ed6964d9a78ca7b06501eb606988b192.ppt

- Количество слайдов: 21

İş Yatırım Menkul Değerler A. Ş. PERFORMANCE & FINANCIAL RESULTS 2008 Ocak 2005 April 8, 2009

İş Yatırım Menkul Değerler A. Ş. PERFORMANCE & FINANCIAL RESULTS 2008 Ocak 2005 April 8, 2009

ABOUT US OVERVIEW OF CAPITAL MARKETS OUR PERFORMANCE FINANCIAL RESULTS EXPECTATIONS FOR THE REST OF THE YEAR

ABOUT US OVERVIEW OF CAPITAL MARKETS OUR PERFORMANCE FINANCIAL RESULTS EXPECTATIONS FOR THE REST OF THE YEAR

THE ONLY LISTED INVESTMENT HOUSE - ISE FITCH: “AAA(tur)” IS Investment offers variety of domestic and international services, such as; ª Brokerage ª Investment Advisory ª Asset Management ª Corporate Finance ª Research The leading investment house in Turkey and the investment arm of IS Bank

THE ONLY LISTED INVESTMENT HOUSE - ISE FITCH: “AAA(tur)” IS Investment offers variety of domestic and international services, such as; ª Brokerage ª Investment Advisory ª Asset Management ª Corporate Finance ª Research The leading investment house in Turkey and the investment arm of IS Bank

CREDIT RATING - ‘AAA(tur)’ Fitch Ratings has affirmed IS Investment’s national long-term credit rating of 'AAA(tur)‘ with stable outlook

CREDIT RATING - ‘AAA(tur)’ Fitch Ratings has affirmed IS Investment’s national long-term credit rating of 'AAA(tur)‘ with stable outlook

ONCE AGAIN…BEST EQUITY HOUSE IN TURKEY IS Investment - once again - rewarded as the “Best Equity House in Turkey”

ONCE AGAIN…BEST EQUITY HOUSE IN TURKEY IS Investment - once again - rewarded as the “Best Equity House in Turkey”

ABOUT US OVERVIEW OF TURKISH CAPITAL MARKETS OUR PERFORMANCE FINANCIAL RESULTS EXPECTATIONS FOR THE REST OF THE YEAR

ABOUT US OVERVIEW OF TURKISH CAPITAL MARKETS OUR PERFORMANCE FINANCIAL RESULTS EXPECTATIONS FOR THE REST OF THE YEAR

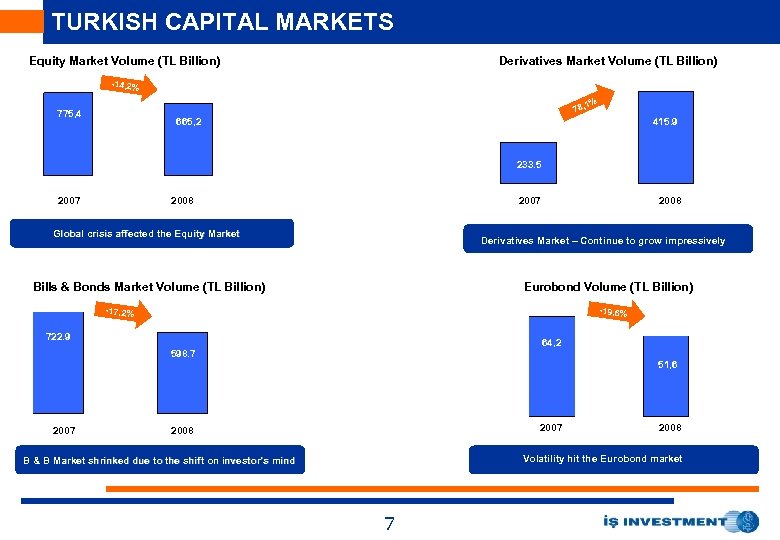

TURKISH CAPITAL MARKETS Equity Market Volume (TL Billion) Derivatives Market Volume (TL Billion) -14, 2% 78, 775, 4 1% 665, 2 415. 9 233. 5 2007 2008 2007 Global crisis affected the Equity Market 2008 Derivatives Market – Continue to grow impressively Bills & Bonds Market Volume (TL Billion) Eurobond Volume (TL Billion) -17, 2% 722. 9 -19, 6% 3, 5% 64, 2 598. 7 51, 6 2007 2008 Volatility hit the Eurobond market B & B Market shrinked due to the shift on investor’s mind 7

