74cae818f59a027eec23bf438bfb375b.ppt

- Количество слайдов: 26

Investments: Analysis and Behavior Chapter 12 - Growth Stock Investing © 2008 Mc. Graw-Hill/Irwin

Learning Objectives n n n Recognize growth firm opportunities. Be able to value growth potential. Understand identify the risks of growth. Control your own representativeness bias. Know the bias in financial analyst recommendations. 12 -2

Growth Investing n Growth investors look to the future. ¨ Look for firms that will deliver increasing revenue and profits ¨ Often found by looking a past growth n n n Three years of above-average EPS growth Twice the earnings growth of the S&P 500 High profit margins ¨ Can the growth be sustained? n n Competition Capital (internally or externally funded) 12 -3

Growth Indicators n Revenue—top line growth ¨ Generating sales growth n EPS Growth—bottom line growth ¨ Most investors care more about profits than sales… n Dividend Growth ¨ Only some growth firms pay dividends 12 -4

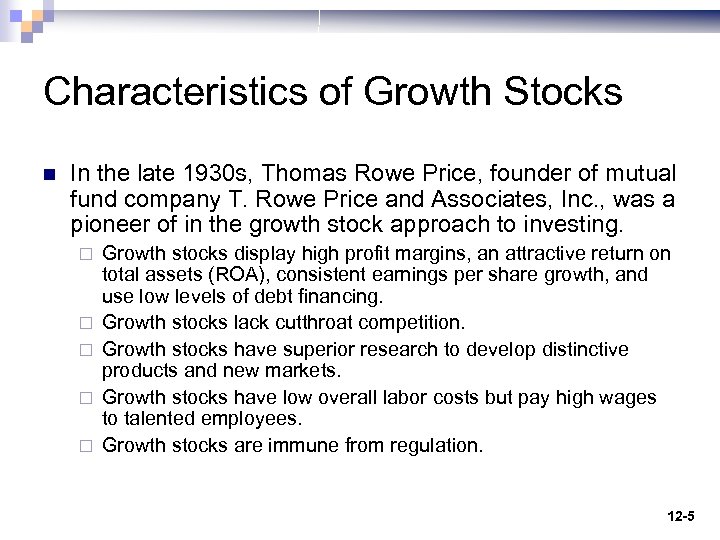

Characteristics of Growth Stocks n In the late 1930 s, Thomas Rowe Price, founder of mutual fund company T. Rowe Price and Associates, Inc. , was a pioneer of in the growth stock approach to investing. ¨ ¨ ¨ Growth stocks display high profit margins, an attractive return on total assets (ROA), consistent earnings per share growth, and use low levels of debt financing. Growth stocks lack cutthroat competition. Growth stocks have superior research to develop distinctive products and new markets. Growth stocks have low overall labor costs but pay high wages to talented employees. Growth stocks are immune from regulation. 12 -5

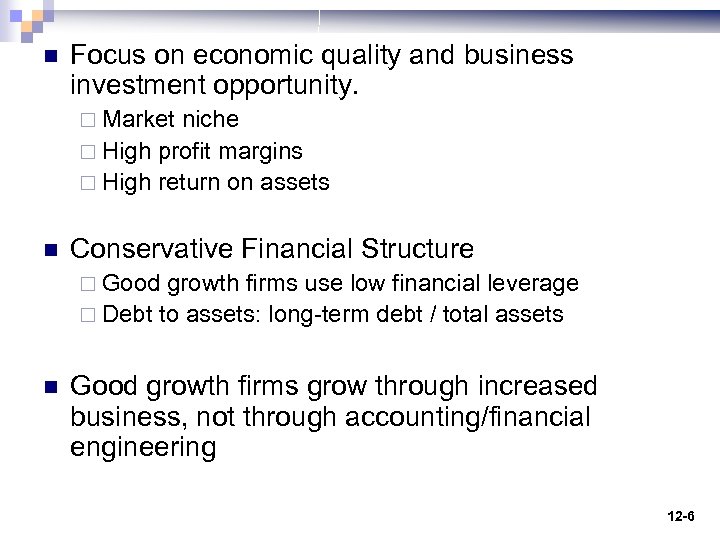

n Focus on economic quality and business investment opportunity. ¨ Market niche ¨ High profit margins ¨ High return on assets n Conservative Financial Structure ¨ Good growth firms use low financial leverage ¨ Debt to assets: long-term debt / total assets n Good growth firms grow through increased business, not through accounting/financial engineering 12 -6

