7413102f63391b45dc411044da70ae62.ppt

- Количество слайдов: 25

Investments: Analysis and Behavior Chapter 20 - Real Estate and Tangible Assets © 2008 Mc. Graw-Hill/Irwin

Learning Objectives · · · Understand the investment characteristics of owning real property. Know the risks of income property. Be able to appraise real estate value. Utilize real estate securities in a portfolio. Learn how to invest in gold. 20 -2

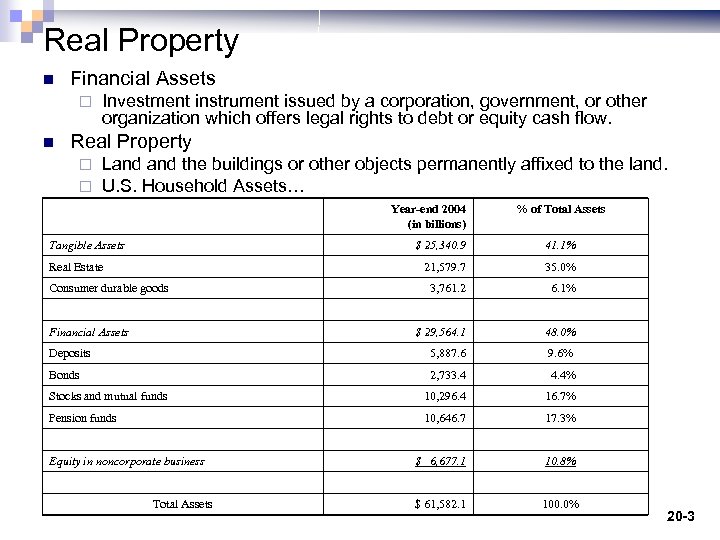

Real Property n Financial Assets ¨ n Investment instrument issued by a corporation, government, or other organization which offers legal rights to debt or equity cash flow. Real Property ¨ ¨ Land the buildings or other objects permanently affixed to the land. U. S. Household Assets… Year-end 2004 (in billions) Tangible Assets % of Total Assets $ 25, 340. 9 41. 1% 21, 579. 7 35. 0% 3, 761. 2 6. 1% $ 29, 564. 1 48. 0% Deposits 5, 887. 6 9. 6% Bonds 2, 733. 4 4. 4% Stocks and mutual funds 10, 296. 4 16. 7% Pension funds 10, 646. 7 17. 3% $ 6, 677. 1 10. 8% $ 61, 582. 1 100. 0% Real Estate Consumer durable goods Financial Assets Equity in noncorporate business Total Assets 20 -3

Real Estate Characteristics n Income property ¨ Real estate bought for the purposes of generating rental income. n Raw land ¨ Unused n Improvements ¨ The n land with no improvements buildings and structures constructed on a property. Buying and Selling ¨ Illiquid ¨ Real n estate agent 6% commission 20 -4

Home Ownership House Price Index (HPI) ¨ US Office of Federal Housing Enterprise Oversight ¨ How do you create an index with heterogeneous assets that trade infrequently? n Sale ¨ US and refinance data bases of Fannie Mae and Freddie Mac (5. 97%), California (8. 6%), Kansas (4. 3%) 20 -5

Income Property n n Cash flow is important for income property investing! Know the revenue determinants ¨ Rental n income, vacancies, collection losses Know the cost determinants ¨ Expenses, n n utilities, insurance, property taxes Assessed value (% of market value) Tax rate 20 -6

