74769b1eec9d38d87c8946a8e01bc4dd.ppt

- Количество слайдов: 53

Investment Opportunities in Tradable Instruments: Treasury Bills, Certificates of Deposit Gilts, Supranational and Corporate Bonds. www. kingandshaxson. com

Investment Landscape A heightened focus on Treasury since the onset of the crisis: - Risk aversion - Counterparty lending lists Principles of Treasury Management remain unchanged: “Security, Liquidity, Yield…In that order!” (DCLG investment principles) 2 www. kingandshaxson. com

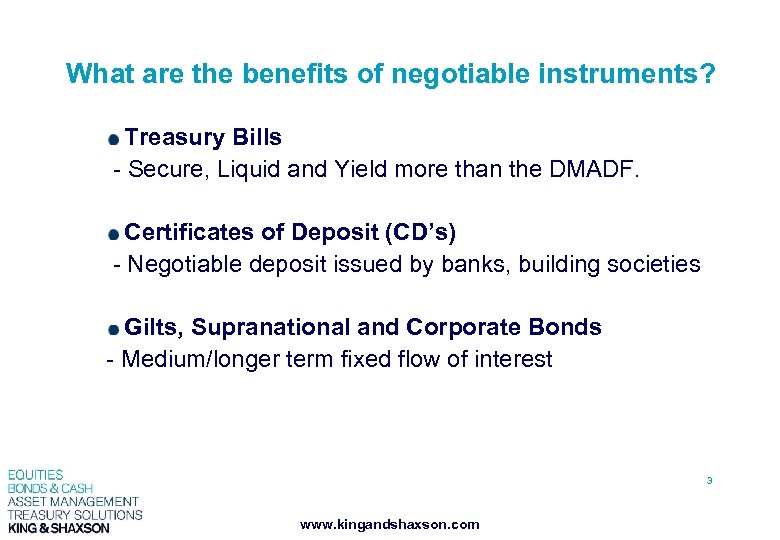

What are the benefits of negotiable instruments? Treasury Bills - Secure, Liquid and Yield more than the DMADF. Certificates of Deposit (CD’s) - Negotiable deposit issued by banks, building societies Gilts, Supranational and Corporate Bonds - Medium/longer term fixed flow of interest 3 www. kingandshaxson. com

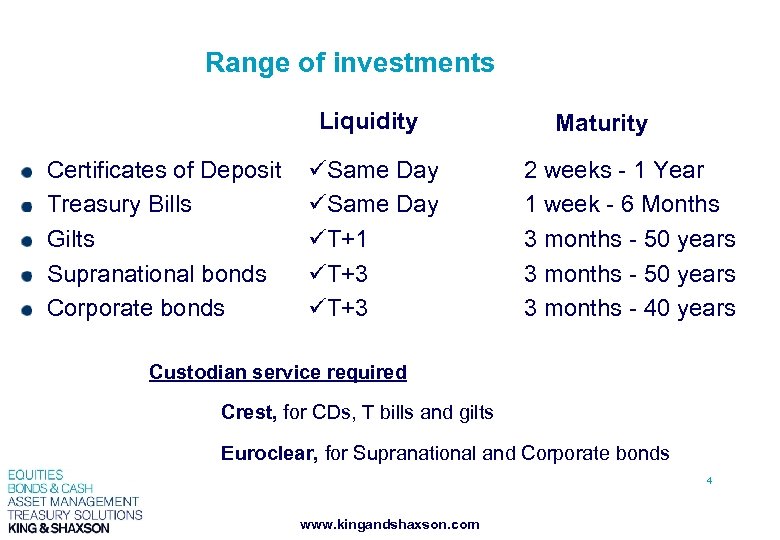

Range of investments Liquidity Certificates of Deposit Treasury Bills Gilts Supranational bonds Corporate bonds Same Day T+1 T+3 Maturity 2 weeks - 1 Year 1 week - 6 Months 3 months - 50 years 3 months - 40 years Custodian service required Crest, for CDs, T bills and gilts Euroclear, for Supranational and Corporate bonds 4 www. kingandshaxson. com

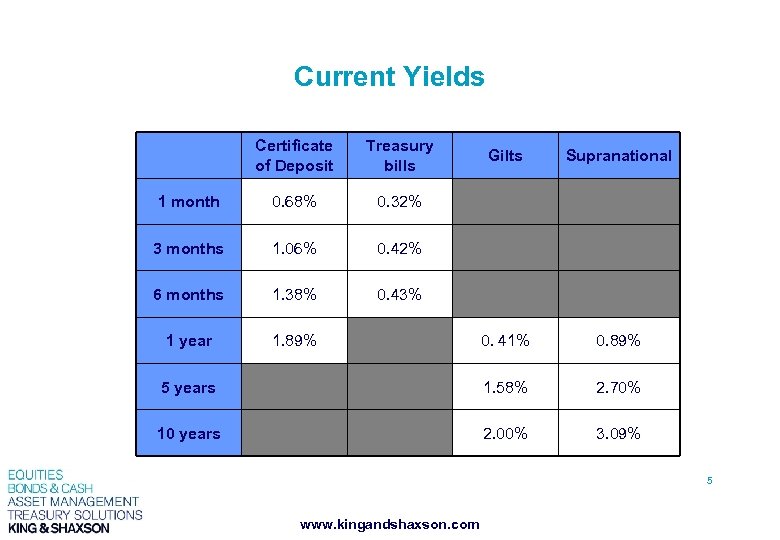

Current Yields Certificate of Deposit Treasury bills 1 month 0. 68% 0. 32% 3 months 1. 06% 0. 42% 6 months 1. 38% 0. 43% 1 year 1. 89% Gilts Supranational 0. 41% 0. 89% 5 years 1. 58% 2. 70% 10 years 2. 00% 3. 09% 5 www. kingandshaxson. com

Treasury Bills 6 www. kingandshaxson. com

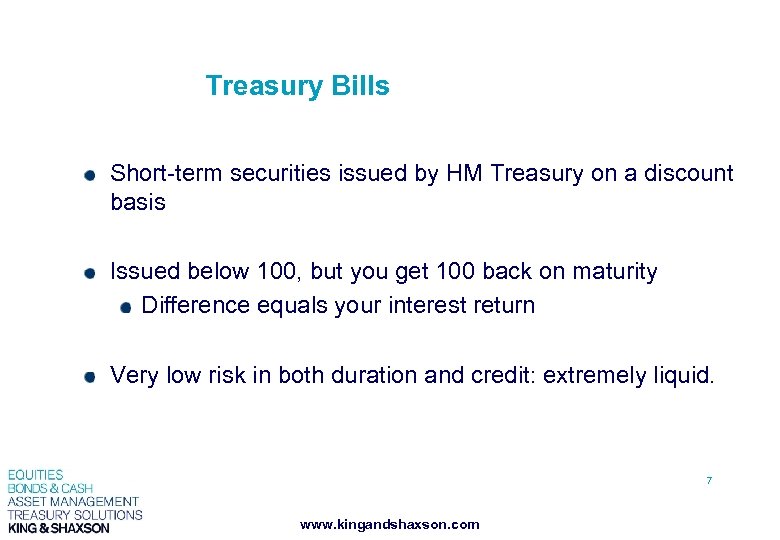

Treasury Bills Short-term securities issued by HM Treasury on a discount basis Issued below 100, but you get 100 back on maturity Difference equals your interest return Very low risk in both duration and credit: extremely liquid. 7 www. kingandshaxson. com

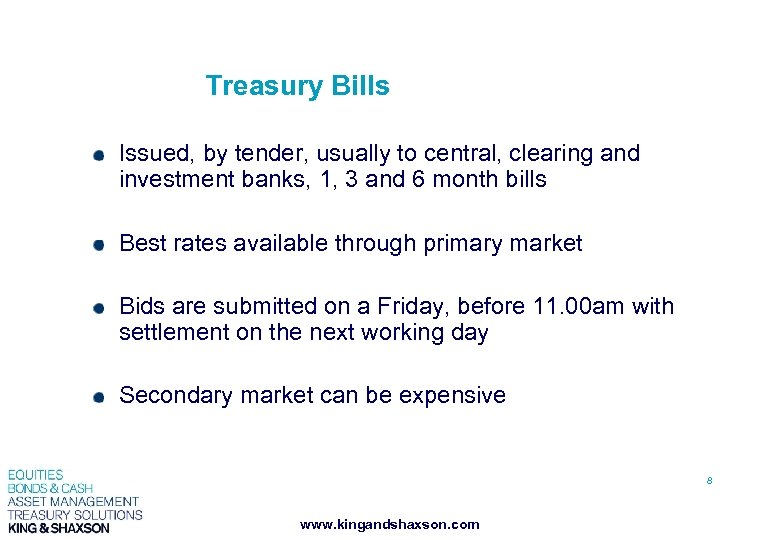

Treasury Bills Issued, by tender, usually to central, clearing and investment banks, 1, 3 and 6 month bills Best rates available through primary market Bids are submitted on a Friday, before 11. 00 am with settlement on the next working day Secondary market can be expensive 8 www. kingandshaxson. com