TURKISH CAPITAL MARKETS Equity Market Volume (TL Billion) Derivatives Market Volume (TL Billion) -14, 2% 78, 775, 4 1% 665, 2 415. 9 233. 5 2007 2008 2007 Global crisis affected the Equity Market 2008 Derivatives Market – Continue to grow impressively Bills & Bonds Market Volume (TL Billion) Eurobond Volume (TL Billion) -17, 2% 722. 9 -19, 6% 3, 5% 64, 2 598. 7 51, 6 2007 2008 Volatility hit the Eurobond market B & B Market shrinked due to the shift on investor’s mind 7

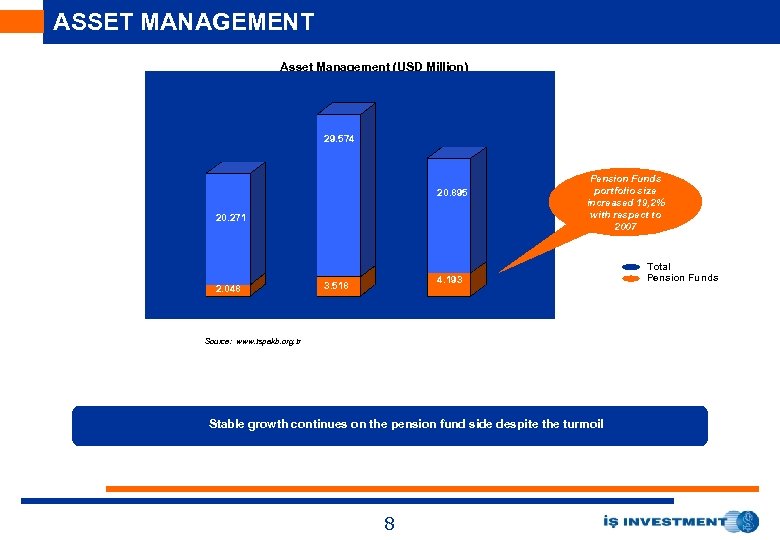

ASSET MANAGEMENT Asset Management (USD Million) 144. 1 29. 574 25. 010 20. 895 20. 271 913 21. 4 2. 048 4. 193 3. 518 2006 Pension Funds portfolio size increased 19, 2% 3. 677 with respect to 2007 2008 Source: www. tspakb. org. tr Stable growth continues on the pension fund side despite the turmoil 8 Total Pension Funds

ASSET MANAGEMENT Asset Management (USD Million) 144. 1 29. 574 25. 010 20. 895 20. 271 913 21. 4 2. 048 4. 193 3. 518 2006 Pension Funds portfolio size increased 19, 2% 3. 677 with respect to 2007 2008 Source: www. tspakb. org. tr Stable growth continues on the pension fund side despite the turmoil 8 Total Pension Funds

