, Upper Upscale Chains and Upper Tier Independents

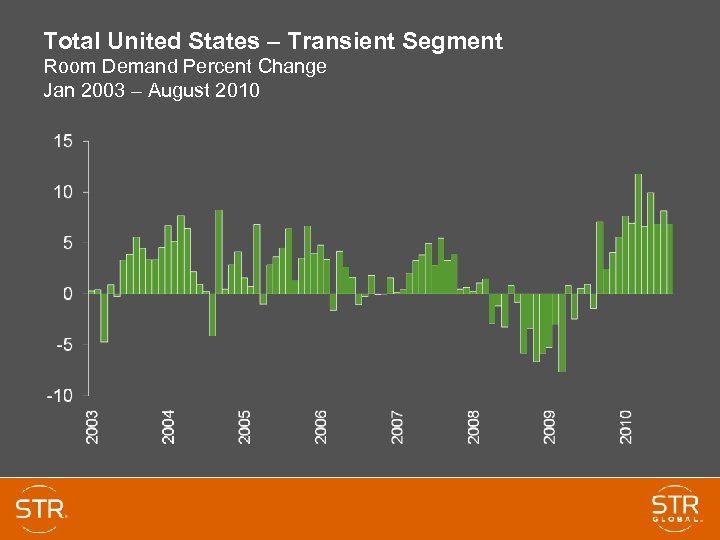

Total United States – Transient Segment Room Demand Percent Change Jan 2003 – August 2010

Total United States – Transient Segment Room Demand Percent Change Jan 2003 – August 2010

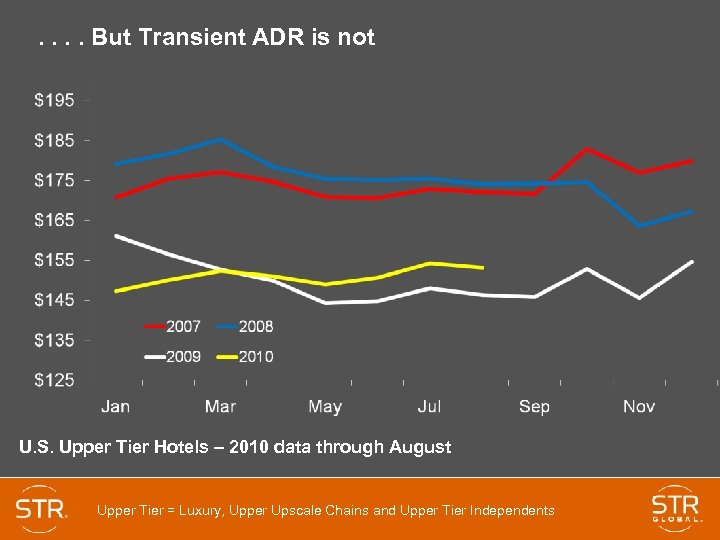

. . But Transient ADR is not U. S. Upper Tier Hotels – 2010 data through August Upper Tier = Luxury, Upper Upscale Chains and Upper Tier Independents

. . But Transient ADR is not U. S. Upper Tier Hotels – 2010 data through August Upper Tier = Luxury, Upper Upscale Chains and Upper Tier Independents

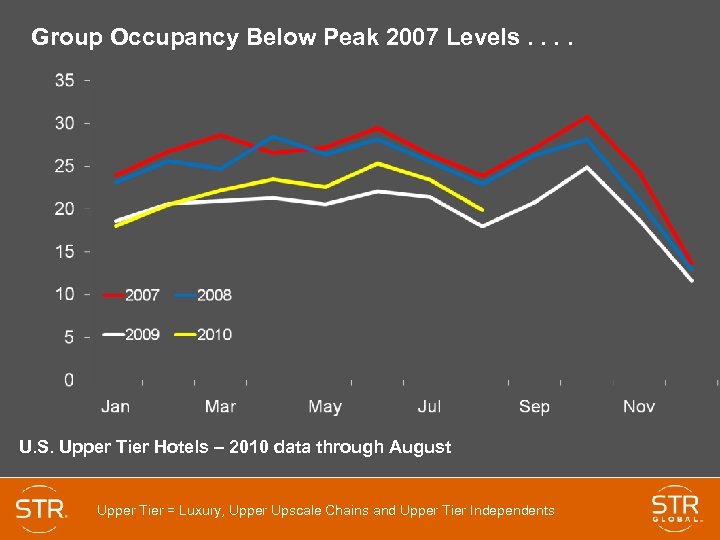

Group Occupancy Below Peak 2007 Levels. . U. S. Upper Tier Hotels – 2010 data through August Upper Tier = Luxury, Upper Upscale Chains and Upper Tier Independents