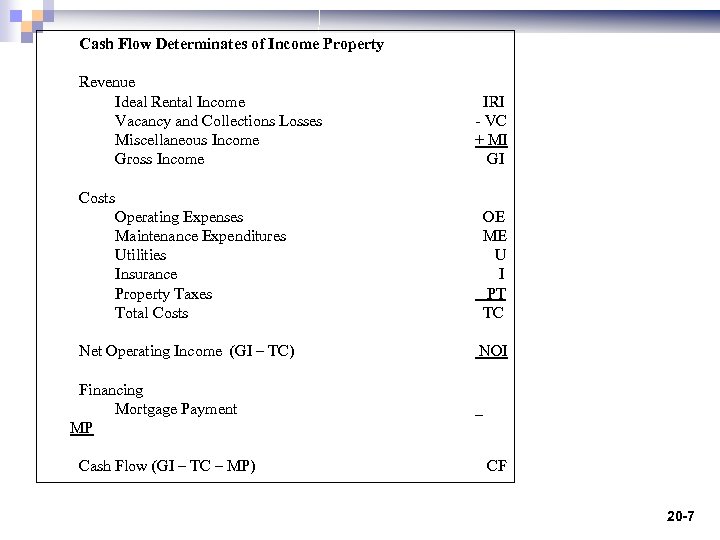

Cash Flow Determinates of Income Property Revenue Ideal Rental Income Vacancy and Collections Losses Miscellaneous Income Gross Income IRI - VC + MI GI Costs Operating Expenses Maintenance Expenditures Utilities Insurance Property Taxes Total Costs Net Operating Income (GI – TC) OE ME U I PT TC NOI Financing Mortgage Payment MP Cash Flow (GI – TC – MP) CF 20 -7

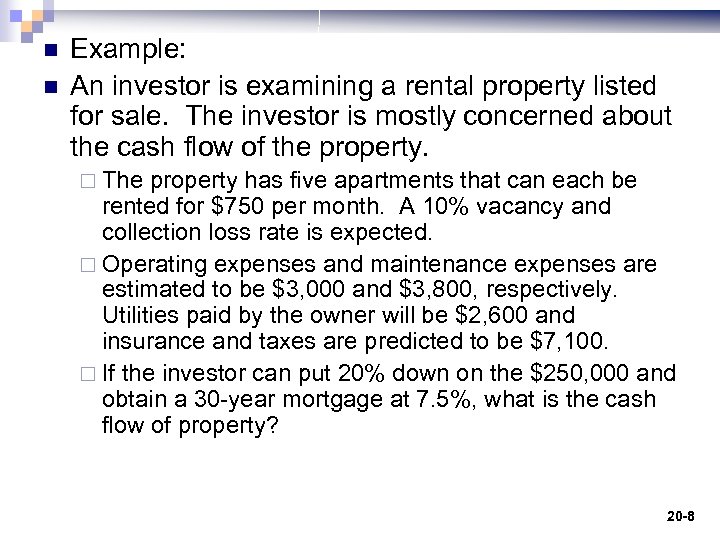

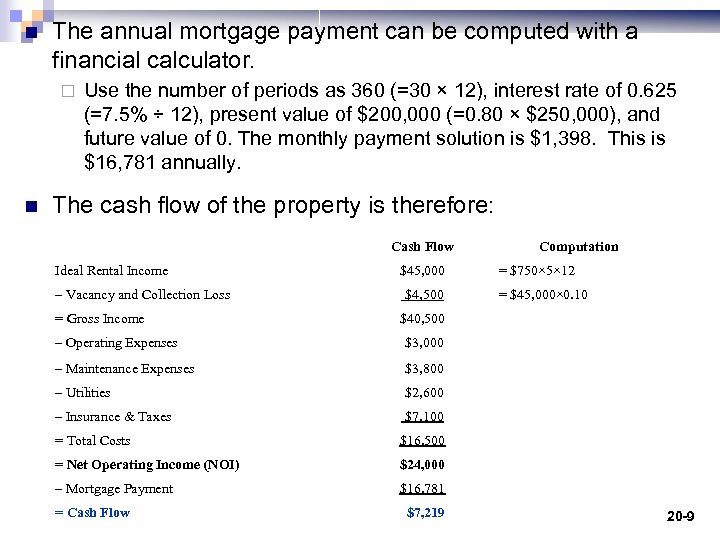

n n Example: An investor is examining a rental property listed for sale. The investor is mostly concerned about the cash flow of the property. ¨ The property has five apartments that can each be rented for $750 per month. A 10% vacancy and collection loss rate is expected. ¨ Operating expenses and maintenance expenses are estimated to be $3, 000 and $3, 800, respectively. Utilities paid by the owner will be $2, 600 and insurance and taxes are predicted to be $7, 100. ¨ If the investor can put 20% down on the $250, 000 and obtain a 30 -year mortgage at 7. 5%, what is the cash flow of property? 20 -8

