f21e0565e348d2dbbe666703a09c08d5.ppt

- Количество слайдов: 15

Investing in climate-smart business: IFC’s experience in Europe & Central Asia Patrick Avato Lead, IFC Climate Business Europe & Central Asia Istanbul, 23 November 2012

Agenda Ø IFC in Context Ø Climate Smart Business in IFC Ø Case Study: Renewable Energy in the Balkans 2

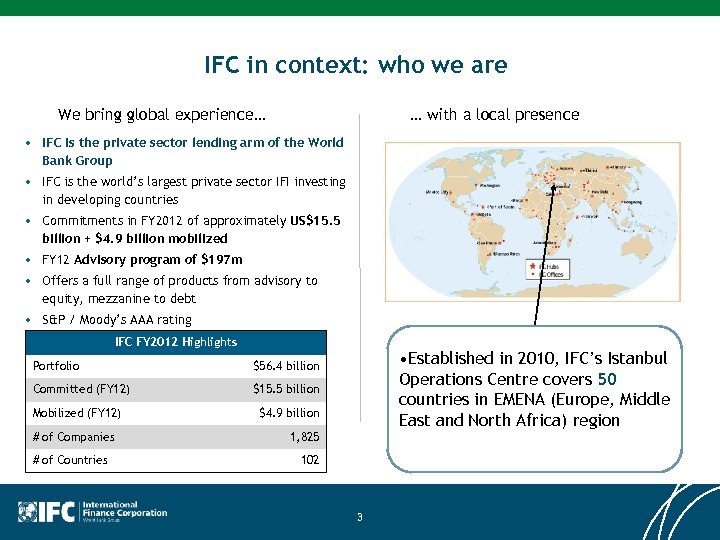

IFC in context: who we are We bring global experience… … with a local presence • IFC is the private sector lending arm of the World Bank Group • IFC is the world’s largest private sector IFI investing in developing countries • Commitments in FY 2012 of approximately US$15. 5 billion + $4. 9 billion mobilized • FY 12 Advisory program of $197 m • Offers a full range of products from advisory to equity, mezzanine to debt • S&P / Moody’s AAA rating IFC FY 2012 Highlights Portfolio Committed (FY 12) • Established in 2010, IFC’s Istanbul Operations Centre covers 50 countries in EMENA (Europe, Middle East and North Africa) region $56. 4 billion $15. 5 billion Mobilized (FY 12) # of Companies # of Countries $4. 9 billion 1, 825 102 3

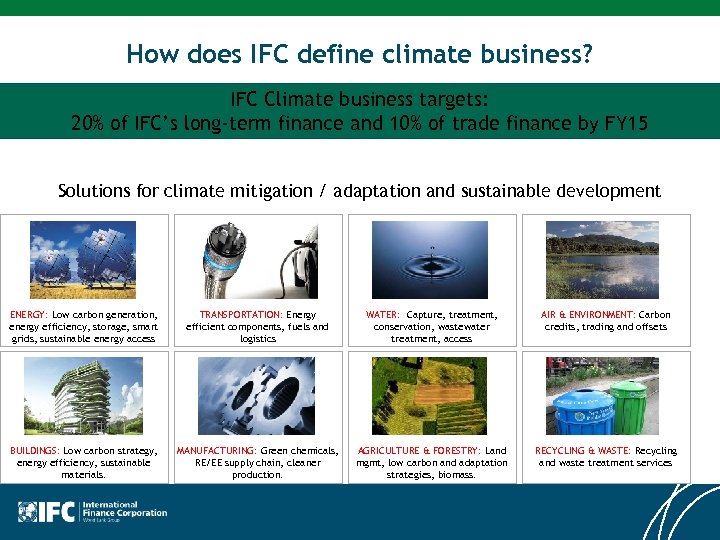

How does IFC define climate business? IFC Climate business targets: 20% of IFC’s long-term finance and 10% of trade finance by FY 15 Solutions for climate mitigation / adaptation and sustainable development ENERGY: Low carbon generation, energy efficiency, storage, smart grids, sustainable energy access TRANSPORTATION: Energy efficient components, fuels and logistics WATER: Capture, treatment, conservation, wastewater treatment, access AIR & ENVIRONMENT: Carbon credits, trading and offsets BUILDINGS: Low carbon strategy, energy efficiency, sustainable materials. MANUFACTURING: Green chemicals, RE/EE supply chain, cleaner production. AGRICULTURE & FORESTRY: Land mgmt, low carbon and adaptation strategies, biomass. RECYCLING & WASTE: Recycling and waste treatment services