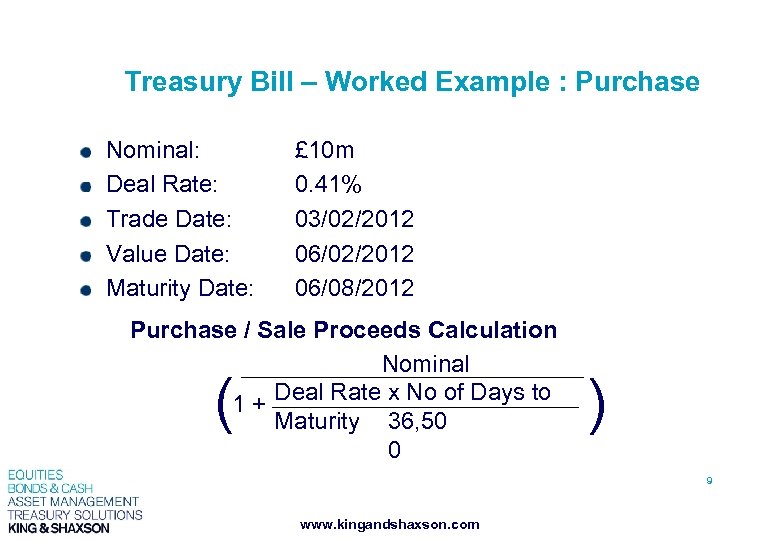

Treasury Bill – Worked Example : Purchase Nominal: Deal Rate: Trade Date: Value Date: Maturity Date: £ 10 m 0. 41% 03/02/2012 06/08/2012 Purchase / Sale Proceeds Calculation Nominal 1 + Deal Rate x No of Days to Maturity 36, 50 0 ( ) 9 www. kingandshaxson. com

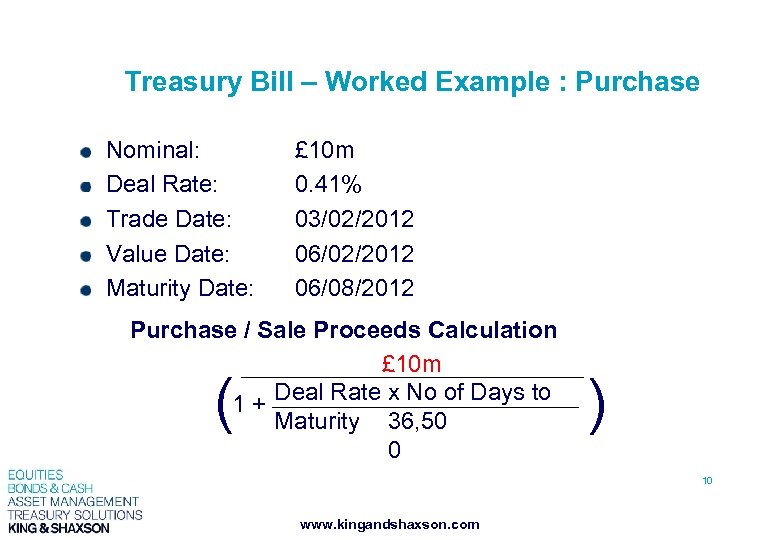

Treasury Bill – Worked Example : Purchase Nominal: Deal Rate: Trade Date: Value Date: Maturity Date: £ 10 m 0. 41% 03/02/2012 06/08/2012 Purchase / Sale Proceeds Calculation £ 10 m 1 + Deal Rate x No of Days to Maturity 36, 50 0 ( ) 10 www. kingandshaxson. com

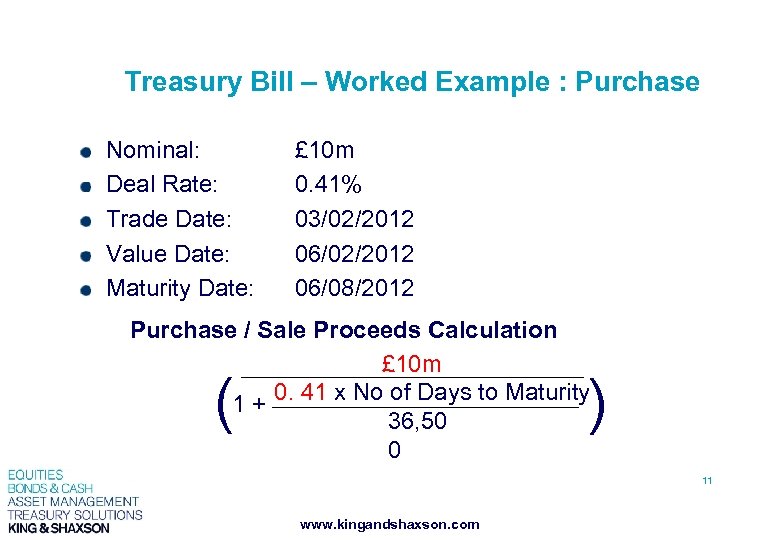

Treasury Bill – Worked Example : Purchase Nominal: Deal Rate: Trade Date: Value Date: Maturity Date: £ 10 m 0. 41% 03/02/2012 06/08/2012 Purchase / Sale Proceeds Calculation £ 10 m 1 + 0. 41 x No of Days to Maturity 36, 50 0 ( ) 11 www. kingandshaxson. com

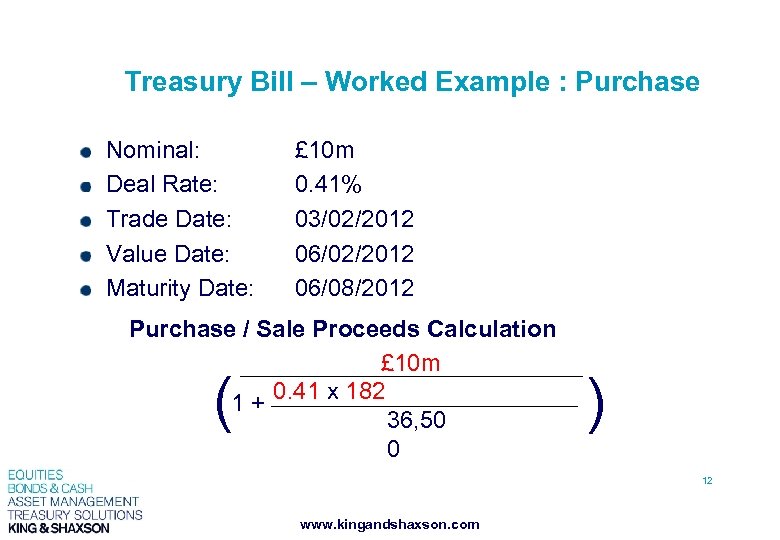

Treasury Bill – Worked Example : Purchase Nominal: Deal Rate: Trade Date: Value Date: Maturity Date: £ 10 m 0. 41% 03/02/2012 06/08/2012 Purchase / Sale Proceeds Calculation £ 10 m 1 + 0. 41 x 182 36, 50 0 ( ) 12 www. kingandshaxson. com

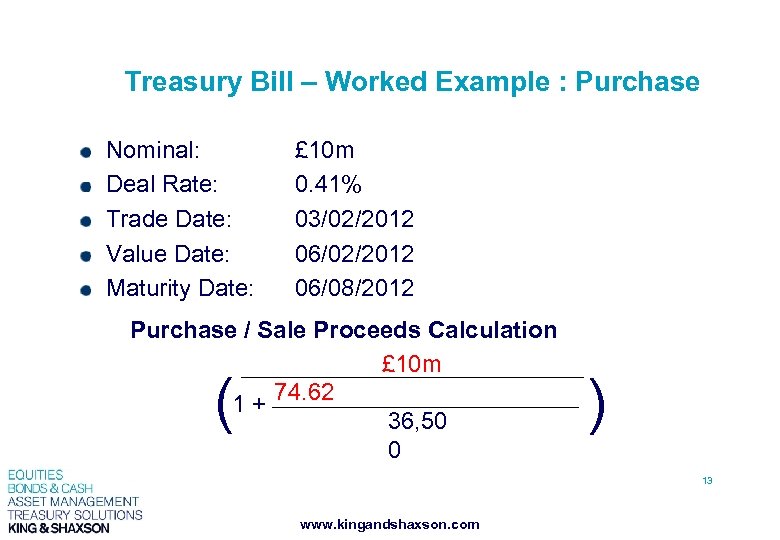

Treasury Bill – Worked Example : Purchase Nominal: Deal Rate: Trade Date: Value Date: Maturity Date: £ 10 m 0. 41% 03/02/2012 06/08/2012 Purchase / Sale Proceeds Calculation £ 10 m 1 + 74. 62 36, 50 0 ( ) 13 www. kingandshaxson. com

