1c12b6b5991167021c0aac9b26afb6f1.ppt

- Количество слайдов: 22

INVESTMENTS 101 STOCK MARKET SUMMARY What is an INVESTMENT? Short term sacrifice long term gain Deregulation began in 1999

INVESTMENTS 101 STOCK MARKET SUMMARY What is an INVESTMENT? Short term sacrifice long term gain Deregulation began in 1999

HISTORY Stock Market Crash (1929)- Banks failed due to over-investing in the stock market. Glass Stegall Act of 1933 - Strict government regulations of banks. De-regulation – in 1999 the government eased up on some of the banking restrictions

HISTORY Stock Market Crash (1929)- Banks failed due to over-investing in the stock market. Glass Stegall Act of 1933 - Strict government regulations of banks. De-regulation – in 1999 the government eased up on some of the banking restrictions

INVESTMENTS Why do people invest? Wealth accumulation Comfortable retirement Maintain purchasing power

INVESTMENTS Why do people invest? Wealth accumulation Comfortable retirement Maintain purchasing power

Factors of INVESTING RISK/ REWARD- The riskier the investment the greater potential for a large gain or loss. Small or new companies are considered a more risky investment. Time Factor- When am I going to need this money back?

Factors of INVESTING RISK/ REWARD- The riskier the investment the greater potential for a large gain or loss. Small or new companies are considered a more risky investment. Time Factor- When am I going to need this money back?

BANK INVESTMENTS Savings Money Markets CD (Certificate of Deposit)

BANK INVESTMENTS Savings Money Markets CD (Certificate of Deposit)

STOCK MARKET Fundamentals of Investing 2 Main Types: Stocks & Bonds

STOCK MARKET Fundamentals of Investing 2 Main Types: Stocks & Bonds

How do companies finance business activities? Stocks (Equities) By issuing: ◦ Shares of stock represent ownership interest in company (i. e. shareholders are part owners) ◦ Shareholders participate in profits of company through growth in value of stock

How do companies finance business activities? Stocks (Equities) By issuing: ◦ Shares of stock represent ownership interest in company (i. e. shareholders are part owners) ◦ Shareholders participate in profits of company through growth in value of stock

Stocks- 3 Types Preferred Stock- Stocks with priority and preference. Common Stock- Most stocks are common unless specified otherwise. Prices changes with the market on a constant daily variation. Treasury Stock- Company issued stock to employees usually in retirement plans (internally held shares of the company’s stock).

Stocks- 3 Types Preferred Stock- Stocks with priority and preference. Common Stock- Most stocks are common unless specified otherwise. Prices changes with the market on a constant daily variation. Treasury Stock- Company issued stock to employees usually in retirement plans (internally held shares of the company’s stock).

Companies also issue… Bonds (Fixed Income) ◦ The purchaser of a bond is lending money to the company at a set interest rate specified at the time of purchase ◦ Ownership of a bond makes them a creditor of the company ◦ If a company bankrupts due to financial difficulty, bond holders have priority claims on assets before stock holders

Companies also issue… Bonds (Fixed Income) ◦ The purchaser of a bond is lending money to the company at a set interest rate specified at the time of purchase ◦ Ownership of a bond makes them a creditor of the company ◦ If a company bankrupts due to financial difficulty, bond holders have priority claims on assets before stock holders

Bonds- 3 Types Government/ Govt backed- Government issued bonds or secured by the government (FEDERAL GOVT) Municipal- Local government issued bonds (Example- School bonds) Corporate- Company issued bonds

Bonds- 3 Types Government/ Govt backed- Government issued bonds or secured by the government (FEDERAL GOVT) Municipal- Local government issued bonds (Example- School bonds) Corporate- Company issued bonds

In what do people generally invest? Stocks Bonds Mutual Funds

In what do people generally invest? Stocks Bonds Mutual Funds

Mutual Fund? !? What is a Mutual Fund? Investors pool their money together into a fund, a “mutual fund” A professional money management team is hired to manage the fund The management team decides which stocks and/or bonds to buy and sell and when

Mutual Fund? !? What is a Mutual Fund? Investors pool their money together into a fund, a “mutual fund” A professional money management team is hired to manage the fund The management team decides which stocks and/or bonds to buy and sell and when

WHY Mutual Funds are popular? By design mutual funds are less risky than individual stocks and even bonds because of DIVERSIFICATION. You can purchase multiple stocks and bonds to spread out the risk. Mutual funds are a very popular way for people to invest due to their features and benefits

WHY Mutual Funds are popular? By design mutual funds are less risky than individual stocks and even bonds because of DIVERSIFICATION. You can purchase multiple stocks and bonds to spread out the risk. Mutual funds are a very popular way for people to invest due to their features and benefits

OTHER INVESTMENTS Annuities Options◦ Calls◦ Puts- Foreign Exchange (FOREX) Commodities-

OTHER INVESTMENTS Annuities Options◦ Calls◦ Puts- Foreign Exchange (FOREX) Commodities-

Saving for retirement is the primary reason most people invest RETIREMENT PLANS ◦ IRA◦ ROTH IRA◦ 401 k-

