83492749ad5a38fa5dcba6baef10c0d4.ppt

- Количество слайдов: 24

IRS Electronic Data for States Rod Sterling Internal Revenue Service Washington DC NESTOA 2011 Conference Wilmington, Delaware September 2011

IRS Electronic Data for States Rod Sterling Internal Revenue Service Washington DC NESTOA 2011 Conference Wilmington, Delaware September 2011

New IRS Organization • • GLD is now part of Privacy, Gov’t. Liaison & Disclosure (PGLD) Includes privacy, information protection, incident management GLD formerly part of SB Operating Div. Change invisible to customers

New IRS Organization • • GLD is now part of Privacy, Gov’t. Liaison & Disclosure (PGLD) Includes privacy, information protection, incident management GLD formerly part of SB Operating Div. Change invisible to customers

Main Topics • GLDEP Extracts • e-Services Suite of Products • Communication & Support

Main Topics • GLDEP Extracts • e-Services Suite of Products • Communication & Support

GLDEP Extracts (cumulative files) versus E-Services Products (online services)

GLDEP Extracts (cumulative files) versus E-Services Products (online services)

GLDEP Extracts • • Data extracted from IRS master files and other databases Cumulative data: age 1 to 24 months Shared to assist with tax admin aka MF extracts, bulk extracts, tape extracts, disclosure reports

GLDEP Extracts • • Data extracted from IRS master files and other databases Cumulative data: age 1 to 24 months Shared to assist with tax admin aka MF extracts, bulk extracts, tape extracts, disclosure reports

e-Services Products • Suite of products designed for tax professionals & trading partners to do business with IRS electronically • Data is real-time or near • Uses a secure online session

e-Services Products • Suite of products designed for tax professionals & trading partners to do business with IRS electronically • Data is real-time or near • Uses a secure online session

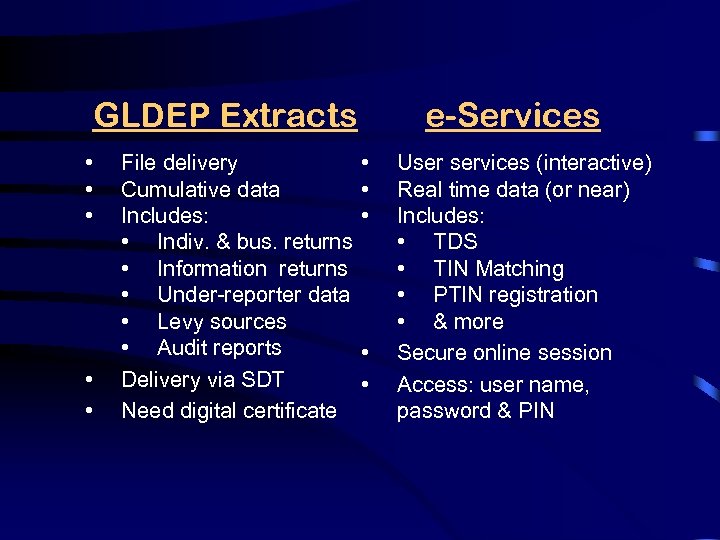

GLDEP Extracts • • • File delivery Cumulative data Includes: • Indiv. & bus. returns • Information returns • Under-reporter data • Levy sources • Audit reports Delivery via SDT Need digital certificate e-Services • • • User services (interactive) Real time data (or near) Includes: • TDS • TIN Matching • PTIN registration • & more Secure online session Access: user name, password & PIN

GLDEP Extracts • • • File delivery Cumulative data Includes: • Indiv. & bus. returns • Information returns • Under-reporter data • Levy sources • Audit reports Delivery via SDT Need digital certificate e-Services • • • User services (interactive) Real time data (or near) Includes: • TDS • TIN Matching • PTIN registration • & more Secure online session Access: user name, password & PIN

