c60021f31dbf7aa904383090fffaaec2.ppt

- Количество слайдов: 13

Investment Banking Involves: 1. Providing advice on new security issues (how to raise funds) 2. Underwriting new security issues (sells at guaranteed price, often using syndicate, after researching issuer’s value in due diligence process & preparing prospectus, lead bank keeps part of spread & divides the rest, profit or spread vs unsold issue) 3. Providing advice & financing for M&As (to seller & buyer willing to pay above MV, fair opinion about offer, helps with capital structure to raise funds, particularly profitable for bank which does not need to invest its own capital) 4. Fin engineering, including risk management (new derivatives & invest. strategies) 5. Research (for hold, buy overweigh or sell underweight recommendations; bank’s trading desks; M&A advising; reports and forecasts; sway market) 6. Proprietary trading (for bank’s own account; major operations & profit source since 1990 s; exposes banks to both interest-rate & credit risk; trading with significant borrowed funds increased leverage & funding risk during fin crises).

“Repo Financing” and Rising Leverage in Investment Banking • Investment banks’ sources of funds include bank’s capital & short-term borrowing. • During 1990 s & 2000 s large investment banks converted from partnerships to publicly traded corporations. Proprietary trading became a more important source of profits. • Financing investments by borrowing rather than by using capital increases leverage. Because a bank’s ROE = ROA * leverage, leverage magnifies ROE for given ROA. • Federal regulations on commercial banks’ leverage didn’t apply to investment banks. Investment banks increasingly borrowed (primarily by issuing commercial paper or repos) to finance investments, became more leveraged than commercial banks. Investment bank can finance buying $10 M mortgage-backed securities with: 1) Equity; 2) Borrowing $7. 5 M & $2. 5 M equity; 3) Borrowing $9. 5 M & $0. 5 M equity. Leverage = assets/capital 10 M/10 M = 1 10 M/2. 5 M = 4 10 M/0. 5 M = 20 If value of mortgage-backed securities or ROA = +/- 5%, ROE = +/- 5%*1 = +/-5% +/- 5%*4 = +/- 20% +/- 5%*20 = +/- 100% • Maturity mismatch = using short-term funds to invest in mortgage-backed securities or long-term loans (JPMorgan Chase 2007 Annual Report: “fin commandment that cannot be violated. ” Unfortunately prior to fin crisis many investment banks did). • The process of reducing leverage is called deleveraging.

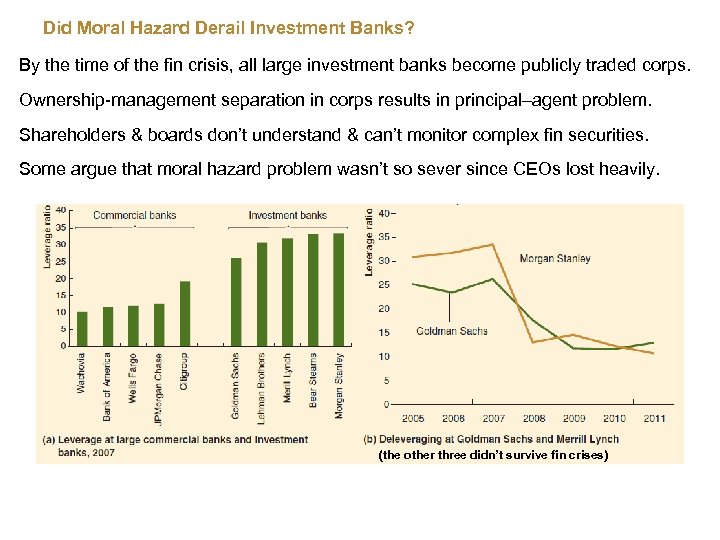

Did Moral Hazard Derail Investment Banks? By the time of the fin crisis, all large investment banks become publicly traded corps. Ownership-management separation in corps results in principal–agent problem. Shareholders & boards don’t understand & can’t monitor complex fin securities. Some argue that moral hazard problem wasn’t so sever since CEOs lost heavily. (the other three didn’t survive fin crises)

