20da639f936a14b01afa524bd3d20c47.ppt

- Количество слайдов: 36

Investor Presentation

Investor Presentation

Presentation Summary Our Company Our Financials Our Business Our Industry BEE Growth Our Listing Rationale 2 2

Presentation Summary Our Company Our Financials Our Business Our Industry BEE Growth Our Listing Rationale 2 2

Our Company Executive Summary • • We design and manufacture antennas Established for 17 years Revenue CAGR of 50% since 2001 Projected exports > 50% World class R&D capability Supported by strong growth in wireless data markets Raising of R 20 m on company value of between R 90 m and R 110 m (Fwd PE of 4. 7 and 5. 8) 3

Our Company Executive Summary • • We design and manufacture antennas Established for 17 years Revenue CAGR of 50% since 2001 Projected exports > 50% World class R&D capability Supported by strong growth in wireless data markets Raising of R 20 m on company value of between R 90 m and R 110 m (Fwd PE of 4. 7 and 5. 8) 3

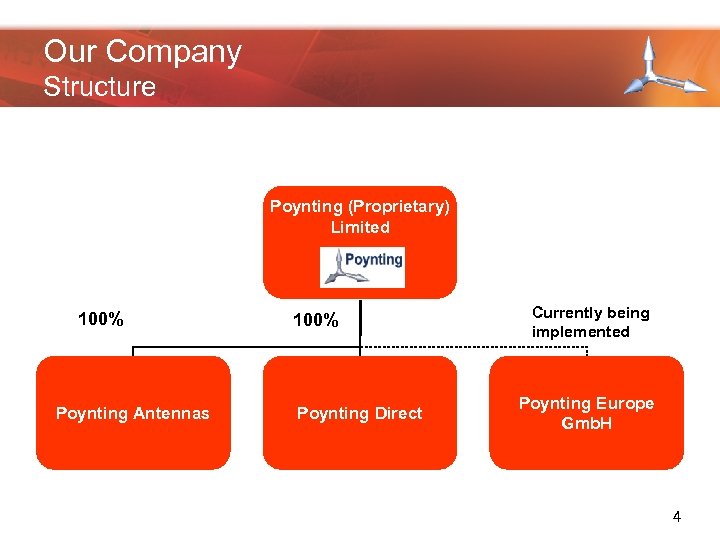

Our Company Structure Poynting (Proprietary) Limited 100% Poynting Antennas 100% Poynting Direct Currently being implemented Poynting Europe Gmb. H 4

Our Company Structure Poynting (Proprietary) Limited 100% Poynting Antennas 100% Poynting Direct Currently being implemented Poynting Europe Gmb. H 4

Our Company History & Milestones • 1990: Established consulting company at Wits University • 1997: Poynting (Pty) Ltd was formed • 2001: Poynting Antennas was formed, moved to Wynberg and started manufacturing • 2005: Established: • The Commercial Division (Cellular and wireless data antennas) • The Defence & Specialised Antenna Division (EW & DF) • 2007: Poynting Direct physical and online stores for distribution of Poynting products to end users • 2007: Poynting Europe Gmb. H which distributes commercial and defence products in Europe 5

Our Company History & Milestones • 1990: Established consulting company at Wits University • 1997: Poynting (Pty) Ltd was formed • 2001: Poynting Antennas was formed, moved to Wynberg and started manufacturing • 2005: Established: • The Commercial Division (Cellular and wireless data antennas) • The Defence & Specialised Antenna Division (EW & DF) • 2007: Poynting Direct physical and online stores for distribution of Poynting products to end users • 2007: Poynting Europe Gmb. H which distributes commercial and defence products in Europe 5

Our Company Vision ‘Making Wireless Happen’ 6

Our Company Vision ‘Making Wireless Happen’ 6

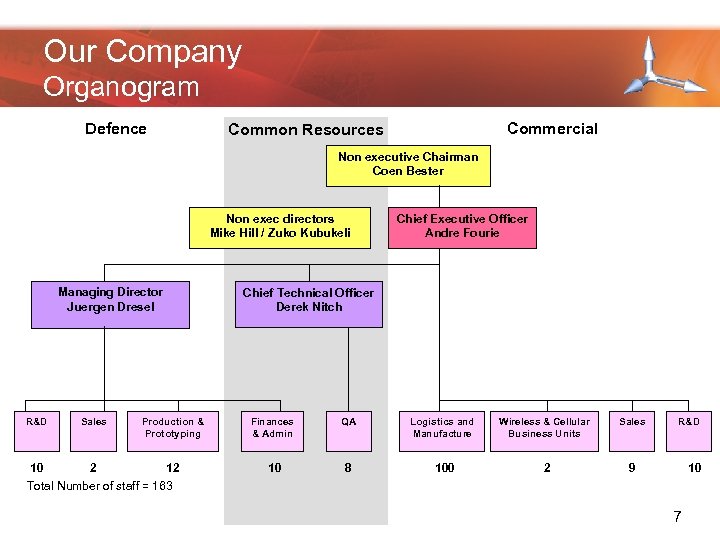

Our Company Organogram Defence Commercial Common Resources Non executive Chairman Coen Bester Non exec directors Mike Hill / Zuko Kubukeli Managing Director Juergen Dresel Chief Executive Officer Andre Fourie Chief Technical Officer Derek Nitch R&D Sales Production & Prototyping Finances & Admin QA Logistics and Manufacture Wireless & Cellular Business Units Sales 10 2 12 10 8 100 2 R&D 9 10 Total Number of staff = 163 7

