72b166270b62a4ee74c33a2479d25d30.ppt

- Количество слайдов: 29

Investments: Analysis and Behavior Chapter 18 - Options Markets and Strategies © 2008 Mc. Graw-Hill/Irwin

Learning Objectives n n Understand the characteristics of call and put options Know the uses of index options Be able to implement covered call and protective put strategies Utilize Black-Scholes option pricing 18 -2

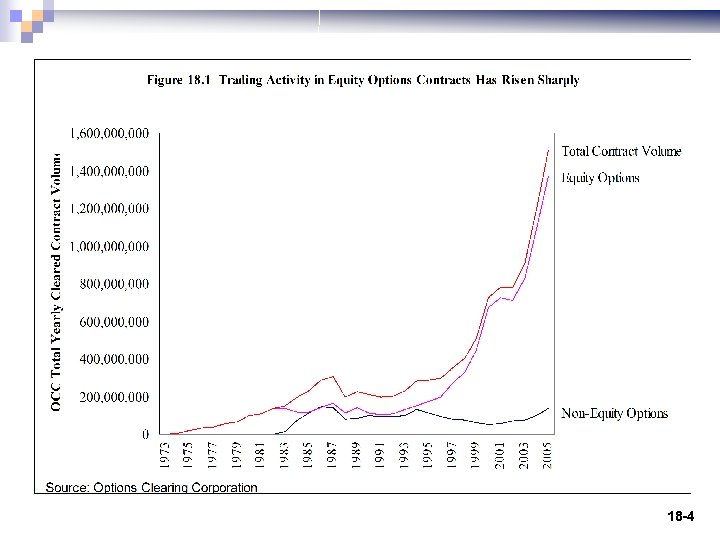

Options Markets n Derivative securities: value is derived or stems from changes in the value of some other assets. n n Call option: the right (but not obligation) to buy Put option: the right (but not obligation) to sell n Total volume - 1. 5 billion contracts (2005) n The most popular options - equity options 18 -3

18 -4

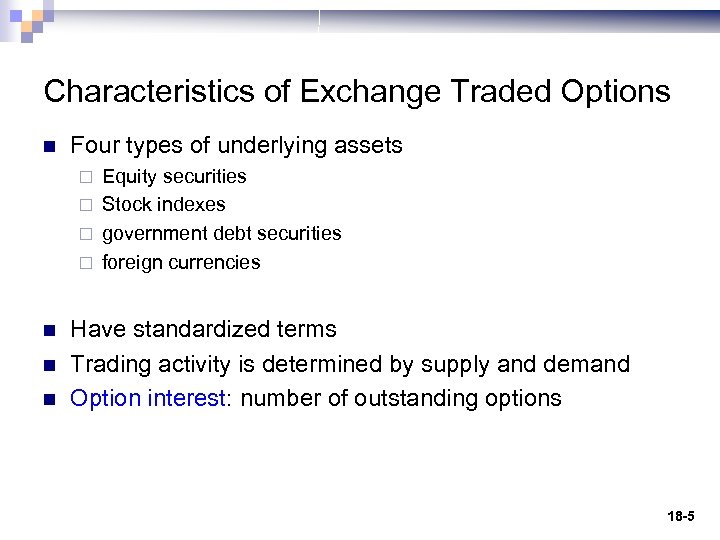

Characteristics of Exchange Traded Options n Four types of underlying assets Equity securities ¨ Stock indexes ¨ government debt securities ¨ foreign currencies ¨ n n n Have standardized terms Trading activity is determined by supply and demand Option interest: number of outstanding options 18 -5