ABOUT US OVERVIEW OF CAPITAL MARKETS OUR PERFORMANCE FINANCIAL RESULTS EXPECTATIONS FOR THE REST OF THE YEAR

ABOUT US OVERVIEW OF CAPITAL MARKETS OUR PERFORMANCE FINANCIAL RESULTS EXPECTATIONS FOR THE REST OF THE YEAR

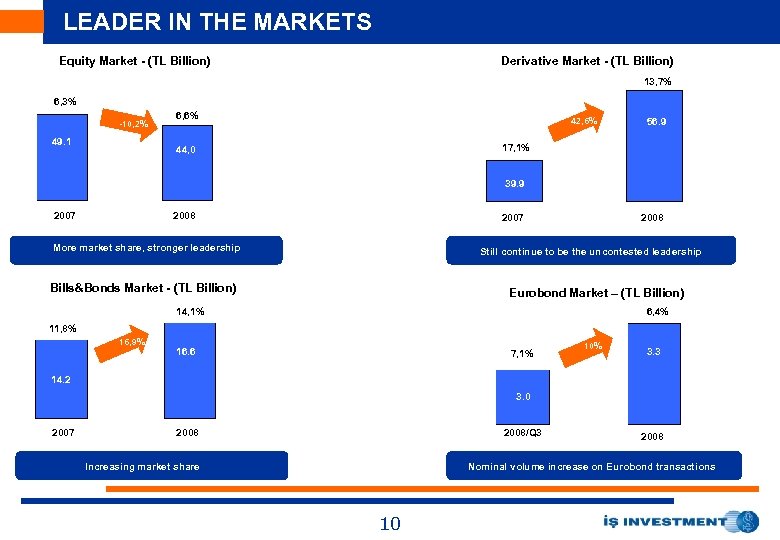

LEADER IN THE MARKETS Equity Market - (TL Billion) Derivative Market - (TL Billion) 13, 7% 6, 3% -10, 2% 49. 1 6, 6% 42, 6% 56. 9 17, 1% 44, 0 39. 9 2007 2008 2007 More market share, stronger leadership 2008 Still continue to be the uncontested leadership Bills&Bonds Market - (TL Billion) Eurobond Market – (TL Billion) 14, 1% 6, 4% 11, 8% 16, 9% 16. 6 7, 1% 10% 3. 3 14. 2 3. 0 2007 2008/Q 3 Increasing market share 2008 Nominal volume increase on Eurobond transactions 10

LEADER IN THE MARKETS Equity Market - (TL Billion) Derivative Market - (TL Billion) 13, 7% 6, 3% -10, 2% 49. 1 6, 6% 42, 6% 56. 9 17, 1% 44, 0 39. 9 2007 2008 2007 More market share, stronger leadership 2008 Still continue to be the uncontested leadership Bills&Bonds Market - (TL Billion) Eurobond Market – (TL Billion) 14, 1% 6, 4% 11, 8% 16, 9% 16. 6 7, 1% 10% 3. 3 14. 2 3. 0 2007 2008/Q 3 Increasing market share 2008 Nominal volume increase on Eurobond transactions 10