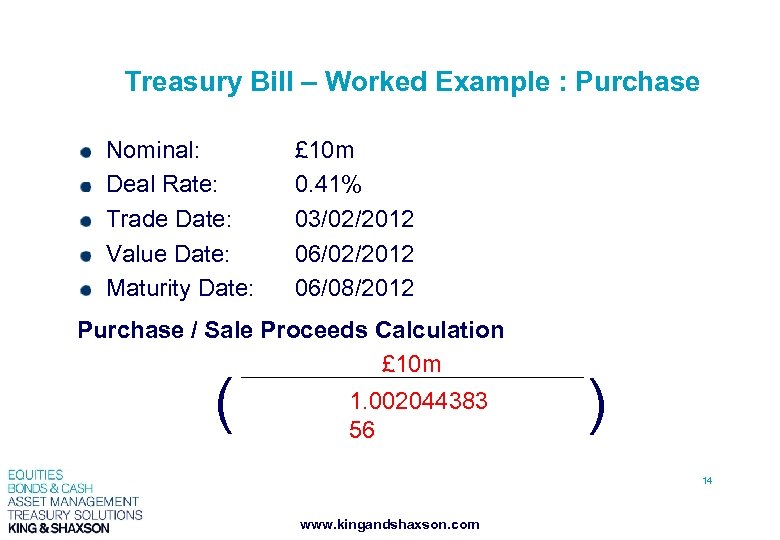

Treasury Bill – Worked Example : Purchase Nominal: Deal Rate: Trade Date: Value Date: Maturity Date: £ 10 m 0. 41% 03/02/2012 06/08/2012 Purchase / Sale Proceeds Calculation £ 10 m ( 1. 002044383 56 ) 14 www. kingandshaxson. com

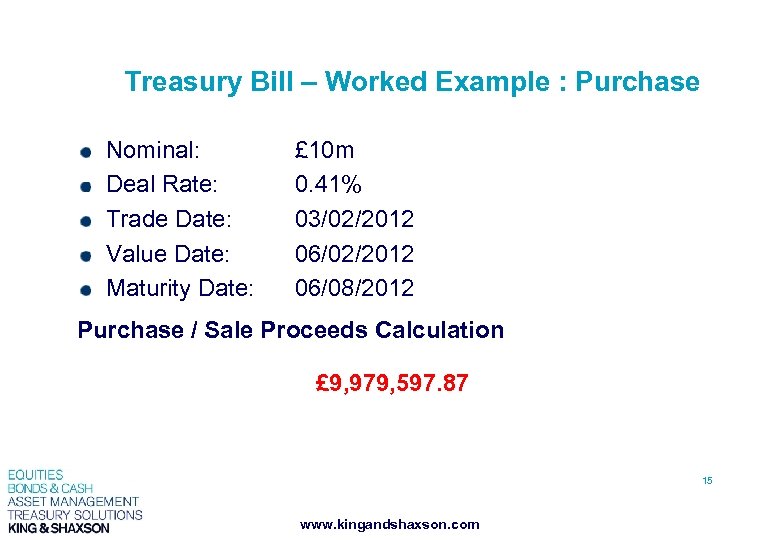

Treasury Bill – Worked Example : Purchase Nominal: Deal Rate: Trade Date: Value Date: Maturity Date: £ 10 m 0. 41% 03/02/2012 06/08/2012 Purchase / Sale Proceeds Calculation £ 9, 979, 597. 87 15 www. kingandshaxson. com

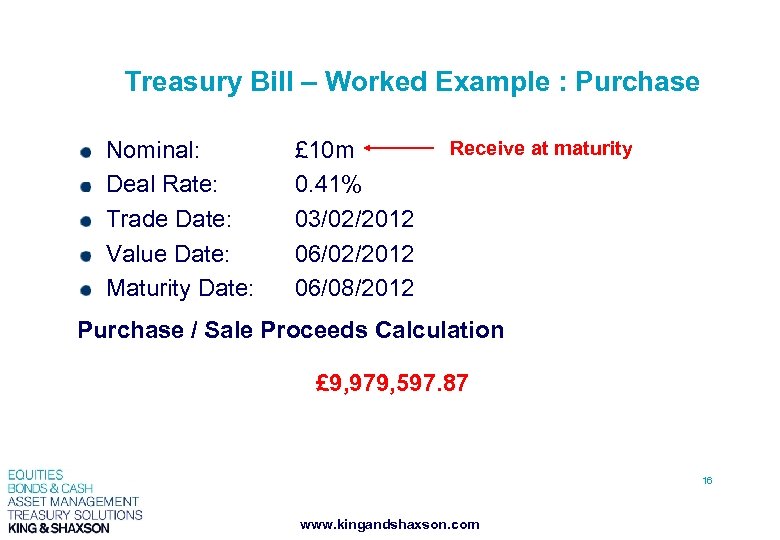

Treasury Bill – Worked Example : Purchase Nominal: Deal Rate: Trade Date: Value Date: Maturity Date: £ 10 m 0. 41% 03/02/2012 06/08/2012 Receive at maturity Purchase / Sale Proceeds Calculation £ 9, 979, 597. 87 16 www. kingandshaxson. com

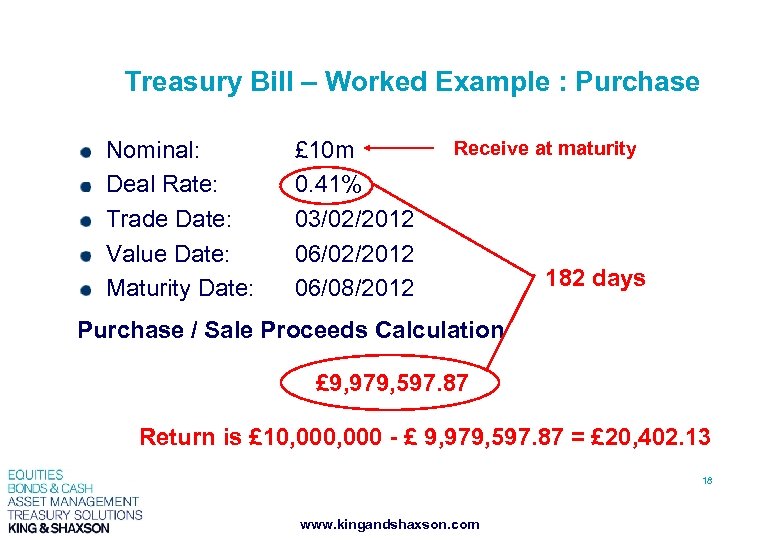

Treasury Bill – Worked Example : Purchase Nominal: Deal Rate: Trade Date: Value Date: Maturity Date: £ 10 m 0. 41% 03/02/2012 06/08/2012 Receive at maturity Purchase / Sale Proceeds Calculation £ 9, 979, 597. 87 Return is £ 10, 000 - £ 9, 979, 597. 87 = £ 20, 402. 13 17 www. kingandshaxson. com

Treasury Bill – Worked Example : Purchase Nominal: Deal Rate: Trade Date: Value Date: Maturity Date: £ 10 m 0. 41% 03/02/2012 06/08/2012 Receive at maturity 182 days Purchase / Sale Proceeds Calculation £ 9, 979, 597. 87 Return is £ 10, 000 - £ 9, 979, 597. 87 = £ 20, 402. 13 18 www. kingandshaxson. com

Certificates of Deposit (CD’s) 19 www. kingandshaxson. com

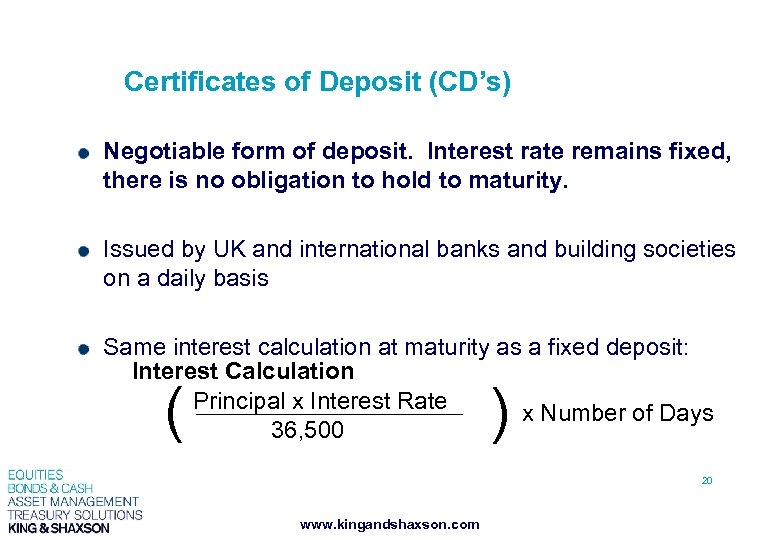

Certificates of Deposit (CD’s) Negotiable form of deposit. Interest rate remains fixed, there is no obligation to hold to maturity. Issued by UK and international banks and building societies on a daily basis Same interest calculation at maturity as a fixed deposit: Interest Calculation Principal x Interest Rate x Number of Days 36, 500 ( ) 20 www. kingandshaxson. com