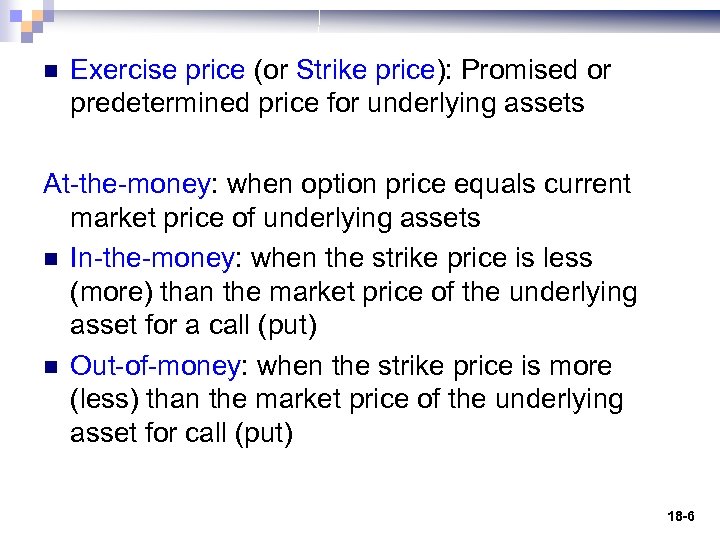

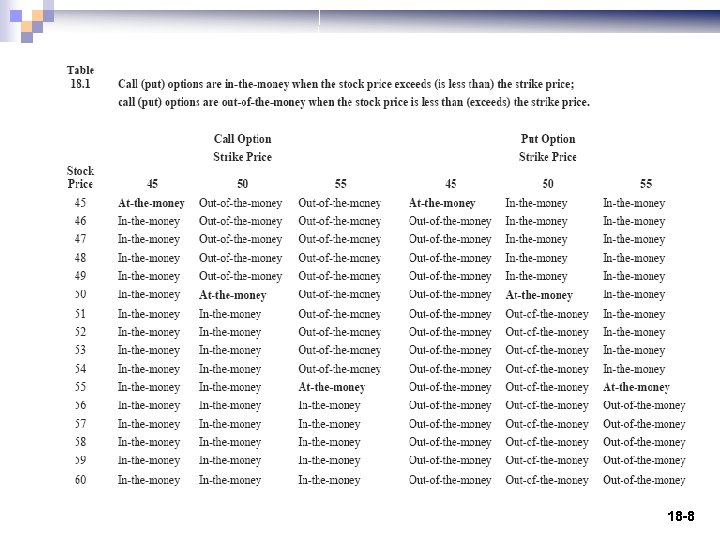

n Exercise price (or Strike price): Promised or predetermined price for underlying assets At-the-money: when option price equals current market price of underlying assets n In-the-money: when the strike price is less (more) than the market price of the underlying asset for a call (put) n Out-of-money: when the strike price is more (less) than the market price of the underlying asset for call (put) 18 -6

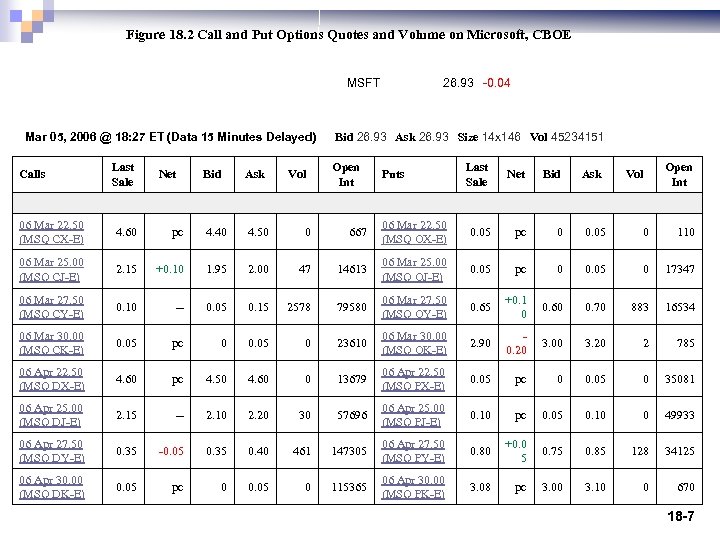

Figure 18. 2 Call and Put Options Quotes and Volume on Microsoft, CBOE MSFT Mar 05, 2006 @ 18: 27 ET (Data 15 Minutes Delayed) Calls Last Sale Net Bid Ask Vol 26. 93 -0. 04 Bid 26. 93 Ask 26. 93 Size 14 x 146 Vol 45234151 Open Int Puts Last Sale Net Bid Ask Vol Open Int 06 Mar 22. 50 (MSQ CX-E) 4. 60 pc 4. 40 4. 50 0 667 06 Mar 22. 50 (MSQ OX-E) 0. 05 pc 0 0. 05 0 110 06 Mar 25. 00 (MSQ CJ-E) 2. 15 +0. 10 1. 95 2. 00 47 14613 06 Mar 25. 00 (MSQ OJ-E) 0. 05 pc 0 0. 05 0 17347 06 Mar 27. 50 (MSQ CY-E) 0. 10 -- 0. 05 0. 15 2578 79580 06 Mar 27. 50 (MSQ OY-E) 0. 65 +0. 1 0 0. 60 0. 70 883 16534 06 Mar 30. 00 (MSQ CK-E) 0. 05 pc 0 0. 05 0 23610 06 Mar 30. 00 (MSQ OK-E) 2. 90 0. 20 3. 00 3. 20 2 785 06 Apr 22. 50 (MSQ DX-E) 4. 60 pc 4. 50 4. 60 0 13679 06 Apr 22. 50 (MSQ PX-E) 0. 05 pc 0 0. 05 0 35081 06 Apr 25. 00 (MSQ DJ-E) 2. 15 -- 2. 10 2. 20 30 57696 06 Apr 25. 00 (MSQ PJ-E) 0. 10 pc 0. 05 0. 10 0 49933 06 Apr 27. 50 (MSQ DY-E) 0. 35 -0. 05 0. 35 0. 40 461 147305 06 Apr 27. 50 (MSQ PY-E) 0. 80 +0. 0 5 0. 75 0. 85 128 34125 06 Apr 30. 00 (MSQ DK-E) 0. 05 pc 0 0. 05 0 115365 06 Apr 30. 00 (MSQ PK-E) 3. 08 pc 3. 00 3. 10 0 670 18 -7