Pioneer investments in early market movers… q Commercial Finance (Equity, Debt and Mezzanine) • Renewable energy generation and supply chains • Resource efficiency (Energy, Waste, Water) • Credit lines and guarantees for Financial Institutions to lend for RE & EE • Climate Change Private Equity Funds • Cleantech growth capital • Carbon Finance q Blended Concessional Finance • Concessional funds for investment and advisory services q Convening industry players for research / standard setting

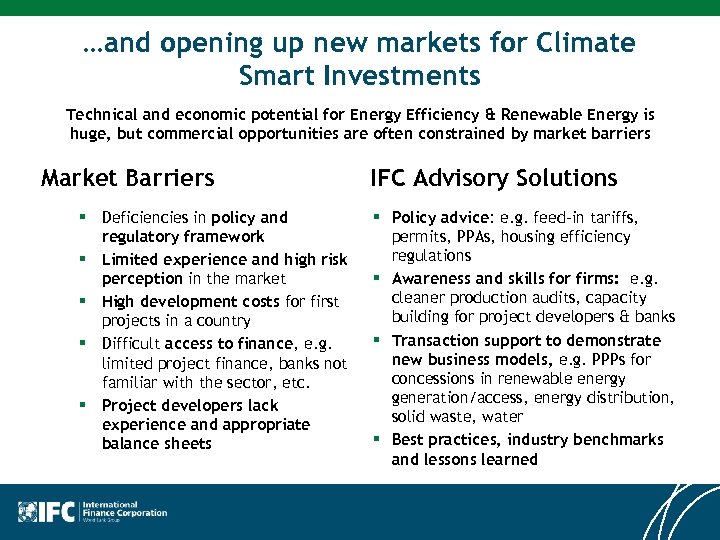

…and opening up new markets for Climate Smart Investments Technical and economic potential for Energy Efficiency & Renewable Energy is huge, but commercial opportunities are often constrained by market barriers Market Barriers § Deficiencies in policy and regulatory framework § Limited experience and high risk perception in the market § High development costs for first projects in a country § Difficult access to finance, e. g. limited project finance, banks not familiar with the sector, etc. § Project developers lack experience and appropriate balance sheets IFC Advisory Solutions § Policy advice: e. g. feed-in tariffs, permits, PPAs, housing efficiency regulations § Awareness and skills for firms: e. g. cleaner production audits, capacity building for project developers & banks § Transaction support to demonstrate new business models, e. g. PPPs for concessions in renewable energy generation/access, energy distribution, solid waste, water § Best practices, industry benchmarks and lessons learned

