d8981cd899c5eded667124baa72ccd5b.ppt

- Количество слайдов: 79

Is the global recovery stalling? Adrian Cooper acooper@oxfordeconomics. com October 2010

Oxford Economics ■ Founded in 1981 as a joint venture with Templeton College in Oxford University, Oxford Economics has since grown into one of the world’s foremost independent providers of global economic research and consulting ■ The rigor of our analysis, calibre of staff and links with Oxford University make us the most trusted resource for decision makers seeking independent thinking and evidencebased research. ■ Over 60 in-house economists. ■ Extensive experience in industry and publicsector analysis. ■ Access to over 100 economic research groups through the UN's project link. ■ Links to Oxford University and other leading research institutes. 2

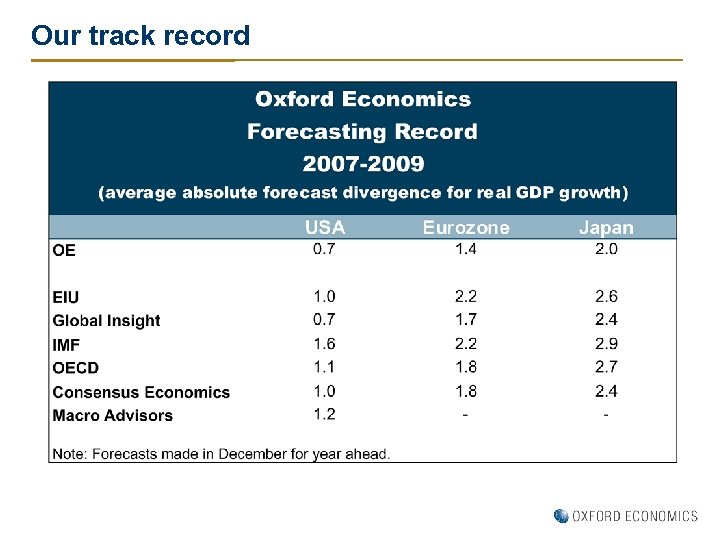

Our track record

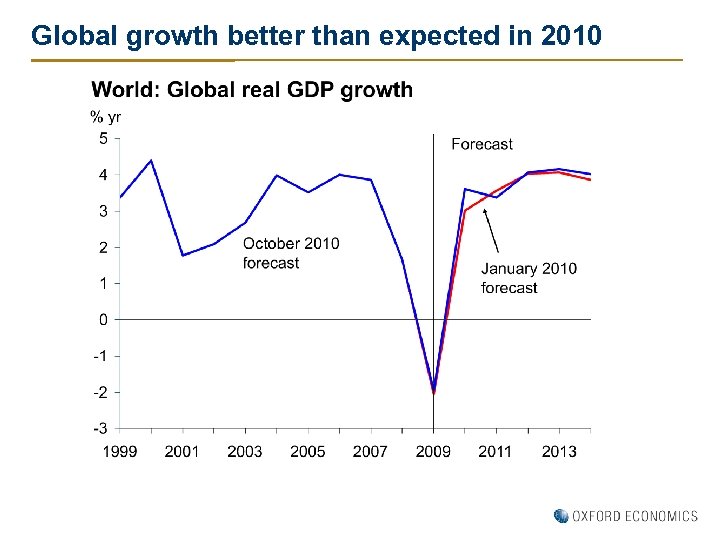

Global growth better than expected in 2010

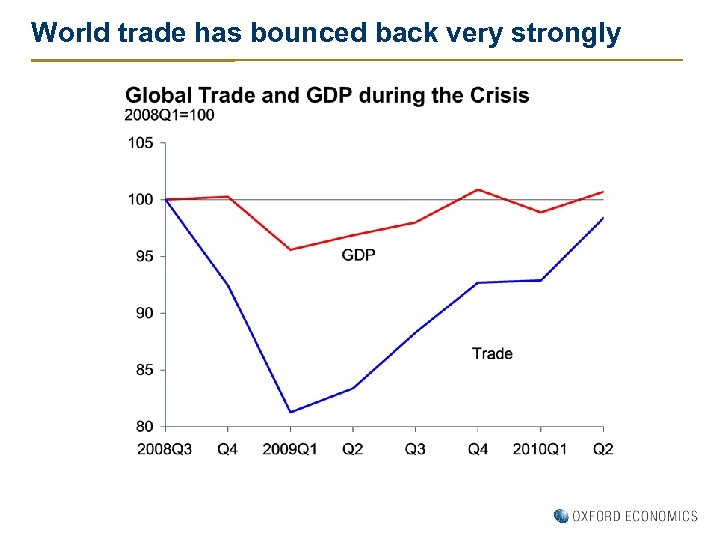

World trade has bounced back very strongly

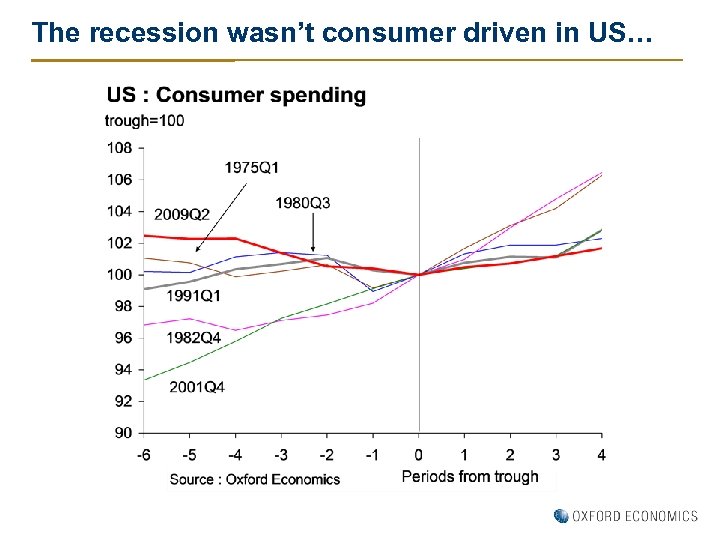

Two key points l There is still a very high level of uncertainty about the outlook, especially in the US and Europe l The recession was driven by the corporate sector and the shape of the recovery will depend on how corporates react in different countries

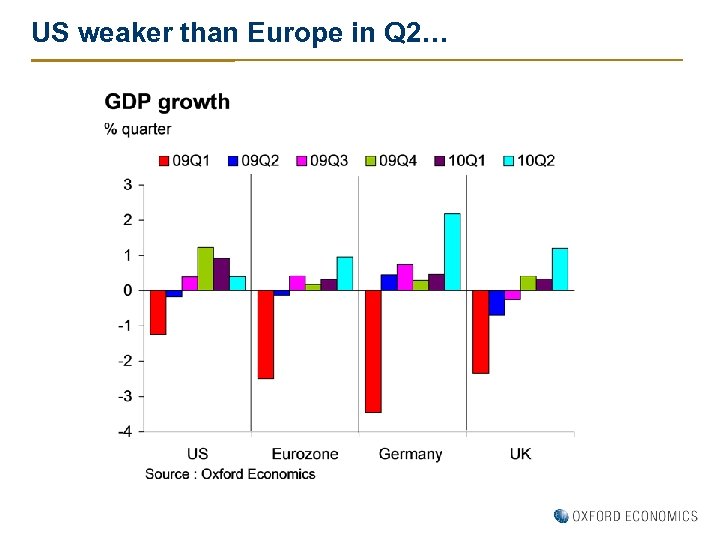

US weaker than Europe in Q 2…

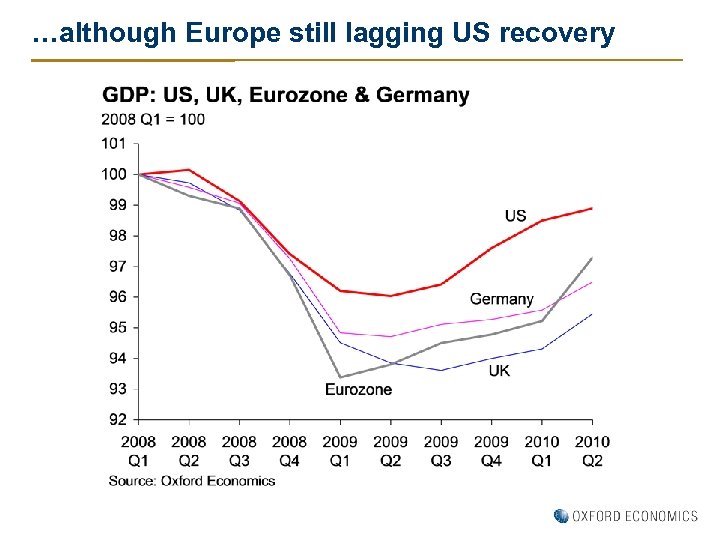

…although Europe still lagging US recovery

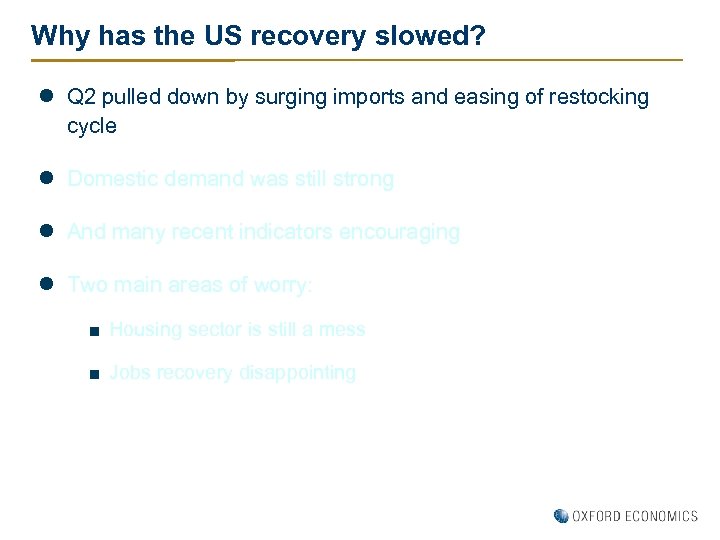

Why has the US recovery slowed? l Q 2 pulled down by surging imports and easing of restocking cycle l Domestic demand was still strong l And many recent indicators encouraging l Two main areas of worry: ■ Housing sector is still a mess ■ Jobs recovery disappointing

Why has the US recovery slowed? l Q 2 pulled down by surging imports and easing of restocking cycle l Domestic demand was still strong l And many recent indicators encouraging l Two main areas of worry: ■ Housing sector is still a mess ■ Jobs recovery disappointing