18 -8

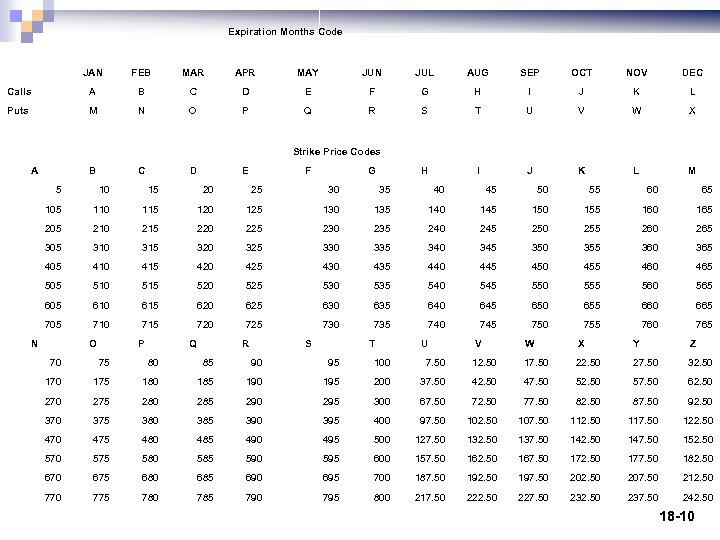

n Option premium: price at which the contract trades (the amount paid for the option) n Long-term Equity Antici. Pation Securities (LEAPS): expiration dates up to three years. Trading symbol for stock options – combination of the stock ticker symbol, plus a letter to indicate the month of the year, plus a final letter to indicate strike price 18 -9

Expiration Months Code JAN FEB MAR APR MAY JUN JUL AUG SEP OCT NOV DEC Calls A B C D E F G H I J K L Puts M N O P Q R S T U V W X H I J K L M Strike Price Codes A B C D E F G 5 10 15 20 25 30 35 40 45 50 55 60 65 105 110 115 120 125 130 135 140 145 150 155 160 165 205 210 215 220 225 230 235 240 245 250 255 260 265 305 310 315 320 325 330 335 340 345 350 355 360 365 405 410 415 420 425 430 435 440 445 450 455 460 465 505 510 515 520 525 530 535 540 545 550 555 560 565 605 610 615 620 625 630 635 640 645 650 655 660 665 705 710 715 720 725 730 735 740 745 750 755 760 765 N O P Q R S T U V W X Y Z 70 75 80 85 90 95 100 7. 50 12. 50 17. 50 22. 50 27. 50 32. 50 175 180 185 190 195 200 37. 50 42. 50 47. 50 52. 50 57. 50 62. 50 275 280 285 290 295 300 67. 50 72. 50 77. 50 82. 50 87. 50 92. 50 375 380 385 390 395 400 97. 50 102. 50 107. 50 112. 50 117. 50 122. 50 475 480 485 490 495 500 127. 50 132. 50 137. 50 142. 50 147. 50 152. 50 575 580 585 590 595 600 157. 50 162. 50 167. 50 172. 50 177. 50 182. 50 675 680 685 690 695 700 187. 50 192. 50 197. 50 202. 50 207. 50 212. 50 775 780 785 790 795 800 217. 50 222. 50 227. 50 232. 50 237. 50 242. 50 18 -10

Options Clearing Corporation (OCC) n n Sole issuer of all securities options listed on exchanges and NASD All option transactions are ultimately cleared through OCC takes the opposite side of every option traded Guarantees contract performance and reduces the credit risk. 18 -11