MARKET RANKS- EQUITY

MARKET RANKS- EQUITY

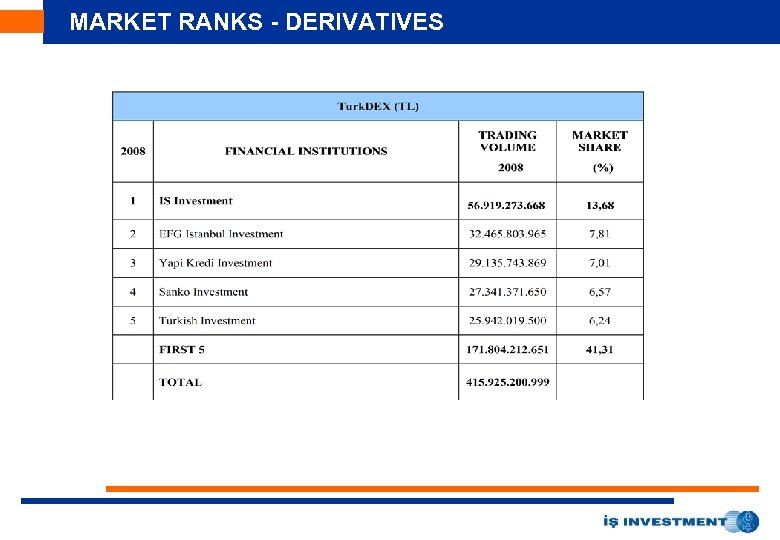

MARKET RANKS - DERIVATIVES

MARKET RANKS - DERIVATIVES

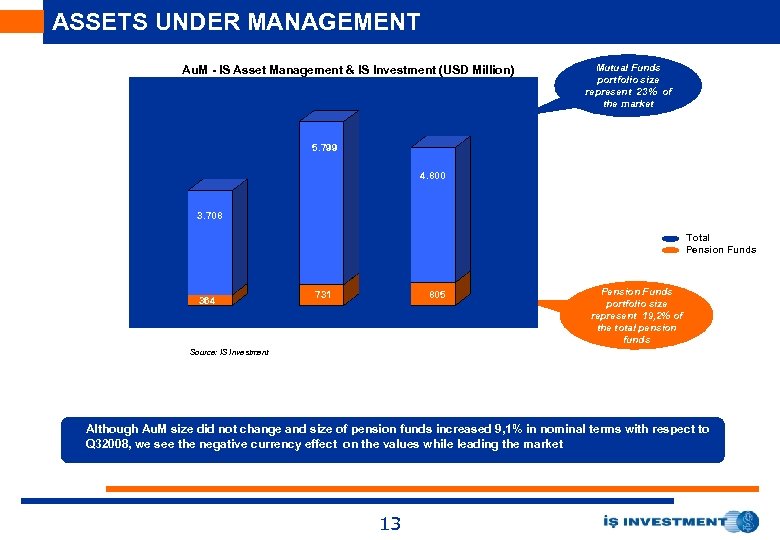

ASSETS UNDER MANAGEMENT Au. M - IS Asset Management & IS Investment (USD Million) 173 7. 043 Mutual Funds portfolio size represent 23% of the market 5. 799 4. 800 3. 708 Total Pension Funds 364 2006 731 805 2007 2008 Pension Funds portfolio size represent 19, 2% of the total pension funds Source: IS Investment Although Au. M size did not change and size of pension funds increased 9, 1% in nominal terms with respect to Q 32008, we see the negative currency effect on the values while leading the market 13

ASSETS UNDER MANAGEMENT Au. M - IS Asset Management & IS Investment (USD Million) 173 7. 043 Mutual Funds portfolio size represent 23% of the market 5. 799 4. 800 3. 708 Total Pension Funds 364 2006 731 805 2007 2008 Pension Funds portfolio size represent 19, 2% of the total pension funds Source: IS Investment Although Au. M size did not change and size of pension funds increased 9, 1% in nominal terms with respect to Q 32008, we see the negative currency effect on the values while leading the market 13

ABOUT US OVERVIEW OF CAPITAL MARKETS OUR PERFORMANCE FINANCIAL RESULTS EXPECTATIONS FOR THE REST OF THE YEAR

ABOUT US OVERVIEW OF CAPITAL MARKETS OUR PERFORMANCE FINANCIAL RESULTS EXPECTATIONS FOR THE REST OF THE YEAR

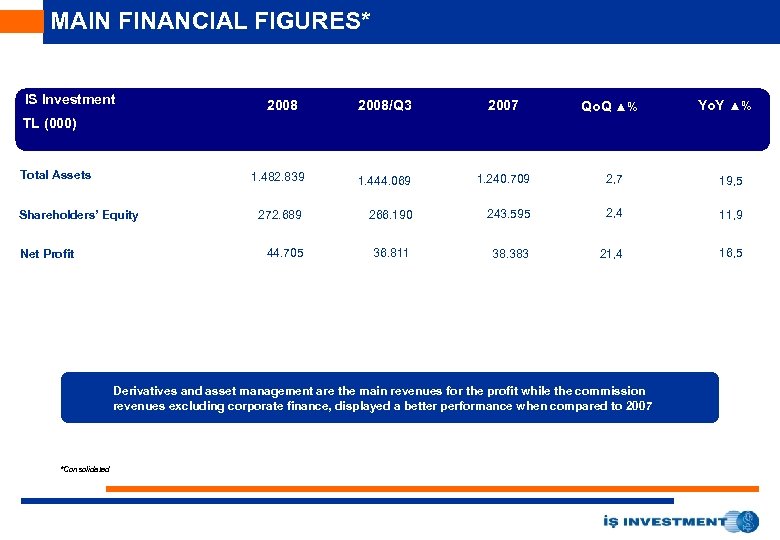

MAIN FINANCIAL FIGURES* IS Investment 2008/Q 3 2007 1. 482. 839 1. 444. 069 1. 240. 709 2, 7 19, 5 272. 689 266. 190 243. 595 2, 4 11, 9 44. 705 36. 811 38. 383 21, 4 16, 5 Qo. Q ▲% Yo. Y ▲% TL (000) Total Assets Shareholders’ Equity Net Profit Derivatives and asset management are the main revenues for the profit while the commission revenues excluding corporate finance, displayed a better performance when compared to 2007 *Consolidated