GLDEP Extracts • • • Governmental Liaison Data Exchange Program (GLDEP) • Annual enrollment required • 32 different files/sorts • Must meet criteria to enroll Non-GLDEP files authorized by MOU Secure electronic delivery via SDT

GLDEP Extracts • • • Governmental Liaison Data Exchange Program (GLDEP) • Annual enrollment required • 32 different files/sorts • Must meet criteria to enroll Non-GLDEP files authorized by MOU Secure electronic delivery via SDT

Extract Use Examples • • • Identify non-filers Identify levy sources Help with audit selection Leads for sales tax non-compliance Identify non-compliant payers Determine discrepancies between federal & state returns

Extract Use Examples • • • Identify non-filers Identify levy sources Help with audit selection Leads for sales tax non-compliance Identify non-compliant payers Determine discrepancies between federal & state returns

CP 2000 Extract • • Under-reporter matching program Data from second tax-year prior Provides agreed assessments State uses: • Generate proposed assessments • Direct-bill taxpayer • ID employers not reporting

CP 2000 Extract • • Under-reporter matching program Data from second tax-year prior Provides agreed assessments State uses: • Generate proposed assessments • Direct-bill taxpayer • ID employers not reporting

Corporate Affiliations • Entity date for parent & sub corp • Fed Forms 1120 & 851 • State uses: § ID non-filers § Audit selection process of corporations v Submit new corp on BMF/BRTF tickler

Corporate Affiliations • Entity date for parent & sub corp • Fed Forms 1120 & 851 • State uses: § ID non-filers § Audit selection process of corporations v Submit new corp on BMF/BRTF tickler

Secure Data Transfer (SDT) • Secure electronic file exchange • IRS provides software • State responsible for Identrust digital certificate (authorization) • All NESTOA revenue agencies have an active SDT account

Secure Data Transfer (SDT) • Secure electronic file exchange • IRS provides software • State responsible for Identrust digital certificate (authorization) • All NESTOA revenue agencies have an active SDT account

E-Services Products: Transcript Delivery System (TDS) • • TP account data in real or near-real time Individual and business accounts Includes approx. 300 transaction codes Two request options • State user requests • Bulk requests

E-Services Products: Transcript Delivery System (TDS) • • TP account data in real or near-real time Individual and business accounts Includes approx. 300 transaction codes Two request options • State user requests • Bulk requests

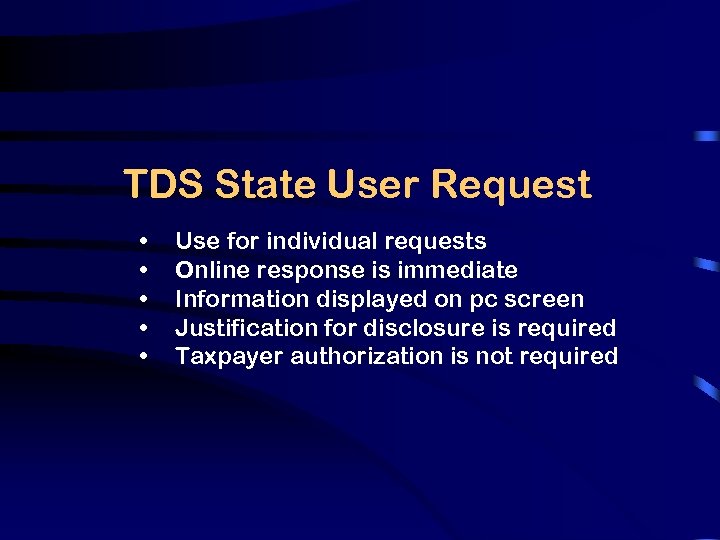

TDS State User Request • • • Use for individual requests Online response is immediate Information displayed on pc screen Justification for disclosure is required Taxpayer authorization is not required

TDS State User Request • • • Use for individual requests Online response is immediate Information displayed on pc screen Justification for disclosure is required Taxpayer authorization is not required

