8156b7ccaa4118640e4eb3c1919ec13f.ppt

- Количество слайдов: 41

IP and Finance: Accounting and Valuation of IP Assets; IP-based Financing Mr. Paul Bodenham Studio Legale Alma

IP and Finance: Accounting and Valuation of IP Assets; IP-based Financing Mr. Paul Bodenham Studio Legale Alma

Assets Wealth of a business includes: • • Working Capital Fixed Assets Intangible Assets IP Assets • • - Created by law Identifiable Transferable Have economic life Other in-identifiable assets like know-how, work force etc

Assets Wealth of a business includes: • • Working Capital Fixed Assets Intangible Assets IP Assets • • - Created by law Identifiable Transferable Have economic life Other in-identifiable assets like know-how, work force etc

Assets Intangible Asset Finance is the branch of finance that deals with intangible assets such as patents (legal intangible) and reputation (competitive intangible).

Assets Intangible Asset Finance is the branch of finance that deals with intangible assets such as patents (legal intangible) and reputation (competitive intangible).

Assets Early Stage Companies have no sales or infrastructure. They only have Intellectual Property assets ( «IP » = people, their knowhow, and drive to succeed). They are difficult to value. Later Stage Companies are also difficult to value: Intangible assets (i. e. , IP) now account for more than 50% of the value of many major multinationals (e. g. , Microsoft).

Assets Early Stage Companies have no sales or infrastructure. They only have Intellectual Property assets ( «IP » = people, their knowhow, and drive to succeed). They are difficult to value. Later Stage Companies are also difficult to value: Intangible assets (i. e. , IP) now account for more than 50% of the value of many major multinationals (e. g. , Microsoft).

Role of Intangible Asset Finance • • In the last few years there has been an increasing awareness of the strategic role played by intellectual property: It now plays, in fact, not only an exclusively defensive role in protecting an enterprise’s products and services, but it can also be monetarized, that is to say turned into a further source of revenue for businesses.

Role of Intangible Asset Finance • • In the last few years there has been an increasing awareness of the strategic role played by intellectual property: It now plays, in fact, not only an exclusively defensive role in protecting an enterprise’s products and services, but it can also be monetarized, that is to say turned into a further source of revenue for businesses.

Valuation • Will depend on PERCEPTIONS of IP • May depend on MARKET SHARE or WHO OWNS the IP asset • May depend on CASH RESERVES & LIQUIDITY • Emphasis is so that there is an AWARENESS thereof • Remember: “BEAUTY IS IN THE EYE OF THE BEHOLDER”

Valuation • Will depend on PERCEPTIONS of IP • May depend on MARKET SHARE or WHO OWNS the IP asset • May depend on CASH RESERVES & LIQUIDITY • Emphasis is so that there is an AWARENESS thereof • Remember: “BEAUTY IS IN THE EYE OF THE BEHOLDER”

Context of Value Is the asset in use/ not in use? Validity and strength of the asset Legal, tax, financial or other business circumstance

Context of Value Is the asset in use/ not in use? Validity and strength of the asset Legal, tax, financial or other business circumstance

Traditional Transactions involving IP Assets acquisition assignment licensing franchising merger & acquisition, joint ventures

Traditional Transactions involving IP Assets acquisition assignment licensing franchising merger & acquisition, joint ventures

Selling IP Assets Permanently transfer ownership of the patent to another entity. Receive an agreed-upon payment once, with no future royalties Value obtained immediately, without having to wait any longer to realize that value progressively Avoid any unforeseen risks that will reduce the value of the IP in the future

Selling IP Assets Permanently transfer ownership of the patent to another entity. Receive an agreed-upon payment once, with no future royalties Value obtained immediately, without having to wait any longer to realize that value progressively Avoid any unforeseen risks that will reduce the value of the IP in the future

Licensing IP Assets Obtain the benefit of royalties for the remainder of the life of the IP Slow incremental value for longer time period Particularly useful if the company that owns the IP is not in a position to conduct business: at all in sufficient quantity to meet a given market need in a given geographical area