MAIN FINANCIAL FIGURES* IS Investment 2008/Q 3 2007 1. 482. 839 1. 444. 069 1. 240. 709 2, 7 19, 5 272. 689 266. 190 243. 595 2, 4 11, 9 44. 705 36. 811 38. 383 21, 4 16, 5 Qo. Q ▲% Yo. Y ▲% TL (000) Total Assets Shareholders’ Equity Net Profit Derivatives and asset management are the main revenues for the profit while the commission revenues excluding corporate finance, displayed a better performance when compared to 2007 *Consolidated

PROPOSED DISTRIBUTION OF PROFIT - 2008 Is Investment’s Board of Directors stated the company’s dividend policy as distributing -at least 30% of the attributable profit as in cash and/or bonus shares IS Investment will propose AGM to distribute the 30% of the attributable profit as cash dividend(TL 12. 9 mn) in parallel with the “Dividend Policy” of the company 16

PROPOSED DISTRIBUTION OF PROFIT - 2008 Is Investment’s Board of Directors stated the company’s dividend policy as distributing -at least 30% of the attributable profit as in cash and/or bonus shares IS Investment will propose AGM to distribute the 30% of the attributable profit as cash dividend(TL 12. 9 mn) in parallel with the “Dividend Policy” of the company 16

ABOUT US OVERVIEW OF CAPITAL MARKETS OUR PERFORMANCE FINANCIAL RESULTS EXPECTATIONS FOR THE REST OF THE YEAR

ABOUT US OVERVIEW OF CAPITAL MARKETS OUR PERFORMANCE FINANCIAL RESULTS EXPECTATIONS FOR THE REST OF THE YEAR

EXPECTATIONS FOR 2009 ª Continue to benefit from the strong equity and cash. ª Belated consolidation is happening in the sector. Number of the brokerage houses will be lower in 2009. ª Our Maslak Branch and Suadiye Liaison Office up and running in Istanbul despite the consolidation. ª We target to increase our market share in 2009 to clinch our uncontested leadership, first signs are approving this tendency. ª Single stock futures are still on the way, waiting for CMB’s approval. ª Extending Prime Brokerage service to newcoming Asset Management Companies. ª Trading foreign securities continue to boom, new products and instruments are on the pipeline. ª Our youngest subsidiary Maxis Securities is enlarging its operations.

EXPECTATIONS FOR 2009 ª Continue to benefit from the strong equity and cash. ª Belated consolidation is happening in the sector. Number of the brokerage houses will be lower in 2009. ª Our Maslak Branch and Suadiye Liaison Office up and running in Istanbul despite the consolidation. ª We target to increase our market share in 2009 to clinch our uncontested leadership, first signs are approving this tendency. ª Single stock futures are still on the way, waiting for CMB’s approval. ª Extending Prime Brokerage service to newcoming Asset Management Companies. ª Trading foreign securities continue to boom, new products and instruments are on the pipeline. ª Our youngest subsidiary Maxis Securities is enlarging its operations.

