0fafcb9246ea807cd199ed846b22c118.ppt

- Количество слайдов: 48

Investing For Your Future: A Resource For Financial Security In Later Life Barbara O’Neill, Ph. D. , CFP, IFYF Project Director Interim Extension Specialist in Financial Resource Management Rutgers Cooperative Extension oneill@aesop. rutgers. edu

Investing For Your Future: A Resource For Financial Security In Later Life Barbara O’Neill, Ph. D. , CFP, IFYF Project Director Interim Extension Specialist in Financial Resource Management Rutgers Cooperative Extension oneill@aesop. rutgers. edu

Investing: A Topic of Great Interest n Baby boomers approaching retirement n More “do it yourself” employer pensions n About $7 trillion in mutual funds n Almost half of U. S. households own stock directly or through funds, 401(k)s n Increased media attention to investing n Empirical research: investing is a topic of interest to learners 2

Investing: A Topic of Great Interest n Baby boomers approaching retirement n More “do it yourself” employer pensions n About $7 trillion in mutual funds n Almost half of U. S. households own stock directly or through funds, 401(k)s n Increased media attention to investing n Empirical research: investing is a topic of interest to learners 2

History of Investing For Your Future Project n Committee wanted national implementation regardless of investment knowledge and comfort level of FCS educators, subject matter responsibilities, agent & specialist vacancies, etc. n Spring 2000 - Print version of IFYF home study course available & online course (www. investing. rutgers. edu) introduced n Summer 2000 - Monthly e-mail message n Fall 2000 - IFYF curriculum available n Fall 2001 - IFYF Study Guide & Web site enhancements & research study data analysis 3

History of Investing For Your Future Project n Committee wanted national implementation regardless of investment knowledge and comfort level of FCS educators, subject matter responsibilities, agent & specialist vacancies, etc. n Spring 2000 - Print version of IFYF home study course available & online course (www. investing. rutgers. edu) introduced n Summer 2000 - Monthly e-mail message n Fall 2000 - IFYF curriculum available n Fall 2001 - IFYF Study Guide & Web site enhancements & research study data analysis 3

IFYF Project Development n Funded by three grants from – Rutgers Cooperative Extension – NE Regional Center For Rural Development – The Foundation For Financial Planning n n Developed by a team from 6 universities and two government agencies “Deliverable” for Extension Financial Security in Later Life initiative Over 1, 200 registered online users Over 4, 500 pre-orders for 2 nd edition 4

IFYF Project Development n Funded by three grants from – Rutgers Cooperative Extension – NE Regional Center For Rural Development – The Foundation For Financial Planning n n Developed by a team from 6 universities and two government agencies “Deliverable” for Extension Financial Security in Later Life initiative Over 1, 200 registered online users Over 4, 500 pre-orders for 2 nd edition 4

Target Audience For Program n Beginning investors – “ 20 and 30 -somethings” – Older persons transitioning from savings n Investors with small dollar amounts to invest at a time 5

Target Audience For Program n Beginning investors – “ 20 and 30 -somethings” – Older persons transitioning from savings n Investors with small dollar amounts to invest at a time 5

Home Study Course Components n n n 11 units + glossary Starts with “the basics” Action Steps at the end of each units “Ask the Experts” on online version Optional monthly e-mail message available to registered online users Two evaluation forms: 2 months and 6 months 6

Home Study Course Components n n n 11 units + glossary Starts with “the basics” Action Steps at the end of each units “Ask the Experts” on online version Optional monthly e-mail message available to registered online users Two evaluation forms: 2 months and 6 months 6

The Second Edition of IFYF n n n Four additional external reviewers Completely updated for 2001 tax law and other changes Professionally printed and distributed through NRAES Two-color print and glossy cover Perfect bound Very reasonable cost (much cheaper than duplicating and binding masters) 7

The Second Edition of IFYF n n n Four additional external reviewers Completely updated for 2001 tax law and other changes Professionally printed and distributed through NRAES Two-color print and glossy cover Perfect bound Very reasonable cost (much cheaper than duplicating and binding masters) 7

IFYF Study Guide n 110 pages n Master copies available from Dr. O’Neill: – Send $5 for a print copy – Send a zip disk to get files (no charge) n Written by Dr. Ruth Lytton, Va Tech n Components: – Review Questions – Applications (e. g. , problems and Web sites) – Answers to Review Questions (separate) 8