Our Company Organogram Defence Commercial Common Resources Non executive Chairman Coen Bester Non exec directors Mike Hill / Zuko Kubukeli Managing Director Juergen Dresel Chief Executive Officer Andre Fourie Chief Technical Officer Derek Nitch R&D Sales Production & Prototyping Finances & Admin QA Logistics and Manufacture Wireless & Cellular Business Units Sales 10 2 12 10 8 100 2 R&D 9 10 Total Number of staff = 163 7

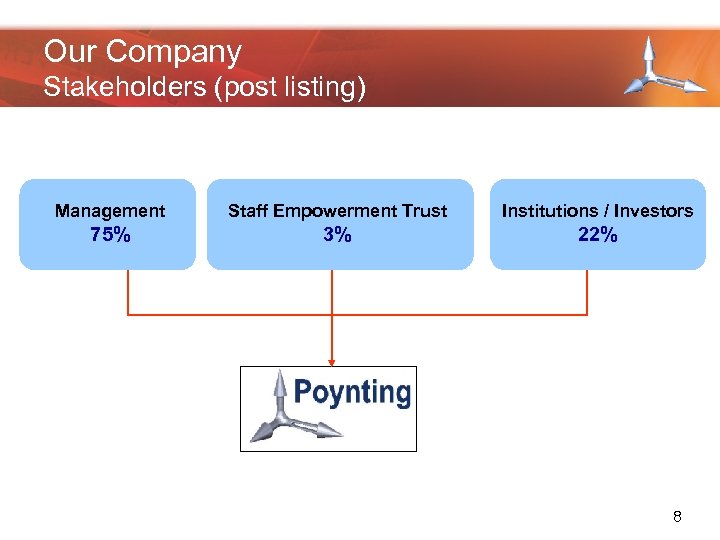

Our Company Stakeholders (post listing) Management Staff Empowerment Trust Institutions / Investors 75% 3% 22% 8

Our Company Stakeholders (post listing) Management Staff Empowerment Trust Institutions / Investors 75% 3% 22% 8

OUR BUSINESS

OUR BUSINESS

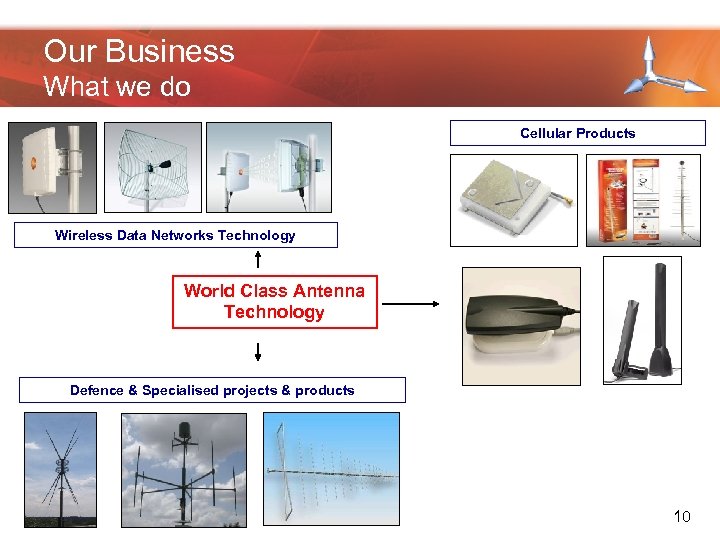

Our Business What we do Cellular Products Wireless Data Networks Technology World Class Antenna Technology Defence & Specialised projects & products 10

Our Business What we do Cellular Products Wireless Data Networks Technology World Class Antenna Technology Defence & Specialised projects & products 10

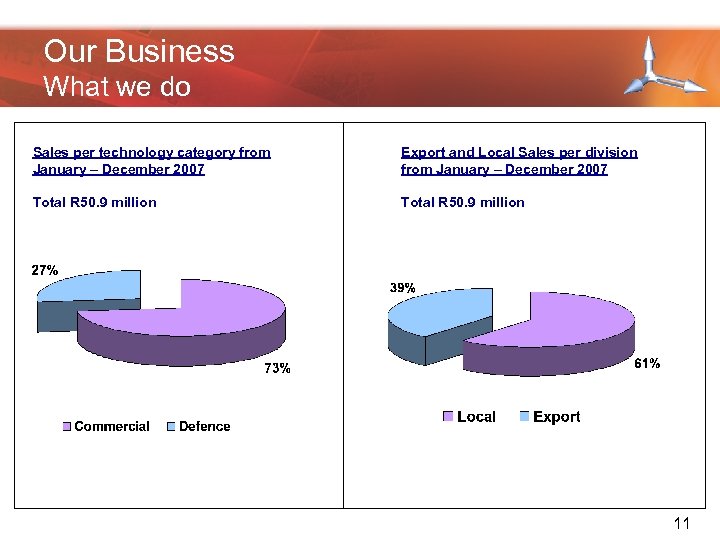

Our Business What we do Sales per technology category from January – December 2007 Export and Local Sales per division from January – December 2007 Total R 50. 9 million 11