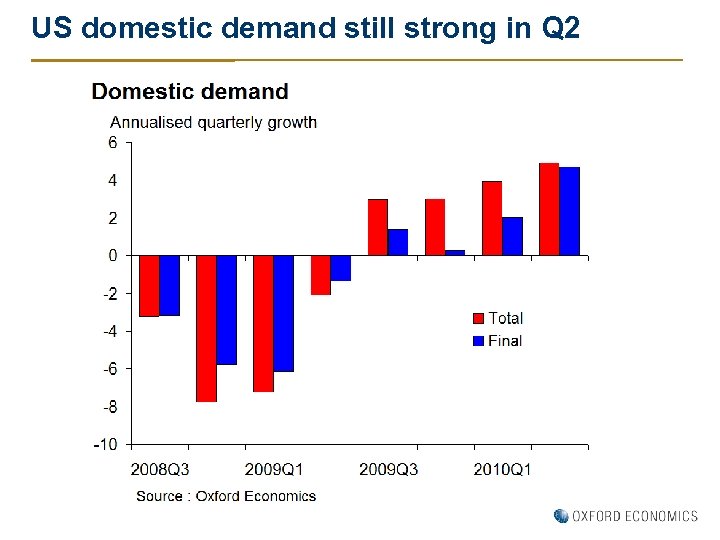

US domestic demand still strong in Q 2

Why has the US recovery slowed? l Q 2 pulled down by surging imports and easing of restocking cycle l Domestic demand was still strong l And many recent indicators encouraging l Two main areas of worry: ■ Housing sector is still a mess ■ Jobs recovery disappointing

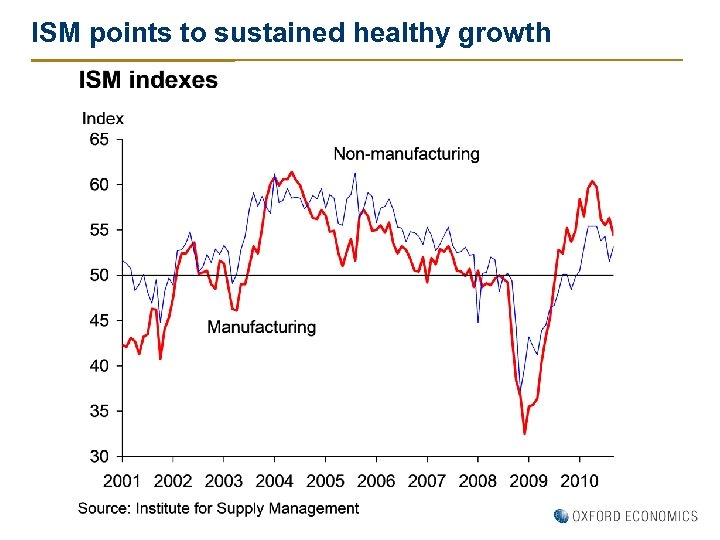

ISM points to sustained healthy growth

Why has the US recovery slowed? l Q 2 pulled down by surging imports and easing of restocking cycle l Domestic demand was still strong l And many recent indicators encouraging l Two main areas of worry: ■ Housing sector is still a mess ■ Jobs recovery disappointing

Why has the US recovery slowed? l Q 2 pulled down by surging imports and easing of restocking cycle l Domestic demand was still strong l And many recent indicators encouraging l Two main areas of worry: ■ Housing sector is still a mess ■ Jobs recovery disappointing

Why has the US recovery slowed? l Q 2 pulled down by surging imports and easing of restocking cycle l Domestic demand was still strong l And many recent indicators encouraging l Two main areas of worry: ■ Housing sector is still a mess ■ Jobs recovery disappointing

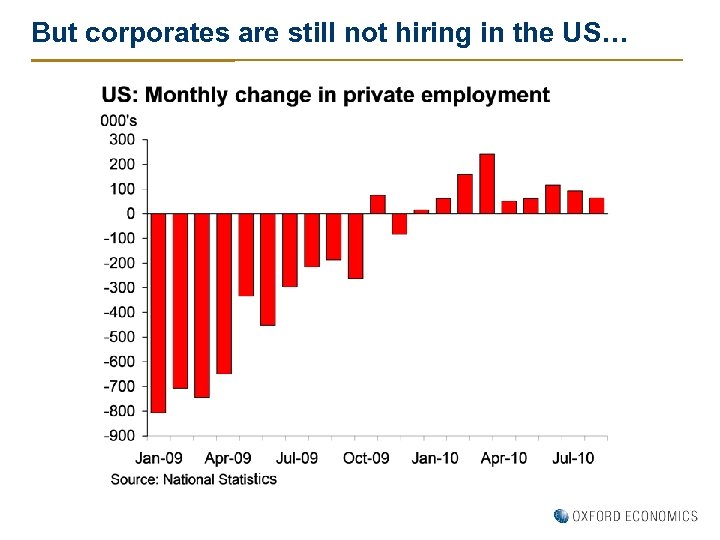

But corporates are still not hiring in the US…

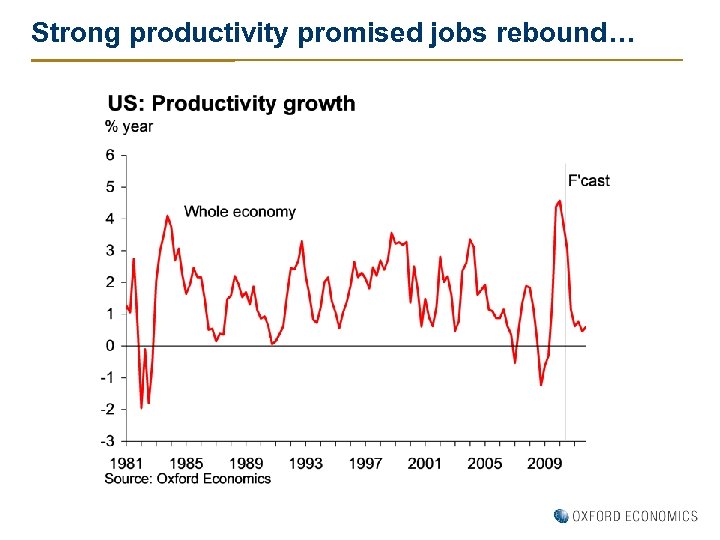

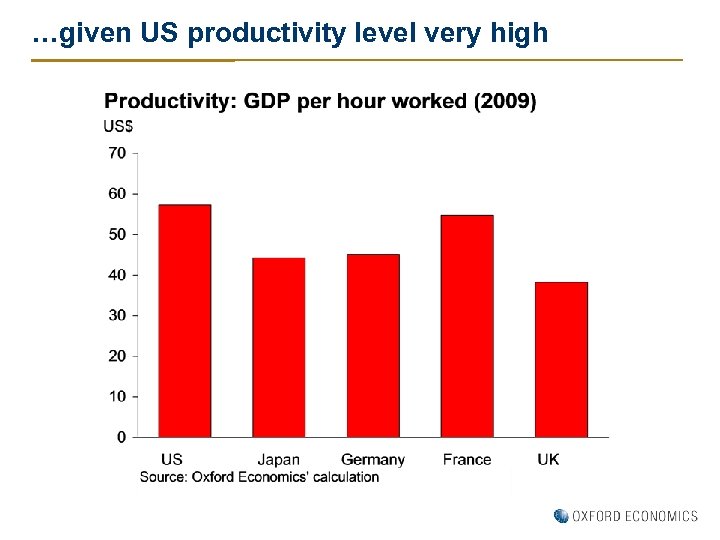

Strong productivity promised jobs rebound…

…given US productivity level very high

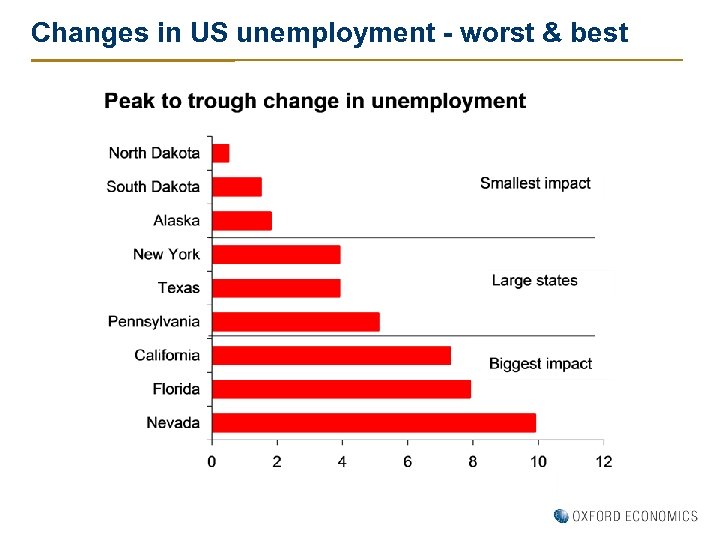

Why aren’t companies hiring in the US? l Long-term unemployment encouraged by more generous benefits? l Job losses concentrated in construction and outlook in this sector is bleak l Regional mismatch between labour demand supply l Uncertainty

Why aren’t companies hiring in the US? l Long-term unemployment encouraged by more generous benefits? l Job losses concentrated in construction l Regional mismatch between labour demand supply l Uncertainty

Why aren’t companies hiring in the US? l Long-term unemployment encouraged by more generous benefits? l Job losses concentrated in construction l Regional mismatch between labour demand supply l Uncertainty

Changes in US unemployment - worst & best

Why aren’t companies hiring in the US? l Long-term unemployment encouraged by more generous benefits? l Job losses concentrated in construction l Regional mismatch between labour demand supply l Uncertainty

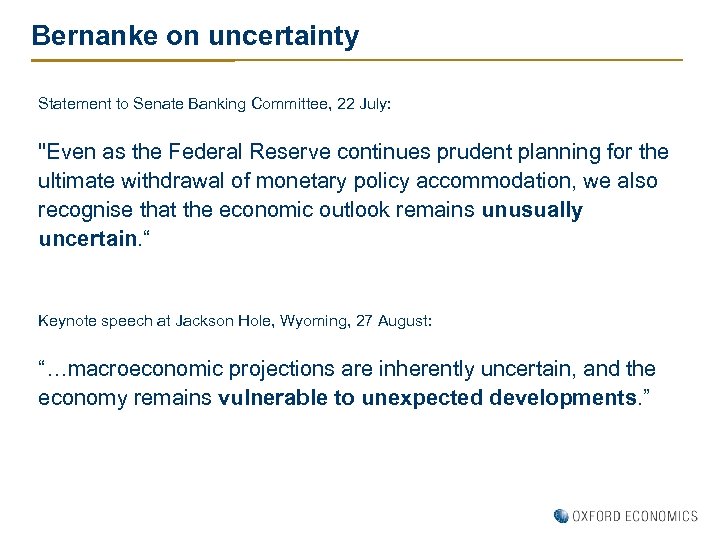

Bernanke on uncertainty Statement to Senate Banking Committee, 22 July: "Even as the Federal Reserve continues prudent planning for the ultimate withdrawal of monetary policy accommodation, we also recognise that the economic outlook remains unusually uncertain. “ Keynote speech at Jackson Hole, Wyoming, 27 August: “…macroeconomic projections are inherently uncertain, and the economy remains vulnerable to unexpected developments. ”

