7c589daa2b96582b36acd3b15763e0d1.ppt

- Количество слайдов: 15

Ise 216 Chapter 4 question hour 23. 03. 2011

Ise 216 Chapter 4 question hour 23. 03. 2011

Q 4. 12 A large automobile repair shop installs about 1250 mufflers per year, 18 percent pf which are for imported cars. All the imported car mufflers are purchased from a single local supplier at a cost of 18. 50$ each. The shop uses a holding cost based on 25 percent annual interest rate. The set up cost for placing an order is estimated to be 28$. a) Determine the optimal number of imported-car mufflers the shop should purchase each time an order is placed, and the time between placement of orders. b) If the replenishment lead time is six weeks, what is the reorder point based o the level of on-hand inventory? c) The current reorder policy is to buy imported car mufflers only once a year. What are the additional holding amd set up costs incured by policy?

Q 4. 12 A large automobile repair shop installs about 1250 mufflers per year, 18 percent pf which are for imported cars. All the imported car mufflers are purchased from a single local supplier at a cost of 18. 50$ each. The shop uses a holding cost based on 25 percent annual interest rate. The set up cost for placing an order is estimated to be 28$. a) Determine the optimal number of imported-car mufflers the shop should purchase each time an order is placed, and the time between placement of orders. b) If the replenishment lead time is six weeks, what is the reorder point based o the level of on-hand inventory? c) The current reorder policy is to buy imported car mufflers only once a year. What are the additional holding amd set up costs incured by policy?