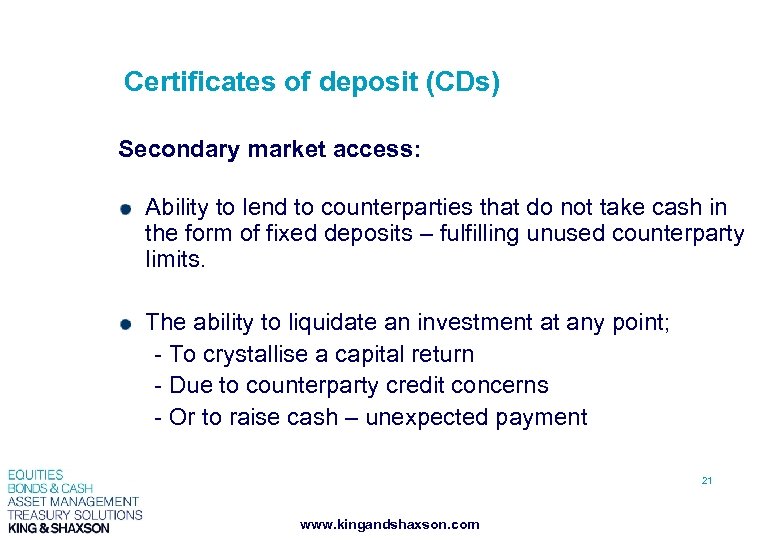

Certificates of deposit (CDs) Secondary market access: Ability to lend to counterparties that do not take cash in the form of fixed deposits – fulfilling unused counterparty limits. The ability to liquidate an investment at any point; - To crystallise a capital return - Due to counterparty credit concerns - Or to raise cash – unexpected payment 21 www. kingandshaxson. com

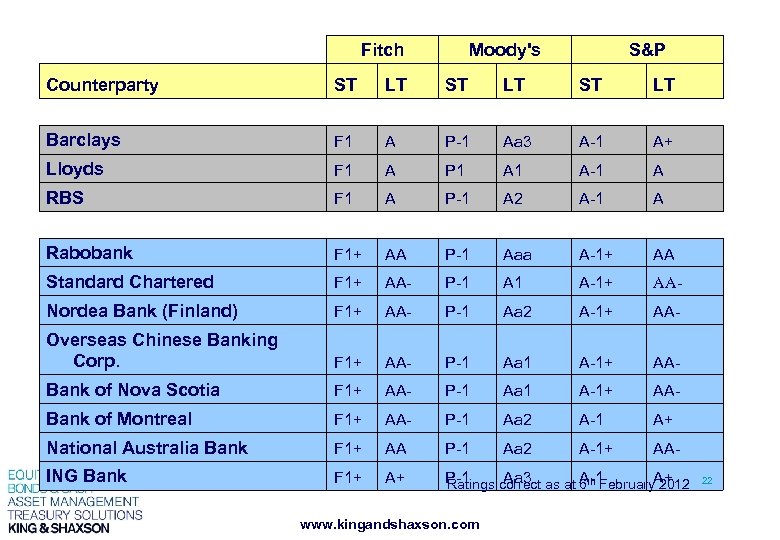

Fitch Moody's S&P Counterparty ST LT Barclays F 1 A P-1 Aa 3 A-1 A+ Lloyds F 1 A P 1 A-1 A RBS F 1 A P-1 A 2 A-1 A Rabobank F 1+ AA P-1 Aaa A-1+ AA Standard Chartered F 1+ AA- P-1 A 1 A-1+ AA- Nordea Bank (Finland) F 1+ AA- P-1 Aa 2 A-1+ AA- Overseas Chinese Banking Corp. F 1+ AA- P-1 Aa 1 A-1+ AA- Bank of Nova Scotia F 1+ AA- P-1 Aa 1 A-1+ AA- Bank of Montreal F 1+ AA- P-1 Aa 2 A-1 A+ National Australia Bank F 1+ AA P-1 Aa 2 A-1+ AA- ING Bank F 1+ A+ P-1 Aa 3 A-1 A+ Ratings correct as at 6 th February 2012 www. kingandshaxson. com 22

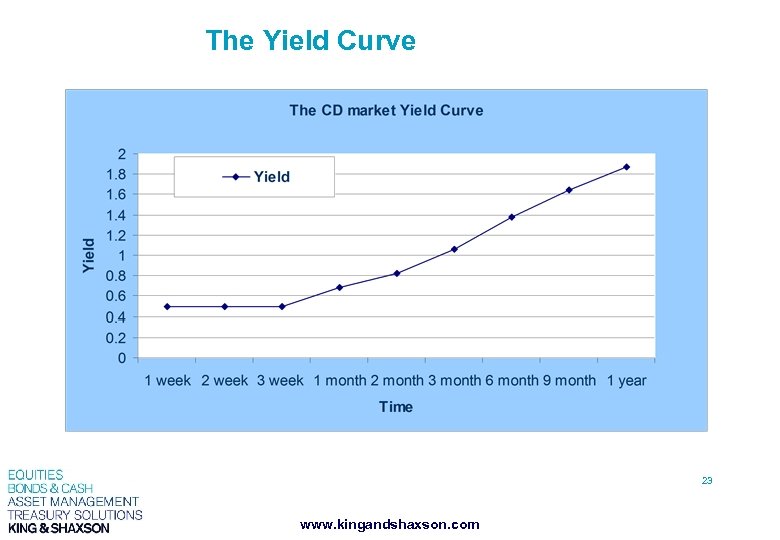

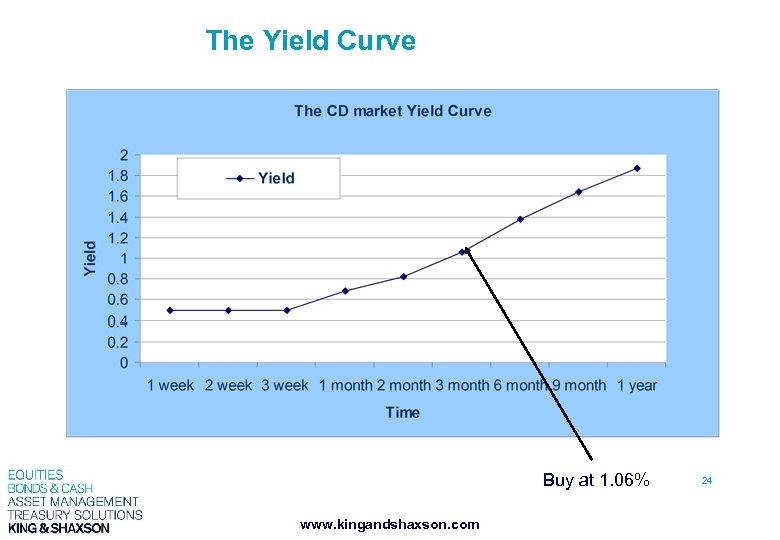

The Yield Curve 23 www. kingandshaxson. com

The Yield Curve Buy at 1. 06% www. kingandshaxson. com 24

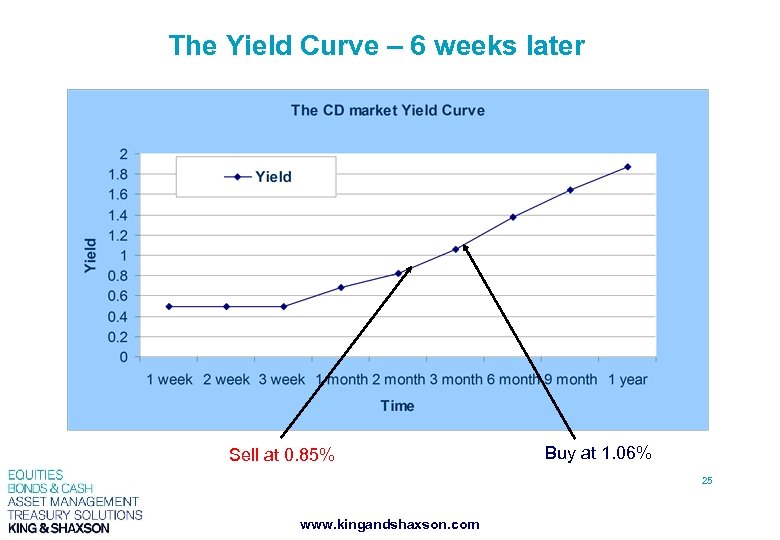

The Yield Curve – 6 weeks later Sell at 0. 85% Buy at 1. 06% 25 www. kingandshaxson. com