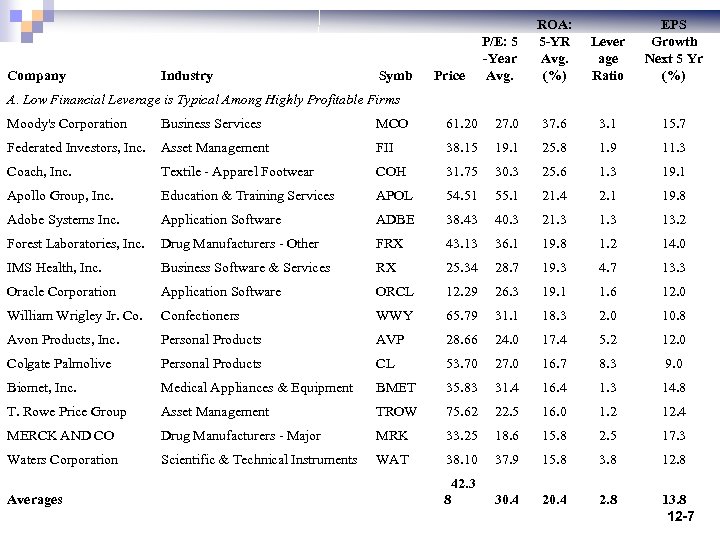

Company Industry Symb Price P/E: 5 -Year Avg. ROA: 5 -YR Avg. (%) Lever age Ratio EPS Growth Next 5 Yr (%) A. Low Financial Leverage is Typical Among Highly Profitable Firms Moody's Corporation Business Services MCO 61. 20 27. 0 37. 6 3. 1 15. 7 Federated Investors, Inc. Asset Management FII 38. 15 19. 1 25. 8 1. 9 11. 3 Coach, Inc. Textile - Apparel Footwear COH 31. 75 30. 3 25. 6 1. 3 19. 1 Apollo Group, Inc. Education & Training Services APOL 54. 51 55. 1 21. 4 2. 1 19. 8 Adobe Systems Inc. Application Software ADBE 38. 43 40. 3 21. 3 13. 2 Forest Laboratories, Inc. Drug Manufacturers - Other FRX 43. 13 36. 1 19. 8 1. 2 14. 0 IMS Health, Inc. Business Software & Services RX 25. 34 28. 7 19. 3 4. 7 13. 3 Oracle Corporation Application Software ORCL 12. 29 26. 3 19. 1 1. 6 12. 0 William Wrigley Jr. Co. Confectioners WWY 65. 79 31. 1 18. 3 2. 0 10. 8 Avon Products, Inc. Personal Products AVP 28. 66 24. 0 17. 4 5. 2 12. 0 Colgate Palmolive Personal Products CL 53. 70 27. 0 16. 7 8. 3 9. 0 Biomet, Inc. Medical Appliances & Equipment BMET 35. 83 31. 4 16. 4 1. 3 14. 8 T. Rowe Price Group Asset Management TROW 75. 62 22. 5 16. 0 1. 2 12. 4 MERCK AND CO Drug Manufacturers - Major MRK 33. 25 18. 6 15. 8 2. 5 17. 3 Waters Corporation Scientific & Technical Instruments WAT 38. 10 37. 9 15. 8 3. 8 12. 8 30. 4 2. 8 13. 8 12 -7 42. 3 Averages 8