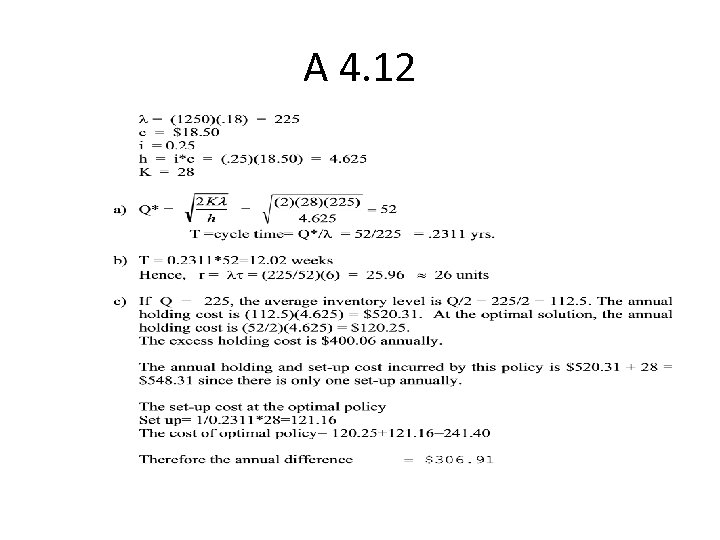

A 4. 12

A 4. 12

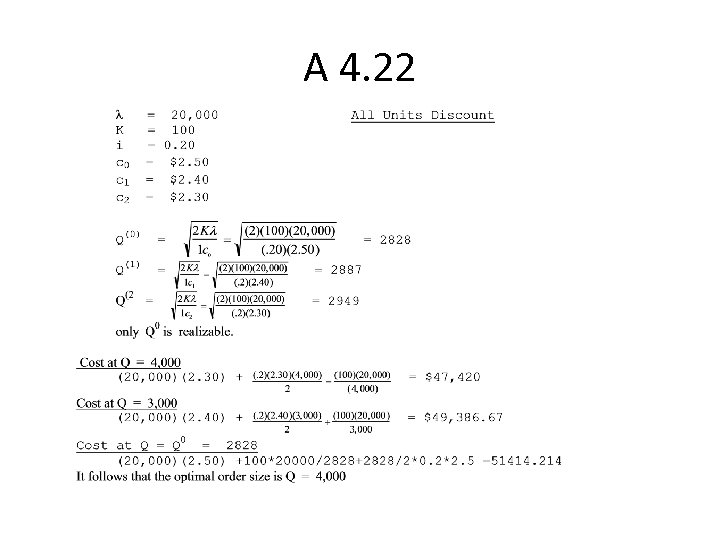

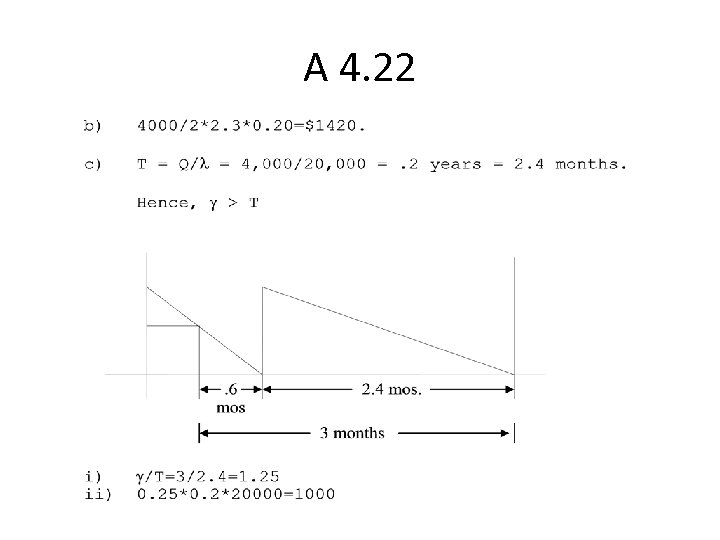

Q 4. 22 A purchasing agent for a particular type of silicon wafer used in the production of semiconductors must decide among three sources. Source A will sell the silicon wafers for 2. 5 per wafer, independently of the number of wafers ordered. Source B will selll the wafers for 2. 4 each but will not consider an order for fewer than 3000 wafers. And source C will sell the wafers 2. 3 each but will not accept an order fewer than 4000 wafers. Assume an order set up cost of $100 and an annual requirement of 20000 wafers. Assume a 20 percent annual interest rate for holding cost calculations. a) Which source should be used, and what is the size of the standing order? b) What is the optimal value of holding and set up costs for wafers when the optimal source is used? c) If the replenishment lead time for wafers is three months, determine the reorder point based on the on-hand level of inventory of waters?

Q 4. 22 A purchasing agent for a particular type of silicon wafer used in the production of semiconductors must decide among three sources. Source A will sell the silicon wafers for 2. 5 per wafer, independently of the number of wafers ordered. Source B will selll the wafers for 2. 4 each but will not consider an order for fewer than 3000 wafers. And source C will sell the wafers 2. 3 each but will not accept an order fewer than 4000 wafers. Assume an order set up cost of $100 and an annual requirement of 20000 wafers. Assume a 20 percent annual interest rate for holding cost calculations. a) Which source should be used, and what is the size of the standing order? b) What is the optimal value of holding and set up costs for wafers when the optimal source is used? c) If the replenishment lead time for wafers is three months, determine the reorder point based on the on-hand level of inventory of waters?