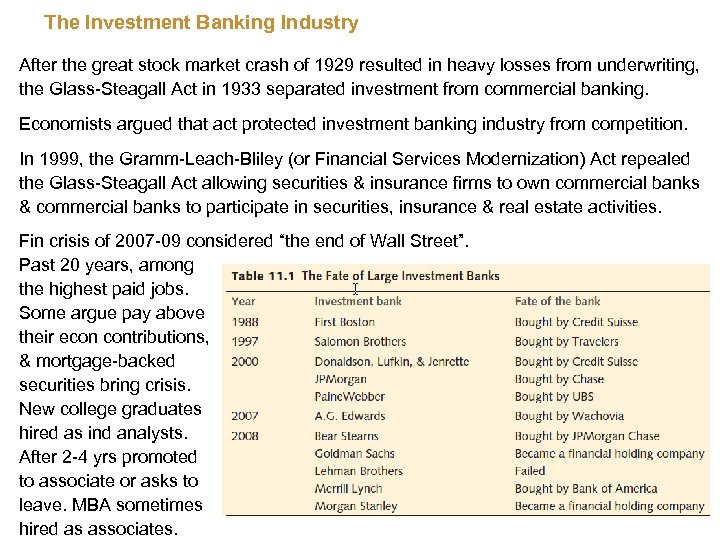

The Investment Banking Industry After the great stock market crash of 1929 resulted in heavy losses from underwriting, the Glass-Steagall Act in 1933 separated investment from commercial banking. Economists argued that act protected investment banking industry from competition. In 1999, the Gramm-Leach-Bliley (or Financial Services Modernization) Act repealed the Glass-Steagall Act allowing securities & insurance firms to own commercial banks & commercial banks to participate in securities, insurance & real estate activities. Fin crisis of 2007 -09 considered “the end of Wall Street”. Past 20 years, among the highest paid jobs. Some argue pay above their econ contributions, & mortgage-backed securities bring crisis. New college graduates hired as ind analysts. After 2 -4 yrs promoted to associate or asks to leave. MBA sometimes hired as associates.

Investment Institutions: Mutual & Hedge Funds, & Fin Companies Investment institution is financial firm that raise funds to invest in loans & securities. Mutual funds sell shares & invest in portfolio of stocks, bonds, mortgages & money market securities (↓ transaction costs, risk-sharing benefits, gather info on investments). • Closed-end mutual funds: a fixed number of nonredeemable shares. • Open-end mutual funds: redeem shares after markets close. • Exchange-traded funds (ETFs): usually indices, trade continuously. Inexpensive diversified portfolio for arbitrage keeps ETF’s close to prices of underlying assets. • No-load funds: funds do not charge a commission, or “load. ” • Front/Back end load funds: charge “load” to both buy & sell shares early. • Index fund: fixed basket of securities, such as stocks in the S&P 500 stock index. Money market mutual fund invests exclusively in short-term assets (T-bills, negotiable CDs & commercial papers). • Most allow savers to write checks against their accounts. • Popular alternative to commercial banks increasing competition.