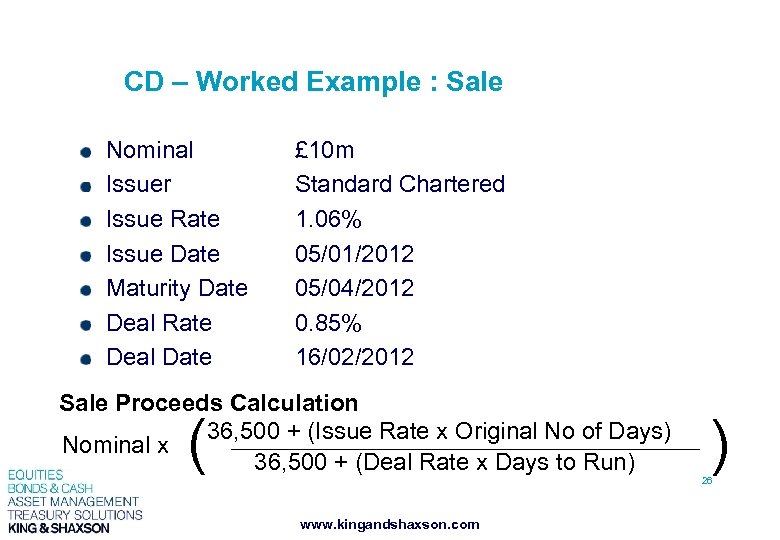

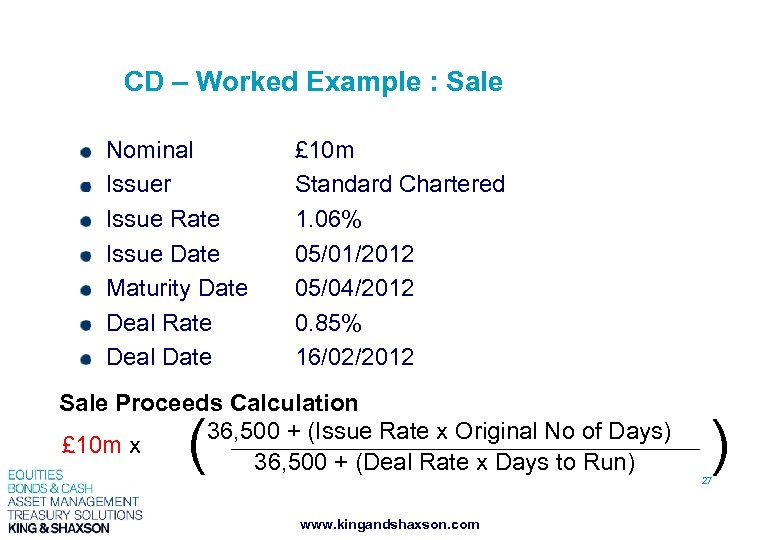

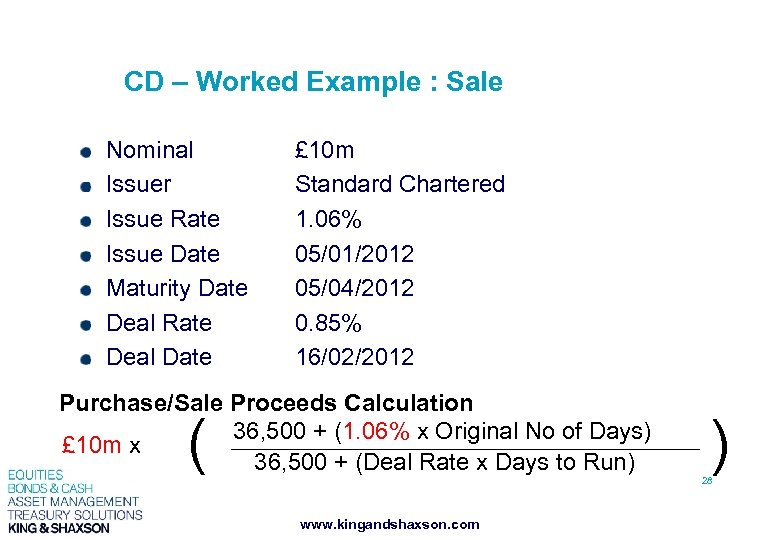

CD – Worked Example : Sale Nominal Issuer Issue Rate Issue Date Maturity Date Deal Rate Deal Date £ 10 m Standard Chartered 1. 06% 05/01/2012 05/04/2012 0. 85% 16/02/2012 Sale Proceeds Calculation 36, 500 + (Issue Rate x Original No of Days) Nominal x 36, 500 + (Deal Rate x Days to Run) ( www. kingandshaxson. com ) 26

CD – Worked Example : Sale Nominal Issuer Issue Rate Issue Date Maturity Date Deal Rate Deal Date £ 10 m Standard Chartered 1. 06% 05/01/2012 05/04/2012 0. 85% 16/02/2012 Sale Proceeds Calculation 36, 500 + (Issue Rate x Original No of Days) £ 10 m x 36, 500 + (Deal Rate x Days to Run) ( www. kingandshaxson. com ) 27

CD – Worked Example : Sale Nominal Issuer Issue Rate Issue Date Maturity Date Deal Rate Deal Date £ 10 m Standard Chartered 1. 06% 05/01/2012 05/04/2012 0. 85% 16/02/2012 Purchase/Sale Proceeds Calculation 36, 500 + (1. 06% x Original No of Days) £ 10 m x 36, 500 + (Deal Rate x Days to Run) ( www. kingandshaxson. com ) 28

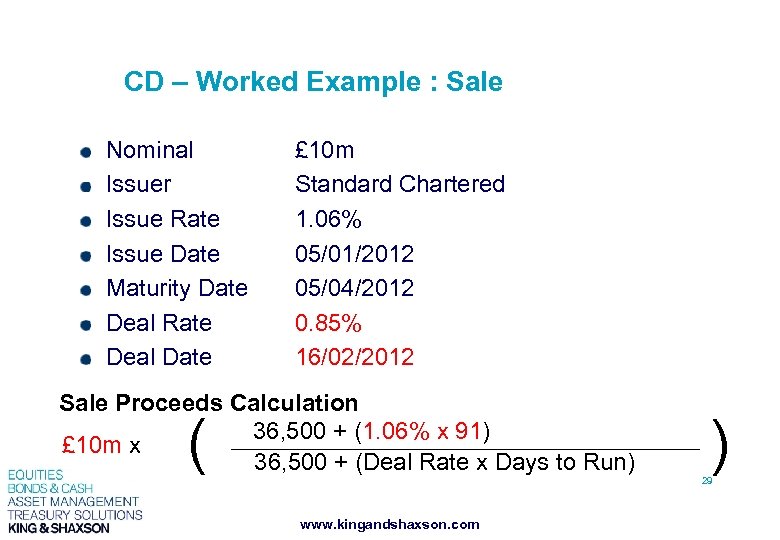

CD – Worked Example : Sale Nominal Issuer Issue Rate Issue Date Maturity Date Deal Rate Deal Date £ 10 m Standard Chartered 1. 06% 05/01/2012 05/04/2012 0. 85% 16/02/2012 Sale Proceeds Calculation 36, 500 + (1. 06% x 91) £ 10 m x 36, 500 + (Deal Rate x Days to Run) ( www. kingandshaxson. com ) 29

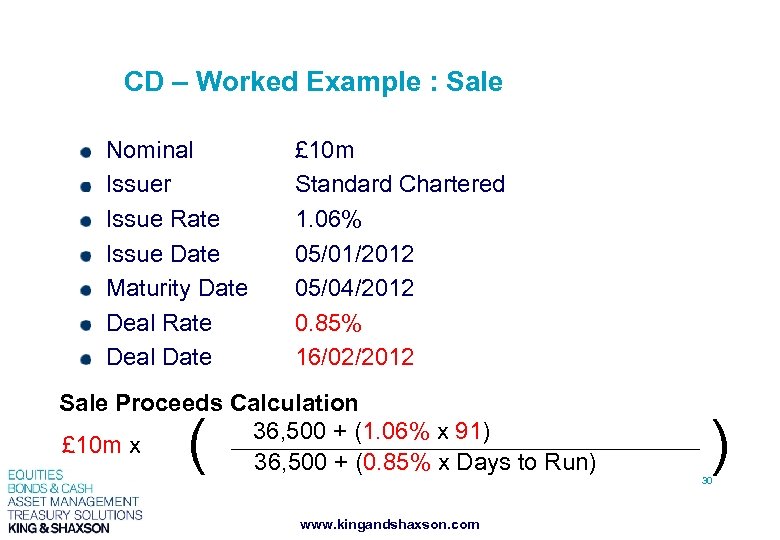

CD – Worked Example : Sale Nominal Issuer Issue Rate Issue Date Maturity Date Deal Rate Deal Date £ 10 m Standard Chartered 1. 06% 05/01/2012 05/04/2012 0. 85% 16/02/2012 Sale Proceeds Calculation 36, 500 + (1. 06% x 91) £ 10 m x 36, 500 + (0. 85% x Days to Run) ( www. kingandshaxson. com ) 30