The recession wasn’t consumer driven in US…

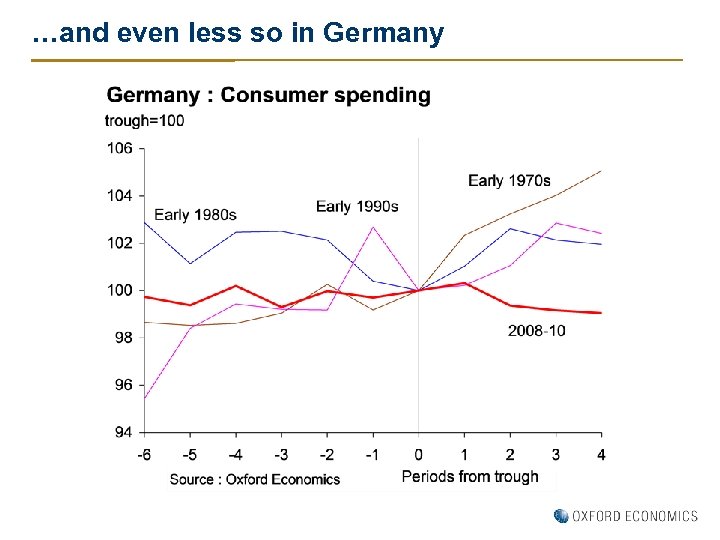

…and even less so in Germany

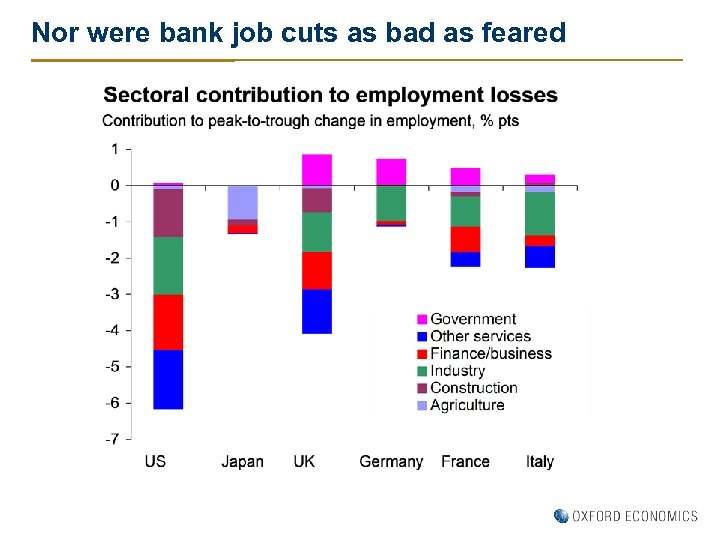

Nor were bank job cuts as bad as feared

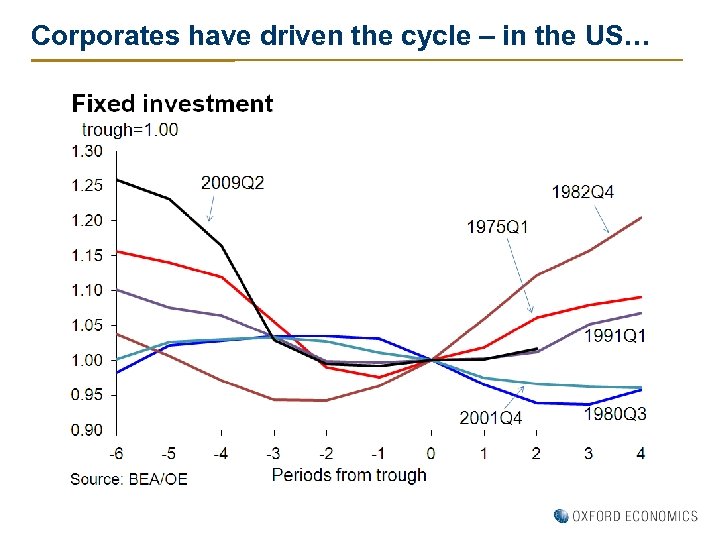

Corporates have driven the cycle – in the US…

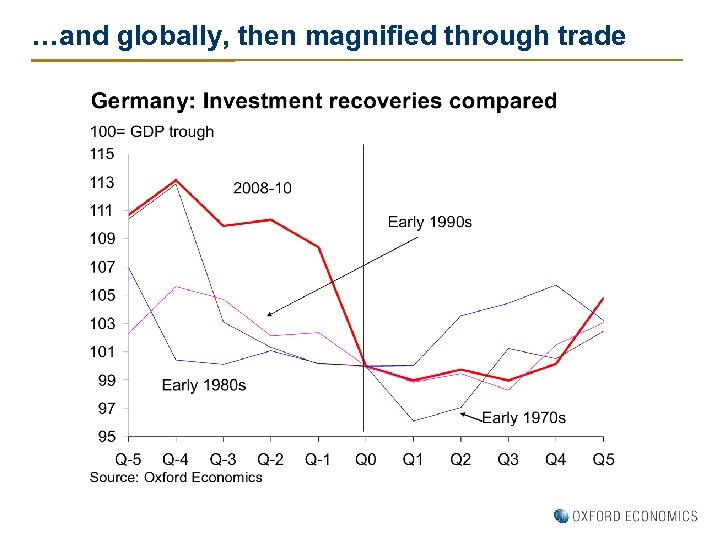

…and globally, then magnified through trade

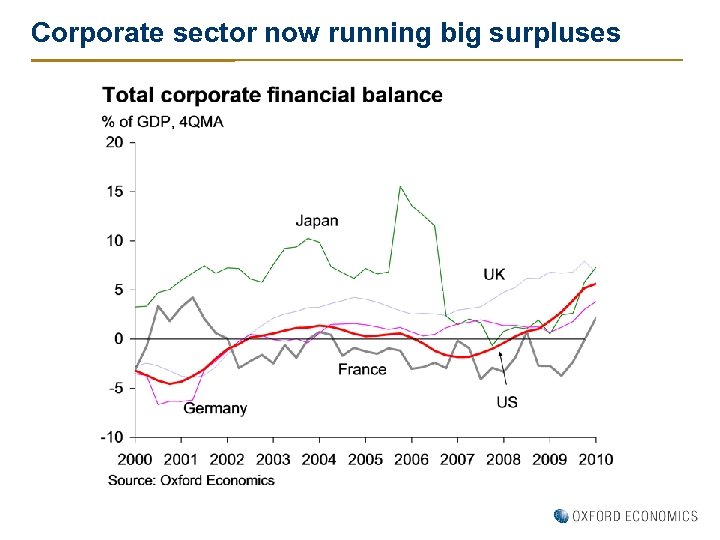

Corporate sector now running big surpluses

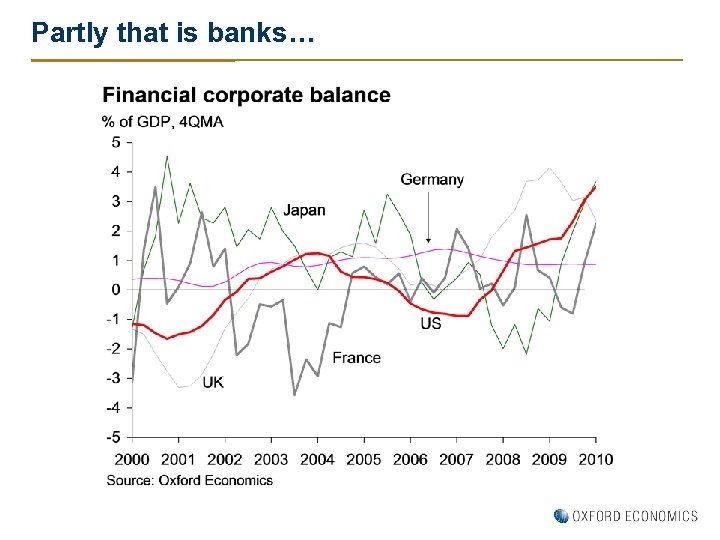

Partly that is banks…

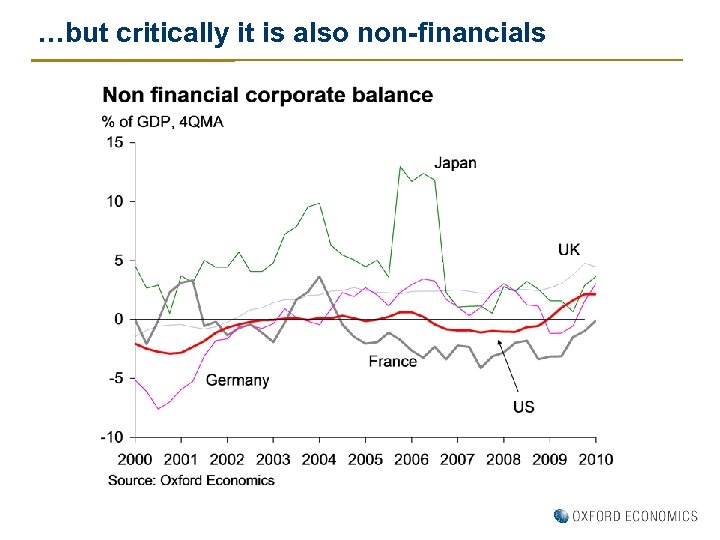

…but critically it is also non-financials

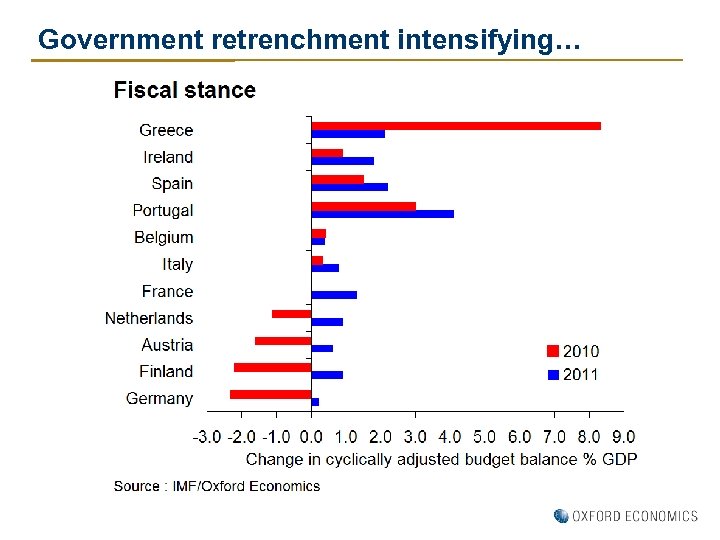

Government retrenchment intensifying…

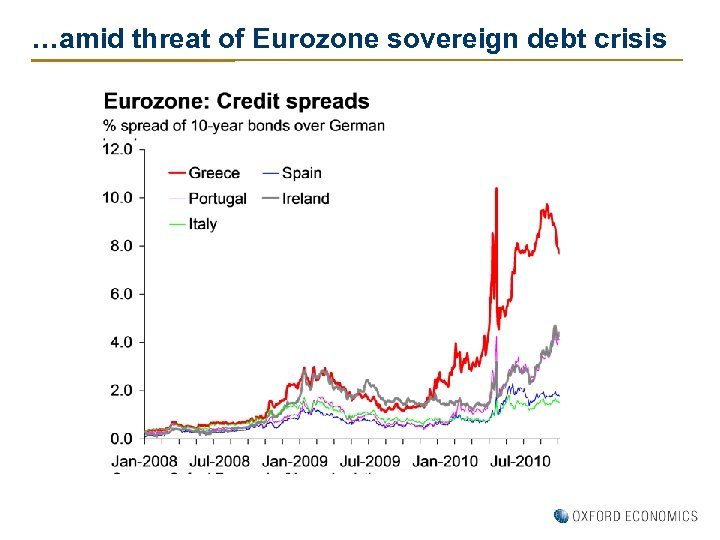

…amid threat of Eurozone sovereign debt crisis

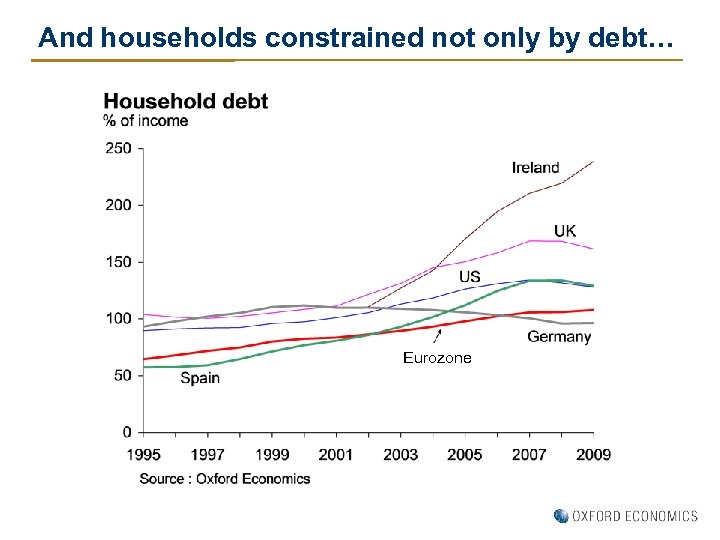