Option concept n n n Hedged position: option transaction to offset the risk inherent in some other investment (to limit risk) Speculative position: option transaction to profit from the inherent riskiness of some underlying asset. Option contracts are a zero sum game before commissions and other transaction costs. 18 -12

Option style and settlement n n n Option holder: long the option position Option writer: short the option position Style American style option: exercised at any time (All stock options in the US) ¨ European style option: only exercised on the expiration date. ¨ n Delivery Physical delivery option: actual delivery of the underlying asset takes place ¨ Cash-settle option: cash payment based on difference between exercise price and current determined price of the underlying asset ¨ n Contract size: usually for 100 shares of stock 18 -13

Option types n n n Stock Options: generally cover 100 shares of underlying securities. Adjustment made for stock dividend, stock split, merger, etc. Index options: Standard and Poor’s 100 Index (OEX) are the most actively traded. Debt Options ¨ Physical delivery price-based options: right to purchase (sell) a debt security ¨ Cash settled price-based options: right to receive cash based on the value of debt security ¨ Yield based options: cash settled based on the difference between the exercise price and value of an underlying yield. 18 -14

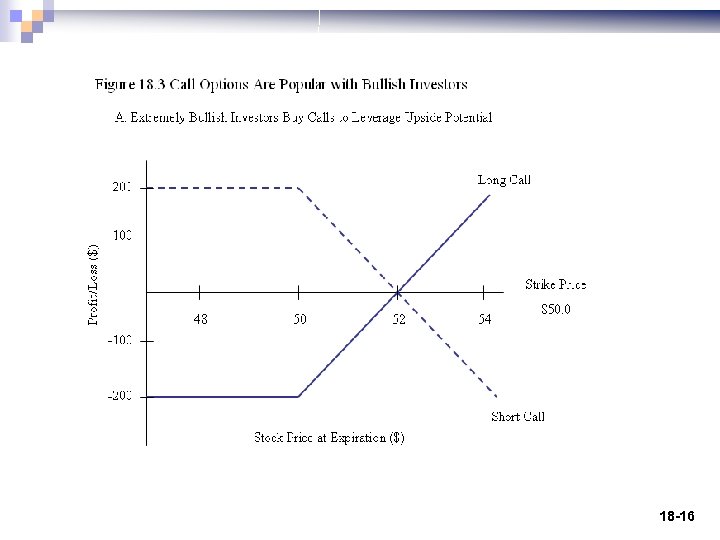

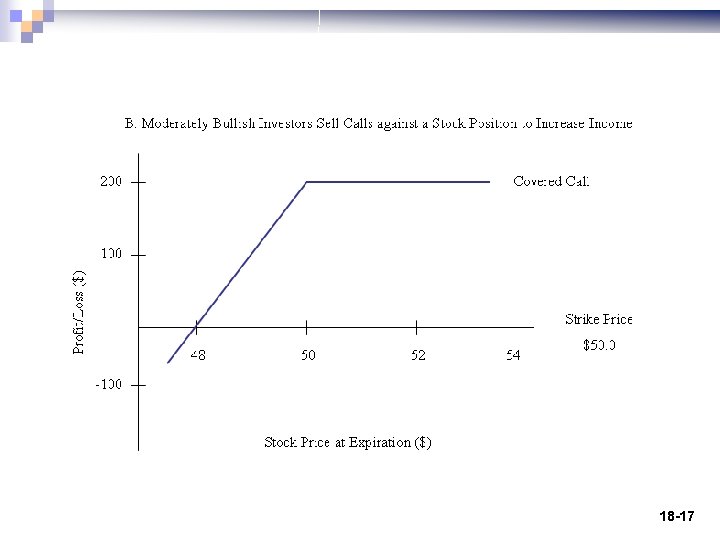

Call Option strategies n Long position: the right (but not obligation) to buy the underlying asset at a strike price for a limited period of time. ¨ The right to buy stock at a fixed price becomes more valuable as price of stock increases (in the money when current stock price > exercise price) ¨ Risk for buyer is limited to the call premium and potential is unlimited n n Short position: payoff mirror image of long position (zero sum game) Covered call: sale of a call option on a stock that is owned. 18 -15