Our Business What we do Sales per technology category from January – December 2007 Export and Local Sales per division from January – December 2007 Total R 50. 9 million 11

Our Business Clients

Our Business Clients

Our Business Competitive Advantages • International recognition of manufacturing technologies • Well developed sales and distribution channels – Network Operators – OEM’s (Original Equipment Manufacturers) – Direct distribution • The Poynting brand • Innovative niche products • Continuous development of new products & range • Price and performance competitiveness – – Unique patented manufacturing technologies Low labour component (15% of COS) Chinese relationships ‘Technology agnostic’ nature of products 13

Our Business Competitive Advantages • International recognition of manufacturing technologies • Well developed sales and distribution channels – Network Operators – OEM’s (Original Equipment Manufacturers) – Direct distribution • The Poynting brand • Innovative niche products • Continuous development of new products & range • Price and performance competitiveness – – Unique patented manufacturing technologies Low labour component (15% of COS) Chinese relationships ‘Technology agnostic’ nature of products 13

OUR INDUSTRY

OUR INDUSTRY

Our Industry Where we function Networking Integrators Wireless internet & cellular service providers Device manufacturers (embedded antennas) Tracking Antenna Products & Applications Military Industry EDGE 3 G HSDPA 15

Our Industry Where we function Networking Integrators Wireless internet & cellular service providers Device manufacturers (embedded antennas) Tracking Antenna Products & Applications Military Industry EDGE 3 G HSDPA 15

Our Industry SA Market • Current product set SA market size ± R 150 million • Market for new whole products in SA an additional R 600 million • 30% CAGR in cellular market (2001 – 2006) • SA is one of the most advanced telecoms systems of all emerging markets • CAGR of 52% in mobile data revenue since 2001 • SA Broadband internet usage ± 2 -3%, increasing by 50% p. a. • Wireless connections (e. g. , EDGE, 3 G, HSDPA, i. Burst) overtook ‘wired’ internet (ADSL) in 2007 16

Our Industry SA Market • Current product set SA market size ± R 150 million • Market for new whole products in SA an additional R 600 million • 30% CAGR in cellular market (2001 – 2006) • SA is one of the most advanced telecoms systems of all emerging markets • CAGR of 52% in mobile data revenue since 2001 • SA Broadband internet usage ± 2 -3%, increasing by 50% p. a. • Wireless connections (e. g. , EDGE, 3 G, HSDPA, i. Burst) overtook ‘wired’ internet (ADSL) in 2007 16

Our Industry Global Market Trends • Growing use of wireless for internet access • Machine-to-machine communication to play a growing role going forward • Rapidly falling electronics costs enable widespread adoption of new wireless applications • The global wireless technology market ± $25 billion* • Antennas constitute 10%20% (& growing) of this market *This excludes the cellular market which is much larger, which Poynting only addresses a subset of (modems and devices) 17

Our Industry Global Market Trends • Growing use of wireless for internet access • Machine-to-machine communication to play a growing role going forward • Rapidly falling electronics costs enable widespread adoption of new wireless applications • The global wireless technology market ± $25 billion* • Antennas constitute 10%20% (& growing) of this market *This excludes the cellular market which is much larger, which Poynting only addresses a subset of (modems and devices) 17

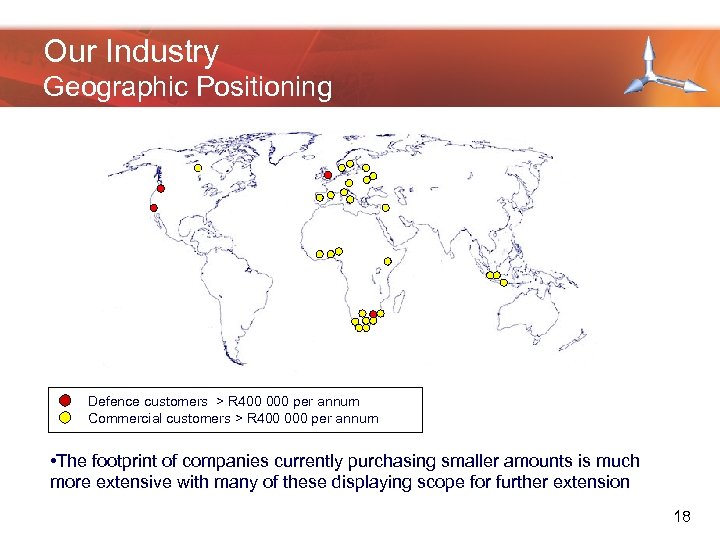

Our Industry Geographic Positioning Defence customers > R 400 000 per annum Commercial customers > R 400 000 per annum • The footprint of companies currently purchasing smaller amounts is much more extensive with many of these displaying scope for further extension 18

