d6bf5263753c530aa7b8c8b83bc28234.ppt

- Количество слайдов: 30

Investment Banking Merrill Lynch ICBC in IPO Financial Institution in HK ECON 310 s 4 g 4

Introduction to investment Bank l Best known in the world l Help companies to raise money in primary market l Intermediaries l Differ from commercial bank & brokerages l Commerical Bank: Take deposits and make commercial and retail loans l Brokerages: Assist in the purchase and sale of stocks, bonds, and mutual funds

Background of Merrill Lynch l Established in 1914 l Owner: Charles E. Merrill & Edmund C. Lynch l Place: Wall street in New York City l In 1959 become 1 st member firms of the New York Stock Exchange l Go public in 1971

Background of Merrill Lynch (con’t) l CEO l President & Chairman of the Board l Industry: Finance & Insurance l Main Products l Financial Services l Investment Banking l Investment Management I’m Stan O’ Neal

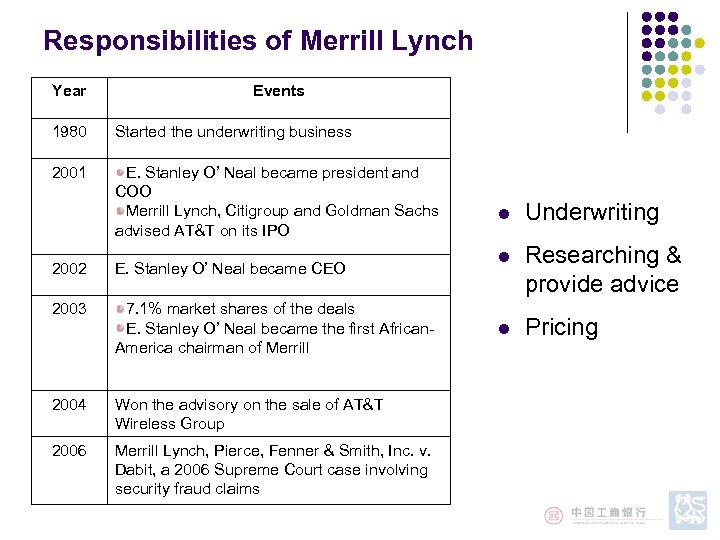

Responsibilities of Merrill Lynch Year Events 1980 Started the underwriting business 2001 E. Stanley O’ Neal became president and COO Merrill Lynch, Citigroup and Goldman Sachs advised AT&T on its IPO 2002 E. Stanley O’ Neal became CEO 2003 7. 1% market shares of the deals E. Stanley O’ Neal became the first African. America chairman of Merrill 2004 Won the advisory on the sale of AT&T Wireless Group 2006 Merrill Lynch, Pierce, Fenner & Smith, Inc. v. Dabit, a 2006 Supreme Court case involving security fraud claims l Underwriting l Researching & provide advice l Pricing

Multicultural Marketing of Merrill Lynch l African American Marketing l Hispanic American Marketing l LGBT (Lesbian, Gay, Bisexual and Transgender) Marketing l Native American Marketing l South Asian Marketing l Special Needs Marketing l Women’s Marketing

Major Locations of Merrill Lynch l New York City, New York, U. S. , global headquarters l Jacksonville, Florida, U. S. , corporate center, supporting North America operations l Hopewell, New Jersey U. S. , corporate center, supporting North America operations l Jersey City, New Jersey U. S. , corporate center, supporting North America operations

Major Locations of Merrill Lynch (Con’t) l l l Princeton, New Jersey, U. S. , corporate center, GPC Home Office Singapore, corporate center, supporting Asian Pacific Rim (APR) operations, namely Hong Kong & Tokyo London, UK, European headquarters Hong Kong, PRC Tokyo, Japan