Group Occupancy Below Peak 2007 Levels. . U. S. Upper Tier Hotels – 2010 data through August Upper Tier = Luxury, Upper Upscale Chains and Upper Tier Independents

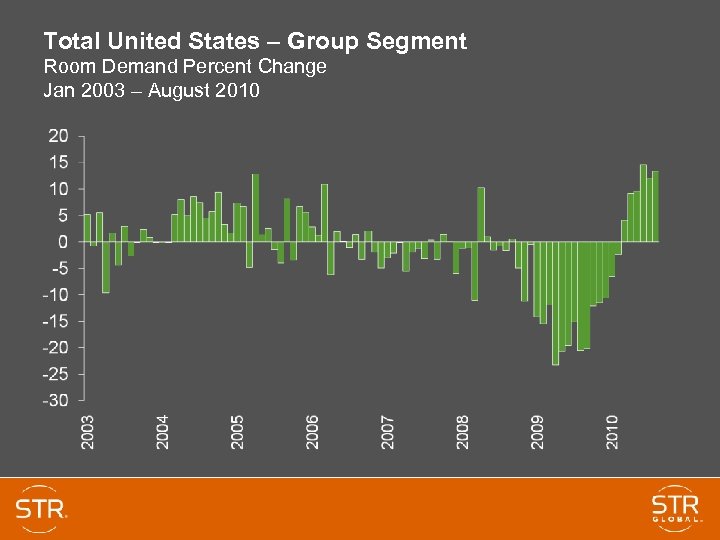

Total United States – Group Segment Room Demand Percent Change Jan 2003 – August 2010

Total United States – Group Segment Room Demand Percent Change Jan 2003 – August 2010

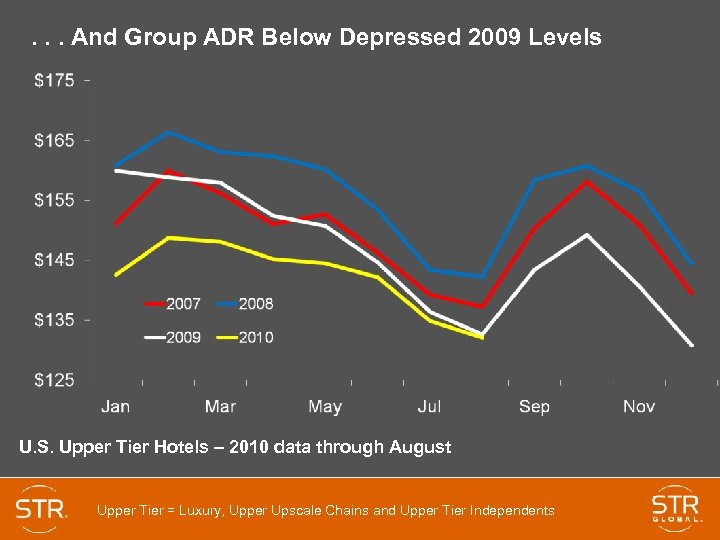

. . . And Group ADR Below Depressed 2009 Levels U. S. Upper Tier Hotels – 2010 data through August Upper Tier = Luxury, Upper Upscale Chains and Upper Tier Independents

. . . And Group ADR Below Depressed 2009 Levels U. S. Upper Tier Hotels – 2010 data through August Upper Tier = Luxury, Upper Upscale Chains and Upper Tier Independents

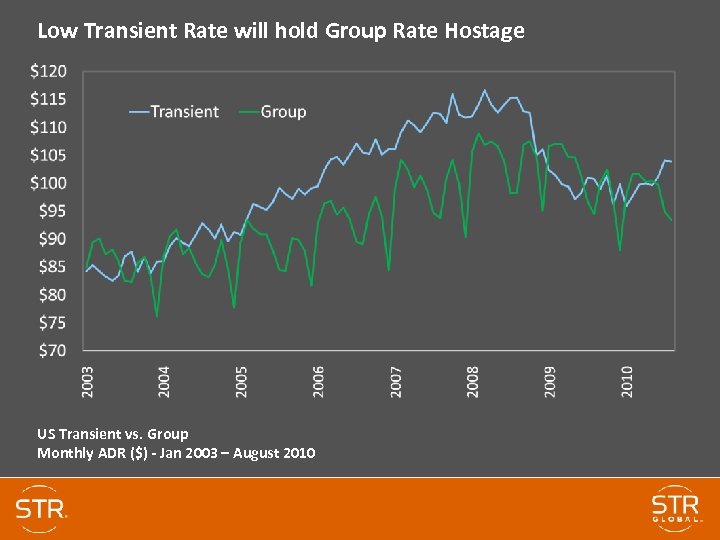

Low Transient Rate will hold Group Rate Hostage US Transient vs. Group Monthly ADR ($) - Jan 2003 – August 2010