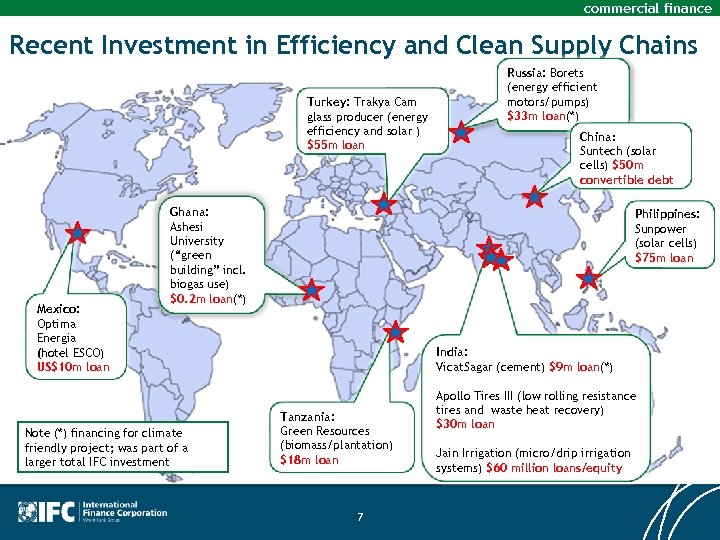

commercial finance Recent Investment in Efficiency and Clean Supply Chains Turkey: Trakya Cam glass producer (energy efficiency and solar ) $55 m loan Mexico: Optima Energia (hotel ESCO) US$10 m loan Russia: Borets (energy efficient motors/pumps) $33 m loan(*) China: Suntech (solar cells) $50 m convertible debt Ghana: Ashesi University (“green building” incl. biogas use) $0. 2 m loan(*) Note (*) financing for climate friendly project; was part of a larger total IFC investment Philippines: Sunpower (solar cells) $75 m loan India: Vicat. Sagar (cement) $9 m loan(*) Tanzania: Green Resources (biomass/plantation) $18 m loan 7 Apollo Tires III (low rolling resistance tires and waste heat recovery) $30 m loan Jain Irrigation (micro/drip irrigation systems) $60 million loans/equity

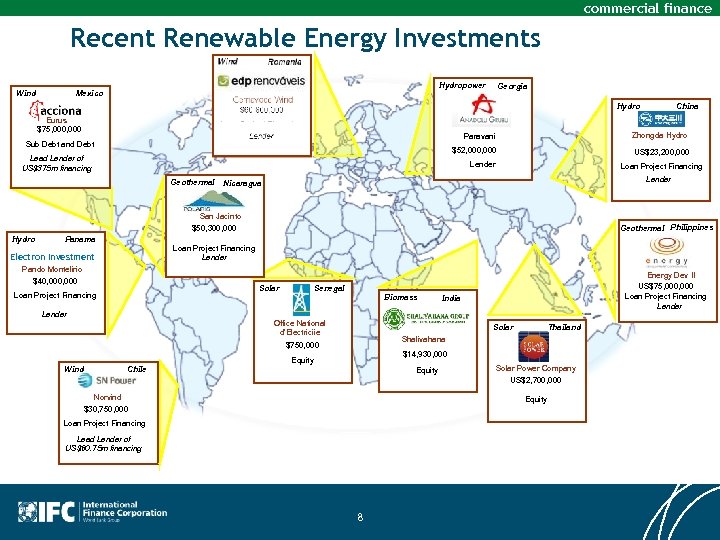

commercial finance Recent Renewable Energy Investments Wind Hydropower Mexico Georgia Hydro Eurus $75, 000 Zhongda Hydro Paravani Sub Debt and Debt $52, 000 Lead Lender of US$375 m financing US$23, 200, 000 Lender Geothermal China Loan Project Financing Lender Nicaragua San Jacinto Geothermal Philippines $50, 300, 000 Hydro Panama Loan Project Financing Lender Electron Investment Pando Montelirio $40, 000 Solar Loan Project Financing Biomass Lender Office National d’Electriciie Chile India Solar Thailand Shalivahana $750, 000 Wind Energy Dev II US$75, 000 Loan Project Financing Lender Senegal $14, 930, 000 Equity Norvind $30, 750, 000 Solar Power Company US$2, 700, 000 Equity Loan Project Financing Lead Lender of US$60. 75 m financing 8

