2de054ad4a44972965c0336c9fe09b3e.ppt

- Количество слайдов: 88

Investment Outlook 2001 Daniel Chan Managing Director & Chief Investment Officer UOB Asset Management Ltd.

Investment Outlook 2001 Daniel Chan Managing Director & Chief Investment Officer UOB Asset Management Ltd.

Investment Outlook 2001 Contents - What Happened in 2000 - The Issues in 2001 - Base Case Investment Scenario - Outlook & Strategy - Global Bonds - US Equities - European Equities - Japan Equities - Asia ex-Japan - Singapore - Conclusions

Investment Outlook 2001 Contents - What Happened in 2000 - The Issues in 2001 - Base Case Investment Scenario - Outlook & Strategy - Global Bonds - US Equities - European Equities - Japan Equities - Asia ex-Japan - Singapore - Conclusions

What Happened in 2000 1. Correction in the technology / telecom sector. 2. Tightening of US monetary policy. 3. Slowdown in US economy. 4. Sharp revision of corporate earnings. 5. The Euro “tanked”. 6. Spike in oil prices. 7. Asia equities did especially poorly.

What Happened in 2000 1. Correction in the technology / telecom sector. 2. Tightening of US monetary policy. 3. Slowdown in US economy. 4. Sharp revision of corporate earnings. 5. The Euro “tanked”. 6. Spike in oil prices. 7. Asia equities did especially poorly.

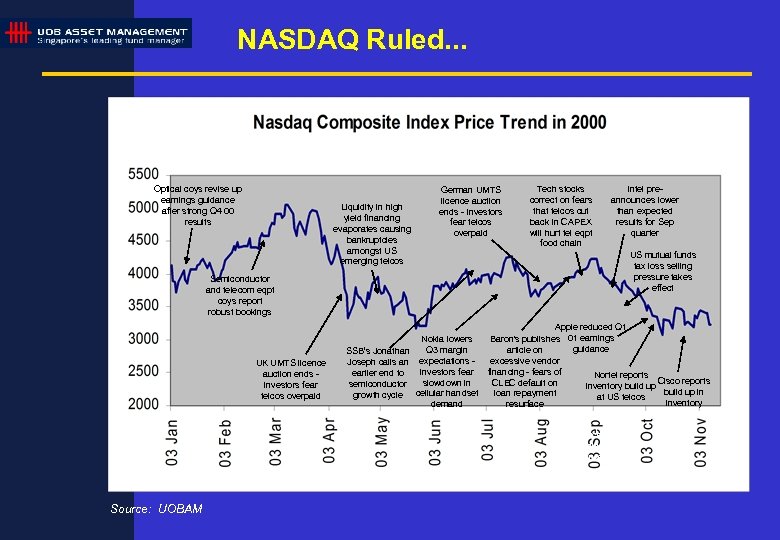

NASDAQ Ruled. . . Optical coys revise up earnings guidance after strong Q 4 00 results Liquidity in high yield financing evaporates causing bankruptcies amongst US emerging telcos German UMTS licence auction ends - investors fear telcos overpaid Tech stocks correct on fears that telcos cut back in CAPEX will hurt tel eqpt food chain Intel preannounces lower than expected results for Sep quarter US mutual funds tax loss selling pressure takes effect Semiconductor and telecom eqpt coys report robust bookings UK UMTS licence auction ends investors fear telcos overpaid Nokia lowers Q 3 margin SSB’s Jonathan Joseph calls an expectations investors fear earlier end to slowdown in semiconductor growth cycle cellular handset demand Apple reduced Q 1 Baron's publishes 01 earnings guidance article on excessive vendor financing - fears of Nortel reports Cisco reports CLEC default on inventory build up in loan repayment at US telcos inventory resurface Apple reduced Q 1 01 earnings guidance Source: UOBAM

NASDAQ Ruled. . . Optical coys revise up earnings guidance after strong Q 4 00 results Liquidity in high yield financing evaporates causing bankruptcies amongst US emerging telcos German UMTS licence auction ends - investors fear telcos overpaid Tech stocks correct on fears that telcos cut back in CAPEX will hurt tel eqpt food chain Intel preannounces lower than expected results for Sep quarter US mutual funds tax loss selling pressure takes effect Semiconductor and telecom eqpt coys report robust bookings UK UMTS licence auction ends investors fear telcos overpaid Nokia lowers Q 3 margin SSB’s Jonathan Joseph calls an expectations investors fear earlier end to slowdown in semiconductor growth cycle cellular handset demand Apple reduced Q 1 Baron's publishes 01 earnings guidance article on excessive vendor financing - fears of Nortel reports Cisco reports CLEC default on inventory build up in loan repayment at US telcos inventory resurface Apple reduced Q 1 01 earnings guidance Source: UOBAM

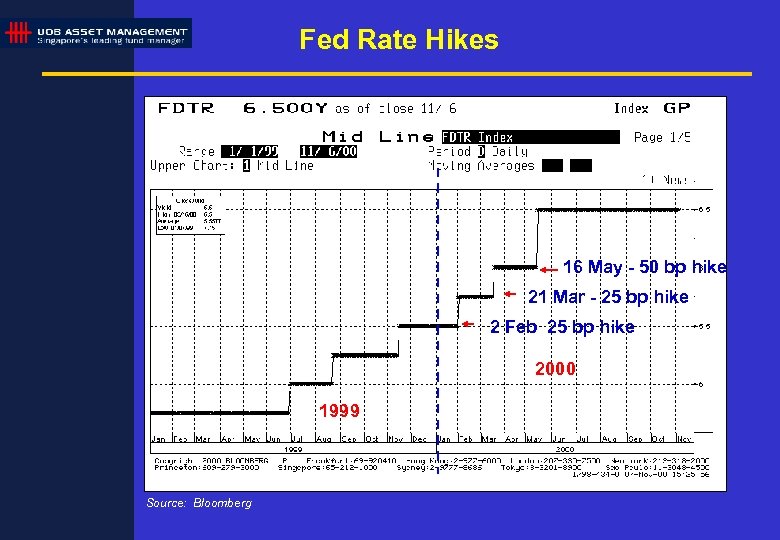

Fed Rate Hikes 16 May - 50 bp hike 21 Mar - 25 bp hike 2 Feb 25 bp hike 2000 1999 Source: Bloomberg

Fed Rate Hikes 16 May - 50 bp hike 21 Mar - 25 bp hike 2 Feb 25 bp hike 2000 1999 Source: Bloomberg

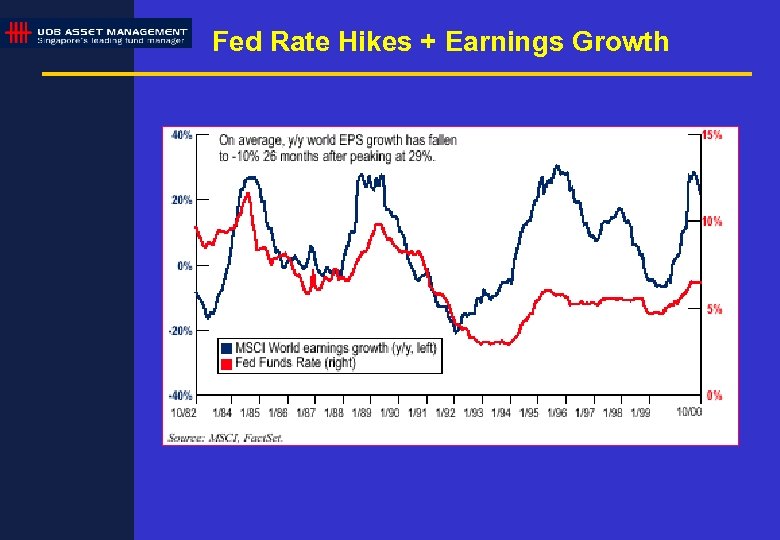

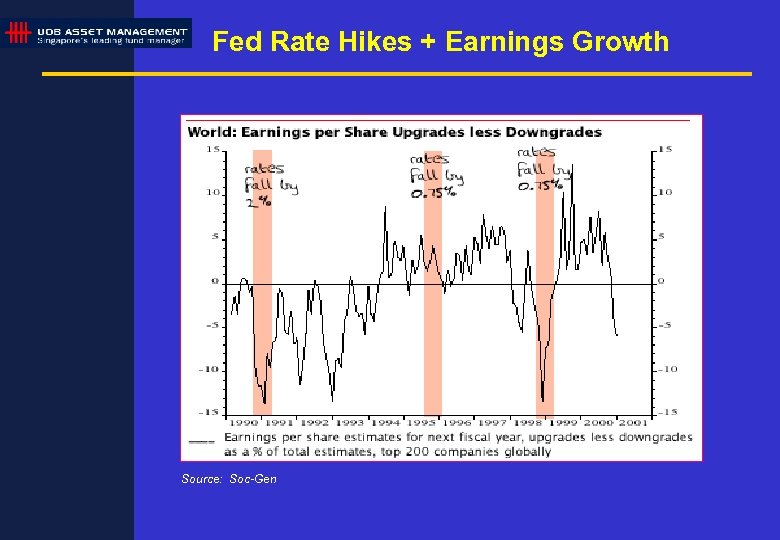

Fed Rate Hikes + Earnings Growth

Fed Rate Hikes + Earnings Growth

Fed Rate Hikes + Earnings Growth Source: Soc-Gen

Fed Rate Hikes + Earnings Growth Source: Soc-Gen

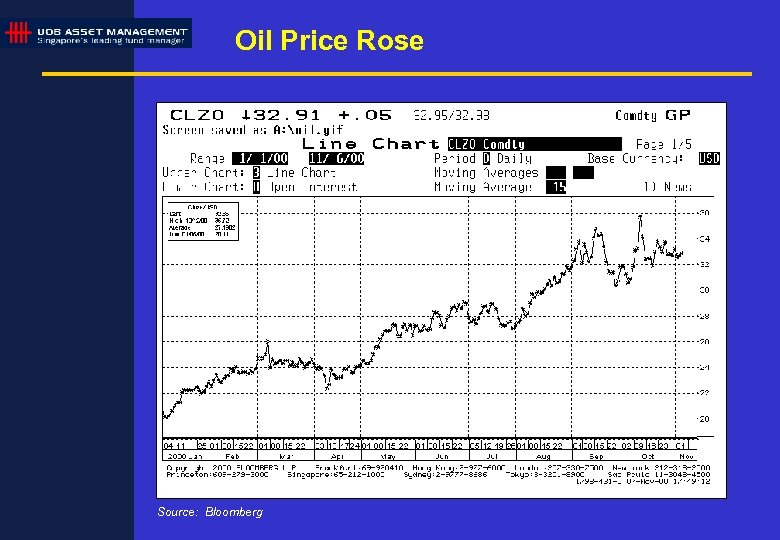

Oil Price Rose Source: Bloomberg

Oil Price Rose Source: Bloomberg

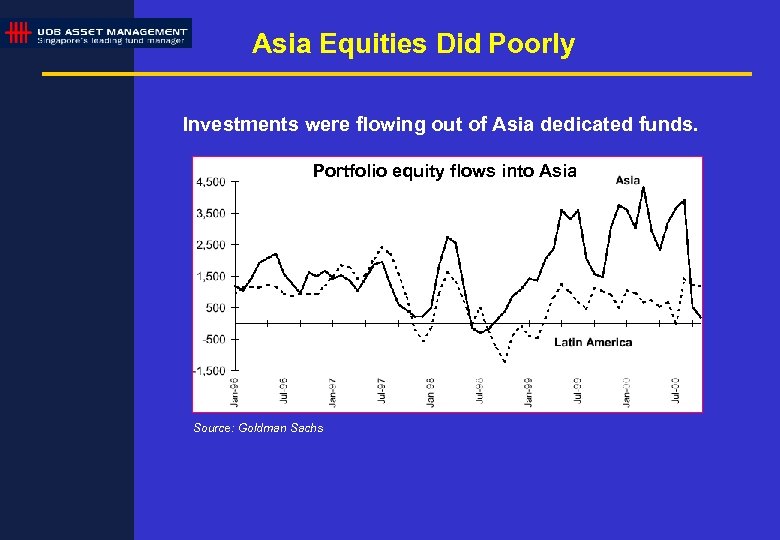

Asia Equities Did Poorly Investments were flowing out of Asia dedicated funds. Portfolio equity flows into Asia Source: Goldman Sachs

Asia Equities Did Poorly Investments were flowing out of Asia dedicated funds. Portfolio equity flows into Asia Source: Goldman Sachs

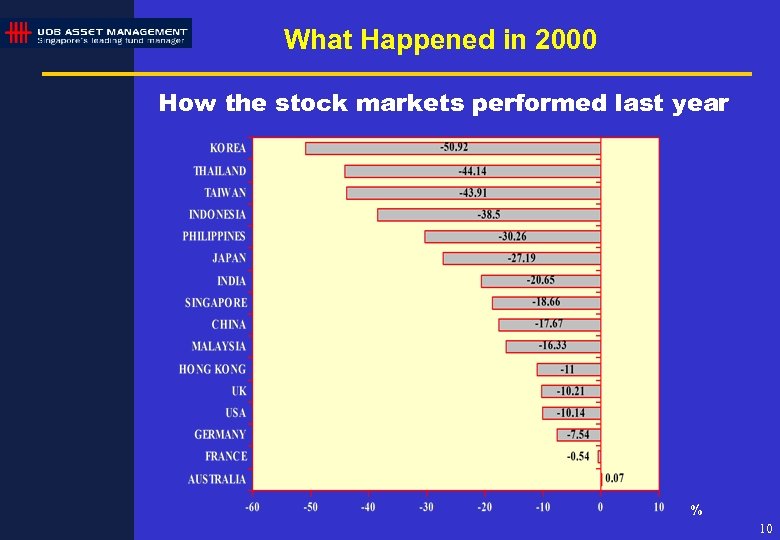

What Happened in 2000 How the stock markets performed last year % 10

What Happened in 2000 How the stock markets performed last year % 10

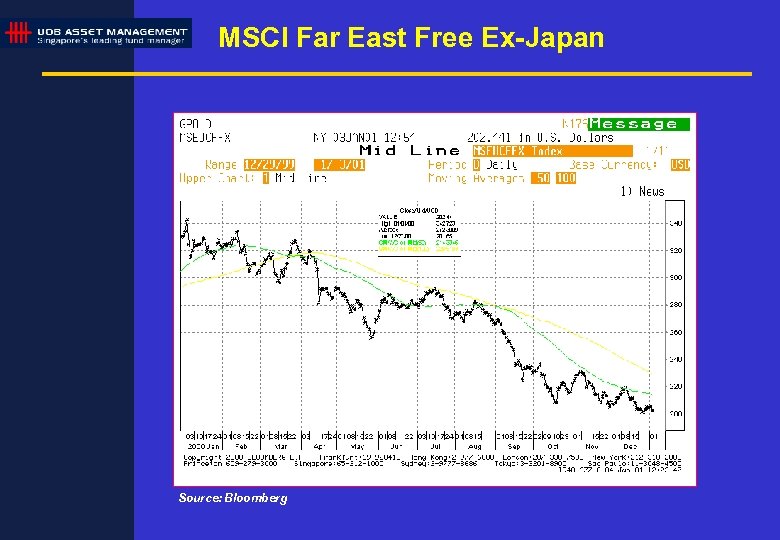

MSCI Far East Free Ex-Japan Source: Bloomberg

MSCI Far East Free Ex-Japan Source: Bloomberg

Investment Opportunities in 2001 Down markets create opportunities. . . Source: MSDW

Investment Opportunities in 2001 Down markets create opportunities. . . Source: MSDW

The Issues in 2001 - Will there be a hard landing ? - Have the TMT sectors bottomed ?

The Issues in 2001 - Will there be a hard landing ? - Have the TMT sectors bottomed ?