IFYF Study Guide n 110 pages n Master copies available from Dr. O’Neill: – Send $5 for a print copy – Send a zip disk to get files (no charge) n Written by Dr. Ruth Lytton, Va Tech n Components: – Review Questions – Applications (e. g. , problems and Web sites) – Answers to Review Questions (separate) 8

Web Site Enhancements n Ask the Experts n Calculating What You Need to Save – Retirement – College – Other financial goals n Online Extension publications (links) 9

Web Site Enhancements n Ask the Experts n Calculating What You Need to Save – Retirement – College – Other financial goals n Online Extension publications (links) 9

Class Series Components n Printed copy of speaker’s notes n Marketing materials n Initial and follow-up evaluation forms n Power. Point slide files on a CD-ROM n Completely updated in December 2001 Class series content is exactly the same as the home study course 10

Class Series Components n Printed copy of speaker’s notes n Marketing materials n Initial and follow-up evaluation forms n Power. Point slide files on a CD-ROM n Completely updated in December 2001 Class series content is exactly the same as the home study course 10

Class Session Titles n Basic Concepts and Investing Pre-requisites n Equity Investing n Fixed-Income Investing n Investing in Mutual Funds n Investing Tax-deferred and With Small Dollar Amounts n Getting Help and Avoiding Investment Fraud 11

Class Session Titles n Basic Concepts and Investing Pre-requisites n Equity Investing n Fixed-Income Investing n Investing in Mutual Funds n Investing Tax-deferred and With Small Dollar Amounts n Getting Help and Avoiding Investment Fraud 11

Session 1 Basic Concepts and Investing Prerequisites

Session 1 Basic Concepts and Investing Prerequisites

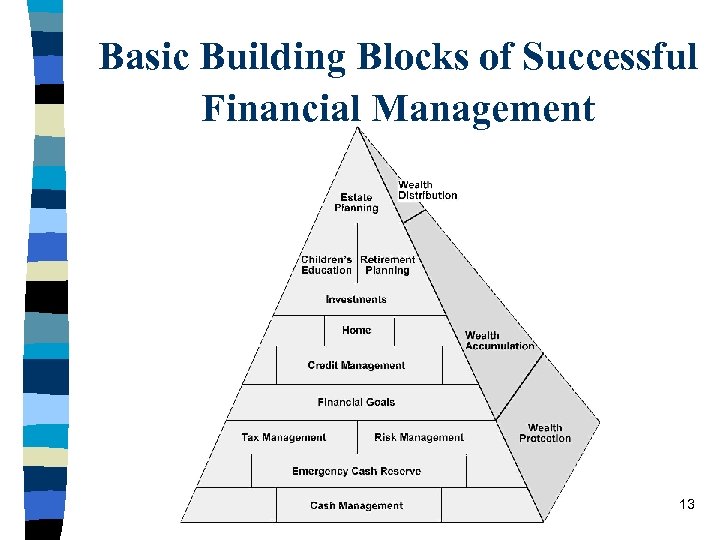

Basic Building Blocks of Successful Financial Management 13

Basic Building Blocks of Successful Financial Management 13

Key Investing Concepts n n n Difference between saving and investing Risk tolerance Risk versus rate of return Impact of time on money accumulation Asset allocation Personal factors that affect investing decisions 14

Key Investing Concepts n n n Difference between saving and investing Risk tolerance Risk versus rate of return Impact of time on money accumulation Asset allocation Personal factors that affect investing decisions 14

Breaking Habits = $$ to Invest 6 Easy Steps n 1. Identify habit, frequency, and cost n 2. Make decision to change n 3. Act immediately n 4. Share your plan n 5. Stick with your plan to change n 6. Celebrate your success 15

Breaking Habits = $$ to Invest 6 Easy Steps n 1. Identify habit, frequency, and cost n 2. Make decision to change n 3. Act immediately n 4. Share your plan n 5. Stick with your plan to change n 6. Celebrate your success 15

Session 2 Equity Investing

Session 2 Equity Investing

Common Stock n Share of ownership in a company n Elect directors n Vote on other matters n Two ways to earn money – value of stock increases – stock pays dividends 17

Common Stock n Share of ownership in a company n Elect directors n Vote on other matters n Two ways to earn money – value of stock increases – stock pays dividends 17

