cd3791b962bbc346f7aeb0bb6535da40.ppt

- Количество слайдов: 22

Investment Saskatchewan The Newest Commercial Crown Janet Wightman November 15, 2005

Investment Saskatchewan The Newest Commercial Crown Janet Wightman November 15, 2005

Investment Saskatchewan • Commercial Crown operating at arms-length from Gov’t. • Capital available for investments in SK businesses • Client focus by adding value to investee company 3 C’s

Investment Saskatchewan • Commercial Crown operating at arms-length from Gov’t. • Capital available for investments in SK businesses • Client focus by adding value to investee company 3 C’s

Overview Investment Saskatchewan Commercial Crown Capital for Investments Client-Focus

Overview Investment Saskatchewan Commercial Crown Capital for Investments Client-Focus

The Gap • GDP growth of 3% in 2004 projected 2. 6% in 2005/2006 • VC activity up 37% in Western Canada • $ 28 million disbursed to 17 SK companies • 21% increase • 2. 9% of deals in Canada • 1. 6% of total Canadian VC dollars invested in SK • Focus on life sciences and traditional sectors • LSVCC account for most VC backing • Local funds typically do smaller deals (<$3 -4 million) Without public capital an equity financing gap exists.

The Gap • GDP growth of 3% in 2004 projected 2. 6% in 2005/2006 • VC activity up 37% in Western Canada • $ 28 million disbursed to 17 SK companies • 21% increase • 2. 9% of deals in Canada • 1. 6% of total Canadian VC dollars invested in SK • Focus on life sciences and traditional sectors • LSVCC account for most VC backing • Local funds typically do smaller deals (<$3 -4 million) Without public capital an equity financing gap exists.

A New Commercial Crown • Created in September 2003 to: • • • Independent private sector board mandated to make decisions at arms-length on: • • invest public capital to encourage economic activity and separate decision making from political system investments/divestments management investment management model Challenge is to balance: • • commercial operations and return shareholder expectations on public policy Unique in its governance structure

A New Commercial Crown • Created in September 2003 to: • • • Independent private sector board mandated to make decisions at arms-length on: • • invest public capital to encourage economic activity and separate decision making from political system investments/divestments management investment management model Challenge is to balance: • • commercial operations and return shareholder expectations on public policy Unique in its governance structure

Mandate • Invest public capital in SK businesses on commercial terms • Leverage investments in order to encourage private sector investments • Achieve return commensurate with risk on new investments • Maximize return on existing portfolio • Seek private sector management of portfolio Focused Operating Mandate

Mandate • Invest public capital in SK businesses on commercial terms • Leverage investments in order to encourage private sector investments • Achieve return commensurate with risk on new investments • Maximize return on existing portfolio • Seek private sector management of portfolio Focused Operating Mandate

New Investments • Full Range of investments – Directly or – Through sub-manager • Direct Investments >$3 million – Equal terms with partners – 5 -7 year hold period – Prefer < 40% ownership • Channel other Investments through sub-managers: – Small or specialty niche investments – PFM, Westcap, Primaxis, Foragen, Western Life Sciences, PVF Covers full spectrum of capital needs

New Investments • Full Range of investments – Directly or – Through sub-manager • Direct Investments >$3 million – Equal terms with partners – 5 -7 year hold period – Prefer < 40% ownership • Channel other Investments through sub-managers: – Small or specialty niche investments – PFM, Westcap, Primaxis, Foragen, Western Life Sciences, PVF Covers full spectrum of capital needs

Evolution - A New Model • Board’s task was to determine best model for private sector management between: – Existing third party firm – Create investment management company • Open national competitive process involving >50 firms – RFP process completed - no award of contract for variety of reasons • Board is investigating creation of an employee owned IMC (e. g. Greystone): – – Better economics Mind and management in Saskatchewan Retention of expertise and existing investee relationships Add to the investment management industry in SK Outcome - unknown

