9298cf648fa3fa1a5c276feaadcd8a2c.ppt

- Количество слайдов: 47

Investment Themes in Data Center Infrastructure September 2001 Chris Le. Blanc – Data Center Systems & Software s vice Ser Hardw are ftw So For Sal e$

Overview Ø Defining the Ecosystem Ø Data Center Issues Ø Segment Review § Service Providers § Software § Servers § Storage Fabric § Storage Subsystems § Components s vice Ser Hardw are Ø Industry Status are ftw So For Sal e$ 2

Defining The Ecosystem s vice Ser Hardw are ftw So For Sal e$ 3

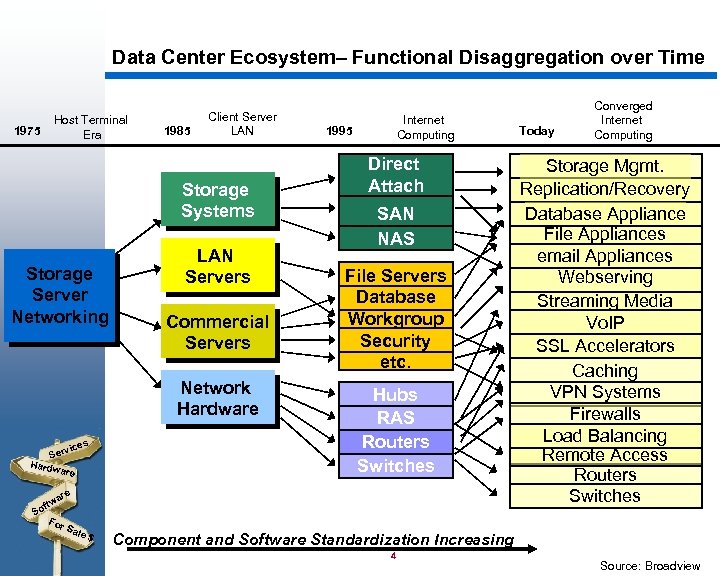

Data Center Ecosystem– Functional Disaggregation over Time 1975 Host Terminal Era 1985 Client Server LAN Storage Systems Storage Server Networking LAN Servers Commercial Servers Network Hardware s vice Ser Hardw are ftw So For Sal e$ 1995 Internet Computing Direct Attach SAN NAS File Servers Database Workgroup Security etc. Hubs RAS Routers Switches Today Converged Internet Computing Storage Mgmt. Replication/Recovery Database Appliance File Appliances email Appliances Webserving Streaming Media Vo. IP SSL Accelerators Caching VPN Systems Firewalls Load Balancing Remote Access Routers Switches Component and Software Standardization Increasing 4 Source: Broadview

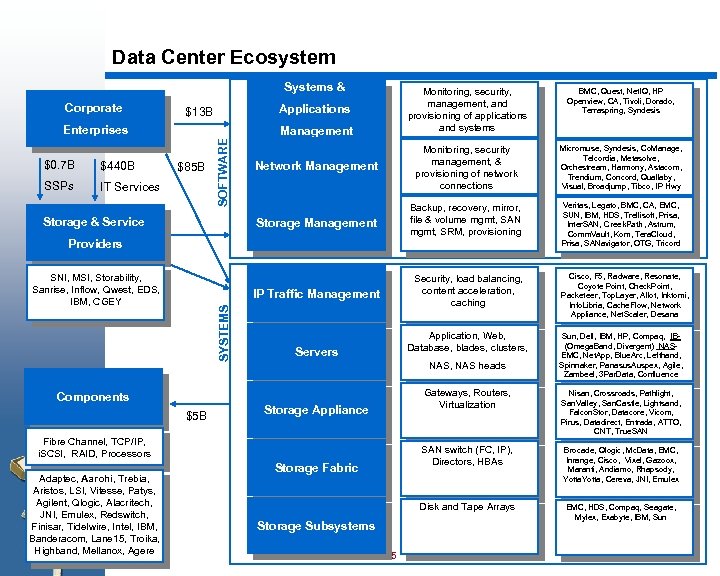

Data Center Ecosystem Systems & Corporate SSPs Network Management Monitoring, security management, & provisioning of network connections Micromuse, Syndesis, Co. Manage, Telcordia, Metasolve, Orchestream, Harmony, Astacom, Trendium, Concord, Quallaby, Visual, Broadjump, Tibco, IP Hwy Storage Management Backup, recovery, mirror, file & volume mgmt, SAN mgmt, SRM, provisioning Veritas, Legato, BMC, CA, EMC, SUN, IBM, HDS, Trellisoft, Prisa, Inter. SAN, Creek. Path, Astrum, Comm. Vault, Kom, Tera. Cloud, Prisa, SANavigator, OTG, Tricord Management IT Services $85 B SOFTWARE $440 B BMC, Quest, Net. IQ, HP Openview, CA, Tivoli, Dorado, Terraspring, Syndesis Applications $13 B Enterprises $0. 7 B Monitoring, security, management, and provisioning of applications and systems Storage & Service Providers SNI, MSI, Storability, Sanrise, Inflow, Qwest, EDS, IBM, CGEY SYSTEMS IP Traffic Management Components $5 B Fibre Channel, TCP/IP, ices i. SCSI, v RAID, Processors Ser Hardw are Adaptec, Aarohi, Trebia, Aristos, e. LSI, Vitesse, Patys, ar Agilent, Qlogic, Alacritech, ftw So JNI, Emulex, Redswitch, For Finisar, Sa Tidelwire, Intel, IBM, le Banderacom, $Lane 15, Troika, Highband, Mellanox, Agere Security, load balancing, content acceleration, caching Application, Web, Database, blades, clusters, Servers NAS, NAS heads Cisco, F 5, Radware, Resonate, Coyote Point, Check. Point, Packeteer, Top. Layer, Allot, Inktomi, Info. Libria, Cache. Flow, Network Appliance, Net. Scaler, Desana Sun, Dell, IBM, HP, Compaq, IB(Omega. Band, Divergent) NASEMC, Net. App, Blue. Arc, Lefthand, Spinnaker, Panasus. Auspex, Agile, Zambeel, 3 Par. Data, Confluence Gateways, Routers, Virtualization SAN switch (FC, IP), Directors, HBAs Storage Fabric Storage Subsystems 5 Brocade, Qlogic, Mc. Data, EMC, Inrange, Cisco, Vixel, Gazoox, Maranti, Andiamo, Rhapsody, Yotta, Cereva, JNI, Emulex Disk and Tape Arrays Storage Appliance Nisan, Crossroads, Pathlight, San. Valley, San. Castle, Lightsand, Falcon. Stor, Datacore, Vicom, Pirus, Datadirect, Entrada, ATTO, CNT, True. SAN EMC, HDS, Compaq, Seagate, Mylex, Exabyte, IBM, Sun

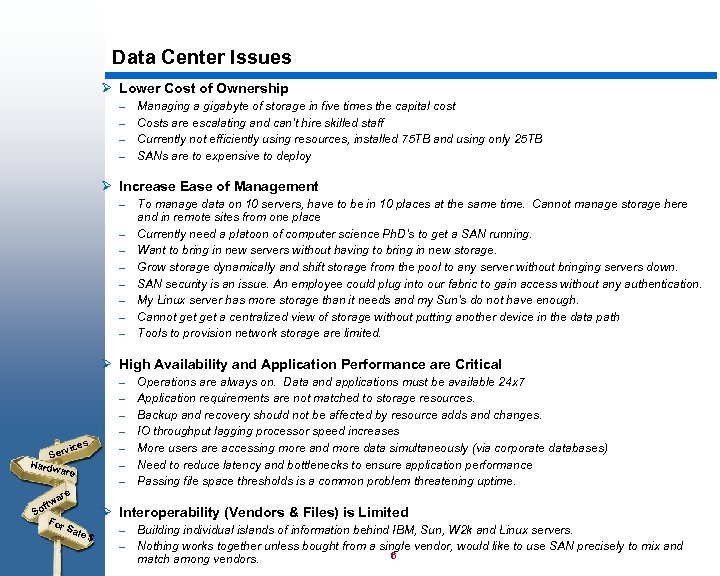

Data Center Issues Ø Lower Cost of Ownership – – Managing a gigabyte of storage in five times the capital cost Costs are escalating and can’t hire skilled staff Currently not efficiently using resources, installed 75 TB and using only 25 TB SANs are to expensive to deploy Ø Increase Ease of Management – – – – To manage data on 10 servers, have to be in 10 places at the same time. Cannot manage storage here and in remote sites from one place Currently need a platoon of computer science Ph. D’s to get a SAN running. Want to bring in new servers without having to bring in new storage. Grow storage dynamically and shift storage from the pool to any server without bringing servers down. SAN security is an issue. An employee could plug into our fabric to gain access without any authentication. My Linux server has more storage than it needs and my Sun’s do not have enough. Cannot get a centralized view of storage without putting another device in the data path Tools to provision network storage are limited. Ø High Availability and Application Performance are Critical – – es rvic Se Hardw are re wa ft For So Sal e$ – – – Operations are always on. Data and applications must be available 24 x 7 Application requirements are not matched to storage resources. Backup and recovery should not be affected by resource adds and changes. IO throughput lagging processor speed increases More users are accessing more and more data simultaneously (via corporate databases) Need to reduce latency and bottlenecks to ensure application performance Passing file space thresholds is a common problem threatening uptime. Ø Interoperability (Vendors & Files) is Limited – – Building individual islands of information behind IBM, Sun, W 2 k and Linux servers. Nothing works together unless bought from a single vendor, would like to use SAN precisely to mix and 6 match among vendors.