Licensing IP Assets Obtain the benefit of royalties for the remainder of the life of the IP Slow incremental value for longer time period Particularly useful if the company that owns the IP is not in a position to conduct business: at all in sufficient quantity to meet a given market need in a given geographical area

Licensing Opportunities Exclusive license: a single licensee has the right to use the IP, which cannot be used by the owner Sole license: a single licensee and the owner have the right to use the IP Non-exclusive license: several licensees and the owner have the right to use the IP

Licensing Opportunities Exclusive license: a single licensee has the right to use the IP, which cannot be used by the owner Sole license: a single licensee and the owner have the right to use the IP Non-exclusive license: several licensees and the owner have the right to use the IP

Reasons for Valuation Financing based on IP Assets Attracting investment Procuring loans Borrowing against the license stream Securitization of IP assets

Reasons for Valuation Financing based on IP Assets Attracting investment Procuring loans Borrowing against the license stream Securitization of IP assets

Characteristics of IP Assets Trademarks leverage the brand equity through brand extensions, franchise set-ups Patents exclusivity for markets, technologies Designs strong customer connect like in trademarks Copyrights derivatives for downstream revenues from merchandizing, adaptations

Characteristics of IP Assets Trademarks leverage the brand equity through brand extensions, franchise set-ups Patents exclusivity for markets, technologies Designs strong customer connect like in trademarks Copyrights derivatives for downstream revenues from merchandizing, adaptations