Real Estate Options n n n Home Rental property Crop/mineral land Land for development Real Estate Investment Trust (REIT) Real estate limited partnership 18

Real Estate Options n n n Home Rental property Crop/mineral land Land for development Real Estate Investment Trust (REIT) Real estate limited partnership 18

To Make Money With Collectibles n Keep items in top condition n Focus on true value of property n Document evidence of value n Insure property n You may have to wait for right buyer n No regular income provided 19

To Make Money With Collectibles n Keep items in top condition n Focus on true value of property n Document evidence of value n Insure property n You may have to wait for right buyer n No regular income provided 19

Session 3 Fixed-Income Investing

Session 3 Fixed-Income Investing

Two Types of Investments: n Ownership – Investors own all or part of an asset – Examples include: • • stock real estate growth mutual funds collectibles n Loanership – Investors loan money to companies, government, or financial institutions – Examples include: • bonds • money market funds • CDs 21

Two Types of Investments: n Ownership – Investors own all or part of an asset – Examples include: • • stock real estate growth mutual funds collectibles n Loanership – Investors loan money to companies, government, or financial institutions – Examples include: • bonds • money market funds • CDs 21

Bond Ratings n Ratings predict ability of a bond issuer to repay debt n Investment grade: top 4 grades – Baa to Aaa from Moody’s – BBB to AAA from Standard & Poor’s n Lower ratings: substandard grade (a. k. a. , “junk”, “high yield”) 22

Bond Ratings n Ratings predict ability of a bond issuer to repay debt n Investment grade: top 4 grades – Baa to Aaa from Moody’s – BBB to AAA from Standard & Poor’s n Lower ratings: substandard grade (a. k. a. , “junk”, “high yield”) 22

Five Tips for Fixed-Income Investors: n 1. Know the risks n 2. Beware of guarantees n 3. Ladder your portfolio n 4. Use zero-coupon bonds to hedge stock investments n 5. Match investments with goals 23

Five Tips for Fixed-Income Investors: n 1. Know the risks n 2. Beware of guarantees n 3. Ladder your portfolio n 4. Use zero-coupon bonds to hedge stock investments n 5. Match investments with goals 23

Session 4 Investing in Mutual Funds

Session 4 Investing in Mutual Funds

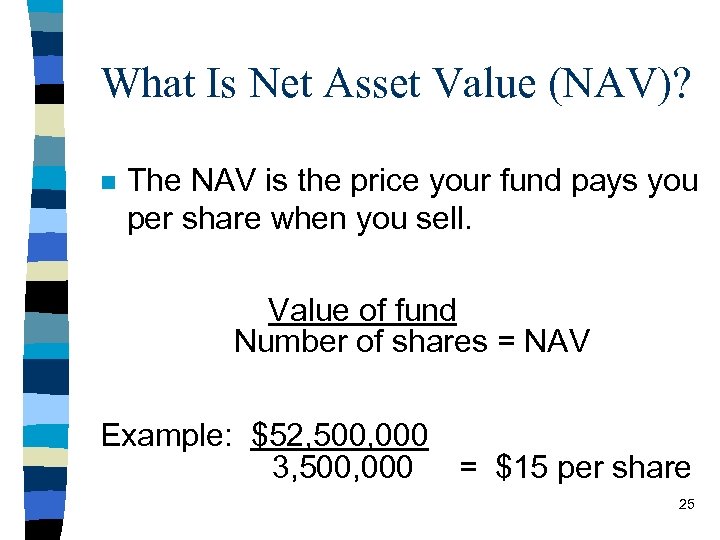

What Is Net Asset Value (NAV)? n The NAV is the price your fund pays you per share when you sell. Value of fund Number of shares = NAV Example: $52, 500, 000 3, 500, 000 = $15 per share 25

What Is Net Asset Value (NAV)? n The NAV is the price your fund pays you per share when you sell. Value of fund Number of shares = NAV Example: $52, 500, 000 3, 500, 000 = $15 per share 25

Match Your Goal to the Right Fund Categories with a growth objective n Growth n International n Aggressive growth n Global n Small cap n Index n Specialty (Sector) 26

Match Your Goal to the Right Fund Categories with a growth objective n Growth n International n Aggressive growth n Global n Small cap n Index n Specialty (Sector) 26

