e193a99d686093691ec9e62f4e9badc5.ppt

- Количество слайдов: 19

Is there really a Resource Curse? Implications for Governance and Production Jonathan Di John • Resource Curse: Natural resource abundance leads to: 1. 2. 3. poor economic performance/growth collapses high levels of corruption/poor governance greater political violence. • Contrary to earlier arguments that mineral abundance can help overcome traditional resource gaps (savings, fiscal and foreign exchange constraints). Innis (1966) ‘staple thesis’ • Resource Curse theory applied to all natural-resource abundant economies, not just in Sub-Saharan Africa

Is there really a Resource Curse? Implications for Governance and Production Jonathan Di John • Resource Curse: Natural resource abundance leads to: 1. 2. 3. poor economic performance/growth collapses high levels of corruption/poor governance greater political violence. • Contrary to earlier arguments that mineral abundance can help overcome traditional resource gaps (savings, fiscal and foreign exchange constraints). Innis (1966) ‘staple thesis’ • Resource Curse theory applied to all natural-resource abundant economies, not just in Sub-Saharan Africa

Variants of the Resource Curse Argument: • Dutch Disease: natural resource booms render manufacturing and agricultural sectors uncompetitive

Variants of the Resource Curse Argument: • Dutch Disease: natural resource booms render manufacturing and agricultural sectors uncompetitive

Variants of the Resource Curse Argument: • Rentier State and theory of rent-seeking: the economic effects • oil abundance, especially when controlled by the state, is assumed to generate extraordinarily large degrees of rent-seeking and corruption • increases in rent-seeking and corruption will generate lower growth • Corrupt transactions—the need to keep bribes secret reduces the security of property rights, which lowers investment in long-gestating projects

Variants of the Resource Curse Argument: • Rentier State and theory of rent-seeking: the economic effects • oil abundance, especially when controlled by the state, is assumed to generate extraordinarily large degrees of rent-seeking and corruption • increases in rent-seeking and corruption will generate lower growth • Corrupt transactions—the need to keep bribes secret reduces the security of property rights, which lowers investment in long-gestating projects

Variants of the resource curse argument • Rentier State and theory of rent-seeking: effects on political stability • 1) ‘honey pot’, or rent-seeking argument, which suggests that oil abundant less developed countries generate valuable rents and that the existence of these rents tends to generate violent forms of rent-seeking that take the form of ‘greed-based’ insurgencies. • 2) rentier state argument: oil states are more likely to have weak state structures because they have less need to create strong bureaucracies to raise revenue. Weak state structures, in turn, can make the state more vulnerable to insurgency.

Variants of the resource curse argument • Rentier State and theory of rent-seeking: effects on political stability • 1) ‘honey pot’, or rent-seeking argument, which suggests that oil abundant less developed countries generate valuable rents and that the existence of these rents tends to generate violent forms of rent-seeking that take the form of ‘greed-based’ insurgencies. • 2) rentier state argument: oil states are more likely to have weak state structures because they have less need to create strong bureaucracies to raise revenue. Weak state structures, in turn, can make the state more vulnerable to insurgency.

The Resource Curse and Political Violence • rentier state model: mineral abundance generates: a) low levels of government legitimacy, b) slow economic growth; c) higher levels of political violence. Why? • A) a growing independence of states from citizens due to high levels of unearned income (from mineral rents) and low levels of domestic taxation. • B) a potentially retarding effect on state capacity of unearned income is the decline in bureaucratic capacity. . • C) mismanagement of resource wealth can create grievances that, when combined with a history of ethnically-based secessionist tendencies, can increase the likelihood of organised armed rebellion. • The plausibility of these arguments depends on the extent to which oil wealth necessarily generates the aforementioned problems.

The Resource Curse and Political Violence • rentier state model: mineral abundance generates: a) low levels of government legitimacy, b) slow economic growth; c) higher levels of political violence. Why? • A) a growing independence of states from citizens due to high levels of unearned income (from mineral rents) and low levels of domestic taxation. • B) a potentially retarding effect on state capacity of unearned income is the decline in bureaucratic capacity. . • C) mismanagement of resource wealth can create grievances that, when combined with a history of ethnically-based secessionist tendencies, can increase the likelihood of organised armed rebellion. • The plausibility of these arguments depends on the extent to which oil wealth necessarily generates the aforementioned problems.