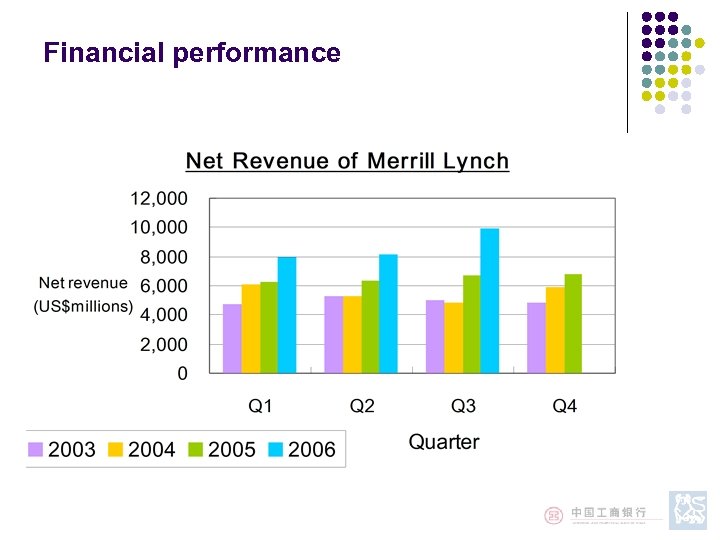

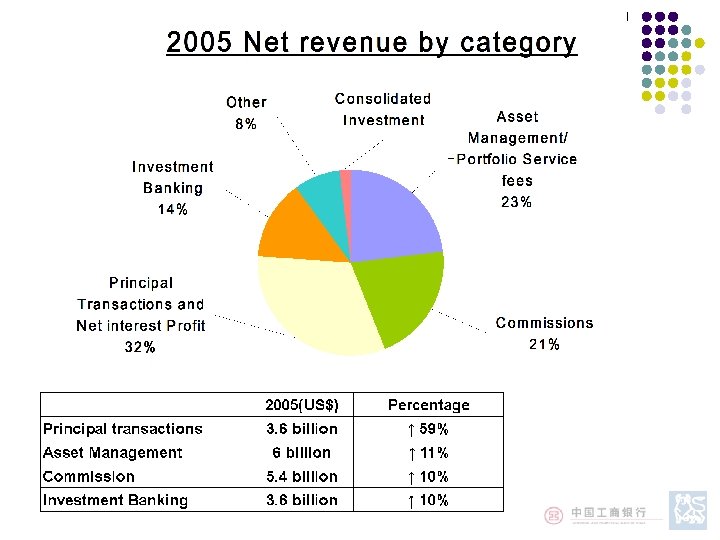

Financial performance

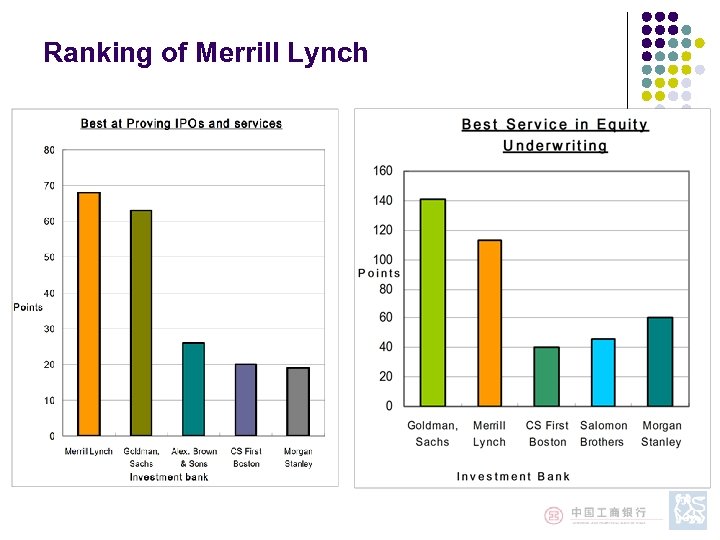

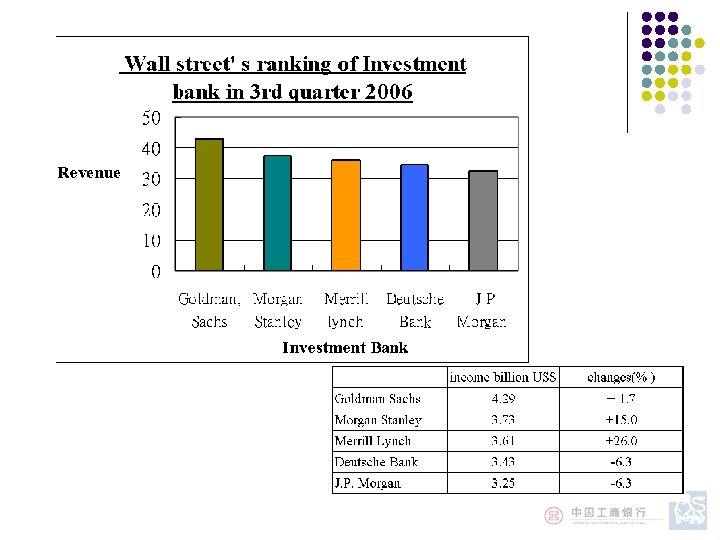

Ranking of Merrill Lynch

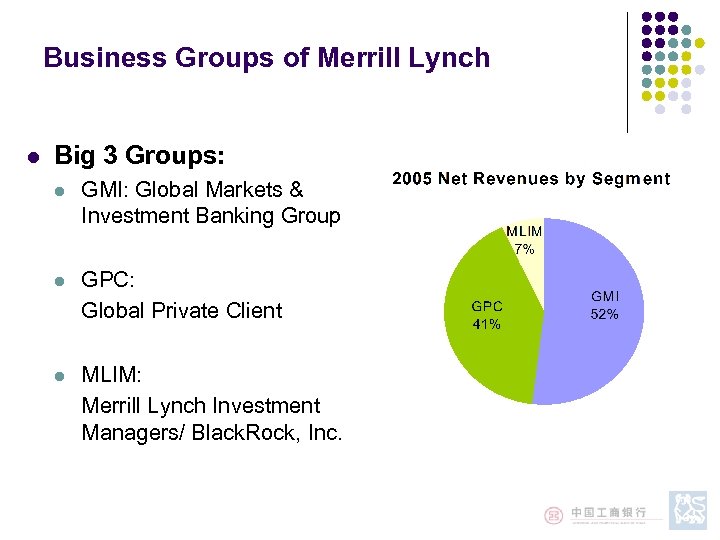

Business Groups of Merrill Lynch l Big 3 Groups: l GMI: Global Markets & Investment Banking Group l GPC: Global Private Client l MLIM: Merrill Lynch Investment Managers/ Black. Rock, Inc.

Highlights achieved in the markets l No. 1 trader of U. S. Stocks (NYSE) since 1989 l 2005 