n The annual mortgage payment can be computed with a financial calculator. ¨ n Use the number of periods as 360 (=30 × 12), interest rate of 0. 625 (=7. 5% ÷ 12), present value of $200, 000 (=0. 80 × $250, 000), and future value of 0. The monthly payment solution is $1, 398. This is $16, 781 annually. The cash flow of the property is therefore: Cash Flow Ideal Rental Income – Vacancy and Collection Loss = Gross Income $45, 000 $4, 500 Computation = $750× 5× 12 = $45, 000× 0. 10 $40, 500 – Operating Expenses $3, 000 – Maintenance Expenses $3, 800 – Utilities $2, 600 – Insurance & Taxes $7, 100 = Total Costs $16, 500 = Net Operating Income (NOI) $24, 000 – Mortgage Payment $16, 781 = Cash Flow $7, 219 20 -9

Real Estate Valuation n Valuing real estate is called appraisal. n Discounted Cash Flow Method ¨ n Converts expected cash flow and price appreciation to a present value Comparable Transactions Method ¨ Uses the transaction prices of similar properties to estimate value. 20 -10

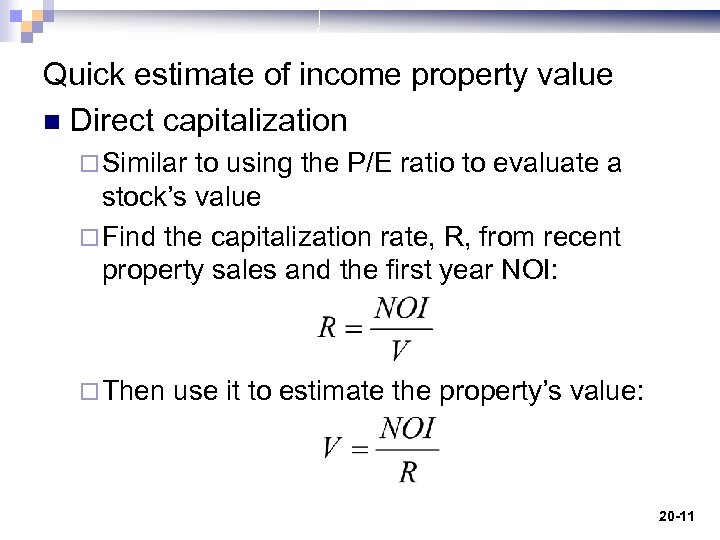

Quick estimate of income property value n Direct capitalization ¨ Similar to using the P/E ratio to evaluate a stock’s value ¨ Find the capitalization rate, R, from recent property sales and the first year NOI: ¨ Then use it to estimate the property’s value: 20 -11

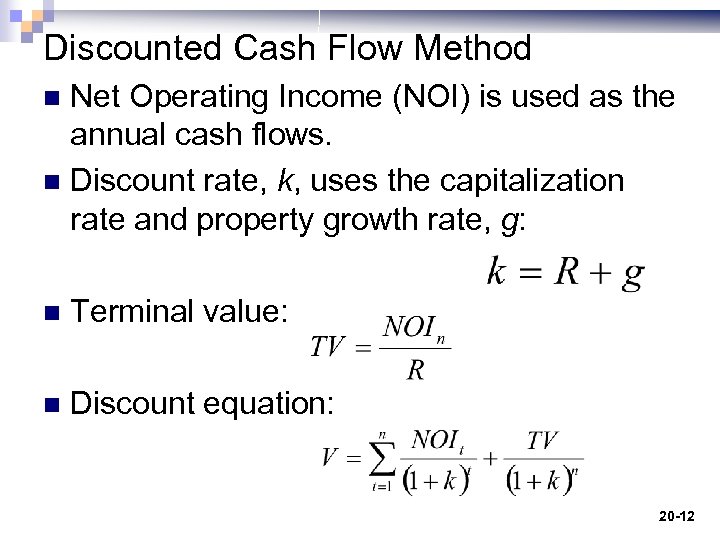

Discounted Cash Flow Method Net Operating Income (NOI) is used as the annual cash flows. n Discount rate, k, uses the capitalization rate and property growth rate, g: n n Terminal value: n Discount equation: 20 -12