Theoretical and Empirical Problems • Leaders are implicitly assumed to “own” the natural resources, that is, they are assigned the ‘property rights’ over resources. • How rulers appropriate and maintain power is not adequately analysed.

Theoretical and Empirical Problems • Leaders are implicitly assumed to “own” the natural resources, that is, they are assigned the ‘property rights’ over resources. • How rulers appropriate and maintain power is not adequately analysed.

Theoretical and Empirical Problems • Rent distribution through patronage is common to all economies at lower levels of development. • North et al (2009) on ‘limited access orders’: • The principal solution through history to the classic Hobbesian problem of endemic violence is the creation of what Nortth et al (2007) call limited access orders (as opposed to the much rarer, open access orders, which characterizes advanced market economies). • The limited access order creates limits on the access to valuable political and economic functions as a way to generate rents. • When powerful individuals and groups become privileged insiders and thus possess rents relative to those individuals and groups excluded (and since violence threatens or reduces those rents), the existence of rents makes it in the interest of the ‘privileged insiders’ to cooperate with the coalition in power rather than to fight.

Theoretical and Empirical Problems • Rent distribution through patronage is common to all economies at lower levels of development. • North et al (2009) on ‘limited access orders’: • The principal solution through history to the classic Hobbesian problem of endemic violence is the creation of what Nortth et al (2007) call limited access orders (as opposed to the much rarer, open access orders, which characterizes advanced market economies). • The limited access order creates limits on the access to valuable political and economic functions as a way to generate rents. • When powerful individuals and groups become privileged insiders and thus possess rents relative to those individuals and groups excluded (and since violence threatens or reduces those rents), the existence of rents makes it in the interest of the ‘privileged insiders’ to cooperate with the coalition in power rather than to fight.

Theoretical and Empirical Problems • Leaders are assumed to have predatory as opposed to developmental aims. • Implicitly assumed that leaders in petro-states are revenue-satisficers and not revenue-maximizers.

Theoretical and Empirical Problems • Leaders are assumed to have predatory as opposed to developmental aims. • Implicitly assumed that leaders in petro-states are revenue-satisficers and not revenue-maximizers.

Theoretical and Empirical Problems • Selection Bias • Is resource abundance the result of failed policies? • By definition, most countries that do not have a diversified agricultural and manufacturing base are natural resource dependent. • Abundance versus dependence

Theoretical and Empirical Problems • Selection Bias • Is resource abundance the result of failed policies? • By definition, most countries that do not have a diversified agricultural and manufacturing base are natural resource dependent. • Abundance versus dependence

Theoretical and Empirical Problems • Resource curse theorists do not examine the possibility that mineral abundance can be central to the development of manufacturing industry in particular • (Wright and Czelusta (2007); Lederman and Maloney (2007).

Theoretical and Empirical Problems • Resource curse theorists do not examine the possibility that mineral abundance can be central to the development of manufacturing industry in particular • (Wright and Czelusta (2007); Lederman and Maloney (2007).

Is there empirical evidence to support the resource curse? • Variation and Change in growth of mineral abundant economies not well explained (e. g Botswana, Malyasia, Venezuela, Nigeria) • Economic growth in non-mineral rich economies not well explained (e. g. India, China, Tanzania, Malawi) • Recent growth accelerations in aid dependent economies not well explained (e. g. Mozambique, Uganda, Tanzania, Ghana). The fact that aid dependent economies may be pursuing more liberal economic policies demonstrates that policy matters more than levels of rents in the economy • Corruption rates/governance indicators indeterminate with respect to long-run growth • Mineral abundance economies do not appear to be more corrupt than non- mineral abundant economies