Low Transient Rate will hold Group Rate Hostage US Transient vs. Group Monthly ADR ($) - Jan 2003 – August 2010

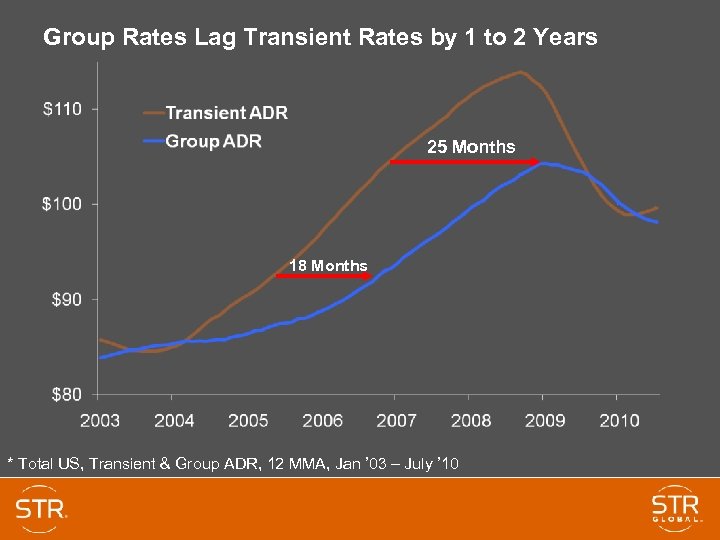

Group Rates Lag Transient Rates by 1 to 2 Years 25 Months 18 Months * Total US, Transient & Group ADR, 12 MMA, Jan ’ 03 – July ’ 10

Group Rates Lag Transient Rates by 1 to 2 Years 25 Months 18 Months * Total US, Transient & Group ADR, 12 MMA, Jan ’ 03 – July ’ 10

Pipeline

Pipeline

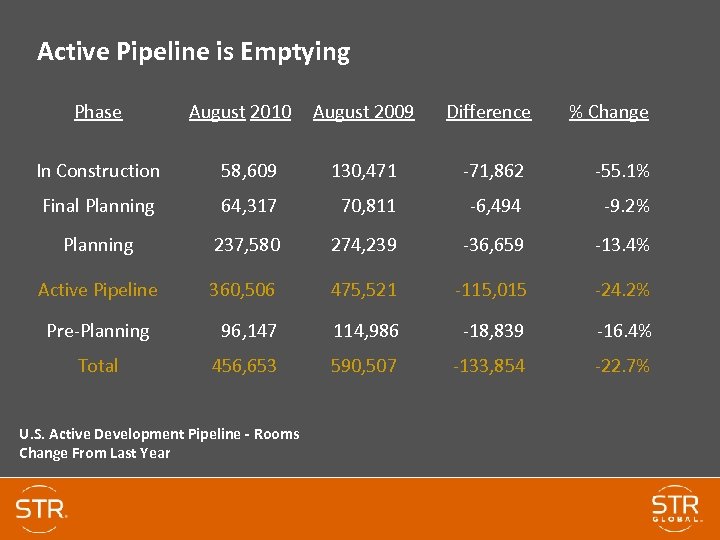

Active Pipeline is Emptying Phase August 2010 August 2009 Difference % Change In Construction 58, 609 130, 471 -71, 862 -55. 1% Final Planning 64, 317 70, 811 -6, 494 -9. 2% Planning 237, 580 274, 239 -36, 659 -13. 4% Active Pipeline 360, 506 475, 521 -115, 015 -24. 2% Pre-Planning 96, 147 114, 986 -18, 839 -16. 4% Total 456, 653 590, 507 -133, 854 -22. 7% U. S. Active Development Pipeline - Rooms Change From Last Year