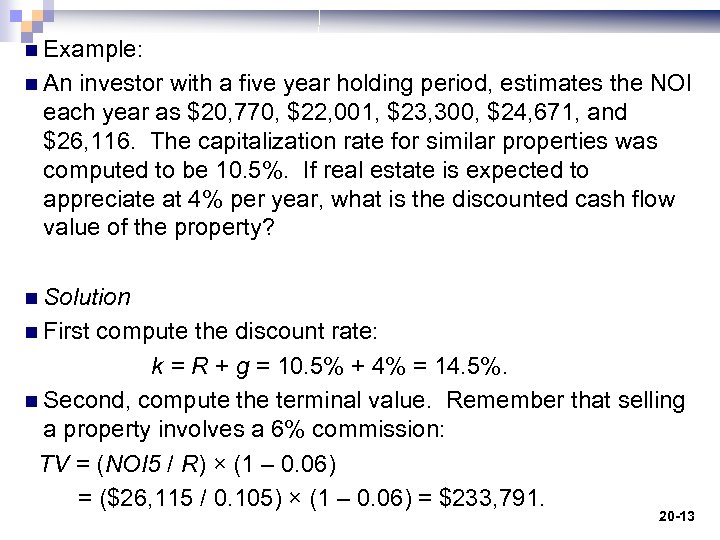

n Example: n An investor with a five year holding period, estimates the NOI each year as $20, 770, $22, 001, $23, 300, $24, 671, and $26, 116. The capitalization rate for similar properties was computed to be 10. 5%. If real estate is expected to appreciate at 4% per year, what is the discounted cash flow value of the property? n Solution n First compute the discount rate: k = R + g = 10. 5% + 4% = 14. 5%. n Second, compute the terminal value. Remember that selling a property involves a 6% commission: TV = (NOI 5 / R) × (1 – 0. 06) = ($26, 115 / 0. 105) × (1 – 0. 06) = $233, 791. 20 -13

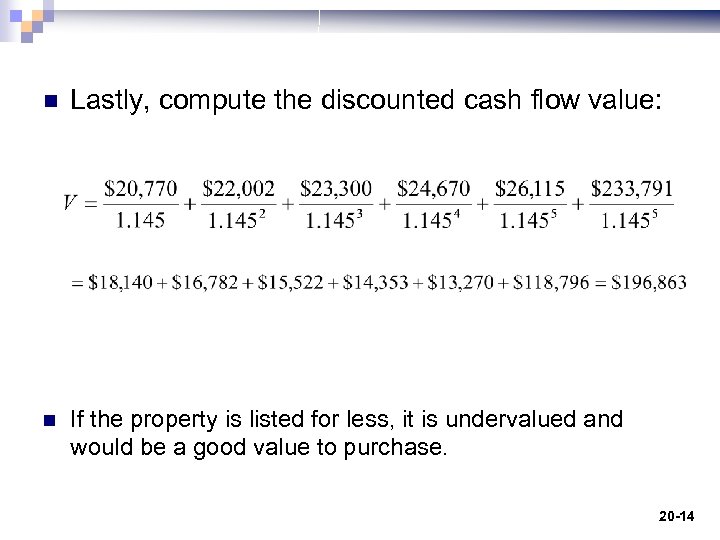

n Lastly, compute the discounted cash flow value: n If the property is listed for less, it is undervalued and would be a good value to purchase. 20 -14

Comparable Transactions Method 3 steps ¨ Find n sale transactions of comparable properties Similar location, location ¨ Compute the final adjusted comparable price for each transaction n Adjust for differences in bedrooms, bathrooms, lot size, time from sale, etc. ¨ Reconcile final adjusted prices to estimate the indicated value n Average, median, etc. 20 -15

