32df18673f5eeee254c0fe43303f4bb7.ppt

- Количество слайдов: 22

IPAA Oil & Gas Investment Symposium April 20, 2004

IPAA Oil & Gas Investment Symposium April 20, 2004

Forward-looking Statements This presentation contains projections and other forwardlooking statements within the meaning of Section 27 A of the U. S. Securities Act of 1933 and Section 21 E of the U. S. Securities Exchange Act of 1934. These projections and statements reflect the Company’s current views with respect to future events and financial performance. No assurances can be given, however, that these events will occur or that these projections will be achieved, and actual results could differ materially from those projected as a result of certain factors. A discussion of these factors is included in the Company’s periodic reports filed 2

Forward-looking Statements This presentation contains projections and other forwardlooking statements within the meaning of Section 27 A of the U. S. Securities Act of 1933 and Section 21 E of the U. S. Securities Exchange Act of 1934. These projections and statements reflect the Company’s current views with respect to future events and financial performance. No assurances can be given, however, that these events will occur or that these projections will be achieved, and actual results could differ materially from those projected as a result of certain factors. A discussion of these factors is included in the Company’s periodic reports filed 2

Good First Year… • Combined the H&P and Key organizations – Grew our exploration staff by 45% • Invested $160 MM in E&D (73% of Cash Flow) • Replaced production and grew our proved reserves • Strong earnings and cash flow – Net Income: $94. 6 MM / $2. 22 per share – Cash from operations: $217 MM • No debt and over $40 MM of cash 3

Good First Year… • Combined the H&P and Key organizations – Grew our exploration staff by 45% • Invested $160 MM in E&D (73% of Cash Flow) • Replaced production and grew our proved reserves • Strong earnings and cash flow – Net Income: $94. 6 MM / $2. 22 per share – Cash from operations: $217 MM • No debt and over $40 MM of cash 3

Approach to the Business • Consistent profitable growth • Blended-risk exploration program • Generate (versus buy) our own drilling inventory • Some acquisitions, but not principle focus • Multi-basin, lower-48 focus • Local competitor and decentralized organization 4

Approach to the Business • Consistent profitable growth • Blended-risk exploration program • Generate (versus buy) our own drilling inventory • Some acquisitions, but not principle focus • Multi-basin, lower-48 focus • Local competitor and decentralized organization 4

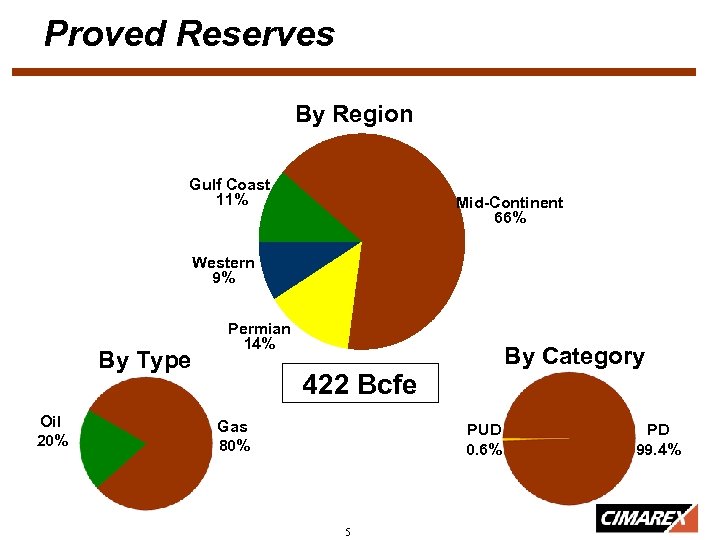

Proved Reserves By Region Gulf Coast 11% Mid-Continent 66% Western 9% By Type Oil 20% Permian 14% By Category 422 Bcfe Gas 80% PUD 0. 6% 5 PD 99. 4%

Proved Reserves By Region Gulf Coast 11% Mid-Continent 66% Western 9% By Type Oil 20% Permian 14% By Category 422 Bcfe Gas 80% PUD 0. 6% 5 PD 99. 4%