And households constrained not only by debt… Eurozone

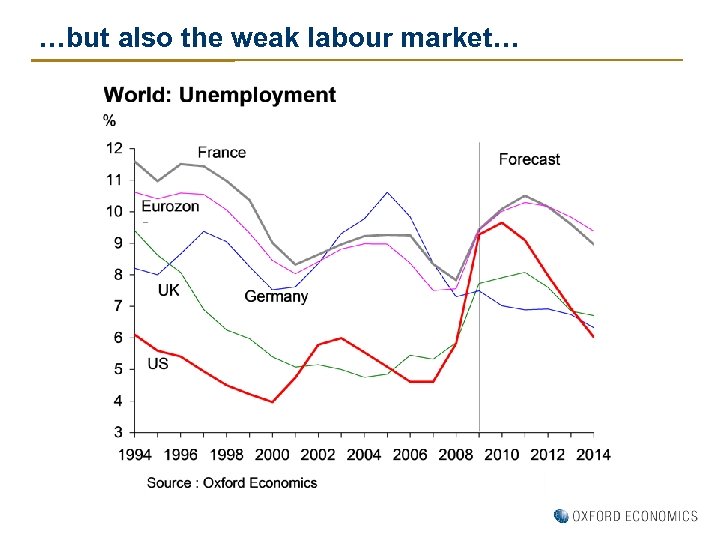

…but also the weak labour market…

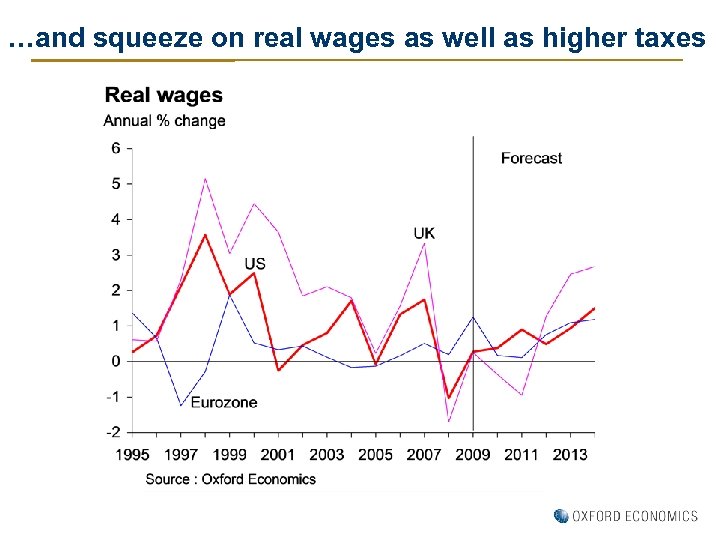

…and squeeze on real wages as well as higher taxes

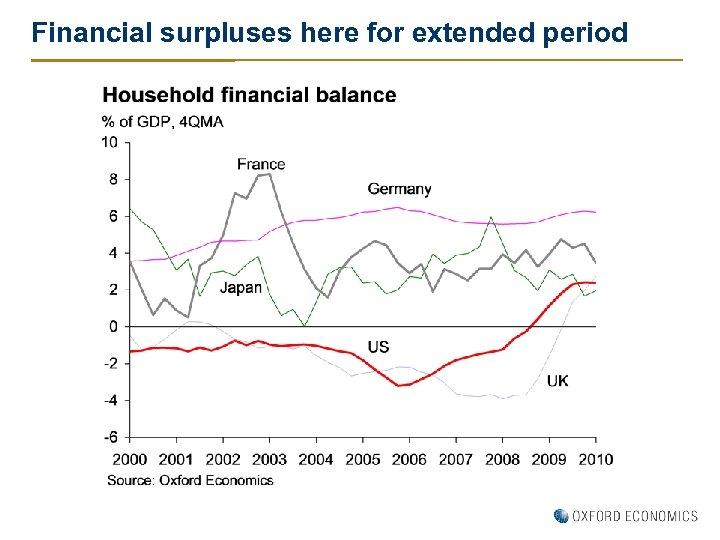

Financial surpluses here for extended period

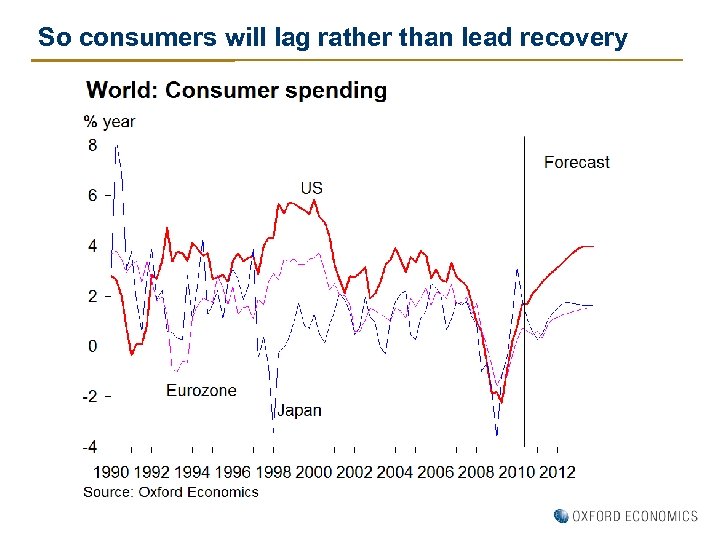

So consumers will lag rather than lead recovery

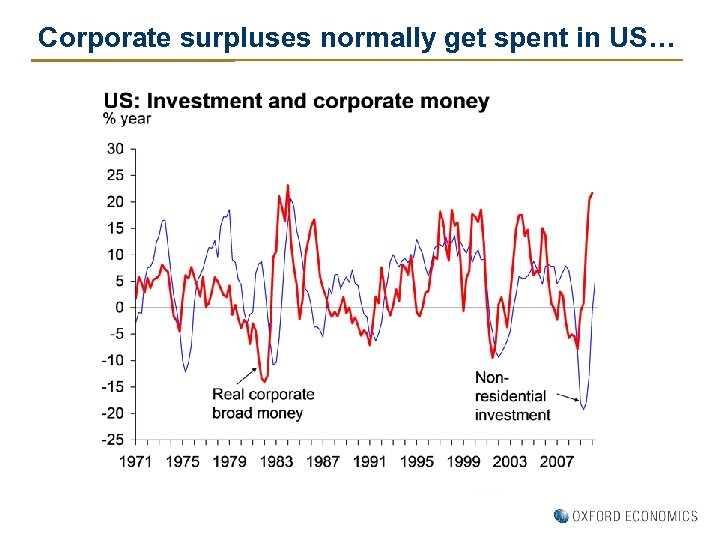

Corporate surpluses normally get spent in US…

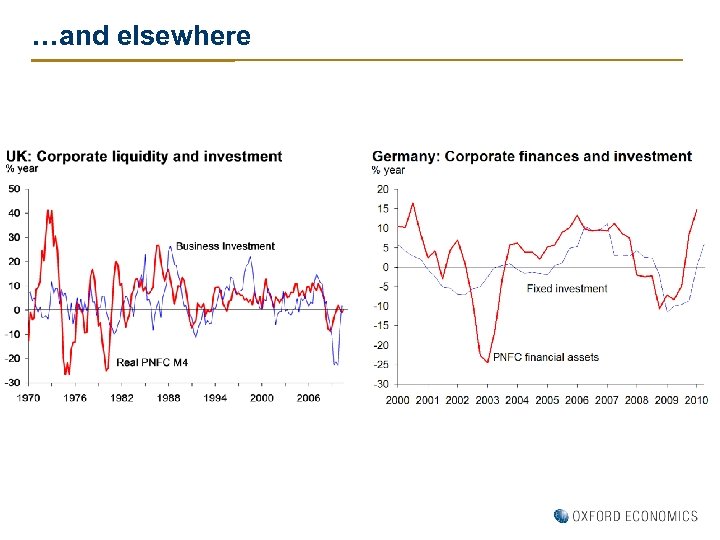

…and elsewhere

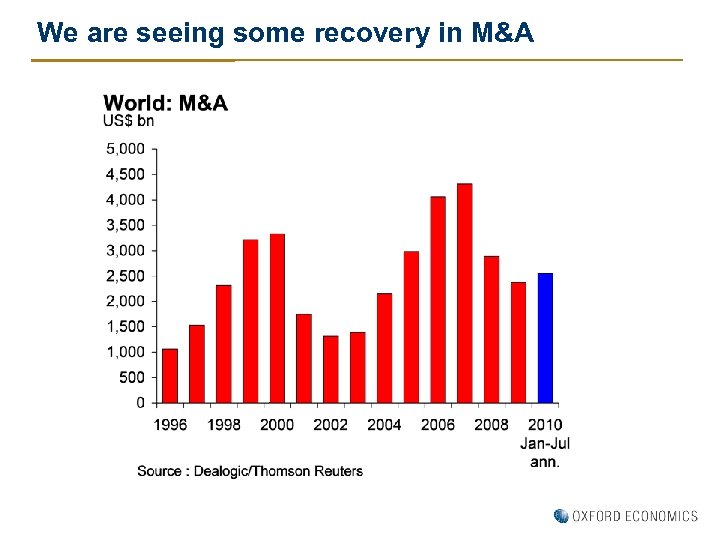

We are seeing some recovery in M&A

What might hold companies back this time? l Unusual uncertainty l Excess capacity l Debt l Credit constraints

What might hold companies back this time? l Unusual uncertainty l Excess capacity l Debt l Credit constraints

