7aec25f3295ec271dcbd674dc71d8d9b.ppt

- Количество слайдов: 89

Investing in High Yield and Distressed Debt A growing asset class in difficult times LIUC April 2009 1

AGENDA n Basics of Credit Investing n Investing in HY and Distress n Strategies and Trading Technicals n Current situation n Appendix 2

Basics of Credit Investing A Focus on High Yield Bonds and Leverage Loans 3

Credit Investing n Lending to corporations n n a direct private financing contract (loan) underwriting newly issued corporate bonds n n vs. public offerings Secondary market investing in corporate bond n n private placement Publicly listed debt vs. OTC transactions Return on credit investments n periodic interest payments until maturity n n vs. payment-in-kind (PIK loans) Repayment of the principal (end of the game) n n n in cash entirely at maturity (bonds, bullet loans) according to a scheduled amortization (most loans) Capped return on the investment 4

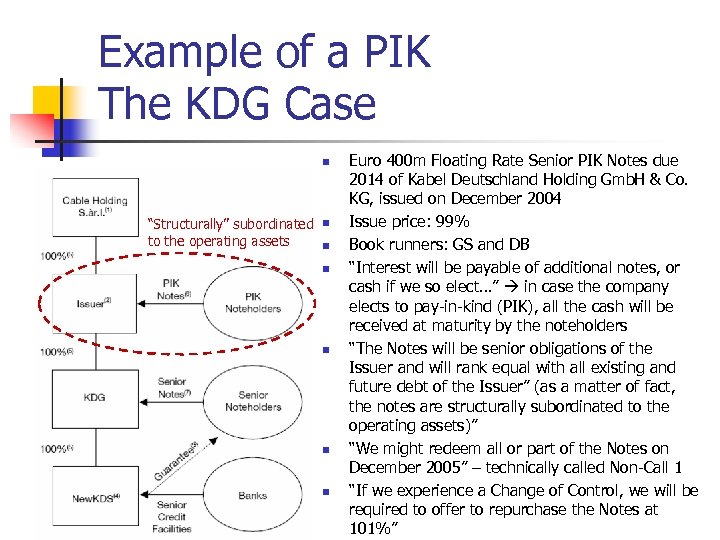

Example of a PIK The KDG Case n “Structurally” subordinated to the operating assets n n n Euro 400 m Floating Rate Senior PIK Notes due 2014 of Kabel Deutschland Holding Gmb. H & Co. KG, issued on December 2004 Issue price: 99% Book runners: GS and DB “Interest will be payable of additional notes, or cash if we so elect…” in case the company elects to pay-in-kind (PIK), all the cash will be received at maturity by the noteholders “The Notes will be senior obligations of the Issuer and will rank equal with all existing and future debt of the Issuer” (as a matter of fact, the notes are structurally subordinated to the operating assets)” “We might redeem all or part of the Notes on December 2005” – technically called Non-Call 1 “If we experience a Change of Control, we will be required to offer to repurchase the Notes at 101%”

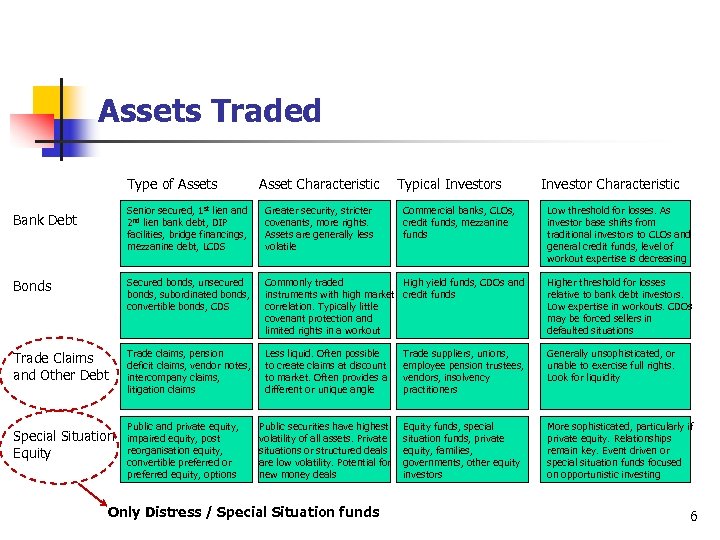

Assets Traded Type of Assets Asset Characteristic Typical Investors Senior secured, 1 st lien and 2 nd lien bank debt, DIP facilities, bridge financings, mezzanine debt, LCDS Greater security, stricter covenants, more rights. Assets are generally less volatile Bonds Secured bonds, unsecured bonds, subordinated bonds, convertible bonds, CDS Commonly traded High yield funds, CDOs and instruments with high market credit funds correlation. Typically little covenant protection and limited rights in a workout Higher threshold for losses relative to bank debt investors. Low expertise in workouts. CDOs may be forced sellers in defaulted situations Trade Claims and Other Debt Trade claims, pension deficit claims, vendor notes, intercompany claims, litigation claims Less liquid. Often possible to create claims at discount to market. Often provides a different or unique angle Trade suppliers, unions, employee pension trustees, vendors, insolvency practitioners Generally unsophisticated, or unable to exercise full rights. Look for liquidity Public securities have highest volatility of all assets. Private situations or structured deals are low volatility. Potential for new money deals Equity funds, special situation funds, private equity, families, governments, other equity investors More sophisticated, particularly if private equity. Relationships remain key. Event driven or special situation funds focused on opportunistic investing Bank Debt Special Situation Equity Public and private equity, impaired equity, post reorganisation equity, convertible preferred or preferred equity, options Only Distress / Special Situation funds Commercial banks, CLOs, credit funds, mezzanine funds Investor Characteristic Low threshold for losses. As investor base shifts from traditional investors to CLOs and general credit funds, level of workout expertise is decreasing 6

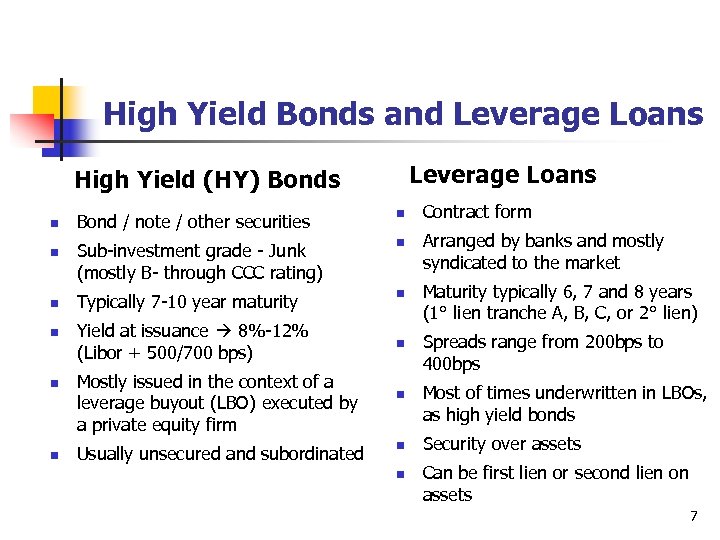

High Yield Bonds and Leverage Loans High Yield (HY) Bonds n n n Bond / note / other securities n Sub-investment grade - Junk (mostly B- through CCC rating) n Typically 7 -10 year maturity n Yield at issuance 8%-12% (Libor + 500/700 bps) Mostly issued in the context of a leverage buyout (LBO) executed by a private equity firm Usually unsecured and subordinated n n Contract form Arranged by banks and mostly syndicated to the market Maturity typically 6, 7 and 8 years (1° lien tranche A, B, C, or 2° lien) Spreads range from 200 bps to 400 bps Most of times underwritten in LBOs, as high yield bonds Security over assets Can be first lien or second lien on assets 7

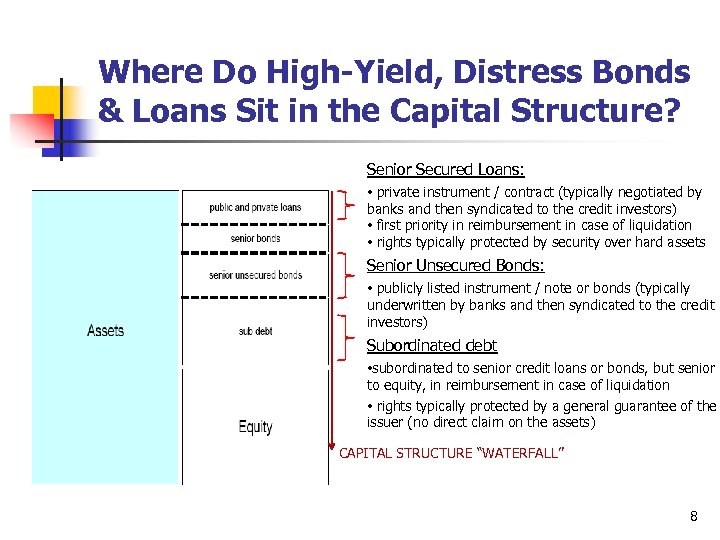

Where Do High-Yield, Distress Bonds & Loans Sit in the Capital Structure? Senior Secured Loans: • private instrument / contract (typically negotiated by banks and then syndicated to the credit investors) • first priority in reimbursement in case of liquidation • rights typically protected by security over hard assets Senior Unsecured Bonds: • publicly listed instrument / note or bonds (typically underwritten by banks and then syndicated to the credit investors) Subordinated debt • subordinated to senior credit loans or bonds, but senior to equity, in reimbursement in case of liquidation • rights typically protected by a general guarantee of the issuer (no direct claim on the assets) CAPITAL STRUCTURE “WATERFALL” 8

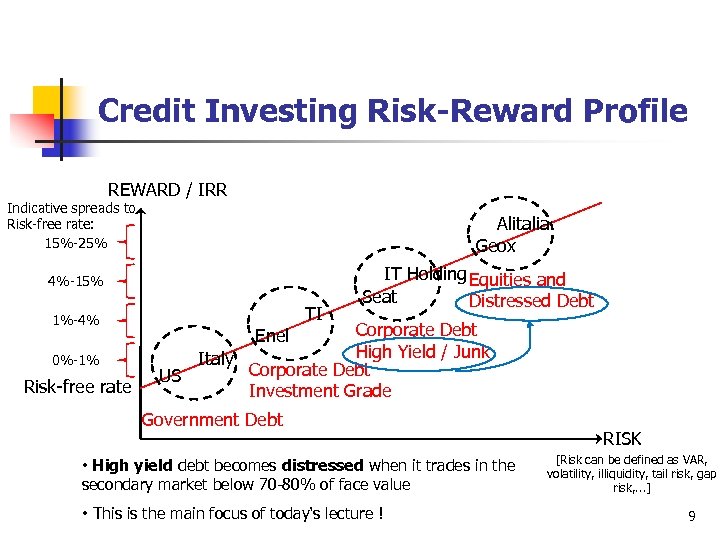

Credit Investing Risk-Reward Profile REWARD / IRR Indicative spreads to Risk-free rate: 15%-25% Alitalia Geox 4%-15% 1%-4% 0%-1% Risk-free rate TI IT Holding Equities and Seat Distressed Debt Corporate Debt High Yield / Junk Italy Corporate Debt US Investment Grade Enel Government Debt • High yield debt becomes distressed when it trades in the secondary market below 70 -80% of face value • This is the main focus of today‘s lecture ! RISK [Risk can be defined as VAR, volatility, illiquidity, tail risk, gap risk, . . . ] 9

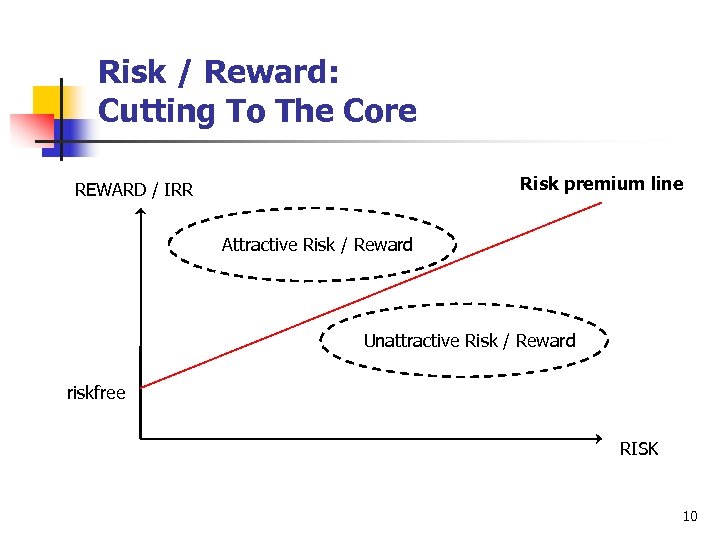

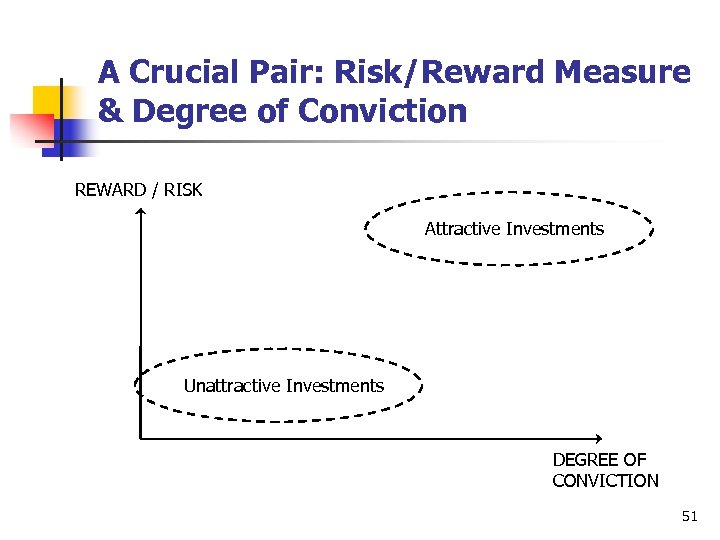

Risk / Reward: Cutting To The Core Risk premium line REWARD / IRR Attractive Risk / Reward Unattractive Risk / Reward riskfree RISK 10