Active Pipeline is Emptying Phase August 2010 August 2009 Difference % Change In Construction 58, 609 130, 471 -71, 862 -55. 1% Final Planning 64, 317 70, 811 -6, 494 -9. 2% Planning 237, 580 274, 239 -36, 659 -13. 4% Active Pipeline 360, 506 475, 521 -115, 015 -24. 2% Pre-Planning 96, 147 114, 986 -18, 839 -16. 4% Total 456, 653 590, 507 -133, 854 -22. 7% U. S. Active Development Pipeline - Rooms Change From Last Year

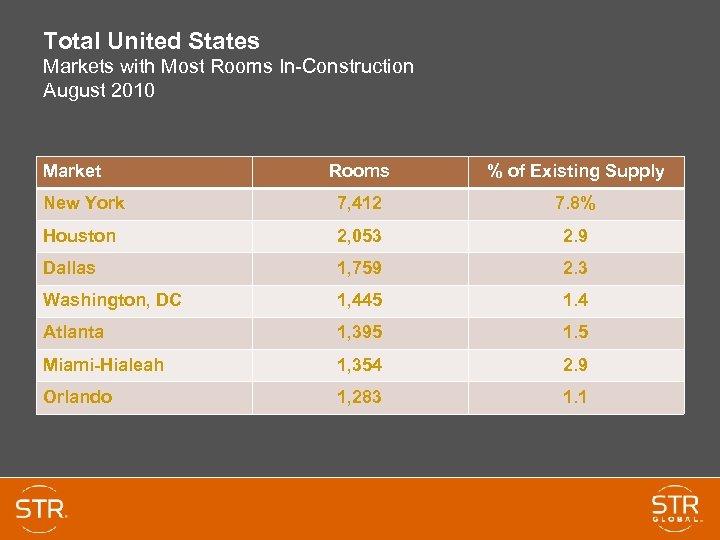

Total United States Markets with Most Rooms In-Construction August 2010 Market Rooms % of Existing Supply New York 7, 412 7. 8% Houston 2, 053 2. 9 Dallas 1, 759 2. 3 Washington, DC 1, 445 1. 4 Atlanta 1, 395 1. 5 Miami-Hialeah 1, 354 2. 9 Orlando 1, 283 1. 1

Total United States Markets with Most Rooms In-Construction August 2010 Market Rooms % of Existing Supply New York 7, 412 7. 8% Houston 2, 053 2. 9 Dallas 1, 759 2. 3 Washington, DC 1, 445 1. 4 Atlanta 1, 395 1. 5 Miami-Hialeah 1, 354 2. 9 Orlando 1, 283 1. 1

Key 15 U. S. Markets Absolute Occupancy August 2010 YTD Excludes Las Vegas

Key 15 U. S. Markets Absolute Occupancy August 2010 YTD Excludes Las Vegas

Key 15 U. S. Markets Absolute ADR August 2010 YTD Excludes Las Vegas

Key 15 U. S. Markets Absolute ADR August 2010 YTD Excludes Las Vegas

U. S. Industry Outlook

U. S. Industry Outlook

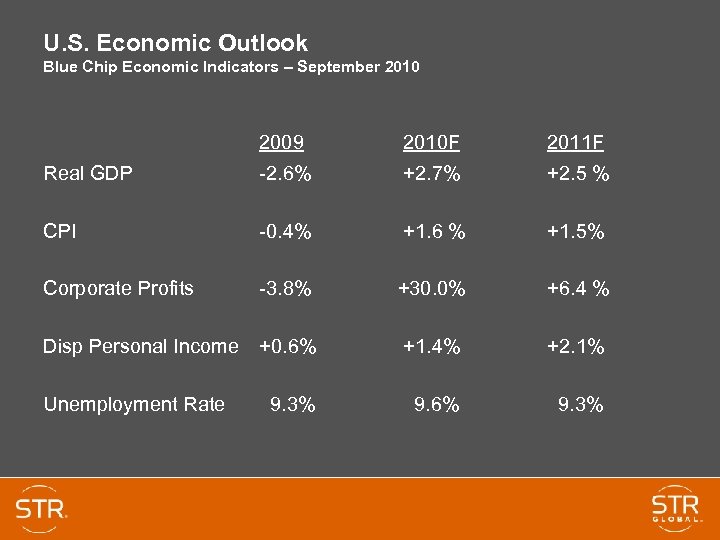

U. S. Economic Outlook Blue Chip Economic Indicators – September 2010 2009 2010 F 2011 F Real GDP -2. 6% +2. 7% +2. 5 % CPI -0. 4% +1. 6 % +1. 5% Corporate Profits -3. 8% +30. 0% +6. 4 % Disp Personal Income +0. 6% +1. 4% +2. 1% 9. 3% 9. 6% 9. 3% Unemployment Rate