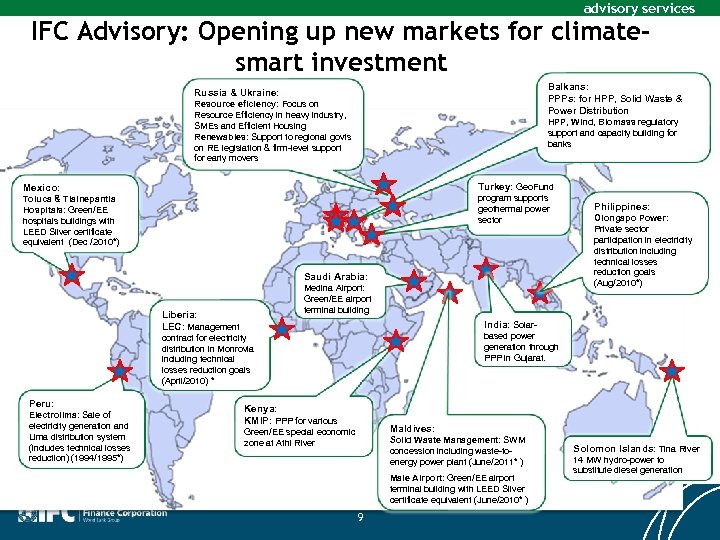

advisory services IFC Advisory: Opening up new markets for climatesmart investment Balkans: PPPs: for HPP, Solid Waste & Power Distribution Russia & Ukraine: Resource eficiency: Focus on Resource Efficiency in heavy industry, SMEs and Efficient Housing Renewables: Support to regional govts on RE legislation & firm-level support for early movers HPP, Wind, Biomass regulatory support and capacity building for banks Mexico: Turkey: Geo. Fund Toluca & Tlalnepantla Hospitals: Green/EE hospitals buildings with LEED Silver certificate equivalent (Dec /2010*) program supports geothermal power sector Saudi Arabia: Medina Airport: Green/EE airport terminal building Liberia: LEC: Management Electrolima: Sale of electricity generation and Lima distribution system (includes technical losses reduction) (1994/1995*) Olongapo Power: Private sector participation in electricity distribution including technical losses reduction goals (Aug/2010*) India: Solarbased power generation through PPP in Gujarat. contract for electricity distribution in Monrovia including technical losses reduction goals (April/2010) * Peru: Philippines: Kenya: KMIP: PPP for various Maldives: Green/EE special economic zone at Athi River Solid Waste Management: SWM concession including waste-toenergy power plant (June/2011* ) Male Airport: Green/EE airport terminal building with LEED Silver certificate equivalent (June/2010* ) 9 Solomon Islands: Tina River 14 MW hydro-power to substitute diesel generation

Case Study: Opening up Western Balkans for RE investment Opportunity • • • High cost of electricity, expensive energy imports Significant small-hydro, biomass and wind potential, export potential to EU Interest by government, banks and industry to develop the RE sector IFC approach • Comprehensive program in Albania, Bosnia, Kosovo, Macedonia, Montenegro and Serbia: 1. Regulatory reform: support governments with developing feed-in tariffs, streamline licensing and standardizing contracts (e. g. PPA, wheeling etc. ) 2. Access to Finance: provide long-term financing & risk-sharing to banks for RE credit lines, coupled with technical support on project assessment & direct investment in individual projects 3. Capacity building: Support project developers with technical advice and access to international partners & finance early mover projects 10

Annex 11

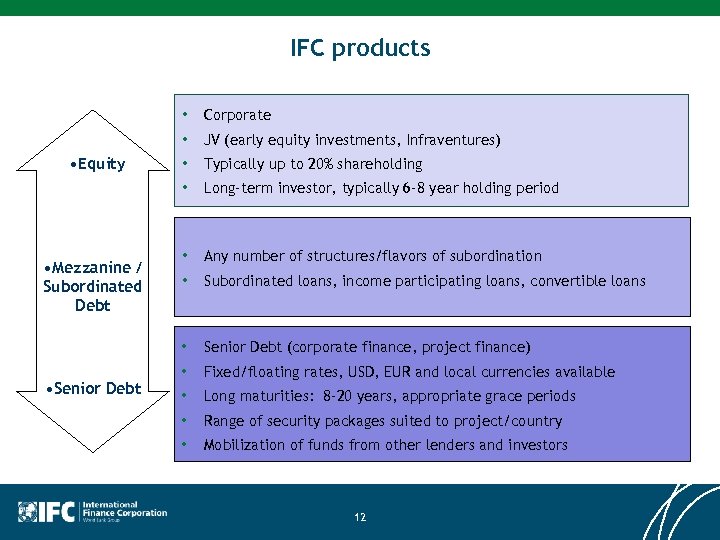

IFC products • • • Senior Debt • Typically up to 20% shareholding Long-term investor, typically 6 -8 year holding period • Any number of structures/flavors of subordination • Subordinated loans, income participating loans, convertible loans • • Mezzanine / Subordinated Debt JV (early equity investments, Infraventures) • • Equity Corporate Senior Debt (corporate finance, project finance) • Fixed/floating rates, USD, EUR and local currencies available • Long maturities: 8 -20 years, appropriate grace periods • Range of security packages suited to project/country • Mobilization of funds from other lenders and investors 12