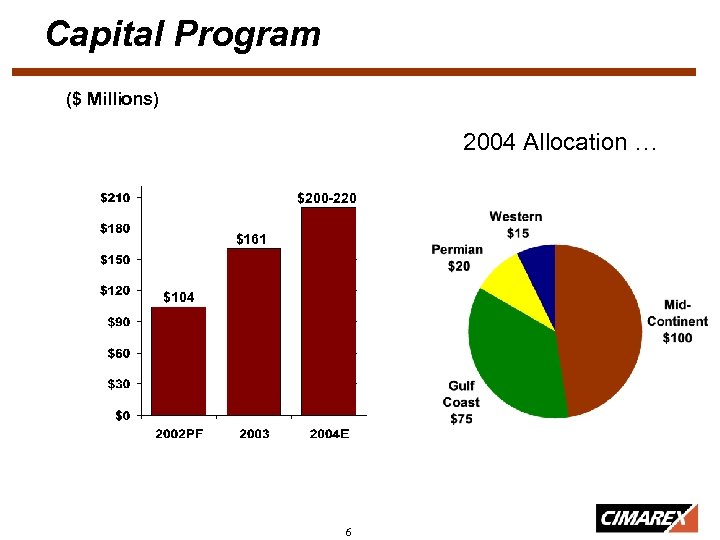

Capital Program ($ Millions) 2004 Allocation … $200 -220 $161 $104 6

Capital Program ($ Millions) 2004 Allocation … $200 -220 $161 $104 6

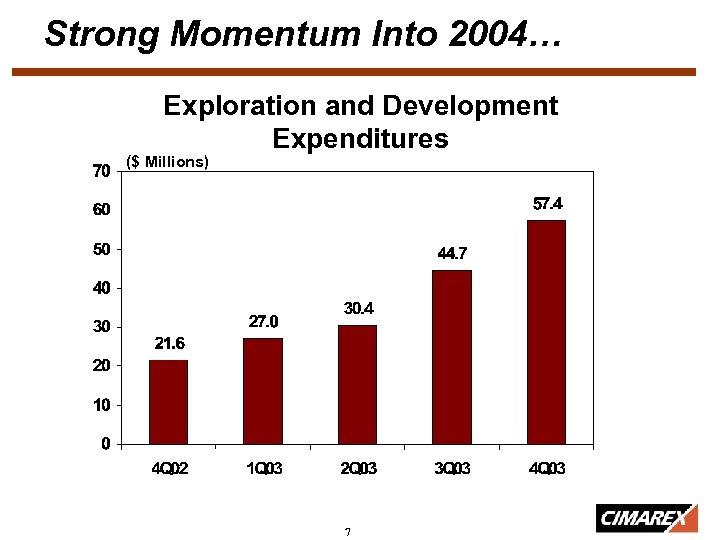

Strong Momentum Into 2004… Exploration and Development Expenditures ($ Millions) 7

Strong Momentum Into 2004… Exploration and Development Expenditures ($ Millions) 7

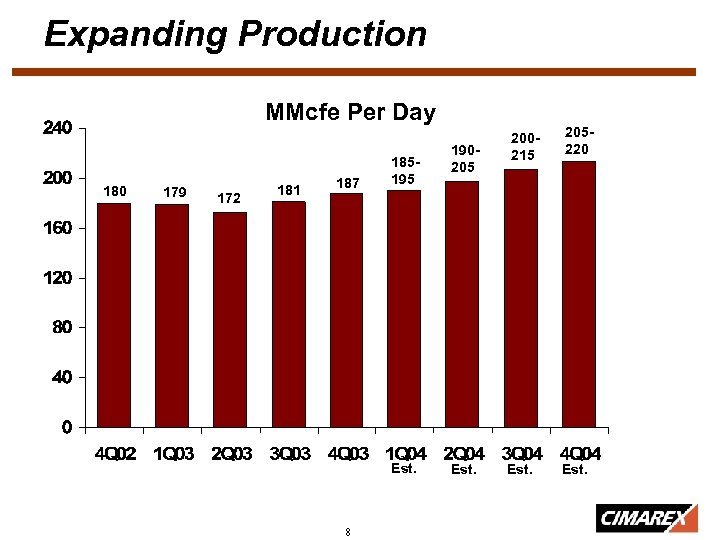

Expanding Production MMcfe Per Day 180 179 172 181 187 185195 Est. 8 190205 Est. 200215 Est. 205220 Est.