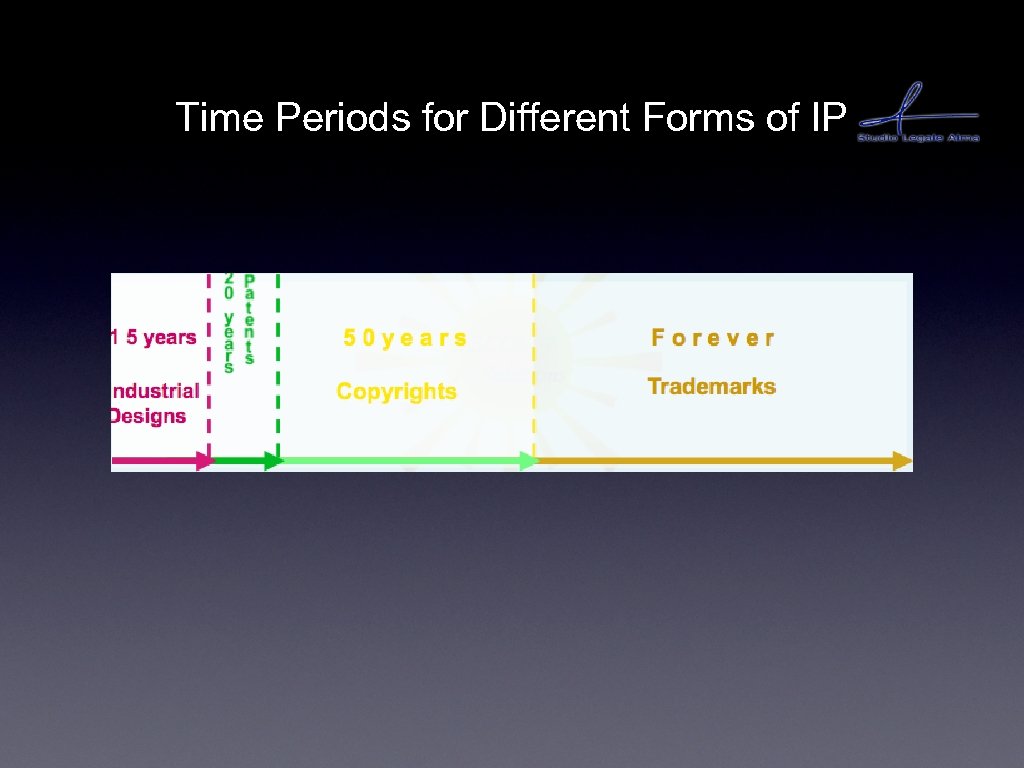

Time Periods for Different Forms of IP

Time Periods for Different Forms of IP

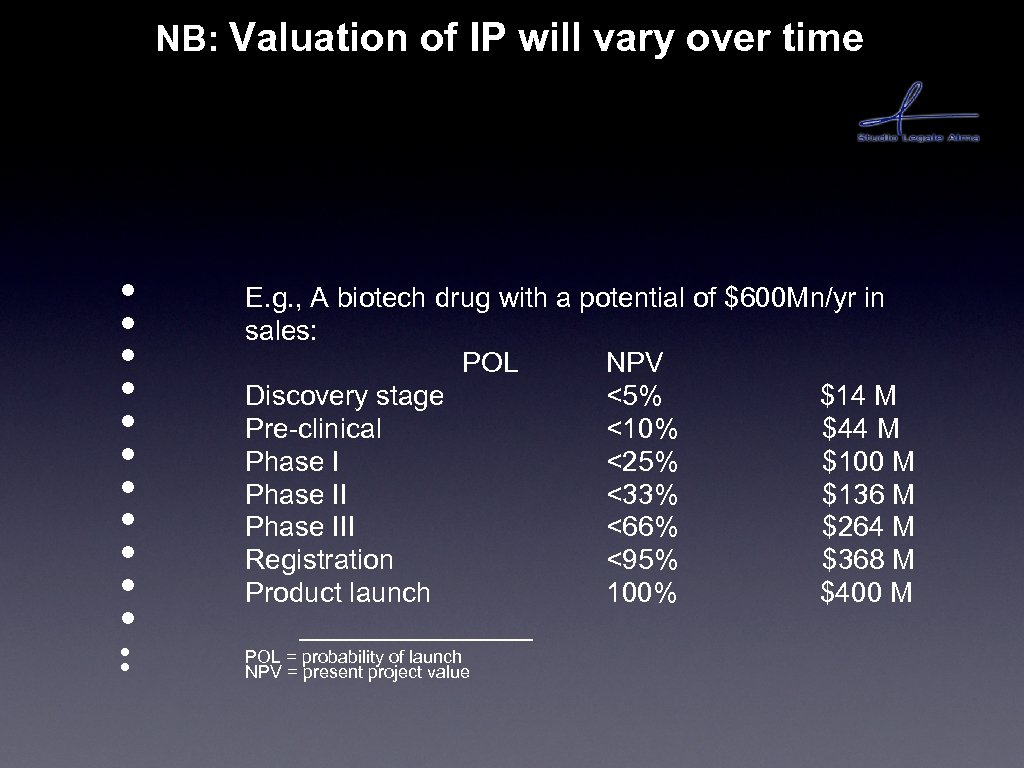

NB: Valuation of IP will vary over time • • • • E. g. , A biotech drug with a potential of $600 Mn/yr in sales: POL NPV Discovery stage <5% $14 M Pre-clinical <10% $44 M Phase I <25% $100 M Phase II <33% $136 M Phase III <66% $264 M Registration <95% $368 M Product launch 100% $400 M ________ POL = probability of launch NPV = present project value

NB: Valuation of IP will vary over time • • • • E. g. , A biotech drug with a potential of $600 Mn/yr in sales: POL NPV Discovery stage <5% $14 M Pre-clinical <10% $44 M Phase I <25% $100 M Phase II <33% $136 M Phase III <66% $264 M Registration <95% $368 M Product launch 100% $400 M ________ POL = probability of launch NPV = present project value

Bottom Line on IP & Financing: “Valuation is in the eye of the beholder” (e. g. its strategic needs) It is an Art, not a Science Amount received is not the most important issue “Value Added” of investor can be much more important Very complex and specialist field: expertise required Know who you are speaking to and what their metrics are Be conservative but use synergies Present & manage your IP according to your financing strategy.