Is there empirical evidence to support the resource curse? • Variation and Change in growth of mineral abundant economies not well explained (e. g Botswana, Malyasia, Venezuela, Nigeria) • Economic growth in non-mineral rich economies not well explained (e. g. India, China, Tanzania, Malawi) • Recent growth accelerations in aid dependent economies not well explained (e. g. Mozambique, Uganda, Tanzania, Ghana). The fact that aid dependent economies may be pursuing more liberal economic policies demonstrates that policy matters more than levels of rents in the economy • Corruption rates/governance indicators indeterminate with respect to long-run growth • Mineral abundance economies do not appear to be more corrupt than non- mineral abundant economies

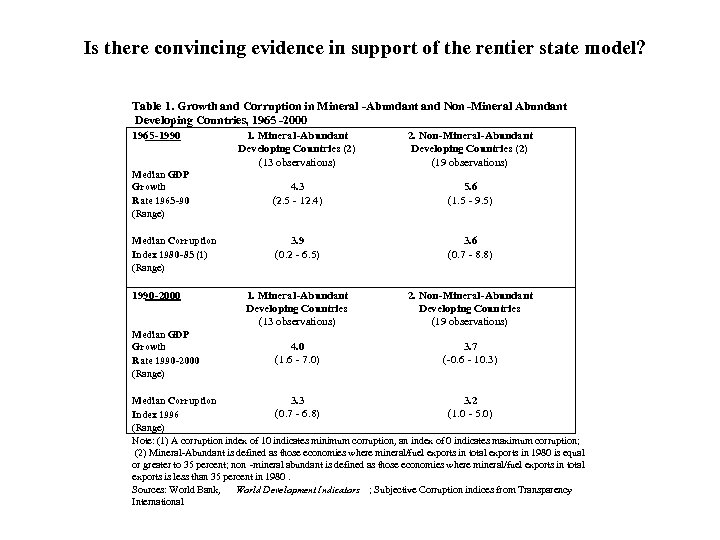

Is there convincing evidence in support of the rentier state model? Table 1. Growth and Corruption in Mineral -Abundant and Non -Mineral Abundant Developing Countries, 1965 -2000 1965 -1990 Median GDP Growth Rate 1965 -90 (Range) Median Corruption Index 1980 -85 (1) (Range) 1990 -2000 Median GDP Growth Rate 1990 -2000 (Range) 1. Mineral-Abundant Developing Countries (2) (13 observations) 2. Non-Mineral-Abundant Developing Countries (2) (19 observations) 4. 3 (2. 5 - 12. 4) 5. 6 (1. 5 - 9. 5) 3. 9 (0. 2 - 6. 5) 3. 6 (0. 7 - 8. 8) 1. Mineral-Abundant Developing Countries (13 observations) 2. Non-Mineral-Abundant Developing Countries (19 observations) 4. 0 (1. 6 - 7. 0) 3. 7 (-0. 6 - 10. 3) 3. 3 3. 2 Median Corruption (0. 7 - 6. 8) (1. 0 - 5. 0) Index 1996 (Range) Note: (1) A corruption index of 10 indicates minimum corruption, an index of 0 indicates maximum corruption; (2) Mineral-Abundant is defined as those economies where mineral/fuel exports in total exports in 1980 is equal or greater to 35 percent; non -mineral abundant is defined as those economies where mineral/fuel exports in total exports is less than 35 percent in 1980. Sources: World Bank, World Development Indicators ; Subjective Corruption indices from Transparency International