The Issues in 2001 Will there be a hard landing ? The case for : – Negative wealth effect – Investment boom (especially IT) over – Consumer is tapped out – Corporate debt build-up

The Issues in 2001 Will there be a hard landing ? The case for : – Negative wealth effect – Investment boom (especially IT) over – Consumer is tapped out – Corporate debt build-up

The Issues in 2001 Will there be a hard landing ? The case against : – Room for interest rate cuts – IT and other technological investment still needed in a fiercely competitive environment – Other policy options available (tax cuts, fiscal stimulus, US dollar weakens) – US economy remains highly competitive

The Issues in 2001 Will there be a hard landing ? The case against : – Room for interest rate cuts – IT and other technological investment still needed in a fiercely competitive environment – Other policy options available (tax cuts, fiscal stimulus, US dollar weakens) – US economy remains highly competitive

The Issues in 2001 For a HARD LANDING scenario to happen, these must happen: - Core inflation rises rapidly, preventing a relaxation of monetary policy, - Wage rise (labor costs) outstripping productivity growth, - Oil prices skyrocketing out of control, - Extreme risk aversion spreading to investment grade credits, - Occurrence of an unexpected and contagious event risk that results in confidence flight. Our conclusion is that the odds of this happening is smaller than that of a SOFT LANDING.

The Issues in 2001 For a HARD LANDING scenario to happen, these must happen: - Core inflation rises rapidly, preventing a relaxation of monetary policy, - Wage rise (labor costs) outstripping productivity growth, - Oil prices skyrocketing out of control, - Extreme risk aversion spreading to investment grade credits, - Occurrence of an unexpected and contagious event risk that results in confidence flight. Our conclusion is that the odds of this happening is smaller than that of a SOFT LANDING.

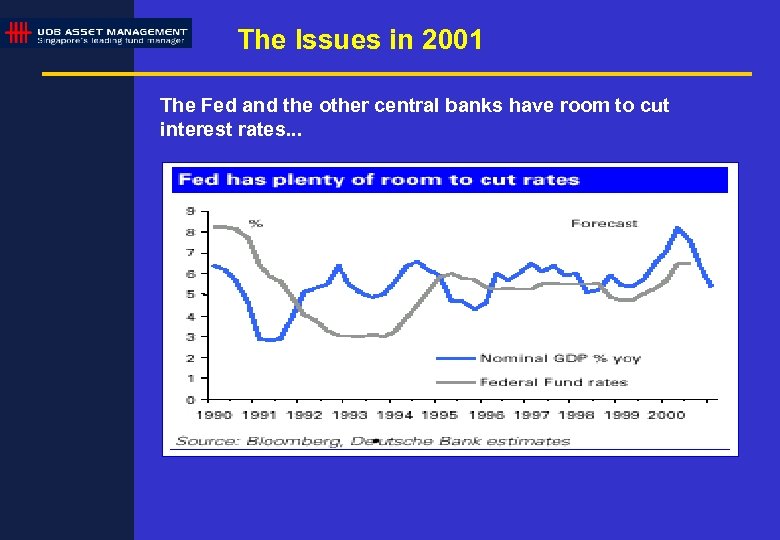

The Issues in 2001 The Fed and the other central banks have room to cut interest rates. . .

The Issues in 2001 The Fed and the other central banks have room to cut interest rates. . .

The Issues in 2001 Have the TMT sectors bottomed ?

The Issues in 2001 Have the TMT sectors bottomed ?

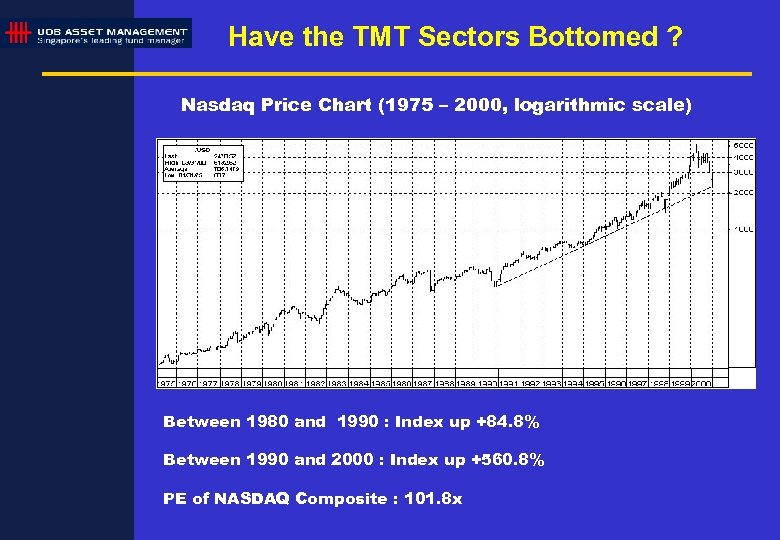

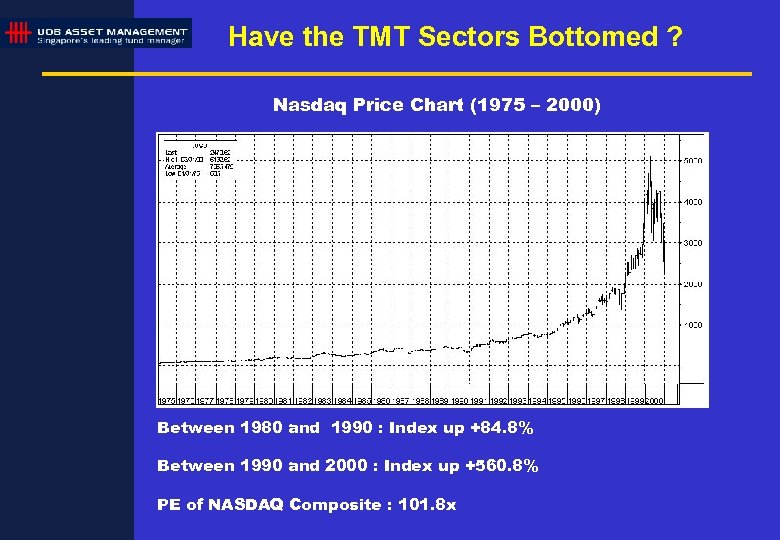

Have the TMT Sectors Bottomed ? Nasdaq Price Chart (1975 – 2000, logarithmic scale) Between 1980 and 1990 : Index up +84. 8% Between 1990 and 2000 : Index up +560. 8% PE of NASDAQ Composite : 101. 8 x

Have the TMT Sectors Bottomed ? Nasdaq Price Chart (1975 – 2000, logarithmic scale) Between 1980 and 1990 : Index up +84. 8% Between 1990 and 2000 : Index up +560. 8% PE of NASDAQ Composite : 101. 8 x

Have the TMT Sectors Bottomed ? Nasdaq Price Chart (1975 – 2000) Between 1980 and 1990 : Index up +84. 8% Between 1990 and 2000 : Index up +560. 8% PE of NASDAQ Composite : 101. 8 x

Have the TMT Sectors Bottomed ? Nasdaq Price Chart (1975 – 2000) Between 1980 and 1990 : Index up +84. 8% Between 1990 and 2000 : Index up +560. 8% PE of NASDAQ Composite : 101. 8 x

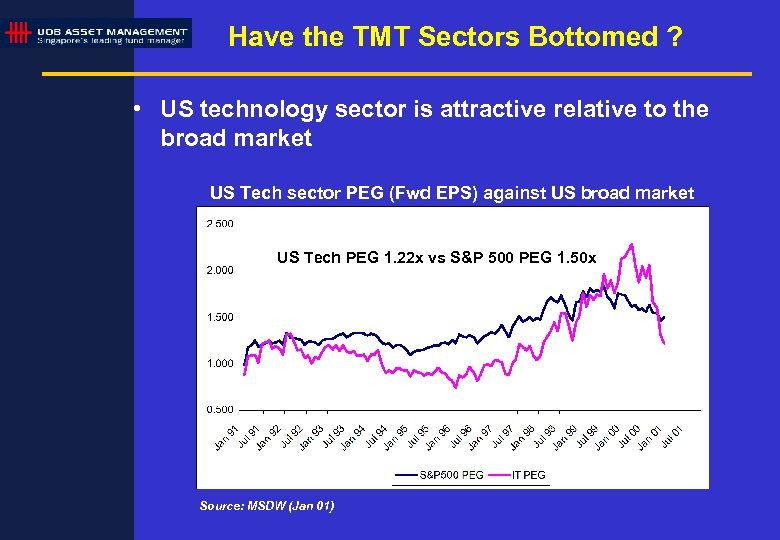

Have the TMT Sectors Bottomed ? • US technology sector is attractive relative to the broad market US Tech sector PEG (Fwd EPS) against US broad market US Tech PEG 1. 22 x vs S&P 500 PEG 1. 50 x Source: MSDW (Jan 01)

Have the TMT Sectors Bottomed ? • US technology sector is attractive relative to the broad market US Tech sector PEG (Fwd EPS) against US broad market US Tech PEG 1. 22 x vs S&P 500 PEG 1. 50 x Source: MSDW (Jan 01)

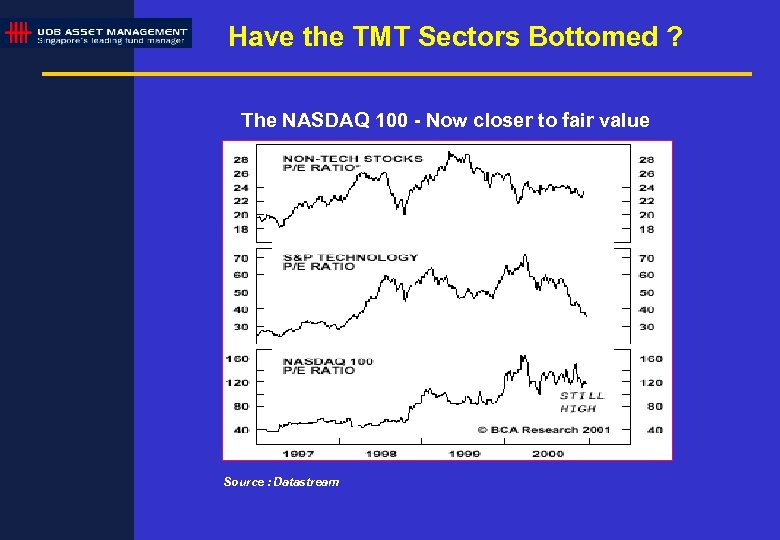

Have the TMT Sectors Bottomed ? The NASDAQ 100 - Now closer to fair value Source : Datastream

Have the TMT Sectors Bottomed ? The NASDAQ 100 - Now closer to fair value Source : Datastream

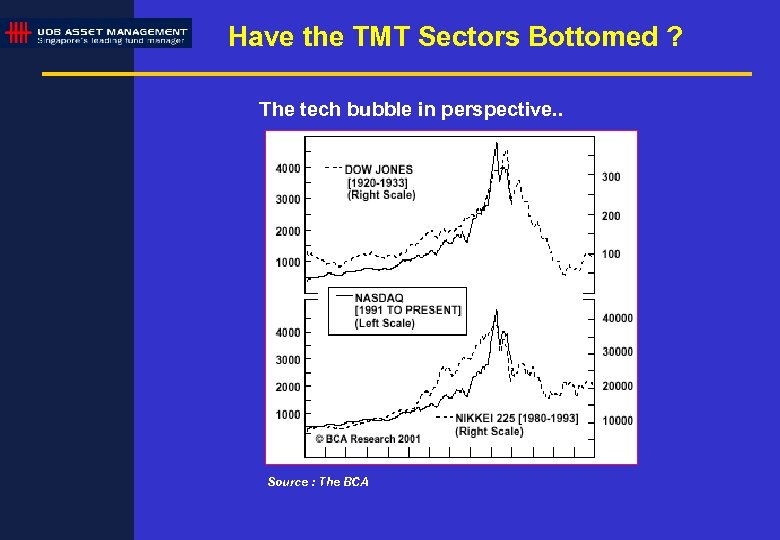

Have the TMT Sectors Bottomed ? The tech bubble in perspective. . Source : The BCA

Have the TMT Sectors Bottomed ? The tech bubble in perspective. . Source : The BCA

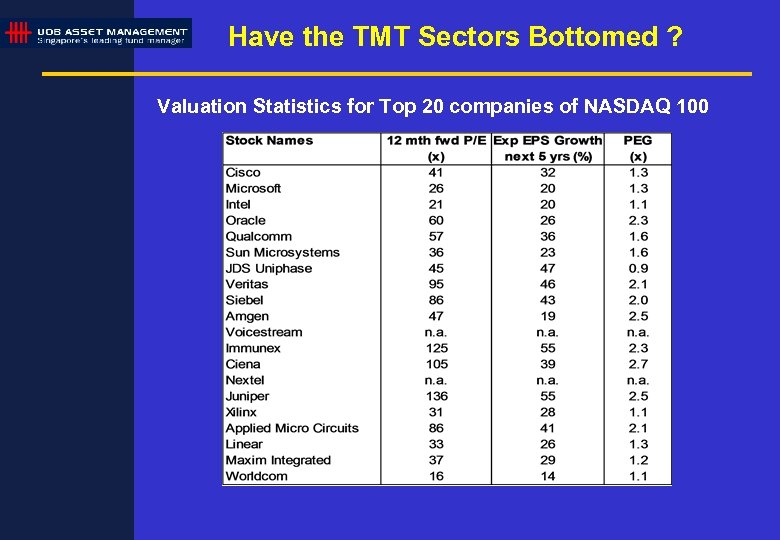

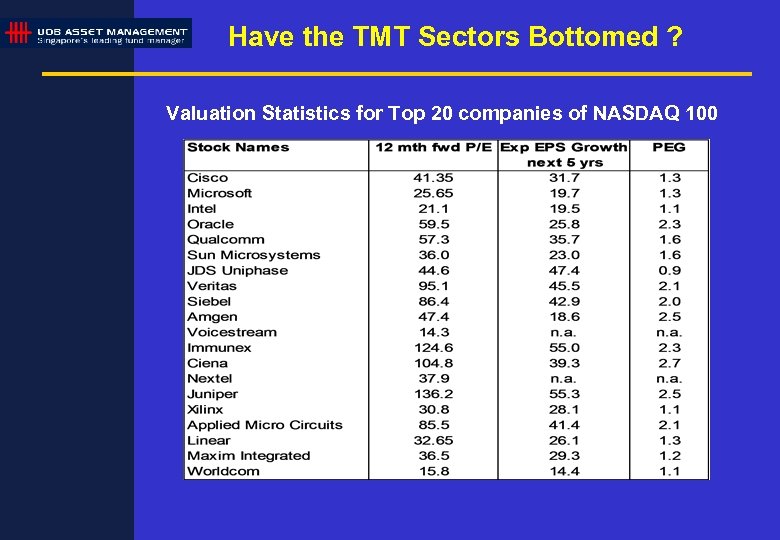

Have the TMT Sectors Bottomed ? Valuation Statistics for Top 20 companies of NASDAQ 100

Have the TMT Sectors Bottomed ? Valuation Statistics for Top 20 companies of NASDAQ 100

Have the TMT Sectors Bottomed ? Valuation Statistics for Top 20 companies of NASDAQ 100

Have the TMT Sectors Bottomed ? Valuation Statistics for Top 20 companies of NASDAQ 100