Real Estate Securities n Securities can be issued that represent ownership in portfolios of real estate properties: n Real Estate Investment Trusts (REITs) Equity REITs ¨ Mortgage REITs ¨ Hybrid REITs ¨ n Real Estate Mutual Funds n Real Estate oriented companies 20 -16

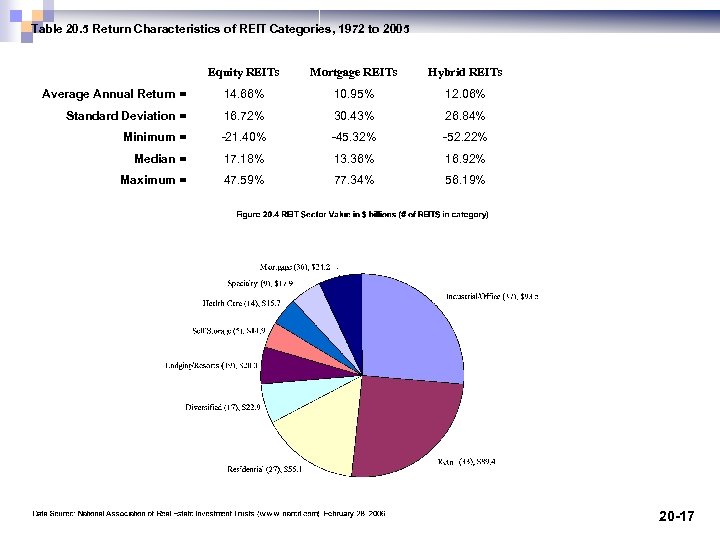

Table 20. 5 Return Characteristics of REIT Categories, 1972 to 2005 Equity REITs Mortgage REITs Hybrid REITs Average Annual Return = 14. 66% 10. 95% 12. 06% Standard Deviation = 16. 72% 30. 43% 26. 84% Minimum = -21. 40% -45. 32% -52. 22% Median = 17. 18% 13. 36% 16. 92% Maximum = 47. 59% 77. 34% 56. 19% 20 -17

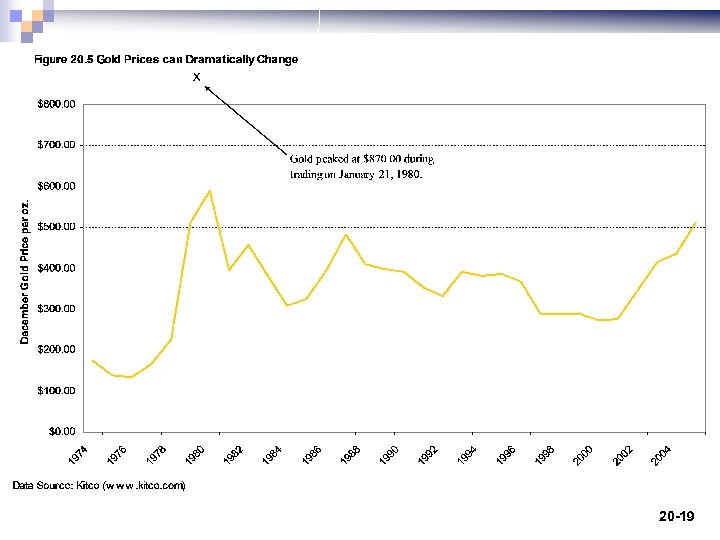

Investing in Gold n U. S. individuals were banned from owning hold until 1974. ¨ n Except jewelry Now you can invest in gold: ¨ ¨ ¨ Gold coins Gold bars Gold mining stocks Gold mutual funds Gold Exchange Traded Fund 20 -18