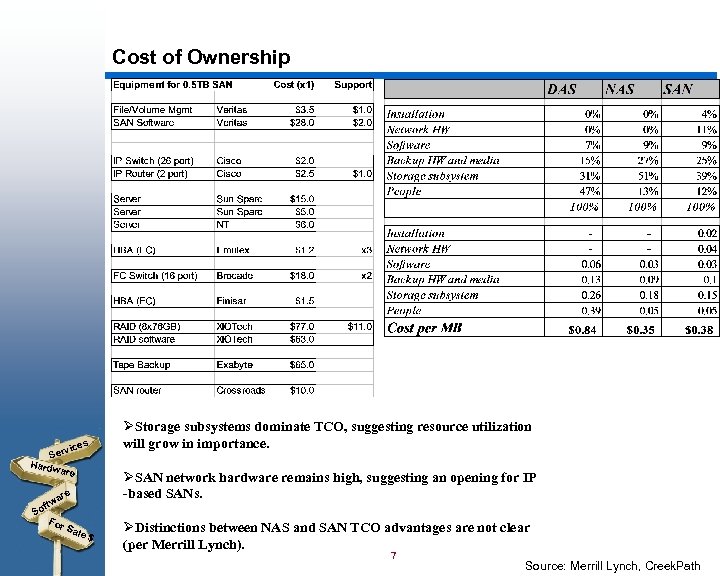

Cost of Ownership s vice Ser Hardw are ftw So For Sal e$ ØStorage subsystems dominate TCO, suggesting resource utilization will grow in importance. ØSAN network hardware remains high, suggesting an opening for IP -based SANs. ØDistinctions between NAS and SAN TCO advantages are not clear (per Merrill Lynch). 7 Source: Merrill Lynch, Creek. Path

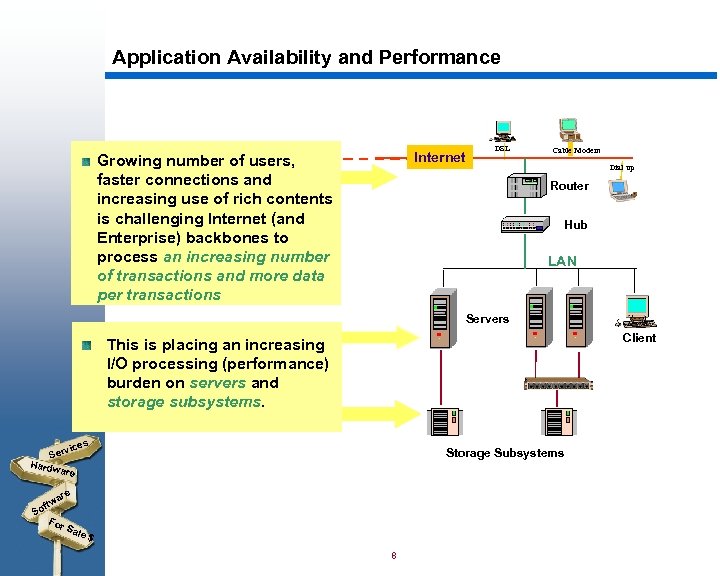

Application Availability and Performance Internet Growing number of users, faster connections and increasing use of rich contents is challenging Internet (and Enterprise) backbones to process an increasing number of transactions and more data per transactions DSL Cable Modem Dial up Router Hub LAN Servers Client This is placing an increasing I/O processing (performance) burden on servers and storage subsystems. s vice Ser Hardw are Storage Subsystems are ftw So For Sal e$ 8

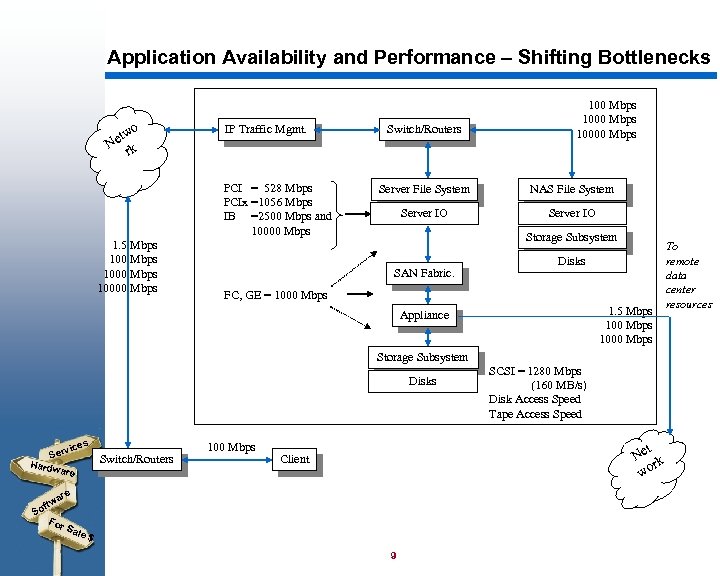

Application Availability and Performance – Shifting Bottlenecks o etw N k r IP Traffic Mgmt. PCI = 528 Mbps PCIx =1056 Mbps IB =2500 Mbps and 10000 Mbps 1. 5 Mbps 10000 Mbps Switch/Routers 100 Mbps 10000 Mbps Server File System NAS File System Server IO Storage Subsystem SAN Fabric. Disks FC, GE = 1000 Mbps 1. 5 Mbps 1000 Mbps Appliance Storage Subsystem Disks s vice Ser Hardw are Switch/Routers 100 Mbps SCSI = 1280 Mbps (160 MB/s) Disk Access Speed Tape Access Speed t Ne k r wo Client are ftw So For Sal e$ 9 To remote data center resources

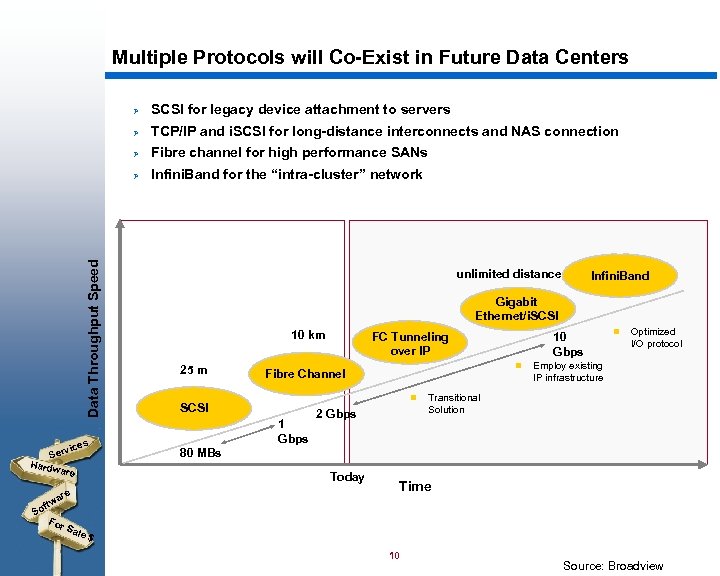

Multiple Protocols will Co-Exist in Future Data Centers ft For So Fibre channel for high performance SANs Ø re wa TCP/IP and i. SCSI for long-distance interconnects and NAS connection Ø s vice Ser Hardw are SCSI for legacy device attachment to servers Ø Data Throughput Speed Ø Infini. Band for the “intra-cluster” network unlimited distance Infini. Band Gigabit Ethernet/i. SCSI 10 km 25 m FC Tunneling over IP n Fibre Channel n SCSI 1 Gbps 10 Gbps 2 Gbps n Optimized I/O protocol Employ existing IP infrastructure Transitional Solution 80 MBs Today Time Sal e$ 10 Source: Broadview

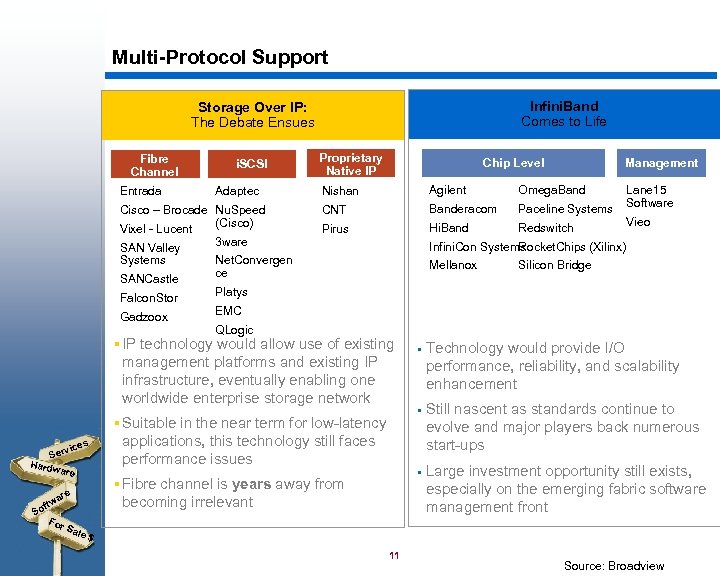

Multi-Protocol Support Infini. Band Comes to Life Storage Over IP: The Debate Ensues Fibre Channel over IP Entrada i. SCSI Adaptec Cisco – Brocade Nu. Speed (Cisco) Vixel - Lucent SAN Valley Systems SANCastle Falcon. Stor Gadzoox 3 ware Proprietary Native IP Chip Level Nishan Agilent Omega. Band CNT Banderacom Paceline Systems Pirus Hi. Band Redswitch re wa ft For So Lane 15 Software Vieo Infini. Con Systems Rocket. Chips (Xilinx) Net. Convergen ce Mellanox Silicon Bridge Platys EMC QLogic § IP technology would allow use of existing management platforms and existing IP infrastructure, eventually enabling one worldwide enterprise storage network s vice Ser Hardw are Management § § § Suitable in the near term for low-latency applications, this technology still faces performance issues § § Fibre channel is years away from becoming irrelevant Technology would provide I/O performance, reliability, and scalability enhancement Still nascent as standards continue to evolve and major players back numerous start-ups Large investment opportunity still exists, especially on the emerging fabric software management front Sal e$ 11 Source: Broadview