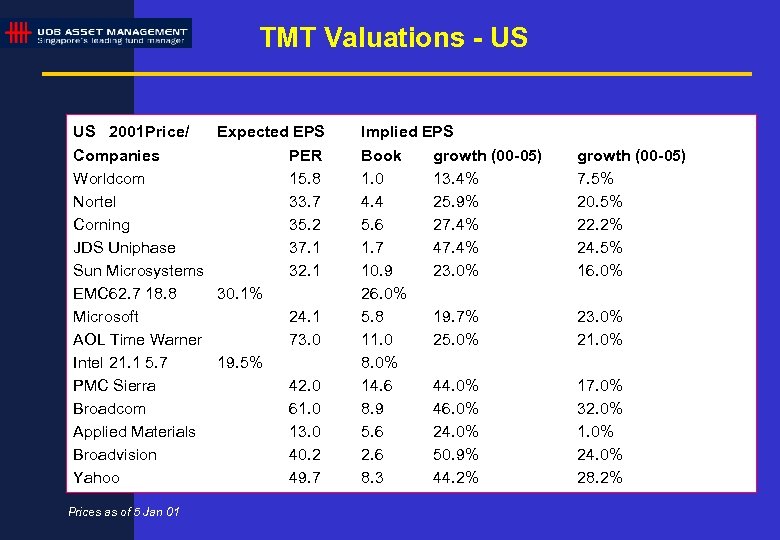

TMT Valuations - US US 2001 Price/ Expected EPS Companies PER Worldcom 15. 8 Nortel 33. 7 Corning 35. 2 JDS Uniphase 37. 1 Sun Microsystems 32. 1 EMC 62. 7 18. 8 30. 1% Microsoft 24. 1 AOL Time Warner 73. 0 Intel 21. 1 5. 7 19. 5% PMC Sierra 42. 0 Broadcom 61. 0 Applied Materials 13. 0 Broadvision 40. 2 Yahoo 49. 7 Prices as of 5 Jan 01 Implied EPS Book growth (00 -05) 1. 0 13. 4% 4. 4 25. 9% 5. 6 27. 4% 1. 7 47. 4% 10. 9 23. 0% 26. 0% 5. 8 19. 7% 11. 0 25. 0% 8. 0% 14. 6 44. 0% 8. 9 46. 0% 5. 6 24. 0% 2. 6 50. 9% 8. 3 44. 2% growth (00 -05) 7. 5% 20. 5% 22. 2% 24. 5% 16. 0% 23. 0% 21. 0% 17. 0% 32. 0% 1. 0% 24. 0% 28. 2%

TMT Valuations - US US 2001 Price/ Expected EPS Companies PER Worldcom 15. 8 Nortel 33. 7 Corning 35. 2 JDS Uniphase 37. 1 Sun Microsystems 32. 1 EMC 62. 7 18. 8 30. 1% Microsoft 24. 1 AOL Time Warner 73. 0 Intel 21. 1 5. 7 19. 5% PMC Sierra 42. 0 Broadcom 61. 0 Applied Materials 13. 0 Broadvision 40. 2 Yahoo 49. 7 Prices as of 5 Jan 01 Implied EPS Book growth (00 -05) 1. 0 13. 4% 4. 4 25. 9% 5. 6 27. 4% 1. 7 47. 4% 10. 9 23. 0% 26. 0% 5. 8 19. 7% 11. 0 25. 0% 8. 0% 14. 6 44. 0% 8. 9 46. 0% 5. 6 24. 0% 2. 6 50. 9% 8. 3 44. 2% growth (00 -05) 7. 5% 20. 5% 22. 2% 24. 5% 16. 0% 23. 0% 21. 0% 17. 0% 32. 0% 1. 0% 24. 0% 28. 2%

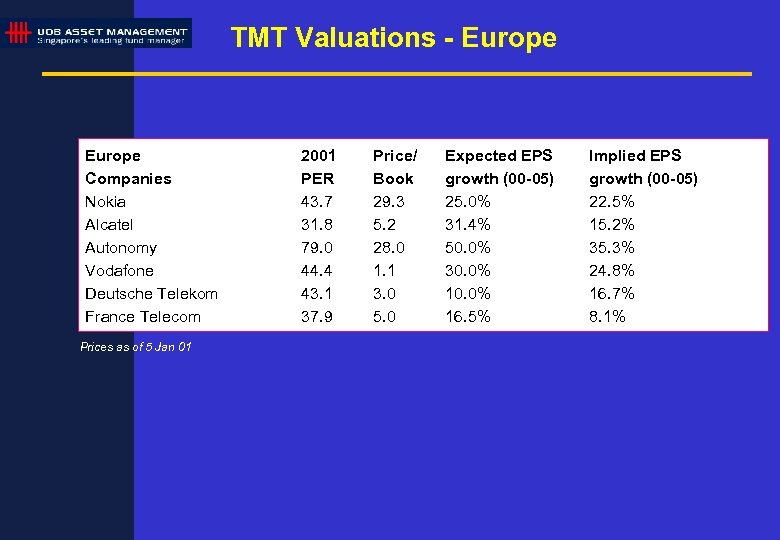

TMT Valuations - Europe Companies Nokia Alcatel Autonomy Vodafone Deutsche Telekom France Telecom Prices as of 5 Jan 01 2001 PER 43. 7 31. 8 79. 0 44. 4 43. 1 37. 9 Price/ Book 29. 3 5. 2 28. 0 1. 1 3. 0 5. 0 Expected EPS growth (00 -05) 25. 0% 31. 4% 50. 0% 30. 0% 16. 5% Implied EPS growth (00 -05) 22. 5% 15. 2% 35. 3% 24. 8% 16. 7% 8. 1%

TMT Valuations - Europe Companies Nokia Alcatel Autonomy Vodafone Deutsche Telekom France Telecom Prices as of 5 Jan 01 2001 PER 43. 7 31. 8 79. 0 44. 4 43. 1 37. 9 Price/ Book 29. 3 5. 2 28. 0 1. 1 3. 0 5. 0 Expected EPS growth (00 -05) 25. 0% 31. 4% 50. 0% 30. 0% 16. 5% Implied EPS growth (00 -05) 22. 5% 15. 2% 35. 3% 24. 8% 16. 7% 8. 1%

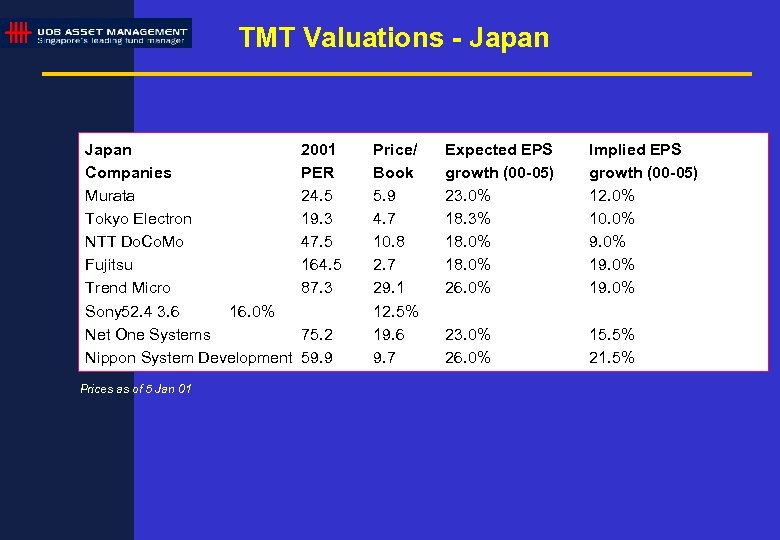

TMT Valuations - Japan Companies Murata Tokyo Electron NTT Do. Co. Mo Fujitsu Trend Micro Sony 52. 4 3. 6 16. 0% Net One Systems Nippon System Development Prices as of 5 Jan 01 2001 PER 24. 5 19. 3 47. 5 164. 5 87. 3 75. 2 59. 9 Price/ Book 5. 9 4. 7 10. 8 2. 7 29. 1 12. 5% 19. 6 9. 7 Expected EPS growth (00 -05) 23. 0% 18. 3% 18. 0% 26. 0% Implied EPS growth (00 -05) 12. 0% 10. 0% 9. 0% 19. 0% 23. 0% 26. 0% 15. 5% 21. 5%

TMT Valuations - Japan Companies Murata Tokyo Electron NTT Do. Co. Mo Fujitsu Trend Micro Sony 52. 4 3. 6 16. 0% Net One Systems Nippon System Development Prices as of 5 Jan 01 2001 PER 24. 5 19. 3 47. 5 164. 5 87. 3 75. 2 59. 9 Price/ Book 5. 9 4. 7 10. 8 2. 7 29. 1 12. 5% 19. 6 9. 7 Expected EPS growth (00 -05) 23. 0% 18. 3% 18. 0% 26. 0% Implied EPS growth (00 -05) 12. 0% 10. 0% 9. 0% 19. 0% 23. 0% 26. 0% 15. 5% 21. 5%

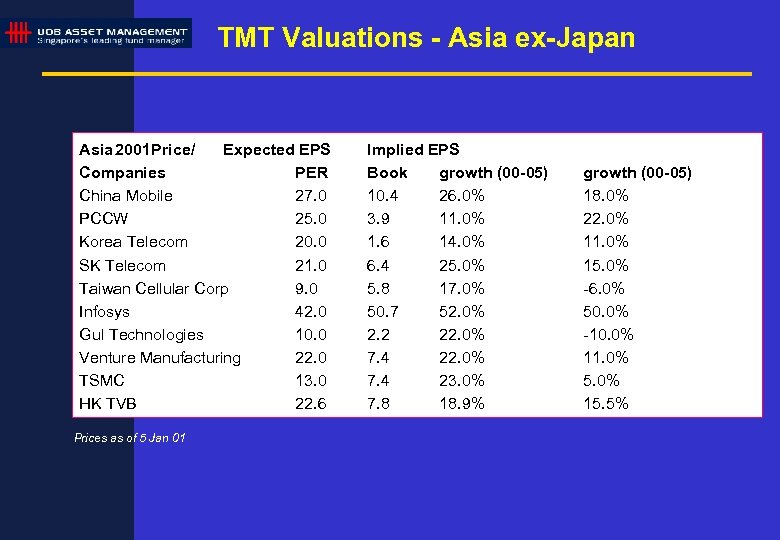

TMT Valuations - Asia ex-Japan Asia 2001 Price/ Expected EPS Companies PER China Mobile 27. 0 PCCW 25. 0 Korea Telecom 20. 0 SK Telecom 21. 0 Taiwan Cellular Corp 9. 0 Infosys 42. 0 Gul Technologies 10. 0 Venture Manufacturing 22. 0 TSMC 13. 0 HK TVB 22. 6 Prices as of 5 Jan 01 Implied EPS Book growth (00 -05) 10. 4 26. 0% 3. 9 11. 0% 1. 6 14. 0% 6. 4 25. 0% 5. 8 17. 0% 50. 7 52. 0% 2. 2 22. 0% 7. 4 23. 0% 7. 8 18. 9% growth (00 -05) 18. 0% 22. 0% 11. 0% 15. 0% -6. 0% 50. 0% -10. 0% 11. 0% 5. 0% 15. 5%

TMT Valuations - Asia ex-Japan Asia 2001 Price/ Expected EPS Companies PER China Mobile 27. 0 PCCW 25. 0 Korea Telecom 20. 0 SK Telecom 21. 0 Taiwan Cellular Corp 9. 0 Infosys 42. 0 Gul Technologies 10. 0 Venture Manufacturing 22. 0 TSMC 13. 0 HK TVB 22. 6 Prices as of 5 Jan 01 Implied EPS Book growth (00 -05) 10. 4 26. 0% 3. 9 11. 0% 1. 6 14. 0% 6. 4 25. 0% 5. 8 17. 0% 50. 7 52. 0% 2. 2 22. 0% 7. 4 23. 0% 7. 8 18. 9% growth (00 -05) 18. 0% 22. 0% 11. 0% 15. 0% -6. 0% 50. 0% -10. 0% 11. 0% 5. 0% 15. 5%

Base Case Investment Scenario 1. A soft landing for the global economy - with the slowdown led by the US. 2. Inflation to remain subdued. 3. Interest rates to fall in 2001. 4. Oil prices to stabilize at current levels.

Base Case Investment Scenario 1. A soft landing for the global economy - with the slowdown led by the US. 2. Inflation to remain subdued. 3. Interest rates to fall in 2001. 4. Oil prices to stabilize at current levels.

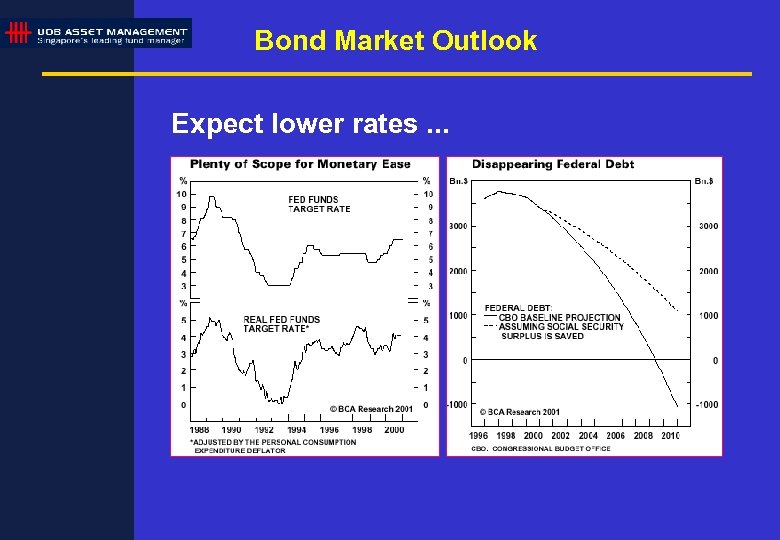

Bond Market Outlook Expect lower rates. . .

Bond Market Outlook Expect lower rates. . .