Our Industry Geographic Positioning Defence customers > R 400 000 per annum Commercial customers > R 400 000 per annum • The footprint of companies currently purchasing smaller amounts is much more extensive with many of these displaying scope for further extension 18

Our Industry Competition • High barriers to entry • Poynting is the dominant manufacturer in SA market. Most competition from imports. • Competitors: Webb Industries, Pacific Wireless (USA), Maxrad (USA), MTI Wireless (Israel), Kenbotong (China) • International “giants” do not compete in the “new” markets of cellular cpe and wireless data 19

Our Industry Competition • High barriers to entry • Poynting is the dominant manufacturer in SA market. Most competition from imports. • Competitors: Webb Industries, Pacific Wireless (USA), Maxrad (USA), MTI Wireless (Israel), Kenbotong (China) • International “giants” do not compete in the “new” markets of cellular cpe and wireless data 19

GROWTH

GROWTH

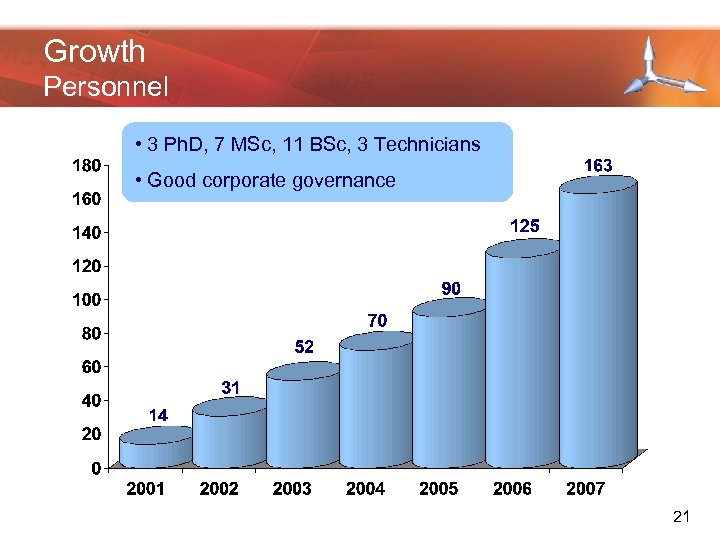

Growth Personnel • 3 Ph. D, 7 MSc, 11 BSc, 3 Technicians • • 3 Ph. D, 4 MSc, 11 BSc, 3 Technicians Good corporate governance 21

Growth Personnel • 3 Ph. D, 7 MSc, 11 BSc, 3 Technicians • • 3 Ph. D, 4 MSc, 11 BSc, 3 Technicians Good corporate governance 21

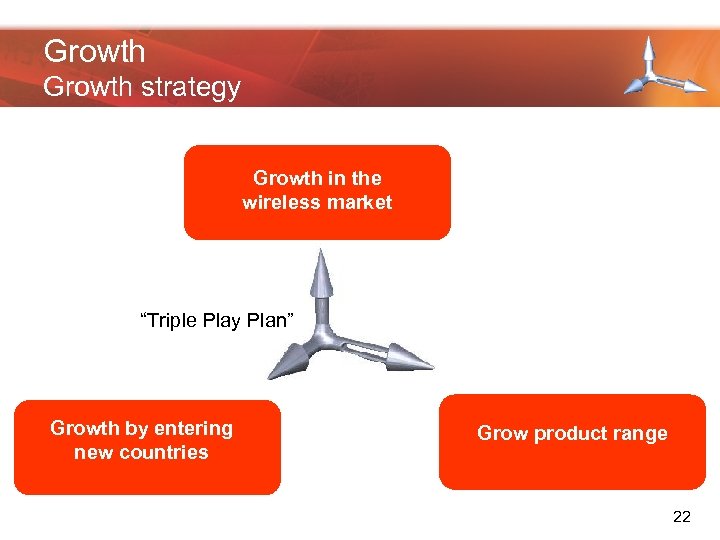

Growth strategy Growth in the wireless market “Triple Play Plan” Growth by entering new countries Grow product range 22

Growth strategy Growth in the wireless market “Triple Play Plan” Growth by entering new countries Grow product range 22