Is there convincing evidence in support of the rentier state model? Table 1. Growth and Corruption in Mineral -Abundant and Non -Mineral Abundant Developing Countries, 1965 -2000 1965 -1990 Median GDP Growth Rate 1965 -90 (Range) Median Corruption Index 1980 -85 (1) (Range) 1990 -2000 Median GDP Growth Rate 1990 -2000 (Range) 1. Mineral-Abundant Developing Countries (2) (13 observations) 2. Non-Mineral-Abundant Developing Countries (2) (19 observations) 4. 3 (2. 5 - 12. 4) 5. 6 (1. 5 - 9. 5) 3. 9 (0. 2 - 6. 5) 3. 6 (0. 7 - 8. 8) 1. Mineral-Abundant Developing Countries (13 observations) 2. Non-Mineral-Abundant Developing Countries (19 observations) 4. 0 (1. 6 - 7. 0) 3. 7 (-0. 6 - 10. 3) 3. 3 3. 2 Median Corruption (0. 7 - 6. 8) (1. 0 - 5. 0) Index 1996 (Range) Note: (1) A corruption index of 10 indicates minimum corruption, an index of 0 indicates maximum corruption; (2) Mineral-Abundant is defined as those economies where mineral/fuel exports in total exports in 1980 is equal or greater to 35 percent; non -mineral abundant is defined as those economies where mineral/fuel exports in total exports is less than 35 percent in 1980. Sources: World Bank, World Development Indicators ; Subjective Corruption indices from Transparency International

Is there empirical evidence to support the resource curse? • comparative work on oil states, Smith (2004) has found that, in the period 1974 -1999, oil wealth is robustly associated with increased regime stability, even when controlling for repression, and with a lower likelihood of civil war. • As Smith notes: • “Durable regimes in oil rich states are not the outliers that both rentier state and resource curse theorists have assumed them to be. Regimes such as Suharto’s in Indonesia, which lasted 32 years, Saddam Hussein’s Ba’athist regime in Iraq, which lasted 35 years (and was only ousted by a full-scale U. S. -British invasion in March, 2003), and long-lived monarchs of the Persian Gulf appear to be more representative of regime durability than do the favourite cases of Iran, Nigeria, Algeria, and Venezuela –the “big four. ” Moreover, the durability effect has been independent of the consistent access to rents with which regimes can buy legitimacy, since the busts created no trend toward regime crisis or instability in exporting states. ” (p. 242)

Is there empirical evidence to support the resource curse? • comparative work on oil states, Smith (2004) has found that, in the period 1974 -1999, oil wealth is robustly associated with increased regime stability, even when controlling for repression, and with a lower likelihood of civil war. • As Smith notes: • “Durable regimes in oil rich states are not the outliers that both rentier state and resource curse theorists have assumed them to be. Regimes such as Suharto’s in Indonesia, which lasted 32 years, Saddam Hussein’s Ba’athist regime in Iraq, which lasted 35 years (and was only ousted by a full-scale U. S. -British invasion in March, 2003), and long-lived monarchs of the Persian Gulf appear to be more representative of regime durability than do the favourite cases of Iran, Nigeria, Algeria, and Venezuela –the “big four. ” Moreover, the durability effect has been independent of the consistent access to rents with which regimes can buy legitimacy, since the busts created no trend toward regime crisis or instability in exporting states. ” (p. 242)

Policy Considerations • Taxation of mineral rents inadequate in sub-Saharan Africa (e. g. Zambia, DRC). • Need for governments to develop productive strategies that exchange mineral rights for local content conditions, whereby foreign investors are obligated to use domestic suppliers on an increasingly greater scale. Local content management has been one of the main ways in which FDI can be utilised for the benefit of national productive capacity. • Capacity-building in the geological survey capacity in sub-Saharan Africa needs to be developed in order to improve the bargaining power of states vis-à-vis multinationals. This is an area where the international financial institutions can play a leading role. • Dual Track strategy of growth (e. g. Mauritius, Malaysia) promising for promoting growth and political stability. Requires strong national political parties (e. g. China, Malaysia, Indonesia).

Policy Considerations • Taxation of mineral rents inadequate in sub-Saharan Africa (e. g. Zambia, DRC). • Need for governments to develop productive strategies that exchange mineral rights for local content conditions, whereby foreign investors are obligated to use domestic suppliers on an increasingly greater scale. Local content management has been one of the main ways in which FDI can be utilised for the benefit of national productive capacity. • Capacity-building in the geological survey capacity in sub-Saharan Africa needs to be developed in order to improve the bargaining power of states vis-à-vis multinationals. This is an area where the international financial institutions can play a leading role. • Dual Track strategy of growth (e. g. Mauritius, Malaysia) promising for promoting growth and political stability. Requires strong national political parties (e. g. China, Malaysia, Indonesia).