A 4. 22

A 4. 22

A 4. 22

A 4. 22

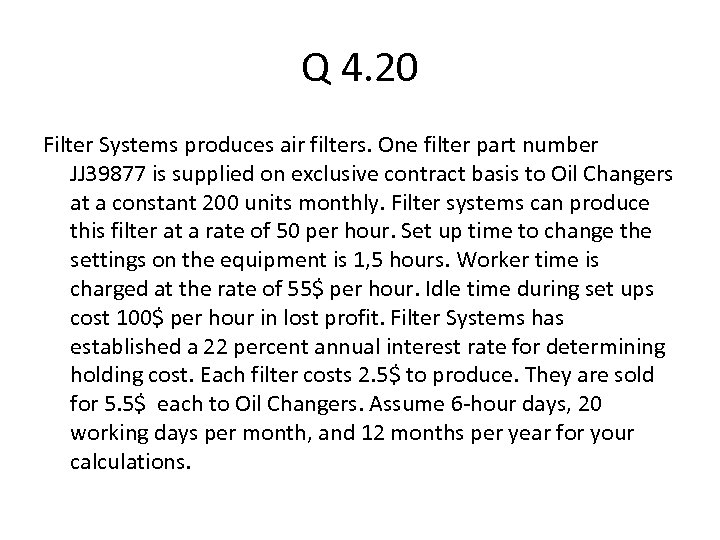

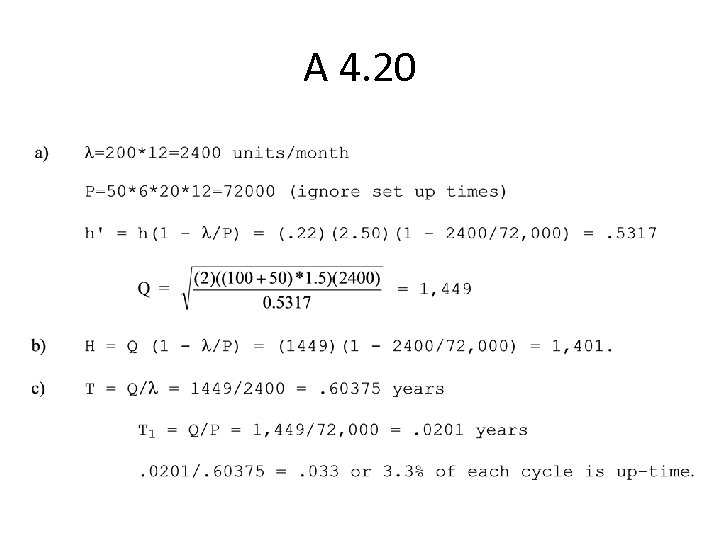

Q 4. 20 Filter Systems produces air filters. One filter part number JJ 39877 is supplied on exclusive contract basis to Oil Changers at a constant 200 units monthly. Filter systems can produce this filter at a rate of 50 per hour. Set up time to change the settings on the equipment is 1, 5 hours. Worker time is charged at the rate of 55$ per hour. Idle time during set ups cost 100$ per hour in lost profit. Filter Systems has established a 22 percent annual interest rate for determining holding cost. Each filter costs 2. 5$ to produce. They are sold for 5. 5$ each to Oil Changers. Assume 6 -hour days, 20 working days per month, and 12 months per year for your calculations.

Q 4. 20 Filter Systems produces air filters. One filter part number JJ 39877 is supplied on exclusive contract basis to Oil Changers at a constant 200 units monthly. Filter systems can produce this filter at a rate of 50 per hour. Set up time to change the settings on the equipment is 1, 5 hours. Worker time is charged at the rate of 55$ per hour. Idle time during set ups cost 100$ per hour in lost profit. Filter Systems has established a 22 percent annual interest rate for determining holding cost. Each filter costs 2. 5$ to produce. They are sold for 5. 5$ each to Oil Changers. Assume 6 -hour days, 20 working days per month, and 12 months per year for your calculations.

A 4. 20

A 4. 20

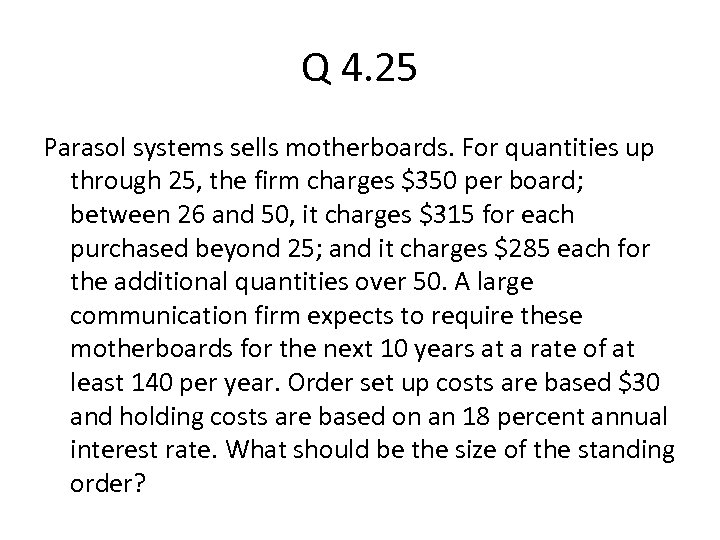

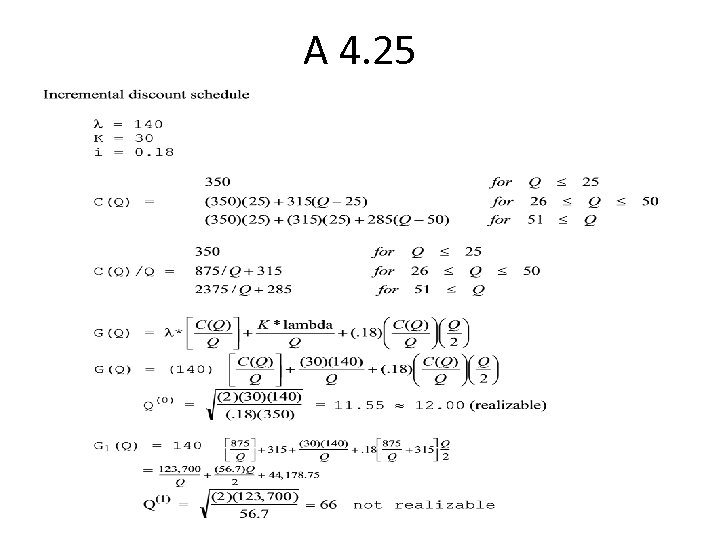

Q 4. 25 Parasol systems sells motherboards. For quantities up through 25, the firm charges $350 per board; between 26 and 50, it charges $315 for each purchased beyond 25; and it charges $285 each for the additional quantities over 50. A large communication firm expects to require these motherboards for the next 10 years at a rate of at least 140 per year. Order set up costs are based $30 and holding costs are based on an 18 percent annual interest rate. What should be the size of the standing order?