Evolution - A New Model • Board’s task was to determine best model for private sector management between: – Existing third party firm – Create investment management company • Open national competitive process involving >50 firms – RFP process completed - no award of contract for variety of reasons • Board is investigating creation of an employee owned IMC (e. g. Greystone): – – Better economics Mind and management in Saskatchewan Retention of expertise and existing investee relationships Add to the investment management industry in SK Outcome - unknown

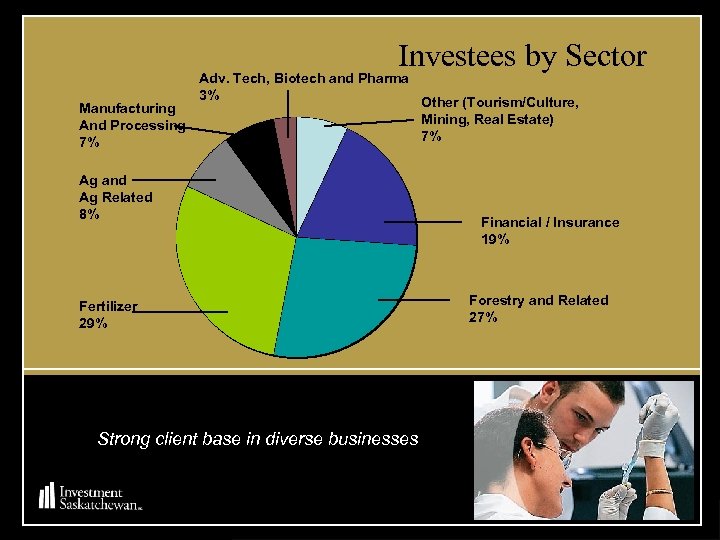

Investees by Sector Manufacturing And Processing 7% Adv. Tech, Biotech and Pharma 3% Ag and Ag Related 8% Fertilizer 29% Strong client base in diverse businesses Other (Tourism/Culture, Mining, Real Estate) 7% Financial / Insurance 19% Forestry and Related 27%

Investees by Sector Manufacturing And Processing 7% Adv. Tech, Biotech and Pharma 3% Ag and Ag Related 8% Fertilizer 29% Strong client base in diverse businesses Other (Tourism/Culture, Mining, Real Estate) 7% Financial / Insurance 19% Forestry and Related 27%

Direct Investments Beauval • Minds Eye Entertainment Ltd. . • Big Sky Farms Inc. • Pangaea Systems Inc. • Bioriginal • Premium Brands Inc. • Centennial Food Partnership • • Hypor Saskatchewan Valley Potato Corporation • • • Meadow Lake Pulp Limited Partnership • Meadow Lake OSB Limited Partnership • Canadian Western Bank • Great Western Brewing Co. Equity • Debt Properties • Sask. Ferco Products Inc. Solido • HARO Financial Corporation • Kitsaki/Zelensky Sawmill Various Our contribution is unique to each business

Direct Investments Beauval • Minds Eye Entertainment Ltd. . • Big Sky Farms Inc. • Pangaea Systems Inc. • Bioriginal • Premium Brands Inc. • Centennial Food Partnership • • Hypor Saskatchewan Valley Potato Corporation • • • Meadow Lake Pulp Limited Partnership • Meadow Lake OSB Limited Partnership • Canadian Western Bank • Great Western Brewing Co. Equity • Debt Properties • Sask. Ferco Products Inc. Solido • HARO Financial Corporation • Kitsaki/Zelensky Sawmill Various Our contribution is unique to each business

Partnering Through Fund-of-funds • Prairie Ventures Limited Partnership – Local fund currently $18. 25 million – fundraising mode • Foragen Technologies Limited Partnership – National early stage Ag biotech – growing value & planning exits Western Life Sciences Ventures Fund Limited Partnership – Western early stage life sciences – growing value & planning exits • Primaxis Technology Ventures Incorporated – National early stage advanced technologies – growing value & exits • WTC/PCF Outsource Contracts – Small investments (< $3 million)- original book $20 m – now <$10 m – Primarily economic development driven investments – Mandate to maximize returns & liquidate as appropriate Complements private sector investment capacity