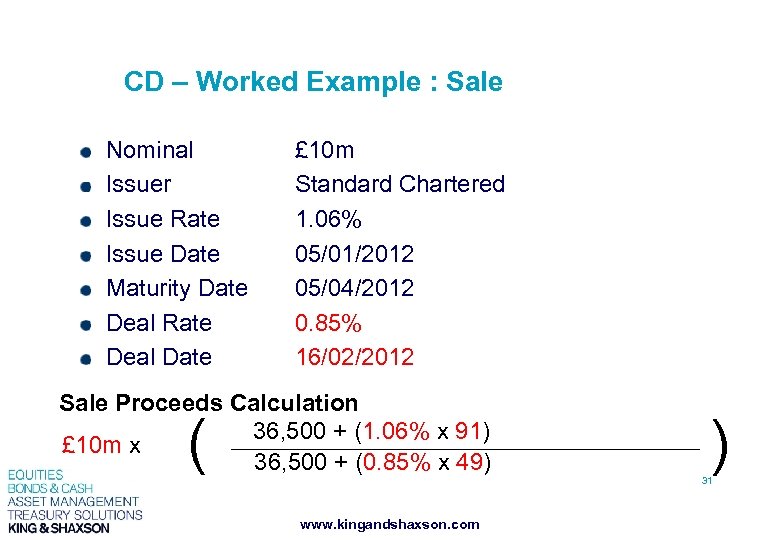

CD – Worked Example : Sale Nominal Issuer Issue Rate Issue Date Maturity Date Deal Rate Deal Date £ 10 m Standard Chartered 1. 06% 05/01/2012 05/04/2012 0. 85% 16/02/2012 Sale Proceeds Calculation 36, 500 + (1. 06% x 91) £ 10 m x 36, 500 + (0. 85% x 49) ( www. kingandshaxson. com ) 31

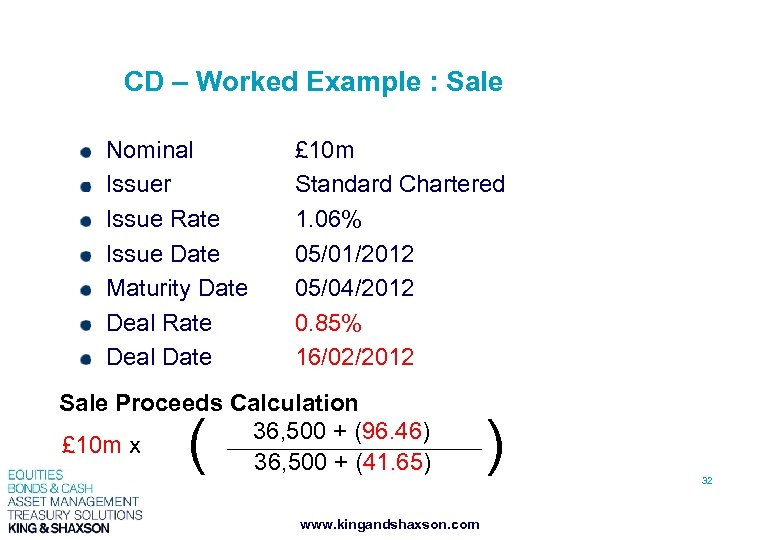

CD – Worked Example : Sale Nominal Issuer Issue Rate Issue Date Maturity Date Deal Rate Deal Date £ 10 m Standard Chartered 1. 06% 05/01/2012 05/04/2012 0. 85% 16/02/2012 Sale Proceeds Calculation 36, 500 + (96. 46) £ 10 m x 36, 500 + (41. 65) ( www. kingandshaxson. com ) 32

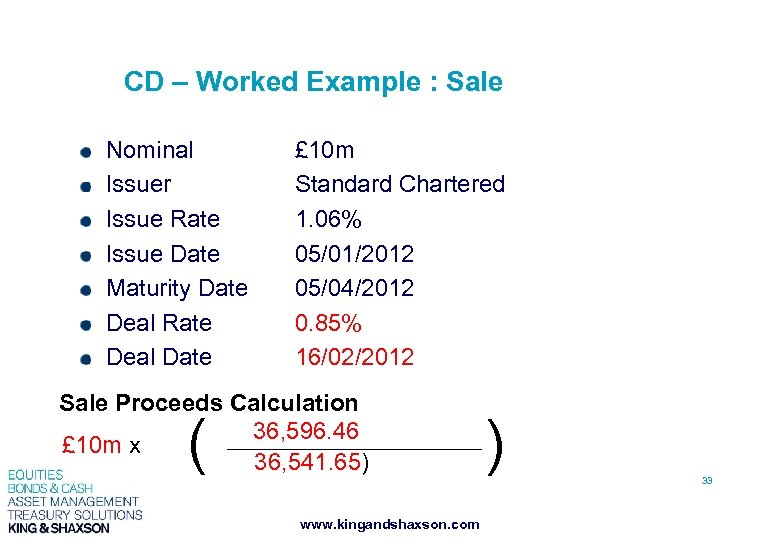

CD – Worked Example : Sale Nominal Issuer Issue Rate Issue Date Maturity Date Deal Rate Deal Date £ 10 m Standard Chartered 1. 06% 05/01/2012 05/04/2012 0. 85% 16/02/2012 Sale Proceeds Calculation 36, 596. 46 £ 10 m x 36, 541. 65) ( www. kingandshaxson. com ) 33

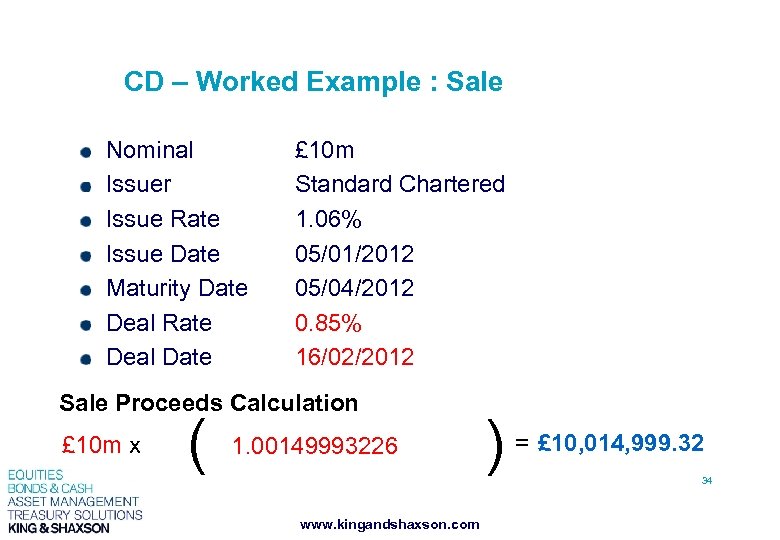

CD – Worked Example : Sale Nominal Issuer Issue Rate Issue Date Maturity Date Deal Rate Deal Date £ 10 m Standard Chartered 1. 06% 05/01/2012 05/04/2012 0. 85% 16/02/2012 Sale Proceeds Calculation £ 10 m x ( 1. 00149993226 www. kingandshaxson. com ) = £ 10, 014, 999. 32 34

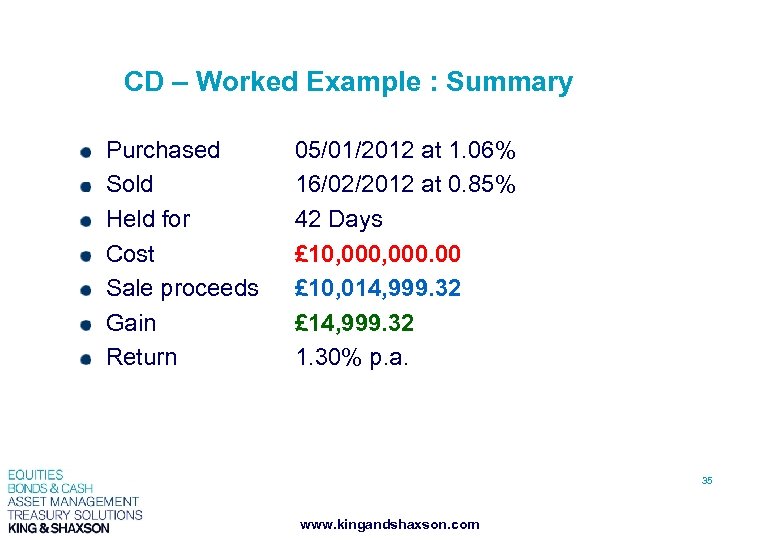

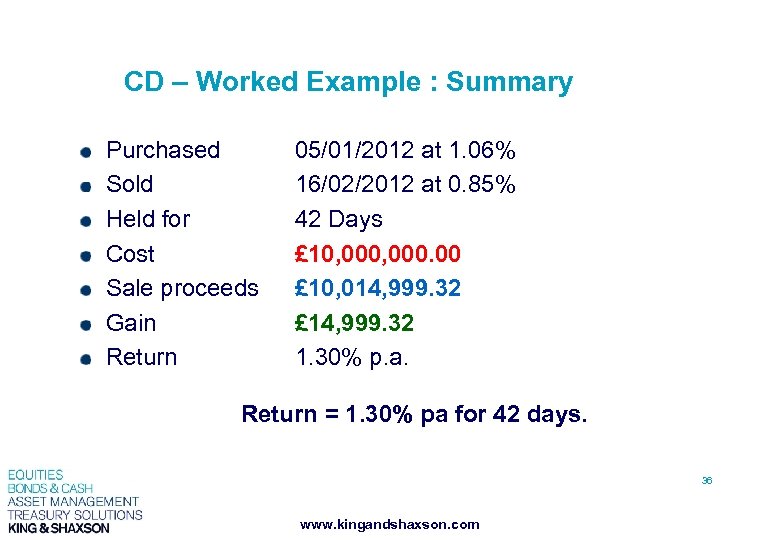

CD – Worked Example : Summary Purchased Sold Held for Cost Sale proceeds Gain Return 05/01/2012 at 1. 06% 16/02/2012 at 0. 85% 42 Days £ 10, 000. 00 £ 10, 014, 999. 32 £ 14, 999. 32 1. 30% p. a. 35 www. kingandshaxson. com