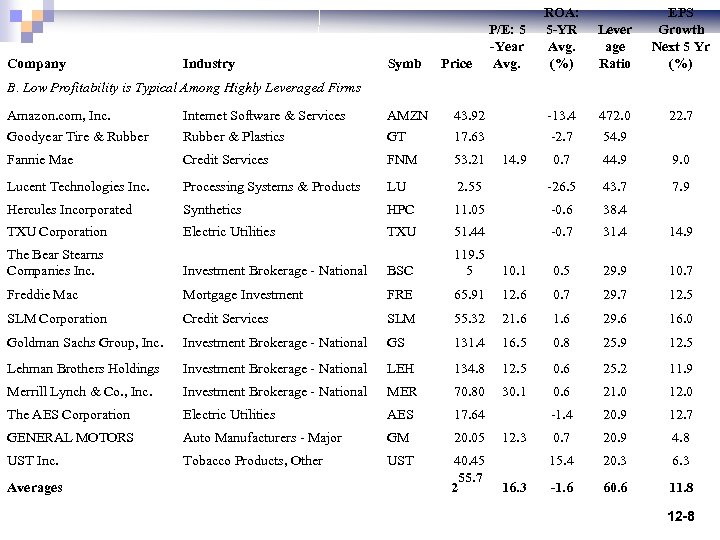

Company Industry Symb Price P/E: 5 -Year Avg. ROA: 5 -YR Avg. (%) Lever age Ratio EPS Growth Next 5 Yr (%) 22. 7 B. Low Profitability is Typical Among Highly Leveraged Firms Amazon. com, Inc. Internet Software & Services AMZN 43. 92 -13. 4 472. 0 Goodyear Tire & Rubber & Plastics GT 17. 63 -2. 7 54. 9 Fannie Mae Credit Services FNM 53. 21 0. 7 44. 9 9. 0 Lucent Technologies Inc. Processing Systems & Products LU 2. 55 -26. 5 43. 7 7. 9 Hercules Incorporated Synthetics HPC 11. 05 -0. 6 38. 4 TXU Corporation Electric Utilities TXU 51. 44 -0. 7 31. 4 14. 9 10. 1 0. 5 29. 9 10. 7 14. 9 The Bear Stearns Companies Inc. Investment Brokerage - National BSC 119. 5 5 Freddie Mac Mortgage Investment FRE 65. 91 12. 6 0. 7 29. 7 12. 5 SLM Corporation Credit Services SLM 55. 32 21. 6 29. 6 16. 0 Goldman Sachs Group, Inc. Investment Brokerage - National GS 131. 4 16. 5 0. 8 25. 9 12. 5 Lehman Brothers Holdings Investment Brokerage - National LEH 134. 8 12. 5 0. 6 25. 2 11. 9 Merrill Lynch & Co. , Inc. Investment Brokerage - National MER 70. 80 30. 1 0. 6 21. 0 12. 0 The AES Corporation Electric Utilities AES 17. 64 -1. 4 20. 9 12. 7 GENERAL MOTORS Auto Manufacturers - Major GM 20. 05 0. 7 20. 9 4. 8 UST Inc. Tobacco Products, Other UST 40. 45 55. 7 2 15. 4 20. 3 6. 3 -1. 6 60. 6 11. 8 Averages 12. 3 16. 3 12 -8

Pitfalls to Growth n Customer Loyalty Risk ¨ There is often very little loyalty in new and rapidly growing markets n Merger Risk ¨ The best growth comes from self-expansion ¨ Less successful is the growth from acquisitions n Roll-up is a company that grows through a constant acquisition binge. • Regulation Risk • Price Risk – Good company, price too high 12 -9

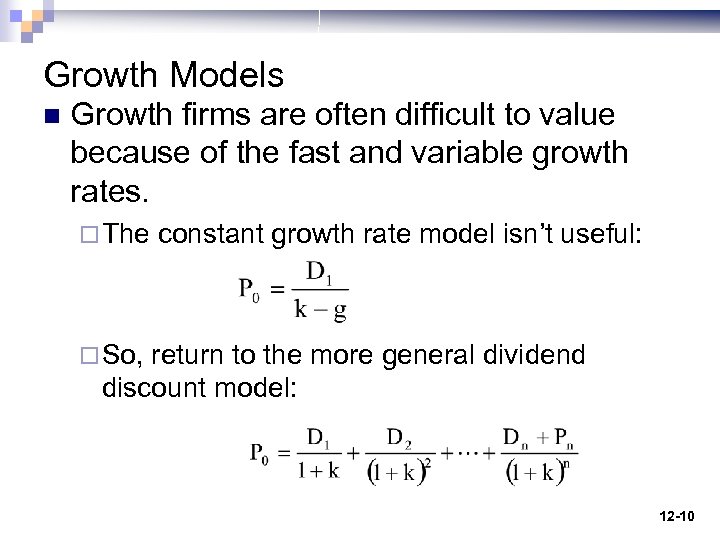

Growth Models n Growth firms are often difficult to value because of the fast and variable growth rates. ¨ The constant growth rate model isn’t useful: ¨ So, return to the more general dividend discount model: 12 -10