Treasury Yield Curve 11

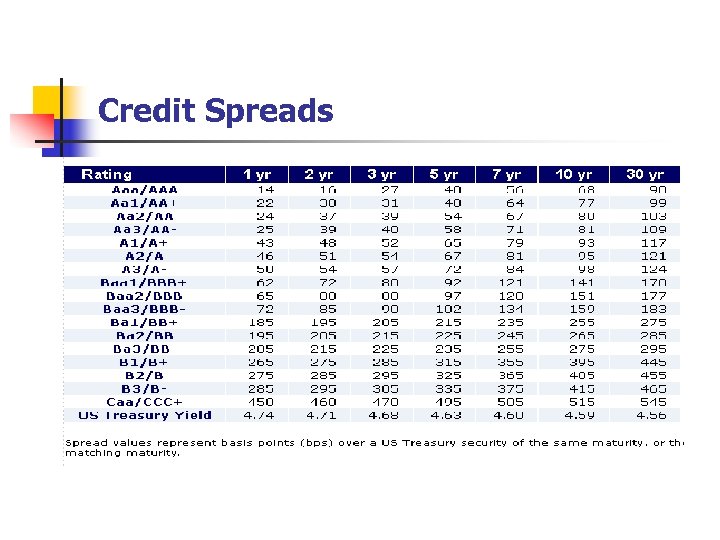

Credit Spreads

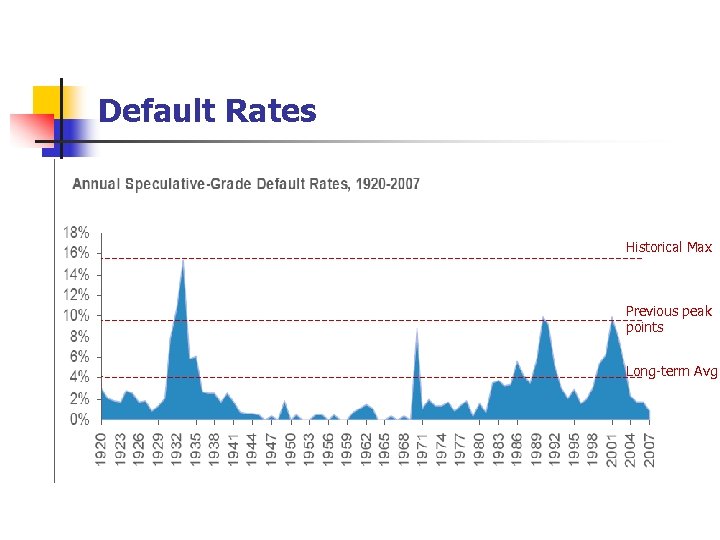

Default Rates Historical Max Previous peak points Long-term Avg

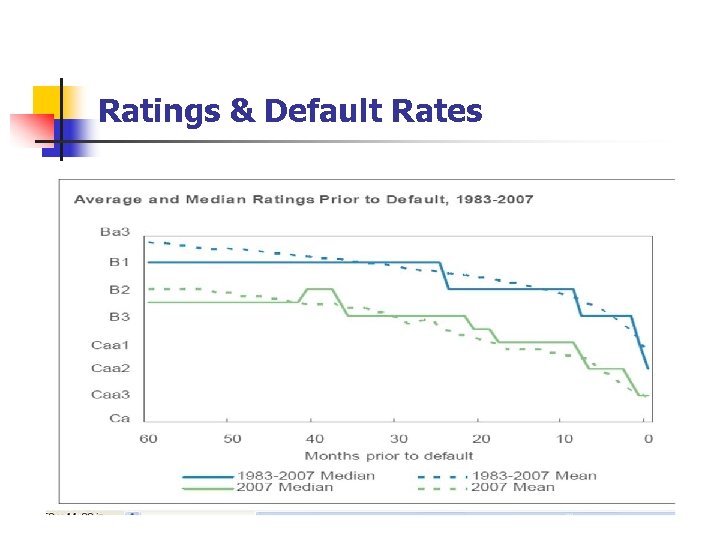

Ratings & Default Rates

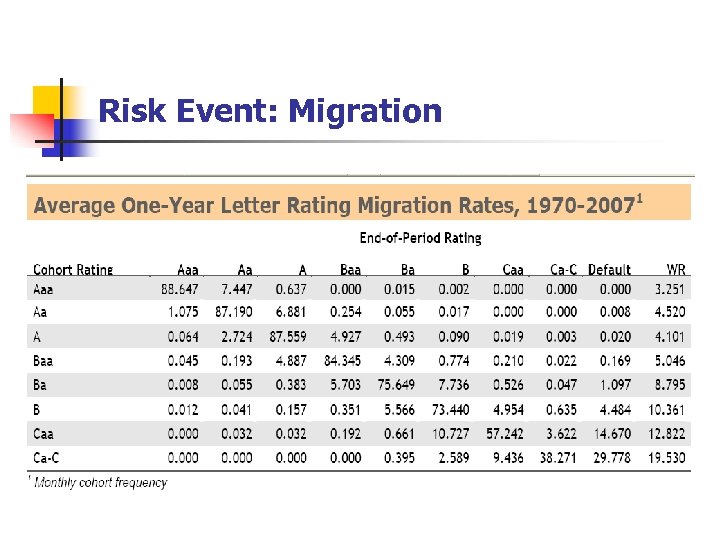

Risk Event: Migration

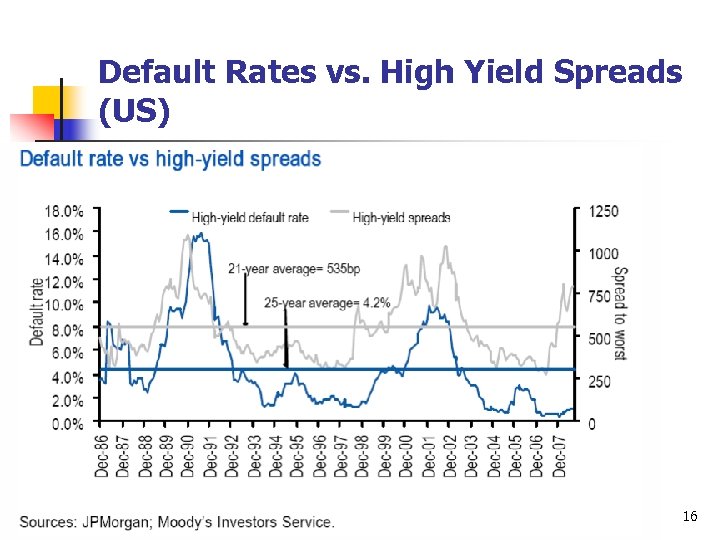

Default Rates vs. High Yield Spreads (US) 16

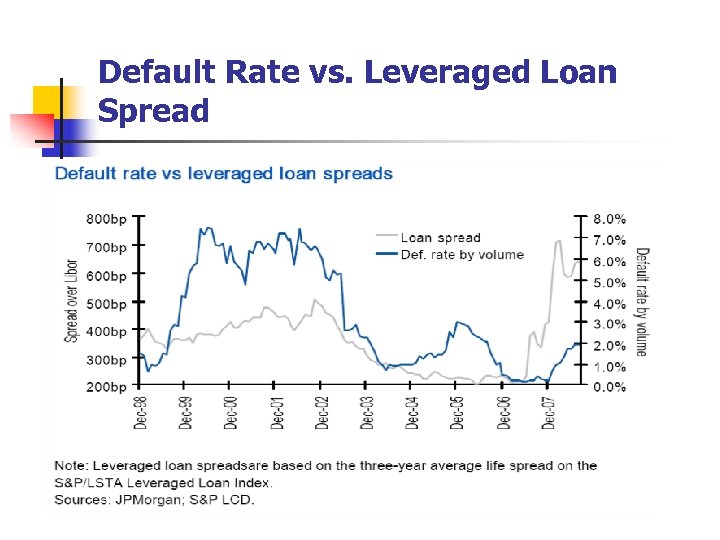

Default Rate vs. Leveraged Loan Spread

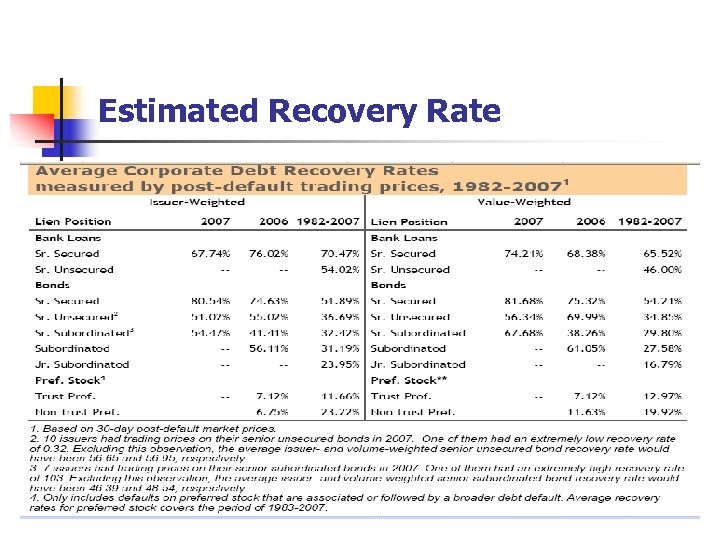

Estimated Recovery Rate

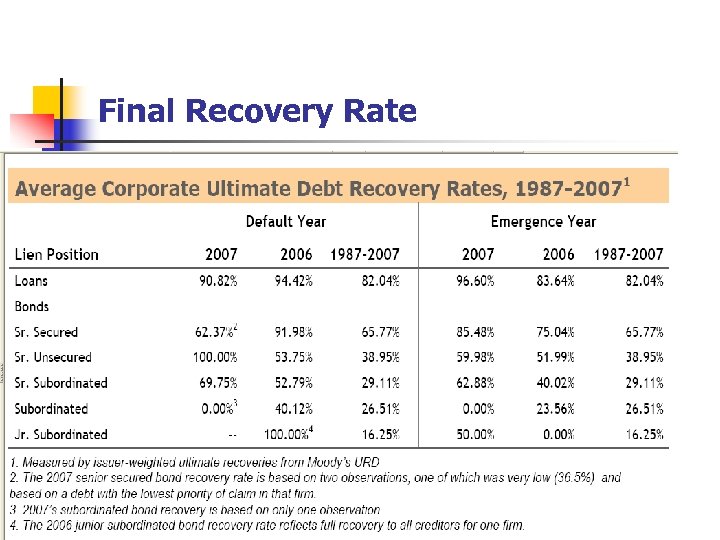

Final Recovery Rate

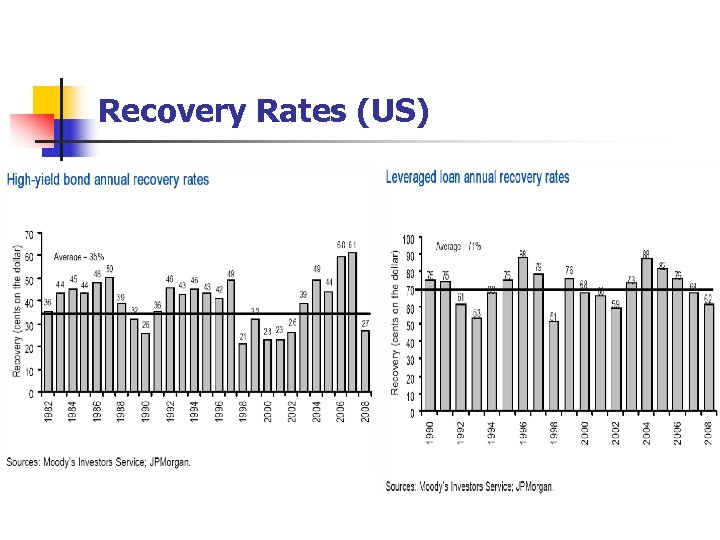

Recovery Rates (US)