l l Leading Player l Best Investment Bank of the Year by The Banker. l Top European Equity House by International Financing Review l l No. 1 Private Banking Assets, fifth consecutive year, Top China Equity House by International Financing Review Asia. 2006 l Best Investment Bank by Euromoney l Barron's Best 100 Brokers l Top Full-Service Brokerage House

Background of ICBC l Established in 1 Jan 1984 l One of the big four commercial bank l Decided to restructure

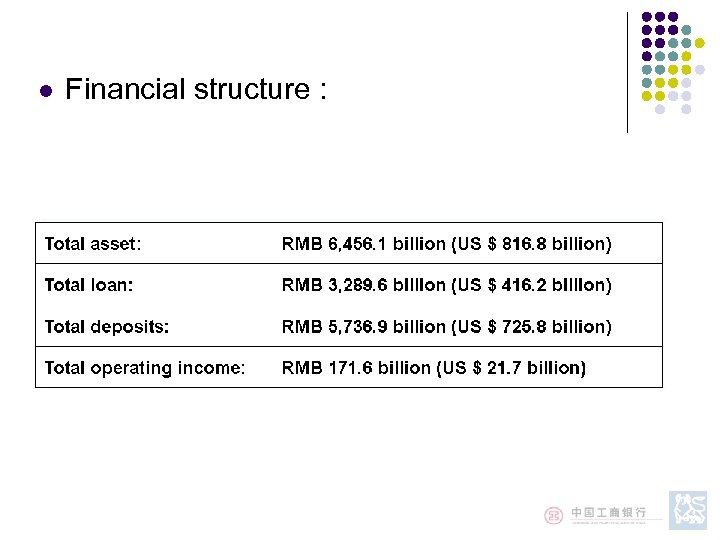

l Financial structure :