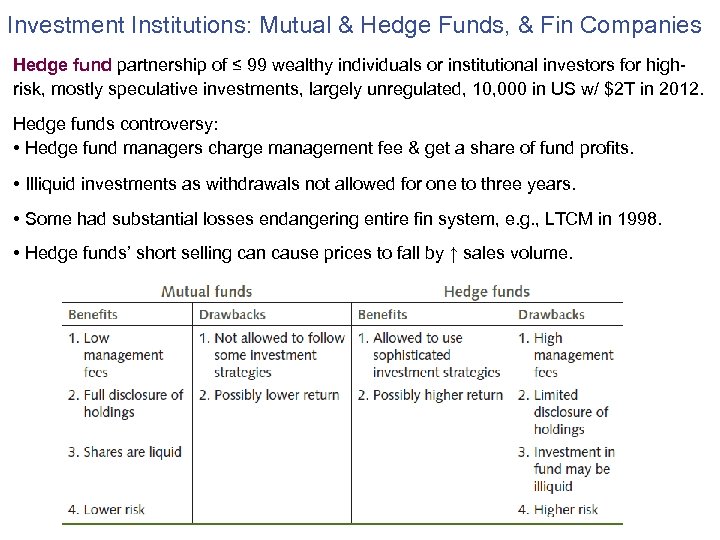

Investment Institutions: Mutual & Hedge Funds, & Fin Companies Hedge fund partnership of ≤ 99 wealthy individuals or institutional investors for highrisk, mostly speculative investments, largely unregulated, 10, 000 in US w/ $2 T in 2012. Hedge funds controversy: • Hedge fund managers charge management fee & get a share of fund profits. • Illiquid investments as withdrawals not allowed for one to three years. • Some had substantial losses endangering entire fin system, e. g. , LTCM in 1998. • Hedge funds’ short selling can cause prices to fall by ↑ sales volume.

Finance Companies Nonbank financial intermediary that raises money through sales of securities and uses the funds to make small loans to households and firms. • A lower degree of regulation allows finance companies to tailor loans closer to the needs of borrowers than do the standard loans. • The three main types of finance companies are consumer finance, business finance, and sales finance firms. • Finance companies have an advantage over commercial banks in monitoring the value of collateral, so they are key lenders for consumer durables and business equipment.

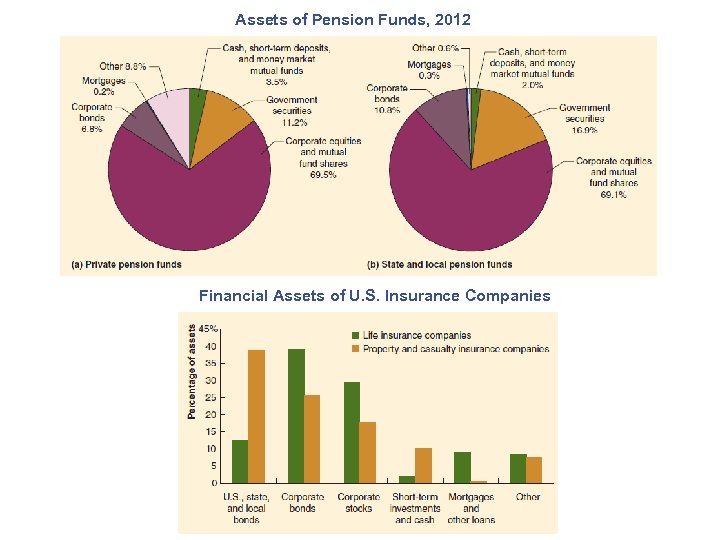

Contractual Savings Institutions Receive payments from individuals as a result of a contract & make investments. Pension fund invests workers’ & firms’ contributions for retirement benefit (the largest institutional participants in capital markets, assets ≈ $10 T in US in 2012). For pension benefits employee must be vested (# of years you must work). Employees prefer pension plans to personal savings for three reasons: 1) pension plans can manage a portfolio more efficiently and at a lower cost; 2) benefits such as annuities are expensive for individuals to obtain; and 3) the tax treatment of pension funds benefits the employee. Defined benefit vs Defined contribution (e. g. 401(k): employee makes tax-deductible contributions through regular payroll deductions). Issuing firm liable for the difference in underfunded plans (funds < promised benefits). Employee Retirement Income Security Act (ERISA) in 1974 set national standards for vesting & funding. Pension Benefit Guaranty Corporation (PBGC) created to insure pension benefits up to a limit if underfunding due to bankruptcy or other reasons.