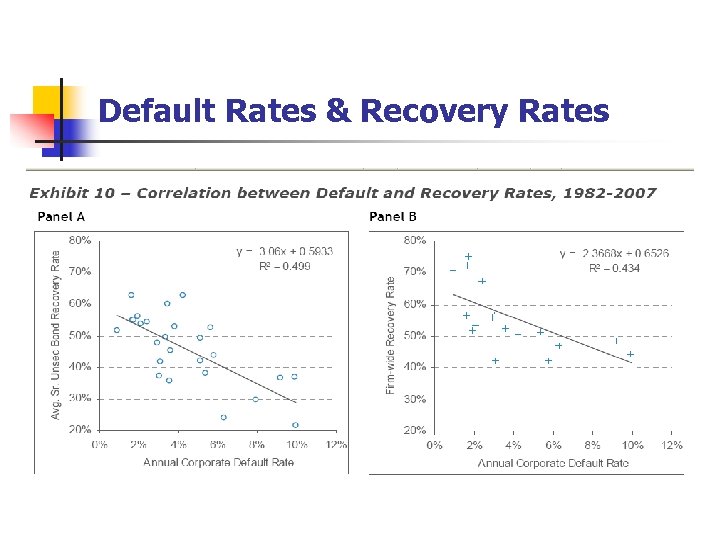

Default Rates & Recovery Rates

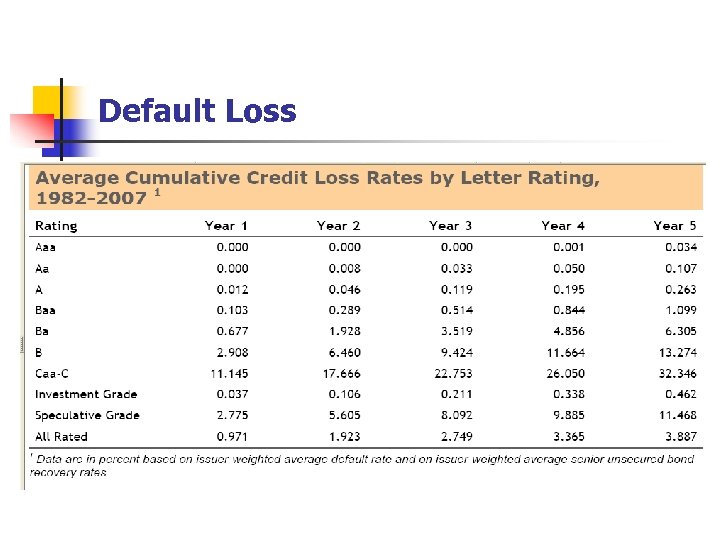

Default Loss

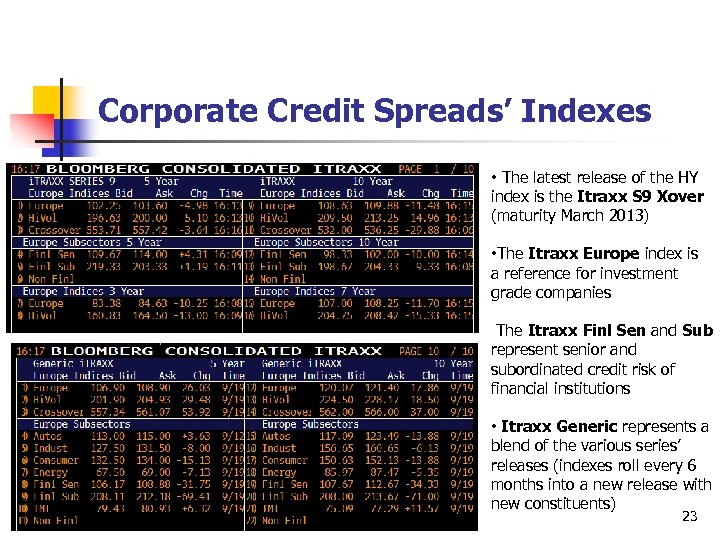

Corporate Credit Spreads’ Indexes • The latest release of the HY index is the Itraxx S 9 Xover (maturity March 2013) • The Itraxx Europe index is a reference for investment grade companies The Itraxx Finl Sen and Sub represent senior and subordinated credit risk of financial institutions • Itraxx Generic represents a blend of the various series’ releases (indexes roll every 6 months into a new release with new constituents) 23

Itraxx Generic Xover Index 24

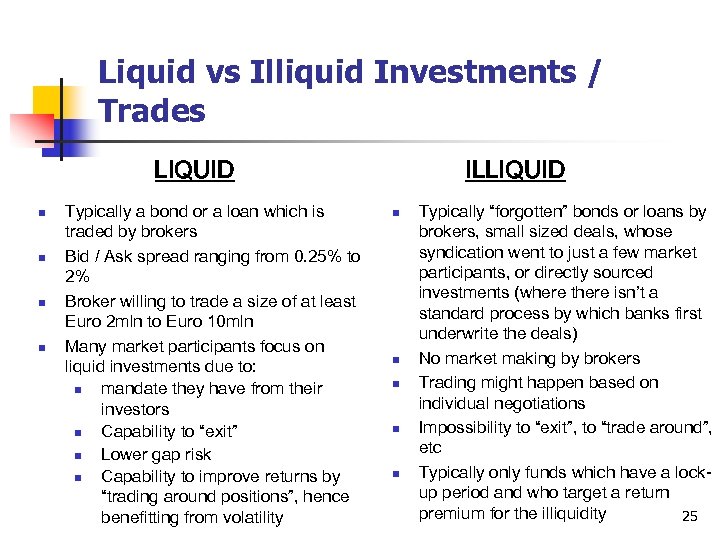

Liquid vs Illiquid Investments / Trades LIQUID n n Typically a bond or a loan which is traded by brokers Bid / Ask spread ranging from 0. 25% to 2% Broker willing to trade a size of at least Euro 2 mln to Euro 10 mln Many market participants focus on liquid investments due to: n mandate they have from their investors n Capability to “exit” n Lower gap risk n Capability to improve returns by “trading around positions”, hence benefitting from volatility ILLIQUID n n n Typically “forgotten” bonds or loans by brokers, small sized deals, whose syndication went to just a few market participants, or directly sourced investments (where there isn’t a standard process by which banks first underwrite the deals) No market making by brokers Trading might happen based on individual negotiations Impossibility to “exit”, to “trade around”, etc Typically only funds which have a lockup period and who target a return premium for the illiquidity 25

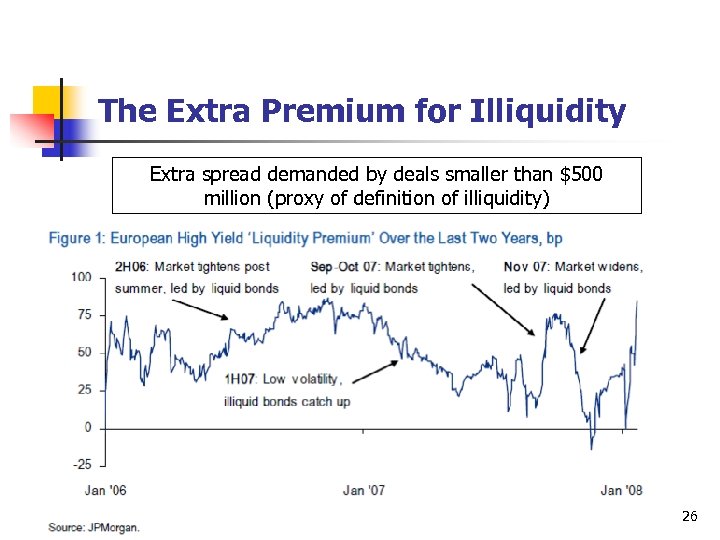

The Extra Premium for Illiquidity Extra spread demanded by deals smaller than $500 million (proxy of definition of illiquidity) 26

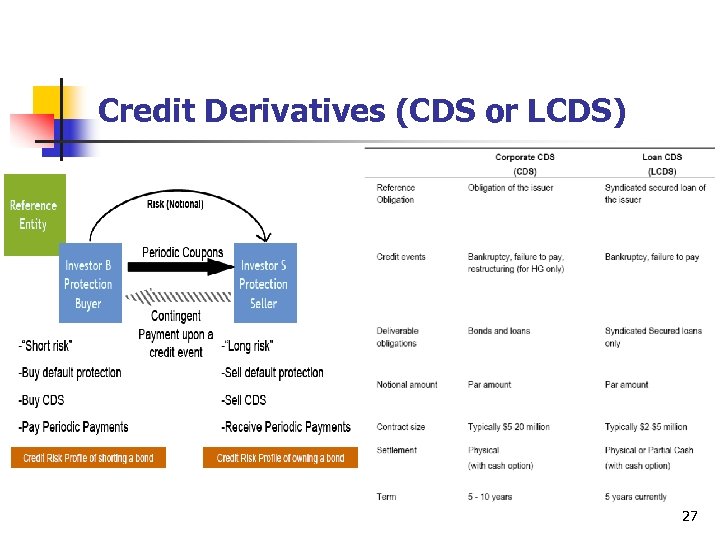

Credit Derivatives (CDS or LCDS) 27

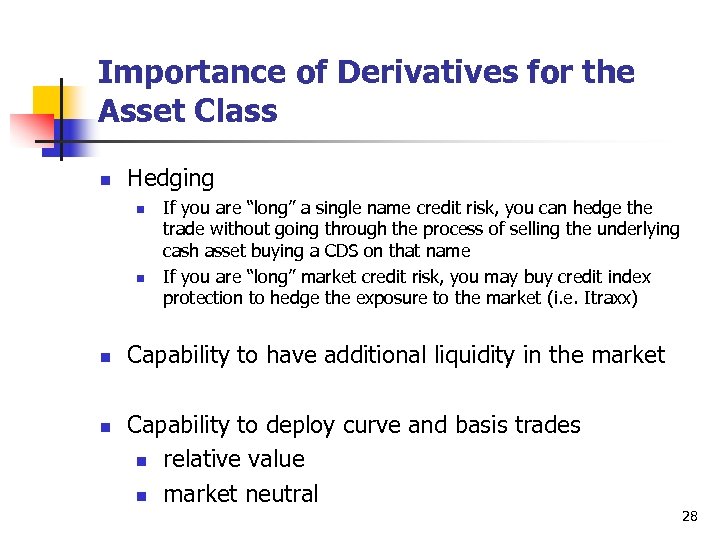

Importance of Derivatives for the Asset Class n Hedging n n If you are “long” a single name credit risk, you can hedge the trade without going through the process of selling the underlying cash asset buying a CDS on that name If you are “long” market credit risk, you may buy credit index protection to hedge the exposure to the market (i. e. Itraxx) Capability to have additional liquidity in the market Capability to deploy curve and basis trades n relative value n market neutral 28

Invest in HY and Distress Evolving Asset Class by the Day 2929

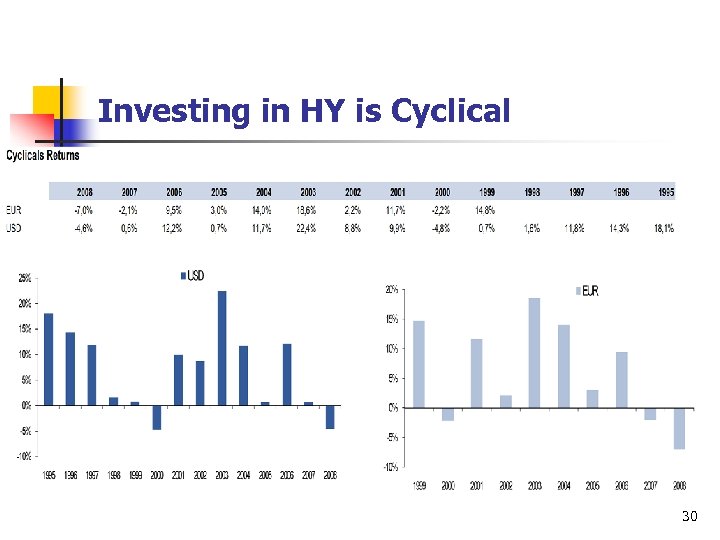

Investing in HY is Cyclical 30

The Difference Between a Trade and an Investment TRADE n n n Short Term Potentially look at arbitrage opportunities Trade based on trading technicals INVESTMENT n n n Medium-Long Term Take a view on market/sector/company Investment based mostly on analysis and macro view 31