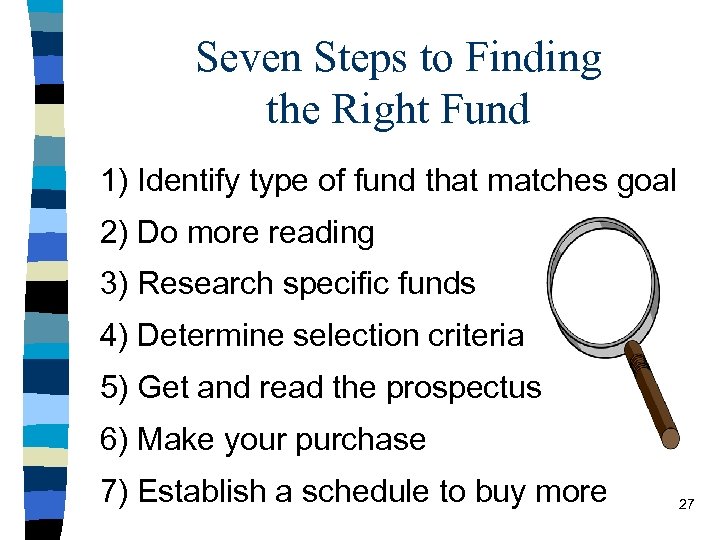

Seven Steps to Finding the Right Fund 1) Identify type of fund that matches goal 2) Do more reading 3) Research specific funds 4) Determine selection criteria 5) Get and read the prospectus 6) Make your purchase 7) Establish a schedule to buy more 27

Seven Steps to Finding the Right Fund 1) Identify type of fund that matches goal 2) Do more reading 3) Research specific funds 4) Determine selection criteria 5) Get and read the prospectus 6) Make your purchase 7) Establish a schedule to buy more 27

Session 5 Investing Tax-Deferred and With Small Dollar Amounts

Session 5 Investing Tax-Deferred and With Small Dollar Amounts

Class Topics Include: n Tax-Deferred Investing – Tax-free versus taxdeferred – Employer retirement savings plans – IRAs – Plans for the selfemployed n Investing With Small Dollar Amounts – – – Employer plans IRAs Fixed-income assets Equity assets Mutual Funds Other investments 29

Class Topics Include: n Tax-Deferred Investing – Tax-free versus taxdeferred – Employer retirement savings plans – IRAs – Plans for the selfemployed n Investing With Small Dollar Amounts – – – Employer plans IRAs Fixed-income assets Equity assets Mutual Funds Other investments 29

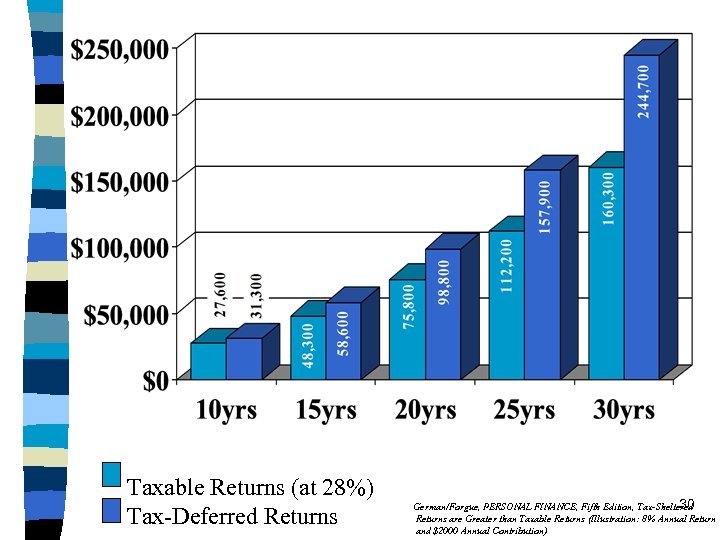

Taxable Returns (at 28%) Tax-Deferred Returns 30 German/Forgue, PERSONAL FINANCE, Fifth Edition, Tax-Sheltered Returns are Greater than Taxable Returns (Illustration: 8% Annual Return and $2000 Annual Contribution)

Taxable Returns (at 28%) Tax-Deferred Returns 30 German/Forgue, PERSONAL FINANCE, Fifth Edition, Tax-Sheltered Returns are Greater than Taxable Returns (Illustration: 8% Annual Return and $2000 Annual Contribution)