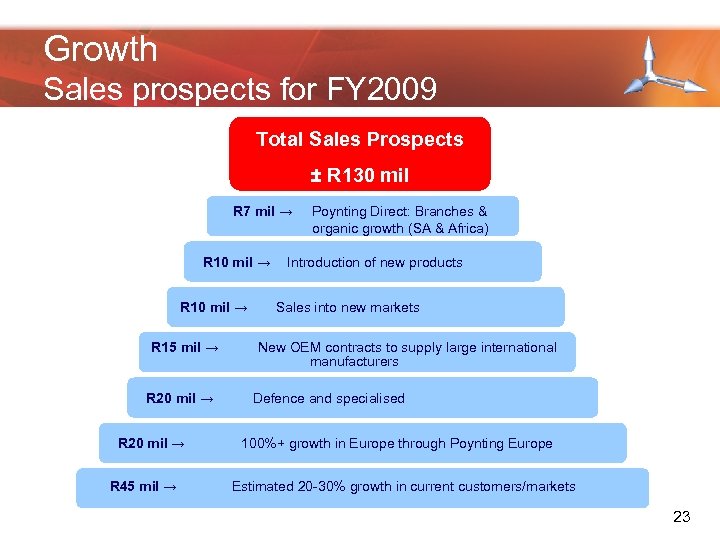

Growth Sales prospects for FY 2009 Total Sales Prospects ± R 130 mil R 7 mil → Poynting Direct: Branches & organic growth (SA & Africa) R 10 mil → Introduction of new products R 10 mil → Sales into new markets R 15 mil → New OEM contracts to supply large international manufacturers R 20 mil → Defence and specialised R 20 mil → 100%+ growth in Europe through Poynting Europe R 45 mil → Estimated 20 -30% growth in current customers/markets 23

Growth Sales prospects for FY 2009 Total Sales Prospects ± R 130 mil R 7 mil → Poynting Direct: Branches & organic growth (SA & Africa) R 10 mil → Introduction of new products R 10 mil → Sales into new markets R 15 mil → New OEM contracts to supply large international manufacturers R 20 mil → Defence and specialised R 20 mil → 100%+ growth in Europe through Poynting Europe R 45 mil → Estimated 20 -30% growth in current customers/markets 23