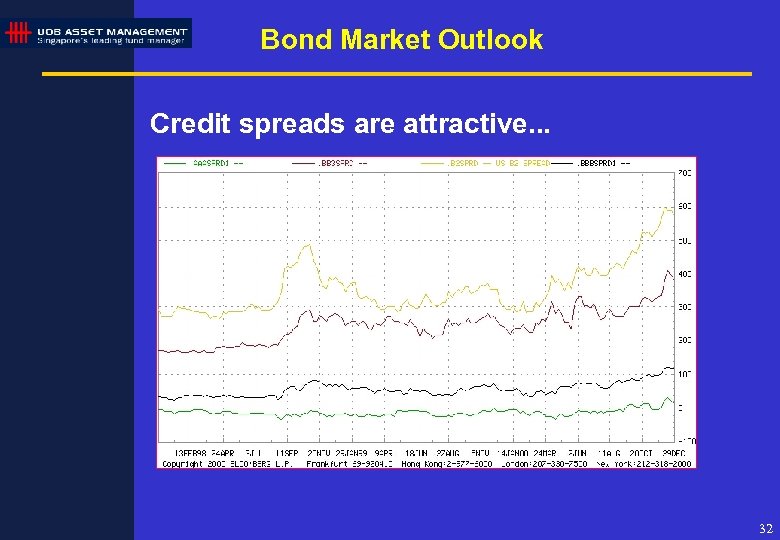

Bond Market Outlook Credit spreads are attractive. . . 32

Bond Market Outlook Credit spreads are attractive. . . 32

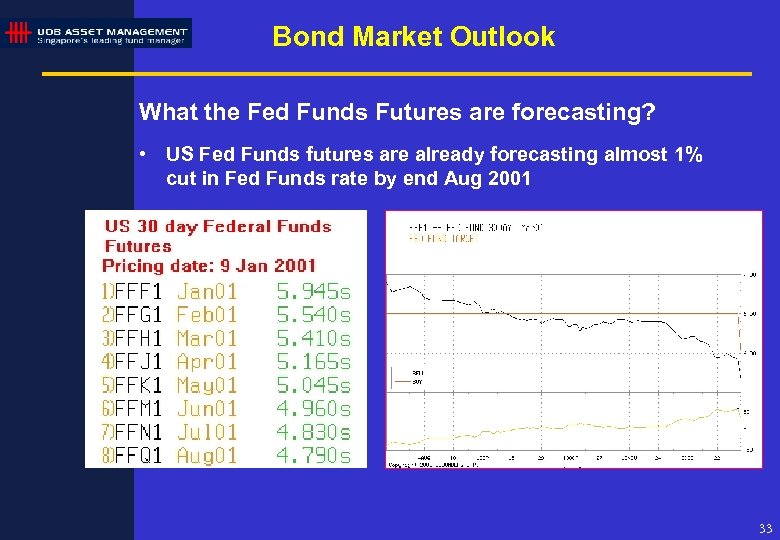

Bond Market Outlook What the Fed Funds Futures are forecasting? • US Fed Funds futures are already forecasting almost 1% cut in Fed Funds rate by end Aug 2001 33

Bond Market Outlook What the Fed Funds Futures are forecasting? • US Fed Funds futures are already forecasting almost 1% cut in Fed Funds rate by end Aug 2001 33

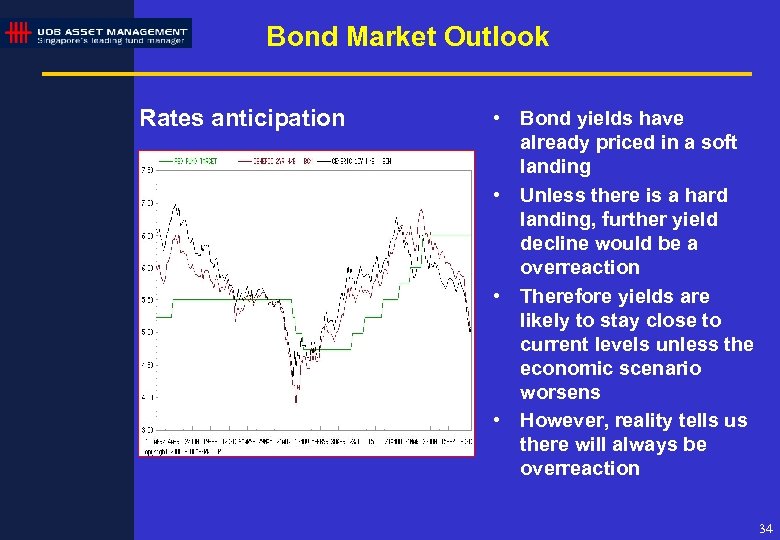

Bond Market Outlook Rates anticipation • Bond yields have already priced in a soft landing • Unless there is a hard landing, further yield decline would be a overreaction • Therefore yields are likely to stay close to current levels unless the economic scenario worsens • However, reality tells us there will always be overreaction 34

Bond Market Outlook Rates anticipation • Bond yields have already priced in a soft landing • Unless there is a hard landing, further yield decline would be a overreaction • Therefore yields are likely to stay close to current levels unless the economic scenario worsens • However, reality tells us there will always be overreaction 34

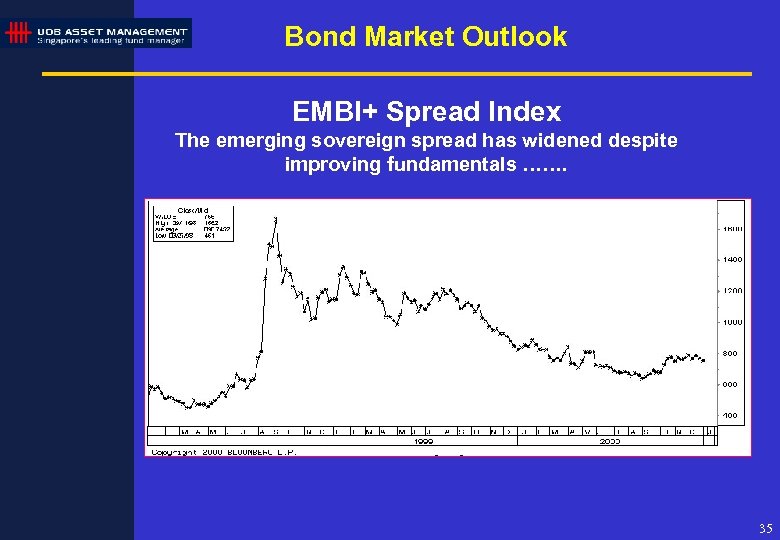

Bond Market Outlook EMBI+ Spread Index The emerging sovereign spread has widened despite improving fundamentals ……. 35

Bond Market Outlook EMBI+ Spread Index The emerging sovereign spread has widened despite improving fundamentals ……. 35

Bond Market Outlook US Real Yields - Little room to fall Source: Bloomberg 36

Bond Market Outlook US Real Yields - Little room to fall Source: Bloomberg 36

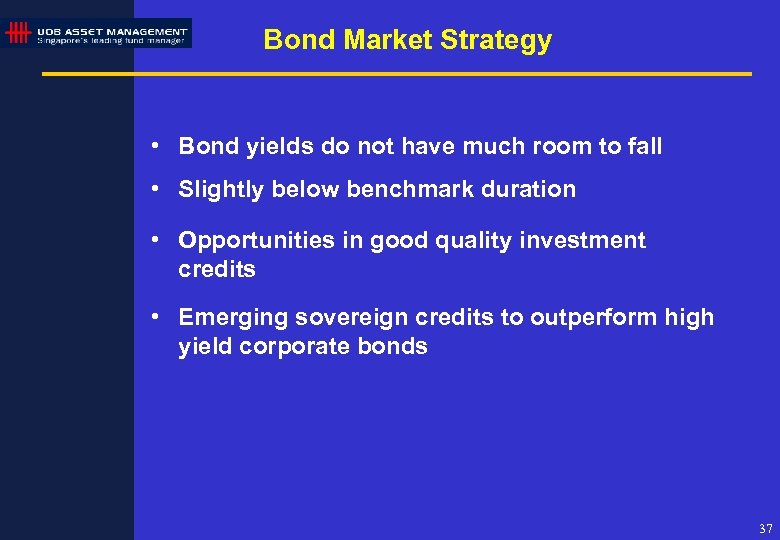

Bond Market Strategy • Bond yields do not have much room to fall • Slightly below benchmark duration • Opportunities in good quality investment credits • Emerging sovereign credits to outperform high yield corporate bonds 37

Bond Market Strategy • Bond yields do not have much room to fall • Slightly below benchmark duration • Opportunities in good quality investment credits • Emerging sovereign credits to outperform high yield corporate bonds 37

Equity Market Strategy 1. At current levels, equities have adequately discounted the risks, and are well underpinned by more reasonable valuations. 2. Stay invested and stay diversified - equities are attractive in a soft landing scenario. 3. Equity market strategy: US Europe Japan Asia ex-Japan Underweight Neutral Overweight

Equity Market Strategy 1. At current levels, equities have adequately discounted the risks, and are well underpinned by more reasonable valuations. 2. Stay invested and stay diversified - equities are attractive in a soft landing scenario. 3. Equity market strategy: US Europe Japan Asia ex-Japan Underweight Neutral Overweight

Equity Market Strategy 4. Sector Strategy - Financials and interest rate sensitive sectors should benefit from lower rates. - Healthcare - the consistent growers, resilient to earnings disappointment. - Technology & Telecom - selective in telecom and tech fallen angels.

Equity Market Strategy 4. Sector Strategy - Financials and interest rate sensitive sectors should benefit from lower rates. - Healthcare - the consistent growers, resilient to earnings disappointment. - Technology & Telecom - selective in telecom and tech fallen angels.

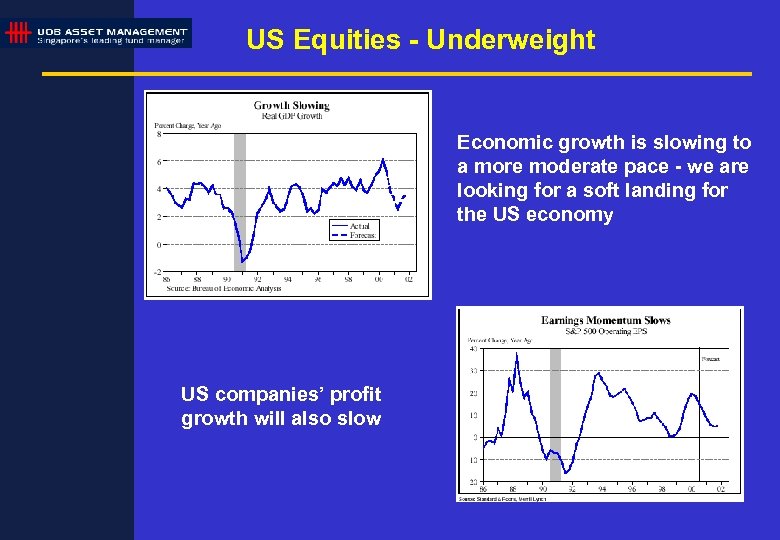

US Equities - Underweight Economic growth is slowing to a more moderate pace - we are looking for a soft landing for the US economy US companies’ profit growth will also slow

US Equities - Underweight Economic growth is slowing to a more moderate pace - we are looking for a soft landing for the US economy US companies’ profit growth will also slow

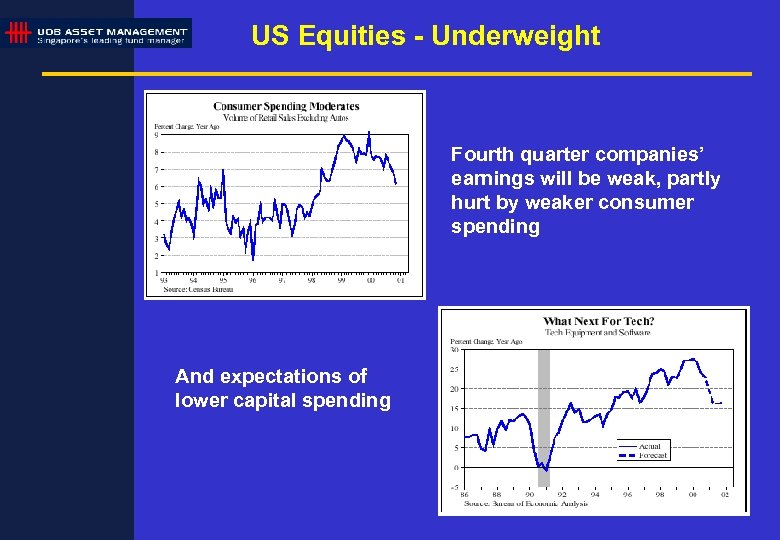

US Equities - Underweight Fourth quarter companies’ earnings will be weak, partly hurt by weaker consumer spending And expectations of lower capital spending

US Equities - Underweight Fourth quarter companies’ earnings will be weak, partly hurt by weaker consumer spending And expectations of lower capital spending

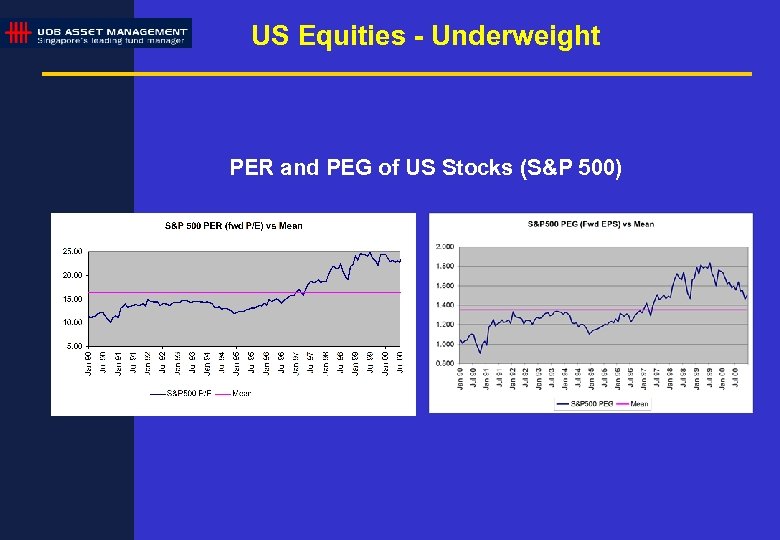

US Equities - Underweight PER and PEG of US Stocks (S&P 500)

US Equities - Underweight PER and PEG of US Stocks (S&P 500)

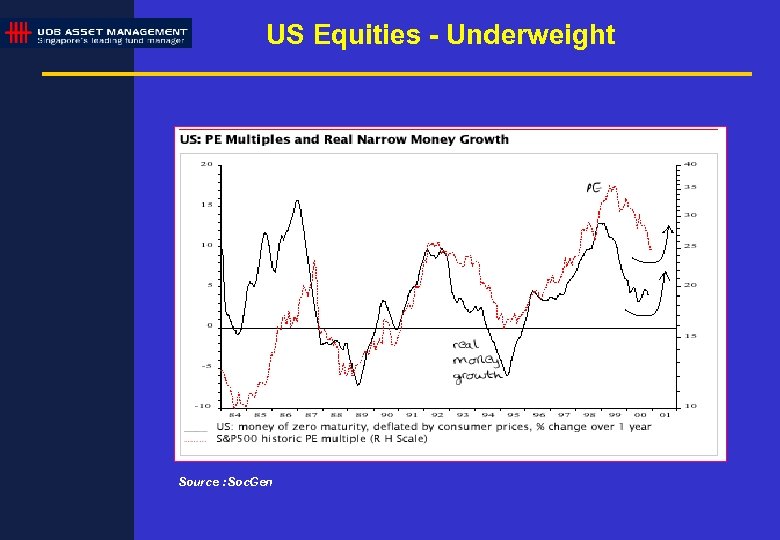

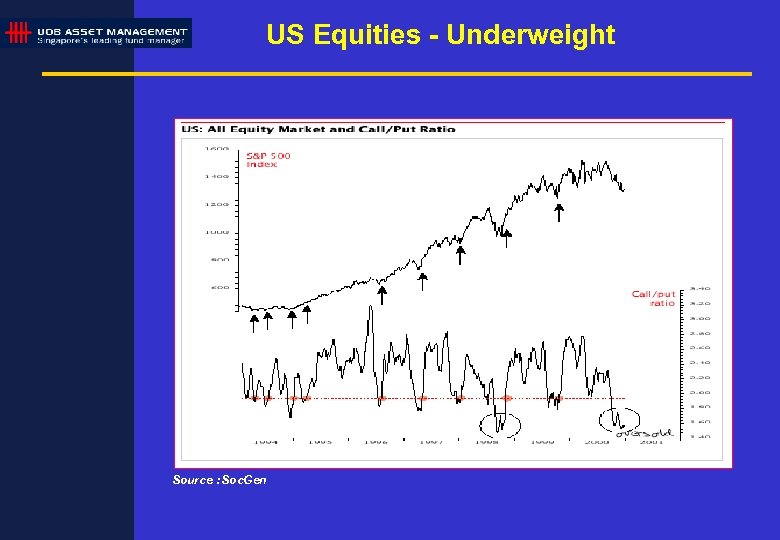

US Equities - Underweight Source : Soc. Gen

US Equities - Underweight Source : Soc. Gen

US Equities - Underweight Source : Soc. Gen

US Equities - Underweight Source : Soc. Gen

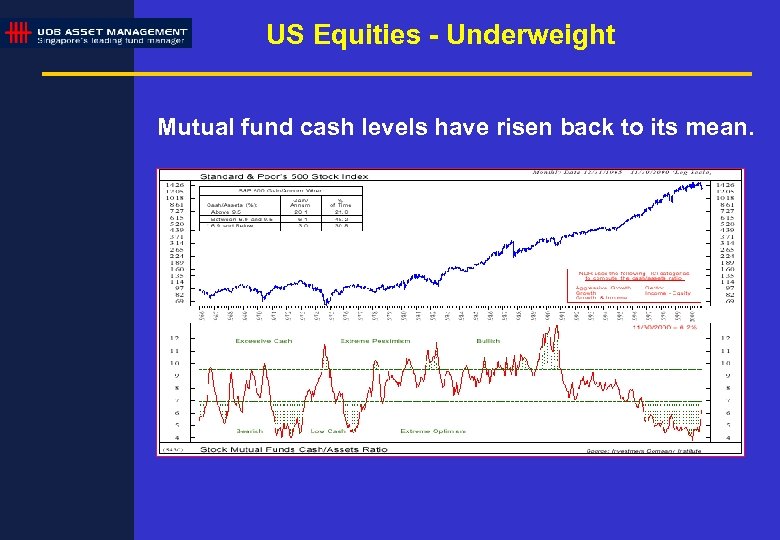

US Equities - Underweight Mutual fund cash levels have risen back to its mean.