Threshold effects: which factors enhance the development prospects of mineral and fuel abundant less developed economies? • Taxing Resource Abundance Effectively • The Ownership Structure of Exporting Industries • Implementing Dual-Track Growth Strategies

Threshold effects: which factors enhance the development prospects of mineral and fuel abundant less developed economies? • Taxing Resource Abundance Effectively • The Ownership Structure of Exporting Industries • Implementing Dual-Track Growth Strategies

Political Stability: elite bargains and political parties • The degree of centralised rule and patronage matters for political stability • A cursory examination of relatively peaceful polities (Tanzania, Zambia. Malawi, South Africa, Botswana) and those where the state survived even during civil war (Mozambique) suggests that: • The construction of political organisations, particularly political parties, has been central to providing the institutional mechanisms of distributing patronage to regional elites and to important political constituencies in ways that either prevent challenges to authority and/or maintain cohesion of the ruling coalition • Unravelling of elite bargains in Zimbabwe has led to instability and violence.

Political Stability: elite bargains and political parties • The degree of centralised rule and patronage matters for political stability • A cursory examination of relatively peaceful polities (Tanzania, Zambia. Malawi, South Africa, Botswana) and those where the state survived even during civil war (Mozambique) suggests that: • The construction of political organisations, particularly political parties, has been central to providing the institutional mechanisms of distributing patronage to regional elites and to important political constituencies in ways that either prevent challenges to authority and/or maintain cohesion of the ruling coalition • Unravelling of elite bargains in Zimbabwe has led to instability and violence.

Business Climate: Infrastructure, taxation, and regional trade pacts • Johannesburg –Maputo Corridor presents promising opportunities for FDI • Landlocked countries—Zambia, Malawi have high transport costs • Corporate Taxation on FDI, especially mining projects is not generally burdensome. Most countries use taxation to promote FDI. • Large Taxpayer Offices make tax payments relatively simple. • SADC has the most promise among African regional trade pacts (mostly due to the diversification of production and development level of South Africa, the dominant partner in the region).

Business Climate: Infrastructure, taxation, and regional trade pacts • Johannesburg –Maputo Corridor presents promising opportunities for FDI • Landlocked countries—Zambia, Malawi have high transport costs • Corporate Taxation on FDI, especially mining projects is not generally burdensome. Most countries use taxation to promote FDI. • Large Taxpayer Offices make tax payments relatively simple. • SADC has the most promise among African regional trade pacts (mostly due to the diversification of production and development level of South Africa, the dominant partner in the region).

Politics of Business • Many big projects involve personal deals with political party elites. Property rights are selectively protected. • Many large mining deals are off-budget and contracts remain secret.

Politics of Business • Many big projects involve personal deals with political party elites. Property rights are selectively protected. • Many large mining deals are off-budget and contracts remain secret.

Vulnerabilities for Growth, Investment and Stability • Exports and tax base overly reliant on prices of natural resources. • Apart from South Africa, the infrastructure gap is large (i. e. road, ports, and electricity, irrigation). Landlocked countries worst affected. • Likely revision of tax regimes to increase mining tax royalties. • Skilled labour in short supply in most countries as a result of deindustrialisation, especially in Zambia, Mozambique, less so in South Africa. • Political party fragmentation a threat to stability (e. g. Zambia, South Africa, especially Zimbabwe). • History of large-scale capital flight, emigration of skilled workers.

Vulnerabilities for Growth, Investment and Stability • Exports and tax base overly reliant on prices of natural resources. • Apart from South Africa, the infrastructure gap is large (i. e. road, ports, and electricity, irrigation). Landlocked countries worst affected. • Likely revision of tax regimes to increase mining tax royalties. • Skilled labour in short supply in most countries as a result of deindustrialisation, especially in Zambia, Mozambique, less so in South Africa. • Political party fragmentation a threat to stability (e. g. Zambia, South Africa, especially Zimbabwe). • History of large-scale capital flight, emigration of skilled workers.