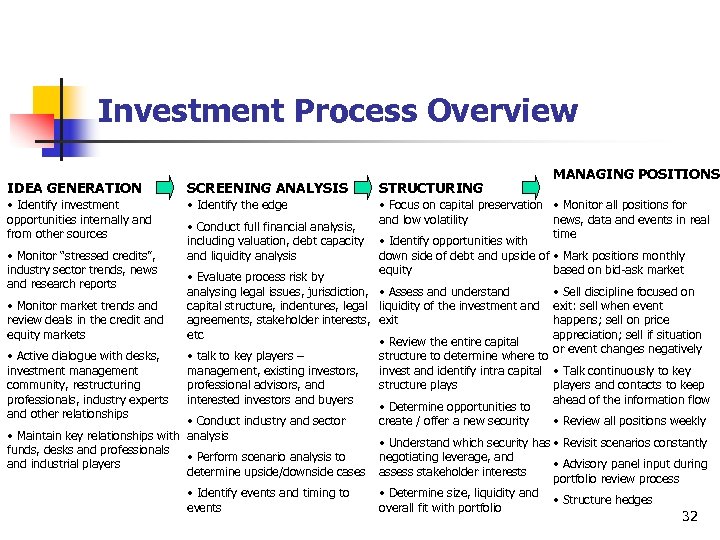

Investment Process Overview MANAGING POSITIONS IDEA GENERATION SCREENING ANALYSIS STRUCTURING • Identify investment opportunities internally and from other sources • Identify the edge • Focus on capital preservation • Monitor all positions for and low volatility news, data and events in real time • Identify opportunities with down side of debt and upside of • Mark positions monthly equity based on bid-ask market • Monitor “stressed credits”, industry sector trends, news and research reports • Conduct full financial analysis, including valuation, debt capacity and liquidity analysis • Evaluate process risk by analysing legal issues, jurisdiction, • Assess and understand • Sell discipline focused on • Monitor market trends and capital structure, indentures, legal liquidity of the investment and exit: sell when event review deals in the credit and agreements, stakeholder interests, exit happens; sell on price equity markets etc appreciation; sell if situation • Review the entire capital or event changes negatively • Active dialogue with desks, • talk to key players – structure to determine where to investment management, existing investors, invest and identify intra capital • Talk continuously to key community, restructuring professional advisors, and structure plays players and contacts to keep professionals, industry experts interested investors and buyers ahead of the information flow • Determine opportunities to and other relationships • Conduct industry and sector create / offer a new security • Review all positions weekly • Maintain key relationships with analysis • Understand which security has • Revisit scenarios constantly funds, desks and professionals negotiating leverage, and • Perform scenario analysis to and industrial players • Advisory panel input during determine upside/downside cases assess stakeholder interests portfolio review process • Determine size, liquidity and • Identify events and timing to • Structure hedges overall fit with portfolio events 32

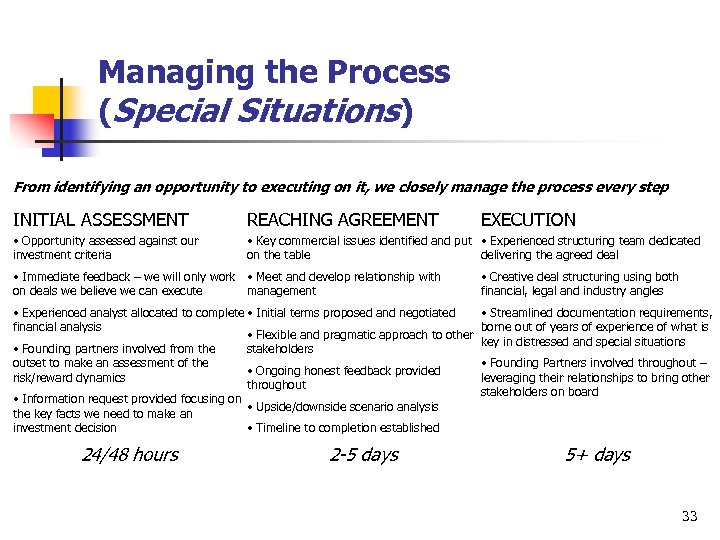

Managing the Process (Special Situations) From identifying an opportunity to executing on it, we closely manage the process every step INITIAL ASSESSMENT REACHING AGREEMENT EXECUTION • Opportunity assessed against our investment criteria • Key commercial issues identified and put • Experienced structuring team dedicated on the table delivering the agreed deal • Immediate feedback – we will only work • Meet and develop relationship with on deals we believe we can execute management • Creative deal structuring using both financial, legal and industry angles • Experienced analyst allocated to complete • Initial terms proposed and negotiated financial analysis • Flexible and pragmatic approach to other • Founding partners involved from the stakeholders outset to make an assessment of the • Ongoing honest feedback provided risk/reward dynamics throughout • Information request provided focusing on • Upside/downside scenario analysis the key facts we need to make an • Timeline to completion established investment decision • Streamlined documentation requirements, borne out of years of experience of what is key in distressed and special situations 24/48 hours 2 -5 days • Founding Partners involved throughout – leveraging their relationships to bring other stakeholders on board 5+ days 33

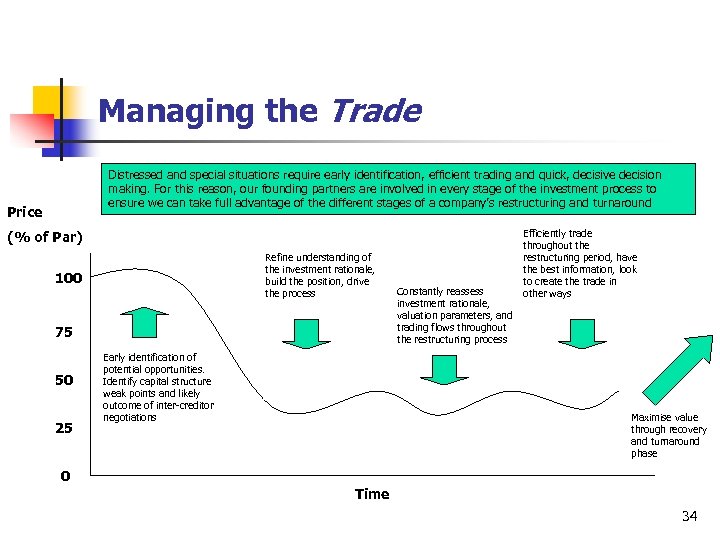

Managing the Trade Distressed and special situations require early identification, efficient trading and quick, decisive decision making. For this reason, our founding partners are involved in every stage of the investment process to ensure we can take full advantage of the different stages of a company’s restructuring and turnaround Price (% of Par) Refine understanding of the investment rationale, build the position, drive the process 100 75 50 25 Early identification of potential opportunities. Identify capital structure weak points and likely outcome of inter-creditor negotiations Constantly reassess investment rationale, valuation parameters, and trading flows throughout the restructuring process Efficiently trade throughout the restructuring period, have the best information, look to create the trade in other ways Maximise value through recovery and turnaround phase 0 Time 34

Risk return profile for an HY manager n n n Target return: 15%-20% IRR 10%-15% volatility Key risk measures: n DIV 01 = change of the underlying security value to a change of 1 bps in credit curve; also indicative of the duration of a security. n Example: For a bond with 5 y duration, if the credit curve widens by 20 bps, its value decreases by 1% (20 bps * duration of 5). n Leverage n VAR

Making an Investment Recommendation n n Market screening Building an investment idea n n n Sector analysis Company analysis Equity and credit comps Assessing risk-reward profile Degree of conviction The investment recommendation 36

Market Screening n Scouting for companies with traded debt securities n n Take a look at sectors we deem to be attractive Take a look at bonds/loans deeply discounted to par value n A HY investor restrict himself to names offering a potential levered return of at least Libor+600 bps n Brokers or research analysts might suggest ideas, companies and situations to look at n Who is focused on distressed looks at firms with an important credit event (imminently due or just past) n n bankruptcy process, like Alitalia or Lehman Brothers downgrades 37

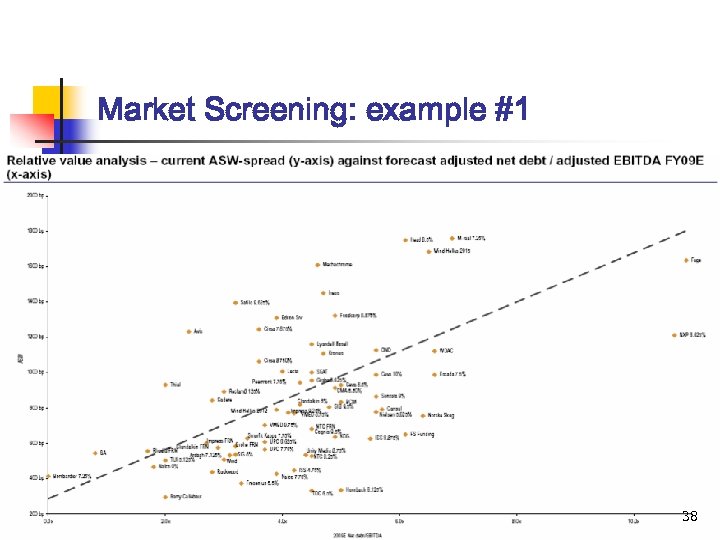

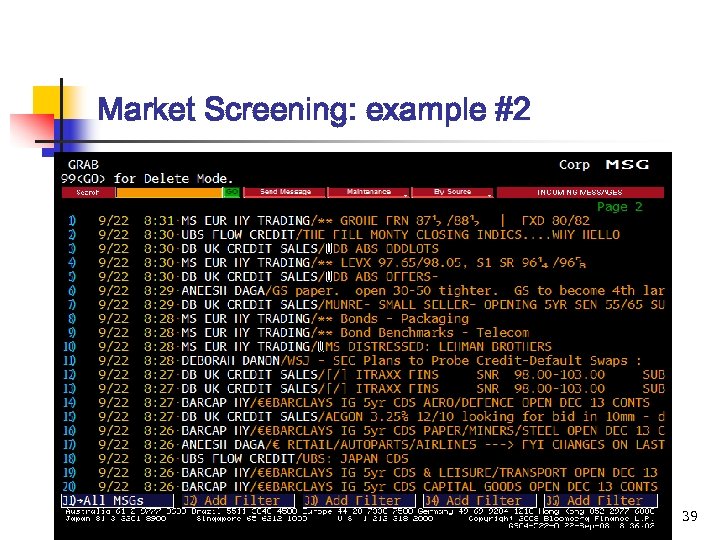

Market Screening: example #1 38

Market Screening: example #2 39

Building an Investment Idea n n n Choose the right sector Choose a company with a very good management team in that sector Pick cheap debt securities of that company in relative value terms 40

(1) Sector Analysis n n Most of our actual return on capital depends on the sector we invest in A deep understanding of all the challenges faced by the companies in the sector are facing is then of paramount importance n n To gain an educated view on the company sector condition and outlook n n n e. g. raw material price increases, price pressure, intense competition, … look at the competitors/peers in terms of their operating and financial stats (sales growth, EBITDA margin, leverage, cashflow conversion, etc) when a listed competitor / peer reports its quarterly numbers, we might find a lot of information from its reports and subsequent brokers’ analysis In the current context (recession) we n n favor sectors like utilities, telecom, healthcare, aerospace, niche technologies (“defensive” sectors, uncorrelated with economic cycles) avoid retail, fashion and luxury, financials, automotive and related, airlines, consumer goods (“cyclical” sector, highly correlated with the economic environment) 41

(2) Company Analysis n Review of n n Financial accounts (annual reports, quarterly financials statements) Sell side research (equity and credit analyst research) n Interviews to suppliers, customers, peers, etc. n Aim to gain a deep knowledge of: n n firm’s business model and business plan firm’s financial structure firm’s traded debt securities or loans The end product is an excel-based output, including a granular operating and financial model of the company 42

(3) Equity and Credit Comps n n Need to understand if the debt securities we are considering investing in are “cheap” or “expensive” - compared to the securities of other companies in the same sector or with similar leverage Especially true if we are trying to deploy a relative value investment strategy to isolate the “ALFA” n n One of the key features to make money over time is to invest in cheap securities Often we find better investment opportunities (better risk/reward and better companies) in comps/peers we look at n By analyzing comps’ securities as well, we might find a better way to express our views by combining together various trades 43

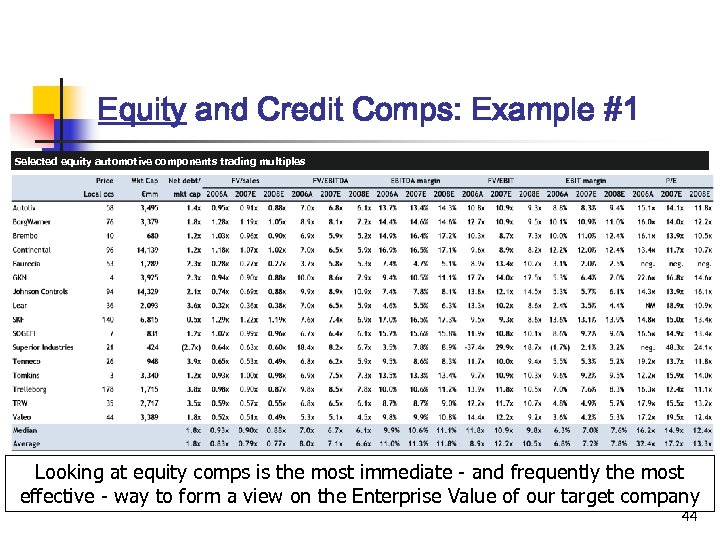

Equity and Credit Comps: Example #1 Selected equity automotive components trading multiples Looking at equity comps is the most immediate - and frequently the most effective - way to form a view on the Enterprise Value of our target company 44