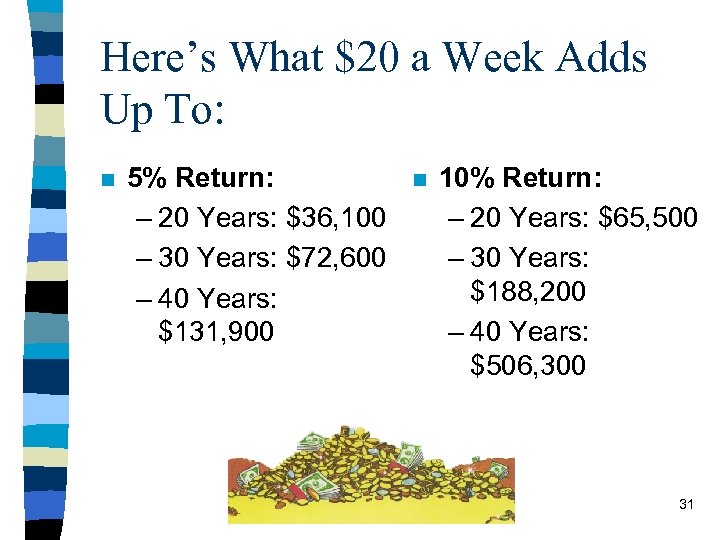

Here’s What $20 a Week Adds Up To: n 5% Return: – 20 Years: $36, 100 – 30 Years: $72, 600 – 40 Years: $131, 900 n 10% Return: – 20 Years: $65, 500 – 30 Years: $188, 200 – 40 Years: $506, 300 31

Here’s What $20 a Week Adds Up To: n 5% Return: – 20 Years: $36, 100 – 30 Years: $72, 600 – 40 Years: $131, 900 n 10% Return: – 20 Years: $65, 500 – 30 Years: $188, 200 – 40 Years: $506, 300 31

Session 6 Getting Help and Avoiding Investment Fraud

Session 6 Getting Help and Avoiding Investment Fraud

What This Lesson Covers n n n Investment resources (e. g. , investment clubs, Web sites, publications) Selecting financial professionals Investment fraud and how to avoid it 33

What This Lesson Covers n n n Investment resources (e. g. , investment clubs, Web sites, publications) Selecting financial professionals Investment fraud and how to avoid it 33

Questions for Financial Planners n What services do you offer? n What can I expect from you? n What will it cost and how are you paid? n Who will work with me? n May I see a sample financial plan? n Are you registered with state or federal regulators? 34

Questions for Financial Planners n What services do you offer? n What can I expect from you? n What will it cost and how are you paid? n Who will work with me? n May I see a sample financial plan? n Are you registered with state or federal regulators? 34

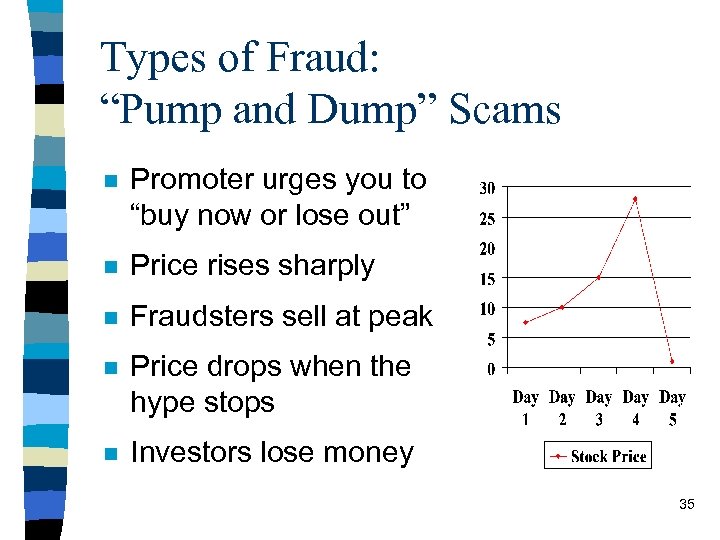

Types of Fraud: “Pump and Dump” Scams n Promoter urges you to “buy now or lose out” n Price rises sharply n Fraudsters sell at peak n Price drops when the hype stops n Investors lose money 35