Partnering Through Fund-of-funds • Prairie Ventures Limited Partnership – Local fund currently $18. 25 million – fundraising mode • Foragen Technologies Limited Partnership – National early stage Ag biotech – growing value & planning exits Western Life Sciences Ventures Fund Limited Partnership – Western early stage life sciences – growing value & planning exits • Primaxis Technology Ventures Incorporated – National early stage advanced technologies – growing value & exits • WTC/PCF Outsource Contracts – Small investments (< $3 million)- original book $20 m – now <$10 m – Primarily economic development driven investments – Mandate to maximize returns & liquidate as appropriate Complements private sector investment capacity

Overview Investment Saskatchewan Commercial Crown Capital for Investments Client-Focus

Overview Investment Saskatchewan Commercial Crown Capital for Investments Client-Focus

Available Capital • Annual allocation of $50 million for new investments – New capital generated from existing portfolio • $459 million assets pooled from previous programs – Each with different mandates (CIC III, SOCO, SEDCO) • Strong cash-flow – Mandate to be self-sustaining • No dependency on appropriation from shareholder – Except if additional capital required for large investment Existing portfolio throws off capital for new investments

Available Capital • Annual allocation of $50 million for new investments – New capital generated from existing portfolio • $459 million assets pooled from previous programs – Each with different mandates (CIC III, SOCO, SEDCO) • Strong cash-flow – Mandate to be self-sustaining • No dependency on appropriation from shareholder – Except if additional capital required for large investment Existing portfolio throws off capital for new investments

2004 Financials • Financials – $ 459 million portfolio reduced from $600 million – $ 19. 3 net income ($7 m budget) – $ 42 million dividend to shareholder (0 budget) – $ 125 million cash Strong portfolio performance

2004 Financials • Financials – $ 459 million portfolio reduced from $600 million – $ 19. 3 net income ($7 m budget) – $ 42 million dividend to shareholder (0 budget) – $ 125 million cash Strong portfolio performance

Historic Results • Since 1999 invested $93. 7 million in 8 new projects – levered $284 million of private sector capital • Since 2000 committed $54 million to 4 funds – levered additional $157 million in private sector funds • In 2002 outsourced management of small portfolio – valued at approximately $23 million • Forecast Returns – weighted average 3% IRR – not commercial rates of return

Historic Results • Since 1999 invested $93. 7 million in 8 new projects – levered $284 million of private sector capital • Since 2000 committed $54 million to 4 funds – levered additional $157 million in private sector funds • In 2002 outsourced management of small portfolio – valued at approximately $23 million • Forecast Returns – weighted average 3% IRR – not commercial rates of return

Portfolio Diversification • Restricted geographically therefore diversification is achieved through: • all sectors (forestry, agribusiness, advanced technology, IT, environmental technology, resource extraction & energy) • alll stages (early stage, start-up, expansion, mbo’s, turnarounds, succession) • all financing instruments (equity, common & preferred, sub-debt, mezz etc. ) Portfolio management through diversification

Portfolio Diversification • Restricted geographically therefore diversification is achieved through: • all sectors (forestry, agribusiness, advanced technology, IT, environmental technology, resource extraction & energy) • alll stages (early stage, start-up, expansion, mbo’s, turnarounds, succession) • all financing instruments (equity, common & preferred, sub-debt, mezz etc. ) Portfolio management through diversification