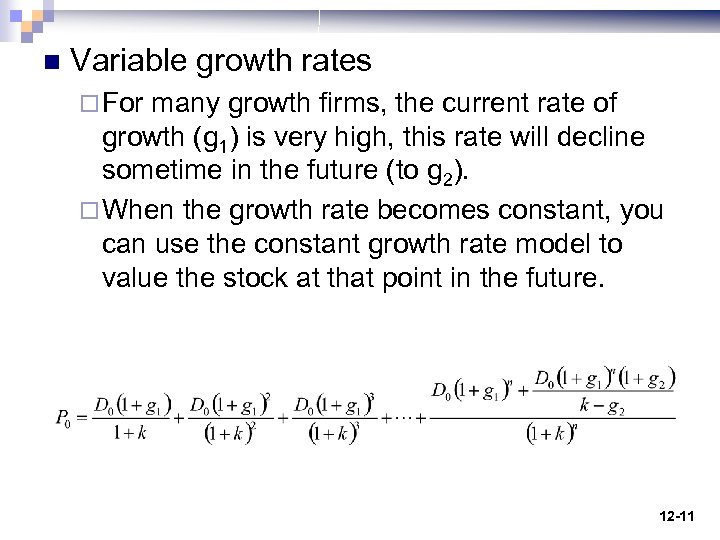

n Variable growth rates ¨ For many growth firms, the current rate of growth (g 1) is very high, this rate will decline sometime in the future (to g 2). ¨ When the growth rate becomes constant, you can use the constant growth rate model to value the stock at that point in the future. 12 -11

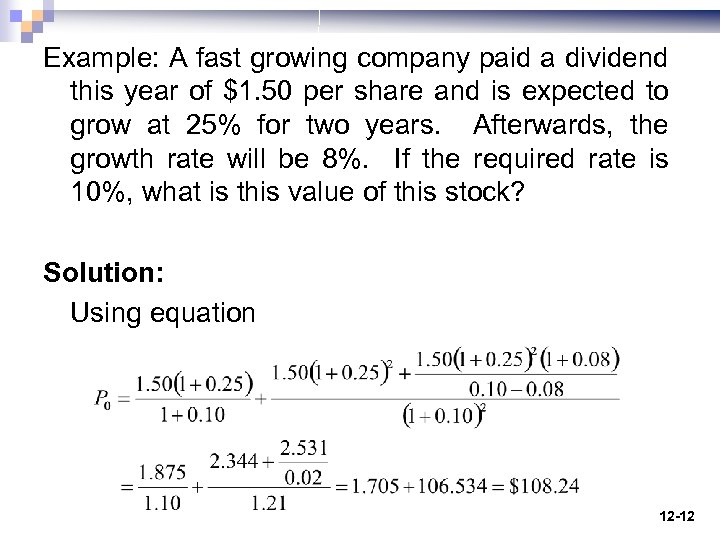

Example: A fast growing company paid a dividend this year of $1. 50 per share and is expected to grow at 25% for two years. Afterwards, the growth rate will be 8%. If the required rate is 10%, what is this value of this stock? Solution: Using equation 12 -12

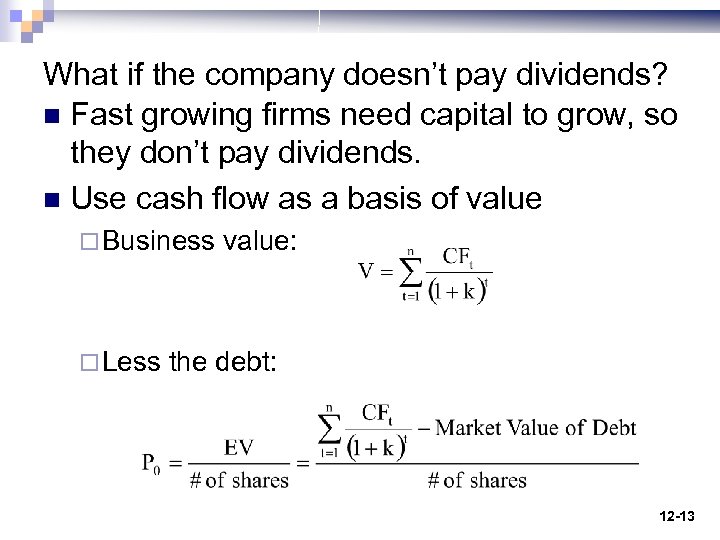

What if the company doesn’t pay dividends? n Fast growing firms need capital to grow, so they don’t pay dividends. n Use cash flow as a basis of value ¨ Business value: ¨ Less the debt: 12 -13