18 -16

18 -17

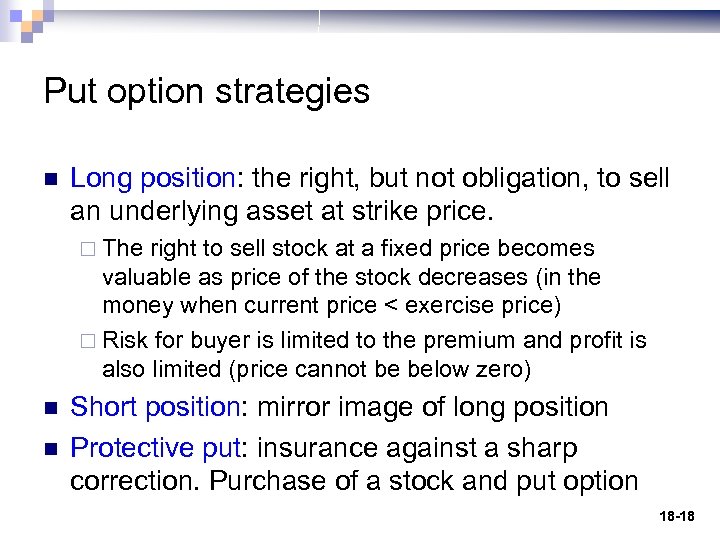

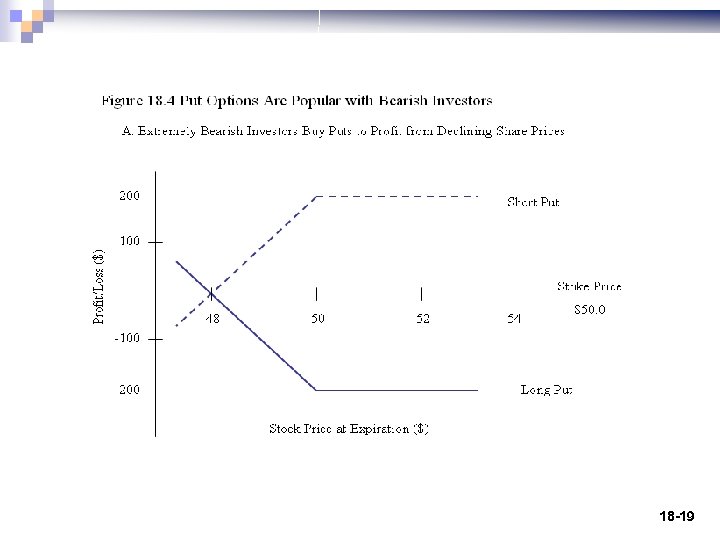

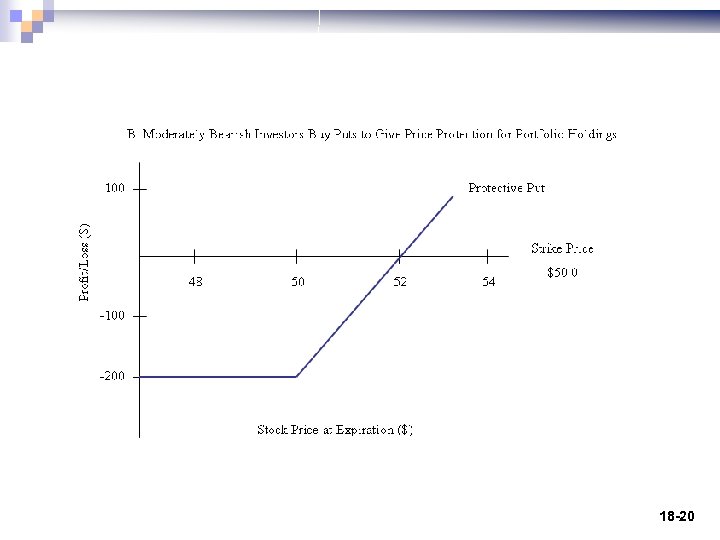

Put option strategies n Long position: the right, but not obligation, to sell an underlying asset at strike price. ¨ The right to sell stock at a fixed price becomes valuable as price of the stock decreases (in the money when current price < exercise price) ¨ Risk for buyer is limited to the premium and profit is also limited (price cannot be below zero) n n Short position: mirror image of long position Protective put: insurance against a sharp correction. Purchase of a stock and put option 18 -18