20 -19

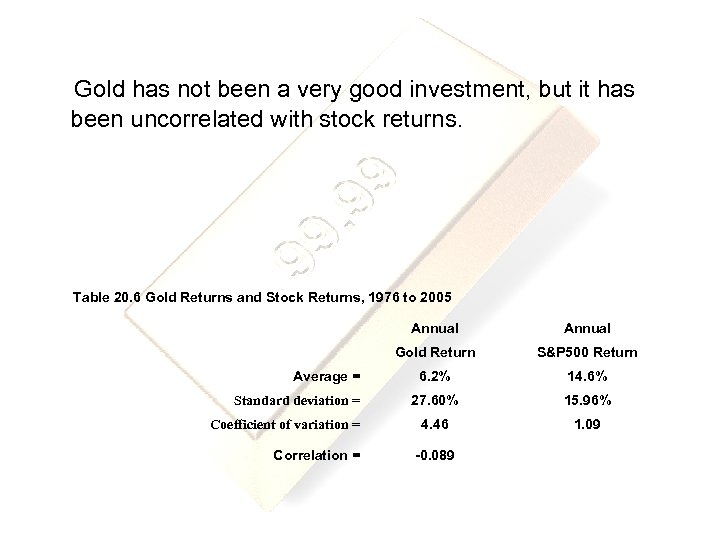

Gold has not been a very good investment, but it has been uncorrelated with stock returns. Table 20. 6 Gold Returns and Stock Returns, 1976 to 2005 Annual Gold Return Average = Standard deviation = Coefficient of variation = Correlation = Annual S&P 500 Return 6. 2% 14. 6% 27. 60% 15. 96% 4. 46 1. 09 -0. 089 20 -20

Trading Gold Coins n One ounce gold coins Other sizes available too n Gold quality (22 karat versus 24 karat) n British Sovereign (0. 235 Troy oz. ) Gold coin price: Coin price = value of gold + numismatic value + dealer spread n n Numismatic value is the amount of premium attributed to collector attributes. The scarcity of the coin and its appearance (fine, extra fine, proof, etc. ) are the attributes that coin collectors evaluate. Gold investors have little interest in paying premiums for obtaining gold. Therefore, gold bugs tend to buy common gold coins with no numismatic value. 20 -21

Art and Collectibles n Art derives its value from the demand of people who want to own it. ¨ Supply n No new Rembrandts or Van Gogh's ¨ Supply n n is fixed is increasing New artists and new works Art and collectibles are traded in auctions 20 -22

Auctions n Two largest international auction firms: n Christie’s www. christies. com n Sotheby’s www. sothebys. com n Hundreds of millions of dollars in art and collectibles are sold every day. 20 -23

Auction Costs n Buyer’s premium ¨ Commonly n 20% Seller’s commission costs ¨ Variable n n 10% fee on the first $100, 000 of the sale, 8% fee on the next $150, 000 of value, 7% on the next $250, 000, 5% on the next $500, 000, and so on 20 -24

Beware the Fad “Investment” n Beanie Baby craze of the late 1990 s Beanie Babies are small beanbag animals made by Ty Inc. ¨ Cute names like “Roary” the lion and “Bucky” the beaver ¨ Beanies cost less than a dollar to make and retailed for about $5. ¨ n n ¨ ¨ Then, one day the demand dried up. People who had bought dozens of beanies at inflated prices all tried to sell at once. n n n ¨ n As they became popular, children tried to collect them all. Adults insisted that one day their collections would be valuable. Collectors bought “retired” Beanie’s for $10 or $20 dollars and resold them for $50. Rare Beanies such as Peanut, the Royal Blue Elephant, sold for over $4, 000 at online auctions. And Derby, the Horse, was once valued at $4, 500. Parents planned to send their children to college on their “investment” in Beanie Babies. As collectors became sellers, the price of the toys plummeted. In 2005, a search for Beanie Babies on e. Bay produced nearly 15, 000 auctions of retired Beanies. Many were being sold in groups. A group of 19 animals were offered at a minimum bid of $7. 49––there were no bids. A mint condition Peanut was offered for $2. 99—there were no takers. From a price of $5, up to thousands, and back down to $3. The great Beanie Baby bubble had burst! Baseball cards, Beatle memorabilia, POGs, etc. 20 -25

7413102f63391b45dc411044da70ae62.ppt