SEGMENT REVIEW IT Service Providers s vice Ser Hardw are ftw So For Sal e$ 12

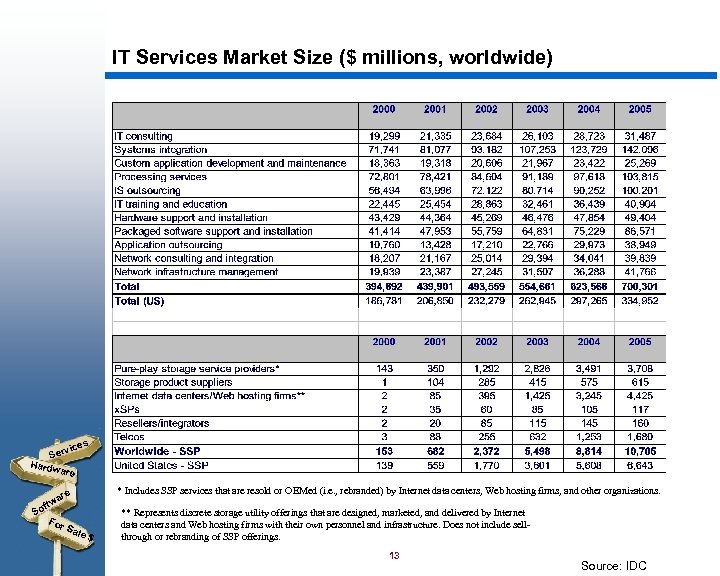

IT Services Market Size ($ millions, worldwide) s vice Ser Hardw are S w oft are For Sal e$ * Includes SSP services that are resold or OEMed (i. e. , rebranded) by Internet data centers, Web hosting firms, and other organizations. ** Represents discrete storage utility offerings that are designed, marketed, and delivered by Internet data centers and Web hosting firms with their own personnel and infrastructure. Does not include sellthrough or rebranding of SSP offerings. 13 Source: IDC

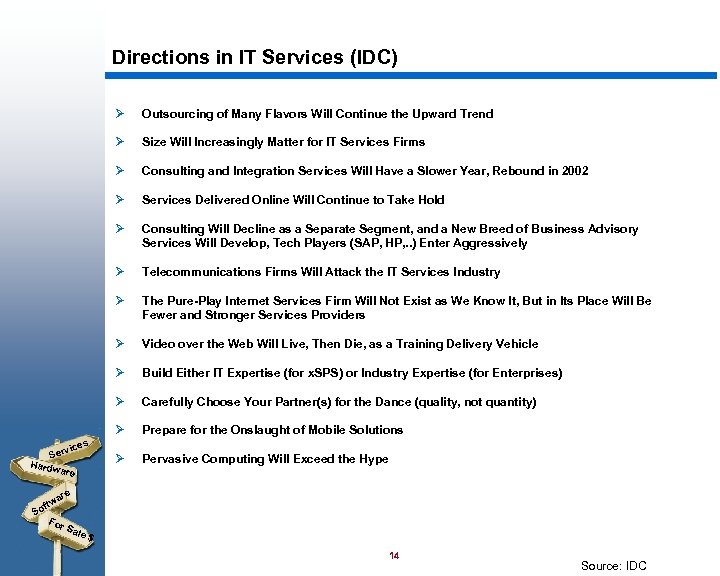

Directions in IT Services (IDC) Ø Ø Consulting and Integration Services Will Have a Slower Year, Rebound in 2002 Ø Services Delivered Online Will Continue to Take Hold Ø Consulting Will Decline as a Separate Segment, and a New Breed of Business Advisory Services Will Develop, Tech Players (SAP, HP, . . ) Enter Aggressively Ø Telecommunications Firms Will Attack the IT Services Industry Ø The Pure-Play Internet Services Firm Will Not Exist as We Know It, But in Its Place Will Be Fewer and Stronger Services Providers Ø Video over the Web Will Live, Then Die, as a Training Delivery Vehicle Ø Build Either IT Expertise (for x. SPS) or Industry Expertise (for Enterprises) Ø Carefully Choose Your Partner(s) for the Dance (quality, not quantity) Ø Se Hardw a Size Will Increasingly Matter for IT Services Firms Ø es rvic Outsourcing of Many Flavors Will Continue the Upward Trend Prepare for the Onslaught of Mobile Solutions Ø Pervasive Computing Will Exceed the Hype re are ftw So For Sal e$ 14 Source: IDC

Software s vice Ser Hardw are ftw So For Sal e$ 15

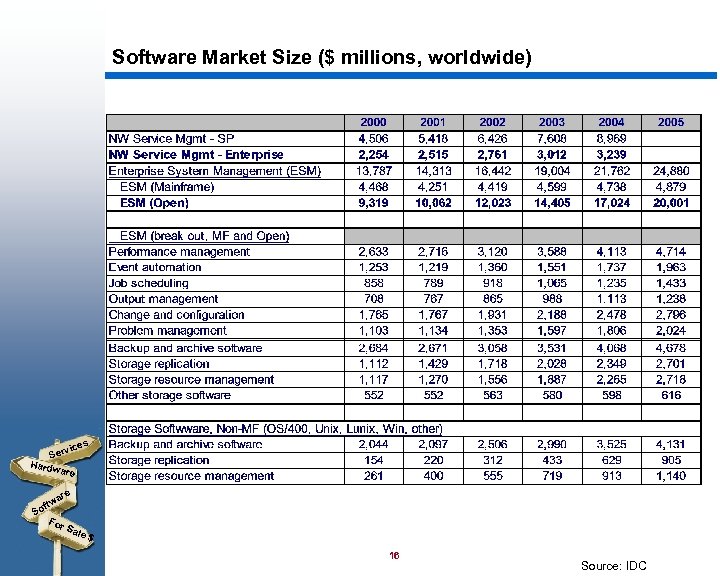

Software Market Size ($ millions, worldwide) s vice Ser Hardw are ftw So For Sal e$ 16 Source: IDC

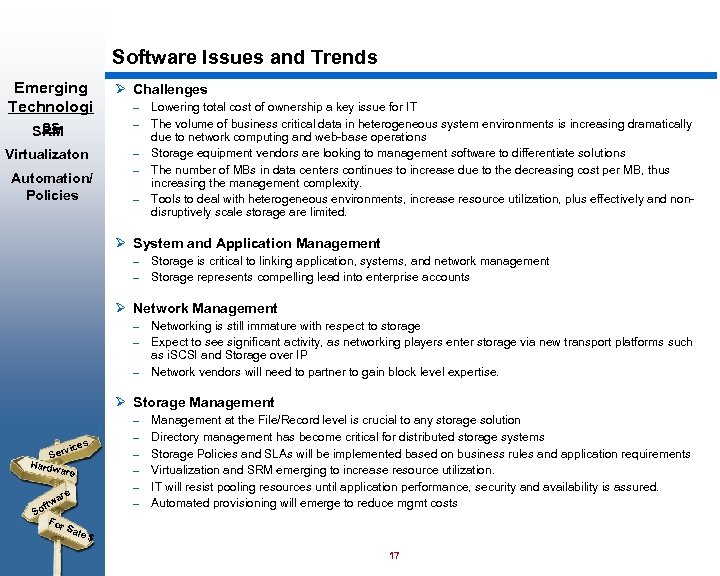

Software Issues and Trends Emerging Technologi es SRM Virtualizaton Automation/ Policies Ø Challenges – – – Lowering total cost of ownership a key issue for IT The volume of business critical data in heterogeneous system environments is increasing dramatically due to network computing and web-base operations Storage equipment vendors are looking to management software to differentiate solutions The number of MBs in data centers continues to increase due to the decreasing cost per MB, thus increasing the management complexity. Tools to deal with heterogeneous environments, increase resource utilization, plus effectively and nondisruptively scale storage are limited. Ø System and Application Management – – Storage is critical to linking application, systems, and network management Storage represents compelling lead into enterprise accounts Ø Network Management – – – Networking is still immature with respect to storage Expect to see significant activity, as networking players enter storage via new transport platforms such as i. SCSI and Storage over IP Network vendors will need to partner to gain block level expertise. Ø Storage Management – es vic Ser Hardw a re re wa ft For So – – – Management at the File/Record level is crucial to any storage solution Directory management has become critical for distributed storage systems Storage Policies and SLAs will be implemented based on business rules and application requirements Virtualization and SRM emerging to increase resource utilization. IT will resist pooling resources until application performance, security and availability is assured. Automated provisioning will emerge to reduce mgmt costs Sal e$ 17