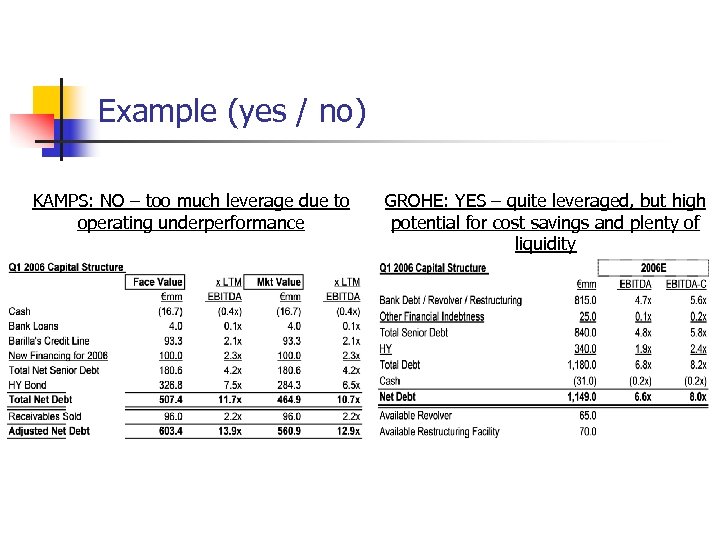

Example (yes / no) KAMPS: NO – too much leverage due to operating underperformance GROHE: YES – quite leveraged, but high potential for cost savings and plenty of liquidity

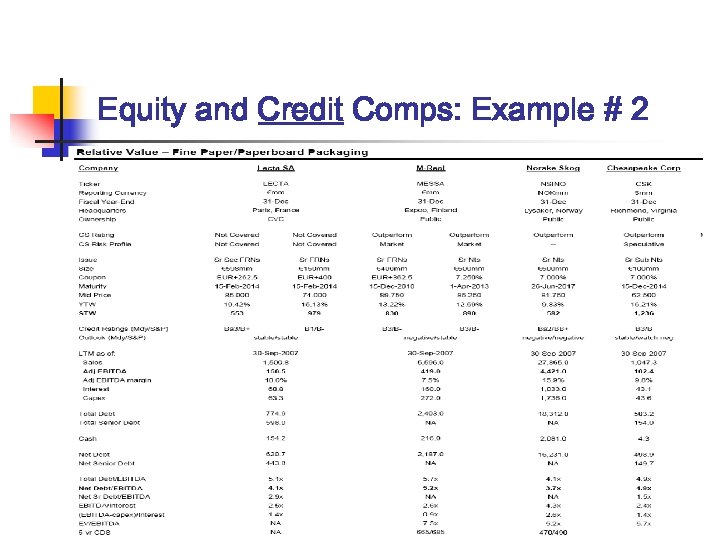

Equity and Credit Comps: Example # 2 46

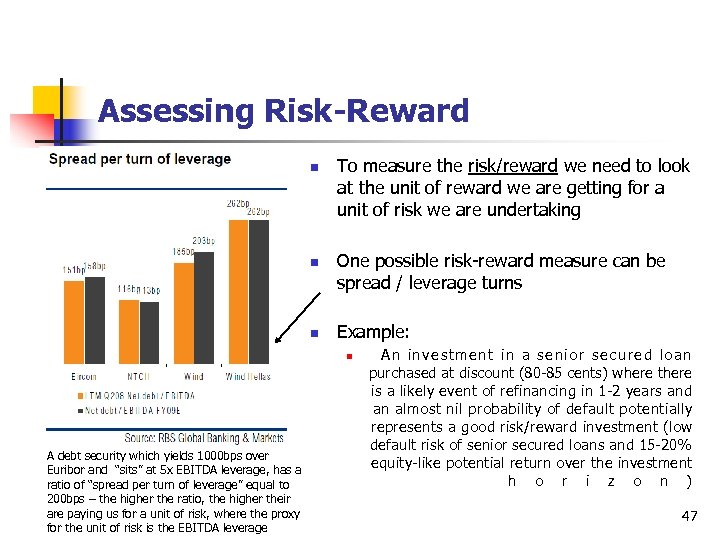

Assessing Risk-Reward n n n To measure the risk/reward we need to look at the unit of reward we are getting for a unit of risk we are undertaking One possible risk-reward measure can be spread / leverage turns Example: n A debt security which yields 1000 bps over Euribor and “sits” at 5 x EBITDA leverage, has a ratio of “spread per turn of leverage” equal to 200 bps – the higher the ratio, the higher their are paying us for a unit of risk, where the proxy for the unit of risk is the EBITDA leverage An investment in a senior secured loan purchased at discount (80 -85 cents) where there is a likely event of refinancing in 1 -2 years and an almost nil probability of default potentially represents a good risk/reward investment (low default risk of senior secured loans and 15 -20% equity-like potential return over the investment h o r i z o n ) 47

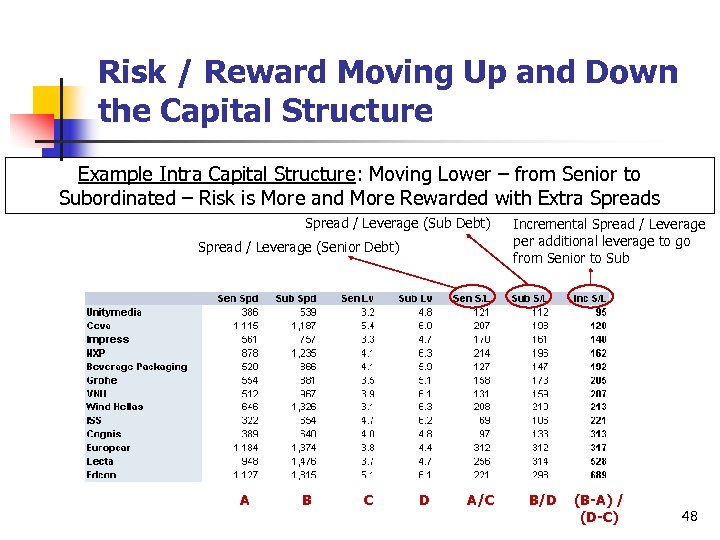

Risk / Reward Moving Up and Down the Capital Structure Example Intra Capital Structure: Moving Lower – from Senior to Subordinated – Risk is More and More Rewarded with Extra Spreads Spread / Leverage (Sub Debt) Spread / Leverage (Senior Debt) A B C D A/C Incremental Spread / Leverage per additional leverage to go from Senior to Sub B/D (B-A) / (D-C) 48

Degree of Conviction n n The degree of conviction represents how comfortable we are in the numbers and in the judgment calls at the basis of our analysis Having a high degree of conviction in high yield and distress investing is of paramount importance since n n the loss can be huge Exit may be difficult 49

Degree of Conviction: Examples n Situations where we might have a high degree of conviction: n n n We have been studying the company for a long time and we have had the chance to verify that our financial model works well in terms of forecasting We have a good relationship with the CEO or CFO of the target company and we feel we have a better understanding of their body language We know the sector well because we have been investing in it for a long time We have already invested in the company Situations where we might NOT have a high degree of conviction: n n It is the first time we are looking at the sector of our target company We have little historical financial information on the target company Earnings have historically proven to be very volatile The sector is going through a transformational period 50

A Crucial Pair: Risk/Reward Measure & Degree of Conviction REWARD / RISK Attractive Investments Unattractive Investments DEGREE OF CONVICTION 51

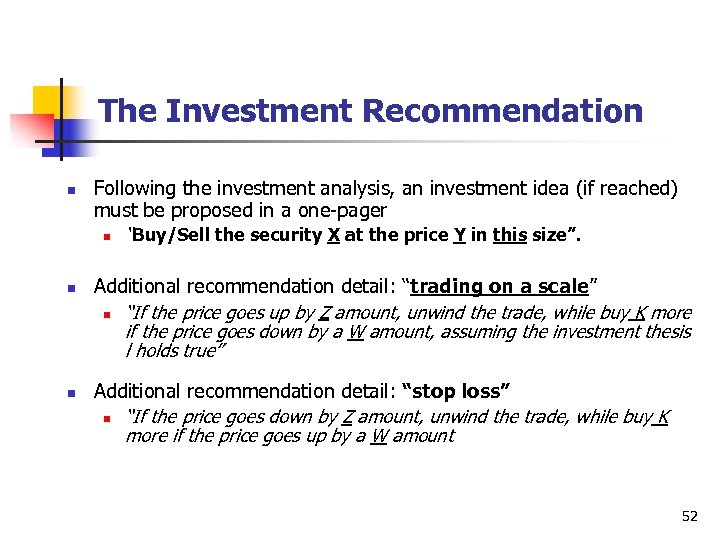

The Investment Recommendation n Following the investment analysis, an investment idea (if reached) must be proposed in a one-pager n “Buy/Sell the security X at the price Y in this size”. Additional recommendation detail: “trading on a scale” n “If the price goes up by Z amount, unwind the trade, while buy K more if the price goes down by a W amount, assuming the investment thesis l holds true” Additional recommendation detail: “stop loss” n “If the price goes down by Z amount, unwind the trade, while buy K more if the price goes up by a W amount 52

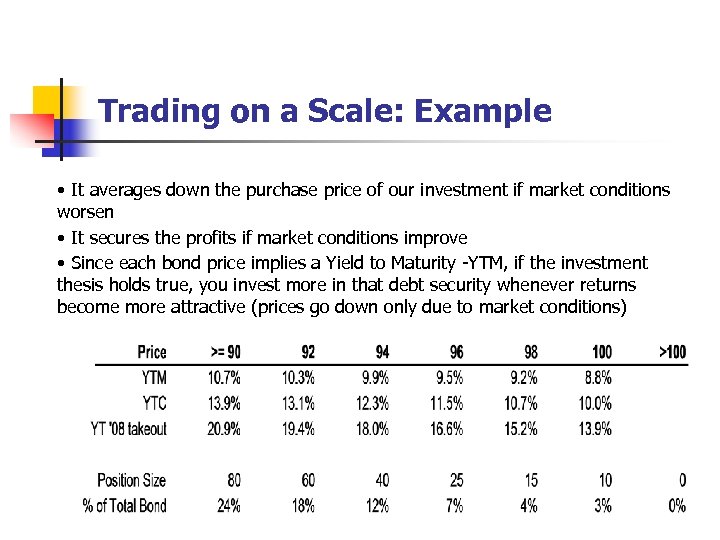

Trading on a Scale: Example • It averages down the purchase price of our investment if market conditions worsen • It secures the profits if market conditions improve • Since each bond price implies a Yield to Maturity -YTM, if the investment thesis holds true, you invest more in that debt security whenever returns become more attractive (prices go down only due to market conditions)

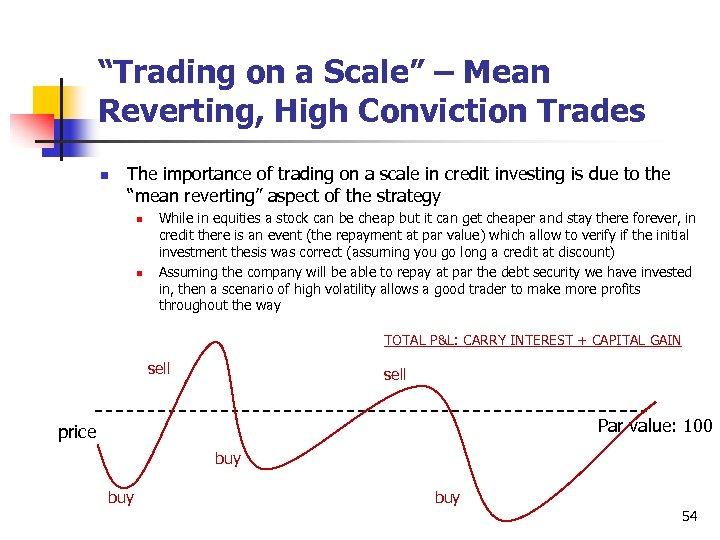

“Trading on a Scale” – Mean Reverting, High Conviction Trades n The importance of trading on a scale in credit investing is due to the “mean reverting” aspect of the strategy n n While in equities a stock can be cheap but it can get cheaper and stay there forever, in credit there is an event (the repayment at par value) which allow to verify if the initial investment thesis was correct (assuming you go long a credit at discount) Assuming the company will be able to repay at par the debt security we have invested in, then a scenario of high volatility allows a good trader to make more profits throughout the way TOTAL P&L: CARRY INTEREST + CAPITAL GAIN sell Par value: 100 price buy buy 54

Strategies and Trading Technicals The Devil is in the Detail 5555

Detailed Company Fundamentals n n Having a bottom-up granular operating and financial model allows to forecast quarterly developments of the financials of the company, You can potentially understand if covenants will be triggered or other events will unfold and act immediately on this expectations n n n should prices of raw materials price increase, you may immediately run your model to assess changes in the profitability (i. e. EBITDA) of the company without the need to wait for the next quarterly financial release to understand what the numbers are we can act sooner on our investment (exiting or adding more) before the vast majority of investors who lack a precise and detailed operating and financial model Credit investors have a much more sophisticated bottom-up approach than equity investors since forecasting cashflows in detail is their core business n in equity investing you will very rarely find people who have detailed operating and financial models on companies under analysis 56