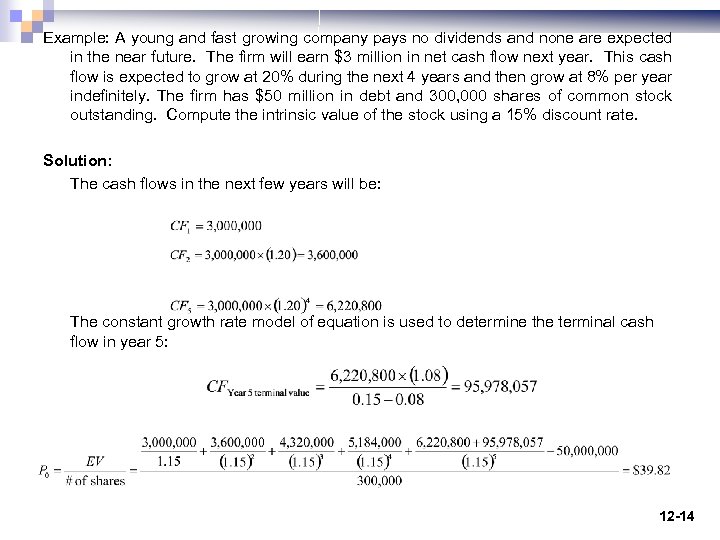

Example: A young and fast growing company pays no dividends and none are expected in the near future. The firm will earn $3 million in net cash flow next year. This cash flow is expected to grow at 20% during the next 4 years and then grow at 8% per year indefinitely. The firm has $50 million in debt and 300, 000 shares of common stock outstanding. Compute the intrinsic value of the stock using a 15% discount rate. Solution: The cash flows in the next few years will be: The constant growth rate model of equation is used to determine the terminal cash flow in year 5: 12 -14

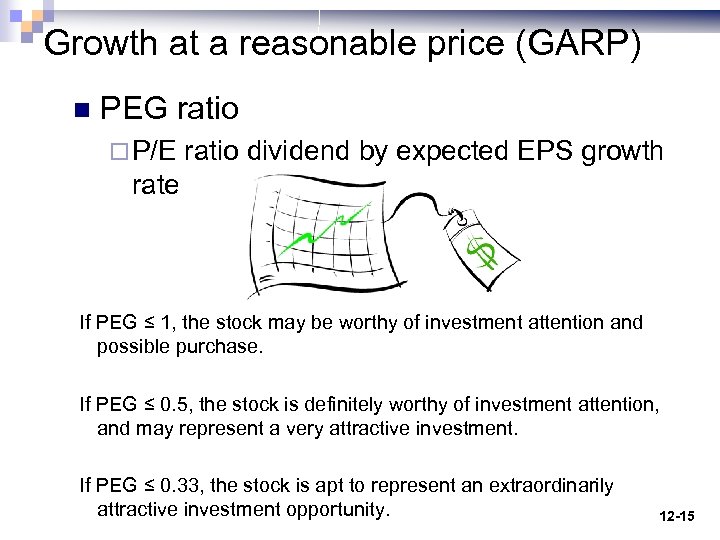

Growth at a reasonable price (GARP) n PEG ratio ¨ P/E ratio dividend by expected EPS growth rate If PEG ≤ 1, the stock may be worthy of investment attention and possible purchase. If PEG ≤ 0. 5, the stock is definitely worthy of investment attention, and may represent a very attractive investment. If PEG ≤ 0. 33, the stock is apt to represent an extraordinarily attractive investment opportunity. 12 -15