18 -19

18 -20

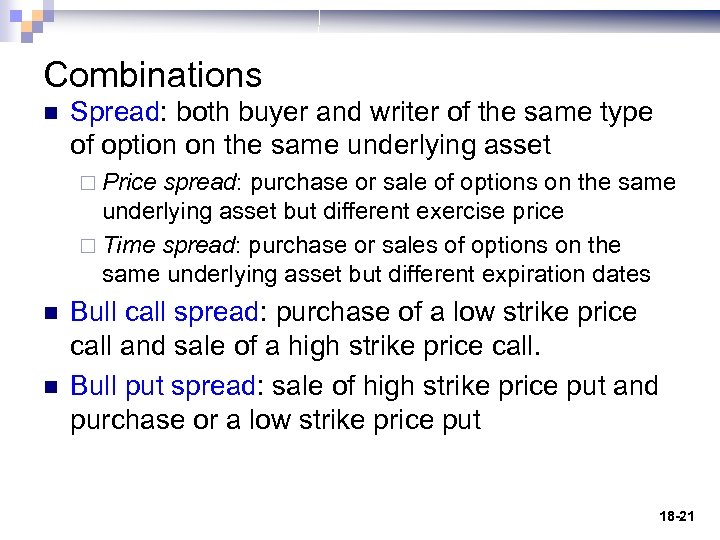

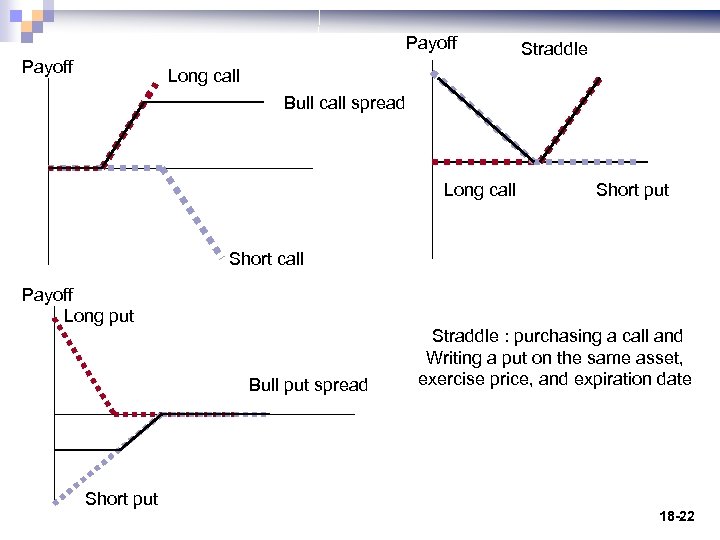

Combinations n Spread: both buyer and writer of the same type of option on the same underlying asset ¨ Price spread: purchase or sale of options on the same underlying asset but different exercise price ¨ Time spread: purchase or sales of options on the same underlying asset but different expiration dates n n Bull call spread: purchase of a low strike price call and sale of a high strike price call. Bull put spread: sale of high strike price put and purchase or a low strike price put 18 -21

Payoff Straddle Long call Bull call spread Long call Short put Short call Payoff Long put Bull put spread Straddle : purchasing a call and Writing a put on the same asset, exercise price, and expiration date Short put 18 -22