Expanding Production MMcfe Per Day 180 179 172 181 187 185195 Est. 8 190205 Est. 200215 Est. 205220 Est.

Key Principles • Each region will be a top competitor • Regional effort built upon local expertise • Drilling program with mostly moderate risk prospects • Close integration between geology, land, and engineering • Monitor results and provide continuous feedback 9

Key Principles • Each region will be a top competitor • Regional effort built upon local expertise • Drilling program with mostly moderate risk prospects • Close integration between geology, land, and engineering • Monitor results and provide continuous feedback 9

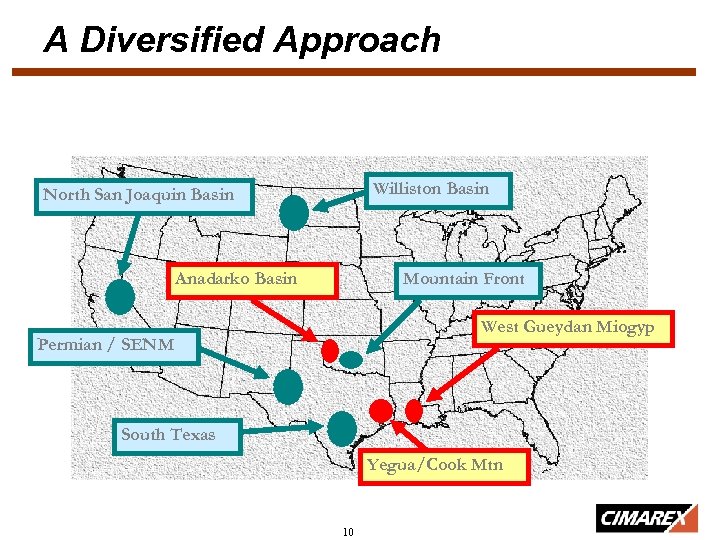

A Diversified Approach Williston Basin North San Joaquin Basin Anadarko Basin Mountain Front West Gueydan Miogyp Permian / SENM South Texas Yegua/Cook Mtn 10

A Diversified Approach Williston Basin North San Joaquin Basin Anadarko Basin Mountain Front West Gueydan Miogyp Permian / SENM South Texas Yegua/Cook Mtn 10

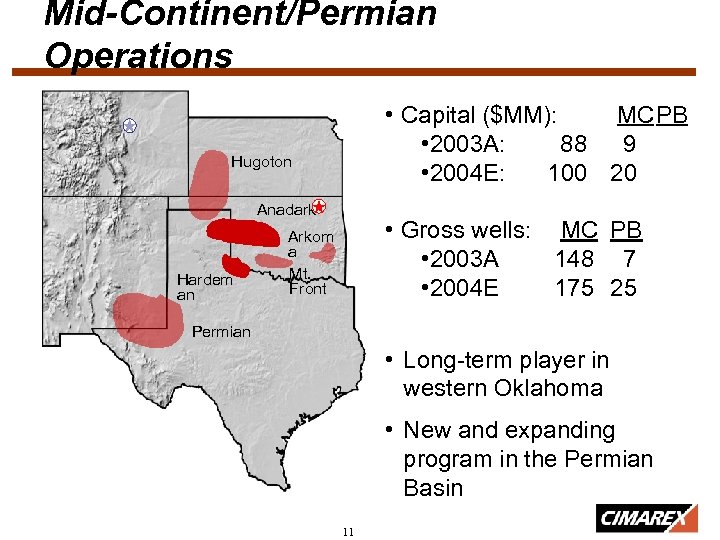

Mid-Continent/Permian Operations • Capital ($MM): MCPB • 2003 A: 88 9 • 2004 E: 100 20 Hugoton Hardem an Anadark o Arkom a Mt. Front • Gross wells: MC PB • 2003 A 148 7 • 2004 E 175 25 Permian • Long-term player in western Oklahoma • New and expanding program in the Permian Basin 11