Bottom Line on IP & Financing: “Valuation is in the eye of the beholder” (e. g. its strategic needs) It is an Art, not a Science Amount received is not the most important issue “Value Added” of investor can be much more important Very complex and specialist field: expertise required Know who you are speaking to and what their metrics are Be conservative but use synergies Present & manage your IP according to your financing strategy.

PLAYERS INVOLVED IN IP FINANCING Business Angels VCs Banks

PLAYERS INVOLVED IN IP FINANCING Business Angels VCs Banks

IP & Venture Capitalists Venture capital is a typical example of equity financing, based on an exchange of money for a share in a business

IP & Venture Capitalists Venture capital is a typical example of equity financing, based on an exchange of money for a share in a business

IP & Venture Capitalists • • A VC is a financial intermediary, that raises equity capital from different types of investors (pension funds, financial institutions, corporations and individuals) and invests it directly in the portfolios of private enterprises. A VC fund is typically organized as a limited partnership, where the venture capitalist acts as the general partner of the fund and the other investors as limited partners

IP & Venture Capitalists • • A VC is a financial intermediary, that raises equity capital from different types of investors (pension funds, financial institutions, corporations and individuals) and invests it directly in the portfolios of private enterprises. A VC fund is typically organized as a limited partnership, where the venture capitalist acts as the general partner of the fund and the other investors as limited partners

IP & Venture Capitalists • • A VC is an active investor that monitors and supports the enterprise’s growth through strategic and managerial support. To do this, VCs generally take a seat in the board of the enterprises to give advice and help at the highest level of the organization and also takes an important role in the professionalization of the enterprises. • Finally, a VC has the primary goal to maximize its financial returns by exiting investments after a certain period of time.

IP & Venture Capitalists • • A VC is an active investor that monitors and supports the enterprise’s growth through strategic and managerial support. To do this, VCs generally take a seat in the board of the enterprises to give advice and help at the highest level of the organization and also takes an important role in the professionalization of the enterprises. • Finally, a VC has the primary goal to maximize its financial returns by exiting investments after a certain period of time.

How does Venture Capital operate? • • Deal Origination. During this phase, enterprises are considered as investment prospects. Screening. Some of these proposals are immediately rejected if they do not fit with the focus of the VC strategy. • Due Diligence. The VC analyses in depth these proposals through a set of key policy variables which reduce investment prospects to a more manageable number for in-depth evaluation.

How does Venture Capital operate? • • Deal Origination. During this phase, enterprises are considered as investment prospects. Screening. Some of these proposals are immediately rejected if they do not fit with the focus of the VC strategy. • Due Diligence. The VC analyses in depth these proposals through a set of key policy variables which reduce investment prospects to a more manageable number for in-depth evaluation.

How does Venture Capital operate? • • Deal evaluation. VC managers assess the levels of perceived risk and expected return of the potential investee enterprise to decide whether or not to invest. Deal contracting. The price of the deal and the covenants which limit the risk of the investor are negotiated. • Investment and post-investment activities. VCs monitor and assist the investee enterprise along its growth by supporting the recruitment of key executives and strategic planning, providing further financing through various financial rounds and organizing a merger, acquisition or public offering to exit and liquidate the investment.

How does Venture Capital operate? • • Deal evaluation. VC managers assess the levels of perceived risk and expected return of the potential investee enterprise to decide whether or not to invest. Deal contracting. The price of the deal and the covenants which limit the risk of the investor are negotiated. • Investment and post-investment activities. VCs monitor and assist the investee enterprise along its growth by supporting the recruitment of key executives and strategic planning, providing further financing through various financial rounds and organizing a merger, acquisition or public offering to exit and liquidate the investment.