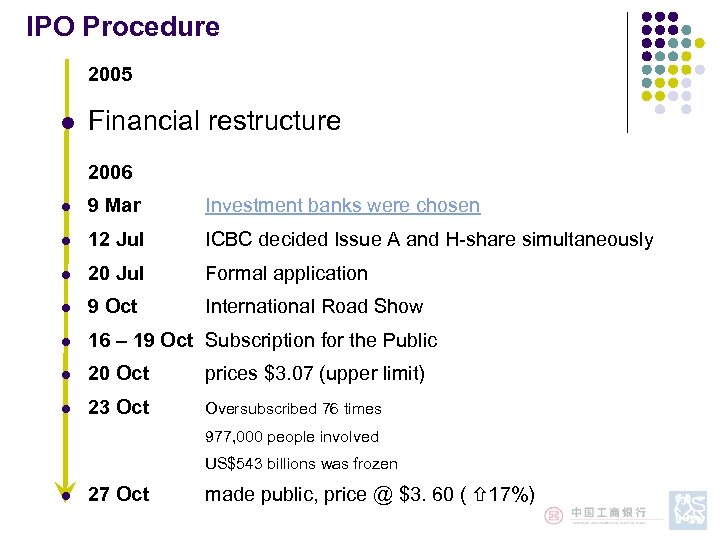

IPO Procedure 2005 l Financial restructure 2006 l 9 Mar Investment banks were chosen l 12 Jul ICBC decided Issue A and H-share simultaneously l 20 Jul Formal application l 9 Oct International Road Show l 16 – 19 Oct Subscription for the Public l 20 Oct prices $3. 07 (upper limit) l 23 Oct Oversubscribed 76 times 977, 000 people involved US$543 billions was frozen l 27 Oct made public, price @ $3. 60 ( 17%)

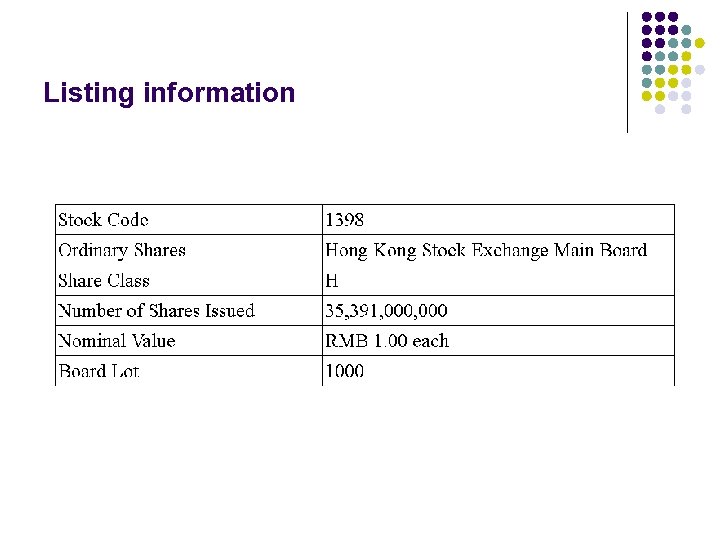

Listing information

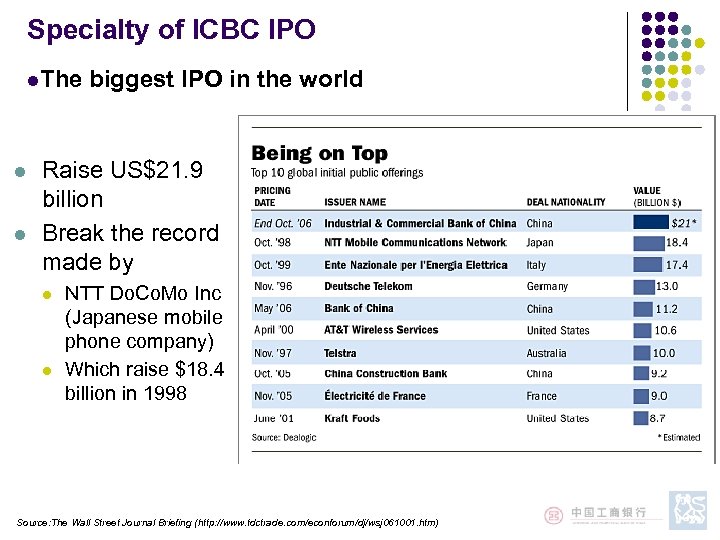

Specialty of ICBC IPO l. The l l biggest IPO in the world Raise US$21. 9 billion Break the record made by l l NTT Do. Co. Mo Inc (Japanese mobile phone company) Which raise $18. 4 billion in 1998 Source: The Wall Street Journal Briefing (http: //www. tdctrade. com/econforum/dj/wsj 061001. htm)

Specialty of ICBC IPO(con’t) l First time issue A and H-shares simultaneously l Landmark of the stock history l the Chief Executive l Mayor of Shanghai l Good example for other enterprises attended the ICBC’s IPO ceremony in Hong Kong and Shanghai respectively

Specialty of ICBC IPO(con’t) l Biggest white form e. IPO application l ~10% investors using e. IPO (~ 83, 000 people) l Protect the environment l Convenient to investors l Saving the transaction fee to investors l Receive allotment result by email