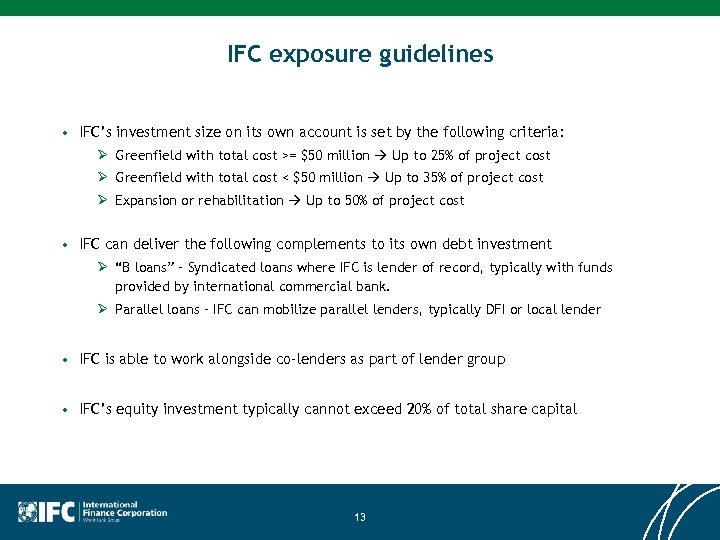

IFC exposure guidelines • IFC’s investment size on its own account is set by the following criteria: Ø Greenfield with total cost >= $50 million Up to 25% of project cost Ø Greenfield with total cost < $50 million Up to 35% of project cost Ø Expansion or rehabilitation Up to 50% of project cost • IFC can deliver the following complements to its own debt investment Ø “B loans” – Syndicated loans where IFC is lender of record, typically with funds provided by international commercial bank. Ø Parallel loans – IFC can mobilize parallel lenders, typically DFI or local lender • IFC is able to work alongside co-lenders as part of lender group • IFC’s equity investment typically cannot exceed 20% of total share capital 13

Cumulative experience of 7. 7 GW of RE investments • Hydro: Ø Long standing experience, with well over 4, 500 MW of HPP investments, across more than 40 projects in all regions. • Wind: Ø IFC’s first investment in 2008, with over 1, 500 MW since then in over 15 projects; approximately 40% in SEE. • Solar: Ø More than 10 PV investments over the last 3 years, totaling 165 MW. Ø A pipeline of CSP projects, and further PV investments in development • Geothermal: Ø A difficult but promising sector in which IFC has made investments totally over 1, 300 MW, in Guatemala, Nicaragua, and Philippines. • Biomass Ø 275 MW of investments, from Brazil to China 14

Case Study: Financing HPPs in Armenia 1. Supporting RE and EE financing through local banks Ameriabank CJSC: AS from ASEF + IFC $15 million for small hydropower plant (SHPP) financing ü Results: 11 SHPPs financed; installed capacity of 33. 2 MW; annual generation of 101. 8 GWh; GHG reduction 40, 720 t. CO 2 e/year HSBC Armenia CJSC: AS from ASEF + IFC $15 million for SME EE financing ü Results: 6 projects in pipeline for $13. 05 million; 6. 5 GWh/year savings, GHG reduction of ~2, 500 t. CO 2 e/year Byblos Bank Armenia CJSC: AS from ASEF + IFC $5 million for Residential EE financing ü Results: bank has launched a broad marketing campaign and started to provide loans 15

f21e0565e348d2dbbe666703a09c08d5.ppt