Q 4. 25 Parasol systems sells motherboards. For quantities up through 25, the firm charges $350 per board; between 26 and 50, it charges $315 for each purchased beyond 25; and it charges $285 each for the additional quantities over 50. A large communication firm expects to require these motherboards for the next 10 years at a rate of at least 140 per year. Order set up costs are based $30 and holding costs are based on an 18 percent annual interest rate. What should be the size of the standing order?

A 4. 25

A 4. 25

A 4. 25(2)

A 4. 25(2)

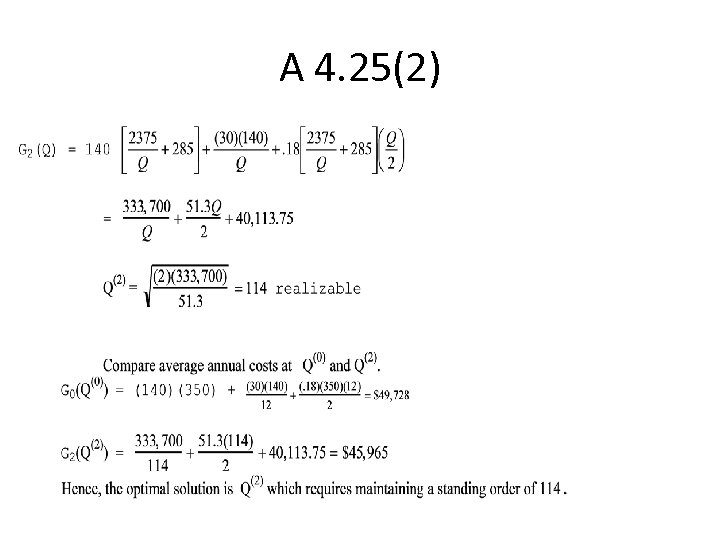

Q 4. 26 A local outdoor vegetable stand has exactly 1000 sq feet of space to display three vegetables. Tomatoes, lettuce, zucchini. The appropriate data for these items are: The set up cost for replenishment of vegetables is $100. The space consumed by each vegetable is proportional to its costs. With tomatoes requiring 0, 5 sq foot per pound. The annual int. rate 0, 25. What are the optimal quantities that should be purchased of these three vegetables?

Q 4. 26 A local outdoor vegetable stand has exactly 1000 sq feet of space to display three vegetables. Tomatoes, lettuce, zucchini. The appropriate data for these items are: The set up cost for replenishment of vegetables is $100. The space consumed by each vegetable is proportional to its costs. With tomatoes requiring 0, 5 sq foot per pound. The annual int. rate 0, 25. What are the optimal quantities that should be purchased of these three vegetables?