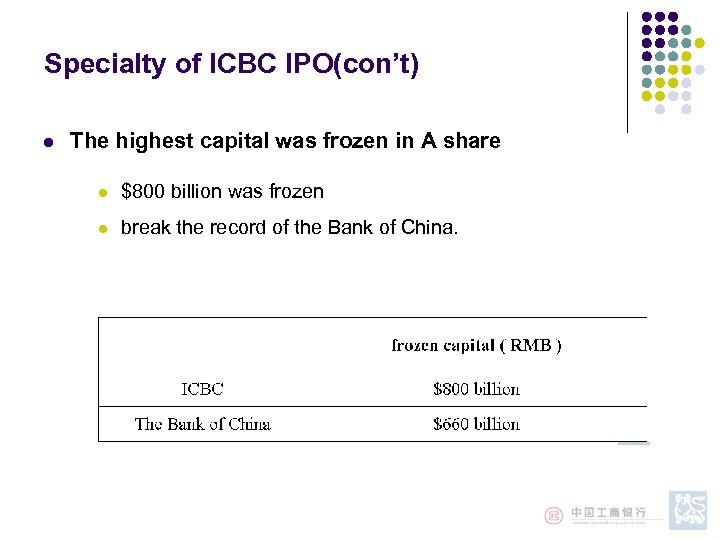

Specialty of ICBC IPO(con’t) l The highest capital was frozen in A share l $800 billion was frozen l break the record of the Bank of China.

Specialty of ICBC IPO(con’t) l Other new records l Most retailer investors apply ( 997, 000 people) l First day HK$37. 4 billion l No. of bank collect form 7 Banks, 88 branches l Issue Warrant and Share simultaneously

Influence in HK l Ensure the international financial position in HK l 2004 l l l world 3 rd largest fund raised market After New York and Madrid 2006 l l HK has good banking system & listing requirement ICBC & Bo. C IPO → the largest fund raised market

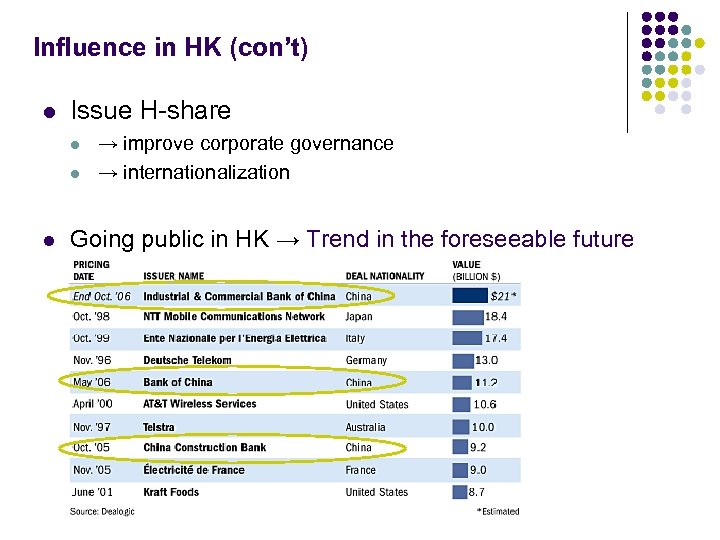

Influence in HK (con’t) l Issue H-share l l l → improve corporate governance → internationalization Going public in HK → Trend in the foreseeable future

Comment l Playing an important role on adjusting the initial price of stock advice: not to issue so many warrants to stabilize the initial price l Setting of initial price a gain for all the subscribers in the market underwriting fee: 2. 5% per book runner Merrill Lynch itself earned $50 M 043083 SIU KAM HA JOYCE

Comment (Con’t) l Position has been raised l Exposure of a variety of risks e. g. market risk, Liquidity Risk, Competitive Environment caused by the unpredictable factors Suggestion: paying more attention + identifying the risks + solutions 043083 SIU KAM HA JOYCE

Conclusion l Merrill Lynch had played an important role on the success of ICBC stock issuing giving contributable advice gaining satisfactory earnings + growth being one of the most famous investment banks in the world affecting other companies’ ranking somehow a promotion of a stock with the invitation of large book runner 043083 SIU KAM HA JOYCE

t. H e E n D

l Joint Coordinator & Joint Sponsors l l CICC ICEA Merrill Lynch Joint Bookrunners l l l Merrill Lynch CICC Credit Suisse Deutsche Bank ICEA Back

d6bf5263753c530aa7b8c8b83bc28234.ppt