Types of Fraud: “Pump and Dump” Scams n Promoter urges you to “buy now or lose out” n Price rises sharply n Fraudsters sell at peak n Price drops when the hype stops n Investors lose money 35

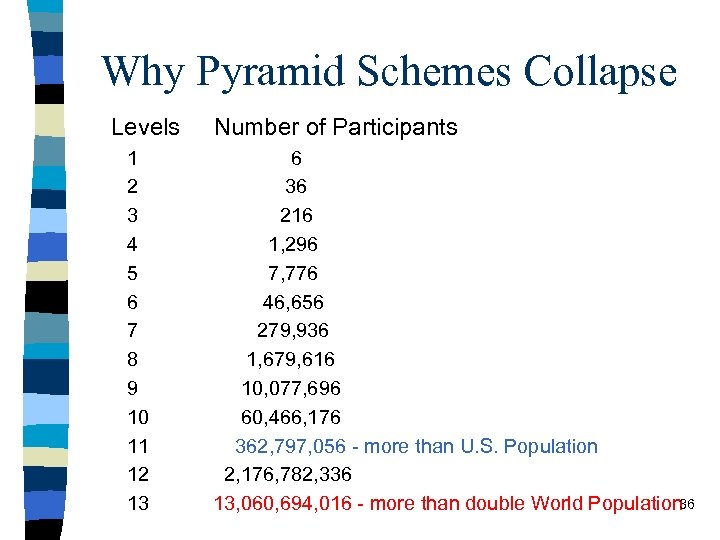

Why Pyramid Schemes Collapse Levels 1 2 3 4 5 6 7 8 9 10 11 12 13 Number of Participants 6 36 216 1, 296 7, 776 46, 656 279, 936 1, 679, 616 10, 077, 696 60, 466, 176 362, 797, 056 - more than U. S. Population 2, 176, 782, 336 13, 060, 694, 016 - more than double World Population 36

Why Pyramid Schemes Collapse Levels 1 2 3 4 5 6 7 8 9 10 11 12 13 Number of Participants 6 36 216 1, 296 7, 776 46, 656 279, 936 1, 679, 616 10, 077, 696 60, 466, 176 362, 797, 056 - more than U. S. Population 2, 176, 782, 336 13, 060, 694, 016 - more than double World Population 36

IFYF Class Series Evaluation n Post-class evaluation – Reactions to class – Usefulness of information – Demographic info about participants n Follow-up evaluation – 15 specific financial behaviors- planned & actual change as a result of IFYF – Increased savings amount 37

IFYF Class Series Evaluation n Post-class evaluation – Reactions to class – Usefulness of information – Demographic info about participants n Follow-up evaluation – 15 specific financial behaviors- planned & actual change as a result of IFYF – Increased savings amount 37

IFYF Class Marketing Materials n Promotional flyers n Radio script n News release n Guidelines for using financial professionals as IFYF volunteers Speaker agreement form n Logos Certificate of completion n n 38

IFYF Class Marketing Materials n Promotional flyers n Radio script n News release n Guidelines for using financial professionals as IFYF volunteers Speaker agreement form n Logos Certificate of completion n n 38

IFYF Class Series is Meant to be Flexible n Use individual sessions (e. g. , mutual funds) as stand-alone classes n Use parts of class sessions (e. g. , investment fraud in Session 6) as short presentations n Mix and match or delete slides, as desired 39

IFYF Class Series is Meant to be Flexible n Use individual sessions (e. g. , mutual funds) as stand-alone classes n Use parts of class sessions (e. g. , investment fraud in Session 6) as short presentations n Mix and match or delete slides, as desired 39

Supplemental Materials Could Include: n n n Net worth worksheet Applicable Web site information (e. g. , article about decimalization of stock share prices) Applicable clipping from newspapers (e. g. , The WSJ) 40

Supplemental Materials Could Include: n n n Net worth worksheet Applicable Web site information (e. g. , article about decimalization of stock share prices) Applicable clipping from newspapers (e. g. , The WSJ) 40

Additional Supplements n n n n Investment books (display) Pages from Morningstar & Value Line Newspaper financial pages Clippings about current investment news (e. g. , change in savings bond rates) Guest speakers Investment quizzes (financial firms) Hands-on activities (e. g. , reading prospectus)41