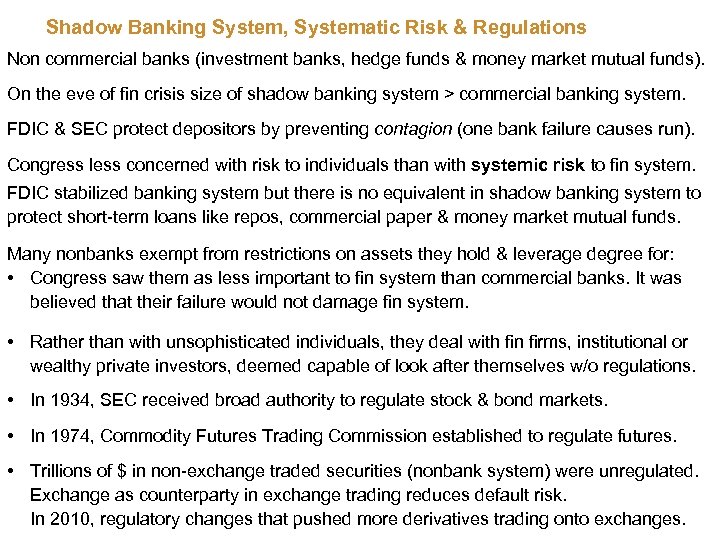

Contractual Savings Institutions Insurance company specializes in writing contracts to protect policyholders from the risk of financial loss associated with particular events. Funds from premiums used for investments or private placements. Typically profits come from investing premiums since claims exceed premiums. Life insurance: protect against lost earnings from disability, retirement, or death. Property and casualty: protect from illness, theft, fire, accidents, or natural disasters. Risk Pooling and Diversification: issue enough policies to cover risk of an event based on actuary probability tables. Screening and Risk-Based Premiums ↓ Adverse Selection (People most likely to require insurance are the most eager to buy it): screen out insurance risks & charge risk-based premiums (based on probability of claim). Deductibles, Coinsurance & Restrictive Covenants ↓ Moral Hazard (change behavior once you have insurance): align policy holder & insurers interests through Deductible to reduce the likelihood that an insured event takes place. Coinsurance (copayment) for lower premium further keeps cost down. Restrictive covenants limit risky activities for claim to be paid.

Assets of Pension Funds, 2012 Financial Assets of U. S. Insurance Companies

Shadow Banking System, Systematic Risk & Regulations Non commercial banks (investment banks, hedge funds & money market mutual funds). On the eve of fin crisis size of shadow banking system > commercial banking system. FDIC & SEC protect depositors by preventing contagion (one bank failure causes run). Congress less concerned with risk to individuals than with systemic risk to fin system. FDIC stabilized banking system but there is no equivalent in shadow banking system to protect short-term loans like repos, commercial paper & money market mutual funds. Many nonbanks exempt from restrictions on assets they hold & leverage degree for: • Congress saw them as less important to fin system than commercial banks. It was believed that their failure would not damage fin system. • Rather than with unsophisticated individuals, they deal with fin firms, institutional or wealthy private investors, deemed capable of look after themselves w/o regulations. • In 1934, SEC received broad authority to regulate stock & bond markets. • In 1974, Commodity Futures Trading Commission established to regulate futures. • Trillions of $ in non-exchange traded securities (nonbank system) were unregulated. Exchange as counterparty in exchange trading reduces default risk. In 2010, regulatory changes that pushed more derivatives trading onto exchanges.

The Fragility of the Shadow Banking System Many firms in shadow banking system borrowed short term to lend long term. Investors lending to investment banks unprotected by FDIC more susceptible to runs. Due in part to no regulation highly leveraged investment banks made risky investments. Many investment banks lost heavily due to investments in mortgage-backed securities. Are Shadow Banks Still Vulnerable to Runs Today? Following 07 -09 Fin Crisis calls for extensive regulation of the shadow banking system. However Dodd-Frank Act contained limited regulation of the shadow banking system: o Trading of derivatives needed to be carried out on exchanges. o Large hedge funds needed to be registered with the SEC. o Firms selling mortgage-backed securities were required to hold 5% of the credit risk. A basic problem (some shadow banks borrow short term for highly leveraged long-term investments) was still not addressed.

c60021f31dbf7aa904383090fffaaec2.ppt