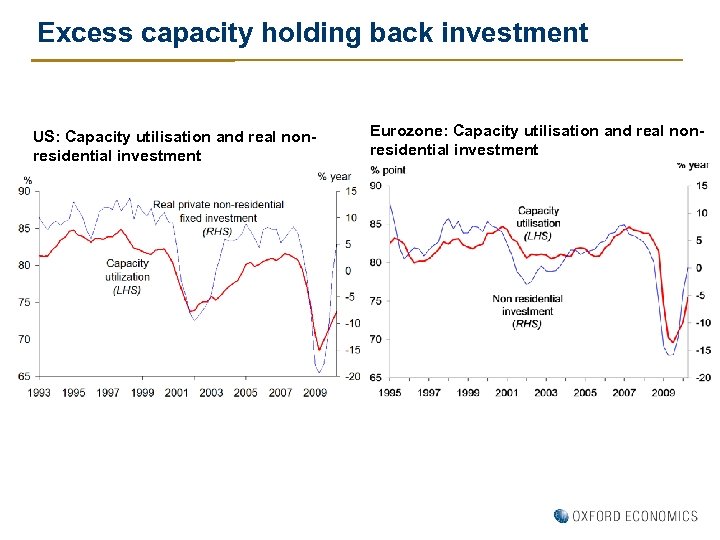

Excess capacity holding back investment US: Capacity utilisation and real nonresidential investment Eurozone: Capacity utilisation and real nonresidential investment

What might hold companies back this time? l Unusual uncertainty l Excess capacity l Debt l Credit constraints

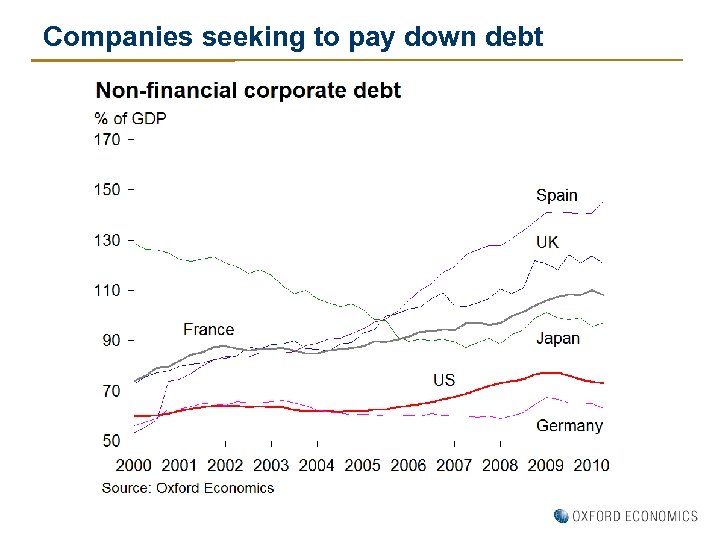

Companies seeking to pay down debt

What might hold companies back this time? l Unusual uncertainty l Excess capacity l Debt l Credit constraints