US Equities - Underweight Mutual fund cash levels have risen back to its mean.

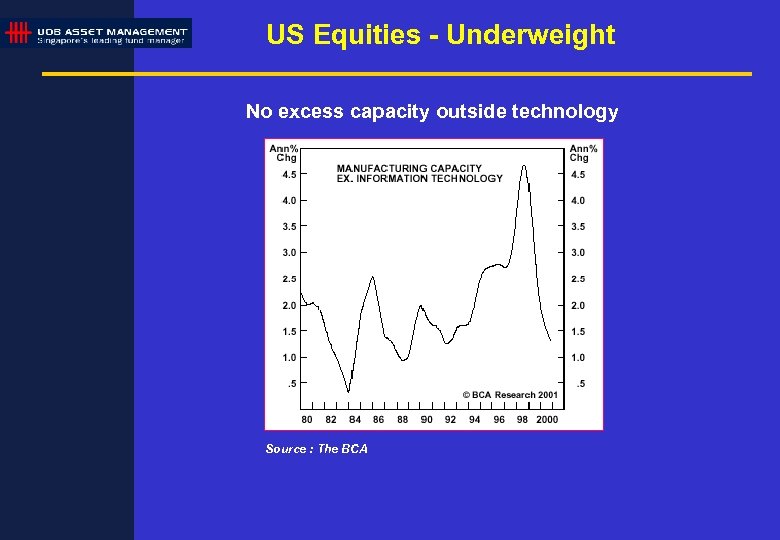

US Equities - Underweight No excess capacity outside technology Source : The BCA

US Equities - Underweight No excess capacity outside technology Source : The BCA

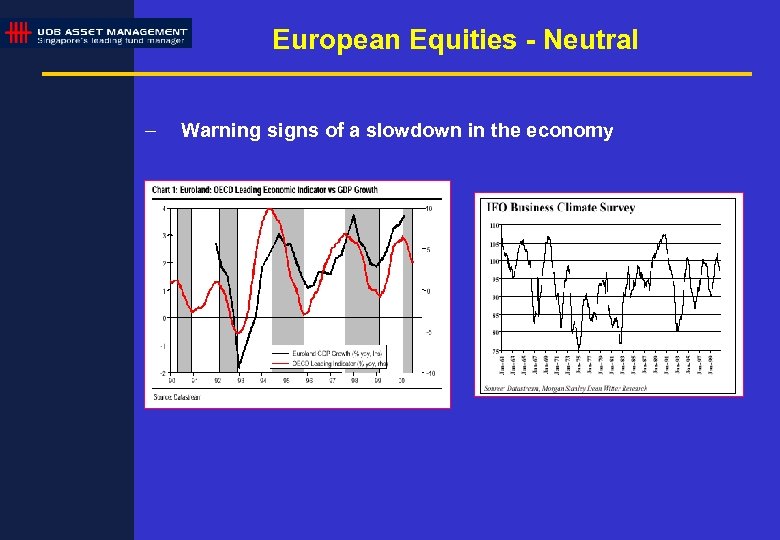

European Equities - Neutral – Warning signs of a slowdown in the economy

European Equities - Neutral – Warning signs of a slowdown in the economy

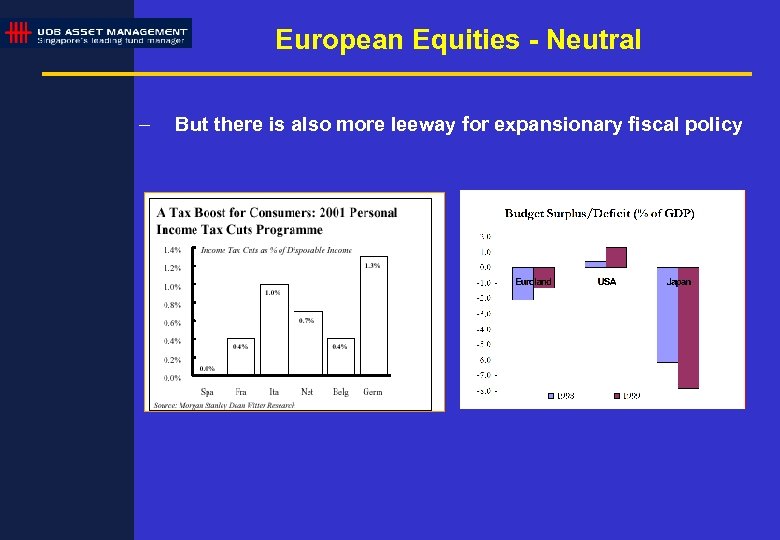

European Equities - Neutral – But there is also more leeway for expansionary fiscal policy

European Equities - Neutral – But there is also more leeway for expansionary fiscal policy

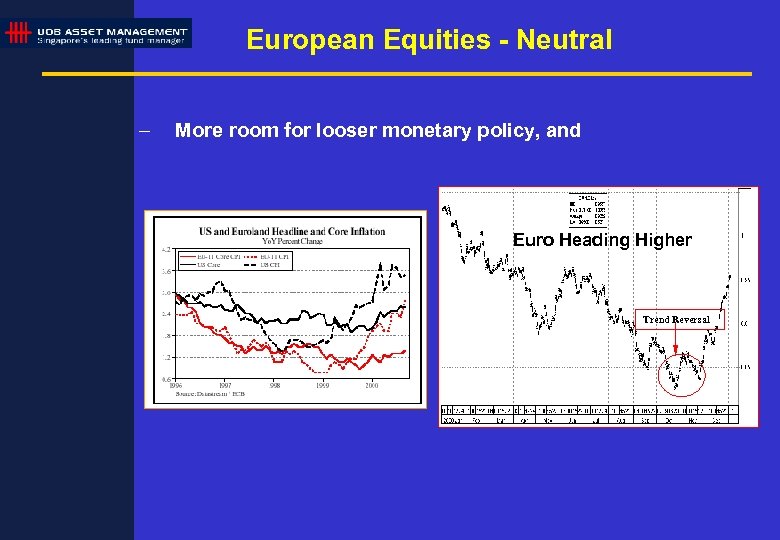

European Equities - Neutral – More room for looser monetary policy, and Euro Heading Higher Trend Reversal

European Equities - Neutral – More room for looser monetary policy, and Euro Heading Higher Trend Reversal

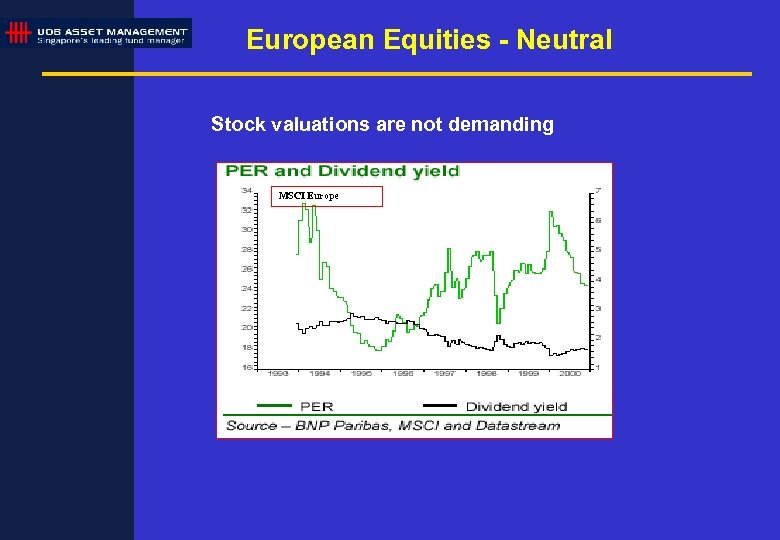

European Equities - Neutral Stock valuations are not demanding MSCI Europe

European Equities - Neutral Stock valuations are not demanding MSCI Europe

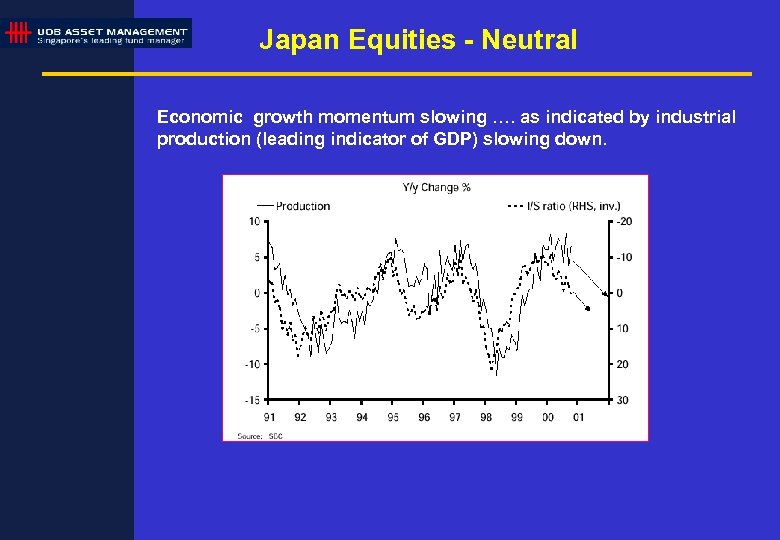

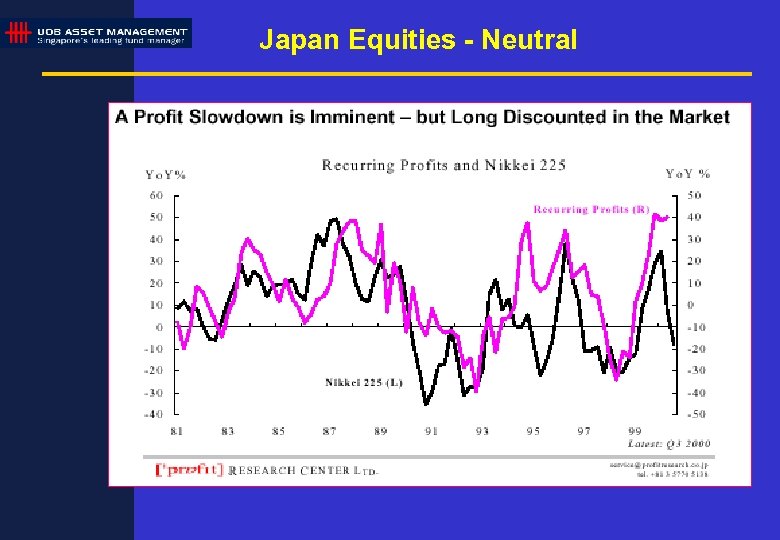

Japan Equities - Neutral Economic growth momentum slowing …. as indicated by industrial production (leading indicator of GDP) slowing down.

Japan Equities - Neutral Economic growth momentum slowing …. as indicated by industrial production (leading indicator of GDP) slowing down.

Japan Equities - Neutral

Japan Equities - Neutral

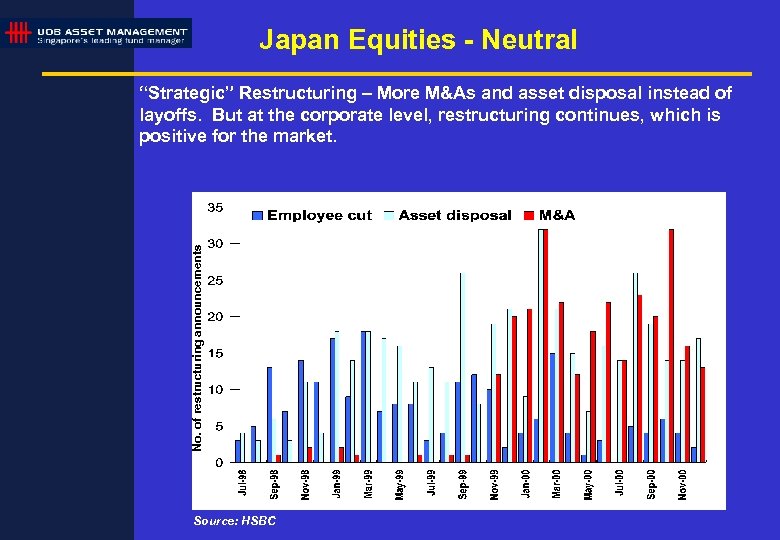

Japan Equities - Neutral No. of restructuring announcements “Strategic” Restructuring – More M&As and asset disposal instead of layoffs. But at the corporate level, restructuring continues, which is positive for the market. Source: HSBC

Japan Equities - Neutral No. of restructuring announcements “Strategic” Restructuring – More M&As and asset disposal instead of layoffs. But at the corporate level, restructuring continues, which is positive for the market. Source: HSBC

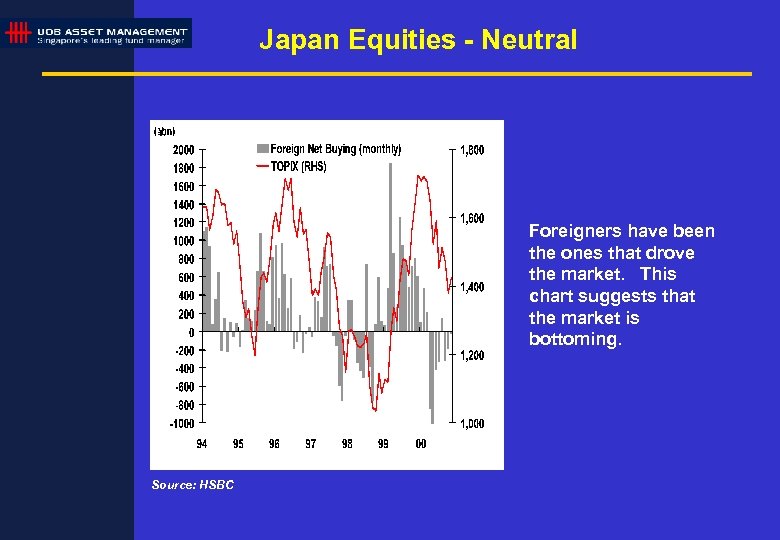

Japan Equities - Neutral Foreigners have been the ones that drove the market. This chart suggests that the market is bottoming. Source: HSBC

Japan Equities - Neutral Foreigners have been the ones that drove the market. This chart suggests that the market is bottoming. Source: HSBC

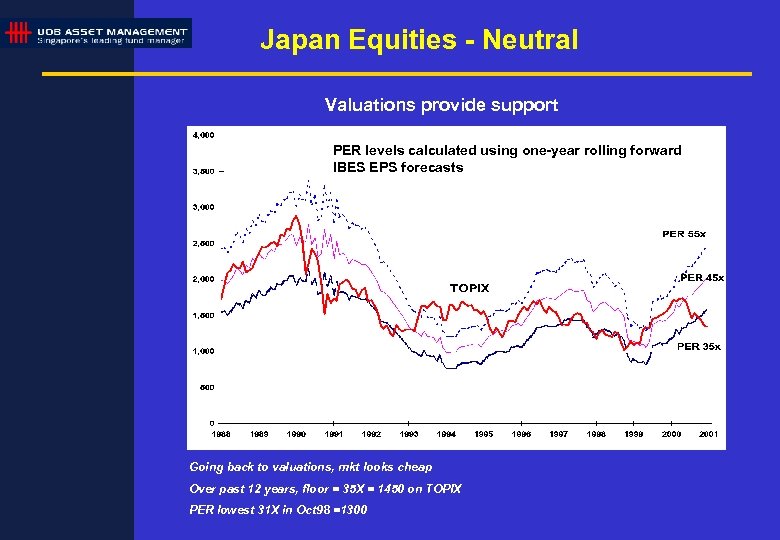

Japan Equities - Neutral Valuations provide support PER levels calculated using one-year rolling forward IBES EPS forecasts Going back to valuations, mkt looks cheap Over past 12 years, floor = 35 X = 1450 on TOPIX PER lowest 31 X in Oct 98 =1300