U. S. Economic Outlook Blue Chip Economic Indicators – September 2010 2009 2010 F 2011 F Real GDP -2. 6% +2. 7% +2. 5 % CPI -0. 4% +1. 6 % +1. 5% Corporate Profits -3. 8% +30. 0% +6. 4 % Disp Personal Income +0. 6% +1. 4% +2. 1% 9. 3% 9. 6% 9. 3% Unemployment Rate

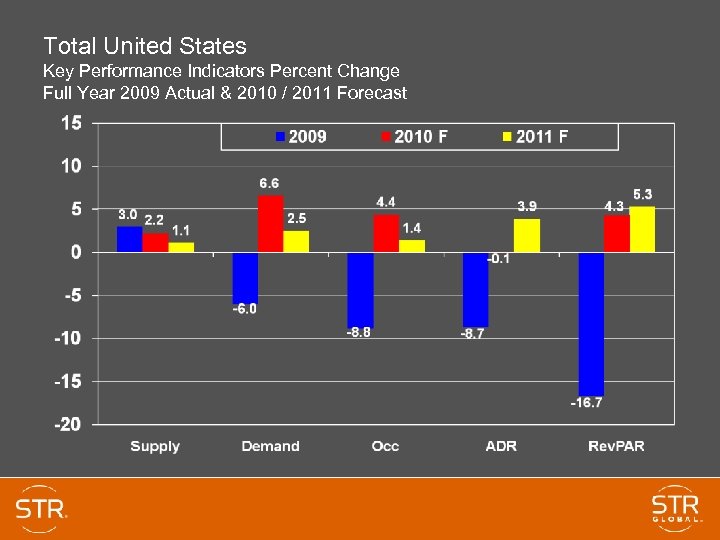

Total United States Key Performance Indicators Percent Change Full Year 2009 Actual & 2010 / 2011 Forecast

Total United States Key Performance Indicators Percent Change Full Year 2009 Actual & 2010 / 2011 Forecast