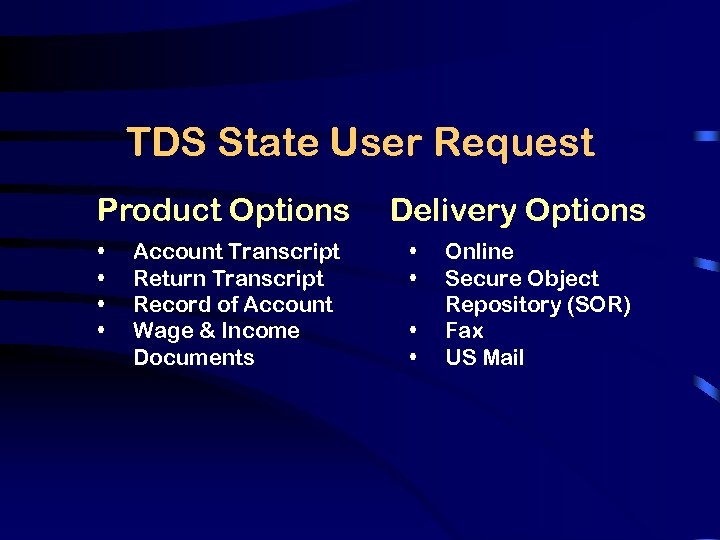

TDS State User Request Product Options • • Account Transcript Return Transcript Record of Account Wage & Income Documents Delivery Options • • Online Secure Object Repository (SOR) Fax US Mail

TDS State User Request Product Options • • Account Transcript Return Transcript Record of Account Wage & Income Documents Delivery Options • • Online Secure Object Repository (SOR) Fax US Mail

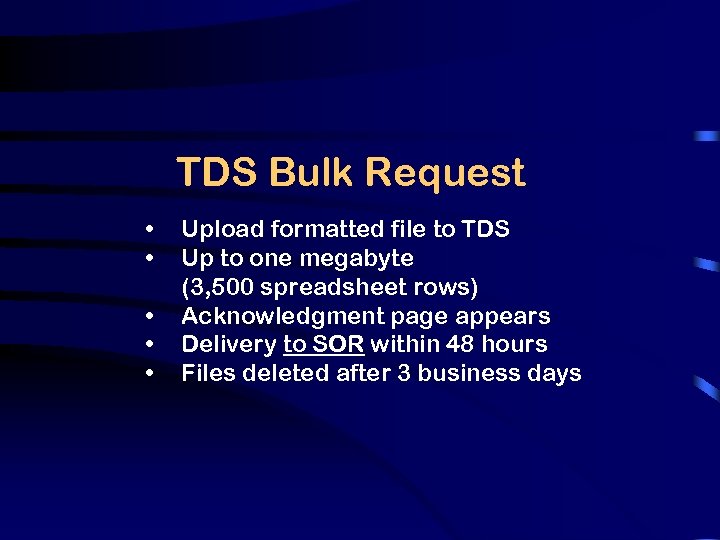

TDS Bulk Request • • • Upload formatted file to TDS Up to one megabyte (3, 500 spreadsheet rows) Acknowledgment page appears Delivery to SOR within 48 hours Files deleted after 3 business days

TDS Bulk Request • • • Upload formatted file to TDS Up to one megabyte (3, 500 spreadsheet rows) Acknowledgment page appears Delivery to SOR within 48 hours Files deleted after 3 business days