OUR FINANCIALS

OUR FINANCIALS

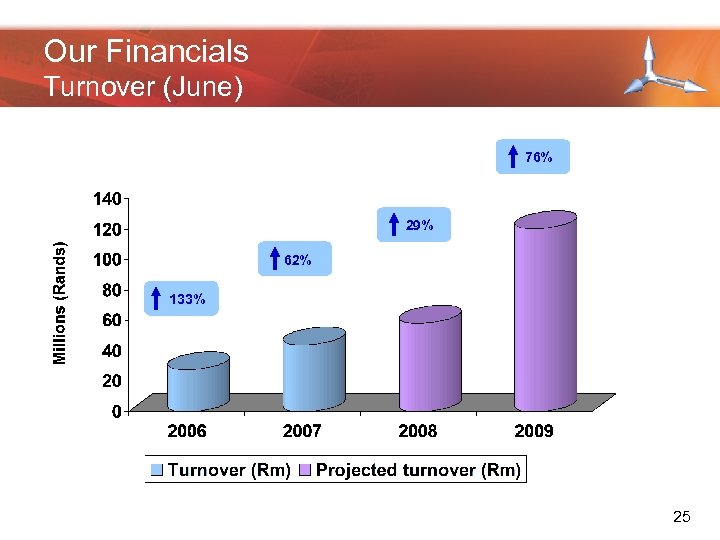

Our Financials Turnover (June) 76% 29% 62% 133% 25

Our Financials Turnover (June) 76% 29% 62% 133% 25

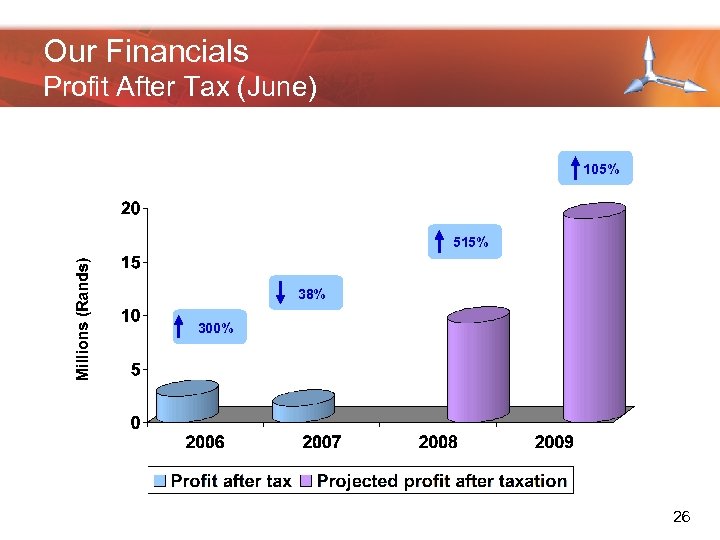

Our Financials Profit After Tax (June) 105% 515% 38% 300% 26

Our Financials Profit After Tax (June) 105% 515% 38% 300% 26

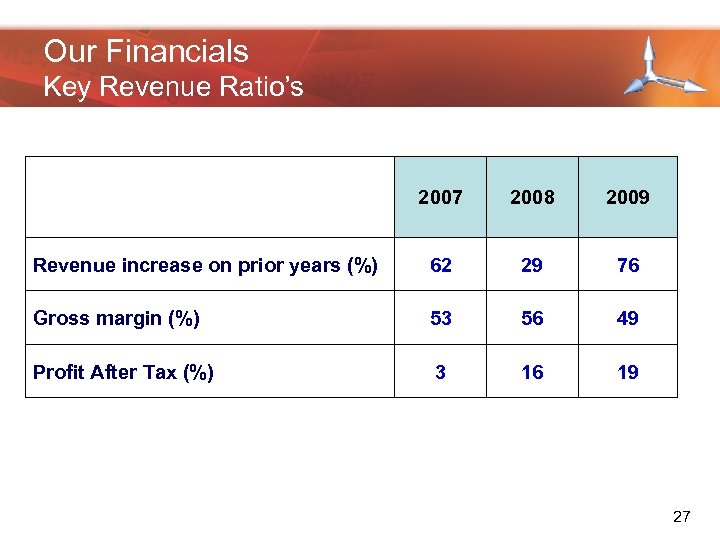

Our Financials Key Revenue Ratio’s 2007 2008 2009 Revenue increase on prior years (%) 62 29 76 Gross margin (%) 53 56 49 Profit After Tax (%) 3 16 19 27

Our Financials Key Revenue Ratio’s 2007 2008 2009 Revenue increase on prior years (%) 62 29 76 Gross margin (%) 53 56 49 Profit After Tax (%) 3 16 19 27

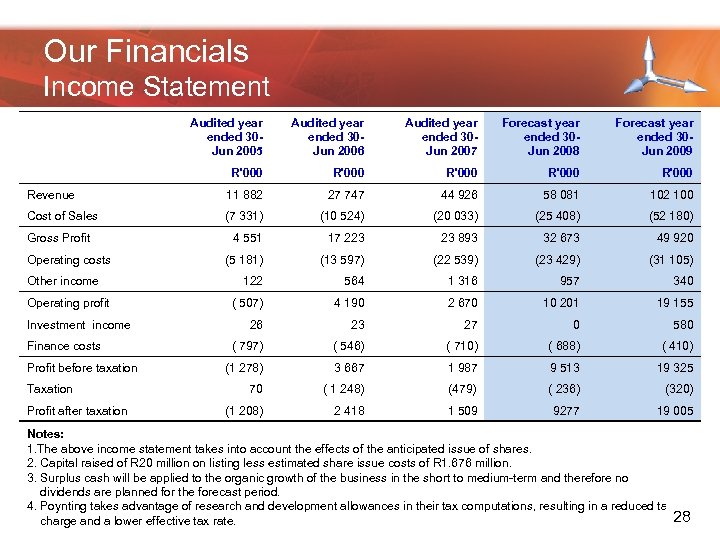

Our Financials Income Statement Audited year ended 30 Jun 2005 Audited year ended 30 Jun 2006 Audited year ended 30 Jun 2007 Forecast year ended 30 Jun 2008 Forecast year ended 30 Jun 2009 R'000 R'000 Revenue 11 882 27 747 44 926 58 081 102 100 Cost of Sales (7 331) (10 524) (20 033) (25 408) (52 180) 4 551 17 223 23 893 32 673 49 920 (5 181) (13 597) (22 539) (23 429) (31 105) 122 564 1 316 957 340 ( 507) 4 190 2 670 10 201 19 155 26 23 27 0 580 ( 797) ( 546) ( 710) ( 688) ( 410) (1 278) 3 667 1 987 9 513 19 325 70 ( 1 248) ( 236) (320) (1 208) 2 418 9277 19 005 Gross Profit Operating costs Other income Operating profit Investment income Finance costs Profit before taxation Taxation Profit after taxation (479) 1 509 Notes: 1. The above income statement takes into account the effects of the anticipated issue of shares. 2. Capital raised of R 20 million on listing less estimated share issue costs of R 1. 676 million. 3. Surplus cash will be applied to the organic growth of the business in the short to medium-term and therefore no dividends are planned for the forecast period. 4. Poynting takes advantage of research and development allowances in their tax computations, resulting in a reduced tax 28 charge and a lower effective tax rate.

Our Financials Income Statement Audited year ended 30 Jun 2005 Audited year ended 30 Jun 2006 Audited year ended 30 Jun 2007 Forecast year ended 30 Jun 2008 Forecast year ended 30 Jun 2009 R'000 R'000 Revenue 11 882 27 747 44 926 58 081 102 100 Cost of Sales (7 331) (10 524) (20 033) (25 408) (52 180) 4 551 17 223 23 893 32 673 49 920 (5 181) (13 597) (22 539) (23 429) (31 105) 122 564 1 316 957 340 ( 507) 4 190 2 670 10 201 19 155 26 23 27 0 580 ( 797) ( 546) ( 710) ( 688) ( 410) (1 278) 3 667 1 987 9 513 19 325 70 ( 1 248) ( 236) (320) (1 208) 2 418 9277 19 005 Gross Profit Operating costs Other income Operating profit Investment income Finance costs Profit before taxation Taxation Profit after taxation (479) 1 509 Notes: 1. The above income statement takes into account the effects of the anticipated issue of shares. 2. Capital raised of R 20 million on listing less estimated share issue costs of R 1. 676 million. 3. Surplus cash will be applied to the organic growth of the business in the short to medium-term and therefore no dividends are planned for the forecast period. 4. Poynting takes advantage of research and development allowances in their tax computations, resulting in a reduced tax 28 charge and a lower effective tax rate.