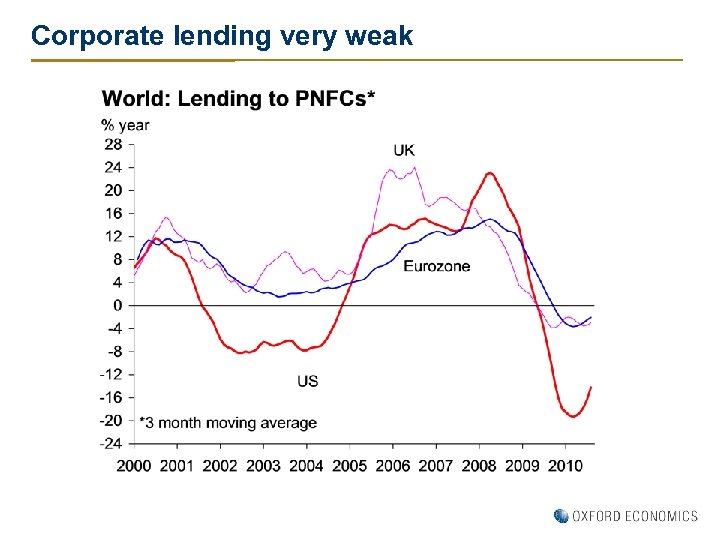

Corporate lending very weak

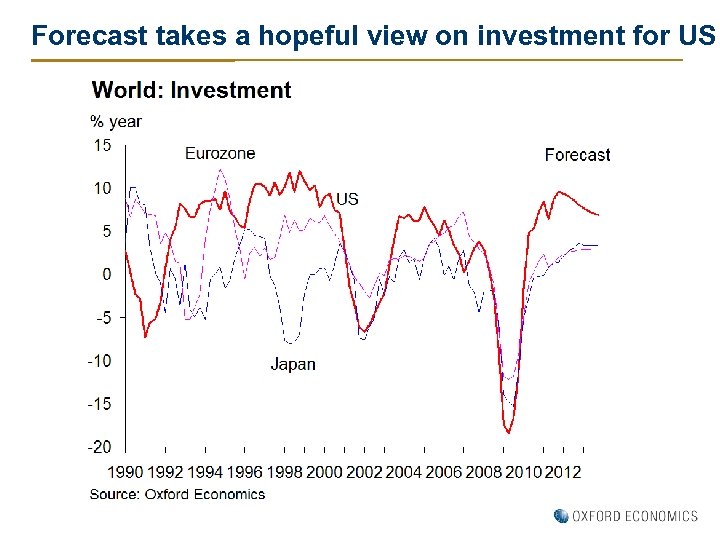

Forecast takes a hopeful view on investment for US

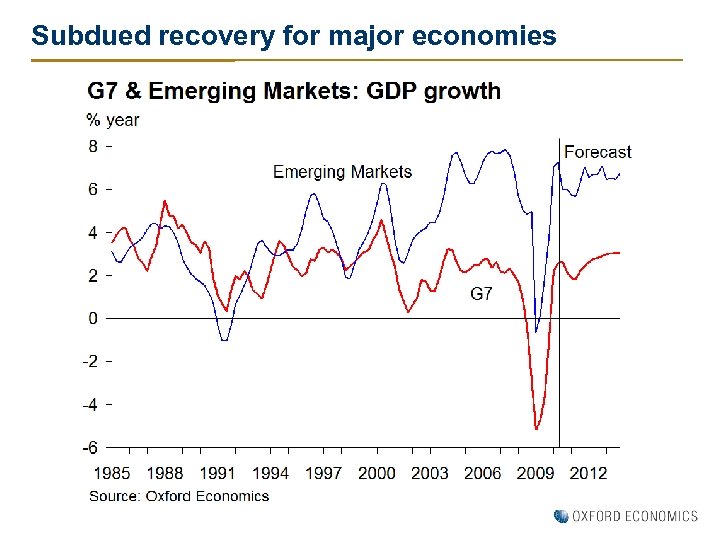

Subdued recovery for major economies

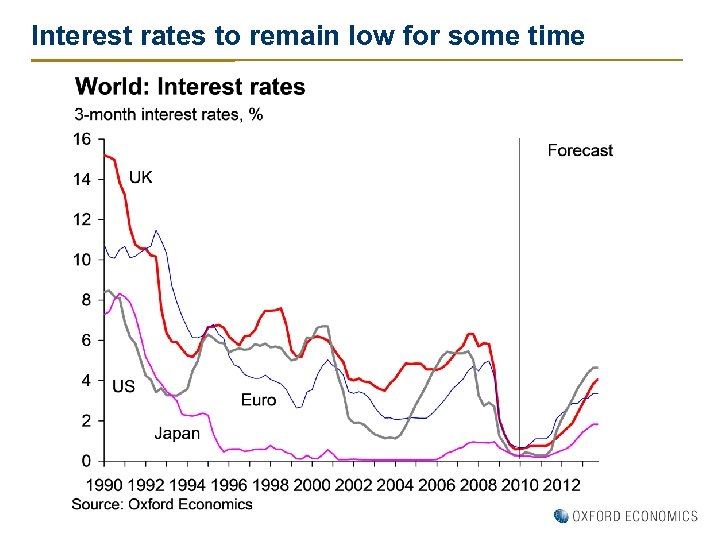

Interest rates to remain low for some time

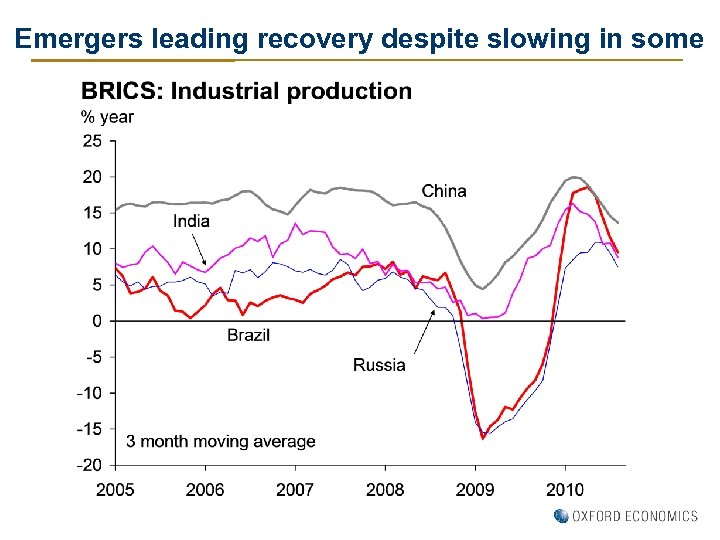

Emergers leading recovery despite slowing in some

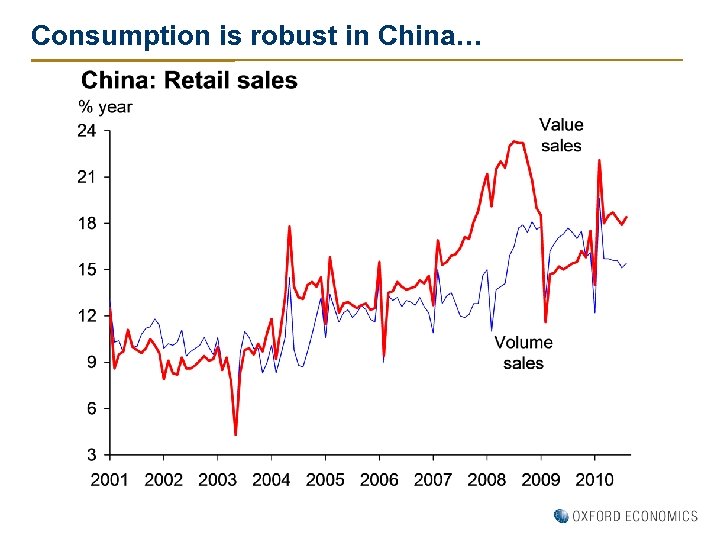

Consumption is robust in China…

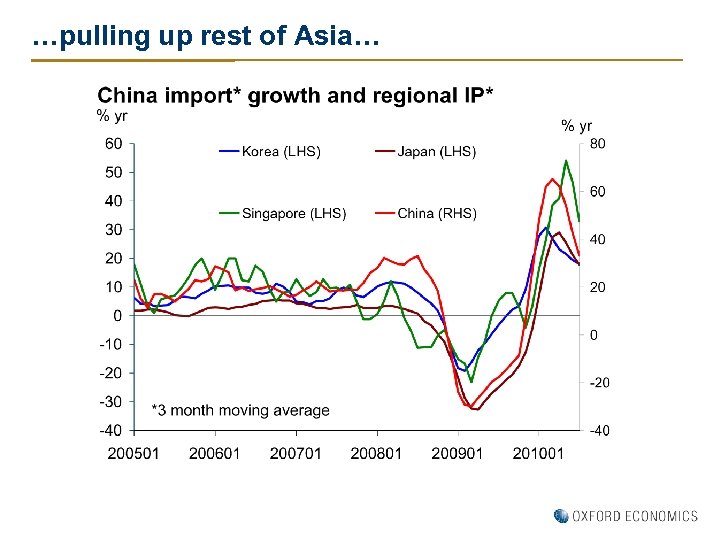

…pulling up rest of Asia…

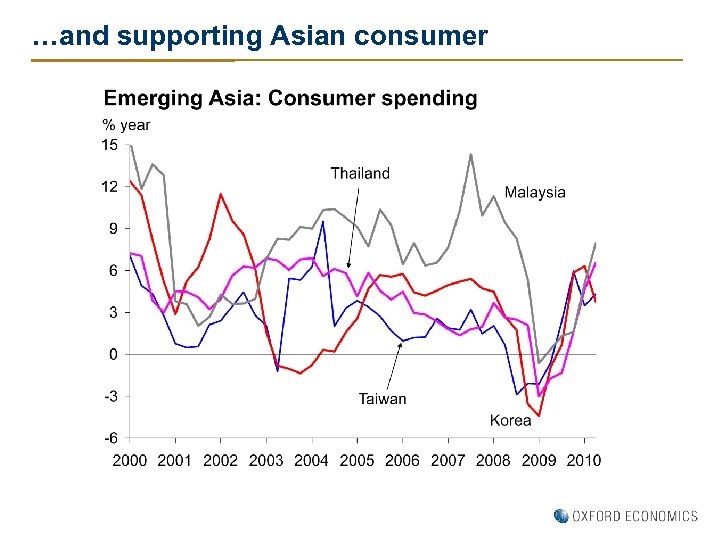

…and supporting Asian consumer

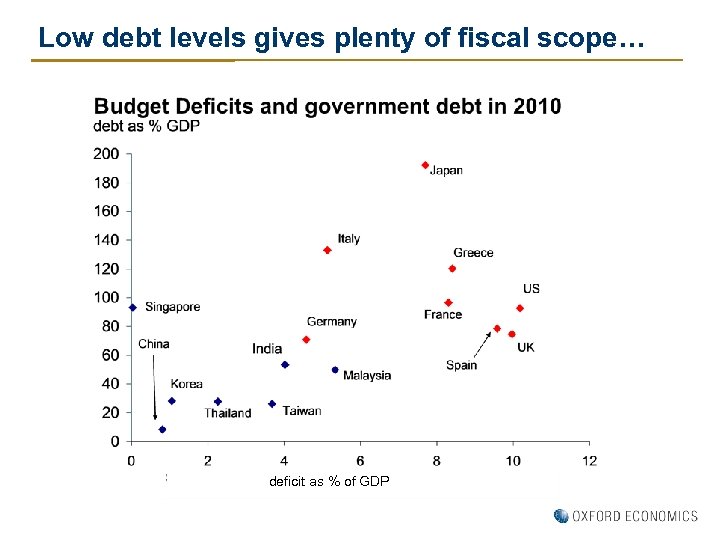

Low debt levels gives plenty of fiscal scope… deficit as % of GDP

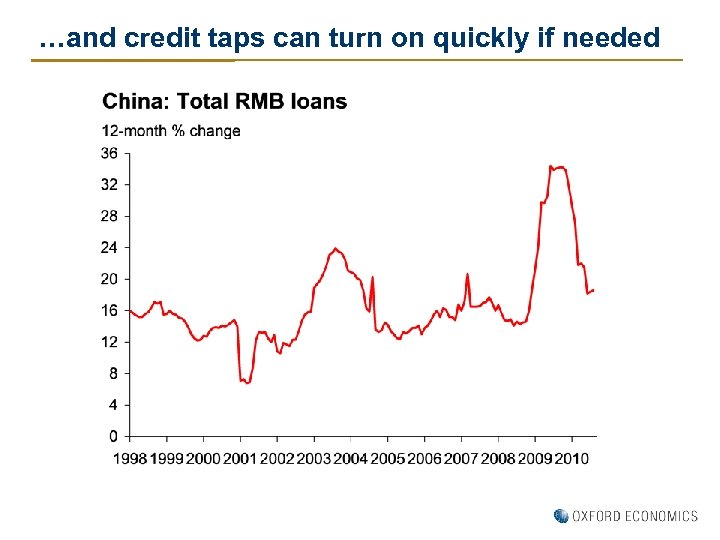

…and credit taps can turn on quickly if needed

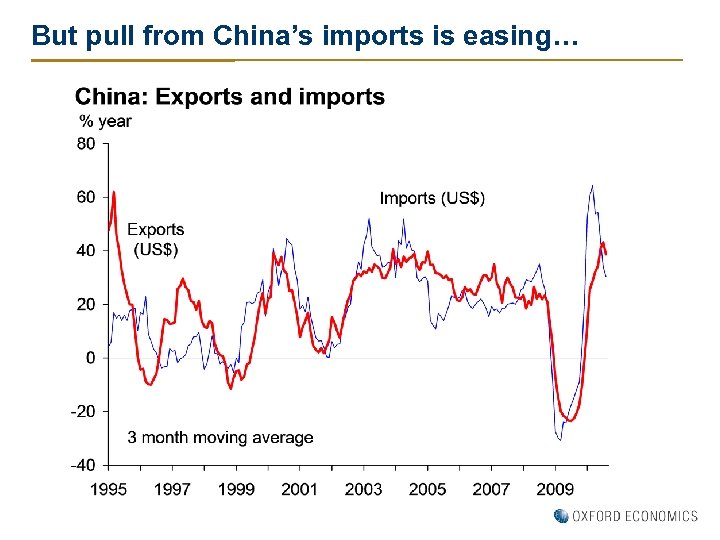

But pull from China’s imports is easing…

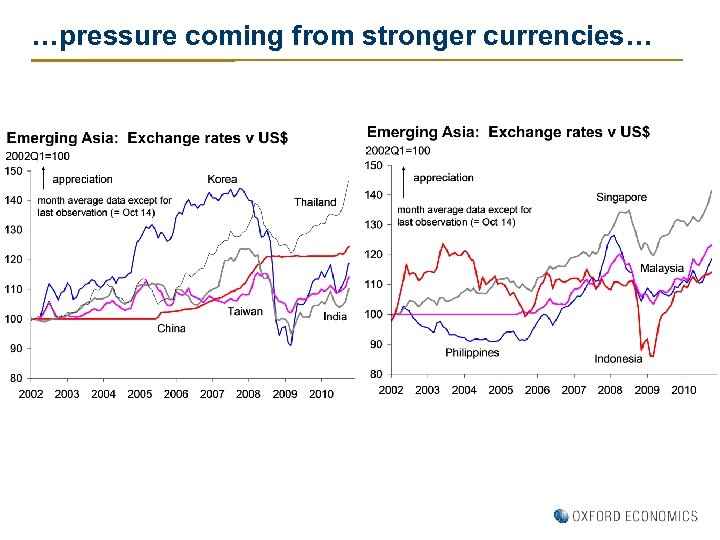

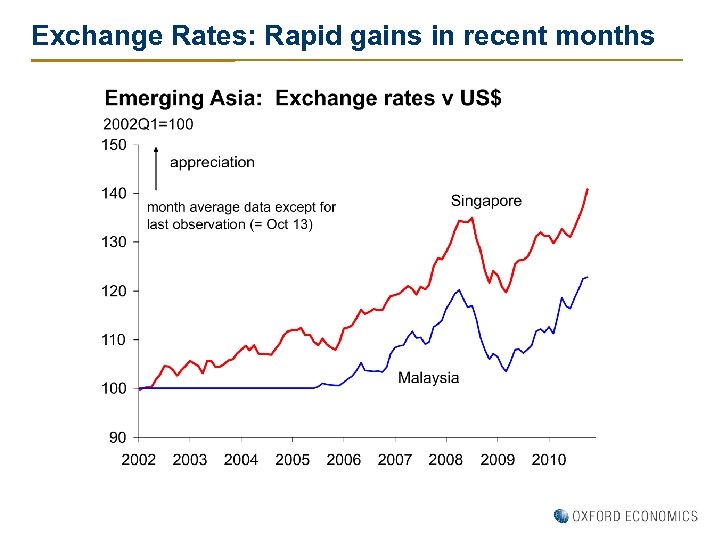

…pressure coming from stronger currencies…

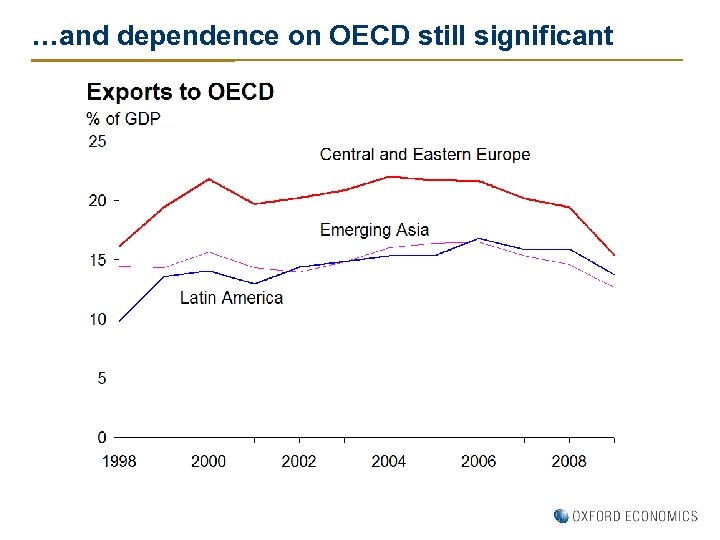

…and dependence on OECD still significant

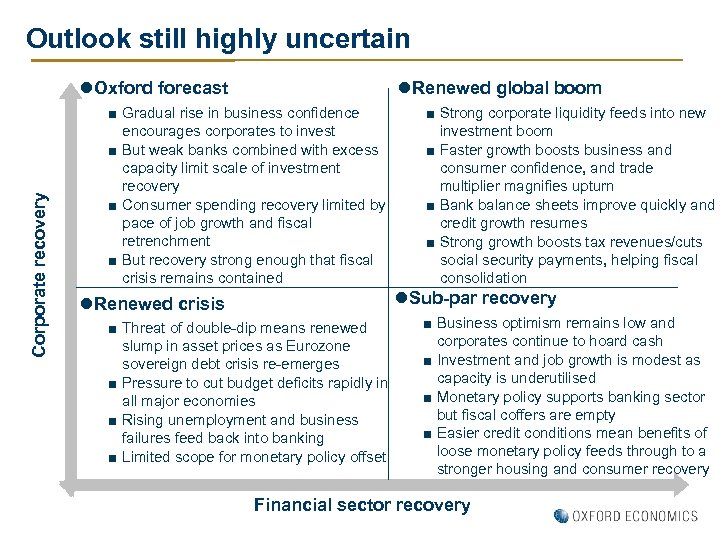

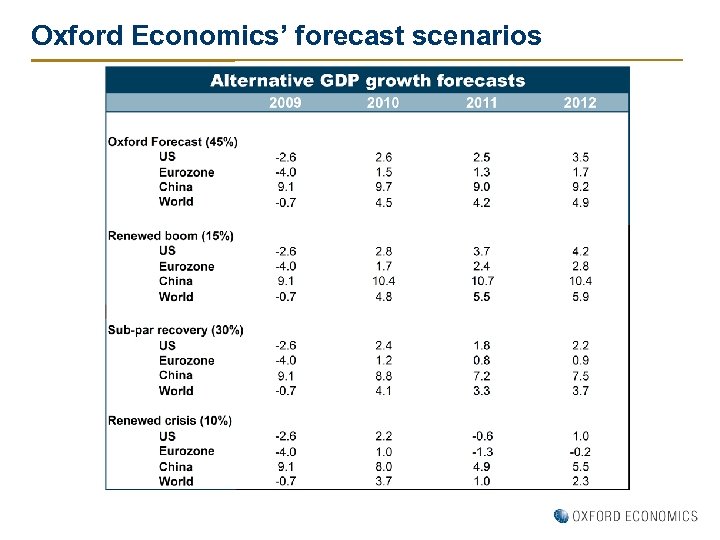

Outlook still highly uncertain Corporate recovery l. Oxford forecast l. Renewed global boom ■ Gradual rise in business confidence encourages corporates to invest ■ But weak banks combined with excess capacity limit scale of investment recovery ■ Consumer spending recovery limited by pace of job growth and fiscal retrenchment ■ But recovery strong enough that fiscal crisis remains contained ■ Strong corporate liquidity feeds into new investment boom ■ Faster growth boosts business and consumer confidence, and trade multiplier magnifies upturn ■ Bank balance sheets improve quickly and credit growth resumes ■ Strong growth boosts tax revenues/cuts social security payments, helping fiscal consolidation