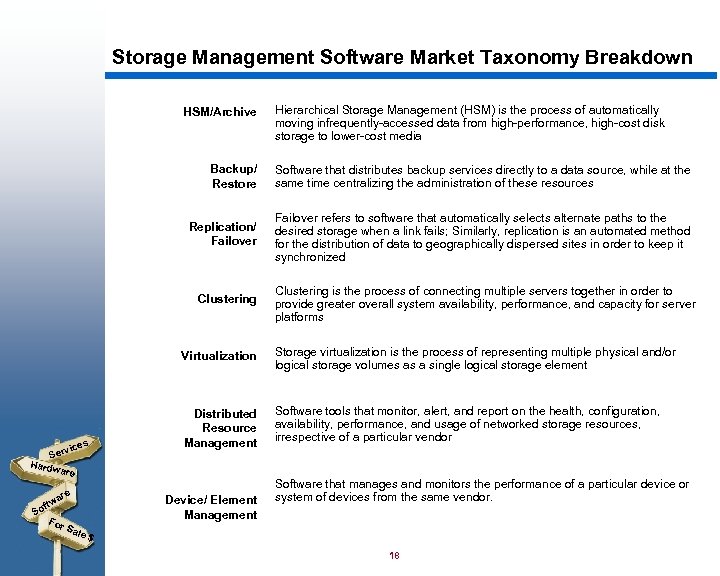

Storage Management Software Market Taxonomy Breakdown HSM/Archive Hierarchical Storage Management (HSM) is the process of automatically moving infrequently-accessed data from high-performance, high-cost disk storage to lower-cost media Backup/ Restore Software that distributes backup services directly to a data source, while at the same time centralizing the administration of these resources Replication/ Failover refers to software that automatically selects alternate paths to the desired storage when a link fails; Similarly, replication is an automated method for the distribution of data to geographically dispersed sites in order to keep it synchronized Clustering is the process of connecting multiple servers together in order to provide greater overall system availability, performance, and capacity for server platforms Virtualization s vice Ser Hardw are re wa ft For So Storage virtualization is the process of representing multiple physical and/or logical storage volumes as a single logical storage element Distributed Resource Management Software tools that monitor, alert, and report on the health, configuration, availability, performance, and usage of networked storage resources, irrespective of a particular vendor Device/ Element Management Software that manages and monitors the performance of a particular device or system of devices from the same vendor. Sal e$ 18

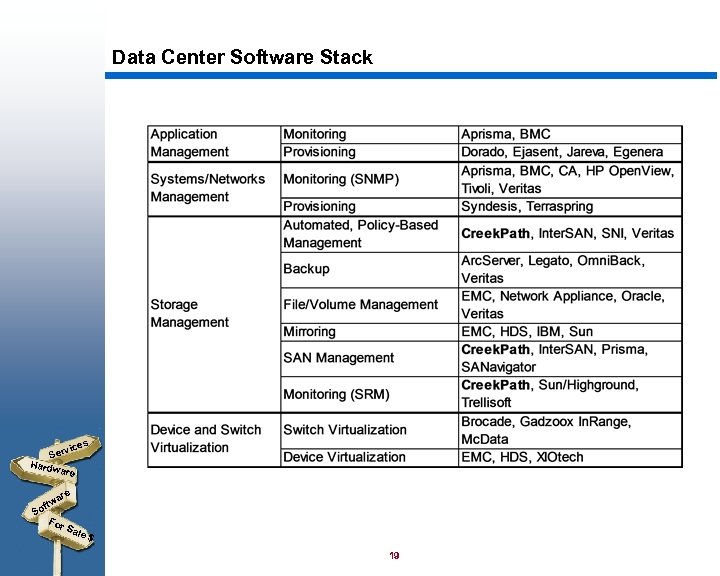

Data Center Software Stack s vice Ser Hardw are ftw So For Sal e$ 19

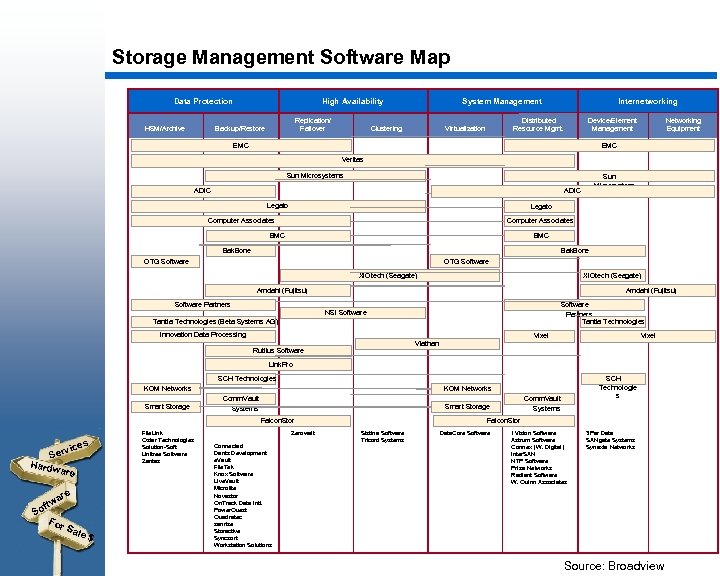

Storage Management Software Map Data Protection HSM/Archive High Availability Replication/ Failover Backup/Restore System Management Clustering Internetworking Distributed Resource Mgmt. Virtualization Device/Element Management EMC Networking Equipment EMC Veritas Sun Microsystem s ADIC Legato Computer Associates BMC Bak. Bone OTG Software XIOtech (Seagate) Amdahl (Fujitsu) Software Partners Tantia Technologies NSI Software Tantia Technologies (Beta Systems AG) Innovation Data Processing Vixel Viathan Rutilus Software Vixel Link. Pro SCH Technologie s SCH Technologies KOM Networks Smart Storage KOM Networks Comm. Vault Systems Falcon. Stor es rvic Se Hardw are ftw So For Sal e$ File. Link Qstar Technologies Solution-Soft Unitree Software Zantaz Comm. Vault Systems Smart Storage Zerowait Connected Dantz Development e. Vault File. Tek Knox Software Live. Vault Microlite Novastor On. Track Data Intl. Power. Quest Quadratec sanrise Storactive Syncsort Workstation Solutions Falcon. Stor Sistina Software Tricord Systems 20 Data. Core Software 1 Vision Software Astrum Software Connex (W. Digital) Inter. SAN NTP Software Prisa Networks Radiant Software W. Quinn Associates 3 Par Data SANgate Systems Synaxia Networks Source: Broadview

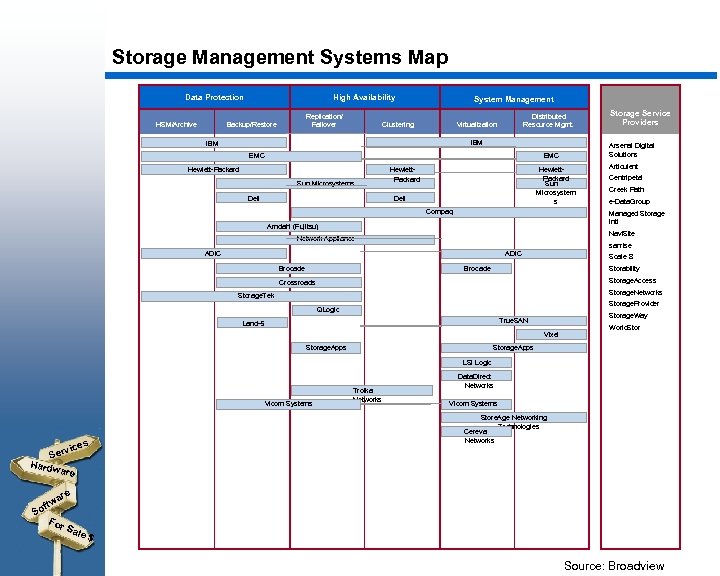

Storage Management Systems Map Data Protection HSM/Archive High Availability Replication/ Failover Backup/Restore System Management Clustering Distributed Resource Mgmt. Virtualization IBM EMC Arsenal Digital Solutions EMC Hewlett-Packard Sun Microsystems Dell Hewlett. Packard Sun Microsystem s Hewlett. Packard Dell Compaq Storage Service Providers Articulent Centripetal Creek Path e-Data. Group Managed Storage Intl Amdahl (Fujitsu) Navi. Site Network Appliance sanrise ADIC Brocade Scale 8 Brocade Storability Storage. Access Crossroads Storage. Networks Storage. Tek Storage. Provider QLogic Storage. Way True. SAN Land-5 Vixel Storage. Apps World. Storage. Apps LSI Logic Vicom Systems Data. Direct Networks Troika Networks Vicom Systems Store. Age Networking Technologies Cereva Networks s vice Ser Hardw are ftw So For Sal e$ 21 Source: Broadview

Systems - Servers s vice Ser Hardw are ftw So For Sal e$ 22

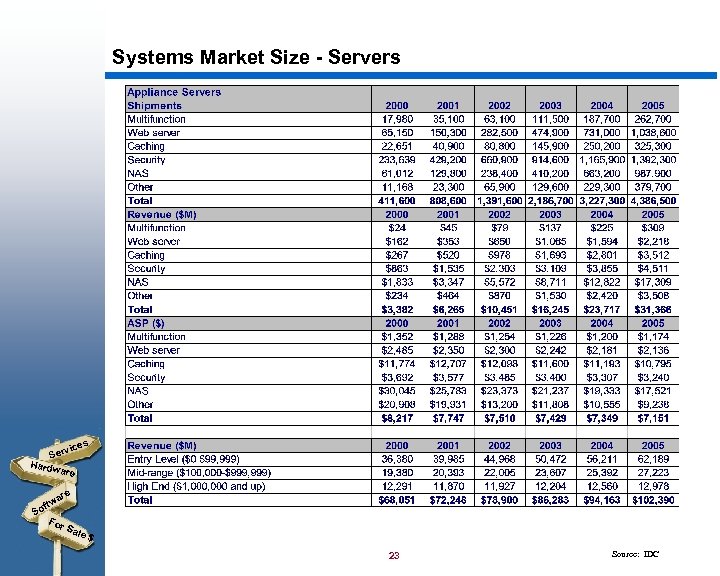

Systems Market Size - Servers s vice Ser Hardw are ftw So For Sal e$ 23 Source: IDC