Mid-Continent/Permian Operations • Capital ($MM): MCPB • 2003 A: 88 9 • 2004 E: 100 20 Hugoton Hardem an Anadark o Arkom a Mt. Front • Gross wells: MC PB • 2003 A 148 7 • 2004 E 175 25 Permian • Long-term player in western Oklahoma • New and expanding program in the Permian Basin 11

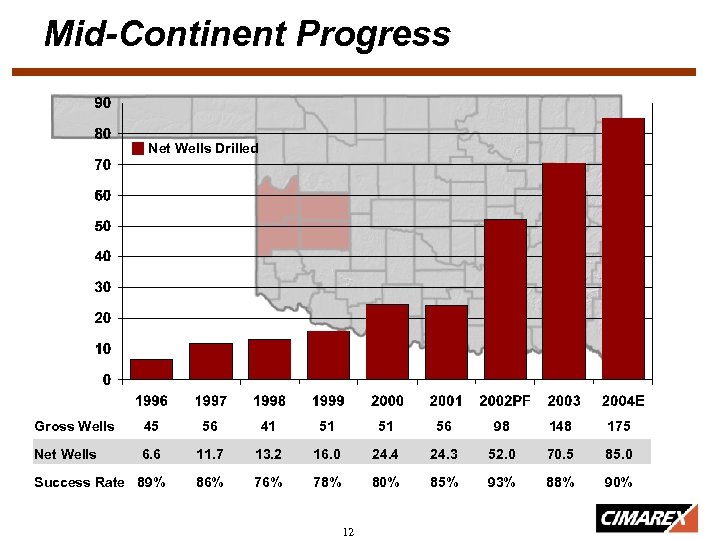

Mid-Continent Progress Net Wells Drilled Gross Wells 45 56 41 51 51 56 98 148 175 Net Wells 6. 6 11. 7 13. 2 16. 0 24. 4 24. 3 52. 0 70. 5 85. 0 86% 78% 80% 85% 93% 88% 90% Success Rate 89% 12

Mid-Continent Progress Net Wells Drilled Gross Wells 45 56 41 51 51 56 98 148 175 Net Wells 6. 6 11. 7 13. 2 16. 0 24. 4 24. 3 52. 0 70. 5 85. 0 86% 78% 80% 85% 93% 88% 90% Success Rate 89% 12

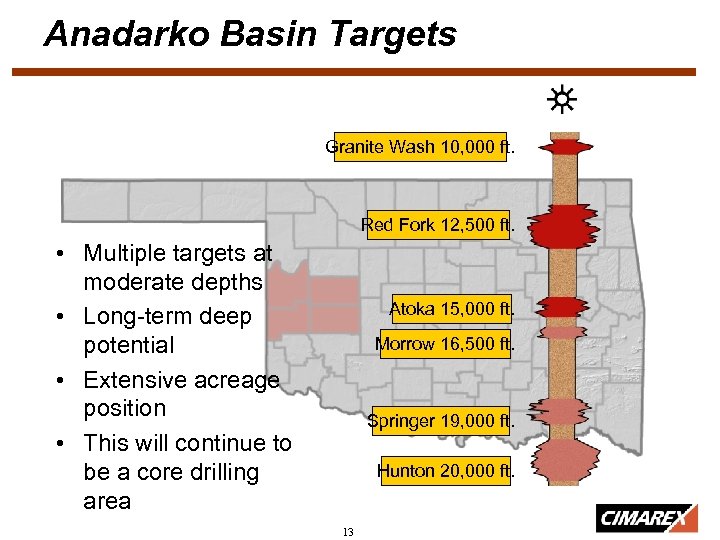

Anadarko Basin Targets Granite Wash 10, 000 ft. Red Fork 12, 500 ft. • Multiple targets at moderate depths • Long-term deep potential • Extensive acreage position • This will continue to be a core drilling area Atoka 15, 000 ft. Morrow 16, 500 ft. Springer 19, 000 ft. Hunton 20, 000 ft. 13