IP & Banks or Pools • • • May be possible to get a lien or loan on registered IP assets May be possible to sell future patent royalty income stream (“royalty banks”) May be possible to leverage greater value out of IP assets by pooling with others (e. g. , “Patent Trolls”) Not possible if SME is only a licensee and not assignee of IP rights in question. Finally, IP may be all that is left in case of bankruptcy.

IP & Banks or Pools • • • May be possible to get a lien or loan on registered IP assets May be possible to sell future patent royalty income stream (“royalty banks”) May be possible to leverage greater value out of IP assets by pooling with others (e. g. , “Patent Trolls”) Not possible if SME is only a licensee and not assignee of IP rights in question. Finally, IP may be all that is left in case of bankruptcy.

IP & Business Angels • • • Business angels are private individuals who invest their own money in high potential start-ups to help them grow and achieve success in return for shares in the enterprise, and also contribute their expertise in business management and their personal network of contacts. These enterprises are not held by either family or friends. As such, business angels play a crucial role as providers of early stage, informal, venture capital and competences at the seed and/or development stages of the business lifecycle. Angel intervention is long-term, active, and may take a variety of forms.

IP & Business Angels • • • Business angels are private individuals who invest their own money in high potential start-ups to help them grow and achieve success in return for shares in the enterprise, and also contribute their expertise in business management and their personal network of contacts. These enterprises are not held by either family or friends. As such, business angels play a crucial role as providers of early stage, informal, venture capital and competences at the seed and/or development stages of the business lifecycle. Angel intervention is long-term, active, and may take a variety of forms.

IP & Business Angels The role of business angels is especially important in view of both the decreasing levels of formal venture capital investment at these stages and the growing average amount of individual deals. Angel investors typically invest at an earlier stage of growth and provide more business guidance than venture capital providers. Therefore, angel investors are key players in generating high-growth enterprises essential to regional economic development.

IP & Business Angels The role of business angels is especially important in view of both the decreasing levels of formal venture capital investment at these stages and the growing average amount of individual deals. Angel investors typically invest at an earlier stage of growth and provide more business guidance than venture capital providers. Therefore, angel investors are key players in generating high-growth enterprises essential to regional economic development.

IP & Business Angels • Will depend on his/her area of expertise/experience • Typically, IP is not understood and is seen as purely technical

IP & Business Angels • Will depend on his/her area of expertise/experience • Typically, IP is not understood and is seen as purely technical

IP & Business Angels • • Formal venture capital operators invest a minimum of Euro 2. 5 million in enterprises, which leaves a market gap or failure in smaller amounts of equity. Individual business angels invest between Euro 20, 000 and Euro 250, 000. The average amount invested per individual in Europe is Euro 80, 000 and up to Euro 250, 000, depending on the business type and the region. These amounts can increase when business angels co-invest with other investors or through a co-investment fund.

IP & Business Angels • • Formal venture capital operators invest a minimum of Euro 2. 5 million in enterprises, which leaves a market gap or failure in smaller amounts of equity. Individual business angels invest between Euro 20, 000 and Euro 250, 000. The average amount invested per individual in Europe is Euro 80, 000 and up to Euro 250, 000, depending on the business type and the region. These amounts can increase when business angels co-invest with other investors or through a co-investment fund.

IP & Business Angels • • Business angels have become an increasingly important source of equity finance over the last decade for new and nascent businesses as venture capital investors are not able to accommodate a large number of small deals with their attendant due diligence and oversight needs. In particular, Business angels can overcome the information problem plaguing banks and venture capital funds because they can make investment decisions using their knowledge of the field, and their appreciation of the potential of the enterprise they are investing

IP & Business Angels • • Business angels have become an increasingly important source of equity finance over the last decade for new and nascent businesses as venture capital investors are not able to accommodate a large number of small deals with their attendant due diligence and oversight needs. In particular, Business angels can overcome the information problem plaguing banks and venture capital funds because they can make investment decisions using their knowledge of the field, and their appreciation of the potential of the enterprise they are investing