l. Sub-par recovery l. Renewed crisis ■ Threat of double-dip means renewed slump in asset prices as Eurozone sovereign debt crisis re-emerges ■ Pressure to cut budget deficits rapidly in all major economies ■ Rising unemployment and business failures feed back into banking ■ Limited scope for monetary policy offset ■ Business optimism remains low and corporates continue to hoard cash ■ Investment and job growth is modest as capacity is underutilised ■ Monetary policy supports banking sector but fiscal coffers are empty ■ Easier credit conditions mean benefits of loose monetary policy feeds through to a stronger housing and consumer recovery Financial sector recovery

Oxford Economics’ forecast scenarios

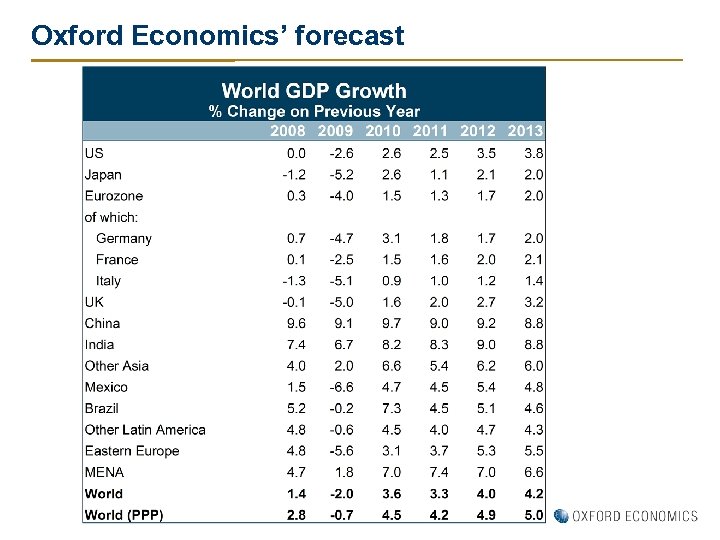

Oxford Economics’ forecast

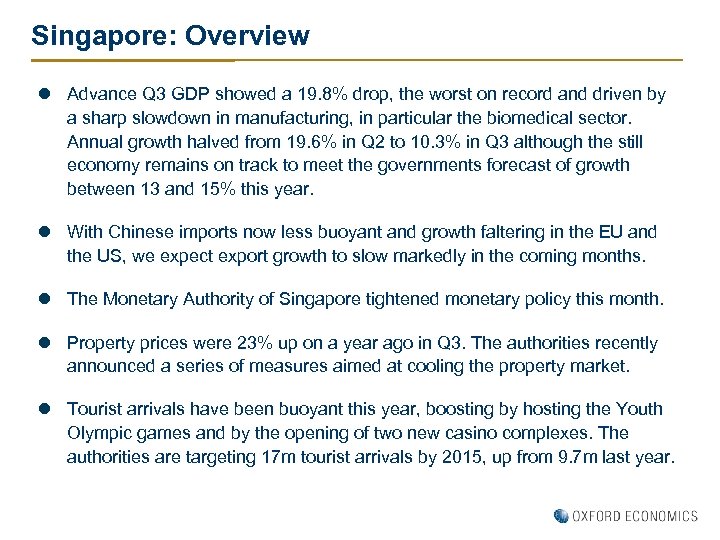

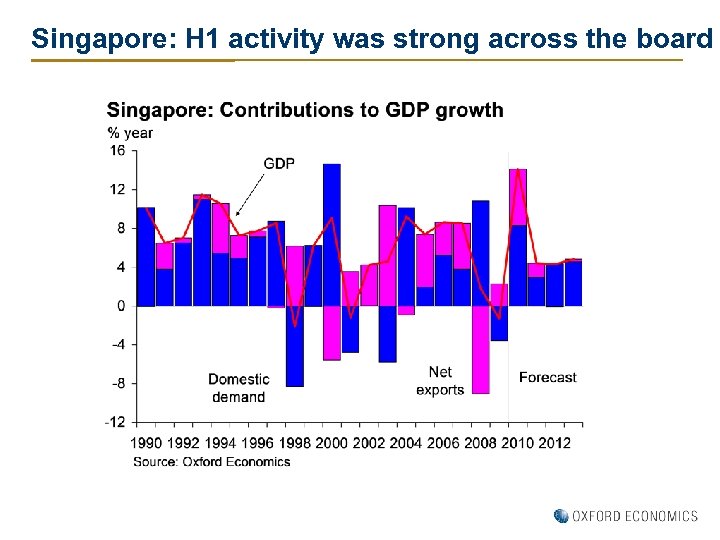

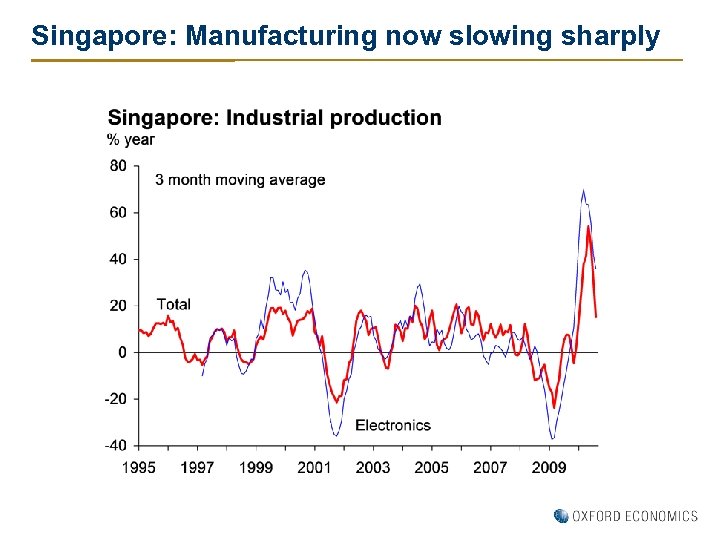

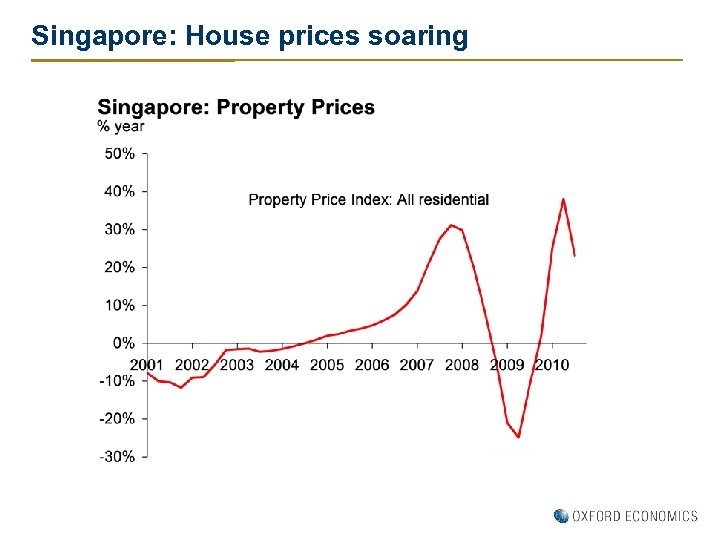

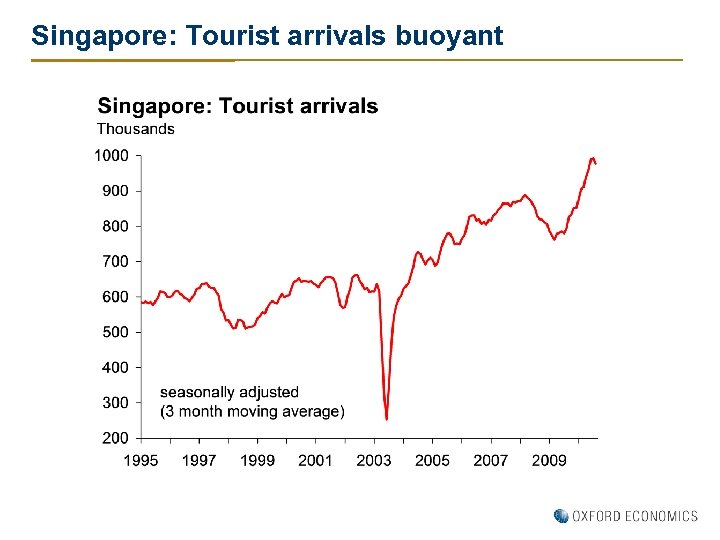

Singapore: Overview l Advance Q 3 GDP showed a 19. 8% drop, the worst on record and driven by a sharp slowdown in manufacturing, in particular the biomedical sector. Annual growth halved from 19. 6% in Q 2 to 10. 3% in Q 3 although the still economy remains on track to meet the governments forecast of growth between 13 and 15% this year. l With Chinese imports now less buoyant and growth faltering in the EU and the US, we expect export growth to slow markedly in the coming months. l The Monetary Authority of Singapore tightened monetary policy this month. l Property prices were 23% up on a year ago in Q 3. The authorities recently announced a series of measures aimed at cooling the property market. l Tourist arrivals have been buoyant this year, boosting by hosting the Youth Olympic games and by the opening of two new casino complexes. The authorities are targeting 17 m tourist arrivals by 2015, up from 9. 7 m last year.