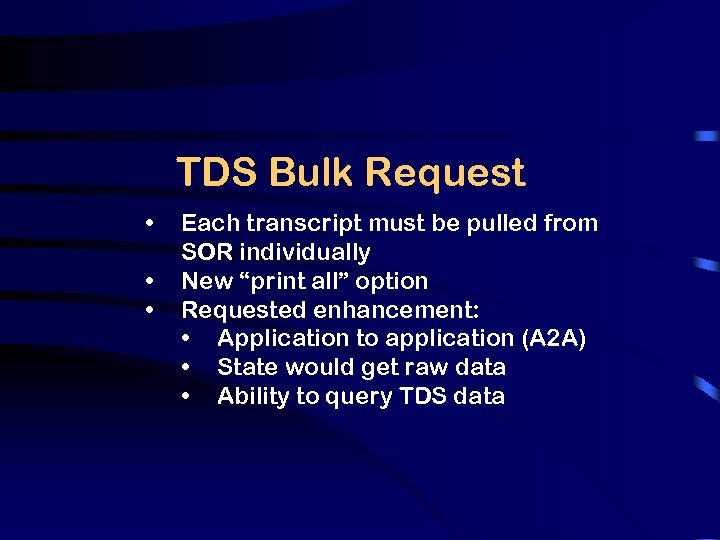

TDS Bulk Request • • • Each transcript must be pulled from SOR individually New “print all” option Requested enhancement: • Application to application (A 2 A) • State would get raw data • Ability to query TDS data

TDS Bulk Request • • • Each transcript must be pulled from SOR individually New “print all” option Requested enhancement: • Application to application (A 2 A) • State would get raw data • Ability to query TDS data

TDS State Usage Report • • • Monthly report – not a transcript Used by IRS Disclosure Delivered to states monthly via SDT Monthly list of individual TDS accesses by state users Only aspect of TDS that uses SDT

TDS State Usage Report • • • Monthly report – not a transcript Used by IRS Disclosure Delivered to states monthly via SDT Monthly list of individual TDS accesses by state users Only aspect of TDS that uses SDT

Communication & Support

Communication & Support

Communication & Support • • IRS Digital Daily (irs. gov) Local Governmental Liaison FTA’s Tax. Exchange web site IRS extract listserv (FTA)

Communication & Support • • IRS Digital Daily (irs. gov) Local Governmental Liaison FTA’s Tax. Exchange web site IRS extract listserv (FTA)

e-Services products • • Information on e-Services products is available on irs. gov Click on Tax Professionals Click on e-Services for Tax Pros Tutorials are available for users of e. Services

e-Services products • • Information on e-Services products is available on irs. gov Click on Tax Professionals Click on e-Services for Tax Pros Tutorials are available for users of e. Services

Local Governmental Liaison • • • First point of contact Current list on Tax. Exchange (www. taxexchange. org) Click on “IRS/Federal Agencies” on left side of page

Local Governmental Liaison • • • First point of contact Current list on Tax. Exchange (www. taxexchange. org) Click on “IRS/Federal Agencies” on left side of page

![IRS State Governmental Liaisons [GL] Contacts [updated May 10, 2011] [more Contact Information] [more IRS State Governmental Liaisons [GL] Contacts [updated May 10, 2011] [more Contact Information] [more](https://present5.com/presentation/83492749ad5a38fa5dcba6baef10c0d4/image-23.jpg) IRS State Governmental Liaisons [GL] Contacts [updated May 10, 2011] [more Contact Information] [more on IRS Data Exchange and Extracts] Automated SDT Notifications SDT Monthly Update June 2011 [More New & Archived SDT Tumbleweed updates] Other IRS Documents New IRS Pub 1075 for Disclosure and Computer Security Officers [2010]

IRS State Governmental Liaisons [GL] Contacts [updated May 10, 2011] [more Contact Information] [more on IRS Data Exchange and Extracts] Automated SDT Notifications SDT Monthly Update June 2011 [More New & Archived SDT Tumbleweed updates] Other IRS Documents New IRS Pub 1075 for Disclosure and Computer Security Officers [2010]

Questions? Rod Sterling IRS Governmental Liaison Robert. J. Sterling@irs. gov

Questions? Rod Sterling IRS Governmental Liaison Robert. J. Sterling@irs. gov