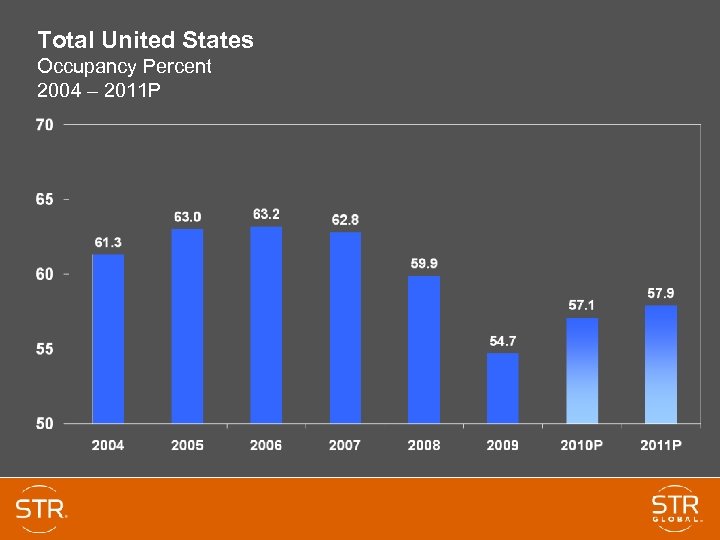

Total United States Occupancy Percent 2004 – 2011 P

Total United States Occupancy Percent 2004 – 2011 P

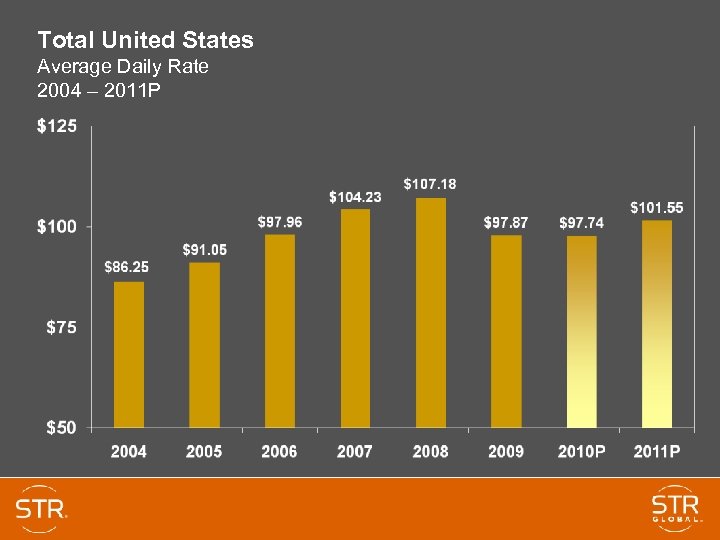

Total United States Average Daily Rate 2004 – 2011 P

Total United States Average Daily Rate 2004 – 2011 P

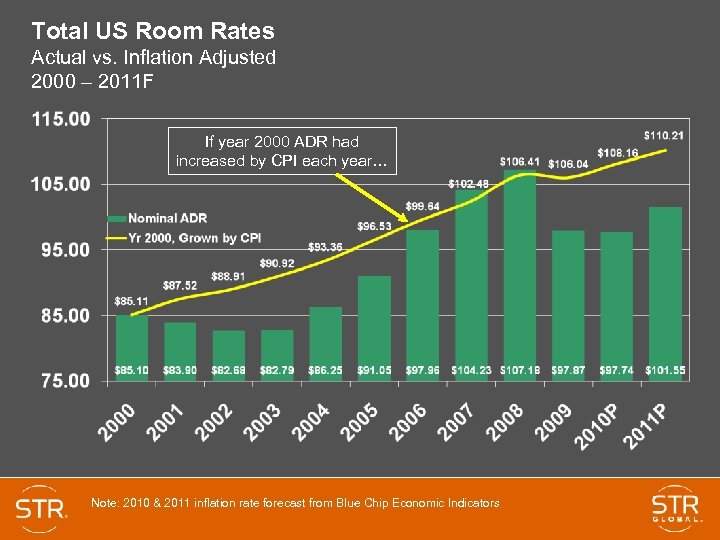

Total US Room Rates Actual vs. Inflation Adjusted 2000 – 2011 F If year 2000 ADR had increased by CPI each year… Note: 2010 & 2011 inflation rate forecast from Blue Chip Economic Indicators

Total US Room Rates Actual vs. Inflation Adjusted 2000 – 2011 F If year 2000 ADR had increased by CPI each year… Note: 2010 & 2011 inflation rate forecast from Blue Chip Economic Indicators

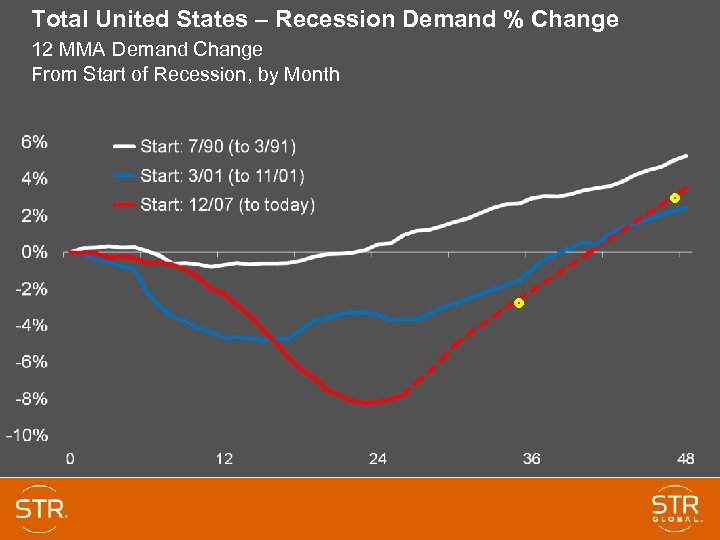

Total United States – Recession Demand % Change 12 MMA Demand Change From Start of Recession, by Month

Total United States – Recession Demand % Change 12 MMA Demand Change From Start of Recession, by Month

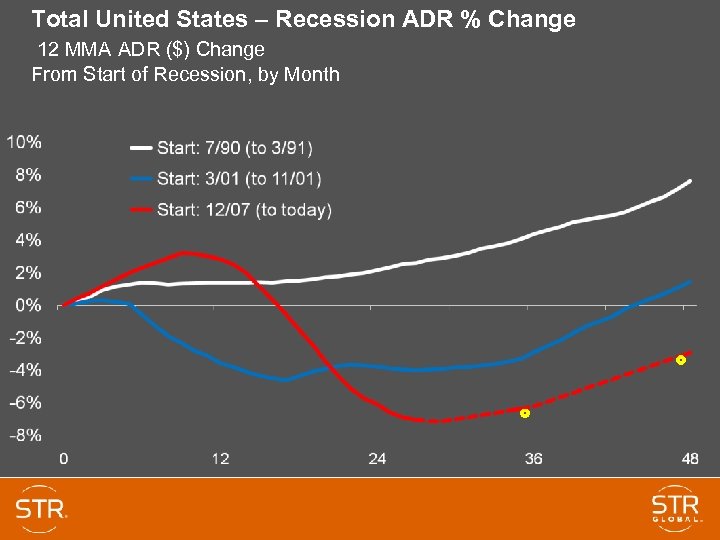

Total United States – Recession ADR % Change 12 MMA ADR ($) Change From Start of Recession, by Month