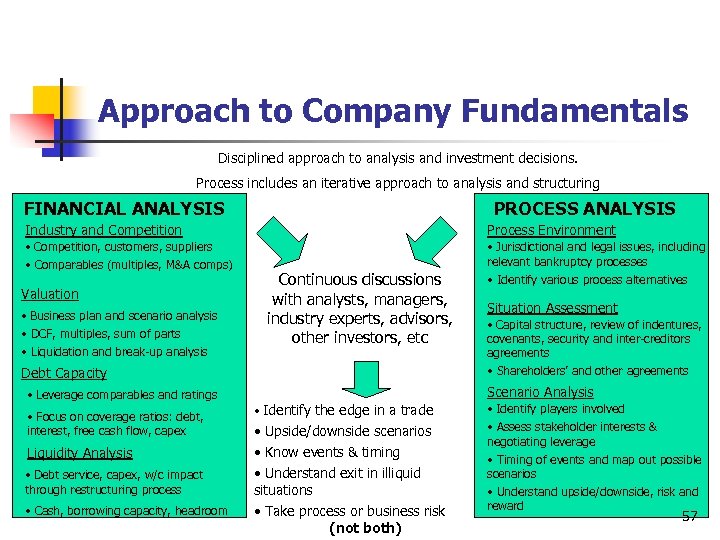

Approach to Company Fundamentals Disciplined approach to analysis and investment decisions. Process includes an iterative approach to analysis and structuring FINANCIAL ANALYSIS PROCESS ANALYSIS Industry and Competition Process Environment • Competition, customers, suppliers • Jurisdictional and legal issues, including relevant bankruptcy processes • Comparables (multiples, M&A comps) Valuation • Business plan and scenario analysis • DCF, multiples, sum of parts • Liquidation and break-up analysis Continuous discussions with analysts, managers, industry experts, advisors, other investors, etc • Debt service, capex, w/c impact through restructuring process • Cash, borrowing capacity, headroom • Capital structure, review of indentures, covenants, security and inter-creditors agreements Scenario Analysis • Leverage comparables and ratings Liquidity Analysis Situation Assessment • Shareholders’ and other agreements Debt Capacity • Focus on coverage ratios: debt, interest, free cash flow, capex • Identify various process alternatives • Identify the edge in a trade • Identify players involved • Upside/downside scenarios • Know events & timing • Understand exit in illiquid situations • Take process or business risk (not both) • Assess stakeholder interests & negotiating leverage • Timing of events and map out possible scenarios • Understand upside/downside, risk and reward 57

![Company Fundamentals: Example I/IV [SEE ATTACHMENT] 58 Company Fundamentals: Example I/IV [SEE ATTACHMENT] 58](https://present5.com/presentation/7aec25f3295ec271dcbd674dc71d8d9b/image-58.jpg)

Company Fundamentals: Example I/IV [SEE ATTACHMENT] 58

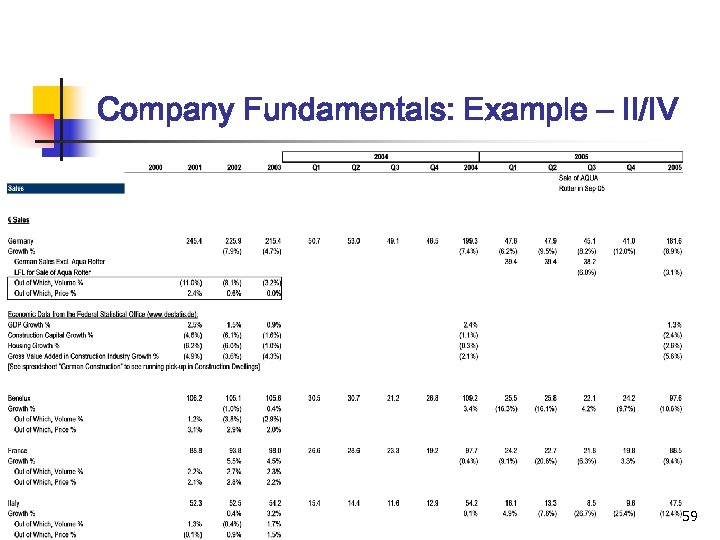

Company Fundamentals: Example – II/IV 59

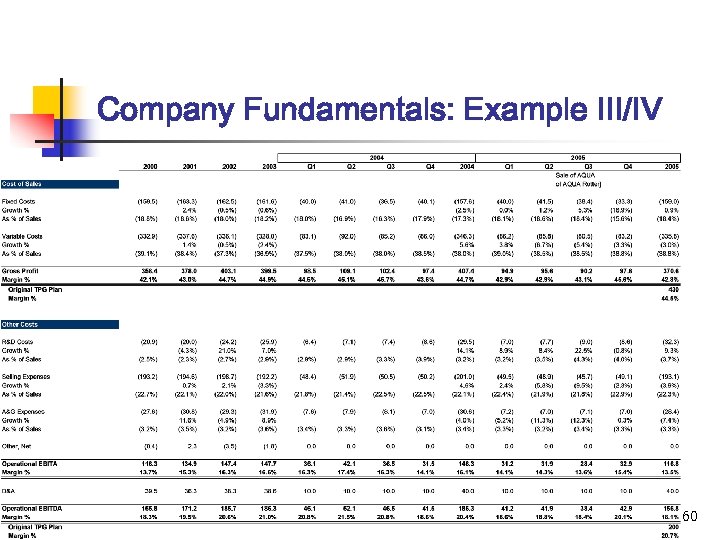

Company Fundamentals: Example III/IV 60

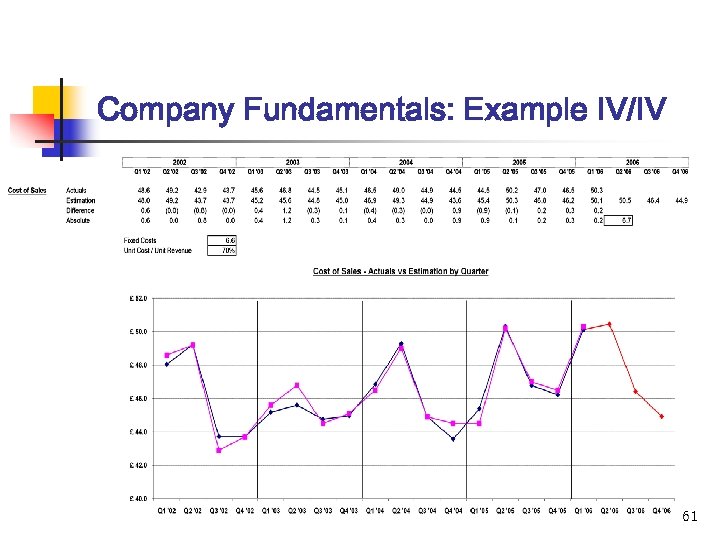

Company Fundamentals: Example IV/IV 61

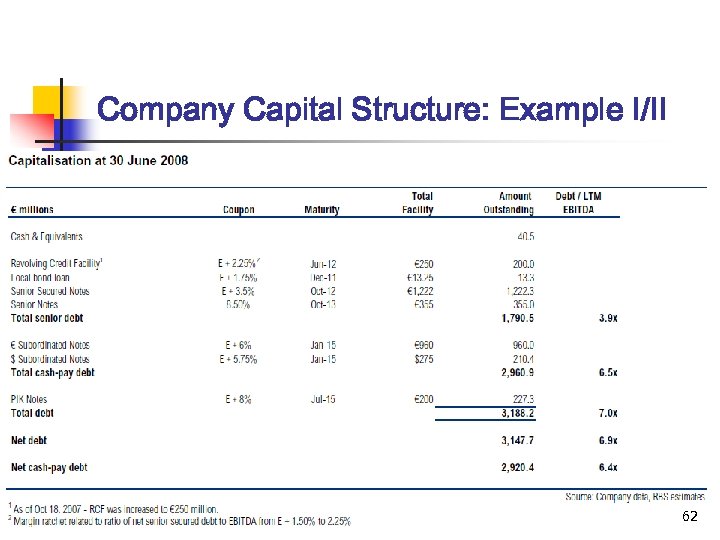

Company Capital Structure: Example I/II 62

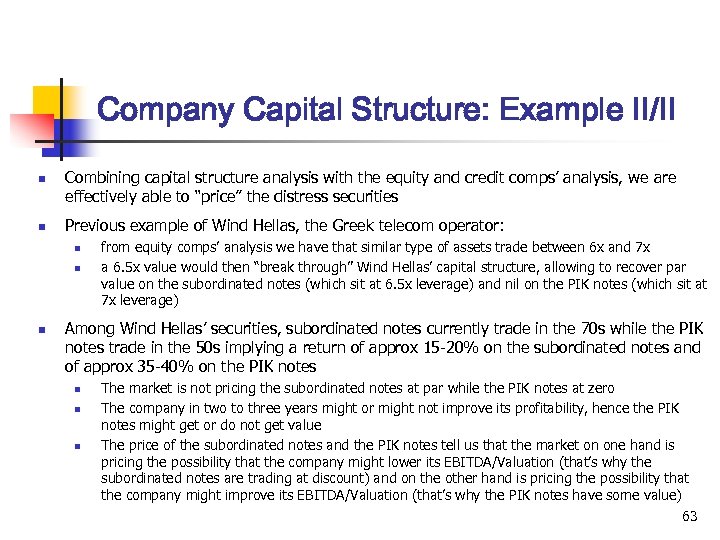

Company Capital Structure: Example II/II n n Combining capital structure analysis with the equity and credit comps’ analysis, we are effectively able to “price” the distress securities Previous example of Wind Hellas, the Greek telecom operator: n n n from equity comps’ analysis we have that similar type of assets trade between 6 x and 7 x a 6. 5 x value would then “break through” Wind Hellas’ capital structure, allowing to recover par value on the subordinated notes (which sit at 6. 5 x leverage) and nil on the PIK notes (which sit at 7 x leverage) Among Wind Hellas’ securities, subordinated notes currently trade in the 70 s while the PIK notes trade in the 50 s implying a return of approx 15 -20% on the subordinated notes and of approx 35 -40% on the PIK notes n n n The market is not pricing the subordinated notes at par while the PIK notes at zero The company in two to three years might or might not improve its profitability, hence the PIK notes might get or do not get value The price of the subordinated notes and the PIK notes tell us that the market on one hand is pricing the possibility that the company might lower its EBITDA/Valuation (that’s why the subordinated notes are trading at discount) and on the other hand is pricing the possibility that the company might improve its EBITDA/Valuation (that’s why the PIK notes have some value) 63

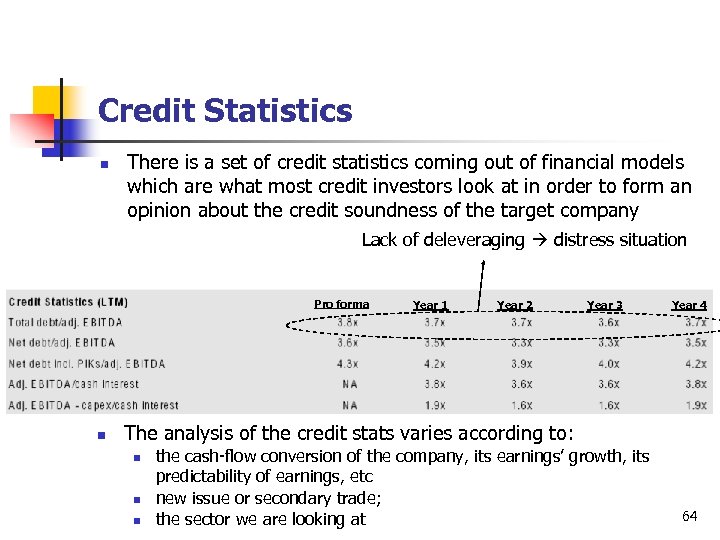

Credit Statistics n There is a set of credit statistics coming out of financial models which are what most credit investors look at in order to form an opinion about the credit soundness of the target company Lack of deleveraging distress situation Pro forma n Year 1 Year 2 Year 3 Year 4 The analysis of the credit stats varies according to: n n n the cash-flow conversion of the company, its earnings’ growth, its predictability of earnings, etc new issue or secondary trade; the sector we are looking at 64