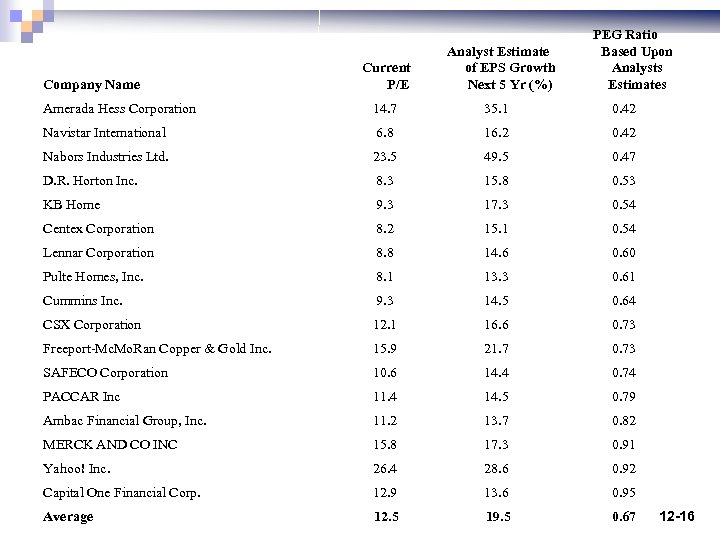

Company Name Current P/E Analyst Estimate of EPS Growth Next 5 Yr (%) PEG Ratio Based Upon Analysts Estimates Amerada Hess Corporation 14. 7 35. 1 0. 42 Navistar International 6. 8 16. 2 0. 42 Nabors Industries Ltd. 23. 5 49. 5 0. 47 D. R. Horton Inc. 8. 3 15. 8 0. 53 KB Home 9. 3 17. 3 0. 54 Centex Corporation 8. 2 15. 1 0. 54 Lennar Corporation 8. 8 14. 6 0. 60 Pulte Homes, Inc. 8. 1 13. 3 0. 61 Cummins Inc. 9. 3 14. 5 0. 64 CSX Corporation 12. 1 16. 6 0. 73 Freeport-Mc. Mo. Ran Copper & Gold Inc. 15. 9 21. 7 0. 73 SAFECO Corporation 10. 6 14. 4 0. 74 PACCAR Inc 11. 4 14. 5 0. 79 Ambac Financial Group, Inc. 11. 2 13. 7 0. 82 MERCK AND CO INC 15. 8 17. 3 0. 91 Yahoo! Inc. 26. 4 28. 6 0. 92 Capital One Financial Corp. 12. 9 13. 6 0. 95 Average 12. 5 19. 5 0. 67 12 -16

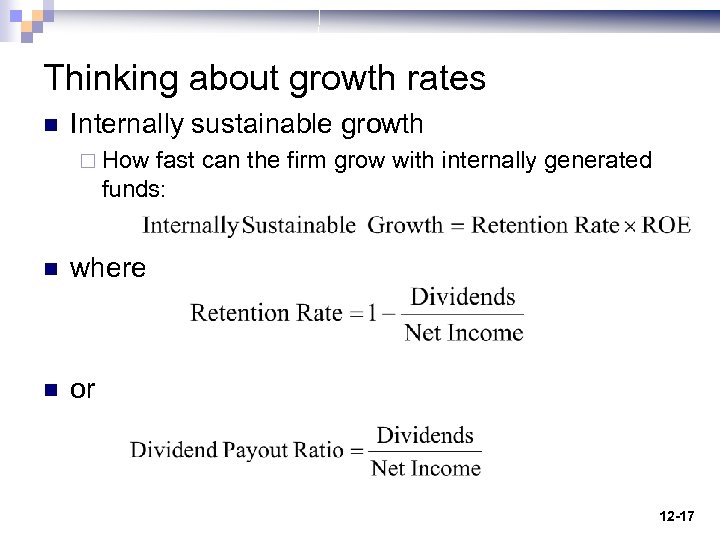

Thinking about growth rates n Internally sustainable growth ¨ How fast can the firm grow with internally generated funds: n where n or 12 -17

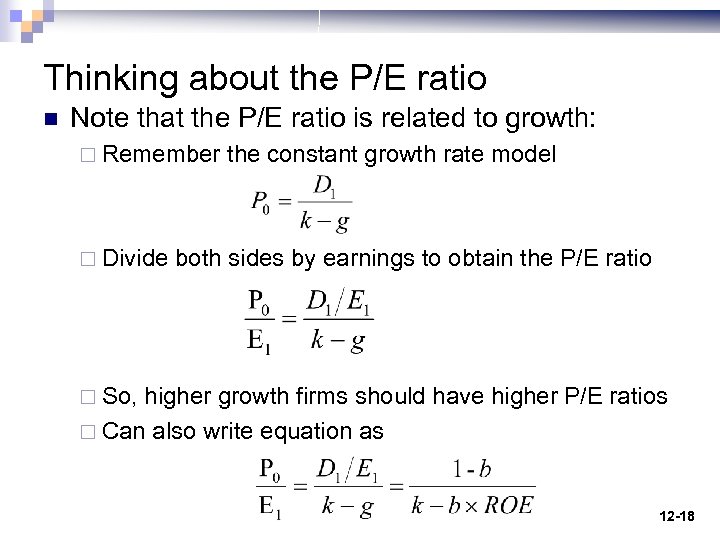

Thinking about the P/E ratio n Note that the P/E ratio is related to growth: ¨ Remember the constant growth rate model ¨ Divide both sides by earnings to obtain the P/E ratio ¨ So, higher growth firms should have higher P/E ratios ¨ Can also write equation as 12 -18