IP & Business Angels • BUT PERCEPTION IS 9/10 ths OF REALITY: START NOW! üStart branding identity immediately: Check and protect company name (e. g. , registrar of companies, DNS) Logos, TMs: will start to be associated and recognized as of now. Verify your © ownership issues as of now too. Understand list your key IP assets This will help you in future fundraising aspects ü ü ü

IP & Business Angels • BUT PERCEPTION IS 9/10 ths OF REALITY: START NOW! üStart branding identity immediately: Check and protect company name (e. g. , registrar of companies, DNS) Logos, TMs: will start to be associated and recognized as of now. Verify your © ownership issues as of now too. Understand list your key IP assets This will help you in future fundraising aspects ü ü ü

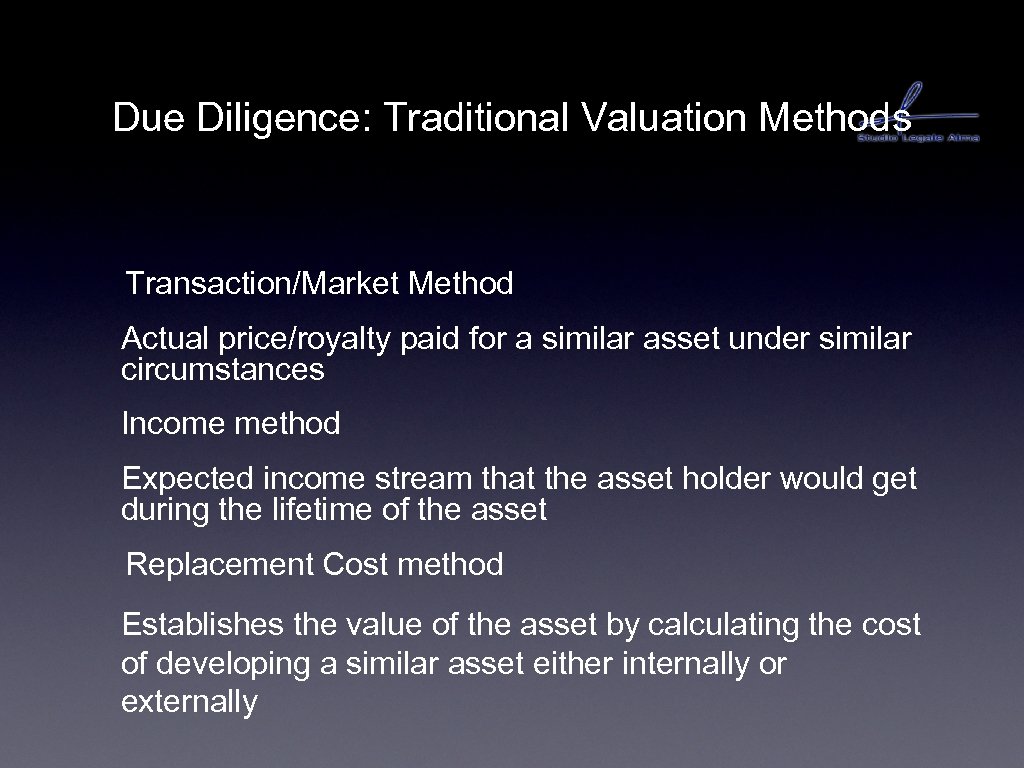

Due Diligence: Traditional Valuation Methods Transaction/Market Method Actual price/royalty paid for a similar asset under similar circumstances Income method Expected income stream that the asset holder would get during the lifetime of the asset Replacement Cost method Establishes the value of the asset by calculating the cost of developing a similar asset either internally or externally

Due Diligence: Traditional Valuation Methods Transaction/Market Method Actual price/royalty paid for a similar asset under similar circumstances Income method Expected income stream that the asset holder would get during the lifetime of the asset Replacement Cost method Establishes the value of the asset by calculating the cost of developing a similar asset either internally or externally