Additional Supplements n n n n Investment books (display) Pages from Morningstar & Value Line Newspaper financial pages Clippings about current investment news (e. g. , change in savings bond rates) Guest speakers Investment quizzes (financial firms) Hands-on activities (e. g. , reading prospectus)41

IFYF Research Results n 195 respondents – 127 online (nationwide) of 752 usable surveys sent – 68 print version (3 states: NJ, FL, AZ) n n Data collected June-July 2001 Purposes of study – identify characteristics/behaviors of users – feedback on course content and format – determine knowledge gained and behavior changed 42

IFYF Research Results n 195 respondents – 127 online (nationwide) of 752 usable surveys sent – 68 print version (3 states: NJ, FL, AZ) n n Data collected June-July 2001 Purposes of study – identify characteristics/behaviors of users – feedback on course content and format – determine knowledge gained and behavior changed 42

The Sample n Predominantly white & middle aged – 17. 7% age 35 to 44 – 29. 2% age 45 to 54 – 21. 3% age 55 to 64 n 53. 7% had a college degree n 69. 1% were married; 31. 4% with dependents n 51. 3% had “some” prior investing experience; 28. 3% had “a little” 43

The Sample n Predominantly white & middle aged – 17. 7% age 35 to 44 – 29. 2% age 45 to 54 – 21. 3% age 55 to 64 n 53. 7% had a college degree n 69. 1% were married; 31. 4% with dependents n 51. 3% had “some” prior investing experience; 28. 3% had “a little” 43

Course Ratings n 45. 4% “very valuable” n 44. 3% “valuable” n Five highest ranked units (in order) – Unit 8 (Investing With Small Dollar Amounts) – Unit 6 (Investing in Mutual Funds) – Unit 2 (Investing Basics) – Unit 4 (Equity Investing) – Unit 5 (Fixed-Income Investing) 44

Course Ratings n 45. 4% “very valuable” n 44. 3% “valuable” n Five highest ranked units (in order) – Unit 8 (Investing With Small Dollar Amounts) – Unit 6 (Investing in Mutual Funds) – Unit 2 (Investing Basics) – Unit 4 (Equity Investing) – Unit 5 (Fixed-Income Investing) 44

Other Findings n 70. 2% of respondents rated course as “basic”; 27. 5% as “somewhat advanced” n 128 (70%) reported investing money since completing course n Median amount: $1, 800 (mode: $1, 000) n Significant variable relationships – content level rating and course rating – being a saver and demographic variables – amount of savings and demographic variables – knowledge gained and planned action 45

Other Findings n 70. 2% of respondents rated course as “basic”; 27. 5% as “somewhat advanced” n 128 (70%) reported investing money since completing course n Median amount: $1, 800 (mode: $1, 000) n Significant variable relationships – content level rating and course rating – being a saver and demographic variables – amount of savings and demographic variables – knowledge gained and planned action 45

Behavioral Changes n Questions about 15 behavioral changes n Behaviors from IFYF Action Steps n Top 3 actions taken: – using new investor resources (63. 4%) – learning more about investment fraud (56. 1%) – investigating specific investments (48. 9%) n Top 3 actions planned: – determining amount needed to achieve goals (37. 0%) – setting specific (date/cost) financial goals (34. 5%) – increasing amount invested monthly (30. 9%) 46

Behavioral Changes n Questions about 15 behavioral changes n Behaviors from IFYF Action Steps n Top 3 actions taken: – using new investor resources (63. 4%) – learning more about investment fraud (56. 1%) – investigating specific investments (48. 9%) n Top 3 actions planned: – determining amount needed to achieve goals (37. 0%) – setting specific (date/cost) financial goals (34. 5%) – increasing amount invested monthly (30. 9%) 46

Implications n IFYF is positively impacting participants n Diversity of audience outreach can be improved n The level of course content is on target n Emphasizing action steps results in action n Need to help learners with planned behavior changes (e. g. , goals) 47

Implications n IFYF is positively impacting participants n Diversity of audience outreach can be improved n The level of course content is on target n Emphasizing action steps results in action n Need to help learners with planned behavior changes (e. g. , goals) 47

Any Questions? IFYF curriculum materials can be ordered through Barbara O’Neill, project team leader. 48

Any Questions? IFYF curriculum materials can be ordered through Barbara O’Neill, project team leader. 48