Emerging Technologie s Virtual Directions in Servers Interface (VI) Blades Infini. Band Ø Modular architecture with server blades and switch-based server processing fabric Ø Cluster servers emerge – clustering supports flexible computing through the use of many servers, arranged in “tiers, ” in Internet-style computing infrastructure – server “nodes” ensure capacity as workloads scale up in size, and as user communities grow – clusters will evolve over the next few years, creating opportunities for advanced clustering software, management software, hardware interconnects and servers Clusters Ø Solution bundling with servers s vice Ser Hardw are ftw So For Sal e$ 24

Systems - Switch Fabrics s vice Ser Hardw are ftw So For Sal e$ 25

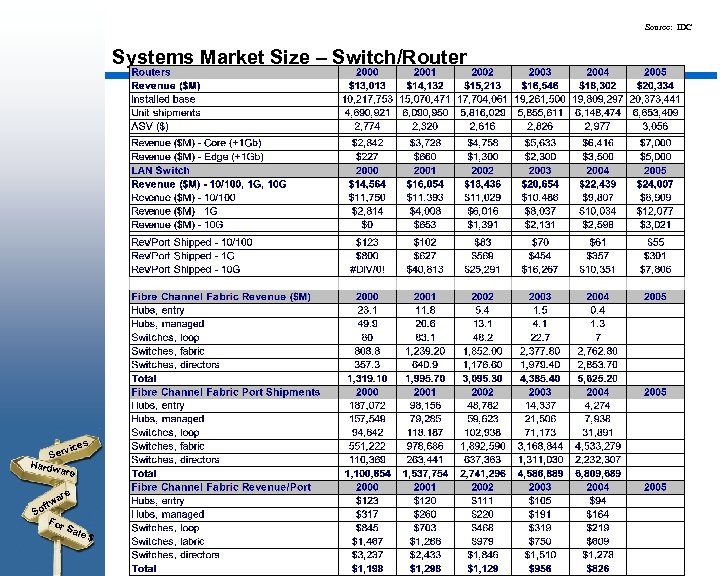

Source: IDC Systems Market Size – Switch/Router s vice Ser Hardw are ftw So For Sal e$ 26

Emerging Technologi es Virtualizati on i. SCSI, Storage Over IP Infini. Band Server-Less Backup Directions in Switch Fabrics Ø Multi-protocol support is required Ø Support for NAS and SAN solutions will be required Ø Port densities will increase in order to flatten SAN architectures Ø Fabrics are trending to increased intelligence and throughput (stand alone functionality will be incorporated into switch fabrics – – – Quality of Service (Qo. S) attributes System Instrumentation Real time volume mapping and load balancing Virtualization Protocol translation Ø Ø are ftw So For Sal e$ SANs currently remain dedicated to a single application due to concerns regarding availability, security, and performance. Ø s vice Ser Hardw are Vendors may try to migrate storage management applications (replication, snap shot, back up, . . ) from host servers to file systems within intelligent fabrics. Currently dominated by Fibre Channel players, who are building partnerships to address IP onslaught. IP (i. SCSI) will emerge as an alternative to FC SANs in mid-tier markets that have not already implemented FC. 10 GE when available will begin to challenge FC at the high end. Ø Ø Software players looking to enter this layer via the virtualization and IP switching frontier HBA vendors facing commoditization – looking to differentiate with multi-protocol support and management capabilities. Infini. Band threatening existence and forcing design adaptation 27

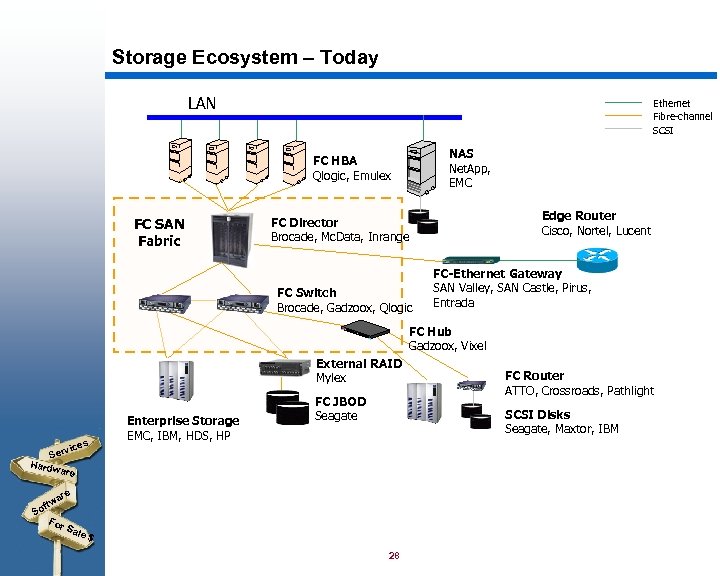

Storage Ecosystem – Today LAN Ethernet Fibre-channel SCSI NAS Net. App, EMC FC HBA Qlogic, Emulex FC SAN Fabric Edge Router Cisco, Nortel, Lucent FC Director Brocade, Mc. Data, Inrange FC Switch Brocade, Gadzoox, Qlogic FC-Ethernet Gateway SAN Valley, SAN Castle, Pirus, Entrada FC Hub Gadzoox, Vixel External RAID Mylex s vice Ser Hardw are Enterprise Storage EMC, IBM, HDS, HP FC JBOD Seagate FC Router ATTO, Crossroads, Pathlight SCSI Disks Seagate, Maxtor, IBM are ftw So For Sal e$ 28

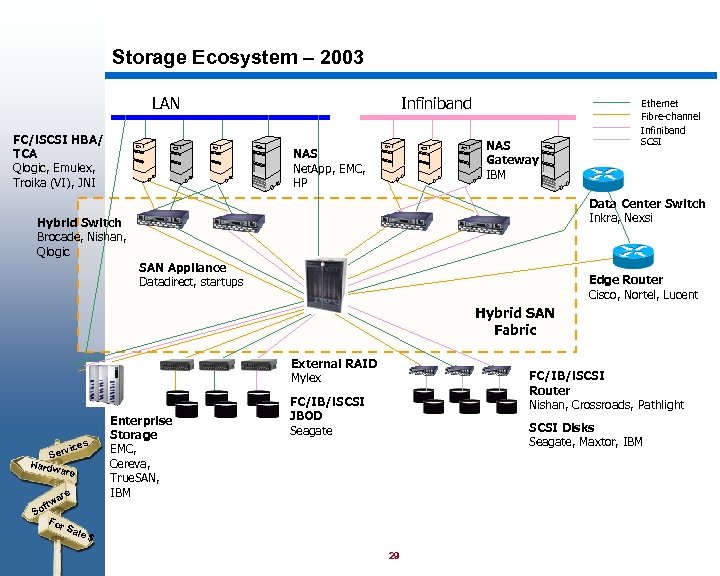

Storage Ecosystem – 2003 LAN FC/i. SCSI HBA/ TCA Qlogic, Emulex, Troika (VI), JNI Infiniband NAS Gateway IBM NAS Net. App, EMC, HP Ethernet Fibre-channel Infiniband SCSI Data Center Switch Inkra, Nexsi Hybrid Switch Brocade, Nishan, Qlogic SAN Appliance Datadirect, startups Edge Router Cisco, Nortel, Lucent Hybrid SAN Fabric External RAID Mylex s vice Ser Hardw are ftw So For Sal e$ Enterprise Storage EMC, Cereva, True. SAN, IBM FC/IB/i. SCSI Router Nishan, Crossroads, Pathlight FC/IB/i. SCSI JBOD Seagate SCSI Disks Seagate, Maxtor, IBM 29

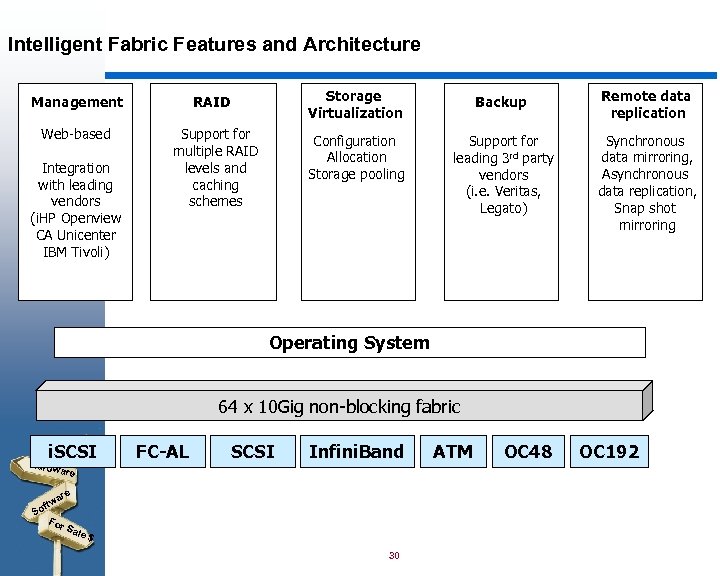

Intelligent Fabric Features and Architecture Management RAID Storage Virtualization Backup Remote data replication Web-based Support for multiple RAID levels and caching schemes Configuration Allocation Storage pooling Support for leading 3 rd party vendors (i. e. Veritas, Legato) Synchronous data mirroring, Asynchronous data replication, Snap shot mirroring Integration with leading vendors (i. HP Openview CA Unicenter IBM Tivoli) Operating System 64 x 10 Gig non-blocking fabric es vic i. SCSI Ser Hardw a FC-AL SCSI Infini. Band re are ftw So For Sal e$ 30 ATM OC 48 OC 192