Limitations of Valuation methods • • Depends on the context Transaction method - right selection of baseline may not be available Income Method - Predictive, as good as assumptions Replacement Cost Method – May not be an accurate representation of value, development cost may be small, but market impact may be huge

Limitations of Valuation methods • • Depends on the context Transaction method - right selection of baseline may not be available Income Method - Predictive, as good as assumptions Replacement Cost Method – May not be an accurate representation of value, development cost may be small, but market impact may be huge

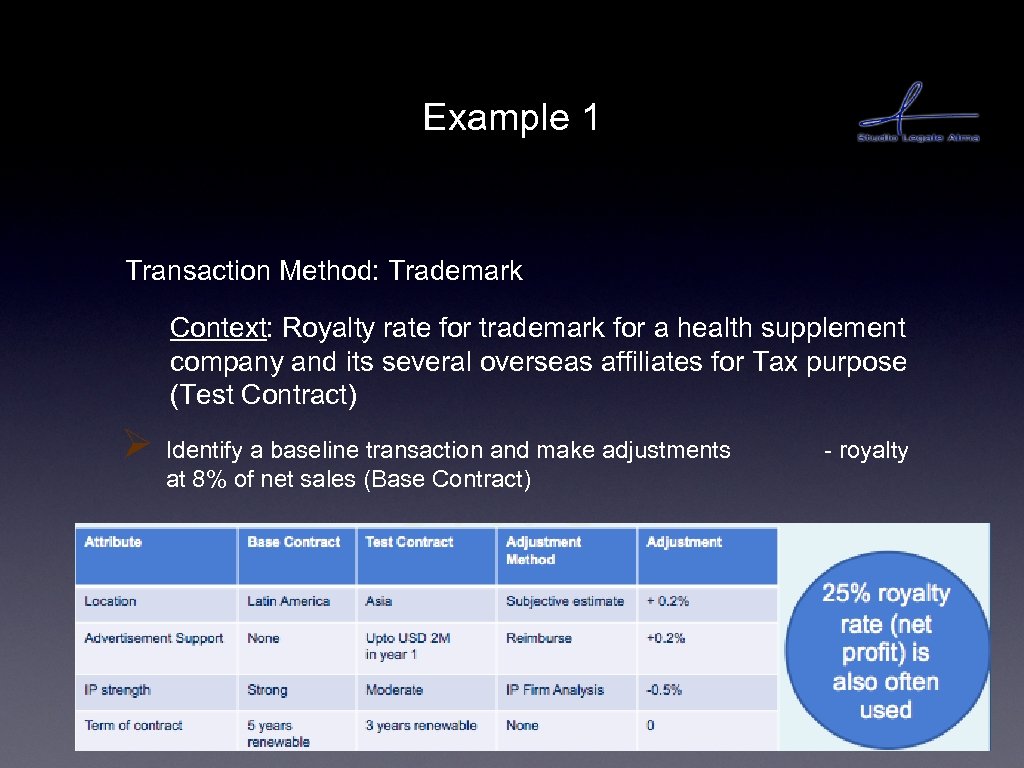

Example 1 Transaction Method: Trademark Context: Royalty rate for trademark for a health supplement company and its several overseas affiliates for Tax purpose (Test Contract) Ø Identify a baseline transaction and make adjustments at 8% of net sales (Base Contract) - royalty

Example 1 Transaction Method: Trademark Context: Royalty rate for trademark for a health supplement company and its several overseas affiliates for Tax purpose (Test Contract) Ø Identify a baseline transaction and make adjustments at 8% of net sales (Base Contract) - royalty

Example 2 Income Method : Trademark Context: Trademark of a retail gasoline brand for tax planning Identify price for similar grade unbranded gasoline Price premium for trademark brand = USD 50 Downward adjustments for costs for advertising, promotions, etc (APP) (0. 2%) Estimate Annual expected sales (AS) =USD 3, 000 Time : Infinite life Discount Rate of 20% based on typical rates of return