Anadarko Basin Targets Granite Wash 10, 000 ft. Red Fork 12, 500 ft. • Multiple targets at moderate depths • Long-term deep potential • Extensive acreage position • This will continue to be a core drilling area Atoka 15, 000 ft. Morrow 16, 500 ft. Springer 19, 000 ft. Hunton 20, 000 ft. 13

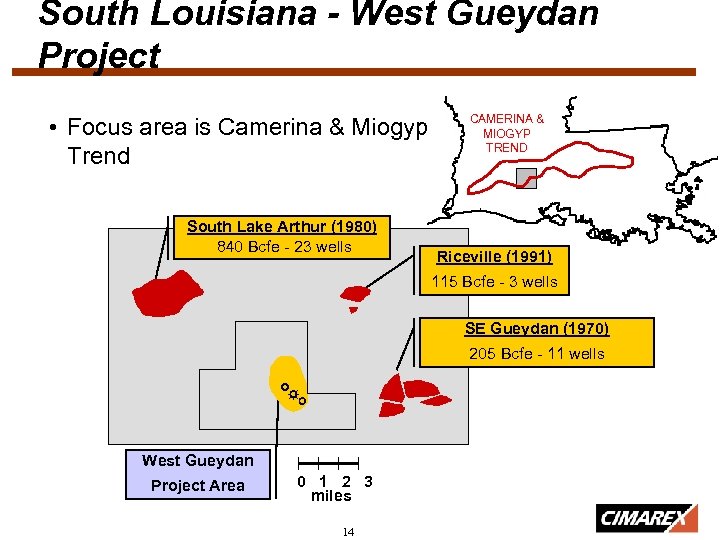

South Louisiana - West Gueydan Project • Focus area is Camerina & Miogyp Trend South Lake Arthur (1980) 840 Bcfe - 23 wells CAMERINA & MIOGYP TREND Riceville (1991) 115 Bcfe - 3 wells SE Gueydan (1970) 205 Bcfe - 11 wells ☼ West Gueydan Project Area 0 1 2 3 miles 14

South Louisiana - West Gueydan Project • Focus area is Camerina & Miogyp Trend South Lake Arthur (1980) 840 Bcfe - 23 wells CAMERINA & MIOGYP TREND Riceville (1991) 115 Bcfe - 3 wells SE Gueydan (1970) 205 Bcfe - 11 wells ☼ West Gueydan Project Area 0 1 2 3 miles 14