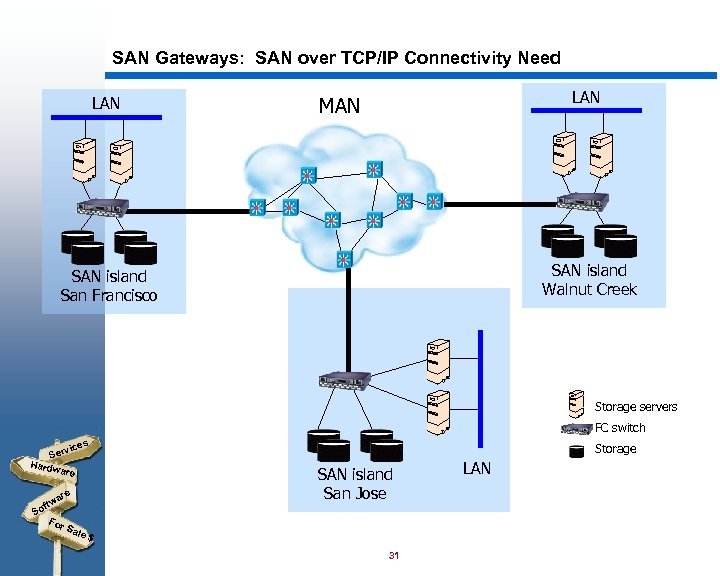

SAN Gateways: SAN over TCP/IP Connectivity Need LAN MAN SAN island Walnut Creek SAN island San Francisco Storage servers FC switch es rvic Se Hardw are ftw So For Sal e$ Storage SAN island San Jose 31 LAN

Storage Subsystems s vice Ser Hardw are ftw So For Sal e$ 32

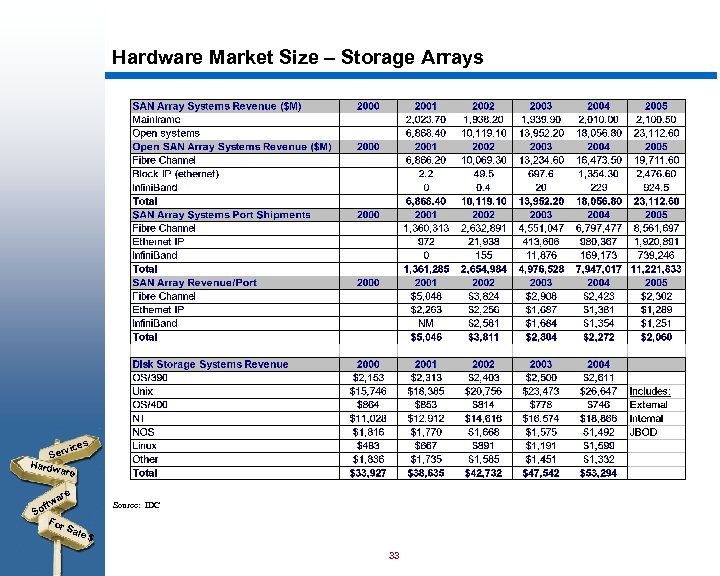

Hardware Market Size – Storage Arrays s vice Ser Hardw are ftw So For Sal e$ Source: IDC 33

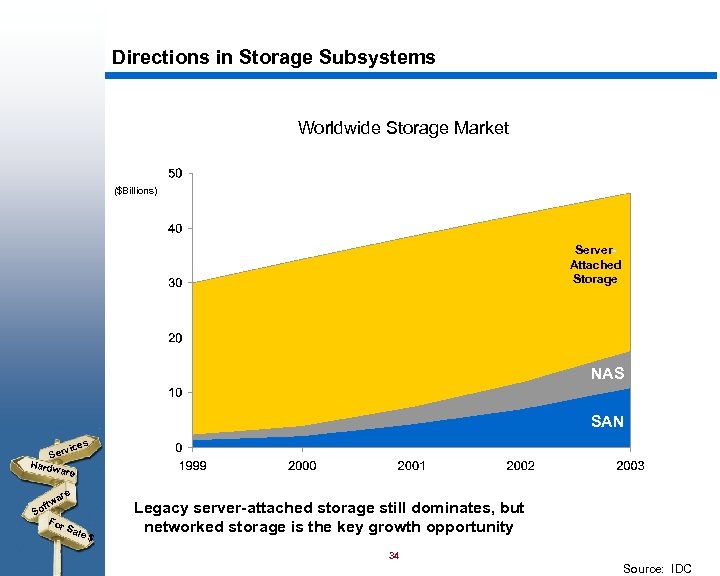

Directions in Storage Subsystems Worldwide Storage Market ($Billions) Server. Attached Storage NAS SAN s vice Ser Hardw are ftw So For Sal e$ Legacy server-attached storage still dominates, but networked storage is the key growth opportunity 34 Source: IDC

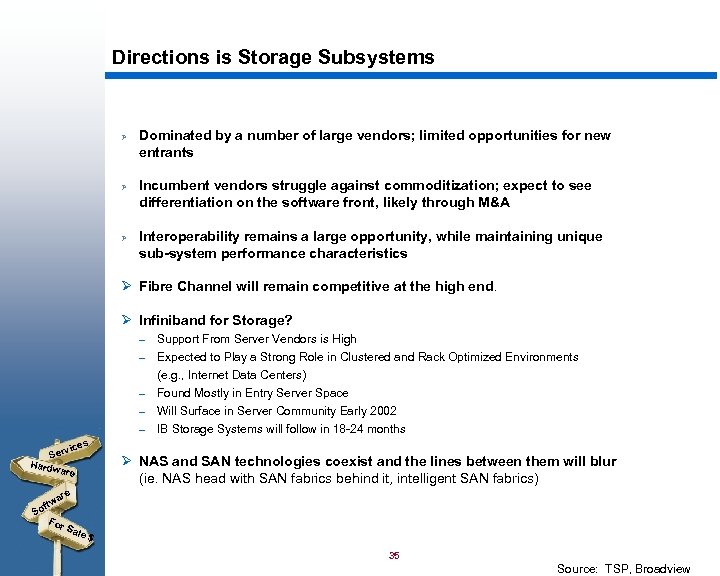

Directions is Storage Subsystems Ø Ø Ø Dominated by a number of large vendors; limited opportunities for new entrants Incumbent vendors struggle against commoditization; expect to see differentiation on the software front, likely through M&A Interoperability remains a large opportunity, while maintaining unique sub-system performance characteristics Ø Fibre Channel will remain competitive at the high end. Ø Infiniband for Storage? – Support From Server Vendors is High – Expected to Play a Strong Role in Clustered and Rack Optimized Environments (e. g. , Internet Data Centers) Found Mostly in Entry Server Space Will Surface in Server Community Early 2002 IB Storage Systems will follow in 18 -24 months – – – es rvic Se Hardw a re Ø NAS and SAN technologies coexist and the lines between them will blur (ie. NAS head with SAN fabrics behind it, intelligent SAN fabrics) are ftw So For Sal e$ 35 Source: TSP, Broadview

Components s vice Ser Hardw are ftw So For Sal e$ 36

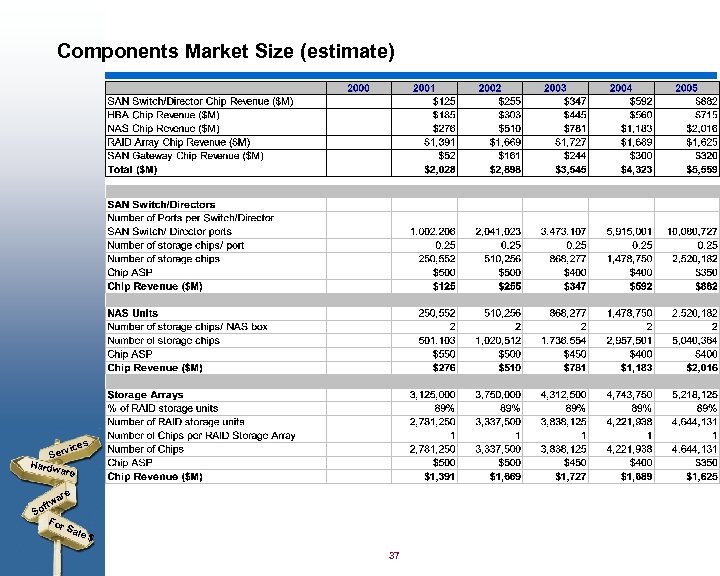

Components Market Size (estimate) s vice Ser Hardw are ftw So For Sal e$ 37

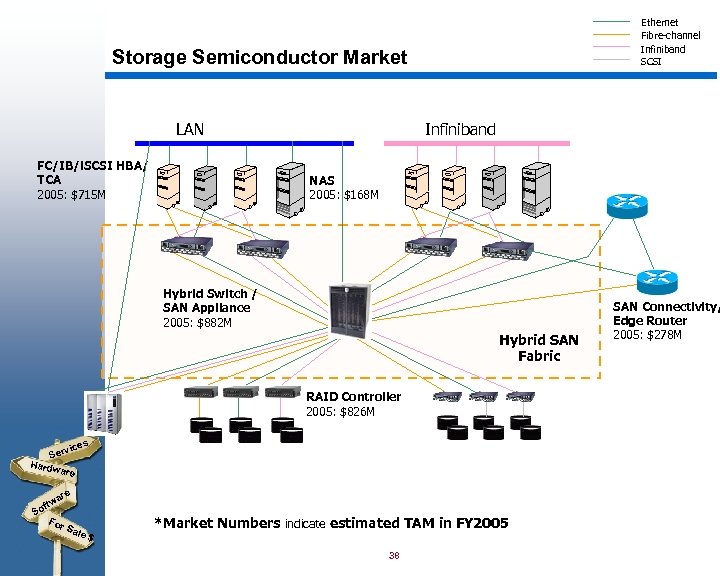

Ethernet Fibre-channel Infiniband SCSI Storage Semiconductor Market LAN FC/IB/i. SCSI HBA/ TCA 2005: $715 M Infiniband NAS 2005: $168 M Hybrid Switch / SAN Appliance 2005: $882 M Hybrid SAN Fabric RAID Controller 2005: $826 M s vice Ser Hardw are ftw So For Sal e$ *Market Numbers indicate estimated TAM in FY 2005 38 SAN Connectivity/ Edge Router 2005: $278 M