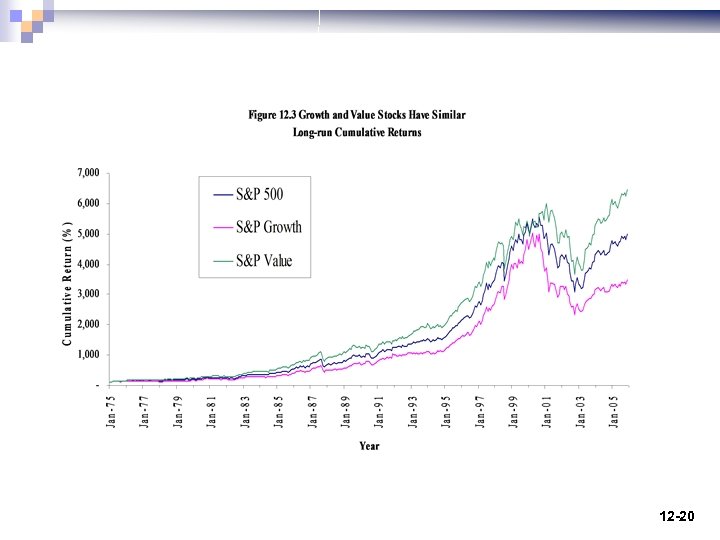

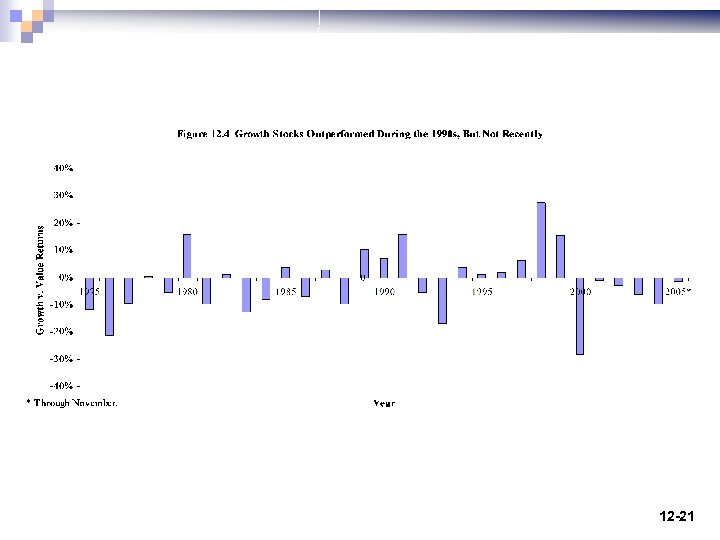

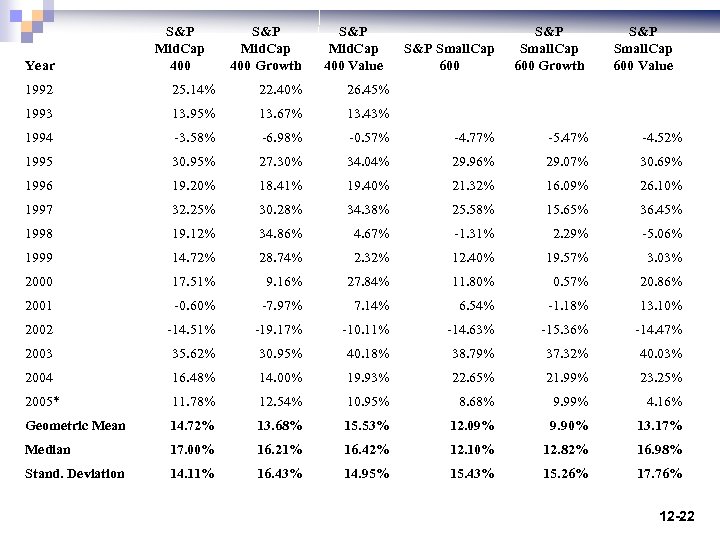

Growth versus Value n S&P/Barra Value and Growth Indexes ¨ SP 500 Index firms are split by firm’s P/B ratio Higher P/B firms assigned the Growth index n Lowe P/B firms are assigned the Value Index n ¨ Done in 1992, but then done historically back to 1975 ¨ Done with SP Mid. Cap 400 and SP Small. Cap 600 too! 12 -19