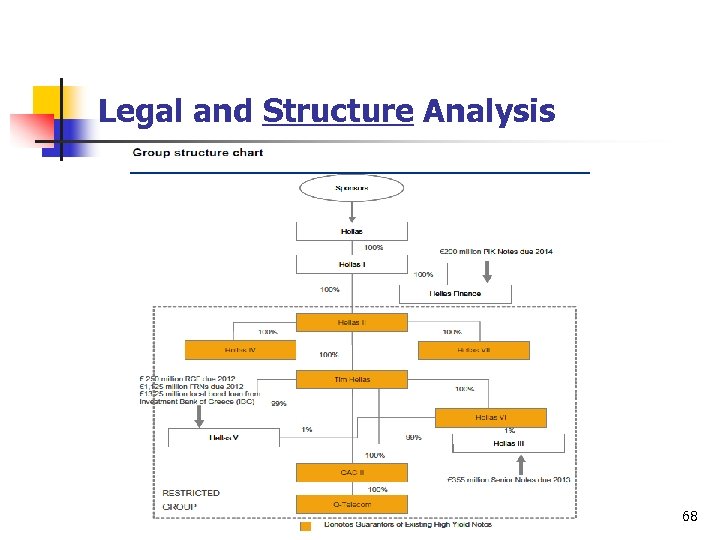

Legal and Structure Analysis n Investing in credit offers a variety of legal rights as outlined in legal norms and either loan provisions or bond indenture n n n Being able to identify our own rights as creditor is an important step of the investment decision process n n Basic one: priority be reimbursed vs equity in case of liquidation That’s why credit return is capped the priority in the capital structure, covenants’ protection, majority clauses to change the contract if loan or the bond indenture if bond, etc The legal and structure analysis becomes more and more important the more distress the situation we are looking at is n n When investing in high yield, hopefully we will not get to the point where we have to worry about liquidation priorities, etc In distress, instead, the legal and structure analysis is paramount 65

Legal and Structure Analysis n When investing in debt securities, the legal documentation analysis and the understanding of our own and other creditors’ rights is of paramount importance n n n n n Security / collateral (mainly in case of loans, but also bonds sometimes) Seniority in the capital structure (structural and contractual) Change of control clause Super majority clauses (specifically in case of loans) Covenants and events of default Application of excess cashflow …. . …… …. . 66

Liquidation Analysis n High yield and distress investors must understand: n the bankruptcy regime of the country where the default would take place (Center of Main Interest) n n Privileged creditors Concordato Preventivo vs Fallimento vs Legge Marzano etc …. . Understanding of treatment of each class of creditors & waterfall mechanics 67

Legal and Structure Analysis 68

Trading Dynamics and Scale n n Given the illiquidity of the product, being able to rightly identify which broker to deal with in order to build up a position, which timing to use, etc is a key aspect of investing in high yield and distress bonds/loans While stocks can be cheap/expensive but can always get cheaper/more expansive, credit investing is mean reverting, i. e. the company will pay you back par value unless it defaults This feature makes the trading scale strategy crucial When prices deteriorate because of market conditions, usually high yield and distress investors who have a high degree of conviction would tend to add to their positions (technically called “double down”) 69

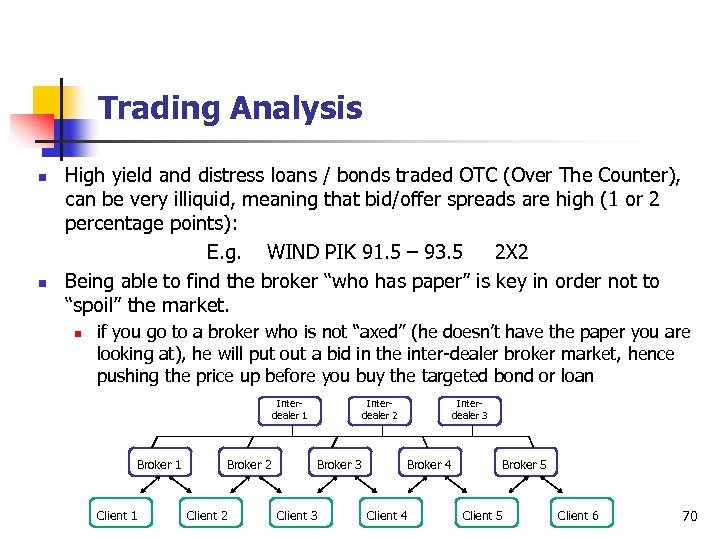

Trading Analysis n n High yield and distress loans / bonds traded OTC (Over The Counter), can be very illiquid, meaning that bid/offer spreads are high (1 or 2 percentage points): E. g. WIND PIK 91. 5 – 93. 5 2 X 2 Being able to find the broker “who has paper” is key in order not to “spoil” the market. n if you go to a broker who is not “axed” (he doesn’t have the paper you are looking at), he will put out a bid in the inter-dealer broker market, hence pushing the price up before you buy the targeted bond or loan Interdealer 1 Broker 1 Client 1 Broker 2 Client 2 Interdealer 2 Broker 3 Client 3 Interdealer 3 Broker 4 Client 4 Broker 5 Client 6 70

Which Investments to Place in the Portfolio? n n In a Portfolio Manager’s perspective, it is key to evaluate where an investment opportunity stands compared to others when added to his portfolio Each new investment should fit at the “margin” with the existing portfolio when considering risk/reward, degree of conviction and other diversification profiles This “marginal investment opportunity” needs to be one where the manager think he has a particular edge (competitive advantage) Investments can be: n n market directional (beta exposure, both positive or negative) market neutral (long/short credit, curve trades, basis trades, markethedged trades, etc) 71

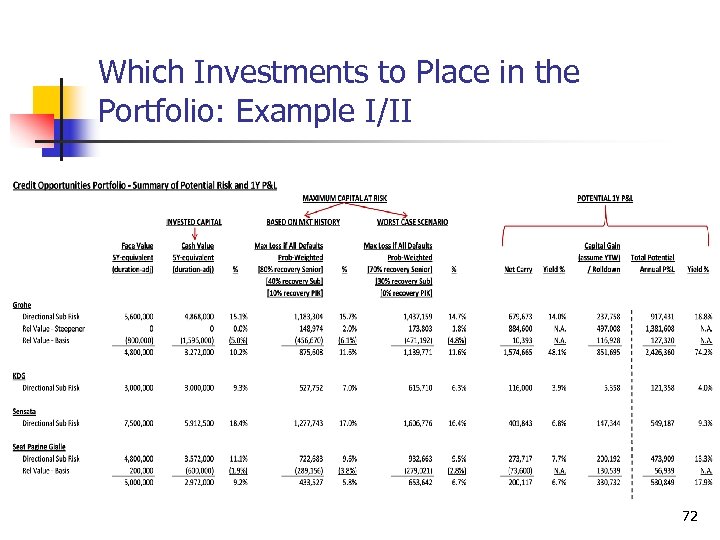

Which Investments to Place in the Portfolio: Example I/II 72

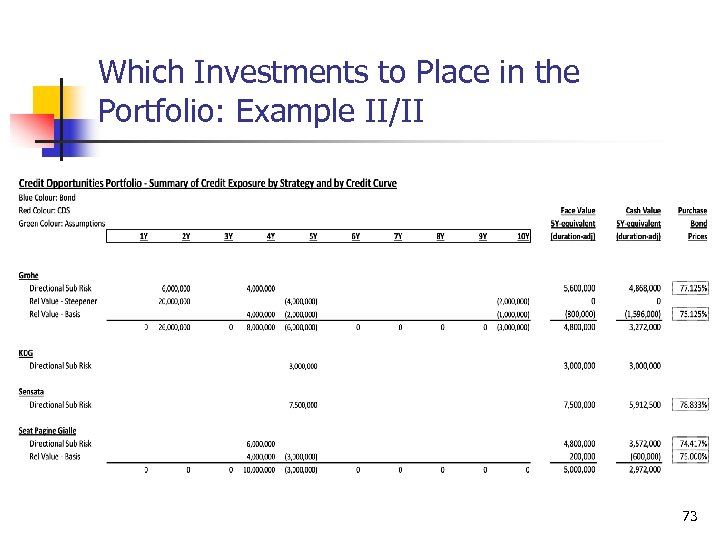

Which Investments to Place in the Portfolio: Example II/II 73

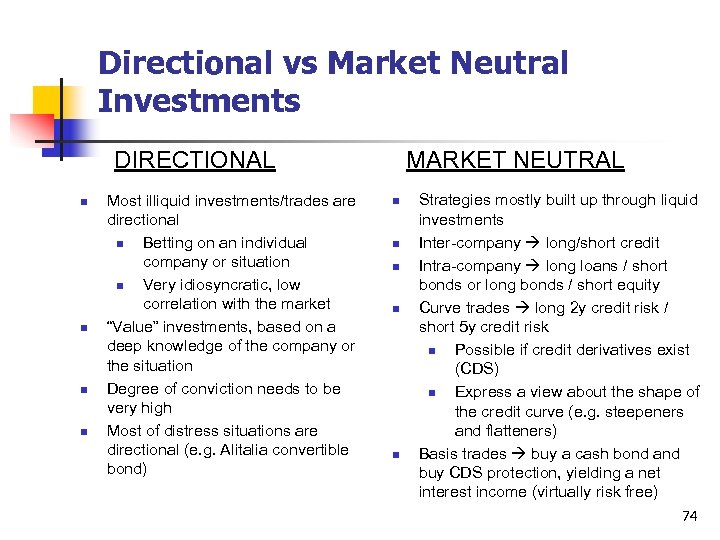

Directional vs Market Neutral Investments DIRECTIONAL n n Most illiquid investments/trades are directional n Betting on an individual company or situation n Very idiosyncratic, low correlation with the market “Value” investments, based on a deep knowledge of the company or the situation Degree of conviction needs to be very high Most of distress situations are directional (e. g. Alitalia convertible bond) MARKET NEUTRAL n n n Strategies mostly built up through liquid investments Inter-company long/short credit Intra-company long loans / short bonds or long bonds / short equity Curve trades long 2 y credit risk / short 5 y credit risk n Possible if credit derivatives exist (CDS) n Express a view about the shape of the credit curve (e. g. steepeners and flatteners) Basis trades buy a cash bond and buy CDS protection, yielding a net interest income (virtually risk free) 74

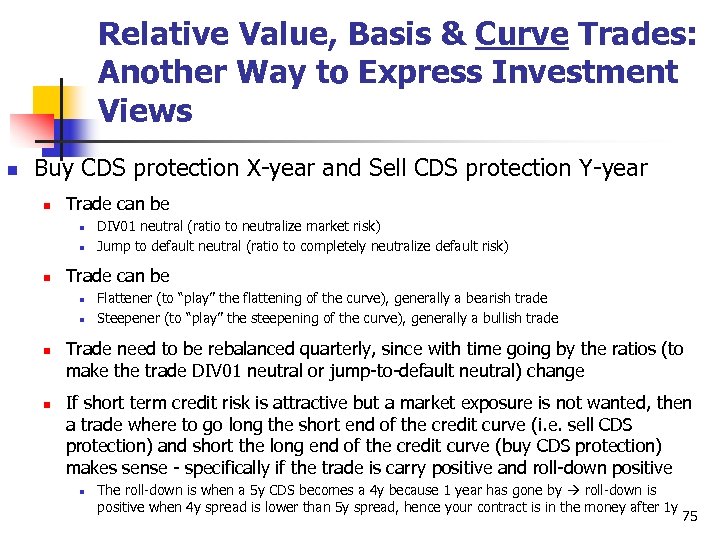

Relative Value, Basis & Curve Trades: Another Way to Express Investment Views n Buy CDS protection X-year and Sell CDS protection Y-year n Trade can be n n n n DIV 01 neutral (ratio to neutralize market risk) Jump to default neutral (ratio to completely neutralize default risk) Flattener (to “play” the flattening of the curve), generally a bearish trade Steepener (to “play” the steepening of the curve), generally a bullish trade Trade need to be rebalanced quarterly, since with time going by the ratios (to make the trade DIV 01 neutral or jump-to-default neutral) change If short term credit risk is attractive but a market exposure is not wanted, then a trade where to go long the short end of the credit curve (i. e. sell CDS protection) and short the long end of the credit curve (buy CDS protection) makes sense - specifically if the trade is carry positive and roll-down positive n The roll-down is when a 5 y CDS becomes a 4 y because 1 year has gone by roll-down is positive when 4 y spread is lower than 5 y spread, hence your contract is in the money after 1 y 75