Japan Equities - Neutral Valuations provide support PER levels calculated using one-year rolling forward IBES EPS forecasts Going back to valuations, mkt looks cheap Over past 12 years, floor = 35 X = 1450 on TOPIX PER lowest 31 X in Oct 98 =1300

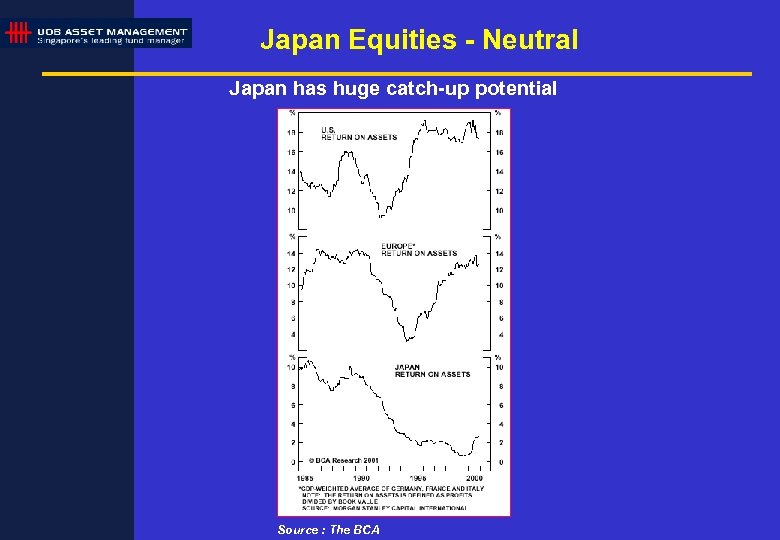

Japan Equities - Neutral Japan has huge catch-up potential Source : The BCA

Japan Equities - Neutral Japan has huge catch-up potential Source : The BCA

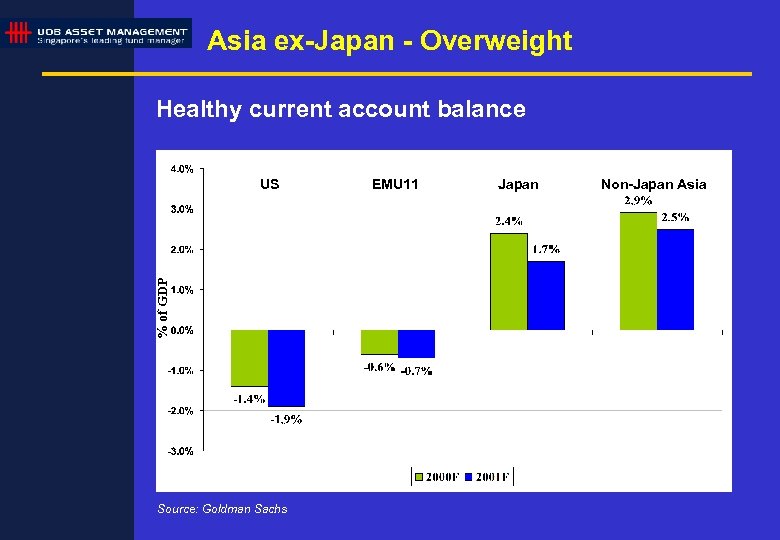

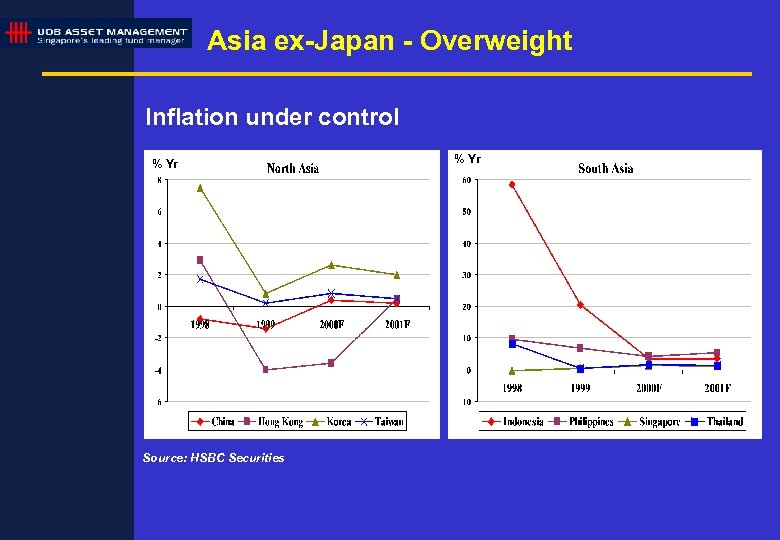

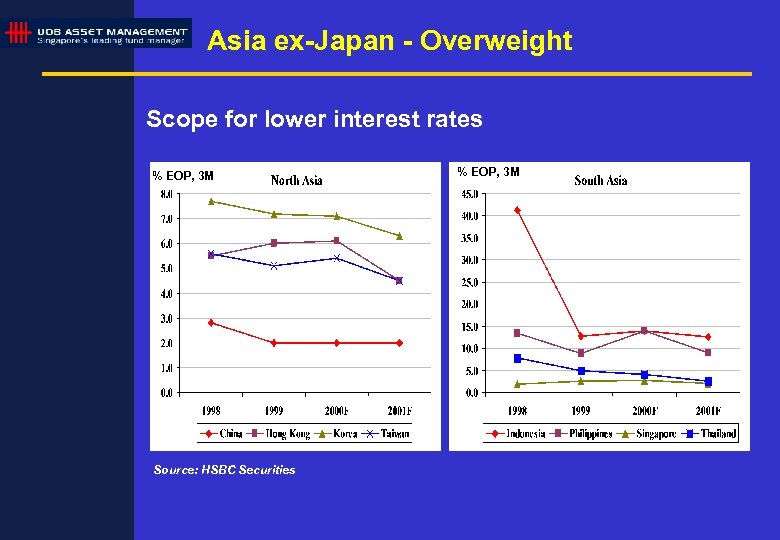

Asia ex-Japan - Overweight The investment case for Asia ex-Japan: – Favorable liquidity conditions Þ Healthy current account balance Þ Mild inflation Þ Low interest rates – Increasing trend of M&A and privatization – Prime beneficiary of outsourcing trend – China’s WTO accession in 2001 – Compelling valuations

Asia ex-Japan - Overweight The investment case for Asia ex-Japan: – Favorable liquidity conditions Þ Healthy current account balance Þ Mild inflation Þ Low interest rates – Increasing trend of M&A and privatization – Prime beneficiary of outsourcing trend – China’s WTO accession in 2001 – Compelling valuations

Asia ex-Japan - Overweight Healthy current account balance % of GDP US Source: Goldman Sachs EMU 11 Japan Non-Japan Asia

Asia ex-Japan - Overweight Healthy current account balance % of GDP US Source: Goldman Sachs EMU 11 Japan Non-Japan Asia

Asia ex-Japan - Overweight Inflation under control % Yr Source: HSBC Securities % Yr

Asia ex-Japan - Overweight Inflation under control % Yr Source: HSBC Securities % Yr

Asia ex-Japan - Overweight Scope for lower interest rates % EOP, 3 M Source: HSBC Securities % EOP, 3 M

Asia ex-Japan - Overweight Scope for lower interest rates % EOP, 3 M Source: HSBC Securities % EOP, 3 M

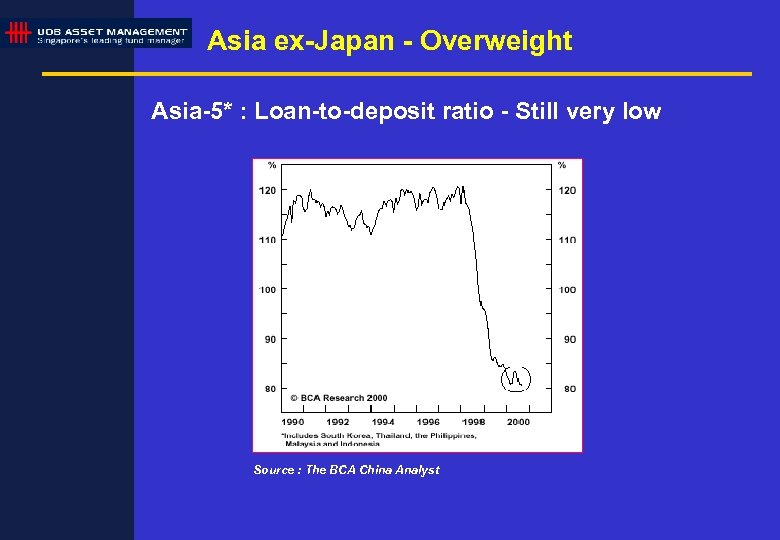

Asia ex-Japan - Overweight Asia-5* : Loan-to-deposit ratio - Still very low Source : The BCA China Analyst

Asia ex-Japan - Overweight Asia-5* : Loan-to-deposit ratio - Still very low Source : The BCA China Analyst

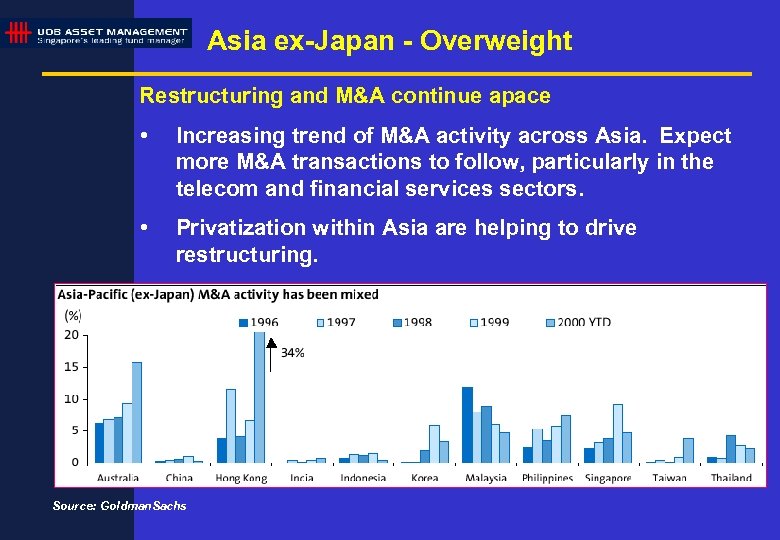

Asia ex-Japan - Overweight Restructuring and M&A continue apace • Increasing trend of M&A activity across Asia. Expect more M&A transactions to follow, particularly in the telecom and financial services sectors. • Privatization within Asia are helping to drive restructuring. Source: Goldman. Sachs

Asia ex-Japan - Overweight Restructuring and M&A continue apace • Increasing trend of M&A activity across Asia. Expect more M&A transactions to follow, particularly in the telecom and financial services sectors. • Privatization within Asia are helping to drive restructuring. Source: Goldman. Sachs

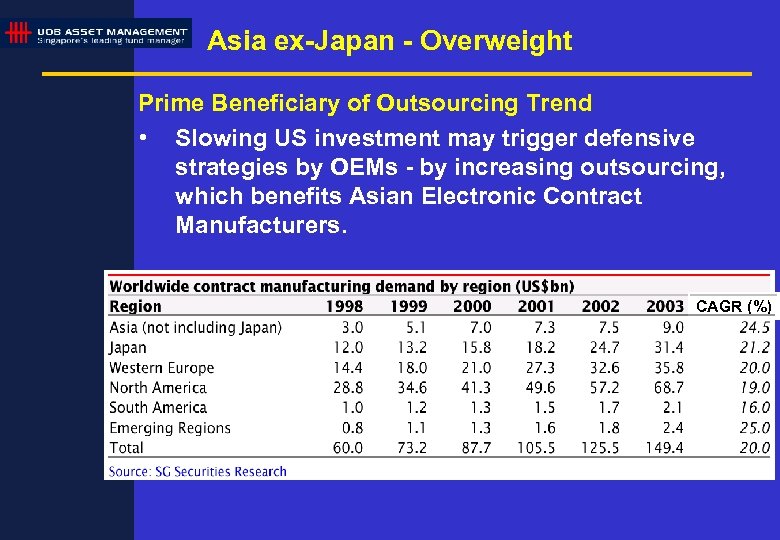

Asia ex-Japan - Overweight Prime Beneficiary of Outsourcing Trend • Slowing US investment may trigger defensive strategies by OEMs - by increasing outsourcing, which benefits Asian Electronic Contract Manufacturers. CAGR (%)

Asia ex-Japan - Overweight Prime Beneficiary of Outsourcing Trend • Slowing US investment may trigger defensive strategies by OEMs - by increasing outsourcing, which benefits Asian Electronic Contract Manufacturers. CAGR (%)

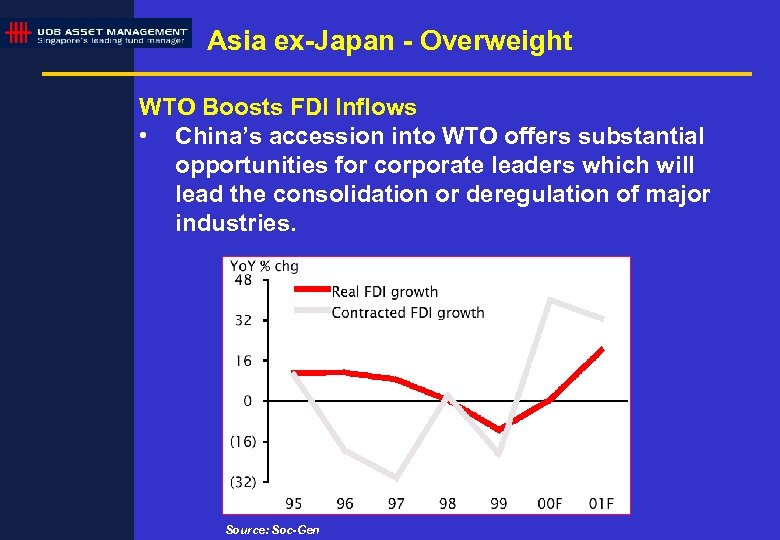

Asia ex-Japan - Overweight WTO Boosts FDI Inflows • China’s accession into WTO offers substantial opportunities for corporate leaders which will lead the consolidation or deregulation of major industries. Source: Soc-Gen

Asia ex-Japan - Overweight WTO Boosts FDI Inflows • China’s accession into WTO offers substantial opportunities for corporate leaders which will lead the consolidation or deregulation of major industries. Source: Soc-Gen