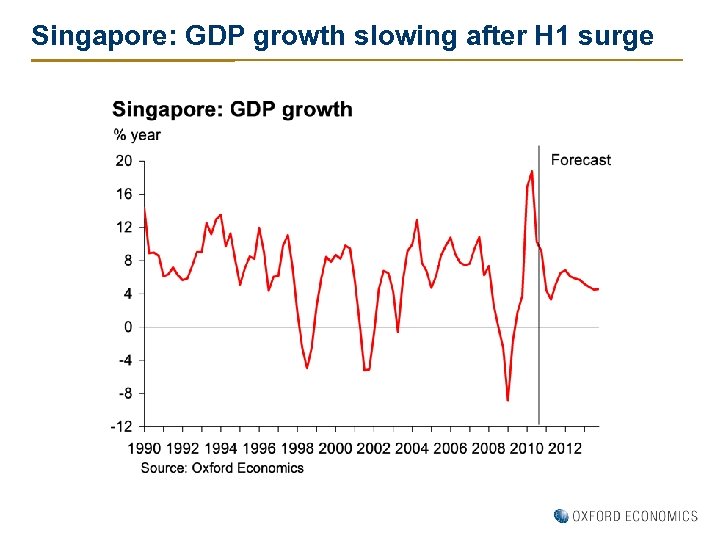

Singapore: GDP growth slowing after H 1 surge

Singapore: H 1 activity was strong across the board

Singapore: Manufacturing now slowing sharply

Singapore: House prices soaring

Singapore: Tourist arrivals buoyant

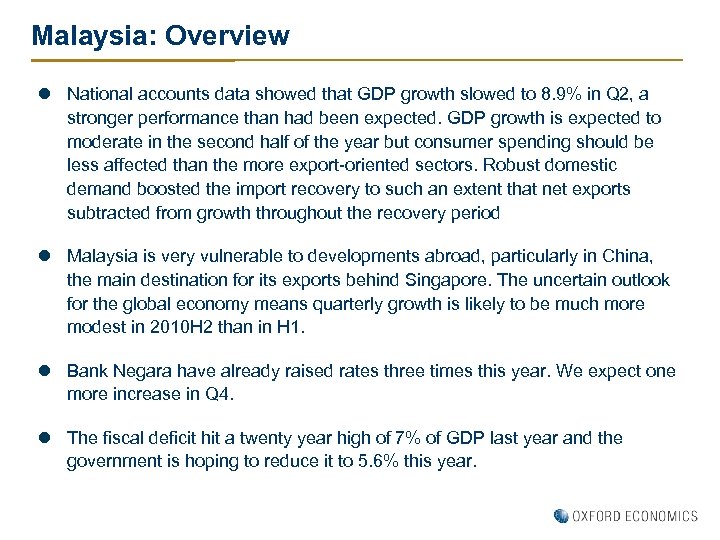

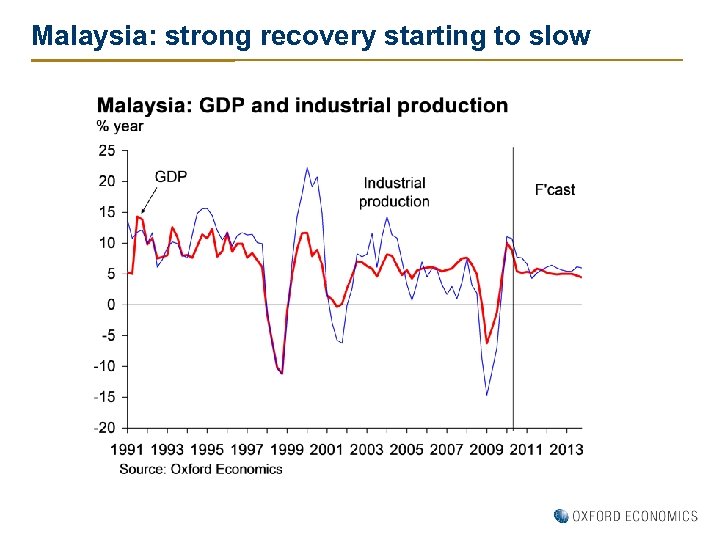

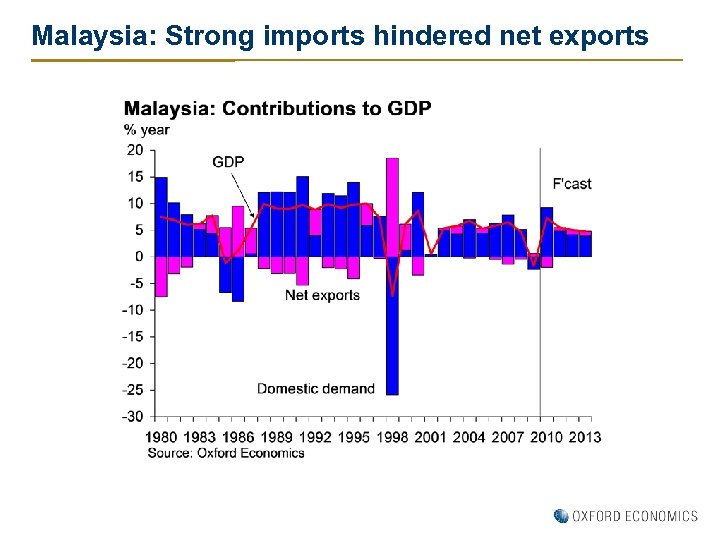

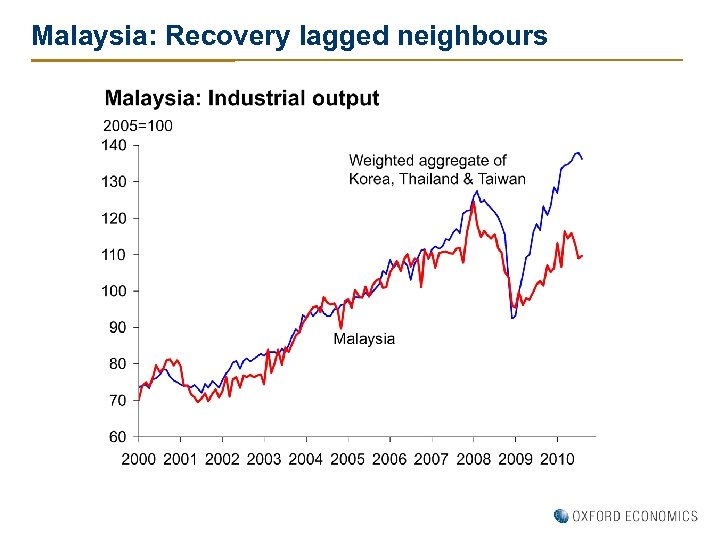

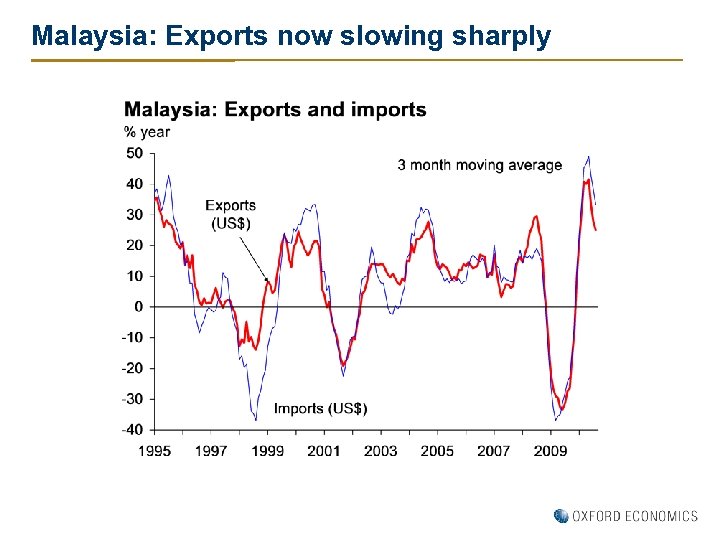

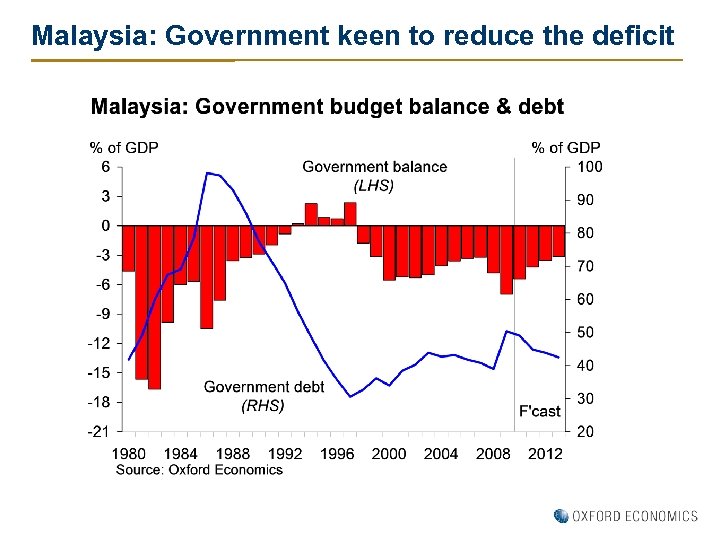

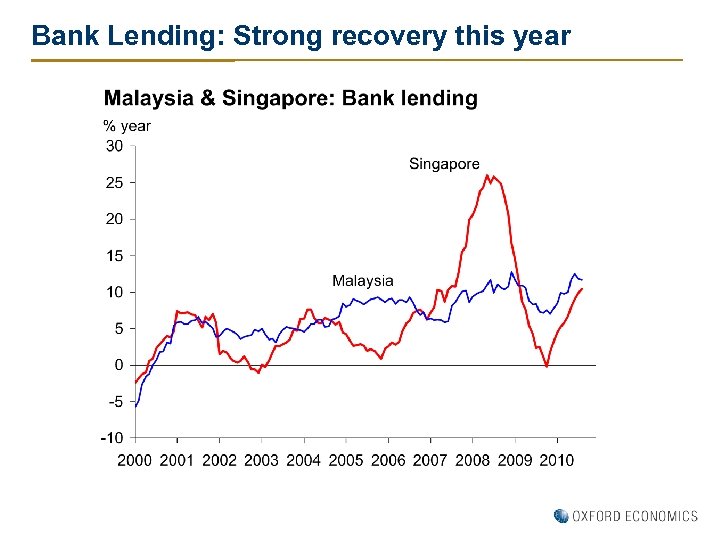

Malaysia: Overview l National accounts data showed that GDP growth slowed to 8. 9% in Q 2, a stronger performance than had been expected. GDP growth is expected to moderate in the second half of the year but consumer spending should be less affected than the more export-oriented sectors. Robust domestic demand boosted the import recovery to such an extent that net exports subtracted from growth throughout the recovery period l Malaysia is very vulnerable to developments abroad, particularly in China, the main destination for its exports behind Singapore. The uncertain outlook for the global economy means quarterly growth is likely to be much more modest in 2010 H 2 than in H 1. l Bank Negara have already raised rates three times this year. We expect one more increase in Q 4. l The fiscal deficit hit a twenty year high of 7% of GDP last year and the government is hoping to reduce it to 5. 6% this year.

Malaysia: strong recovery starting to slow

Malaysia: Strong imports hindered net exports

Malaysia: Recovery lagged neighbours

Malaysia: Exports now slowing sharply

Malaysia: Government keen to reduce the deficit

Bank Lending: Strong recovery this year

Exchange Rates: Rapid gains in recent months

d8981cd899c5eded667124baa72ccd5b.ppt