INVESTOR RELATIONS Mert Erdoğmuş Assistant General Manager Phone : +90 0212 350 24 12 Fax : +90 0212 350 20 01 E-mail : merdogmus@isinvestment. com The Investor Relations Department is responsible for the timely communication of necessary, accurate, complete, comprehensible and easily accessible information and explanations http: //www. isinvestment. com/wwa_ir. aspx Ozan Altan Vice President Phone : +90 0212 350 28 72 Fax : +90 0212 350 28 73 E-mail : oaltan@isinvestment. com 19

INVESTOR RELATIONS Mert Erdoğmuş Assistant General Manager Phone : +90 0212 350 24 12 Fax : +90 0212 350 20 01 E-mail : merdogmus@isinvestment. com The Investor Relations Department is responsible for the timely communication of necessary, accurate, complete, comprehensible and easily accessible information and explanations http: //www. isinvestment. com/wwa_ir. aspx Ozan Altan Vice President Phone : +90 0212 350 28 72 Fax : +90 0212 350 28 73 E-mail : oaltan@isinvestment. com 19

The information in this report is prepared by “IS YATIRIM MENKUL DEGERLER A. S. ” (İş Investment) and it is not to be construed as an offer or solicitation for the purchase or sale of any financial instrument or the provision of an offer to provide investment services. Information, opinions and comments contained in this material are not under the scope of investment advisory services. Investment advisory services are given according to the investment advisory contract, signed between the intermediary institutions, portfolio management companies, investment banks and the clients. Opinions and comments contained in this report reflect the personal views of the analysts who supplied them. The investments discussed or recommended in this report may involve significant risk, may be illiquid and may not be suitable for all investors. Therefore, making decisions with respect to the information in this report cause inappropriate results. All prices, data and other information are not warranted as to completeness or accuracy and are subject to change without notice. Any form of reproduction, dissemination, copying, disclosure, modification, distribution and/or publication of this report is strictly prohibited. The information presented in this report has been obtained from sources believed to be reliable. Is Investment cannot be held responsible for any errors or omissions or for results obtained from the use of such information. 20

The information in this report is prepared by “IS YATIRIM MENKUL DEGERLER A. S. ” (İş Investment) and it is not to be construed as an offer or solicitation for the purchase or sale of any financial instrument or the provision of an offer to provide investment services. Information, opinions and comments contained in this material are not under the scope of investment advisory services. Investment advisory services are given according to the investment advisory contract, signed between the intermediary institutions, portfolio management companies, investment banks and the clients. Opinions and comments contained in this report reflect the personal views of the analysts who supplied them. The investments discussed or recommended in this report may involve significant risk, may be illiquid and may not be suitable for all investors. Therefore, making decisions with respect to the information in this report cause inappropriate results. All prices, data and other information are not warranted as to completeness or accuracy and are subject to change without notice. Any form of reproduction, dissemination, copying, disclosure, modification, distribution and/or publication of this report is strictly prohibited. The information presented in this report has been obtained from sources believed to be reliable. Is Investment cannot be held responsible for any errors or omissions or for results obtained from the use of such information. 20

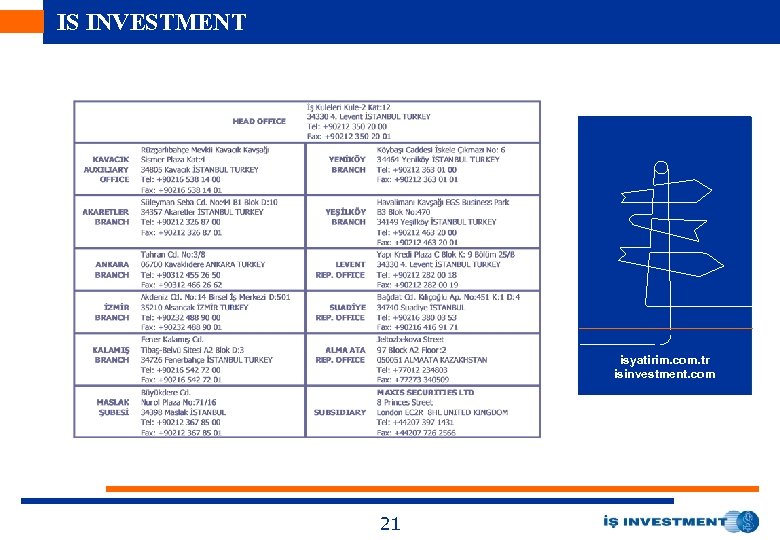

IS INVESTMENT isyatirim. com. tr isinvestment. com 21

IS INVESTMENT isyatirim. com. tr isinvestment. com 21