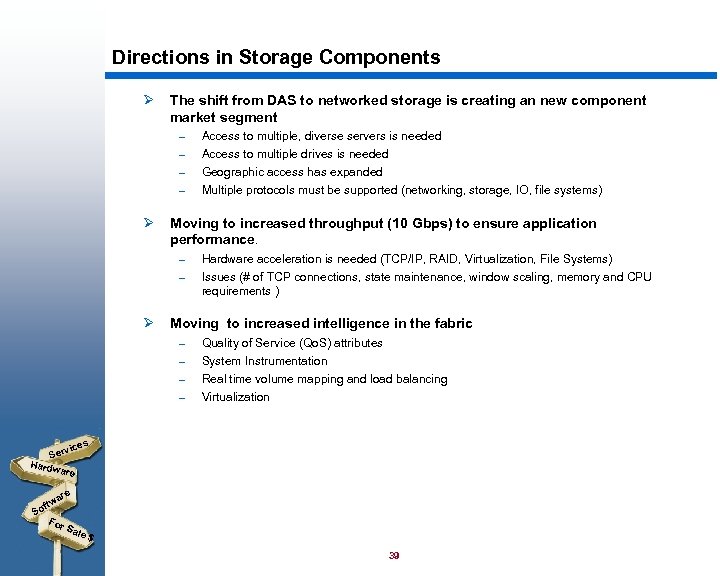

Directions in Storage Components Ø The shift from DAS to networked storage is creating an new component market segment – – Ø Access to multiple, diverse servers is needed Access to multiple drives is needed Geographic access has expanded Multiple protocols must be supported (networking, storage, IO, file systems) Moving to increased throughput (10 Gbps) to ensure application performance. – – Ø Hardware acceleration is needed (TCP/IP, RAID, Virtualization, File Systems) Issues (# of TCP connections, state maintenance, window scaling, memory and CPU requirements ) Moving to increased intelligence in the fabric – Quality of Service (Qo. S) attributes – System Instrumentation Real time volume mapping and load balancing Virtualization – – s vice Ser Hardw are ftw So For Sal e$ 39

Industry Status s vice Ser Hardw are ftw So For Sal e$ 40

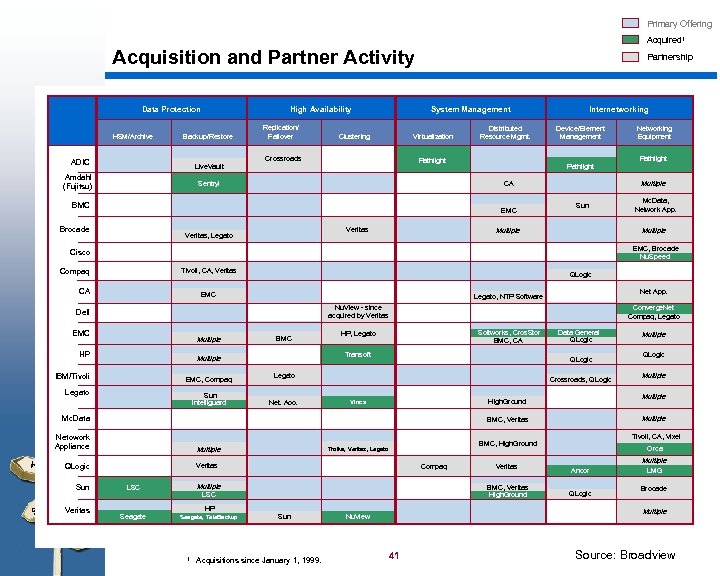

Primary Offering Acquired 1 Acquisition and Partner Activity Data Protection HSM/Archive High Availability Backup/Restore ADIC Live. Vault Amdahl (Fujitsu) Replication/ Failover Partnership System Management Clustering Virtualization Crossroads Distributed Resource Mgmt. EMC Veritas, Legato Multiple Sun EMC, Brocade Nu. Speed Compaq Tivoli, CA, Veritas CA QLogic EMC Nu. View - since acquired by Veritas EMC Multiple HP BMC EMC, Compaq Legato Sun Intelliguard Converge. Net Compaq, Legato Softworks, Cros. Stor BMC, CA HP, Legato Transoft Multiple IBM/Tivoli Legato Net. Aoo. Crossroads, QLogic v Ser Hardw QLogic are Multiple Veritas LSC Multiple LSC Seagate, Tele. Backup Compaq BMC, Veritas High. Ground HP 1 Veritas Sun Acquisitions since January 1, 1999. QLogic Multiple Tivoli, CA, Vixel BMC, High. Ground Troika, Veritas, Legato Multiple High. Ground Vinca BMC, Veritas Netowork Appliance ices ft Veritas For Sal e$ Data General QLogic Mc. Data So Net App. Legato, NTP Software Dell Sun Mc. Data, Network App. Multiple Cisco re wa Networking Equipment Pathlight CA BMC Brocade Device/Element Management Pathlight Sentryl Internetworking Orca Ancor QLogic Multiple LMG Brocade Multiple Nu. View 41 Source: Broadview

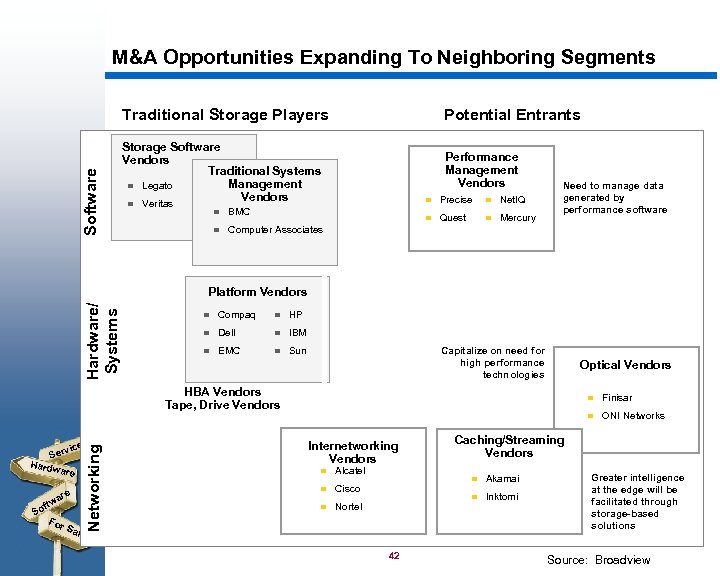

M&A Opportunities Expanding To Neighboring Segments Software Traditional Storage Players Potential Entrants Storage Software Vendors Traditional Systems Management g Legato Vendors Performance Management Vendors g Veritas BMC g Precise g Net. IQ g g g Quest g Mercury Need to manage data generated by performance software Computer Associates Hardware/ Systems Platform Vendors g Compaq g HP g Dell g IBM g EMC g Sun Capitalize on need for high performance technologies Optical Vendors HBA Vendors Tape, Drive Vendors Hardw a re Networking es are ftw So For Sal e$ Internetworking Vendors g Alcatel g Cisco g Nortel ONI Networks Caching/Streaming Vendors g Akamai g 42 Finisar g vic Ser g Inktomi Greater intelligence at the edge will be facilitated through storage-based solutions Source: Broadview

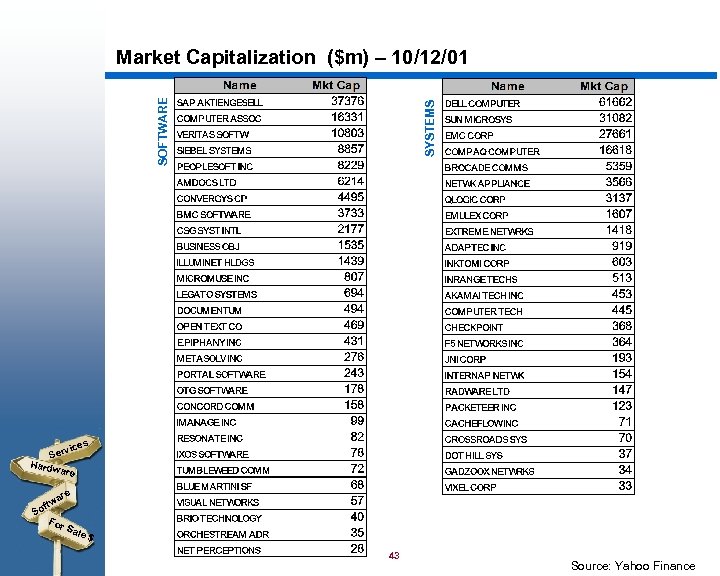

SYSTEMS SOFTWARE Market Capitalization ($m) – 10/12/01 s vice Ser Hardw are ftw So For Sal e$ 43 Source: Yahoo Finance