Example 2 Income Method : Trademark Context: Trademark of a retail gasoline brand for tax planning Identify price for similar grade unbranded gasoline Price premium for trademark brand = USD 50 Downward adjustments for costs for advertising, promotions, etc (APP) (0. 2%) Estimate Annual expected sales (AS) =USD 3, 000 Time : Infinite life Discount Rate of 20% based on typical rates of return

Example 3 Replacement Cost Method: Patents Context: A company spends USD 250, 000 per year to develop and patent a technology Period for development: 2 years Time cost of money : 10% per annum Risk for success (Chances for failure in market): 40% Replacement cost = (Total Funds invested + Time Cost for money )* Success Factor [500, 000 + {250, 000*. 1 + 500, 000*. 1) ]*1. 67

Example 3 Replacement Cost Method: Patents Context: A company spends USD 250, 000 per year to develop and patent a technology Period for development: 2 years Time cost of money : 10% per annum Risk for success (Chances for failure in market): 40% Replacement cost = (Total Funds invested + Time Cost for money )* Success Factor [500, 000 + {250, 000*. 1 + 500, 000*. 1) ]*1. 67

Main IP Finance Models • • IP Loans IP Securitization IP Sale and Lease Back Private Equity

Main IP Finance Models • • IP Loans IP Securitization IP Sale and Lease Back Private Equity

IP Loans • IP Loans - a bank loan using IP asset as collateral. The Lender usually offers the borrower loans at a loan to value ratio of 25 -30% of the appraised value of the asset (depending on the asset quality, asset holder creditworthiness, and other risk factors);

IP Loans • IP Loans - a bank loan using IP asset as collateral. The Lender usually offers the borrower loans at a loan to value ratio of 25 -30% of the appraised value of the asset (depending on the asset quality, asset holder creditworthiness, and other risk factors);

IP Securitizations • A structured finance tool typically applied to illiquid contracts whereby an enterprise transfers IPRs in receivables (e. g. , royalties) to an independent legal entity, which in turn issues securities to capital market and gives the proceeds back to the owner of the IPR;

IP Securitizations • A structured finance tool typically applied to illiquid contracts whereby an enterprise transfers IPRs in receivables (e. g. , royalties) to an independent legal entity, which in turn issues securities to capital market and gives the proceeds back to the owner of the IPR;

IP Sale and Lease Back • An operation in which an IP asset is sold to an intermediary. Later the original owner leases the IP asset back from the intermediary and agrees to pay leasing interests.

IP Sale and Lease Back • An operation in which an IP asset is sold to an intermediary. Later the original owner leases the IP asset back from the intermediary and agrees to pay leasing interests.

Private Equity • Private equity is the provision of equity capital by financial investors - over the medium or long term - to non-listed enterprises with high growth potential. • Private equity covers not only the financing required to create a business, but also includes financing in the subsequent development stages of its life cycle. When financing is required by a management team to buy an existing enterprise from its current stakeholders, such a transaction is called a buyout.

Private Equity • Private equity is the provision of equity capital by financial investors - over the medium or long term - to non-listed enterprises with high growth potential. • Private equity covers not only the financing required to create a business, but also includes financing in the subsequent development stages of its life cycle. When financing is required by a management team to buy an existing enterprise from its current stakeholders, such a transaction is called a buyout.

Conclusion • • • Start early on a consistent IP policy Plan, prepare and communicate accordingly Know your sources of finance: who do you plan to target? Know your projected IP commercialization strategy Be careful when trying to set valuations on your IP

Conclusion • • • Start early on a consistent IP policy Plan, prepare and communicate accordingly Know your sources of finance: who do you plan to target? Know your projected IP commercialization strategy Be careful when trying to set valuations on your IP

Thanks for the attention! Mr. Paul Bodenham pb@avvbodenham. it

Thanks for the attention! Mr. Paul Bodenham pb@avvbodenham. it