CD – Worked Example : Summary Purchased Sold Held for Cost Sale proceeds Gain Return 05/01/2012 at 1. 06% 16/02/2012 at 0. 85% 42 Days £ 10, 000. 00 £ 10, 014, 999. 32 £ 14, 999. 32 1. 30% p. a. Return = 1. 30% pa for 42 days. 36 www. kingandshaxson. com

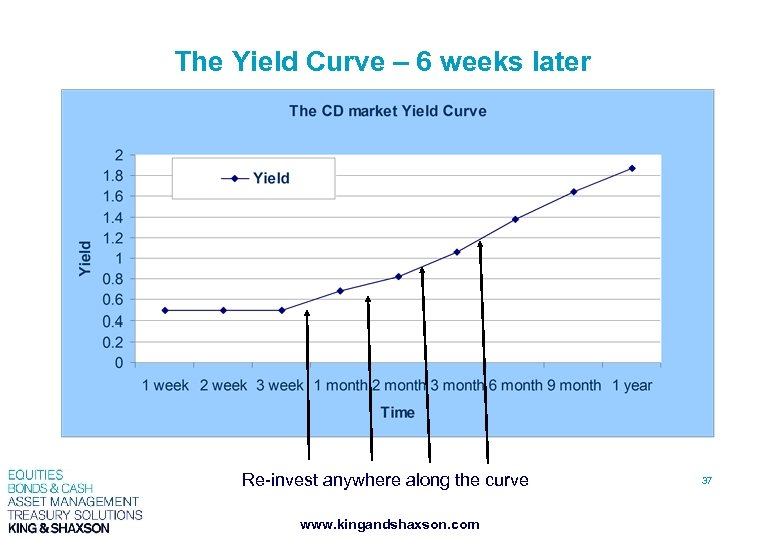

The Yield Curve – 6 weeks later Reinvest at 0. 68 Re-invest anywhere along the curve www. kingandshaxson. com 37

Conventional Fixed and Corporate Bonds 38 www. kingandshaxson. com

Conventional Fixed and Corporate Bonds Types of fixed bond: UK Gilt: HM Treasury AAA-rated, Sterling-denominated bond. Supranational: Joint and several liability of leading developed nations e. g. World Bank or EIB. Corporate bond: Issued by Banks, Building Societies and Corporate institutions. 39 www. kingandshaxson. com

Conventional Fixed and Corporate Bonds Guarantees to pay holder a coupon every 6 months until maturity on same dates each year Fixed flow of interest income and at maturity a fixed capital repayment. Coupon refers to the cash payment per £ 100 nominal that holder will receive each year. 40 www. kingandshaxson. com

Fixed income – accrued interest A holder of £ 1, 000 nominal of UKT 5. 25% 2012: - Receives two coupon payments of £ 26, 250 a year on 7 th March and 7 th September - Interest accrued since last interest payment date is paid in addition to the capital price. 41 www. kingandshaxson. com

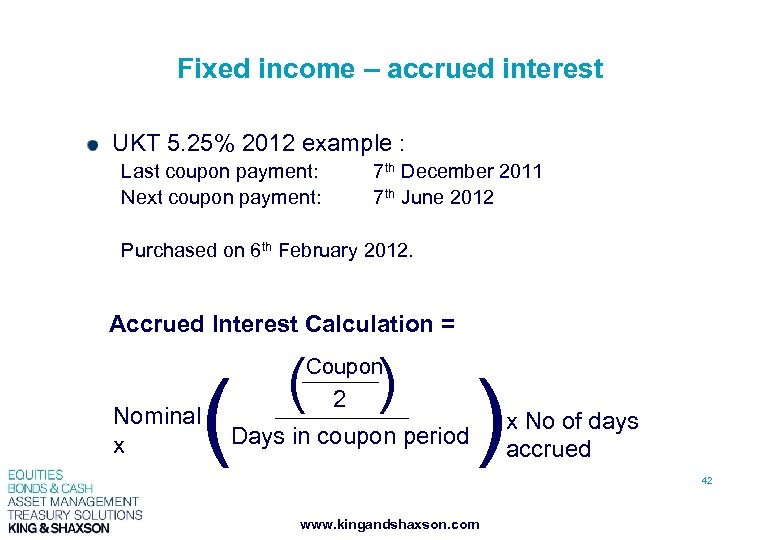

Fixed income – accrued interest UKT 5. 25% 2012 example : Last coupon payment: Next coupon payment: 7 th December 2011 7 th June 2012 Purchased on 6 th February 2012. Accrued Interest Calculation = ( ( ) Coupon 2 Nominal Days in coupon period x ) x No of days accrued 42 www. kingandshaxson. com

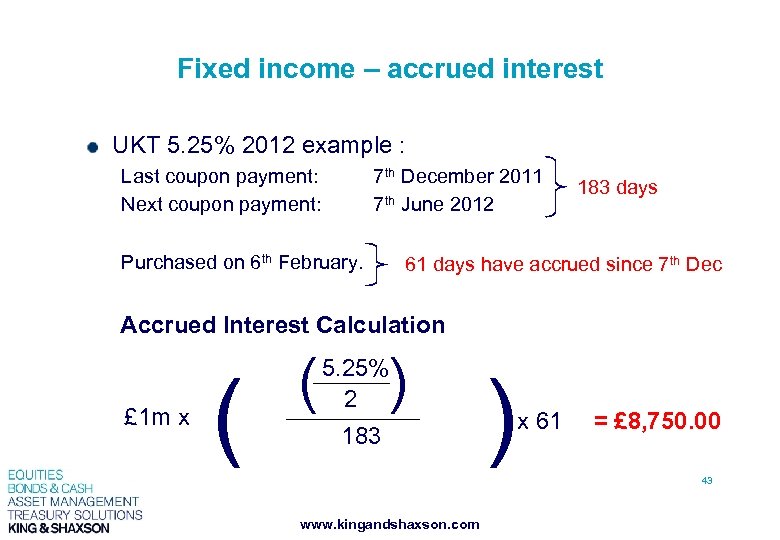

Fixed income – accrued interest UKT 5. 25% 2012 example : Last coupon payment: Next coupon payment: 7 th December 2011 7 th June 2012 Purchased on 6 th February. 183 days 61 days have accrued since 7 th Dec Accrued Interest Calculation £ 1 m x ( ( ) 5. 25% 2 183 ) x 61 = £ 8, 750. 00 43 www. kingandshaxson. com