Recent Private Financings s vice Ser Hardw are ftw So For Sal e$ 44 Source: Venture. Source

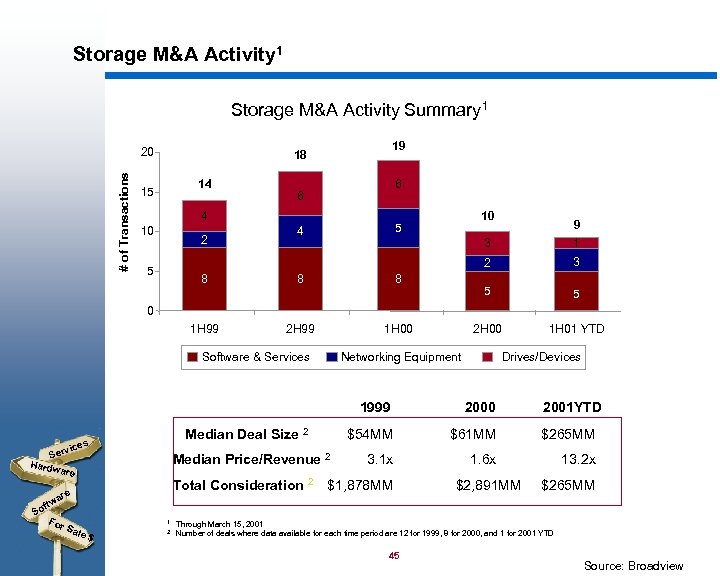

Storage M&A Activity 1 Storage M&A Activity Summary 1 # of Transactions 20 19 18 14 15 6 6 4 10 2 10 5 4 9 8 8 3 5 5 2 H 00 8 1 2 5 3 1 H 01 YTD 0 1 H 99 2 H 99 1 H 00 Software & Services Networking Equipment Drives/Devices 1999 Se Hardw a Median Price/Revenue 2 re Total Consideration 2 re wa ft For So Sal e$ $54 MM Median Deal Size 2 es rvic 1 2 2000 $61 MM $265 MM 3. 1 x 1. 6 x 13. 2 x $1, 878 MM $2, 891 MM 2001 YTD $265 MM Through March 15, 2001 Number of deals where data available for each time period are 12 for 1999, 8 for 2000, and 1 for 2001 YTD 45 Source: Broadview

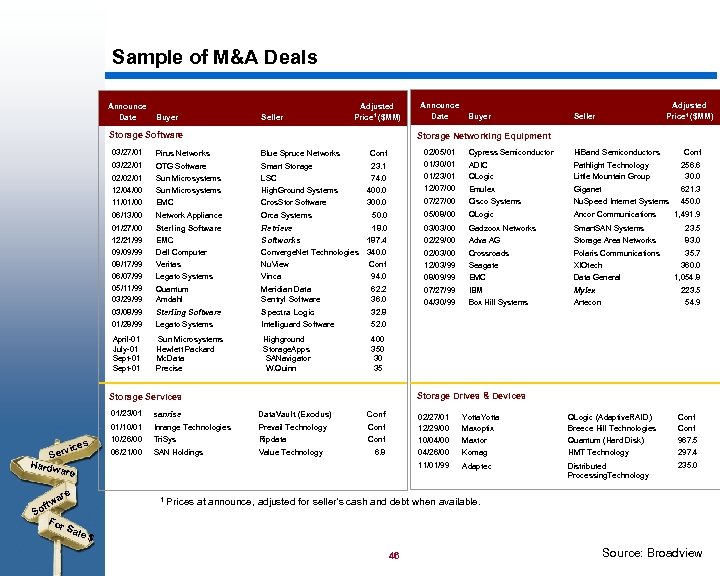

Sample of M&A Deals Announce Date Buyer Seller Adjusted Price 1 ($MM) Storage Software 03/27/01 Pirus Networks Announce Date Buyer Adjusted Price 1 ($MM) Seller Storage Networking Equipment Blue Spruce Networks Conf 02/05/01 Cypress Semiconductor Hi. Band Semiconductors 23. 1 01/30/01 01/23/01 ADIC QLogic Pathlight Technology Little Mountain Group 256. 6 30. 0 12/07/00 07/27/00 Emulex Cisco Systems Giganet Nu. Speed Internet Systems 621. 3 450. 0 03/22/01 OTG Software Smart Storage 02/02/01 12/04/00 11/01/00 Sun Microsystems EMC LSC High. Ground Systems Cros. Stor Software 06/13/00 Network Appliance Orca Systems 50. 0 05/08/00 QLogic Ancor Communications 01/27/00 12/21/99 Sterling Software EMC Retrieve Softworks 18. 0 187. 4 03/03/00 Gadzoox Networks Smart. SAN Systems 23. 5 02/29/00 Adva AG Storage Area Networks 83. 0 09/09/99 08/17/99 Dell Computer Veritas Converge. Net Technologies Nu. View 340. 0 Conf 02/03/00 Crossroads Polaris Communications 12/03/99 Seagate XIOtech 06/07/99 Legato Systems Vinca 94. 0 08/09/99 EMC Data General 05/11/99 03/29/99 Quantum Amdahl Meridian Data Sentryl Software 62. 2 36. 0 07/27/99 IBM Mylex 04/30/99 Box Hill Systems Artecon 03/08/99 Sterling Software Spectra Logic 32. 8 01/28/99 Legato Systems Intelliguard Software 52. 0 April-01 July-01 Sept-01 Sun Microsystems Hewlett Packard Mc. Data Precise Highground Storage. Apps SANavigator W. Quinn 400 350 30 35 74. 0 400. 0 300. 0 01/23/01 sanrise Data. Vault (Exodus) Conf 01/10/01 es Inrange Technologies Conf 10/26/00 Tri. Sys Prevail Technology Ripdata 1, 054. 8 223. 5 54. 9 06/21/00 SAN Holdings Value Technology Conf 02/27/01 12/29/00 10/04/00 Yotta Maxoptix Maxtor QLogic (Adaptive. RAID) Breece Hill Technologies Quantum (Hard Disk) Conf 967. 5 6. 8 04/26/00 Komag HMT Technology 297. 4 11/01/99 Adaptec Distributed Processing. Technology 235. 0 Hardw a re are ftw So For Sal e$ 35. 7 360. 0 Storage Drives & Devices Storage Services vic Ser 1, 491. 9 1 Prices at announce, adjusted for seller’s cash and debt when available. 46 Source: Broadview

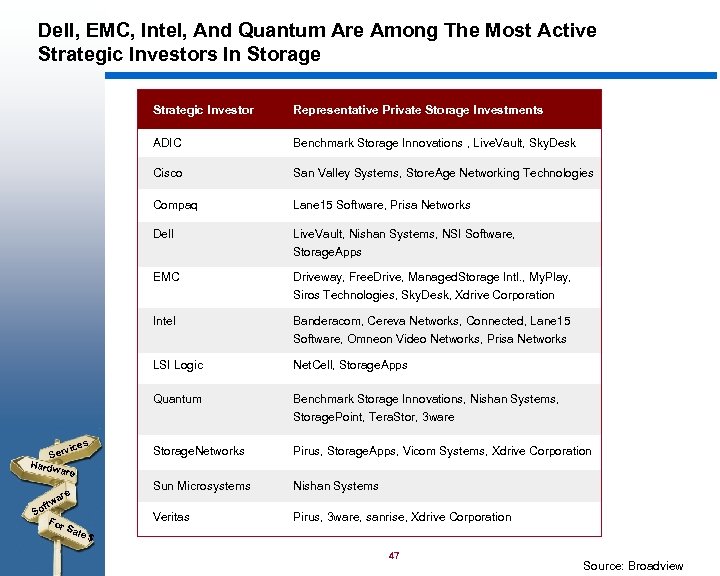

Dell, EMC, Intel, And Quantum Are Among The Most Active Strategic Investors In Storage Strategic Investor ADIC Driveway, Free. Drive, Managed. Storage Intl. , My. Play, Siros Technologies, Sky. Desk, Xdrive Corporation Intel Banderacom, Cereva Networks, Connected, Lane 15 Software, Omneon Video Networks, Prisa Networks LSI Logic Net. Cell, Storage. Apps Quantum Sal e$ Live. Vault, Nishan Systems, NSI Software, Storage. Apps EMC ft For Lane 15 Software, Prisa Networks Dell So San Valley Systems, Store. Age Networking Technologies Compaq re wa Benchmark Storage Innovations , Live. Vault, Sky. Desk Cisco s vice Ser Hardw are Representative Private Storage Investments Benchmark Storage Innovations, Nishan Systems, Storage. Point, Tera. Stor, 3 ware Storage. Networks Pirus, Storage. Apps, Vicom Systems, Xdrive Corporation Sun Microsystems Nishan Systems Veritas Pirus, 3 ware, sanrise, Xdrive Corporation 47 Source: Broadview

9298cf648fa3fa1a5c276feaadcd8a2c.ppt