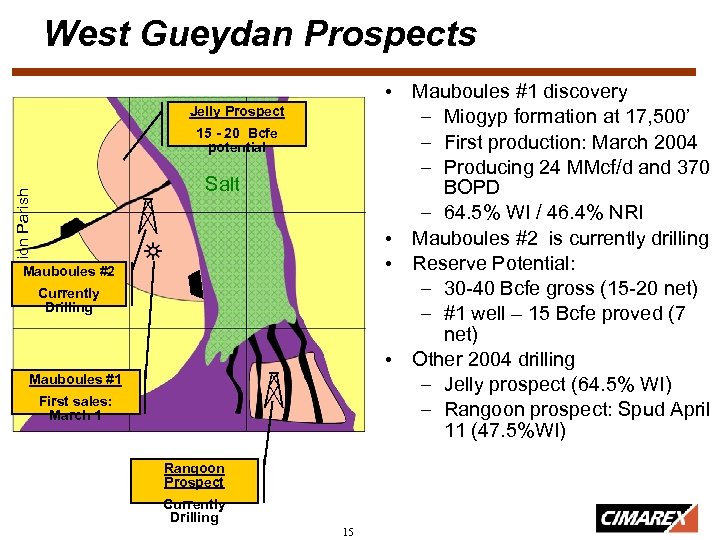

West Gueydan Prospects • Mauboules #1 discovery – Miogyp formation at 17, 500’ – First production: March 2004 – Producing 24 MMcf/d and 370 BOPD – 64. 5% WI / 46. 4% NRI • Mauboules #2 is currently drilling • Reserve Potential: – 30 -40 Bcfe gross (15 -20 net) – #1 well – 15 Bcfe proved (7 net) • Other 2004 drilling – Jelly prospect (64. 5% WI) – Rangoon prospect: Spud April 11 (47. 5%WI) Jelly Prospect Vermilion Parish 15 - 20 Bcfe potential Salt Mauboules #2 Currently Drilling Mauboules #1 First sales: March 1 Rangoon Prospect Currently Drilling 15

West Gueydan Prospects • Mauboules #1 discovery – Miogyp formation at 17, 500’ – First production: March 2004 – Producing 24 MMcf/d and 370 BOPD – 64. 5% WI / 46. 4% NRI • Mauboules #2 is currently drilling • Reserve Potential: – 30 -40 Bcfe gross (15 -20 net) – #1 well – 15 Bcfe proved (7 net) • Other 2004 drilling – Jelly prospect (64. 5% WI) – Rangoon prospect: Spud April 11 (47. 5%WI) Jelly Prospect Vermilion Parish 15 - 20 Bcfe potential Salt Mauboules #2 Currently Drilling Mauboules #1 First sales: March 1 Rangoon Prospect Currently Drilling 15

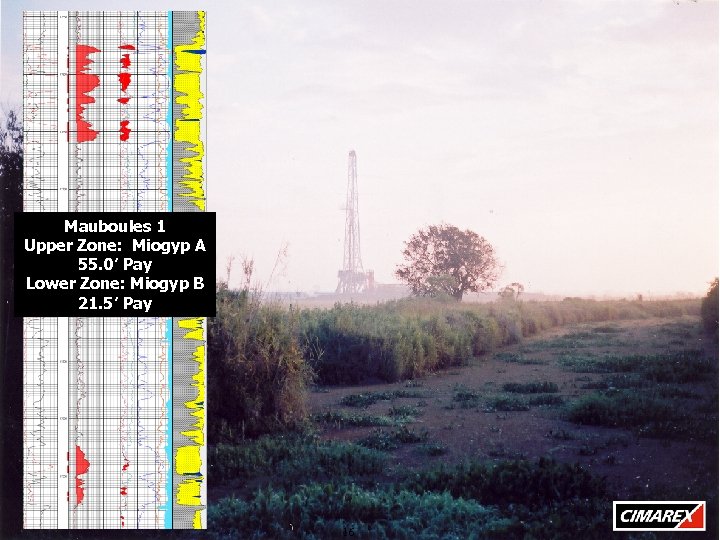

Mauboules 1 Upper Zone: Miogyp A 55. 0’ Pay Lower Zone: Miogyp B 21. 5’ Pay 16

Mauboules 1 Upper Zone: Miogyp A 55. 0’ Pay Lower Zone: Miogyp B 21. 5’ Pay 16

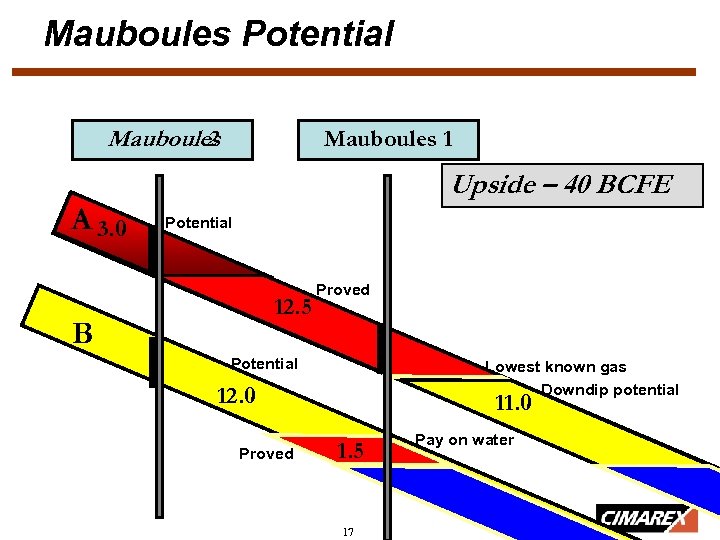

Mauboules Potential Mauboules 2 Mauboules 1 Upside – 40 BCFE A 3. 0 Potential 12. 5 B Proved Potential Lowest known gas Downdip potential 12. 0 Proved 11. 0 1. 5 17 Pay on water