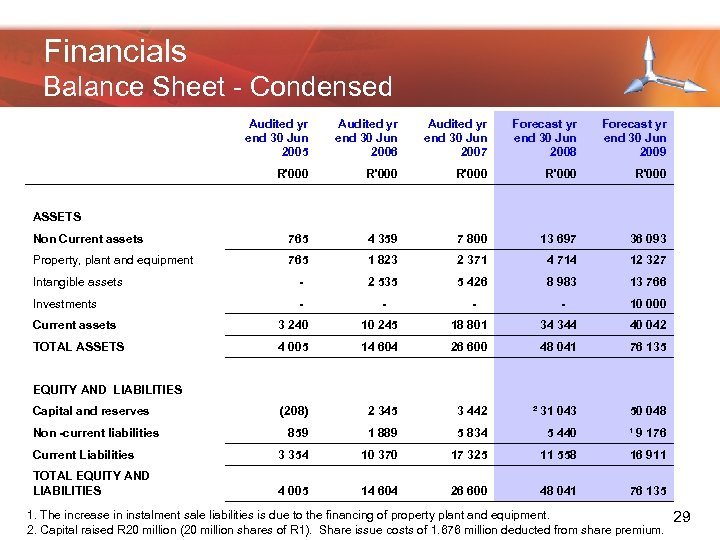

Financials Balance Sheet - Condensed Audited yr end 30 Jun 2005 Audited yr end 30 Jun 2006 Audited yr end 30 Jun 2007 Forecast yr end 30 Jun 2008 Forecast yr end 30 Jun 2009 R'000 R'000 ASSETS Non Current assets 765 4 359 7 800 13 697 36 093 Property, plant and equipment 765 1 823 2 371 4 714 12 327 Intangible assets - 2 535 5 426 8 983 13 766 Investments - 10 000 Current assets 3 240 10 245 18 801 34 344 40 042 TOTAL ASSETS 4 005 14 604 26 600 48 041 76 135 EQUITY AND LIABILITIES Capital and reserves (208) 2 345 3 442 ² 31 043 50 048 859 1 889 5 834 5 440 ¹ 9 176 Current Liabilities 3 354 10 370 17 325 11 558 16 911 TOTAL EQUITY AND LIABILITIES 4 005 14 604 26 600 48 041 76 135 Non -current liabilities 1. The increase in instalment sale liabilities is due to the financing of property plant and equipment. 2. Capital raised R 20 million (20 million shares of R 1). Share issue costs of 1. 676 million deducted from share premium. 29

Financials Balance Sheet - Condensed Audited yr end 30 Jun 2005 Audited yr end 30 Jun 2006 Audited yr end 30 Jun 2007 Forecast yr end 30 Jun 2008 Forecast yr end 30 Jun 2009 R'000 R'000 ASSETS Non Current assets 765 4 359 7 800 13 697 36 093 Property, plant and equipment 765 1 823 2 371 4 714 12 327 Intangible assets - 2 535 5 426 8 983 13 766 Investments - 10 000 Current assets 3 240 10 245 18 801 34 344 40 042 TOTAL ASSETS 4 005 14 604 26 600 48 041 76 135 EQUITY AND LIABILITIES Capital and reserves (208) 2 345 3 442 ² 31 043 50 048 859 1 889 5 834 5 440 ¹ 9 176 Current Liabilities 3 354 10 370 17 325 11 558 16 911 TOTAL EQUITY AND LIABILITIES 4 005 14 604 26 600 48 041 76 135 Non -current liabilities 1. The increase in instalment sale liabilities is due to the financing of property plant and equipment. 2. Capital raised R 20 million (20 million shares of R 1). Share issue costs of 1. 676 million deducted from share premium. 29

BLACK ECONOMIC EMPOWERMENT

BLACK ECONOMIC EMPOWERMENT

Black Economic Empowerment • Keen to enhance our BBBEE rating • Establishing an Employee Empowerment Trust - will own 3% equity of the company • Seeking genuine participation by an empowerment partner which will add value to the business • Employment Equity Plan has been submitted 31

Black Economic Empowerment • Keen to enhance our BBBEE rating • Establishing an Employee Empowerment Trust - will own 3% equity of the company • Seeking genuine participation by an empowerment partner which will add value to the business • Employment Equity Plan has been submitted 31