Saving for retirement is the primary reason most people invest RETIREMENT PLANS ◦ IRA◦ ROTH IRA◦ 401 k-

Retirement planning is critical The reality is that each one of us is in control of our own retirement destiny The earlier you begin saving the more likely you will be in a better position in retirement More time to accumulate retirement dollars Compounding effect of your earnings making earnings is more powerful the longer you invest

Retirement planning is critical The reality is that each one of us is in control of our own retirement destiny The earlier you begin saving the more likely you will be in a better position in retirement More time to accumulate retirement dollars Compounding effect of your earnings making earnings is more powerful the longer you invest

How much money does it take to retire? The reality is that everyone has a different amount that will work for them but there are some consistent rules of thumb: You should only expect to be able to draw out about 5% per year for income from the value of the assets you have accumulated (i. e. $1, 000 x 5% = $50, 000) You will need approximately 75 to 85 percent of your working years income to maintain your standard of living during retirement

How much money does it take to retire? The reality is that everyone has a different amount that will work for them but there are some consistent rules of thumb: You should only expect to be able to draw out about 5% per year for income from the value of the assets you have accumulated (i. e. $1, 000 x 5% = $50, 000) You will need approximately 75 to 85 percent of your working years income to maintain your standard of living during retirement

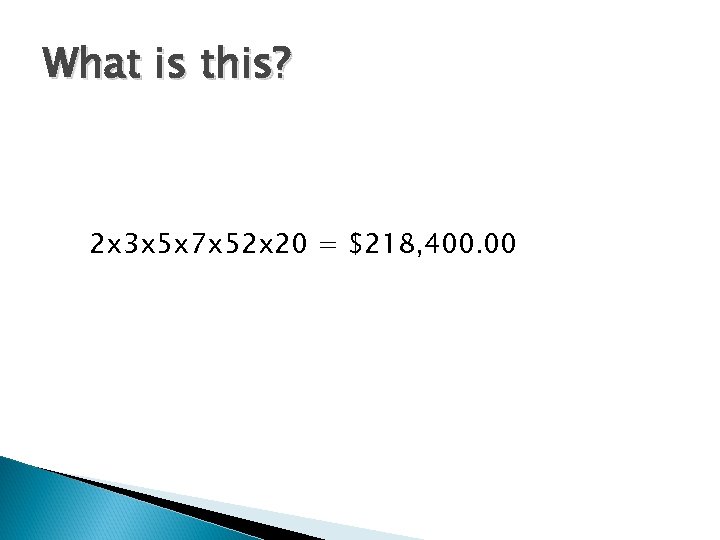

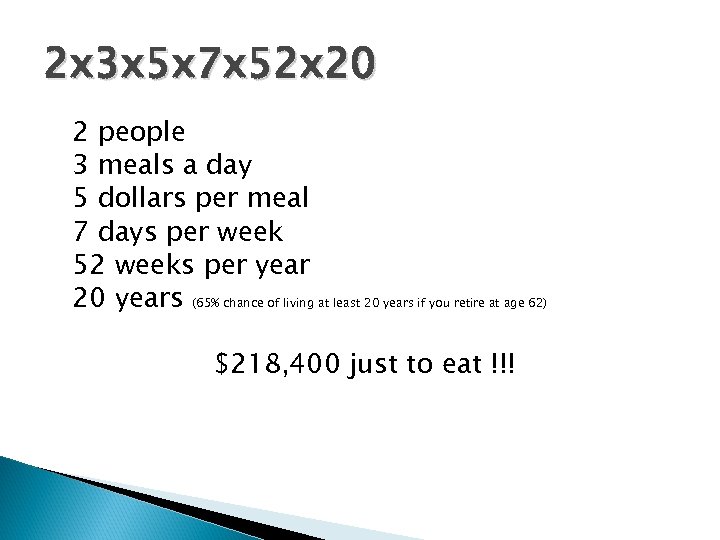

What is this? 2 x 3 x 5 x 7 x 52 x 20 = $218, 400. 00

What is this? 2 x 3 x 5 x 7 x 52 x 20 = $218, 400. 00

2 x 3 x 5 x 7 x 52 x 20 2 people 3 meals a day 5 dollars per meal 7 days per week 52 weeks per year 20 years (65% chance of living at least 20 years if you retire at age 62) $218, 400 just to eat !!!

2 x 3 x 5 x 7 x 52 x 20 2 people 3 meals a day 5 dollars per meal 7 days per week 52 weeks per year 20 years (65% chance of living at least 20 years if you retire at age 62) $218, 400 just to eat !!!

THE MARKET INDEX- ◦ DJIA◦ S&P 500 MARKETSNYSENASDAQ-

THE MARKET INDEX- ◦ DJIA◦ S&P 500 MARKETSNYSENASDAQ-

Careers in the investment industry Financial Advisor Financial Analyst Portfolio Manager Investment Banker

Careers in the investment industry Financial Advisor Financial Analyst Portfolio Manager Investment Banker

THE END

THE END