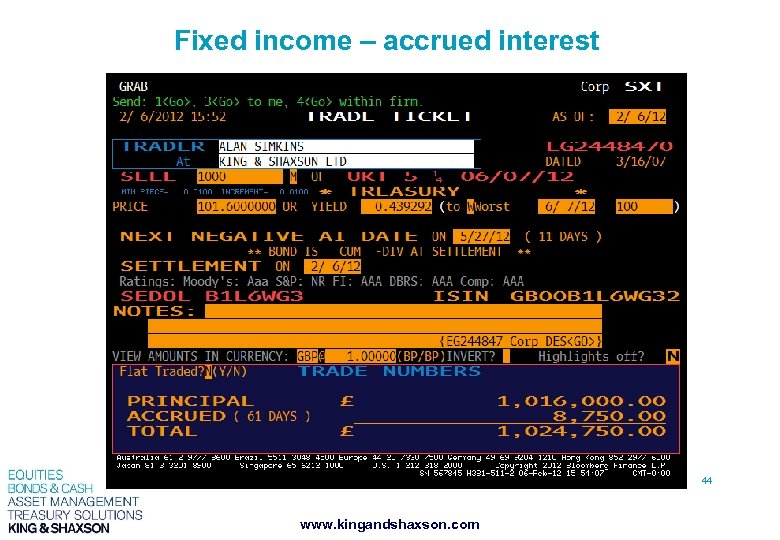

Fixed income – accrued interest 44 www. kingandshaxson. com

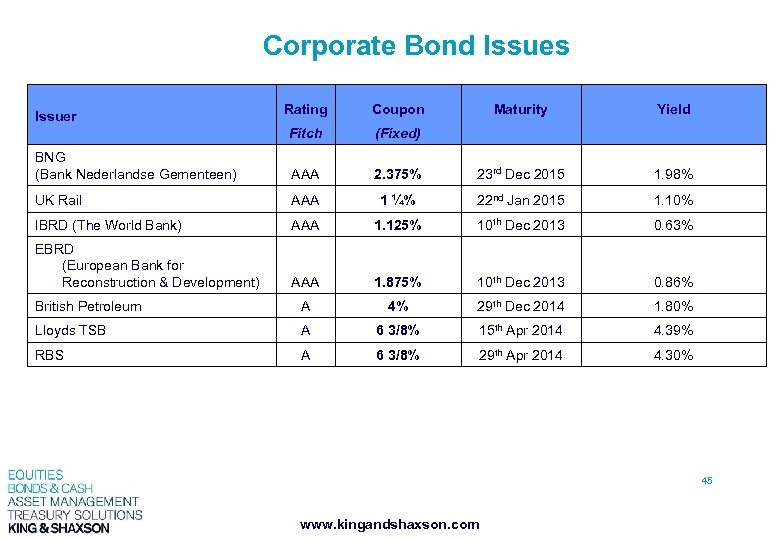

Corporate Bond Issues Rating Coupon Maturity Fitch (Fixed) BNG (Bank Nederlandse Gementeen) AAA 2. 375% 23 rd Dec 2015 1. 98% UK Rail AAA 1 ¼% 22 nd Jan 2015 1. 10% IBRD (The World Bank) AAA 1. 125% 10 th Dec 2013 0. 63% EBRD (European Bank for Reconstruction & Development) AAA 1. 875% 10 th Dec 2013 0. 86% British Petroleum A 4% 29 th Dec 2014 1. 80% Lloyds TSB A 6 3/8% 15 th Apr 2014 4. 39% RBS A 6 3/8% 29 th Apr 2014 4. 30% Issuer Yield 45 www. kingandshaxson. com

Floating Rate Notes (FRN’s) 46 www. kingandshaxson. com

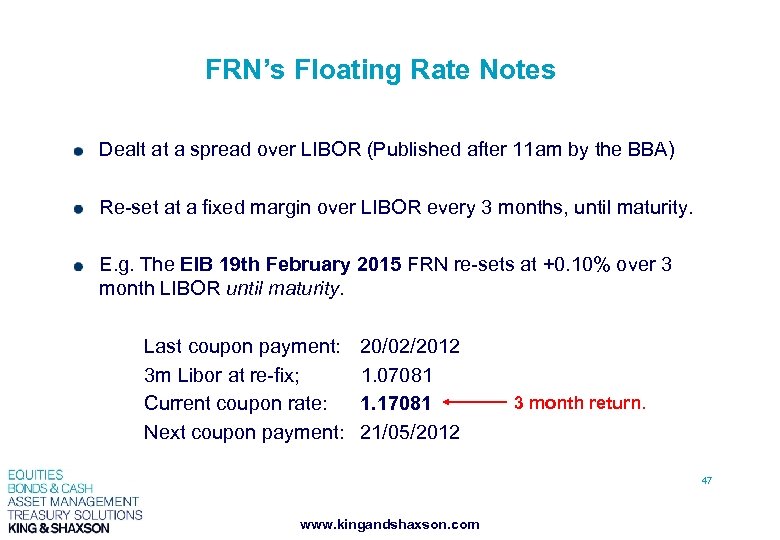

FRN’s Floating Rate Notes Dealt at a spread over LIBOR (Published after 11 am by the BBA) Re-set at a fixed margin over LIBOR every 3 months, until maturity. E. g. The EIB 19 th February 2015 FRN re-sets at +0. 10% over 3 month LIBOR until maturity. Last coupon payment: 20/02/2012 3 m Libor at re-fix; 1. 07081 Current coupon rate: 1. 17081 Next coupon payment: 21/05/2012 3 month return. 47 www. kingandshaxson. com

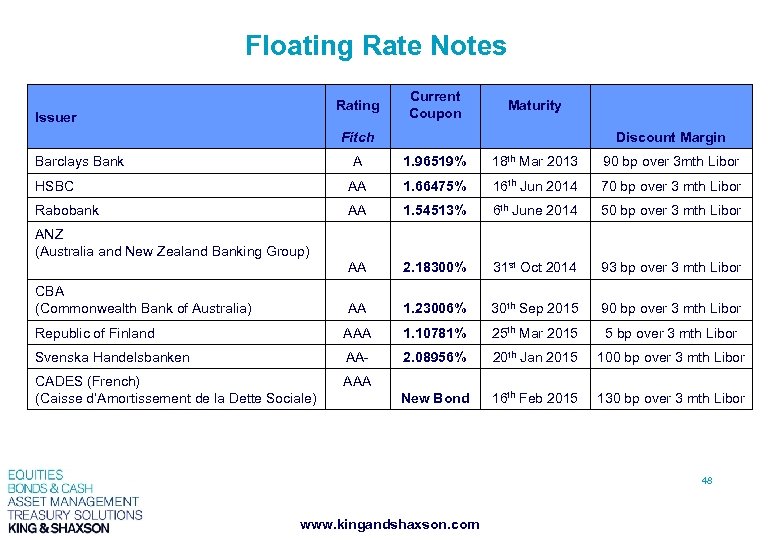

Floating Rate Notes Rating Issuer Current Coupon Fitch Barclays Bank Maturity Discount Margin A 1. 96519% 18 th Mar 2013 90 bp over 3 mth Libor HSBC AA 1. 66475% 16 th Jun 2014 70 bp over 3 mth Libor Rabobank AA 1. 54513% 6 th June 2014 50 bp over 3 mth Libor AA 2. 18300% 31 st Oct 2014 93 bp over 3 mth Libor AA 1. 23006% 30 th Sep 2015 90 bp over 3 mth Libor Republic of Finland AAA 1. 10781% 25 th Mar 2015 5 bp over 3 mth Libor Svenska Handelsbanken AA- 2. 08956% 20 th Jan 2015 100 bp over 3 mth Libor CADES (French) (Caisse d’Amortissement de la Dette Sociale) AAA New Bond 16 th Feb 2015 130 bp over 3 mth Libor ANZ (Australia and New Zealand Banking Group) CBA (Commonwealth Bank of Australia) 48 www. kingandshaxson. com

Summary Negotiable instruments offer additional avenues of investment, including: • Increased Liquidity • Counterparty diversification. • High quality credit, without sacrificing yield www. kingandshaxson. com

Any questions? www. kingandshaxson. com

Contact Details King & Shaxson Limited 5 th Floor, Candlewick House 120 Cannon Street LONDON, EC 4 N 6 AS Telephone: 020 7929 5300 Fax: 020 7283 6835 Alan Simkins Telephone: 020 7426 5966 Email: alan. simkins@kasl. co. uk Paul Turner Telephone: 020 7929 8529 Email: paul. turner@kasl. co. uk 51 www. kingandshaxson. com

King & Shaxson Capital Limited Reg. No. 2863591 and King & Shaxson Limited Reg. No. 869780, members of the London Stock Exchange, and King & Shaxson Asset Management Limited Reg. No. 3870667. The Registered Office for all companies is 6 th Floor, Candlewick House, 120 Cannon Street, London, EC 4 N 6 AS. All companies are registered in England are part of the hillip. Capital Group. P King & Shaxson Capital Limited (FSA Reg. No. 169760), King & Shaxson Limited (FSA Reg. No. 179213), and King & Shaxson Asset Management Limited Reg. No. 3870667 (FSA Reg. No. 193698) are Authorised and Regulated by the Financial Services Authority, 25 The North Colonnade, Canary Wharf, London E 14 5 HS. 52 www. kingandshaxson. com

Disclaimer General Past performance is no guarantee of future performance and the value of investments and the income from them may go down as well as up and is not guaranteed. The value of foreign currency dominated investments may be affected by exchange rates. The level of yield may be subject to fluctuation and is not guaranteed. No Offer The information contained in this document does not constitute and offer to buy or sell securities of any type. Nothing in this document should be construed as an offer, or the solicitation of an offer, to purchase or subscribe to sell any investment or to engage in any other transaction. No basis for decision making All information contained in this presentation has been prepared by King & Shaxson on the basis of publicly available information, internally developed data and other sources believed to be reliable. It is for general information purposes only and should not be considered an individualised recommendation or personalised investment, tax or legal advice. The information is subject to change without notice. Reasonable care has been taken to ensure that the materials are accurate and that the opinions stated are fair and reasonable. All opinions and estimates constitute our judgement as of the date of publication and do not constitute general or specific investment advice. All numbers are unaudited unless otherwise stated. Furthermore, please note that King & Shaxson and/or its affiliates and employees may have interests or positions in relevant securities or may have a relationship with the issuers. 53 www. kingandshaxson. com

74769b1eec9d38d87c8946a8e01bc4dd.ppt