Total United States – Recession ADR % Change 12 MMA ADR ($) Change From Start of Recession, by Month

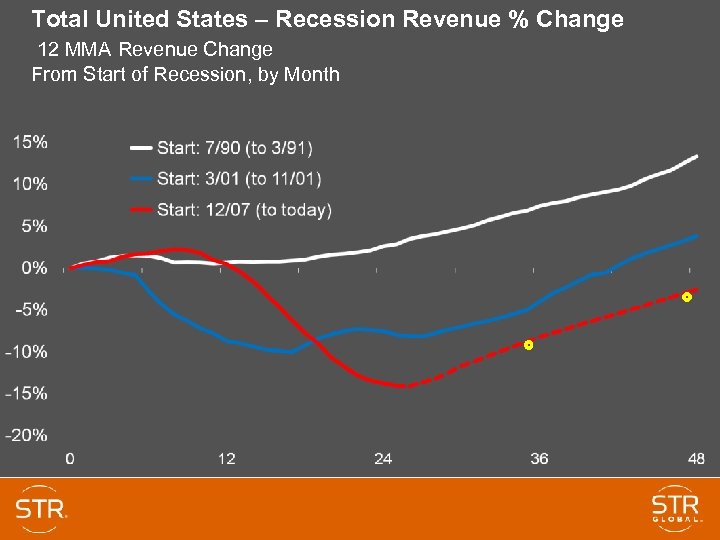

Total United States – Recession Revenue % Change 12 MMA Revenue Change From Start of Recession, by Month

Total United States – Recession Revenue % Change 12 MMA Revenue Change From Start of Recession, by Month

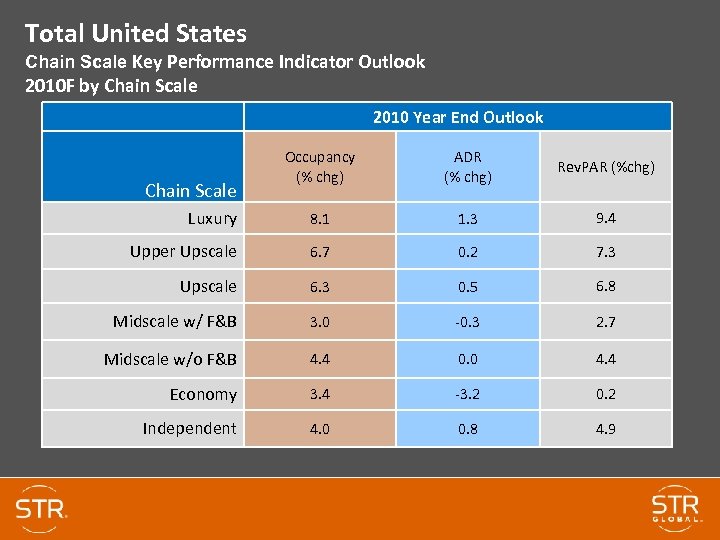

Total United States Chain Scale Key Performance Indicator Outlook 2010 F by Chain Scale 2010 Year End Outlook Occupancy (% chg) ADR (% chg) Rev. PAR (%chg) Luxury 8. 1 1. 3 9. 4 Upper Upscale 6. 7 0. 2 7. 3 Upscale 6. 3 0. 5 6. 8 Midscale w/ F&B 3. 0 -0. 3 2. 7 Midscale w/o F&B 4. 4 0. 0 4. 4 Economy 3. 4 -3. 2 0. 2 Independent 4. 0 0. 8 4. 9 Chain Scale

Total United States Chain Scale Key Performance Indicator Outlook 2010 F by Chain Scale 2010 Year End Outlook Occupancy (% chg) ADR (% chg) Rev. PAR (%chg) Luxury 8. 1 1. 3 9. 4 Upper Upscale 6. 7 0. 2 7. 3 Upscale 6. 3 0. 5 6. 8 Midscale w/ F&B 3. 0 -0. 3 2. 7 Midscale w/o F&B 4. 4 0. 0 4. 4 Economy 3. 4 -3. 2 0. 2 Independent 4. 0 0. 8 4. 9 Chain Scale