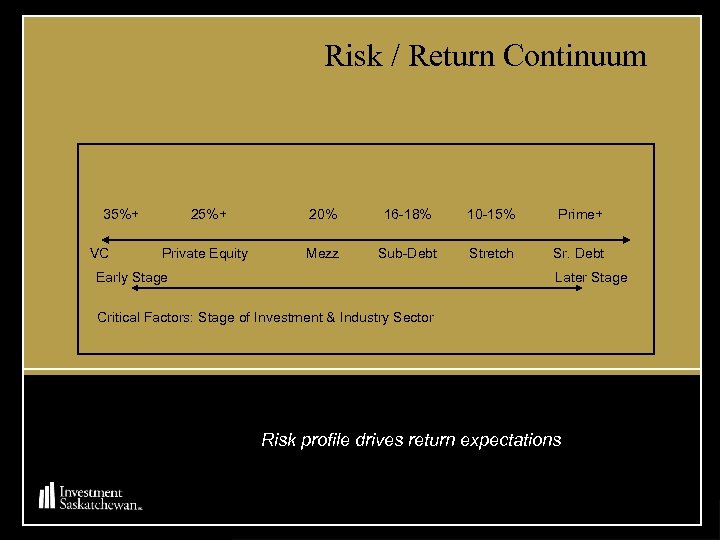

Risk / Return Continuum 35%+ VC 25%+ 20% 16 -18% 10 -15% Prime+ Private Equity Mezz Sub-Debt Stretch Sr. Debt Early Stage Later Stage Critical Factors: Stage of Investment & Industry Sector Risk profile drives return expectations

Risk / Return Continuum 35%+ VC 25%+ 20% 16 -18% 10 -15% Prime+ Private Equity Mezz Sub-Debt Stretch Sr. Debt Early Stage Later Stage Critical Factors: Stage of Investment & Industry Sector Risk profile drives return expectations

Overview Investment Saskatchewan Commercial Crown Capital for Investments Client Focus

Overview Investment Saskatchewan Commercial Crown Capital for Investments Client Focus

Focus on the Client • Objective is to grow investee companies – Over 5 -7 year average hold period • Active ownership contributes to growth of investee companies: – On boards and owners committees – With management teams in sharing expertise • • External Board appointees chosen for skills/domain expertise Strong network of strategic and joint venture partners Work in the best interests of investee companies In distress - workout for best return for shareholders Clients access resources which might otherwise be unavailable

Focus on the Client • Objective is to grow investee companies – Over 5 -7 year average hold period • Active ownership contributes to growth of investee companies: – On boards and owners committees – With management teams in sharing expertise • • External Board appointees chosen for skills/domain expertise Strong network of strategic and joint venture partners Work in the best interests of investee companies In distress - workout for best return for shareholders Clients access resources which might otherwise be unavailable

Differentiators • Strong knowledge of local market and business environments • Experienced, professional management • Best-in-class governance framework – Policies & investment guidelines – Due diligence, monitoring and reporting protocols – Quarterly valuation reviews and annual re-valuation (CVCA/EVCA standards) • Patient partner with long-term view • Risk adjusted return expectations – no one size fits all • Commercial terms and flexible to “tailor-fit” (e. g. puts/calls, buy -backs, etc. ) “Investment Saskatchewan will make decisions about future investment opportunities independent of the government” (Premier L. Calvert, September 2003)

Differentiators • Strong knowledge of local market and business environments • Experienced, professional management • Best-in-class governance framework – Policies & investment guidelines – Due diligence, monitoring and reporting protocols – Quarterly valuation reviews and annual re-valuation (CVCA/EVCA standards) • Patient partner with long-term view • Risk adjusted return expectations – no one size fits all • Commercial terms and flexible to “tailor-fit” (e. g. puts/calls, buy -backs, etc. ) “Investment Saskatchewan will make decisions about future investment opportunities independent of the government” (Premier L. Calvert, September 2003)

Key Points to Remember • Commercial Crown corporation – Independent private sector board with delegated authority • Capital - $50 million annually for new investments – Active partnerships and connections with other sources of capital • Client Focused – Growth objective – Active ownership in the best interests of investee company Saskatchewan is business friendly

Key Points to Remember • Commercial Crown corporation – Independent private sector board with delegated authority • Capital - $50 million annually for new investments – Active partnerships and connections with other sources of capital • Client Focused – Growth objective – Active ownership in the best interests of investee company Saskatchewan is business friendly