OUR LISTING RATIONALE

OUR LISTING RATIONALE

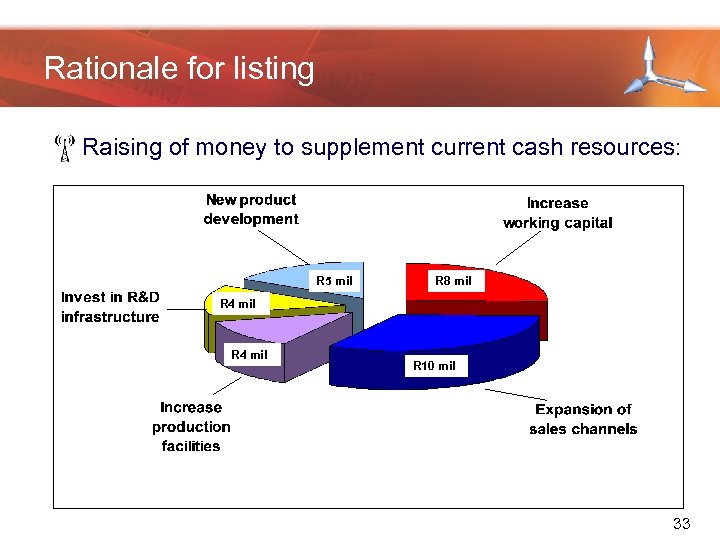

Rationale for listing • Raising of money to supplement current cash resources: R 5 mil R 8 mil R 4 mil R 10 mil 33

Rationale for listing • Raising of money to supplement current cash resources: R 5 mil R 8 mil R 4 mil R 10 mil 33

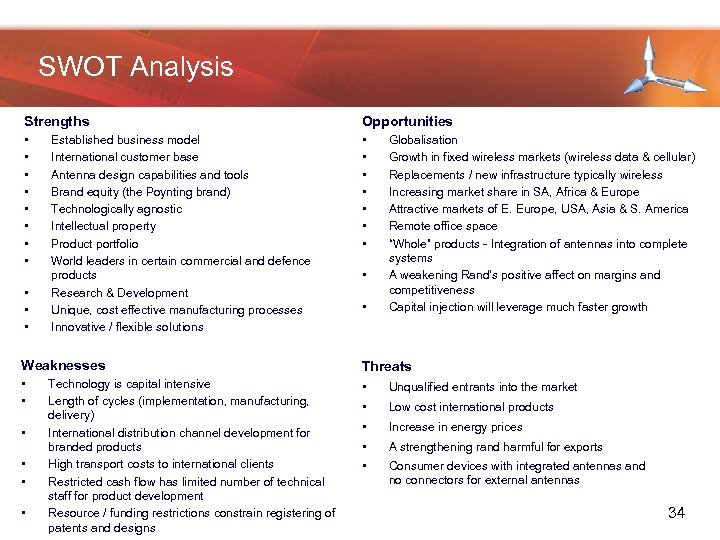

SWOT Analysis Strengths Opportunities • • • • • Established business model International customer base Antenna design capabilities and tools Brand equity (the Poynting brand) Technologically agnostic Intellectual property Product portfolio World leaders in certain commercial and defence products Research & Development Unique, cost effective manufacturing processes Innovative / flexible solutions • • Globalisation Growth in fixed wireless markets (wireless data & cellular) Replacements / new infrastructure typically wireless Increasing market share in SA, Africa & Europe Attractive markets of E. Europe, USA, Asia & S. America Remote office space “Whole” products - Integration of antennas into complete systems A weakening Rand’s positive affect on margins and competitiveness Capital injection will leverage much faster growth Weaknesses Threats • • • Unqualified entrants into the market • Low cost international products • Increase in energy prices • A strengthening rand harmful for exports • Consumer devices with integrated antennas and no connectors for external antennas • • Technology is capital intensive Length of cycles (implementation, manufacturing, delivery) International distribution channel development for branded products High transport costs to international clients Restricted cash flow has limited number of technical staff for product development Resource / funding restrictions constrain registering of patents and designs 34 34

SWOT Analysis Strengths Opportunities • • • • • Established business model International customer base Antenna design capabilities and tools Brand equity (the Poynting brand) Technologically agnostic Intellectual property Product portfolio World leaders in certain commercial and defence products Research & Development Unique, cost effective manufacturing processes Innovative / flexible solutions • • Globalisation Growth in fixed wireless markets (wireless data & cellular) Replacements / new infrastructure typically wireless Increasing market share in SA, Africa & Europe Attractive markets of E. Europe, USA, Asia & S. America Remote office space “Whole” products - Integration of antennas into complete systems A weakening Rand’s positive affect on margins and competitiveness Capital injection will leverage much faster growth Weaknesses Threats • • • Unqualified entrants into the market • Low cost international products • Increase in energy prices • A strengthening rand harmful for exports • Consumer devices with integrated antennas and no connectors for external antennas • • Technology is capital intensive Length of cycles (implementation, manufacturing, delivery) International distribution channel development for branded products High transport costs to international clients Restricted cash flow has limited number of technical staff for product development Resource / funding restrictions constrain registering of patents and designs 34 34

Summary • Excellent international growth prospects • Strong, experienced management • Highly qualified and experienced R&D team is the company core strength • Innovative product range • Very high historical company growth with strong future prospects • Seeks to list in June 2008 • Intends to raise R 20 million through private placement 35

Summary • Excellent international growth prospects • Strong, experienced management • Highly qualified and experienced R&D team is the company core strength • Innovative product range • Very high historical company growth with strong future prospects • Seeks to list in June 2008 • Intends to raise R 20 million through private placement 35

Thank You & Questions 36

Thank You & Questions 36