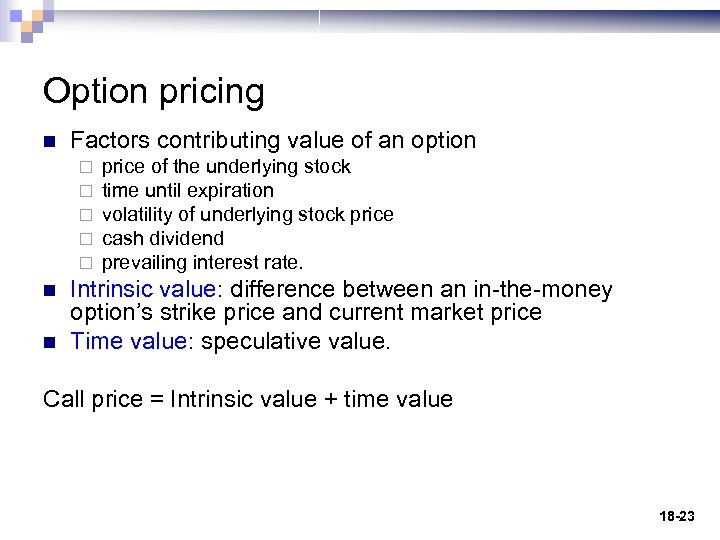

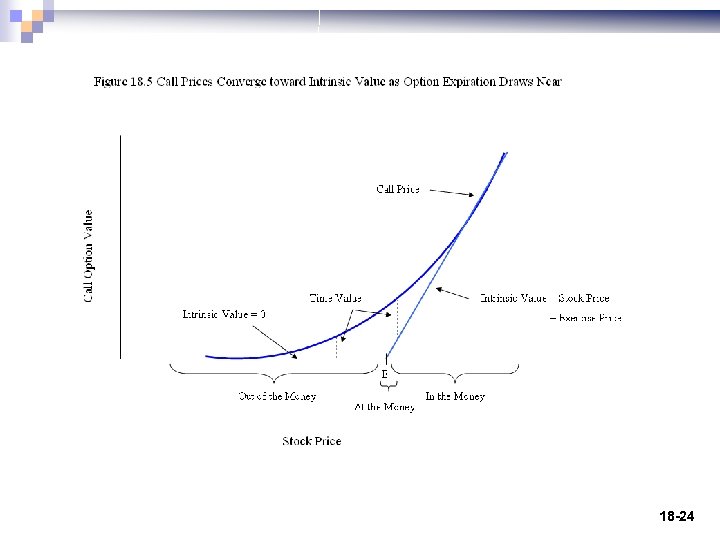

Option pricing n Factors contributing value of an option ¨ ¨ ¨ n n price of the underlying stock time until expiration volatility of underlying stock price cash dividend prevailing interest rate. Intrinsic value: difference between an in-the-money option’s strike price and current market price Time value: speculative value. Call price = Intrinsic value + time value 18 -23

18 -24

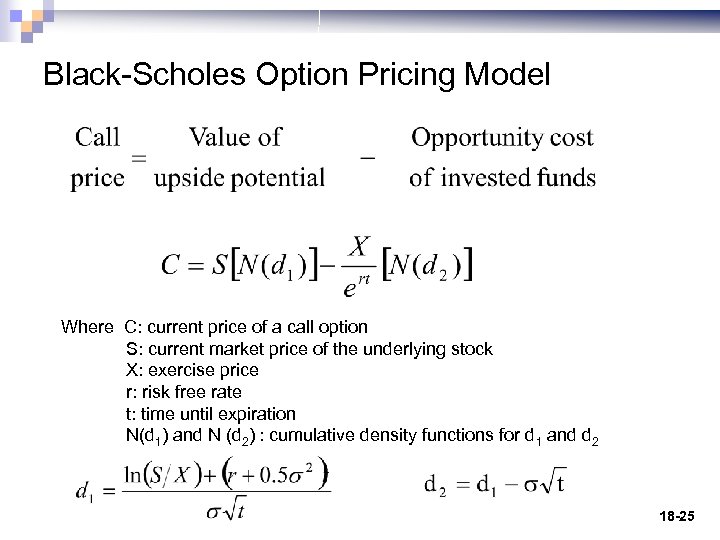

Black-Scholes Option Pricing Model Where C: current price of a call option S: current market price of the underlying stock X: exercise price r: risk free rate t: time until expiration N(d 1) and N (d 2) : cumulative density functions for d 1 and d 2 18 -25

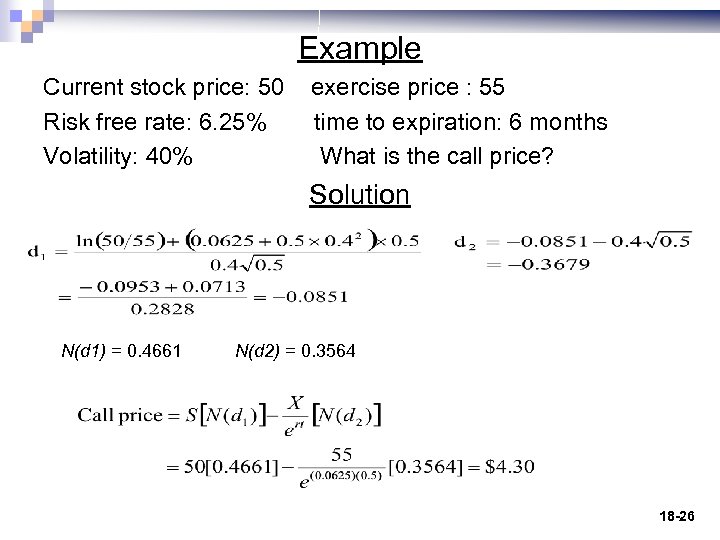

Example Current stock price: 50 exercise price : 55 Risk free rate: 6. 25% time to expiration: 6 months Volatility: 40% What is the call price? Solution N(d 1) = 0. 4661 N(d 2) = 0. 3564 18 -26