Mauboules Potential Mauboules 2 Mauboules 1 Upside – 40 BCFE A 3. 0 Potential 12. 5 B Proved Potential Lowest known gas Downdip potential 12. 0 Proved 11. 0 1. 5 17 Pay on water

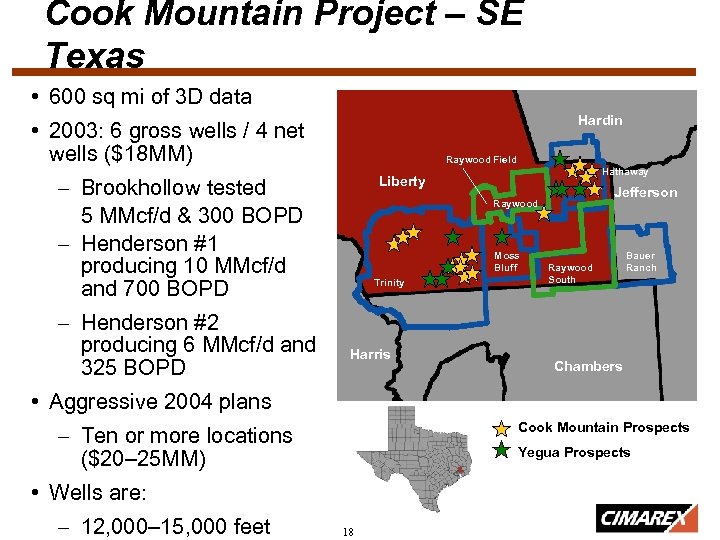

Cook Mountain Project – SE Texas • 600 sq mi of 3 D data Hardin • 2003: 6 gross wells / 4 net wells ($18 MM) Raywood Field – Brookhollow tested 5 MMcf/d & 300 BOPD – Henderson #1 producing 10 MMcf/d and 700 BOPD – Henderson #2 producing 6 MMcf/d and 325 BOPD Hathaway Liberty Jefferson Raywood Moss Bluff Trinity Harris Raywood South Bauer Ranch Chambers • Aggressive 2004 plans Cook Mountain Prospects – Ten or more locations ($20– 25 MM) Yegua Prospects • Wells are: – 12, 000– 15, 000 feet 18

Cook Mountain Project – SE Texas • 600 sq mi of 3 D data Hardin • 2003: 6 gross wells / 4 net wells ($18 MM) Raywood Field – Brookhollow tested 5 MMcf/d & 300 BOPD – Henderson #1 producing 10 MMcf/d and 700 BOPD – Henderson #2 producing 6 MMcf/d and 325 BOPD Hathaway Liberty Jefferson Raywood Moss Bluff Trinity Harris Raywood South Bauer Ranch Chambers • Aggressive 2004 plans Cook Mountain Prospects – Ten or more locations ($20– 25 MM) Yegua Prospects • Wells are: – 12, 000– 15, 000 feet 18