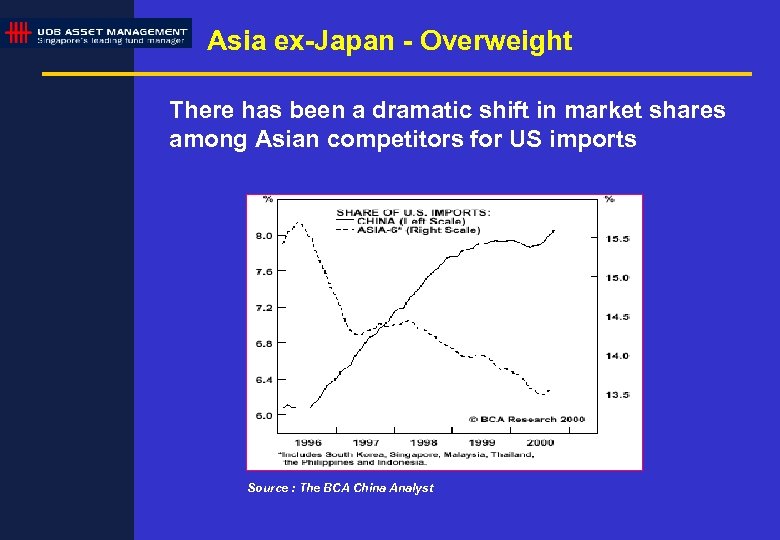

Asia ex-Japan - Overweight There has been a dramatic shift in market shares among Asian competitors for US imports Source : The BCA China Analyst

Asia ex-Japan - Overweight There has been a dramatic shift in market shares among Asian competitors for US imports Source : The BCA China Analyst

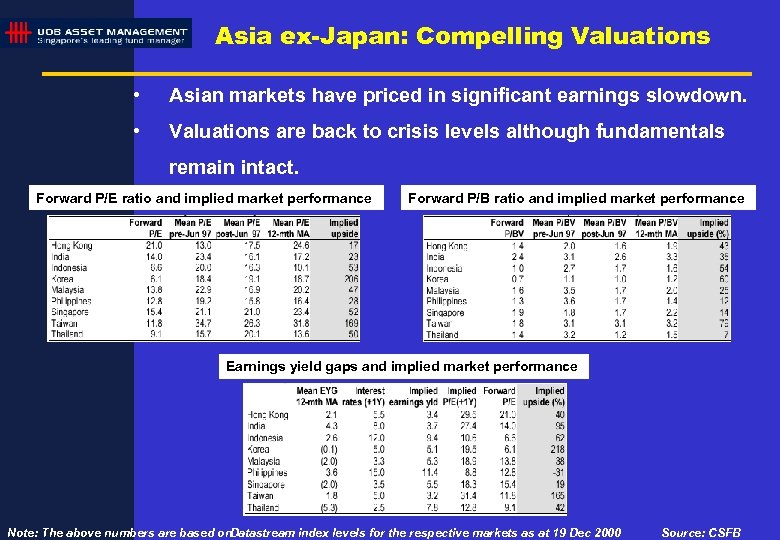

Asia ex-Japan: Compelling Valuations • Asian markets have priced in significant earnings slowdown. • Valuations are back to crisis levels although fundamentals remain intact. Forward P/E ratio and implied market performance Forward P/B ratio and implied market performance Earnings yield gaps and implied market performance Note: The above numbers are based on. Datastream index levels for the respective markets as at 19 Dec 2000 Source: CSFB

Asia ex-Japan: Compelling Valuations • Asian markets have priced in significant earnings slowdown. • Valuations are back to crisis levels although fundamentals remain intact. Forward P/E ratio and implied market performance Forward P/B ratio and implied market performance Earnings yield gaps and implied market performance Note: The above numbers are based on. Datastream index levels for the respective markets as at 19 Dec 2000 Source: CSFB

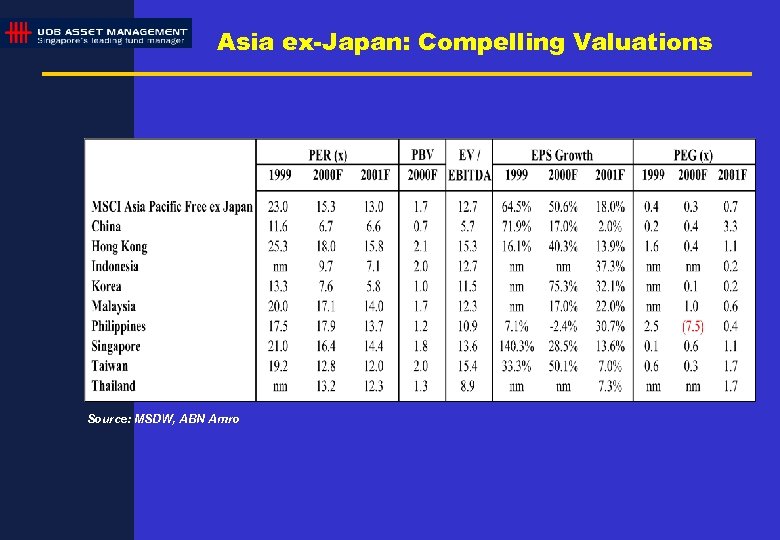

Asia ex-Japan: Compelling Valuations Source: MSDW, ABN Amro

Asia ex-Japan: Compelling Valuations Source: MSDW, ABN Amro

Asia ex-Japan - Overweight Investment Strategy • Overweight: Kong, Korea Singapore, China & Hong • Neutral: Taiwan • Underweight: Thailand, Indonesia, Philippines & Malaysia

Asia ex-Japan - Overweight Investment Strategy • Overweight: Kong, Korea Singapore, China & Hong • Neutral: Taiwan • Underweight: Thailand, Indonesia, Philippines & Malaysia

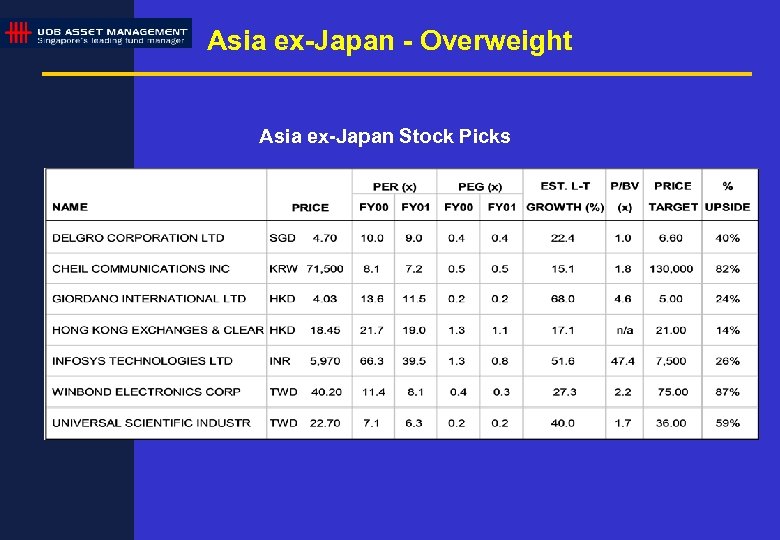

Asia ex-Japan - Overweight Asia ex-Japan Stock Picks

Asia ex-Japan - Overweight Asia ex-Japan Stock Picks

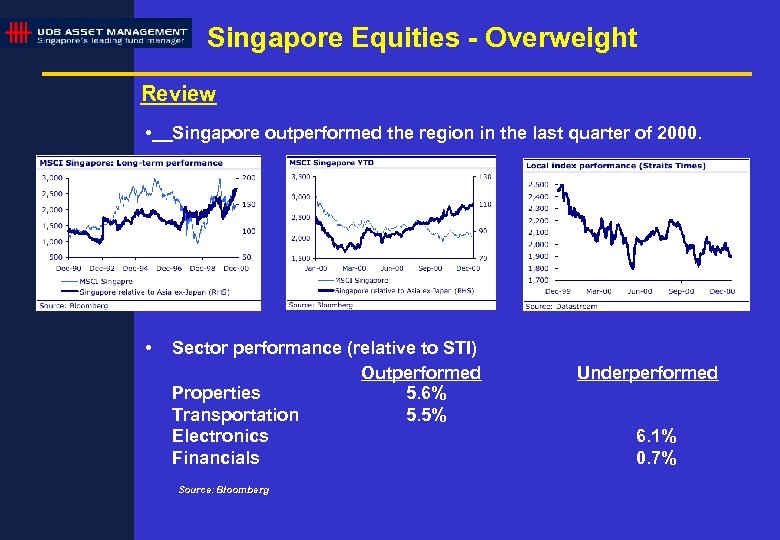

Singapore Equities - Overweight Review • Singapore outperformed the region in the last quarter of 2000. • Sector performance (relative to STI) Outperformed Properties 5. 6% Transportation 5. 5% Electronics Financials Source: Bloomberg Underperformed 6. 1% 0. 7%

Singapore Equities - Overweight Review • Singapore outperformed the region in the last quarter of 2000. • Sector performance (relative to STI) Outperformed Properties 5. 6% Transportation 5. 5% Electronics Financials Source: Bloomberg Underperformed 6. 1% 0. 7%

Singapore Equities - Overweight • We are overweight Singapore in our Asia-Ex-Japan portfolio. Investment Rationale • Safe-haven status. • High earnings stability (14% earnings growth in 2001 following a high 29% in 2000), low gearing, and still improving ROEs. • Good corporate governance. • Significant restructuring expected in the banking and conglomerate sectors - this will drive margin expansion and greater capital efficiency. • Domestic liquidity is good with interest rates low, the banking sector's loan-to-deposit ratio low and the potential for US rates to fall further.

Singapore Equities - Overweight • We are overweight Singapore in our Asia-Ex-Japan portfolio. Investment Rationale • Safe-haven status. • High earnings stability (14% earnings growth in 2001 following a high 29% in 2000), low gearing, and still improving ROEs. • Good corporate governance. • Significant restructuring expected in the banking and conglomerate sectors - this will drive margin expansion and greater capital efficiency. • Domestic liquidity is good with interest rates low, the banking sector's loan-to-deposit ratio low and the potential for US rates to fall further.

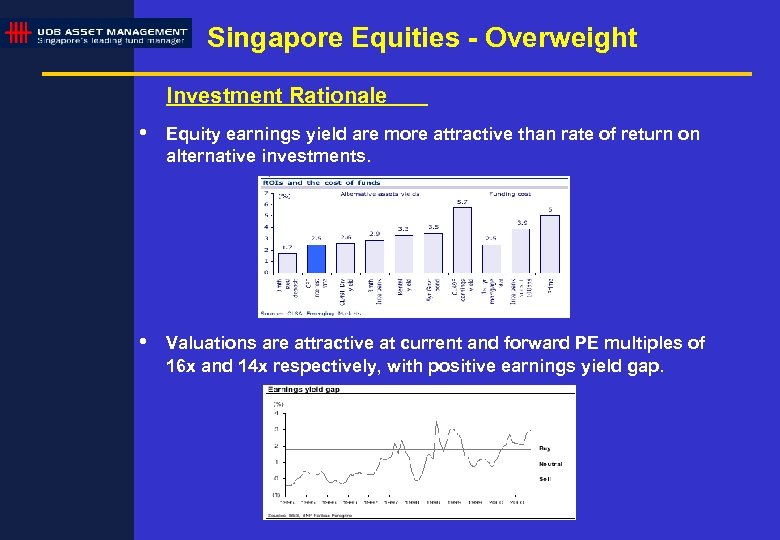

Singapore Equities - Overweight Investment Rationale • Equity earnings yield are more attractive than rate of return on alternative investments. • Valuations are attractive at current and forward PE multiples of 16 x and 14 x respectively, with positive earnings yield gap.

Singapore Equities - Overweight Investment Rationale • Equity earnings yield are more attractive than rate of return on alternative investments. • Valuations are attractive at current and forward PE multiples of 16 x and 14 x respectively, with positive earnings yield gap.

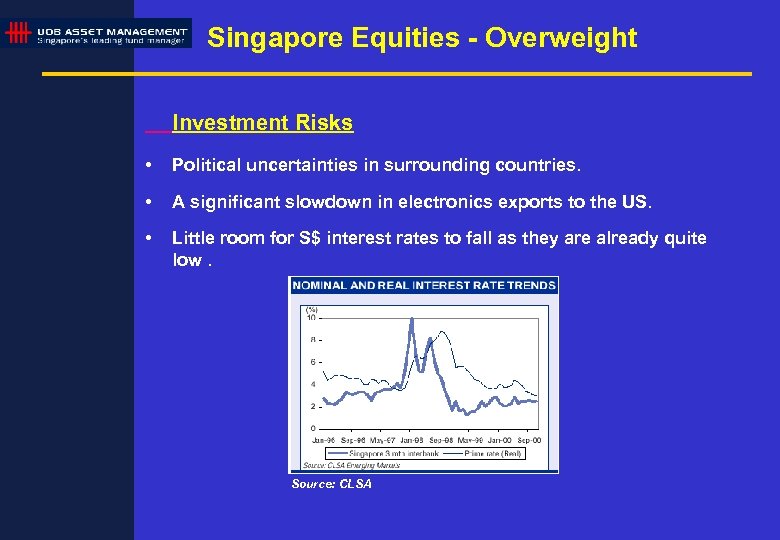

Singapore Equities - Overweight Investment Risks • Political uncertainties in surrounding countries. • A significant slowdown in electronics exports to the US. • Little room for S$ interest rates to fall as they are already quite low. Source: CLSA

Singapore Equities - Overweight Investment Risks • Political uncertainties in surrounding countries. • A significant slowdown in electronics exports to the US. • Little room for S$ interest rates to fall as they are already quite low. Source: CLSA

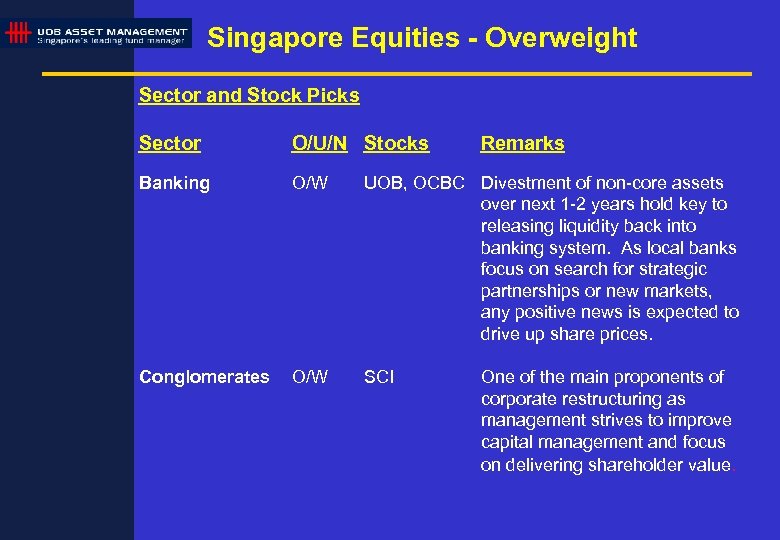

Singapore Equities - Overweight Sector and Stock Picks Sector O/U/N Stocks Remarks Banking O/W UOB, OCBC Divestment of non-core assets over next 1 -2 years hold key to releasing liquidity back into banking system. As local banks focus on search for strategic partnerships or new markets, any positive news is expected to drive up share prices. Conglomerates O/W SCI One of the main proponents of corporate restructuring as management strives to improve capital management and focus on delivering shareholder value.

Singapore Equities - Overweight Sector and Stock Picks Sector O/U/N Stocks Remarks Banking O/W UOB, OCBC Divestment of non-core assets over next 1 -2 years hold key to releasing liquidity back into banking system. As local banks focus on search for strategic partnerships or new markets, any positive news is expected to drive up share prices. Conglomerates O/W SCI One of the main proponents of corporate restructuring as management strives to improve capital management and focus on delivering shareholder value.