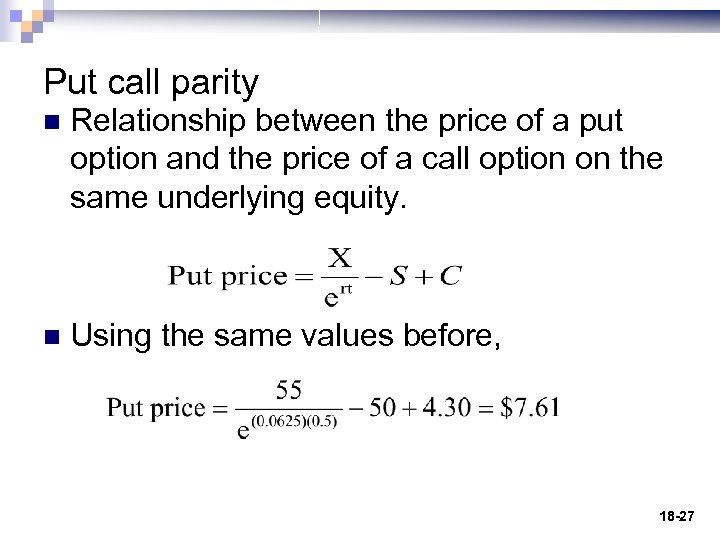

Put call parity n Relationship between the price of a put option and the price of a call option on the same underlying equity. Using the same values before, n 18 -27

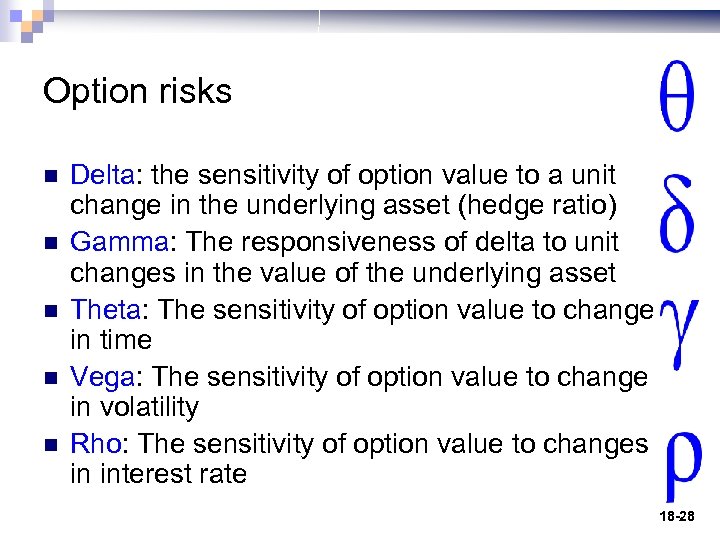

Option risks n n n Delta: the sensitivity of option value to a unit change in the underlying asset (hedge ratio) Gamma: The responsiveness of delta to unit changes in the value of the underlying asset Theta: The sensitivity of option value to change in time Vega: The sensitivity of option value to change in volatility Rho: The sensitivity of option value to changes in interest rate 18 -28

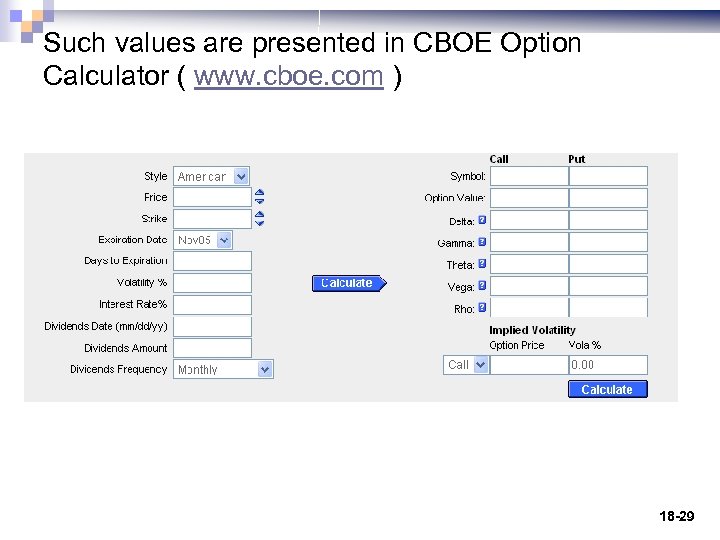

Such values are presented in CBOE Option Calculator ( www. cboe. com ) 18 -29

72b166270b62a4ee74c33a2479d25d30.ppt