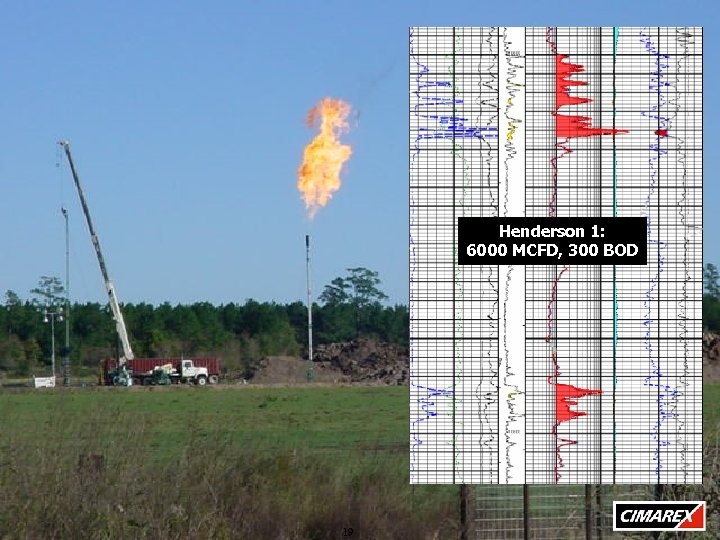

Henderson 1: 6000 MCFD, 300 BOD 19

Henderson 1: 6000 MCFD, 300 BOD 19

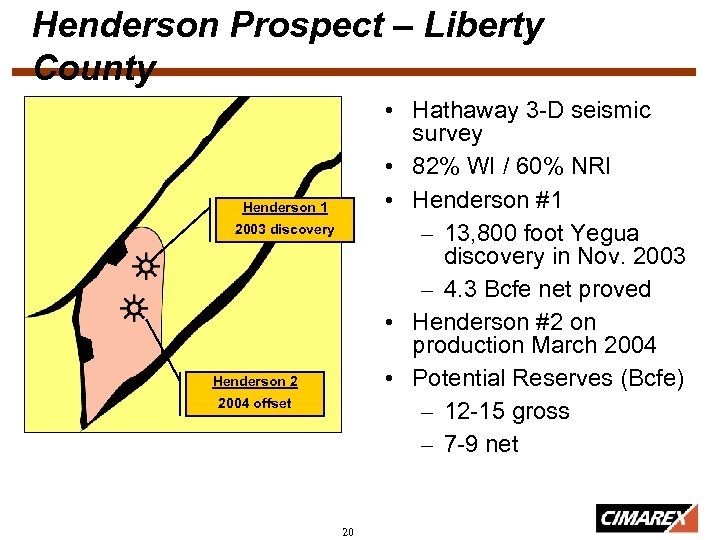

Henderson Prospect – Liberty County • Hathaway 3 -D seismic survey • 82% WI / 60% NRI • Henderson #1 – 13, 800 foot Yegua discovery in Nov. 2003 – 4. 3 Bcfe net proved • Henderson #2 on production March 2004 • Potential Reserves (Bcfe) – 12 -15 gross – 7 -9 net Henderson 1 2003 discovery Henderson 2 2004 offset 20

Henderson Prospect – Liberty County • Hathaway 3 -D seismic survey • 82% WI / 60% NRI • Henderson #1 – 13, 800 foot Yegua discovery in Nov. 2003 – 4. 3 Bcfe net proved • Henderson #2 on production March 2004 • Potential Reserves (Bcfe) – 12 -15 gross – 7 -9 net Henderson 1 2003 discovery Henderson 2 2004 offset 20

Recap • Right size to participate in meaningful exploration and acquisition projects • Small enough to grow through drilling • Strong cash flow, no debt and un-hedged • Rising production profile from organic growth • Solid 2003 drilling program • Strong 2004 inventory and building momentum for 2005 21

Recap • Right size to participate in meaningful exploration and acquisition projects • Small enough to grow through drilling • Strong cash flow, no debt and un-hedged • Rising production profile from organic growth • Solid 2003 drilling program • Strong 2004 inventory and building momentum for 2005 21

CONTACT INFORMATION Paul Korus Cimarex Energy Co. 707 Seventeenth Street, Suite 3300 Denver, CO 80202 -3404 Phone (303) 295 -3995 Fax (303) 285 -9299 www. cimarex. com 22

CONTACT INFORMATION Paul Korus Cimarex Energy Co. 707 Seventeenth Street, Suite 3300 Denver, CO 80202 -3404 Phone (303) 295 -3995 Fax (303) 285 -9299 www. cimarex. com 22