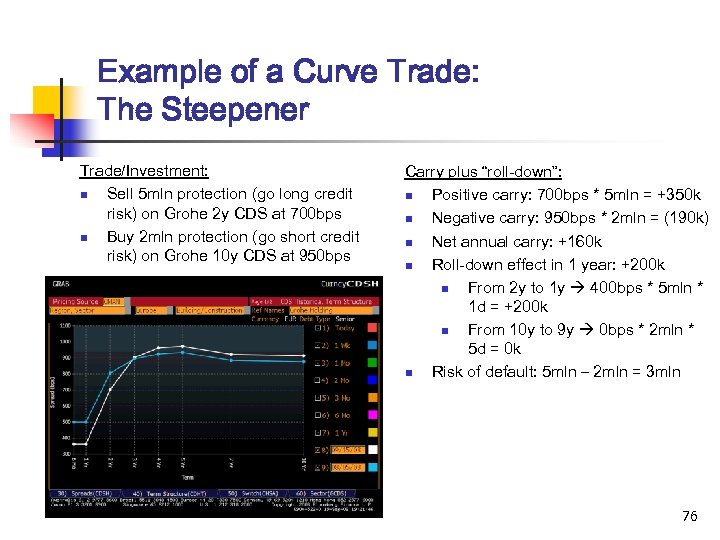

Example of a Curve Trade: The Steepener Trade/Investment: n Sell 5 mln protection (go long credit risk) on Grohe 2 y CDS at 700 bps n Buy 2 mln protection (go short credit risk) on Grohe 10 y CDS at 950 bps Carry plus “roll-down”: n Positive carry: 700 bps * 5 mln = +350 k n Negative carry: 950 bps * 2 mln = (190 k) n Net annual carry: +160 k n Roll-down effect in 1 year: +200 k n From 2 y to 1 y 400 bps * 5 mln * 1 d = +200 k n From 10 y to 9 y 0 bps * 2 mln * 5 d = 0 k n Risk of default: 5 mln – 2 mln = 3 mln 76

Liquidating a Position n Liquidating a position in high yield can be very expensive (in distress is virtually impossible) n Bid / Ask spread can be up to 5 points in the less liquid names, and most likely would work in max 2 mln size n n n Once you hit a bid of a broker in 2 mln, the next “market” the broker might offer you can be 1 or 2 points lower In a market where there is lack of liquidity, e. g. the days after the Lehman bankruptcy, there is literally no bid for the higher yielding products The CDS is much more liquid, however not all the cash bonds do have CDS protection outstanding (only the more traded and liquid names) 77

Monitoring Risk n Risk monitoring is done through a portfolio management tool n n n n n Interest rate or currency risk exposure Breakdown of exposure by sector Breakdown of exposure by seniority of securities in the capital structure Analysis of carry interest vs accrual of principal (PIK or capital appreciation when securities purchased at discount) Analysis of liquidity of the instruments Analysis of volatility by instruments Analysis of estimated tail risk (capital at risk in case of financial shocks) Risk management performed daily with update of prices Risk management need to be put into the overall hedge fund context 78

Hedging Strategies: Which Risks to Hedge? n Market risk n n n Tail / Shock market risk n n n Buying out of the money put options on the reference index Buying out of the money put options on the listed public equity of the company, assuming the company is listed Operating risks n n n Hedged through shorting the reference index (Itraxx Xover 5 y in high yield) Hedged through shorting basket of comps Capital structure trades (long loan, short bond) Curve or basis trades Assuming the company is highly exposed to a raw material, then short the best proxy of such raw material or buy out of the money call options Assuming the company has significant portion of EBITDA in US$, then hedge the currency risk Financial risks n Assuming we want to buy a long dated fixed coupon bond, then probably a good idea would be to hedge the interest rate risk 79

Why is Information so Important? n To refine the company fundamentals analysis n n n To forecast events that the market is not aware of n n Better operating and financial modeling Better knowledge of suppliers’ and customers’ opinion of company’s products M&A or extraordinary finance transactions which might have an impact on bonds and loans From a strictly trading perspective, better execution on buying and selling n n Knowing who has the paper Knowing how many buyers and sellers there are in the market 80

Current Market Conditions Are You Ready for Distress? 81

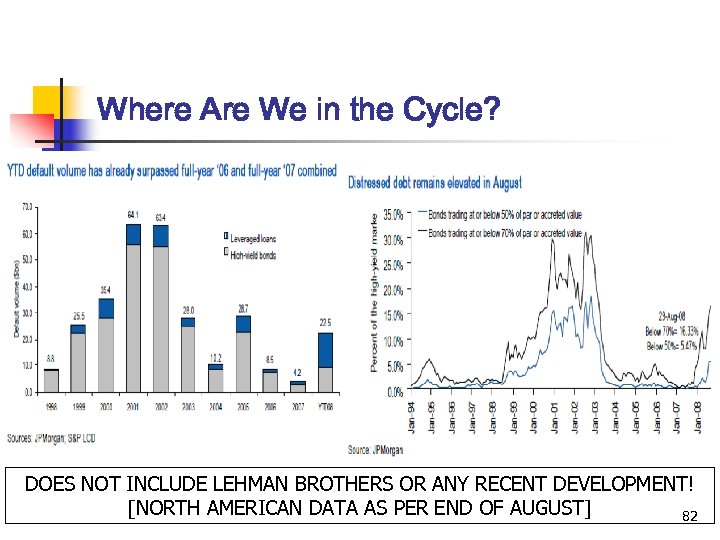

Where Are We in the Cycle? DOES NOT INCLUDE LEHMAN BROTHERS OR ANY RECENT DEVELOPMENT! [NORTH AMERICAN DATA AS PER END OF AUGUST] 82

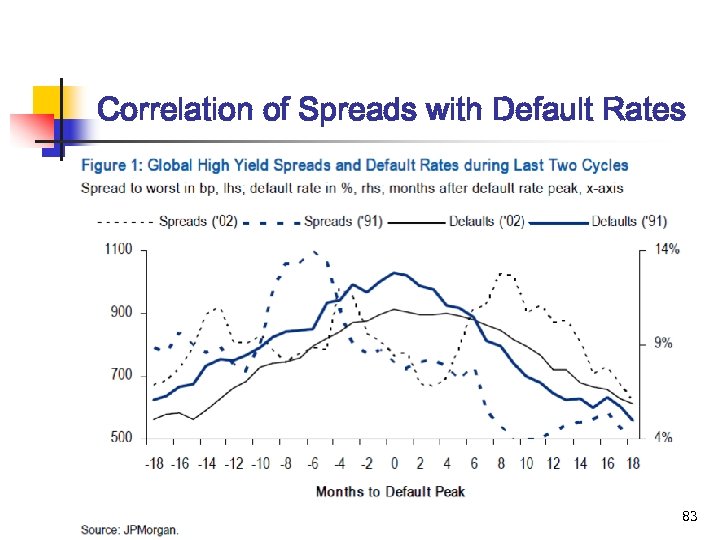

Correlation of Spreads with Default Rates 83

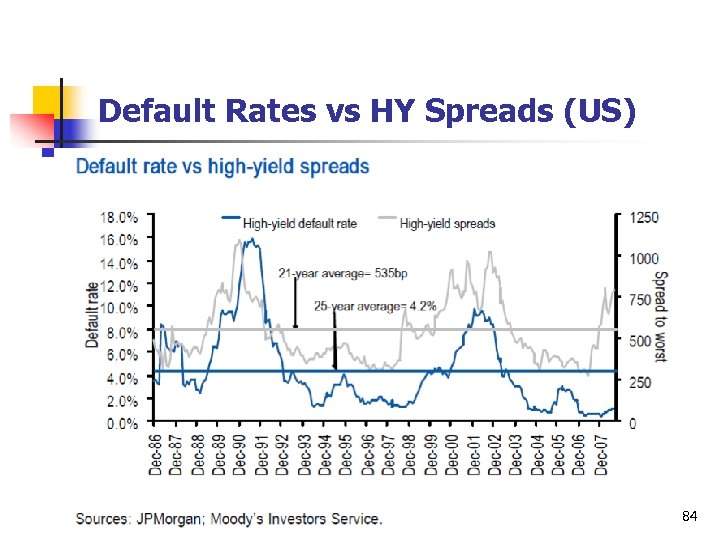

Default Rates vs HY Spreads (US) 84

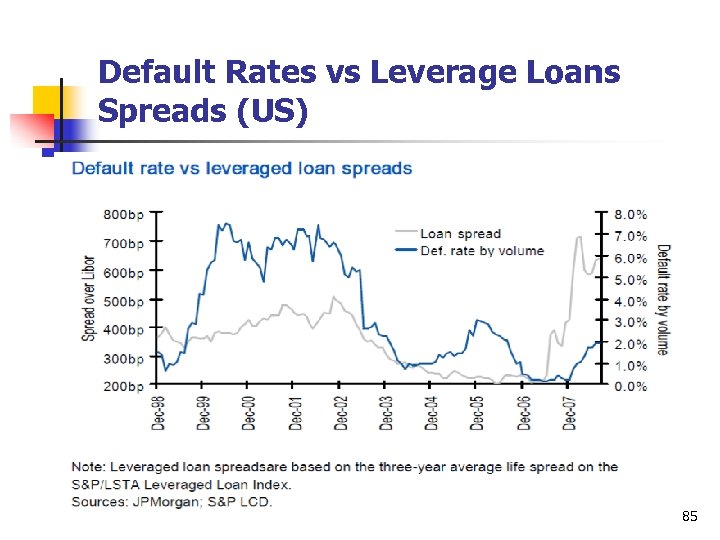

Default Rates vs Leverage Loans Spreads (US) 85

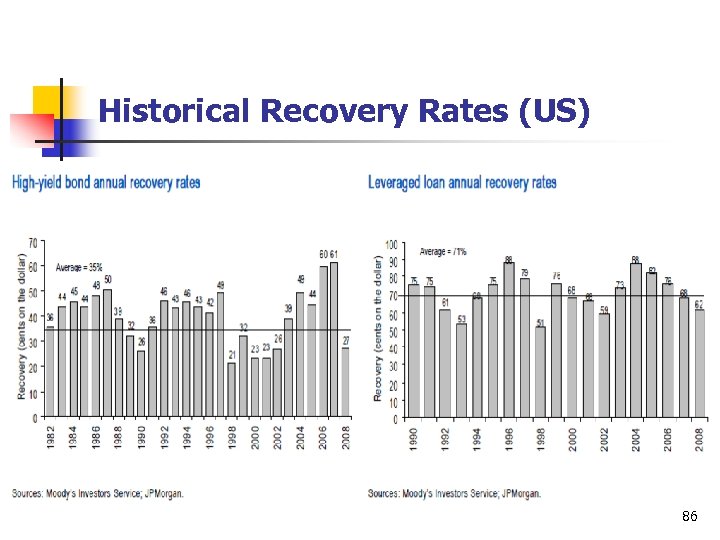

Historical Recovery Rates (US) 86

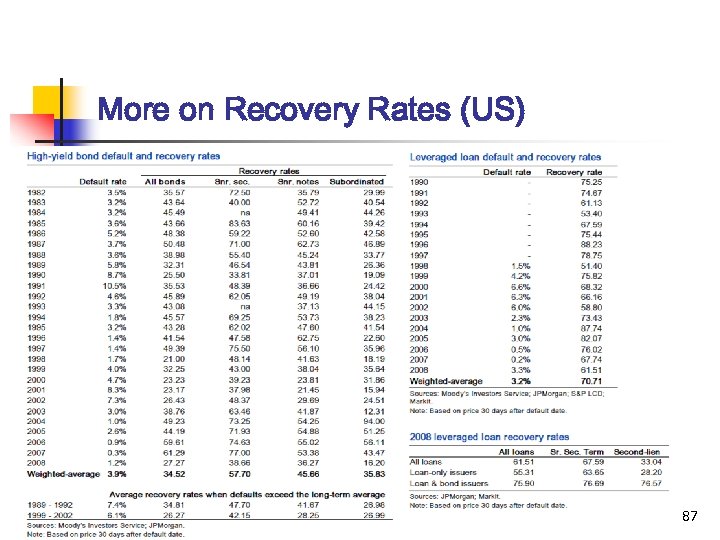

More on Recovery Rates (US) 87

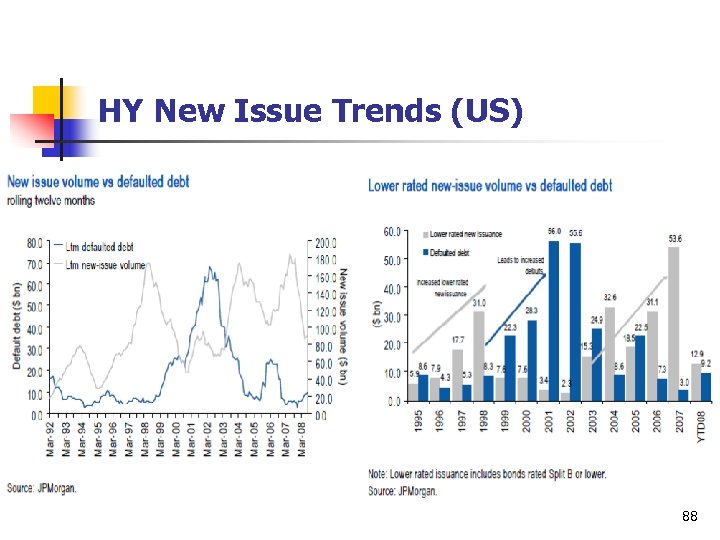

HY New Issue Trends (US) 88

Conclusions n Distressed debt is already out there n n Spreads are currently on the rise, and there to stay for 12 -24 months n n Many private equity funds and other institutional funds are setting up more and more dedicated funds to this asset class Carry interest is currently high, looking at historical average, which makes the asset class already attractive Default rates will peak in the next 12 -24 months n Market prices (hence spreads) anticipate default rates 89

7aec25f3295ec271dcbd674dc71d8d9b.ppt