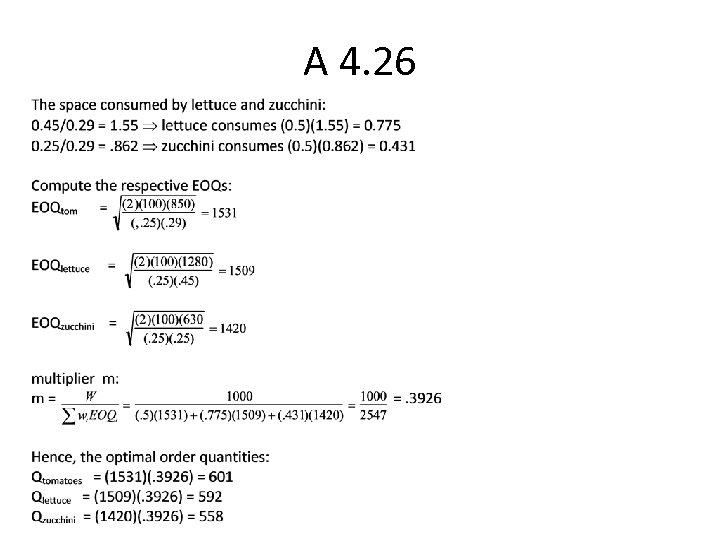

A 4. 26

A 4. 26

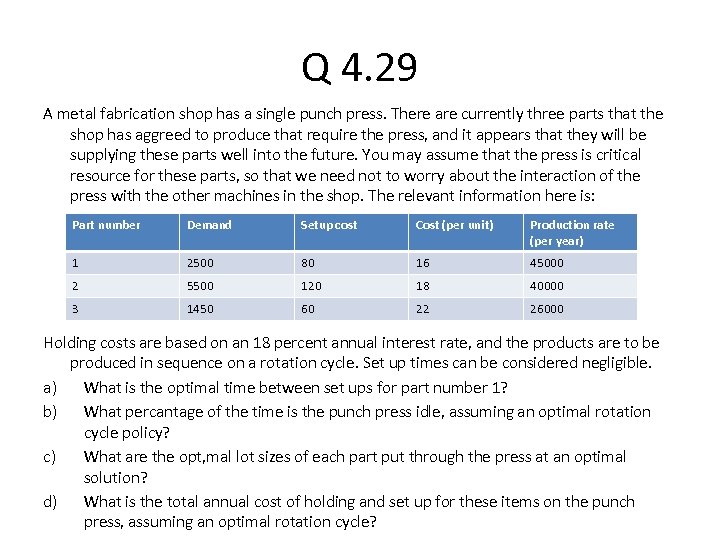

Q 4. 29 A metal fabrication shop has a single punch press. There are currently three parts that the shop has aggreed to produce that require the press, and it appears that they will be supplying these parts well into the future. You may assume that the press is critical resource for these parts, so that we need not to worry about the interaction of the press with the other machines in the shop. The relevant information here is: Part number Demand Setup cost Cost (per unit) Production rate (per year) 1 2500 80 16 45000 2 5500 120 18 40000 3 1450 60 22 26000 Holding costs are based on an 18 percent annual interest rate, and the products are to be produced in sequence on a rotation cycle. Set up times can be considered negligible. a) What is the optimal time between set ups for part number 1? b) What percantage of the time is the punch press idle, assuming an optimal rotation cycle policy? c) What are the opt, mal lot sizes of each part put through the press at an optimal solution? d) What is the total annual cost of holding and set up for these items on the punch press, assuming an optimal rotation cycle?

Q 4. 29 A metal fabrication shop has a single punch press. There are currently three parts that the shop has aggreed to produce that require the press, and it appears that they will be supplying these parts well into the future. You may assume that the press is critical resource for these parts, so that we need not to worry about the interaction of the press with the other machines in the shop. The relevant information here is: Part number Demand Setup cost Cost (per unit) Production rate (per year) 1 2500 80 16 45000 2 5500 120 18 40000 3 1450 60 22 26000 Holding costs are based on an 18 percent annual interest rate, and the products are to be produced in sequence on a rotation cycle. Set up times can be considered negligible. a) What is the optimal time between set ups for part number 1? b) What percantage of the time is the punch press idle, assuming an optimal rotation cycle policy? c) What are the opt, mal lot sizes of each part put through the press at an optimal solution? d) What is the total annual cost of holding and set up for these items on the punch press, assuming an optimal rotation cycle?

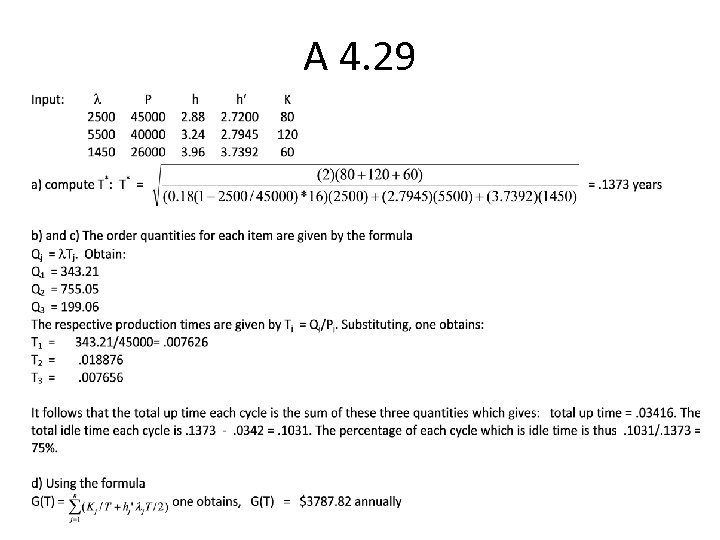

A 4. 29

A 4. 29