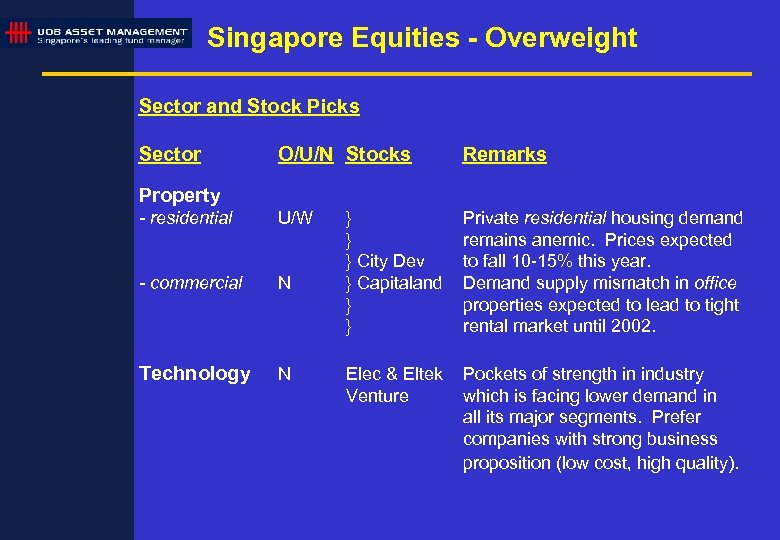

Singapore Equities - Overweight Sector and Stock Picks Sector O/U/N Stocks Remarks - residential U/W - commercial N } } } City Dev } Capitaland } } Private residential housing demand remains anemic. Prices expected to fall 10 -15% this year. Demand supply mismatch in office properties expected to lead to tight rental market until 2002. Technology N Elec & Eltek Venture Pockets of strength in industry which is facing lower demand in all its major segments. Prefer companies with strong business proposition (low cost, high quality). Property

Singapore Equities - Overweight Sector and Stock Picks Sector O/U/N Stocks Remarks - residential U/W - commercial N } } } City Dev } Capitaland } } Private residential housing demand remains anemic. Prices expected to fall 10 -15% this year. Demand supply mismatch in office properties expected to lead to tight rental market until 2002. Technology N Elec & Eltek Venture Pockets of strength in industry which is facing lower demand in all its major segments. Prefer companies with strong business proposition (low cost, high quality). Property

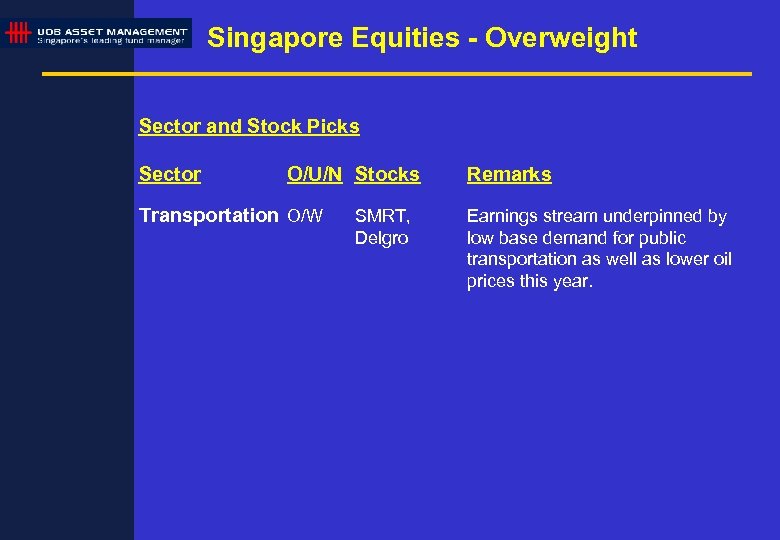

Singapore Equities - Overweight Sector and Stock Picks Sector O/U/N Stocks Transportation O/W SMRT, Delgro Remarks Earnings stream underpinned by low base demand for public transportation as well as lower oil prices this year.

Singapore Equities - Overweight Sector and Stock Picks Sector O/U/N Stocks Transportation O/W SMRT, Delgro Remarks Earnings stream underpinned by low base demand for public transportation as well as lower oil prices this year.

Strategy & Outlook SECTOR STRATEGY

Strategy & Outlook SECTOR STRATEGY

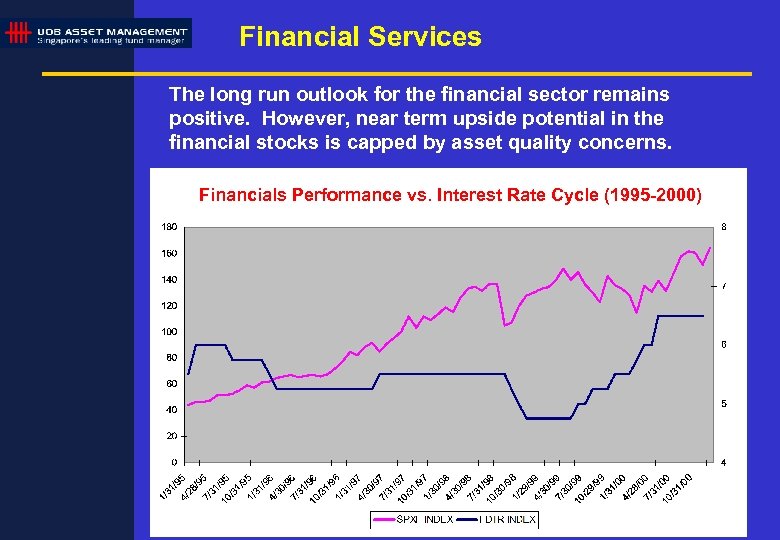

Financial Services The long run outlook for the financial sector remains positive. However, near term upside potential in the financial stocks is capped by asset quality concerns. Financials Performance vs. Interest Rate Cycle (1995 -2000)

Financial Services The long run outlook for the financial sector remains positive. However, near term upside potential in the financial stocks is capped by asset quality concerns. Financials Performance vs. Interest Rate Cycle (1995 -2000)

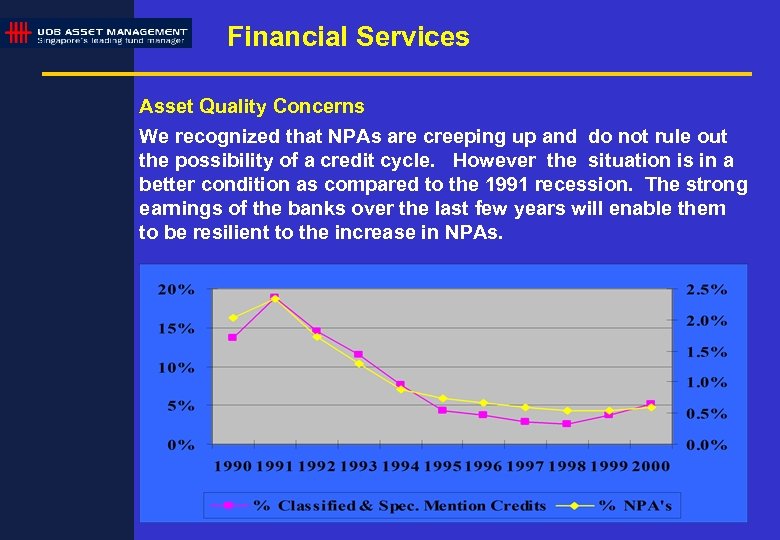

Financial Services Asset Quality Concerns We recognized that NPAs are creeping up and do not rule out the possibility of a credit cycle. However the situation is in a better condition as compared to the 1991 recession. The strong earnings of the banks over the last few years will enable them to be resilient to the increase in NPAs.

Financial Services Asset Quality Concerns We recognized that NPAs are creeping up and do not rule out the possibility of a credit cycle. However the situation is in a better condition as compared to the 1991 recession. The strong earnings of the banks over the last few years will enable them to be resilient to the increase in NPAs.

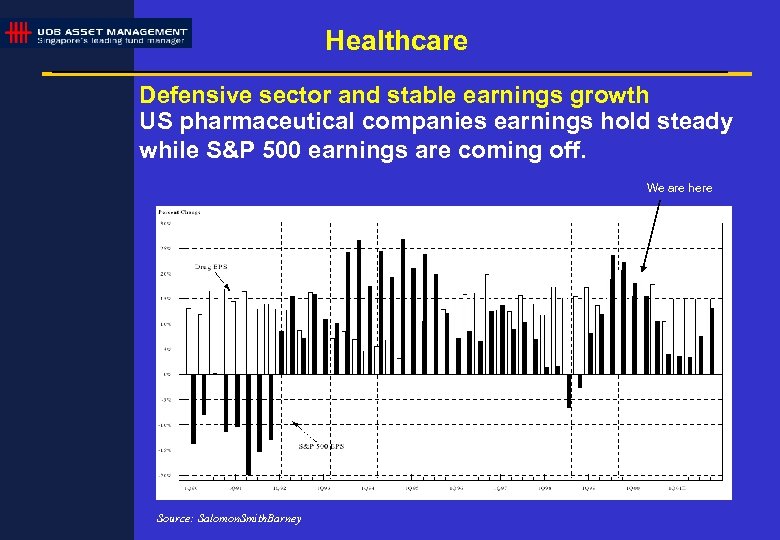

Healthcare Defensive sector and stable earnings growth US pharmaceutical companies earnings hold steady while S&P 500 earnings are coming off. We are here Source: Salomon. Smith. Barney

Healthcare Defensive sector and stable earnings growth US pharmaceutical companies earnings hold steady while S&P 500 earnings are coming off. We are here Source: Salomon. Smith. Barney

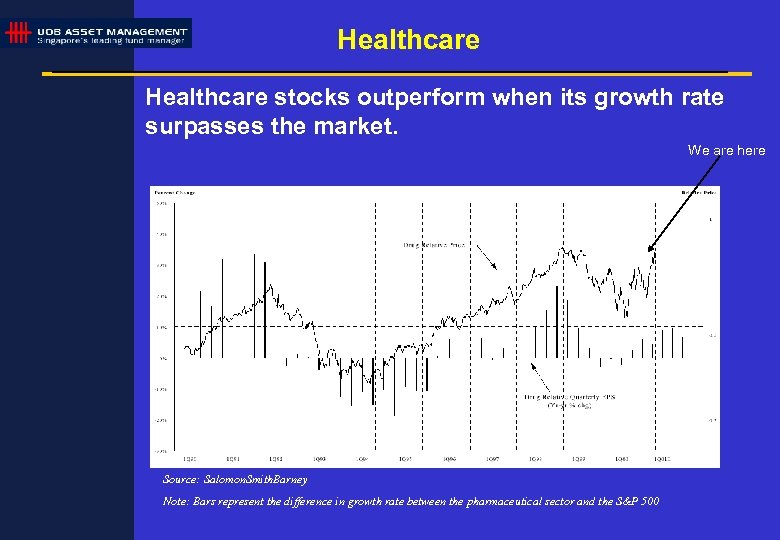

Healthcare stocks outperform when its growth rate surpasses the market. We are here Source: Salomon. Smith. Barney Note: Bars represent the difference in growth rate between the pharmaceutical sector and the S&P 500

Healthcare stocks outperform when its growth rate surpasses the market. We are here Source: Salomon. Smith. Barney Note: Bars represent the difference in growth rate between the pharmaceutical sector and the S&P 500

Healthcare Still Positive on Healthcare: – Secular outlook also intact, – driven by the aging global population, – rising health care spending and – technological advances.

Healthcare Still Positive on Healthcare: – Secular outlook also intact, – driven by the aging global population, – rising health care spending and – technological advances.

Technology/Telecom • Lower earnings visibility in general for 2001 – Downgrades should continue into H 1 01 – Demand / supply imbalance biased against demand • Telecoms sector over-geared – Credit problems may worsen for telecoms – Pricing pressures hurt fixed line operators – Mobile operators face increasing competition • Tech sector growth intact albeit slower pace – Further CAPEX cuts expected – Increased vendor financing raises concerns over credit quality

Technology/Telecom • Lower earnings visibility in general for 2001 – Downgrades should continue into H 1 01 – Demand / supply imbalance biased against demand • Telecoms sector over-geared – Credit problems may worsen for telecoms – Pricing pressures hurt fixed line operators – Mobile operators face increasing competition • Tech sector growth intact albeit slower pace – Further CAPEX cuts expected – Increased vendor financing raises concerns over credit quality

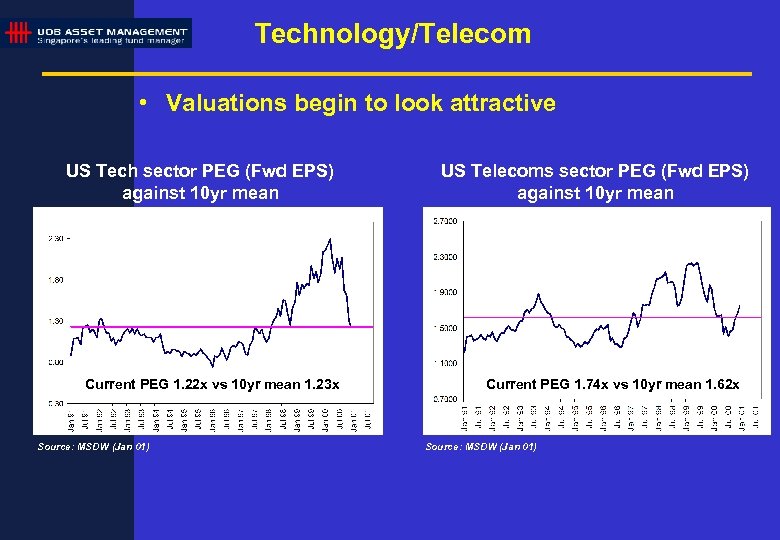

Technology/Telecom • Valuations begin to look attractive US Tech sector PEG (Fwd EPS) against 10 yr mean Current PEG 1. 22 x vs 10 yr mean 1. 23 x Source: MSDW (Jan 01) US Telecoms sector PEG (Fwd EPS) against 10 yr mean Current PEG 1. 74 x vs 10 yr mean 1. 62 x Source: MSDW (Jan 01)

Technology/Telecom • Valuations begin to look attractive US Tech sector PEG (Fwd EPS) against 10 yr mean Current PEG 1. 22 x vs 10 yr mean 1. 23 x Source: MSDW (Jan 01) US Telecoms sector PEG (Fwd EPS) against 10 yr mean Current PEG 1. 74 x vs 10 yr mean 1. 62 x Source: MSDW (Jan 01)

Technology/Telecom • Long term growth trends still intact – IT spending will remain an important driver of productivity – Broadband growth will accelerate – Alternate internet access devices becoming more widespread – Outsourcing trend will pick up

Technology/Telecom • Long term growth trends still intact – IT spending will remain an important driver of productivity – Broadband growth will accelerate – Alternate internet access devices becoming more widespread – Outsourcing trend will pick up

Investment Outlook - Conclusions I – Base case scenario - soft landing of US economy but risk of recession not insignificant. – TMT sector bottoming out but some areas still vulnerable. On the other hand, certain stocks looking very attractive. – US dollar has likely peaked against the Euro. – Japanese recovery stalling and risk of recession increased.

Investment Outlook - Conclusions I – Base case scenario - soft landing of US economy but risk of recession not insignificant. – TMT sector bottoming out but some areas still vulnerable. On the other hand, certain stocks looking very attractive. – US dollar has likely peaked against the Euro. – Japanese recovery stalling and risk of recession increased.

Investment Outlook - Conclusions II – The economic outlook is cloudy but unlikely to be disastrous. – Forecasting economic conditions is difficult enough. Even more difficult is predicting how markets will behave. – Therefore, focus on long term investing and stock selection. – Fundamentals and valuation do matter.

Investment Outlook - Conclusions II – The economic outlook is cloudy but unlikely to be disastrous. – Forecasting economic conditions is difficult enough. Even more difficult is predicting how markets will behave. – Therefore, focus on long term investing and stock selection. – Fundamentals and valuation do matter.

Investment Outlook 2001 OUR CONCLUSION - A BETTER 2001.

Investment Outlook 2001 OUR CONCLUSION - A BETTER 2001.