12 -20

12 -21

Year S&P Mid. Cap 400 Growth S&P Mid. Cap 400 Value S&P Small. Cap 600 Growth S&P Small. Cap 600 Value 1992 25. 14% 22. 40% 26. 45% 1993 13. 95% 13. 67% 13. 43% 1994 -3. 58% -6. 98% -0. 57% -4. 77% -5. 47% -4. 52% 1995 30. 95% 27. 30% 34. 04% 29. 96% 29. 07% 30. 69% 1996 19. 20% 18. 41% 19. 40% 21. 32% 16. 09% 26. 10% 1997 32. 25% 30. 28% 34. 38% 25. 58% 15. 65% 36. 45% 1998 19. 12% 34. 86% 4. 67% -1. 31% 2. 29% -5. 06% 1999 14. 72% 28. 74% 2. 32% 12. 40% 19. 57% 3. 03% 2000 17. 51% 9. 16% 27. 84% 11. 80% 0. 57% 20. 86% 2001 -0. 60% -7. 97% 7. 14% 6. 54% -1. 18% 13. 10% 2002 -14. 51% -19. 17% -10. 11% -14. 63% -15. 36% -14. 47% 2003 35. 62% 30. 95% 40. 18% 38. 79% 37. 32% 40. 03% 2004 16. 48% 14. 00% 19. 93% 22. 65% 21. 99% 23. 25% 2005* 11. 78% 12. 54% 10. 95% 8. 68% 9. 99% 4. 16% Geometric Mean 14. 72% 13. 68% 15. 53% 12. 09% 9. 90% 13. 17% Median 17. 00% 16. 21% 16. 42% 12. 10% 12. 82% 16. 98% Stand. Deviation 14. 11% 16. 43% 14. 95% 15. 43% 15. 26% 17. 76% 12 -22

Growth Stocks Appear Attractive n The human brain uses shortcuts to reduce the difficulty of analyzing complex information. ¨ Representativeness bias n A cognitive error where things that seem similar are assumed to be alike. n Extrapolate past performance n Good companies are assumed to be good investments n Investors are wired to believe that the great past growth of a company will continue into the future. ¨ Great growth can’t last forever! 12 -23

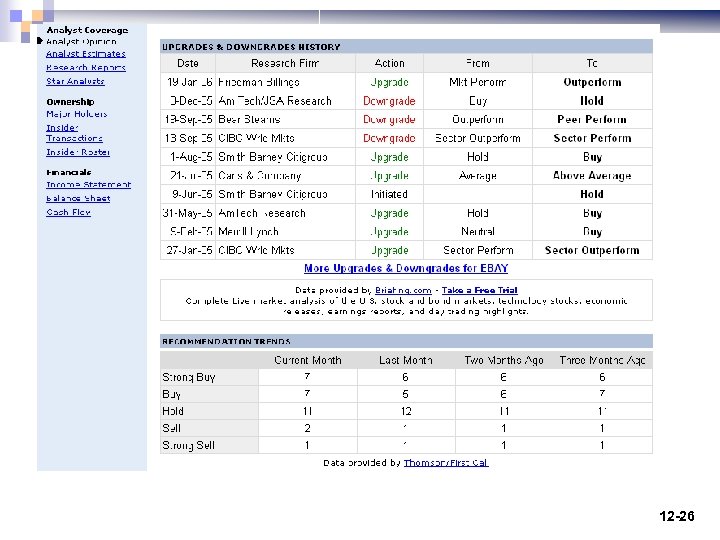

Financial Analyst Bias n Analysts suffer from the same psychological biases as other investors n Sell-side analysts ¨ Work for investment banks and brokerage firms n Buy-side analysts ¨ Work for investment firms, mutual funds, etc. 12 -24

12 -25

12 -26

74cae818f59a027eec23bf438bfb375b.ppt