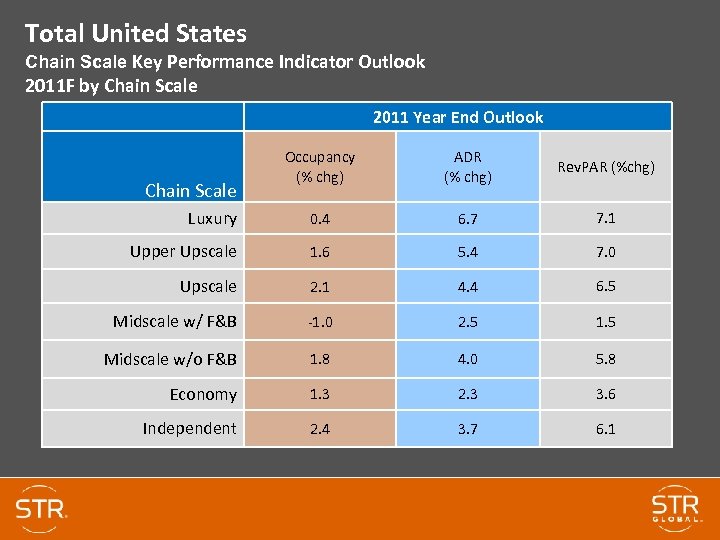

Total United States Chain Scale Key Performance Indicator Outlook 2011 F by Chain Scale 2011 Year End Outlook Occupancy (% chg) ADR (% chg) Rev. PAR (%chg) Luxury 0. 4 6. 7 7. 1 Upper Upscale 1. 6 5. 4 7. 0 Upscale 2. 1 4. 4 6. 5 Midscale w/ F&B -1. 0 2. 5 1. 5 Midscale w/o F&B 1. 8 4. 0 5. 8 Economy 1. 3 2. 3 3. 6 Independent 2. 4 3. 7 6. 1 Chain Scale

Total United States Chain Scale Key Performance Indicator Outlook 2011 F by Chain Scale 2011 Year End Outlook Occupancy (% chg) ADR (% chg) Rev. PAR (%chg) Luxury 0. 4 6. 7 7. 1 Upper Upscale 1. 6 5. 4 7. 0 Upscale 2. 1 4. 4 6. 5 Midscale w/ F&B -1. 0 2. 5 1. 5 Midscale w/o F&B 1. 8 4. 0 5. 8 Economy 1. 3 2. 3 3. 6 Independent 2. 4 3. 7 6. 1 Chain Scale

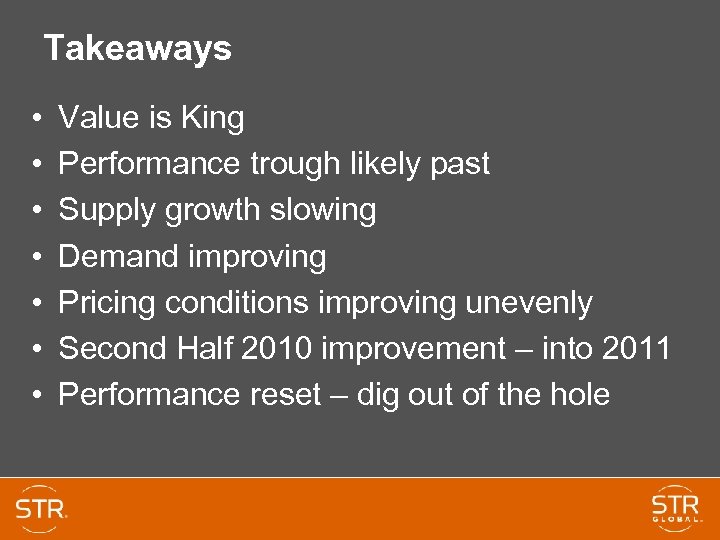

Takeaways • • Value is King Performance trough likely past Supply growth slowing Demand improving Pricing conditions improving unevenly Second Half 2010 improvement – into 2011 Performance reset – dig out of the hole

Takeaways • • Value is King Performance trough likely past Supply growth slowing Demand improving Pricing conditions improving unevenly Second Half 2010 improvement – into 2011 Performance reset – dig out of the hole

Thank you. www. hotelnewsnow. com Click on “Industry Presentations”

Thank you. www. hotelnewsnow. com Click on “Industry Presentations”